HANG IN THERE, INTEREST RATES ARE WINDING DOWN PAGE 3

REMOTE working is about much more than just being able to work from home; it is even bigger than being able to work in a different area or province to where your employer is based – just ask South African Meg Wilson who is living and working in Panama.

Although the international public relations specialist is not technically regarded as a digital nomad, due to her having residency in the Central American country, she is, nonetheless, a remote worker who is reaping the benefits of being able to work from anywhere.

The trend is becoming such a growing global movement that the City of Cape Town has been pushing the South African government to introduce a digital nomad visa that will allow international workers to base themselves in the country, work for their companies back home, and contribute to the economy.

FNB Property Economist John Loos also believes that such a visa would be of great benefit to the country and the economies in the areas foreign workers choose to settle. In fact, he equates it to the positives that come from European swallows or retirees investing in property here.

“Such people bring with them amazing purchasing power, whether they are drawing a pension or working for a company in, for example, Germany. They are not taking people’s jobs, just working from South Africa.

“Effectively, they will be working in Germany but spending their money here. It just makes sense.”

This foreign market of retirees and workers offers “great potential” for economic activity as many parts of South Africa are cheap for people to live in, considering the strength of their home currencies.

“While I do believe that there are more negatives than positives to a weak rand, one of the positives is that we become cheap for tourists, retirees and remote workers who want to live here because of the great lifestyle and weather on offer.”

Citing the Eagles song The Last Resort, Loos says there are many reasons why people would see South Africa as some sort

of paradise. At the same time though, he cites the last verse of the song, “They call it paradise, I don’t know why; You call some place paradise, kiss it goodbye”, as the only major downside to attracting more people to the economy, which is the scarcity of resources.

“This, however, is a challenge in any economy.”

In November, James Vos, the City of Cape Town’s mayoral committee member for economic growth, said the City was the “perfect destination” for foreign remote workers.

“Increasing numbers of professionals are seeking out employers that let them work from anywhere, and with beaches, bars and mountains all on one’s doorstep in the Mother City, it is the perfect place for digital nomads who blend work and play into their travels.”

He said he was pushing the South African government to institute a remote worker visa as four other African countries and 40 global countries have done.

“Research indicates that digital nomads tend to stay in one destination longer than three months while spending up to R50 000.

“One report of a remote worker incentive programme in a city in Oklahoma in the US shows that these travellers generated nearly $20 million (about R371m) in additional local gross domestic product. With a special visa, South Africa stands to realise such gains.”

Last month, however, he said the date for implementation of the remote workers’ visa was missing from President Cyril Ramaphosa’s State of the Nation Address.

“I first proposed the remote worker model after the lifting of lockdown when Covid-19 almost wiped out the travel and hospitality sectors. Since then, we have been lobbying for the introduction of a remote working visa because of its massive economic spin-offs for the industry. Our research shows that a special visa would help attract more international visitors, particularly ‘digital nomads’ who can work virtually from anywhere in the world.”

Citing the latest Tourism Sentiment Index, Vos says global sentiment for tourist activities in South Africa had increased, with

the country ranked 16th in the world. This Index “proves that there is a thirst for South African travel”.

“If, however, our visa system is not revised and improved, we stand to lose out to destinations with less arduous administrative platforms.”

To make the visa a reality, he explains that the government “would simply” need to make an amendment to Section 11 of the Immigration Act which relates to an extension of visas beyond 90 days for specific activities. He suggested that the act also included the following requirements:

✦ An applicant must provide evidence of employment abroad, as well as a sufficient income from such employment or own business registered abroad.

✦ Prohibit the applicant’s work activities in South Africa.

✦ Allow the applicant’s dependants to accompany them, on application.

“If South Africa were to implement such strategies, we could indeed create a tourismrelated job in every home in the country.”

BY BONNY FOURIE bronwyn.fourie@inl.co.zastrategic location in the world and excellent air links. Other reasons include its sound economy, the fact that the country is one of the world’s greenest/cleanest countries, and it offers outstanding health care, pension benefits, and “a raft” of discounts to older residents.

It also has mountain areas with cooler temperatures, does not experience major natural disasters, and has a culture and language she loves.

“I love to travel and have been working mostly remotely, in and out of South Africa, for the past 30 years, but the extreme difficulty of travelling out of SA during 2020 and 2021, due to the world’s mistaken view of the country as a source of several Covid variants, really reinforced for me the need to have at least one more ‘home base’ in the world where I had permanent residence as a minimum.”

Similarly, Loos says, if South Africans can work remotely overseas, this could potentially be good as it could reduce the number of people emigrating, and taking their skills and purchasing power with them.

If the government does not make movements like international remote working difficult for its people by putting up financial hurdles, it will allow them to be paid by companies here and taxed here.

“Exchange controls prevent money from going out of the country, but they also discourage money from coming in; if you restrict it going out, you restrict it coming in as more people are then likely to cut financial ties completely with South Africa.

“If the government and companies do not accommodate remote working, and keep skills and money tied to South Africa while workers live elsewhere, people would rather just cut all ties.”

Wilson, who has clients in the US, Europe and Africa, including South Africa, says a lot of thinking and research went into her decision to move overseas, and that she settled on Panama because of its proximity to her daughter in the US, its central and

She has been living in Boquete, in the western highlands of Panama, since January 2022, and plans to be there for at least another year, interspersed with travel to other places, including South Africa. She remains a taxpaying citizen of South Africa.

“I will then probably go to a few other places on digital nomad visas or longer tourism visas and experience life there for a few months or a year at a time… I’m also really fortunate to have clients who are used to me working remotely and have really embraced and encouraged my current plan.”

While Wilson had international clients before her move to Panama, her work split is 60% South African clients and 40% international clients.

“One cannot sell any goods or services inside Panama without a work permit, but I have just received mine, so hope to have one or two clients here soon.”

In terms of her contribution to her current home’s tourism economy – and further example of the possible benefits of introducing a digital nomad visa in South Africa, she has visited at least one tourist destination a month since living in Panama, and sometimes more.

“I also ‘buy local’ as much as possible, especially to support the small businesses and charities that were hit very hard by Covid.”

HOMEOWNERS, hang in there.

The country seems to be at the end of its interest rate hiking cycle, and even if there is an increase this month, it is expected to be the last.

And next year, the rate could even start coming down, economists and property experts say.

Harcourts South Africa is anticipating that the South African Reserve Bank (SARB) will either not increase the interest rate this month, or put it up by just 0.25%, says chief executive Richard Gray.

“We believe that the upward interest rate cycle is reaching its end, and that further increases could have a negative impact on our struggling economy.”

Furthermore, he says, while the recent weakening of the rand has made it less certain that there will be no change in interest rates, “we remain hopeful that a decision to hold interest rates steady would be good news for consumers who have been dealing with a lot of negative economic developments lately”.

“Such a decision would also help to improve consumer sentiment, which is always positive for the housing market.”

Reading from the lower-thanexpected repo rate increase in January 2023, Thulani Vilakazi, the chief executive of Ithala SOC Limited, believes that the next

@iolproperty

@iolproperty @iolproperty.co.za

BY BONNY FOURIE bronwyn.fourie@inl.co.za

BY BONNY FOURIE bronwyn.fourie@inl.co.za

Monetary Policy Committee decision will be to keep the repo rate unchanged at 7.5%, which will see the prime lending rate remain at 10.75%.

“The inflation-targeted repo rate increase that has been noted since November 2021 is expected to have normalised now.”

Leonard Kondowe, the national manager for Rawson Property Group Finance, says the SARB will intend to curb inflation against the backdrop of rising fuel costs, the energy crisis, rising unemployment, and poverty rates that are leading to an economic downturn.

For this reason, he expects that the interest rate will rise again this month, either by 0.25% or a maximum of 0.5%.

Echoing this, Carl Coetzee, the chief executive of BetterBond, is expecting the SARB to “ease off a little” and possibly increase the repo rate by only 0.25% at the end of March. He says the SARB, in line with international trends, has been increasing the repo rate in a bid to curb inflation.

“In South Africa, inflation is still outside the acceptable 3% to 6% range, so interest rates are likely to increase slightly, but then we expect them to hold steady towards the end of this year and into 2024.”

FNB property economist John Loos says the SARB has pencilled in a 0.25% repo rate increase later

this month, which will take the repo rate to 7.75% and the prime lending rate to 11%. And this would still be fair as it is “important to normalise interest rates”.

“What people don’t realise is that interest rate hikes do not only affect debt, they also affect savings… It is important for the Reserve Bank to guard against macro-economic imbalances such as the housing bubble trap that we fell into during 2020.”

He further explains that the interest rate cuts in 2020 were abnormal due to an abnormal crisis, and while higher rates leave some people disappointed because there is then reduced demand for property, for example, rate hikes are important for long-term health as they prevent increased incometo-debt ratios.

“We must remember the big elephant in the room which is the huge level of debt here and all over the world. If we keep the interest rate under control it boosts savings rates.”

If the interest rate is increased to 11%, Loos states that this is not high, given the country’s inflation rate.

“We don’t want to fuel the ‘buy now, pay later’ trend. Not hiking the rate makes credit cheaper and fuels borrowing, and this is not good in the long term. Pre-2008 there was a housing bubble, but this was followed by a

lot of financial pain.

“The interest rate plays an important role in keeping indebtedness levels manageable.”

Impact of rate hikes on homeowners

If the interest rate rises by 0.25%, Coetzee says it means homeowners would need to pay “slightly more” into their bonds each month. However, there is some comfort to be taken from the fact that the country is “most likely very near” the peak of this rate-hiking cycle.

“Market activity has certainly slowed slightly, but there are still opportunities for aspirant buyers, and some provinces are showing positive house price growth. Affordability should always be the biggest consideration when owning a home, regardless of where we are in the interest rate cycle.”

The rising interest rates are definitely eating into consumer affordability, Kondowe says.

“Between the rising cost of things like credit card debt and vehicle finance, the increasing expense of fuel and groceries, and poor salary growth, it’s no surprise that South Africans are feeling the pinch. This hasn’t only affected new bond applicants, but also those paying off home loans.

“As bond originators, we’re sometimes able to advise struggling bondholders on ways to restructure their personal finances to free up capital for their bond. When this isn’t possible or the results aren’t significant enough, it’s essential that bondholders approach their lenders directly, and as quickly as possible.”

He adds that consumers should save money and do as much as

they can to reduce debt or lower their monthly expenses so that they can comfortably pay their monthly bond instalments.

Vilakazi says the prime lending rate of 10.5% has not been seen since 2016, and so the impact of the higher rate “will be felt by homeowners for months to come”.

“For instance, a home loan of R1 million in September 2021 at prime (7.75%) cost a homeowner about R8 646 per month, and 16 months later in February 2022, at the current prime rate of 10.75%, it costs an additional R2 000+ per month.

“This increase in interest rate is not limited to home loans, but other interest-linked products such as credit cards, overdraft facilities, personal loans, and revolving loans. This then leads to a reduction in disposable income, which leads to financial strain on middle- to low-income households.”

If the interest rate remains unchanged, however, Gray says it would signal that the recent cycle of increases is over for now. And this would be “a welcome development” for the housing market as it would provide greater stability and certainty for homeowners, buyers and sellers.

“Additionally, I believe that a decision to hold interest rates steady would be particularly beneficial given the challenges facing our power utility Eskom, as well as the low levels of economic growth.

“By keeping interest rates steady, the South African Reserve Bank would be sending a strong message of support for our struggling economy and property market.”

DISCLAIMER: The publisher and editor of this magazine give no warranties, guarantees or assurances and make no representations regarding any goods or services advertised within this edition. Copyright ANA Publishing. All rights reserved. No portion of this publication may be reproduced in any form without prior written consent from ANA Publishing. The publishers are not responsible for any unsolicited material.

Publisher Vasantha Angamuthu vasantha@africannewsagency.com Executive editor Vivian Warby vivian.warby@inl.co.za

Features Writer Bonny Fourie bronwyn.fourie@inl.co.za Design Kim Stone kim.stone@inl.co.za

Finally, the upward cycle that has been eating into consumers’ affordability is expected to hold steady for a while before it dips

OUR SUPERB retirement lifestyle is based on hospitality and underpinned by our four security pillars: lifestyle security, physical security, healthcare security and financial security. We want you to fall in love with your retirement, from enjoying the comfort of your own private home to the excellent facilities on offer.

Retiring at Oasis Life is about becoming part of a comfortable way of life, which includes contemporary designed, age-tailored homes of exceptional quality. It means enjoying your independence and leaning into the golden years of life.

Since 2019, our happy Oasis Life communities have thrived, first at Clara Anna Fontein in Durbanville and thereafter at Burgundy Estate that adjoins the historic De Grendel Estate. We proudly present Oasis Life Constantia, Rabie’s third secure retirement estate in the beautiful Western Cape. With its combination of natural beauty, historical significance, and modern amenities, Constantia is a truly unique destination that embodies the essence of Cape Town’s charm and allure. Enjoy a tranquil and serene environment with Kirstenbosch National botanical garden on your doorstep. Both Muizenberg and Hout Bay beaches are a 20-minute drive away.

Situated in the lush green belt of Cape Town, nestled at the foot of the Table Mountain range, Oasis Life Constantia will be settled in a very convenient location, with Constantiaberg Mediclinic and several shopping destinations on your doorstep. Located off Kendal Road, you will be surrounded by abundant greenery as Constantia is dotted with parks and nature reserves, providing ample opportunities for outdoor activities.

What can you expect at Oasis Life Constantia?

In addition to all our standard Oasis Life features such as being pet friendly, beautiful indigenous landscaping, contemporary age-tailored design and 24-hour security, Oasis Life Constantia will feature the following:

✦ Free-standing homes from R5.5-million Free-standing homes, all with double garages with two bedrooms and many with studies, have exclusive use landscaped gardens, fireplaces, and built-in braai areas on the patios.

✦ Apartments from R2.1-million With easy access to the Lifestyle Centre, three low-rise blocks of apartments all have undercover basement parking and either one or two

bedrooms. All apartments have balconies, with some of the larger ones boasting a balcony from both the living room and the master suite.

Ground floor apartments flow out into exclusive use gardens and all the blocks have full back-up electricity.

Amenities

At the heart of the estate, you will find a modern Lifestyle Centre with deli, bar, multi-purpose room, lounge, a sunny veranda that spills outside, primary healthcare suite, heated indoor swimming pool and fitness equipment.

A resort-type lifestyle is yours for the taking, with a variety of activities, amenities, and facilities to choose from. Our outstanding facilities are staffed by friendly, efficient, service minded people. In fact, all our hospitality staff are trained to hotel industry standards, and you can be assured that your retirement will be the best years of your life!

Get in touch

To schedule a one-on-one appointment with one our friendly agents and get the answers to all the questions you may have, contact Nikki Edenborough at 082 417 7807, or Faith Knight at 083 950 8883 or visit www.oasislife.co.za

R 1 295 000

2 BEDROOMS | 2 BATHROOMS

SPACIOUS APARTMENT IN DIEP RIVER.

2 bedroom 2 bathroom apartment in Clarewood, Diep River, a short walk to the station, Martins Bakery and other local amenities, above the railway line.

• Fitted kitchen with electric oven, hob and extractor and plumbing for washing machine.

• Open-plan lounge with parquet flooring

•Two double bedrooms with an en-suite bathroom complete with bath and shower. • Covered Parking bay. • Prepaid electricity

ERF: 1471m2 | HOME: 70m2 | RATES: R 450 p/m | LEVIES: R 1500 p/m

PLEASE CONTACT: Collin Mbiriri on 071 879 8564 or email cmbiriri@gmail.com or mmnyandoro@gmail.com

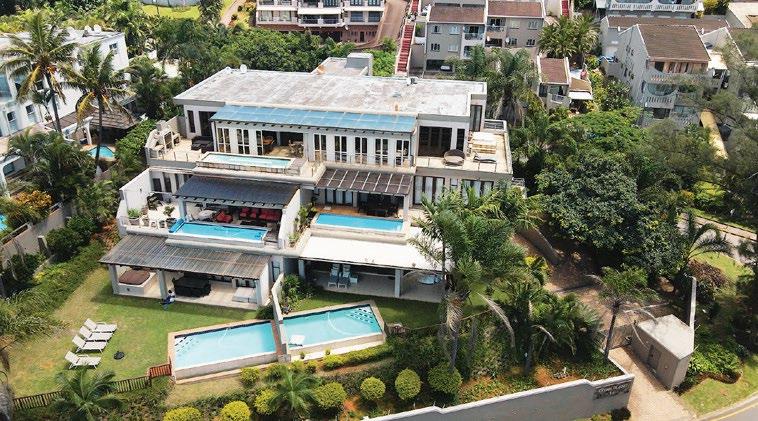

The properties are located in Orange Rock Road and Crown Road, Margate:

• Portion 0 of Erf 2193 in extent of 1093m²

• Portion 0 of Erf 2194 in extent of 2731m²

• Portion 0 of Erf 2197 in extent of 843m²

• Portion 0 of Erf 2198 in extent of 843m²

• Portion 0 of Erf 2199 in extent of 843m²

Sale Procedure : sites will be offered individually and thereafter as a lot

Contact

on 082 801 6827 / 033 397 1190 • R50 000 buyer's card deposit

by EFT • 10% deposit on each purchase price payable on fall of hammer • FICA to be provided • Terms are subject to change without prior notice • Sale subject to confirmation • “E&OE”

*Bidding is subject to Automatic staggered ending times

DOGON GROUP PROPERTIES

Atlantic Seaboard Office 021 433 2580

thekings@dogongroup.com

www.dogongroup.com

RHONDA RAAD PROPERTIES

Cape Town Office 082 448 7795

Email: rrpsales@mweb.co.za

www.rhondaraadproperties.co.za

SHELLEY RESIDENTIAL

KZN

Office 082 412 4463

Email: hello@shelley.co.za

www.shelley.co.za

DOGON GROUP RENTALS

Sea Point Office 021 433 2580

enquiries@dogongroup.com

www.dogongroup.com

ASKA PROPERTY GROUP

Sandown, Milnerton Estates Office 071 604 8493

Email: corlia@aska.co.za

www.askaproperty.co.za

REMAX PROPERTY ASSOCIATES

Sandown, Milnerton Estates

Office 083 653 0595

Email: cristina@remaxpa.co.za

www.remaxpropertyassociates.co.za

DOGON GROUP PROPERTIES

Southern Suburbs, Claremont Office 021 671 0258

southernsuburbs@dogongroup.com

www.dogongroup.com

PETER MASKELL AUCTIONEERS

KZN

Office: 033 397 1190

Email: info@maskell.co.za

www.bidlive.maskell.co.za

BALWIN PROPERTIES

Ballito Office 084 788 1020

Email: michelle@balwin.co.za

www.balwin.co.za

DOGON GROUP PROPERTIES

Western Seaboard

Office: 021 556 5600 or 021 433 2580

enquiries@dogongroup.com

www.dogongroup.com

VAN’S AUCTIONEERS

Gauteng Office 086 111 8267

www.vansauctions.co.za

www.iolproperty.co.za

WIDENHAM RETIREMENT

VILLAGE South Coast, KZN 066 306 0669 / 066 306 0612

www.hibiscusrv.co.za

www.widenhamretirementvillage.co.za