MANY homeowners who are not in a rush to sell their properties or forced to do so through financial pressure, take time to get their homes ready to fetch the best price.

And this often means making repairs or renovations before putting their home on the market.

Sometimes though, owners make too many renovations and lose money in the sale, and other times, they spend money on repairing the wrong features and ignoring those that buyers place more importance on.

Choosing what to fix and what to leave is dependent on the potential value the property can obtain, the cost to repair and the expectation of the seller, says Sheriese Potgieter, a sales property practitioner at Just Property Queensburgh.

Her Heidelberg colleague, Carin Howell, adds: “You don’t have to fix everything but it’s worth getting input from your property professional on which defects, when fixed, will help you achieve a higher selling price.”

Many buyers place importance on kitchens and bathrooms, and so experts often advise that the areas should be the focus for any repairs or renovations.

After all, whether for their own enjoyment or resale value, it is always worth considering which improvements will add value to the home, says Adrian Goslett, the regional director and chief executive of Re/Max of Southern Africa.

“This way, homeowners can ensure that whatever improvements are undertaken are most likely to generate a good return on investment when it comes time to sell the home.”

He notes that upgrading a kitchen or bathroom could add great value, but acknowledges that this can easily become expensive. Sellers should therefore focus on small projects that will add more than it costs to install.

“For example, you could upgrade the cabinets by painting or staining them to give them a modern look. You could also upgrade the cabinet handles, light fixtures and faucets. As cliché as it is to say, it is truly amazing what a fresh coat of paint can do for your home. Just keep in mind that when selling a house, it would be better to keep the colours neutral to appeal to as many buyers as possible.”

Rhoda Dangazele, of Just Property Berea, agrees that the kitchen is the main area that will allow for a higher return on your home, “so make sure that it is in great condition”.

Nico Howell, of Just Property Heidelberg, warns, however, that while you might prefer to leave all defects as they are and rather drop your asking price, you don’t want defects to put potential purchasers off. He has seen keen buyers back away from a leaking roof, damp, mould and mildew in the bathroom, unmatched or cracked tiles, and flaking shower ceilings.

“Sort out problems like these, or at least get quotes from specialists, handymen or builders.”

When it comes to performing major remodelling or home improvement projects, Grahame Diedericks, the manager principal for Lew Geffen Sotheby’s International Realty, says statistics show that you’re unlikely to recoup the costs, so careful consideration is needed.

BY BONNY FOURIE bronwyn.fourie@inl.co.za“If you’ve owned your home for five years or longer, or if you’ve been putting off maintenance tasks that you know needed doing, you may have a fair amount of work to do, but not all repairs are equal in this instance.

“And, with the costs of materials at an all-time high, you can’t afford to make mistakes at this juncture if you hope to realise the biggest possible return on the sale of what is probably your largest asset.”

If you plan on selling, make a list of all the significant repairs you think are required and if you aren’t sure which are critical, it would be wise to hire a home inspector who can prepare a report listing necessary repairs, especially those that you would be required to disclose them to potential buyers.

Once you have your list, Diedericks suggests you divide the repairs into three categories:

✦ Minor and relatively inexpensive repairs that can easily be done before buyers come to view, such as landscaping, cleaning/repair of gutters or a fresh coat of paint.

✦ Major issues that you’ll either have to fix or otherwise disclose to buyers, such as water and electrical systems, structural problems, wood-destroying insects or hazardous materials such as asbestos.

✦ Issues from either of the lists that have the greatest potential to become deal-breakers that deter potential buyers. This could include a cracked foundation, extensive termite damage or an ageing roof that needs replacing – and this is the list you ultimately want to focus on.

“What you add to the final list largely depends on your goals and the prevailing local market. Does a quick sale take precedence over maximum profit, or is your

main goal a high selling price?

“Ask your agent if they have noticed any issues that potential buyers are consistently walking away from and ask them to help you determine which repairs will strike the balance in between.”

There are many low-cost improvements that will also help sell your home, says Margaret Msimango of Just Property Pretoria North.

“Curb appeal is extremely important –those first impressions last. It’s important to present a neat road frontage and entrance.”

Most purchasers are looking for a wellmaintained property,” agrees Dumisani Sibisi, of Just Property Queensburgh.

“Yard cleaning and general tidying inside can assist in getting the results sooner, as can sensible paint touch-ups.”

Dangazele echoes this: “A fresh coat of paint for dirty and untidy walls will do wonders to assist with selling a home or apartment. Declutter living areas, bedrooms and kitchens and stage the home so it has a neat but ‘lived-in’ feel.

“Outside, make sure garden areas and driveways look appealing.”

Apart from these tried-and-true tricks, Goslett says there are other ways to increase the resale value of a home.

“For example, you would be surprised how simply installing a new outlet can declutter and modernise your home, especially if you install wall outlets equipped with built-in ports that are ready to plug your USB cables into.

“LED lighting can also have an impact on a home’s value because of its durability and low energy consumption – not to mention that it can be used as trendy décor to light up cabinets and recessed corners in the home.”

He also suggests that homeowners think about the heating and cooling solutions.

“Everyone knows that South African summers can be sweltering, but installing air conditioning can be expensive.

“Those without the budget could add ceiling fans, which are an appealing addition to any home. Not only will they help keep a room cool, but they also add a nice decorative touch to the space which can make the home more appealing to future buyers.

“Similarly, installing a wood-burning stove or fireplace to warm the home in our icy winters can also increase the resale value of the home.”

You could also add insulation.

on how to avoid wasting money on making too many renovations and repairing the wrong things

MUCH has been said about South Africa reaching the peak of its interest rate cycle but there is a strong possibility of an interest rate hike at the end of the month.

Property experts are predicting a hike of 0.25%, or 0.5% at the most, and if this materialises, then it could be another nasty shock for consumers.

Some hope remains that the rate could be unchanged, but as was seen last month, nothing is certain until the announcement is made.

FNB’s view is that interest rates have reached their peak and will remain unchanged “from here onward until well into 2024”, says property economist John Loos.

“Therefore, in the near term, we don’t expect any change in the direct impact on the cost of servicing mortgage debt for existing property owners.”

Nick Tyson, the managing director of Tyson Properties, also does not believe that the interest rate will be hiked but says that if it is, it will be by 0.25%.

Tyson chief executive Nick Pearson does not predict an increase this month either, but “will not be surprised if we see another increase this year”.

And this is where the positivity ends.

BetterBond shares the view of some economists and analysts that the rate will be increased by 0.25%, taking the repo rate to 8% and the interest rate to 11.5%.

But the good news, says chief executive Carl Coetzee, is that “this is likely to be the last increase we will see in this current rate-hiking cycle”.

“It is expected that inflation is unlikely to remain about the Reserve Bank’s upper target range for much longer, so we should see a lowering of interest rates in the second half of this year.”

If his prediction comes true, homeowners will have to pay more on their bond monthly.

“On a R2 million home, a 0.25% increase will push the prime lending rate to 11.5%, adding R344 to the monthly bond payment. This means that, for a 20-year bond, the monthly repayments will increase from R20 985 to R21 329. Should the repo rate increase by 0.5%, the homeowners will have to pay almost R700 more each month on their bond.”

Coetzee says an increase in the repo rate will negatively affect homeowners, especially in an economic climate where fuel, electricity and living expenses are also on the rise. But, South Africans must take a long-term view when it comes to the housing market and buying property.

“The Reserve Bank acted swiftly to curb inflation by starting to increase interest rates in November 2021, and forecasts indicate that this could be the last increase for a while. The strong possibility that interest rates are likely to drop during the second half of this year will bring homeowners welcome financial relief.

“Affordability is always a consideration when buying a home, and homeowners are advised to budget prudently and factor possible interest rate hikes into their calculations when applying for a bond.”

Agreeing with Coetzee, Tyson says an increase in interest rate will be viewed negatively by homeowners as they are “already under extreme pressure due to the numerous other increases we have seen in the cost of living over the past year”.

Many homeowners would be negatively impacted as they are under pressure, says Pearson.

“On a positive note, many areas where homes on the market are overpriced will need to adjust their pricing and this will bring prices back in line with the current demand.

“We would encourage people wanting to invest in properties to make sure they have at least a 10% deposit and the transfer duties. We would also recommend that people look at all the costs involved on a monthto-month basis.”

Reserve Bank governor Lesetja Kganyago recently said the widely held belief was that not curbing inflation would be more harmful than hiking the interest rate in the long term, so Yael Geffen, the chief executive of Lew Geffen Sotheby’s International Realty believes “we can certainly expect another bump of 0.25% to 0.5%”.

“That said, in a country like South Africa, with very high unemployment and rampant food inflation, I believe it’s almost criminal to not try to curb inflation.”

She adds: “As a nation, we are in the highest food inflation cycle since 2009, we’re at the highest prime lending rate since 2009, and if the economy continues to shrink, we’re going to be in a deep recession from which it would be very difficult to recover.”

Some people, Geffen says, are spending up to 60% of their salaries servicing debt, and each time the interest rate rises, so does the struggle to service debt. More money then has to be borrowed and it becomes a vicious debt cycle.

“This does not bode well for a market that has been under growing pressure for some time. We are seeing an

increase in distressed sales by homeowners who are no longer able to service their debt and are forced to sell and, although it’s happening across the board, it’s most prevalent at the lower end of the market which is struggling to survive.

“Nobody is getting salary increases that can accommodate R5 500 worth of monthly mortgage repayment hikes in 18 months, which is currently the case for every household in the country right now servicing a R2m bond.”

Following the March 2023 rate increase of 0.5%, says Richard Gray, the chief executive of Harcourts South Africa, most analysts believed that the country was at a turning point, with headline inflation close to the target band.

However, given the surprisingly high CPI figures in March, mainly fuelled by food inflation and transport, the SARB’s Monetary Policy Committee “probably has no choice” but to seriously consider another rate increase of 0.25% at the end of May.

“An increase of 0.5% on the back on the March increase will be too aggressive.”

He says homeowners who are bonded will be further negatively impacted by another interest rate increase as it will place an additional burden on households’ cash flows and general affordability, especially the bonded homeowners who are fighting to make ends meet every month.

“The rising cost of living is coming at the general public from all angles and most people are struggling. Bonded home owners make up roughly 30% of all property owners in South Africa. It might push some homeowners over the edge of affordability, forcing them to sell.”

Even if the interest rate is not hiked, Loos says it is likely that increased financial pressure on a portion of property owners would be witnessed in the near term. This would be the lagged impact of what are sharply higher interest rates compared with a year to two years ago.

“From a 2% growth in 2022, the economy is forecast to slow to 0.1% for 2023. This hampers household income growth at a time when the cost of debt servicing is elevated. And in a weaker economy with now higher interest rates, which also results in a weaker property market, it becomes a bit tougher to offload properties proactively when an owner is under financial pressure.

“While we expect interest rates to remain unchanged, one must take into account the lagged impact of recent rate hiking, and at a time when the economy is under pressure. I expect things to still become tougher for property owners in the near term before they get better.”

The continued squeeze on consumers’ finances is expected to tighten, leaving many with little choice but to sell

R 1 295 000

2 BEDROOMS | 2 BATHROOMS

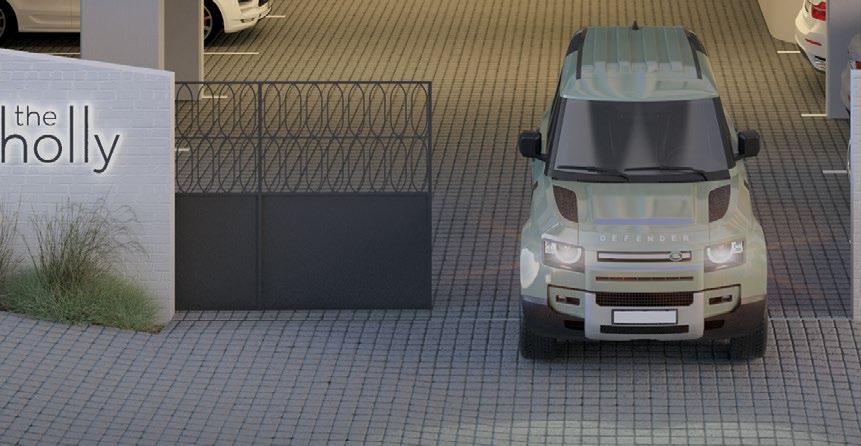

SPACIOUS APARTMENT IN DIEP RIVER.

2 bedroom 2 bathroom apartment in Clarewood, Diep River, a short walk to the station, Martins Bakery and other local amenities, above the railway line.

• Fitted kitchen with electric oven, hob and extractor and plumbing for washing machine.

• Open-plan lounge with parquet flooring

•Two double bedrooms with an en-suite bathroom complete with bath and shower. • Covered Parking bay. • Prepaid electricity

ERF: 1471m2 | HOME: 70m2 | RATES: R 450 p/m | LEVIES: R 1500 p/m

PLEASE CONTACT:

Collin Mbiriri on 071 879 8564 or email cmbiriri@gmail.com or mmnyandoro@gmail.com

Spacious Three Bedroomed Apartment (123m²) above the Main Road in pretty garden setting. Fitted Kitchen and Bathroom. *Parking Bay. Walk to UCT,

Fitted Kitchen. *Garage. *Walk to Shopping Centres, Restaurants, UCT and Transport.

CONTACT: RHONDA C: 082 448 7795 T: 021 685 2212 E: RRPSALES@MWEB.CO.ZA / WWW.RHONDARAADPROPERTIES.CO.ZA

Section 18, in extent of 304m², together with its undivided share in the common property. (Door no. 8, 1st Floor, Building C).

The property is situated on the eastern corner of the 1st floor & accessed via a staircase / elevator The unit has been split into two areas: The larger portion comprises a reception with archives room and kitchenette The unit has partitioned offices centered by a large common office The smaller of the two areas has a reception and further partitioned offices There are 5 exclusive -use basement parking bays and 7 shaded parking bays

Extent: 5,0744 ha Zoning: Agricultural & special

mprovements:

Main single storey building (± 200 m²) Ÿ Outbuildings (± 70 m²): Ÿ Guard house, shed & quarters

Ÿ 2nd dwelling

Ÿ Vodacom/MTN Tower (T14336)

Ÿ Recycling site

Potential:

Ÿ Ideal for commercial or residential development.

Ÿ Located on Daan De Wet Nel Drive, close to major routes and highway.

Extent: 2,0831 ha Vacant Stand

Improvements:

Ÿ Vacant land

Ÿ Usage category: Residential

Potential:

Ÿ Ideal for residential development.

Ÿ Well located close to schools, residential estates, shopping mall and main routes.

12 BRAND NEW EXECUTIVE LUXURY UNITS IN FULLY COMPLETED DEVELOPMENT ON THE BEACH

Ocean Terraces, Poste Lafayette, Rivière du Rempart District ELIGIBILITY TO HAVE PERMANENT RESIDENCE

An opportunity not to be missed - 5 Apartments already sold

Ground floor units – 161m² - 163m² | 4 x First floor units – 156m²-172m² | 2 x Penthouse – 389m² each 1 x Penthouse – 227m² each | All apartments including Penthouse – 3 Bedrooms (Main en-suite and some with wardrobes) | 1 Shared bathroom | Kitchen | Living & dining room | Some with terraces and balconies | All Penthouses – Rooftops and plunge pools | The development is surrounded by luxury hotels such as the Radisson Blu and Le Prince Maurice | 100% completed project | 5 mins away from 9-Hole Golf Course & 10 mins away from 18-Hole Golf Course | Well-known spot for Kite surfing

Harisha: +23 052 501 323 (MU) | Hein +27 83 639 0558 (SA)

INDUSTRIAL INVESTMENT

2-4 Halifax Road, New Germany

Extent: ± 7 451 m² | Made up of

INDUSTRIAL PLATFORMED LAND 74/88 Wiltshire Road, Southmead, Pinetown

Extent : ± 66 802 m² | GLA: ± 51 131 m² usable platformed area | Ideal logistics, trucking hub | Fully fenced & secure with access control | Fully concreted yard

5 NEW UPMARKET APARTMENTS IN UMHLANGA RIDGE

Sections 15, 120, 302, 406 & 423 SS Le Boulevard, 47 Aurora Drive

4 Units of ± 78 m² & 1 unit of ± 111 m² | Brand new units | Modern development with high quality finishes | Stylish architecture

ACCOMMODATION BLOCK

Pearl Heights, 18-20 Dr Langalibalele Dube (Winder) Street, Durban CBD

5 Storey Building | 57 Rooms | Newly painted and refurbished | Communal fitted kitchens & bathrooms, Automated lighting, CCTV Cameras

STUDENT ACCOMMODATION BLOCK

80 Anton Lembede (Smith) Street, Durban CBD

Extent: ± 854 m² | GBA: ± 2 600 m² | 99 Rooms | Accommodates 210 Students | Communal fitted kitchen & Bathrooms | Biometric access system

TM

SECTION 11 (DOOR 7) SS MONTEITH ESTATE, 25 MONTEITH PLACE, DURBAN NORTH VIREND | 071 383 1735

Unit Extent: ± 865 m² | Exclusive Landscaped Garden Area: ± 990 m² | 5 Bedrooms (4 en-suite) | Formal & TV lounge, dining room, modern kitchen | Covered entertainment area | 2 x Double garages | Full automated home (C-Bus Home Automation, Invertor) | Office, recording studio, cinema room | Lift within unit, various water features, generator, JOJO tank filtering system | Sold vacant occupation

OFFERS TO BE SUBMITTED BY 31 MAY 2023

063 500 1652

VIREND | 071 383 1735

ACCOMMODATION

Heights, 18 Ismail C Meer Street, Durban CBD

Building | 100 Rooms | oor retail shops | Place – Expiring Nov

VIREND | 071 383 1735

ACCOMMODATION BLOCK

Pearl Heights, 18-20 Dr Langalibalele Dube (Winder) Street, Durban CBD

MUHAMMAD | 079 458 4256

STUDENT ACCOMMODATION BLOCK

80 Anton Lembede (Smith) Street, Durban CBD

Annual Income: & Retail: ± R630K

5 Storey Building | 57 Rooms | Newly painted and refurbished | Communal fitted kitchens & bathrooms, Automated lighting, CCTV Cameras

Extent: ± 854 m² | GBA: ± 2 600 m² | 99 Rooms | Accommodates 210 Students | Communal fitted kitchen & Bathrooms | Biometric access system

Auction Venue: Mount Edgecombe Country Club, Gate 2, 1 Golf Course Drive, Mount Edgecombe | registration deposit. Strictly by EFT. FICA Documents are required | Auctioneer: Andrew Miller

1735

GROUP

Atlantic Seaboard 021 433 2580

TM

ASKA PROPERTY GROUP

Sandown, Milnerton Estates Office 071 604 8493

ESTATE, 25 MONTEITH PLACE, DURBAN NORTH

thekings@dogongroup.com www.dogongroup.com

Email: www.rhondaraadproperties.co.za

Email: corlia@aska.co.za

Garden Area: ± 990 m² | 5 Bedrooms (4 en-suite) | Formal & TV lounge, dining room, modern kitchen | Full automated home (C-Bus Home Automation, Invertor) | Office, recording studio, cinema room | JOJO tank filtering system | Sold vacant occupation

OFFERS TO BE SUBMITTED BY 31 MAY 2023

BE VIEWED ON OUR WEBSITE

www.in2assets.com

063 500 1652

DOGON GROUP RENTALS

Sea Point Office 021 433 2580

enquiries@dogongroup.com www.dogongroup.com

www.askaproperty.co.za www.in2assets.com or at Unit 505, 5th Floor, Strauss Daly Place, 41 Richefond Circle, Ridgeside Office Park, Umhlanga Ridge. Bidders must on registration. The Rules of Auction contain the registration requirements if you intend to bid on behalf of another person or an by auction is subject to a right to bid by or on behalf of the owner or auctioneer. In terms of the POPI Act, our contact details have been future marketing communication via email, mobile and WhatsApp. Email optout@in2assets.com to be removed from all future communication.

Durban 0861 444 769

Email: info@in2assets.com www.in2assets.com

IRENE PORTER PROPERTIES

Simon’s Town Office 021 786 3947

Debbie 073 140 2543

www.ireneporterproperties.co.za

DOGON GROUP PROPERTIES

Southern Suburbs, Claremont Office 021 671 0258

southernsuburbs@dogongroup.com www.dogongroup.com

PETER MASKELL AUCTIONEERS

KZN

Office: 033 397 1190

Email: info@maskell.co.za

www.bidlive.maskell.co.za

MURAMBI HOUSE

Wynberg Office murambihouse@telkomsa.net

www.murambi.co.za

fully prepared

• Laundry, Daily Activities as arranged Tuckshop available Landscape Garden Water feature All our facilities NEW easily

Address: Cnr Langley Road & Wellington Avenue, Wynberg,

DOGON GROUP PROPERTIES

Western Seaboard

Office: 021 556 5600 or 021 433 2580

enquiries@dogongroup.com www.dogongroup.com

VAN’S AUCTIONEERS

Gauteng

Office 086 111 8267

www.vansauctions.co.za

www.iolproperty.co.za

WIDENHAM RETIREMENT

VILLAGE South Coast, KZN 066 306 0669 / 066 306 0612

www.hibiscusrv.co.za

www.widenhamretirementvillage.co.za