FUTURE SEMIGRATION THE CAPE WILL COPE PAGE 3

Data analytics and consumer credit reporting company Experian, advises that, in most cases, it makes sense to pay off credit card debt before buying a home.

This can increase your credit score and decrease your debt-toincome (DTI) ratio, both of which may qualify you for lower mortgage rates.

“Merely having credit card debt likely won’t disqualify you from buying a home,” the company states in an article, “but it may negatively affect you in other ways, for example, in the way mortgage lenders view you as a potential borrower.”

This is how:

Credit card debt increases your DTI. One of the most important elements of your mortgage application is your DTI, including your projected monthly mortgage payment. The greater your credit card debt, the greater your DTI, and the higher the likelihood your mortgage application may be denied.

Credit card debt impacts your credit score. Lenders look closely at your credit score and at the details in your credit report, including the types of debt you owe and their balances.

Paying down credit card debt lowers your amounts owed, which is a major factor in your credit score

MANY financially stable and creditworthy homebuyers are shocked when their home loan applications are declined due to negative credit records.

They do not realise that even “seemingly minor” things can count against them, says Cobus Odendaal, the chief executive of Lew Geffen Sotheby’s International Realty in Johannesburg and Randburg.

These include late payments and unresolved disputes with companies, even if they, the homebuyers, are in the right.

“All too often, we see financially stable and generally creditworthy buyers having their property dreams scuppered by long-forgotten debts, often innocently overlooked because of circumstances like moving house.

“And, although they may have originally been small amounts, legal fees and penalties can escalate the amount owing and, sometimes, there is even a judgment against them.”

Knowledge is therefore crucial when it comes to managing your credit.

“The more you understand the factors that affect your credit score, the easier it will be to maintain a good rating, especially

if you are planning to apply for substantial finance like a mortgage.”

Although the two most critical requirements when applying for a home loan are a good credit score, with a track record of repaying contractual debt responsibly and being able to afford the monthly bond instalments, Odendaal says banks also take several other factors into consideration.

“For instance, a factor which one would expect to count in an applicant’s favour is having high but unused credit available on retail accounts and credit cards, but the opposite is true.

“Banks will automatically include the potential instalments on these unused credit facilities in their affordability calculation, with the rationale being that the applicant could, at any stage, max their credit facilities.”

Before you apply for home finance, Odendaal says you should either reduce your credit limit or close unused accounts so that your affordability isn’t prejudiced.

He also advises that, in the time leading up to your bond application, you limit any other finance applications to only those that are necessary. This is because too many credit enquiries,

whether for a credit card or a loan, can negatively impact your score.

Aspirant homeowners should also know that there is a difference between affordability and qualifying for credit with regard to gross income, both of which the banks the banks take into consideration.

“As a rule of thumb, the larger the margin between gross income and expenses, the better the rate applicants are likely to be offered, so I always also advise people to not go buy a brand-new car just before they apply for a mortgage.”

Odendaal says a good credit score is equally important in the rental sector as it can be difficult finding a home to rent if you are regarded as high risk.

“Although a tenant’s credit score is not necessarily an accurate indicator of how reliably they will pay their rent, especially in these tough economic times, it’s generally the only way agents have of gauging potential payment behaviour.”

Therefore, the best way to establish a good credit score is consistently over time. If you have a “scant record”, then you should start with small accounts like store credit and cellphone accounts, and try to include a credit card in the mix.

“Keep your debt low and always pay on time, paying more than the minimum instalment when possible.”

Although the Credit Amnesty Bill, implemented on April 1, 2014, stipulates that credit bureaus must automatically remove paidup judgments and paid-up adverse information listings, he says banks still have access to payment profile information that displays payment history.

Among the many checks that banks carry out when deciding whether to approve your application, is the amount of debt you have at that time, as well as the deposit you can pay, says Nondumiso Ncapai, the managing executive at Absa Home Loans.

She says there are a range of factors that influence an individual’s borrowing risk and their likelihood of being approved for a home loan. These include:

✦ Income

✦ Actual expenses

✦ Credit profile or credit record

✦ Current credit exposure (that is how much debt you have or are owing to creditors)

✦ The term of the loan

✦ The amount of the loan being applied for

✦ The property to be mortgaged

✦ Whether you have a deposit

Credit card debt limits the mortgage payment you can afford. If you’re making a substantial credit card payment each month, taking on a mortgage could be a strain. Not only will lenders take this into account when evaluating your application, but your budget could be overburdened.

“In most cases, paying off credit card balances – or paying as much as you can to bring their balances down – is the right move. You’ll be able to lower your DTI and, hopefully, increase your credit score and qualify for a lower interest rate on your mortgage.”

To have a better chance of being approved for a home loan, Vivienne Cox, of ooba Home Loans agrees that you should try to settle your debts.

“When banks look at a potential homebuyer’s profile, they check their credit history and risk profile.

“Although settling an outstanding debt does not automatically guarantee a favourable credit score – as the repayment history of a debt remains on your credit record for two years – good debt management can work in your favour as the banks can only assess what you will do with credit if they can study your repayment track record.”

You should also try to pay the balance owed on your credit card as this has a strong influence on your credit score.

“Paying back your credit card balance has a significant impact on your score, as it’s not just about having the credit, but how you deal with it that the banks are assessing.”

Coastal areas in the province that are proving to be popular alternatives to Cape Town include Hout Bay and Llandudno, Plettenberg Bay and Mossel Bay.

Hout Bay and Llandudno

The number of transactions was, however, slightly down compared to the record year of 2021, but the overall value ended “very much on par”.

CAPETONIANS who are concerned that their city may not be able to sustain the growing influx of residents from other parts of the country should not fear, experts say.

After all, not all semigrants are moving to Cape Town; some are choosing to settle in other areas of the province.

And even if they are choosing the Mother City as their new home, the municipality can cope.

Erwin Rode, the managing director and chief executive of Rode & Associates, which specialises in real state economics, property valuations, property research and town planning, says the Western Cape government and the City of Cape Town know what needs to be done to accommodate the growing numbers of residents.

Officials are “acutely aware” of the potential infrastructure problems posed by the influx of semigrants, and are working on the issues.

There may be a bottleneck, but he believes this will be temporary as the City will react appropriately and timeously.

Rode also does not believe that Cape Town will run out of space for its growing population.

“I personally don’t think there will be a limitation factor as the private sector is already increasing residential property development.

@iolproperty

@iolproperty @iolproperty.co.za

There are also areas north of the city that can accommodate new residential developments.”

Similarly, FNB property economist John Loos says the Western Cape, as a whole, can sustain the increasing numbers of semigrants “for many years”.

“You have to remember that there is Cape Town, and then there is the rest of the province.”

Even though people will not stop relocating to the city –despite its big city problems and challenges, including poverty and congestion – data over recent years has shown that semigration is growing in other areas like the Southern Cape and those on the west coast.

“More towns that were not previously attractive are now bringing people in, and not just semigrants but people from Cape Town and other parts of the province. These towns were never really seen as semigration destinations in the past.

“More and more towns are becoming favourable alternatives to Cape Town as the city fills up, becomes crowded, and sees exorbitant property values. This is also being seen in the Stellenbosch property market.”

Loos says the Western Cape is “quite a big province”, and that there are many towns untouched by semigrants.

And while many Capetonians may feel inconvenienced by the

congestion in their city, there is also an economic and business upside to the influx.

“Semigrants, who are not only those with high-incomes and skills but people who are lowincome and moving to the city for a better life, greatly benefit the economy and businesses.

“They also drive the economy with their skills and higher incomes.”

Retirees, for example, are sometimes not working, but they are big purchasers and also good for retail. There are, however, challenges posed by increasing numbers of people moving to a particular place.

“Pressure is put on resources and infrastructure, particularly nature resources. This is where well-run councils are crucial as they need to plan for greater power and water supply, as well as work out how to preserve natural resources,” Loos says.

Higher volumes of tourists have the same impact on natural resources.

George, for example, needs to plan for “clever densification” if the number of residents continues growing.

Seeff Property Group agents say the demand for coastal property in the Western Cape continues unabated and that, in some instances, last year was notably better compared to the pre-pandemic period.

Last year, says Stephan Cross, the manager for Seeff Hout Bay and Llandudno, Hout Bay ended with 457 transactions worth more than R1.3 billion in another record year.

The average transaction price also increased to R4.389 million, up from R3.518m in 2021. This was largely due to more sales at the higher price bands.

Llandudno ended with a record of 18 transactions worth more that R478m compared to eight sales worth R143m the year before. It also achieved a significant number of sales above R20m.

He says Hout Bay has become a great alternative for buyers looking to be close to the Atlantic Seaboard on the one side and the Southern Suburbs on the other side.

“It offers a great villagelike lifestyle, fully contained with great restaurants, schools, shopping and more. There are a number of desirable lifestyle estates in the area which contribute to the high demand.”

Plettenberg Bay

While it was expected that the Plettenberg Bay property market would ease towards the second half of 2022, it ended the year with around 800 transactions and an overall value which is somewhat staggering, at around R2.3bn, says Alet Ollemans, the licensee for Seeff Plettenberg Bay.

The average transaction price for Plettenberg Bay is now around R2.6m, about 4% higher compared to 2021 and about 30% up on 2019.

While the bulk of the transactions falls below R2.5m, she says there was “excellent activity” above this price band, with many sales above R10m and three above R20m, all in Seaside Longships. The luxury estates also continue seeing strong demand.

Mossel Bay

Herman Spies, the sales team leader of Seeff Mossel Bay, says the area has become the “darling” of coastal buyers over the past few years and, enjoyed another solid year in 2022.

The buying market is moving faster, and with less stock, and sellers were calling the shots towards the end of last year.

“Semigration, retirement and holiday home buyers continue to flock to the town for the excellent lifestyle and value on offer.”

The average price for full title residential property here is around R2.8m. Great areas to invest in include Dana Bay, with an average transaction price, according to Lightstone, of around R1.7m, Diaz at around R1.8m, and Island View and Reebok, both with an average of around R1.8m.

There is high demand for properties below R3m. Vacant land is under supplied and prices have doubled over the past 12 months.

DISCLAIMER: The publisher and editor of this magazine give no warranties, guarantees or assurances and make no representations regarding any goods or services advertised within this edition. Copyright ANA Publishing. All rights reserved. No portion of this publication may be reproduced in any form without prior written consent from ANA Publishing. The publishers are not responsible for any unsolicited material.

Publisher Vasantha Angamuthu vasantha@africannewsagency.com Executive editor Vivian Warby vivian.warby@inl.co.za

Features Writer Bonny Fourie bronwyn.fourie@inl.co.za Design Kim Stone kim.stone@inl.co.za

An influx of people and more developments will have positive spin-offs for the economy and business , experts say

R 1 295 000

2 BEDROOMS | 2 BATHROOMS

SPACIOUS APARTMENT IN DIEP RIVER.

2 bedroom 2 bathroom apartment in Clarewood, Diep River, a short walk to the station, Martins Bakery and other local amenities, above the railway line.

• Fitted kitchen with electric oven, hob and extractor and plumbing for washing machine.

• Open-plan lounge with parquet flooring

•Two double bedrooms with an en-suite bathroom complete with bath and shower. • Covered Parking bay. • Prepaid electricity

ERF: 1471m2 | HOME: 70m2 | RATES: R 450 p/m | LEVIES: R 1500 p/m

PLEASE CONTACT: Collin Mbiriri on 071 879 8564 or email cmbiriri@gmail.com or mmnyandoro@gmail.com

BRAND NEW DEVELOPMENT - EMBASSY EDITION - BISHOPSCOURT

Championing understated luxury, Embassy Edition embraces modern life with a refreshing approach to boutique security estate living. With contemporary minimalist design harmonious with swathes of surrounding nature, this 2-home development in Bishopscourt is the premium balance of leading-edge architecture, & state-of-the-art security With a sweeping panorama that takes in mountains, forests, and endless sky, the step-back design of each home allows impressive views from almost every room This is paradise beyond compare. Priced from R28.98 M illion (VAT Incl. - No Transfer Duty)

Bidding opens 22nd MARCH 2023 @ 12h00

https://bidlive.maskell.co.za

Obo the Joint Liquidators of Central Zone Trading (Pty) Ltd ( In Liquidation) Master Ref: D172/2017

The properties are located in Orange Rock Road and Crown Road, Margate:

• Portion 0 of Erf 2193 in extent of 1093m²

• Portion 0 of Erf 2194 in extent of 2731m²

• Portion 0 of Erf 2197 in extent of 843m²

• Portion 0 of Erf 2198 in extent of 843m²

• Portion 0 of Erf 2199 in extent of 843m²

Sale Procedure : sites will be offered individually and thereafter as a lot

Contact Danielle Hoskins (Candidate Property Practitioner) on 082 801 6827 / 033 397 1190 • R50 000 buyer's card deposit payable by EFT • 10% deposit on each purchase price payable on fall of hammer • FICA to be provided • Terms are subject to change without prior notice • Sale subject to confirmation • “E&OE”

*Bidding is subject to Automatic staggered ending times

Duly instructed by the Trustees of the Insolvent Estate of TK and VTZ Khanyile, Master Ref: D53/2020

TENDERS ARE INVITED FOR THE PURCHASE OF A 9-BED DOUBLESTOREY DWELLING FEATURING TWO DOUBLE GARAGES, COVERED ENTERTAINMENT AREA, SWIMMING POOL AND OUTBUILDING 53A HAYGARTH ROAD, KLOOF, KWAZULU-NATAL

The property comprises: lower level: reception area, 2 lounges, study, glass enclosed verandah, O/P lounge and kitchen serviced by a pantry & scullery. Entertainment area with bathroom, billiards room and a fully fitted cinema room & two en suite bathrooms. Upper area: Landing with a fitted office, 5 en - suite bedrooms with a large main bedroom. Further improvements: 2 - dbl garages; covered entertainment area overlooking the swimming pool; Servant’s quarters comprising of 3 rooms, ablutions and an open plan lounge kitchen area

TENDER CLOSING DATE : 12 APRIL 2023 at 12H00

• For further details & tender documents, contact Danielle Hoskins (Candidate Property Practitioner) on 033-3971190

• 082 801 6827 or email danielle@maskell.co.za or visit our website www.maskell.co.za • Tenders are to be delivered in a sealed envelope to JV Hart, Executors of Estates, Unit 1, Block C, 460 Townbush at Cascades, Montrose, Pietermaritzburg, 3201, Attention: Kate Guiot and clearly marked “Insolvent Estate TK & VTZ Khanyile - Tender document” • “Above subject to change without prior notice” “E & O • Sale is subject to confirmation

DURBAN BOUTIQUE HOTEL

25-27 Bond Street, Mount Moreland, Durban

Two separate erven with combined extent: ± 8 094 m² | 13 Large executive ensuite bedrooms | Industrial kitchen with walk in cold-room, dining area, bar | Indoor, outdoor, and kiddies swimming pools, and entertainment areas | Conference room, outside boma, rooftop entertainment zone | Health Spa and Treatment Facility with Zen Garden | 40 Parking bays with additional overflow parking area | Directly accessible via Dube Trade City

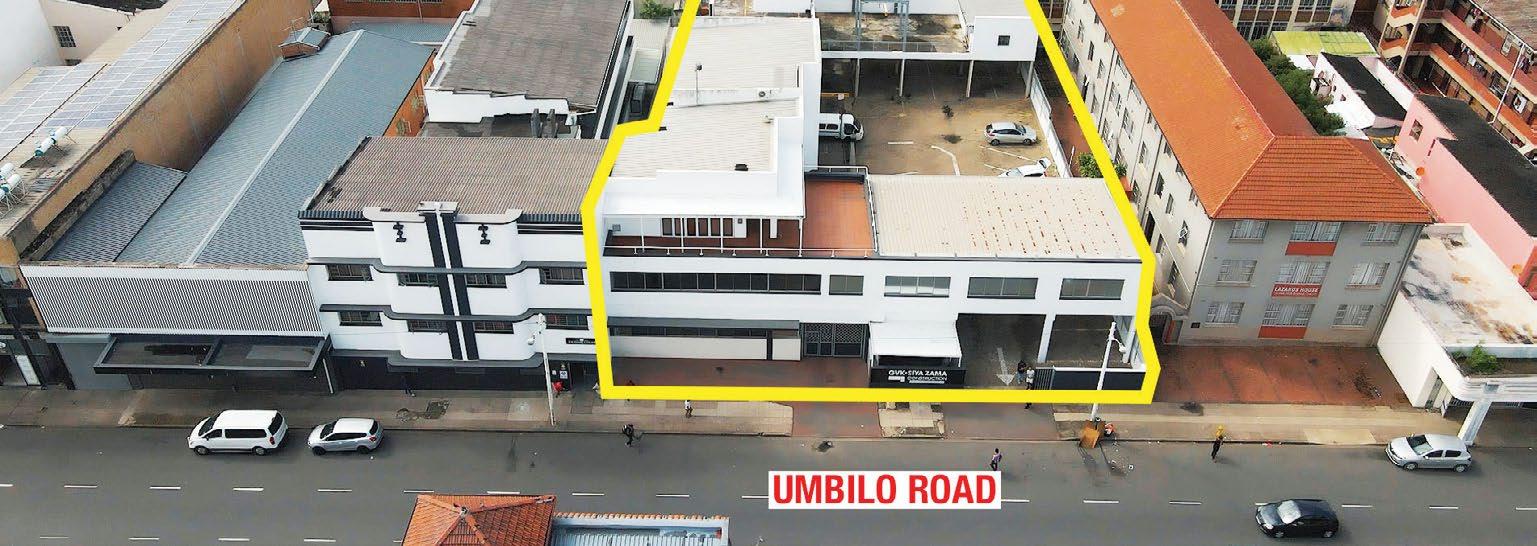

UPMARKET MIXED-USE PROPERTY WITHIN MITCHELL PARK NODE

15 Lumsden Crescent, Morningside

Site Extent: ± 2 540 m² | GBA: ± 540 m² | One of last remining residential sites with Special Consent in final stages of approval for commercial use | Potential to be sub-divided | Various open plan and individual offices, entertainment areas, ancillary units, pool | Landscaped gardens with ample parking | 3 x Access points | 2 Road frontages | Sold vacant occupation

MULTI-USE COLDROOM FACILITY

35 Fettes Road, North End, Gqeberha (Port Elizabeth)

Extent: ± 718 m² | GLA: ± 510 m² | ± 200 m² Offices/ storage | ±170 m² Warehouse | ±140 m² Cold room facility

INDUSTRIAL PROPERTY WITH SECTIONALISATION

OPPORTUNITY

13 Hagart Road, Pinetown

Extent: ± 4 245 m² | GBA: ± 1 600 m² | Versatile industrial property | Multiple income-generating units | High potential ROI | Sectionalisation opportunity available

16 TWO BEDROOM APARTMENTS IN ISIPINGO

16 Khan Lane, Isipingo Rail

Site Extent: ± 2 250 m² | GLA: ± 700 m² | Repainted, refurbished apartments | Gross Annual Income: ± R900K | Additional development land | Ample on-site parking | Positioned ± 3km from Mangosuthu University – Umlazi Campus

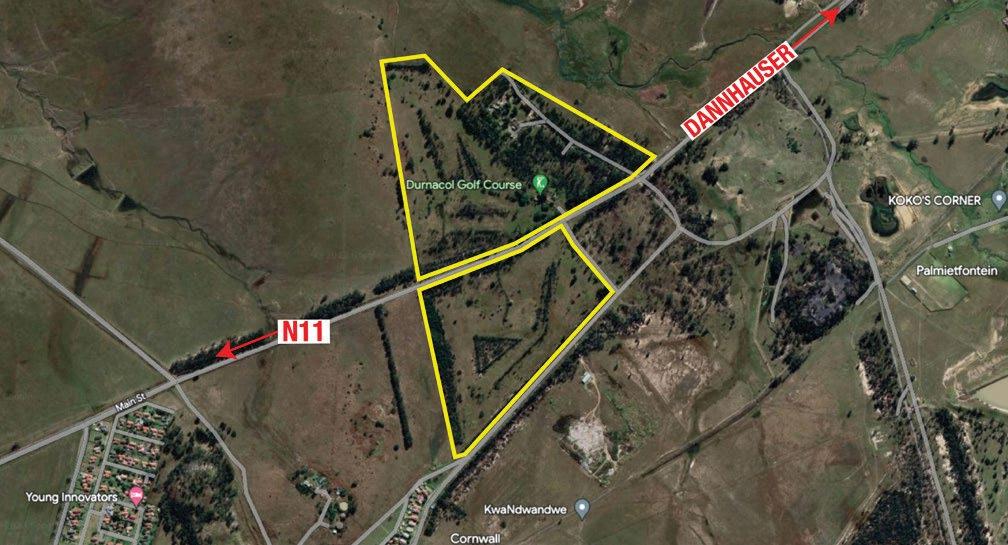

DURNACOL GOLF COURSE

± 6.3km off the N11 towards Durnacol, Dannhauser, KwaZulu-Natal

Total Extent: ± 51 Ha | 3 Adjoining portions | Currently comprised of vacant land | Easily accessed off the N11 between Dundee and Newcastle

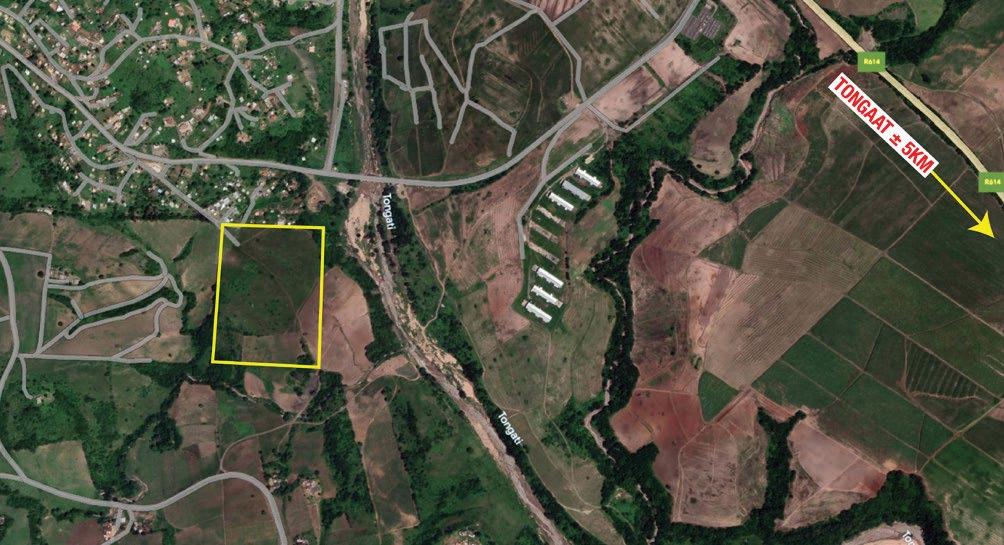

SMALL HOLDING ON THE NORTH COAST

Portion 8 of the Farm Lot 82 No. 1573, Tongaat

Extent: 10.1172 Ha | ± 2 Km of the R614 Main Road | ± 8 Km from Tongaat CBD | Situated close to the Tongati River | Good quality shale within the property

A-GRADE OFFICE BLOCK WITH BLUE CHIP TENANT IN BEDFORDVIEW

18 Skeen Boulevard, Bedfordview, Gauteng

Site Extent: ± 3 799 m² | GLA: ± 3 850 m² | Gross Annual Income: ± R 6.5 Million (excluding recoveries) | Blue Chip Anchor Tenant – Lease Expiry 2026 | 149 Parking bays | 4 Storey modern, upmarket office block in Bedfordview Commercial Node

BEAUTIFUL ESTABLISHED MOUNTAINOUS HOTEL AND RESORT

Katberg, Eastern Cape

Extent: ± 86 143m²

HIGHLY VISIBLE WAREHOUSE

6 Magnolia Street, Braelyn Industrial, East London

Extent: ± 1 721 m² | GLA: ± 2 200 m² (750m² let / 1450m² vacant) | Income: ± R62 495 ± R36 000 ending 31 March 2023) | Partially tenanted

444 769

± 5 HA UMLAAS ROAD DEVELOPMENT PROPERTY D234 The Somerfords, Camperdown

Close proximity to N3 | Part of Development Corridor | ± 50,580 m² Level land | Spacious farmhouse | Unlocked from agriculture | Huge upside

DOGON GROUP PROPERTIES

Atlantic Seaboard Office 021 433 2580

thekings@dogongroup.com

www.dogongroup.com

RHONDA RAAD PROPERTIES

Cape Town Office 082 448 7795

Email: rrpsales@mweb.co.za

www.rhondaraadproperties.co.za

SHELLEY RESIDENTIAL

KZN

Office 082 412 4463

Email: hello@shelley.co.za

www.shelley.co.za

DOGON GROUP RENTALS

Sea Point Office 021 433 2580

enquiries@dogongroup.com

www.dogongroup.com

ASKA PROPERTY GROUP

Sandown, Milnerton Estates Office 071 604 8493

Email: corlia@aska.co.za

www.askaproperty.co.za

REMAX PROPERTY ASSOCIATES

Sandown, Milnerton Estates

Office 083 653 0595

Email: cristina@remaxpa.co.za

www.remaxpropertyassociates.co.za

DOGON GROUP PROPERTIES

Southern Suburbs, Claremont Office 021 671 0258

southernsuburbs@dogongroup.com

www.dogongroup.com

PETER MASKELL AUCTIONEERS

KZN

Office: 033 397 1190

Email: info@maskell.co.za

www.bidlive.maskell.co.za

BALWIN PROPERTIES

Ballito Office 084 788 1020

Email: michelle@balwin.co.za

www.balwin.co.za

DOGON GROUP PROPERTIES

Western Seaboard

Office: 021 556 5600 or 021 433 2580

enquiries@dogongroup.com

www.dogongroup.com

VAN’S AUCTIONEERS

Gauteng Office 086 111 8267

www.vansauctions.co.za

www.iolproperty.co.za

SERENITY HILLS ECO ESTATE

Simon’s Town Office 021 786 3947/073 140 2543

Email: iporter@yebo.co.za

www.ireneporterproperties.co.za