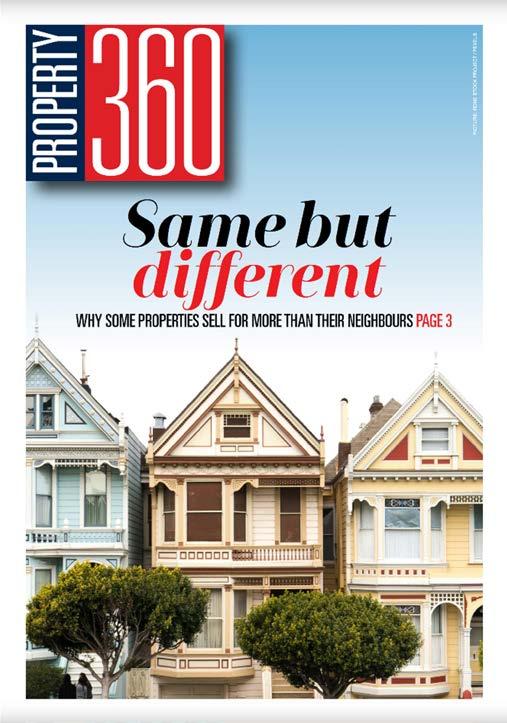

CRACKS

APPEARING IN THE NORMALLY RESILIENT PROPERTY RENTAL MARKET PAGE 3

APPEARING IN THE NORMALLY RESILIENT PROPERTY RENTAL MARKET PAGE 3

MOST tenants are under considerable financial pressure because of high inflation and rising interest rates, coupled with load shedding and low economic growth, which is creating a higher risk of unemployment.

Consequently, the rental market is increasingly competitive, and the risk of rental defaults is rising. Therefore, landlords need to be wary of unilaterally implementing rental increases that might easily prompt tenants to leave or put new tenants off, says Andrew Schaefer, the managing director of property management company Trafalgar.

He says landlords should rather focus on attracting and retaining quality tenants by “doing whatever they can to increase the desirability of their rental properties and ensure that they provide good value for money”.

How can landlords make tenants feel that they are getting great value for their rent?

Schaefer gives several tips:

✦ Provide or improve features tenants value the most at the moment, such as installing a gas stove, so that load shedding does not necessarily interrupt meal preparation, or installing an inverter and battery system to power fridges, computers and other essential items during blackouts.

✦ In freehold properties, a solar power system or, at least, a solar geyser is a drawcard. Even in sectional title homes, it is possible to increase the appeal by providing eco-friendly items that are increasingly sought-after, such as LED light bulbs, water-efficient taps and showers and sustainable flooring.

✦ Good security is also a priority, so it is worth taking steps to improve the security and safety of the property, especially if it is not located in an access-controlled complex or estate. Secure locks, burglar guards and good outdoor lighting are essential, and landlords should consider adding electric fencing, security cameras and an alarm system if possible.

✦ Good maintenance and prompt repairs are vital to ensure that the grounds and exterior of the property always look well-maintained and inviting, and that the interior is clean, well-lit and visually appealing. “Tenants also really appreciate quick and positive responses to requests for essential repairs,” Schaefer says.

✦ Wrap the cost of certain amenities into the rent, such as high-speed internet, laundry facilities, secure parking and additional storage space, or even a certain amount of prepaid electricity.

✦ Maintain good communication and giving good customer service. “This creates a positive landlord-tenant relationship and a sense of satisfaction and loyalty that encourages tenants to stay put and renew their leases,” he says. “And it is always preferable to retain a quality client who looks after the property and pays the rent on time, even if you have to settle for a lower increase when renewing.”

✦ Offer lease flexibility and incentives, for example in some areas, landlords may find that shorter lease terms are attractive to certain tenants, such as those on six to eightmonth work contracts, and that they are prepared to pay a premium rental rate for this convenience. On the other hand, landlords may want to consider incentives for great long-term tenants who renew, such as a smaller rental increase, or an increase only once every two years.

But before making any changes, Schaefer says, landlords should engage a qualified and experienced rental agent to advise them about current rentals in the area and what “extras” tenants are looking for, and to ensure that all potential tenants are properly screened.

“Finding new tenants who are reliable is increasingly difficult because of the financial problems many people are experiencing, so it is really important to be sure that anyone who is moving into your rental property is not only creditworthy and employed, but also has a good rental payment record.”

WHILE it can be a lengthy process to evict tenants who fail to pay their rent, there are procedures in place to make sure that the tenant’s and landlord’s rights are protected.

Following the necessary steps is key to a hassle-free eviction process.

Adrian Goslett, the regional director and CEO of Re/Max of Southern Africa, explains that both the tenant and the landlord must play fair in respect to their rental agreement.

“It is crucial to abide by the contractual agreements and, if not, to then proceed with the required legal procedures stipulated in this regard. It is only when people deviate from this that issues start to occur,” he says.

Tenants are protected by two pieces of legislation:

✦ The Prevention of Illegal Eviction from Unlawful Occupation of Land Act, No. 19 of 1998 (PIE Act).

✦ The Rental Housing Act of 1999 (RH Act) as amended.

The PIE Act sets out the process for evicting tenants and the RH Act makes it

a criminal offence for a landlord to simply cut the supply of electricity or water, change the locks, confiscate tenants’ belongings or stop a tenant from having access to the property.

“It is vital to always play by the rules. While you might think you can get a nonpaying tenant out quicker if you change the locks or defer to other intimidation tactics, the truth is that this will most likely provide the tenant with ammunition to use against you in the court proceedings. This will only drag things out further and cause more unnecessary complications and delays,” says Goslett.

Although it might be forgivable for the odd late payment if it’s a bank or financial system-related problem, a landlord cannot be so lenient if their tenant gets into the habit of paying their rent late.

“Because the monthly payment date forms part of the rental agreement, which must also comply with the Consumer Protection Act, when a tenant doesn’t pay on time, they are technically in breach of contract. Legally, this means that a landlord should send the tenant a formal

letter explaining that they have 20 business days to make the payment, and if they don’t pay their rent in that time, their lease will be cancelled,” Goslett explains.

If the tenant fails to pay what is due in the stipulated timeframe, the landlord can legally terminate the lease and ask them to leave. If the tenant refuses, the landlord can then take out a court order to evict the tenant for breach of contract.

“This process can take up to six months, during which your tenant can stay in your property and will probably still not pay rent. Once the eviction is granted, the tenant is usually given at least another 14 days to find new accommodation before the eviction order is executed,” says Goslett.

The eviction process can be lengthy, so he suggests taking steps as soon as possible to prevent too great a loss of income.

“The longer you take to act on a late or missed payment, the longer it will be before you can legally evict a tenant who continues to miss payments.”

ALTHOUGH the residential rental property market has remained surprisingly resilient in recent quarters despite the financial stress consumers are under, the number of tenants in good standing deteriorated in the first quarter of 2023 in all provinces, according to TPN’s latest Residential Rental Monitor report.

The resilience has been driven by the high interest rate, which has dissuaded potential buyers, says Waldo Marcus, the industry principal at TPN Credit Bureau.

The expectation of further interest rate hikes will serve to retain a healthy demand for residential property.

However, although rental growth continues to improve, Marcus says property investors need to keep a close eye on the financial health of consumers and their ability to keep paying their rentals.

The Residential Monitor Report reveals that vacancies were at 6.19% in the first quarter of 2023. TPN’s Market Strength Index, which measures the perceived demand and availability of supply within the residential rental market, remains strong at 9.14 points above equilibrium, a figure last seen in 2017.

“Traditional market factors indicate that the residential rental market is buoyant, with improved returns and lower vacancies.

“A further interest rate hike before the end of the year is expected to further deter property purchases and retain healthy demand for residential rental property,” Marcus says.

However, TPN’s data reveals that tenants in good standing have declined slightly for three consecutive quarters as economic challenges continue to filter into households.

This mirrors the result of the National Credit Regulator’s age analysis which indicates that almost all consumer credit types in good standing deteriorated slightly in the same period.

TPN’s Squat Index, defined as the number of tenants who, monthly, fall into a category of non-payment, has also seen an increase in the past two quarters.

Marcus points out that a decrease in credit good standing is typically a predictor of rental payment rates.

“Although overall sentiment in the sector remains positive, property owners need to consider how a tenant’s late or no payment will impact them.

“Tenants classified as squatting pose a severe risk to the ability of landlords to collect and recover rental due. Landlords, therefore, need to act proactively and utilise the various legal tools available to them to collect the outstanding rental.”

He further advises that escalations should be considered cautiously, given that consumers are under extreme and everincreasing pressure.

“Landlords need to take advantage of the current market strength but bear in mind that there is an upward trend in the number of tenants classified as squatting. They, therefore, need to ensure that adequate tenant risk monitoring is

implemented to mitigate the risk of an increase in defaulting tenants.”

The residential market recovered faster than most property sectors post Covid-19, with reduced vacancy rates and steadily recovering rental escalations.

The sector’s recovery was assisted by an aggressive interest rate hike cycle which dissuaded potential buyers from entering the property market.

FNB’s House Price Index, which peaked in the first quarter of 2021 to 5.1%, dropped to 2.3% in the first quarter of 2023 as a result of interest rate hikes and is expected to remain around this number for the balance of 2023.

Rental escalations have been recovering since mid-2021 as demand for residential rental property grew, providing property owners with an opportunity to play catchup with the consumer price index which, at the end of March 2023, was 7.1%.

“A pause in the interest rate hiking cycle by the South African Reserve Bank in July 2023, for the first time since November 2021, would have provided some relief to a severely stretched consumer base,” says Marcus.

“We expect residential rentals to continue their gradual climb but to slow towards the end of 2023 as the balance between rental growth and vacancies becomes a finer balancing act.”

The TPN report found that tenants in the Western Cape were the most committed to paying their rent while those in KwaZuluNatal had the highest number of squatting

tenants, up from 4.67% in the fourth quarter of 2022 to 5.09% in the first quarter of 2023. Gauteng is only marginally behind in the number of squatting tenants, at 4.58%.

When it comes to rental payment performance by the rental band, tenants paying R3 000 or less a month – the lowest rental band – continue to struggle to pay their rental, with a continued deterioration of tenants in good standing.

Tenants paying between R7 000 and R12 000 have been the best-performing category of tenants since 2014, with the highest proportion of tenants in good standing of all rental bands, followed by tenants paying between R12 000 and R25 000 a month.

The luxury market – defined as rental properties costing more than R25 000 a month – has the highest vacancy rate.

Marcus explains that although a lower vacancy rate and higher escalations are a move in the right direction, ultimately, a successful property investment relies on the ability of tenants to pay their rent.

“Early signs indicating that consumer credit repayments are slipping, combined with lacklustre economic growth, cloud the positive outlook for the residential rental market for the rest of the year.

“The current economic landscape means that the risk of defaulting tenants is more likely, making proper background checks and vetting more important now than ever before. The right tenant in the right rental bracket is gold right now.”

As landlords take advantage of increased interest, they also need to keep in mind the increasing number of defaulters, and mitigate the risksThe rental property market is showing resilience as interest rate hikes deter potential homebuyers but more tenants are struggling to pay rent. PICTURE ANDRES AYRTON / PEXELS

WE’D LIKE TO introduce the realest agent to help take off those rosetinted glasses. The realest agent would probably say things like, ‘Yes, the trees are lovely and create a lovely, shaded area for those hot summer days, but they seem rather close to the drain.’

And keeping it real also means knowing how you can save money and time through a simplified process of accessing funds, after these real home occurrences come up. If you need a financial partner who keeps it real, ask about HomeVision with your Nedbank home loan and save time and money upfront for those future home needs.

It’s almost impossible to buy ‘the perfect home’ – after a few

years of settling in, there’s always going to be something you want to do. HomeVision will allow you to register a higher loan amount at the deeds office (up to 30% more than the property price, up to a maximum of R5 million), so that when you need extra money at a later stage, a portion or all of it can be applied for easily after a few quick checks. Nedbank will only need to do an affordability check and a property valuation when you apply for these funds, which can be used for any need you have. Only once you use some or all of your readvance funds will the interest rate and monthly instalment be reassessed.

The benefit is that you don’t

have to apply for a further loan, which can be a lengthy process and will cost you additional registration fees.

Ask for HomeVision when you apply for your home loan and get access to funds to use in the future without having to register another loan. Simply call 0800 555 111 to speak to a home loan expert who will guide you through the process, or ask us to call you.

If you apply online, you can get up to R20 000 cash back and 50% discount on your attorney bond registration fee. Join the bank that’s best for your money.

Terms and conditions apply

We understand that buying property is a big step... and having someone who’ll keep things real with you is just as important as bagging the best deal.

R 1 295 000

2 BEDROOMS | 2 BATHROOMS

SPACIOUS APARTMENT IN DIEP RIVER.

2 bedroom 2 bathroom apartment in Clarewood, Diep River, a short walk to the station, Martins Bakery and other local amenities, above the railway line.

• Fitted kitchen with electric oven, hob and extractor and plumbing for washing machine.

• Open-plan lounge with parquet flooring

•Two double bedrooms with an en-suite bathroom complete with bath and shower. • Covered Parking bay. • Prepaid electricity

ERF: 1471m2 | HOME: 70m2 | RATES: R 450 p/m | LEVIES: R 1500 p/m

PLEASE CONTACT: Collin Mbiriri on 071 879 8564 or email cmbiriri@gmail.com or mmnyandoro@gmail.com

Erf 509 Witfontein Ext 30 in extent of 1029m² and known as, 2 Reedbuck Close, Serengeti Estate, Witfontein, Kempton Park - The property comprises of a levelled undeveloped tract of land & is located in a cul-de-sac in the Serengeti Estate which is one of Gauteng`s premier and exclusive lifestyle estates & one of the country's most naturally beautiful locations

Ref.: T000250/2023

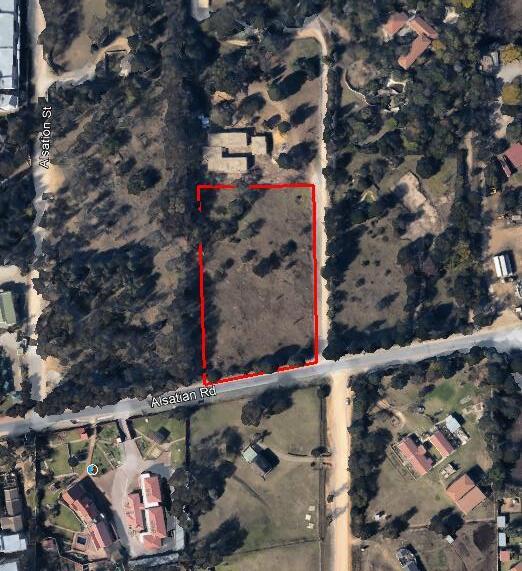

Portion 1 of Holding number 621 in the Glen Austin Agricultural Holdings, Ext 3 in extent of 8565m² and known as 20 Alsatian Road, Glen Austin AH

The property comprises of a levelled undeveloped tract of land located in the suburb of Glen Austin & situated about half way between Johannesburg and Pretoria.

Bidding opens 13 th September 2023 at 10h00 & closes *from 10h00 on 14th September 2023 Erf

Contact Danielle Hoskins (Candidate Property Practitioner l Registered with the PPRA) on 082 801 6827 / 033 397 1190 • R50 000 buyer's card deposit payable by EFT • 10% deposit on purchase price payable by successful bidder on fall of hammer • FICA to be provided • “Above subject to change without prior notice • Sale subject to confirmation (E&OE)

TUES, 22nd AUG 2023 @ 12 NOON https//:bidlive.maskell.co.za

Bidding opens Tuesday, 22 nd August 2023 at 12h00 & closes *from 12h00 Wednesday, 23 rd August 2023

DOGON GROUP PROPERTIES

Atlantic Seaboard Office 021 433 2580

thekings@dogongroup.com

www.dogongroup.com

RHONDA RAAD PROPERTIES

Cape Town Office 082 448 7795

Email: rrpsales@mweb.co.za

www.rhondaraadproperties.co.za

ASKA PROPERTY GROUP

Sandown, Milnerton Estates

Office 071 604 8493

Email: corlia@aska.co.za

www.askaproperty.co.za

DOGON GROUP RENTALS

Sea Point Office 021 433 2580

enquiries@dogongroup.com

www.dogongroup.com

DE PLATTEKLOOF

Cape Town 060 960 0100

Email: live@deplattekloof.co.za

www.deplattekloof.co.za

IRENE PORTER PROPERTIES

Simon’s Town Office 021 786 3947

Debbie 073 140 2543

www.ireneporterproperties.co.za

DOGON GROUP PROPERTIES

Southern Suburbs, Claremont Office 021 671 0258

southernsuburbs@dogongroup.com

www.dogongroup.com

PETER MASKELL AUCTIONEERS

KZN

Office: 033 397 1190

Email: info@maskell.co.za

www.bidlive.maskell.co.za

MURAMBI HOUSE

Wynberg Office

murambihouse@telkomsa.net

www.murambi.co.za

DOGON GROUP PROPERTIES

Western Seaboard

Office: 021 556 5600 or 021 433 2580

enquiries@dogongroup.com

www.dogongroup.com

VAN’S AUCTIONEERS

Gauteng Office 086 111 8267

www.vansauctions.co.za

www.iolproperty.co.za