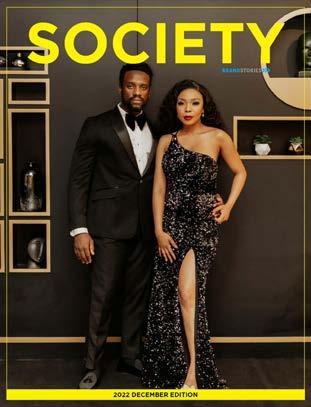

THE RETIREMENT ISSUE

BY DHIVANA RAJGOPAUL

BY DHIVANA RAJGOPAUL

THE WAY women and men spend their money before and after retirement is different and, therefore, so is their thinking about retirement.

Women should start saving towards retirement as soon they start working, even if they work as a part-time student, says Kerry Sutherland, a certified financial planner at Alexforbes.

“Should you wish to receive 75% of your final salary at age 60, you have to start saving 19.1% of your salary from the age of 20. Should you start at age 40, this savings requirement increases to 49% of your salary.

“It is difficult to apportion one’s monthly budget between debt repayments, life insurance

and living expenses, but the earlier you start, even if this is a small percentage, it will have more than 40 years to compound, and this has a substantial effect on growth over time.”

There are many factors that have an impact on the retirement plans of women, including:

✦ On average, women live five years longer than men. This means that women need to save more money for a longer retirement, with more years of expenses to pay.

✦ Women taking time off work to start a family or have a baby could reduce the number of years they contribute to their retirement savings overall.

✦ Women can be too conservative with their portfolio choices in

the long term.

✦ The salary gap between men and women means less income is available to save for retirement.

5 important things to note to help women start saving for retirement

1Start early Hildegard Wilson, a product solution design specialist at Momentum Investments, says women should start saving for retirement as early as possible.

“Even if it is a small amount every month, over time, this can become a significant sum of money.”

Sutherland adds: “You can make use of a tax-free savings account. You can contribute up to R36 000 a year. It is advantageous

to start these as early as you can, as they have a lifetime contribution limit of R500 000, but all growth in these funds is tax-free.”

2Don’t cash out your retirement when changing jobs Should women choose to quit their jobs or change employers, they should not cash out their company retirement fund.

Rather, she says, they should leave this in the fund as a paidup member or transfer to a preservation fund or retirement annuity, where it can continue to grow.

“If possible you should continue to save while you are staying home. Your family budget during this period should include savings towards your retirement.”

Echoing this, Wilson says one of the biggest reasons for people not having enough retirement savings includes the lack of preserving retirement savings when changing jobs and not saving towards retirement.

3

Speak to a financial adviser

A financial adviser can ensure that a woman’s investment portfolio in her retirement fund or savings matches her risk profile and the strategies she wishes to follow at retirement.

Wilson also notes that retirement planning is “very personal”.

“Just as women’s retirement

planning differs from men’s, each woman’s situation is unique. Therefore, it is important to seek advice from a financial adviser who can look at your personal retirement plan and help you on your journey to success.”

4

Don’t draw from your retirement fund too early She says the goal is to retire as late as possible because the longer women delay drawing an income from their retirement savings, the greater the chance they will be able to cover their expenses throughout retirement.

“This does not mean you need to stay working for as long as possible but it could also mean turning a hobby into a source of an additional income to delay drawing from your retirement fund.”

5

Manage taxable income Sutherland says women who have a taxable annual income should make use of retirement fund vehicles for savings either through their company retirement fund or a private retirement annuity.

“Contributions into these funds are tax-deductible (within certain limits) and, in addition, there is no capital gains tax, dividends tax or tax on interest within the retirement fund.

“This means it compounds more over time compared to, for example, a unit trust where these taxes are deducted on growth in the product.”

Various factors and individual circumstances affect how women invest money for later years compared to men

MODERN retirement developments, with their focus on quality lifestyles, well-being, and community, are a far cry from the often-restrictive “old-age homes” of the past, but choosing to make the move can be a tough task.

Not only are you faced with the prospect of making a huge physical life change, but the idea can also affect you psychologically, depending on how you view your looming retirement years.

Even if you are keen on moving into a thriving retirement community, you could feel overwhelmed by the number of new accommodation choices available. You also have to choose the right home, and the right area in which to enjoy your golden years.

Another choice you need to make is the type of property purchase that will work best for you. There are three possibilities offered in retirement villages – life rights, freehold purchases and sectional title purchases.

FIND US HERE:

@iolproperty

@iolproperty @iolproperty.co.za

Life rights essentially means that once you pass away and your unit is resold, your estate gets back the amount you paid for the property, minus some costs, but no profit made on the sale. However, it does come with other benefits.

Furthermore, most retirement complexes no longer offer outright ownership, says Jason Appel, financial planner at Chartered Wealth Solutions.

“Internationally, it’s mostly life rights, but we’re still getting used to it here.”

Life rights options are more budget friendly than ownership.

“You can generally get a life rights unit at a lower cost than outright ownership. You do pay levies, but these cover all external maintenance, security and, perhaps, a meal a day. And the fact that there’s a maintenance team on the property to respond quickly to any problems.”

Levies also cover care of the garden, a swimming pool – if there is one – and all communal areas.

If you go for life rights,

however, you forgo the capital appreciation in the property’s value.

“This growth is hard to estimate as residential property valuations vary quite drastically. I would suggest that people consult their financial planners before making the decision.”

One of the main benefits of life rights, he explains, is that if you live to a really old age, and you run out of money, the village will not throw you out. Rather, the cost of your continued care is deducted from the capital amount you paid upfront.

“For example, if you paid R1.5 million for a flat, and the village cares for you for an extra few years after your money runs out, after selling the unit, your estate will get the R1.5m minus the care costs. There may well be other deductions too, such as a sales commission and/or an amount to refurbish the unit for the next purchaser.”

Appel says people sometimes avoid life rights because the feeling is that their heirs will lose out on

the initial investment. However, personally, he would rather know his parents were being well cared for and that there was no risk of him having to put in extra money down the line.

“You’re paying upfront for the occupation of the building for you and your spouse for the remainder of your lives.”

Echoing this, Rob Jones, the managing director of Shire Retirement Properties, says details differ from village to village, but life rights usually means that if you pass away and your unit is sold, your estate will get back the amount you paid, but not any portion of the increase in value (gain).

“In some estates, a share of the profit will be paid to your estate; in others, you will get back a bit less than you originally paid.”

He adds: “Life rights can be a bit cheaper as a capital investment because the developer knows he can make a profit over and over again, as he resells the unit over the years. In essence, the life rights village owner wants to look after

the building because he wants to resell it.”

FREEHOLD PURCHASE

The option, Jones explains, means you own the land and building. It is your responsibility and you pay rates and taxes as there is a registered title deed in your name.

“You can leave it to your heirs and any gains in value would be for you. There may be some exit levy to pay to the complex, but it differs from place to place.”

SECTIONAL TITLE

Here, you own a portion of the building, for example, an apartment or townhouse.

“You will have a title deed and you can leave it to your estate. You are responsible for internal maintenance, while the body corporate takes responsibility for outside maintenance as a general rule. You pay for that in your levies, of course.

“There may be some exit levy to pay to the complex, but it differs from place to place,” Jones says.

DISCLAIMER: The publisher and editor of this magazine give no warranties, guarantees or assurances and make no representations regarding any goods or services advertised within this edition. Copyright ANA Publishing. All rights reserved. No portion of this publication may be reproduced in any form without prior written consent from ANA Publishing. The publishers are not responsible for any unsolicited material.

Publisher Vasantha Angamuthu vasantha@africannewsagency.com Executive editor Vivian Warby vivian.warby@inl.co.za

Features Writer Bonny Fourie bronwyn.fourie@inl.co.za Design Kim Stone kim.stone@inl.co.za

There are many benefits to choosing this option of three possibilities when you retire but there are also conditions that you might not be keen on

FOR THOSE who want to live in a community-centric development, investing in a sectional-title residence or freehold ownership within a secure estate might be the best option.

Capri Village offers sectional title and freehold ownership, allowing purchasers to benefit from capital appreciation and leave a legacy for their loved ones. Investing in freehold ownership also allows homeowners to customise and create their dream home while building equity.

With independent living, pet-friendly homes, professional medical services and state-of-the-art security, Capri Village offers a lifestyle that stands out from other retirement options.

Residents of Capri Village will have access to all Salta Sibaya’s features and facilities, including the Marine Walk shopping centre, an exclusive residents’ clubhouse comprising an indoor heated pool, Bocce ball, library, bar and areas for entertaining. Here, a community of like-minded residents with a zest for life can relax and socialise within the convenience of the estate. Those who prefer to spend their leisure time outdoors will also enjoy Salta Sibaya’s green parks and extensive nature trails, as well as its proximity to uMdloti’s 6km of pristine beaches surrounded by lush coastal forest.

Stands and one-, two- and three-bedroom residences at Capri Village are available, with prices starting from R1 295 000 for land and R2 705 000 for homes.

Call 087 550 1300 for more information or visit www.saltasibaya.co.za/#capri_village.

When purchasing a property in your mature years, it is important to consider your retirement plans and lifestyle aspirations

DE PLATTEKLOOF Lifestyle Estate is located in the most exclusive suburb in the Cape’s Northern Suburbs and offers a five-star lifestyle for the over-fifties.

De Plattekloof is celebrating its fifth birthday and is close to completion, with only a few of its full title ownership opportunities available.

These include Independent Living Apartments, Assisted Living Apartments and Independent Homes.

Three of the Independent Living Apartment options –Bloemendal, Lebenstijn, and Diemerskuijl – are sold out and complete.

Launched in the fourth quarter of 2022, De Hoogekraal is under construction and 60% is sold out. It is set for delivery in the first quarter of next year, and offers one- and two-bedroom Independent Living Apartments priced from R2.387 million (including transfer duty and a parking bay).

De Hoogekraal has an excellent setting within the estate, fronting and overlooking The Manor House Garden.

The Tijgerzicht Assisted Living Apartments are complete, with 75% of them sold. The remaining available 27 units include studio and one- and two-bedroom suites priced from R1.406m (including transfer duty).

Forty-five modern and spacious two- and three-bedroom Independent Homes have been constructed and released to market, with only 22 homes still for sale. These are priced from R4.995m (including transfer duty) and are the perfect choice for retirees who are self-sufficient and wish to continue living an expansive and luxurious lifestyle.

Phase 1 of The Manor House Garden is also complete. It includes an outdoor recreational area, covered seating, a bowling green and numerous trees, forming a centralised green zone within the estate where residents can enjoy the facilities or simply relax and take in the views and peaceful gardens.

De Plattekloof Lifestyle Estate is a full-ownership, sectional title development, which means that you own the property and benefit from its future capital growth. This is different from life rights schemes, where units are merely “sold” to you for the remaining years of your life.

Johan Laubscher, from Arun Holdings (Pty) Ltd which

partnered with Old Mutual Alternative Investments on the estate, explains: “Calculated over a 10-year period, this capital growth on your fully owned property at De Plattekloof could entail a significant component that could be added to your estate. It could also be kept as an investment by your children and be rented out, again, unlike with life rights schemes. In this way, it continues to create generational wealth, which can be carried forward.”

The estate has a first-class Care Centre on site, which is housed in Tijgerzicht and is complete.

Laubscher adds that De Plattekloof Lifestyle Estate is one of the “few lifestyle-orientated retirement schemes in the Western Cape that makes provision for age-appropriate care” with its Assisted Living Units and Care Centre, which is run by Medwell SA.

Situated adjacent to Baronetcy Estate and sharing the same developer, De Plattekloof offers proximity to the city. It is within 10 minutes’ drive of Panorama Mediclinic with its world-class facilities, and offers comprehensive,

The elevated position of the estate means that many apartments and homes offer iconic, panoramic views of Table Mountain, Table Bay and Robben Island.

Other amenities that residents enjoy include a restaurant, lounge and bar, braai and function facilities, a coffee shop, library, hair and beauty salon, a soon-to-be-completed heated pool and treatment room and future clubhouse.

Activities range from a bridge club, music club and choir to a reading club and cinema and theatre nights. Interested parties are invited to make an appointment for a private tour of the estate and its show units Call Dawid Prinsloo at 060 960 0100, or email live@deplattekloof.co.za. For more information, visit www.deplattekloof.co.za

Virtual tours of show units for all categories of properties at De Plattekloof are available at www.deplattekloof.co.za/virtual-tours/

ticks all the right boxes for a luxurious retirement lifestyle

De Plattekloof Lifestyle Estate is located in the most exclusive suburb in the Cape’s Northern Suburbs and offers a five-star lifestyle for the over-fifties

The Cotton Club frail care centre is situated in the scenic, calm and tranquil grounds of the boutique, upmarket Palm Garden Retreat retirement complex in Sea Point, Cape Town. Offering long-term frail care services for elders aged 55 and over, the beautifully renovated frail care centre has a warm, caring environment where our residents feel at ease.

The eight single rooms each have an en-suite toilet and basin, and assisted shower and bath facilities are located on the wing. Each room has a TV, including DStv, and a nurse call system.

Our qualified and compassionate nursing staff offer 24/7 world-class palliative care, while making your loved one feel at home. Our activities, including in-house occupational

therapy, ensure that our Residents are happy and active, and we encourage visits from family members and friends.

We provide a delicious breakfast, lunch, dinner and two tea snacks daily, overseen by a professional dietician.

R 1 295 000

2 BEDROOMS | 2 BATHROOMS

IN DIEP RIVER.

2 bedroom 2 bathroom apartment in Clarewood, Diep River, a short walk to the station, Martins Bakery and other local amenities, above the railway line.

• Fitted kitchen with electric oven, hob and extractor and plumbing for washing machine.

• Open-plan lounge with parquet flooring

•Two double bedrooms with an en-suite bathroom complete with bath and shower. • Covered Parking bay. • Prepaid electricity

ERF: 1471m2 | HOME: 70m2 | RATES: R 450 p/m | LEVIES: R 1500 p/m

PLEASE CONTACT: Collin Mbiriri on 071 879 8564 or email cmbiriri@gmail.com or mmnyandoro@gmail.com

Duly instructed by the Trustees of the Insolvent Estate of TK and VTZ Khanyile, Master Ref: D53/2020

The property comprises: lower level: reception area, 2 lounges, study, glass enclosed verandah, O/P lounge and kitchen serviced by a pantry & scullery. Entertainment area with bathroom, billiards room and a fully fitted cinema room & two en suite bathrooms. Upper area: Landing with a fitted office, 5 en - suite bedrooms with a large main bedroom. Further improvements: 2 - dbl garages; covered entertainment area overlooking the swimming pool; Servant’s quarters comprising of 3 rooms, ablutions and an open plan lounge kitchen area

TENDER CLOSING DATE : 12 APRIL 2023 at 12H00 • For further details & tender documents, contact Danielle Hoskins (Candidate Property Practitioner) on 033-3971190 • 082 801 6827 or email danielle@maskell.co.za or visit our website www.maskell.co.za • Tenders are to be delivered in a sealed envelope to JV Hart, Executors of Estates, Unit 1, Block C, 460 Townbush at Cascades, Montrose, Pietermaritzburg, 3201, Attention: Kate Guiot and clearly marked “Insolvent Estate TK & VTZ Khanyile - Tender document” • “Above subject to change without prior notice” “E & O • Sale is subject to confirmation

2 Workshops | 57 Parking bays

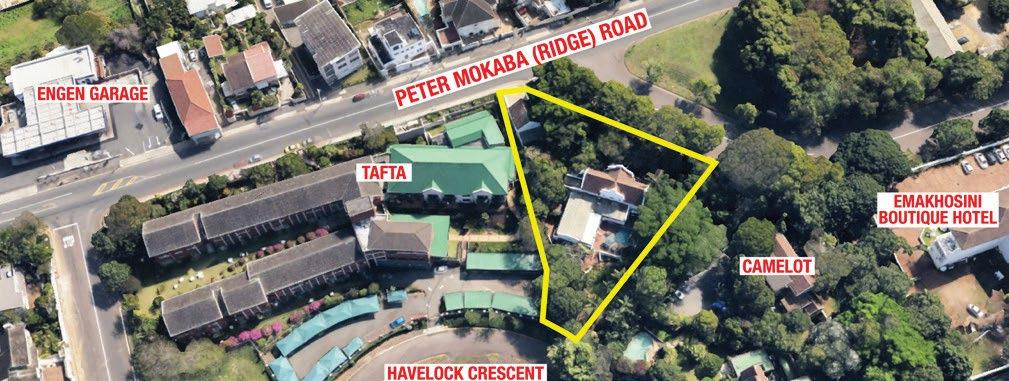

UPMARKET MIXED-USE PROPERTY WITHIN MITCHELL PARK NODE

15 Lumsden Crescent, Morningside

Site Extent: ± 2 540 m² | GBA: ± 540 m² | One of last remining residential sites with Special Consent in final stages of approval for commercial use | Potential to be sub-divided | Vacant occupation

INDUSTRIAL PROPERTY WITH SECTIONALISATION

BEAUTIFUL ESTABLISHED MOUNTAINOUS HOTEL AND RESORT Katberg, Eastern Cape Extent: ± 86 143m²

HIGHLY VISIBLE OFFICES IN SOUTHERNWOOD 9 Wynne Street, Southernwood, East London, Eastern Cape Extent: ± 709 m² | GLA: ± 330 m² | Vacant occupation

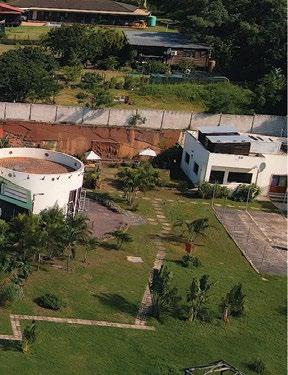

DURNACOL GOLF COURSE ± 6.3km off the N11 towards Durnacol, Dannhauser, KwaZulu-Natal

Total Extent: ± 51 Ha | 3 Adjoining portions | Currently comprised of vacant land | Easy access off the N11 between Dundee and Newcastle

DOGON GROUP PROPERTIES

Atlantic Seaboard Office 021 433 2580

thekings@dogongroup.com

www.dogongroup.com

RHONDA RAAD PROPERTIES

Cape Town Office 082 448 7795

Email: rrpsales@mweb.co.za

www.rhondaraadproperties.co.za

SHELLEY RESIDENTIAL

KZN

Office 082 412 4463

Email: hello@shelley.co.za

www.shelley.co.za

DOGON GROUP RENTALS

Sea Point Office 021 433 2580

enquiries@dogongroup.com

www.dogongroup.com

DE PLATTEKLOOF

Cape Town 060 960 0100

Email: live@deplattekloof.co.za

www.deplattekloof.co.za

PALM GARDEN

Sea Point Office 021 430 6200

operationsmanager@palmgarden.co.za

www.palmgarden.co.za

The Cotton Club frail care centre in the scenic, calm and tranquil the boutique, upmarket Palm retirement complex in Sea Point, Offering long-term frail care elders aged 55 and over, renovated frail care centre caring environment where our at ease.

DOGON GROUP PROPERTIES

Southern Suburbs, Claremont Office 021 671 0258

southernsuburbs@dogongroup.com

www.dogongroup.com

PETER MASKELL AUCTIONEERS

KZN

Office: 033 397 1190

Email: info@maskell.co.za

www.bidlive.maskell.co.za

MURAMBI HOUSE

Wynberg Office

murambihouse@telkomsa.net

www.murambi.co.za

The eight single rooms each have toilet and basin, and assisted bath facilities are located on the Each room has a TV, including nurse call system.

Our qualified and compassionate staff offer 24/7 world-class while making your loved one Our activities, including

DOGON GROUP PROPERTIES

Western Seaboard Office: 021 556 5600 or 021 433 2580

enquiries@dogongroup.com

www.dogongroup.com

VAN’S AUCTIONEERS

Gauteng Office 086 111 8267

www.vansauctions.co.za

www.iolproperty.co.za

WIDENHAM RETIREMENT

VILLAGE South Coast, KZN 066 306 0669 / 066 306 0612

www.hibiscusrv.co.za

www.widenhamretirementvillage.co.za