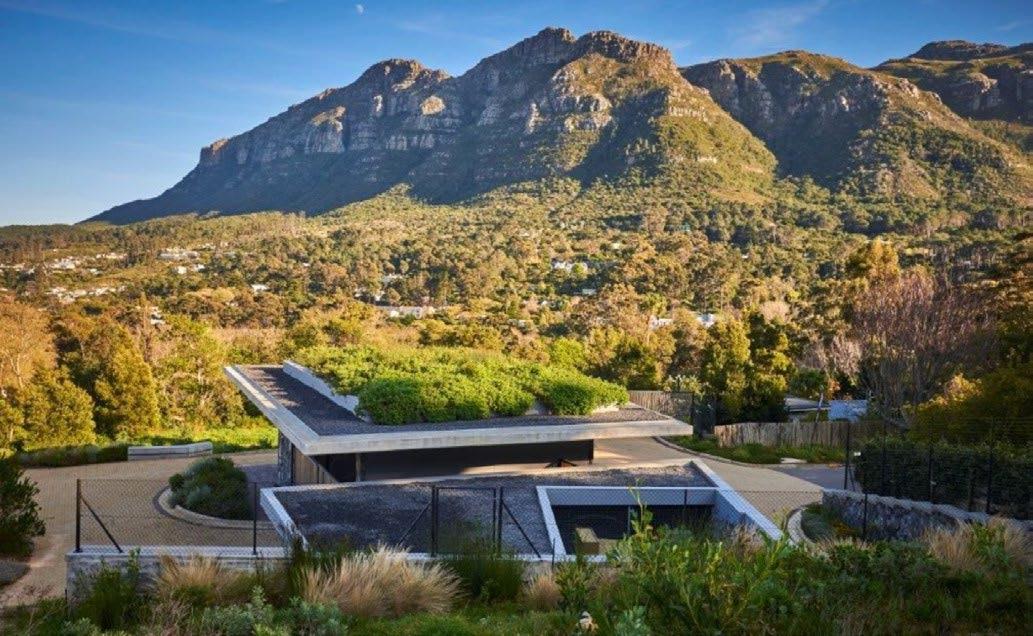

PROPERTY trends, just like life, are ever-evolving, but one which experts agree will be huge this year –and grow consistently in years to come – is the demand for green homes.

Homeowners are increasingly investing in off-grid and climatefriendly facilities, and more buyers are placing value on such offerings.

While this is not just being seen in South Africa and is a growing global trend, the constant power outages due to load shedding and electrical faults, plus inconsistent water service delivery in many parts of the country, makes green homes even hotter.

Some property professionals estimate that investing in certain installations could add up to R1 million to your home’s value.

Thanks to regular load shedding and power failures, Ally Nezar, the head of growth at Kandua.com, says solar panels and boreholes are on every homeowner’s wish list, and that the trend will not be slowing in 2023.

“Kandua.com’s data shows that solar power and boreholes are increasingly in demand as they enable homeowners to secure their supply of water and electricity.”

The statistics show that bookings for solar power and

borehole installation service providers increased by 71% and 60% respectively in the past 12 months.

The company’s architectural technologist Eric Turck adds that most solar energy systems deliver reliable electricity supply for 25 years-plus while ensuring that productivity is retained if you work from home.

“You’ll usually recoup the installation costs in just a few years, and homes fitted with solar technology sell more quickly than homes without alternative power options. This makes solar energy a good investment for homeowners, and one that a growing number of households will make in the new year.”

Citing Lightstone’s latest estate agents’ survey, Carl Coetzee, the chief executive of BetterBond, agrees that an increasing number of buyers want homes with solar power and other green features.

“With no end in sight to load shedding, homeowners are willing to invest in homes that offer alternative energy options. Some banks include finance options for solar solutions with their bond offering.

“There is the assurance that while paying off a bond, you are also paying for your solar system which will offer a reprieve from

load shedding.”

With Stage 6 load shedding firmly in effect and the threat of Stage 8 blackouts looming, Grant Smee, the property entrepreneur and managing director of the Only Realty Property Group, says it is no wonder many households are turning to “off-grid” power sources to keep the lights on and return to some semblance of normality.

“Solar power has emerged as the most popular alternative energy option due to its relatively quick installation, soundless efficiency (unlike a noisy generator), its environmental benefits, and the prospect of lower future energy bills.

“However, the upfront costs associated with solar installation may be prohibitive for the average middle-class homeowner, with options ranging from between R59 000 and R289 000, according to pricing from solar provider Solana Energy.”

Fortunately, he adds, the increased popularity of solar power has given rise to a variety of innovative financing options to make it more accessible and affordable.

These include:

✦ Outright purchase

Buying the system outright using one’s own funds

✦ Financing the system

“Some of the major banks now offer the ability to ‘add the cost of solar installation to one’s home loan.”

✦ Rent-to-own

Smee says various solar financing companies have popped up in recent years, offering consumers the option to pay a monthly fee for solar, with the understanding that you will own the equipment after a certain period, usually five to seven years.

✦ A subscription service

“Solar providers such as GoSolr offer a fixed-monthly subscription to solar power using their equipment. Prices generally start at R1 580 a month,” he says.

✦ Long-term value

Smee cites the importance of justifying the significant initial financial investment by considering the value it will add to your home in the long-term.

South African home loan experts ooba Home Loans says solar panels can increase the value of a property by around 3 to 4%.

“Taking into account the current electricity crisis in South Africa and with no long-term solution in sight, I believe that this estimate is actually rather conservative.”

Having such installations on your property gives sellers the opportunity to offer buyers longterm peace of mind, and this is important considering that most of the country is experiencing a buyer’s market, meaning that many well-priced and welldesigned homes are sitting on the market for far longer than they usually would, due to an oversupply of homes.

“Solar power is definitely a unique selling point and a way for sellers to distinguish themselves from the competition. Thus, I would encourage homeowners to make the transition now while they can afford it, as it can be a lifeline should they become financially distressed and need to make a quick sale.”

By investing in solar power, owners are also able to market the “peace of mind” that their property will offer prospective buyers, both in the short and long-term.

“The buyer has the assurance

that they will be able to work from home and perform daily household tasks such as cooking without interruption,” Smee says, adding: “Another positive selling point is the prospect of lower electricity bills and resilience against unforeseen tariff increases.

“Eskom was recently approved to implement an 18.65% tariff hike come April 2023, which is yet another blow to South Africans dealing with interest rate hikes and the rising cost of living.

“In contrast, most solar providers’ annual price increases are in line with annual inflation, giving consumers the ability to plan and budget accordingly.”

There are, however, factors that homeowners need to consider in order to maximise their solar investments. He outlines them:

✦ Choose your financing option wisely: If you’re investing in solar power with the goal of adding to the value of your home, make sure that you own the equipment outright. If you’ve opted for the “rent-to-own” (and haven’t completed the contract) or solar subscription option, the new owner will have to carry the costs of the contract.

✦ Take the size of the installation into account: The more solar panels on your roof, the more electricity can be generated.

✦ Make sure that you purchase a hybrid solution: A hybrid system consists of solar panels, a smart inverter, and a battery. The battery is what keeps your electricity running during load shedding, using the power generated from the solar panels during non-load shedding periods.

✦ Choose a reputable service provider: Make sure your provider is accredited, uses the highest quality materials to increase their lifespan and offers a warranty should something go wrong.

✦ Remember that location is key: If your roof is constantly in shade, the solar panels will receive very little sunlight to generate electricity, making a costly installation essentially useless. Solar power has the potential to greatly increase the selling potential of your home, but all factors must be considered to maximise your return on investment.

More people are seeing the benefits of adopting alternative energy sources to power their properties and make them more attractive to buyers

IT WAS pretty much a given that the South African Reserve Bank (SARB) would increase the repo rate last month, but with the hike being 0.25%, there is little for homeowners and property buyers to be bitter about.

Experts predicted that the best-case scenario would be a 0.25% increase and the worstcase a 0.75% raise, leaving many people holding out for a 0.5% rise as a compromise.

When the announcement was made, many people were breathing a sigh of relief.

While a rate hike is never welcome news, Samuel Seeff, the chairperson of the Seeff Property Group, says that because it was expected, it was largely factored in by the property market.

Still, he feels that the SARB could have kept the rate steady, as a reprieve for the economy and consumers, especially considering the escalating Eskom energy crisis.

He hopes to see the rate coming down towards the latter part of the year.

Understandably, says Tony Clarke, the managing director of the Rawson Property Group, people are feeling the everincreasing pinch of the recent series of hikes, but, in the long run, not increasing them will do more harm.

“A potential hold on the rate could follow in May and July, with the latter part of the year seeing another 0.5% increase in total.

“Looking even further ahead

FIND US HERE:

@iolproperty

@iolproperty @iolproperty.co.za

– if current hikes have the desired effect – we could start seeing reductions in the latter part of 2024.”

While there is no doubt that the higher interest rate will weigh on the market and result in “slightly fewer” buyers, Seeff’s assessment is that the market will remain stable and see “good activity”.

“People always need a roof over their heads, lifestyle needs change, and for a variety of other reasons, we will continue seeing demand in the market. We are also likely to continue seeing strong migration to the coastal areas, especially in view of the growing service delivery challenges and Eskom energy crisis.

“We are still seeing strong support from the banks, with mortgage lending remaining favourable for the market.

“Buyers should therefore not hesitate to get into the market, but must now factor in the higher costs.”

Furthermore, asking prices will increasingly come under pressure, and sellers will need to heed the advice of local agents if they want to take advantage of the demand in the market, he says.

But while homeowners may be justifiably concerned about the potential impact on their property values, Clark says the reality is not nearly as dire as popular opinion would have them think.

“There are a lot of myths and misconceptions doing the rounds

on the property market. A lot of them are easy to believe because they tie into our biggest fears as property owners, buyers and sellers.”

Instead of falling prey to panic, however, he encourages homeowners to separate fact from fiction – preferably with the help of a property expert – before making any decisions that might backfire in the long run.

Adrian Goslett, the regional director and chief executive of RE/Max of Southern Africa, advises homeowners and future buyers to prepare themselves for the worst-case scenario of having interest rates climb by roughly 1% over the course of the year.

“It is better to make room in your budget now than to be caught short if interest rates do climb further.”

He adds that the effects of the interest rate hikes are becoming more evident.

“The total number of registered transactions lessened during the last quarter of 2022. Following this latest interest rate hike, it is likely that the property market will quieten down somewhat further over the course of the year.”

The good news, says Carl Coetzee, the chief executive of BetterBond, is that the country could be heading for the peak of this cycle of interest rate hikes.

“We could see interest rates start to stabilise in the coming months and, hopefully, even drop towards the end of this year and into next year.”

It’s important to take the long

view when it comes to the housing market and buying property.

“Our Reserve Bank acted swiftly to curb inflation by starting to increase interest rates in November 2021. That’s why we think today’s increase may be one of the last hikes for a while.”

If that proves to be the case, he says it will give homeowners some welcome breathing room as they grapple with food, fuel and electricity costs, and load shedding.

“It could also create more opportunities for new buyers to enter the housing market by investing in homes of their own in the near future. And that would be good news for our economy too.”

Andrew Golding, the chief executive of the Pam Golding Property group, also hopes that the country has reached the peak of the interest rate cycle.

For the housing market, however, he says activity remains steady across all sectors, buoyed by favourable bank lending as well as cash buyers, particularly in the luxury market. Soughtafter nodes also continue to experience high demand.

Rhys Dyer, the chief executive of ooba Home Loans, also believes that the “moderate increase” is one of the last rate hikes this year.

Current and potential homeowners can possibly breathe a sigh of relief.

“With the exception of a possible single small additional rate hike this year, I believe that

we are now out of the woods, and that South Africans can start to plan around the interest rate of 10.75% to 11%.

“We also believe that this stabilisation will allow more buyers to better budget their monthly repayments, knowing that we are at the peak of the interest rate cycle.”

Echoing this, Chris Tyson, the founder and chairperson of Tyson Properties, says the interest rate hike is “extremely positive” and that while it may inject a little caution, it will not frighten buyers out of the market.

“In fact, we see this as extremely positive. It is a sign that interest rates are levelling off to be in line with pre-Covid levels.”

Nick Pearson, the chief executive of Tyson Properties, believes there has been a correction in interest rates over the past year and that the latest increase, “which is likely to be one of or even the last in this cycle”, will enable buyers and sellers to readjust to a postpandemic economy.

“An interest rate hike definitely forces people to be more correct a it comes to pricing their properties for sale or making an offer on a property.”

He does state though, that the interest rate increase will affect various parts of the market differently, with wealthier buyers more likely to weather the increased cost of home loan repayments. In addition, the provinces are also likely to each respond differently.

DISCLAIMER: The publisher and editor of this magazine give no warranties, guarantees or assurances and make no representations regarding any goods or services advertised within this edition. Copyright ANA Publishing. All rights reserved. No portion of this publication may be reproduced in any form without prior written consent from ANA Publishing. The publishers are not responsible for any unsolicited material.

Publisher Vasantha Angamuthu vasantha@africannewsagency.com Executive editor Vivian Warby vivian.warby@inl.co.za

Features Writer Bonny Fourie bronwyn.fourie@inl.co.za Design Kim Stone kim.stone@inl.co.za

Spacious Three Bedroomed Apartment (123m²) above the Main Road in pretty garden setting. Fitted Kitchen and Bathroom. *Parking Bay. Walk to

over Bath. Fitted Kitchen. *Garage. *Walk to Shopping Centres, Restaurants, UCT and Transport.

CONTACT: RHONDA C: 082 448 7795 T: 021 685 2212 E: RRPSALES@MWEB.CO.ZA / WWW.RHONDARAADPROPERTIES.CO.ZA

This magnificent home sits high on our beautiful mountain at the edge of National Parks land and has uninterrupted views across False Bay towards Simon’s Town, the Hottentots Holland Mountains of Somerset West/Stellenbosh and South to Rooi Els as far as the eye can see.

Once you enter you almost have the feeling of being on board ship with every room boasting breathtaking views from every corner of the property.

PROPERTY DESCRIPTION:

TOP LEVEL: 1:

3 Garages with direct access double glazing, sliding doors and Euro style open in/tilt windows and doors for easy cleaning with lounge and dining view preserving Luxaflex Blinds. Fantastic entertainers kitchen with views, Luxaflex Blinds, open in/tilt windows, easy access drawer and cupboard systems. Energy saving instant water heaters for kitchen and bathrooms. 3 phase energy supply to enable load balancing and instant water heating. Beautifully appointed entrance, secure and side garden patio, lounge and dining areas with large balcony, 3 x 316 plate stainless steel pillars clad in ALU support sea facing beam. Low maintenance Rhein Zinc Eave cladding and gutter on main roof. Warranties on main and new garage roofing. Stainless steel recessed gutter on main roof feeds 2 x 6000 litre tanks in large level 3 store room, programmable water system.

LEVEL 2.

2 Bedrooms both with beautiful en suites, common balcony access and fabulous views. Ample cupboards. Carpeted bedroom areas..

LEVEL 3.

This level is office space with a separate bathroom at the moment but can be turned into an apartment with its own entrance or alternately another 2 bedrooms. Inside ALU American Shutters for security and comfort.

Bidding opens 22 FEB 2023 @ 12h00

https://bidlive.maskell.co.za

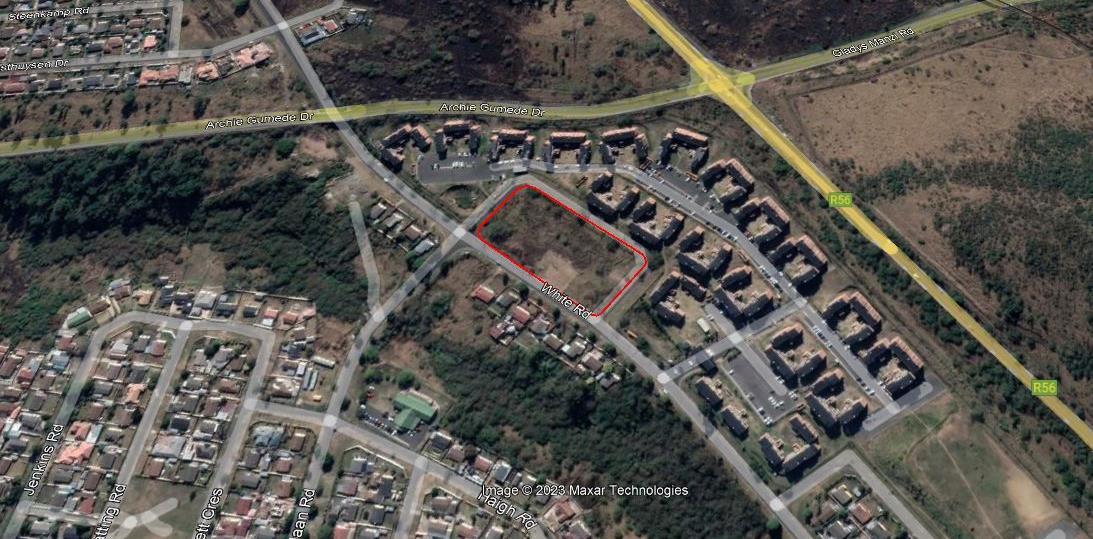

URGENT ONLINE AUCTION OF A PRIME ±8396m² MEDIUM IMPACT MIXED USE STAND WITH ROAD FRONTAGE TO BOTH WHITE ROAD AND MURDOCH CRESCENT: LOCATED IN WESTGATE, PIETERMARITZBURG IDEAL OPPORTUNITY FOR DEVELOPERS AND INVESTORS

a restricted

Contact Danielle (Candidate Property Practitioner) on 082 801 6827 / danielle@maskell.co.za • R50 000 buyer's card deposit payable by EFT • 10% deposit payable on fall of hammer • FICA to be provided • “Above subject to change without prior notice • Sale subject to confirmation (E&OE) *Automatic staggered ending time : if a lot receives a bid within the last 10 min, bidding will remain open for an additional 10 min - If any further bidding occurs, the extension timer will reset to 10 min - If no further bidding activity occurs, the lot closes when the timer runs out

Bidding opens 7th Feb 2023 At 12h00 & closes from* 12h00 on 8th Feb 2023

https://bidlive.maskell.co.za

Erf 9211 Pietermaritzburg in extent of 461m² : 3 Dassie Lane, VCCE Park Village

The property comprises a double storey 3 bedroom, 3 bathroom (all en suite) residence with an open plan lounge, kitchen / scullery & dining room, domestic accommodation, guest bathroom, double

DOGON GROUP PROPERTIES

Atlantic Seaboard Office 021 433 2580

thekings@dogongroup.com

www.dogongroup.com

RHONDA RAAD PROPERTIES

Cape Town Office 082 448 7795

Email: rrpsales@mweb.co.za

www.rhondaraadproperties.co.za

SHELLEY RESIDENTIAL

KZN

Office 082 412 4463

Email: hello@shelley.co.za

www.shelley.co.za

DOGON GROUP RENTALS

Sea Point Office 021 433 2580

enquiries@dogongroup.com

www.dogongroup.com

DOGON GROUP PROPERTIES

Southern Suburbs, Claremont Office 021 671 0258

southernsuburbs@dogongroup.com www.dogongroup.com

CAPE WINELANDS

Nicho 072 601 1772

Hannes 066 476 1890

sales@aandewijnlanden.co.za

viognier.aandewijnlanden.co.za

SERENITY HILLS ECO ESTATE

KZN, South Coast Office 073 142 8292

Email: home@serenityhills.co.za

www.serenityhills.co.za

PETER MASKELL AUCTIONEERS

KZN

Office: 033 397 1190

Email: info@maskell.co.za

www.bidlive.maskell.co.za

BALWIN PROPERTIES

Ballito Office 084 788 1020

Email: michelle@balwin.co.za

www.balwin.co.za

DOGON GROUP PROPERTIES

Western Seaboard

Office: 021 556 5600 or 021 433 2580 enquiries@dogongroup.com www.dogongroup.com

VAN’S AUCTIONEERS

Gauteng Office 086 111 8267

www.vansauctions.co.za

www.iolproperty.co.za

WIDENHAM RETIREMENT

VILLAGE South Coast, KZN 066 306 0669 / 066 306 0612

www.hibiscusrv.co.za

www.widenhamretirementvillage.co.za