SMART TIPS ON KEEPING THOSE BOND REPAYMENTS DOWN PAGE 3

WHILE tech continues to revolutionise the property industry and change the way people find their homes, the industry also needs to follow social media trends to capitalise on the global shot in the arm that proptech has given it.

More and more property practitioners are turning to short-form video content – the trend leader in the social media space, says market research company GWI.

Its flagship report on the latest trends in social media shows that short videos are quick to create and tend toward the less polished, more spontaneous content people are after.

Consumers on channels like TikTok, Instagram, Reels, YouTube Shorts and Facebook Stories are far more likely to use social media for creative inspiration.

Furthermore, short clips are not only a huge hit with Gen Z, but 25% of consumers watch a video made by a brand, each month. They’re also shared extensively on messaging platforms like WhatsApp, opening access to consumers who might not be on TikTok.

Harnessing the trend to showcase their expertise and their properties to would-be buyers is the next step for an industry rapidly coming to terms with the need to adopt off-site ads and social media marketing, says Flow co-chief executive and co-founder Gil Sperling.

“For businesses, and property practitioners in particular, the change in the way the algorithms on these platforms function

plays into the hands of those who can create compelling content.

“The algorithms – once focused on aggregating content from connections, friends and family – now draw far more on content that users regularly interact with to populate their feeds.”

She says the short-form videos are incredibly addictive because it’s easy to consume scores of videos that the algorithm knows you’ll be interested in, in a short period.

“The most successful short-form videos are also authentic, meaning they don’t need to be polished and produced by experts: a boon to property practitioners who can showcase their portfolio of properties more easily.”

As more people start to trust social media platforms as sales channels, Sperling says there is no reason the property industry shouldn’t be able to harness social media platforms to help the right homes find the right people.

Citing a 2022 marketing survey by real estate site The Close, social media platform Hootsuite states in a blog post that social media is second only to referrals as the next best source of real estate leads. And because of this, 80% of real estate agents plan to spend more time on their social media marketing strategies in the next year.

Hootsuite offers real estate agents a few ideas on how they can use social media to get more leads, including:

✦ Always sharing new listings to your social media pages.

✦ Sharing video walkthroughs.

✦ Sharing statistics and trends on your local market to help buyers make decisions on where they want to live.

✦ Offering tips to buyers, as well as sharing mistakes they should avoid.

✦ Sharing before and after photographs of home renovations to inspire homeowners.

✦ Running polls to find out more about your audience.

✦ Sharing testimonials from buyers and sellers.

✦ Sharing “just sold” photographs to demonstrate your experience and expertise.

✦ Conducting weekly recaps on show houses coming up.

✦ Holding show days.

While putting your home on show can be stressful, David Jacobs, the Gauteng regional manager for the Rawson Property Group, says it is also one of the best ways to achieve fast and favourable sales.

“If you get it right the first time, you may only need a single show day to get the offers rolling in.”

He also shares these tips to help boost your chances of bagging a buyer on your first show day

The more repairs you can cross off your maintenance list before opening your home to buyers, the better your chances of a quick and profitable sale.

“Buyers love nothing more than a home that is move-in-ready. That said, talk to your agent before doing a full overhaul right before a show house. Some repairs and

upgrades add more value than others. You don’t want to end up overcapitalising right before a sale.”

It might sound premature, but Jacobs says having documentation like approved plans and compliance certificates in hand before a show house can be really beneficial to making a sale.

“Buyers appreciate knowing that all is in order with the property, and there will be no unexpected delays if they do make an offer. It’s also reassuring for them to work with a seller who clearly understands their legal responsibilities and takes them seriously. It bodes well for an open, honest and ethical sale.”

A little bit of polish is always a good idea before a show house. Jacobs suggests a deepclean, garden tidy-up and a good declutter.

“The neater and more neutral a picture you present, the better. Buyers want to be able to imagine themselves living in your property, and that can be hard to do when they’re dodging kids’ toys and family photos in every room.”

While you don’t need to completely denude your property of personality, he says it is important to remove objects that might be seen as supporting political, religious or social issues.

“Prospective buyers may not share your beliefs, and those differences could colour their opinions of your home.”

Jacob’s final tip for holding a successful show day is to leave it to the experts; pack up the kids and the pets and take them off for a day of fun.

“It can feel like an imposition having to vacate your property so that strangers can explore it, so why not turn the tables and make those few hours something to look forward to, instead?

“Plan a pamper session, an adventure, or simply some quality family time. Who knows, by the time you get home, you may be halfway to a sale!”

Knowing the best ways to use social media for property marketing is integral for today’s real estate agents. That said, not everything traditional is lost as homeowners can still benefit from show daysTechnology continues to revoluntionise the property industry.

HOMEOWNERS struggling against the rising costs of living, including inflation and interest rate and fuel price hikes, may not know that there are ways they can save money on their home loan repayments.

Property buyers purchasing for R1.1 million and below will save on transfer duty costs following the recent increase in the exemption threshold, while those who are shopping around for the best home loan interest rates will benefit from the competition between banks.

But homeowners who don’t think they have options for reprieve are wrong.

Rhys Dyer, the chief executive of ooba Home Loans says the succession of interest rate hikes has had a “big impact” on homeowners who are paying more on their home loans.

Thankfully though, there are several ways they can reduce the financial burden of home loan repayments in tough economic times.

These include renegotiating the interest rates and repayment terms on their home loans, applying for payment holidays or applying for the government’s Flisp subsidy retrospectively.

Renegotiate the interest rate on your home loan First, Dyer says, homeowners have the option to renegotiate the interest rate on

FIND US HERE:

@iolproperty

@iolproperty @iolproperty.co.za

their home loans by approaching their banks.

“This is provided that your home loan is in good standing –paid on time each month. The bank will also be more inclined to agree to a lower interest rate if the value of your property, compared to the original loan amount borrowed, has increased, meaning that the bank’s loan-tovalue (LTV) ratio and the associated risk has reduced.”

Renegotiate the repayment term on your home loan Homeowners can also apply for an extension on the remaining term of their home loan to reduce their monthly bond repayments.

“For instance, if you initially applied for a home loan over 20 years, you can request that the home loan term be reset back to 20 years or even extended over a longer period of up to 30 years,” he says.

However, the homeowner will need to agree to the updated terms and conditions, and will be subject to a higher total interest charged over the extended loan term. Apply for a payment holiday While payment holidays were widely requested during the Covid-19 pandemic and have their financial drawbacks in the long-term, Dyer says it is an avenue that homeowners can take for short-term relief.

“In this case, you should contact your bank to request a payment holiday or to pay a reduced loan instalment for a short

period. These payments, and the interest accumulated, will need to be repaid over an agreed number of months following the expiration of the payment holiday period.”

Take advantage of Flisp The Finance Linked Individual Subsidy Programme is a government project that works to close the gap in the home-buying market.

“South African first-time homebuyers with either a single or joint gross monthly household income of between R3 501 and R22 000 can qualify for Flisp. Subsidies range from R30 000 to R130 505,” he explains, adding that homeowners who meet the criteria but have never applied for or received the subsidy, are eligible to receive it retrospectively. This is provided that the application is made within 12 months of bond registration.

“Upon approval, the subsidy is paid to your home loan account; it reduces the bank’s risk and enables you to renegotiate the interest rate on your home loan.” Save to soften the blow Homeowners who have money set aside may consider taking a percentage of emergency savings and depositing these into their bonds.

“Paying more than your regular monthly home loan repayment each month will reduce the total interest charged in the long-term. This is also a great way to enjoy tax-free savings.”

Echoing this, Carl Coetzee, the chief executive of BetterBond, says

BY BONNYhomeowners and buyers can pay extra into their bonds and “shave years off” their repayment periods. For example, on a R2 million home loan at a prime lending rate of 10.5%, a payment of R1 000 extra a month could reduce one’s loan period by almost three years and save R461 187 in interest.

Adrian Goslett, the regional director and chief executive of Re/Max Southern Africa, says the biggest benefit of settling a home loan faster is that, over the loan term, owners will save on interest costs.

“Once your home is paid off, then your monthly expenses decrease, which means that more money is freed up to deposit into things such as retirement savings or other debt repayments.

“Another great advantage is that you also minimise your financial risk and when you do eventually sell, you’ll make a greater ROI (return on investment) on the sale if you have less outstanding on the home loan.”

In addition, if one has an access bond facility, they can treat their home loan accounts as savings accounts by depositing any extra cash they might have into them.

“You can then later access this capital through your home loan if an emergency arises,” Goslett says.

While there are many factors to consider, Coetzee offers five ways buyers can help reduce their bond

payments in order to comfortably afford their dream homes:

Work with a bond originator A bond originator will apply to more than one bank on a buyer’s behalf for a competitive interest rate. Again, using the example of a R2m bond, a prime lending rate of 10.5%, and BetterBond’s average interest rate reduction of 0.61% when applying to four banks, he says one could save R813 a month.

Save up for a deposit A deposit will affect the gross monthly income required to qualify for a bond, and will reduce the monthly bond repayments and interest payable over the loan period, he says.

Banks also look more favourably at a client who is able to manage their money, and a deposit suggests that a client is a lower lending risk.

“A deposit will therefore make a significant difference when banks decide whether to approve or decline a bond application.”

Maintain a good credit score

Banks are more likely to offer a competitive interest rate if one has a solid credit score and presents less of a lending risk.

Weigh up the pros and cons of fixing your interest rate While it is a personal choice, Coetzee says it is worth noting that fixed rates are generally higher than the base or prime lending rate, and can be negotiated only once the bond has been approved.

“Also, the period over which you can fix the interest rate on a bond repayment is a maximum of five years.”

DISCLAIMER: The publisher and editor of this magazine give no warranties, guarantees or assurances and make no representations regarding any goods or services advertised within this edition. Copyright ANA Publishing. All rights reserved. No portion of this publication may be reproduced in any form without prior written consent from ANA Publishing. The publishers are not responsible for any unsolicited material.

Publisher Vasantha Angamuthu vasantha@africannewsagency.com Executive editor Vivian Warby vivian.warby@inl.co.za

Features Writer Bonny Fourie bronwyn.fourie@inl.co.za Design Kim Stone kim.stone@inl.co.za

It’s been a tough past few years, financially, and many are barely holding on but before rushing to sell your home, consider the options available

FOURIE bronwyn.fourie@inl.co.zaTHE bank will be more open to agreeing to a lower interest rate if the property value has increased. PICTURE: TOWFIQU BARBHUIYA/UNSPLASH

ON

Prime Position! Spacious Two Bedroomed Duplex Apartment with Garage for Sale. Dining Area and Lounge leading to Large Balcony with Views! Fitted Kitchen and Full Bathroom. Walking distance to Schools, UCT, Shops and Transport.

Security Complex in Pretty Garden! Spacious Three Bedroomed Duplex Apartment (115m²) with Two Balconies and Mountain Views! Lounge, Dining Room, Fitted Kitchen (in need of TLC,) Full Bathroom & Guest Toilet. Parking - first come, first serve. *Walk to UCT, Jammie Shuttle, Shops & Transport.

ON

Charming Two Bedroomed Apartment with Fitted Kitchen (with built-in Oven, Hob and Extractor Fan) open plan to Lounge and Balcony. Two Bedrooms with Ample Cupboards. Bathroom with Shower over Bath, Toilet and Basin. **Plus Carport. Academic Mile - Walk to UCT!.

Charming and Large Modernised Three Bedroomed, Two Bathroomed Apartment with Entrance Hall, Lounge and Balcony. Modern Fitted Kitchen with built-in Oven, Hob and Extractor Fan. Close to Kelvin Grove Club, Newlands Cricket Stadium, leading Schools, Shops and Transport.

DOGON GROUP PROPERTIES

Atlantic Seaboard Office 021 433 2580

thekings@dogongroup.com

www.dogongroup.com

RHONDA RAAD PROPERTIES

Cape Town Office 082 448 7795

Email: rrpsales@mweb.co.za

www.rhondaraadproperties.co.za

SHELLEY RESIDENTIAL

KZN

Office 082 412 4463

Email: hello@shelley.co.za

www.shelley.co.za

DOGON GROUP RENTALS

Sea Point Office 021 433 2580

enquiries@dogongroup.com

www.dogongroup.com

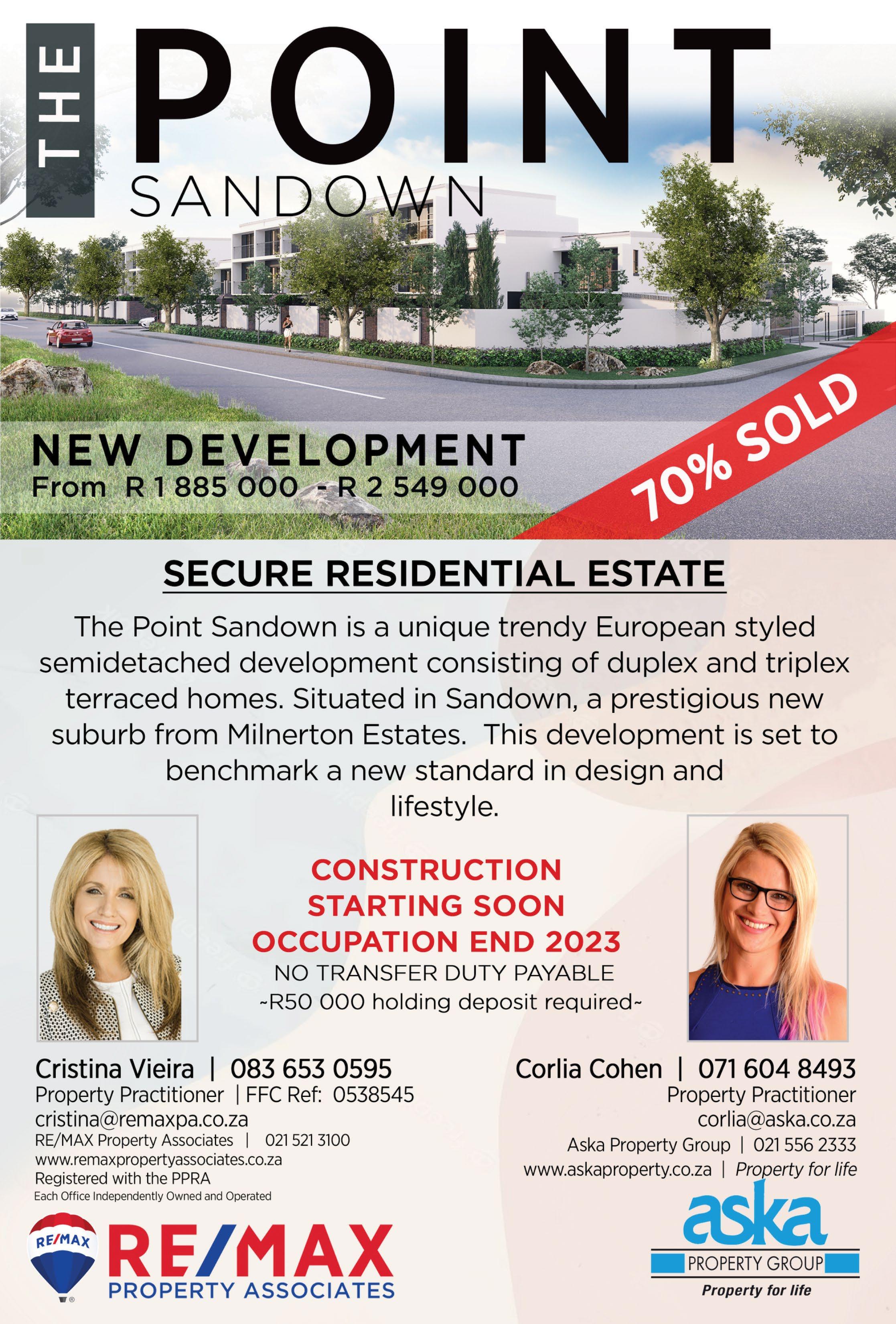

ASKA PROPERTY GROUP

Sandown, Milnerton Estates Office 071 604 8493

Email: corlia@aska.co.za

www.askaproperty.co.za

REMAX PROPERTY ASSOCIATES

Sandown, Milnerton Estates

Office 083 653 0595

Email: cristina@remaxpa.co.za

www.remaxpropertyassociates.co.za

DOGON GROUP PROPERTIES

Southern Suburbs, Claremont Office 021 671 0258

southernsuburbs@dogongroup.com

www.dogongroup.com

PETER MASKELL AUCTIONEERS

KZN

Office: 033 397 1190

Email: info@maskell.co.za

www.bidlive.maskell.co.za

BALWIN PROPERTIES

Ballito Office 084 788 1020

Email: michelle@balwin.co.za

www.balwin.co.za

DOGON GROUP PROPERTIES

Western Seaboard

Office: 021 556 5600 or 021 433 2580

enquiries@dogongroup.com

www.dogongroup.com

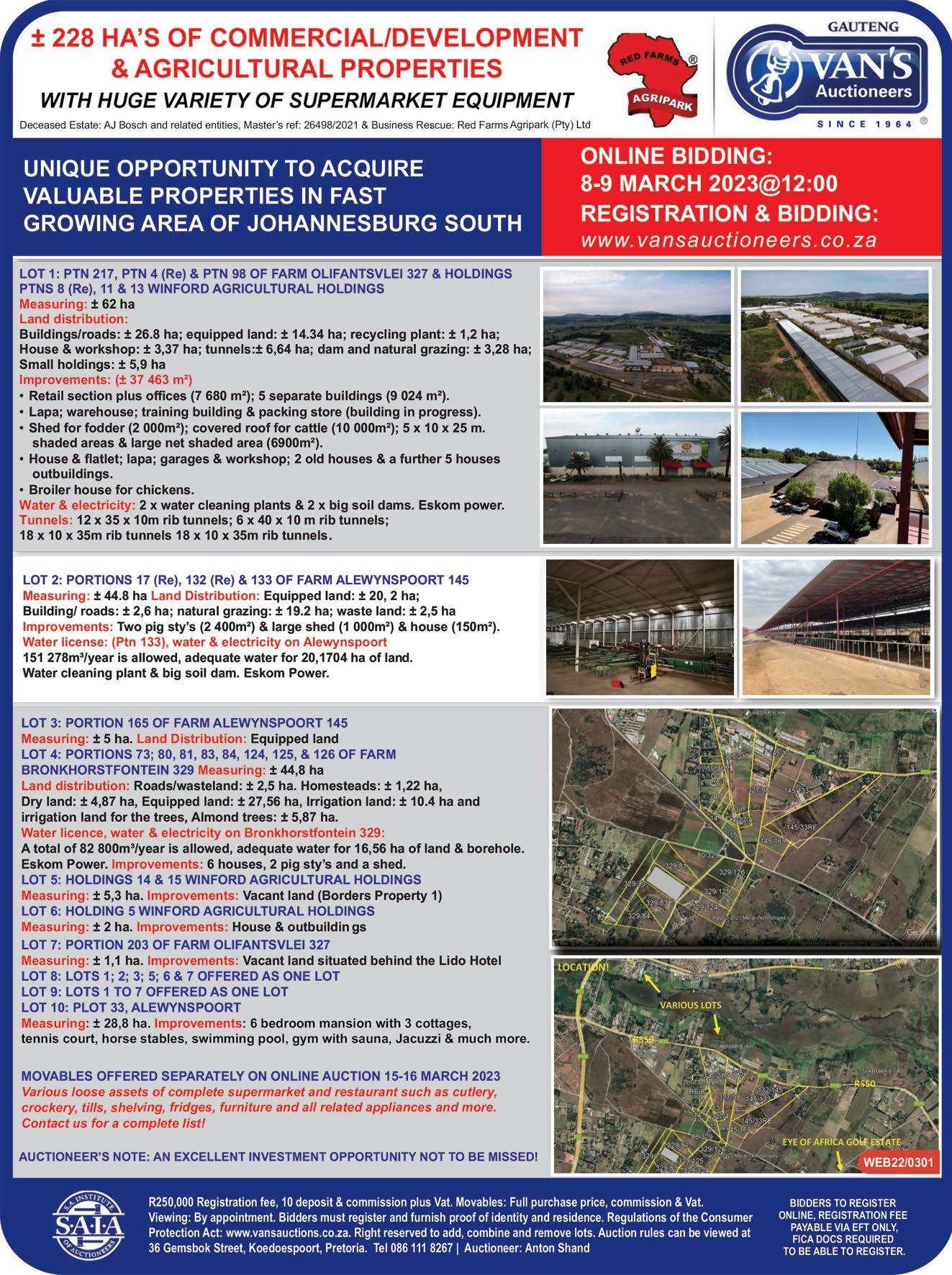

VAN’S AUCTIONEERS

Gauteng Office 086 111 8267

www.vansauctions.co.za

www.iolproperty.co.za

WIDENHAM RETIREMENT

VILLAGE South Coast, KZN 066 306 0669 / 066 306 0612

www.hibiscusrv.co.za

www.widenhamretirementvillage.co.za