7 minute read

MAULIK MEHTA

INDIA AS A HUB FOR CHEMICAL MANUFACTURING

Maulik Mehta, CEO, Deepak Nitrite Limited shares his views on global trends, company’s performance, R&D plans, supply chain plans, plans of DPL and DNL, expansion plans and CSR activities. Excerpts of the interview:

Advertisement

MAULIK MEHTA

CEO, DEEPAK NITRITE LIMITED

What are the global trends in the chemical sector and how will it impact India?

The chemical industry across the globe is undergoing a strategic shift in the supply chain from China to India as a source of raw materials. This presents an opportunity for India to be the global hub for chemical manufacturing.

There is an increased focus on downstream value-added products. We expect govt to promote the setting up of new Naphtha cracking units to meet the growing demand for building block chemicals for down-stream industries. promised to bring PLI in agrochemical manufacture but the government should also include AI (Agro-ingredients) manufacturers for Agrochemicals to complete the value chain and lower our dependence on AI import from China.

With the increase in upward mobility and per capita GDP, Indians will not only increase consumption of bulk chemicals that eventually go into end segments like consumer goods and automobiles etc. but it will also consume more of personal care products, Agro-chemicals and inturn speciality chemicals.

Key learnings for the company during COVID-19 and how are you planning to deploy these learnings in 2021?

COVID-19 challenged a lot of preconceived notions of business. The company decided to double down on its responsibility for protecting both the safety and China’s commitment to be Carbon Neu- livelihood of its employees during the tral by 2060 is one major reason for strin- pandemic ensuring that nobody was let gent environmental norms and tighten- go and salaries and wages were not only ing of financing options for polluters. paid in full but even increased to tide This evaporates their erstwhile advantage them through a difficult period. The comand now brings such companies on par pany prepared for worst-case scenarios with Indian environmental and financing and created ‘safety bubbles’ where critical benchmarks. If Indian manufacturers employees would be housed in safe zones can supply quality material in the desired and transported between pre-booked quantity, then this shift of sourcing from houses/hotels and the factories. It also China to India will become sustainable. ramped up social outreach to improve

Post-Covid, countries across the globe health and nutrition in villages surroundare focusing on China+ 1 Policy, ing all our facilities. Safety of we expect the Government men, material, and equipto extend the Productivity “Deepak Nitrite has ment was taken as a top Linked Incentive (PLI), recently acquired 127-acre priority which helped scheme to the chemi- land in Dahej, which will us avoid accidents that cal sector to capture be developed over the next could arise from limthe global market ef- couple of years. Further, ited manpower and ficiently. it has plans for medium mitigate potential

Trade conflicts to large investments damage from Cyclone across major economies each year for the next 2-3 Nisarg that ravaged the present an opportunity years.” coastal areas in Mahafor Indian chemical manu- rashtra in July’20. facturers to consolidate their We studied the challenges position as a supplier to the global of the lockdown and the reopening of chemical market. the economy in China and chose to prior-

India’s growing per capita consump- itise local employment in contract labour tion and demand for agriculture and phar- and forward booked container and shipmaceutical-related chemicals offer a huge ping rates in anticipation of shortages. scope for the sector. The government has

Company’s performance in terms of revenue and profit during FY 202021 and what is the forecast in FY 202122? What are the growth drivers?

For FY 2019-20, consolidated revenue

stood at Rs. 4,265 crore while Profit was at Rs. 611 crore. For the quarter ended Q3 FY21 Revenue was at Rs. 1,240 crore, up by 9 per cent YoY and profit stood at Rs. 217 crore, up by 38 per cent YoY.

Our major growth drivers are a consistent focus on production, productivity, and a customer-centric approach. In production, we focus on opportunities such as Brownfield expansion of key products; downstream production in existing value chains; and new product development for new platforms.

In productivity, our focus is mainly

on: Process before product; Value from waste initiatives; and Improvement on SHE scores and asset integrity.

In a customer-centric approach: We ensured timely delivery and good quality products to our customers when demand for an end application returned, and offer innovative solutions to customers to help them reduce their Opex.

What are the upcoming research initiatives at Nandesari R&D centre and any plans of adding manpower in the R&D division?

We focus on 2 channels: product development and process intensification. The company has quadrupled investment into R&D with a mix of talent, instruments, and software and plans to set up a new R&D centre at the outskirts of Baroda.

How is the company developing robust supply chain infrastructure and logistics? What are your plans for 2021?

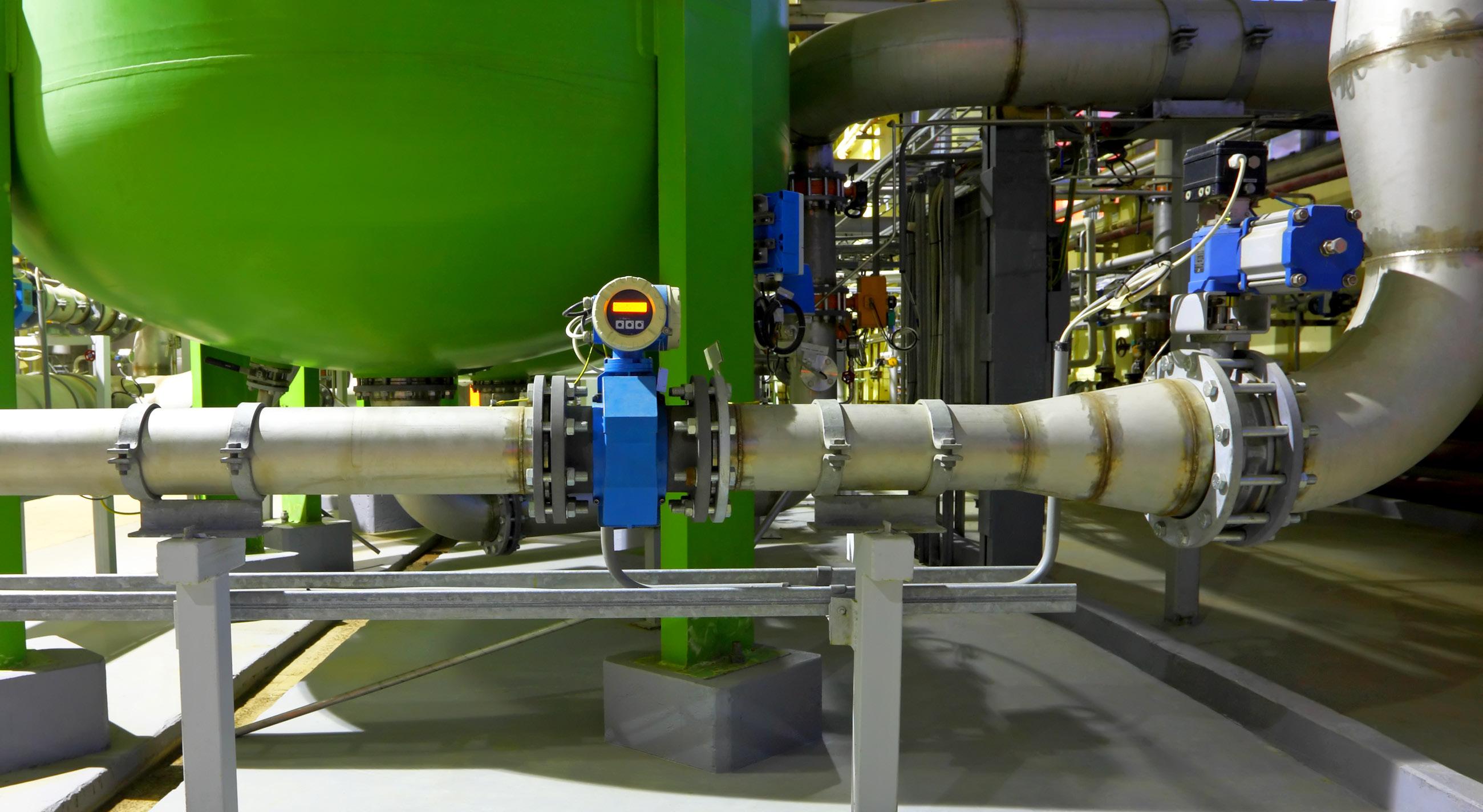

To monitor a vast network of logistics and vehicles covering raw materials, finished products, including spent, we have implemented a GPS enabled tracking system, monitored 24/7. This system has been implemented by one of the bestin-class vendors, LCS. Further, Deepak Nitrite Limited (DNL) is a Star Export House and Authorised Economic Operator (AEO) holder.

We follow lean manufacturing concepts and work on sweating our plants to maximise plant utilisation. Our asset turnover is more than 2.5 (Net sales/ Gross assets). The company has begun site development of its newly acquired land parcels in strategic locations that

will house new products from DNL and its subsidiary Deepak Phenolics Limited (DPL). per cent q-o-q to Rs. 747 crore in Q3 FY21 compared to Rs. 545 crore in Q2 FY21. Initiatives such as elevating plant efficiency have resulted in utilization above 115 per cent of stated capacity. Growth in EBITDA at 36 per cent was in line with revenue growth and the EBITDA margin was stable.

The current manufacturing capac-

ity of Phenol is 200 KTPA, Acetone 120 KTA, IPA 30 KTPA. Further, IPA capacity will double within the first two quarters of FY22.

On the lines of Aatmanirbhar Bharat, DPL aims to make India selfreliant on Phenolics and explore various value-added, downstream products from Phenolics and Acetone.

Our Phenol and Acetone and up-

How has DPL performed in 2020 and plans for 2021? What is the current manufacturing capacity and how do you plan to scale it up and make India self-reliant?

DPL witnessed revenue increase by 37 coming derivatives project are all - a step towards building India’s chemical security. At full capacity, we anticipate that Deepak Phenolics will save close to US $400 million in the value of imports for the country. Besides, many SMEs will also benefit due to the local availability of Phenol and Acetone.

Deepak Group has six manufacturing facilities. Does the company plan to set up any new manufacturing plants or expand into new territories?

Deepak Nitrite has recently acquired 127-acre land in Dahej, which will be developed over the next couple of years. Further, it has plans for medium to large investments each year for the next 2-3 years.

We are looking at creating value by backward integration, export substitution as well as exploring possibilities in new territories of speciality chemicals. We are aggressively investing in R&D to build in-house product development capability. This will help us to create a pipeline of products to drive future growth.

How is the company striking a balance between environmentfriendly policies and sustainable growth? What are the key CSR initiatives being undertaken by the company?

The company is accredited with Responsible Care and has taken targets for achieving TfS scores of 90+ for all its sites.

New products will be launched keeping the strictest effluent treatment norms in mind, with ZLD wherever possible. We will also enhance the focus on developing a circular economy with our value from waste initiatives.

As a part of building R&D capability, we have put up a treatability study lab to develop the most environmentally friendly treatment processes. Our investment in R&D will also help us develop and implement green chemistry to drive growth in an environmentally friendly manner.