13 minute read

Business and Finance

Clean Plus finds the winning formula with St.George

The Clean Plus business owned by CEO Wasim Farhart, has enjoyed year-on-year growth since 1992.

Advertisement

Clean Plus CEO Wasim Farhart runs one of Australia’s hardiest manufacturing businesses located at Auburn, a light industrial suburb in Sydney. For 30 years, he has helmed the cleaning supply business which became an essential service during the recent COVID crisis.

Farhart started the business in 1992 after he and his family (originally from Lebanon) migrated from France. He had already graduated with an engineering degree, and had been working for a food processing company where he became acutely aware of the need for high levels of cleanliness for food manufacturers.

It was while he was operating within the French food processing

industry, that he observed the opportunities for selling bleach. He brought that insight to Australia with the plan to establish what has now become Clean Plus.

Setting up a business as a migrant in the nineties had its challenges, including a hefty $87,000 start up cost required to fund the initiative and the initial lease on a 210sqm premises at Roselands. Whilst the challenges were apparent, Farhart was committed to realising his vision to “formulate and manufacture the highest quality cleaning and hygiene chemicals in Australia.”

Developing the right team

Over the years, as Farhart built his business, he created and refined his own formula for business success, held together by a loyal team and overwhelming family support. His brother, also an engineer, assisted with initial funding while his wife was a pillar of strength, particularly in the early days when she became the single income earner for close to five years.

Farhart’s focus on attracting and retaining employees has been a cornerstone for the business’ success, with General Manager Nikki Hursaslas contributing to the team for 27 years.

Staff retention has always been a top priority, which Farhart attributes to a team-first culture where everyone works with a sense of “partnership” within the Organisation.

“The key is to give employees a comfortable workplace with initiatives and incentives while keeping communication clear.”

“They need to feel that they are remunerated above the market rate. We make sure we offer a 10-20 percent profit share and I’m blessed to have a business like this which feels like family,” he says.

Despite the production pressures of such an unexpected increase in demand from COVID-19, Farhart’s team of trusted and loyal companions pulled together as needed, sometimes running three shifts over 24 hours to meet demand.

Building business resilience

The Clean Plus business model is one based around flexibility and innovation with a pure B2B focus. Supplying to the highly competitive hospitality, healthcare, aged care, food processing, laundry, automotive and commercial industries requires a resilient operation.

“When COVID hit we grew significantly, and have maintained a 16 per cent per annum growth rate since” Farhart explains.

One of Clean Plus’ highest revenue generating services is the ‘white label’ service which is offered alongside the comprehensive product catalogue. Clean Plus offers an extensive range of customised solutions to meet the cleaning needs of its customers.

“This enables them to stand out and make an impact with a customised rangeof branded products with personalised packaging, “ he says.

“One of our ongoing challenges is to keep clients happy so that they don’t get tempted by our competitors, so we are always thinking of the next innovation.”

“There are currently three to four projects that we are working on. This includes a product that is based on enzymes as well as tablets that make cleaning more environmentally friendly,” he said.

Consistent growth

Since the first office and warehouse were set up in Roselands, Clean Plus has been on a geographical journey through Condell Park (450sqm) and Milperra (750sqm) before finally settling at Auburn in 2008 at more than 3,000sqm.

The company also owns two large warehouses in Brisbane and Perth. With the support of St. George and the relationship fostered by Head of Manufacturing and Wholesale NSW and Regional General Manager, Matt Kelly, Clean Plus is poised to upscale once again.

This includes new warehousing facilities next door to the current Auburn location, along with an investment in new blending vessels, packaging machines and a new platform using AI, all with the aim of diversifying production.

Kelly, who has known Farhart for nearly six years said “We love working with Clean Plus and have proudly fostered a strong relationship with them. They are incredibly focused on growing their business and have done so successfully year on year since 1992. I’m happy to say we’ve been able to meet their complex needs to allow them to further grow their warehousing and manufacturing footprint. We’ve also connected them with the right contacts to assist with Government Grants.”

Clean Plus Chemicals

cleanplus.com.au

St.George Bank

stgeorge.com.au/ manufacturing

Budget is good news for manufacturers

The Australian Government handed down the 2022 Federal Budget with very few surprises, unlike the largesse of the past several years, as the fight went on to counter the economic shock from COVID.

This year’s Budget contained incentives for manufacturers, with boosts to encourage employment, training and apprenticeships, along with 120 percent taxation writeoff for expenses relating to upgrade of software for cybersecurity, cloud based programs and payment devices. A temporary reduction in fuel excise will also help offset the recent vast increase in fuel prices.

EOFY is nigh

The last Budget contained measures for Temporary full expensing and Loss Carryback which continue only into the next financial year. In essence, large capital purchases may give rise to a taxation loss which may then be used as a ‘credit’ against tax paid in the past several years – which in turn can mean a refund of taxes previously paid; or a loss carried forward against future profits. • There is no limit to the value of capital purchases, nor a limit to the number • Goods purchased may be new or secondhand

In our view this is an unprecedented gift, unlikely to be repeated, and although these provisions continue until 30 June 2023, they are ideal for planning as the end of financial year 2022 draws close.

Interest rates

It is clear that the uber low rates of the past several years are behind us, although the rises to date have been modest. New equipment and vehicle purchases can still be financed beneath 5 percent, financiers are very competitive and, in our experience, will discount heavily in the final months of the financial year ending 30 June.

As finance markets continue to evolve and change, there is a constant march of new lenders, many of which identify a niche or opening, left by the major banks which concentrate on a narrow band of customer and asset types for which they will provide finance.

COVID measures have ended

The final restriction upon lending following the pandemic crisis was removed only in the past fortnight, by the largest and most aggressive (consequently the cheapest) equipment financier. This means a full return to ‘matrix’ type lending – automatic approval without having to present financials, tax returns, BAS or bank statements.

Australiawide finance director and broker, Colin Cooper advises manufacturers “to begin your finance transactions early”.

A caution – get in early

Financiers have lengthy delays as they come to terms with their increased responsibilities relating to the Anti Money Laundering & Counter Terrorism Financing Act (AML). Since the Act was first introduced in 2006, the rules have intensified each year.

The larger lenders now have departments set up to meet obligations to positively identify (with certified identification documents) every person identifiable with an equipment finance transaction. This becomes complex with multiple directors and shareholders, Trusts and beneficiaries.

The secret is to begin your finance transaction early – having finance approval prior to purchase gives certainty with the added benefit of acting as a cash buyer would (possibly extracting a big discount for immediate settlement).

LOOKING FOR FINANCE?

We specialise in commercial asset finance. Buy your business assets with confidence and arrange fast, competitive finance with one call

Vehicles, Plant & Equipment and Machinery Personal Finance for Cars, Caravans, Marine, Motorbikes, Jetskis etc. Finance for Technology & Green Energy Assets New & Used, Older Goods, Dealer, Auction & Private Sales Full Service: from Consultation to Application, Approval, Settlement and beyond

Wide & lengthy experience, ongoing customer service

1300 367 327

austwidefinance.com.au

MEMBERSHIPS

BRING YOUR BUSINESS VISION TO LIFE!

australiawide FINANCE offers a wide and varied range of finance products, tailored for business asset purchases

SCAN FOR PRODUCT RANGE

Eyeing growth despite turbulence

According to the Deloitte 2022 manufacturing industry outlook, the global manufacturing industry is building back fast, undeterred by significant labour and supply chain challenges. To maintain this momentum, Deloiite suggests that manufacturers navigate elevated risks while advancing sustainability priorities.

This extract from the 2022 outlook explores three manufacturing industry trends that can help organisations turn risks into advantages and capture growth.

Manufacturers are remaking supply chains for advantage beyond the next disruption, says the report, with record numbers of unfilled jobs likely to limit higher productivity and growth in 2022.

Talent scarcity is also compelling more manufacturers to consider raising pay. Although the industry has historically had a higher baseline wage for production workers, some competing industries are increasing wages faster than manufacturers.

As digitization transforms manufacturing work, automation of recurring tasks could help to blunt some of the labour shortage’s impact. Organisations may also have more incentive to “pull forward” futureof-work strategies by re-architecting work, rethinking the composition and capabilities of the workforce, and adopting flexible and innovative workplace strategies.

To attract and retain talent, manufacturers should pair strategies such as reskilling with a recasting of their employment brand. Shrinking the industry’s public perception gap by making manufacturing jobs a more desirable entry point could be critical to meeting hiring needs in 2022.

In Deloiite’s survey, 38 percent of executives report that attracting new workers is their top priority for the production workforce in 2022, followed by retention (31percent) and reskilling (13 percent).

Reputational harm from a history of moving jobs to lower cost regions or outsourcing remains a generational challenge for some manufacturers to overcome. The industry may need to deploy creative solutions to improve workforce perception and experience.

Manufacturing executives may need to balance goals for retention, culture, and innovation. Remote work for office workers was one of the early successes

for business continuity in the pandemic and has changed the minds of many employees and employers.

Hybrid and flexible work models will likely continue to evolve. As flexible work is taking root in offices, manufacturers should explore ways to add flexibility across their organisation in order to attract and retain workers. Organisations that can manage through workforce shortages and a rapid pace of change today can come out ahead.

Supply chain resilience

Supply chain resilience has been a thread through our recent outlooks, and the challenges are acute and still unfolding.

There is no mistaking that manufacturers face near-continuous disruptions globally that add costs and test abilities to adapt. Purchasing manager reports continue to reveal systemwide complications from high demand, rising costs of raw materials and freight, and slow deliveries in the US.

Transportation challenges are likely to continue in 2022, including driver shortages in trucking and congestion at US container ports. As demand outpaces supply, higher costs are more likely to be passed on to customers.

Root causes for extended US supply chain instability may include overreliance on low inventories, rationalisation of suppliers, and hollowing out of domestic capability.

Supply chain strategies in 2022 are expected to be multi pronged, according to our survey, including 41percent of executives who report their companies will further add or diversify suppliers in existing markets. Fiftythree percent of surveyed organisations plan to enhance data integration for supply-and-demand visibility and planning.

Digital supply networks and data analytics can be powerful enablers for more flexible, multi-tiered responses to disruptions. The risks from not “connecting the dots” through available data can be significant: A lack of supply chain integration could stall smart factory initiatives for 3 in 5 manufacturers by 2025.

Beyond the data, reshoring of components or even final assemblies are likely to pick up steam as global sourcing and low-inventory models continue to diverge. Rising wages and transportation costs globally make nearshoring or onshoring more competitive at the same time that organisations look to avoid a repeat of 202021. Twenty-four percent of manufacturing executives surveyed are considering moving operations closer to end customers in different regions in 2022.

Acceleration in digital technology

Manufacturers looking to capture growth and protect long-term profitability should embrace digital capabilities from corporate functions to the factory floor. Smart factories, including greenfield and brownfield investments for many manufacturers, are viewed as one of the keys to driving competitiveness.

More organisations are making progress and seeing results from more connected, reliable, efficient, and predictive processes at the plant. In 2022, 45 percent of manufacturing executives surveyed expect further increases in operational efficiency from investments in industrial Internet of Things (lloT) that connect machines and automate processes.

US manufacturers have room to run with advanced manufacturing compared to many competitors globally. The number of industrial robots as a share of manufacturing workers in the United States is below countries like Korea, Singapore, and Germany.

Half of executives we surveyed expect to increase operational efficiency in 2022 through their investments in robots and cobots. Investment in artificial intelligence technologies is also expected to see a compound annual growth rate (CAGR) above 20 percent through 2025.

Discrete manufacturing is among the top-three industries expected to invest most heavily in Al, primarily in quality management and automated preventive maintenance use cases. Advanced global “lighthouse” factories showcase the art of the possible in bringing smart manufacturing to scale. Foundational technologies such as cloud computing enable computational power, visibility, scale, and speed.

Meanwhile, Industrial 5G deployment may also expand in 2022 with advances in technology and use cases. One global equipment manufacturer has invested in multiple private 5G networks to enable automation and intelligence on factory floors as well as to support connected products.

Rising threats

High-profile cyberattacks across industries and governments in the past year have elevated cybersecurity as a risk management essential for most executives and boards. Surging threats during the pandemic added to business risk for manufacturers in the crosshairs for ransomware. An expanding attack surface from the connection of operational technology (OT), information technology (IT), and external networks requires more controls. Legacy systems and technology weren’t purpose-fit for today’s sophisticated network challenges. Now, remote work vulnerabilities leave manufacturers even more susceptible to breaches.

Manufacturers should look not only at their cyber defences, but also at the resiliency of their business in the event of a cyberattack. The potential for additional oversight is likely to prompt more industrials to rethink preparedness for crisis response.

Half of executives Deloitte surveyed expect to increase operational efficiency in 2022 through their investments in robots and cobots.

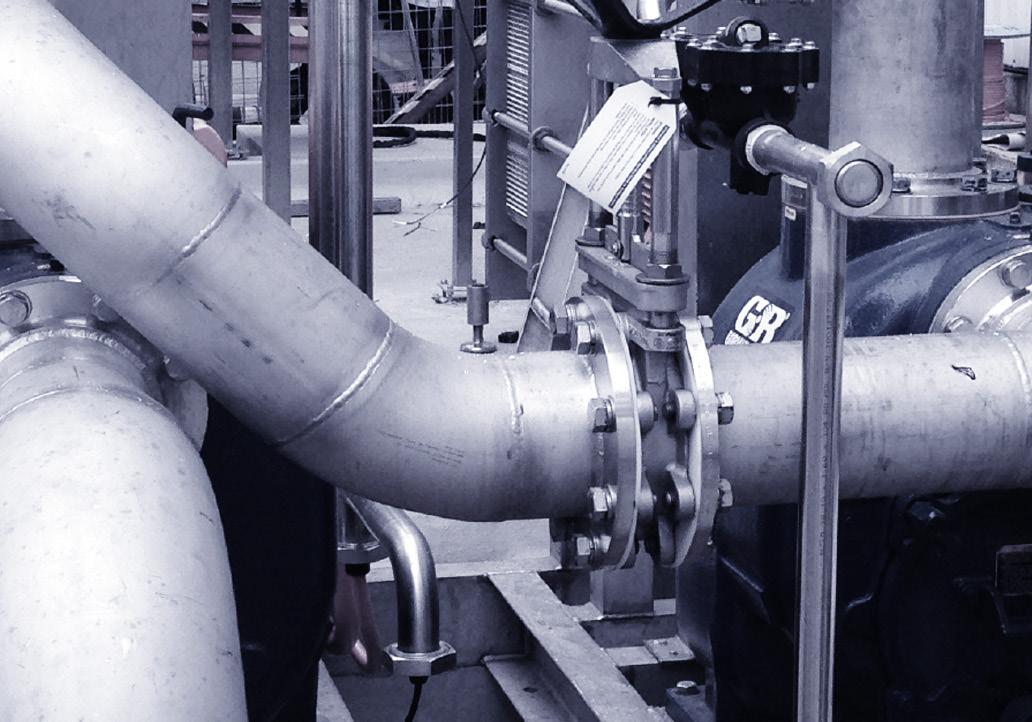

RUGGED & RELIABLE WASTEWATER PUMPS

• Self Priming Pumps are mounted above ground for easy access and maintenance • Designed to minimise blockages • Pumps rags and stringy materials with ‘eradicator’ technology • Does not require multiple personnel to maintain.