Successful CEOs are those who have the ability to inspire and motivate others, to build strong teams, and to lead by example.

- Cyril Ramaphosa

Astheworldshiftsitsfocustoemergingmarkets,Africastandsoutwithpromisingeconomic

prospects.In2025,thecontinentisanticipatedtoexperiencesignificantgrowth,projectedataround 4%.Thispositivetrajectoryisfueledbyacombinationoffactors,includingayouthfulpopulationand abundantnaturalresources.Theriseofdigitalfinanceisalsotransformingthedomain,makingfinancial servicesmoreaccessibletomillions.

Theprivatesector'sinterestinAfricaissurging,withmultinationalcorporationsincreasinglyinvestinginkey sectorssuchasrenewableenergyandtechnology.CompaniesarerecognizingthevastpotentialwithinAfrica's borders,particularlyinitsrichmineralresourcesandexpandingconsumermarkets.Thisinfluxofinvestment notonlyboostseconomicactivitybutalsofostersinnovationandjobcreation.

However,challengesremain.Structuralissuessuchasinadequateinfrastructureandhighdebtlevelsmustbe addressedtodiscoverAfrica'sfullpotential.InitiativesliketheAfricanContinentalFreeTradeArea (AfCFTA)aimtocreateaunifiedmarket,facilitatingtradeandenhancingeconomiccooperationamong nations.Thisstrategicmoveisexpectedtoreducebarriersandpromoteregionalintegration.

Insummary,Africa'sfinancialfutureisbright,characterizedbyresilienceandopportunity.Withtheright strategiesinplace,includingimprovedregulatoryframeworksandenhancedpublic-privatepartnerships,the continentispoisedtoemergeasakeyplayerontheglobaleconomicstage.Asthesedevelopmentsunfold, Africa'sjourneytowardssustainablegrowthwillundoubtedlycapturetheworld'sattention.

Inthelatesteditionof Insights Success,titled"Top10InvestmentBanksShapingAfrica'sFinancial Future,"highlightsleaderswhohavebeeninstrumentalinshapingthecontinent'sfinanciallandscape.These investmentbanksarenotonlyfacilitatingcapitalflowsbutalsodrivinginnovationandsustainablepractices withinthefinancialsector

Haveagoodreadahead!

-AlayaBrown

F E A T U R I N G

08. Development Bank Ghana Empowering Economic Growth and Inclusion

P R O F I L E S

16. 24.

CRDB Bank Group Transforming Lives Through Financial Literacy

I&M Group PLC Permitting Financial Futures as a Trusted Financial Partner

30. Stanbic Bank Botswana Empowering Communities through Sustainable Banking 40. UBA Kenya Empowering Economies through Innovative Banking Solutions

20. 36. A R T I C L E S How Investment Banking Strategies Differ Across Global Markets

Why Cross-Border Transactions Present Unique Challenges for Investment Banks

Bramel | Bou�que investment bank bramel.co.za

Tyrone Niland Director Company

CRDB Bank Plc crdbbank.co.tz

Development Bank Ghana dbg.com.gh

Dry Associates Investment Bank dryassociates.com

Faida Investment Bank fib.co.ke

Fidelity Bank Gh Ltd idelitybank.com

I&M Group PLC imbankgroup.com

NCBA Investment Bank Limited investment-bank. ncbagroup.com

Stanbic Bank Botswana stanbicbank.co.bw

UBA Kenya ubakenya.com

Featuring

Abdulmajid Nsekela Group CEO and Managing Director

Eric Osei-Assibey Chief Economist

James Dry Managing Director

Bramel is a bou�que investment bank based in South Africa, specializing in providing tailored financial services and strategic advisory solu�ons to businesses and ins�tu�onal investors.

CRDB Bank Plc is a leading financial ins�tu�on in Tanzania, renowned for its innova�ve banking solu�ons, customercentric approach, and commitment to economic growth.

Development Bank Ghana (DBG) is a government-backed financial ins�tu�on dedicated to fostering economic growth and suppor�ng businesses across Ghana.

Dry Associates Investment Bank is a leading investment and financial advisory firm dedicated to providing tailored capital market solu�ons in Kenya and beyond.

Lucas O�eno Managing Director

Faida Investment Bank is a premier financial services provider in Kenya, specializing in investment banking, wealth management, and capital markets advisory

Julian Opuni Managing Director

Kihara Maina Regional CEO

Kathure Githinji-Nyamu Managing Director

Fidelity Bank Ghana Ltd is one of Ghana’s leading financial ins�tu�ons, commi�ed to providing innova�ve and customer-centric banking solu�ons.

I&M Group PLC is a leading financial services provider with a strong presence across East Africa, offering a diverse range of banking and investment solu�ons.

NCBA Investment Bank Limited is a leading financial services provider specializing in investment banking, asset management, and advisory solu�ons across East Africa.

Chose Modise

CEO

Ms. Mary Mulili MD/CEO

Stanbic Bank Botswana is a premier financial ins�tu�on commi�ed to driving economic growth and providing worldclass banking solu�ons in Botswana.

UBA Kenya, a subsidiary of the United Bank for Africa (UBA) Group, is a premier financial ins�tu�on providing a comprehensive range of banking products and services to individuals, businesses, and corporate clients across Kenya.

DBG has made substantial investments in establishing a stateof-the-art data center with the objective of creating the largest data repository for SMEs in Ghana.

ThejourneyofDevelopment

BankGhana(DBG)is intricatelywovenintothedaily experiencesandaspirationsof individualsandfamiliesacrossGhana. Fromthefarmertendingtofields,to theenterprisingyoungpersonstriving tolaunchastartup,andthedetermined marketwomanambitiouslygrowing herbusiness,andallthoseforginga pathtowardsabrighterfuture.While othersmayseethesepursuitsasmere jobs,DBGseeslivesandlegacy

DBGhasbecomeanindispensable financialbackboneinGhana, particularlysupportingkeysectors suchasagricultureandtechnology As ofMay2024,DBGhaddisbursedover GHS1.3billioninloans,providing strategicfinancialinterventionsthat havehelpedstabilizeandgrowthese industries,evenintimesofeconomic uncertainty.DBGhasallocated substantialresourcestowards empoweringwomen-ledbusinesses.So far,137millionGhanaCedishasbeen directedtowardssupportinggender equalitytofostereconomicdiversity andpromotemassprosperity.

TosafeguardDBG'svisionof acceleratinginclusiveandsustainable economictransformationthrougha competitiveprivatesector,theBank, ledbyKDuker,iscommittedto ensuringitslong-termfinancial sustainability,whichtypicallyhinges onpredictablefunding.Thisrequires notonlyattractinginvestorsand fundingpartnersbutalsomaintaining theirconfidencethroughdedicated effort,trust-building,andunwavering commitmenttotheBank'smissionand objectives.

DBGtrulyexemplifieshowvisionand innovativeapproachesseamlessly convergetomeetandsurpassthe rigorousdemandsofdevelopment finance.TheBank'sstrategyto securingpredictablefundingis multifaceted,combiningstrategic

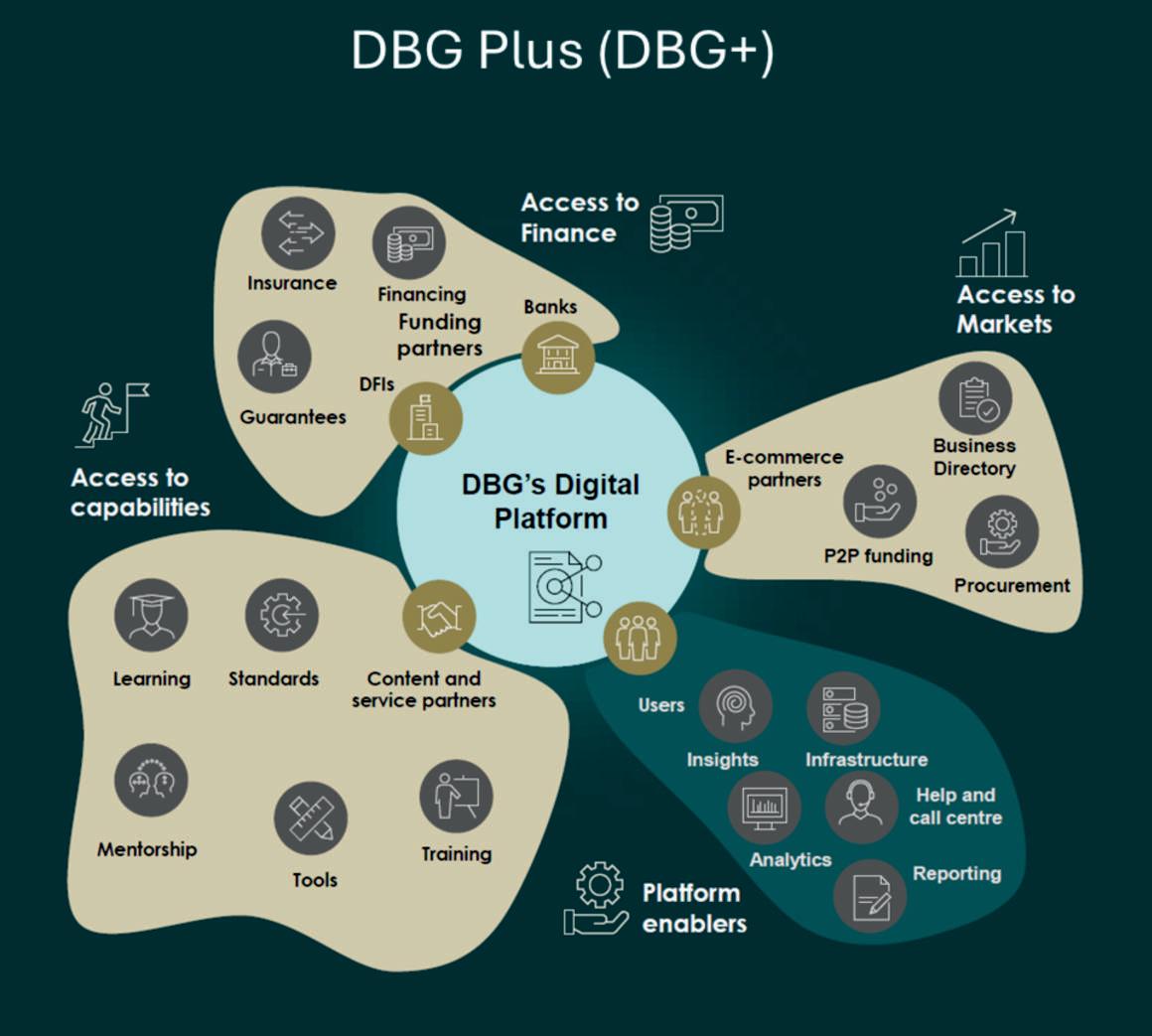

GIFE serves as a platform for financial education, access to finance, and entry into international marketplaces.

leadership,innovativefinancial instruments,androbustrisk managementpractices.This comprehensiveapproachensuresthat DBGcontinuestoberesilientand forward-thinking,becausethevisionto improvelivesisonlyprotectedwhen thebusinessissustainable.

Drawingparallelsfromtheadage"It takesavillagetoraiseachild,"DBG, whilewhollyownedbythe GovernmentofGhana,isbackedbya communityofglobaldevelopment banks.Theirsteadfastsupportnotonly fueledtheinceptionofDevelopment BankGhanabutalsocontinuesto propelourstrategicinitiativesforward.

TheWorldBankGrouphasbeena pillarofdevelopmentgloballysince 1944,withasteadfastcommitmentto reducingpovertyandpromoting sustainabledevelopment.In2020,they launchedtheGhanaDevelopment FinanceProjectwithasignificant investmentof$250million.This visionaryproject,emergingfroman extensivefeasibilitystudy,aimsto stimulateeconomicgrowthandjob creation,focusingparticularlyon SMEsandvitalsectorssuchas agribusinessandmanufacturing.The DevelopmentBankGhana,birthed fromthisinitiative,isdesignedto bridgelong-standingfinancialgapsand enhanceournation'seconomic competitiveness.

TheEuropeanInvestmentBank, knownforbolsteringeconomicgrowth andregionalintegrationwithinthe

EuropeanUnionsince1958,has extendedalineofcreditof€170 milliontoDBG.Thissubstantial supportunderscorestheEIB's confidenceinourpotentialtodrive significanteconomicchangesin Ghana.

KfWBank,abeaconofreconstruction andsustainabledevelopmentin Germanysince1948,hasgenerously providedDBGwithaloanof€46.5 million.Thisfundingispivotalin supportingourgreenandsustainable initiatives,layingdownthe infrastructureforaresilientGhanaian economy

TheAfricanDevelopmentBank, dedicatedtospurringsustainable economicdevelopmentandsocial progressacrossAfricasince1964,has fortifiedourfoundationwithagrantof $38.3million.Thisgrantisatestament totheAfDB'scommitmenttonurturing economictransformationacrossthe continent.

Thesepartnershipsareacollective testamenttotheglobalconfidencein Ghana'spotentialandDBG'sroleasa catalystforchange.Togetherwith theseesteemedinstitutions,DBGisset totransformtheeconomiclandscapeof Ghana,ensuringprosperityand sustainabilityforfuturegenerations. Weareimmenselygratefulforthetrust andresourcesthatthesepartnershave investedinDBG.Theirsupport enablesustomoveforwardwith confidenceanddetermination, committedtoachievinginclusive growthandeconomicresiliencefor Ghana.

Despitethisgreatsupportthereisa realismthatthatthetraditional developmentbankbusinessmodelis notsustainablewithoutpredictableand regularreplenishment.Thisisbecause asaDevelopmentBank,DBGfaces threeexistentialthreatstofinancial sustainabiliy

• High-RiskInvestments:DBGis taskedwithrevitalizing underservedsectors,committing toinvestmentsinareasthat,while crucialfordiversification,are oftenneglectedbytraditional financiersduetotheirvolatility.

• LimitedProfitability:In alignmentwithitsdevelopmental mandate,DBGisconstrainedfrom significantlyboostingprofitsby transferringinterestrateincreases toitsborrowers.Thisapproach ensuresthatfinancialsupport remainsaccessibleandaffordable, especiallyduringeconomic downturns.

• RoleDuringCrises:Asa designated'stresspartner,'DBG's

• rolebecomesevenmorecrucial duringeconomiccrises.It providesstabilityandsupport whenotherfinancialinstitutions mayretreat,actingasastabilizing forcewithinthefinancialsector andensuringcontinuityinfunding forcriticaldevelopmentprojects.

Macro-EconomicChallenges:Impact ofEconomicDownturnsonlyworsen thecongenitalproblem

Therecentglobalandlocaleconomic downturnshaveaccentuatedtheneed forachangetotheunsustainable traditionalmodel:

• Inflation:Ghanaexperienced dramaticinflationrates,peakingat 54.1%inlate2022,whichposed significantchallengesin

maintainingthecostofoperations withoutcompromisingservice delivery

• CurrencyDepreciation: Alongsideinflation,theGhanaian Cedifacedsignificant depreciation,droppingby46.6% inUSDtermsfromMarch2021to March2024.Thisdepreciation severelyimpactsthevalueof DBG'sequity,originallyvaluedat USD238.2million,but consequentlydecreasingtoUSD 127.3million.

Despitetheeconomicturbulence,DBG hasdemonstratedremarkableresilience andeffectiveness:

DBGasaStressPartner:Intimesof economicvolatilityanduncertainty, DBGstandsasasteadfaststress partnerforbusinessesinGhana.As oneillustrationin thehospitality industry,DBGprovidedfundingfor localhotelsduringtheCOVID-19 pandemicwhentheirbusinesseswere mostvulnerable,andmanybanks couldnotlendtothem.Onehotelfor instance,receivedaDBGloanofGHS 128millionthroughDBGPartner Bankstorenovateandexpandtheir facilities,consequentlycreatingabout 188directjobsand750indirectjobs. AnotherHotelusedaDBGloanto upgradefroma2-startoa3-star establishment,increasingtheirstaff from30to55.Businessgrowthis expectedtoreflectintheirrespective

fiscalandforeignincomecontribution totheGhanaianeconomy.DBG ensurescontinuityandresilienceby helpingbusinessesandcommunities navigatechallengeswithconfidence.

DBGasaCatalyst:DBG'sinnovative approachestodevelopmentfinanceis stronglyreflectedinitsroleasa catalyst.IncollaborationwithProxtera (Singapore)andBankofGhana (BOG),DBGhascuratedtheGhana IntegratedFinancialEcosystem(GIFE) project.GIFEisaplatformdesignedto supportMSMEsthroughtraining, marketplaceintegration,financing, equitybuilding,andmarketlisting.The GIFEproject,undertheBankof Ghana'sSandbox,hassuccessfully onboarded5,843SMEsanddisbursed 8millionGhanaCedistosomeSMEs

throughConsolidatedBankGhana (CBG)withoutcollateral.Asacatalyst, DBGalsostrivestopositionGhanaas aburgeoninghubforfinancial technologyandinnovation.Atypical exampleisthe3iAfricaSummit, organizedinpartnershipwithBOGand Elevandi(Singapore),inMay2024. TheSummitfosterednewpartnerships andattractedinternationalinvestment, highlightingDBG'sroleindriving significantsocio-economicimpactand positioningitselfasacatalystfor changeevenunderchallenging conditions.

DBGasaCollaborator:DBG continuestocollaboratewithrelevant partnersandstakeholderstodrive impact.Topromoteagribusinessand foodsecurityforexample,DBGhas

collaboratedwiththeGhanaIncentiveBasedRisk-SharingSystemfor AgriculturalLending(GIRSAL). DBG,inpartnershipwithGIRSAL enhancesagriculturalfinancing throughdealfacilitation,project monitoring,partialcreditguarantees, andcapacitybuildingofParticipating FinancialInstitutions(PFIs)and SMEs.Thepartnershipsupportslargescaleintegratedprojectsinkey agriculturalvaluechains,leveraging complementarystrengthstostimulate andbolsteragriculturalfinancing. Additionally,DBG'sintroductionof PartialCreditGuarantees(PCGs) furthermitigatesrisksforlenders, makingitmorefeasibleforSMEsto accessthenecessaryfunding.

Thefutureofsustainingdevelopment banksgoesbeyondrelianceonexternal funding.DBGisuniquelypositionedat theintersectionoffinancial institutions,MSMEs,andthe Government,DBGisleadingthewave ofAfricandevelopmentbanksevolving fromfinancierstoecosystembuilders. Bystandardizingunderwritingterms, behavioralexpectations,andpolicy frameworks,DBGhasthepotentialto unleashsynergythatenhancesthe efficiencyandreachofdevelopment initiatives.Theaggregationand monetizationofthesesynergiespoint toasustainablefuture. Thisintegrated strategywilldefinethefuturesuccess andsustainabilityofdevelopment banks.DBGleadsthistransformative shift,demonstratingthatwhenthese sectorsalignundercommongoals,the potentialforsubstantial,scalable impactisunlimited.

DBGisworkinghardtoconsolidate oureffortintoDBG+,acomplex ecosystembringingtogethermultiple stakeholderstodeliveraholistic solutionthatwillrevolutionizeSME enablement.

DBGsetsastandardforexcellencein developmentbankinginAfricaby adheringtostrictgovernancestandards andbestpractices,enhancingbothits credibilityandoperational effectiveness.Ghanahasseen developmentbanksinthepastthat couldnotsustainthetraditional developmentbankmodelandwere compelledtotransforminto commercialretailbankstostayafloat.

Incontrast,DBGstandsasatestament tothepowerofresilientleadershipand strategicmanagementindevelopment banking.Bynavigatingthesector's

inherentchallengeswithablendof innovativestrategiesandleadership, DBGestablishesanewbenchmarkfor howdevelopmentbankscandrive significantsocio-economicimpact, evenunderchallengingconditions. Throughitsactionsandachievements, DBGnotonlysupportsbutinspires, provingthatwithdeterminationand vision,eventhesteepestchallengescan besurmounted.

DBGsimplydoesitdifferent!

Leadership is not about being in charge, Its about taking care of those in your charge.

- Simon Sinek

Identifyingthegraveimportanceof

financialinclusionandeconomic empowermentisvitalintoday's hastilychangingworld.Individuals andcommunitiesareincreasingly seekingaccesstovitalfinancial services,suchasbankingandcredit, whicharecrucialfornurturing economicstabilityandgrowth. Innovativeapproachesarebreaking downbarriersandexpandingthe financialsystemtoincludemore people.Theseinitiativesnotonly promoteentrepreneurshipandbroaden accesstoeducationbutalsoequip individualswiththenecessarytools andresourcestosucceed.

Attheforefrontofthismovementis CRDBBankGroup,Tanzania's leadingfinancialservicesprovider

Withacommitmenttofinancial literacy,CRDBBankhaslaunched programslike"ZogoMchongo,"a televisioninitiativeaimedateducating citizensaboutfinancialservicesand opportunities.

Thisprogram,praisedbygovernment officials,isdesignedtocombat ignoranceandpoverty,empowering Tanzanianstoachieveeconomic independenceandcontributeto nationalgrowth.CRDBBank'sefforts extendbeyondeducation.

ThebankhasdevelopedtheCRDB Wakalanetwork,whichallows individualsinbothurbanandrural areastoaccessbankingservices conveniently Thisinnovativeapproach hasmadebankingmoreaccessible,

CRDB Bank operates a responsive strategy to modify its products and services to meet speci�c needs

particularlyforunderserved populations,thuspromotingamore inclusivefinancialenvironment.

RecognizedasTanzania'sBestBank forfourconsecutiveyears,CRDB Bank'sachievementsreflectits dedicationtosustainablegrowthand customerserviceexcellence.The bank'sdigitaltransformationstrategy hasenhancedservicedelivery,making iteasierforcustomerstoengagewith financialproductsandservices.

Throughtheseinitiatives,CRDBBank isnotjustafinancialinstitution;itisa catalystforchange,transforminglives andfosteringamoreequitablesociety inTanzania.Asthebankcontinuesto expanditsreachandenhanceits offerings,itremainscommittedtoits missionofdrivingfinancialinclusion andeconomicempowermentforall Tanzanians.

Let's discover their amazing journey!

AbdulmajidNsekela,GroupCEOand ManagingDirectorofCRDBBank Group,bringsnearly25yearsof experiencetothefinancialsector Drivenbyadeepbeliefinbanking's powertosubstituteforeconomic empowerment,Nsekelahasdedicated hiscareertopromotingfinancial inclusion.

AtCRDBBank,heleadseffortsto deliverinnovative,accessiblefinancial solutionsthatpositivelyimpact individuals,businesses,and communitiesacrossEastAfrica.

CRDBBankGroupwasfoundedin 1996followingtheprivatizationofthe government-ownedCooperativeand RuralDevelopmentBank.Thegoal wastotransformtheinstitutionintoa moreefficient,attentive,and innovativefinancialservicesprovider.

Sinceitsinception,CRDBBankhas growntobecomealeadingfinancial institutioninTanzania,withapresence inthebroaderEasternAfricaregion, includingtheRepublicofBurundiand theDemocraticRepublicoftheCongo (DRC).

Thebank'sjourneyhasbeen characterizedbystrategicexpansions, technologicaladvancements,anda vowtofinancialinclusion.

APioneerinTanzania'sSector

CRDBBankstandsoutasaleaderin Tanzania'sfinancialmarketthroughits technologicalandproductinnovations. ItwasthefirstTanzanianbankto expandinternationally,opening subsidiariesinBurundiin2012andthe DRCin2023.

Withavigorousinfrastructureand extensivedistributionnetwork,CRDB

Bankdeliverstailoredfinancial serviceseventoremoteareas.Its strongcorporategovernanceandrisk managementpracticesupholdhigh standardsofintegrityand accountability

CRDBBank'sgrowthandinnovation arefueledbyaclearvisionand strategicinvestmentsintechnologyand humancapital.Thebankconsistently introducesnewproductsandservices tomeettheevolvingneedsofits customers.

Itseffortindigitalbankinghas enhancedconvenienceandefficiency, whileitscommitmenttofinancial inclusionhasextendedservicesto underservedcommunities.Thisblend ofgrowthandinnovationhasreputable CRDBBankasthepreferredfinancial partnerintheregion.

CRDBBankprovidesawidearrayof servicestovariouscustomersegments, includingindividuals,SMEs, corporations,andinstitutions.Its offeringsencompasspersonaland businessbanking,loansandcredit facilities,savingsandinvestment products,insurance,andtreasury services.

Thebankalsofeaturesspecialized productssuchasagribusiness financing,microfinance,andmobile bankingsolutions.Thisdiverse portfolioenablesCRDBBankto effectivelyaddresstheuniquefinancial needsofeachcustomersegment.

CRDBBankoffersabroadrangeof servicesdesignedforvariouscustomer segments,includingindividuals,

SMEs,corporations,andinstitutions. Itscomprehensiveportfolioincludes personalandbusinessbanking,loans andcreditfacilities,savingsand investmentproducts,insurance,and Treasuryservices.

Additionally,thebankprovides specializedproductslikeagribusiness financing,microfinance,andmobile bankingsolutions.Thisextensiverange allowsCRDBBanktoeffectivelycater totheuniquefinancialneedsofeach segment.

CRDBBank'scollaborationswith microfinanceinstitutionsandCRDB Wakalaagentsgreatlyincreaseits reachandimpact,particularlyin underservedandruralareas.These partnershipsallowthebanktoextend itsfinancialservicestocommunities withlimitedaccesstotraditional bankingchannels.

This blend of growth and innovation has reputable CRDB Bank as the preferred �nancial partner in the region.

Throughexploitingthenetworksof theseinstitutionsandagents,CRDB Bankoffersessentialservicessuchas savings,loansandmoneytransfers, therebyadvancingfinancialinclusion andeconomicempowermentatthe grassrootslevel.

CRDBBankoperatesaresponsive strategytomodifyitsproductsand servicestomeetspecificneeds.The bankactivelyengageswithcustomers throughsurveys,feedback mechanisms,anddirectinteractionsto

gatherinsightsintotheirpreferences andrequirements.

Thisinputguidesthedevelopmentand refinementofproductsandservices. Additionally,CRDBBankinvestsin dataanalyticsandmarketresearchto identifytrendsandanticipatefuture needs,ensuringthatitsofferings remaininnovativeandmalleable.

CRDBBank'streasuryservices, includingforeignexchangeand investmentmanagement,helpmanage

liquidity,mitigaterisks,andoptimize returns.Itslendingservicessupportthe growthofSMEsand microentrepreneurswithfundingand technicalsupport.

Theseservicesaugmentprofitability whilereinforcingthebank'svowto financialinclusionandeconomic development.

CRDBBank'streasuryservices,which includeoverseasexchangeand investmentmanagement,area necessityformanagingliquidity, mitigatingrisks,andoptimizing returns.Thebank'slendingservices contributetothegrowthofSMEsand microentrepreneursbyproviding necessarysubsidiesandtechnical support.Theseservicesboost

profitabilityandunderscoreCRDB Bank'senthusiasmforfinancial inclusionandeconomicdevelopment.

CRDBBankhasintroducedseveral innovativeproductsandservicestothe market.TheSimBankingmobile applicationallowscustomersto conductawiderangeofbanking transactionsviatheirmobilephones, increasingconvenienceand accessibility

Thebankalsooffersspecialized productsforSMEs,includingbusiness loans,advisoryservices,andcapacitybuildingprograms.Additionally,with over25,000CRDBWakalaagents,the bankprovidesanalternative transactionchannel,furtherexpanding itsreachandservicedelivery

CRDBBankisdedicatedtoadhering tothehigheststandardsofcorporate governanceandriskmanagement.The bankhasestablishedacomprehensive governanceoutlinefeaturingrobust internalcontrols,policies,and procedurestocertifycompliancewith regulatoryrequirementsandindustry bestpractices.

TheBoardofDirectorsprovides strategicoversight,whilethededicated riskmanagementdepartment continuouslymonitorsandassesses risks.Additionally,CRDBBank investsinregulartrainingand developmentprogramstomakesure thatemployeesarewell-equippedto maintainthesestandards.

Investmentbankingisanintermediarybetweencapital

seekersandinvestorsinaglobalfinancialcontext. Investmentbankshavedifferentstrategiesusedbased onthevariouseconomicandpoliticalcircumstances surroundingeachinternationalmarketplace,thecultures, andmanymore.Withknowledgeofthedifferencesthat distinguishinternationalmarketplaces,aninvestmentbank thereforeneedstobewellawareofinternationalfinance andtobesuccessful.

Thestateoftheglobaleconomyisoneofthemost importantinputsintoinvestmentbankingstrategies. Economicgrowthusuallyleadstoariseindemandforall typesofservicesthatinvestmentbankersoffer,which includeM&A,fundraising,andadvisoryservices.

Forinstance,astheireconomiesgrow,companiesusually liketoexpandandexplorenewterritories,thusleavingthe investmentbanktohelpconductthesetransactions.The globalinvestmentbankingmarket,accordingtoprojections, issupposedtohitimportantgrowthfiguresinthecoming yearsbecauseofincreasingGDPandimprovingbusiness confidence2.

Conversely,economicrecessionreducesactivityin investmentbanking.CompaniesmayopposeM&Aand raisingcapitalatrecessionsandeconomiccriseswhere outlooksremaindubious.Aninvestmentbankmayhaveto revisititsstrategiesthatbestfitalessriskyre-structuring, therebyassistingitsclientsindealingwiththetroubled financialtimes.

Regulatoryframeworksareverydifferentbetweenregions andcanplayasignificantroleinhowinvestmentbanks operate.InNorthAmericaandEurope,forexample,there arequitestrictregulations,whichwereimposedafterthe lastfinancialcrises.Theseregulationsentailcapital requirementsandoperationalpractices,whichbanksmust achievetoensurestabilityandprotectinvestors.Investment banksintheseregionsofteninvestalotincomplianceand riskmanagementsystemstomeettheserequirements.

Ontheotherhand,theemergingmarketshaverelatively morerelaxedregulatoryenvironmentsthatprovideunique investmentopportunitiesforinvestmentbanks.For example,intheAsia-Pacificregions,rapideconomic growthtendstooutstripthedevelopmentofregulation,thus providinginvestmentbankswiththeopportunitytofreely engageininnovativefinancialproductsandservices. However,thislackofregulationalsoposesrisksbecauseit canleadtovolatilityandevenmarketmanipulation.

Culturalfactorsalsodeterminetheinvestmentbanking strategiesacrossdifferentmarkets.InmostWestern countries,transparencyandaccountabilitytakecenterstage. Investmentbankstypicallyemphasizeclearcommunication withclientsandstakeholders,whichcreatestrustthrough opendialogueregardingrisksandopportunities.

Contrarily,inotherAsianmarkets,theculturecouldbe moreinclinedtorelationshipsratherthanformalities.Here, one'spersonalconnectionisimportantintheconductof business.Theinvestmentbanksherehavetotaketimeto spendonrelationshipbuildingbeforeenteringanyformal negotiationoreventransaction.Thereisaneedto understandlocalcustomsandthewaybusinessisconducted inthismarket.

Theriseoftechnologyhastransformedthelandscapeof investmentbankingglobally.Investmentbanksincreasingly useadvancedtechnologieslikeartificialintelligence(AI) andmachinelearningintheiroperationstoenhancetheir offerings.Thesetechnologiesallowforefficientdata analysis,riskassessment,andclientservicedelivery.

Indevelopedmarkets,suchasNorthAmericaandEurope, investmentbanksarepioneersintheadoptionofthese technologiesforthestreamliningofprocessesand

improvingdecision-makingcapabilities.TheyareusingAIdrivenplatformsineverythingfromtradingalgorithmsto customerrelationshipmanagementsystems.

Whilethisishappening,developingmarketsareslowly embracingthesametechnologybutfacechallengesof infrastructureandaccess.Aninvestmentbankwouldneed tofindnewwaysaroundthesameissuesasittriestoreach themarketswithoutcompromisingitsfront-endservices.

Themarketvolatilitydiffersfromoneregiontoanother.In NorthAmericaandEurope,maturemarketsusually experiencemorevolatilefluctuationsaspromptedbythe changesinmacroeconomicsorevengeopolitical happenings.Theserisksarehighlymitigatedhereby employingsomeoftheriskmanagementtechniquesonthe portfolio,whichaninvestmentbankadoptsinitspractices.

Forinstance,thepoliticalinstabilityoreconomicreforms areknowntoincreasethelocalizedvolatilityinemerging markets.Assuch,investmentbanksarerequiredtobeagile andresponsive,especiallychangingthestrategiesrapidly basedonchangingconditions.

Investmentbankingisnotaone-size-fits-allindustry;it requiresaverynuancedunderstandingofvariousglobal factorsthatinfluenceitsoperations.Eachmarket,withits uniquechallengesandopportunities,hasdifferenteconomic conditions,regulatoryframeworks,culturalconsiderations, andtechnologicaladvancements.

Asglobalizationcontinuestoshapethefinanciallandscape, investmentbanksmustadaptandinnovatetostayaheadof thecurve.Understandingtheuniquenessofeachmarket theyoperateinallowsthemtotailorstrategiestomeet clientneedsandcapitalizeonemergingtrends.

Investmentbankingisgoingtothrivedespiteuncertaintyas longasflexibilityandtechnologyblendwellwithvery goodclientrelations.Putsimply,globalmarketsdeciding thefactorsatplaydeterminesuccessfulinvestmentbanking.

Permitting Financial Futures as a Trusted Financial Partner

Inthespeedilyprogressingglobal

economy,theroleofatrusted financialpartnerhasbecome crucial.Thesepartnersoffertailored solutionsthataddresstheuniquegoals ofindividualsandbusinesses, encompassingbothbasicbankingand investmentservices.

Theyprovideaccesstowide-ranging financialsolutionsandguidecustomers astheynavigatefinancialcomplexities, growtheirwealthandenhancetheir financialresilience.I&MGroupPLC RegionalCEOKiharaMaina overseestheEastAfricanBanking Group'soperationsacrossKenya, Mauritius,Tanzania,Rwandaand Uganda.

HedrivestheGroup'scorporate strategywithafocusonsustainability, technologicalinnovationandculture changeintheprovisionofrelevant productsandservicestodifferent customersegments.

Let us learn more about his journey:

Kiharaisaseasonedbankerwith30 yearsofexperienceinthefinancial sector.HeheldvariousTreasuryroles beforeservingasManagingDirectorof BarclaysTanzaniaforsevenyears.In 2016,hebecameCEOofI&MBank Kenya,wherehesuccessfully

implementedtheiMarastrategy, elevatingthebanktoTier1status.In January2023,hewasappointed RegionalCEOofI&MGroupPLC.

MainaservesontheboardsofI&M GroupPLC,I&MBankRwandaPLC, I&MBankUganda,I&MBank Tanzania,BankOneLimited,andThe EastAfricanBondExchange(EABX). HeisalsoaTrusteeoftheAlliance HighSchoolEndowmentFundTrust.

Outsideofwork,heisadevoted husbandandfatheroftwo,aswellasa golfenthusiast.Hisbankingcareer beganatMoiUniversity,wherehis mathematicsdegreeandinterestin computerscienceledhimtoa ManagementTraineeProgramme, launchinghissuccessfulcareer

I&MGroupPLChasastrongpresence intheKenyanmarket,providing banking,insurance,andrealestate services.Itoffersarangeoffinancial services,includingCorporate& InstitutionalBanking,Personal& BusinessBanking,Bancassurance, WealthManagement,andAdvisory servicesacrossfivecountries:Kenya, Uganda,Tanzania,Rwanda,and Mauritius.

Foundedin1974,I&MBankevolved fromafinancialservicescompanyinto acommercialbankandisnowa

whollyownedsubsidiaryofI&M GroupPLC,whichislistedonthe NairobiSecuritiesExchange(NSE).

TheGroupisregulatedbytheCentral BankofKenya,theCapitalMarkets AuthorityofKenya,andtheNairobi SecuritiesExchange.ItsRwandan subsidiary,I&MBankRwandaPLC,is alsolistedontheRwandaStock Exchange,enhancingtheGroup’s regionalpresence.

UnderKihara'sleadership,I&MGroup PLC.haspursuedatransformative strategydubbediMara(Swahilifor strong).TheiMaraStrategywas designedtobedeliveredacrossthree horizonsinthree-yearcycles.The initialphaseestablishedastrong foundation,focusingonre-platforming anddigitalenhancements,likewise refiningtheGroupOperatingModel. TheseeffortsachievedTier1statusin Kenya,increasedmarketsharein TanzaniaandRwanda,andcontributed 89%ofprofitbeforetaxfromI&M BankKenyawhileelevatingthe organization’sHealthIndexranking.

In2020,theGrouppivotedtowards diversification,emphasizingvalue propositionboosts,increasingshareof wallet,andadaptingdigitalstrategies tomeetchangingcustomerneeds. Currently,thefocusisonsolidifying

Under Kihara's leadership, I&M Group PLC. has pursued a transformative iMara strategy centered on three key horizons

leadershipinprioritysegmentsand expandingintoemergingmarkets.In theprimarymarketofKenyafor example,thebankingentityI&MBank Limitedhaslaunchedaward-winning propositionsforMSMEs,strengthened fintechpartnerships,andembarkedon anambitiousbranchexpansionstrategy with20newbranchessettoopenby thecloseof2024.

Underhisheadship,I&MBankLtd. hasconfirmedsignificantTrade FinanceandTreasurylimitswithtop internationalcounterpartiesforLetter ofCredit(LC)confirmationsand MoneyMarketactivities.Whenits subsidiarybanksfacecapital constraints,I&MBankKenya’sstrong balancesheetsupportsthemthrough re-issuance,ensuringcontinuedTrade Financeoperations.

Thebankhasforgedlasting partnershipswithglobalbanks, includingJPMorgan,CitiGroup, CommerzBank,StandardChartered Plc,andtheInternationalFinance Corporation(IFC),expandingits internationaltradenetwork.Asan issuingbankundertheGlobalTrade FinanceProgram(GTFP),I&MBank Ltd.enhancesitsabilitytoprovide tradefinancing,withIFCguarantees mitigatingpaymentrisksforvarious tradetransactions.

TofacilitatepaymentsandTreasury operations,I&MBankLtd.leveragesa networkoftopglobalbanks,ensuring accesstomajorfinancialmarketsfor real-timeoperations.Additionally, thoughI&MCapitalLimitedandBank OneMauritius,theGroupoffers customersaccesstointernational investmentmarketsanddiversified wealthmanagementsolutions.

KiharaofI&MBankLtd.underlines thebank'sdedicationtounique

financialsolutionsinKenyaand beyond.Notably,I&MBankisthe onlyinstitutioninKenyaofferingfree BanktoMobileWallettransactions, providingsubstantialdailysavingsfor customers,witharecentextensionof theofferingtotheTanzanianmarket.

Thebankalsofeaturesthelargest unsecuredpersonalloanofferingin Kenyaandhasreceivedpositive feedbackforitsdigitallending products.In2013,I&MBankwasthe firstBankintheregiontointroducethe MastercardMulticurrencyPrepaid Card,aidingtravelerstoholdGBP, EUR,andUSD,thusavoiding currencyconversionfees.

In2017,Kiharalaunchedthefirst GermanDeskinAfricafortailored financingservicesforGermanSMEsin Kenya,aChineseDesktoaddressthe growingChinesetradecorridorwould soonfollow.I&MBankisalsounique inissuingLettersofCredit(LCs)with two-yearterms,reinforcingits leadershipininnovativebanking solutions.

AnOverviewoftheGroup'sRisk& ComplianceStrategy

I&Mhasdeterminedacomprehensive GroupMinimumStandards ComplianceFrameworkthataligns withglobalregulatorystandards.The bankmaintainsregularengagement withregionalregulatorstosafeguard transparencyandadherenceto compliancerequirements.

Robustinternalauditsareconducted alongsidetheutilizationofadvanced compliancetechnologyforeffective monitoringandreporting.Ongoing trainingprogramsforstafffurther developthebank'scomplianceculture.

Additionally,third-partyauditsare carriedouttoverifyadherenceto regulations,confirmingthatI&MBank Ltd.operatesconsistentlyinlinewith bothinternationalandlocalregulations acrossalljurisdictions.

Kiharahasbeeninstrumentalin strengtheningtheGroup'sESGrisk managementposition,thereby facilitatingthecompany’sresilience andsustainablegrowth.

Initiativesincludeproviding comprehensivecomplianceguidelines andongoingsupportforallfacilities utilizedbyTheGroupandmakingsure thatsustainablepracticesareintegrated intotheiroperations.

In2019asCEOofI&MBankKenya, Kiharaoversawtheformalisationof theBank'sdigitalinnovationhub iCubefocusedoncustomer-centricand future-readydigitalbankingsolutions. iCubehasdevelopedinitiativesto improvecustomerexperience,suchas hastydigitalaccountopeningand machinelearningapplicationsfor advanceddataanalyticsandpredictive modeling,enablingpersonalized bankingsolutions.

TosuccessfullyflightiCube,Kihara prioritisedbuildinganagileworkforce byrecruitingadiverseteamand embarkingonaculturetransformation programmethatwouldfacilitatea paradigmshiftinternallytodrivethe pushforinnovation.

In2021,I&MBankpartneredwith BackbasetolaunchI&MOntheGo (OTG),adisruptiveomnichannel bankingplatform.Thissolutionallows individualandbusinesscustomersto accessbankingservicesinrealtime acrossvariouschannels,makingI&M thefirstbankintheregiontoadoptthis technology

Withover2millionmonthly transactionsonOTGinKenyaalone, theGroupisleadingthechargein catalysingthedigitalbanking landscape,shapingthefutureofthe digitaleconomy.AsofJune2024,82%

ofI&MBankLtd.’scustomerswere digitallyactive,markinga4%increase fromthepreviousyearand demonstratingthatdigitizationiskey tothebank’sbrandrelevanceand customergrowth.

Thebankhasintroducedinnovative digitalfinancialsolutionslikethe award-nominated‘NiSareKabisa’for freebank-to-mobilewallettransfers andthecountry’slargestunsecured personalloanproduct.With approximately77.3millionregistered mobilemoneyaccountsinKenyaby December2023,thereachofNiSare Kabisaissignificant.

I&MBankhasalsoenhanceditsdigital loanofferings,providingshort-term loans,salaryadvances,overdrafts,and long-termloans.Self-serviceoptions nowallowcustomerstoopenaccounts, applyforloans,andthenmanage paymentsonline.

Dataanalyticsfromdigitalchannels continuestoinformproduct development,enablingI&MBankto offerpersonalizedbankingservicesand proactivecustomersupport.

I&MGroupPLCseestoitthatwhen itssubsidiariesborrowForeign Currency(FCY)foron-lendingto customers.Thebankseestoitthat whenitssubsidiariesborrowFCYfor on-lending,thebeneficiariesgenerate revenueinthesamecurrency, effectivelyminimizingexposureto foreignexchange(FX)risk.Overthe years,I&MGroupPLC.has successfullysecuredFCYfacilities fromesteemedinstitutionssuchas Proparco,DEG,FMO,IFC, ResponsibilityAG,andtheEuropean InvestmentBank,allofwhichhave beenfullypaid.

I&MGroupPLC.employsarobust riskmanagementframeworkwhen disbursinganyFCYfacility.Customers arerequiredtoprovideevidenceof

adequateincomeinFCYtofurther mitigateFXrisk.

Aswell,I&MGroupPLC.utilizes industry-leadinghedgingstrategies whenissuingtradefacilities,including LettersofCredit(LC)andStandby LettersofCredit(SBLC),tosupport workingcapitalneedsandother customerrequirements.

I&MGroupPLCWelcomesNew ShareholdertoDriveGrowth& MSMELending

In2024I&MGroupPLCwelcomed EastAfricanGrowthHoldings (EAGH)asashareholder Thegroup recognizesEAGH'scommitmentto Sub-SaharanAfricaasasourceof confidenceinmaintainingits momentumandadvancingfinancial inclusionwithinitsoperational markets.

ThisdevelopmentalignswithI&M GroupPLC'sstrategicgoalof becomingtheleadingfinancialpartner forgrowthintheregion.Withthis development,thebankanticipates receivingenhancedtechnicaland financialsupporttofurtherbuildonthe progressachievedundertheir predecessor.

InAugust2024,I&MGroupPLC's subsidiaries—I&MBankKenya,I&M BankRwandaPLC,andI&MBank TanzaniaLimited—becamethefirstin EastAfricatoachievetheISO/IEC 27001:2022certificationfor InformationSecurityManagement Systems(ISMS).Thiscertification, awardedbytheBritishStandards Institution(BSI),highpointsthe group'sdedicationtotop-tier informationsecurity

TheGroupprioritizestheprotectionof customerdataandintellectualproperty, implementingmeasureslikemultifactorauthenticationandreal-time

frauddetection.I&MBankKenya excelledinPhysicalSecurityand BusinessContinuityManagement, whileI&MBankTanzaniascored highlyinInformation&Cyber Security.

I&MBankRwandaachievedtop scoresinDataCentremanagement, ProcurementandHumanResources. Additionally,I&MBankUgandahas begunitscertificationauditprocess, reinforcingthegroup'sdedicationto safeguardingcustomerprivacyand operationalintegrity.

Inits50-yearhistory,I&MGroupPLC hasemployedavarietyofassessment toolstosafeguardoptimalcustomer satisfactionandoperationalsuccess. Thebankcloselymonitorstransaction successratesthroughreal-time dashboards,utilizesmediamonitoring toolstogaugeonlinesentiment,and gathersfeedbackfromitscustomer servicecenters.

Also,arobustRelationship Managementreportingstructureisin place,complementedbyregular stakeholderengagementeventsfor bothinternalandexternalcustomers. TheGroupalsoconductssurveysto measureitsNetPromoterScore(NPS) andCustomerSatisfactionScore, whichcurrentlystandatanimpressive 75%and95%,respectively, significantlyexceedingindustry standards.

Chose Modise Chief Execu�ve Officer Stanbic Bank

Thechallengeofencouragingeconomicgrowthin

Botswanahaslongbeenasignificantconcern, particularlyinadomainwherefinancialinclusion andsustainablepracticesareparamount.StanbicBank Botswana,amemberofthe Standard Bank Group,has risentothischallengesinceitsinception32yearsago.With acommitmenttocreatingvalueforitscustomers,thebank hasestablisheditselfasakeyplayerinthefinancialsector

AtthehelmofthistransformativejourneyisChose Modise,theChiefExecutiveOfficerofStanbicBank Botswana.Underhisleadership,thebankhasnotonly becomethethird-largestcommercialbankbyprofitability butalsoamarketleaderinCorporateandInvestment Banking.Modise’svisionemphasizesthatbankingshould extendbeyondmeretransactions;itshouldempower individualsandbusinessesalike. “Our mission is to create lasting value for our clients and communities,” hestates, reflectingthebank'scorephilosophy.

StanbicBankBotswana’sapproachisholistic,cateringtoa diverseclientelethatincludescorporates,SMEs,andretail clients.Thebank’s630dedicatedstaffmembersacross13 branchesembodythisethos,workingtirelesslytoensure thateveryinteractionisrootedinvaluecreation.This commitmentisevidentintheirsustainablepractices,which prioritizecommunitywelfareandeconomicgrowth.

AsBotswananavigatesitseconomicchallenges,Stanbic Bankremainsresoluteinitsambitiontocontribute positivelytothecountry’sdevelopment.Withinnovative bankingsolutionsandadeepunderstandingoflocalneeds, Modiseandhisteamarenotjustrespondingtothedemands

oftoday;theyarelayingthegroundworkforaprosperous future.Indoingso,theyexemplifyhowfinancial institutionscanbepowerfulagentsofchangeinsociety.

Canyoupleaseintroduceyourselfandyourmotivation toembarkonthissector?

IamincrediblyprivilegedandhonouredtoleadStanbic BankBotswanawhichformspartofadiverseanddynamic familyofprofessionals,andthisisnotaresponsibilityI takelightly,supportedbyanexceptionalcadreof executivescomprisingourCountryLeadershipCommittee, andindeed630talentedstaffacrossBotswana.

OurpassionatStanbicBankisunwavering,andthisis somethingtobeenormouslyproudof.Together,weaimto establishtheBankasnotonlyatrustedpartnerinthe financialservicesindustrybutalsoasaleadingforcein shapingthefutureofbankinglocally. Botswana is our home; we drive her growth.

MyjourneywiththebankstartedinJanuary2022asthe ChiefFinanceOfficer AstheChiefFinancialOfficer (CFO),Ihadtheprivilegeofgainingcomprehensive insightsintothebank'soperations,financialstrategies,and brandpositioning.Thisroleallowedmetodeeply understandtheorganisation'scorevalues,itsapproachto fosteringclienttrust,andtheintricaciesofaligning financialperformancewithbrandreputationandmarket presence.Ihadtheprivilegetoworkacross12African countriesinsectorssuchasFMCG,hotels,banking,and insurance.IamamemberofboththeAssociationof CharteredCertifiedAccountants(ACCA)andtheBotswana

InstituteofCharteredAccountants(BICA).)However,itis morethanwhatisonaresumeandlessabout“me”or“I.” Itismyprofoundbeliefinthepowerofleadershipto inspireexcellenceanddrivethecultureofgrowthand performanceatbothpersonalandteamlevel.

HowdoesStanbicBankBotswanaleverageits membershipintheStandardBankGrouptoprovide valuetoitsclients?

WearefortunatetobepartofthebiggestbankinAfrica, StandardBankGroup(operatingin20AfricanMarkets), celebratinganimpressivehistoryofmorethan162yearsof operationinAfrica.Aspartofthegroup,wehaveaccessto resourcesincludingStandardBankglobalexpertise, experiencefromothermarketsandskillsacrossourbanking solutions.

Forexample,wecontinuouslyleveragethedepthof expertiseandcapabilitiesacrosstheStandardBankGroup, supportingourownBotswanatalenttocreatemeaningful andsustainablevalueforBatswanathroughour secondmentsprogramme.Itiswhatallowsandenables ustomakeadifferenceforourpeople,andthisis somethingIamincrediblyproudtobeapartof.

Wefurtherleveragetheglobalexpertiseofthe Grouptoofferinnovativebankingsolutionstoour clientstoenhanceservicedelivery,includingthe StanbicApp,whichenablesclientstoaccess bankingservicesfromtheirsmartphoneseasily. Thisapplicationincorporatesthemostrecent globalfintechadvancements,includingreal-time transactionalerts,effortlessfundtransfers,and immediateaccountmanagement.

We have been fortunate in this space to also earn global recognition in 2024, the Global Banking & Finance Awards for Best Corporate Bank, Best Investment Bank, and Best Trade Finance Bank in Botswana, alongside the Best Bank for Sustainable Development Botswana 2024. We have also been named the Botswana's Best Bank for Environmental, Social and Governance (ESG) by Euromoney. This is in part building on the exceptional work of our team in Botswana, as well as through leveraging Standard Bank Group. Standard Bank Group has been recognised by Forbes as one of the Top 20 World's Best Employers, an incredible feat we are so proud of.

“

We con�nuously leverage the depth of exper�se and capabili�es across the Standard Bank Group, suppor�ng our own Botswana talent to create meaningful and sustainable value for Batswana through our secondments programme. It is what allows and enables us to make a difference for our people, and this is something I am incredibly proud to be a part of.

“

WhatstepsdoesStanbicBanktaketoensurea progressiveandmeaningfulbankingexperienceforits clientsandstakeholders?

Wewanthappystaff,happycustomersandthriving communities.Ifwecandeliverthis,Ithinkwecanbeproud thatwearecontributingtoBotswana’sgrowth.

Whatdoesthismean?Itmeanswearealwayssolvingfor ourcustomers’needsandputtingtheirexperienceatthe fore,offeringamodernandvaluablebankingexperienceby embracinginnovationandonsolutionsthatprioritisethe needsofourcustomers.

Weconstantlyinvestinadvancedtechnologiesanddigital platformstomakebankingprocessesmoreefficientand improveaccessibility,supportedofcoursebytheright peopletochampionthis.Ourvalues,ourstrategyandour talentmakeforanincredibleforcetoconfidentlysayweare partneringwithBotswanaanddrivinghergrowth.

HowdoesStanbicBank'sCorporateandInvestment Banking(CIB)segmentdelivercomprehensivesolutions toawiderangeofclientrequirements?

Weareproudtobealeaderinthisspace,withaproven trackrecordoftangibleresultsforthebusinessandour clients.

OurCorporateandInvestmentBanking(CIB)segment offersasuiteofsolutionstailoredspecificallyforlarge corporationsandmultinationalclients.Bycombiningindepthindustryknowledgewithastrategicunderstandingof complexfinancialneeds,ourCIBdivisiondelivers customisedservicesdesignedtomeettheunique requirementsofeachclient.

Thisincludestailoredfinancingsolutions,strategicadvisory onmergersandacquisitions,andsophisticatedinvestment strategiesthatalignwiththeircorporategoalsand operationalchallengesacrosskeyportfolios.Weare constantlyintrospecting,innovatingandleveringour insightsandexpertisetoenhancehowwegrowourclients anddeepentheimpactwehelpdeliverforthemandwith them.

Havingamongsttheverybesttalentinmarketisjustone partofthat,forwealsothenreachintoourextensiveGroup networkanddepthofcapabilitywhilststillprovidingan authenticandpersonalengagementwithourCIBclients.It isthroughthisapproachthatwehavesupportedsuch momentoustransactionswithclientssuchasVunani, WildernessandNorsad.

Whileclientsatisfactionisamoreimportantmetricforus thanawards,wearenonethelessprivilegedtohavewon suchaccoladesovertheyearsthroughCIBasBestTrade FinanceBank,BestESGBank,andanumberofother accoladesfromGlobalFinance,EuroMoneyandthe AfricanBankerAwards.

WhatroledoesinnovationplayinStanbicBank's Personal&PrivateBanking(PBB)divisiontomeet evolvingcustomerneeds?

InnovationiskeyacrosstheBankasawholeandisdeeply entrenchedinhowwecreatevalueforourcustomersacross allsegmentsandportfolios,supportedbyaferventdesireto alwaysensureexceptionalcustomerexperiencesaswe worktocreatevalueforthem.Wearepassionateaboutour customers,andthisdrivesustodeliveronourmandate.

Weworktoenhancecustomerexperiencesthroughtailored, innovativesolutions.Bycontinuouslyintegratingadvanced technologies,suchasmobileappsandonlineplatforms,the bankprovidesintuitiveandsecurebankingoptionsthat catertoevolvingcustomerneeds.

Thefocusontechnologicaladvancementensuresthatboth personalandprivatecustomershaveaccesstoefficientand flexibleservicesthatadapttotheirchanginglifestyles.It alsohelpsusempowerourcustomers(andevenourown staff)tomanagetheirfinancialjourneyswithgreaterease andconfidenceandthecomfortandconfidencethatwe supportthemateveryturn.

“

We want happy staff, happy customers and thriving communi�es. If we can deliver this, I think we can be proud that we are contribu�ng to Botswana’s growth.

“

HowdoesStanbicBank'sextensivebranchandATM networkinBotswanacontributetoitscompetitive advantage?

Clientconvenienceandaccesstobankingsolutionsisa corecomponentofourbusinessmodelwhichincludesour ATMnetworkandbranches. Weoperate13strategically locatedbranchesacrossthecountryandwellas79ATMs andPointofSaledevicestogiveourclientstheopportunity totransact24/7.

WhatstrategiesdoesStanbicBankemploytostayatthe forefrontoffinancialservicestechnologyand digitalization?

AtStanbicBank,weprioritiseinnovationbycontinuously investinginresearchanddevelopmentandforming strategicpartnerships,includingthosewithtechnology providersandSMEsthroughCEEP.Bycollaboratingand stayingengagedwithourcustomers,weensureourdigital solutionsarebothrelevantandimpactful.

KeyinitiativeslikeUnayo,ourdigitalbankingplatform; Shyft,forseamlessforeignexchangeandinternational transactions;andDigitalLending,whichoffersunsecured loansthroughdigitalchannels,exemplifyourcommitment todeliveringcutting-edgefinancialservicesthatmeetour customers'evolvingneeds.Ourstaffcanbeproudthatthey empowercustomerswithprogress,andourcustomerscan beconfidentwewillalwayshavetheirinterestsatheart.

WhatinitiativesdoesStanbicBankhaveinplaceto supportthegrowthanddevelopmentofsmalland mediumenterprisesinBotswana?

WesupportandempowerSMEgrowthforwerecognisethe gravitasofthissectoringrowingoureconomy,thussince inception,wehaveaidedmanycustomersandclientsto growtheirbusinesses.Someoftheinitiativesinclude.

• AfricaChinaAgentProposition(ACAP)–launched in2022,thisaimstoassistBotswana’simporters sourceandvalidatequalitygoods,safelyand efficiently,fromthemostcompetitivesuppliersin China.

• AccelerateEmpowermentProcurement(AEP)-is aflagshipassetofStanbicBankBotswana,launched in2019anddrivestheSocial,Economicand Environment(SEE).Itwassetupwiththeviewto createsharedvalueandaddressyouthemployability andentrepreneurshipthroughacollaborativemodel thatinvolvestheaffectedtoberoleplayersintryingto findsolutionsforthesetwoissues.Thisinitiative makesiteasierforlocalyouthand/orwomen-owned enterprisestosupplytheirgoodsandservicestothe bank.Aspartofgrowingsmallmediumenterprises, wehadsetourselvesatargetofP12millionfor2023. WesurpassedittoreachtransactionalspendofP13.4 millionfortheyearunderreview

• CEEP - Stanbicisactivelyexpandingitseffortsunder CEEP,demonstratingagrowingawarenessofthe connectionbetweeneconomicactivitiesand environmentalwell-being.Ourrecentinitiativeshave involvedformingpartnershipswithTokalafa, Wilderness,Debswana,andseveralother organisations.TheBank'sdedicationisclearthrough itsstrategicinvestmentsingreentechnologiesand sustainableinfrastructure.

Theseinclude:

- StanbicBankBotswanasponsoredthe2024 OkavangoWildernessSafarisLocalSupplierExpo withacontributionofBWP150,000.00.This sponsorshipsupportedlogisticsfornearly120 localenterprisesparticipatingintheExpo. Additionally,itprovidedsignificantvalueto citizen-ownedbusinessesinthetourismand hospitalitysectorsbyhelpingthemaccessthe Wildernessprocurementecosystem.

TheExpoalignswiththeBank'sAccelerate Incubator,whichchampionsCitizenEconomic EmpowermentandtheCitizenEconomic EmpowermentProgramme(CEEP),by encouraginglocal,citizen-ownedsuppliersto showcasetheirproductsandservicesforpotential partnershipswithWildernesscampsinBotswana.

- The sponsorship from Stanbic Bank of BWP 1 million to the Tokafala Development Programme is aimed at supporting the growth of small and growing business in Botswana. It aims to address the challenges that entrepreneurs often encounter in the country. The services provided by Tokafala have benefitted over 215 Small and Medium Enterprises, offering valuable advice and mentorship to entrepreneurs. This support has enabled them to enhance their business, financial management, and marketing skills, ultimately leading to the establishment of successful and sustainablebusinesses.

Cross-bordertransactionsareanintegralpartof

internationaltrade,enablingbusinessesandindividuals toengageintrade,investment,andremittancesacross nationalborders.However,thesetransactionsalsopresentsome uniquechallengesthatinvestmentbankshavetonavigate. Understandingthesechallengesiscriticalforfinancial institutionslookingtoimprovetheirservicesandremain competitiveintheinternationalmarket.

Probably,themostdifficultchallengethatcomesalongwith cross-bordertransactionsisregulatorycomplexity Thelawsand regulationsofdifferentcountriesassociatedwithconductinga financialtransactionoftenhavealotofdifferences.Itbecomes necessaryforinvestmentbankstobeinstrictadherencetothe lawsandregulationsoftheircustomers'countriestoavoid penaltiesandlossofreputation.Moreso,ruleschangebecauseof thedynamicinvolvedintransitingtechnology,marketcondition, andsocialexpectations.

Thebestwayforbankstodealwiththisregulatorylandscapeis toheavilyinvestincomplianceinfrastructure.Thisincludes hiringspecializedstaff,implementingadvancedcompliance technologies,andestablishingrobustinternalcontrols.Noncompliancewillresultinthemostseverepenalties,suchasfines andlegalrepercussions.

Thetechnologicalinfrastructureofmanyinvestmentbankscan beanobstacleaswellinefficientlydoingcross-border transactions.Manyofthesystemsusedareveryoldandcannot beadaptedintoflexiblesystems,whichdonotsupportthespeeds andefficienciesmodernfinancialtransactionsrequire.Thesewill bringaboutdelaysinprocessingtimes,whichwillautomatically translatetomoreoperationalcosts.

Ofgreatersignificanceisthatitrequiressignificant innovationeffortsintraditionalbankingbyembracing newertechnologies,forinstance,blockchainorreal-time paymentsystems.Mostpromisingforthemtoachievean accelerationinspeedoftransactioncoupledwithreduction ofcosts.Allthesedocallforquitesubstantialinvestments, whilenewworkingculturesmustalsocomeabout.Their hesitationoverchangeiswheretheirbankshave comparativedisadvantagesincemostfintechentitiesare relativelynimbleintakingstepstomodernizetheir structures.

Anotheraspectthatlinkedcross-bordertransactionswith challengesisthefluctuationsofcurrency.Businesses involvedininternationaltradeorinvestmentoftenhave risksassociatedwithchangesinexchangerates.Thedrastic depreciationofacurrencycanevenimpactthevalueofa transaction,forcingbusinessesintounexpectedlosses.

Inmitigatingalltheserisks,investmentbankswillhaveto bestrategic.Therearehedgingtechniquesthatwillbeused andotherproductsmeanttoprotecttheirclientsfromthese risksofvolatilecurrencies.Itis,however,complex strategieswhichmaynotatallbeaccessedbysmall-scale businessesorsingleinvestors.

Cross-bordertransactionsincreasetheriskoffraudbecause oftheinvolvementofseveralpartiesindifferent jurisdictions.Thereisapossibilitythatthefraudstercan exploitsomeweaknessinthesystem,sobanksmusttake propersecuritymeasures.Advancedtechnologiesmustbe investedinbyinvestmentbanksforthepreventionoffraud andtoprotectsensitivedataduringcommunicationthrough propersecurityprotocols.

Thelawsassociatedwithdataprivacyalsoaddyetanother dimension.Financialinstitutionsshouldbeawareofthe differentregulationsondataprotectionfromonecountryto anotherwhilehandlingcustomerdatasothatnothinggoes againstthoseregulations.

Culturaldifferencesarealsopredominantlyfoundincrossbordertransactions.Differentbusinessculturesandwaysof communicatingmaycauseagapbetweenthem.Thismakes investmentbanksmorevigilantaboutculturaldifferences whiledealingsothatsuchcommunicationgapwillnot affectdealsanddamagerelationships.

Ithasalwaysbeenimportantthatgloballyoperatingbanks makestafftrainingregardingculturalsensitivityand effectivecommunicationskills.Thisbuildsabetterchance forbankstodeliverservicesfromacross-border perspective.

Againstthesechallenges,investmentbankshavebecome veryopentoinnovativesolutionsasameansofpromoting efficiencyandclarityincross-bordertransactions. Technology,suchasartificialintelligence,canbetappedto makecomplianceeasierbyhelpingautomateroutinetasks andenablereal-timemonitoring.

Collaborationwithfintechcompaniesmayfurtheropenthe avenuefortraditionalbankstouseleading-edgesolutionsto acceleratetransactionspeedsandcutcosts.Agiletechfirms, byworkingincloseassociationwithinvestmentbanks,may enablethelattertoprovideimprovedserviceswithout violatingthesetregulations.

Investmentbanksshouldbeabletomaintainflexibilityby developingclient-tailoredflexiblepaymentsolutions. Flexibilityinpaymentsolutionswillhelpbanks accommodatevariouspaymentmethodsandcurrencies, therebymakingtransactionsasmootherprocessand increasingclientsatisfaction.

Conclusion

Globalcross-bordertransactionsformanessentialpartof alltheeconomicactivitiestakingplaceglobally kindofspecialchallengesthattheinvestmentbanks encounter.Theinstitutionsfacechallenges,including complexregulatoryenvironments,technology-related limitations,andfraudrisks,forwhichthefinancial institutionshavetobeproactive.Withinnovations, investmentintechnology,andbuildingcultural understandingswithinteams,investmentbankscan overcomeallsuchchallengestositatthetoprungofthe globalmarketleaders.

Therewillalwaysbeaneedtosustainthepaceof competitiontostayaheadofemergingtrendsinthis interconnectedworld.Hence,theinvestmentbanksmust makeefficiency,transparency,andsecurityatthe transactionboundariescomplementarytoeachotherto ensureclientsatisfactionwhilesupportingsignificantlyin thegrowthofinternationalcommerce.

How Technology is Shaping the Next Generation of Financial Services!

Aseconomiesexpandanddiversify,thedemandfor

accessibleanddependablefinancialservices increases,andtheroleofinnovativebanking solutionshasbecomecrucial.Organizationsthatpromote customer-centricapproachesandtechnological advancementsdoboosteconomicdevelopment.These banksarenotjustfinancialentitiesbutcatalystsforchange thatempowerindividualsandbusinessestoreachtheir potential.

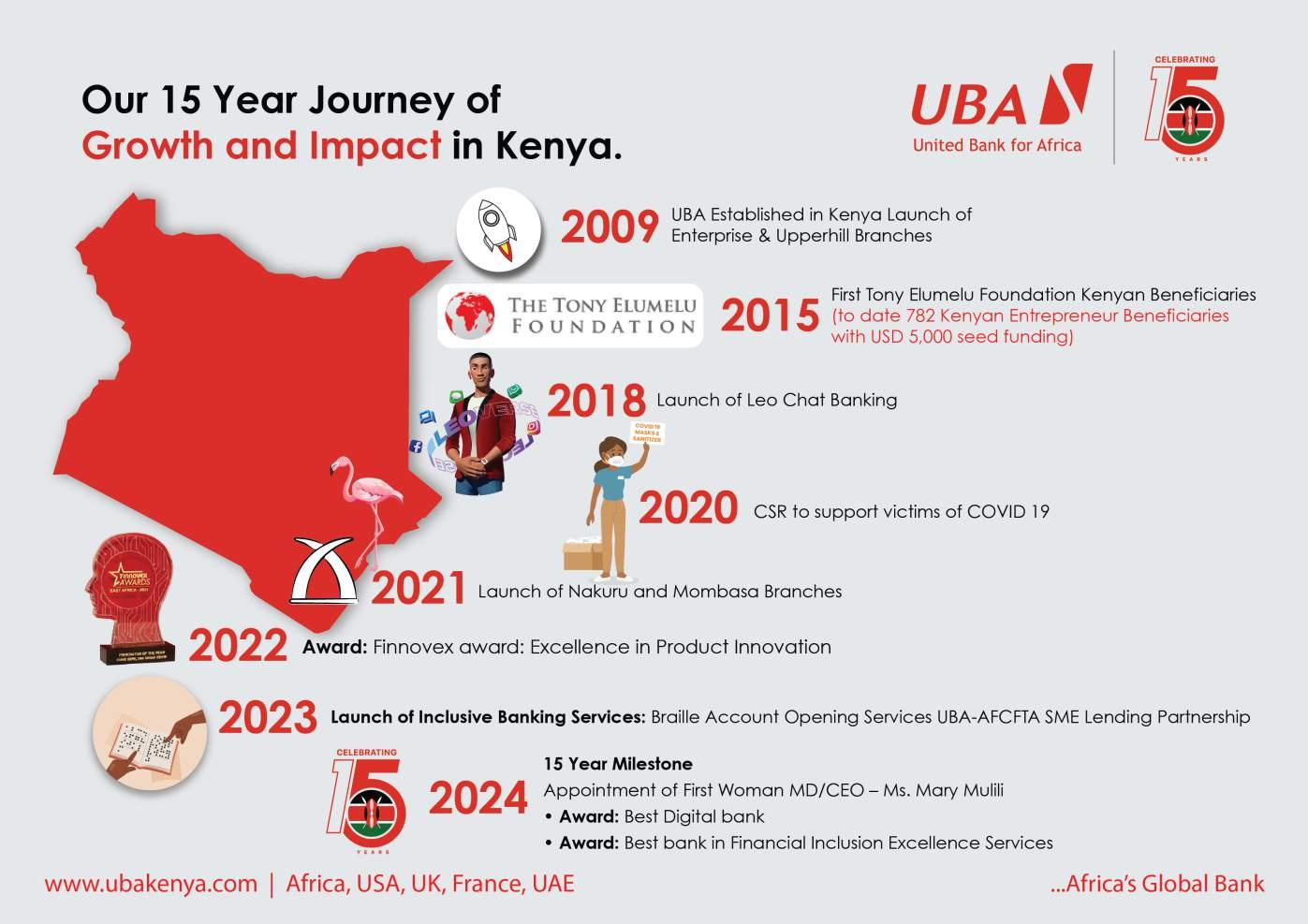

UBAKenyaBankLtdwasestablishedin2009asa subsidiaryofUnitedBankforAfrica(UBA)Plc.United BankforAfricaPlcisaleadingPan-Africanfinancial institution,offeringbankingservicestomorethanforty-five millioncustomers,across1,000businessofficesand customertouchpointsin20Africancountries.With presenceinNewYork,London,ParisandDubai,UBAis connectingpeopleandbusinessesacrossAfricathrough retail,commercialandcorporatebanking,innovativecrossborderpaymentsandremittances,tradefinanceand ancillarybankingservices.

UBAKenyaispositionedtobeagotopartnerfor individuals,SMEs,Corporates,Governments,NGOs, EmbassiesandMultilateralAgenciesoperatinginKenya andbeyondborders.

KenyastandsasadynamichubinEastAfrica,witharobust economydrivenbyinnovation,entrepreneurship,and strategicconnectivitytoglobalmarkets.UBArecognizes

Kenya’spivotalroleinAfrica’seconomiclandscapeand haspositioneditselftosupportthisgrowththroughtailored bankingsolutions,tradefinance,anddigitalinnovation.

Unveiling the Leadership Journey:

MaryMuliliservesastheManagingDirector/CEOof UBAKenya,markingasignificantmilestoneinher extensivebankingcareer Withovertwodecadesof experience,shehasexcelledinvarioussectors,including corporate,commercial,publicsector,anddigitalbanking. Herdedicationtodeliveringinnovativefinancialsolutions hasgarneredrecognitionfrombothcustomersandindustry stakeholders.

JoiningUBAKenyarepresentedapivotalmomentfor Mary,aligningwithhervaluesofinnovationandcustomer focuswhilecontributingtoAfrica'seconomicgrowth.Her ascenttoCEOisparticularlynoteworthyasshebecomes thefirstfemaleleaderofthebank,symbolizingprogressin genderequalitywithinthefinancialsector This achievementreflectshercommitmenttoempowering womentopursueleadershiprolesinbanking.

Throughouthercareer,shehasemphasizedtheimportance ofmaintainingone'svaluesandfosteringinclusive environments.AsUBAKenyanavigatestheevolving bankinglandscape,sheremainsdedicatedtodriving positivechangeandsupportingdiversity,ensuringthatthe bankcontinuestothriveinexcellencewithinthefinancial industry.

UBA Kenya implements several ini�a�ves to a�ract and retain top talent within the organiza�on.

ForUBAPlc,thepast75yearshavenotmerelymarkedthe passageoftimebuthavebirthedalegacyofresilience, innovation,andunwaveringcommitmenttomeetingthe financialneedsofitsdiverseclientele.Fromitshumble beginningstoitscurrentstatusasapan-Africanfinancial leaderwithaglobalfootprint,UBA’sjourneyisatestament toitsstrategicforesightandadaptabilityinaconstantly evolvingbankinglandscape.

UBA Kenya evaluates the effec�veness of its strategies through various metrics focused on customer acquisi�on and reten�on. “

Established in Nigeria 75 years ago, UBA has transformed from its modest origins into a global financial powerhouse.

InnovationisintegraltoUBAKenya'sstrategyfor achievingacompetitiveadvantageinthebankingsector.By embracingadigital-firstapproach,thebankcaterstoatechsavvycustomerbase,enhancingservicedeliveryand expandingitsreach.KeyinnovationsincludeLEOChat Banking,anAI-poweredchatbotthatfacilitatesbanking transactionsviasocialmediaplatforms,andcomprehensive internetbankingservicesthatprovide24/7accountaccess. Thismobile-centricstrategypositionsUBAKenyaasa leaderinconvenienceamidstarapidlyevolvingfinancial landscape.

Additionally,UBAKenyaprioritizesfinancialinclusion throughtechnology.InitiativessuchastheBrailleaccount openingserviceensurethatvisuallyimpairedindividuals canaccessbankingserviceswithoutbarriers. CollaborationswithorganizationsliketheKenyaSociety fortheBlindfurtherunderscoreUBA'scommitmentto inclusivity

Theseinnovativepracticesnotonlyenhancethecustomer experiencebutalsodifferentiateUBAKenyaasasocially responsibleinstitution.Byfocusingonaccessiblebanking solutions,UBAKenyaeffectivelymeetsthediverseneeds ofallKenyans,solidifyingitspositionasatrustedfinancial partnerandleaderintheAfricanbankingindustry

UBAKenyaplaysacrucialroleinpromotingintra-African tradebyprovidingacomprehensiverangeofbanking servicestailoredtosupportbusinessesengagedincrossbordertransactions.WithaPan-Africanpresencespanning 20countriesandconnectionstomajorglobalfinancialhubs, UBAKenyaenablescrossbordertransactionsandprovide paymentsolutionstobusinessesoperatingoutsideofKenya andwithintheAfricanContinentandbeyond.

UBAConnect,allowscustomerstowithdrawanddeposit fundsatanyUBAbranchacrossAfrica,reducingthe complexitiesassociatedwithmulti-countryoperations.The Africashplatformfacilitatesinstantcross-bordermoney transfers,streamliningpaymentprocessesforbusinesses needingtotransactquicklywithsuppliers.

Additionally,UBAKenyaoffersrobusttradefinance solutions,includinglettersofcreditandbankguarantees, ensuringthatimportersandexportershavethenecessary financialresourcestoconducttheiroperationswhile

managingtraderisks.Thebankalsoprovidesvariousforex andcurrencysolutionstohelpbusinessesnavigatethe complexitiesofmulti-currencytransactions.

ThroughitspartnershipwiththeAfricanContinentalFree TradeArea(AfCFTA),UBAKenyaiscommittedto supportingexportersandmanufacturers,furtherenhancing itsroleasafacilitatoroftradewithinAfrica.

AtUBA,wehaveawell-entrenchedriskmanagementand strongcorporategovernancepracticesessentialforbuilding trustwithourcustomers,stakeholdersandregulators.The Bankhasarobustregulatoryunderstandingandinterface ledbydynamicmanagementteamacrossgeographies.

UBAKenyaprovidesvariousfinancingsolutionsthatcater tothecapital-intensivenatureofinfrastructureprojects. Theseincludelong-termloans,projectfinance,andpublicprivatepartnership(PPP)fundingforsectorssuchas transport,energy,healthcare,andeducation.

• ProjectFinance:UBAKenyaoffersprojectfinance forlarge-scaleinfrastructureprojects,includingroads, bridges,airports,powerplants,andmore.Thebank workscloselywithdevelopers,governmentbodies, andprivateinvestorstoensuretheavailabilityof fundsthroughouttheprojectlifecycle.

• Public-PrivatePartnerships(PPPs):UBAKenya facilitatesPPPsbyprovidingfinancingsolutionsto projectsthatinvolvebothgovernmententitiesand privatesectorplayers.PPPsarecrucialfor infrastructuredevelopment,especiallyinareaslike energy,healthcare,andtransportation,wherepublic andprivatesectorcollaborationcanaccelerateproject delivery.

• SyndicatedLoans:Forparticularlylarge infrastructureprojects,UBAKenyaparticipatesin syndicatedloans,wheremultiplebankscollaborateto providethecapitalrequired.Thisallowsthebankto sharetheriskwhilefundingmajorprojectsthat contributetoeconomicdevelopment.

UBAKenyageneratesvalueforitsstakeholdersthrougha rangeofinitiativesdesignedtopromotemutualgrowthand sustainability Thebankfocusesonprovidingtailored financialsolutionsthatcatertothediverseneedsofits customers,fromsmallandmediumenterprises(SMEs)to largecorporationsandindividuals.

• FacilitatingCross-BorderTradeandPayments:Oneof themostsignificantwaysUBAKenyaleveragesthe Group’spresencein20Africancountriesisby facilitatingcross-bordertradeandpaymentswithinthe continent.

• LeveragingaPan-AfricanCustomerBase:UBA Group’spresenceacrossAfricagivesUBAKenya accesstoabroadcustomerbasethatincludes businessesandindividualsspreadacrossmultiple countries.Thisallowsthebanktoofferservicesthat catertobothlocalandregionalclients.

• StrengtheningRegionalPartnershipsandAlliances: TheUBAGroup’sextensiveAfricanpresenceallows UBAKenyatoengageinregionalpartnershipsand collaborationsthatstrengthenitspositionasakey playerinthefinancialsector Thebankcanleverage UBAGroup’srelationshipswithregionaldevelopment institutions,governments,andotherkeystakeholders.

UBAKenyahaseffectivelyadaptedtochangesinthe financialservicessectorbyembracingdigital transformationandinnovation.Thebankhasintegrated advancedtechnologiestoenhanceefficiencyandcustomer accessibility,aligningwiththegrowingdemandfordigital banking.

Topromotefinancialinclusion,UBAKenyahasdeveloped productsspecificallydesignedforunderservedpopulations. AnotableexampleistheintroductionofBrailleaccount openingforms,whichempowervisuallyimpaired customerstoaccessbankingservicesindependently This initiativereflectsUBAKenya'scommitmenttoinclusivity andalignswithnationalgoalsforbroaderfinancialaccess.

Byfocusingontheseinnovations,UBAKenyanotonly meetsregulatoryrequirementsbutalsopositionsitselfasa leaderinprovidingaccessiblefinancialservices,ensuring thatnosegmentofthepopulationisleftbehindinthe evolvingbankinglandscape.

AsUBAKenyalookstothefuture,itremainscommittedto itscorevaluesofexcellence,enterprise,andexecution.The overallbank’svisionistobetheundisputedleadingand dominantfinancialservicesinstitutioninAfrica,delivering superiorvaluetoallitsstakeholders.

Toachievethisvision,UBAwillcontinuetoinvestin innovation,anddeepenitscustomerrelationships.The bank’sstrategicprioritiesincludeenhancingoperational efficiency,drivingdigitaltransformation,andleveraging dataanalyticstodeliverpersonalizedservices.

"We are committed to embark on a journey focused on accelerating growth, providing value to our customers and shareholders and aligned with the broader vision of sustainable banking," MaryMulili,MD/CEOUBAKenya.