24 minute read

3 Takeaways from a Decade of Ins. Digital Transformation

written by Mikhail Palatnik, CoreLogic

As 2020 marks CoreLogic’s 10th anniversary, we’re reflecting on the insurance industry’s transformation over the last decade.

I did not even begin to realize that at the start of my career, this industry and all its nuances, peculiarities and intricacies would become my passion. Part of what drew me to the insurance industry, and what has kept me here well over two decades, was knowing how much of this industry was ready to be disrupted.

Here are three ways we’ve seen the industry transform over the past decade:

1. Digital Modernization and the Evolution of Customer Experience

With any disruption, all parties must adapt. Agents are now challenged to operate differently and to find ways to increase value for consumers in the face of fierce competition in the direct-to-consumer business models. Underwriters are becoming more tech-savvy and developing solutions to simplify the consumer experience. Claims officers are moving more of their capabilities from the field to the desk, as they face constant pressure to reduce loss adjustment costs and streamline the claims process for consumers. Emerging InsurTech carriers continue to push the boundaries by operating with a small physical or fully digital agency footprint, forcing established carriers to innovate.

The consumer experience has moved front and center as insurance interaction experiences begin to mimic all other digital interaction that consumers have grown accustomed to like Amazon, Uber and Airbnb. J.D. Power introduced consumer experience metrics for insurance quoting and claims management processes and AM Best has introduced a ranking for innovation.

A challenge in the shift to digital is the expectation of immediate gratification. As with nearly every aspect of our lives today, we all expect things to be instant, digital and easy to access. So, it becomes even more important to build a relationship with the customer by discussing their risk to help offset any extra time that may be necessary to complete the quote and perform a thorough analysis of their overall exposure.

2. Climate Variability and Advancement of CAT Event Management

Just a decade ago, private flood insurance was rarely thought about, but events like Hurricane Harvey in 2017 highlighted the need for private flood insurance, especially for homes outside of designated flood areas. For an accurate assessment of risk, the need for properly assessing the risk of a property itself – as opposed to the risk of a property centroid – is now available with high-resolution granular risk data.

Significant improvements have been made in catastrophe risk modeling for wildfire and flood – relatively new modeled perils – along with hurricane, earthquake and severe convective storms.

3. Progression from Risk Avoidance to Risk Management Products

With so many new ways to predict and prevent, there are also continued on page 30

OPEN SEMCI

Single-entry, multiple-company interface (SEMCI) is like magic!

Acuity, long recognized as a leader in agency interface technology, is committed to supporting SEMCI in commercial lines. SEMCI drives efficiency in the quote and application process and allows you to choose how you want to do business with Acuity. Acuity currently partners with several of the leading commercial lines insurtechs. We are building, exploring partnerships, or expanding with numerous other independent agency technology solutions. And Acuity is on the forefront of integration technology, continually building the connections necessary to be ready to connect to new insurtechs as they emerge.

PPP Forgiveness and the BCPP

written by Wyatt Stewart, Big "I" Sr. Director of Gov. Affairs

sponsored by our partners at

In early June, Congress passed and the President signed into law H.R. 7010, the Paycheck Protection Program Flexibility Act, sponsored by Rep. Dean Phillips (D-Minnesota) and Chip Roy (R-Texas).

The bipartisan Paycheck Protection Program Flexibility Act was strongly supported by the Big “I” and creates additional Paycheck Protection Program (PPP) flexibility for Big “I” members and their clients. Specifically, the legislation will extend the expense forgiveness period from eight weeks to 24 weeks, reduce the 75% payroll ratio requirement to 60%, eliminate the 2-year loan repayment restrictions for future borrowers, allow payroll tax deferment for PPP recipients and extend the June 30 rehiring deadline.

Earlier this week, the Department of the Treasury and the Small Business Administration (SBA) issued a statement thanking President Trump and Congress for their work on this important legislation. They have now released a new EZ loan forgiveness application, as well as a revised full forgiveness application for PPP loans.

The new information makes clear that the provision reducing the 75% payroll ratio to 60%, will not be a “cliff.” That means that if a borrower spends less than 60% of the PPP loan amount for expenses that otherwise would be forgivable "payroll costs," then that borrower will benefit from partial forgiveness for their “payroll costs,” instead of no forgiveness. Previously, there had been questions about how the Treasury and the SBA would interpret that provision.

The new EZ version of the application applies to borrowers that meet one of the following requirements:

Are self-employed and have no employees. Did not reduce the salaries or wages of their employees by more than 25% and did not reduce the number of hours of their employees. Experienced reductions in business activity as a result of health directives related to COVID-19 and did not reduce the salaries or wages of their employees by more than 25%.

The BCPP - A Plan for Future Pandemics

The PPP has been a necessary supplement for businesses in this time, but what about future planning? Recently, Bob Rusbuldt, Big “I” president and CEO, joined with David Sampson, president and CEO of the American Property Casualty Insurance Association (APCIA) and Charles Chamness, president and CEO of the National Association of Mutual Insurance Companies (NAMIC) in writing an op-ed in The Hill newspaper titled "A Plan for Future Pandemics."

The op-ed explains the difficulty of insuring pandemics and notes that pandemics, “are too widespread, too severe, and too unpredictable for the insurance industry to model or underwrite. A nationwide economic shutdown of millions of businesses simultaneously is beyond the capacity of any private industry to provide protections.”

While insuring for future pandemics would be extremely difficult, if not impossible, the Big “I” remains committed to finding solutions that work for policyholders, agents and brokers, and carriers. That is why the Big “I,” APCIA and NAMIC released a plan to create the Business Continuity Protection Program (BCPP). As outlined in the op-ed, the BCPP is designed to bolster the country’s economic resilience by providing simple, timely, and efficient financial protection and payroll support to the private sector in the event of a future declared health emergency.

Businesses would purchase their desired level of revenue replacement assistance through state-regulated insurance entities that voluntarily participate with the BCPP. The BCPP would be subsidized and look more like a prospective PPP than an insurance product. In addition to making rates affordable for businesses, this would allow for immediate funding to businesses when they need it most, without having to go through the time-consuming insurance claims process.

The op-ed goes on to to say that, “the BCPP is a solution that can work for everyone – customers of all sizes and structures – to provide protection against widespread economic shutdowns due to a future viral outbreak.” Additionally, the op-ed details that, “the BCPP would provide revenue replacement assistance for payroll, employee benefits, and operating expenses following a presidential viral emergency declaration. The BCPP would reimburse up to 80% of payroll, benefits and expenses for three months.”

As Congress begins to look at options to deal with future pandemics, the Big “I” and its company partners at APCIA and NAMIC look forward to working with the business community to meet their needs in this vitally important public policy discussion.

About the Author

Wyatt Stewart is Big “I” senior director of federal government affairs. He may be contacted at wyatt.stewart@iiaba.net u

The Impact of COVID-19 on Quote Volume

written by Laird Rixford, Insurance Technologies Corporation (ITC)

The past four months have been a whirlwind of change for the entire nation. There are national health concerns about the spread of COVID-19 and how we contain it, as well as the concerns about the impact of COVID-19 on our economy. The insurance industry is not immune to these concerns.

I’m here to say that there is a basis to that concern—we all feel it—but the insurance industry is strong. Now is the time to show strength and capture the essence of what makes working with an independent agency great.

Through its personal lines comparative rater platform, TurboRater, Insurance Technologies Corporation (ITC) collects millions of carrier rates every month. That data, combined with our business intelligence and analytical products, provides valuable insight regarding the state of consumerism in the insurance industry.

Many concerned agencies and carriers have reached out to ITC to gain understanding of this insight and what is happening in the industry. We have included what we have found below.

Traditionally, the insurance industry receives an uptick in quoting volume in late February and early March because the IRS delays tax refunds until then that include the Earned Income Tax Credit or the Additional Child Tax Credit. This uptick usually peaks during the first week of March—this year is no different with the heaviest day being March 2.

Month-by-Month Data

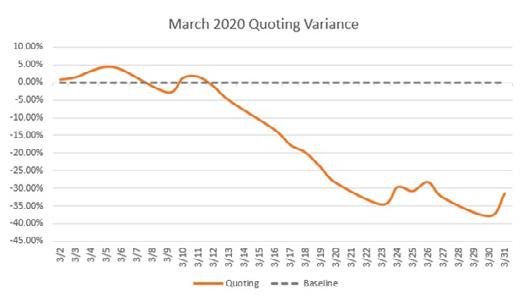

March: For the full month of March, ITC’s clients recognized a 13.5% decrease in expected quoting volumes, with the first

two weeks representing 2.6% over the expected volume. The following two weeks saw quotes 28.3% below expected volumes. The final week of March settled in the mid-30% range below the projection.

April: Throughout April, quoting volumes consistently improved, but at the beginning of April, things were looking dire: quoting volumes were 32.4% below expected numbers. The second week of April looked even worse with quoting numbers falling to 34.7% below expectations. The industry was reeling and reacting with carriers offering refunds to customers under the scrutiny of lower claim numbers.

The last two weeks of the month signaled a marked change with the introduction of stimulus checks. Consumers were building confidence and were starting to shop. Rating activities for the weeks of April 13 and April 20 ended at 22.9% and 25.1%, respectively.

This noticeable bump in the middle of the month signaled that consumers are still out there – it is the financial hardships consumers are feeling that is depressing insurance spending.

May: Throughout May, quoting volumes continuously improved week over week with the first week averaging 11.5% behind expectations, the second week 10% behind, the third week 7.6% behind and the final week settled at 7.4% below expectations.

While all states showed improvements, there were states that performed at higher than expected levels. Those states that reopened late April or early May showed drastic improvement continued on page 44

Daniel Talks Agency Technology: Agency Management Systems pt. 4

What's the Difference? written by Daniel Smith, CAE

What are the key pieces of technology for the modern agency? How should you implement them and train your staff to use them? In this series I will look into agency technology and specific systems and how you can implement them at your agency.

In the third article in this series, we continued with what questions you should be asking to sort through the systems and find the one that's best for your agency. In this edition, we're going to look at some of the differences between these systems.*

To determine this information, we researched the system companies' websites, talked with member users and studied independent user reviews of each product. 1 This overview is based on information available through reviews, websites and user forums and is not official software company information. It should be used for perspective and research only.

Applied DORIS®, Epic® & TAM

DORIS: Applied states that DORIS, "delivers the fundamental capabilities, workflows and insurer connectivity you need to efficiently and securely run your growing agency within a single system."

In user reviews, DORIS rates highly in Ease of Use and Quality of Support. It had its lowest reviews in the categories of Accounting and Innovation.

Epic: Applied states that Epic allows you to, "Power your agency with the only system in the industry that has integrated capabilities to manage P&C, Benefits and Sales in a single application." Also claiming that Epic is the, "world’s most widely used agency management system," this is the system we most frequently hear about being used by Insurors members.

In user reviews, Epic rates highly in the categories of Ease of Use, Quality of Support and Meeting Requirements. It had its lowest reviews in the category of Ease of Setup.

TAM: Applied states that TAM, "offers visibility into your clients and day-to-day operations."

In user reviews, TAM rates highly in the areas of Policy Management, Contact Management and Invoicing. Its user concerns seem to be focused on Sales Tools, Commission Management and Product Direction. What's the Difference?: Most users seem to agree that Applied is an industry leader in agency management software, and they have some of the most widely used systems in the industry. There are concerns from users on the price vs. value aspect of their systems, and additional concerns that Applied has shifted its focus to the Epic platform.

Applied seems to have a three-tier option for agencies, with DORIS being the entry level online system, TAM being the middle market system and Epic being the more scalable solution for medium to large agencies. That being said, Applied has one of the most robust catalogs of tools and add-ons available in the industry, and can likely accommodate any management technology issue that an agency faces.

Cost to value and extent of training needed are still issues that come up when discussing the systems with users. The Applied user groups, networks and events do seem to have great value to agents. In addition, third party systems commonly try to offer integrations for their systems.

Projected Cost: $$$$$ Overall User Reviews: DDDDE

EZLynx Agency Management

EZLynx states that their agency management system, "allows you to maximize your agency's potential by increasing your ability to retain current customers while acquiring new business. Find all of your customer's quotes, policies, and documents in one organized place and easily remarket with up-to-date information that is synced from your daily policy downloads."

In user reviews, EZLynx rated highly in Innovation, Workflow and Integration. People often praise their Rater and its integration. Its user concerns seem to be focused on the Quality of Support and Ease of Setup.

What's the Difference?: EZLynx seems to provide a lot of innovation to the agents that utilize their system and especially those that integrate their other programs for rating, marketing and online quoting. Concerns seem to be in the area of support, which agents say can be troubling when multiple contacts are needed to provide a solution.

Hawksoft states that its insurance agency management system, "...gives you an unfair advantage by improving the overall efficiency of your agency."

In user reviews, Hawksoft rates highly in Ease of Use, Flexibility and Growth capacity. Its user concerns were generally based around stability of the program (some minor crash reports) and the accounting functions not being robust enough.

What's the Difference?: Hawksoft has solid reviews and seems to provide great functionality for policy management, claims management, documentation and ease of use. Concerns may be in the reporting and accounting functions, but we have talked with agents who have said those areas are improving.

Projected Cost: $$$$$ Overall User Reviews: DDDDE

ITC AccuAgency & Agency Matrix

AccuAgency: ITC states that the AccuAgency Agency Management System is, "A complete web-based system that integrates agency management and document storage all in one easy-to-use service."

Agency Matrix: ITC states that Agency Matrix, "...is simple and easy to use for the efficiency and effectiveness you need. With our system you can focus on what you are best at – selling insurance and growing your agency."

In user reviews, ITC's systems rated highly in Ease of Use, Customer Service and Features. Its user concerns seem to be in the areas of Training, Updates and Scalability.

What's the Difference?: ITC offers many great products for agents that integrate with its other systems. TurboRater and their various agency marketing systems provide opportunities for agents to add to their management system capabilities. The AccuAgency rater is often praised as well. Concerns seem to be in the area of commercial lines capabilities and the ability to scale up with rapidly growing agencies.

Projected Cost: $$$$$ Overall User Reviews: DDDDA

Jenesis

Jenesis states that their software is designed to, "help insurance agents manage existing clients, market to potential prospects, increase efficiency and build strong relationships with their policyholders."

In user reviews, Jenesis rates highly in Ease of Use, Quality of Support and Ease of Setup. It also had several positive reviews highlighting their customer service. Its user concerns were generally based around stability of the program (some minor crash reports) and data conversion.

A Partner for the Independent Agent in Tennessee

Strategic Insurance Software 4181 Arlingate Plaza, Columbus, Ohio 43228 800.747.9273 | sales@sisware.com | www.sispartnerplatform.com

Michael Doran President Nick Massaro Regional Sales Manager

What's the Difference?: Jenesis seems to provide an affordable option with solid support and a lower learning curve. Concerns may be around scalability with agency growth and processing of downloads.

Projected Cost: $$$$$ Overall User Reviews: DDDDE

SIS states that their Partner Platform, "...integrates multiple communication methods including Outlook Email Integration, Integrated Text Messaging, Document Management, Personalized Workflows, and Carrier Downloads so you can trust and rely on the Partner Platform as the heartbeat of your agency."

In user reviews, Partner Platform rates highly in Support, Ease of Use, Features and Ease of Setup. Its user concerns were generally based around specific errors on search features and notes.

What's the Difference?: Partner Platform is known among its users as a platform that provides excellent service. When issues arise, they tend to be very aggressive in helping agents find a solution. The value level seems to be high with agents praising the cost relative to the functionality. Concerns may be in the area of forms, but it appears they are working through those issues on a case-by-case basis.

Projected Cost: $$$$$ Overall User Reviews: DDDDE

Vertafore AMS360, QQCatalyst & Sagitta

Vertafore states that AMS360, "...provides the foundation for independent agencies to grow their businesses and boost their profitability. It helps streamline workflows, improve renewals and retention, and drive new business resulting in improved employee productivity and superior customer experience."

Vertafore states that QQCatalyst, "...provides operational, marketing, and sales pipeline management tools. It enables agencies to strengthen customer relationships and ensure effective business management, so they can focus on growing their book of business."

Vertafore states that Sagitta, "...provides the foundation for independent agencies to grow their businesses and boost their profitability. It helps streamline workflows, improve renewals and retention, and drive new business resulting in improved employee productivity and superior customer experience."

In user reviews, AMS360 rates the highest in the areas of Policy Management, Tax Management and Invoicing. Its user concerns were generally based around Sales Tools and Email Integration.

In user reviews, QQCatalyst rates the highest in the areas of Ease of Use, Quality of Support and Ease of Setup. Its user concerns were generally based around System Lagging and Accounting.

In user reviews, Sagitta rates the highest in the areas of Ease of Use and Quality of Support. Its user concerns were generally based around Functionality and Marketing tools.

What's the Difference?: If you had to break it down into sections, it appears that Vertafore has a tiered approach of offering QQCatalyst as a solution for small to mid-size agencies, Sagitta for medium agencies and those growing through aquistion, and AMS360 for medium to large agencies.

The concerns with Vertafore continue to be centered around costs and extensive training needs. The company provides very powerful tools for agents, and agencies that invest in training and user groups can really benefit from the many features and functions of their systems. They have integrations with many carrier and third party systems, but they also limit some of those integrations.

Their networks and events provide a very valuable tool for agents, and they are still considered a market leader for a reason.

Projected Cost: $$$$$ Overall User Reviews: DDDDE

Xanatek IMS4

Xanatek states that IMS4, "Provides the capability to effectively manage all of your customers, prospects, and carriers. There is no limit on the amount of space to store your data and documents. As your business grows, IMS will help increase the overall success of your business."

In user reviews, Xanatek rates highly in Features, Ease of Use and Downloads. Its user concerns were generally based around Accounting and general interface design.

What's the Difference?: Tailored for small to medium agencies, Xanatek IMS4 seems to offer value with useability and support. They appear to be willing to work with their agencies to offer solutions that aren't readily available.

Projected Cost: $$$$$ Overall User Reviews: DDDDE

Which One is Best for Your Agency?

Which system is right for your agency? It depends on your size, goals and needs. The systems discussed in this article all have pros and cons, but they all seem to be viable options for the right agency. Take your time and do you research and you'll find the answer may be more obvious than you realize.

*Based on information available as of 6/20/20. This is not a comprehensive report and is based on author research. 1-aggregated from G2.com software reviews, "Best Insurance Agency Management Software 2020" section and Capterra.com "Insurance Agency Software." u

Future Leaders Spotlight presented by

Trey Powell • RSS Insurance - Chattanooga

Trey Powell grew up on Signal Mountain just outside of Chattanooga. He attended The McCallie School (high school) and then Auburn University. After college, he moved back to Signal Mountain with his wife Laurel and their four sons; Preston, who is 8, Miller, who is 6, Meade, who is 2 and Ham, who is just 4 months. Laurel Trey Powell of RSS Insurance owns an architecture firm, so the family stays extremely busy between both parents working and having 4 small children.

Their kids love sports, so when not at work the family can usually be found at a little league baseball tournament, flag football game, basketball camp, or cheering on the Auburn Tigers in-person. Trey and his older sons also love to hunt and fish as time allows.

The Insuror: Can you tell us a little about your current job title and responsibilities?

Trey: I am one of the Owners/Principals at RSS Insurance, so I have many responsibilities in addition to being a Producer for the agency. Day-to-day you can find me managing agency operations, facilitating carrier relationships, helping mentor our younger producers, and producing/servicing my own book of business. It is a lot of different "hats" but it has been both challenging and rewarding for me.

The Insuror: What can you tell us about your educational background?

Trey: I graduated from Auburn University with Degree in Business Administration.

The Insuror: How and why did you get your career in the insurance industry started?

Trey: I always knew I wanted to be in sales because I have always been very social and loved being around people and meeting new people. I took some insurance classes while I was in school at Auburn – which I enjoyed – so I decided that insurance was a career I wanted to pursue. for my uncle's agency. He sold his agency about a year later and I ended up talking with Tom Rowland and John Slaten and taking a position with RSS Insurance. My role has obviously evolved from there but I definitely think I have found my calling.

The Insuror: Do you have any influences/role models in the industry?

Trey: I have absolutely had some mentors that have impacted my career and my personal outlook. Happy Powell, Tom Rowland and John Slaten were all extremely important mentors for me when I first started in this industry. And then again in 2013 – when I first became an agency principal – their help was invaluable.

The Insuror: Is there any advice you could offer Young Agents or others in the industry to achieve success in their careers?

Trey: Other than hard work and putting in the hours to allow yourself to succeed, I would tell any young agent that a key to success is to find a couple of good mentors. My suggestion would be to have one in the insurance business and one in another industry. Meet with those mentors regularly and constantly ask them for help and advice. This will help you develop guidelines as well as ways to measure your progress and success.

The Insuror: As an independent agent, you have many partners in this industry, including carriers, MGAs and many more. How do you determine which ones are the right relationships?

Trey: At the end of the day this is a relationship business. You have to find partners that you have a strong relationship with and that you enjoy doing business with. Also, always check yourself and make sure you are being a good partner to your carriers and MGAs as well – building a solid relationship takes work from both sides. I think sometimes as agents we can get caught up in just looking at what we need, and we have to do some work for our carrier and MGA partners as well. It will definitely pay dividends in the long run.

The Insuror: Thank you for giving us your time, Trey, we appreciate it and wish you continued success.

Young Agents '20

Upcoming Events and Information

Our Young Agents Committee strives to offer young insurance professionals with opportunities to network and develop in the industry. We accomplish this by hosting receptions, classes and volunteer opportunities designed to meet the needs of insurance professionals under 40 years of age across Tennessee. Over 500 Insurors members participate in the Young Agents program in some fashion.

With most of our 2020 events cancelled or postponed, our committee will revisit opportunities to hold local events in the next available window of scheduling. We hope you'll join us at a future scheduled Young Agents event or contact us for more information. In the meantime, we have put together a virtual event we think will provide a lot of value to attendees:

Virtual Panel Discussion: “How to Emerge from a Pandemic Ahead of Your Competition” presented by our partners at Berkley SE and Penn National Ins. Thursday, August 27 • 3 pm CT/4 pm ET Featuring Ashley Fitzsimmons, Bradley Flowers & Ryan Hanley Register now at insurors.org

Young Agents Committee

Cy Young - Chair President Young-Hughes Insurance Alamo cy@younghughesinsurance.com

Forbes Harris - Region I Producer Harris, Madden & Powell Insurance Memphis fharris@hmpins.com

Matt Felgendreher - Region II Executive Vice President W.C. Dillon Company & Insight Risk Management Nashville mfelgendreher@irmllc.com

Derek Wright - Region III Agent/Principal Graham & Cook Insurance Knoxville derek@grahamandcook.com

For more info, or for any questions on the Young Agents Committee and its programs, please contact Daniel Smith at dsmith@insurors.org or call 615.515.2601. u

Are you making the Right Choice for their

Business?

BSIG Makes It Easy With Choice Classes For Middle Market Risks Middle Market Choice Classes* Below is just a broad listing. If you don’t see what you’re looking for, please contact us. • General Contractors • Services Contractors • Building Trade • Building Cleaning &

Contractors Maintenance Contractors • Utility Contractors • Construction • Land Improvement Material Suppliers

Contractors • Manufacturing • Pavement • Wholesale and

Maintenance-Non DOT Distributing

* All classes may not be available in all states.

Our Claim Commitment • 24/7/365 loss reporting-including online • • Accelerated auto and property estimating and repair options • • “Fast Track” medical only claims handling program • • Tele-emergent medicine program-connects injured workers to medical care, not “triage” •

Want to know more? Bill Vanderslice, Regional Vice-President 615-932-5508 | bvanderslice@berkleysig.com or your Middle Market Underwriter

Follow us on

A M BEST

Berkley Southeast Insurance Group is a member company of W. R. Berkley Corporation, whose insurance company subsidiaries are rated A+ (Superior) by A.M.Best.

Products and services are provided by one or more insurance company subsidiaries of W. R. Berkley Corporation. Not all products and services are available in every jurisdiction, and the precise coverage afforded by any insurer is subject to the actual terms and conditions of the policies as issued. ©2019 Berkley Southeast Insurance Group. All rights reserved.