19 minute read

Broker Spotlight

Strickland General Agency

Strickland General Agency (SGA) is a family owned and operated Insurance Wholesale Broker proudly serving the Southeast. For over 55 years, Strickland General Agency has been helping independent agents “Think Strickland First” by providing coverages in Commercial P&C, Garage, Commercial Auto and Personal Lines.

SGA is dedicated to offering service beyond their agents' expectations. They pride themselves on the ease of doing business with their agents. In order to offer this, they have experienced and knowledgeable underwriters that are only a phone call away.

They also offer the SGA ePortal, which offers a variety of resources that are readily available and at the agent’s fingertips 24/7. Agents can quote General Liability, Property, Inland Marine and Personal Lines straight from the ePortal. Through the ePortal agents can also access forms, contact information for all departments and download needed documents.

Personal Lines

New! Strickland General Agency is excited to announce they have a new market offering Personal Lines for Tennessee, Georgia, Alabama and Mississippi. SGA will be offering coverages in Tennessee for Manufactured Homes, HO-6, HO3, DP-1 and DP-3.

Commercial General Liability

Strickland General Agency can offer Excess and Surplus Insurance for many Difficult-To-Place or Specialty Classes of Business on an Excess and Surplus Lines basis – Secure e-Portal on the website with over 600 classes you can rate and request binding.

Garage

For over 30 years, Strickland General Agency has been providing a complete line of insurance products that meet the needs of the automotive service industry. SGA writes many classes of garage business including the following: Gas Stations, Auto/Truck Repair Shops, Body Shops, Motorcycle Sales and Repairs, Used Auto Dealers, Valet Services, Mobile Repair and Trailer Sales.

Commercial Auto Think Strickland First

Commercial Auto segment of the industry by offering flexible coverage and value-added service. SGA will work with you to provide the very best coverage at the most reasonable price. They are truly your “one-stop shop” for auto coverage and service.

With SGA's coverage and available options there is no reason to bother with multiple auto policies. Strickland General Agency can tailor an insurance program for you without sacrificing quality, protection or service. Areas of expertise include Commercial Trucking, Public Transportation and Business Auto.

Contact Strickland General Agency

The experts at SGA are ready to work with you to place Specialty and Surplus Lines Insurance for your customers. Check out their new website and get more information by visiting www.sgainga.com or call them at 1.800.825.5742 for immediate assistance. u

DON’T GET BITTEN DON’T GET BITTEN!

BY AN E&O CLAIM YOU COULD HAVE AVOIDED.

Swiss Re policyholders written through the Big “I” Professional Liability Program have access to an exclusive risk management web site.

Log on today to fish for E&O claims frequency data, real-life case studies and analysis, sample client letters, sample agency procedures, agency E&O self assessments, podcasts on important E&O topics, and much more.

www.independentagent.com/EOHappens

Visit the E&O Risk Management website at www.independentagent.com/eohappens

Company Briefs

J.D. Power Highlights Digital Experience

In June, J.D. Power released its 2020 U.S. Insurance Digital Experience Study, and several Insurors Associate Members were highlighted. J.D. Power researchers determined that insurers have made significant technological strides in the nine years since the firm began looking at digital user experiences, although many carriers still struggle with exactly how to present themselves and their product in the digital space.

Among the carriers excelling, based on the study, are AutoOwners Insurance, Progressive, Travelers, The Hartford, MetLife, Liberty Mutual and Allstate.

FCCI Announces Welch as New CEO

The FCCI Insurance Group board of directors recently announced its selection of Christina ‘Cina’ Welch as president & CEO. Welch began her career with FCCI in 1998 as attorney in the legal department and has held varied and progressively complex roles during her tenure, taking on the role in 2018 of executive vice president, general counsel, as well as chief audit & compliance officer.

Welch’s many accomplishments include the development of FCCI’s Data Security Incident Response and Information Security programs; building a robust Enterprise Risk Management program; managing FCCI’s Business Continuity Management program – including the corporate COVID-19 response; and leading the company’s geographic expansion efforts.

INSBANK Parent Adds Echlov to Board

InsCorp, Inc. – the parent entity of our endorsed banking partners at INSBANK – shareholders elected Russell Echlov to join the company's board of directors at its annual meeting. Echlov, a graduate of Dartmouth College, has more than 20 years' experience in analysis and investing in the financial services sector. Since 2016 he has represented one of the bank's larger investors, Mendon Capital.

AIG Moving Certain PL Business to Safeco

American International Group Inc. has announced a deal with Safeco Insurance and Heritage Insurance Holdings Inc. to

We help churches navigate an uncertain world.

For more than 90 years, Southern Mutual Church Insurance Company has worked with churches across the Southeast to help them meet their insurance needs. Our work is built upon long-term relationships with our church policyholders, and that starts with strong relationships with our independent agents. If you are interested in partnering with us to serve churches in your area, please call 1-800-922-5332 to learn more.

Serving churches since 1928.

HOME ABOUT QUICK QUOTE TOOLS

AUTO INSURANCE HOME INSURANCE BUSINESS INSURANCE

LIFE INSURANCE

PERSONAL BUSINESS CONTACT

HEALTH INSURANCE RECREATIONAL INSURANCE

ABOUT

Our Company Our Team Testimonials Insurance Carriers Blog

QUOTES

Quick Quote Auto Insurance Quote Home Insurance Quote Business Insurance Quote Life Insurance Quote Health Insurance Quote Recreational Insurance Quote

TOOLS

Make a Payment Report a Claim Update Contact Info Policy Change Proof of Insurance

INSURANCE

Auto Insurance Home Insurance Business Insurance Life Insurance Health Insurance Recreational Insurance

CONTACT

Contact Us Contact Carrier Free Consultation

© 2020 Suncon Insurance Advisors | Nashville Web Design by Titan Web Marketing Solutions | Terms of Service | Privacy Policy

A subsidiary of

Preferred Property Program can help you procure Umbrella coverage for your insureds with an AXV A.M. Best rated carrier for the following types of risks:

Developer Sponsored Boards Master Associations High-rise Associations & Apartments to 35 stories are eligible and more Limit options ranging from $5 million to $50 million Coverage can include excess D&O ● General Liability ● Auto ● Employee Benefits Employers Liability, Including Employment Practices Liability* (*if covered under the D&O) Follow Form EPLI is available only up to $25 Million limit

In 2016 we partnered with American Union Risk Underwriters (AURA) located in Florida. With our new partner we can now also oer our comprehensive Umbrella, with unsurpassed service and for the following types of risks: Hotels ● Motels ● Timeshares ● Lessor’s Risk Enclosed Malls Shopping Centers Retail ● Oce Buildings ● Warehouses ● Light Industrial Apartments Limit options ranging from $5 million to $100 million For information on our AURA program, contact our experienced underwriter Tom Clementi at 877-506-1430 or visit our website, www.aurains.com

For more information contact our team of Underwriters 888-548-2465 www.ppp-quotes.com

offer AIG Private Client Group’s agents the ability to transition their upper middle market personal insurance business to Safeco and Heritage.

Subject to regulatory approval, a "select portion" of personal lines business with home, auto and umbrella insurance policies may be moved in the 4th Quarter of 2020.

Allstate to Acquire National General

Recently, Allstate announced that it has reached a deal to acquire National General Holdings Corp. for a deal reported to total nearly $4 billion.

When the transaction closes in early 2021, pending regulatory approval and other closing conditions, Allstate will become the fifth largest independent agency carrier. The merger promises to provide independent agencies with a broader, more modern suite of products, including non-standard auto coverage.

In addition to increasing Allstate’s presence in the nonstandard auto market, the deal will also provide agents with the ability to utilize National General’s innovative and highly intuitive technology platform, increasing customer satisfaction and the ease of doing business with independent agents.

Hippo Raises $150M in Funding Round

Palo Alto, California-based insurance technology business Hippo Insurance has just completed a round of financing that raised $150 million. Hippo, which is now valued at about $1.5 billion after the new funding, is preparing for a potential initial public offering, said Chief Executive Officer Assaf Wand.

Hippo is on track for more than $100 million of revenue in the next year, according to Wand. Hippo’s goal is to have “a clear path to profitability” by next year when it expects to be ready to go public, he said.

TDCI Adds Fortman as Captive Leader

The Tennessee Department of Commerce & Insurance (TDCI) has announced that nationally recognized captive insurance executive and global leader Belinda Fortman will join TDCI as Captive Insurance Section Director.

Fortman, who moved to Tennessee from Vermont in 2013 to support the growth of captive insurance in Tennessee, draws on decades of experience in the industry – most recently leading her own captive management firm. Captive insurance is an option for companies to self-insure certain aspects of their business. The captive insurance sector has an estimated economic impact in Tennessee of $31 million in direct annual spending and employs more than 100 full-time professionals. Ryan Specialty Group, LLC (RSG) and All Risks, Ltd. (All Risks) have announced they have signed a definitive agreement to merge. The two firms are insurance specialists with strengths that complement one another. Both have proven track records of excellence in transactional wholesale distribution and managed underwriting businesses in the form of managing general underwriters, programs and delegated binding authorities.

RSG is headquartered in Chicago, IL and All Risks in Delray Beach, Florida; each entity has a national U.S. footprint complemented by RSG’s European operations. RSG is approaching $12 billion in premium in 2020, while All Risks is projecting $2.6 billion in premium for the year.

Arlington/Roe Announces Promotions

Arlington/Roe has announced the promotions of Carrie Heinlein, John Immordino, Amanda Koluch and Patrick Roe.

Heinlein is now Vice President, Commercial Lines Team Lead for the wholesaler. She joined Arlington/Roe in 2014 as a Commercial Lines Assistant Underwriter. Since then, she has held a variety of positions within the Commercial Binding area.

Immordino is now Senior Vice President, Professional Liability. He rejoined Arlington/Roe in 2012 as Vice President, leading the Professional Liability department and affinity program initiatives.

Koluch is now Vice President, Marketing & Communications. She was previously promoted to Marketing Operations Leader and Executive Assistant in 2018. She works closely with Jim and Patrick Roe and oversees agency relations, events and communication.

Roe is now Senior Vice President, Marketing & Sales. Following in the footsteps of grandfather, Francis “Leo”, and father, Jim, Patrick joined his brother Andy at Arlington/ Roe in 2003 as the second member of the third generation of the Roe family. He first began working as a Personal Lines Assistant Underwriter and Underwriter.

Central Promotes Pfeifer to Senior VP

The Central Insurance Companies have announced the promotion of Jocelyn Pfeifer to Senior VP of Underwriting. In this new role at Central, Pfeifer will lead the entirety of the company’s underwriting organization including CL, PL, Loss Control and Underwriting Operations. u

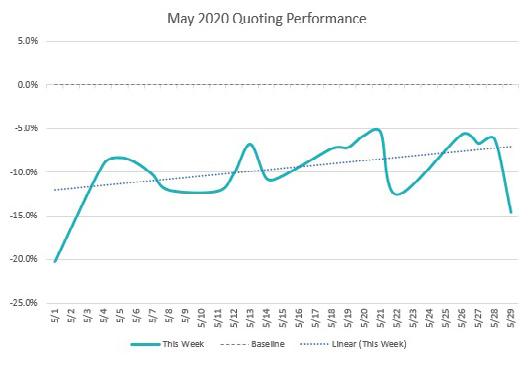

Impact of COVID-19 on Quote... ...continued from page 12 compared to states that reopened toward the end of May.

June: As predicted, rating activity in June continued to improve as states reopened further. The month was the closest to projected rating volume since early March, ending at only 6% below expectations. But toward the end of the month the number of positive COVID-19 cases started to grow again in certain states and we saw this reflected in the decrease of rating activity in those states and continuing into July.

The above data is only the rating activities agents were doing in TurboRater and does not include any consumer-driven rating activities. Through our website platform Insurance Website Builder, our consumer rating platform TurboRater for Websites, and the TurboRater Rate Engine API, we’ve seen a different story.

For the month of March, online rating activities were 3% higher than expected versus the 13.5% decrease seen within agency quoting.

As shelter-in-place directives continued during April, consumers used online resources to transact their day-to-day business, including insurance. The numbers of consumers shopping for their insurance policy online outperformed the historical model of calling or stopping by the agency office.

Traffic to Insurance Website Builder clients was up 3%. Online quote requests and goal completions jumped considerably with these two online activities as high as 25.2% above expectations.

Agencies and InsurTechs that have invested in online properties with consumer-driven quoting have not been as significantly affected within their online activities as much as agencies that rely on foot, referral or phone traffic. Online insurance offerings are a significant opportunity for insurance agencies and carriers during the current situation.

I highly recommend that agents and carriers invest in their online properties. This may include insurance agency websites, automated agency marketing, and online comparative rating portals. Nonstandard markets could be adversely affected above and beyond the current impact of the industry, according to J.D. Power. Their report shows a couple of factors could be driving this: nonstandard shoppers can be less aware of premium relief, or they are more likely to encounter financial hardship. Both of these could cause a higher incidence of shopping.

This argument doesn’t take into account an important component—nonstandard consumers are the regular and savvy price shoppers, and therefore there are already higher quoting and rating activities in nonstandard markets.

An argument can be made that nonstandard agencies are better prepared for a shift in buying habits. In the same J.D. Power report, consumers are looking to their agents and carriers for better rate management options. These include reducing premiums, forgiving missed payments, and suspending coverages at will. These actions are nothing new to agencies focused on volume sales.

I’ve had discussions with agencies across the nation, and those focused on nonstandard shoppers have seen a minimal downturn in business with active renewal, rewriting and education campaigns replacing any decrease in quoting.

Agencies that have focused on value selling are now facing the reality that their long-term clients have become price shoppers. These agencies will need to use assistive technologies to aid their client base at scale.

Methodology

ITC maintains a regular baseline of expected quoting volume for TurboRater. We also maintain an expectation of submission and traffic on the Insurance Website Builder, TurboRater for Websites and TurboRater Rate Engine API platforms.

We built the baseline on a model that reflects multi-year historical performance, usage of the platform, state demographics and market conditions using data from ITC’s business intelligence and analytical products.

The margin of error for the agency quoting and rating baseline averages less than 1.5% as calculated daily. The data analysis excludes rates returned without a premium. The margin of error for the online properties and submission volumes averages less than 5%, as calculated weekly.

All models only attempt to predict Monday through Friday. Agency operations over a weekend have too much variability.

About the Author

Laird Rixford is CEO of Insurance Technologies Corporation (ITC), a provider of websites, marketing, rating and management software and services to the insurance industry. u

Should an Agency Purchase E&O Coverage from Appointed Carriers?

written by Chris Boggs, Big "I" Virtual University

Proper placement of an agency’s errors & omissions (E&O) coverage is of utmost importance. Protection provided by an E&O policy can be the difference between an agency's continued success and financial ruin.

Agencies have many options available for the placement of their E&O coverage. For some, one of the options is purchasing E&O coverage directly from one of their appointed carriers. In fact, these carriers constantly solicit their appointed agents for placing their E&O coverage with exclusive perks, such as points towards carrier incentive plans, reductions in deductibles for E&O claims and application of the E&O premiums toward overall production.

On the surface, this seems like a good deal, especially since the agency already has a relationship with the appointed carrier. The agency trusts them to protect its customers, they are highly rated and they have a great reputation for paying claims.

But serving the agency’s clients and defending the agency from E&O claims are two separate and distinct relationships. The line between what is best for the agency and best for the customer becomes blurred – the two aren't always compatible. Further, what is best for the carrier and best for the agency may not be the same either. It's seldom spoken of when this happens, but it's always lurking in the background and it's called: "conflict of interest."

Before placing E&O coverage with any carrier the agency is appointed to represent, there are several factors that must be considered:

1. Agent or Direct

The Big "I" considers promoting the value insurance agents bring to their customers as part of its mission. Independent agents know the value they add to customers, so why would the agency not want the benefit of a trained professional liability agent working on its behalf? Professional liability can be tricky and just because an agent knows the coverage needs of his or her customers, doesn't necessarily translate into knowing the nuances of agents' E&O coverage. Big "I" state association personnel whose only focus is professional liability work closely with the agency to service its E&O needs. Yes, even the best agency benefits from the professional service and knowledge offered by a dedicated E&O professional.

2. Carrier Relationships

The intrinsic value of agencies is their book of business and carrier appointments. A disagreement about the handling of an E&O claim has the potential to severely strain that relationship and may hamper any long-term representation. If the agency is embroiled in an E&O claim involving the same carrier, maybe even forcing the carrier to fight both for and against its agent, relationships are harmed.

3. Application Data

E&O applications necessarily contain large amounts of sensitive and proprietary information necessary for underwriting, including premiums by line of business, revenue, staff count, appointed carriers and descriptions of office procedures. In addition to knowing all the carriers with which the agency is appointed, the E&O carrier will also know the amount of business with each carrier. Will the E&O department keep this information confidential, or is it shared with other departments?

The hope is that the information is kept confidential, but there may be no guarantees. It is easy to imagine the carrier's field underwriter hounding the agency for more business because of this inside information.

4. Increasing Carrier Claims Against Agents

E&O claims data is analyzed regularly to reveal claim trends. One clear trend that began nearly two decades ago is the steady in-

crease in carriers suing agents for mistakes that result in damages to the carrier. In such a scenario, defending an agent against itself creates a clear conflict of interest for the carrier.

Once the carrier is convinced the agent is guilty of the E&O incident, all the years of a pleasant and profitable business relationship are quickly forgotten. The carrier only has one purpose in mind, forcing the agent to pay the claim. If the E&O is with that same carrier, there is an immediate conflict of interest because the E&O contract places the sole duty of defending the agency on the carrier.

But if the carrier is also trying to lay blame on the agency; how can it, in good faith, also defend the agency? What kind of defense can the agency expect when the carrier is defending the agency against itself?

5. E&O Claims History Protection

Many potential E&O incidents involve, "he said, she said" accounts of the incidents. What happens when a customer written by same carrier is the subject of the potential E&O incident?

Even if the agency didn’t make a mistake, the customer may misrepresent the facts in an attempt to secure payment from the E&O policy. The E&O carrier must make the decision to defend the agent or pay the retail customer's underlying claim to appease them. Maybe the carrier just decides to pay the loss as an E&O claim under the agency’s account because it is less expensive than defending it.

There are two problems with this approach for the agency. One, the agency’s E&O policy has a deductible and the E&O carrier can use the claim to justify future rate increases or simply cancel the policy. Two, the loss will show up on the agency’s loss history and will likely have a negative impact on the agency’s ability to shop E&O coverage in the future.

Agencies have a choice to make regarding the placement of E&O coverage. These are just a few factors that must be considered when making this very important decision. Although placing the coverage with a carrier the agency represents may seem safe and convenient, the ultimate risk may be too high.

Agents are better served placing their E&O coverage with long-term, stable programs focused solely on agents' E&O coverage. Not only are these programs more focused, they aren’t full of the inherent conflicts of interest common when placing coverage with an appointed carrier.

About the Author

Christopher J. Boggs, CPCU, ARM, ALCM, LPCS, AAI, APA, CWCA, CRIS, AINS, joined the insurance industry in 1990. He is the Executive Director of the Big "I" Virtual University. His current duties involve researching, writing, and teaching property and casualty insurance coverages and concepts to Big "I" members and others in the insurance industry. u INTELLAGENTS ™ INSIGHTS FOR INDEPENDENT AGENTS

IN PARTNERSHIP WITH

WHO THEY ARE

Strategic Business Partner

Create a new competitive advantage for agencies by aligning people, processes, and products

Data & Analytics Expert

Enable agencies to make more informed business decisions using technology and data

Change Agent & Innovator

Equip agencies with critical insights to help them thrive in an ever-changing marketplace

Trusted Advisor

Provide agencies with unbiased guidance that arms them with the knowledge to succeed

CREATE YOUR DREAM TEAM!

Does the thought of hiring a new employee leave you overwhelmed? Are you seeing turnover, or posting a job, but just aren’t finding the “right” person?

You’re not alone.

According to the Agency Universe Study 44% of independent insurance agency owners say finding qualified new recruits is their top challenge.

Find the right recruits with Big " I" Hires, a one-stop resource for independent insurance agencies to identify, hire and assess top-performing Producers and CSRs.