THE TENNESSEE INSUROR September/October 2023 Volume 34 | Number 5 4 8 Insurefest 2023 14 THANK YOU ! Convention Sponsors Convention Throwback... Cherish the Memories 1893-2023 Celebrating 130 Years October 21-24, 2023, Knoxville, TN

not dollars. not line items. DREAMS PEOPLE not relationships. FRIENDSHIPS Because we’re a different kind of local bank. One that’s been proudly helping Tennessee businesses –people we consider friends –for more than 16 years. THAT’S WHAT WE’RE AIMING FOR. 5614 Franklin Pike Circle, Brentwood, TN 37027 I 2106 Crestmoor Road, Nashville, TN 37215 615.515.2265 I 866.866.2265 I www.insbanktn.com I Open Mon. - Fri., from 8:30 AM – 4 PM.

Editor: Ron Travis Publisher: MarketWise, Inc

INSURORS OFFICERS

President ..............................................Matt Swallows, CIC, CRM

IIABA National Director ........................John McInturff III, ARM

VP Region I ...................................................................Bobby Sain

VP Region II .........................................Battle Bagley, III, CIC, CPA

VP Region III, President-elect .............Kym Clevenger, CPCU

Treasurer ....................................................Richard Whitley, CIC

Secretary ..................................................................Kevin Ownby

Director, Region I ....................................Eric Collison, CIC, CRM

Director, Region I ............................................Pam Lofton-Wells

Director, Region I ........................................................... Cy Young

Director, Region II .....................................Cameron Winterburn

Director, Region II ......................................................... Chip Piper

Director, Region II ...................................... Paul Steele, CIC, CRM

Director, Region III .................................................... Tim Goss, CIC

Director, Region III .......................................... Bill Oldham III, CIC

Director, Region III ...................................................Josh Gibbons

Director, Young Agents .................................John Brock, CAWC

Immediate Past President ......................... Norfleet Anthony III

3 The Tennessee Insuror INSURORS OF TENNESSEE 2500 21st Avenue South, Suite 200 Nashville, TN 37212-0539 www.insurors.org THE TENNESSEE INSUROR

Free: 1.800.264.1898

Phone 615.385.1898 Toll

Email: marketing@insurors.org

ADVERTISING

advertising rates, deadlines and specifications may be obtained by writing to Insurors of Tennessee, 2500 21st Avenue South, Suite 200, Nashville, TN 37212, calling

e-mailing marketing@insurors.org or online at www.insurors.org The Tennessee Insuror is provided to all Insurors of Tennessee members and associate members as a member service. contents 6 Special Bulletin: Annual Business Meeting - October 24 8 Thank You! Convention Sponsors 10 Meet Your 2023 Convention Speakers 13 Visit These Convention Exhibitors 14 Convention Throwback... Cherish the Memories 1893-2023 departments 21 From Your President Ready... On Three...Break!!! 23 Your Big "I" Insurors of Tennessee Recognized at Annual Big ‘I’ Fall Leadership Conference 25 From Your CEO Kicking Off the 130th Annual Conference 26 Tennessee Young Agents '23 Young Agents of Insurors Enjoy Annual Big “I” Young Agents Leadership Institute 28 Partners for Tennessee - Thank you for your support! 31 Government & Legal Update Advocacy Update: Carrier Receivership Impacts Tennessee; Big I Opposes NAIC Model Act 35 Association Update 40 Company Briefs 48 Education Calendar 50 Meetings - Mark Your Calendars 53 Your Big "I" Charles Symington Becomes Big ‘I’ President & CEO 54 Directory of Advertisers 4 Celebrating 130 Years Insurefest 2023 Volume 34, Number 5 September/October 2023

Display

615.385.1898,

Celebrating 130 Years...

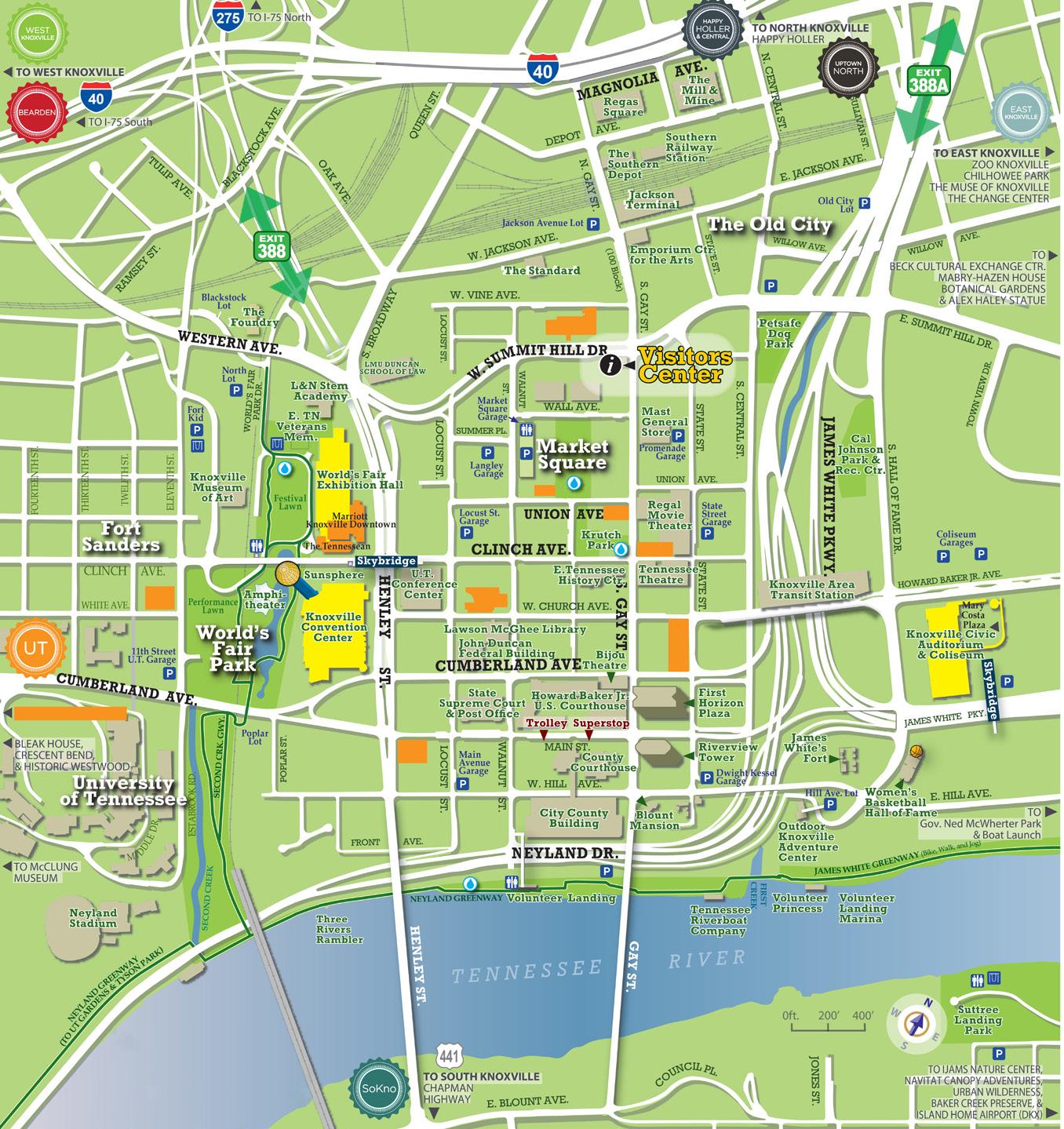

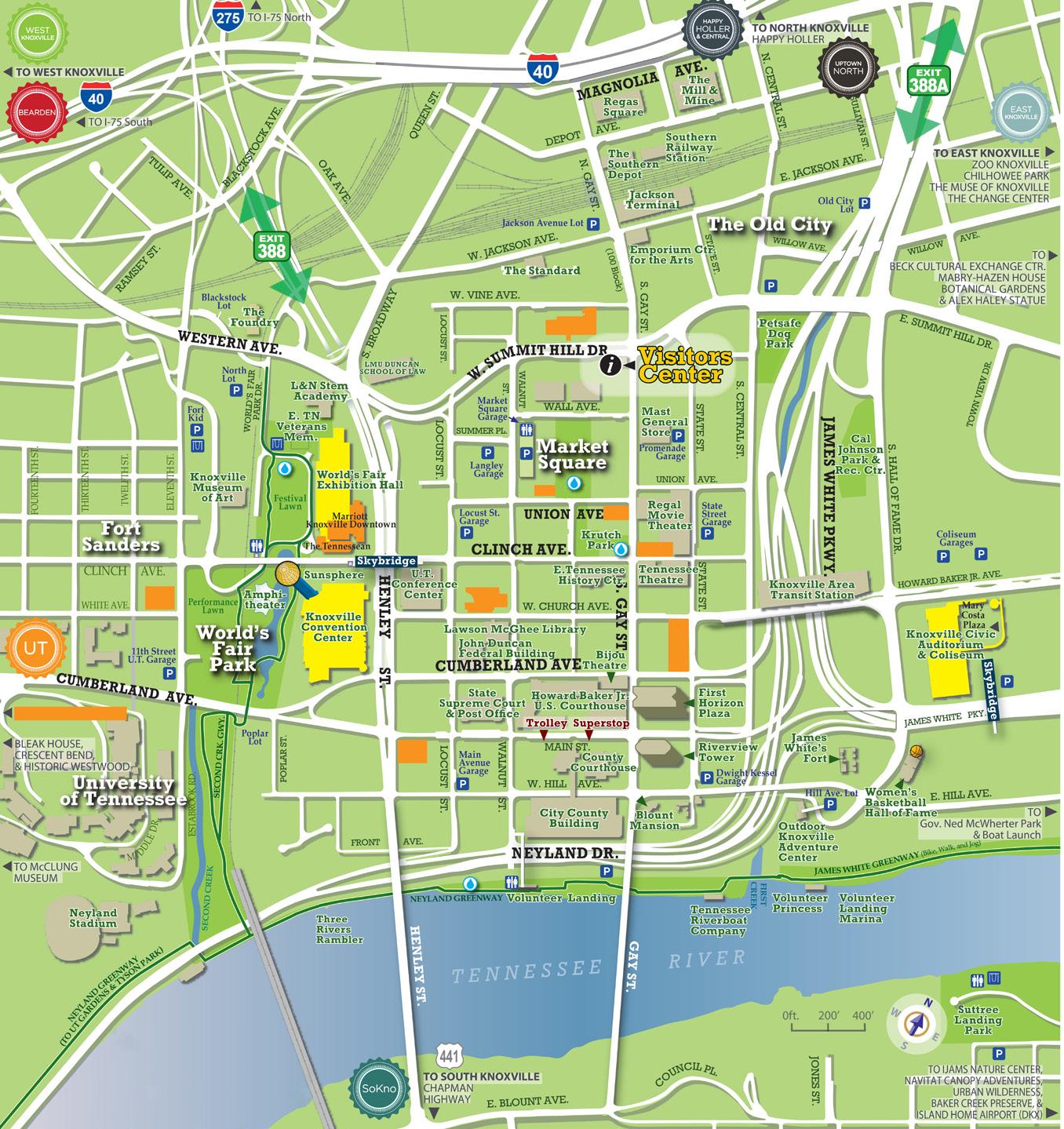

Welcome to the Insurors of Tennessee 129th Annual Convention. We are excited to meet in our host city of Knoxville, at the newly renovated Marriott hotel in the heart of Knoxville. We have a great lineup of events planned and hope you take advantage of the many opportunities to learn and network. Of course, there will be plenty of time to relax and socialize as well. The schedule of events follows. If you have any questions after you arrive please visit us at the on-site registration desk. Find a map of the downtown Knoxville on page 6.

Schedule of Events • All times Eastern • Meeting rooms in italics

Saturday, October 21, 2023 • Football Watch Party • Tennessee vs Alabama

Time dependent Join us for a welcoming night of football and fellowship as we kickoff our Annual Convention! on kickoff Wear your schools colors to show your support! The Den

Sunday, October 22, 2023 • Day One • Registration • Trade Show Opens • WINS Session • Opening Dinner

8:00 am - 11:00 am

11:30 am - 12:30 pm

Board of Directors Meeting (by invitation only) Wiley

Past Presidents Luncheon (by invitation only) Hope

1:00 pm - 5:00 pm Registration Open Atrium

1:00 pm - 2:00 pm

2:00 pm - 6:00 pm

6:30 pm - 8:00 pm

9:00 pm – 11:00 pm

WINS: Women in Insurance Breakout Session Wiley + Milani

Sunday Trade Show World's Fair Exhibition Hall

Opening Night Dinner- guest speaker US Representative Dr. Mark Green Belle Meade 1 & 2

Young Agents Night Out (registration required) Maple Hall

Presented by EMC Insurance

YA

The Tennessee Insuror

Monday, October 23, 2023 • Trade Show • 3 Breakout Sessions • Top Golf • River Cruise • Company Night

7:30 am - 9:0 0 pm All Attendee Breakfast Ballroom B

8:00 am - 12 :00 pm Registration Table Open Atrium

8:00 am - 10 :00 pm Monday Trade Show World's Fair Exhibition Hall

8:30 am - 10:00 am

10:00 am - 11:00 am

Breakout Session #1 - “When Words Collide: Resolving Insurance Ballroom A

Coverage and Claims Disputes” featuring Bill Wilson, CPCU, ARM, AIM, AAM

Breakout Session #2 - InsureTech Panel- Join Chip Bacciocco, CEO of TC.com, Ballroom A

Jason Walker, President of Agency Revolution, Adam Kiefer, Founder of Talage, and Lou Moran III, Vice-Chair of the IIABA Executive Committee

11:00 am - 12:00 pm

Breakout Session #3 - Recreational Marine CE Course (1HR) Ballroom A

Presented by Martin & Zerfoss and Chubb

12:00 pm - 6:00 pm Free Time (Optional Activities Available)

1:00 pm - 3:00 pm

2:00 pm - 4:00 pm

Exclusive Fall Foliage Tennessee River Cruise (registration required)

Presented by Martin & Zerfoss and Chubb Insurance

TopGolf Outing (registration required) 11400 Outlet Drive, Farragut, TN

Presented by Travelers Insurance

6:00 pm - 9:00 pm Company Night (events and/or dinner on your own)

Tuesday, October 24, 2023 • Association Day Breakfast & Business Meeting

8:00 am - 10:00 am

Association Day Breakfast and Annual Business Meeting Ballroom B

(Please read the Special Bulletin on page 6 for business matters to be voted on.)

10:00 am - 11:00 am 2024 Board of Directors Meeting and Portraits (by invitation only) Ballroom B

11:00 am End of Program u

The Tennessee Insuror

Special Bulletin: Annual Business Meeting - October 24, 2023

The following association changes are to be voted on by our agency members at the Annual Business Meeting being held at the Downtown Marriott on Tuesday, October 24th at 8 o’clock in the morning in conjunction with our 2023 Annual Convention in Knoxville.

Agency Members must be present at the Business Meeting to vote.

2024 Board Elections and Nominees

Immediate Past President – Matt Swallows (Region II)

President – Kym Clevenger (Region III)

President-Elect – Bobby Sain (Region I)

Vice Presidents - Elected Annually

Region I Bobby Sain has served 2 years (moving to President-elect)

Region II Battle Bagley III has served 1 year

Region III Kym Clevenger (moving to President)

NOMINEE Kevin Ownby

Treasurer - Elected Annually

Treasurer Richard Whitley has been nominated to continue 1 year of service

Marriott Knoxville Downtown

525 Henley Street Knoxville, Tennessee 37902

865-522-2800

www.marriott.com

Located in the heart of downtown Knoxville with an easy walk to entertainment, shopping and dining options in Market Square; galleries, coffee shops, and breweries in Old City Knoxville; and the Arts District along Gay Street.

All accommodations feature mini-refrigerators and floor-to-ceiling windows with stunning city views. Stay fit in our expansive state-of-the-art fitness center or take a stroll in our backyard to enjoy a park setting with fountains and water features.

A clever nod to Knoxville’s history as a maker city, the on site Restaurant at Maker Exchange is the spot for enjoying drinks and noshing on fresh regional foods that encompass the spirit of Knoxville in a social and energetic setting. Open everyday 6:30 AM - 11:00 PM.

Secretary - Elected Annually

Secretary Kevin Ownby has served 1 year

NOMINEE Jamie Williams

Directors - Elected for 3-Year Term

Region I Eric Collison has served 3 years

NOMINEE Andrew Maddox

Region I Cy Young has served 2 years

Region I Pam Wells has served 1 year

Region II Paul Steele has served 3 years

NOMINEE Matt Felgendreher

Region II Chip Piper has served 2 years

Region II Cam Winterburn has served 1 year

Region III Bill Oldham, III has served 3 years

NOMINEE Stuart Oakes

Region III Tim Goss has served 2 years

Region III Josh Gibbons has served 1 year

Young Agent Director - Elected Annually John Brock has served his term

NOMINEE Sam Organek

6 The Tennessee Insuror

8 The Tennessee Insuror

Convention Sponsors ! ACCIDENT FUND INSURANCE COMPANY OF AMERICA • AMTRUST • ASSOCIATED INSURANCE ADMINISTRATORS, INC • BERKSHIRE HATHAWAY GUARD INS BURNS & WILCOX • THE CASON GROUP • CELINA INSURANCE GROUP • CINCINNATI INSURANCE • CORNERSTONE NATIONAL INSURANCE • EMC INSURANCE FRANKENMUTH INSURANCE • GOVERNMENTAL RISK INSURANCE PLANS • J.M. WILSON • METHOD INSURANCE • NATIONAL GENERAL, AN ALLSTATE COMPANY PIE INSURANCE • PREVISOR INSURANCE • RT SPECIALTY • SAFEWAY INSURANCE COMPANY • SOUTHERN INSURANCE UNDERWRITERS UTICA NATIONAL • WESTFIELD DiamonD PL aTInUm GoLD SiLver Bronze evenT SPonSorS CHUBB - Breakout Session #3-Recreational Marine CE Course and Fall Foliage Tennessee River Cruise MARTIN & ZERFOSS - Breakout Session #3-Recreational Marine CE Course and Fall Foliage Tennessee River Cruise TRAVELERS - TopGolf Outing EXCHANGE MEDIA GROUP - Sunday Trade Show EMC INSURANCE - Young Agent Night Out RT SPECIALTY AND IMPERIAL PFS - WINS Breakout FLOOD INSURANCE

THANK YOU

9 The Tennessee Insuror ONE SIZE FITS ONE. Selective is committed to working with independent agents in Tennessee just like you. Together, we can provide Commercial, Personal, and Flood coverage for each unique customer. Contact Dan Schilling, Territory Manager, at dan.schilling@selective.com and help your customers Be Uniquely Insured. © 2021 Selective Ins. Group, Inc., Branchville, NJ. Products vary by jurisdiction, terms, and conditions and are provided by Selective Ins. Co. of America and its insurer affiliates. Details at selective.com/about/ affiliated-insurers.aspx. SI-21-037 9

Meet Your 2023 Convention Speakers

Bill Wilson, CPCU, ARM, AIM, AAM is the former Assistant Executive Director and Director of Education & Technical Affairs for the Insurors of Tennessee. After an 11-year tenure at the state association, Bill joined the staff of the national Big “I” association to build their Virtual University, serving as the IIABA national Director of Education & Research. He is the author of six books and thousands of articles and has developed and presented hundreds of seminars and convention keynotes. According to former Big “I” CEO Bob Rusbuldt, “Bill Wilson is the nation’s foremost leading expert on form, coverage, and technical issues.” Among many other state and national industry awards, Bill is a member of the Tennessee Insurance Hall of Fame.

Charles Symington is the new President and CEO of the Independent Insurance Agents & Brokers of America (the Big “I"), effective Sept.

1. Joining the Big “I" nearly 20 years ago, Symington previously served as senior vice president for external, industry and government affairs. Last September, he was promoted to executive vice president and selected to succeed the retiring Bob Rusbuldt as president &

CEO. He has been a key leader in many industry coalitions on Capitol Hill, advocating on issues important to Big “I" members. Symington joined the Big “I" in 2004 on the government affairs staff. Under Symington's leadership, the Big “I" has had numerous legislative wins, including securing substantial small business tax relief, defending a modernized state regulatory system for insurance, preserving the Federal Crop Insurance Program and National Flood Insurance Program, and extending the Terrorism Risk Insurance Act (TRIA).

John Costello is senior vice president and construction practice member at USI Insurance. He served as Independent Insurance Agents & Brokers of New York (IIABNY) chair of the board from 2001 to 2002 and on the IIABNY Trusted Choice committee. At the national level, he served on the IIABA Trusted Choice board of directors and Professional Liability Committee. Costello has served as the New York national director, IIABA Finance Committee chair and was the IIABA Executive Chairman for 2023. He is a member of the Society of Certified Insurance Counselors and past president of the board of directors of Sunset House, a home for the terminally ill.

Full PEO Support To Take Your Business To The Next Level

With BBSI, you’ll have a dedicated Business Unit team who knows you and your business. In addition to payroll support and our full suite of consulting services, you’ll have access to our unique pay-as-you-go workers’ compensation program. BBSI will help you look at your business holistically in order to improve your efficiency, mitigate risk, and reduce administrative burdens.

10 The Tennessee Insuror

Retirement Services Staffing Services

Call today or visit www.bbsi.com/nashville to learn more. Dion Matos - Area Manager 760.445.5909 Dion.Matos@bbsi.com

11 The Tennessee Insuror LAURA GAUNT | Sales Executive | 224.443.0443 | laura.gaunt@ipfs.com Premium financing made easy with the Imperial PFS® suite of industry-leading technology to start your digital transformation

1. Imperial PFS is a trade name affiliated with IPFS Corporation® (IPFS®), a premium finance company. Access to products and services described herein may be subject to change and are subject to IPFS’ standard terms and conditions in all respects, including those specifically applicable to use of IPFS’ website, mobile application, and IPFS’ eForms Disclosure and Consent Agreement. 2. Our electronic payment processing provider charges a technology fee where permitted by law. Copyright © 2022 IPFS Corporation. All rights reserved.

12 The Tennessee Insuror Talk to your territory manager or find one at LibertyMutualGroup.com/Business and Safeco.com/agent-resources © 2021 Liberty Mutual Insurance, 175 Berkeley Street, Boston, MA 02116 We do more. So you can grow more. The right products and programs to help you compete.

Visit These Convention Exhibitors

Agents Alliance Services

AmTrust

AmWins Group, Inc.

Applied Systems, Inc.

Arlington/Roe

Associated Insurance Administrators

Bailey Special Risks, Inc.

BBSi

Berkley Southeast Insurance Group

Berkshire Hathaway GUARD Insurance Cos.

MidSouth Mutual

Builders Insurance Group

ClearPath Mutual

Columbia Insurance Group

Commercial Sector Insurance Brokers

Encova Insurance

Falls Lake Insurance Companies

FFVA Mutual Insurance Co.

Glatfelter Public Entities

Governmental Risk Insurance Plans (GRIP)

Grange Insurance Companies

Harford Mutual Insurance Company

Heartland Payroll

Donegal Insurance Group

Host My Calls

HoundDog

ICW Group Insurance Companies

Imperial PFS

Insurance Program Managers Group

INVO Underwriting

J.M. Wilson

Jencap Insurance Services Inc.

Liberty Mutual Insurance

LUBA Workers' Comp

Main Street America Insurance

Martin & Zerfoss, Inc.

Mountain Life Insurance Company

National General, an Allstate company

Nationwide Insurance

Normandy Insurance Company

North Point Underwriters, Inc.

Novum Underwriting Partners

Parrot Surety Services, LLC

Penn National Insurance

PLRisk Advisors

Previsor Insurance

Risk Placement Services

RT Specialty

Ryan Specialty Group

Safeco Insurance Company

Selective Insurance Company of America

SFM Mutual Insurance Company

Skyward Specialty Insurance Group

Society Insurance

South & Western Southern Insurance Underwriters, Inc.

Southern Pioneer Insurance

Southern Trust Insurance Co.

State Auto Insurance Companies

Stonetrust Workers' Compensation

Summit Consulting, Inc.

TAPCO Underwriters, Inc.

The National Security Group

Titan Digital

Travelers

Westfield Insurance

XS Brokers Insurance Agency, Inc.

Zenith Insurance Company

The Tennessee Insuror

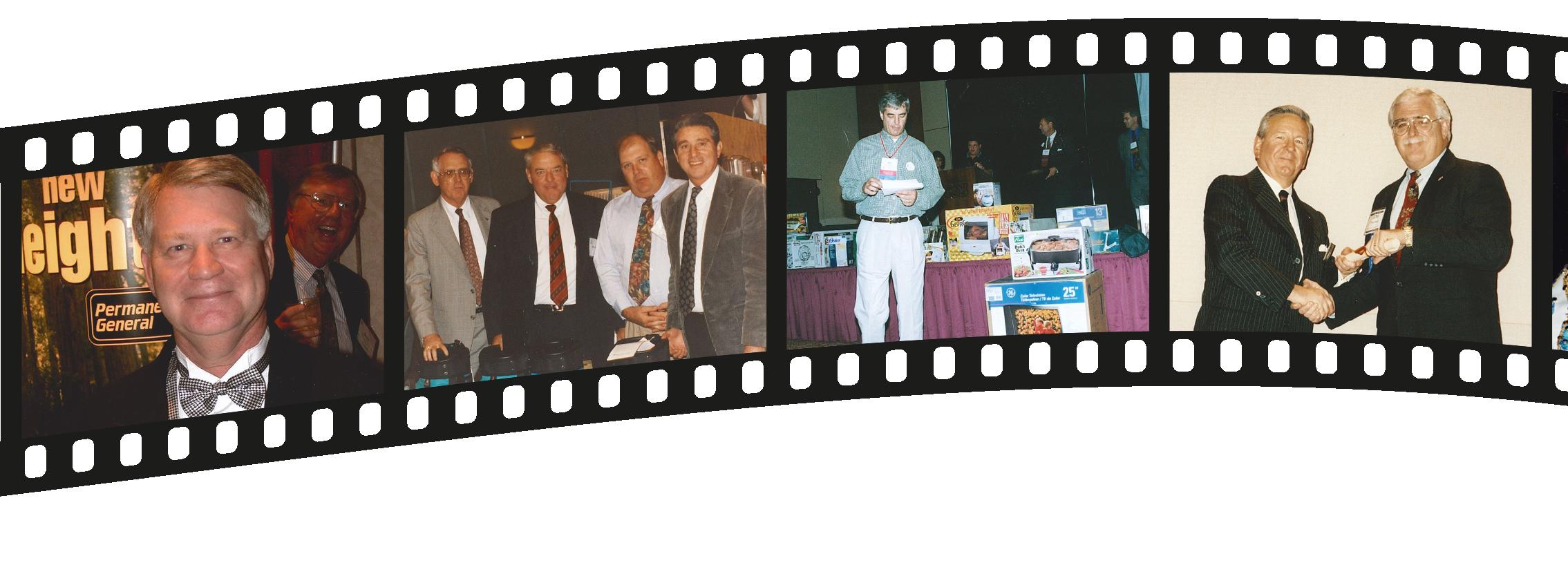

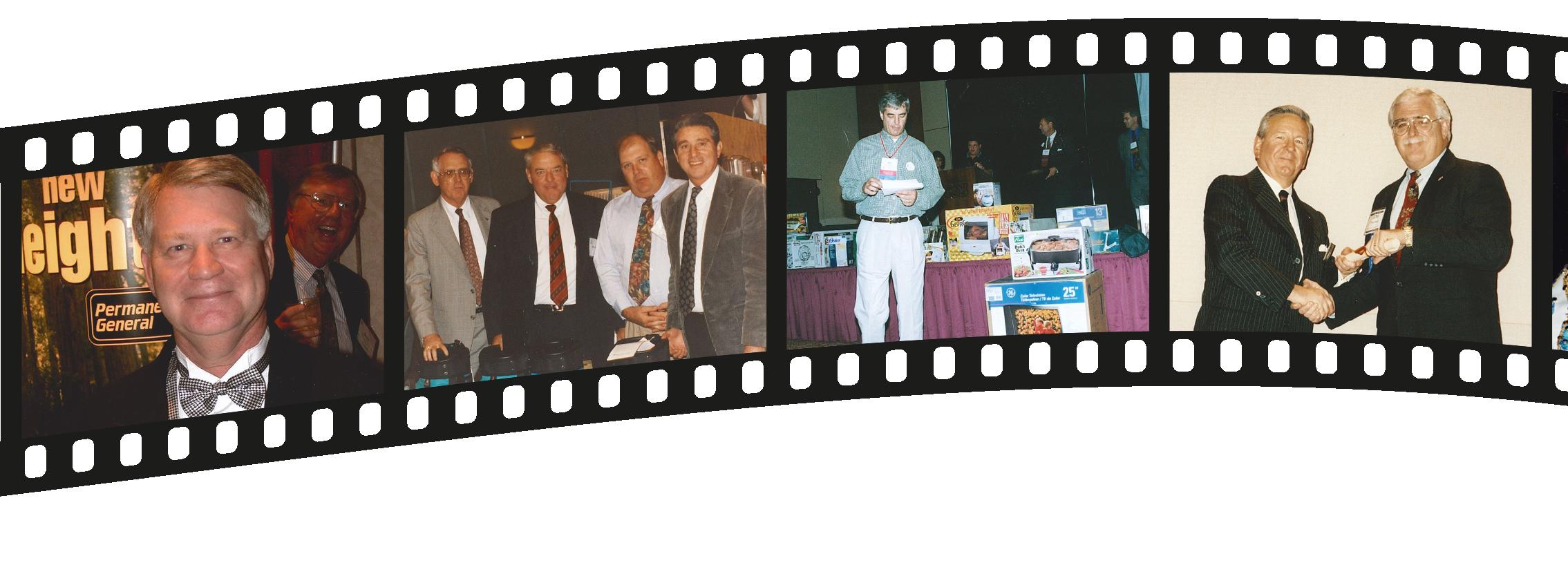

Convention Throwback... Cherish the Memories 1893-2023

The Tennessee Insuror

The Tennessee Insuror

Your attorney clients know their firm inside and out. You know your markets and your competitors. At Swiss Re Corporate Solutions, we have the capabilities and the financial strength to meet the risk needs of insureds for Lawyer’s Professional Liability. Whether the risk is basic or complex, we believe there’s only one way to arrive at the right solution. And that’s to work together and combine your experience with our expertise and your strengths with our skills. Long-term relationships bring long-term benefits. We’re smarter together.

= Your

Our

insights

strengths and expertise Top-class protection around the world +

Swiss Re Corporate Solutions is proud to be the exclusively endorsed Lawyer’s Professional Liability provider for the Insurors of Tennessee. For more information or to access the program, please contact administrator Jeff Severino of Lockton Affinity at JSeverino@locktonaffinity.com or 913.652.7520. Insurors of Tennessee Ph 1 800 264 1898 E info@insurors.org Insurance products underwritten by Westport Insurance Corporation, Overland Park, Kansas, United States, a member of Swiss Re Corporate Solutions.

HARD TO PLACE RISK

Doesn’t have to be

Ryan Specialty Underwriting Managers is a specialty delegated authority underwriting business consisting of property and casualty managing general underwriters and distinct national specialty programs. With solutions for over 150 lines of business, Ryan Specialty Underwriting Managers o ers innovative, bespoke solutions for even the most complex risks. Within our extensive marketplace, we have the following solutions available to retail agents and brokers through the featured MGUs and National Specialty Programs.

ryanspecialtyum.com

Energy

Healthcare Hospitality

Marine

Social

Sports

Transactional

The Tennessee Insuror

Liability

Cyber

Services

& Entertainment

Liability Packaged Industry Solutions

Convention Throwback... Cherish the Memories 1893-2023

The Tennessee Insuror

The Tennessee Insuror

Meet Maddox Insurance Agency –Huntingdon, McKenzie, Camden

We present the Maddox Insurance Agency in our Small Town/ Rural Market feature article. The Maddox Agency is found between Nashville and Memphis on U.S. 70 in Huntingdon, Tennessee. In an interesting side note, prior to the development of the interstate system, U.S. 70 was one of the major East-West routes in the nation extending from the Atlantic, N.C. at the waters edge near the Cape Lookout National Seashore and ending in Globe, Arizona just 88 miles East of Phoenix. U.S. 70 was sometimes referred to as the "Broadway of America", due to its status as one of the main thoroughfares in the nation at the time. Today, it still connects vibrant communities across America.

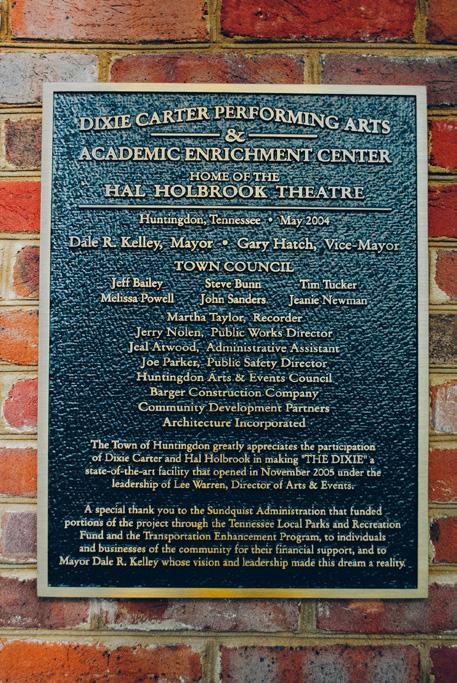

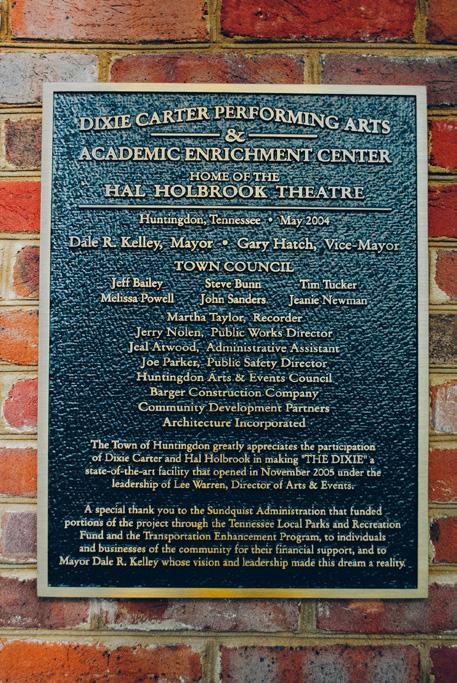

Huntingdon is in Carroll County and is the county seat. The town has a population of 4,439 as per the 2020 census. Huntingdon celebrates a rich history and has a lot to offer to its residents and visitors alike. The town is home to what is now called The Dixie, which is one of the region’s great music and arts venues offering music and theatrical shows, art galleries, educational opportunities and so much more. To provide a bit of context about The Dixie, plans for The Dixie Carter Performing Arts and Academic Enrichment Center were unveiled in December of 1999. The center was developed on the Court Square in Huntingdon and named in honor of the area’s most famous resident, actor Dixie Carter from nearby McClemoresville. Today, The Dixie is also home to the Hal Holbrook Theatre which is a 470-seat venue that has hosted a wide range of famous artists from around the country. The Dixie is also home to the Dixie Carter Museum and the Hal Holbrook Museum.

Huntingdon has many recreational opportunities. The new Carroll County 1000 Acre Recreational Lake is a wonderful place to spend time with family and friends. The town has scenic parks that are perfect for picnics and other outdoor activities. Huntingdon’s downtown area, including the town square, is vibrant and beautiful, offering many shops, local eats, boutiques, and plenty of unique finds. The annual Heritage Festival, which combines fun, food, and music is a capstone event for the community each year.

In 1947, Maddox Insurance was established by Mrs. Maynard Maddox at a time when it was atypical for a young woman to start any business much less an insurance agency. Her story is one of perseverance. Prior to founding the agency,

Mrs. Maddox worked in the cafeteria of a local school and her husband was an area attorney. Sadly, Mr. Maddox suffered a sudden cardiac arrest far too early in life and passed away. Mrs. Maddox needed to do something different to support her children and raise her family. Out of those circumstances, she started the Maddox Agency initially working out of the family home. In time, she moved the agency into an office location. She continued to serve as principal in the agency for many years.

Her son Web Maddox took over the operation of the agency in 1975 and became a partner in 1983. Web became the sole owner of Maddox Insurance in 1992. He then became President of Maddox Insurance, LLC until his death in 2016. Web Maddox was dedicated to serving his clients and saw helping clients with their insurance and risk management not just as a job but as his mission. He was devoted to his family and an important part of their lives, laying the foundation for the next generation of the Maddox family. He is missed and always remembered by his family, friends, and the community. Web Maddox was a member of Huntingdon Church of Christ.

Andrew Maddox, son of Web, is now the third generation of his family to own and manage the agency. It should be noted that in today’s insurance industry there are not that many family-owned agencies that make it to the third generation. Maddox Insurance is now in its seventy-sixth year of doing business as a family-owned agency and is to be commended for its resilience and perseverance as it adapted and developed to continue serving clients and the community.

Today, Andrew is the President of Maddox Insurance, LLC. Andrew started his insurance career with the agency in 2009 shortly after graduating from Bethel University where he earned a Bachelor of Business Administration degree with a concentration in management. His education prepared him well for the next chapter of his life.

The Maddox Agency offers clients a broad array of insurance products for businesses and families including life and health insurance. The agency expanded its market footprint to include offices in McKenzie and Camden. A consistent element of the Maddox Insurance agency’s success is its clear focus on delivering exemplary service and support to clients.

Continued on page 38

18 The Tennessee Insuror

INNOVATIVE INSURANCE SOLUTIONS. PARTNERSHIP FOCUSED.

RLI is a proud member of the Big “I”. Contact us to gain access to comprehensive insurance solutions and protect your commercial and personal lines customers from the unique risks they face. From our specialized solutions to our focus on building strong relationships with the agents we work with, we’re different. And at RLI, DIFFERENT WORKS .

PRODUCTS AVAILABLE THROUGH BIG “I” MARKETS:

• Home Business

• Personal Umbrella

Learn more about our specialty insurance solutions at RLICORP.COM

19

We answer to main street, not Wall Street.

As a mutual company, we are owned by our policyholders. We focus our time, attention, and resources on delivering superior financial strength and stability, a comprehensive product portfolio, and most of all, on doing what’s right for policyholders. To us, policyholders are much more than insurance consumers. And because of that, all of our business decisions are made with a policyholder-first focus.

For more information about our products, please contact one of our territory managers at 615-889-2740.

Brent Potts ext 7514

Jane Kinard ext 7518

Andy Wilder ext 7545

20 The Tennessee Insuror

www.PennNationalInsurance.com

From Your President

Matt Swallows

presented by

Ready... On Three...Break!!!

It is football time in Tennessee! These few words spoken by John Ward during his radio broadcast are iconic in this state and will be forever tied to the beloved radio sports announcer of the University of Tennessee football games. Across the state and the nation, football brings people together in unique and surprising ways. Whether you are supporting your alma mater, rooting for your favorite team, or just enjoying the sport in general, football brings a lot of enjoyment to people on a Fall afternoon.

For those of you who don’t know and that may very well be most of our members, I played football in high school and college starting at Livingston Academy, as a walk on at Vanderbilt for a short time, and then at Tennessee Tech University for many of my playing days. While I was a good athlete and our teams were successful, please be clear, there were no NFL teams calling me on draft day. Nevertheless, the things I took away from football helped me grow and develop in business and in life.

So, what did I learn? I learned the importance of discipline and focus and that there are no shortcuts to being successful. You must learn the playbook, study

the tendencies of the opposition, and understand your team’s game plan to be successful. Success is found in preparation, sweating the details, and executing to the best of your ability. It is about always improving and getting better at the craft of your position whether you’re the quarterback, wide receiver, or safety. I also learned the importance of being on a team and how powerful a team can be when everyone is working together, giving their best and actively pursuing the same goal. I learned it’s about doing what you say you’re going to do and having your team members back when the going gets tough. Most importantly, I learned it is about the lasting relationships with players, coaches and team managers forged on the football field on the days and nights of football in the South.

The reality is that football, baseball, soccer, basketball, volleyball or just about any team sport can create the same dynamic just described. Being in a marching band, playing in an orchestra, singing in a chorus also creates the same attributes of being on a team working together in common purpose. Sports and other competitive groups truly can be a metaphor for life. You don’t have to be an athlete or musician to experience the power of being part of a strong

team. No doubt, if you’re reading this article, you are part of a successful team at your independent insurance agency, brokerage, or insurance company. As an Insurors of Tennessee member, associate member, or valued partner, you are part of a historic and talented team that has been working collectively through generations for over 130 years to serve our industry.

As I approach the end of my term as President of this association, I have come to fully appreciate the exceptional teamwork that must happen to ensure that the Insurors of Tennessee continues to be the preeminent insurance association in this state and a recognized leader at the national level. So many of the elements of “team” are what has made and continues to make this organization a success. From the Insurors of Tennessee Staff to the Board of Directors and most certainly our Partners, critical elements of teamwork are at the core of who we are as an association. Teamwork and the active participation of all team members is the engine that drives our success. I look forward to seeing you all at InsureFest. Ready… on three… break!!! u

The Tennessee Insuror

22 The Tennessee Insuror Managing General Agents | Wholesale Insurance Brokers We are third-generation, family-owned & independent. Honesty, Integrity & Trust. We’ve been Doing the Right Thing since 1964. We are a third-generation, family-owned, independent managing general agency and wholesale insurance broker with a history of valuing and trusting business relationships. Our underwriters and brokers coordinate among specialty teams to meet the needs of multi-faceted risk opportunities, piecing each risk puzzle together for our producers. We strive to be a premier resource through our core pillars of honesty, integrity, respect and trust. 800.878.9891 ArlingtonRoe.com Let us help you find the right solutions. Aviation | Bonds | Cannabis | Casualty | Commercial Agribusiness | Farm Healthcare & Human Services | Personal Lines | Professional Liability | Property | Transportation | Workers’ Compensation

Your Big "I"

Insurors of Tennessee Recognized at Annual Big ‘I’ Fall Leadership Conference

The Insurors of Tennessee was recognized for a 4th consecutive year with the Big ‘I’ Excellence in Education Award. This award was received by conference attendees Kym Clevenger; PresidentElect, Teresa Durham; Insurance & Education Director, and CEO Ron Travis. “I think the biggest factor with us winning this award in 2023 was our ability to install and operate state-of-the-art audio and video equipment to enhance our education classes. This allowed us the opportunity to offer education classes both in-person and through high-quality online broadcasts to our members in Tennessee and insurance professionals across the country,” says Durham, “We also took the opportunity to engage with students in the Risk Management program at Middle Tennessee State University to showcase the independent insurance landscape through job fairs and connections that open doors for these young aspiring insurance professionals.”

“We are so proud of the work that Teresa is doing in our education department here at the Insurors of Tennessee, she has taken a huge step in establishing a standard of excellence that is consistently recognized by our national association,” says Travis. “The feedback that we receive from our education class attendees is proof of the work that Teresa and our staff is doing within our educa -

By Jake Smith

tion department. This award would not be possible without the support of our members attending our variety of CE classes.”

On Saturday, September 9th, Insurors member and Past President Lou Moran III of Inter-Agency Insurance Services was installed as the Vice Chair for the Executive Committee of the Independent Insurance Agents & Brokers of America –the Big ‘I’. Leading into his appointment as Vice Chair, Lou became the first agent from the state of Tennessee to serve on the Big ‘I’ executive committee. Lou joined by vote in September of 2019 at the Fall Leadership Conference in Savannah, Georgia.

Lou will serve 1 year as Vice Chair before moving up to President-elect in 2024; from there Lou will have the honor of serving as the Big ‘I’ Executive Chairman for 2025. Upon his outlook at his future service, Lou is excited at what's to come, “I look forward to seeing Charles Symington grow in his new role as Big ‘I’ CEO and President. I also am looking forward to see the Big ‘I’ Executive Committee pivot to a new agenda in order to push the association forward. The association has a special place in my heart, Chuck Bidek was like a second dad to me. Chuck helped me get licensed and get involved,” says Moran. “I want to

make the Tennessee association proud and make the members proud. I want to see the benefit of our state association through this service on the national level.”

The Big ‘I’ Fall Leadership Conference is located in the home state of the incoming Executive Chairman. Nashville will be the host city for the conference in 2025 and Lou expects a level of southern hospitality for our contemporaries that will attend from across the country. “I want this to be a celebration of Tennessee, not me. This is our opportunity to show the country how special the state of Tennessee is,” says Moran.

Upon his recent years serving on the Executive Committee Lou states: “The past chairs have done a great job of mentoring me as I prepare to lead. It is all about looking at what is best for the association going forward. The Big ‘I’ plays a vital role in government affairs and legal advocacy for us and our members. They are looking at our best interests when it comes to carrier relationships and helping grasp opportunities to advance the abilities of independent agents. I encourage everyone to dig deeper into the many services and programs that the Big I offers – all of which are listed on their website www.independentagent.com.” u

The Tennessee Insuror

Lou Moran III with the Big I Executive Committee

WEST BEND

THE BEST REMEDY FOR WORKERS’ COMPENSATION

West Bend Mutual Insurance has a long history of writing workers’ compensation insurance. Our underwriters are knowledgeable and experienced. Our loss control reps have the expertise and tools to help keep employees safe. And our claims practices are the best in class.

From Main Street-type businesses to specialty businesses like childcare, West Bend has the experience and expertise to protect businesses of many kinds and many sizes. We want to write all of your workers’ compensation business, small to large!

When you select West Bend for your valued customers, you can rest assured you made the right choice. After all, we are the best remedy for workers’ compensation.

To find an agent near you, visit thesilverlining.com.

24 The Tennessee Insuror

From Your CEO

Ron Travis

presented by

Kicking Off the 130th Annual Conference

Congratulations to members, associate members, and partners as we celebrate our 130th anniversary as an association. Thank you to board members, former board members and leadership over the past 130 years who built this association, ensured that it navigated countless challenges, and strongly positioned our association for the future. As we kick-off the 130th Insurors of Tennessee Annual Conference, this year we should be proud of our heritage, who we are, and what we have accomplished for our membership and the insurance industry in our state. Never growing complacent, we will chart our course forward at the annual conference, learn from an exceptional slate of speakers, and enjoy the fellowship the event always provides. After all, it is the relationships we form and foster that is the sinew that keeps our association healthy and productive. We look forward to seeing you and celebrating our shared success during the conference in Knoxville.

Your association has been busy on many fronts in 2023 working to improve and enhance our association to ensure we are able to meet the needs of members and associate members of this organization. At a time when the insurance industry is rapidly evolving, we are always seeking to adapt to provide members and the industry at large with the support and action needed for continued success. Associations do not live to be 130 years old without having the ability to meet the moment.

We continue to work to advance our profession and industry at the state and national level during the year through

our advocacy work in Tennessee and in Washington. In fact, we just returned a few weeks ago from attending the 2023 Big “I” Fall Conference held in Grand Rapids, Michigan on September 6-10, 2023. The following members of the Insurors of Tennessee were also part of our contingent attending the event:

Jake Smith, Director of Operations

Teresa Durham, Insurance & Education Specialist

Kym Clevenger, Vice-President Region III & President Elect

John Brock, Young Agents President

Lou Moran, III, Past President, Past State National Director and Vice-Chair of the Big "I" Executive Committee

The conference was productive and impactful, providing us with the opportunity to learn about a range of topics on issues of importance to us all. We also had the opportunity to spend some time with Charles Symington our new Big “I” national President and Chief Executive Officer. While Charles has been a part of the Big “I” leadership team for many years, we wish him well as embarks upon his new role leading the association in Washington, D.C.

At the conference, the Insurors of Tennessee was recognized for its education efforts winning the Big “I” Excellence in Education Award for the fourth consecutive year. Teresa Durham leads the education efforts for our association. We are proud of her accomplishments in helping to grow and develop the education and professional development opportunities available to Tennessee independent insurance agents.

In a first for Tennessee, one of our own has ascended to the position of ViceChair of the Executive Committee of the Big “I” at the national level. Simply put, this is a big deal. Lou Moran, III will be the first member of this association elected to serve in this lofty position within the “Big I” national organization. He will be working with the Executive Committee and national leadership team to guide and lead the association in 2024. Lou has been serving the members of our association in many capacities over the years, giving his time and talent to the significant benefit of our industry. We are very pleased about Lou’s election to his new post and know he will be a strong contributor to the work of the Executive Committee next year and beyond.

I encourage you to read more about the “Big I” Fall conference in a separate and more detailed article written by Jake Smith in this issue of the Tennessee Insuror magazine. Jake provides more information about the Excellence in Education Award, Lou Moran, III’s appointment and the Young Agent’s Leadership component of the conference. Be sure to give it a read!

Finally, depending on when you read this article, if you have not already registered for our annual convention also known as InsurFest 2023 being held on October 21-24, 2023, please do so as soon as possible. Join us for a great conference and enjoy all Knoxville has to offer. We look forward to seeing you! u

Insuror

The Tennessee

Tennessee Young Agents '22

Young Agent Focus

presented by

Young Agents of Insurors Enjoy Annual Big “I” Young Agents Leadership Institute

By Jake Smith, Director of Operations and John Brock, YA President

The Independent Insurance Agents and Brokers of America –a.k.a. the Big “I”– held its annual Fall Leadership Conference in Grand Rapids, Michigan on September 6-10. Within the week-long national conference, the Big “I” segments a portion of the program specifically for Young Agents.

This year, Young Agent Director John Brock and Director of Operations Jake Smith journeyed north to connect and learn with fellow Young Agents from across the country. The Young Agents Leadership Institute spanned across three days and supplied engaging speakers and opportunities for attendees to take back to their home states.

Friday was the main day of content for the national conference, starting with a dynamic panel of agents that spoke about the challenges, opportunities, and successes of working in a world where many different generations are present. Today we see 5 generations that are actively contributing to the workforce in many industries but especially in the independent insurance industry: Traditionals, Baby Boomers, Generation X, Millennials, and now Generation Z. The panel of agents provided unique insights on the working dynamics of the various generations within their agency. Each generation holds its own general view towards company loyalty, problem solving, technology, and workplace culture. We learned several techniques and practices on how to navigate these nuances to succeed with your staff regardless of the generational differences.

Shortly following the panel, the keynote speaker for the Young Agents Leadership Institute was Robyn Benincasa delivering her presentation called Why Winners Win. Robyn has a unique backstory as a firefighter turned endurance athlete turned adventure racer. Many of the attendees had not ever heard of the sport called ‘adventure racing’ but Robyn was creatively able to share its origin and how her foray into this sport developed an expert understand of winning culture and success within a team environment. Adventure Racing is an outdoors endurance sport where teams are dropped off into the deep wilderness and given a set of supplies and a map to find their way to the finish line. Some races can take

up to over a week with teams setting their own strategies as they navigate terrain, weather, elevation, and wildlife!

The main message of Robyn was ultimately driven by her experiences working within a team to compete in the sport of adventure racing. Aside from the incredibly inspiring feats that she accomplished, one key takeaway from the presentation is that “success is the determined by your response to change and challenges.” Each of us face new challenges and changing situations on a regular basis. We must strive to find the best possible response within ourselves and our team in order to achieve success.

After learning some winning strategies from Robyn Benincasa, the Young Agents were treated to a networking lunch where we had more opportunities to connect with our counterparts from other states. Each state has its own Young Agents program with varying levels of engagement and participation. Getting to know each other was incredibly beneficial as we now have more contacts across the country to keep the conversation alive throughout the calendar year.

Shortly after our networking lunch, another guest speaker was on the docket for the Young Agents. Kelly Donahue-Piro from Agency Performance Partners delivered a presentation called ‘How to Become a Hard Market Hero.’ Kelly has consulted with over 1,000 agencies in the US and Canada and was able to provide extensive knowledge for agents about working with clients in the current hard market.

Concluding the on-stage content for the day was another insightful panel discussion from agency principals on the topic of ‘Tackling Hard Conversations.’ Each member of the panel was an agency owner who oversees their agency staff. As Young Agents aspire to become agency leaders, this discussion allowed for unique perspectives and stories of success and failure when it comes to the difficult conversations that must take place with staff. Ultimately, each member of the panel used personal experiences as well as helpful mentorship to craft their managerial acumen to lead their agency.

26 The Tennessee Insuror

Following the speakers and panels, another opportunity for the Young Agent attendees to connect was offered with a fun bingostyle icebreaker game that kept the session light and active. Shortly after more networking, the Big ‘I’ Young Agent Awards were presented to the state committees that are excelling with their respective Young Agent programs.

Saturday morning concluded the Young Agent Leadership Institute with a session where the Young Agent Award recipients took some time to share the variety of ways in which they were recognized for their award. Each state shared the challenges and successes of events, community service, membership development, and government affairs initiatives that have found footing within their states Young Agent community.

Not enough can be said about the depth of what was shared and learned from the Young Agent Leadership Institute. Next year the event will be held in Indianapolis and then in 2025 it will be hosted in our very own backyard in Nashville. We want to encourage all Tennessee Young Agents to get involved with our program by attending future Young Agents events in their area as well as attend our annual convention each year. These are great ways to get plugged-in to our association. We also encourage any interested Young Agents to reach out to our Young Agent Committee with any questions, comments, requests, or inquiries as to how we can best serve your needs in your career.

For more information about Young Agents, check out our website page www.insurors.org/young-agents/ where you can read about our committee, join our LinkedIn group, and subscribe to our Young Agents Email list. u

BSIG Makes It Easy With Choice Classes

Middle Market Risks

27 The Tennessee Insuror berkleysig.com Berkley Southeast Insurance Group is a member company of W. R. Berkley Corporation, whose insurance company subsidiaries are rated A+ (Superior) by A.M.Best. Products and services are provided by one or more insurance company subsidiaries of W. R. Berkley Corporation. Not all products and services are available in every jurisdiction, and the precise coverage afforded by any insurer is subject to the actual terms and conditions of the policies as issued. ©2019 Berkley Southeast Insurance Group. All rights reserved. Bill Vanderslice, Regional Vice-President 615-932-5508 | bvanderslice@berkleysig.com or your Middle Market Underwriter Your Back-in-Business Insurance Company® Follow us on Our Claim

• 24/7/365 loss reporting-including online • • Accelerated auto and property estimating and repair options • • “Fast Track” medical only claims handling program • • Tele-emergent medicine program-connects injured workers to medical care, not “triage” • Below is just a broad listing. If you don’t see what you’re looking for, please contact us. 0719-38 A M BEST Are you making the Right Choice for their Business?

Commitment

* All classes may not be available in all states.

Middle Market Choice Classes*

For

• General Contractors • Building Trade Contractors • Utility Contractors • Land Improvement Contractors • Pavement Maintenance-Non DOT • Services Contractors • Building Cleaning & Maintenance Contractors • Construction Material Suppliers • Manufacturing • Wholesale and Distributing

to know more? YA REGISTER

Want

28 certified iamonD 2023 certified Bronze 2023 certified GoLD 2023 certified SiLver 2023 certified PL aTinUm 2023 Thank you for your supporT of Tennessee IndependenT agenTs ACCIDENT FUND INSURANCE COMPANY OF AMERICA • AMTRUST • ASSOCIATED THE CASON GROUP • CELINA INSURANCE GROUP • CINCINNATI INSURANCE • GOVERNMENTAL RISK INSURANCE PLANS • METHOD INSURANCE • NATIONAL SAFEWAY INSURANCE COMPANY • SOUTHERN INSURANCE UNDERWRITERS • UTICA PARTNERS F O R T E NN E S S E E The Tennessee Insuror

ASSOCIATED INSURANCE ADMINISTRATORS, INC • BERKSHIRE HATHAWAY GUARD INS. • BURNS & WILCOX CORNERSTONE NATIONAL INSURANCE • EMC INSURANCE • FRANKENMUTH INSURANCE • J.M. WILSON NATIONAL GENERAL, AN ALLSTATE COMPANY • PIE INSURANCE • PREVISOR INSURANCE • RT SPECIALTY UTICA NATIONAL • WESTFIELD 29 FLOOD INSURANCE The Tennessee Insuror

30 The Tennessee Insuror EMC provides personalized, local service that supports long-lasting partnerships, helping us better understand your business and offer the right insurance options to keep your manufacturing operation running smoothly. And with the knowledge and expertise to protect countless types of manufacturers, you can Count on EMC ® to have you covered. Check us out: emcins.com/manufacturing-insurance ©Copyright Employers Mutual Casualty Company 2023. All rights reserved. EMC Insurance Companies | Des Moines, IA | 800-447-2295 Protection Made for Manufacturers

Government & Legal Update

Advocacy Update: Carrier Receivership Impacts Tennessee; Big I Opposes NAIC Model Act

United Home Receivership

The receivership of United Home Insurance Company in Arkansas has sent ripples across state lines, impacting not only Arkansas policyholders but also Tennessee insurance agents and policyholders who may have been affiliated with the company. This situation raises various concerns and considerations for insurance professionals and customers in both states.

Background on the Receivership: United Home Insurance Company, an Arkansas-based insurer, found itself facing financial instability, prompting the Arkansas Insurance Department to initiate receivership proceedings and the court to name Arkansas Commissioner Alan McClain as receiver. The company’s Risk Based Capital is at the Mandatory Control Level. The Department will NOT allow the company to write any new business, including for example, adding or replacing a vehicle, thereby adding additional exposure to an impaired company.

Implications for Tennessee Insurance Agents: Based in Paragould, Arkansas, United Home experienced a decline in its financial condition due to substantial weatherrelated losses, the Arkansas Department of Insurance said in a statement. The company currently writes business in Arkansas, Kentucky, Missouri, Oklahoma, and Tennessee.

Insurance agents in Tennessee who previously sold policies for United Home Insurance Company must be prepared to address inquiries and concerns from policyholders regarding the status of their policies and claims. Agents may need to assist clients in navigating the process of transferring policies to alternative carriers, as all policies will be canceled on 12/31/2023 if not replaced sooner.

Implications for Tennessee Policyholders: Tennessee policyholders who held insurance policies with United Home Insurance Company will need to be informed about the developments in the receivership process, as there may be uncertainties regarding the timing and extent of claim payments. Policyholders should reach out to the receiver's office or the Tennessee Department of Commerce and Insurance for guidance on filing claims and understanding the status of their policies. It's crucial for policyholders to explore their options, which may ultimately include seeking coverage through Tennessee's guaranty association.

The situation underscores the importance of financial stability and regulatory oversight in the insurance industry

and serves as a reminder of the need for insurance agents and policyholders to be proactive and well-informed in such challenging circumstances.

Any questions regarding United Home Insurance may also be directed to the following:

-Contact the Deputy Receiver at 501-371-2776 or michael. surguine@arkansas.gov

-Contact United Home Insurance Company at 800-467-0723

-Contact the Arkansas Insurance Department at 800-2829134 or 501-371-2600

-As always, feel free to reach out to us at Insurors of Tennessee.

Privacy Protections Model Law Faces Industry Opposition

The Big I has expressed strong concerns and opposition to the National Association of Insurance Commissioners’ (NAIC) proposed Insurance Consumer Privacy Protections Model Law (Version 1.2). The letter, addressed to Chair Katie Johnson of the Privacy Protections Working Group at the NAIC, highlights a series of concerns regarding the latest draft of the proposed privacy law. The current draft would significantly restrict how and when data may be used and retained by licensees, impose unrealistic marketing restrictions, force small licensees to unreasonably police third-party service providers, and create other burdensome and unprecedented requirements, the letter read.

Furthermore, the letter suggests that the new proposal would dramatically reshape privacy laws, targeting the insurance industry in a way that creates mandates more onerous and restrictive than those applicable to other industries. The IIABA argues that such a proposal could have unwarranted negative effects on the industry, hinder its ability to serve consumers, and particularly burden small licensees and independent agents.

Legislative Conflicts and Constitutional Implications

The letter highlights that the proposed draft conflicts with comprehensive privacy measures already enacted by thirteen states, representing over 41% of the country's population. This legislative activity, suggesting the proposal may be out of touch with the current perspective of many state policy makers.

Finally, the Big I raises constitutional concerns, particularly regarding First Amendment protections. Recent Supreme Court decisions have expanded the protection of commercial speech, which could affect the proposed restrictions on the

31

Government & Legal Update

use and sharing of information. The IIABA suggests that these restrictions may need to withstand a higher level of scrutiny and could potentially be found unconstitutional.

The Way Forward

Ultimately, the Big I calls for a reconsideration of the proposed legislation, urging regulators to focus on addressing marketplace problems and regulatory gaps instead of completely overhauling the existing privacy framework. They propose exploring alternative approaches and identifying reasonable objectives that align with the industry's needs and concerns.

General Assembly Special Session Concludes

The special legislative session in Tennessee, convened on August 21st in the aftermath of a tragic school shooting at the Covenant School, concluded on a contentious note with limited action on gun-related reforms. Despite the heightened emotions and calls for substantial changes to the state's gun laws, the Republican supermajority in the General Assembly showed reluctance to enact gun reform measures. Despite the session's challenges and divisiveness, Governor

Bill Lee expressed hope and encouraged progress, though he did not specify his plans for future gun reform proposals. The session highlighted the difficult conversations that lie ahead in Tennessee, as stakeholders seek solutions to address gun violence while navigating a politically polarized environment. Insurors was on-hand to monitor the legislative activity. Ultimately, no bills impacting the insurance industry were seriously considered.

The General Assembly will reconvene for Regular Session at noon on Tuesday, January 9, 2024.

About the Author—Trey Moore is the government and legal consultant for Insurors. He operates Trey Moore Consulting in Nashville and formerly served as senior public policy counsel for one of Nashville’s largest law firms. Trey has over a decade of experience in representing clients before the Tennessee General Assembly and state government. u

& Personal Lines

32 The Tennessee Insuror Insurance solutions for homeowners and small, medium, and large businesses. Competitive pricing, multi-product discounts, and easy submission process!

APPLY TO BE AN AGENT: WWW.GUARD.COM/APPLY/ Not all Berkshire Hathaway GUARD Insurance Companies provide the products described herein nor are they available in all states. Visit www.guard.com/states/ to see our current product suite and operating area.

Commercial

33 The Tennessee Insuror But do they come with all the extras? Aggregation? Check. National carrier contracts? Check. Basic networks can do a lot for an agency. Keystone does all that and more. We’re sure other networks are great. ©2023 Keystone Insurers Group ®. All rights reserved. This does not constitute an offer to sell a franchise in any state in which the Keystone Insurers Group franchise is not registered. https://lp.keystoneinsgrp.com/sa-learn-more Learn more about how Keystone can sweeten your agency offerings

WORK

Anderson, Bedford, Bledsoe, Blount, Bradley, Campbell, Cannon, Carter, Chester, Claiborne, Clay, Cocke, Coffee, Crockett, Cumberland, Davidson, Decatur, Dekalb, Dickson, Fayette, Fentress, Franklin, Giles, Grainger, Greene, Grundy, Hamblen, Hamilton, Hancock, Hardeman, Hardin, Hawkins, Haywood, Henderson, Hickman, Jackson, Jefferson, Johnson, Knox, Lauderdale, Lawrence, Lewis, Lincoln, Loudon, Macon, Marion, Marshall, Maury, McMinn, McNairy, Meigs, Monroe, Moore, Morgan, Overton, Perry, Pickett, Polk, Putnam, Rhea, Roane, Rutherford, Scott, Sequatchie, Sevier, Shelby, Smith, Sullivan, Tipton, Trousdale, Unicoi, Union, Van Buren, Warren, Washington, Wayne, White, Williamson, and Wilson

MEAA EXPERTS

FOR

LET THE

IS PROUDLY A MASTER AGENCY OF

year 1.

YOUR AGENCY

MEAA

Independent doesn’t have to mean alone. Join our network and unlock professional consultation for every aspect of your business and see growth from

MEAA SERVES THE FOLLOWING TN COUNTIES. VISIT OUR WEBSITE FOR A FULL TERRITORY LIST. MOUNTAIN EMPIRE AGENCY ALLIANCE meaa4u.com/insurors 423-560-6077

Association Update

Rains/Sunbetl Now SBK Insurance

Rains Insurance Agency of Cookeville and Sunbelt Insurance were recently renamed and rebranded to SBK Insurance. In fact, the former Rains Insurance Agency just had a ribbon cutting in Cookeville officially recognizing the new name. The former Rains Agency and Sunbelt Insurance will continue to be a subsidiary of SmartBank, bringing the agency greater strength, better market reach, and more carrier expansion opportunities for the overall organization. The senior management team of SBK Insurance includes: (pictured left to right above)

Mark Slater, CEO

Jessica Parrott, President

Carolyn Kell, Regional President–Chattanooga

Ed Lambert, TRS, Transportation Sales Manager

The leadership team that has been an integral part of the growth and success of the organization remains the same and they have the same great team of insurance professionals to deliver the same excellent service to clients across the organization. The new name of the organization better reflects the organization going into the future.

The rebranding initiative includes a new logo, website, and marketing collateral that feature the SBK Insurance name and brand identity. The company’s email addresses and contact information will also be updated to reflect the new name.

“Our rebranding is more than just a new name,” said Jessica Parrott, SBK Insurance President. “While our name may have changed, our commitment to clients remains the same and we will continue to provide them with excellent service and unwavering dedication. We are proud of our legacy, but we’re even more excited about our future as SBK Insurance and the opportunities it brings for our team and our clients.” SBK Insurance looks forward to serving clients across its service across the region.

35

2023 JM Wilson Tennessee Insuror OUTLINES.indd 4 1/11/23 6:42 PM

FSB Insurance Acquires Claiborne & Taylor Insurance

FSB Insurance in Jackson, TN recently announced its acquisition of the Claiborne & Taylor Insurance agency in Murfreesboro, Tennessee. The agency nicely complements FSB’s Middle Tennessee footprint relative to the company’s strategy of intelligent strategic growth. Perhaps more importantly, the staff at Claiborne & Taylor Insurance share FSB’s values and commitment to provide clients with smart insurance and risk management solutions supported by exceptional service. FSB now has four West Tennessee locations and two in Middle Tennessee. FSB is part of Sunstar Insurance Group based in Memphis, Tennessee further extending the capabilities of our organization.

Oakbridge Acquires Cole Agency in Georgia

Oakbridge Insurance Agency LLC said Thursday it has acquired Cole Agency Inc. Montezuma, Georgia-based Cole specializes in poultry insurance and the agribusiness sector, from site prep and construction to equipment, vehicle and general liability, an Oakbridge statement said. Cole, which

lists 13 employees on its website, will maintain its office in Montezuma, the statement said.

BTJ Insurance Agency Makes Acquisitions

BTJ Insurance Agency, headquartered in Nashville, TN, and with five other locations across the state, is excited to announce the acquisition of two agencies: MJC Insurance Group and Chandler Insurance Agency. BTJ Insurance Agency has been an affiliate of nationwide insurance broker, Leavitt Group, since 2021. These acquisitions will offer current and future clients additional resources and benefits that were previously unavailable.

Chandler Insurance Agency was most recently under the leadership of Parks Chandler. Pete Chandler, Parks’ father, started Chandler Insurance Agency in 1970; since then, the agency has worked to provide clients with high-quality service and insurance. “We’ve been looking for the right fit to help us move to a more modern approach without losing the personal hometown touch that our clients have grown so accustomed to over the years,” said Parks Chandler. “We’re excited to provide new and competitive options in this fastchanging world.” u

36 The Tennessee Insuror Association Update continued SERVING INDEPENDENT AGENTS & THEIR CLIENTS SINCE 1989 Bailey Special Ri S k S , i nc. We specialize so you don’t have to. 1.800.768.7475 • www.bsrins.com • questions@bsrins.com Professional Liability • Management Liability • Data Privacy & Security Liability

we give you peace of mind, which gives us peace of mind. simple human sense

We are dedicated to the independent agency system and proudly stand behind the agents who represent us. auto-owners.com

37 The Tennessee Insuror

®

Continued from page 18–

Meet Maddox Insurance Agency – Huntingdon, McKenzie, Camden

One of the key strengths of the agency is their experienced and knowledgeable staff who work to help clients navigate the complex world of insurance every day. To further extend their product offering, capabilities and market reach, the agency is a member of the Keystone network of agencies. The agency is strongly positioned to serve the insurance and risk management needs of the region and beyond going forward.

Andrew and his wife Meagen were married in 2009 shortly after he graduated from college. Meagen graduated from U.T. Martin with a Bachelor of Science degree and continued on to earn her Master of Science Degree in Physician Assistant Studies from Bethel University. She fulfilled her goal of becoming a board certified and licensed Physician’s Assistant. She practiced at the Evans Clinic taking care of patients and then took a break after the birth of their third child. Earlier this year Meagen started a new practice in Huntingdon called Beauty Sense Med Spa. She and Andrew are excited about this new opportunity to serve the needs of people across West Tennessee.

Andrew also serves the community as a town council member and is now in his second term. As a council member he serves his constituents by listening to their needs and issues to develop prudent solutions to meet the needs of those constituents. He also offers input and guidance on town business, governance, planning and oversight of the departments involved in running the town. Andrew enjoys serving his community as council member, helping to shape the future of the town where he was born and raised.

Andrew and Meagen have three wonderful children including two sons, Bryce age 11, Grey age 9, and daughter Elyza age 4. The children keep them busy with school events and sports activities including baseball and football. Andrew and the family are avid fans of the Tennessee Volunteers and the Tennessee Titans. In fact, they have season tickets to the Tennessee Titans and enjoy making the short drive to Nashville for home games. Andrew is also a duck hunter and a collector of sports cards continuing a family tradition started by his father. Andrew, Meagen and the children are active members of Huntingdon Church of Christ and find joy in being part of the church community. u

38 The Tennessee Insuror

Homeowner’s insurance they can trust from a company you can trust. NEW PROGRAM! ABOUT US For over 75 years, National Security has been dedicated to providing competitive and affordable insurance solutions. We take pride in supporting our agents by offering competitive commissions, delivering excellent customer service, and providing access to experienced company adjusters. As a regional company based in the Southeast, we prioritize fast and efficient service. Through our user-friendly online platform, agents can easily obtain fast quotes, issue policies online, print declarations pages, and access real-time policy information. At National Security, our commitment to serving both policyholders and agents remains unwavering, making us a trusted partner in the insurance industry for generations. Visit nationalsecuritygroup.com or call 1-800-798-2294 for more information. ELBA, ALABAMA $350,000 Maximum Policy Limits 20% New & 15% Renewal Commission AAIS HO3 & HO2 Policies Available Direct Contract with National Security Partnership Profit Sharing Easy Payment Options Welcome & Claim Free Discounts

INDEPENDENT DOESN’T HAVE TO MEAN ALONE

We are proud to introduce to you, MEAA – your region’s Master Agency with SIAA Mountain Empire Agency Alliance is a division of SIAA (Strategic Independent Agents Alliance) which has been around since 1982 Our network of 7,000 agencies currently writes over 10.8 Billion dollars in premium. MEAA is always looking for talented agency owners who want to dramatically increase their revenue and gain additional markets and stability, all while remaining independent.

Through direct carrier appointments with very small volume requirements, MEAA can increase your revenue with considerable excess commission and profit-sharing You retain 100% ownership of your business and commissions! Whether you own your agency or are looking to open your own soon, MEAA is the best choice to fast-track your success.

39 TERRITORY MANAGER Robert Wells 423-765-9916 rwells@meaa4u.com

MOUNTAIN EMPIRE AGENCY ALLIANCE IS AVAILABLE IN 118 COUNTIES THROUGHOUT THE STATES OF NORTH CAROLINA, TENNESSEE, AND VIRGINIA. COMPANY ACCESS | INCREASED REVENUE | MENTORING | COACHING | STABILITY MEAA4U.COM The Tennessee Insuror

Company Briefs

Harford Mutual Insurance Group Announces Merger Agreement

Harford Mutual Insurance Group (“Harford Mutual”), a Ward’s 50® top performing commercial property and casualty insurance company headquartered in Maryland, today announced that it has received final approval from the Maryland Insurance Administration of the Merger Agreement with ClearPath Mutual Insurance Company (“ClearPath Mutual”), a monoline workers’ compensation carrier headquartered in Louisville, Kentucky. Under the terms of the Merger Agreement, ClearPath Mutual merged into Harford Mutual Insurance Group and converted to a stock insurer. Post-merger it will be renamed Clearpath Insurance Company marketed as “Clearpath Specialty”. All policyholders of ClearPath Mutual will obtain membership rights in Harford Mutual as policyholders of the newly formed Clearpath Specialty. The merger is effective August 4, 2023.

“This is an exciting step forward in Harford Mutual’s nearly 181-year-old history,” said Steve Linkous, President & CEO of Harford Mutual. “There is a natural synergy between Harford Mutual and Clearpath. Both companies share similar values and missions, and this merger helps both companies achieve their strategic goals of continued state expansion and accelerated growth.”

Linkous added, “We are thrilled to welcome the Clearpath team, agency partners, and policyholders to Harford Mutual and to partner with a successful carrier to broaden our workers’ compensation line and deliver our shared vision of being a regional carrier of choice.”

ClearPath Mutual, formerly KESA of Kentucky for over 40 years, was formed in 2018 and currently provides monoline workers’ compensation coverage in Indiana, Kentucky, Georgia, Tennessee, and West Virginia. ClearPath Mutual writes over $52 million in direct written premium across nearly 7,000 policies.

As part of the Merger Agreement, which was approved by the boards of directors and policyholders of both companies, ClearPath Mutual’s current home office in Louisville will remain in place and serve as Harford Mutual’s Midwest Office. Harford Mutual will retain all ClearPath Mutual employees and plans to merge efficiencies. The newly formed Clearpath Specialty has re-domesticated to Maryland.

Under the terms of the agreement, ClearPath Mutual’s current President & CEO, Jeff Borkowski, will become a vice president of Harford Mutual and remain President of Clearpath Specialty with Steve Linkous becoming CEO. ClearPath Mu-

tual’s Board of Directors will remain intact for two years, with Linkous joining the board as a director. ClearPath Mutual board chair, Sean Garber, will remain on Clearpath Specialty’s board as chair and will join Harford Mutual’s Board of Directors.

“We look forward to joining the talented Harford Mutual team,” said Borkowski. “This merger was a strategic decision for ClearPath Mutual. It unites two purpose-led organizations and allows us to leverage Harford Mutual’s expertise, systems, and successful track record in the multi-line carrier field. We recognized that together we could provide the enhanced service and opportunities to our policyholders, agency partners, employees, and community partners and support ClearPath’s continued growth.”

Penn National Partners with Sapiens to Optimize Reinsurance Process

Sapiens International Corporation, a leading global provider of software solutions for the insurance industry, announced today that Penn National Insurance, a super-regional P&C mutual insurance company, has selected Sapiens ReinsurancePro solution as a part of its multiyear legacy modernization and automation initiative. Penn National Insurance will also use Sapiens cloud services for a seamless and secure hosting experience.

Penn National Insurance needed a next-generation solution to improve efficiencies in several divisions, most notably its reinsurance administration, and respond more quickly to reinsurance opportunities. Their decision to choose Sapiens' cloud reinsurance system was prompted by its outstanding functionality, 24/7 platform access, and Sapiens' cloud services. ReinsurancePro also enables Penn National Insurance to automate reinsurance contract requirements from an infrastructure and planned cost perspective. Penn National Insurance is an existing Sapiens customer and uses the StatementPro annual statement filing solution. Their ReinsurancePro implementation is expected to be completed by January 2024.

"Implementing Sapiens ReinsurancePro will help us modernize our reinsurance processes and better manage the increasing volume and complexity of future transactions," said Jacquelyn Anderson, Penn National Insurance Senior Vice President, CFO and Treasurer. "The solution will also help us respond quickly to new reinsurance structures within a competitive cost structure."

"A simplified and streamlined reinsurance administration platform will help strengthen Penn National Insurance's long-term financial performance," said Jamie Yoder, Sapiens North America President and General Manager. "Sapiens looks

40 The Tennessee Insuror

Reach new heights.

You have invested time and energy into your firm, and you’re still passionate about the insurance business, your clients and your employees. If you’re interested in taking your business to the next level, while enjoying the fruits of your labor, let’s explore a possible partnership.

Why insurance firms choose to partner with Higginbotham:

• Ten-year average return of 30% IRR

• Ten-year average annual shareholder distribution of 25%

• Insurance Business America, 2022 Top Insurance Employer

• Privately-held and run by insurance professionals

• Majority ownership held by employee shareholders

• Leverage Higginbotham’s consistent 20% compound annual growth rate

• Broad risk management and benefit plan services add client value to support your growth

• Maintain your leadership role

• $5 million donated to nonprofits through the Higginbotham Community Fund

Are you ready to soar?

Contact David Fishel | (817) 349-2260 | dfishel@higginbotham.com higginbotham.com

Our Tennessee-based Partners

See what our agency partners are saying

Company Briefs continued

forward to providing Penn National Insurance with the tools to build on their recent industry gains and pursue their goals."

Created and designed exclusively for the reinsurance market by some of the industry's leading experts, Sapiens ReinsurancePro manages the entire range of reinsurance contracts and activities for all lines of business. Built-in automation of contracts, calculations, and processes provides flexible and full financial control of reinsurance processes, including auditing requirements and statutory compliance. More than 100 insurers worldwide use Sapiens' reinsurance solutions.

Acuity Insurance Honors Truck Drivers

Acuity Insurance honored truck drivers during National Truck Driver Appreciation Week with a special message of thanks. Employees who have a truck driver in their lives wrote letters of appreciation, then surprised the truck driver with a meeting that was captured in video.

National Truck Driver Appreciation Week, celebrated this year from September 10-16, is an annual, nationwide celebration recognizing and honoring the vital contributions of truck drivers to everyone’s daily lives and the economy. Acuity also commemorated the week with special contributions to the St. Christopher Truckers Relief Fund and the Women in Trucking (WIT) Foundation.

“Thank you, Acuity Insurance, for once again recognizing and supporting our hard-working highway heroes during Truck Driver Appreciation with a donation to the St. Christopher Truckers Relief Fund. Your continued generosity and support of drivers through SCF provides help and hope when drivers need it most. We are proud to partner with such an amazing company,” said Shannon Currier, Director of Philanthropy.

“The WIT Foundation is powered by donors like Acuity who help us fund scholarships that change lives. The scholarship program breaks down barriers, facilitates opportunities for women in the male-dominated trucking industry, and allows women to overcome financial barriers to access education and training programs, empowering them to pursue successful careers in trucking,” said Christina McCoy, WIT Foundation Executive Director.

Forbes Ranks BlueCross as Top Tennessee Employer

BlueCross BlueShield of Tennessee has once again been named the No. 1 employer in Tennessee by Forbes in their 2023 list of America’s Best-in-State Employers.

“We’re honored to be named Tennessee’s number one employer for the second straight year and to have our efforts recognized nationally,” said Roy Vaughn, SVP and chief human resources officer. “Every employee at BlueCross contributes to our mission and success – and to creating our strong culture. We’re a great place to work because we have incredible people.”

The Best Employers by State survey considered several dimensions of an employee’s experience including potential for growth, diversity, openness to remote work and salary. Of the thousands of companies eligible for this recognition, only a select few are awarded in each state.

The list is divided into 51 rankings, one for each of the 50 states, plus the District of Columbia. It was compiled by surveying 70,000 U.S. employees across 25 industry sectors working for businesses with at least 500 employees.

The final list ranked the 1,392 employers that received the most recommendations.

BlueCross has earned recognition on several fronts in 2023, including placements on Forbes’ Best Employers for Women, Best Employers for Diversity, and Best Large Employers lists. The company has also been recognized as one of Disability:IN’s Best Places to Work for Disability Inclusion.

ICW Group Named to Ward’s 50 Top Performing Property & Casualty Insurance Companies for 2023

Company Earns Ninth Consecutive Recognition for Superior Results in Safety, Consistency and Financial Performance

ICW Group Insurance Companies, a leading group of property and casualty carriers, has been named a Ward’s 50 top performing P&C company for 2023. This marks the ninth consecutive year and 17th time overall the multi-line insurance company has received this prestigious award. Nearly 2,900 property-casualty insurance companies domiciled in the United States are analyzed each year to identify the industry’s top performers.

Only companies that can pass financial stability requirements and demonstrate the ability to grow while maintaining strong capital positions and underwriting results achieve this recognition. ICW Group has continued to deliver superior results compared to the overall industry in safety, consistency, and financial performance over the last five years.

42 The Tennessee Insuror

43 Things go sideways. KNOW YOU’RE COVERED.

things at work are unexpected. No matter what happens, LUBA is here to help get things back to

Find out more at www.LUBAwc.com/sideways 888-884-5822 | Rated A- Excellent by

Sometimes

normal.

WILL THEIR HOMEOWNERS INSURANCE PROVIDE COVERAGE WHEN…

• Business equipment is stolen out of their vehicle? . . . . . . . . . . . NO!

• They accidentally knock over the display next to them at an exhibition or show? NO!

• Groceries spill onto inventory in the trunk of their car? . . . . . . . . . . . . NO!

• A power surge damages their computer and fax machine? NO!

• Someone steals their cash box? NO!