THE URUS PERFORMANTE

Our world is still reeling from the aftermath of the COVID-19 pandemic, the war in the Ukraine and the generalised instability. All this makes Environmental, Social and Governance (ESG) issues a key focus for policymakers, boards and executives.

In today’s business world, companies must focus on more than just profit, and keep in mind the way that they impact society and the environment. Our main article provides an analysis of how ESG practices can be implemented and the difficulties in providing a unified strategy across the board.

Eric Pedersen, Head of Nordea Asset Management’s Responsible Investments Team explains what responsible investors can do to spotlight – and try to stop – activities contributing to climate change.

As investors turn to developing countries to find opportunities, we focus on Fope Oluleye as the founder and CEO of the Zenith Guild Group, and their work in expansion in Africa.

In this uncertain world, you can turn to whiskey, not as comfort, but as a surprisingly safe investment which will stand the test of time. We meet Jay Bradley, CEO of The Craft Irish Whiskey Co who talks about how to empower your portfolio.

In this issue of International Investor you will read all about how companies are taking ESG responsibility to thrive in uncertain times.

Happy reading!

The global challenges that humanity has faced in the last couple of years due to the COVID-19 pandemic, the war in the Ukraine and the generalised instability, have made Environmental, Social and Governance (ESG) issues a key focus for policymakers, boards and executives.

Environment, social and governance (ESG) reporting has become crucial for most companies, as investors, employees and other stakeholders expect them to report on their impact on the wider world.

Environmental, social, and governance (ESG) products are tools to show how companies are reaching targets and objectives on their actions to transition to lower carbon emissions and integrate with target climate frameworks.

In today’s business world, companies must focus on more than just profit, and keep in mind the way that they impact society and the environment, and also revise their own corporate governance policies and practices.

ESG investing is a way to generate sustainable long term financial returns by incorporating environmental, social and governance (ESG) factors into asset allocation and risk decisions. It can potentially bring about financial returns by aligning with societal values, sustainability and climate objectives.

Although ESG principles are key to the ethical functioning of a business, many stakeholders, both private and public, have faced difficulties when it came to deciding on how to set standards, build frameworks and run initiatives to promote ESG.

If there is no consensus on international operation standards regarding ESG, many organisations can feel lost at sea and will struggle to put the well-meaning practices in place.

Due to the lack of standardization in ESG reporting, it is hard to show whether corporations are truly increasing their efforts at the rate which they should in order to achieve the goals in the determined timeframes.

One way that organisations can follow unified standards is by subscribing to the UN’s 2030 Agenda for Sustainable Development, which sets shared standards to promote peace and prosperity for people and the planet, in the present and the future. This agenda includes 17 Sustainable Development Goals (SDGs) which can lead to improving health and education, reducing inequality, and prompting economic growth as well as flighting climate change.

For the private sector to drive progress towards achieving the UN Sustainable Development Goals, a common system of measurement is essential.

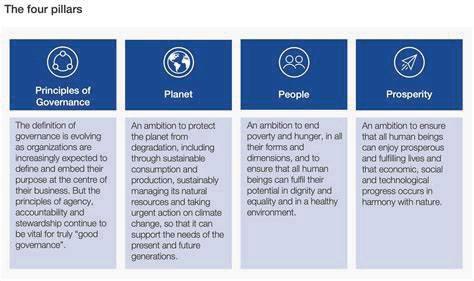

The world Economic Forum, alongside other partners such as Deloitte, EY, kpmG and pwC, has also identified a set of universal metrics and disclosures – the Stakeholder

Capitalism Metrics, which help organisations to meet ESG standards.

These metrics focus on existing standards and create data points that can be used across organisations, irrespective of the industry or region they operate in. These are nonfinancial disclosures that hinge on four points: people, planet, prosperity and principles of governance and they also measure emissions, equal pay and diversity.

International partnerships and initiatives are also considered important forums for facilitating sustainable investment. Some firms which have taken on the Stakeholder Capitalism Metrics are Accenture, Bank of America, Cargolux, Dp world, Eni, Fidelity International, Fubon Financial holding, hSBC holdings, IBm, mastercard, Nestlé, PayPal, Royal DSM, Salesforce, Schneider Electric, Siemens, Total, UBS, Unilever, Yara International and Zurich Insurance Group, as well as others.

Reports from companies that have signed up to the

Capitalism Metrics show how these are improving companies’ sustainability.

In the coming year, getting ESG issues right will be crucial if companies want to survive and thrive. As specialist risk consultancy, Control Risks (www.ControlRisks.com), predicts in its RiskMap forecast, disrupted energy systems, fractious geopolitics, economic strife and armed conflict will be some of the main risks to business in 2023.

Control Risks CEO, Nick Allan said: “The increasingly apparent effects of a changing climate will add additional stresses and strains.” He added “resilience, insight, and courage will be the watchwords for business in the year ahead.”

It is critical to have sustainable investment promotion strategies that lead to economic development by enhancing productive capacities, which will in turn add value locally and establish links with domestic firms. Investments should be equitable, resilient, and inclusive.

If global volatility and fluctuating markets are causing you sleepless nights, now’s the time to join those turning to alternative investments. But not the wine, art and classic cars of days gone by. To diversify their portfolio and hedge against volatility, savvy investors are looking to the potential of a particularly appetising alternative asset class; whiskey.

with rare whiskey topping the knight Frank luxury Investment Index for growth over the past decade, the demand for finely aged bottles is clear. But investing in rare bottles requires patience and if you want to get into this booming market it pays to get in early. So why not buy the spirit as it enters the cask, then sit back and wait for it to mature, and watch your investment mature with it.

With Scotch whisky leading the way as the world’s number one internationally traded spirit, demand for the liquid gold is at a high. And with sales of Irish whiskey in the US predicted to overtake Scotch by 2030 for the first time since before Prohibition in the 1920s, the spirit shows no signs of slowing down. Throw in the growing interest from emerging markets such as Asia and the future certainly looks bright for those sitting on a cask or two of well-crafted Scotch or Irish whiskey.

Canny investors have spotted the potential in a spirit that matures in both flavour and value in the barrel but owning these barrels was previously reserved for industry insiders. Whiskey & Wealth Club has opened up the world of cask whiskey ownership to private investors and has been at the forefront of this exciting opportunity since 2018.

The company offers clients the chance to capitalise on the growth in whiskey by purchasing and storing casks of premium whiskey from handpicked Scottish, Irish and American distilleries. A team of whiskey fanatics, there’s little this company can’t tell you about whiskey, with and without an ‘e’. With over 400 5* reviews on Trustpilot, Whiskey & Wealth Club’s clients clearly value this knowledge and the service they receive. Consider the average returns of 13.09% per annum¹ – with Scotch whisky, for example, consistently outperforming the FTSE-100 (2.86% on average over 20 years, as per This Is money²) and 5.4% london property rental returns in 2022³ – it’s easy to see how the company has grown its client base to over 2,500 people in just four years.

Investing in cask whiskey is a straightforward process, thanks to the expertise of Whiskey & Wealth Club’s team. From the first phone call to the final exit, they’re by your side. Clients are invited into the office for whiskey tastings or on distillery tours in Scotland and Ireland where you can see the process for yourself and, more importantly, sample the final product! Unlike many investments, this is one you can see, touch, and taste.

The company sources liquid produced by award-winning distilleries with established names such as Bladnoch, Bunnahabhain and Tullibardine. With casks of whiskey from premium brands, clients can enjoy far greater growth potential than with unbranded distilleries so it pays to work with a team who know their whiskey, and have the industry relationships to secure those soughtafter casks.

Once you’ve chosen your casks, they’re safely stored in bonded warehouses with storage and insurance included in the purchase price for five to ten years. As well as being one of the first companies to offer cask whiskey ownership to investors, Whiskey & Wealth Club was one of the first to register with wOwGr - ensuring compliance with HMRC for the company and clients from over 85 jurisdictions globally. So you can be confident your investment is safely stored, and in safe hands.

When the time comes to devise an exit strategy, you’ll be able to take advantage of a number of opportunities, with Whiskey & Wealth Club on hand to assist should you need help. From bottling the contents of your cask under

a private marque to selling it back to the original distillery, you’ll be able to explore a range of options and choose the one that best fits your financial goals.

As part of the Craft Distilling Group, Whiskey & Wealth Club shares its award-winning pedigree with The Craft Irish whiskey Co. From The Devil’s keep - recently judged the world’s Best Irish Single Malt at the World Whiskies Awards - to The Emerald Isle - a record-breaking collection of rare whiskey and the world’s first Fabergé Celtic Eggthe company is leading the way in crafting premium Irish whiskey.

Whiskey & Wealth Club and The Craft Irish Whiskey Co. have revolutionised the whiskey market, in both casked whiskey and rare bottles. A cask of whiskey created by The Craft Irish Whiskey Co. and donated by Whiskey & Wealth Club was recently auctioned for £20,000, an incredible validation of the value placed on award-winning premium casked whiskey.

Investors certainly approve of Whiskey & Wealth Club’s groundbreaking investment model. Despite only launching in 2018, the company has enjoyed exceptional growth and recently announced a Q2/Q3 turnover figure of just shy of £15,000,000, a huge 148% increase on the £6,000,000 turnover in 2019, its first full year of trading. From winning Golds for ‘Best new Business’ and ‘Insurance/Banking and Financial Services’ at the Uk Business Awards 2020 to winning SME of the Year at the Business Champion Awards 2022, Whiskey & Wealth Club has gone from strength-to-strength.

And the company isn’t resting on its laurels. with an office recently opened in Sydney, Australia and another due to open in the US in 2023, Whiskey and Wealth Club is now bringing the benefits of cask whiskey ownership to investors across the globe. It’s building new relationships with international distillers, all with the intention of expanding its offering of whiskeys to include more styles and opportunities. For investors, this means more choice, and more potential growth.

while the uncertainty in traditional financial markets may have some investors on the rocks, Whiskey & Wealth Club and its clients have discovered the enjoyment and gains to be found in an asset that matures in both taste and value in the cask.

1. https://www.independent.co.uk/news/business/business-reporter/ whisky-casks-good-investment-b1904545.html

2. https://www.thisismoney.co.uk/money/diyinvesting/ article-8101459/The-FTSE-100-15-20-years-invest-long-term.html

3. https://www.propertyreporter.co.uk/landlords/rental-yieldsreamin-steady-but-landlords-facing-a-balancing-act-amid-widereconomic-challenges.html

Speedy essentials about Whiskey & Wealth Club’s straightforward investing process…

1. Whiskey as an asset increases in value bringing average returns of 13.09% every year.

2. To start investing in whiskey barrel proprietorship from carefully-selected distilleries, contact Whiskey & Wealth Club on +44 203 129 1639 or at invest@ whiskeywealthclub.com to arrange an inperson whiskey tasting. Similarly, book your place on one of its upcoming distillery tours.

3. Select which casks you wish to purchase. Your exclusive barrels are subsequently stored and indemnified in bonded hmrC-compliant warehouses for up to a decade, or longer if required.

4. Finally, sell your asset to reap the rewards of your investment, with exit strategies including the distillery or brand the casks were produced by purchasing them back.

Thrilled clients explain their motives for investing with Whiskey & Wealth Club…

“I’m completely delighted to be investing. After meeting everyone in person, you just feel a part of what’s going on here.”

- Robert Pepper, business owner.

“One of the main reasons I invested is because the people behind it definitely know their business.”

- Denis lynch, retired.

“The distillery I visited is absolutely beautiful. And whiskey is a better investment than property, art and wine.

Whiskey & Wealth Club are also very nice people to deal with.”

- Antonella Barbati, business owner.

Zenith Guild Group is not just an organization. It is a group of highly successful companies dedicated to making groundbreaking advancements in their respective fields. Our focus is to invest and revolutionize major industries such as venture capital, real estate, and renewable energy. Ever since its foundation in 2011, Zenith Guild Group has expanded rapidly across various countries around the world, including Europe, America, and Nigeria.

Zenith Guild Group has invested in some of the most defining companies that play a leading role in their fields. This has been made possible because of the hard work of our team and our pursuit of dynamism, ambition, and innovation at every step of our journey. Zenith Guild Group consists of over 20 employees located in three different countries, fully dedicated to pursuing excellence and expanding our global footprint. The efforts of Zenith Guild Group have been recognized and internationally awarded, symbolizing our unparalleled focus on achieving success.

The rich history of the Zenith Guild Group is what has come to define its values. Our core values are innovation, ambition, and dynamism. These core values have driven each one of our companies towards reaching the zenith in their respective fields. Thanks to this, our companies are generating millions of pounds of revenue today.

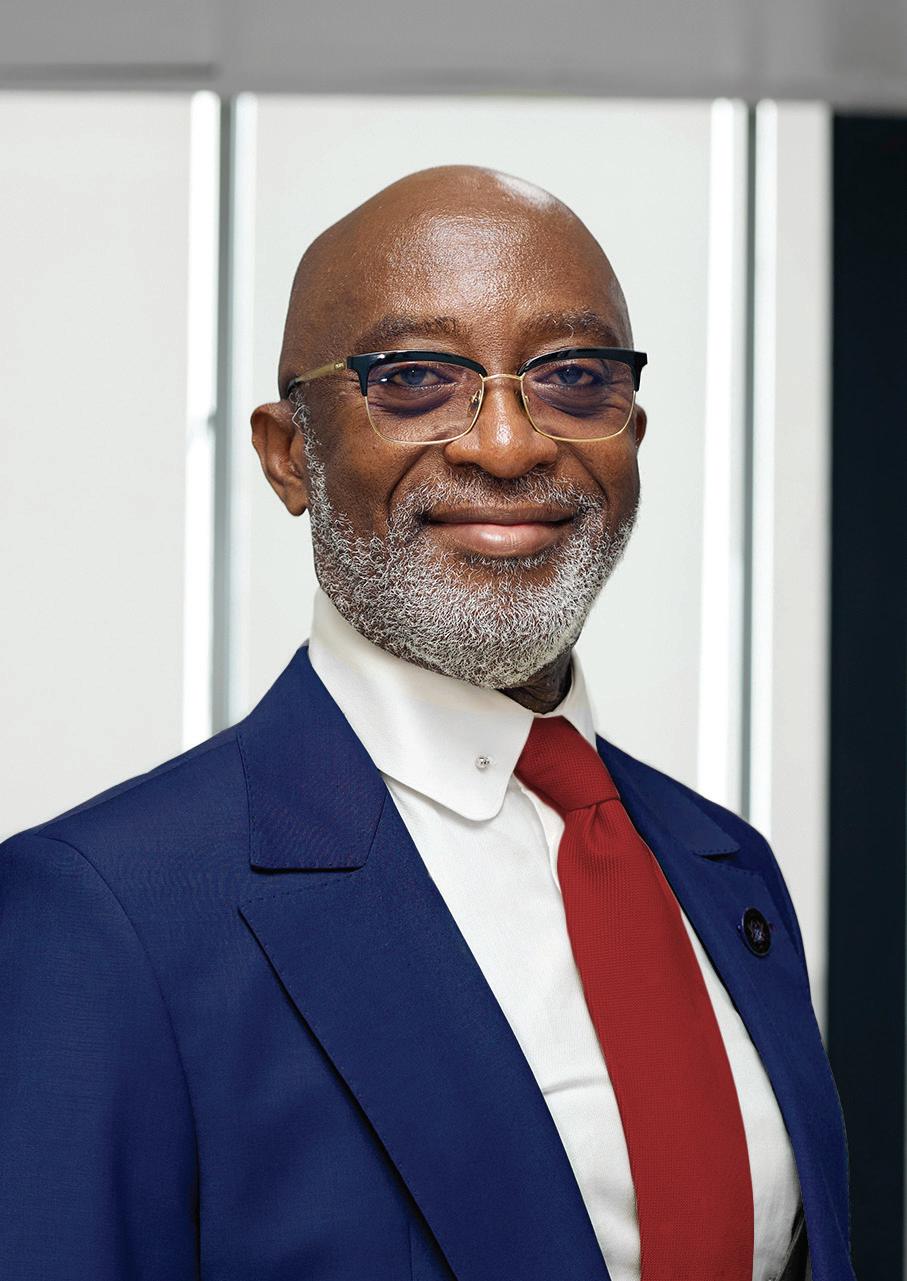

The Zenith Guild Group was founded in 2011 in the United kingdom. This was also the same year the Guild Property Investors real estate subsidiary was established. Fope Oluleye is the founder and CEO of the Zenith Guild Group. his background in real estate and finance allowed him to utilize his exceptional insight and become a seasoned entrepreneur.

He has studied in one of the most prestigious business schools in the Uk. This helped him stand out in the competitive environment of the entrepreneurship business, enabling him to create and grow many successful businesses, with Zenith Guild Group being one. His keen ability to spot opportunities has played a vital role in expanding the portfolio of the Zenith Guild Group.

In 2015, the Zenith guild Group started its expansion into the African markets by founding Zenith Guild Enterprises nigeria ltd. The focus of this new enterprise is making profitable investments, real estate development, and renewable energy. With this milestone achieved, the Zenith Guild Group began its international expansion. 2015 was also the year the Brightstar Solar Global Renewable Energy subsidiary branch was created with the prime aim of leading the renewable energy industry and building renewable energy projects in Nigeria and sub-saharan Africa.

The Venture Capital Company arm of the Zenith Guild Group was established in 2017. With its establishment, Zenith Guild Group was able to start actively investing in companies and promote the growth of various startups. The Zenith Guild Group also founded its American branch in 2017, named Zenith Group America Inc. With the establishment of this branch in the USA, Zenith Guild Group officially started to operate in three different countries. The Zenith Group Americas Inc was established mainly focused to focus on venture capital and real estate investment in that region.

In 2018, after signing the MOU with the Nigerian government, a 30MW solar project was established. Commencement of the construction of the project should start early 2023 with the view to supply directly to the grid and surrounding region. The rationale is to boost socio-economic activities in the region and enhance its electrification capacity massively. The Brightstar Solar

Global project has helped attract investors to the region, promoting commercial activities and prosperity.

PRINCIPAL INVESTMENT IN PASH GLOBAL

Zenith Guild Group made a principal investments in PASH global in June 2021. This investment was to bolster renewable projects portfolio of Zenith Global Groups. The vision of the investment was to further bolster group expertise and promote utility, industrial and commercial distributable renewable energy around the globe, including in African, European, and Asian regions.

AWARDS WON BY ZENITH GUILD GROUP

The efforts of the Zenith Guild Group have been recognized worldwide. Therefore we are the proud recipient of multiple prestigious awards from reputed organizations.

Zenith Guild Group is the proud owner of the “Best EarlyStage renewable Energy VC Firm 2019” award. This award has been bestowed by The International wealth & Finance Awards, one of the leading international fund managers publications in the world.

The ACQ Global Awards recognized the CEO of the Zenith Guild Group, Fope Oluleye, as the “Gamechanger Of The Year” in 2019, acknowledging his keen insights and leadership skills.

Fope Oluleye has also been awarded the “Venture Capital CEO of the Year 2019” award by the International Investors Award. He then won the same award again in 2020. Also international investor of the Year in 2021, 2022.

Corporate livewire recognized the pioneering approach of its VC arm to venture capitalism by awarding it the “Most Innovative VC Firm 2020” award.

The aggressive investment strategy of Zenith Guild Group has been acknowledged by the prestigious The European. Therefore The European awarded Zenith Guild Group with the “European ESG private Equity Firm of the Year 2021.”

The T Bridge venture partner is a subsidiary of the Zenith Guild Group, founded in 2017. It mainly focuses on venture capital seed to series B and private equity into funds. This allows those firms to attain greater success thanks to the encouraging and fostering environment provided by T Bridge. T Bridge provides further resources and support for new startups so they can achieve maximum growth through capital raising and bringing strategic value to portfolio companies.

T Bridge Venture Partners has been the principal investor in highly successful companies from sectors such as:

TMT

• Proptech

• Agritech

FinTech

• Retail

• Consumer

At T Bridge Venture Partners, we have not limited ourselves to just one country. Instead, we have invested in companies in Asia, Europe, the Uk, Africa, and the Americas. There are three things we look for in a startup before investing.

The first is potential. By ensuring that the company tackles a key problem in the industry, we ensure that it has growth potential. By investing in such a promising company, we can guarantee success.

The second factor we look for in a company is competence. We ensure that the founding team has all the knowledge and information it requires to achieve its vision realistically. This includes the knowledge of the market they are trying to get into. They should also understand the full extent of the problem they are trying to solve with their product.

The last factor we look for in a startup is a sense of clear identity. For a company to be successful, it should have a clear understanding of how it can impact the sector it is trying to revolutionize. All of these factors combined help

us determine if it is beneficial to invest in a startup, we are interested in.

Zenith Guild Group has invested in several companies with the view to help with their growth strategically and backing ambitious and dedicated founders.

Elexys is an Australian-based company founded in 2012 dedicated to paving the way for renewable energy systems adoption worldwide. They have made great advancements in developing cutting-edge technology that allows for electricity to be fed back into distribution grids. This is all done without requiring billion-dollar infrastructure changes to the grids.

Elxsys has made it much easier for businesses to export back their distributed energy resources reliably. These contributions are the reason why Elxsys has been the winner of the Renewable Energy Category in the Davos Energy Week Start-up Pitch Competition 2021.

It has also been given the Most Innovative Proptech Award by the Proptech Association of Australia. Additionally, Elexsys recently unveiled one of the largest battery and EV charging installations. This is a huge step towards making renewable energy more accessible.

Ziglu is a Uk-based crypto asset firm that allows its customers to earn and invest in various cryptocurrencies quickly and easily. It also provides cash account and debit card services to its customers. Ziglu even allows for currency exchanges, making it ideal for travel enthusiasts. Additionally, it is FCA authorized with high-end security features in place.

In April 2022, Ziglu announced it set to be acquired by the cryptocurrency market giant Robinhood. Robinhood intends to utilize the amazing talent at Ziglu to help them expand into international markets. This has made cryptocurrency much more accessible to customers across Europe.

launch Africa is one of the most renowned VC funds in the Pan-African region. It invests in promising startups in various sectors. Additionally, the large advisory network of launch Africa allows startups to benefit from corporate distribution channels across Africa.

launch Africa has invested in startups in green tech, education, financial services, and telecom industries. To date they have invested $28m into 121 companies across 20 countries in the African continent.

launch Africa Fund II is looking to raise $100 million in funds allowing it to focus more on becoming a larger more pre-eminent pan-African fund for early-stage startups in both B2C and B2B arenas. This will help launch Africa to bring new revolutionary startups to the spotlight.

Velocity Black, founded in 2014, offers an artificial intelligence powered lifestyle assistant with the supervision of human experts to help people bring out the full potential of their lives. With their team located all around the world, Velocity Black can put the needs of their customer first using a human touch in their services.

Velocity is one of the world’s fastest growing companies - the 3rd fastest headquartered in the Uk according to Forbes and was named in Deloitte’s Fast 50 2020 list of the Uk’s fastest growing tech companies based on revenue growth over the last 4 years.

Today, Velocity black has the backing of venture capital of $28 million, showing the trust investors have in their success. with also B2B clients in the hospitality, fintech, private banking, automotive space they are steadily adding new dimensions to the business. Additionally, their charitable support for Action Against Hunger has helped save lives and provide access to clean water to communities around the world.

PASH Global is an investor and developer company dedicated to providing clean power projects around the globe. It achieves this by utilizing the latest technologies and innovations to improve clean energy production in every possible way. PASH Global works diligently towards making clean energy production more efficient and effective, helping protect the environment while also keeping energy costs low.

PASH Global has made major strides in developing wind power, hydropower, solar power, biomass power, natural gas, and solar hybrid energy production systems. They have also worked towards improving energy storage practices in the industry.

In the second half of 2022, PASH global aims to expand its pipelines to Africa, Asia, Europe, and lATAm. For this purpose, they are raising $250 million. Additionally, PASH Global is extending invitations to family offices in these regions to participate in projects focused on solar power and wind power generation.

Our extensive experience in the real estate industry has allowed us to find and invest in promising real estate

opportunities.

Zenith Guild Group is working diligently on development projects in Nigeria. We are also seeking promising opportunities for the development of large commercial and residential schemes in lagos, nigeria. This is made possible thanks to the formation of new and productive partnerships with established groups in the region. These projects are bound to boost the local economy and create new jobs.

THE UNITED KINGDOM AND THE UNITED STATES

Zenith Guild Group helped originate and assembled a land deal in 2018, which has been acquired by Cole Waterhouse. This land will be used to create Upper Trinity Street, consisting of a new public park, 943 new homes, a 133-bedroom hotel, and 60,000 square feet of commercial space. Despite Covid-19 and legal hurdles, we were able to finalise and complete the deal. Finally, the planning and sale of this project has been completed in October 2022.

The development of this project is expected to create 600 jobs in just the construction phase, boosting the local economy. Over 300 jobs are expected to be created once the construction phase is over as well. This mix-use scheme is ideal for transforming the Digbeth area and harboring a wonderful community.

Zenith Guild Group also owns multiple properties in both the Uk, USA and nigeria. we are exploring opportunities for financing and building projects in key cities such as london, Boston, lA, new York, and miami with the US division of the company.

Zenith Guild Group has always been a strong promoter of the use of renewable energy. Zenith Guild Group has invested heavily into both renewable energy companies, projects and companies. This is why we have shown our support through practice as well as words by investing in projects such as Brightstar Solar Global and PASH Global.

We also have ownership stakes across various renewable energy projects across the world through. We are targeting utility scale, commercial and industrial, distributed renewable energy projects across lATAm, EMEA, Asia and African regions. We will be looking to partner also with family offices, funds and JV partners to reach these objectives. Our aim is to increase our renewable energy portfolio to 1GW within the next year.

Jeremy lau is the managing partner and director here at Zenith Guild Group. he is a UAl london graduate, with his main interest being graphics and spatial communication.

This degree has helped him hone his real estate expertise. Additionally, he has extensive experience in the real estate sector, focusing on regional Uk-based cities and london.

These qualities of Jermey lau have proven to be instrumental in the development of the real estate side of Zenith Guild Group. Jeremy lau has great analytical skills, which, combined with his great attention to detail, have allowed him to spot opportunities and get the most out of them. Although he places a great amount of focus on the real estate sector, Jermy lau works and contributes to all the sectors Zenith Guild Group operates in, including renewable energy and venture capital.

he is also an investor and principal at honour Group ltd, mainly investing in startups and real estate. Honour Group and Zenith Guild Group where they look at projects, deals and investments together. Jeremy lau has concluded real estate deals of over £300 million GDV.

The Group CEO of Zenith Guild Group, Fope Oluleye, recently attended the African Wealth Summit conducted

on 25-28th May 2022 in Morocco. He spoke about many important topics, such as venture capital, renewable energy, and real estate.

He also went into the details of the activities of Zenith Guild Group to raise awareness about new business ventures. He emphasized the various interests of the Zenith Guild Group and expressed its desire to bring value to the African continent by seeking new partnerships and contributing to its growth and help to be bridge to other locations worldwide.

We at Zenith Guild have always believed in our core values which are the constant pursuit of innovation, ambition, and dynamism. We intend to uphold these values in the future as they have brought us great success in the past. Our premise is to be a game-changer remains unchanged as we continue to invest and develop dynamic and highly successful companies. Our aim is to continue committing to achieving this goal by giving our all in the pursuit of success.

We provide post- esta blishme nt suppor t to resolve i nvestor challe nges through re lationshi p bui ldi ng and advisor y se r vices .

and i mple me nt an at trac tive i nvestme nt framework to e nable both local and fore ign i nvestor s transac t busi ness seamlessly i n Ghana .

Ghana as an attractive and rewarding investment destination to the domestic and global business community

for an e nabli ng i nvestme nt e nvi ronme nt , which champions the i nte rests of both local and fore ign i nvestor s , while fac tori ng thei r conce rns i nto policy maki ng , for a bet te r regulator y and busi ness cli mate .

reginald Yofi Grant, CEO of GIpC, draws from over three decades of a successful career and experience in investment banking and finance as he heads the Ghana Investment Promotion Agency, under the Office of the president of Ghana.

More than 500 delegates, from all over the world, participated in the 8th International Funds Summit in Nicosia

Andreas Yiasemides: The Investment Funds sector in Cyprus is resistant to difficulties

The spotlight of the Investment Funds sector was in Cyprus on 7 and 8 of November 2022. More than 500 delegates, from more than 30 countries, participated in the works of the 8th International Funds Summit, which was held for another year, and with great success, in Nicosia.

The Summit under the title, “Insights for 2023 and beyond”, was coorganized by the Cyprus Investment Funds Association (CIFA) and Invest Cyprus and gathered leaders from the field of Investment Funds internationally, executives of organizations providing related services, supervisory authorities, and European institutions.

The International Funds Summit has been established and is considered one of the most important conferences in the sector, where the latest developments and trends are presented and analysed by leading speakers. The mass participation in this year’s conference demonstrated once again the recognition that Cyprus now enjoys as an established destination for investment funds and managers.

It is recalled that Cyprus recently received the positive vote of the members of the International Investment Funds Association (IIFA), and in 2023 it will host the 36th annual international conference of the Organization.

The agenda of the International Funds Summit featured important issues, with the leader’s Stage standing out—the summit section where worldclass speakers and distinguished professionals shared their insights on the latest international trends shaping the industry. The discussion on the future of asset management also was of particular interest, as experts suggested ways to capitalize on trends in revenue streams, as well as ways to protect investments.

The Minister of Finance, Constantinos Petrides, addressed the conference, and among other things, he shared that “the Funds industry is essential in the provision of alternative tools for the financing of longterm projects, businesses, and start-ups and the local economy of each EU member state. With investor protection being one of the Government’s key objectives, the legal framework for the funds industry has been carefully developed in the last decade. Having said that, as the market develops and matures, the ministry of Finance is open to adjustments and additions according to best practice, in collaboration with the Cyprus Securities and Exchange Commission and the industry, that would serve the needs of both the fund managers and investors alike”.

In his greeting speech, the Chairman of the Cyprus Securities and Exchange Commission (CySec), Dr George Theocharides, emphasized that “over the last nine years, following the modernization of our legal framework,

we have contributed towards the development of an established collective investment funds industry--one that has experienced a threefold increase since 2016, with assets under management currently standing at €10,6billion. Around, €2,6 billion or 24% are invested in Cyprus. The 71,8% of the investments in Cyprus are in Private Equity, while the 11,7% are in Real Estate”.

The Chairman of the Board of Directors of Invest Cyprus, Evgenios Evgeniou, pointed out that “we are now able to record the tangible contribution of the Investment Funds sector to the economy, which also reinforces the effort to diversify the economic model of the country. Cyprus is an established regional center for financial services, and as such is uniquely positioned to serve the needs of the investment funds industry. At Invest Cyprus, we aim to improve the investor experience and to reduce pain points, whilst at the same time intensifying our efforts to attract new businesses and investments that create

new, highly skilled jobs and add sustainable value to our economy.”

The President of CIFA, Andreas Yiasemides, noted that “despite the difficulties, the Investment Funds sector in Cyprus has proven its resilience, both during the period of the COVID-19 pandemic, as well as recently with the effects of the war on Ukraine, the energy crisis, and the inflationary pressures. Cyprus is steadily gaining momentum in the international capital and asset management industry.”

prominent figures such as Thomas Tilley, Senior Economist of the European Fund and Asset management Association (EFAmA), Stéphane Janin, Co-Chair of Asset Management and Investors Council, International Capital Market Association (ICMA) and Dr Nicolaos Mastrogiannopoulos, Chief Scientist of Research & Innovation and Chairman of the Board of Directors of

research and Innovation Foundation Cyprus (rIF), were hosted on the stage of the conference. In addition, presentations were made by executives from leading international organizations such as UBS, Morgan Stanley, northern Trust, rSm, kroll Advisory, Jp morgan, mercer, and Generali.

The conference was held under the auspices of the President of the Republic of Cyprus and CySec.

The world’s wealthy have a reputation for adding to their fortunes during crisis, as evidenced by huge jumps in the net worth of the likes of Jeff Bezos and Elon Musk through the 2020-21 COVID-19 pandemic. Now, with the world economy headed for a likely recession in 2023, high net worth individuals (HNWI) are aiming to continue growing and protecting their wealth.

“The 2022 trends of HNWIs diversifying their asset portfolios by buying property offshore and snapping up luxury brands are likely to continue,” says Tarina Vlok, MD of Elite Risk Acceptances, a subsidiary of Old Mutual Insure.

Just this week rolls-royce announced the price tag of its first electric vehicle, the Spectre at $413,000 or R7.5-million. It is the most expensive EV coupé on the market, yet there have already been more than 300 US buyers putting down deposits. Similarly, the latest results from luxury brands louis Vuitton and Ferrari show an explosion in sales.

“However, against this climate, there are several trends playing out that make insurance complex. It is worthwhile for the affluent to account for this in their wealth plans and protecting their assets in 2023.”

According to the Africa Wealth Report 2022, published by Henley Global, private wealth held on the continent will rise by 38% over the next decade, with many families investing in offshore real estate to diversify their asset portfolios. Second homes are seen as a great hedge against inflationary pressures. The report also says that the affluent are buying residency by investment, which has become an optimal way for families to protect their futures, rather than to move away from their country of residence due to political or socio-economic challenges.

Against this background, she encourages HNWIs to look for local insurance brokers that have knowledge of the country in which their assets are located due to the vagaries of the insurance laws in different jurisdictions. Similarly, she says if the children of the HNWI individual are studying abroad, it is also important to insure the assets in that country.

“Remember that you cannot add foreign assets to your South African insurance policy,” says Vlok, highlighting the misconception that a locally issued all-risks policy

covers the assets used by the insured’s children while they study abroad. “All-risks cover is designed to protect personal items when insureds leave the country temporarily, for a business trip or holiday,” she says.

Another trend is that of semi-gration, where many HNWIs are moving to coastal towns, such as the Whale and West Coasts and the Garden Route.

“There is often a big premium to pay on properties in these areas, so it is best to insure homes at replacement rather than market value. If you are moving to a remote area, remember to choose an insurer who has suppliers that has the capacity to repair or replace assets in remote areas,” says Vlok.

HNWIs must also appreciate the potential limitations following loss or damage to expensive – and often rare –items.

“It may seem simple to insure your ZAR1 million watch or ZAR4 million exotic vehicle, but it can be almost impossible to replace some of these items like-for-like, especially given the current world economy’s supply chain shortages and disruptions,” says Vlok, adding that HNWIs often prefer replacement over cash settlement in these instances, but this is not always possible.

“Consider choosing a specialist insurer who are aware of the complexities around the replacement or repair of luxury items in today’s climate.”

Events that are shaping the South African economy in 2023, that also highlight the complex and evolving nature of insurance, are loadshedding and consequent power surge damages; households investing cash to go off grid; and climate risk and weather-related losses.

“Each of these trends requires tweaks to the HNWI’s shortterm insurance policy,” says Vlok.

As an example, she says changing weather patterns are translating into an increase in frequency and severity of weather-related claims. Cars and homes are most at risk to flood and storm, so hnwIs must ensure they have location-appropriate cover for these assets and consult with their insurers about any risk mitigation measures that may be required. Similarly, she suggests HNWIs use appropriate service providers with the right certifications and qualifications if installing back-up power supplies to hedge against loadshedding.

“This is why it is very important to work with specialist insurers in today’s climate. To remain adequately insured, talk to your broker about higher excesses or reducing certain covers,” she concludes.

Elite Property Insurance - your property equals your success. Protect it, and you will ensure a secure and prosperous tomorrow.

Elite Bespoke Motor Insurance - impeccable performance, absolute reliability and the ultimate in convenience.

In a strong move towards sustainability in the maritime and car industries, the Bmw Group is working with Danish company plASTIX to produce trim parts from recycled fish nets and ropes.

This sustainable recycling technique will be used in both non-visible and visible areas of the exterior and interior of the nEUE klASSE models from 2025.

The new models will have a 25 percent lower carbon footprint than previous models produced with conventional plastic.

BMW Group plans to increase the proportion of secondary materials in the thermoplastics used in new vehicles from currently around 20 percent to an average of 40 percent by 2030.

This new technique aims to conserve resources, as well as reduce the carbon footprint and avoid ocean pollution.

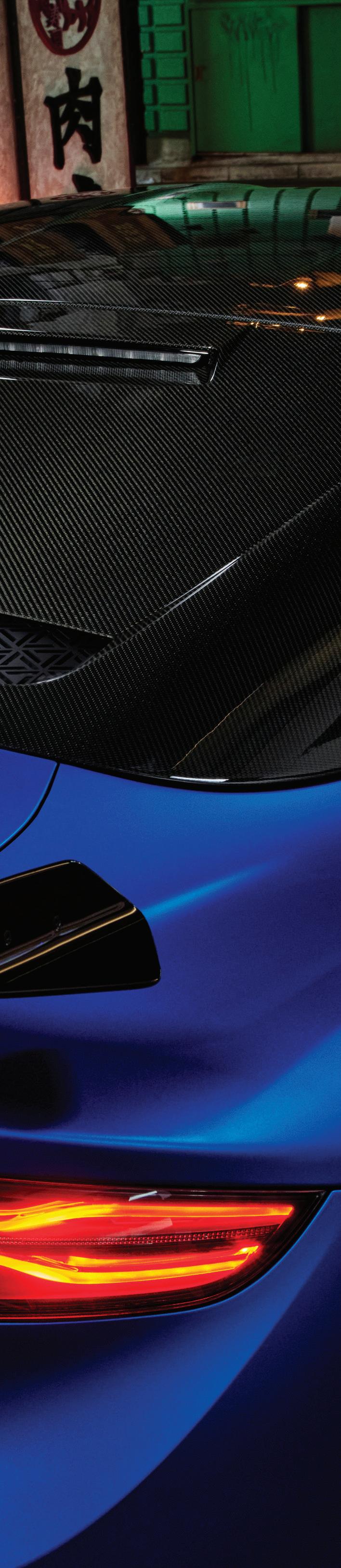

The latest addition to Alpine’s range – the A110 R is in a category all of its own, thanks largely to the broad use of carbon fiber, a new race-tuned chassis, and countless improvements to key elements effecting performance and handling.

It’s the first Alpine to clock in under 4 seconds for the 0-100 km/h standing start, delivering 0 – 100 km/h in 3.9 seconds, with the 1000m standing start in 21.9 seconds. And while it’s quite possible to find supercars that are able to do better, the Alpine’s lightweight body and razor-sharp cornering result in exhilarating driving pleasure. There is nothing quite like it.

On the circuit or on the road, the newly released fourth member of the Alpine A110 team – the A110 R – has raised the bar when it comes to agility.

The engineers’ specifications were clear: “Do whatever it takes to make this car radically fast. lighten it up. Tighten it up. make it so exciting that the driver will never let go.”

Thanks to the broad use of carbon fiber parts, the radical redesigning of key elements, and the deletion of certain parts, the A110 R is in an entirely new category. The Alpine engineering team worked exclusively to develop aerodynamics – with new front blade, side skirts, rear swanneck wing, rear diffuser, lateral flaps, C-pillar air deflectors, and carbon wheels. The rear wing position and inclination was found and tuned with the support of our BwT Alpine F1 Team engineers by using their numeric modelization tools. Compared to the A110 S, a model already renowned for driving pleasure and performance, track ride height has been reduced by 10mm, drag by 2%, and brake cooling improved by 20%. High-performance tunable suspension and new anti-roll bar result in vastly improved handling.

Making the car this much lighter, while adding key performance parts, was quite a challenge – for the engineers, this was part of the game. Carbon fiber has been made omnipresent, resulting in a radically lighter A110 R. It weighs just 1082kg – down 34kg on the “already very light” A110 S. And it’s this lightness that makes all the difference.

Today’s road cars are imminently safer, more comfortable, and more reliable than their counterparts of yesteryear. However, the spirit of the original model was taken into account when designing the modern day A110.

The key elements taken into account were the design, the ground contact, and the light weight of the car. The lightness was translated by the choice of making a vehicle with both chassis and body in aluminum, with front end and wishbone also in aluminum.

“We tried to keep that in the equation, and each time we worked on the steering, the braking, and the ‘feeling’ of the car, we kept in mind that it should be a car that evoked passion, and that was pleasurable.”

lightness is an essential factor in the car’s success. Alpine’s head of design, Antony Villain, says the idea to make the lighter, faster, and nimbler A110 R wasn’t recent: “We already had this version of the car in mind when we first worked on the A110 in 2013. And now, when the decision was made to say ‘yeah, we’ll do it.

This “art of lightness” also carries-over to Alpine’s development of future electric models - due for release in the coming years. It will be a key factor in their energy efficiency, but perhaps more importantly, in their sporty handling and performance. It’s simply part of the brand’s DNA.

Find out more about Alpine: www.alpinecars.com

The challenges of fighting poverty, climate change and nature loss are inextricably linked and, in order to make a lasting, positive impact on any of them, they need to be tackled together through a holistic and integrated approach to ESG. That is why at Barrick we call it sustainability, says Mark Bristow, president and chief executive of Barrick Gold Corporation (nYSE:GOlD) (TSX:ABX).

With a sizeable portion of Barrick’s 18-country portfolio of gold and copper mines and projects located in the poorer regions of the world, Bristow says the greatest benefit a mining company could bestow on a host nation and its communities is to effect positive and sustainable socioeconomic change through job creation, infrastructure development, education and skills transfer, economic opportunity generation and quality of life improvements.

“The E in ESG has received much of the attention lately but I would argue that its social dimension is as, if not more, important and needs to be developed through holistic and integrated sustainability management. In its current form, ESG is skewed towards environmental concerns at the expense of social factors. The upliftment and development of societies and countries that have been left behind by the developed world is a major challenge that needs urgent attention. Resilience to climate change is not only a requirement for businesses, but is also a necessity for communities and host countries. I am particularly concerned that the issue of poverty –perhaps the greatest problem facing mankind – is not more prominently on the agenda. Poverty is particularly a big issue in Africa, which hosts two of our Tier One* mines and many of our prospects. Africa holds 17% of the world’s population but, due to its developmental neglect, accounts for only 3% to 4% of global carbon emissions. Eradicating poverty will require a global, not just a local response,” Bristow says.

Bristow says a good business also has to be a good citizen, particularly in emerging countries where mining companies have a moral obligation as well as a commercial motivation to help develop economies and uplift people. “If the gold mining industry is to survive in the changing world, it must recognize and acknowledge its duty to all stakeholders, and make sure that they

benefit fairly from the value it creates,” he says.

Barrick’s philosophy of partnership with its stakeholders is embedded throughout the business and its effectiveness was a key factor in Barrick’s successful Covid-19 containment programs, which buffered the impact of the pandemic on its business and people, and also enabled it to provide much-needed support to its host countries. The partnership strategy is also credited with resolving long-standing legacy issues, notably the resurrection of the North Mara and Bulyanhulu mines through a formal partnership with the Tanzanian government.

“This is not to say we underestimate the gravity of the environmental challenge. Barrick has a clear climate resilience and action strategy, including a roadmap for the reduction of greenhouse gas emissions, that is based on climate science and is demonstratable, and this is constantly reviewed in the light of technological advances. Identification and realization of the opportunities these offer enabled us to demonstrate a 2030 emissions reduction target roadmap of 30%, against a 2018 baseline, while maintaining a steady ounce profile. Our ultimate aim is to achieve net zero emissions by 2050,” he says.

Barrick’s roadmap includes energy efficiency measures across the group and ambitious plans to add a worldclass copper component to its Tier One gold portfolio. It delivers more solar power in Mali and Nevada and the conversion of a power station in Nevada from coal to natural gas. Adding to this are the achievements to date with new battery technology installed to augment its hydropower stations in the Democratic Republic of Congo, and the conversion of its power station in the Dominican Republic from heavy fuel oil to cleaner energy sources.

As Barrick implements its climate resilience strategy in tandem with socio-economic development, it also introduced a new biodiversity standard in 2022 that aligns with its sustainability approach. The biodiversity standard sets out the principles for operations to partner with conservation areas and focus on key biodiversity features and measurable conservation actions.

* A Tier One Gold Asset is an asset with a reserve potential to deliver a minimum 10-year life, annual production of at least 500,000 ounces of gold and total cash costs per ounce over the mine life that are in the lower half of the industry cost curve.

From board diversity to biodiversity, climate risk to community relations, Barrick’s commitment to managing sustainability effectively and responsibly has long been entrenched in its DNA and Barrick approaches it with the same diligence it applies to understanding its orebodies and accounts. www.barrick.com | NYSE : GOLD

Barrick Gold Corporation’s 18-country portfolio holds 14 gold mines, including six of the world’s Tier One operations as well as three strategic copper producers, all with long-term business plans based on declared resources.

leading fund managers looking to establish funds focused on climate solutions are increasingly looking to quantify positive climate impact by calculating avoided emissions.

Avoided emissions, also referred to as ‘Scope 4’ emissions, can be defined as reductions that occur outside of a product’s life cycle or value chain, but as a result of the use of that product.

The metric serves a number of purposes for investors, namely:

• Pre-investment: to compare the impact of various potential investments to allow allocation of capital to the most impactful in terms of quantity of avoided emissions per unit of investment over a particular timespan (also known as the ‘Carbon Yield’); and,

• Post-investment: to monitor and communicate quantitative climate impact to investors

Unlike scope 1-3 corporate and financed emissions reporting[1] which follow clear standards under the greenhouse gas (GHG) protocol and the Partnership for Carbon Accounting Financials (pCAF), there is no officially recognised agreed standards for the measurement and reporting of avoided emissions.

This is a clear problem for the metric, as the lack of a prescriptive methodology means that there is scope for ‘cherry picking’ of best-case outcomes and inevitably concerns around use of the metric for greenwashing.

However, there are a number of globally recognised credible frameworks available that provide guidance on how to address this, for example the Comparative Emissions Working Paper from the World Resources Institute, and the Avoided Emissions Framework from mission Innovation, both of which are included as an acceptable framework in CDP reporting.

THERE ARE TWO METHODOLOGICAL APPROACHES TO CALCULATING AVOIDED EMISSIONS – ATTRIBUTIONAL AND CONSEQUENTIAL:

• Consequential approach - assesses the system-wide change in emissions from a specific decision

• Attributional approach - looks at the absolute emissions and removals of a product when compared to a reference product

The consequential approach is more holistic and looks at both secondary impacts and unintended consequences, and whilst this is the preferred theoretical approach, in practice due to information or time constraints the attributional approach is typically used.

An often-cited example is the avoided emissions associated with plant-based protein - the replacement of animal protein with plant-based protein results in reduced meat production. As meat production is associated with high emissions from agriculture and land-use, there is anticipated reduced emissions from this switch.

Taking an attributional approach, we can compare the lifecycle emissions of a functional unit, e.g. 1kg of plantprotein versus 1kg of animal protein (the ‘comparative impact’). The total annual avoided emissions will be equivalent to the anticipated sales in kg of the plantprotein multiplied by the comparative impact for each kg.

However, whilst this seems simple enough, the devil is in the details, or rather in the assumptions

• How is the reference product chosen? Is this a kilo of beef? Or a weighted basket of ‘meat products’ (e.g. beef, lamb, pork, chicken etc.)

• Is it a 1 for 1 replacement of meat for plant-protein? Is the nutritional value the same? What if consumers were previously buying vegetables or pulses?

• What is the system boundary and time-period assessed?

What data sources are we using for the lifecycle analysis? Is this country-specific?

• Is there any attribution across the value chain needed?

• Are we using sales forecasts? What is the associated uncertainty level?

TO ADDRESS THIS, COMMON ACROSS THE FRAMEWORKS ARE SOME FUNDAMENTAL KEY PRINCIPLES, WHICH WE CAN GROUP INTO:

• Robustness – how well would the model stand up to scrutiny? Are you adopting the ‘precautionary principle’ by taking conservative assumptions? Are you consistent in your application of assumptions? If there is uncertainty are you using sensitivity analysis?

Transparency – could a third party recalculate the outcome or have the calculations been assured or verified by a third party?

Balance – are you also considering and disclosing the scope 1-3 emissions footprint of the portfolio and have you set decarbonisation targets?

Amy Cai, PwC China ESG Managing Partner, says: “Our expectation is that as fund managers start to develop their climate solutions focused funds we will start to see a lot more disclosure of avoided emissions. In our view, whilst the benefits of quantified climate impact metrics are evident, it is critical that they should be supported with robust and transparent methodologies and crucially should not detract from fund managers measuring, disclosing, and reducing their portfolio emissions.”

As the best supporter of the ‘Belt and Road’ Green Investment Principles (GIP), and a global leader in sustainability and ESG business services named by Verdantix (an independent analyst firm), pwC is committed to achieving net-zero greenhouse gas emissions globally within 2030 and practicing sustainable development. It helps clients with lowcarbon transition, sustainability strategies, ESG reporting and assurance, climate change, responsible investment, green finance, and other areas. It has developed carbon neutral management solutions and a variety of digital tools to help organisations in this area.

At PwC, our purpose is to build trust in society and solve important problems. we’re a network of firms in 156 countries with over 295,000 people who are committed to delivering quality in assurance, advisory and tax services. We provide organisations with the professional service they need, wherever they may be located.

PwC China is accelerating the integration of ESG across all functions and creating value for corporations. Our end-to-end ESG services deliver sustainable development and drive social impact and low-carbon transformation. PwC’s global network has more than 1,900 dedicated specialists providing ESG and Sustainability services in 60 territories. You can find out more by visiting us at www.pwccn.com.

[1] Scopes 1, 2 and 3 respectively refer to direct GHG emissions from companies or financing projects, indirect GhG emissions from purchased electricity, and other indirect GHG emissions within the value chain.

Eric Pedersen, Head of Nordea Asset Management’s Responsible Investments Team explains the company’s philosophy.

In 2020, while engaging with a Japanese bank on climate issues, we became aware of Vung Ang-2 coal-fired power plant project, currently under construction in Ha Tinh Province, Vietnam. The project is situated on a site near the Vung Ang-1 coal plant and the Formosa Steel plant—both have caused local environmental degradation and are major emitters of Greenhouse Gases (GHG).

Global energy-related carbon dioxide emissions surged by 1.5 billion tonnes in 2021, the second-largest increase in history, reversing most of last year’s decline caused by the Covid-19 pandemic. According to the International Energy Agency, this driven in large part by the resurgence of coal and gas use in the power sector. In emerging markets like Vietnam, this is particularly evident.

The new Vung Ang-2 project consists of two turbines to be commissioned in 2024 and 2025—both will be fuelled by imported anthracite, hard coal. This project will significantly add to regional GHG emissions in the short term, and hence will very likely be closed down long before the end of its economic life, creating significant financial risk. Because of this, Nordea Asset Management identified a series of companies and lenders involved in the project, and led a consortium of 25 investors representing EUR 4.8tn in AuM in sending a letter urging the firms involved to withdraw from the project, and end all forms of involvement in new coal projects worldwide. The letter cited the associated climate-related financial and reputational risks, as well as the risk companies pass along to investors when failing to address climate risk exposure. In addition to the letter, NAM and our collaborators followed up with direct, individual dialogues with the companies associated with Vung Ang-2.

Determining whether to divest or engage is an important decision — we are not afraid to exclude companies when we find it necessary to do so, but we strongly believe in engagement as an effective tool for change. In the case of Vung Ang 2, we chose collaborative engagement to deliver the best result.

The project stands out for several reasons. First, we found that the emission levels from this project are estimated to be almost three times as high as levels from the average plant in the EU, China and the USA. Secondly, the environmental impact assessment that had been carried out on this project had major flaws, e.g. it failed to assess renewables as an alternative to coal, which was remarkable, given the price competitiveness of clean energy. A September 2019 report by the Uk think tank Carbon Tracker, concludes that the cost of constructing new renewables will be lower than operating costs of existing coal-fired power generation in Vietnam by as early as 2022. Thirdly, Vung Ang 2 has been significantly delayed since its approval in 2009 inflicting significant cost to investors—in the meantime, the price of renewables has plummeted. And finally, the health and safety issues tied to this project are numerous.

Consequently, we found that Vung Ang 2 is not only questionable from a climate perspective but also from a financial point of view. It is highly symbolic, as a highprofile example of what are hopefully the last generation

of large coal-fired power plants to be built.

Identifying the most suitable engagement targets is important – and they can be indirect. To maximise our influence, we decided to engage with the companies that are tied to the Vung Ang 2 construction project (owners, contractors, financing banks etc.). Our engagement objective was ambitious: not only did we want them to withdraw from this specific plant construction, but also to make a commitment to exit the entire coal industry. By extending an invitation to other shareholders to carry this engagement out collectively, we were able to leverage the knowledge and influence of other investors to increase our ownership share in the companies tied to this project.

Today, we are happy to share our engagement strategy has borne fruit. While we currently do not have news that development of Vung Ang 2 has stopped, significant related results have been achieved by our engagement: The shareholder pressure we and our peers applied has played a key role in Samsung C&T’s commitment to withdraw from all future coal projects and exit the coal industry. kEpCO, mitsubishi Corporation and Sumitomo mitsui Financial Group have also announced plans to end future coal projects. In addition, Mitsubishi Corporation has announced they are withdrawing from the sister project of Vung Ang-2, Vinh Tan-3. Moreover, this engagement was cited by pro-climate members of korea’s parliament during a climate debate which ultimately led the korean government to announce a net zero target for emissions. Moreover, Japan recently announced that it is withdrawing official financing from the construction of coal power plants outside its borders. The consequences of this decision for Vung Ang 2 are not clear at the time of writing.

NAM is committed to continuing our engagement activities concerning the Vung Ang 2 project, and we urge investors and investee companies to make commitments to end involvement in new coal projects. Our engagement on this issue is driven by our belief that it is our fiduciary duty to deliver returns with responsibility . That’s why we have built a comprehensive ESG toolbox in which engagement and exclusion work hand-in-hand.

1. There can be no warranty that an investment objective, targeted returns and results of an investment structure is achieved. The value of your investment can go up and down, and you could lose some or all of your invested money.

Nordea Asset Management is the functional name of the asset management business conducted by the legal entities nordea Investment Funds S.A. and nordea Investment management AB (“the legal Entities”) and their branches and subsidiaries. This document is advertising material and is intended to provide the reader with information on nordea’s specific capabilities. This document (or any views or opinions expressed in this document) does not amount to an investment advice nor does it constitute a recommendation to invest in any financial product, investment structure or instrument, to enter into or unwind any transaction or to participate in any particular trading strategy. This document is not an offer to buy or sell, or a solicitation of an offer to buy or sell any security or instruments or to participate to any such trading strategy. Any such offering may be made only by an Offering Memorandum, or any similar contractual arrangement. This document may not be reproduced or circulated without prior permission. © The legal Entities adherent to nordea Asset management and any of the legal Entities’ branches and/or subsidiaries.

Nordea Asset Management is the functional name of the asset management business conducted by the legal entities Nordea Investment Funds S.A. and Nordea Investment Management AB (“the Legal Entities”) and their branches and subsidiaries. This document is advertising material and is intended to provide the reader with information on Nordea’s specific capabilities. This document (or any views or opinions expressed in this document) does not amount to an investment advice nor does it constitute a recommendation to invest in any financial product, investment structure or instrument, to enter into or unwind any transaction or to participate in any particular trading strategy. This document is not an offer to buy or sell, or a solicitation of an offer to buy or sell any security or instruments or to participate to any such trading strategy. Any such offering may be made only by an Offering Memorandum, or any similar contractual arrangement. This document may not be reproduced or circulated without prior permission. © The Legal Entities adherent to Nordea Asset Management and any of the Legal Entities’ branches and/or subsidiaries.

Cop

This year, the meeting of 198 countries will focus on taking strong action on climate issues.

This summit will focus on economic losses caused by climate catastrophes and on industrialised nations taking the lead in public investment in clean energy and technology.

Some of the challenges that CO27 will discuss are the need for more research and investment in green technologies in industrialised nations and for emerging markets face to decarbonize their economies.

Finance needs to be at the centre of the discussion if COP27 is to be successful according to International Centre for Climate Change and Development (ICCCAD) Professor Saleemul Huq.

The main objectives for this COP 27 were:

Climate Change Mitigation refers to efforts to reduce or prevent the emission of greenhouse gases. Mitigation can mean using new technologies and renewable energy

sources, making older equipment more energy efficient, or changing management practices or consumer behaviour.

Countries are expected to show how they are planning to implement the Glasgow pact call, to review their climate plans and create a work programme related to mitigation.

Countries must adapt to climate consequences so that they can protect their citizens. Beyond doing everything possible to cut emissions and slow the pace of global warming.

At COp26, delegates adopted a work programme on the global goal of adaptation established in the Paris Agreement

The plan was put in place to equip communities and countries with the knowledge and tools to ensure that adaptation actions they take, are indeed moving the world towards a more climate-resilient future.

The COP27 Presidency expects nations to capture and

assess their progress toward enhancing resilience and helping the most vulnerable communities. This means countries making more detailed and ambitious commitments in the adaptation components of their national climate plans.

last year, developed countries agreed to at least double finance for adaptation, and many stakeholders are calling for even greater levels of adaptation funding to match the amounts that are now being spent on mitigation, as established in the paris Agreement. This will definitely be a big conversation topic at Sharm el-Sheikh.

UnFCCC is clear that to respond to the present and future climate risks it is necessary to significantly increase the scale of adaptation finance, from all sources – public and private sources. All players must come on board –governments, financial institutions, and the private sector.

Climate finance will be a top theme once again at COp27, many finance-related discussions are already on the agenda, with developing countries making a loud call for developed countries to reassure sufficient and adequate

financial support, particularly to the most vulnerable.

We will probably hear a lot about the yearly $100 billion promise by developed nations that isn’t being delivered. In 2009 in Copenhagen, rich countries committed to this financing, but official reports still show that this target is being missed. Experts expect COP27 to actually make this pledge a reality finally, in 2023.

The Egyptian Presidency aims to follow up on this and other commitments and pledges made in previous COPs.

A breakthrough agreement was reached at COP 27 to provide “loss and damage” funding for vulnerable countries hit hard by climate disasters.

Simon Stiell, UN Climate Change Executive Secretary said that this was a way forward in addressing the impact on communities affected by climate change.

COP27 countries reached resolutions that renewed their commitment to limit global temperature rise to 1.5

degrees Celsius above pre-industrial levels. The package also strengthened action by countries to cut greenhouse gas emissions and adapt to the inevitable impacts of climate change, also boosting the support of finance, technology and capacity building needed by developing countries.

Putting in place a dedicated fund for loss and damage marked an important point of progress, as this is the first time this has happened at COP27.

This dedicated fund will assist developing countries in responding to loss and damage. There will also be a ‘transitional committee’ to make recommendations on how to operationalize both the new funding arrangements and the fund at COP28 next year. The transitional committee is expected to meet before the end of March 2023.

COP27 brought together more than 45,000 participants to share ideas, solutions, and build partnerships and coalitions. Indigenous peoples, local communities, cities and civil society, including youth and children, showcased how they are addressing climate change and shared how it impacts their lives.

The decisions made at COP 27 also reemphasize the critical importance of empowering all stakeholders to engage in climate action; in particular through the fiveyear action plan on Action for Climate Empowerment and the intermediate review of the Gender Action Plan. Parties should now work together to address imbalances in participation and provide stakeholders with the tools required to drive greater and more inclusive climate action at all levels.

A summary of some of the other key outcomes of COP27 follows below.

COp27 saw the launch of a new five-year work program at COP27 to promote climate technology solutions in developing countries.

COp27 significantly advanced the work on mitigation. A mitigation work programme was launched in Sharm el-Sheikh, aimed at urgently scaling up mitigation ambition and implementation. The work programme will start immediately following COP27 and continue until 2026 when there will be a review to consider its extension. Governments were also requested to revisit and strengthen the 2030 targets in their national climate plans by the end of 2023, as well as accelerate efforts to phasedown unabated coal power and phase-out inefficient fossil fuel subsidies.

The decision text recognizes that the unprecedented global energy crisis underlines the urgency to rapidly transform energy systems to be more secure, reliable, and resilient, by accelerating clean and just transitions to renewable energy during this critical decade of action.

Delegates at the UN Climate Change Conference COP27 wrapped up the second technical dialogue of the first global stocktake, a mechanism to raise ambition under the Paris Agreement. The UN Secretary-General will convene a ‘climate ambition summit’ in 2023, ahead of the conclusion of the stocktake at COP28 next year.

India has become the second most favoured market for sovereign wealth funds and public pension fund investors, as a close second to the US, according to a study by Invesco Global Sovereign Asset

India has also overtaken China as the most popular emerging market, reaching No. 2 in 2022.

The study said that India was favoured over China due to its positive economic reforms and strong demographic profile.

Sovereign investors, which now manage close to $33 trillion in assets, have observed an increase in allocations to private markets, although this development may slow with fixed income back in favour, according to the Invesco Global Sovereign Asset Management Study.

Some sovereign investors were keen to rebalance portfolios, fearing they had become overly reliant on U.S. markets which left them vulnerable to the correction in equity markets seen this year, Invesco said. Back in 2014, the Uk was the most desirable destination.

Average annual returns for sovereign investors over the past decade stood at 6.5% and, for sovereign wealth funds alone, at 10% in 2021, Invesco found. however, 2022 could prove to be a turning point with higher inflation and tighter monetary policy hitting long-term expected returns.

Emerging markets were set to benefit from the latest shift, the study predicted.

Many of us are now familiar with shopping for organic food, but there used to be a time when we were confused by the many organic labels and various certifications used.

We went through a period educating ourselves so that as consumers we would not be misled– and we learnt the difference between non-GMO, natural, organic and 100% organic products.

Today, investors looking to invest in ESG products (incorporating environmental, social and good corporate governance factors) are in a similar situation.

As more products are launched, concerns about ESG and ‘greenwashing’ the practice of putting spin over substance and including misleading claims, are also growing.

It refers to investment solutions where the investment manager’s claims of ESG integration are exaggerated or

misleading. Examples include environment funds holding coal companies that do not have a clear transition plan or the fund manager does not have an engagement strategy or where the integration of ESG factors is optional.

As we consider sustainable investments, it is key that we evaluate the credibility of the ESG funds presented to us. here are some questions investors can ask their financial advisors:

1. ARE CERTAIN SECTORS EXCLUDED FROM THE ESG FUND AND IS THERE THOUGHTFUL THINKING BEHIND EXCLUSIONS?

The discussions around exclusions are often personal and investors have differing opinions. Some investors prefer that their ESG funds not include alcohol, tobacco, fossil fuel and controversial weapons, while others may be

comfortable with alcohol companies.

However, we would caution against the complex nature of supply chains when applying exclusions. The key is to know where to draw the line with respect to the nature of business involvement and the companies’ materiality thresholds. For example, we may exclude tobacco manufacturers from the ESG funds selected, but not exclude supermarkets and stores distributing cigarettes if the proportion of revenue from cigarettes is less than 10% of its overall revenues.

As an investor, you should decide on what is important to you.

ESG strategies range from thematic ones focused on the environment, water, and sustainable foods, through to best-in-class integration, where ESG factors are considered alongside financial metrics in the analysis of a company.

For thematic strategies, the fund should be easily understood in terms of how the portfolio companies fit within the ESG story. For example, some managers of environmental funds select companies that contribute towards innovation and reduction of carbon emissions while others may select based on companies’ focus on technology and carbon footprint. It is important to understand the manager’s intent and whether all other aspects of the due diligence align with and support the strategy.

For best-in-class integration funds, we found that leaders in the space have a strong understanding of how different ESG factors affect their portfolio company and highlight that not all metrics are of equal importance. For instance, environmental factors are more important in the mining sector from a risk management perspective and not so for a bank in financial services, so weighting of these factors should differ. How a manager determines a fund’s ESG rating should also be considered, whether there is thoughtfulness behind it and if it makes sense, versus solely relying on an ESG score by rating agencies.

The experience and expertise of the ESG investment team is important. Some fund houses have a large central

ESG team while others emphasise portfolio managers and analysts having strong ESG knowledge. leaders in the space have a good balance of both, and a structured training process alongside systems to ensure effective embedding of ESG decisions. It is usually helpful too if the ESG head reports into senior management and ESG is on the Board’s agenda.

To better understand how ESG factors are integrated, we ask portfolio managers to walk us through examples of companies being selected for inclusion in the fund, of positions being exited, and how ESG factors are considered at each stage of the process.

leaders in the space have a clear articulation of this, and a systematic, institutionalised way of embedding ESG from the selection of the initial universe of companies through to analysis and evaluation. As part of the process, ESG research should contribute significantly towards the eventual decision of including or exiting a company and not just exist as an optional reference point.

Another huge consideration is active ownership/ stewardship activities of the fund houses, specifically how involved they are with proxy voting and engagement with companies.

Finally, for ESG funds marketing themselves as impact funds, we ask for quantitative and qualitative data on how they are measuring impact. meaningful quantification of impact is not always easy, especially for public companies, since their impact may not be as direct as investments made in the private markets. It is important that fund managers are honest about the challenges faced, and the steps being taken to plug data gaps and provide investors with meaningful reporting.

There is work taking place globally on standardisation and the labelling of sustainable finance solutions by regulators. In the meantime, for investors exploring ESG investments and who are concerned about ESG washing, asking some of these questions will go some way in helping you better understand the funds presented to you. As Benjamin Franklin wisely said, “An investment in knowledge pays the best interest”.

COVID-19 change the way businesses work, the investment community had to take a step further and reinvent in many ways. In order to recognise the effort behind every individual and company during this time, we selected champions from a wide range of businesses.

The awards are open to any business, large, mid-size or small, established or start-up, provided they display first rate service, opportunity, innovation and performance. The following pages celebrate organisations that drive forward the world of international business and investment.

Best Bank // Cape Verde 2022

Best Sustainable Bank // Cape Verde 2022

““Banco Interatlântico’s (BI) activity has been conducted by a solid commitment of the staff, a strong social and sustainability policies, innovation and personal relationships.