“There’s something one should expect not only of a watch but also of oneself: to never stand still.” Company founder Walter Lange’s aspirational guiding principle still characterises the craftsmanship of A. Lange & Söhne across all areas of the manufacture. In their state-of-the-art workshops in Glashütte, the highly skilled watchmakers and 昀椀nishers strive passionately to perfect every watch down to the very last detail. In doing so, they pursue a single goal: to build timepieces that belong to the pinnacle of international watchmaking artistry.

During the division of Germany, there was one man who never gave up his dream of making the 昀椀nest timepieces under the name A. Lange & Söhne again: Walter Lange, the great-grandson of Ferdinand Adolph Lange, who brought 昀椀ne watchmaking to the former mining town Glashütte in 1845. Immediately after German reuni昀椀cation, Walter Lange resumed the family tradition with a clear vision, that each new Lange watch must set new standards while matching the craftsmanship of the prestigious pocket watches the brand had once been famous for. The breakthrough came with the 昀椀rst collection and the LANGE 1, a successful combination of tradition and innovation that to this day epitomises Lange’s art of watchmaking.

At A. Lange & Söhne, product developers and watchmakers work hand in hand to harmonise precision and aesthetics in the best possible way. Each of the 73 different watch movements created since 1990 is developed in-house, whilst every component is decorated with its own speci昀椀c type of 昀椀nissage, whether or not it is visible through the sapphire-crystal caseback. A special type of 昀椀nish is reserved for the balance cock, which is engraved with the Lange-style 昀氀oral pattern that makes each Lange watch unique. Each movement is assembled twice by hand to ensure highest precision.

A. Lange & Söhne is creating extraordinary mechanical masterpieces, encouraging the passion from every single employee, and making their working environment the very best it can be. Perfection, simplicity, community spirit and combining innovative spirit with the preservation of tradition are highly valued in the company.

The theme for this year’s World Economic Forum Annual Meeting is ‘Collaboration for the Intelligent Age’. This seems 昀椀tting, as debates on how, or indeed even if, we should include arti昀椀cial intelligence in our daily lives. How can the public and private sectors invest in human capital development and good jobs that contribute to the development of a modern and resilient society?

To that end, in this edition of International Investor, Bugatti presents its 昀椀rst-ever hybrid vehicle, PASHA Bank explains its role in Azerbaijan’s sustainable economic transformation and we ask if bitcoin is back. ATFX Africa explores impact beyond 昀椀nancial markets, engaging in social responsibility initiatives that creates lasting value in local communities while SpaceVIP invites you to consider the possibilities of living luxuriously among the stars.

Whether it’s helping people or the planet, there’s a lot of potential for the technologies of this Intelligent Age to inspire us all.

Happy reading, Sophie

10 Navigating the Complexity of Business Development

At the heart of Intercorp Group’s success is Leonardo Braune, a veteran tax consultant.

14 Collaboration for the Intelligent Age

The World Economic Forum Annual Meeting will bring together world leaders to tackle global issues.

18 Bugatti Tourbillon: the inaugural hybrid vehicle of its modern era to the world

This is the most technologically advanced Bugatti ever made.

26 Investing in Net Zero by 2050

What are the key developments around the world for countries taking on the challenge of reaching net zero?

20 Women and investing around the world

What progress was made to get women investing in 2024?

30 How Traders Built the Broker of Their Dreams

The vision for XPBEE came from years of experience navigating various trading platforms.

1018

16 ATFX Connect Strengthens Presence in Australia

The opening of its new Sydney of昀椀ce, underscore its commitment to growth.

22

The Future of Sri Lanka’s Capital Markets

How First Capital went from hidden gem to investment hub.

32 Embracing diversi昀椀cation with the Seventy Ninth Group

What does it take to become the fastest growing asset management company in the UK?

36

ATFX Africa Honored as Africa’s Best and Most Trusted Broker

The company has established itself as a prominent force in online trading, earning recognition for its commitment to innovation, transparency, and client satisfaction.

44 PASHA Bank’s role in Azerbaijan’s economic growth

The private-sector leader has been instrumental in Azerbaijan’s diversi昀椀cation journey.

38

The Lotus Theory: a new design manifesto

This manifesto is underpinned by three core principles – Digital, Natural, and Analogue (DNA).

42 A rum with a legacy of luxury

For 135 years, Flor de Caña has been crafting some of the world’s 昀椀nest rums.

52

Luxury among the stars

SpaceVIP has been dedicated to educating the public about the vital role of space and space technology in improving life on Earth

48

Swisscom: consistent pursuit of climate goal

For more than 25 years, Switzerland’s leading ICT company has been improving sustainability throughout its supply chain.

54 A Leading Force in Saudi Arabia’s Commercial Real Estate Sector

Alandalus Property has become a key player in Saudi Arabia’s dynamic real estate landscape.

50 Your Trusted Partner in Wealth Management

Banco Invest is a trusted leader in the 昀椀eld of wealth management, known for its expertise and strategic approach.

56

Is bitcoin back?

Taking a look at the Cryptocurrency’s Resurgence and Future in 2025.

60

Value for money in real time

At WPS Advisory, the focus is on the theme of Quicker – Easier – Better.

62 Balancing Tradition with Innovation Produces Excellence

‘AcrossGen’ (Across Generations) is Cornèr Bank’s new approach to managing clients’ portfolios.

66

International Investor Awards Winners

Amongst our award winners there are some exceptional banks, businesses and leaders and we want to recognise their roles and achievements.

Inrecentyears,thegrowingnumberoffamiliesandhighnetworthentrepreneurslookingtoexploreinternationalbusiness orshifttoothercountriesarefacingaplethoraofchallenges. Despite the allure of better economic opportunities and politicalstability,navigatingtheintricaciesofforeignmarkets can be a daunting task. These individuals face a range of concerns,frominvestmentrestructuringandassetprotection to legal compliance and regulatory frameworks, that require expert guidance.

Investment restructuring is a critical aspect of business that demands sophisticated strategies and a deep understanding of the legal and regulatory frameworks of foreign markets. Navigating complex tax implications and minimizing risk while maximising returns is a complex task thatrequiresmeticulousattentiontodetail.Legalconsultants with experience in cross-border investments can provide the necessary guidance to ensure that these individuals can successfully navigate the maze of international investment markets.

Effective asset protection is another vital concern for people exploring international business or shifting to other countries. The need to protect assets from potential threats such as lawsuits, creditors, and political instability is paramount. Consultants with a thorough knowledge of local laws and regulations can help these individuals implement effective asset protection strategies that not only protect their wealth but also ensure compliance with legal and regulatory frameworks.

Intercorp Group is an international consulting 昀椀rm that is dedicated to helping individuals navigate the complexities of international business, tax, 昀椀nancial management, and investment markets. With their expert guidance and deep understanding of laws, regulations, and markets, the companyisonamissiontoprovideimpeccableservicesthat solve the challenges faced by these individuals, including investment restructuring, asset protection, legal compliance, and various other 昀椀nancial and legal aspects of a business.

Intercorp Group is a highly esteemed international tax consulting boutique, led by the visionary Leonardo Braune, with its headquarters based in the vibrant city of London. The 昀椀rm’s exceptional specialisation in diverse areas such as international tax, real estate planning, wealth preservation, 昀椀duciary advice, and project management has earned it a niche for itself in the market. The 昀椀rm caters to high-networth entrepreneurs and their families globally, providing bespoke solutions that are tailor-made to meet their needs.

Thecompany’suniquebusinessmodelleveragesitsextensive network of global strategic partners, which it has carefully built over several years. The network comprises hundreds of quality-assured, vetted, and specialised partners, enabling the 昀椀rm to offer clients unparalleled access to experts in any given 昀椀eld while maintaining its independence. The team of highly skilled consultants at the corporation works with clients on a long-term basis to solve complex issues, providing them with customised solutions that meet their unique requirements.

At the heart of Intercorp Group’s success is Leonardo Braune, a veteran tax consultant with close to three decades of experience in the industry. Braune’s expertise covers international tax, real estate planning, wealth preservation, 昀椀duciary advice, implementation, and project management. Hisleadershiphastransformedthe昀椀rmintoatrustedpartner forhigh-net-worthfamiliesworldwide,deliveringcustomised solutions for tax, estate planning, and 昀椀duciary structures.

The organisation’s commitment to delivering value to its clients is evident in its approach, which is centered on building long-term relationships with them. The 昀椀rm’s consultants work closely with clients, gaining a deep understanding of their unique circumstances and goals, and thendesigningsolutionsthataretailoredtomeettheirneeds. This personalised approach has earned Intercorp Group a reputation for excellence in the industry, making it the go-to 昀椀rm for high-net-worth families worldwide.

AND PRESERVING WEALTH: INTERCORP GROUP’S COMPREHENSIVE RANGE OF SERVICES

Intercorp Group is a distinguished consulting 昀椀rm that caters to the intricate and unique 昀椀nancial portfolios of Ultra-HighNet-Worth (UHNW) families. The 昀椀rm’s services cover an extensive range of areas such as global relocation, postIPO strategic planning, international investment structuring, protection of family businesses abroad, asset protection, corporaterestructuring,realestateinvestment,andadapting to structural change.

Thecompany’sglobalrelocationserviceisapopularoffering of the 昀椀rm. Their expert consultants provide comprehensive and customised solutions to the challenges of relocating internationally.Theycatertotheuniquerequirementsofeach family, including language barriers, cultural differences, and legal requirements. The Group’s global network of partners ensures that its clients receive the highest level of support, regardlessoftheirdestination.Thisservicenotonlyensuresa smooth transition but also enables families to focus on other crucial aspects of their lives.

The organisation’s post-IPO strategic planning service is another area where the 昀椀rm excels. The 昀椀rm’s consultants understand the importance of astute decision-making in ensuring the success of an IPO. Their experts offer tailored solutions that maximise shareholder value, manage shareholder relations, and streamline the post-IPO process. Intercorp Group’s experienced consultants provide comprehensive advice that takes into account the speci昀椀c needs of each family, ensuring a smooth transition postIPO. This service ensures that families can capitalise on their investment while navigating the complexities of the post-IPO process.

The company’s international investment structuring service is designed to help clients diversify their investments in other countries while mitigating associated tax obligations. The 昀椀rm’sconsultantspossessin-depthknowledgeofthevarious investment vehicles and structures available, and they analysethedomicileanddestinationjurisdictionstominimise tax liabilities for their clients. Its experts provide tailored solutions that cater to the unique needs of each family. This serviceenablesfamiliestomaximisetheirinvestmentreturns while minimising their tax liabilities, ensuring their 昀椀nancial portfolios receive the highest level of support.

IntercorpGroupisanexceptionalconsultancy昀椀rmthatoffers advisory and consulting services that are unparalleled in the industry. The 昀椀rm’s distinctive approach is personalized and tailored to meet its clients’ complex and multidisciplinary international needs. Their services offer access to a global network of professionals and specialists, allowing them to provide the most ef昀椀cient approach to ful昀椀ll their client’s wishes.

The cornerstone of Intercorp Group’s services is their team of quali昀椀ed coordinators, who act as the client’s representative throughout the entire advisory and consulting process. The coordinators have access to an international network of professionals and specialists in many areas and are responsible for “playing the role of the client.” As a result, theyarecapableofclarifyingqueriesandprovidingpractical solutions to their client’s issues. Their approach guarantees

that clients receive the best advice and solutions to their problems, making them feel con昀椀dent and comfortable that their matters are being handled correctly and ef昀椀ciently. The Group’s commitment to creativity, technicality, quality, and reliability are its core strengths. They understand that strategic decisions are made at the right time rather than at the earliest opportunity. As a result, they promise to assume responsibility for their client’s best interests as if they were their own. Trust and respect between the client and the 昀椀rm are essential to yield the best results.

Intercorp Group, a trailblazing company in the realm of international tax and wealth management, boasts an impressive track record of success. With over 300 families relocated with ease, 80 private investment funds expertly managed, and 200 private family trusts secured, the company’s exceptional services have earned them a prominent place in the industry. Their outstanding achievements have not gone unnoticed, with a slew of accolades under their belt. These include Leading Taxation and Wealth Planning Consultancy (UK) in the year 2021 by AI Global Media, Succession Planning Advisory Firm of The Year (BR) in 2022 by Game Changers, International Tax Advisory Firm Of The Year 2023 by International Investor Magazine, The Advisory of the Year-Brazil 2017 by Chase Publishing, Consulting Firm of the Year by Deal Makers Monthly, International Tax Firm of the Year by InterContinental Finance & Law, and International Investment Structuring Excellence by Corporate Livewire. As a company, Intercorp is dedicated to staying ahead of the curve, constantly expanding its expertise, and adapting to changing regulatory frameworks. With a proven track record of success and a commitment to excellence, Intercorp Group is the trusted partner that clients can rely on for all their international tax and wealth management needs.

“Intercorp Group is an international consulting firm that serves high-net-worth entrepreneurs and their families. They pride themselves on finding professional solutions to often very personal issues, from migration and succession planning, through to finding the right property and a good school”.

The World Economic Forum Annual Meeting 2025, taking place in Davos-Klosters from 20 to 24 January, convenes global leaders under the theme, Collaboration for the Intelligent Age. The meeting will focus on five key areas:

• Reimagining Growth - Reviving and reimagining growth is critical to building stronger and more resilient economies. How can we identify the new sources of growth in this new global economy?

• Industries in the Intelligent Age - Industries have had to adapt their business strategies to account for major geoeconomic and technological shifts. How can business leaders strike a balance between the short-term goals and long-term imperatives in the transformation of their industries?

• Investing in People - Geoeconomic changes, the green transition and technological advancements are impacting everything from employment, skills and wealth distribution to healthcare, education and public services. How can the public and private sectors invest in human capital development and good jobs that contribute to the development of a modern and resilient society?

• Safeguarding the Planet - Innovative partnerships and dialogue that enable investments and the deployment of climate and clean technologies will be critical to make progress on global climate and nature goals, as well as to address the energy triangle of achieving equitable,

secure and sustainable energy systems. How can we catalyse energy, climate and nature action through innovative partnerships, increased 昀椀nancing and the deployment of frontier technologies?

• Rebuilding Trust - In an increasingly complex and fast-moving world, societal divides have deepened, geopolitics is multipolar, and policy is shifting towards protectionism, hampering both trade and investment. How can stakeholders 昀椀nd new ways to collaborate on solutions both internationally and within societies?

The meeting is accessible for the wider public through livestreaming of the public sessions, complemented by the presence of media leaders and reporting press, and through local engagement at the Open Forum in Davos.

The Forum’s purpose-driven extended reality (XR) platform, the Global Collaboration Village, will also bring together diverse global stakeholders in immersive, real-time environments to accelerate, enhance, and scale up progress on the key themes of the meeting.

ATFX Connect, the institutional arm of leading global broker ATFX, has made signi昀椀cant strides in expanding its presence in Australia. With the opening of its new of昀椀ce and participation in the FMPS 2024 (Financial Markets Paci昀椀c Summit), ATFX Connect is strengthening its foothold in the Australian 昀椀nancial market, underscoring its commitment to providing cutting-edge trading solutions to institutional clients.

Known for its advanced technology and bespoke liquidity solutions, ATFX Connect provides access to tier 1 bank and nonbank liquidity, competitive spreads, and low latency, making it an attractive choice for 昀椀nancial institutions, hedge funds, and highnet-worth individuals.

In August 2024, ATFX Connect participated in the Finance Magnates Paci昀椀c Summit (FMPS) held in Sydney, Australia. This prestigious event is renowned for gathering the leading minds in the 昀椀nancial services sector, focusing on critical areas such as online trading, payments, 昀椀ntech, and cryptocurrency. The summit offered ATFX Connect an excellent platform to showcase its innovative solutions, engage with industry leaders, and discuss emerging trends and opportunities in the 昀椀nancial markets. The participation in FMPS 2024 was a notable success, further solidifying ATFX Connect’s reputation in the Asia-Paci昀椀c region.

Adding to its achievements, ATFX Connect recently opened a new of昀椀ce in Sydney, marking a signi昀椀cant milestone in its expansion strategy. The new of昀椀ce underscores ATFX Connect’s commitment to providing exceptional service and support to its clients in Australia. The opening of this of昀椀ce not only enhances ATFX Connect’s presenceintheregionbutalsodemonstrates itsdedicationtofosteringcloserrelationships with its clients and partners. This strategic move is set to strengthen ATFX Connect’s position as a leading institutional platform, offering unparalleled services and solutions to its clients.

In conclusion, ATFX Connect’s strategic initiatives in Australia, including its active participation in FMPS 2024 and the opening of its new Sydney of昀椀ce, underscore its commitment to growth and excellence in the 昀椀nancial services industry. These efforts are set to enhance its standing as a leading institutional platform, providing top-tier services and solutions to its clients. As ATFX Connect continues to expand its footprint in the Asia-Paci昀椀c region, it remains dedicated todeliveringinnovativeandreliable昀椀nancial services that meet the evolving needs of its clients.

In June 2024, BUGATTI revealed the 昀椀rst ever hybrid vehicle of itsmoderneratotheworld:theBugattiTourbillon.Combining the timeless wonderment of an all-new V16 engine with the instant power and 昀氀exibility of the electric motor, the Tourbillon is the most technologically advanced Bugatti ever made. Drawing on Ettore Bugatti’s spirit of innovation in designing electrically powered vehicles for his personal use, the shift to an electri昀椀ed powertrain marks a new chapter in the company’s history of innovation and responsibility.

Founded by Ettore Bugatti in 1909 in Molsheim, France, the company has always maintained a deep connection to its surroundings. In fact, Ettore himself established a forest in Alsace more than 110 years ago – a haven for nature that continues to 昀氀ourish. At the company’s headquarters, a four-hectare forest area by the Château serves as home to a thriving herd of fallow deer, embodying the harmony between luxury manufacturing and nature conservation. This admiration for the in昀氀uential power of nature has been wovenintothefabricofthecompany,fromitsearliestdaysof crafting automotive masterpieces like the Type 35 and Type 57 SC Atlantic, through to the modern era of the Veyron and Chiron.

Since 2020, Bugatti has utilized 100% green biogas and electricity for production at its Molsheim headquarters, reducing emissions at every stage of production. And while a Bugatti covers an average of approximately a thousand kilometersperyear,thecompany’smeasurestocompensate for emissions go further than both production and the vehicle itself: the company has been planting over 13,600 trees in recent years near their Molsheim facility, creating new forest ecosystems that will capture carbon emissions for generations to come. These trees will be maintained for 150 years before being replaced with new shoots, ensuring a continuous cycle of environmental stewardship for future generations.

ButBugatti’sprofoundrespectforcommunitycausesextends

beyond environmental awareness. Fostering and nurturing relationships with local people within its birth-region, Alsace, has always been close to the hearts of the Bugatti family working in Molsheim. Support is at the center-stage of the community spirit – a belief guiding Bugatti in developing strong ties with local charities, including Semeurs d’Étoiles, which supports hospitalised children and their families at the Strasbourg hospital.

It is through partnerships like these that Bugatti can help in contributing to those in need – from donations to facilitating dream-come-true passenger-rides and experiences at Bugatti’s headquarters for in昀椀rm children. During the 2023 holiday season, with special gifts Bugatti had the opportunity tobringjoytoyoungpatients,whiledeliveringelectricBugatti models for children unable to leave their hospital rooms.

The spirit of giving to the community pervades through the Bugatti family, with employees having the opportunity to embrace these values themselves. Contributing their efforts to help combat food insecurity, Bugatti employees and the companyhaveforgedameaningfulpartnershipwithBanque Alimentaire du Bas-Rhin. Building on the power of teamwork, arecentdonationtothefoodbankenabledthedistributionof more than 30,000 meals to those in need through 120 partner associations in the region.

“Sustainable, responsible production is at the forefront of our long-term vision,” says Christophe Piochon, President of Bugatti. “While we continue to create the world’s most extraordinary cars, we remain deeply committed to reducing our environmental impact and supporting our local communities.”

Thisbalanceofexcellenceincraftandresponsibilityinaction showcases how even the most exclusive luxury brands can lead the way in environmental and social governance, proving that performance and sustainability can coexist at the highest levels of automotive achievement.

Recent昀椀ndingsfromFidelity’s2024Women&InvestingStudy highlight a signi昀椀cant increase in the number of American women engaging in investment activities. According to the study, the percentage of women who own investments has grown by nearly 20% compared to 2023. This surge in participationisparticularlynotableamongoldergenerations, with the percentage of Gen X and Boomer women investing in the stock market increasing by 18% and 23%, respectively. Despite this progress, there are still underlying challenges related to con昀椀dence and 昀椀nancial empowerment.

Younger women, particularly those in Gen Z, continue to lead thechargeinincreasingtheirinvestmentportfolios.However, the most striking year-over-year growth has occurred among older women. Gen X women, typically aged between 43 and 58, and Boomer women, aged 59 and above, have signi昀椀cantly increased their stock market participation in 2024, signaling a broadening of investment involvement across generations.

Onekeyfactorbehindthisgrowthistheincreasingavailability of resources and information. According to the study, social media remains a prominent source of investment ideas for many women (46%). However, the younger Gen Z demographic shows a clear preference for more personal and trusted guidance. 52% of Gen Z women turn to family and friends, while 47% rely on their own research to inform their investment decisions. Only 11% of Gen Z women consider social media to be their most trustworthy source of investmentguidance,furtherdemonstratingtheirpreference for learning from more personal, real-world sources. This focus on research aligns with how Gen Z women view themselves—as “researchers” who want to fully understand whattheyownandbuildtheirinvestmentknowledgethrough multiple resources.

Interestingly,despitetheirinclinationtoconductindependent research, 89% of Gen Z women have sought, or plan to seek, help from 昀椀nancial professionals. This indicates a balance between their desire for self-empowerment and recognition of the value that 昀椀nancial experts bring to wealth management.

While the increase in the number of women investors is a positive trend, Fidelity’s research suggests a continuing con昀椀dence gap when it comes to managing personal 昀椀nances and making investment decisions. The study found thatwomenarenearlytwiceaslikelyasmentodescribetheir level of investing knowledge as “non-existent.” Furthermore, women tend to feel more overwhelmed and intimidated by investing and 昀椀nancial management than their male counterparts.

Despite the growing number of women taking control of their 昀椀nances, this gap in con昀椀dence may prevent many from fully realising their 昀椀nancial potential. The research suggests that many women still feel uncertain about navigating the complexities of the 昀椀nancial world, which may lead to hesitations in making investments or building wealth. As women continue to gain access to investment tools, education,andresources,tacklingthiscon昀椀dencegapwillbe crucialforempoweringthemtomakeinformedandassertive 昀椀nancial decisions.

While women in the United States are making strides in investing, other parts of the world are also witnessing a shift

in women’s involvement in managing 昀椀nances. In India, for example, women have become increasingly active in managing their 昀椀nancial portfolios. According to a March 2024reportbytheAssociationofMutualFundsinIndia(AMFI), the share of industry assets owned by women investors has grown signi昀椀cantly, from 15% in March 2017 to nearly 21% by December 2023.

Thisgrowthre昀氀ectsbroadertrendsinwomen’sempowerment acrossIndia,wherewomenarenotonlytakingonmoreactive roles in 昀椀nancial management but also gaining greater 昀椀nancial independence and decision-making power. This shift is seen in both urban and rural areas, as more women understand the importance of managing their 昀椀nances, securing investments, and planning for long-term wealth.

In Europe, the investment habits of women show a more nuanced picture. According to a report by N26, European women invest 29% less of their monthly income on average than men. This disparity could be attributed to a number of factors, including wage inequality, societal expectations, and a lower level of investment education. Women, particularly in countries with strong gender income gaps, may have less disposable income to invest, which can limit their ability to accumulate wealth through investments.

This trend underscores the need for more targeted 昀椀nancial education and access to investment tools that help women maximise their investment potential, regardless of their income levels. Financial institutions and governments can play a key role by addressing the systemic barriers that prevent women from investing and building wealth at the same rates as men.

As women continue to take control of their 昀椀nances across the globe, social, economic, and institutional support will be essential to ensuring they are equipped with the tools to thrive in an increasingly complex 昀椀nancial landscape. With the right support and encouragement, women can continue to close the investment gap and take their place as equal participants in wealth creation on a global scale.

First Capital Holdings PLC has established itself as a prominent player in the 昀椀nancial services sector, with a legacy that spans over four decades. Being a pioneering investment institution and a leading institution in non-bank primary dealing appointed by the Central Bank of Sri Lanka, thecompanyaimstoserveasacatalystforgrowthincapital markets. With a “Performance-First” ethos, First Capital envisions to improving the lives of all Sri Lankans through innovative 昀椀nancial solutions. Featuring a diverse portfolio that includes investment banking, asset management and capital markets, the company plays a pivotal role in driving economic growth and supporting businesses across various industries. First Capital has garnered signi昀椀cant recognition within the industry, including the prestigious title of Most Valuable Consumer Brand in the Investment Banking Sector awarded by Brand Finance. The organisation also received the Gold Award for its Annual Report in the Investment Banking Sector at the Chartered Accountants Sri Lanka TAGS Awards. Additionally, First Capital has achieved two Silver Awards at the CFA Society Sri Lanka Capital Market Awards, honouring its 昀氀agship Unit Trust Fund and outstanding Equity Research efforts. These accolades re昀氀ect First Capital’s commitment to excellence and innovation in the investment banking landscape.

International Investor Magazine recently sat down with Dilshan Wirasekara, Managing Director and CEO of First Capital Holdings PLC. Dilshan was recently honoured with the “Financial CEO of the Year Sri Lanka 2024” award, while First Capital Holdings secured the title of “Best Comprehensive Investment Firm Sri Lanka 2024.”

Dilshan has over 28 years of extensive experience in 昀椀nancial services, and since joining First Capital in 2013, he has guided the company to become a major player in Sri Lanka’s capital markets. He has overseen the expansion of its services to include government securities, stock broking, unit trusts, wealth management, debt structuring, and corporate 昀椀nance advisory, all supported by a robust research division. His leadership has also been central to several large-scale debtstructuringtransactionsandstrategicpartnershipswith global institutions. An alumnus of INSEAD Business School, France,andAOTS,Tokyo,Japan,DilshanisalsotheChairman of the Colombo Stock Exchange. DiscussingthepotentialofSriLanka’scapitalmarkets,Dilshan offers valuable insights into the opportunities that lie ahead.

“Sri Lanka’s capital markets are an undervalued treasure chest, with untapped potential. Currently, the market trades at a price-to-earnings (PE) ratio of 8.0 and a price-to-book (PBV) ratio of 0.90, both of which are significantly below historical highs of 17 times PE and 1.5 times PBV. This presents a prime opportunity for investors to tap into its immense growth potential. The Colombo Stock Exchange (CSE) is on the cusp of a significant upswing in 2024, buoyed by a broader economic revival in Sri Lanka. The numbers tell the story - With the All Share Price Index (ASPI) up 11% and the S&P SL20 index rising 13% as at 3Q2024, investor enthusiasm is palpable. Daily turnover has skyrocketed from LKR 715 million in January to LKR 1.7 billion by September, indicating heightened investor engagement.

Sri Lanka’s external debt restructuring nearing completion and the anticipated removal of its default status, alongside a robust 5.3% GDP growth in early 2024, the stage is set for a surge in foreign investment.

Sri Lanka’s financial landscape is undergoing a dramatic turnaround as previously sky-high fixed income yields— exceeding 20%—start to taper off. With the Central Bank of Sri Lanka cutting policy rates and the Average Weighted Prime Lending Rate (AWPLR) approaching 9.0%, equities are making a strong comeback while the bond markets giving you trading opportunities. “

“As of 2024, and looking forward, favourable conditions promise improved valuations and appealing equity multiples, while rising IPO interest and innovative financial instruments like sustainable bonds, infrastructure bonds and Sukuks offer diverse fundraising opportunities. The CSE is set to shine with its versatile listing boards—Main Board, Diri Savi Board, and Empower Board—plus exciting additions like the Multi Currency Board for foreign listings. New equity products,

such as stock borrowing and lending, will enhance market liquidity and investor flexibility.

The Sri Lankan bond market has seen a rollercoaster ride in recent years, with investors navigating through periods of both opportunity and uncertainty. While the local bond market and corporate debt market have historically offered attractive yields and diversification benefits, several factors have influenced investor sentiment and market dynamics.

One of the most significant challenges faced by investors was the fear of a local debt restructuring. This refers to the government’s potential actions to restructure or reduce its debt burden, which can have a profound impact on bond prices and interest rates. The anticipation of such a move pushed yields to a level beyond 20%, making investors hesitant to invest in government securities.

However, a turning point came when the government announced a limited local debt restructuring plan that would only affect provident funds. This announcement provided much-needed clarity and eased investor concerns, leading to a sharp decline in interest rates.

Within a short period, rates dropped from a high of 30% to 12.00%, creating a favourable environment for investors to reap higher returns.

First Capital advised clients to invest and take advantage of the high interest rate offered by government securities. We also analysed the impact of the local debt restructuring precisely through our in-house research arm, enabled our organisation and our valuable clients to investment in government securities to achieve a higher return. Being the pioneers in raising funds though government securities to support the government of Sri Lanka. Our foresight in interest rate movement helps us to advise our clients in raising as well as investing in fixed income securities.

The outlook remains positive for both government securities and corporate debt market as all economic indicators are signalling towards a strong growth trajectory. The governments commitment to remain in the IMF programme and the positive signs of concluding the external debt restructuring process will enable Sri Lanka

to improve its current credit ratings from the ‘Restricted Default’ (RD) status. This will boost foreign investor confidence, and we believe that foreign investor interest in Sri Lanka will improve. “

“By 2025, the Securities and Exchange Commission (SEC) plans to roll out a cutting-edge market surveillance system in partnership with Nasdaq, designed to detect trading anomalies and ensure fairness. In a nod to global sustainable finance trends, the Colombo Stock Exchange (CSE) is developing a framework for carbon credit derivatives and launching an ESG index, positioning Sri Lanka as a key player in the ESG investment arena.

Recent amendment to CSE listing rules and the updated SEC Act are tightening investor protections, curbing insider trading, and ensuring transparency. The introduction of an independent Dispute Resolution Committee (DRC) will also ensure that investor concerns are addressed fairly.

Sri Lanka’s capital markets are undergoing significant transformations. New regulations, technologies, and infrastructure upgrades are improving market surveillance, promoting sustainability, and introducing innovative financial products. These advancements aim to attract investors, reduce risks, and enhance market efficiency. While challenges persist, the overall outlook for Sri Lanka’s capital markets is positive. “

First Capital, as a leading innovator in Sri Lanka’s capital markets,excelsinprovidingexpertguidancetoinvestors.The teamisdedicatedtohelpingclientsnavigatethecomplexities of the market, leveraging deep insights to maximize returns while implementing robust risk management strategies. With a wealth of experience that spans more than forty two years, First Capital understands the unique dynamics of the Sri Lankan capital market and offers clients tailor-made investment solutions that align with their 昀椀nancial goals and risk tolerance. With First Capital, investors can navigate the market with con昀椀dence, assured that they have a trusted partner dedicated to their success.

As the recent wildfires in California have shown, climate change is an ever-pressing global challenge, an increasing number of countries are committing to achieving net zero emissions by 2050. This ambitious goal—where the amount of greenhouse gases emitted into the atmosphere is balanced by the amount removed—has gained significant traction in international climate policy. As we look ahead to the rest of 2025, what are the key developments around the world for countries taking on the challenge of reaching net zero?

Achieving net zero emissions by 2050 involves drastically reducing the amount of carbon dioxide (CO2) and other greenhouse gases released into the atmosphere. This reduction can be achieved through energy transitions, industrial decarbonization, shifting to renewable energy, and enhancing carbon removal methods, such as afforestation or carbon capture technologies.

The “net” part of “net zero” refers to balancing emissions with the removal or offsetting ofanequivalentamountofgreenhousegases,whichmeansthatwhilesomeemissions may still occur, their environmental impact is neutralised.

The European Union (EU) has set one of the most ambitious frameworks for achieving net zero emissions by 2050. The European Green Deal, unveiled in 2019, lays out a roadmap for transforming the EU’s economy and society to achieve carbon neutrality. In 2021, the EU Climate Law was passed, legally binding the goal of reaching net zero emissions by 2050, with an intermediate target of reducing emissions by 55% by 2030 compared to 1990 levels.

In2024,theEuropeanCounciladoptedtheNet-ZeroIndustryAct,aninitiativestemming from the Green Deal Industrial Plan to enhance European manufacturing capacity for net-zero technologies and key components, addressing barriers to scaling up production in Europe.

This Act will attract investments and create better conditions and market access for clean tech in the EU. The aim is that the Union’s overall strategic net-zero technologies manufacturingcapacityapproachesorreachesatleast40% of annual deployment needs by 2030.

TheUnitedKingdom(UK)becamethe昀椀rstmajoreconomyto pass a legally binding net zero emissions target by 2050. In 2019, the UK government introduced the Climate Change Act Amendment, which formally set the target of achieving net zeroby2050.TheUKalsopledgedtoreacha40%reductionin emissions by 2030, and has already made signi昀椀cant strides in sectors such as renewable energy, where wind power has become a key contributor to the nation’s electricity generation.

The raft of comprehensive policies should leverage around £100billionofprivateinvestmentasthegovernmentdevelops new industries and innovative low carbon technologies, and these ambitions will support up to 480,000 jobs in 2030.

In 2021, President Joe Biden’s administration introduced an ambitious goal to reach net zero emissions by 2050. The U.S. ClimateLeadershipplanfocusesoncleanenergyinnovation, reducing emissions from the power sector, and enhancing carbon removal technologies. Although the U.S. does not have a federal law binding the country to net zero by 2050, the Biden administration has worked to restore the country’s commitment to the Paris Agreement and is pushing for signi昀椀cant investments in clean energy and infrastructure.

While several states, such as California, New York, and Washington, have already adopted net zero targets, national progresshasbeenhinderedbypoliticalchallenges.However, recent legislative movements like the In昀氀ation Reduction Act (2022) signal progress toward clean energy adoption, electric vehicle incentives, and the expansion of renewable energy sources.

China,theworld’slargestemitterofgreenhousegases,made a signi昀椀cant commitment in 2020 when President Xi Jinping announced that China would strive to achieve net zero

emissions by 2060—a decade later than many other major economies. Despite this later deadline, China has become a critical player in the global race to tackle climate change. In recent years, China has invested heavily in renewable energy, particularly solar and wind power, and has become the world leader in electric vehicle production. The country’s long-termplans,suchasthe14thFive-YearPlanforEcological and Environmental Protection, set a pathway toward carbon neutrality,evenasChinacontinuestorelyoncoalformuchof its energy consumption.

Australia,knownforitsvastcoalexports,hasfacedsigni昀椀cant debate regarding its commitment to reaching net zero by 2050. However, in 2021, the Australian government committed to this goal at the Glasgow Climate Pact during COP26. Australia’s transition to net zero is underpinned by investments in renewable energy, green hydrogen, and emissions reduction in the industrial sector.

On 28 November 2024, the Australian Parliament passed legislation that will enable the Australian Government to put elements of its A$22.7 billion Future Made in Australia (FMA) agenda into action. The FMA agenda supports Australia’s net zero transformation. It includes a range of measures to encourage investment, including reforming and renewing Australia’s foreign investment framework, innovation grants and government-backed 昀椀nance for transformational projects.

Countries committing to net zero by 2050 are part of a growing global movement that is reshaping the global energy landscape. While progress has been made in some regions, challenges remain in balancing economic growth with environmental responsibility. Key hurdles that remain in 2025 include ensuring a just transition for workers in highemission industries, managing the economic impacts of decarbonisation, and developing technologies that can remove or offset carbon emissions at scale.

In the dynamic world of 昀椀nancial markets, where competition and innovation go hand in hand, the emergence of new brokerage 昀椀rms never goes unnoticed. One such standout is XPBEE, a company founded by a group of seasoned traders determined to create a multifunctional ecosystem tailored to the needs of both novice and professional market participants.

The name XPBEE encapsulates two core ideas: Experience and Unity (Bee). These principles highlight the company’s origins and approach. As traders themselves, the founders infused their passion for trading and their drive to improve market conditions intothecompany’sfoundation.Whatbeganasasmall community of trading enthusiasts aiming to craft a unique solution for active trading has grown into what XPBEE is today.

The vision for their own brokerage arose from years of experience navigating various trading platforms. The founders encountered many of the typical challenges faced daily by traders, including high spreads, slow order execution, a limited range of instruments, and insuf昀椀cient support. These obstacles inspired them to create a company that combines the best industry practices with an intuitive interface.

The development of XPBEE was meticulously planned. Initially, the team brought together specialists with extensiveexpertiseintrading,IT,andriskmanagement, laying a robust foundation for the company. Next came the testing of platforms designed to meet the demands of traders across all levels. This process led to the selection of not just one but two platforms capable of facilitating CFD trading across more than 1,000 instruments. These include currency and

cryptocurrency pairs, gold and silver, energy resources, stock indices, ETFs, and shares of leading companies in the US, Europe, and Asia. Negotiations are currently underway to integrate two additional platforms, which willenableclientstotradeUSfuturesandbuyorsellreal digital assets.

XPBEE offers truly unique conditions. Narrow spreads minimise trading costs, making the market accessible even to beginners. Instant order execution ensures high-speed transactions, crucial for active traders. A wide range of instruments provides opportunities to implement diverse strategies. Additionally, the company actively supports its clients by offering training through a partner educational centre and 24/7 technical assistance.

For XPBEE, the goal is not merely to provide services but to foster a community where traders can share experiences and grow professionally. The company aspires to be a place where every trader, regardless of theirskilllevel,feelspartofalarge,thrivingnetwork.This approach empowers clients to achieve their 昀椀nancial goals, paving the way to stable pro昀椀ts and 昀椀nancial independence.

Transparency and integrity are the cornerstones of XPBEE’s business philosophy. Every process, from registration to fund withdrawal, is streamlined and clear. This fosters an atmosphere of trust, where clients can be con昀椀dent in the safety of their funds and the fairness of operations. Such practices not only bolster the company’s reputation but also promote long-term collaboration with its clients.

The launch of XPBEE exempli昀椀es how a team of professionals, deeply attuned to traders’ needs, successfully created a product that meets the highest industry standards in a remarkably short time. It is for this reason that International Investor Magazine awarded XPBEE the title of Fastest Growing Broker 2024.

Of course, XPBEE is far from resting on its laurels. The company’s future plans include expanding its service offeringsandenteringnewmarkets.Particularemphasis will be placed on developing additional training programmes and enhancing client engagement to ensure that every user can unlock their full potential for professional growth and ultimately achieve complete 昀椀nancial freedom.

by Jake Webster, Managing Director, The Seventy Ninth Group

When my family and I saw an opportunity to move into Asset Management, we didn’t hesitate. With an extensive backgroundinRealEstate,theevolutiontoAssetManagement was a natural progression.

Theopportunityweidenti昀椀edwastogiveinvestorstheunique access we have to acquire assets at a fraction of their value and share the upsides. We’d been doing it ourselves for generations and our existing partners had an appetite to join us, it was a no-brainer.

What makes us different is that we only make a pro昀椀t when our clients make a pro昀椀t. We don’t charge any fees, we consistently deliver fantastic results, and we’ve never had a project default. It’s a partnership in every sense of the word. We put our own money into our acquisitions alongside our clients, we’re in it together.

How we differentiate from competitors is our unique ability to 昀椀nd value combined with the basic principles of buy low, sell high. We’re industry disruptors, grafters, and we love a challenge.

As a family we’ve been in business for decades, things really took off in the eighties when my father Dave Webster got into property,becomingBritain’sbiggestprivatelandlordby2006.

My father went on to establish several other successful business ventures and worked as a consultant, he then founded the Seventy Ninth Group in 2020, with my brother Curtis and I. Utilising our collective skill sets and Dave’s signi昀椀cantexperience,we’veexperiencedremarkablegrowth ever since.

We have continued to grow our property portfolio, branching out from short term lucrative development opportunities. Additionally, we’ve expanded into natural resources, acquiring several junior mining assets in diverse regions like Canada and Guinea.

In the last twelve months we’ve experienced signi昀椀cant growth,havingstartedfromjustahandfulofstafftooverone hundred staff in of昀椀ces globally.

Since the start of 2024, the group has undertaken several major real estate projects, including a £15m development in Loch Ness and a £250m development in Anglesey, with more multimillion-pound initiatives in the pipeline.

Additionally, we’ve launched our own private equity fund, securing£10minpledges,andprovidingauniqueinvestment opportunity on listed exchanges.

The expansion continues, with ambitions to recruit many morepermanentmembersofnewstaffintheUKandglobally, in a variety of positions. We’re also expanding our network of partners with an additional 200 advisors and agents.

2024 was an incredibly exciting year for the group, with the launch of its Disruptor Tour taking place at our annual Dubai Golf event attended by hundreds of high-pro昀椀le existing and prospective clients.

2025 promises to be a landmark for us as we prepare to enter the aviation sector and undertake some of our most signi昀椀cant acquisitions yet. It’s an incredibly exciting time to invest with our team.

In today’s climate of economic uncertainty, the investment landscape can feel daunting. However, amidst these challenges, there are signi昀椀cant opportunities for those who have the expertise and industry knowledge to know where to look.

For experienced investors like us, these conditions represent an opportunity, allowing us to acquire distressed assets with high growth potential. By purchasing these assets, we can helpourclientsbene昀椀tfromportfoliosthatnotonlywithstand market pressures but capitalise and pro昀椀t from them.

Diversi昀椀cation acts as a buffer against market downturns.

While one area of the market may be struggling, other investments may be thriving, providing a defense against volatility. This strategy not only shields against potential losses but positions investors to seize opportunities across a broader range of markets that we can access.

Consider the housing market, for instance. As landlords exit the buy-to-let sector, savvy investors are stepping in. Real Estate Investment Trusts (REITs), property funds, and 昀椀xedincome products are providing opportunities to diversify and reduce risk.

Thekeyisadaptability,seeingpotentialwhereothersseeonly challenges. This is what sets the professionals apart from the amateurs, turning market turbulence into an advantage.

Oneareawhereweareactivelyinvestingisshort-termholiday lettings in the UK. Following the pandemic, domestic holidays have surged in popularity, and we’ve seized the opportunity by acquiring and developing sites across the country. This approach marks a shift from the long-term lettings model, which has become increasingly dif昀椀cult to navigate.

Our strategy is rooted in anticipating market trends and seizing opportunities, a central approach our family has followed for years. By diversifying investments, we’ve not only weathered periods of instability but thrived in them.

Building a resilient portfolio demands a deliberate blend of diverse assets. Fixed-income products ensure stability with reliable returns during uncertain times, while private equity

funds offer growth potential and exclusivity.

But don’t overlook the power of alternative investments, hedge funds, commodities, and venture capital. Each of these offer sophisticated strategies for navigating market complexities.

Our natural resources division has been active in gold, focusing not only on the commodities market but also in gold exploration through strategic acquisitions in Guinea and Canada. As global demand for gold continues to rise, driven by its role in technology and as a safe-haven asset during uncertain times, this investment opportunity provides another avenue for expansion and growth.

The strength of a strategic portfolio lies in its ability to spread risk and adapt to changing market conditions. It’s crucial to understand how different assets perform under varying economic scenarios and global events.

The current market environment requires a sophisticated, multi-faceted investment strategy. While the markets may be unpredictable, your investment approach doesn’t have to be.

Embracing diversi昀椀cation across different asset classes not only safeguards your wealth but also positions you to capitalise on opportunities as they arise. By navigating uncertainty, you can guide yourself toward a future where your investments thrive, not just remain secure.

ATFX Africa has established itself as a prominent force in online trading, earning recognition for its commitment to innovation, transparency, and client satisfaction.

ATFX Africa is committed to expanding its footprint across the continent, providing a seamless trading experience through a cutting-edge platform that offers a wide array of opportunities tailored to clients’ needs. Recently, the companyimplementedacomprehensivestructuralupgrade, enhancingeveryaspectoftheclientjourney—fromsimpli昀椀ed sign-ups to expedited withdrawals. These updates not only improve the user experience but also streamline critical processes that make trading smoother and more ef昀椀cient for every client. These advancements re昀氀ect ATFX Africa’s dedication to leveraging innovative technology, fostering trust, and building long-lasting relationships with valued clients and partners.

At the core of ATFX Africa’s success is its unwavering dedication to integrity, transparency, and service excellence. A highly skilled and committed team provides personalised support, fostering strong relationships and instilling con昀椀dence among its clients. This level of support ensures that clients can trust ATFX Africa to guide them through market complexities and achieve their trading objectives. By prioritising trust and client satisfaction, ATFX Africa has established itself as a reliable and dependable trading partner, enabling traders to achieve their 昀椀nancial goals. This has resulted in a loyal client base and solidi昀椀ed ATFX Africa’s position as a go-to partner for traders seeking both excellence and reliability in the 昀椀nancial markets.

ATFX Africa’s impact extends far beyond 昀椀nancial markets, actively engaging in social responsibility initiatives that createslastingvalueinlocalcommunities. Collaborationwith institutions such as UNISA and the Thabo Mbeki Foundation are prime examples, which focuses on alleviating student debt and support education for future generations. These initiatives demonstrate ATFX Africa’s dedication to making a positive societal impact, in line with its mission to contribute to Africa’s broader economic growth.

Receiving prestigious awards such as Best Broker - Africa and Most Trusted Broker highlights ATFX Africa’s exceptional contributions to the trading industry. These accolades are a testament to the company’s relentless pursuit of excellence and its ability to consistently deliver innovative solutions.

“At ATFX Africa, we are honoured to be recognised with these prestigious awards. As we look ahead to 2025, our commitment to understanding and meeting our clients’ needs remains stronger than ever, fostering enduring

relationships built on trust. Equally, we remain dedicated to uplifting the communities we serve, reflecting our core values of excellence and responsibility.”

- Linton White, Country Head of ATFX Africa.

Looking ahead, ATFX Africa is poised to expand its footprint and rede昀椀ne the trading landscape across Africa. With a steadfast focus on innovation, trust, and community engagement, the company is well-positioned to empower traders while contributing to the continent’s economic growth.

AT Global Markets SA (Pty) Ltd is an authorised 昀椀nancial services provider (FSP44816) and licensed OTC derivatives provider. This content does not constitute advice. Should advice be necessary, please consult a 昀椀nancial advisor. Trading carries a high degree of risk and is not suitable for all investors.

Lotus has introduced Theory 1, its first concept car that encapsulates the future of intelligent performance vehicles. Alongside this exciting reveal, the company has launched The Lotus Theory, a new design manifesto that will serve as the foundation for all future Lotus vehicles. This manifesto is underpinned by three core principles – Digital, Natural, and Analogue (DNA) – which together embody the brand’s vision for the future of automotive design.

The Digital principle highlights an immersive, intelligent, and intuitive driving experience, integrating advanced technologies to enhance functionality and interaction. Natural brings to life a human-centric approach, focusing on emotional connection and the tactile, organic elements that make driving a Lotus unique. Finally, Analogue represents the brand’s commitment to advancing performance engineering, drawing on its rich motorsport heritage to ensure a perfect blend of raw power and cutting-edge technology.

By fusing these principles with the latest innovations from Lotus, Theory 1 is designed to simplify and elevate the driving experience, ensuring the car adapts to the driver’s needs and delivers the ultimate driving performance.

A standout feature of Theory 1 is the innovative LOTUSWEAR™ system, which aims to provide a deeply personalised driving experience. This cutting-edgesystemisdesignedtoconnectthedrivertothecarinaway that evokes pure excitement and emotional engagement. LOTUSWEAR™ features an adaptive, lightweight, robotic textile material that communicates with the driver and passengers in real time, enhancing comfort,support,andoverallin-carexperience.Thisisachievedthrough in昀氀atable pods in the seats and steering wheel, which adjust in realtime to offer additional grip, support, and haptic feedback. For example, pulses on the steering wheel will alert the driver when it’s time to turn, providing seamless communication between the car and driver.

The system also includes 昀椀ve drive modes – Range, Tour, Sport, Individual, and Track – each designed to optimise the car’s ef昀椀ciency, performance, and comfort based on the surrounding environment.

Theory 1 introduces a seamless integration of projections, screens, and haptics to create a borderless user experience. The car provides information to the driver using intuitive, analogue components and digital systems, including intelligent environmental lighting and laserlightprojections.Forexample,thecaruseslaserlightsonthedashboard to indicate turning directions, while RGB LEDs on the suspension modules signal acceleration or braking needs. The system also features immersive 3D graphics that evolve in response to vehicle speed and driving modes, improving the driver’s peripheral vision and minimising distractions.

In line with its commitment to sustainability, Lotus has embraced a minimalist approach to material use in Theory 1. The car is constructed using only ten main A-surface materials, each chosen for its lightweight, durable, and recyclable properties. These materials include recycled carbon 昀椀bre, titanium, polycarbonate, and aluminium, re昀氀ecting Lotus’ dedication to a circular economy and ecofriendly manufacturing processes.

The car’s design also utilises innovative laser lighting technology, developed in collaboration with Kyocera SLD Laser,toreducecomponentsizeandweightwhileenhancing both performance and safety.

PERFORMANCE AND DYNAMIC EXCELLENCE

Theory 1 is not just about innovation and design – it’s

also about exceptional performance. Drawing on Lotus’ motorsportheritage,thecarfeaturesadvancedaerodynamic and cooling systems designed to maximise ef昀椀ciency and stability. This includes a nose cone with drag-reducing de昀氀ectors, a contoured under昀氀oor for improved air昀氀ow, and side pods designed to isolate turbulent wake from the car’s air昀氀ow. The car’s low centre of gravity, combined with its active and passive aerodynamics, ensures exceptional handling and stability.

Theory1introducesagroundbreakingsportscardoorsystem, designedforeaseofaccess.Thereverse-opening,wrap-over doors enable occupants to enter the car with ease, even in tight spaces, while the three-seater con昀椀guration places the driver in the centre for optimal visibility and control. The car also features a steer-by-wire system, allowing for precise control and smooth driving dynamics.

There are many reasons to choose Eccelsa Aviation for your trips to Sardinia

· State-of-the-art dedicated Business Executive Terminal

· Gateway to Costa Smeralda and Sardinia since 1963 *

· 3 km from the Marina of Olbia and 25 km from Porto Cervo

· Complete under the wing services for aircraft up to A340 and B747

· Tailored passenger services

· Full plannig for crew stay(s) at preferential rates

· Hangarage recovery

· Maintenance service in cooperation with Meridiana Maintenance

· Slot- and PPR-free landing and take-off **

· Great value-for-money services and easy payment methods

· Award-winning professional and experienced multi-language staff

However, you can forget about all of them.

In fact, what you’ll really appreciate is how you will feel

And that’s all the difference between simply landing and truly arriving.

So whatever your reason for visiting Sardinia, keep in mind you are always welcome to

Costa Smeralda Airport, 07026 Olbia, Italy Air Freq. 131.675 | Fax +39 0789 563 481 | Tel +39 0789 563 480 handling@eccelsa.com | www.eccelsa.com

FlordeCañaRum,a traditionofexcellence andsustainability

For 135 years, Flor de Caña has been crafting some of the world’s 昀椀nest rums. Born from a family’s passion and a commitment to excellence, this iconic brand has etched its name in the annals of history. As the brand celebrates this milestone anniversary in 2025, let’s delve into the captivating story of Flor de Caña.

The journey began in 1890 when Alfredo Francisco Pellas Canessa, a visionary Italian, established a distillery at the foot of the San Cristóbal volcano in Nicaragua. This fertile land, blessed with ideal climatic conditions, proved to be the perfect setting for crafting extraordinary rum. Over the decades, the family has nurtured this legacy, passing down their expertise from generation to generation.

One of the secrets behind Flor de Caña’s exceptional quality lies in its meticulous natural aging process. Each drop of rum is patiently aged in hand-selected bourbon barrels for up to 30 years. This extended aging period, combined with the absence of arti昀椀cial additives or sugar, results in a smooth, complex, and incredibly 昀氀avorful spirit.

Flor de Caña is more than just a premium rum brand; it’s a pioneer in sustainable spirits production. The company has been committed to environmental responsibility and social impact since its inception. As the world’s 昀椀rst Carbon NeutralandFairTradecerti昀椀edspirit,FlordeCañasetsanew standard for the industry.

By harnessing 100% renewable energy, capturing CO2 emissions, and planting over a million trees, the brand minimizes its ecological footprint. Additionally, Flor de Caña ensures fair labor practices and supports local communities, fostering a positive impact on society.

Flor de Caña’s unwavering commitment to quality has been recognized globally. The brand has garnered numerous awards and accolades, including the prestigious title of “Global Rum Producer of the Year” by the International Wine and Spirit Competition.

Whether you’re a seasoned rum connoisseur or a curious newcomer, Flor de Caña offers a truly exceptional drinking experience. From sipping neat to crafting elegant cocktails, this premium spirit is sure to delight your palate.

As Flor de Caña celebrates its 135th anniversary, we raise a glass to this timeless tradition. It’s a testament to the brand’s enduring legacy, its unwavering commitment to quality, and its pioneering spirit.

Azerbaijan, located at the crossroads of Europe and Asia, is rapidly emerging as a hub of economic innovation. Rich in cultural heritage and strategically positioned along the Caspian Sea, the nation is transitioning towards sustainable development and economic diversi昀椀cation. Historically reliantonitsabundantoilandgasreserves,Azerbaijanisnow shifting focus towards non-oil sectors such as agriculture, manufacturing, transportation, and tourism as part of its broader strategy to decarbonize the economy and create a more sustainable and balanced economic framework. In 2024, Azerbaijan’s economy showcased resilience, achieving 4.3% growth driven by non-oil industries like transportation, construction, and manufacturing. By October 2024, GDP surpassed 103,495.8 million AZN, and projections

indicate a 6.4% expansion of the non-oil sector by yearend. This robust performance re昀氀ects strategic investments in infrastructure, regulatory enhancements, and workforce development,positioningAzerbaijanasapremierdestination for global investors.

Asaprivate-sectorleader,PASHABankhasbeeninstrumental in Azerbaijan’s diversi昀椀cation journey. Established in 2007, the bank has continuously aligned its 昀椀nancial solutions with the nation’s evolving priorities, particularly focusing on emerging sectors such as agriculture, retail, construction, and transportation.

• MarketLeadership:PASHABankholdsa21.3%sharein businessloansandnearly17%ofdeposits,strengthening itspositionasa昀椀nancialpowerhouse.

• RegionalIntegration:WithbranchesinGeorgiaand Turkey,thebankfosterscross-bordertrade,connecting dynamicmarketsinBaku,Tbilisi,andIstanbul.

• GlobalPartnerships:Collaborationswithinstitutionslike BNYMellonandRaiffeisenBankhaveenabledthebankto provideworld-classservices,reinforcingitsreputationas atrustedpartnerforlocalandinternationalbusinesses.

• FinancialStability:PASHABank’sstrong昀椀nancials, includingaloan-to-depositratioof47.2%,underscore itsresilienceamidglobalchallenges.Notably,thebank’s contributionshavesupportedAzerbaijan’screditrating upgradebyFitchRatingsfrom“BB+”to“BBB-”in2024.

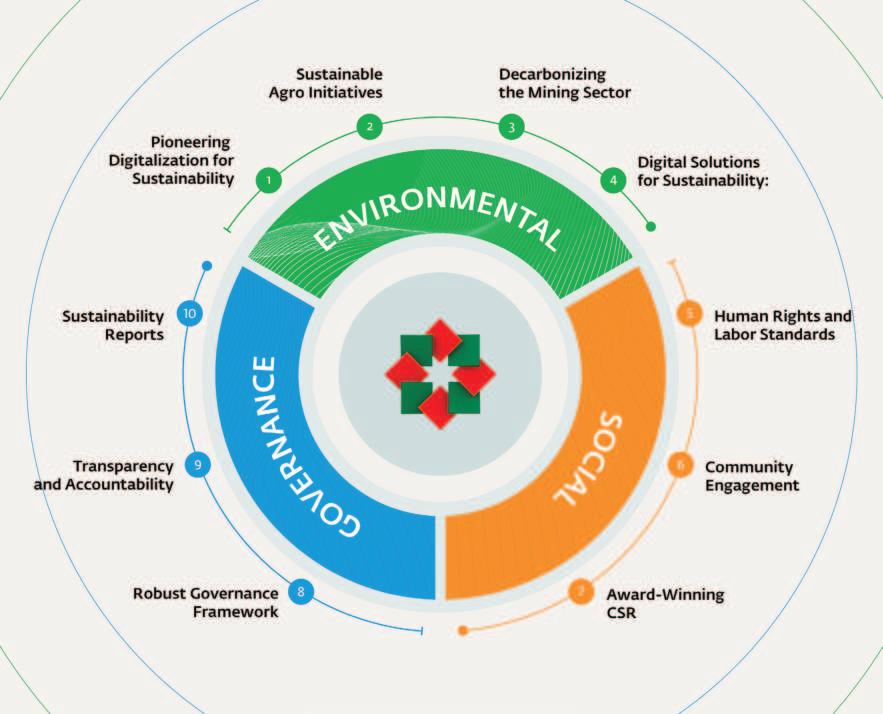

As global economies shift towards sustainability, PASHA Bank stands out as a pioneer in Environmental, Social, and Governance (ESG) initiatives in Azerbaijan. The bank is actively supporting Azerbaijan’s green transition by:

• Developing Sustainable Finance Products: Offering tailored solutions for renewable energy and ESG-aligned projects.

• Engaging Stakeholders: Hosting educational sessions featuring international experts like Bloomberg NEF and Deloitte to equip businesses with tools for integrating sustainable practices.

• Aligning with Global Standards: Ensuring compliance with Azerbaijan’s forthcoming green taxonomy and global climate commitments, as highlighted during COP29 in Baku.

These efforts not only attract environmentally conscious investors but also reinforce PASHA Bank’s role in advancing

Azerbaijan’s long-term prosperity. In 2025, PASHA Bank was honored with the Best Bank Azerbaijan Award at the International Investor Awards, celebrating its leadership in sustainability and innovation within non-oil sectors.

PASHA Bank’s ambitions extend beyond Azerbaijan. Its brancheswithinthe“Baku-İstanbul-Tbilisi”economictriangle are critical to fostering regional economic integration, providing vital corporate and investment banking services.

Looking to the future, PASHA Bank plans to pursue a public listing, locally and internationally, to attract global capital and elevate its standing on the world stage.

AsAzerbaijancontinuestodiversifyitseconomyandembrace global trends, PASHA Bank remains at the forefront, shaping a prosperous and sustainable future. With its unwavering commitmenttoexcellence,innovation,andresponsibility,the bank is set to remain a key driver of Azerbaijan’s success for years to come.

For more than 25 years, Swisscom, the leading ICT company in Switzerland, has been improving sustainability throughout its supply chain.

By 2035, Swisscom aims to achieve net zero greenhouse gas emissions across its entire value chain. The company has reduced direct emissions by over 85% since 1990 by pursuing a consistent sustainability strategy comprising 100% renewable energies, heat pumps, postconsumer recycled plastic (PCR) in Swisscom products, and digitalisation to support environmentally friendly business operations.

AsamemberoftheJointAllianceforCorporate

Social Responsibility (JAC), Swisscom has introduced supplier climate programmes to help and encourage its suppliers to reduce the carbon footprint of their products. Their progress is tracked via the digital platform Sweep.

Swisscom also remains focused on halving direct CO2 emissions from its vehicle 昀氀eet by 2025 and fully eliminating them by 2030. The move to electric for the company’s 昀氀eet of around 2,500 vehicles will signi昀椀cantly reduce operational emissions. To help make this a reality, Swisscom has taken the ambitious step oforderingaround1,200electricvehiclesforthe summer of 2024.

“This recognition confirms that we are on the right track with our ambitious sustainability goals. This motivates us to work even harder and continue pursuing our goals,” says Saskia Günther, Head of Sustainability at Swisscom.

Smart applications are the ICT industry’s biggestcontributiontoclimateprotection.They are helping to reduce emissions in the 昀椀elds of building technology, mobility, agriculture and industry, amongst others. Swisscom offers various services in this area. Some help companiesreducebusinesstravel,whileothers encourage the use of climate-friendly, energyef昀椀cient cloud services, for example. Since 2016, Swisscom has been offering IoT (Internet of Things) services to help Swiss companies

develop intelligent services, such as remote monitoring systems to save heating energy.

Swisscom’s new data-driven sustainability portfolio has been available since 2022. Swiss companies are given support in selecting and implementing the most suitable ESG tools for their requirements. These tools professionalise sustainability management and help the companies achieve their ambitious sustainability goals. For guidance, Swisscom published a Sustainability Software Radar, analysing around 250 ESG software providers andtheirsolutions.In2024,Swisscom’sportfolio of environmentally friendly services helped customers quadruple their emissions savings.

Besides its environmental commitments, Swisscom is also committed to getting everyone ready for the digital future by equipping them with the necessary media skills. For many years, the telecommunications company has been working to ensure that the entire Swiss population can take advantage of the opportunities offered by digitalisation – while also raising awareness of possible dangers,suchasthoseposedbycyberbullying. The Swisscom Campus online content hub providestipsandadviceonusingdigitalmedia for children, young people, parents and older people. It also provides a comprehensive educationprogrammewith25differentcourses covering all areas of life.

Saskia Günther comments: “In my role as Head of Sustainability and also as a mother of two, I see the importance of strengthening media literacy in society. This is why our explicit goal, by 2025 at the latest, is to support two million people a year in the use of digital media.”

Banco Invest is proud to receive the “Best Private Bank 2025” award from International Investor Magazine. This recognition reflects our committed dedication to providing exceptional service and leadership in the private banking industry.

In the delicate art of wealth management, Banco Invest is a trustedleader,knownforitsexpertiseandstrategicapproach.

With a strong foundation in 昀椀nancial knowledge, we focus on the effective management of savings and investments, offering customised solutions designed to meet the distinct 昀椀nancial objectives and aspirations of each client.

At Banco Invest, we recognise that each client’s 昀椀nancial situationisdifferent,andwearededicatedtoofferingtailored solutions that cater to their individual needs. Our mission is to foster long-term relationships by delivering personalised advice and strategies aligned with their unique goals and risk tolerance. By thoroughly understanding their 昀椀nancial

aspirations, we empower our clients to make informed decisions and con昀椀dently pursue their path to 昀椀nancial success.

With a broad and diverse range of investment opportunities, both locally and globally, we are committed to offering our clients the 昀氀exibility and choice they need to build resilient, well-rounded portfolios. Our approach ensures that these portfoliosarenotonlydiversi昀椀edbutalsocarefullytailoredto alignwitheachclient’sunique昀椀nancialgoalsandobjectives. Whether a client’s focus is on achieving long-term capital growth, planning for a secure retirement, or preserving wealth for future generations, we bring deep expertise and

a strategic approach to navigate these complex 昀椀nancial areas effectively.

Atthecoreofourserviceistrust,avalueweprioritiseinevery interaction. We believe that through close collaboration, transparent communication, and ongoing support, we can empower our clients to reach their long-term 昀椀nancial aspirations. Our team of professionals is dedicated to offering specialised advice, building lasting relationships, and providing thoughtful guidance throughout the various stages of life. We understand that the 昀椀nancial landscape is constantly evolving, and we pride ourselves on adapting to these changes while ensuring our clients are well prepared for any challenges or opportunities that may arise.

At Banco Invest, we are committed to upholding the highest standardsoftransparencyandindependence.Ourapproach centers around providing impartial, client-focused advice, always aimed at advancing our clients’ 昀椀nancial well-being.

As a responsible 昀椀nancial institution, we emphasise the importanceofsustainableandsociallyresponsibleinvesting. We ensure that our clients’ portfolios are not only designed to deliver strong 昀椀nancial returns but also make a positive impact on society and the environment.

We are honoured to have been awarded the “Best Private

Bank 2025” award by International Investor Magazine. This distinguished recognition inspires us to further elevate our standards and reinforces our dedication to helping clients achieve enduring 昀椀nancial success.

Discover the distinctive approach of Banco Invest. Whether you are a seasoned investor or just beginning your 昀椀nancial journey, we are dedicated to providing strategic guidance and personalised support at every stage, ensuring that your 昀椀nancial goals are met with expertise and precision.

Together, we can shape a brighter 昀椀nancial future for you and your loved ones.

Contact us today to learn why we were honoured with the “BestPrivateBank2025”awardandhowourtailoredsolutions canhelpyouachieveyour昀椀nancialgoals.Yoursuccessisour greatest achievement.

From its inception, SpaceVIP has been dedicated to educating the public about the vital role of space and space technology in improving life on Earth and advancing global sustainability goals.

SpaceVIP’s private astronauts contribute to critical space research, and during our Michelin-star dining experience aboard Spaceship Neptune, renowned chef Rasmus Munk will craft a narrative through Holistic Cuisine. This immersive storytelling challenges diners to re昀氀ect on humanity’s responsibility to protect our planet, inspiring a deeper connection to Earth and all its inhabitants.

The Space Prize Foundation, our non-pro昀椀t arm, empowers young people by highlighting the transformative power of the space economy. Our core message, Why Space Matters to Earth, emphasizes that space literacy is essential for addressing humanitarian and environmental challenges. Satellite technology, for instance, provides vital internet connectivity and Earth observation data, fostering solutions for education, healthcare, business, and governance.

By leveraging space technology, we can help close the wealth gap, create opportunities across economic sectors, and build a more sustainable and equitable future for all.

Alandalus Property Company is a premier commercial real estate developer and asset management 昀椀rm listed on the Saudi Stock Exchange (Tadawul). With a solid foundation built on visionary leadership and market expertise, Alandalus has become a key player in Saudi Arabia’s dynamic real estate landscape. Established in 2006, the company has consistently delivered high-quality projects, establishing itself as a leader in retail, hospitality, and of昀椀ce spaces.

“At Alandalus Property, we are proud of our journey as a trusted real estate developer and asset manager in Saudi Arabia. Our commitment to growth, sustainability, and innovation has positioned us to seize the opportunities presented by Vision 2030 and beyond. We remain dedicated to delivering value-driven developments that enrich communities and create lasting returns for our investors.”

– Faisal Al Nasser, CEO