The build-up to the 2020 US election has been like nothing we have witnessed before. More than 75 million Americans have voted early and nearly 50 million of them by post, in a surge driven by the covid-19 pandemic. With deep-running divisions between the two presidential “rivals” and their supporters, as well as Amy Coney Barrett’s appointment to the supreme court, the polarisation of US politics has rarely been more stark. As the world waits with bated breath to see who will emerge victorious, can anyone answer how this election will impact the US investment scene (p.12).

This year has seen many businesses forced to adjust to a “new normal” imposed by a deadly virus. In our final edition of 2020, a number of our interviewees detail their response to the challenges they have faced this year but what of the future? We examine how Islamic Finance could be the way forward in helping navigate the ever-increasing economic turbulence (p.48).

From one crisis to another, almost daily a new report describes the perilous extent of why the climate crisis cannot be ignored. We look at the role that climate risk reporting has to play in this crucial matter (p.20) and whether a circular economy could be the answer to a new, more prosperous future (p.8).

The financial industry is also beginning to wake up to the importance (and benefits) of gender inclusion. Anastasia Soloveva, CEO of Athena Bank, reveals the value of financial education for women (p.18) and we profile the ‘Making Finance Work for Women Virtual Summit’ (p.32). In addition, we speak to Areej Mohsin Darwish, Oman’s Businesswoman of the Year, about the challenges of leadership and her rise to the top (p.66).

And what better way to end the year than recognising the hard work and perseverance of organisations across the globe. My sincere congratulations to all individuals and companies that have bagged International Investor awards (p.69).

Raj Kaur Editor

08

How history has forged the path to a circular economy

Looking back at how the global economy has evolved from the prescience age to post-digital

12 The impact of the US election on the American investment scene

How will the result affect policies and international relations?

16

Perfecting the art of service

The Okkami digital solution to ef昀椀ciency whilst maintaining customer satisfaction

20 Climate’s risky business

Adapting business practices to challenges posed by climate change

24

Investing in young companies

Chief Strategy Of昀椀cer at FX Primus, Manmohan.S shares his story to being awarded most trusted broker in his region

32

Making Finance Work for Women

The annual summit explores how to help women recover from the current economic and health crises

34

Investing in Cannabis

The potential investment in weed as more nations legalise cannabis

38

Taking the FX industry by storm

How Tomasz Wisniewski from Axiory Intelligence has risen the ranks

40 Invest in Sharjah

Driving the continued transformation of this Arab emirate

42

The changing landscape of trading

How the pandemic and traders from different backgrounds are transforming the trade scene

44

Postal voting in the US election

What is the controversy and will it affect the outcome?

48

Islamic Finance in tackling Covid-19

Could Sharia-compliant 昀椀nance be the answer to economic challenges posed by the pandemic?

52

Behind the scenes of an award-winning platform

We ask Bybit what’s their secret to success in such a competitive industry

58

Scaling 昀椀nancial reporting accuracy

Private Wealth Systems’ CEO, Craig Pearson, explains how data accuracy can cost a 昀椀rm

66

In conversation with... Areej Mohsin Darwish

The Outstanding Businesswoman of the Year winner reveals what it takes for a woman to succeed

By Harrison Wavell, Schools & Colleges Programme Manager, Ellen MacArthur Foundation

Put simply, the circular economy is a way of designing, making, and using things within the limits of the planet. And yet for anyone truly engaged in the topic there is something intriguing about it, a sense that, behind this simple idea, there is a far richer story.

For the sake of simplicity, we can split this story into three parts: the pre science worldview, the scienti昀椀c worldview of the enlightenment, and the emerging worldview of the digital age.

In the pre-science worldview, our understanding of the universe came about primarily through observation of our natural surroundings coupled with intuition and religious precepts. We had no reliable frameworks or theories for guidance. The constants that guided life were the divine entities embodied in the sun, moon, stars, and seasons. Religion not science explained how the world worked: in essence, that humanity was at the mercy of the Gods whose heavenly will was re昀氀ected on Earth.

This was a period marked by radical changes in perspective and ideals, culminating in a fervent belief in the power of the rational mind to transform humanity. The result was a number of important inventions, books, essays, discoveries, laws, and two signi昀椀cant revolutions: The American Revolution (1775–1783) and the French Revolution (1789–1799).

One of the era’s most signi昀椀cant breakthroughs was Isaac newton’s ‘Philosophiae naturalis Principia Mathematica’ (Mathematical Principles of natural Philosophy) published in 1687. In it, newton set down the three laws of motion and the law of universal gravity that would become the building blocks of modern physics.

During this time of discovery, science took centre stage leading to a new worldview that would eclipse the old. Humanity was no longer positioned at the fringes of the universe, helpless and at the mercy of the Gods, but instead placed at the centre of it, able to measure and quantify the physical world and understand its laws through careful analysis.

The best we could do was to be in accord with these powerful forces and hope that through‘correct’ action the Gods would look favourably upon us. This conception of the world can be seen in the myriad elements of ritual and sacri昀椀ce common to early polytheistic cultures. Human sacri昀椀ce, as a means of appeasing the Gods in the hope of a good harvest or good hunting, for example, was common to the ancient Egyptians and the Aztecs.

The spiritual world was all important because it was seen as indivisible from the physical world; even to the point that man’s creative inspiration came from Gods or muses. The word ‘inspiration’ stems from the latin ‘inspirare’ (‘to breathe or blow into’) which came to be used in early forms of written English in the 昀椀gurative sense of being ‘moved by divine guidance’.

Between the 14th and 17th Centuries, the cultural movements of the Renaissance and Humanism gathered momentum, laying the seeds of a new worldview that would grow to maturity around the time of the Enlightenment (17th and 18th Century Europe). German philosopher, Immanuel Kant, summed up this era in the following terms: “Dare to know! Have courage to use your own reason!”

Ultimately, this gave rise to the three pillars of the scienti昀椀c worldview that continues to dominate our thinking to this day: understand, predict, and control. The underlying metaphor in this worldview is the universe as machine or mechanism. From this perspective, the universe is a clockwork system of interlocking parts that follow a basic set of laws. It is logical, measurable, and predictable because it operates on mathematical principles of cause and effect.

Pierre Simon Laplace (1749-1827) captured this notion clearly in his work A Philosophical Essay on Probabilities when he wrote: “We may regard the present state of the universe as the effect of the past and the cause of the future. An intellect which at any given moment knew all of the forces that animate nature and the mutual positions of the beings that compose it, if this intellect were vast enough to submit the data to analysis, could condense into a single formula the movement of the greatest bodies of the universe and that of the lightest atom; for such an intellect nothing could be uncertain and the future just like the past would be present before its eyes.”

Interestingly, faith in God was still very much alive (newton wrote more about alchemy and the Bible than he did about science) but the physical and spiritual worlds became separated where once they had been indivisible.

In western civilisation, this underlying assumption about the universe (as a machine) has permeated all spheres of life - social, cultural, and scienti昀椀c. And it has, of course, furnished us with the scienti昀椀c method of reductionism: understanding the whole through analysis of the parts.

The Father of Modern Philosophy, Rene Descartes, described the reductionist method perfectly in his 1637 publication A Discourse on the Method: “To divide all the dif昀椀culties under examination into as many parts as possible, and as many as were required to solve them in the best way... to conduct my thoughts in a given order, beginning with the simplest and most easily understood objects, and gradually ascending, as it were step by step, to the knowledge of the most complex.”

We have become so adept at using this method, which is now so ingrained in western thinking and education, that we now use it unconsciously in our approach to all manner of problems. This is useful for dealing with problems rooted in linear cause and effect such as how to 昀椀x an engine, but potentially harmful when applied to highly complex and dynamic problems such as how to tackle climate change.

THE EMERGING WORLDVIEW OF THE DIGITAL

“Science has explored the microcosmos and the macrocosmos; we have a good sense of the lay of the land.

The great unexplored frontier is complexity.”

Heinz Pagel, The Dreams of Reason (1988)

With the arrival of the digital age and the power to compute unprecedented amounts of data, came new insights that cast doubt on the certainties of a deterministic scienti昀椀c worldview. Progressively, the scienti昀椀c pillars of understanding, prediction, and control began to erode. new discoveries would prove that the universe is dynamic and nonlinear, full of interdependence and feedback. We can observe and come to recognise certain patterns, but we cannot predict or control the outcomes.

Human beings have understood this intuitively for Millennia. After all, it was Aristotle who said: “The whole is greater than the sum of its parts.” But until very recently we have lacked the tools to make sense of this complexity. now that we have those tools, we are witnessing the emergence of a new type of science known as Complexity Science (the study of complex systems). Complexity examines the nature of the relationships that exist in complex phenomena, how elements combine to produce an effect on the whole that is supremely greater than the capabilities of those individual elements. In order to have any kind of grasp on complex systems, proponents argue that we need to break out of the con昀椀nes of linear reductionist thinking and start thinking in systems.

In her book, Complexity: A Guided Tour, Melanie Mitchell writes of complex systems: “no-one knows exactly how any community of social organisms - ants, termites, humans - come together to collectively build the elaborate structures that increase the survival probability of the community as a whole. Similarly mysterious is how the intricate machinery of the immune system 昀椀ghts disease; how a group of cells organises itself to be an eye or a brain; how independent members of an economy, each working chie昀氀y for its own gain, produce complex but structured global markets; or, most mysteriously, how phenomena we call ‘intelligence’ and ‘consciousness’ emerge from non-intelligent, nonconscious material substrates.”

So what is the universe like if not like a machine? Science is now showing us that a better metaphor is one more rooted in living systems: as something alive, in 昀氀ux rather than stasis, adapting and evolving in response to feedback in in昀椀nite, unpredictable ways; more akin to a murmuration of starlings than a series of cogs whirring in a clock. This is important. As cognitive linguist George Lakoff reminds us: “metaphors are capable of creating new understandings and, therefore, new realities.” Of course, we don’t all share the same reality: indigenous peoples the world over have long identi昀椀ed with this conception of the universe as a living, breathing entity.

Where the western mind sees a world of inert things, the indigenous mind sees a world of process and relationship.

While this shift, her alded by new scienti昀椀c discoveries, might be underway, we should be careful not to do away with the mechanistic mindset altogether - it has, after all, helped humanity enormously. The Industrial Revolution was built on such principles and helped lift millions out of poverty into prosperity. The great thinkers of the future are likely to be those that can pick and choose perspectives and approaches (reductionist and systems) and apply them in their correct context, skilfully weaving the two, able to adopt a systems approach as intuitively as we now use the reductionist.

The below graphic captures the shifting focus from an educational standpoint as we approach a new way of understanding more 昀椀tting for the 21st Century.

The circular economy, as an idea, is indicative of this greater shift at play. Inspired by the principles of nature, it is entirely consistent with notions of process and relationship, of 昀氀ux and 昀氀ow rather than stasis. With 4.6 billion years of evolutionary tinkering behind it, why would we look anywhere else for inspiration?

As circular economy pioneer Ken Webster points out in The Circular Economy: A Wealth of Flows, the circular economy is “about the possibilities of abundance, of meeting people’s needs by designing out waste, and recreating the kind of elegant abundance so evident in living systems.”

In many ways we are coming full-circle, with a new scienti昀椀c understanding beginning to illuminate and reinforce aspects of our pre-science worldview, which, hopefully, will set us on a more harmonious path of living.

Seen in this context, the circular economy represents a lot more than just a clever way of using resources. The growing interest in the concept may be the outward sign of a deeper shift marking the beginning of a new and more prosperous future.

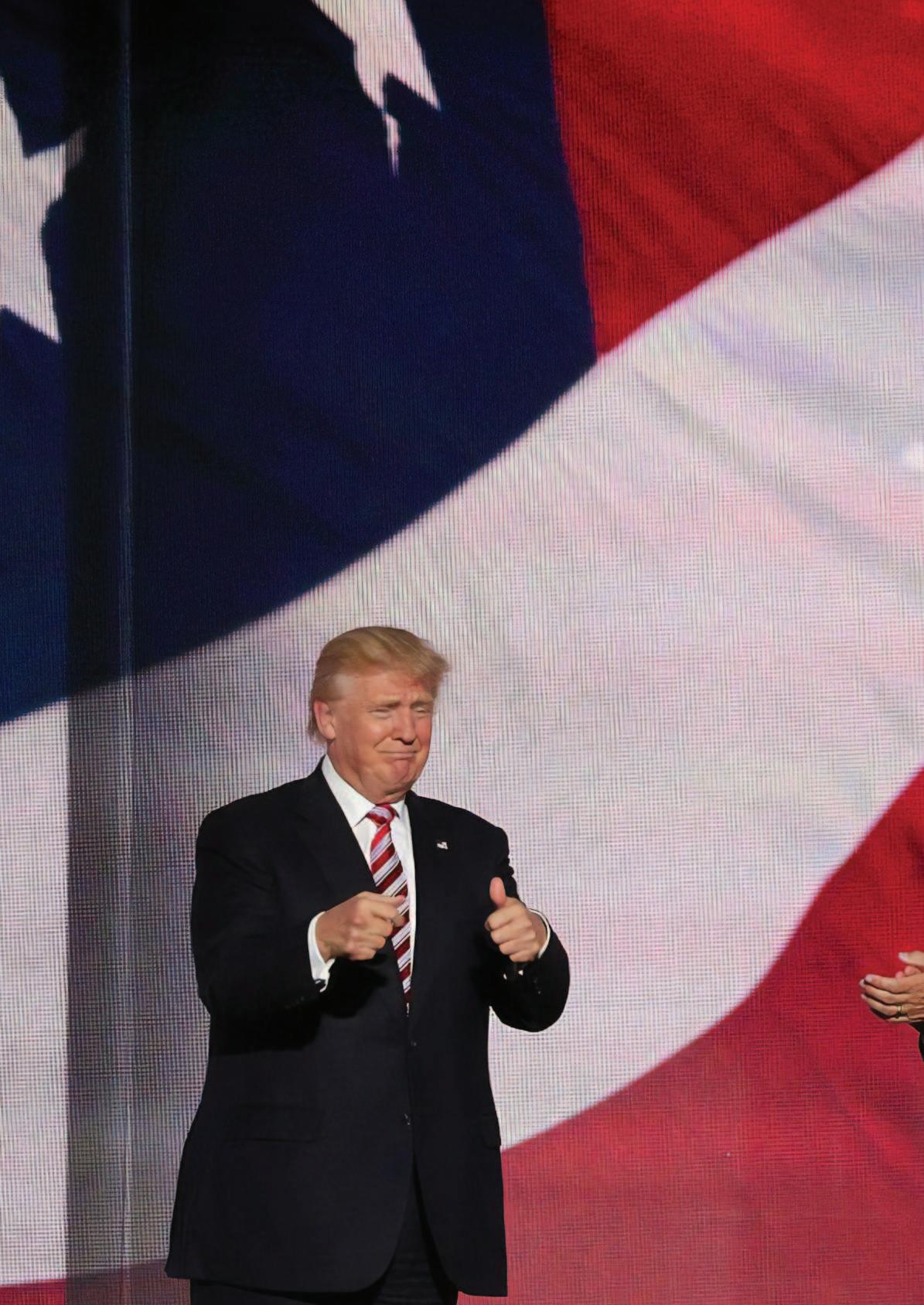

This autumn, the world will witness one of the most awaited presidential election in US history. On 3rd november, Americans will vote to elect the leader of the world’s biggest economy and one of the largest military structures. Understandably, the election’ outcome will signi昀椀cantly impact reforms, policies, and international relations.

According to a survey from the asset manager Hartford Funds, 93% of investors believe the presidential race will affect the stock market, while 84% admit they expect to change their investing habits as a result.

But should they? Let’s pull the curtain and 昀椀nd out what history can say about it…

Historical data reveals that markets’ behavior depends on whether we are looking at the midterm election years, the pre-, or post-election period.

A review of market data of the S&P 500 for the last 90 years suggests that equity and bond markets tend to behave more calmly in the 12-month run-up period prior to the presidential elections. Compared to non-election years, they have produced between 1.00% and 2.5% fewer gains (6.00% vs. 8.5% for the stock markets, and 6.5% vs. 7.5% for bond markets).

Data about DJIA indicates that, since 1833, the index has averaged 10.4% in the pre-election 12-month period, compared to 6% during the election year. According to JP Morgan Asset Management, the S&P 500’s historical volatility had been higher in election years. The reason is that investors try to “price” the probability of the candidates’ ideas.

On the other hand, the post-election period is marked with relatively lower stock market returns, with an af昀椀nity for bonds to outperform slightly. U.S. Bank Wealth Management division’s reports reveal that the stock market consistently beats projections in the year after the midterms.

When it comes to the effect of the winner’s political party af昀椀liation, conventional wisdom reveals that markets should react more positively when a Republican president is elected as the ideas are considered more market-friendly. Looking back to data collected since 1900, however, Democrat-elected presidents have been more favorable for stocks, with the DJIA averaging 9% compared to 6% for Republican presidents.

According to Russ Koesterich, chief investment strategist at BlackRock, normal variations in annual stock market returns will mitigate the difference. That is why, today, most analysts suggest that there is no difference in which party takes control over the White House. In the end, the market retains its long-term growth either way.

Source: Capital Group

The thing that can affect the market more notably is whether there is a shift in power. According to some reports, when a new party comes, stock market gains usually average 5.00%. On the other hand, when the president is re-elected, or the same party retains control, the returns average 6.5%. The reason for markets to react more positively to the latter is that they already know what to expect, and the uncertainty is lower.

However, all this could turn out wrong if the candidates give investors a major reason to start a selloff.

When it comes to the Fed, the common narrative is that it is “election neutral” as it tries to maintain a more quite policy in election years to avoid destabilizing the situation

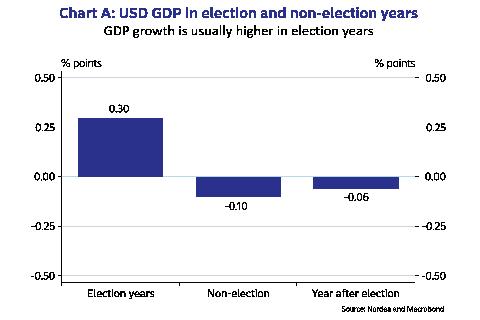

The historical records reveal that since 1948, the US economy performs slightly better in election years. GDP growth is higher with 0.3% on average, while potential growth outperforms by 0.4%. The reason is the expansionary 昀椀scal policy of the cabinet in charge ahead of elections.

An important remark is that, since 1932, an incumbent US president has never failed to win re-election, unless a recession unfolded during his time at the of昀椀ce.

If we are to analyze the presidential race at any other point in time, we would usually consider common factors like the state of the economy, the candidates’ ideas about 昀椀scal and monetary policy, views on international relations, proposed reforms, etc.

However, the equation in 2020 has a unique variable - the COVID pandemic. President Trump’s handling of the health crisis was a total disaster. The US was hit the hardest, with close to 200 000 deaths. In comparison, the EU lost approximately 15 000 fewer lives, despite its signi昀椀cantly bigger population.

The pandemic has brought uncertainty to the markets and further distorted investors’ perspective. And markets hate uncertainty. According to a 2019 Dimensional Funds report, for the period 1928 – 2016, negative market returns arose only four times, all of which accompanied by geopolitical events leading to global instabilities and market uncertainty.

All this in addition to the looming economic recession, and we have the reason why Mr. Trump went from a favorite to an underdog in the span of six months. Survey data from the Pew Foundation revealed that over 67% of the Biden voters are more like “anti-Trump” votes.

At the start of this year, the consensus was that Donald Trump would be re-elected easily, due to the resilient US economy and his favorite metric – the performance of the S&P 500. Fast forward to a month before the elections, and polls and betting markets indicate a convincing victory for Joe Biden. Even the nasdaq index that moved in line with Trump’s positive re-election prospects, now keeps climbing, despite his diminishing chances

Source: FT

Trump’s international policy and the trade war were at the core of the global manufacturing slowdown, which indicates that a potential second term will further increase the risk of escalation. In such a scenario, the most affected will be international stocks like European carmakers, for example. U.S. equities are expected to continue their rise thanks to Trump’s pressure on the Fed, the tax cuts, and the deregulation.

However, according to Stephanie Link, chief investment strategist and portfolio manager at Hightower, the market would favor a scenario where Trump is re-elected, and the Congress is split between both parties. She adds that small companies and sectors like 昀椀nancials, technology, and traditional energy might rally on the news.

For quite some time, the Democrats couldn’t come up with a clear campaign candidate. While Elizabeth Warren and Bernie Sanders advocated for radical policy changes, including going against the big banks and tech 昀椀rms, banning fracking, imposing wealth taxes, and increasing the corporate taxes, Joe Biden’s policy is more moderate. Although he still plans to reverse tax cuts, markets are likely to take a Biden win as mildly positive news.

According to Link, a small selloff between 2% to 4% might be plausible, creating “buy-the-dip” opportunities for investors in pharmaceutical and tech stocks. On the other hand, infrastructure, clean energy, and healthcare services companies are projected to do well. Link also believes a scenario where Biden wins, and the Congress remains split between both parties will lead to a market rally.

Lizz Ann, Charles Schwab’s chief investment strategist, shares similar ideas, admitting that a Biden presidency won’t be “a guaranteed disaster for the stock market”. According to JP Morgan’s analysts, such a scenario can even have a neutral-toslight-positive effect on markets. Their conclusions lay on Biden’s proposed policies, including infrastructure spending, softening on tariffs, higher wages, and a generally more diplomatic approach, which should lower the volatility levels and increase the aggregate demand.

According to JP Morgan’s forecasts, even a partial reversal of Trump’s Tax Cuts and Jobs Act (TCJA) bene昀椀ts will send rates back up to 28%, leading to a hit on S&P 500 of up to $9 per share. However, they also conclude that, in COVID times, the more likely scenario is a prioritization of job growth over policies that threaten economic growth. According to the bank’s analysis, the potential outperformers in such circumstances are expected to be companies like Tesla, Johnson & Johnson, and Boeing. Similar views are also shared by the UBS Chief Investment Of昀椀ce, which projects a mounting pressure on heavy industries and carmakers due to Biden’s greener agenda. Such a scenario will also lead to bene昀椀ts for Asian solar and biotech companies.

UBS Wealth Management suggests that after the elections, some initial volatility might be expected, but the good thing is it would be short-lived until investors learn to manage the uncertainty surrounding proposed policies. However, the volatility might be higher if the result is inconclusive. Still, according to Thomas McLoughlin, Head of the Americas Fixed Income division at UBS Global Wealth Management, even then, it will weaken over time and won’t justify shifts to safe-haven assets.

Morgan Stanley predicts that, in a situation with a Republican President and Senate and a Democratic House, we might witness short-lived recession and continuing deregulation that bene昀椀ts the energy, telecom, and asset management sectors. In a scenario with a Democratic President and House and a Republican Senate, the bank predicts pressure on the 昀椀nancial, energy, telecom, I.T., and pharmaceutical sectors, accompanied by better handling of the pandemic. Considering that the 昀椀ve FAANG stocks (Facebook, Amazon, Apple, Net昀氀ix, and Google) are 20% of the U.S. stock market and are currently pushing it up, the whole market might suffer if they come under scrutiny.

In case Republicans win all three, the bank expects a V-shaped recovery, with an extension on the expiring tax provisions and a massive anti-China policy. This would lead to a strong dollar and potentially weakened T-bonds. Again, U.S. energy, telecom, and asset management shares are expected to bene昀椀t. In an all-democratic leadership, Morgan Stanley projects high infrastructure spending and expansion in the healthcare sector, accompanied by higher interest rates and in昀氀ation. The likely winners from such a scenario are healthcare, international oil and natural gas, transportation, and large-cap banks, with potential dips in pharmaceuticals.

The consensus among experts is that, although investors might be tempted to make bold moves and capitalize on the political uncertainty, it is better to retain their long-term approach. The reasoning is that economic cycles last much longer than presidential terms.

Instead of focusing on capturing the short-term volatility, investors should be aiming at portfolio evaluation that takes into account new policies with the potential to impact their long-term performance.

According to Tony DeSpirito, Co-manager of BlackRock north American Income Trust, investors should be looking at highquality sectors such as technology and healthcare that can offer long-term growth in either scenario. Jonathan Simon, Manager of JPMorgan American Investment Trust, suggests looking for companies that have proven to be adaptable and capable of overcoming unexpected crises. On the value side of the portfolio, he provides Booking.com as an example of a business that should be highly affected by the pandemic but manages to adjust its cost structure and come out even stronger.

The UBS Chief Investment Of昀椀ce’s advice for investors is to adhere to a strategic portfolio allocation with long-term goals in mind. This includes anything from automation, biotechnology, and renewable energy, to sectors that will bene昀椀t from global trends like globalization.

If investors want to hedge against the uncertainty of presidential elections, they should consider sectors and companies with no US exposure. This translates to a global, multi-asset portfolio that is resilient to industry- and regional-speci昀椀c risks and with

the potential to bene昀椀t from all election outcomes. Examples include domestically-oriented niches like utilities or stable sectors like consumer staples. There are also investment opportunities, projected to do well in either outcome, including sectors exposed to infrastructure and technology investments.

All analysts are united by the idea that a Biden presidency will favor emerging markets and foreign equities. According to JPMorgan, equity returns in emerging markets are projected to surpass those of other markets in the upcoming years, which means they should be prioritized when building or rebalancing a long-term portfolio.

In a nutshell, the cream of the crop on Wall Street doesn’t see the need for any drastic changes in well-diversi昀椀ed and balanced long-term portfolios. And there is sound reasoning behind this.

As the nobel-laureate Paul Krugman states in his new York Times opinion pieces, nowadays, the economy and the stock market can’t be further away from each other. The Federal Reserve Bank of new York’s weekly economic index indicates that the economy is still more depressed than it was at any point during the post2008 recession. There are 11.5m fewer jobs in the US economy than February this year.

There is an old economists’ joke that the market has predicted nine of the last 昀椀ve recessions.

Yet, despite the economic doom and gloom and the deepening implications of the pandemic, the market is soaring. At the start of September, the S&P 500 hit an all-time high, while Apple surpassed the $2 trillion valuation mark.

A partial reason for the dissonance is that over 50% of all stocks are currently owned by 1% of Americans. The rest 50% own just 0.7% of the market. The rumor on Wall Street is that we should brace ourselves for a “K-shaped recovery” that will materialize in rising stock valuations and individual wealth for the richest, and falling incomes for the poorest.

What all this comes to show is that despite what the theory says, presidential elections might not have a signi昀椀cant effect on your portfolio if it is well-diversi昀椀ed. Economic policies, investments, geopolitical ideas – all these factors will most likely affect your investments in the short-term, but they don’t have a major role in long-term planning.

This article does not constitute investment advice. It is a general communication being provided for informational purposes only. It is not designed to be taken as advice or a recommendation for any speci昀椀c investment product, strategy, plan feature or other purpose in any jurisdiction.

As the hospitality industry shifts to a “new normal”, digital services and technology are needed more than ever to facilitate a more ef昀椀cient yet personalised customer engagement solution.

OKKAMI is an all-in-one hospitality platform that allows hotels to focus on their core business. The OKKAMI digital solution enables hotels to increase revenue centres, streamline operations, connect with customers, and improve guest satisfaction. OKKAMI specialises in a touch-free experience such as contactless express check-in/out with digital signature, QR code menus, digital compendium, and more. The OKKAMI solution supports safety & hygiene programmes from established brands like Chatrium, Six Senses, Anantara, Avani, and Akaryn.

OKKAMI’s main centre of operations is located in Bangkok Thailand. Operating out of Bangkok which is the heart of travel in Southeast Asia has provided OKKAMI keen insight on trends which have affected the local economy. Every country in Southeast Asia is preparing steps on how to kickstart their local tourism industry safely. Thailand has successfully achieved a low infection and mortality rate during the pandemic, but since the local economy depends on tourism, hotel owners are struggling to generate revenue. Staying open means jobs for locals and expatriates that work at the hotels and related companies. The Thai government has been instrumental in helping promote domestic tourism by providing extra approved government holidays to simulate local travel.

As Thailand opens for tourism, incoming guests will be required to stay at Government Approved Hotels which have strict protocols in place to isolate and safely manage any potentially infected guest. As such OKKAMI has pledged to provide SHA (Safety and Health Administration) approved hotels in Thailand complimentary services for six months. Key features found in the complimentary package will include the OKKAMI live chat uni昀椀ed messaging software and QR code digital menus. Each QR Code Digital eMenu also supports multiple languages and automatic translations when customers use the chat function.

By doing so OKKAMI hopes to address safety & hygiene concerns that hotels are currently facing. Addressing these issues will allow hotels to stay open, prepare for re-opening, and provide assistance for new hotel openings. These features are designed to help minimise physical interaction between staff and guests while allowing staff to continue to offer personalised services. Guests can now order in-room dining menus from the comfort of their rooms by scanning the QR code or chatting with hotel staff

directly. By supporting menus in various languages, OKKAMI will help SHA approved hotels cater to guests from all corners of the globe.

The OKKAMI LiveChat Uni昀椀ed Messaging module combines the ease-of-use of guests’ preferred messaging tools with the personal touch of the property’s concierge. With OKKAMI messaging you can also offer website chat support as well as messaging support through popular Apps such as WhatsApp and Facebook Messenger with the added bene昀椀t of supporting in-chat payments. The currently supported applications are WhatsApp, Facebook Messenger, Telegram, Viber and WeChat. All of the applications directly feed into the OKKAMI Uni昀椀ed Message Manager Dashboard.

The OKKAMI LiveChat Manager Dashboard includes the OKKAMI payment gateway, which allows hotels to capture payments for services such as early check-in, airport pickup and other special packages before guests arrive. The payment gateway feature helps properties capture lost revenue even before the guest arrives.

OKKAMI understands that for today’s’ travellers time is limited and that smart technologies help improve the guest relationship services which hotel brands are built on. This is why OKKAMI has developed an all-round cost-effective and seamless communication solution between hotel team members and the guests.

The advantage of the OKKAMI Uni昀椀ed Messaging software is that the guest can communicate with the property before, during or after each stay. Guests simply send their query and receive an immediate reply from the respective hotel. The Message Manager Dashboard also displays the guest pro昀椀le and the response can be customised to each guest’s personal preference.

The OKKAMI LiveChat module also makes it very convenient for guests to easily make a restaurant booking or schedule an inproperty spa appointment. With the added bene昀椀t of the hotel being able to request and capture immediate payments results in an increased revenue stream for the property.

Six Senses has partnered with OKKAMI to create a uni昀椀ed inventory management platform for all of their properties. This will enable the Six Senses group to manage the life-cycle of their

products, services, customers, and resources. Aside from the advantage of being cloud-native and highly 昀氀exible, the platform is also available across all property classes and geographic regions. OKKAMI will provide an API to allow Six Senses website to present room inventory from IHG’s booking engine while offering add-on products stored on the newly created API. An added bene昀椀t of the API is the ability for guests to view available inventory of experiences based on selected dates online. The goal of this integration is to maintain the existing booking 昀氀ow while con昀椀guring a direct work昀氀ow to route add-on products to the assignment department after guests have completed their bookings. Once the request arrives at the property, OKKAMI’s work昀氀ow module will map the request to the correct department for ful昀椀lment and follow up. This would allow, for example, spa add-ons to go directly to spa staff onsite to follow up with guests before arrival.

The booking 昀氀ow begins with guests accessing room inventory based on availability pulled from IHG’s booking engine vs SynXis Central Reservation. Based on the guests’ selected property, available product inventory will be displayed accordingly. Products that are dependent on dates and inventory available will be able to be 昀椀ltered based on dates entered during the booking process. For example, a one-way transfer can have inventory allotments based on the arrival date. In the last step of the booking process, total booking rate and total add-on cost will be displayed. Guests’ data collected during booking will be sent back via the API to route add-on requests to the property’s departments.

Once an order is posted via the API, the department lead and relevant staff will be alerted. Alerts are sent to emails, Six Senses app push noti昀椀cation, and OKKAMI’s dashboard popup noti昀椀cation. Once staff have reviewed the add-on request, it can be moved to “Scheduled”. As soon as an order is marked as “Scheduled”, it will automatically move to the top of the list on the day of the guests’ arrival. This acts as a reminder for staff to ful昀椀l the request before the guests arrive.

To assist staff with the follow-up process, OKKAMI has built an escalation feature into the ful昀椀lment dashboard. The escalation feature ensures no requests are left unattended by escalating the request to the next available team member if the request has not been marked “Done” after a speci昀椀c time. The escalation will continue to occur until the request status has been changed.

Once the order has been posted, guests will receive a noti昀椀cation on the Six Senses app and details will also be displayed in the chat message. From the chat, staff and guests can communicate directly. Moreover, guests can review their add-on requests by browsing through the “My Request” panel or “Pro昀椀le History” inside the app. All requests are collected in a guests’ pro昀椀le and are connected to OKKAMI’s powerful CRM system. Guests data and preferences are shared among all Six Senses properties, allowing staff to offer personalised services and anticipate guests’ needs no matter which property they visit.

Inventory and add-on products are managed from a comprehensive store builder. Each product will support manual updates of basic data 昀椀elds and image uploading. Moreover, the products support the ability to be 昀氀agged for online ordering through the API. OKKAMI’s user-friendly store builder allows staff to update the information once from a single dashboard and it will automatically update on all platforms.

Essentially, the uni昀椀ed inventory management platform is about managing connectivity, transferring information to and from devices and locations, and enhancing guest engagement. OKKAMI expects this uni昀椀ed inventory management system to help Six Senses better personalise their hospitality approach and cater to their esteemed travellers. Both companies share a vision to create personalised travel relying on world-class technology strategy and bold investments for the future.

It seems like new banks are continually popping up, offering the same services, and failing to stand out. nevertheless, are banks looking forward to who their future customers are? Who is going to hold assets soon, and how prepared are they?

Studies show that women will control two-thirds of the consumer wealth in the USA over the next decade, yet only 18% can pass a 昀椀nancial literacy test. In general, are banks appealing to female customers? If so, why is it that banks lose $700bn in pro昀椀ts from underserved female customers?

But once in a while, a different kind of bank comes along, not simply offering monetary wealth but also a wealth of knowledge. Athena is a 昀椀nancial education platform with a speci昀椀c target: young women starting their 昀椀nancial independence journey.

Anastasia Soloveva, the CEO of Athena, has worked in 昀椀nance for two well-known institutions in the past 15 years - Citibank and Credit Suisse. A graduate of Harvard Business School, Anastasia has worked as a wealth manager. During her time in the 昀椀nancial industry, she noticed a pattern; the people who were having the most dif昀椀culty managing their 昀椀nances were women.

When most people think of 昀椀nance and gender, they think of the pay gap between men and women. However, that is only the tip of the iceberg. Women are living longer, but most of them have no long-term 昀椀nancial plan for their future. More than 80% of women cannot even pass a 昀椀nancial literacy test. In short, women are the largest group that is being underserved in the 昀椀nancial industry today.

The lack of 昀椀nancial education in women goes back to societal gender roles. For the 昀椀rst half of the 20th Century, most of the labour force was male. This has built up the widespread bias that men are more suited to handle 昀椀nances. There is also the longstanding presumption that women are meant to focus on raising children, not managing money. These stereotypes have helped feed into the gender pay gap. Working women receive 20% less income than their male counterparts, and those who try to negotiate for a bigger salary are seen as overly aggressive.

This disadvantage creates a problem for the future. Women are living at least 昀椀ve years longer than men, and many are going through a divorce. One way or another, most women will 昀椀nd themselves at a point where they cannot rely on men to take care of their 昀椀nances.

There have been a number of 昀椀nancial service companies popping up with women as their target audience. However, most of them focus more on acting as 昀椀nancial advisors rather than giving women the knowledge and resources to be 昀椀nancially independent.

That is where Athena Bank comes in.

Interviews with their customers gave Athena Bank a better understanding of what females are actually looking for on their platform:

• How to plan and take care of the future of their kids or grandchildren. That’s probably the number one 昀椀nancial goal they usually highlight.

• Personal goal: purchase a house, travelling around the world, or opening their own business - that’s another kind of 昀椀nancial goal we see.

• Education - many women worldwide are willing to get a master’s or MBA to push their careers further.

What the Athena platform offers are educational courses for women to learn the basics of handling their 昀椀nances. These courses cover many issues such as investing and budgeting. Athena have gone out of their way to put together a primarily female team to assist with content, marketing, and fundraising.

Climate-linked natural disasters and increasingly gloomy scienti昀椀c outlooks are pushing the international business community to think more about climate risk, as governments start to factor it into their policies.

The effects of climate change - which include extreme weather events and higher temperatures - are becoming more pronounced and more worrying, leading to growing concerns about their human and economic impact.

According to the World Economic Forum’s 2020 Global Risks Report, environmental factors top the list, although the virus outbreak has to some extent replaced those concerns in the most recent rankings.

Some sectors and businesses are more exposed to climate breakdown than others: European companies that rely on inland shipping are at risk because of drought, while gas and nuclear power stations cannot run at full capacity when the mercury rises too quickly.

That is why there is now a trend of businesses being asked to disclose their climate risks, so that investors can build long-term trust in projects without fear that they are, for example, funding soonto-be stranded assets.

“Scienti昀椀c advances mean that climate risks can now be modeled with greater accuracy and incorporated into risk management and business plans,” said John Drzik, Chairman of Marsh & McLennan Insights.

Aside from the business side of matters, regulators want climate risks declared so that global and regional emissionscutting targets can be met. Without the involvement of companies in that process, vulnerabilities in economic systems could 昀氀y under the radar.

The next 12 months will be a hot-bed of climate policy-making as administrations on both sides of the Atlantic potentially gear up to pursue new green agendas. In Brussels, EU heads will decide whether to ratchet up all the legislation linked to curbing greenhouse gas output - from car CO2 standards to renewable energy benchmarks - with tough talks scheduled for the next 10 months or so.

Lawmakers have already agreed on a ‘sustainable taxonomy’ that is designed to put a label on what is and what is not a green investment, while a €750 billion virus recovery fund will give priority to countries that submit risk-proofed applications.

Depending on who wins the US presidential race in november, a Joe Biden White House is also on track to implement environmental policies that are much more ambitious than previously seen in Washington.

In several countries around the world, climate risk is already enjoying spells in the limelight, to varying degrees.

norway, which boasts a €1 trillion sovereign wealth fund, is now asking the companies on its books to start disclosing more climate-related data, especially those 昀椀rms that are known to have an emissions-heavy output.

“We want scenario analysis, including a two-degree scenario analysis, and we want the company to be open about the assumptions for the analysis,” Carine Smith Ihenacho, the fund’s corporate governance of昀椀cer, said in August.

She added that the fund, which counts around 9000 companies in its portfolio, wants to be sure that they “can survive in a low-carbon society and to understand how they will address that”.

The fund’s drive for transparency is part of norway’s attempts to polish its international image as a green champion, because although it counts on massive clean energy reserves and is the world’s biggest user of electric cars, its oil and gas assets are problematic. In fact, the sovereign fund - set up to channel the proceeds of the country’s fossil fuel resources - has a carbon footprint that is double that of norway’s.

new Zealand is on course to go a step further and make climate risk reporting mandatory. If the plans come to light, it would make the Antipodean country the 昀椀rst in the world to make it a legal requirement.

Under a proposal that was praised by nobel Laureate Joseph Stiglitz, any new Zealand 昀椀nancial institution with more than $1 billion in assets would be obliged to report on climate change risks every year and detail how they are being managed.

“Many large businesses in new Zealand do not currently have a good understanding of how climate change will impact on what they do,” said Minister for Climate Change James Shaw, a Green Party member who announced the proposal.

Prime Minister Jacinda Ardern won a second term with a landslide victory in new Zealand’s general election in October. She has agreed on a governing “cooperation agreement” with the Green Party to help achieve her net zero emissions target for 2050.

Companies themselves are also leading the charge. Swedish electric-carmaker Polestar is urging the automotive industry to get serious about disclosing risks and emissions, especially when it comes to lifecycle assessments (LCAs).

LCAs show how resource-intensive a car or other product is from the very beginning of manufacturing up until it is disposed or recycled. In the auto sector, it is a huge point of contention between 昀椀rms that build electric cars and those that produce petrol or diesel-powered vehicles.

“Car manufacturers have not been clear in the past with consumers on the environmental impact of their products,” Polestar boss Thomas Ingenlath said. “That’s not good enough. We need to be honest, even if it makes for uncomfortable reading.”

Australia, Canada, EU countries and the United Kingdom are all at various stages of enacting their own risk reporting initiatives. The UK government in August announced that pension schemes with £5 billion or more could be required by 2022 to publish climate assessments. The idea is currently in consultation until October.

Secretary of State for Work and Pensions, Thérèse Coffey, said that “these measures will ensure pension schemes are in an ideal position to drive change to a sustainable, low carbon economy which will bene昀椀t everyone.”

The consultation period will also look into whether pension schemes should disclose how closely they are aligned with the targets of the Paris Agreement on climate change.

“Corporates, asset owners, including pension schemes, and asset managers should use the Taskforce on Climaterelated Financial Disclosures (TCFD) framework to disclose climate-related risks and opportunities,” said former Bank of England governor, now Un special envoy, Mark Carney.

Un leaders meet in September but the acid test is expected next year at the delayed COP26 climate summit, where the debate will shift from what needs to be done to halt climate breakdown to how it can be curbed, especially from a business standpoint.

An interview with Manmohan S., Chief Strategy Of昀椀cer at FXPRIMUS.

“Sometimes the entrepreneurial journey starts with jumping o昀昀 a cli昀昀 and trying to 昀椀gure out how to put a plane together on your way down. The key is to have the right team jumping o昀昀 the cli昀昀 with you to increase your chance of putting that plane together.”

FXPRIMUS’ Chief Strategy Of昀椀cer is well known for his unorthodox approaches, innovative ideas and leading by example. So how did he become a recognised 昀椀gure in the business and 昀椀ntech world?

TELL US ABOUT YOURSELF AND YOUR JOURNEY

I certainly did not follow the conventional way of becoming a businessman. After dropping out of high school, I started as a street vendor and hustled my way from there. That is actually where I acquired my sales skills from. I then moved on to selling life insurance and, by the age of 20, I started my own software development company.

Fast-forward a few years after, we expanded into a telecommunications company and were established in seven different countries across south-east Asia within a year. From there, I expanded into many different business areas.

At the moment, my main focus is on investing in new companies and tech start-ups. At the same time, a lot of my businesses are still operational and running by hand-picked teams, but in essence, I have adopted an active investor role rather than actively running the businesses myself. Having said that, FXPRIMUS is something very close to my heart and that’s why I chose to step into the Chief Strategy Of昀椀cer role; to be actively involved in the company’s future.

I plan to expand FXPRIMUS into a multi-service broker, as I believe there are many upcoming opportunities in the 昀椀nancial services sector. On a personal level, I am planning to continue working on early-stage companies and investing in tech start-ups as well as working for other causes that are close to my heart, like supporting different charity foundations.

WHAT DOES YOUR ROLE ENTAIL AS FXPRIMUS’ CHIEF STRATEGY OFFICER?

As the Chief Strategy Of昀椀cer at FXPRIMUS, my job is to work with the management team to build, implement, and execute the strategy of the company. In a nutshell, I make sure the strategies are put in place and followed on with proper execution across departments. That includes exploring new markets that we can expand our reach and services to.

YOU’VE BEEN AROUND PRIVATE INVESTMENT FIRMS, HEDGE FUNDS AND FINTECH OVERALL FOR OVER A DECADE, AS BOTH AN INVESTOR AND A FOUNDER; HOW HAS THAT INFLUENCED YOU AND YOUR APPROACH WHEN PUTTING NEW STRATEGIES IN PLACE?

Being on both sides of the table, as both an operator and an investor, has given me a fresh and unique perspective on how to strategise a business, depending on the role of the business itself. I now understand how people perceive a business. Sometimes as a businessman, you are so focused on your business and love it so much, that you often become incapable of recognising its 昀氀aws; ultimately this becomes a destructive force. Therefore, even though I own and run businesses and they are all close to my heart, being in the 昀椀ntech world has kept me objective and not blind to the 昀氀aws any business might have.

BEARING THAT IN MIND, HOW DID FXPRIMUS BECOME THE POWERHOUSE IT IS TODAY OVER THE PAST DECADE?

What has shaped FXPRIMUS into what it is today is not just me. In any business, there is always a single person who leads the company but it takes a team to build and grow the business into what it can become. The same way I recognise the in昀氀uence I had in the company, so do all the other partners and employees. My past experiences have taught me that if you want to build a successful business you need to make sure that you have the right team next to you and you need to keep them motivated and properly supported. As a result, our customers can experience this through the day-to-day services that they receive.

IT’S APPARENT FROM YOUR PREVIOUS AND CURRENT VENTURES THAT YOU ARE AN ADVOCATE FOR A HEALTHY AND INCLUSIVE WORKING ENVIRONMENT. HOW MUCH OF THAT GOES INTO SHAPING THE CULTURE OF YOUR WORKSPACE AND THE RELATIONSHIP BETWEEN EMPLOYER AND EMPLOYEE?

I 昀椀rmly believe that people do not leave their jobs, they leave toxic environments. If you have an environment within the company that is not conducive for people to perform really well, then you will eventually lose valuable team members. Therefore, having an open communication channel with everyone and making sure that people are genuinely happy coming to work every day is key.

As a business owner, I want everyone to take ownership of the business but that can only be achieved if people feel that they are appreciated and they are part of a team which values them. Happy people are always productive and this is what we are working towards every day.

WHAT ARE SOME OF THE ACHIEVEMENTS YOU ARE MOST PROUD OF?

There’s certainly a lot to be proud of at FXPRIMUS! One thing that stands out the most is our ability to thrive with our partners while watching them and their businesses grow through the years. Being able to support them and see them thrive is truly rewarding. Small businesses are now bigger and their owners have what other people dream of.

On a personal level, coming from humble beginnings and being blessed with a successful career, I don’t really think about notable achievements. Rather, I like to think that every day I wake up and do something, that is an achievement by itself. I feel blessed that I am in a place where I am able to work with other people and help them achieve their dreams, which is exactly the reason why I love working with tech start-ups and young companies. And because I know how hard it is when you start, to me, this is my way of giving back. Hence, it is not about achievements, it is all about ful昀椀lment.

HOW HAVE YOU WATCHED THE INDUSTRY CHANGE OVER THE COURSE OF YOUR CAREER?

There have been some major changes in the industry in the last decade. Particularly, the high barrier to entry has lowered signi昀椀cantly. Traders grew and so did their skillsets. We see more and more sophisticated traders coming up, with a different mentality and a higher educational level and this is de昀椀nitely a challenge for new companies if they are not able to provide the right kind of services.

AS A SERIAL ENTREPRENEUR, YOU HAVE BEEN INVOLVED IN MANY DIFFERENT PROJECTS AND STARTUPS. WHAT DOES THE FUTURE HOLD FOR MANMOHAN THE ENTREPRENEUR?

Ah, I wish I had a crystal ball! Having come where I am in my life right now, I am still very active and there is still a lot more I want to do. I am glad to have found my passion; investing in young companies. This is my driving force and I cannot imagine myself ever retiring. Furthermore, I am really excited about what FXPRIMUS is today and where it is heading. I would say that 75% of my time is dedicated solely on working towards achieving the goals of the company.

WITH THE ABOVE IN MIND, HOW DOES THAT TIE INTO YOUR PLANS FOR FXPRIMUS’ FUTURE?

We have a lot of exciting updates and new products coming up in 2021. We recently updated our internal technology and infrastructure to better enhance our clients’ and partners’ experiences.

We will be adding several new products and assets to our existing FX and CFD. ETFs, stocks, and many other instruments will be available as underlying assets, which will bring the total available instruments to trade to over 4000. We aim to transform into a fullservice broker with our upcoming launches and grow as a group.

LASTLY, YOU WERE JUST AWARDED MOST TRUSTED BROKER - SOUTH EAST ASIA & AFRICA 2020. HOW DOES IT FEEL?

We are extremely proud to be receiving this award. It is a great honour to be recognised for what we do as we truly feel that we are the safest broker in the industry. Such third-party endorsements help us build robust relationships with our clients and partners and strengthen our credibility.

In line with its pledge to make time for the planet, luxury Swiss watch brand, Omega, is a proud partner of nekton, a not-forpro昀椀t research foundation committed to protecting our oceans. The partnership was 昀椀rst announced in 2018 and a series of missions to explore and conserve the Indian Ocean, known as ‘First Descent’, kicked off in 2019 and will resume next year.

Each mission combines state of the art technology with inspirational public engagement. An approach greatly admired by Omega’s President and CEO Mr. Raynald Aeschlimann, who sees clear parallels with nekton and the watch company he leads.

“Our friends at Nekton are protecting the ocean with the global goal of 30% protection by 2030. As a pioneering brand with a long history of pushing at the boundaries of what is possible, we have the utmost respect for this bold, con昀椀dent vision and we’re thrilled to help make the goal a reality“, said Aeschlimann.

Omega’s Diver 300M is the most appropriate watch to represent the partnership. The famous Seamaster has played a key role in Omega’s ocean story. A legacy acknowledged by the team at nekton, who dubbed their research submersible Seamaster 2, in tribute to the boat skippered by the late Sir. Peter Blake. The legendary round-the-world yachtsman was a passionate advocate of ocean conservation and a close friend of Omega.

The nekton Edition features a laser ablated black ceramic [ZrO2] dial, matt 昀椀nished with polished waves in positive relief, and unidirectional rotating bezel in grade 5 titanium with laser ablated diving scale in positive relief.

As a tribute to the hard-working foundation, the oriented caseback features an embossed nekton submarine medallion and is engraved with nAIADLOCK, DIVER 300M and the watch’s water resistance.

Driving the nekton Edition is the Master Chronometer Calibre 8806 with special luxury 昀椀nish, Geneva waves in arabesque and rhodium-plated rotor and bridges. Certi昀椀ed by METAS it can resist magnetic 昀椀elds of 15,000 gauss.

Two models are available: The 昀椀rst with an integrated black rubber strap and polished-brushed buckle to complement the black ceramic dial, the second with a stainless steel bracelet to give the Diver a dressier look.

To purchase this watch is to play a part in the protection of the world’s oceans.

On 20-21 October, 2020, Women’s World Banking and industry experts met for the annual Making Finance Work for Women Virtual Summit to discuss how to help women recover from the current economic and health crises, and build resilience against the next.

The two-day virtual summit gathered industry leaders and practitioners as they looked at how to take action towards 昀椀nancial inclusion and improve 昀椀nancial resilience for women. The Summit consisted of interactive sessions, plenary panels, and global research on topics ranging from the widening gender gap, crisis recovery, wage digitisation, leadership and diversity, gender lens investing, G2P payments, and more. In attendance were over 300 thought leaders from the 昀椀nancial services, regulatory, policymaking and technology communities.

During the summit, the four 昀椀nalists of the second annual Making Finance Work for Women Fintech Innovation Challenge were announced. The 昀椀nalists, chosen from a record-breaking pool of competitive and diverse applicants, represent an exciting new wave of innovative solutions designed to support low-income women’s economic empowerment and 昀椀nancial inclusion. This year’s 昀椀nalists were: Boost Capital, Mujer Financiera, myAgro, and Tyme.

The judges selected two Grand Prize Winners: Tyme and myAgro. They will compete as 昀椀nalists in the Monetary Authority of Singapore’s (MAS) Global FinTech Hackcelerator (powered by KPMG Digital Village) during the Singapore FinTech Festival in December 2020. They will also be fast-tracked to receive a MAS Proof-of-Concept Grant worth up to S$200,000 and compete for a S$50,000 cash prize. The Grand Prize Winners will also receive tuition coverage for two participants in Women’s World Banking’s next Leadership and Diversity for Innovation Program, which equips senior executives in emerging markets with the skills to successfully serve low-income women and advance women leaders within their institutions.

“I was inspired by the quality and sheer number of applications this year,” noted Mary Ellen Iskenderian, President and CEO of Women’s World Banking. “Low-income women have been disproportionately impacted by the COVID crisis, facing higher rates of unemployment, bearing an outsized burden of child care and other household responsibilities, and even confronting unprecedented levels of domestic violence. This year’s applicants – of which 62% (74 solutions) were co-founded and/or had women in a C-suite position – left me full of hope for the future of the role that 昀椀ntech can play in women’s 昀椀nancial inclusion and, ultimately, their economic empowerment.”

Until very recently, big fund managers generally ignored cannabis investments. Earlier this year, investment bank Jefferies said institutions accounted for a meagre 5% of the ownership of cannabis companies, compared to 50% in the technology sector. The weed market is still relatively young, and therefore highly volatile. Cannabis stocks have lost about a quarter of their value in the 昀椀rst half of 2020, compounding a 50% drop in 2019.

But as an increasing number of countries and states move to legalise and regulate the purchase, production and cultivation of cannabis, the market shows clear potential. Experts predict that by 2022, the marijuana market will reach $32 billion. COVID-19 may have knocked legalisation off the agenda temporarily but the recent market surge in cannabis and its derivatives are promising.

In 2018, the global medical cannabis market was worth $13.4 billion and there are more companies entering national and international stock exchanges all the time.

There are two primary cannabis markets. Firstly, medical cannabis is for patients who use cannabis or its derivatives to treat health conditions. Meanwhile, recreational cannabis is for customers who use marijuana or cannabis extracts for enjoyment.

Medical cannabis is far more commonly legalised than recreational cannabis. For example, in the U.S., cannabis remains illegal at the federal level but a growing number of states have legalised both.

A company’s geographical location is key in determining its growth prospects.

Canada’s pioneering cannabis legalisation may have helped kickstart a 昀椀nancial revolution in the stock market with the launch of a diverse portfolio of marijuana stocks but investors now fear modest returns thanks to excessive regulation and supply chain bottlenecks.

But the outlook remains positive - in July, sales at Canada’s pot shops increased 15% from June, according to government data released in September.

There are at least 10 cannabis companies in north America with billion-dollar market capitalisations. With cannabis dispensaries designated as essential businesses, the cannabis market has reported strong sales throughout the pandemic. According to the Oregon Liquor Control Commission, $84.5 million of marijuana products were sold in Oregon in March alone!

As states like Arizona and South Dakota potentially move to legalise, the U.S. cannabis market will provide new opportunities for investors and serious competition to its Canadian counterpart.

In november 2018, the UK government legalised cannabis for medical use, requiring a prescription from specialist practitioners in what seemed like a move towards further freeing up regulations in the future. However, due to restrictions put in place around the reforms, less than 200 people have been able to access CBD treatment but that is set to change. According to the Centre for Medicinal Cannabis, the UK medicinal cannabis market is predicted to be worth £1.03billion, servicing nearly 340 000 patients.

From Sativa to Greencare Capital, the UK has nevertheless seen a handful of companies listing on its public markets with cannabis as their core business. But in early 2020, the London Stock Exchange announced that a new thematic exchange-traded fund (ETF) had been launched, focusing on medicinal cannabis.

This new ETF tracks the Medical Cannabis and Wellness Equity Index (CBDX), provided by Solactive, a Germany-based company that designs, calculates, and licenses 昀椀nancial indices. The CBDX ETF consists of publicly listed companies conducting legal business activities in the medical cannabis, hemp and CBD industry, including producers and suppliers of medical cannabis, CBD-focused biotech companies, and companies leasing property to medical cannabis growers, and software solutions for medical cannabis producers.

The development of funds such as the ETF and record sales even during the lockdown suggest that the global medical cannabis sector may be in for a rebound after a slump over the past few months.

An interview with Tomasz Wisniewski, the Newly Appointed CEO and Director of Axiory Intelligence.

Axiory Intelligence is the newest market news and analysis provider to take the FX industry by storm. Launched by global 昀椀ntech company, Axiory, the news portal aims to inform and educate the next generation of traders through a seamless stream of trader-centric content.

At the helm of the project from start to launch, is expert trader Tomasz Wisniewski, who’s been appointed the CEO and Director of Axiory Intelligence. Wisniewski is not new to the Axiory group, having served as Head of Education at their dedicated broker, Axiory Global for close to a year. A savvy and successful trader himself, he’s been in the industry for over a decade, as a market analyst, trader, and a well-known educator.

Over the years, Wisniewski has taught thousands of traders through more than 400 webinars, seminars, lectures, and training courses across the globe. But for the last year, he’s been focused on expanding Axiory’s vision to help the trading community by introducing a new, independent and dedicated news and market analysis portal. His history in trading was and continues to be integral for his new role, because Axiory Intelligence was designed for traders, by traders.

“Every aspect of Axiory Intelligence was designed with the trader in mind. Topics are sectioned off and grouped for easier navigation, 昀椀lters allow every trader to monitor only news that’s relevant to their trades, we’ve included both brief overviews and lengthy in-depth market analysis and we plan to continue developing the interface based on the feedback we get from our traders and viewers” said, Wisniewski in a statement on the company’s website.

We sat down with the newly appointed CEO, to discuss his new role and why he believes there’s never been a more important time to provide traders with accurate and reliable information.

GIVE US A BIT OF BACKGROUND ON AXIORY INTELLIGENCE.

Axiory Intelligence is an independent news portal where traders and investors can access news and analysis on global 昀椀nancial markets. We provide real-time global market coverage and intelligent analysis across a wide range of 昀椀nancial assets including Currencies, Commodities, Energies, Metals, Indices, Stocks, and ETFs, as well as economic events and indicators.

Our teams of dedicated 昀椀nancial analysts watch the markets twenty hours a day, seven days a week, to deliver essential market news and insight to our traders and investors around the world.

Most importantly Axiory Intelligence was built in-line with our core values at all Axiory companies, including our dedicated broker, Axiory Global, to bring value for traders and always put them 昀椀rst. Knowledge being the most important element in trading, Axiory Intelligence caters to that need, by bringing both relative market news pieces to keep traders informed, as well as education that’ll set them in the right direction.

WHAT’S YOUR NEW ROLE AS AXIORY INTELLIGENCE’S DIRECTOR BEEN LIKE SO FAR, AND WHAT ARE YOUR FUTURE GOALS FOR THE COMPANY?

It’s been an incredible year so far, and the culmination of a long year of planning and hard work.

I’m a trader myself, and I know 昀椀rst hand how important it is to have trustworthy new sources providing accurate, realtime information on the 昀椀nancial markets. As traders, we’ve all experienced how valuable it is to have access to that kind of information.

I think the value of this information has recently increased dramatically with all the volatility in the global markets. COVID has had an unprecedented impact on our lives. We’ve noticed that it has also been a catalyst for traders to look for better, more reliable market news and information resources. In many cases, it’s also given us the time to up-level our market knowledge and skill-set through a wide variety of online training and educational resources.

I believe that Axiory Intelligence is uniquely poised to be an essential resource for traders and investors looking for education, veri昀椀ed market information, and intelligent analysis about the future. My role is to make that happen.

Our plan is to take education and support to another level by personalising the experience.

Today, there is no shortage of trading information, analysis, and educational material online.

Type ‘Traders Education’ into Google and you’ll see the overwhelming number of choices you have; videos, webinars, courses, newsletters, articles, and educational resources of all kinds. At Axiory Intelligence, we provide carefully-picked and focused news and education that’s for traders, we also offer oneon-one support and mentorship.

Our plan is to continue to grow our local analyst teams across every Axiory location. We believe that having experienced traders with empathy and knowledge, available to answer any questions a trader or investor may have, is a great way to synthesize and apply the information they learn.

Our on-the-ground analysts provide us with deep local market insights, and they are also there to provide our clients with expert one-on-one support. We’ve found this to be a more effective way of accessing market insight, as well as developing your trading skills.

As a trader myself, I know that this type of support is a keystone to becoming a better trader, and I look forward to Axiory Intelligence being a leader in providing it.

Axiory Intelligence, as an independent source of market analysis and education, is accessible to global viewers without any subscription or fees. You can head to intelligence.axiory.com and get your dose of daily content, that’ll keep you informed and upto-date so you can make better trading decisions.

Sharjah’s investment promotion arm is building on the emirate’s vision of inspiring sustainable development by identifying and facilitating opportunities for investors across various sectors

Sharjah FDI Of昀椀ce (Invest in Sharjah) is the investment promotion agency of the Emirate of Sharjah, launched by the Sharjah Investment and Development Authority (Shurooq) in 2016. Driving the continued transformation and economic diversi昀椀cation of the emirate by attracting diverse, long-term and high-yielding investments from across the world, Invest in Sharjah has done a tremendous job of ramping up national and regional FDI performance and growth.

These efforts have been hailed by reputed global institutions such as the World Association of Investment Promotion Agencies, which nominated Invest in Sharjah to assume MEnA’s regional

directorship at WAIPA for a two-year term, until 2021. The entity also made waves in the international press, with International Finance, a premium UK-based business and 昀椀nance magazine naming it the ‘Best FDI Agency 2019 – UAE’.

naturally, Mohamed Juma Al Musharrkh, CEO of Invest in Sharjah, is very upbeat about Invest in Sharjah’s prospects. He said: “Sharjah is booming with opportunities across several sectors like manufacturing and logistics, road and transport, real estate, healthcare, IT, education, publishing and R&D, that are of interest to global investors.”

“Through our strategic networking efforts and global road shows over the past four years, we have increased investor awareness about the competitive business advantages and economic bene昀椀ts investors can avail right off the bat as they enter our markets. The emirate’s robust network of free zones - home to 12,675 companies - all offer tax exemptions, full

pro昀椀t repatriation, simpli昀椀ed licensing procedures and fast-tracked business registration processes. An additional 61,200 entities registered with the Sharjah Economic Development Department (SEDD), have contributed to the overall industrial development of the UAE, generating job opportunities not just here but also in their countries of origin,” he added.

Sharjah’s vision to attract diverse and responsible FDI includes being realised by six specialised free zones, where every business belonging to almost any market sector will have an opportunity to grow not just locally, but also pursue regional expansion from Sharjah. In Sharjah Media City, enterprises in the media, creative and innovation industries, will 昀氀ourish; while in Sharjah Publishing City, a sprawling 40,000 sqm business town, publishing, printing and allied businesses will have

exclusive rights to operate. Then there is the Sharjah Healthcare City which hosts not only hospitals, clinics and wellness centres, but also healthcare-related warehousing, equipment, light assembly plants, and retail and accommodation facilities across 2.4 million square-metres; and Sharjah Research, Technology and Innovation Park (STRIP), a unique meeting point for government, industry and academia mandated to manage Sharjah’s innovation and R&D ecosystem.

These relatively new free zones complement the Hamriyah Free Zone and Sharjah Airport International Free Zone, established in 1995 with a focus on industry.

Since Invest in Sharjah announced the launch of the Sharjah Investors Services Centre (Saeed) last november. This one-window consultative and business licencing service has already bene昀椀ted 1,500 clients, mostly in real estate and e-commerce.

The single-window facility offers every service a new-comer in the UAE market requires – all in 60 minutes. From attestation of commercial and residential tenancy contracts; membership registration at Sharjah Chamber of Commerce and Industry (SCCI); facilitation

of utility services as well as payment of bills; to issuance and renewal of commercial licenses, entry permits. Additionally, all services under the Federal Authority for Identity & Citizenship; issuing and renewal of all types of trade licenses; legal and tax consultancy services, including maintenance of records related to tax transactions and preparing and submitting VAT returns are also on offer under one roof at Saeed.

Sharjah has made it a strategic goal to build an innovative, inclusive and resilient economy by attracting foreign investments that promote the emirate’s green growth principles, which aim to raise standards of living while ensuring environmental sustainability.

Projects like the US $544m Sharjah Sustainable City, the emirate’s 昀椀rstever net zero energy mega project in partnership with Diamond Developers have opened brand new FDI avenues, and re昀氀ects Sharjah’s commitment to the establishment of worldclass infrastructure that promotes environment-friendly and sustainable living.

Sustainable tourism is another key element of Sharjah’s diversi昀椀cation programme, with the Sharjah Commerce and Tourism Development Authority’s

Vision 2021 initiative aiming to attract 10 million visitors by 2021. The strategy, launched in 2015, seeks to build the emirate into a top regional destination for family tourism by investing in a range of ecotourism and cultural attractions.

The initiative has contributed to a rise in both public and private investment in the sector with a portfolio of completed and ongoing projects worth US $ 2.06 billion. Sharjah aims to achieve the perfect harmony between luxury and culture in developing current and upcoming cultural and eco-tourism projects which offer unique investment opportunities.

“Sharjah’s economic programme is focused on developing into a vibrantly diversi昀椀ed ‘knowledge economy’,” said Mr Al Musharrkh. “We have been investing consistently in education, research, and healthcare sectors to boost local human capital and offer the kind of infrastructure international businesses will need to continue developing in the long term. Sharjah’s comprehensive strategy is also opening out new and emerging markets such as ecotourism or net zero energy communities as viable options for investors. In short, we have what it takes, and would like to reiterate, Sharjah is open for business!,” he added.

By Lean Fisher, AudaCity Capital PR

As the trading industry changes; traders are becoming more and more skilled. However, they are facing the problem of being under-capitalised as they are emerging from retail backgrounds instead of traditional university and banking routes. With the COVID-19 pandemic, trading has become – for some – a skill or hobby to earn extra money, but for others – trading is the beginning of a new career.

Previously, it was dif昀椀cult to participate in the trading and FX market due to the high transaction costs and governments were strict on keeping control of exchanges. This was until CFTC (Commodity Futures Trading Commission) passing two important bills that opened doors for the trading industry. The Commodity Exchange Act and Commodity Futures Modernisation Act allowed traders to take advantage of the new, densely populated FX industry.

However, traders still faced one major problem: being undercapitalised. Traders lacked the funds they needed to trade successfully and achieve maximum success in the industry. Even today, economic uncertainty means the market is becoming more and more sparse due to this issue.

This is where AudaCity Capital steps in. AudaCity Capital, a world-renowned trading 昀椀rm for backing and funding pro昀椀table traders, has changed the way traders are able to achieve success and funding. Founded in 2012 in London, the company has over 500 traders in over 40 countries, providing them with capital and a platform to begin showcasing their talent as traders and drawing out the new, retail-based, era of the FX industry.

The company began just a few years after the recession of 2008. With many Proptrading Firms closing; AudaCity Capital went against the trend as they were determined to keep the industry alive.

“The idea behind AudaCity Capital and the service we wanted to o昀昀er was something I needed personally” states Karim Yous昀椀, CEO and Chief Global Strategist.

He struggled to raise capital for himself, a problem for a lot of traders in the industry and decided to change this with AudaCity Capital.

“I truly believe that the next generation of superstars in this 昀椀eld will come from the retail environment”, he adds.