Managing Director

Shashank M

Co-Founder & CEO

Shankar VS

Chief Editor

Madhusmitha V Patil

Editor

Ujal Nair

Assistant Editor

Medhaj Nair

Head of Operations

Kevin Harris

Head of Production Shank Mendez

Head of Research

Laura Edwards

Head of Media Sales Charles Grey Media Sales Manager

Chris Young

Advertising contact chris@intlbm.com

Content Managers: Daniel Edwards, Sumana Shankar

Business Development

Paul Cooper, Alisha Taylor, Jane Sanders, James Smith, Jason

Graphic Designer

R Ravi Kumar

Account Manager

Agnes Wong

Offies: Registered Adddress: Sharjah Media City (Shams), Al Messaned City, Al Bataeh, Sharjah, United Arab Emirates, P.O. Box: 515000

Offie Address:

Suite No 502, Al Tawhidi 1 Building, Floor 5, Khalid Bin Al Waleed Road, Bur Dubai, Dubai, United Arab Emirates.

Email: info@intlbm.com

Phone: +971 55 686 6713

NOTE FROM

EDITOR

Emergence of unknown gems from familiar grounds

With employment rates steadily increasing and the GDP showing minute signs of growth, the global market seems all set for a major overhaul to embrace the next inevitable revolution. With world leaders making strong resolutions to slow down the fall in revenue and the export volumes of their respective nations, the global economy seems poised for the next bull run in the days to come.

In this issue, dynamic investors and ardent followers of the market would find some interesting pieces of articles. There is a list of market trends to watch out for right now. Do remember to check out the know-it-all article on derivatives trading. Retail investors can learn more about the current inflation and the stagflation in the global economy. There is also some new options to watch out for in different tax-saving options. Crypto investors can also learn about the latest happenings and practices in cryptocurrency exchanges. Two exclusive articles from Legacy FX will surely expand your perspective on the opportunities in the market.

This issue carries a special feature on the exclusive interaction with Luigi Wewege of Caye International Bank. While Caye International won the award for the Best International Private Bank in Central America for 2021, Luigi talks about the current prospects and the upcoming potential of the small, but the fast-growing economy of Belize. This issue also allotted an exclusive space for Krungthai bank and its new super app.

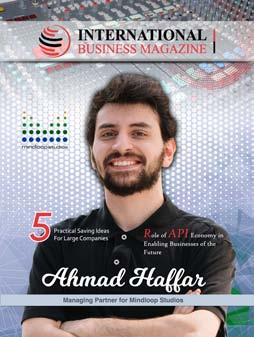

The cover page of the issue features Ahmad Haffar, the Managing Partner for Mindloop Studios. Popularly known as ‘Voice of Dubai‘, he talks about the media and the entertainment industry boom in the MENA region.

The pages in this issue will give you a whole new perspective on the various sectors and the current trends to look out for in each of them. We have covered the freight industry, the eCommerce industry and even the API software application industry. Considering all the hype and excitement around the pharma industry, consider glancing at some of the non-traditional players in the sector as well.

Madhusmitha V Patil Chief Editor

Be sure to check out our website at www.intlbm.com

Connect with us on Twitter: @interna11168480 and Facebook:@intlbm Instagram: @intlbm.

WELCOME

CONTENTS

Cover Story

Managing Partner for Mindloop Studios Ahmad Haffar

Managing Partner for Mindloop Studios Ahmad Haffar

18 28 3834 18Benefits you get when choosing an instant cryptocurrency exchange 28 All you need to know about Derivatives Trading 34 Role of API Economy in Enabling Businesses of the Future 38 ITAD Market aims USD 51.37 Bn by 2030: Straits Research Rosuvastatin Calcium Market will flourish through 2022-2031 How LegacyFX Provides Ways to Potentially Trade Safer and Convenientl 44 56

Krungthai Bank’s super app, ‘Pao Tang’, an all-in-one platform for Thais

Krungthai Bank is a leading commercial bank in Thailand, with a mission to empower better life for all Thais by leveraging financial technologies and innovations to develop products that meet the needs of all groups of customers. One of the key instruments in realizing this mission is ‘Pao Tang’ mobile application, which is now Thailand’s no. 1 open digital platform.

Bank 06

In order to speedily and effectively adapt to changes and thrive amid disruption despite being an incumbent, Krungthai Bank adopts the 2-banking-model strategy, which consists of traditional banking and digital or ganization models. The former is like an aircraft carrier maneuvering the bank’s core banking businesses and its primary goals are to safeguard the core businesses against disruption and minimize the loss of reve nue and profit. The latter acts like a speed boat that ventures around to explore new business opportunities and revenue streams, both from creating new business models and forming partnerships. For this purpose, Infinitas by Krungthai was established to be the bank’s speed boat; It focuses on developing an innovative open banking platform that meets customer needs in the new normal and responds to Thai people’s chang ing behavior. The fruit of this is the Pao Tang mobile application.

Pao Tang is designated to be Thailand’s open digi tal platform which all Thais, including non-Krungthai customers, can use. It is open for integration with third-party partners in both public and private sec tors, so the bank can develop and offer a wide range of products to cover all people’s needs, from bank ing, saving and investment products to healthcare and lifestyle. It helps close the gap in access to the infrastructure for the digital economy and improve financial inclusion, as well as supporting the country on its path to digital economy to ensure stable and sustainable growth.

The app has contributed greatly to helping the

country navigate crises, especially during the Cov id-19 pandemic. G-wallet, the government’s e-wal let in Pao Tang, is a key mechanism for delivering financial aid to all groups of people, and does so in a more transparent and accountable manner com pared to the traditional cash handouts which are prone to corruption. It helps reduce inequality in the society, familiarize the people with mobile payment, and drive the country toward becoming a cashless, digital society. It also served as the registration channel for the Bangkok mass Covid-19 vaccination program to accelerate the vaccination in Bangkok, which is a high-risk area, and used as a channel for free antigen test kit distribution.

Bank 07

Another aspect that Pao Tang has made a huge impact on is the democratization of investment. It started to offer 1-Baht Bonds, government savings bonds with an unprecedentedly low face val ue of only 1 baht and minimum investment of only 100 baht. This opened up opportunities for the younger generations to access this low-risk option for saving and investment, which had previ ously been popular among older and wealthier people because of its high face value and minimum investment. The 1-Baht Bond became a big hit; the first batch of 200 million baht was sold out within 99 seconds. Later batch es were also met with similar responses.

Besides government savings bonds, corporate bonds have also been digitized. For the first time in Asia, cor porate bond primary market subscription and secondary market trading became available fully on a digital platform. This too allows all groups of people to have access to this saving option, meeting the needs of modern investors in a way that is inclusive, equal and sustainable.

Additionally, Gold Wallet in Pao Tang became the first mobile platform in Thailand that offers an end-to-end, all-online, experience of gold trading, making buying and selling gold quick, simple and accessible from an ywhere while maintaining a high level of security.

Bank 08

Another feature in Pao Tang is Health Wallet, which gives people easier and better access to universal healthcare. They can check what medical services they are entitled to and make appointments for ser vices such as medical screenings and tests, vacci nations and free Covid-19 antigen test kits.

The latest development of Pao Tang is the digi tal lottery. Thailand has long been plagued by the problem of overpriced lottery tickets. To solve this, The Government Lottery Office now offers approxi mately 5% of the total lottery tickets on Pao Tang at the fixed price of 80 baht. This enables retail sellers to have access to buyers from all over the country without paying additional costs, while buyers can

easily buy tickets with no surcharge, right on their mobile phones. If they are lucky enough to win the lottery, they can simply claim the prize money within the app if they link Pao Tang to their Krungthai bank account.

In short, Pao Tang has truly become a ‘super app’ that meets the needs of both the people and the government in various aspects, including economic, social and investment. With its 34 million users and counting, Pao Tang will continue to expand its net work of partnerships with public and private organi zations to develop products and services that better meet the needs of all groups of people and lead to sustainability.

Bank 09

Costs and Overheads

Saving Ideas for Large Companies

Saving Ideas for Large Companies

Having savings to use if you find yourself in a difficult financial situation is essential – whether that’s per sonal or within a large company. If you need access to cash in an emergency, payday loans uk can help – but it is always best to have your own pot of funds in case an unprecedented expense crops up. Below, we’ll look at a few ways in which large companies can make savings, from cutting overheads to imple menting automated workflow.

Why should large businesses save?

Even large businesses need to save money where they can, as you never know what is waiting for you

around the corner. If you run a company and find yourself in financial difficulty, you may need an extra sum of cash to help you out of hard times. Wheth er you need to pay for equipment to be repaired or your premises has been damaged in some way – it is always best to have funds put to one side in case of emergency. It could also be advantageous if you need to hire extra staff or pay off any debt built up over time.

Below, we’ll look at 5 ways in which a large business can save each month, so that they have a sum to fall back on should they get into difficulty.

Facility Usage

Technology Trends

Workflow Automation

Cloud Storage and Management

1 2 43 5 Review

Business 10

1. Review Costs and Overheads

One of the first places to start if you’re looking to save money for your business is to review your rev enue; your income and your outgoings. Get to know your bank accounts, familiarise yourself with the amount coming in, and the amount leaving – as well as where it is going. By doing this, you can get an accurate picture of what the business is spend ing money on, and if there is anything you could cut back on.

For example, if you’re spending money on making upgrades to the office – are the changes essential, or could you carry them out later? Or are you buy ing too much on stock or materials? Taking the time to comb through your finances will allow you to get to grips with your spending, and decide if you can cut back, and add a little bit of cash to your savings each month.

2. Facility Usage

The facilities within the office can drain cash quickly. If you find that you’re spending in excess on energy, why not introduce working from home, to cut your overheads – or try a hybrid model so that your work ers will only be using the energy within the business for a couple of days a week. If you find that you’re spending money on amenities that aren’t being used, you could talk to your employees to find out why they’re not being used, or if it would affect them if you stopped access to them. This also allows you to listen to what your employees want – so you can stop spending money on unnecessary extras.

3. Technology Trends

As a larger business, you’re likely to need top tech to help you operate to the most efficient standard.

Upgrades are being made constantly and trying to keep up with the changes can be difficult. It may be worth employing someone to keep on top of your technology for you, so you can optimise the equip ment you have in place and save you money long term.

4. Workflow Automation

Workflow automation could be a good way of mak ing savings within your business. This process makes a time-consuming and manual task, into an automated process, so that your employees don’t have to take the time to complete it. It eradicates the need for employees to take part in monotonous jobs and allows them to do work that is high-quali ty and useful to the business. Workflow automation gets jobs done at the fraction of the cost whilst also allowing the workforce to be more productive and efficient.

5. Cloud Storage and Management

Migrating to the cloud can allow your business to save on expensive hardware and lengthy updates. This type of storage allows you to access all your business’s data, files, and apps in one place – from wherever you are, in the office or at home. Using a cloud platform allows you to scale your storage up and down as and when necessary and means you can save on updates that may cost more with on-premises infrastructure. And you don’t have to pay for any storage you’re not using!

Business 11

The Ambitious Entrepreneur:

Finding Your Place in the Industry

Finding your place in a competi tive industry can be a rewarding experience as a new business owner, but you’ll have to tread lightly. It’s okay to take risks to get ahead, but the slightest mis take can lead to potentially dis astrous results, as startups don’t have the same staying power as industry vets.

Fortunately, you don’t have to work independently, relying on trial and error to accomplish your goals. One of the most signifi cant advantages of companies in this day and age is they can use the example of other successful startups to help them get ahead.

to be new and exciting break throughs in your industry, requir ing you to potentially unlearn certain aspects to make room for others. It’s not an easy mind set to adopt, especially when you already have everything planned out. Even worse, it’s not always going to be in your favor.

you should focus on print mar keting is if your business benefits significantly from local market ing. Otherwise, digital marketing benefits even the local crowd.

If you want to take the plunge as an ambitious entrepreneur, here are a few sure-fire ways to take the industry by storm and make your mark.

An open mind can lead to industry success

However, the pros of having an open mind and being willing to make changes based on feed back far outweigh the cons. There’s little to gain from stand ing still and watching your indus try evolve without you. So long as you are running a business, it’s vital that you keep an eye on any breakthroughs to see how you can grow your business. At the same time, ensure that you listen to customer feedback.

The good news is you won’t have to look very far or pay very much, to get what you want. There are search engine optimization (SEO) solutions that can help your busi ness realize its full potential, even in a competitive industry. All you have to do is look for a company offering top-quality SEO packag es like www.ocere.com. Once you accomplish that, everything else follows.

Take the time to know your audience

While there’s nothing wrong with having a traditional mindset when running a business, it can quickly cause problems if you aren’t flex ible enough to evolve with the times. There are always going

When looking to market your company, focus on the digital side of things

If you had to choose between traditional/print marketing and its digital counterpart, the latter comes out in the top 10 out of 10 times. In fact, even 100 out of 100 times, digital marketing would still win every time. The only time

Could you imagine a time when social media didn’t exist? It was such a phenomenon when it was first implemented, growing mind-bogglingly fast to the point where it’s inseparable from the business sector. Social media is the best place to develop the rela tionship between your company and its supporters. A few tips include maintaining a professional relationship with your audience, staying consistent

Business 12

with updates, and being as active as you possibly can. Make sure your staff knows never to get too personal with social media users, as it opens up the possibility of altercations. Take the time to understand your audi ence through what they say, and try to implement some changes based on their feedback.

Conclusion

It’s a fantastic time for a new business owner to push through a competitive industry. Sure, it might require money and a hectic schedule at first, but it’s all about building a foundation for your business. With enough hard work, you can rest easy as you reap your rewards.

Business 13

the

Middle Eastern Brands are embracing

power of audio and video promotions Cover Story 14

Managing Partner for Mindloop Studios

Managing Partner for Mindloop Studios

Cover Story 15

Cover

In 2020, the media and the entertainment market was valued at USD 30,349.4 million and as per reports, it is expected to reach USD 47,029.82 million by 2026. The same reports also suggest that the industry could see a CAGR growth of 7.4 percent during the 2021-2026 period. With over 3 million internet subscriptions in the UAE, as per findings till March 2021, mobile penetration is further driving digital advertising growth in the MENA region. With more than half of all global ad investments devoted to digital promotion, the MENA region alone is expected to contribute around USD 7.9 billion by 2024.

The voiceover industry is a niche industry with artists recommended for a wide range of projects, including audiobooks, commercials, documentaries, educational videos, corporate promotional materials, apps, toys, announcements, and phone prompts, as well as fictional media like animated films, dubbed series, video games, and radio dramas.

In our tryst to further unravel the influence of audio and visual promo across the MENA region, we came across a voice in Dubai. The voice that we have all heard at the Dubai Expo 2020. We tried chasing down the face behind the voice that we heard for Etisalat, Majid Al Futtaim, Dubai Metro, Emirates Airline, Dubai Opera, Rixos Hotels, Nature Valley and many more. We finally tracked down the man, who is popularly christened as ‘Voice of Dubai’. This is an exclusive interaction with Ahmad Haffar, the 28-year old Lebanese, who is the Managing Partner for Mind Loop Studios.

Starting his career as a music coach, producer and composer, Ahmad Haffar shares with us his insights on the growing potential of the media industry in the GCC region

As for our current projects, we are working on the branding music for Sobha Realty, the new major cam paigns for Dove, Mashreq Bank & the UAE 52 Year national day, alongside a lot of other surprises. We work with passion, dedication and true talent at competitive prices, considering our size. Tell us the inspiration behind Mindloop Studios. Tell us about your company, your team, the target clients, some of the most notable works and a few of the current projects. 01

Mindloop studios is a staple in Dubai for audio production since 2001. Established by my business partner, Ahmad Ghannoum, we currently handle a major portion of voiceover work, advertisement music, branding music, sound design/sound effects for major brands and many more in the Middle East. Our team consists of 8 people, the head of both production and audio headed by an incredibly hungry and talented team with over 10 years of experience, each. Our list of premium clientele includes Etisalat, Du, EXPO, RTA, the UAE Gov., DEWA, Playstation, Emirates Airlines and many more. We have produced most content people enjoy and will continue to do so.

Story 16

Share some important chain of events in the past 10 years that pushed you towards entrepreneurship.

I have gone through some of the biggest tragedies in my life in these past 10 years. I am the sole survivor of a fatal car accident that took place in 2012 in Tripoli, Lebanon, which resulted in the deaths of my best friends, Ahmad Dib & Mohammad Al Omar. This accident caused my heart to stop for 46 seconds and yet I managed to come back to life without medical attention, hailing me as a true survivor. Later I went into a state of coma for 1 month and 3 days. After taking 9 months to heal my physical wounds, I came to the UAE at the age of 19 and a half.

After coming to the UAE, I worked as a freelance music producer for brands, a voiceover artist and all things audio. After I became the Managing Partner for Mindloop studios, we have won over 6 awards in my name and another 5 in Mindloop studios’ name since 2017. I have been the youngest person to be featured on the cover of Arabian Business Magazine in 2020. I have also featured on the cover of Friday Magazine, Runway Dubai, Khaleej Times, Gulf News and now, have the honor to be on IBM. Being a school dropout, without a de gree, I have trained and perfected my skills and knowledge in music, voice-over and the language of English. We are currently working on building the region’s first school that teaches experience in the creative media field of Audio, Video, Photography and Voiceover.

Share your insights on the media industry in the Middle East and in Africa. We would also like to learn your views on the global event management industry.

There is definitely more insight on event management on a global level with the introduction of the METAverse alongside the growing spectrum of both quality and entertainment. As for the media industry in the Middle East and Africa, I am happy to say that the power of audio and music for brands is finally catching wind within this region, which is empowering brands to standout in a brand new manner. We are on the forefront of this innovation as we continue to grow these services beyond their normal means and adapt them to the modern era.

Kindly share your thoughts on the future aspects to look forward to as an investor, entrepreneur, musician, artist, performer, and business influencer in the Gulf region, African region, European region and in Asian countries.

The Middle East is finally ripe for growth, I invite every investor, entrepreneur, artist and manager to join us in this ever-growing field of incredible ideas and executions. When you have a painting that’s half full, it is your duty to continue the drawing, to the best of your abilities. Not all of us are as talented as Picasso, but most of us are more than good enough with exemplary dedication and discipline. Africa and Asia are following suit with the European standards on this evolution, as well.

Cover Story 17

Benefits you get when choosing an instant

cryptocurrency exchange

Cryptocurrencies are steadily becoming part of everyday reali ty. The cryptocurrency market is experiencing another deep crisis. Analysts are sure that frivolous, unviable and frankly fraudulent projects will eventually disappear from the market. Digital coins as

such will not disappear anywhere, but their number will be reduced hundreds of times. The coins that survive the crisis are finally inte grated into the global economy.

Until this happens, about 20,000 coins and tokens are available

for purchase and sale on cryp tocurrency exchanges. The trad ing platforms themselves can be centralized and decentralized, traditional and instant exchange services, a typical example of which is LetsExchange.

Finance 18

The functionality of tradition al cryptocurrency exchanges is gradually approaching the func tionality of online exchanges that specialize in trading traditional assets. Moreover, forex brokers are cautiously starting to connect to cryptocurrency trading.

On early crypto exchanges, it was only possible to exchange one coin for another at the current

market rate. Advanced market places support spot and margin trading, provide crypto wallet services, leverage, the ability to join mining pools, staking, cryp to lending services and the list is constantly growing. As a rule, traditional trading platforms sup port the ability to deposit and withdraw fiat currencies, often in more than one of the currently ex isting ways.

Of course, access to all the fea tures of the traditional site will

open after registering an account. In addition to registration, many sites additionally require identity verification. The requirement to provide proof of identity is man datory on all exchanges that comply with the requirements of the CIS and AML. Further, the details differ, I can ask you for an actual photo with a document in hand or something like that.

Verification of the provided data takes some time, from several tens of minutes to several weeks.

How does a traditional cryptocurrency exchange work?

Finance 19

When choosing a traditional trading platform, you should find out where the company is registered, whether the exchange had security problems, how the team operated. A very important point for which operations and in what amount are exchange com missions charged.

Instant exchange services

LetsExchange is one of the best instant cryptocur rency exchange services. The specifics of the op eration of such a service differs markedly from the operation of a traditional type of exchange.

• The platform interface is extremely simple and intuitive. The platform is equally convenient for both beginners and experienced traders and in vestors, and this is not its only advantage.

• Fast coin exchange. The swap is processed al most instantly after placing an order on the site.

• Complete anonymity. Buying and selling crypto currencies on LetsExchange is available without registration and identity verification. The less data you have on the Internet, the more secure you are.

• The best exchange rate. As soon as you choose the direction of the swap and specify the amount of coins to sell, the SmartRate system will check all available offers on the network and select the best one. You will not need to look for an exchange where you can convert MTL to ETH, spend time registering – the system will complete the trans action automatically and ten times faster.

• Professional support. If you have any problems, the support service will promptly come to the rescue.

• Services not related to storage. The platform does not store your coins and they remain at your complete disposal.

• Large selection of coins and tokens. Over 700 coins are available on LetsExchange.

How it works

The conversion takes just as long as it takes to reg ister a transaction on the blockchain. You need to follow these steps step by step:

• Select a coin for sale in the upper window.

• Specify the transaction amount.

• In the lower window, select or enter the name of the coin to buy.

• Make a deposit and enter your wallet address.

After you press the “Let’s change” button, the SmartRate system will do the rest. After the swap is completed, you can download the receipt if you need it.

Platform Disadvantages

LetsExchange does not provide wallet services and therefore you will definitely need offline storage. It is impossible to exchange cryptocurrency without the recipient’s wallet address.

Perhaps not everyone will like the design of the plat form, but this is hardly such a critical flaw.

Finance 20

Finance 21

President of Caye International Bank Luigi Wewege

President of Caye International Bank Luigi Wewege

Finance 22

Belize is significant in the world of offshore banking and investment

Caye International was recently named the Best International Private Bank – CARICOM 2022 after being awarded last year as the Best International Private Bank – Central America for 2021 by International Busi ness Magazine based out of Dubai.

Belize is a front-runner for those seeking offshore banking and investing opportunities. The pandemic has created unique challenges for financial institutions, and we talked with the President of Caye International Bank, Luigi Wewege to get his take on these challenges and more.

I am the President of Caye International Bank head quartered on the beautiful island of Ambergris Caye in Belize, Central America. I also serve as a mem ber on the bank’s Board: Credit and Asset/Liability Committees.

Outside of my banking responsibilities, I serve as an Instructor at the FinTech School in California. The school delivers online training on the latest tech nology and innovation development in the Financial Services industry.

I am also the published author of The Digital Bank ing Revolution, now in its third edition, and available versions in kindle, audio, and paperback formats in all major international online bookstores.

Previously, I helped complete a pilot study for the Federal Trade Commission during one of the most severe financial times for the American economy. The primary focus of the study was to examine and determine the accuracy of credit bureau information which became published research that was present ed before the United States Congress.

Caye’s history began as a Belizean mortgage com pany in 1996. After a continued success over sever al years, the decision was taken to become an inter national bank.

Caye was granted an unrestricted Class ‘A’

International Banking License on September 29, 2003, from the Central Bank of Belize. The Central Bank of Belize is responsible for regulating Caye International Bank and setting the standards for its liquidity and capital adequacy ratios.

How did Caye International Bank get its start?

Can you tell us a little about yourself?

Finance 23

Caye is the only fully focused international bank in the country. Our bank license permits us to conduct financial services with individuals and corporations outside Belize. The bank offers a full range of tra ditional and non-traditional banking services and accounts in multiple currencies, helping people with

asset protection and asset diversification.

Belize also has a compelling tax structure. There is a zero-tax rate on deposits in many personal and business accounts. That one factor separates Be lize from many other offshore locations.

Caye International Bank clients all face similar con cerns, regardless of their location. The main differ entiator in their response during COVID-19 has been the size of their portfolio.

A small diversification client may need a more

sizeable amount of cash right now, whereas a more significant investor may switch asset classes or make speculative moves. At Caye, we are fortunate that our liquidity ratios far exceed minimum require ments. This allows us to weather these storms sim ilar to those like the financial crisis in 2008.

We decided at the onset that we would not cut staff or reduce salaries. We chose to get through the cri sis as a team. We realized it would be arduous to change an almost two-decade central command point bank service structure to a completely digital

online arrangement with staff now working from home. However, we learned what we thought was an im possible task could be achieved in a matter of days when receiving buy-in from all the bank’s stakeholders.

Caye International Bank has won many awards and is a consistent regional and international contender. What do you think are the primary reasons for this?

How has the bank and business managed to thrive through a pandemic?

Many business leaders had to make hard decisions to survive the pandemic. What steps did Caye make, if any?

Finance 024

We’ve certainly felt the impact of the pandemic in Belize, economic and otherwise. Even so, we’ve managed better than some other areas of the world. Part of the credit goes to the forward-thinking atti tude about all things financial that’s part of our way of doing things. We know that the country and our economy will thrive.

Belize is well poised to continue growing as a force

in the world of offshore banking and investment. The laws continue to be refined to keep the nation at the forefront of ethical and practical banking solu tions. A welcoming culture in general and the fact that banking officials and personnel in this coun try know the industry inside and out also helps en gender confidence. We do not doubt that as more people discover Belize, our market share will keep increasing.

There are two ways of dealing with rapid change. One way is through reactive protectionism. This is often through trying to stop the bleeding when change is forced upon you. This can be done by tweaking costs here and there to still be in the black for each quarterly budget. The other method is a nimbler, more proactive approach. It is knowing that most changes are not short-term and recognizing that the first inkling of any change is a signal of po tential opportunity.

Leaders who can develop an adaptive vision and implement responsive systems to meet clients’ new needs are the ones who will be the most successful. Often the big breakthrough successes come from leveraging disruptive change. It’s important to note that getting to this point also requires helping em ployees develop skills to deal with rapid change and as always, communicating “what” and “why” is criti cal to success.

You have an extensive track record as a leader in the financial service industry. Can you tie this up by telling us what the financial sector needs from its senior managers in an environment like we see today?

With the world working to move past the pandemic, what do you envision as the future of offshore banking in Belize?

Finance 025

BTC to USDT Exchange: Step-by-Step Beginner’s Guide

When it comes to cryptocurrency trading, there’s one pair that keeps topping the volume charts on most crypto exchanges — BTC to USDT. The first cryptocurrency ever created (BTC) and stablecoin with the largest market cap (USDT) are two heavy weights that continue to rein the crypto market.

Before you exchange your BTC to USDT, there are a few aspects to consider for your trade to be suc cessful. In this article, you will learn what those as pects are and how to exchange BTC to USDT using a simple, step-by-step guide.

What Aspects to Consider Before Exchanging BTC for USDT?

Tether (USDT) has a daily trading volume that

exceeds USD51.7 billion. Crypto enthusiasts enjoy Tether for its stability. It’s pegged to the US dollar and less prone to price fluctuation. Here are the as pects you need to pay close attention to before you click the “exchange” button:

• BTC to USDT calculator. Find a reliable BTC to USDT calculator that considers the most up-todate price rates of the coins and their transaction fees.

• Crypto wallet. Get a wallet that supports both coins. The best options would be non-custodi al wallets (Trust Wallet and Atomic Wallet) and hardware wallets (Ledger and MetaMask). With those wallets, you will have complete control of your private keys.

Finance 26

• Minimum exchange amount. Most platforms set a minimum exchange limit. Godex has one of the lowest minimum exchange limits for the BTC and USDT pair (0,003 BTC).

• Exchange fees. There is a standard 31.5 USDT fee that is charged for exchanging any amount of BTC for USDT. Besides that fee, each platform levies an additional transaction fee that can vary from 0% to 1%.

• Anonymity. When exchanging your digital as sets, you want to preserve privacy and keep your identity safe. Most platforms implement proce dures like KYC and 2FA. They put your security at risk because they require sharing your sensitive information

Where to Exchange BTC for USDT?

Most popular crypto exchanges will require you to undergo a registration process to start trading. It in volves giving up your personal info. Sharing your ID online makes it more susceptible to hacker attacks.

In some cases, you will need to pass a KYC. Some times it takes a week to become eligible for trading crypto. Furthermore, a platform like Binance au tomatically set up its in-platform wallet for you. It means that information about your private keys can also be compromised.

The best way to exchange BTC for USDT is to do it using an anonymous trading platform. By doing so, you will keep your personal information and private keys safe. It’s also much faster if you have your wal let set up beforehand.

How to Exchange BTC for USDT via an Exchange Platform and Get Profit?

The majority of exchanges have a BTC to USDT pair.

However, there are only a few that doesn’t require registration — one of them is Godex. To start ex changing BTC for USDT with Godex, all you have to do is to follow this simple step-by-step guide:

• Go to the Godex exchange. In the middle of the page, find two fields with numbers. By clicking on the right side of the “You Send” field, you will be able to choose the token you want to exchange (BTC). By clicking on the left side of the same field, you will be able to enter the number of your BTC that you want to convert to USDT.

• Click on the right side of the “You Get” field and choose USDT.

• If you are satisfied with the exchange ratio, click on the “Exchange” button. After that, you’ll need to enter your USDT wallet address in the “Desti nation address” field. You also can choose the type of network you want to receive USDT from (ETH, BSC, TRX).

• Make sure that the data you entered is accurate and click on the “Exchange” button once again.

• You’ll receive a deposit address. Send the num ber of BTC tokens you specified in the “You Send” field via the generated link.

• Wait for the confirmation of your transaction.

With Godex, you can swiftly and anonymously ex change BTC and 300 other digital coins and tokens. Keep your ID info strictly to yourself. You don’t have to worry about the privacy of your data because Go dex provides complete anonymity. The process is fast and takes from 5 to 30 minutes.

Finance 27

Finance 28

All you need to know about

Derivatives Trading

There are numerous trading avenues and strategies for an investor to try out and embrace. One such popular trading strategy is trading in derivatives. In fact, the use of derivatives trading has been around for decades because of its better returns and risk hedging properties. So, if derivatives trading has got you interested, then read on to know the basic facts about it.

What exactly is derivatives trading?

A derivative refers to a contract that takes place between multiple par ties, and the value of the contract is based on a particular asset or group of assets. Such assets can be currencies, stocks, commodities, or even exchange rates. Thus, you will find derivative trading elements in share, CFD, or currency trading.

In derivatives trading, you benefit mainly from positive market move ments. It is easier for traders because it does not need a heavy capital investment upfront. So, if you keenly watch the global market move ments to have a clear understanding, then derivatives trading is for you.

The participants in the derivatives share trading market

The derivatives market can be broadly divided into three types of play ers –

Arbitrageurs: In this case, traders buy an asset for cheap at one ex change only to sell it for a better price in some other exchange. As you can guess, there is a very small window of opportunity for arbitrageurs.

Hedgers: This group is into CFD trading and derivatives market only to reduce risks.

Traders: These are the ones who operate in the market solely with the aim to take a good position in the desired contract.

Finance 29

The benefits of trading in derivatives

The popularity of trading in derivatives stems from the four main benefits it offers:

• The option to choose risk levels: You can go for a high-risk or conservative strategy based on your trading outlook.

• Better leverage: You get a greater trading exposure in the financial market with a lower margin amount.

• Accessing higher returns: You might get a return even when the market is going down or sideways.

• Hedging the position: There are prospects to keep yourself away from risks by hedging the position.

Finance 30

Different kinds of derivatives to trade

Now, a financial trading consultancy will give you three types of contracts that you can trade in – options, swaps, and forwards. Here’s a brief overview of each:

Options:

Options refer to the contracts that offer traders the rights to sell or purchase the underlying asset. This is the chosen route when you want exposure to major price movements minus the position in the asset.

Swaps:

In swaps, two parties make an agreement to exchange future cash flows as per a pre-decided formula and agreed-upon norms.

Forwards:

Two parties decide to sell or buy an asset at a specific date for a specific price that is determined on the day the contract is signed.

It is important to have an understanding of the market to make derivatives trading work for you. At the same time, your market knowledge will keep improving as you continue to trade more

Finance 31

Questions to ask yourself before picking between the different Tax-Saving options Finance 32

When it comes to tax season, there are many op tions to choose from when you want to save money. Which option is best for you? That can be a difficult question to answer. This blog post will discuss four questions you must ask yourself before making your decision. By answering these questions, you can narrow your options and find the best tax saving option for your needs!

Here are the Questions to Ask Yourself.

How Much Taxes Must You Reduce?

The first question to ask is: how much taxes must you reduce? This will help you decide which tax-sav ing options are the most suitable for your case. If you need to save a lot on taxes, then choosing an option that offers more significant tax breaks might be better.

On the other hand, if you only need to save a small amount on taxes, then a less aggressive option may suffice. This may also help you decide whether us ing more complicated tax-saving strategies is worth the hassle.

What’s Your Risk Tolerance?

Risk is one of the key factors to consider when mak ing any investment decision. How much risk are you willing to take on? This is an important question be cause it will help narrow down your options. For ex ample, life insurance is generally considered a safe investment, while stocks are usually riskier. The lowrisk instruments, in most cases, offer lower returns, but they are also less likely to lose value.

On the other hand, high-risk instruments have the potential to generate higher returns, but there is also a greater chance that you could lose some or all of your investment. So before picking between the dif ferent tax-saving options, you need to ask yourself

how much risk you are willing to take on. Only then can you narrow down your choices and pick the op tion that best suits your needs.

What is Your Budget For Investments?

Knowing your budget is important for a few reasons. The first is that it will help you determine which in vestment option is best for you. For example, if you have a limited budget, then investing in a policy with a higher premium may not be the best option for you. It is also important to know your budget to en sure you are comfortable with the amount of money you are investing.

What are Your Monetary Objectives?

This is the most important question you can ask yourself before deciding to save for retirement. Do you want to retire as soon as possible? Or do you want to save as much money as possible? Your an swer will help you determine which tax-saving op tions are right for you.

The Bottom Line

Regardless of your tax-saving goals, it’s important to remember that there is no one-size-fits-all solu tion. The best way to save on taxes is to tailor your approach to your specific situation. The above ques tions are a great starting point to help you figure out which tax-saving strategies will work best for you.

Finance 33

Role of API Economy in Enabling Businesses of the Future

Businesses across the globe, es pecially in the field of technology and digital services, are more con nected than ever and rely on each other’s services to realize value from their business model. Com panies can provide a wide gamut of services while minimizing the development time and cost by using third-party integrations. For example, Uber, the world’s most prominent ride-hailing service, relies entirely on the application programming interfaces (APIs)

of Google Maps, AWS, Twilio and other businesses to bring its ride-hailing service to customers. Companies such as Salesforce and Expedia derive more than half of their revenues from their APIs. With integrations becoming a key to revenue models, APIs are the de-facto representatives of businesses to their downstream stakeholders and occupy a key role in a company’s go-to-market strategy.

In such a connected business en vironment, APIs have ceased to become just another mode of da ta-sharing and are now regarded as an organization’s most crucial revenue generator and its exter nal representation to the market. Companies are investing in man aging APIs, not as a tool but as a standalone product with develop er experience and lifecycle man agement as key components in API management. The wide spread proliferation of APIs is a

FinTech 34

key driver of rapid digital trans formation in post-COVID times, where businesses have been successful in realigning their business models to the shifting dynamics of the market. In the same way that APIs have enabled retailers to connect with banks to offer in-app payment options, IT applications have been able to share data with each other to offer seamless and feature-rich experiences to end users. With modern APIs designed with ease of use for developers in mind, de velopers can build applications

modularly and combine multiple functionalities to enable new use cases.

Notably, companies across the world are experiencing higher competition in the digital world as the barriers to new entrants drop. This has resulted in shorter development cycles with an em phasis on launching new prod ucts and functionalities quickly. APIs are key enablers in the accel eration of software development cycles and have allowed develop ers to deploy functionalities from

third-party vendors without addi tional coding. The replacement of lengthy coding with API inte grations has also helped devel opment teams deal with talent shortages by managing complex, multi-module products with limit ed resources.

It has also been observed that APIs have played a major role in helping companies modernize and digitize their business prac tices at a limited cost and with out disruptions. Companies have

FinTech 35

FinTech 36

managed to connect their legacy applications to new tools and cloud systems using APIs with out a lengthy systems integration process. Many companies built connected enterprise applica tions internally by connecting dis parate systems across depart ments and business divisions.

However, APIs are not being lev eraged to their full potential, as research from Google indicated; most organizations worldwide believe that their organization’s API usage maturity is low or me dium, with only 38% of organi zations believing that their API practices are highly mature. A key observation is that 50% of companies use APIs for internal stakeholders only, which include an organization’s staff develop ers and contractors, but do not serve developers outside the or ganization. This severely hinders an organization’s capability to collaborate with the wider con nected ecosystem and restricts the variety of use cases that dig itally mature organizations can offer their customers. One of the crucial steps toward improving API maturity is the adoption of cloud or hybrid deployments of API, which a significant number of API owners are pursuing today

to make their APIs and related services more agile and flexible.

APIs are undoubtedly the most efficient method for companies to connect with third parties and vice versa. However, consider ing the revenues that APIs bring to companies and their role in the overall digital economy, APIs have become prime targets for cybercriminals. According to in dustry estimates, malicious API traffic has increased 681% in the past year, and many companies have rolled back or slowed down the deployment of new applica tions or functionalities due to se curity concerns. Notably, Google has observed that the usage of security analytics, bot protection and anomaly detection features has increased by 230% among its API customers. While there is a clear trend toward enhanc ing security capabilities from API owners as well as users, se curity incidents continue to be a concern and more investments toward improving the security posture of APIs are needed. In a modern digital world where API calls will originate from corporate networks, user devices, desktops, smartphones and IoT devices, a company’s firewall or perimeter securing strategies are bound to

become outdated. Companies need to maintain visibility and control over how their API is ac cessed by various stakeholders across endpoints. Role-based access control strategies are one of the most efficient methods of maintaining such control in addi tion to machine learning-based suspicious activity monitoring.

APIs in 2022 are the backbone of the digital economy. Their role in revenue strategies is expect ed to grow as businesses evolve with more connectivity as a core tenant of their business model. Establishing strong API practic es with APIs that cater to a wide range of use cases and applica tions is crucial to the success of digital businesses however, se curity and API data governance need to gain precedence among API developers and users to fur ther the API economy while min imizing the risk. In the next few years, API-first strategies will flourish as APIs become the pri mary product offering for many companies; for others, APIs will become key business enablers.

FinTech 37

The global IT asset disposition (ITAD) market size was valued at USD 18,572 million in 2021, and it is expected to increase to USD 51,377 million by 2030 at a CAGR

of 12% during the forecast period (2022–2030). Asia-Pacific, along with Europe, is expected to have the largest share in the market.

IT asset disposition (ITAD) re cycles, repurposes, and repairs outdated IT equipment in an

environmentally beneficial way. An IT organization can market its assets internally or hire an expert. Repurposing an IT device’s inter nal components prevents elec tronic waste. It prevents plastics and heavy metals from entering the environment.

Although some firms have an organized cycle for replacing electronic devices, others must decide whether to restore, resell,

recycle, or dispose of outdated technology. Asset management, accession, and risk management handle aspects of the IT asset disposition process internally.

A company may also work with ITAD outside firms.

Typically, these companies of fer secure data destruction and electronic trash recycling. ITAD suppliers help clients dispose of IT assets while cutting costs

Information Technology 38

and recovering equipment value. The growing awareness of the customers about the necessity for proper IT asset disposal is behind its growth. Businesses emphasize the benefits of cloud computing. Therefore, the migration from on-prem ise to cloud is a market driver for IT disposition.

IT asset disposition has a reverse value chain, not a for ward one. Reducing costs and boosting profits are critical in a forward value chain, but cost reduction, environmen tal restrictions, and profit maximization are emphasized in a reverse value chain. IT asset disposition value chain in cludes end-users, product acquisition, reverse logistics,

inspection and disposition, refurbishment, and distribution and sales.

Driving the IT Asset Disposition Market

Electronic devices and IT assets, such as mobile phones, wearables, computers, servers, and peripher als, must be discarded appropriately when they become obsolete or end their valuable lives. Commonly referred to as electronic waste or e-waste, these electronic prod ucts are destined for recycling or refurbishment. Inef ficient management of e-waste or improper practices of handling e-waste frequently leads to e-waste accu mulation, potentially polluting the environment and

Information Technology 39

Technology

habitats, harming humans, and endangering wildlife.

The volume of e-waste does not decrease as technological ad vancements continue to drive demand for the most modern electronic devices and IT assets. Consequently, the expanding quantities of e-waste have be come a global issue. The neces sity of a well-organized and se cure plan to dispose of electronic waste and obsolete IT equipment is growing. Several state and fed eral environmental, data security, and privacy protection regula tions have been drafted to ensure that electronic waste is disposed of properly. Significant financial penalties may be imposed for any violation of these standards. Increasing environmental aware ness among individuals and busi nesses is also driving the adop tion of proper e-waste disposal practices. As part of their corpo rate social responsibility initia tives, several companies world wide recycle, recover, or prioritize the safe and secure disposal of e-waste and obsolete IT assets. These factors bode well for the growth of the IT asset disposition market over the forecast period. Also, the growing awareness of the benefits of cloud-based computing, and consequently,

the continued migration from on-premise to cloud-based ser vices, is a significant factor pro pelling the expansion of the IT disposition market.

IT assets, such as storage devic es and servers, and other periph erals and support infrastructures, such as networking equipment, cables, uninterruptible power supplies (UPS), physical security systems, and environmental con trols, are used on-premises to be disposed of appropriately. Their data is cleansed before the com pany transitions from on-premise to cloud-based services. There fore, businesses are turning to IT Asset Disposition (ITAD) ser vice providers to dispose of their unwanted or obsolete IT equip ment secure and environmentally responsible.

Impact of COVID-19

The advent of the noble Corona virus harmed the economies of every country. To slow the spread of the disease, the government declared lockdowns, resulting in the cessation of production, the closure of all work environments, the restriction of public interac tions, and the temporary suspen sion of global manufacturing and trading activities. The pandemic

presented unique challenges to businesses of all sizes when dealing with IT hardware that had reached its maximum capacity. Historically, IT companies were primarily concerned with the rate of development, which necessi tated the effective management of redundant equipment. The transition to remote work ne cessitated businesses’ purchase of new IT equipment during the pandemic. Concerns were raised about how companies would handle the resulting increase in electronic or IT asset waste due to the rise in IT asset purchases related to remote working. As a result of the pandemic, the de mand for IT asset disposition ser vices increased significantly.

The COVID-19 pandemic prompt ed businesses to adopt the “work from home” model and encour age employees to use their own IT resources. As working from home became the norm, com panies began to dispose of their obsolete and unused IT assets, increasing demand for ITAD solutions.

Regional Insights

The Asia-Pacific market will ac count for USD 25,440 million by 2030, expanding at a CAGR of

Information

40

14%, whereas Europe is anticipat ed to have a value of USD 12,813 million with an annual growth rate of 11% by 2030. Existing infrastructure in the Asia-Pacific region has been modernized due to the develop ment of new technologies and digitalization. The rapidly expand ing information technology mar kets in China, Japan, and India have propelled these nations to the forefront of the ITAD indus try. According to the United Na tions University, India generates approximately 3.2 million metric tons of e-waste annually, ranking it third behind China and the Unit ed States. To effectively manage and guarantee the secure dis posal of any e-waste or IT asset waste, the demand for IT asset disposal (ITAD) services has increased.

North American expansion is also anticipated during the forecast period. The region’s economic development will be primarily driven by the thriving information technology industry and the pro liferation of cloud data centers. In addition, the presence of nu merous ITAD service providers in the area, such as Apto Solutions, Inc., Sims Lifecycle Services, Inc., and Iron Mountain, Inc., among others, is already contributing to

the region’s growth. Consequent ly, widespread adoption of cloudbased technologies is anticipat ed to generate optimistic growth prospects for the market.

Key Highlights

• The global IT asset disposi tion market was valued at USD 18,572 million in 2021, and it is expected to increase to USD 51,377 million by 2030 at a CAGR of 12% during the fore cast period (2022–2030).

• Based on asset type, the seg mentation is done as comput ers/laptops, smartphones and tablets, peripherals, storage, and servers. The computer/ laptop segment is expected to have the most significant share during the forecast peri od, with USD 22,254 million at a CAGR of 12%.

• Based on end-user, the market is segmented as BFSI, IT and telecom, government, energy and utilities, healthcare, and media and entertainment. The IT/telecom industry is ex pected to expand at a CAGR of 13% and reach the value of USD 16,772 million by 2030.

• Region-wise, Asia-Pacific will

account for USD About Straits Research Pvt. Ltd.

• Straits Research is a market intelligence company provid ing global business informa tion reports and services. Our exclusive blend of quantitative forecasting and trends analy sis provides forward-looking insight for thousands of deci sion-makers. Straits Research Pvt. Ltd. provides actionable market research data, espe cially designed and presented for decision making and ROI.

• Whether you are looking at business sectors in the next town or crosswise over conti nents, we understand the sig nificance of being acquainted with the client’s purchase. We overcome our clients’ is sues by recognizing and deci phering the target group and generating leads with utmost precision. We seek to collabo rate with our clients to deliver a broad spectrum of results through a blend of market and business research approach es.25,440 million at a CAGR of 14%, whereas Europe will ac count for USD 12,813 million at a CAGR of 11% by 2030.

Information Technology 41

JWEI reveals Pre Market Tobacco Application to the U.S. Food and Drug Administration

JWEI, one of the global leaders in the electronic cigarette indus try, announces recently that they have successfully submitted a Pre Market Tobacco Application to the U.S. Food and Drug Admin istration for a device created with their new innovative technology, which is focusing on safety, harm reduction and designed to curb underage use.

As one of the world leading de vice manufacturers and innova tors of e-cigarette and vaping products, with over 3,600 granted patents and multiple internation ally recognized manufacturing and quality certifications.JWEI is committed to contributing to the advancement of the public health with meaningful and responsible innovations.

Cigarette smoking is one of the biggest public health threats, killing over 7 million people in the world every year.About one in every five deaths in the US is caused by cigarette smoking annually .The litany of tobacco

related diseases is long. Sadly, most of the mortality and mor bidity are preventable.

Tobacco is addictive, primarily due to the presence of nicotine, although nicotine itself is not the direct cause of most smoking-re lated diseases. Many smokers who try to quit, either on their own or with the help from cessation programs, fail in their attempt.

to tackle the cigarette smoking epidemic from regulators, man ufacturers, entrepreneurs, re searchers in academia or private sections, advocacy groups, and distributors while not creating another vaping epidemic in youth and vulnerable populations.

There is a continuum of risks for products that deliver nicotine, ranging from the most harmful combusted products (e.g. ciga rettes) to currently least harmful medicinal nicotine products such as nicotine replacement therapy (NRT). In recent years, attention has turned to the possibility of encouraging those who are una ble or unwilling to quit to either re duce their cigarette consumption or switch to a less harmful alter native such as e-cigarettes as a potential outcome goal.

It requires a comprehensive, mul tifaceted approach and efforts

Firstly, JWEI developed a set of principles to guide through every step of the new product develop ment, led by safety and effective ness studies in early 2019. The design philosophy is the founda tion and guide rails for designing, manufacturing, verifying, validat ing, and continuously improving innovative, responsible, reliable, and high-quality products. The design philosophy was clearly established at the very beginning of the new product platform de velopment: Turning the smoking epidemic challenge into improv ing public health opportunities with meaningful and responsible innovations.

Secondly, JWEI formed a ded icated multidisciplinary team

Report 42

including aerosol chemists, ma terial scientists, toxicologists, epidemiologists, clinicians, be havioral scientists, and other sub ject-matter experts to harness creativity and innovation towards the realization of meaningful and effective product development.

Thirdly, JWEI has held a high standard from the beginning of the new product platform de velopment and throughout the whole process. They brought in domain experts, including bio medical engineers and clinical and regulatory experts with dec ades’ extensive experience in Class III medical devices. They prioritized safety with significant harm reductions for users and device-based access restrictions to deter youth initiation.

Fourthly, JWEI embedded the comprehensive PMTA guideline into a set of coherent criteria for product development and study objectives. The thorough and systematic testing and studies were conducted across three continents (Asia, Europe, and North America) with many cer tified third-party labs and repu table principal investigators and researchers from industry and ac ademia, including aerosol testing, stability testing, E&L testing, in vitro toxicology testing, biomark er studies, in vivo pharmacokinet ics, clinical studies, product per ception and behavioral studies,

human factors study, individual health assessment, actual use studies, population health mod eling, and environmental impact assessment. The hand-in-hand interactive process between the new product platform develop ment and executing PMTA study modules has yielded impressive results efficiently and effective ly. For example, the new product has been shown to reduce>99.9% harmful and potentially harmful constituents (HPHC) compared to combustible cigarettes. This nicotine transfer effectiveness can enable the ability of much lower nicotine consumption to meet users’ needs to ramp down, innovative and pragmatic deterrence features that greatly discourage non-users, and the ability to sustain the switch as the primary source of nicotine in actual use among users.

the vast majority of users are ex isting nicotine product users who are well past young adulthood. The totality of the evidence builds a strong foundation demonstrat ing the new product and its plat form products have a high poten tial to exert a profound impact on the APPH (appropriate for the protection of public health).

Over 1,500 documents, hundreds of study reports, and tens of thou sands of pages in the final PMTA submission have been submitted to the FDA. The application will now be reviewed by the FDA be fore a determination is made by the agency to accept the applica tion for filing at which stage it will then undergo a preliminary scien tific review to ensure the applica tion contains all required items to permit a substantive review by the FDA.

Last but not least, the mission driven motivated team across three continents (Asia, Europe, and North America) tirelessly worked on the project around the clock.

The limited product debut in the UK has received overwhelm ing recognition from users and commercial partners after a few months’ actual use. The high-quality and innovative fea tures resonated well with users. The demographics of the actual use age distribution also showed

“JWEI has been a leader in this industry from the start and this milestone again reiterates our commitment to the industry and public health: ensuring our adult customers continued access to less harmful alternatives to tra ditional tobacco products, while setting a new standard prevent ing underage youth access.” said Jason Yao, VP of JWEI Group.

Report 43

Rosuvastatin Calcium Market Report highlights the potential, and risk factor analyses, and is enhanced with strategic and tac tical decision-making assistance.

The Rosuvastatin Calcium mar ket is at the growing stage. Ac cording to a new analysis present ed by Market (40,000+ published and upcoming reports), the take away and delivery Pharmaceuti cals and Healthcare market will indeed witness an increased de mand in the coming years on top of Rosuvastatin Calcium market.

There has been numerous re search and development activ ities are underway to enhance Rosuvastatin Calcium products and new innovative technologies. The report deals with numerous research objectives, investments plans, business strategies, im port-export scenario, and sup ply-demand scenario. To help in strategic planning, key stake holders can use the tables and figures from this report to gather statistics. It provides insights into key production, revenue and con sumption trends for players in or der to increase sales and growth within the global Rosuvastatin Calcium Market.

Report 44

It examines the most recent developments, sales, market valuation, production, gross margin, as well other significant factors, of the major players in the Rosuvastatin Calcium Market. To fully understand the current as well as future growth of Market, play ers can refer to the report’s market figures and sta tistical analyses. This report examines the major factors that have influenced the industry’s growth and describes how they are contributing to it. The global Rosuvastatin Calcium market is analyzed ob jectively and compares all key segments. The report offers valuable analysis and suggestions for indus try players. The report offers recommendations that will help industry players compete in the market and to survive.

Rosuvastatin calcium market analysis by focusing on competitive landscape and key developments

LGM Pharma, Cadila Pharmaceuticals, Zhejiang Hisun Pharmaceutical, MSN Laboratories, Chang zhou Pharmaceutical Factory, HEC Pharm, Jingxin Pharm, Teva Pharmaceutical Industries, Lianyunga,

AstraZeneca, Lunan Pharmaceutical, Bal Pharma and Nanjing Frochem Tech are leading companies in the Rosuvastatin Calcium market. The market leaders are now focusing on strategies like product innovation, mergers-and-acquisitions, recent de velopments and joint ventures, collaborations and partnerships to improve their market position.

The research then uncovers market opportunities that are simple and gives the business valuable information that will help it thrive in the global Ro suvastatin Calcium market. The report contains de tailed information on the factors that will increase the market’s growth over the next few years, from 2022-2031. The report discusses market segmenta tion, key players and types of applications, as well as rapid growth in key markets.

Report 45

Report 46

Kuwait Financial Centre “Markaz” Buoyed by strong macroeconomic fundamentals, the real estate sector in GCC economies is on a solid trajectory to witness acceleration in the second half of the year, according to the ‘Real Estate H2 2022 Outlook’ reports for the UAE and Saudi Arabia issued recently by the Ku wait Financial Centre “Markaz.” The reports also analyse the performance of subsectors such as residential, office, retail and hospital ity during the first six months and delve into the impact of various new socioeconomic pol icies and real estate reforms and initiatives on the sector.

Prepared by Marmore MENA Intelligence, a fully owned subsidiary of Markaz, based on the ‘Markaz Real Estate Macro Index,’ the re ports help investors identify the current state of the GCC real estate market through various economic indicators such as oil and non-oil GDP growth, inflation, new job creation, in terest rate, and population growth, among others. The findings and observations in the reports are substantiated with data from the past seven years along with estimates for the remainder of the current year and forecasts for the next year.

The ‘UAE Real Estate Outlook H2 2022’ reveals that the real estate sector in the country has overall been trending upwards this year, with a rise in rentals and property prices. Along with an increase in the prices, transaction volume in the first quarter of the year in Dubai touched

its highest total for the first quarter ever re corded in the region. The upward momentum in the national economy fuelled by rising oil prices, growth in the non-oil sector and the success of Expo 2020 Dubai were among key drivers of growth in the real estate sector. Property prices in the UAE continue their up swing momentum in 2022 with average resi dential property prices rising in both Dubai and Abu Dhabi by 11.3 per cent and 1.5 per cent re spectively in the 12 months to March this year. Office rents for grade A offices in both the cities continue to soar, marking an increase of 9 per cent and 5 per cent respectively Y/Y. In the re tail segment, Dubai has witnessed an average rental growth of 10.5 per cent in the first quar ter of 2022, whereas Abu Dhabi witnessed a decline in average rental by 7.8 per cent in the same period. The sector remains positive on the back of increasing demand from new local entrants and international brands. Meanwhile, the hospitality market saw significant growth across all the key metrics including occupan cy rates, average daily rate (ADR), and revenue per available room (RevPAR) in the first quar ter. This rapid growth on the back of global events could steady down in the near term but is expected to continue its growth trajectory in the long term.

Based on its assessment of various macroe conomic factors, the report forecasts that the real estate sector in the UAE is expected to ac celerate in the second half of 2022. Relatively high rental yields coupled with affordability,

Report 47

friendly visa policies and new work permits that aim to enable qualified workforce to live in the UAE and long-term plans of urban and sustainable develop ment under Dubai Urban Master Plan 2040 are ex pected to incentivise investors who are looking for a steady stream of income, while measures targeted towards increasing transparency and reporting with in the real estate sector and restructuring of govern ment entities to increase efficiency and enhance investor experience are set to boost the investor confidence further. However, the report notes that the Central Bank of UAE has raised interest rates in lockstep with the US Fed and warns that higher in terest rates are expected to affect consumer spend ing during the rest of 2022 and 2023.

The ‘KSA Real Estate Outlook H2 2022’ shows that the Saudi Arabian real estate market has made a strong recovery from the coronavirus-induced

slowdown as demonstrated by the rise in the real estate price index by 0.4 per cent year-on-year (y/y) in Q1 2022, mainly driven by a 1.8 per cent y/y in crease in residential land prices. Real estate land prices have been relatively stable in the recent past, showing mild growth. Various measures taken by the government such as ensuring home ownership for all nationals and mandating regional headquar ters for foreign companies have also given new impetus to the real estate sector. In addition, other government initiatives such as Sakani, which ena bles Saudi citizens to own their first home, and the Wafi off-plan sales and rent programme boosted the demand for affordable homes. It also notes that Saudi Arabia’s new giga projects including NEOM, the Red Sea Project, and Riyadh’s Diriyah Gate sig nal a shift in consumer preferences and real estate development.

Report 48

Though the real estate price index for Saudi Arabia is still below its 2015 highs, it has stabilized in re cent quarters. Residential transaction volumes fell by 23.4 per cent in Q1 2022 vs Q1 2021 and the total value of the transactions also fell marginally by 1.9 per cent. On the other hand, the office sector’s per formance improved across the Kingdom in the first quarter of this year, with average rents for Grade A and Grade B office buildings climbing in Riyadh and Jeddah by 8 per cent and 3 per cent respectively. In the retail sector, however, rents for super regional and regional malls declined by 5 per cent and 7 per cent respectively in Riyadh, and by 1 per cent and 5 percent in Jeddah. On the back of rising leisure, business and religious visitation, the hospitality sec tor has been performing well in the Kingdom, espe cially in Riyadh, and is expected to further improve during the remainder of the year.

With the Kingdom’s economic momentum expect ed to continue well through 2022 on the back of an anticipated increase in oil production, the country report forecasts that the real estate sector will show further stability with a chance of mild acceleration in the second half of the year. Solid growth in the oil sector, the growing domestic investments in non-oil sectors by the country’s sovereign wealth fund Pub lic Investment Fund, stronger private consumption, and an increase in religious tourism due to the eas ing of travel restrictions are expected to remain ma jor positive drivers for the economy and the real es tate sector. On the other hand, rising interest rates, which are expected to have a negative effect on mortgage lending and reduce consumer spending, and weak global cues remain the major headwinds.

Report 49

How to Make Use of LegacyFX’s

Compliance Procedures

Experts have found that the foreign exchange mar ket has seen a daily average trading volume of 6.6 trillion dollars from April 2019 until today.

Yet such sizable volumes raise significant concerns about the various risks involved with this type of trading. As such, it is important for forex brokers to establish appropriate procedures and compli ance policies to help regulate and limit risks to

themselves and their clients alike. Considering that forex brokers are financial institutions that deal with other people’s resources, these brokers should ad here to a few common practices. Typically, these policies are standard based on regulatory require ments, depending on the regulatory bodies that gov ern the brokerage. However other policies may vary from broker to broker.

Trading 50

As one of the top forex brokerages, LegacyFX makes all possible efforts to adhere to international regu lations regarding the security of funds and transac tions, anti-money laundering, fraud, and counter-ter rorism financing. Due to such stringent policies, one is, therefore, able to focus more on trading with the assurance that their capital is safe and secure. Ad ditionally, our clientele has access to all pertinent in formation and disclosures regarding commissions, fees, spreads, and trading executions, allowing an overall more transparent experience.

We will talk about some of the policies and proce dures LegacyFX adheres to, per their requirements from financial regulators, and how you, as a trader, can benefit from them to possibly reduce risks and challenges you might encounter when trading.

KYC Documentation

In addition to basic financial information, LegacyFX collects personal information from its clients per its regulator’s Know Your Client (or KYC) policies. Proof of identity (ID, Passport, Driver’s License), proof of payment (Credit/Debit Card), and proof of residence

(recent utility bill or bank statement from the last three months) are among the documents we request from our clients.

These documents that LegacyFX collects, shield our customers from fraud-related activities by identifying who the account holders are. Other purposes for these documents include enabling us to oversee and securely pro cess our client’s transactions. Because LegacyFX complies with international financial regulations and keeps track of all client transactions, we can therefore ensure that any payment methods used are under the account holder’s names, to ensure that no client will ever be mis or overcharged, or that the source of their funds is not derived from illegal means.

The other reasons for gathering personal information by LegacyFX are to inform customers about transac tional or post-transactional services or to keep in line with everchanging banking and financial laws, prod ucts, services, or other commercial partnerships.

Segregated Accounts