WINGATE 24 MULTI-FAMILY INVESTMENT OPPORTUNITY ASHLEY GARNER | CALL/TEXT: 910-409-0861 | ASHLEY@ABGMULTIFAMILY.COM SAMPLE

MULTI-FAMILY INVESTMENT OPPORTUNITY

DEAL AT A GLANCE

• Minimum investment = $50,000

• Total Equity required = $800,000

• Avg. Annual Return = 15%

• Cash on cash Return = 7%

• Duration = 5 year minimum

• Distribution Schedule = Quarterly (after year 2)

• Property = 24 units, built 198

Business Plan - Increase value by increasing net operating income (NOI) by increasing rents to market rates and by renovating units to today’s standards. Reduce expenses by billing back utilities to tenants and through quality property management and thorough maintenance. This phase should take approximately 18 months to complete. Following Phase 1 we will obtain cash-out refinance thus returning as much of investors initial investment as possible. Buy vs Hold decision to be evaluated following this phase (+/- 5 years).

WINGATE 24

ASHLEY GARNER | CALL/TEXT: 910-409-0861 |

SAMPLE

ASHLEY@ABGMULTIFAMILY.COM

EXECUTIVE SUMMARY

Passive Investing in Real Estate

Syndication is a tool used to include passive investors in an entity that purchases, owns and operates an asset. We believe that the benefits of owning cash flow producing real estate are tremendous. These benefits include cash flow during ownership, equity growth through appreciation, tax benefits from depreciation, protection against inflation and the opportunity to increase value (through asset improvement and strong management).

Syndication makes it possible for investors to provide the equity (cash) portion of the purchase price. In return the passive investors (aka Limited Partners) own a portion of the entity that owns the asset.

ABG Multifamily, a North Carolina company headquartered in Wilmington, NC, is arranging for the acquisition of undivided real estate interests in the above property by a limited number of accredited and qualified investors. The property consists of 24 units and is priced at $2.50M.

We are seeking a total investment of $800,000 with a minimum of $50,000 per investor. Investors receive 70% equity with projected average annual returns of 15%-17%. Cash flow distributions are made at the end of each calendar quarter.

Investors should expect a 5 year commitment, even though there is a possibility to re-finance and repay the investor’s principal before then. If we re-finance or sell the property, investors first receive their principal back, then receive 70% of any profits.

Please see below for more information about the property, its current performance, our strategy to increase income and our financial projections.

MULTI-FAMILY INVESTMENT OPPORTUNITY

WINGATE 24

ASHLEY GARNER | CALL/TEXT: 910-409-0861 | ASHLEY@ABGMULTIFAMILY.COM SAMPLE

ABOUT THE PROPERTY

WINGATE 24

MULTI-FAMILY INVESTMENT OPPORTUNITY

The subject property is a 24-unit, walk-up apartment building located at 4404 US-Hwy 74 E, Wingate, NC 28174. The property is comprised of two buildings with a unit mix of 16 One Bedroom/ One Bath and 8 Two Bedroom/Two Bath units. The Lot and building are zoned AW3, with the lot totaling 2.66 Acres.

Each building is two stories tall with a covered breezeway and wood deck system for ingress and egress. Wingate 24 was built in 1986 with vinyl siding, vinyl window, and shingle roof. The concrete parking lot offers ample space for tenants and guests. The property has 346 feet of frontage on US Highway 74 East with two driveway/road cuts.

ASHLEY GARNER | CALL/TEXT: 910-409-0861 | ASHLEY@ABGMULTIFAMILY.COM SAMPLE

Value Add

A “Value Add” investment is one in which we can force the increase in income and thus equity, also stated as “value”. Commonly value is added by increasing the rents collected on a property. This rent increase results in some cases from simply raising the rent to market rate upon the turnover of a lease. The other most common source of added value is to renovate the property to bring it up to the current standards tenants expect. Location is not something that can be changed so it is desirable to find a property that has value add opportunity in a good location. Sometime this will be sated as “a C class property in a A class location”. This situation would allow for increased rents as the property was improved.

OPPORTUNITY AND BUSINESS PLAN

Wingate 24 offers a tremendous opportunity for us to reposition the asset to take advantage of the significant increase in demand associated with the proven success of Wingate University, which is only a quarter of a mile walk away.

The objective to add value by increasing performance will be accomplished in three ways:

• Tenant mix – currently the property is not marketing to the student population at Wingate University. The walk to campus from the property is only 10 minutes (0.2 miles). Proximity to campus is a key driver of rent growth for student populations.

• Capital Improvements – Current owner has renovated 11 of the 24 units resulting in proven rent growth.

• Water and Sewer – currently the owner is paying all of the water and sewer expense at the property. By passing along this expense to the tenant a significant savings will be realized.

In summary, there is a significant opportunity to increase rents by up to 30% from current and also to reduce expenses by passing on the cost of the water and sewer.

MULTI-FAMILY INVESTMENT OPPORTUNITY

WINGATE 24

ASHLEY GARNER | CALL/TEXT: 910-409-0861 | ASHLEY@ABGMULTIFAMILY.COM SAMPLE

THE NEIGHBORHOOD

MULTI-FAMILY INVESTMENT OPPORTUNITY

The subject property is located less ¼ mile from the campus of Wingate University. Wingate University is one of the fastest growing universities in the nation. The University contributes an annual economic impact of $168 million to Union County, while supporting about 1,300 jobs in addition to a student population of 3,600.

The property is also located about six miles (~10-minute drive) from Downtown Monroe, which has seen an increase in business activity and serves as a hub for retail, office, and gov ernment office as the capital of Union County. Easily Accessible from US-74 & Newly-Built 74 Bypass. US-74 One of the areas most highly trafficked roadways. New US 74-Expressway has significantly reduced commute times into Charlotte (about 10 minutes saved each way). The location is very good and in the path of development.

MONROE, NC

The population of Monroe, NC jumped from 26,228 in 2000 to 36,397 in 2010, making it one of the fastest growing cities in the state. Only 20 miles to Charlotte it is easily Accessible from US-74 & Newly-Built 74 Bypass. US-74 One of the areas most highly trafficked roadways. New US 74-Expressway has significantly reduced commute times into Charlotte (about 10 minutes saved each way).

Wingate University

• Overall enrollment has increased by 8% over the past five years. Undergraduate enrollment has increased by 19 percent during this same period.

• 185 full-time faculty and 168 part-time faculty; 90 percent of full-time faculty hold terminal degrees

• 310 full-time staff members and 34 part-time staff

• 49 graduate assistants

• 600-plus student workers

WINGATE 24

ASHLEY GARNER | CALL/TEXT: 910-409-0861 | ASHLEY@ABGMULTIFAMILY.COM

SAMPLE

Underwriting

We use the most sophisticated spreadsheets to analyze the tried and true investor metrics for the purpose of creating an accurate view of the current financial status of the property. In addition, and just as important, we use conservative projections for items such as future rents, expenses and financial market conditions to create a proforma financial performance model for the property. Obviously there is no crystal ball and there are no certainties but with our sound techniques, conservative projections and experience in the business we aim to present a realistic view of the present and future performance of the asset.

Investors then are armed with the information to make a go – no go decision on investing in a particular property.

Closing costs includes origination fees, appraisal, property inspection, legal fees, recording fees, and transfer taxes. The acquisition fee is payable to ABG Multifamily at closing. Repair escrows are kept in the operating account until needed.

INVESTMENT

WINGATE 24 MULTI-FAMILY

OPPORTUNITY

ASHLEY GARNER | CALL/TEXT: 910-409-0861 | ASHLEY@ABGMULTIFAMILY.COM

SAMPLE

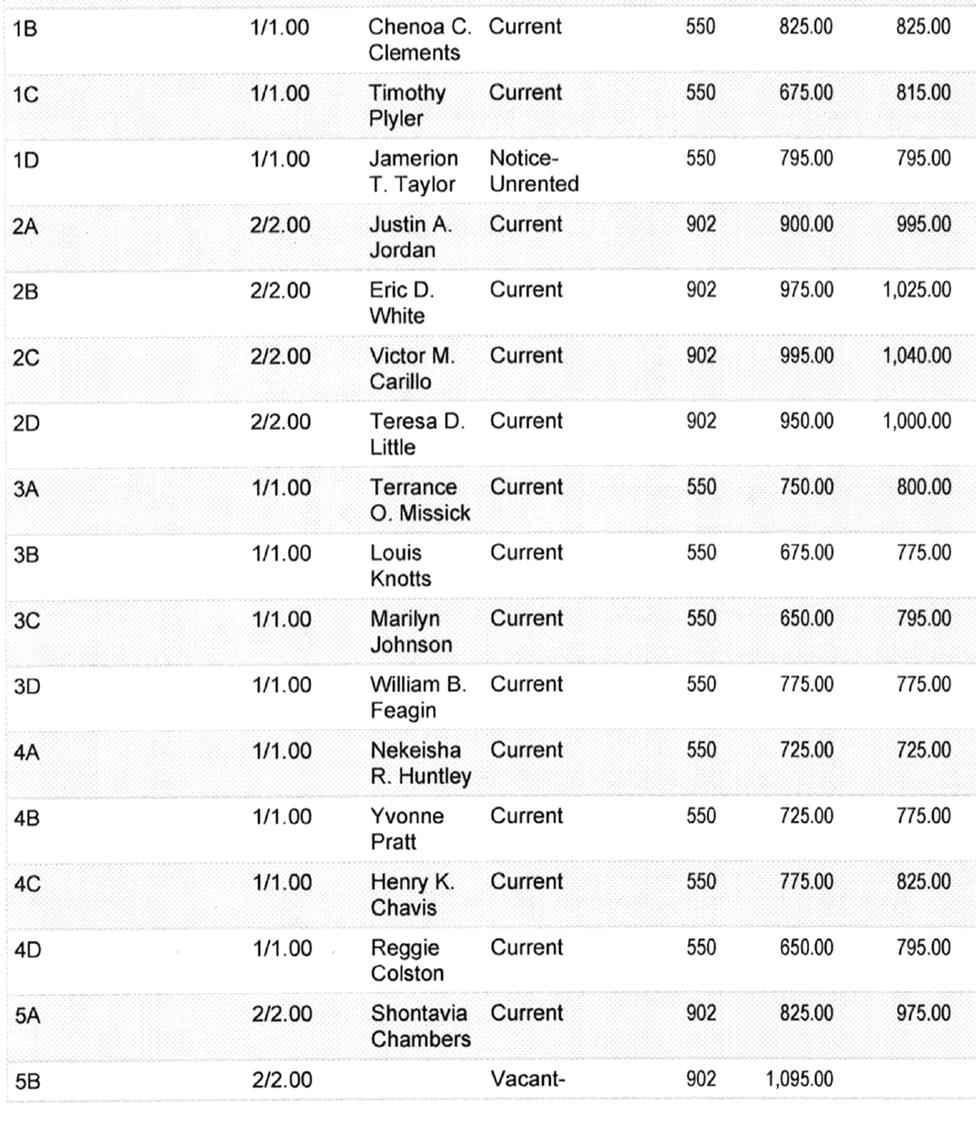

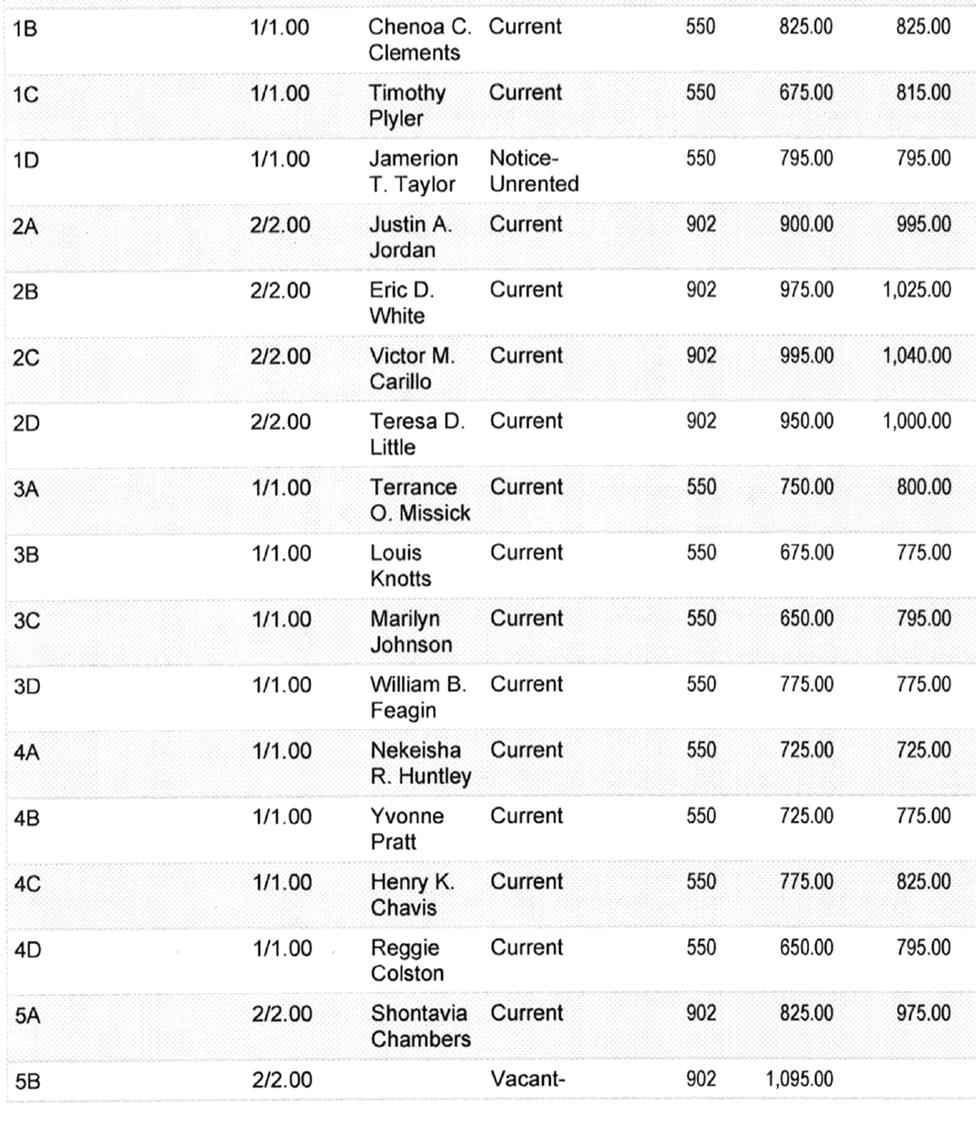

WINGATE 24 MULTI-FAMILY INVESTMENT OPPORTUNITY SELLER-DISCLOSED FINANCIALS - Rent Roll ASHLEY GARNER | CALL/TEXT: 910-409-0861 | ASHLEY@ABGMULTIFAMILY.COM SAMPLE

WINGATE 24 MULTI-FAMILY INVESTMENT OPPORTUNITY INCOME AND EXPENSES - Actual and Projected First Year ASHLEY GARNER | CALL/TEXT: 910-409-0861 | ASHLEY@ABGMULTIFAMILY.COM SAMPLE

WINGATE 24 MULTI-FAMILY INVESTMENT OPPORTUNITY NOTE: The rates of return displayed on this page are only projections and are not guarantees of any sort. Actual returns may vary widely, due to many economic and marketplace factors beyond our control. INCOME AND EXPENSES - Actual and Projected First Year ASHLEY GARNER | CALL/TEXT: 910-409-0861 | ASHLEY@ABGMULTIFAMILY.COM SAMPLE

EQUITY RETURN AT RESALE

Exit Strategy Assumptions

We are assuming we will be able to sell the building at the now-going cap rate of 7.5% which is currently high for a well-performing asset in this area of North Carolina.

All investor capital is returned first before the remaining proceeds are split according to the investors’ equity share.

WINGATE 24 MULTI-FAMILY INVESTMENT OPPORTUNITY

ASHLEY GARNER | CALL/TEXT: 910-409-0861 | ASHLEY@ABGMULTIFAMILY.COM

SAMPLE

MULTI-FAMILY INVESTMENT OPPORTUNITY

MANAGEMENT AND ADVISORS

ASHLEY B. GARNER, Real Estate Investor

Mr. Garner is an experienced and successful real estate investor with over 3 decades in the multifamily business as an owner, operator and manag er. Currently, he owns and operates a portfolio of 132 units (368 beds) in various locations in two states. In addition, Ashley has been a real estate broker since 1996. Real estate is his career; helping others achieve financial freedom through investing in real estate is his passion.

Ashley is married and has two children…they say all he talks about is apartments!

SAM POTTER, Real Estate Attorney

Mr. Potter handles all legal matters related to the real estate transaction and has extensive experience in multifamily real estate.

PROPERTY MANAGEMENT FIRM

All properties are managed by third-party independent property manage ment firms, fully licensed, vetted, and specializing in the specific market and property type.

CONTACT

Questions should be directed to ABG Investments, LLC, c/o Ashley B. Garner 910-409-0861, ashley@abgmultifamily.com.

This information is authorized for use only by a limited number of persons with an existing relationship with ABG Multifamily and who have been qualified and accepted as accredited investors by the ABG Multifamily, by furnishing proof of substantial income (200,000/yr or $300,000/yr if married) over the current last two years, or a net worth of $1,000,000, and extensive investment experience. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the real estate interests in this property package or passed upon the adequacy or accuracy of this document. Any representation to the contrary is a criminal offense.

This material does not constitute an offer or a solicitation to purchase securities. An offer can only be made by the private placement memorandum. This document is an informational summary and is authorized for use only by accredited investors with an existing relationship with ABG Multifamily and have been accepted as qualified and accredited investors by virtue of their experience and financial circumstance.

WINGATE 24

ASHLEY GARNER | CALL/TEXT:

| ASHLEY@ABGMULTIFAMILY.COM SAMPLE

910-409-0861