International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056 p-ISSN: 2395-0072

Volume: 11 Issue: 10 | Oct 2024 www.irjet.net

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056 p-ISSN: 2395-0072

Volume: 11 Issue: 10 | Oct 2024 www.irjet.net

Limat Teklay Gebremariam1 , Fentahun Abebaw Belete2*, Tesfaldet Gebregerges Gebreegziabher3

1Department of Chemical Engineering, African Youth for Peace and Sustainable Development, PO Box 1313, Mekelle, Ethiopia

2Department of Chemical Engineering, Ethiopian Institute of Technology-Mekelle, Mekelle University, PO Box 231, Mekelle, Ethiopia

3Department of Chemical Engineering, Tigray Institute of Policy Studies (TIPS), Mekelle, Ethiopia ***

Abstract

Biomass has emerged in the renewable energy area with a high potential to contribute to the energy needs of both industrialized and developing countries. This study aims to analyze the techno-economic feasibility study of a combustion-based small-scale biomass power plant in Northern Ethiopia. The power plant’s economic feasibility was analyzed, in terms of the payback period (PBP), Internal Rate of return (IRR), net present value (NPV), and profitability index from the developed discount cash flow spreadsheet for different financing conditions (i.e., for FIT incentive scenario and 5% escalation without incentive Scenario) over the plant lifetime period of 30 years. The technology readiness level of the proposed technology was assessed as almost >TRL-6 (Technology readiness level). The economic result showed that the investment in the power plant is positively justified. The net internal return value is 25.58% which is three times greater than the discount rate of this project (8%) and is an acceptable value. The payback period of the investment is 4.15 years in the operational life of the plant and the rate profitability index is 2.61%. Hence, for the projected 30-year operational period of investment, installing a small-scale combustion-based power plant is feasible in the FIT incentive and escalated scenarios. From the sensitivity analysis, capacity factor and net efficiency changes have almost close impact on the cost of electricity Maintenance cost has a relatively lower impact on the cost of electricity (COE) compared to the other factors.

Keywords: Biomass,Combustion,Powerplant,sensitivityanalysis,Whiteeucalyptus

The world's energy supply has been influenced by fossil fuels for decades, which account for approximately 80% of total consumptionofmorethan400EJperyear.Fromthis,biomassaccountsforapproximately10–15%ofthisdemand.Onaverage, biomassaccountsforabout9–14%ofthetotalenergysupplyindevelopedcountriessuchastheUnitedStates,anditaccountsfor aboutone-fifthtoone-thirdindevelopingcountries(Khanetal.2009).Biomassfuelscanbeclassifiedintofourmaincategories basedontheirorigin.1)primaryresidues;whichinclude by-productsoffoodcropsandforestproducts (wood,cereals,maize, etc.);2)Secondaryresidues;whichinclude by-productsofbiomassprocessingfortheproductionof foodproductsorbiomass materials(sawandpapermills,food,andbeverageindustries,apricotseed,etc.);3)Tertiaryresidues;thatincludesby-products of used biomass-derived commodities /waste and demolition wood; and 4) Energy crops (IFC 2017; Khan et al. 2009). Hence, biomassisconsideredafundamentalsourceofenergy,especiallyinsub-Saharan countriessuchasEthiopia.

Ethiopia is suffering from significant depletion of domestic biomass resources. Therefore, the development of appropriate institutions and technologies to produce renewable energy from biomass is extremely valuable (Diriba Guta 2012). The developmentanduseofbiomasspowerplantsystemsimprovethemitigationofsignificanthealthrisksthroughreducedair,land, and water pollution. This technology also improves waste management, nutrient recycling, job creation, the use of surplus agriculturallandandmodernenergysourcesinruralareas,andimproveslandmanagementincountriesthathaveadopteditby law. The economic analysis of the energy potential of biomass has already been studied by many researchers, and the main conclusionisthattheviabilityofbiomassprojectsisinfluencedbylocalconditionsattheprojectsite,includingbiomass waste rawmaterialcost,biomasslogisticscost,costsofashdisposal,andlaborcosts(Abdelhady,Borello,andShaban2018). Evenifit isanultimatesolutionfortheproblemofmanagingwasteandatthesametimerecoveringenergywithhigh stabilityofpower generationandhightotalenergyconversionefficiency,noclearpolicyregardingbiomasspowergenerationinEthiopiahasbeen announcedsofar.Therefore,thisstudyaimedattheevaluationofeconomicfeasibilityandtechnologicalefficiency,availability, affordability,andmaturityofthepowerplantinNorthernEthiopiaparticularlyintheTigrayRegionalState

2.1.

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056 p-ISSN: 2395-0072

Volume: 11 Issue: 10 | Oct 2024 www.irjet.net

BiomasswascollectedfromMai-chewparticleboardfactoryinthesouthernTigrayregionofEthiopia.Tigrayregionisecologically rich and eucalyptus trees are abundant. The study area for this study is located in Tigray, Ethiopia, located at a latitude and longitudeof12.7833and39.5333respectively.TheboldredcolorarrowinFigure1indicatesthelocationofthecollectedsample.

2.2.

The main objective of the techno-economic analysis was to investigate the profitability potential of the implementation of a biomasspowerplantinTigrayregion,whichislocatedinthenorthernpartofEthiopia.ThegoalwastodeterminethePayback period (PBP), Net present value (NPV), and internal rate of return (IRR) that was considered acceptable for the plant. For the successandcommercializationofanynewtechnology,itisessentialtoknow whetherthetechnologyiseconomicallyviableor not. This approachprovidesus witha little more insightinto the decision-makingprocessandhelpsus understand whysome entitiesmightchooseonetechnologyoveranother.

2.2.1.

Atechnologicalassessmentevaluatesthetechnical,regulatory,andmarketconditionsthatinducethesuccessfuldeployment of technology.Thisincludesreferringtobothemergingtechnologiesandexistingcommercialtechnologiesthatcurrentlydonothave a significantpresence in the market. The technology hasthe potential to be more cost-effective,perform more efficiently,and producefewerpollutants.Technologicalreadinesslevel(TRL)isusedtodescribethematurityofthetechnologylevelbased on theprocedureof Figure2(Gladyszetal.,2020).

International Research Journal of Engineering and Technology (IRJET)

Volume: 11 Issue: 10 | Oct 2024 www.irjet.net

Figure2:Technologicalreadinesslevelassessmentprocedure (Gladyszetal.,2020).

Accordingtothestandardmeasuresoftechnologicalreadinesslevel,fromTRL2–3onwards,bothenvironmentalandeconomic performanceareunderestimatedduetohiddendeviationsfromidealconditions,wherebyinscalingvariousefficiencylossesmay appearduetothedifficultyofmassandenergytransfer(FaidiandOlechowski2020).FromTRL-6ahead,environmentalimpact andexpensesarereduced(Sorunmu,Billen,andSpatari2020).

Technologieslikeatmosphericbiomassgasificationandpyrolysisarelessmatureandaffordable,theyareatthebeginningoftheir deploymentstage.Otherslike integratedgasificationcombinedcycle,bio-refineries, andbio-hydrogenare onlyinthe research and development phases as referring in Figure 3. The potential for cost decrement is therefore very heterogeneous and complicated. Only peripheral cost reductions are anticipated in the short-term and developing countries like Ethiopia, but according to an International Renewable Energy Agency (IRENA) report, long-term potential for cost reductions from the technologiesthatarenotyetwidelydeployedisgood(IRENA,2012).

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056 p-ISSN: 2395-0072

Volume: 11 Issue: 10 | Oct 2024 www.irjet.net

Assessing a technology in such a case Figure 3 is completed first to avoid conducting a lengthy techno-economic analysis of a fatallyflawedadvancedtechnology.

Three approaches are combined to evaluate the combustion-based small-scale biomass power plant. Project viability over a lifetime period of 30 years, net present value (NPV), internal rate of return (IRR), and payback period (PBP) were considered under the economic measure of the power plant. NPV allows for keeping a good path of the cash flows over a given period. However,itissensitivetothediscountrate,asasmallincreaseordecreaseinthediscountratewillstronglyaffecttheNPVfinal output(Cardoso,Silva,andEusébio2019).Ontheotherside,theinternalrateofrate(IRR)despiteprovidingasimplerapproach evaluates every investment by delivering merely one single discount rate. It is the average annual return rate on the initial investmentwhenconsideringallcostsandbenefitsoverthegivenprojectperiod.Asforthepaybackperiod(PBP),itpresentsan easilyobservableandstraightforwardanalysiswhencalculatingthespeedofreturn,yet,itconsidersnoinflation,financing, or risksassociatedwiththeinvestment.

The small-scale biomass power plant in the country is a grassroots project in which, it deserves a Pre-design cost estimation methodology.Thetotalcapitalinvestmentcostoftheplantwasthecostoftheequipmentusedtoerectthesmall-scale biomass powerplant.Thisinvestmentcostwasestimated,bybreakingitdownintotwofivemainpartsasBatterylimitsinvestment,Utility investment,Off-siteinvestment,engineeringfees,andWorkingcapital(DeMeyer,Venturoli,andSmit2008).Themainpurchased plant items were a steam turbine (turbine, gearbox, and electrical generator), steam generator, condenser, and pump. The purchased costs of these equipment were estimated by Aspen process economics analyzer (APEA). In addition, the sizing and equipmenttypeselectionandevaluationwereperformedbythisSoftware.Toestimatethecostofequipmentorchemicals,for thepresenttimeandattheprojectlocation,differentcostestimationmechanismswereused.Generally,thedeliverycostdepends onthelocationoftheequipmentsupplier,thelocationofthesite tobedelivered,sizeoftheequipment,anditwasestimatedby usingthelogarithmicrelationshipknownasthesix-tenths-factorrule(AsanteandHao2017;Porcuetal.2019),assuggestedby equation(1):-

a Qb)n (1)

Where;Ca=EquipmentcostwithcapacityQa,Cb=basecostforequipmentwithcapacityQb, andnisconstantdependingon theequipmenttype.

Some sources of data were available in the open Literature, and Published data are often old. Such data was estimated by equation(2)forthetimeeffectusingcostindexes. C1 =CO(I1 IO) (2)

Where;C1isthepresentcostofequipment,Cooriginalcostofequipment,I1,andIOareindexvaluesattheoriginalandpresent stagesoftheequipment.

Thetotalcapitalinvestmentofthesmall-scalebiomasspowerplantwasestimatedbyconsideringthetimeandcapacityfactors. The total capital cost of the process,services,and workingcapital wasobtained by applying multiplying factors or installation factorstothepurchasedequipmentcost,accordingtothedominantphasebeingprocessedandtheirrelative factorisfoundin anyEngineeringeconomicshandbook(DeMeyer,Venturoli,andSmit2008).

CF=∑(���� ∗CE) i (3)

Where;CFisthetotalfixedcapitalcostforthecompletesystem,CEisthecostofdeliveredequipmentandiisalistofitemsin thetotalfixedcapitalcost.

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056 p-ISSN: 2395-0072

Volume: 11 Issue: 10 | Oct 2024 www.irjet.net

Projectcontingency,fieldexpenses,home-officeengineering,constructionactivities,andothercostsrelatedtoconstructionwere computed relative to the total direct cost (TDC) and gives the fixed capital investment (FCI). The sum of FCI and the working capital for the project is the TCI. The Contingency was charged about 10% of the total fixed capital cost. The total capital investment(TCI)wascomputedbasedonthetotalequipmentcostusingtheLangcoefficientmethod.TheLangfactorsmethodis usedfrequentlytoobtainorder-of-magnitudecostestimatesofbothdirectandindirectcostsandisbasedonmultiplyingfactors bythetotalpurchasedequipmentcost(Scott2015).

OperatingcostcanbeexpressedasafixedoperatingcostandVariableoperatingcost.Fixedcostsaregenerallycostingpaidoff whethertheplantfullyworkingornot,theydonotvarysignificantlywithgeneration.Themostcommonlistoffixedoperating costsislaborcosts,routinemaintenancecosts,andvariousoverheaditems(Schroderetal.,2013;YANAGIDAetal.,2015).Whereas variableoperatingcostsareexpensesthatdependontherateofproductionofthepowerplant.Inbio-energysystems,itisknown that the operating cost is subject to unexpected expenses, especially concerning fuel costs and other unforeseen expenses. AccordingtoSchroderandAndreasreport,theoperatingcostofasmallsalebiomass-basedpowerplantin2020is116EUR/KW (Schröder,Andreas;etal,2013).Theoperatingcostofa combustion-basedsteampowerplantinthisstudymainlyincludesthe costoffuels,labor,maintenance,utility,andashdisposalexpenses.

BiomasswasteFuelconsumptionofthepowerplantswasestimatedbyusingequation(4),whereCapacityFactoristhecapacity factoroftheplants,whichissetto85%inthisstudy,and thelowerheatingvalue(LHV)ofthebiomassfuelrefers lowheating valueofthefuelandEffel referselectricalefficiencyoftheplant.Yangidareportedthatthereisastrongscaleadvantage for steam power plant efficiency and electrical efficiency for this steam power plant can be expressed by5.762*ln(���������������������� (����) 26.65, where the installed capacity of the power plant (PC) in kilowatts is 910 KW (YANAGIDA etal. 2015). The mass of fuel consumption rate (mfuel)(mass/period) of the combustion-based biomass power plant is thenestimatedbyusingequation (4).

(4)

Where;PC installedistheinstalledcapacityofthepowerplantinKW,Cf isthecapacityfactor,Effeliselectricalefficiencyand LHVisthelowerheatingvalueofthebiomassfuel.

Hence,thecostoffuelisthenestimatedbyusingequation(5).

Cfuel =mfuel ∗Cfuel,unit (5)

Where;Cfuel,mfuel,andCfuel/unit arethecostoffuel,fuelconsumption,andcostoffuelperunitoffuelrespectively.

Labor cost consists of the numbers of ordinary workers, skilled workers, engineers, supervisors, managers, and office staff (Delivand et al. 2011). The labor cost is estimated by multiplying the number of laborers and the cost of the labor per capita. Yanagida reported in his research on existing steam power plants and found that the required number of operators can be expressedas0.005*Plantcapacity,forpowerplantcapacityintherangeof250kw –1000kW(YANAGIDAetal.2015).Expenses oflaborforthesmall-scalesteampowerplantwerethenestimatedbyusingequation(6);

Clabor =nlabor *Clabor,capita (6)

WhereClabor,nlabor,andClabor, capitaarethecostoflabor,thenumberoflaborers,andlaborcostpercapitarespectively.

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056 p-ISSN: 2395-0072

Volume: 11 Issue: 10 | Oct 2024 www.irjet.net

Maintenanceexpensesdependonwhetherprocessingmaterialsaresolid,liquid,orgas.Handlingsolidprocessingmaterial, for example,increasesitsmaintenancecostduetofrequentshutdownandfractureofpipingandothercrucialdevices.Giventhehigh maturityofcombustion-basedbiomasspowerplantsystems,maintenancecostisreportedtobe1.5–4%ofthetotalcapitalcost forthecombustionplants(Delivandetal.2011).Withinthisstudy,anaveragevalueof3%ofthetotalcapitalcostisusedasthe annual maintenance and repair costs of the power plant. The maintenance cost of the power plant is then estimated by using equation(7).

CM =Ctotal,capital ∗£maintenance (7)

WhereCm,Ctotal,capital,and£maintenancearethecostofmaintenance,totalcapitalcost,andconstantmaintenanceratio respectively.

Utilityoperatingcostsincludeexpenseslikefuel,electricity,steam,coolingwater,refrigeration,compressedair,and,inertgas(De Meyer,Venturoli,andSmit2008).Asitwasdifficulttofindspecificutilitycostsforpowerplants,Yangadaassumedthat theutility costofsmallscalebiomasspowerplantis0.5%oftheinitialcapitalcostofthepowerplant(YANAGIDAetal.2015)andtheash disposalcostofthepowerplantisconductedbyusingequation(8).

Cash =mfuel ∗0.01∗Cash,unit (8)

WhereCashisthecostofash,mfuelisthemassofconsumptionofbiomassfuelandCash,unitiscostofashperunitrespectively.

Itisusedtodeterminetheminimumsellingelectricitypriceperkilowatt-hourofpowerproduced.Todothiscashflow analysis the discount rate, plant operation life, biomass power plant capacity, escalation rate, and construction start-up duration be specified.Tomeasurethefeasibilityanalysisofthepowerplant'snetpresentvalue(NPV),internalrateofreturn(IRR),payback period,andprofitabilityindexaresomeofthebasicengineeringeconomicsmeasurementtoolsconsideredinthisstudy.NPVis estimatedbythesumofthepresentvalueofcashflowsminuscapitalcost,itiscalculatedbyusingequation (9)(OngandThum 2013).

Wherekreferstotheestimatedplantlifewhichisassumed30yearsinthisstudy,CFk referstothecashflowofyeark,drefers discountrateoftheprojectwhichisassumedtobe8%ayear,andtheprojectwithnegativeNPVisnotacceptablewhenthecapital costissubtracted.

TheinternalRateofReturnisthediscountratethatmakestheNPVoftheprojectsequaltozero(Hardingetal.,2018).

Toestimatetheprojectbyinternalrateofrate(IRR),thehurdleratehastobesetwhichisaminimumrateofreturnfortheplant operatorwillaccepttheproject.Inthecaseofthispowergenerationpowerplant,8%isaroughstandardforthevalue.

Thediscountrateisthe interestrateusedto determine the presentvalue offuture cashflowsina discounted cashflow(DCF) analysis.Thishelpsdetermine ifthe futurecashflowsfroma projectorinvestment will be worthmore thanthe capital outlay neededtofundtheprojectorinvestmentinthepresent.TocalculatethecashflowanalysisoftheTechno-EconomicAnalysis ofa Small-ScaleBiomassto-Energy-Gasification-BasedSystem,Porcualsoadoptedadiscountrateof8%(Porcuetal.2019).Inthis research work, the discount rate refers to the interest rate charged to the commercial banks and other financial

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056 p-ISSN: 2395-0072

Volume: 11 Issue: 10 | Oct 2024 www.irjet.net

institutionsforthe loanstheytake fromthe Federal Reserve Bank throughthe discount windowloan process,andsecond,the discountratereferstotheinterestrateusedindiscountedcashflow(DCF)analysistodeterminethepresentvalueoffuturecash flows

According to information from the Ethiopian Electric Utility (EEU), the current price of electricity for the industry is 1.2927 ETB/KWH, which is about 0.02318 USD/KWH. According to the Ethiopian Energy Power Business Portal new report (eepBp) (TigabuAtalo,n.d.,2020),identifyingoff-gridpowerlocationsandintroducingsubsidyprogramsorincentivemechanismsfor a renewableenergysourceinadeepareaisaninvaluabletasktoachievesustainabledevelopmentalgoal-7(SDG-7) Thepriceof electricityinthisresearchworkisconsideredasthepriceofelectricitywithescalationandthepriceofelectricityFITincentive

The price of electricity escalation rates is an important facet of energy-saving performance contracts These stipulated rates dictatetheflowofUSDsavingsthatwillbe available,givenaguaranteedlevelofenergysavings,topayforthedebtservicei.e., initialprojectpriceplusinterest,aswellastheprojectservicingcostssuchasoperationsandmaintenanceormeasurement and verification.Theannualescalationrateofthisprojectisassumedasa5%yearlyincrement.Inthiscase,thepriceofelectricityis adoptedas1.2927ETB/KWHor0.02318USD/KWHasperEthiopia'selectricutility'scurrentpriceofelectricityforindustry.

Feed-in tariff incentive is a reason for the success of many developed countries such as Germany and Greece in extending renewableandprivateoff-gridenergyinashortperiod.Thesuccessesofmanycountriesusingfeed-intariffshaveseveralreasons (PeerapongandLimmeechokchai2014).FITofferslong-termsecurityforinvestorsthroughguaranteedandfixedtariffsforlong periodsonarelativelyhighlevel,theexistenceofwell-builtfinancialsubsidyprograms,regionalinvestmentstowardseconomic and social welfare, technology-specific and location-dependent differentiation, and stable government regulations So, FIT programs have been proven, by experience from some European countries to make larger and faster electricity market penetrationatalowercostthananytypeofpromotion.ThepriceincentiveoftheFITScenariohelpsfortheoff-gridandprivate renewabletechnologytobuildsustainabledevelopment.

Incometaxisaveragedovertheplantlifeandthataveragewascalculatedonaper-kilowattbasis.Theamountofincometaxtobe paidbythepotentialofthe scaleofthepowerplantvariesannuallyduetochangesinthevolumeofproductproducedandthe allowabledepreciationdeduction Three-yeartax-freeistakenasaglobalaverageforstart-ups Thisisbecausethedepreciation andloan interestdeductionsare greater thanthe net income In thecaseofourcountry, many recommendations were raised (TigabuAtalo2018)forrenewableenergypowerplantstobefreefromtaxandtochargepositiveincentives.Henceinthisstudy, tax-freeeconomicevaluationisconsideredtomotivateandpenetrateprivaterenewableenergyeasilyandquicklythrow-outthe country.

3.1. Evaluation

The economic analysis of the biomass power plant is a critical component of the project assessment, involving a detailed evaluationofthefinancialaspectsassociatedwiththeplant'sdevelopmentandoperation Thissectioncoverskeyfinancialmetrics and analyses, including the overall total capital investment cost, the overall operating cost, the cash flow analysis, and the sensitivityanalysis,asoutlinedbelow

Volume: 11 Issue: 10 | Oct 2024 www.irjet.net

Table1: SummaryofbiomasspowerplantcostgeneratedfromAspenPlusandtypicalfactors

Table2: Generalizedbasicfinancialestimatedresults

Volume: 11 Issue: 10 | Oct 2024 www.irjet.net

Thecostofrawmaterialsandproductsellingpricestendtohavethelargestinfluenceontheeconomicperformanceoftheprocess. The cost of fuel and price of product power depends on whether the materials in question are being bought and sold under a contractualarrangementeitherwithinoroutsidethecompanyorontheopenmarket.

Table3: Overalloperatingcostfinancialevaluationresults

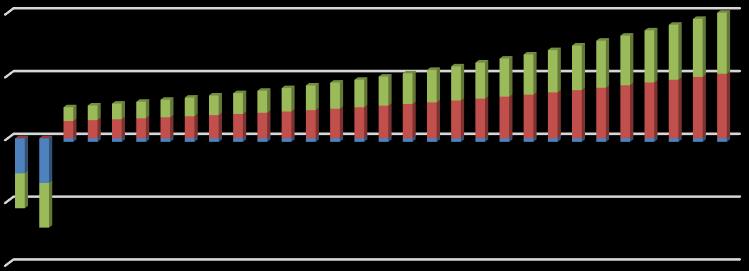

In the Development of cash flow analysis for 30 years of the operational life of the power plant with an 8% discount rate, the electricitypriceswithincentiveandwithoutincentiveswereconsidered.

Inthefirsttwodeploymentyearsofthepowerplant,thenetcashflowisnegative,becauseof1,267,728USDinvestmentspaidout withoutanyincome.But,fromyear3onwardstheproductionisworkingproperlyasshowninFigure4.InthiscashflowScenario, thereisnoFITincentivebutthecashinflowisescalatedeveryyearby5%.Therefore,theamountofincomeisthenincreasedstep wisely.Attheendoftheoperationallifeoftheplant,theamountofcashinflowandnetsavingisaroundfourtimesgreaterthan theFITwithincentivescenario.

Inthiscase,thereisnoconstantagreementorcontractwithelectricityusers.Charginganescalatedelectricitypriceeveryyearis soactivated. AccordingtoinformationfromtheEthiopianElectricUtility(EEU),thecurrentpriceofelectricityfortheindustryis 0.0359USD/KWH,andthischargeistakenperkilowatt-hourand5%escalationperyearforthewithoutincentiveelectricityprice scenario.Thenetincomeinyearthreeis275,115USD/Yearwhereascashinflowinyearthirtyis1,027,131USD/year.Withthis principle,thenetsavinginyearthreeis219,119USD/year;whereasthenetincomeinyear30is971,135USD/year.

Volume: 11 Issue: 10 | Oct 2024 www.irjet.net

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056 p-ISSN: 2395-0072

With out incentive

2,000,000.00

(1,000,000.00)1,000,000.00

(2,000,000.00)

Cash out(USD) Cash in(USD) Net Saving(USD)

1: Graphofnetcashflowofthegraphundertheoperationallifeoftheplantwithoutincentive

3.1.1.2. Cash Flow with FIT Incentive

In the first two years, a total amount of 1,267,728 USD is invested with 556,834.73 USD/year in the first year and 710,893.27 USD/yearinthesecondyearrespectively. IntheFeed-intariffscenario,theconstantcontractualagreement willbeperformed withtheelectricityuser.Besides,thereisneitherincrementnordecrementsituationinthein-cashfloweveryyear.Theamount of money collected in each year is constant, which is 417,983 USD/year cash inflow and 361,987 USD/year net saving. The contractualagreementinthisscenarioisconsideredasasmoothflow.Cashinflowinthiscaseinyearthreeis,approximatelythe sameastheamountofcashinflowcollectedinyearnineintheescalatedscenario.

With incentive

6,00,000.00

4,00,000.00

2,00,000.00 -

(2,00,000.00)

(4,00,000.00)

(6,00,000.00)

(8,00,000.00) Cash out(USD) Cash in(USD) Net Saving

Figure5: GraphofnetcashflowofthegraphundertheoperationallifeoftheplantFITwithincentive.

3.2. Electricity Price Scenarios

3.2.1. Electricity Price for FIT Incentive Scenario

The estimated net present value (NPV), which is the summation of the discounted present value of each year in the 30-year operationallifeoftheplantforthisscenario,ofthissituationis2,304,588USD/30years.Thisvalueindicateshowmuchtheproject willincreasetheinvestor'spropertyoverthewholeprojectperiodintoday’smoneyvalueand,itisanexcellenttool forcomparing differentprojects.IfNPVhasanegativeresult,the projectisnottobe realizedwithoutsufferinglossestakingintoaccountthe

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056 p-ISSN: 2395-0072

Volume: 11 Issue: 10 | Oct 2024 www.irjet.net

assumeddiscountrate.Basedontheresultsofthecashflowanalysisofthepowerplantonthe30yearsofoperationallife,the investmentwouldberepaidin4.15yearsfortheFeed-intariffscenario.Generally,IntheElectricityprice fortheFITIncentive scenario,thenetpresentvalueis2,304,588USD/30yearsgreaterthantotalcapitalinvestment,thenetinternalreturnvalueis 25.58%whichisthreetimesgreaterthanthediscountrateofthisproject(8%),thepaybackperiodoftheinvestmentisalso4.15 yearsintheoperationallifeoftheplantandtherateprofitabilityindexis2.61%whichisgreaterthanzero.Hence,30operational yearsofinvestmentinsmall-scalecombustion-basedpowerplantsisfeasibleintheFITincentivescenario.

Payback Period for FIT Incentive Scenario

3.2.2. Electricity Price for No Incentive Scenario

Inthenoincentivescenario,thepriceofelectricityisescalatedby5%,whiletheelectricitypriceis0.035991USD/KWHaccording tothecurrentEthiopianelectricutilityprice.AsinFigure7shownpaybackperiodfortheescalatedno-incentivescenariois8.29 yearswhichisaroundtwicetheyearsoftheFITincentivescenario.Buttheannualincomemoneyincreasesstepwiselyeachyear. The sum of the net savings of this scenario per 28 years of operational years without considering the deployment time of the projectis3,312,868.395USD.

35,00,000 Payback Period for No Incentive Scenario 30,00,000 25,00,000 20,00,000 15,00,000 10,00,000 5,00,000(5,00,000) 1 2 3 4 5 6 7 8 9 10 1112 13 14 15 16 17 18 19 20 21 22 2324 25 26 27 28 29 30 (10,00,000) (15,00,000) (20,00,000)

Figure7: GraphofthepaybackperiodfornoincentiveScenario

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056 p-ISSN: 2395-0072

Volume: 11 Issue: 10 | Oct 2024 www.irjet.net

Generally,intheelectricitypriceforescalatednoIncentivescenario,thenetpresentvalueis2,605,260.2USD/30years greater thanthetotalcapitalinvestment,andintheFITincentivescenario,thenetinternalrateofthereturnvalueis21.24%,whichis threetimesgreaterthanthe discountrateofthisproject(8%)andaround4yearsgreaterthantheFITincentivescenario.The paybackperiodoftheinvestmentisalso8.29yearswhichistwicetheFITscenariointheoperationallifeoftheplantandtherate profitabilityindexis2.73%whichisgreaterthanzeroandclosetothevalueoftheFITincentivescenario.Hence,30operational yearsofinvestmentinsmall-scalecombustion-basedpowerplantsisfeasibleintheescalatedno-incentivescenario.

Sensitivityanalysiswasperformedtounderstandhowsensitiveaplant’sprofitabilityistochangesintheparametersthatdrive costandrevenue.Theparametersarepercentagesthatareovercrossedbythecostofelectricityandassumedrelativechange.So that,ananalystcanseetheimpactofpercentagechangesincapitalcost,maintenancecost,capacityfactor,fuelcost,ashdisposal contemptratio,andnetefficiencyinthevariablesontheoverallfinancialreturnmeasures.Thismethodwasalsousedtoexamine thesensitivityoffinancialreturnstochangesinprices,whicheasilyfluctuateaccordingtosupplyanddemand andconstitutea majorportionoftheelectricitysellingprice.Capacityfactorandnetefficiencychangeshaveanalmostcloseimpactonthecostof electricity.Maintenancecosthasarelativelylowerimpactonthecostofelectricity(COE)comparedto theotherfactors.

In recent years considerable attention has been paid to renewable power generation from biomass, especially in small-scale biomass power plants. Several technological plant configurations have been proposed and investigated, but so far, definitely preferabletechnologicalsolutionshavenotbeenfoundyet.In,thisstudythetechnologicalreadinesslevelofthebasicequipment ofthepowerplant>6isconsidered.

TheelectricitypricefortheFITincentivescenariohasanetpresentvalueof2,304,588USD/30yearswhichisgreaterthanthe totalcapitalinvestment(1,267,728USD).Thenetinternalreturnvalueis25.58%whichisthreetimesgreaterthanthediscount rateofthisproject(8%).Thecalculatedpaybackperiodoftheinvestmentis4.15yearsintheoperationallifeoftheplantandthe rate profitability index is 2.61%. Hence, for the projected 30-year operational period of investment, installing a small-scale combustion-basedpowerplantatthefactory’ssiteisfeasibleintheFITincentiveandescalatedscenarios.

Volume: 11 Issue: 10 | Oct 2024 www.irjet.net

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056 p-ISSN: 2395-0072

Authors’ Contributions

LTG, FAB, and TGG conceivedtheproblemofthestudy,preparedresearchproposals,anddevelopedtheoveralldesignofthe research;preparedthefirstdraftofthemanuscriptaswellasapprovedthemanuscriptforsubmission.

Funding

Nofunding

Availability of data

Thedatasetsusedand/or analyzedduringthecurrent studyareavailablefromthecorrespondingauthoruponreasonable request.

Ethics approval and consent to participate

Notapplicable.

Consent for publication

Notapplicable.

Competing Interests

Theauthorsdeclarenocompetinginterests

REFERENCES

Abdelhady,Suzan,DomenicoBorello,andAhmedShaban.2018.“Techno-EconomicAssessmentofBiomassPowerPlantFed withRiceStraw:SensitivityandParametricAnalysisofthePerformanceandtheLCOE.” Renewable Energy 115:1026–34.

Álvarez-Álvarez, Pedroetal.2018. “Evaluation of Tree Species forBiomass Energy ProductioninNorthwest Spain.” Forests 9(4):1–15.

Arias, B. et al. 2008. “Influence of Torrefaction on the Grindability and Reactivity of Woody Biomass.” Fuel Processing Technology 89(2):169–75.

Asante,SethAddai-,andTangHao.2017.“Techno-Economic Analysis ofBiomass IntegratedElectricity Generation System.” The International Journal of Engineering and Science 06(03):21–31.

ASTM.2011.82ASTMInternational Standard Test Method for Volatile Matter in the Analysis of Particulate Wood Fuels E87282 WestConshohocken,PA,USA,.

Cardoso,João,ValterSilva,andDanielaEusébio.2019.“Techno-EconomicAnalysisofaBiomassGasificationPowerPlantDealing withForestryResiduesBlendsforElectricityProductioninPortugal.” Journal of Cleaner Production 212(2019):741–53.

Delivand,MitraKami,MirkoBarz,ShabbirH.Gheewala,andBoonrodSajjakulnukit.2011.“EconomicFeasibilityAssessmentof RiceStrawUtilizationforElectricityGeneratingthroughCombustioninThailand.” Applied Energy 88(11):3651–58.

DiribaGuta,Dawit.2012.“AssessmentofBiomassFuelResourcePotentialAndUtilizationinEthiopia:SourcingStrategiesfor RenewableEnergies.” INTERNATIONAL JOURNAL of RENEWABLE ENERGY RESEARCH 2(1).

E871-82, ASTM. 2014. “Standard Test Method for Moisture Analysis of Particulate Wood Fuels 1.” Annual Book of ASTM Standards 82(Reapproved2013):2.

Volume: 11 Issue: 10 | Oct 2024 www.irjet.net

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056 p-ISSN: 2395-0072

Estifanos, Samuel, Miruts Hagos, and and Berhanu Abrha. 2020. “Physico-Chemical Characterization of Stream Water in Maichew.” Global scientfic journal 8(3).

Faidi, S., and A. Olechowski. 2020. “Identifying Gaps in Automating the Assessment of Technology Readiness Levels.” Proceedings of the Design Society: DESIGN Conference 1:551–58.

Gebreegziabher,Tesfaldetetal.2014.“BiomassDryingforanIntegratedPowerPlant:EffectiveUtilizationofWasteHeat.” In Computer Aided Chemical Engineering,,1555–60.

Gladysz,Paweletal.2020.“Techno-EconomicAssessmentofaCombinedHeatandPowerPlantIntegratedwithCarbonDioxide RemovalTechnology:ACaseStudyforCentralPoland.” Energies 13(11).

Gominho,Jorge,AnaLourenço,IsabelMiranda,andHelenaPereira.2012.“ChemicalandFuelPropertiesofStumpsBiomass fromEucalyptusGlobulusPlantations.” Industrial Crops and Products 39(1):12–16.

Guerrero, M. et al. 2005. “Pyrolysis of Eucalyptus at Different Heating Rates: Studies of Char Characterization and Oxidative Reactivity.” Journal of Analytical and Applied Pyrolysis 74(1–2):307–14.

Hamzah, Norfadhilah, Mohammad Zandi, Koji Tokimatsu, and Kunio Yoshikawa. 2017. “Woody Biomass Characterization for 100Megawatt-Hours(MW)PowerGeneration.” Energy Procedia 105:413–18.

Harding,Sue,TrevorLong,SueHarding,andTrevorLong.2018.“InternalRateofReturn(IRR).”In MBA Management Models,, 33–36.

Ho,Katherine.2013.1-105 Current and Prospective Costs of Electricity Generation until 2050 2013 Germen/Berlin.

IFC, International Finance Corporation. 2017. International Finance Corpotation Converting Biomass to Energy: A Guide for Developers and Investors.ed.GunnarKjær.PennsylvaniaAvenue,N.W.Washington,D.C.

Khan,A.A.,W.deJong,P.J.Jansens,andH.Spliethoff.2009.“BiomassCombustioninFluidizedBedBoilers:PotentialProblems andRemedies.” Fuel Processing Technology 90(1):21–50.

DeMeyer,FrédérickJeanMarie,MaddalenaVenturoli,andBerendSmit.2008.95BiophysicalJournal Molecular Simulations of Lipid-Mediated Protein-Protein Interactions.Manchester:JohnWiley&SonsLtd.

Nhuchhen,DayaRam,andP.AbdulSalam.2012.“EstimationofHigherHeatingValueofBiomassfromProximateAnalysis:A NewApproach.” Fuel 99:55–63.

Ong,TzeSan,andChunHauThum.2013.“NetPresentValueandPaybackPeriodforBuildingIntegratedPhotovoltaicProjects inMalaysia.” International Journal of Academic Research in Business and Social Sciences 3(2):2222–6990.

Peerapong, Prachuab,andBunditLimmeechokchai.2014.“Investment Incentive of GridConnectedSolarPhotovoltaicPower PlantunderProposedFeed-inTariffsFrameworkinThailand.” Energy Procedia 52(0):179–89.

Porcu, Andrea et al. 2019. “Techno-Economic Analysis of a Small-Scale Biomass-to-Energy BFB Gasification-Based System.” Energies 12(3).

Protásio, Thiago de Paula et al. 2013. “Brazilian Lignocellulosic Wastes for Bioenergy Production: Characterization and ComparisonwithFossilFuels.” BioResources 8(1):1166–85.

Ramalho,JeanneR.O.,andRicardoF.Bento.2006.“HealingofSubacuteTympanicMembranePerforationsinChinchillasTreated withEpidermalGrowthFactorandPentoxifylline.” Otology and Neurotology 27(5):720–27.

de Sales, Cristina Ap Vilas Bôas et al. 2017. “Experimental Study on Biomass (Eucalyptus Spp.) Gasification in a Two-Stage Downdraft Reactor by Using Mixtures of Air, Saturated Steam and Oxygen as Gasifying Agents.” Energy Conversion and Management 145:314–23.

Volume: 11 Issue: 10 | Oct 2024 www.irjet.net

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056 p-ISSN: 2395-0072

Scott,Michael.2015. Technical Economic Analysis Guide - DRAFT Washington,DC20585.

Sette,CarlosRobertoetal.2020.“DoesthePresenceofBarkintheWoodofFast-GrowingForestSpeciesSignificantlyChange theEnergyPotential?” Bioenergy Research 13(1):222–28.

Sorunmu, Yetunde, Pieter Billen, and Sabrina Spatari. 2020. “A Review of Thermochemical Upgrading of Pyrolysis Bio-Oil: Techno-EconomicAnalysis,LifeCycleAssessment,andTechnologyReadiness.” GCB Bioenergy 12(1):4–18.

TigabuAtalo.2018.“EthiopianEnergyPowerBusinessPortal,EepBp.”:1–5.

Viana, Helder Filipe dos Santos et al. 2018. “Evaluation of the Physical, Chemical and Thermal Properties of Portuguese MaritimePineBiomass.” Sustainability (Switzerland) 10(8):1–15.

YANAGIDA,Takashi,TakahiroYOSHIDA,HirofumiKUBOYAMA,andMasakiJINKAWA.2015.“Relationship betweenFeedstock Price and Break-Even Point of Woody Biomass Power Generation under FIT Program.” Journal of the Japan Institute of Energy 94(3):311–20.

|