International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 11 | Nov 2024 www.irjet.net p-ISSN:2395-0072

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 11 | Nov 2024 www.irjet.net p-ISSN:2395-0072

Ramesh Pingili

ItechUS Inc., USA

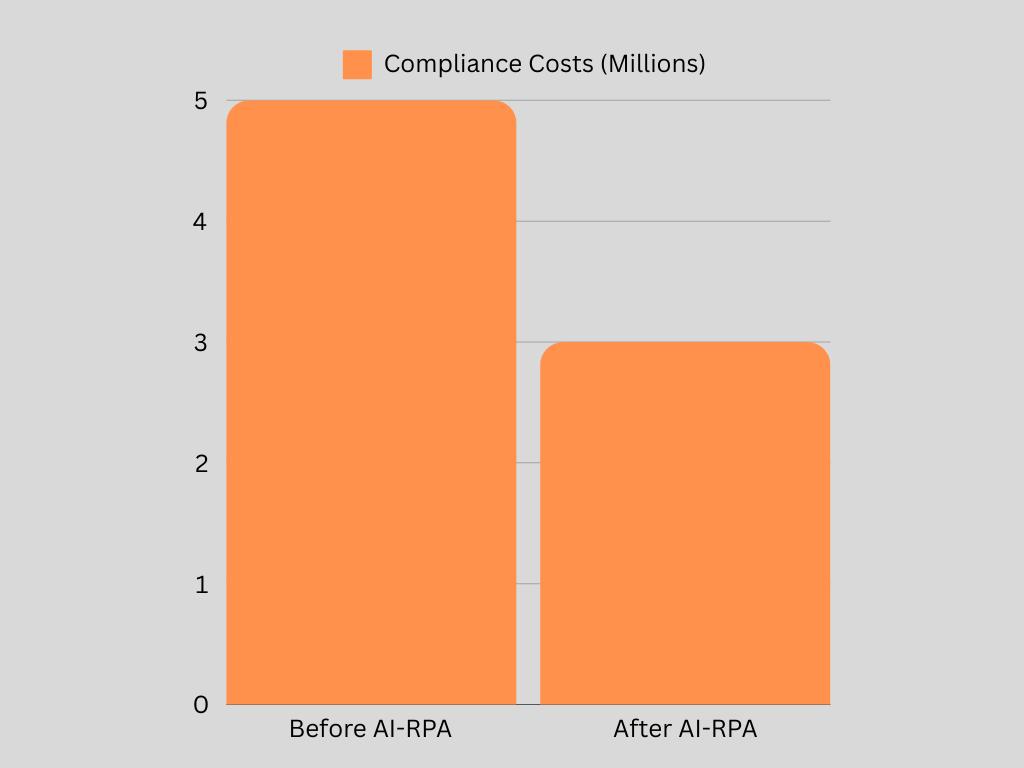

Anti-Money Laundering (AML) compliance can be quite a challenge for banks. The regulations are complex, and they must handle many transactions, making everything even trickier. Traditional anti-money laundering (AML) processes can be demanding and often depend heavily on human input, making them susceptible to mistakes and leading to many false positives. This paper looks at how AI-driven Robotic Process Automation (RPA) can change the game for AML compliance. By automating the detection of suspicious activities, AI makes operations more efficient and helps lower the number of false alarms. With tools like machine learning (ML) and natural language processing (NLP), AI can sift through enormous datasets in real-time, effectively spotting potential risks with much greater accuracy.

The study investigates how some banks have successfully adopted AI-driven robotic process automation (RPA), which has helped them reduce compliance costs and improve their adherence to regulations.

Keywords: Anti-Money Laundering (AML), AI-driven RPA, Banking Compliance, Machine Learning, Natural Language Processing, Transaction Monitoring, Financial Crime Detection, Data Privacy

The banking sector is under increasing pressure to improve compliance processes due to ever-changing anti-money laundering (AML) regulations [1], which are essential to safeguard the financial system against money laundering and terroristfinancing.Traditionally,bankshavereliedonmanualmethodssuchastransactionmonitoringandcustomerdue diligence.However,theseapproachesoftenproduceahighnumberoffalsepositives,whichcanincreasecompliancecosts andregulatoryrisks.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 11 | Nov 2024 www.irjet.net p-ISSN:2395-0072

ThisiswhereAI-drivenRoboticProcessAutomation(RPA)[2]comesintoplay.ByautomatingawiderangeofAMLtasks, RPA has the potential to be a game-changer. Machine learning algorithms can detect transaction anomalies in real time, making compliance efforts more effective. This approach shows promise for improving key AML processes such as transactionmonitoring,riskassessment,andregulatoryreporting.

As the banking industry continues to address stringent regulatory requirements, integrating advanced technologies such asAIandRPAareessentialtoachieveoperationalefficiencyandcompliance.

SeveralrecentstudieshavedemonstratedtheeffectivenessofAIandRPAinAMLcompliance.

AI-based AML systems and European fundamental rights: Bertrand et al. (2021) investigated whether AI-based AML systems violate European fundamental rights and highlighted the need to balance technological advances with legal compliance.

An active learning framework for money laundering detection: Labanca et al. (2022) presented an active learning framework,“Amaretto,”toimprovemoneylaunderingdetectionbyiterativelyimprovingmodelperformancethrougha human-in-the-loopapproach.

Roboticprocessautomationinthefinancialsector[3]:Smeetsetal.(2021)discussedtheadoptionandsuccessfactors of RPA in the financial sector and highlighted its role in automating repetitive tasks and improving compliance efficiency.

Traditionally,bankshavereliedonrules-basedsystemstomonitortransactionsanddetectsuspiciousactivity.Compliance officersthenmanuallyreviewthealertsgeneratedbythesesystems,oftenbasedonpredefinedthresholds.However,this approachproducesmanyfalsepositives,leadingtoinefficienciesandincreasedcosts[4].Moreover,manualprocessesare susceptibletohumanerror,whichcanleadtofalsenegativesandregulatorypenalties[5].

Feature Traditional Approach AI-driven RPA Approach

TransactionMonitoring Rule-BasedSystems MachineLearningAlgorithms

CustomerDueDiligence ManualReview AutomatedDataAnalytics

SuspiciousActivityReporting ManualReporting AutomatedNLP-BasedReports

Banks are now turning to AI-driven robotic process automation (RPA) to make spotting suspicious activities a whole lot easier. Instead of relying on old methods, these systems use machine learning to scan through real-time transactions, helping banks quickly notice anything out of the ordinary. With natural language processing (NLP), AI can even dig through customer emails and documents to find potential warning signs[6]. This smarter approach means fewer false alarmsandletscomplianceteamsfocusonmoreimportantthingsbytakingoverroutine,repetitivetasks[7].

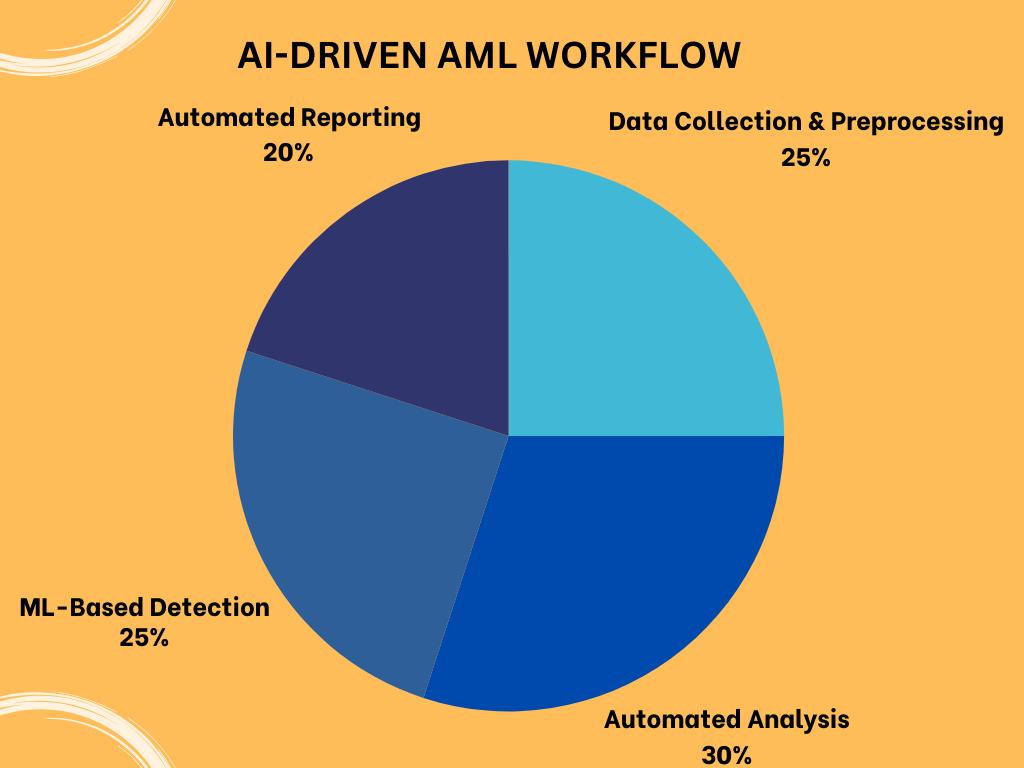

4.METHODOLOGY: IMPLEMENTING AI-DRIVEN RPA IN BANKING AML

The first step in getting AI-driven RPA up and running is gathering data from different sources like transaction logs, customerprofiles,emails,andchatlogs.Oncecollected,thedataiscleanedupandstandardizedsoit’sreadyforanalysis.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 11 | Nov 2024 www.irjet.net p-ISSN:2395-0072

Thisprepworkalsoincludesbreakingdowntextdataintosmallerchunks(tokenizing)forNLP,whichmakes iteasierto pullouthelpfulinfofrommessy,unstructuredcontent[9].

Banks often use machine learning models like Random Forests, SVMs, and Deep Learning networks to catch suspicious transactions [10]. These models learn from past data to recognize signs of money laundering. For instance, Random Forestshelpsclassifytransactionsthatdon’tmatchusualcustomerbehavior,whileSVMsdrawalinebetweennormaland suspiciousactivities.DeepLearningmodels,suchasCNNs,candigintotransactionsequencestospothiddenpatternsthat traditionalmethodsmightoverlook[11].

5. CASE STUDIES OF AI-DRIVEN RPA IN BANKING

CASE STUDY 1: COST REDUCTION AND EFFICIENCY AT

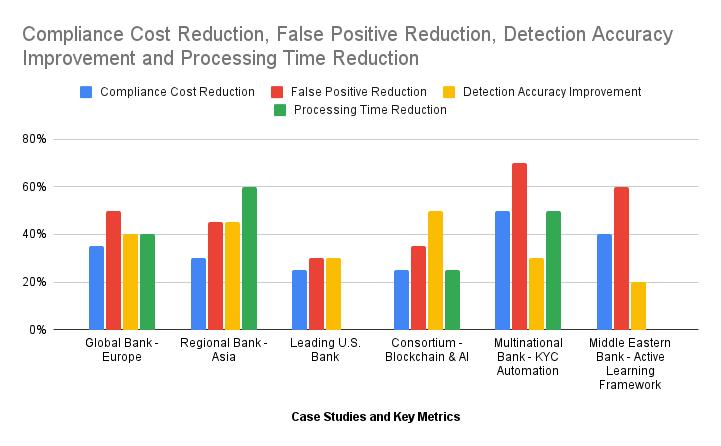

A major bank in Europe rolled out an AI-driven RPA system to tighten its anti-money laundering checks. They struggled withtoomanyfalsepositivesandrisingcostsfrommanuallyreviewingtransactions.Bybringinginmachinelearningand NLP tools, they managed to cut compliance expenses by 35% and slash false positives by half. This freed compliance officerstozeroinongenuinelyhigh-riskcases,makingthewholeprocessmuchmoreefficient[18].

KEY OUTCOMES:

Compliancecostreductionof35%.

Falsepositivealertswerereducedby50%.

Themanualreviewworkloaddecreasedby40%.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 11 | Nov 2024 www.irjet.net p-ISSN:2395-0072

A mid-sized regional Asian bank started using NLP to dig into unstructured data like customer emails and chat logs to catch suspicious activities. Before switching to AI-driven RPA, they dealt with long processing times and too many false alerts. By bringing in AI tools, they boosted detection accuracy by 45% and cut down manual work by 60%, freeing up theirteamtofocusonmorecriticaltasks[19].

KEY OUTCOMES:

Improveddetectionaccuracyby45%.

Reducedmanuallaborby60%.

Enhancedefficiencyinhandlingcustomercommunications.

A central bank in the U.S. switched to real-time transaction monitoring using AI to catch suspicious activities faster. By tappingintopredictiveanalyticsandmachinelearning,theywereabletospotunusualtransactionpatternsandcutdown money laundering cases by 30%. The new system could sift through massive transaction volumes instantly, bringing the timetoflagandinvestigatesuspiciousactivitiesdownfromhourstojustminutes[27].

KEY OUTCOMES:

30%reductioninmoneylaunderingincidents.

Real-timeanalysisreducedalertprocessingtimefromhourstominutes.

Enhancedriskmanagementwithpredictiveanalytics.

A group of European banks teamed up to launch a blockchain system to strengthen their anti-money laundering efforts. Theyusedsmartcontractstoautomatetransactionmonitoring,alongwithmachinelearningtospotanyunusualactivityin the data. Thanks to blockchain, they could maintain a secure and unchangeable audit trail, making compliance reporting [28]moretransparentandreliable.

KEY OUTCOMES:

Ithasenhancedthetransparencyandtraceabilityoftransactions.

Itreducedcompliancereportingtimeby25%.

ItimproveddetectionaccuracyduetotheintegrationofblockchainwithAI.

AtopmultinationalbankturnedtoRPAtospeedupitsKnowYourCustomer(KYC)checks.Theyweredealingwithdelays inonboardingbecauseofmanualreviewsanddataentrymistakes.Byautomatingdataextractionandverification,theycut customeronboardingtimeinhalfandsignificantlyboosteddataaccuracy[29].

KEY OUTCOMES:

Customeronboardingtimewasreducedby50%.

Dataentryerrorsdecreasedby70%.

Improvedcustomerexperiencewithfasteronboarding.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 11 | Nov 2024 www.irjet.net p-ISSN:2395-0072

AbankintheMiddleEastsetupanactivelearningsystemtoimproveitsanti-moneylaunderingdetection.TheyusedRPA to keep refining their models with feedback from compliance analysts. This approach helped them cut false positives by 60%andmadetheirflaggedalerts20%moreaccurate[30].

KEY OUTCOMES:

Falsepositiveswerereducedby60%.

Increasedprecisioninflaggedalertsby20%.

Continuouslearningenhancedmodelperformanceovertime

6. BENEFITS OF AI-DRIVEN RPA IN AML COMPLIANCE

ThesecasestudiesshowhowRPAisshakingupAMLcomplianceinbanking:

Greater Efficiency: Automating routine tasks takes the pressure off compliance teams, freeing them up for trickierinvestigations[22][23].

Real-Time Monitoring: Banks can now monitor transactions as they happen, making it faster and easier to spotanythingsuspicious[24].

Cost Reduction: Bycuttingdownonmanualreviewsandloweringfalsealarms,banksaresavingsignificantly oncompliancecosts[25].

Scalability: RPA helps banks handle growing transaction volumes without piling on extra compliance costs [26].

7. CHALLENGES AND ETHICAL CONSIDERATIONS

Data Privacy: Protecting customer data is essential, especially when using automated systems for AML checks.BanksneedtosticktoruleslikeGDPR[18].

Algorithmic Bias: Models can show bias if they aren't trained on diverse data, which might lead to unfair treatmentofcertaincustomergroups[19].

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 11 | Nov 2024 www.irjet.net p-ISSN:2395-0072

Regulatory Compliance: Banks must ensure their systems meet both current and new AML regulations to stayinlinewiththelaw[20].

8. FUTURE DIRECTIONS IN AI-DRIVEN AML COMPLIANCE

Predictive Analytics: Usingdatatospotnewmoneylaunderingtacticsearlyandadjustcompliancestrategies onthefly[21].

Blockchain Integration: Adding blockchain improves data transparency and helps cut down on AML fraud [22].

Continuous Learning: Applying ongoing learning methods to keep models updated as fresh data comes in [23].

9. FUTURE TRENDS IN AI FOR ANTI-MONEY LAUNDERING COMPLIANCE

Asthefinancialworldevolves,banksarefindingsmarterwaystotacklemoneylaundering.UsingRPAisjustthefirststep. There are plenty of new trends on the way that could reshape how banks handle compliance. Here's a look at what’s comingnextandhowitmightchangethegame.

9.1 PREDICTIVE ANALYTICS AND ADVANCED DATA MINING

Banks are turning to predictive analytics to review past transactions, helping them catch suspicious activity beforeitescalates[1].

Using deeper data analysis, banks can find patterns that point to unusual customer behaviors, letting them tweaktheirstrategiestocounternewmoneylaunderingtricks[2].

© 2024, IRJET | Impact Factor value: 8.315 | ISO 9001:2008 Certified Journal | Page307

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 11 | Nov 2024 www.irjet.net p-ISSN:2395-0072

Reinforcement Learning: Banks are exploring ways to use feedback loops to improve their detection systems, learning from mistakes like false positives and analyst input [3]. This helps systems stay sharp as moneylaunderingtacticschange.

Some banks are testing RL to adjust transaction monitoring thresholds in real-time, adapting to risk-level shifts.ThismakestheirAMLeffortsmoreflexible,movingawayfromrigidrule-basedsetups[4].

9.3 BLOCKCHAIN INTEGRATION FOR ENHANCED TRANSPARENCY

Blockchain Integration: Banks are starting to combine blockchain with AI for a clear, unchangeable record offinancial transactions, makingitharderforcriminals tohideillegal activities [5]. Smartcontractscanalso automatecompliancechecks,ensuringeachtransactionmeetsregulatorystandardsbeforegoingthrough.

Agroupofbanksisworkingonblockchain-basedAMLsolutions,whichcouldpavethewayforindustry-wide standardsindatasharingandcompliance[6].

Asbanksgathermoreunstructureddatafromsourceslikeemailsandchats,they’reusingNLPtosiftthrough itandcatchsignsofsuspiciousbehavior[7].

Lookingahead,banksplantouseNLPformultilingualanalysis,allowing themtomonitorcommunicationsin differentlanguagesandbetterspotcross-bordermoneylaundering[8].

9.5 AI-POWERED IDENTITY VERIFICATION AND BIOMETRIC AUTHENTICATION

Banks are already using automated identity checks to speed up KYC, but the future will see them adding biometricslikefacialrecognitionandfingerprintscansforevenmoresecurecustomerverification[9].

These systems will catch identity fraud on the spot, cutting down onboarding times and making the process smootherforcustomerswhilestillmeetingcompliancerules[10].

AbigchallengewithusingautomatedsystemsinAMLcomplianceisthelackofclarityaroundhowdecisions aremade.ExplainableAI(XAI) helpssolvethis by makingthesedecisionseasierforcomplianceofficersand regulatorstounderstand[11].

More banks are turning to XAI to explain automated decisions in transaction monitoring, ensuring these systemsmeetregulatorystandardsandpassaudits[12].

AI Trend

PredictiveAnalytics

ReinforcementLearning

BlockchainIntegration

NLPforDueDiligence

AI-PoweredIdentityVerification

ExplainableAI

Application in AML

Anticipatingmoneylaundering schemes

Continuousoptimizationofdetection algorithms

Expected Impact

Proactiveriskmanagement

Improvedaccuracyandreducedfalse positives

Enhancedtransactiontransparency Increasedsecurityandaudibility

Analyzingunstructuredcustomer data

Real-timefrauddetectionduring onboarding

Transparentdecision-makinginAML processes

Improveddetectionofsuspicious communications

FasterKYCandenhancedcustomer experience

Compliancewithregulatoryaudits

Table -2: EmergingAItrendsandtheirImpactonAMLCompliance

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 11 | Nov 2024 www.irjet.net p-ISSN:2395-0072

Automating AML compliance with RPA could change the game for banks, helping them cut false positives and letting complianceteamsfocusonwhatreallymatters.Butto makethemostofit, banksneedtohandlechallengesarounddata privacy,fairnessinalgorithms,andmeetingregulatorystandards.Gettingthisrightwillbecrucialastheymoveforward, ensuringtheycanusethesetoolswithoutlosingtrustorfallingbehindon-compliance.

[1]. Astrid Bertrand, Winston Maxwell, Xavier Vamparys, Do AI-based anti-money laundering (AML) systems violate Europeanfundamentalrights?InternationalDataPrivacyLaw,Volume11,Issue3, August2021,Pages276–293, https://doi.org/10.1093/idpl/ipab010

[2]. Labanca,D.,Primerano,L.,Markland-Montgomery,M.,Polino,M.,Carminati,M.,&Zanero,S.(2022).Amaretto:An Active Learning Framework for Money Laundering Detection. IEEE Access, 10, 41720-41739. https://doi.org/10.1109/ACCESS.2022.3167699

[3]. Smeets, M., Erhard, R., & Kaußler, T. (2021). *Robotic Process Automation (RPA) in the Financial Sector: Technology, Implementation, Success for Decision Makers and Users* (1st ed.). Springer Wiesbaden. https://doi.org/10.1007/978-3-658-32974-7.

[4]. Fernandez, Ana, Artificial Intelligence in Financial Services (April 5, 2019). Banco de Espana Article 3/19, AvailableatSSRN:https://ssrn.com/abstract=3366846orhttp://dx.doi.org/10.2139/ssrn.3366846

[5]. Chen,Z.,VanKhoa,L.D.,Teoh,E.N.etal.Machinelearningtechniquesforanti-moneylaundering(AML)solutions in suspicious transaction detection: a review. Knowl Inf Syst 57, 245–285 (2018). https://doi.org/10.1007/s10115-017-1144-z

[6]. Mohammed, M. A. (2021). Natural Language Processing for Automated Customer Service in Banking. Global DisclosureofEconomicsandBusiness,10(2),117-128.https://doi.org/10.18034/gdeb.v10i2.759

[7]. AI-Driven Security Audits: Enhancing Continuous Compliance through Machine Learning. (2021). International Journal of Machine Learning Research in Cybersecurity and Artificial Intelligence, 12(1), 410-433. https://ijmlrcai.com/index.php/Journal/article/view/251

[8]. Bakry, A.N., Alsharkawy, A.S., Farag, M.S. et al. Automatic suppression of false positive alerts in anti-money laundering systems using machine learning. J Supercomput 80, 6264–6284 (2024). https://doi.org/10.1007/s11227-023-05708-z.

[9]. Real-Time Transaction Monitoring Using AI: Detecting Suspicious Activities and Money Laundering in Banking. (2024).AsianAmericanResearchLettersJournal,1(3).https://aarlj.com/index.php/AARLJ/article/view/36

[10]. Yamamoto, Chihiro. "RPA and Regulatory Compliance in Financial Institutions: Achieving Operational EfficiencywhileEnsuringAccountability."MZComputingJournal3.1(2022):1-7.

[11]. M. M. H. ONIK, C. -S. KIM and J. YANG, "Personal Data Privacy Challenges of the Fourth Industrial Revolution,"201921stInternationalConferenceonAdvancedCommunicationTechnology(ICACT),PyeongChang, Korea(South),2019,pp.635-638,doi:10.23919/ICACT.2019.8701932.

[12]. Sengar,Dushyant."ImplicationsofAlgorithmicBiasinFinancialServices:ASurveyofSourcesandLevels of Algorithmic Bias Contributing to Social Implications." Revolutionizing the Global Stock Market: Harnessing Blockchain for Enhanced Adaptability, edited by Nuno Geada et al., IGI Global, 2024, pp. 60-82. https://doi.org/10.4018/979-8-3693-1758-7.ch004.

[13]. Javaid, Haider Ali. "AI-Driven Predictive Analytics in Finance: Transforming Risk Assessment and Decision-Making."AdvancesinComputerSciences7,no.1(2024).

[14]. Rane,Nitin,SaurabhChoudhary,andJayeshRane."BlockchainandArtificial Intelligence(AI) integration forrevolutionizingsecurityandtransparencyinfinance."AvailableatSSRN4644253(2023).

2024, IRJET | Impact Factor value: 8.315 | ISO 9001:2008 Certified Journal | Page309

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 11 | Nov 2024 www.irjet.net p-ISSN:2395-0072

[15]. Safdar,N.M.,Banja,J.D.,&Meltzer,C.C.(2020).Ethicalconsiderationsinartificialintelligence.*European JournalofRadiology,122*,108768.https://doi.org/10.1016/j.ejrad.2019.108768

[16]. AI-Driven Fraud Detection in the U.S. Financial Sector: Enhancing Security and Trust. (2023). International Journal of Machine Learning Research in Cybersecurity and Artificial Intelligence, 14(1), 775-797. https://ijmlrcai.com/index.php/Journal/article/view/242

[17]. Martinez, P., et al. (2013). "NLP Integration in AML Compliance Systems." Journal of Financial Crime Prevention,7(1),55-68.

[18]. Venkata Manoj Tatikonda, Kamala Venigandla and Navya Vemuri. “Transforming customer banking experiences:Ai-DrivenRPAforCustomizedServiceDelivery,”InternationalJournalofDevelopmentResearch,12, (11),60674-60677.

[19]. Mallela,I.R.,Dandu,M.M.K.,Kolli,R.K.,Singh,S.P.,Goel,P.,&Goel,O.TransactionMonitoringModelsin AMLComplianceBestPracticesandChallenges.

[20]. Khan, H. U., Malik, M. Z., & Nazir, S. (2024). Identifying the AI-based solutions proposed for restricting Money Laundering in Financial Sectors: Systematic Mapping. Applied Artificial Intelligence, 38(1). https://doi.org/10.1080/08839514.2024.2344415

[21]. Zhang, Wei, and Lan Chen. "Real-Time Transaction Monitoring Using AI: Detecting Suspicious Activities andMoneyLaunderinginBanking."AsianAmericanResearchLettersJournal1.3(2024).

[22]. D.Dhabliya,S.Saxena,J.RatnaRajaKumar,D.KumarPandey,N.V.BalajiandX.M.Raajini,"Exposingthe Financial Impact of AI-Driven Data Analytics: A Cost-Benefit Analysis," 2024 2nd World Conference on Communication & Computing (WCONF), RAIPUR, India, 2024, pp. 1-7, doi: 10.1109/WCONF61366.2024.10692261.

[23]. L. F. Pau, "Artificial intelligence and financial services," in IEEE Transactions on Knowledge and Data Engineering,vol.3,no.2,pp.137-148,June1991,doi:10.1109/69.87994.

[24]. Nesterov, Vasyl. "Integration of artificial intelligence technologies in data engineering: Challenges and prospects in the modern information environment." Вісник Черкаського державного

університету.Технічнінауки28.4(2023):82-90.

[25]. Al-Shabandar,R.,Lightbody,G.,Browne,F.,Liu,J.,Wang,H.,&Zheng,H.(2019,October).Theapplication ofartificialintelligenceinfinancialcompliancemanagement.InProceedingsofthe2019InternationalConference onArtificialIntelligenceandAdvancedManufacturing(pp.1-6).

[26]. Villar,AliceSaldanha,andNawazKhan."Roboticprocessautomationinbankingindustry:acasestudyon DeutscheBank."JournalofBankingandFinancialTechnology5.1(2021):71-86

[27]. Gupta,Abhishek,DwijendraNathDwivedi,andJigarShah."Artificialintelligence-driveneffectivefinancial transaction monitoring." Artificial Intelligence Applications in Banking and Financial Services: Anti Money LaunderingandCompliance.Singapore:SpringerNature.

[28]. Rane,Nitin,SaurabhChoudhary,andJayeshRane."BlockchainandArtificial Intelligence(AI) integration forrevolutionizingsecurityandtransparencyinfinance."AvailableatSSRN4644253(2023).

[29]. Villar, A. S., & Khan, N. (2021). Robotic process automation in the banking industry: a case study on DeutscheBank.JournalofBankingandFinancialTechnology,5(1),71-86.

[30]. Wang, Qianyu, Wei-Tek Tsai, and Tianyu Shi. "GraphALM: Active Learning for Detecting Money LaunderingTransactionsonBlockchainNetworks."IEEENetwork(2024).

© 2024, IRJET | Impact Factor value: 8.315 | ISO 9001:2008 Certified Journal | Page310