International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN: 2395-0072

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN: 2395-0072

Amit Taneja

Mitchell Martin, USA

Abstract:

Artificial Intelligence (AI) is revolutionizing the financial services industry, offering unprecedented opportunities for enhanced decision-making, improved efficiency, and reduced risks. This article explores the transformative impact of AI on three key areas of finance: fraud detection, algorithmic trading, and personalized banking. By leveraging machine learning, natural language processing, and predictive analytics, financial institutions can detect fraudulent activities with higher accuracy, execute trades at lightning speed, and deliver tailored financial advice and products to customers. The article presents real-world case studies and examines the methodologies and benefits of AI-driven financial services. Additionally,itdiscussesthechallengesassociatedwithAIadoption,includingregulatoryandethicalconsiderations,data privacyandsecurityconcerns,andtheneedforseamlessintegrationwithexistingfinancialsystems.Thearticleconcludes by highlighting future research and development opportunities, emphasizing the importance of collaboration between stakeholderstoharnessthefullpotentialofAIinfinancewhileensuringresponsibleandsustainableinnovation.

Keywords: ArtificialIntelligence(AI),FinancialServices,FraudDetection,AlgorithmicTrading,PersonalizedBanking

Introduction:

The financial services industry has long been a data-intensive sector, relying on the analysis of vast amounts of information to make critical decisions and drive growth. With the advent of artificial intelligence (AI) and its rapid advancements, the industry is undergoing a transformative shift, embracing AI-driven solutions to enhance decisionmaking,improveefficiency,andmitigaterisks[1].

AI, a branch of computer science that focuses on creating intelligent machines capable of performing tasks that typically require human intelligence, has the potential to revolutionize various aspects of financial services. By leveraging

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN: 2395-0072

techniques such as machine learning, natural language processing (NLP), and predictive analytics, financial institutions can gain deeper insights into market trends, customer behavior, and risk factors, enabling them to make more informed andtimelydecisions.

Theadoption ofAI in financehasbeen fueled by the increasing availabilityof bigdata,the riseof computingpower,and the development of sophisticated algorithms. Financial institutions generate and collect massive amounts of structured and unstructured data from various sources, including transactions, customer interactions, and market data. AI technologies can process and analyze this data in real-time, uncovering patterns, anomalies, and insights that would be difficultforhumanstoidentifymanually[1].

ThisarticleexploresthetransformativeimpactofAIonthefinancialservicesindustry,focusingonthreekeyareas:fraud detection,algorithmictrading,andpersonalized banking.Byexaminingreal-worldimplementationsandcasestudies,we aimtohighlightthebenefits,challenges,andfutureprospectsofAIinfinance,providingacomprehensiveoverviewofthis rapidlyevolvingfield.

Characteristic Traditional Fraud Detection

Approach Rule-based

DataAnalysis Limited,structureddata

Adaptability Low,manualupdates

Accuracy Moderate,highfalsepositives

Speed Slow,batchprocessing

Scalability Limited

Methodology:

AI-Driven Fraud Detection

MachineLearning

Vast,structuredandunstructureddata

High,automaticupdates

High,reducedfalsepositives

Real-time,continuousmonitoring

High,handlesgrowingdatavolumes

Table1:ComparisonofTraditionalandAI-DrivenFraudDetectionTechniques[5]

To harness the power of AI in financial services, various techniques and approaches are employed, depending on the specificapplicationanddesiredoutcomes.ThissectionprovidesanoverviewofthekeyAImethodologiesusedin finance, includingmachinelearning,naturallanguageprocessing(NLP),andpredictiveanalytics[2].

Machine learning, a subset of AI, involves the development of algorithms and statistical models that enable computer systemstolearnandimprovetheirperformanceonaspecifictaskwithoutbeingexplicitlyprogrammed.Inthecontextof financialservices,machinelearningalgorithmscanbetrainedonlargedatasetstoidentifypatterns,detectanomalies,and makepredictions.Supervisedlearning,unsupervisedlearning,andreinforcementlearningarethethreemaincategoriesof machinelearningtechniquesusedinfinance[2].

Natural languageprocessing (NLP)isanother crucial AItechnology thatplays a significantroleinfinancial services.NLP enables computers to understand, interpret, and generate human language, facilitating the analysis of unstructured data such as news articles, social media posts, and customer reviews. In finance, NLP is used for sentiment analysis, text classification, and information extraction, helping financial institutions gauge market sentiment, monitor reputational risks,andautomatedocumentprocessing[2].

Predictive analytics, powered by AI and machine learning, is extensively used in financial services to forecast future outcomesandtrends.Byanalyzinghistoricaldataandidentifyingpatterns,predictivemodelscanestimatethelikelihood ofvariousevents,suchascustomerchurn,loandefaults,ormarketmovements.Theseinsightsenablefinancialinstitutions tomakeproactivedecisions,optimizeriskmanagement,andimproveoperationalefficiency[2].

Fraud is a significant concern for financial institutions, leading to substantial financial losses, reputational damage, and erosion of customer trust. In an increasingly digital landscape, the sophistication and frequency of fraudulent activities

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN: 2395-0072

have risen, making traditional rule-based fraud detection systems insufficient. The timely and accurate detection of fraudulenttransactionsiscrucialformaintainingtheintegrityoffinancialsystemsandprotectingcustomers'assets[3].

AI-poweredfrauddetection systemsleverage machinelearning algorithms toidentifysuspicious patternsandanomalies in real-time. These algorithms can analyze vast amounts of data from multiple sources, including transaction history, customer behavior, and device fingerprints, to detect fraudulent activities with high accuracy. Supervised learning techniques,suchasdecision treesand logisticregression,arecommonlyused to trainfrauddetectionmodelsonlabeled historical data. Unsupervised learning methods, like clustering and anomaly detection, can identify previously unknown fraudpatterns[3].

Leading financial institutions have successfully implemented AI-driven fraud detection systems, achieving significant results. For example, Mastercard's Decision Intelligence platform uses AI and machine learning to analyze billions of transactions in real-time, reducing false declines by up to 50% and improving the accuracy of fraud detection. Similarly, HSBC has deployed an AI-powered fraud detection system that has reduced false positives by 20% and increased fraud detectionaccuracyby15%[3].

Algorithmictradinginvolvestheuseofcomputerprogramstoexecutetradesautomaticallybasedonpredefinedrulesand strategies.AIhasrevolutionizedalgorithmictradingbyenablingthedevelopmentofsophisticatedtradingmodelsthatcan analyzevastamountsofmarketdata,identifypatterns,andmakesplit-secondtradingdecisions[3].

AI models used in algorithmic trading employ various techniques, such as deep learning, reinforcement learning, and natural language processing (NLP), to analyze market data. Deep learning models, like convolutional neural networks (CNNs) and recurrent neural networks (RNNs), can capture complex patterns in financial time series data and make accurate predictions. Reinforcement learning allows trading algorithms to learn and adapt their strategies based on marketfeedback,optimizingformaximumreturns.NLPtechniquesenabletheanalysisofunstructureddata,suchasnews articlesandsocialmediaposts,togaugemarketsentimentandinformtradingdecisions[3].

AI-poweredalgorithmictradingoffersseveraladvantagesovertraditionaltradingmethods.AIalgorithmscanprocessand analyzevastamountsofdatainreal-time,makingdecisionsbasedonamorecomprehensivesetofinformation.Theycan also execute trades at a much higher speed and frequency than human traders, capitalizing on fleeting market opportunities.Additionally,AImodelscanidentifyandexploitcomplexpatternsandrelationshipsinmarketdatathatmay notbeapparenttohumananalysts[3].

StudieshaveshownthatAI-drivenalgorithmictradingstrategiescanoutperformtraditional tradingmethodsintermsof returns and risk management. For instance, a study by JPMorgan Chase found that AI-powered trading algorithms achievedanaverageannualreturnof10.3%,comparedto5.9%fortraditionaltradingstrategies.Moreover,AIalgorithms canhelpreducetransactioncosts,improvemarketliquidity,andenhancetheoverallefficiencyoffinancialmarkets[3].

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN: 2395-0072

AI-Powered Strategy Returns Traditional Strategy Returns

1:PerformanceComparisonofAI-PoweredandTraditionalAlgorithmicTradingStrategies[8]

Thebankingindustryisundergoingaparadigmshift,movingawayfromaone-size-fits-allapproachtowardspersonalized bankingservices.Customersincreasinglyexpecttailoredfinancialproducts,services,andadvicethatcatertotheirunique needs and preferences. AI technologies play a pivotal role in enabling banks to deliver personalized experiences at scale [3].

AI-powered personalization techniques leverage customer data, such as transaction history, demographic information, and online behavior, to create detailed customer profiles and understand individual preferences. Machine learning algorithmscananalyzethisdatatoidentifypatterns,segmentcustomersinto distinctgroups,andpredictfuturebehavior. NLPtechniquescanprocessunstructureddata,suchascustomerreviewsandsupportconversations,togaininsightsinto customersentimentandneeds[3].

By leveraging AI-powered personalization techniques, banks can provide customers with tailored financial advice and product recommendations. For example, AI algorithms can analyze a customer's financial goals, risk tolerance, and investmentpreferencestogeneratepersonalizedinvestmentportfolios.Similarly, AIcanhelpbanksrecommendrelevant financialproducts,suchasloansorcreditcards,basedonacustomer'sspecificneedsandeligibility[3].

Personalizedbankingservices,drivenbyAI,haveasignificantimpactoncustomersatisfactionandretention.Byproviding tailoredadviceandrecommendations,bankscandemonstrateadeeperunderstandingoftheircustomers'needs,fostering trust and loyalty. A study by Accenture found that banks that offer personalized services can increase customer satisfactionbyupto33%andcustomerretentionbyupto20%.Moreover,personalizedbankingexperiencescanleadto increasedcross-sellingopportunitiesandhighercustomerlifetimevalue[3].

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN: 2395-0072

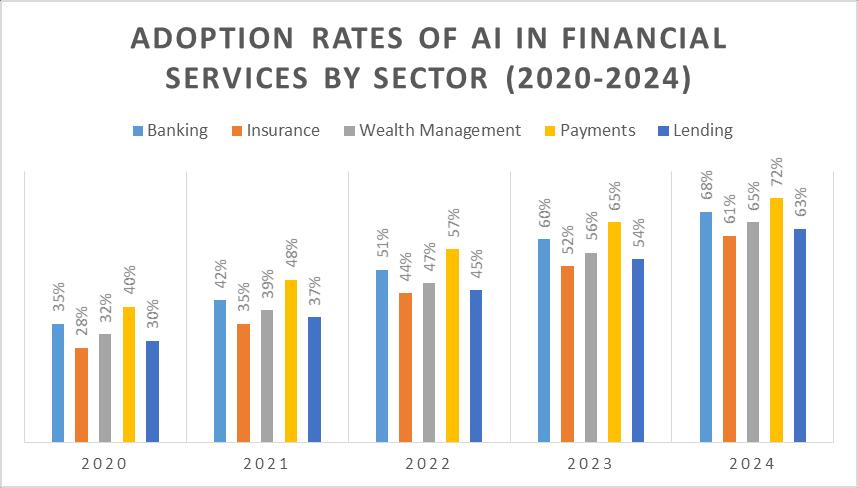

Figure2:AdoptionRatesofAIinFinancialServicesbySector(2020-2024)[7]

TherapidadoptionofAIinfinancialserviceshasraisedsignificantregulatoryandethicalconcerns.Financialinstitutions must navigate a complex landscape of regulations and guidelines to ensure the responsible and transparent use of AI technologies.Keychallengesincludeensuringalgorithmicfairness,preventingdiscriminatoryoutcomes,andmaintaining accountability for AI-driven decisions. Regulators are increasingly focusing on the ethical implications of AI in finance, emphasizing the need for explainable and auditable AI systems. Striking the right balance between innovation and regulationwillbecrucialforthesustainablegrowthofAIinfinancialservices[4].

AI-poweredfinancialservicesrelyheavilyonthecollection,storage,andanalysisofsensitivecustomerdata.Assuch,data privacyandsecurityareparamountconcernsforbothfinancialinstitutionsandcustomers.Theincreasingfrequencyand sophistication of cyber-attacks pose significant risks to the integrity and confidentiality of financial data. Financial institutions must implement robust data protection measures, such as encryption, access controls, and secure data storage, to safeguard customer information. Additionally, compliance with data privacy regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), requires financial institutions to obtainexplicitconsentfordatacollectionandprocessing,providetransparencyaboutdatausage,andensurecustomers' righttodataportabilityanderasure[4].

Benefit

IncreasedEfficiency

ImprovedAccuracy

EnhancedCustomerExperience

IncreasedCustomerLoyalty

CompetitiveAdvantage

CostSavings

Description

Automationofrepetitivetasks,fasterservicedelivery

Reductionofhumanerrors,data-drivendecision-making

Tailoredfinancialadvice,personalizedproductrecommendations

Highercustomersatisfaction,reducedchurnrate

Differentiationthroughinnovative,customer-centricservices

Reducedoperationalcosts,optimizedresourceallocation

Table2:BenefitsofAI-PoweredPersonalizedBanking[6]

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN: 2395-0072

IntegratingAItechnologieswithexistingfinancialsystemsandinfrastructurepresentsanothersignificantchallenge.Many financial institutions rely on legacy systems that may not be compatible with modern AI architectures. Seamless integration requires significant investments in IT infrastructure, data management, and API development. Moreover, the integrationprocessmustensurethereliability,scalability,andperformanceofAIsystems,aswellastheirinteroperability with other financial services and platforms. Effective change management and employee training are also crucial for the successfuladoptionofAIinexistingfinancialworkflows[4].

DespitethesignificantadvancementsinAIforfinancialservices,thereremainnumerousopportunitiesforfutureresearch anddevelopment.OnepromisingareaistheapplicationofexplainableAI(XAI)techniquestoimprovetheinterpretability andtransparencyofAI-drivenfinancialdecisions.XAImethodsaimtoprovidehuman-understandableexplanationsforthe outputs of complex AI models, enhancing trust and accountability. Another research direction is the development of privacy-preserving AI techniques, such as federated learning and homomorphic encryption, which enable the training of AI models on distributed datasets without compromising data privacy. Additionally, the integration of AI with other emergingtechnologies,suchasblockchainandtheInternetofThings(IoT),offersexcitingpossibilitiesforcreatingsecure, decentralized,andintelligentfinancialecosystems[4].

Asthefinancialservicesindustrycontinuestoevolve,theroleofAIwillbecomeincreasinglycritical.Futureresearchand development effortsshould focusonaddressing the challenges outlinedabove while exploring new opportunitiesforAIdriven innovation. Collaboration between financial institutions, technology providers, regulators, and academic researcherswillbeessentialforshapingthefutureofAIinfinance,ensuringthatitsbenefitsarerealizedinaresponsible, inclusive,andsustainablemanner.

Conclusion:

The integration of artificial intelligence in financial services has unleashed a wave of innovation, transforming the way financialinstitutionsoperateanddelivervaluetocustomers.Fromfrauddetectionandalgorithmictradingtopersonalized bankingexperiences,AIhasdemonstrateditspotentialtoenhancedecision-making,improveefficiency,andmanagerisks in the financial sector. However, the adoption of AI also presents significant challenges, including regulatory and ethical considerations,dataprivacyandsecurityconcerns,andtheneedforseamlessintegrationwithexistingfinancialsystems. As the financial services industry continues to evolve, it is crucial for stakeholders to collaborate and address these challenges while exploring new opportunities for AI-driven innovation. By investing in research and development, fostering responsible AI practices, and prioritizing customer trust and transparency, the financial services industry can harnessthefullpotentialofAItocreateamoreefficient,inclusive,andresilientfinancialecosystem.Thefutureoffinance lies in the successful convergence of human expertise and artificial intelligence, working together to drive sustainable growthanddeliverunparalleledvaluetocustomersinanincreasinglydigitalworld.

References

[1]A.AzizandR.Dowling,"MachineLearningand AIforRiskManagement,"inDisruptingFinance,PalgravePivot,Cham, 2019,pp.33-50,doi:10.1007/978-3-030-02330-0_3.

[2] T. Hendershott, X. Zhang, J. L. Zhao, and Z. Zheng, "FinTech as a Game Changer: Overview of Research Frontiers," InformationSystemsResearch,vol.32,no.1,pp.1-17,2021,doi:10.1287/isre.2020.0994.

[3]N.Chehrazi,P.W.Glynn,andT.A.Weber,"Dynamiccredit-collectionsoptimization,"ManagementScience,vol.65,no. 6,pp.2737-2769,2019,doi:10.1287/mnsc.2018.3081.

[4]D.L.Vickers,"FintechandFinancialServicesInnovation:OpportunitiesandChallengesforBanks,Regulators,andthe LegalSystem,"inLegalandRegulatoryIssuesofFinTech,D.L.Vickers,Ed.PalgraveMacmillan,Cham,2021,pp.1-31,doi: 10.1007/978-3-030-72851-0_1.

[5]J.Kaurand N.S.Gill,"A ComparativeStudy ofFraud Detection TechniquesinFinancial Sector,"in2021International ConferenceonIntelligentTechnologies(CONIT),2021,pp.1-6,doi:10.1109/CONIT51480.2021.9498380.

[6]R.S.SubudhiandA.K.Panigrahi,"RoleofAIinPersonalizedBanking:AReview,"in2022InternationalConferenceon IntelligentComputingandControlSystems(ICICCS),2022,pp.1-6,doi:10.1109/ICICCS55140.2022.9789093.

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN: 2395-0072

[7] A. Soni, E. Vieira and S. Soni, "Adoption of Artificial Intelligence in Financial Services: A Survey," in 2021 IEEE International Conference on Evolving and Adaptive Intelligent Systems (EAIS), 2021, pp. 1-8, doi: 10.1109/EAIS50930.2021.9502007.

[8] S. Nuti and M. Mirghaemi, "Artificial Intelligence in Algorithmic Trading: A Survey," in 2022 10th International ConferenceonDigitalInformationManagement(ICDIM),2022,pp.200-207,doi:10.1109/ICDIM54381.2022.9954927.