International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN:2395-0072

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN:2395-0072

Abhinav Chunchu

Wilmington University, USA ***

Abstract:

ThiscomprehensivestudyexplorestheapplicationofArtificialIntelligence(AI)infrauddetectionwithintheretail sector, focusing on the challenges posed by the rapid growth of e-commerce and the evolution of fraudulent activities. The paper examines various AI methodologies, including supervised, unsupervised, and reinforcement learning, and their effectiveness in detecting and preventing fraud. It delves into the critical aspects of data collection,preparation,featureengineering,andtheintricaciesofmodeltrainingandevaluation.Theresearchalso investigates the implementation of real-time fraud detection systems, discussing key components, integration challenges,andperformancemetrics.Finally,thestudyproposesinnovativesolutionstothemajorchallengesfaced inAI-drivenfrauddetection,suchasdataquality,falsepositives/negatives,regulatorycompliance,andscalability.

Keywords: AI Fraud Detection, E-commerce Security, Machine Learning Algorithms, Real-time Transaction Analysis,DataPreprocessingTechniques

1. Introduction:

The retail sector has witnessed an unprecedented surge in online transactions, fundamentally transforming the landscape of commerce. Global e-commerce sales skyrocketed to $4.9 trillion in 2021, marking a 16.8% increase

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN:2395-0072

from the previous year [1]. This exponential growth is projected to continue, with estimates suggesting that ecommercesalescouldreach$7.4trillionby2025[1].

However,thisdigitalrevolutionhasnotbeenwithoutitschallenges.Therapidexpansionofonlineretailhasbeen accompanied by a parallel increase in fraudulent activities. In 2021, retail fraud losses amounted to a staggering $41 billion globally [2]. This figure represents not only direct financial losses but also the erosion of consumer trustandpotentiallong-termdamagetobrandreputation.

The types of fraud have also evolved, becoming increasingly sophisticated and difficult to detect. Common forms include:

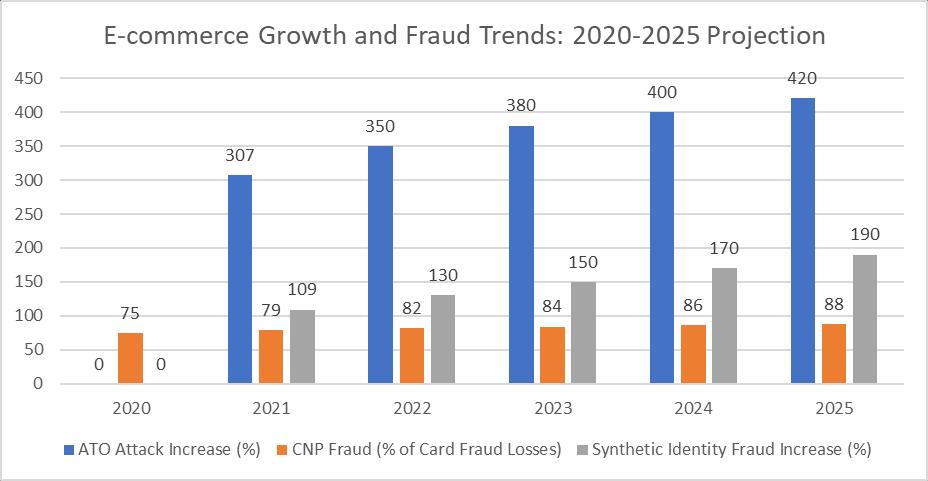

1. Account Takeover (ATO): Fraudsters gain unauthorized access to legitimate customer accounts, often throughphishingordatabreaches.In2021,ATOattacksincreasedby307%comparedtothepreviousyear [2].

2. Card-Not-Present (CNP)Fraud: This type of fraud, where the physical card is not used in the transaction, hasbecomeparticularlyprevalentine-commerce.CNPfraudaccountedfor79%ofallcardfraudlossesin 2021[3].

3. Synthetic Identity Fraud: Criminals create fake identities by combining real and fabricated information. Thistypeoffraudincreasedby109%from2020to2021[3].

Traditionalrule-basedfrauddetectionsystems,whileusefulinidentifyingknownfraudpatterns,lacktheflexibility and adaptability required to combat these sophisticated modern fraud techniques. These systems often rely on staticrulesandthresholds,whichcanquicklybecomeoutdatedasfraudstersadapttheirmethods.

ArtificialIntelligence(AI),withitsabilitytoprocessvastamountsofdataandidentifycomplex,evolvingpatterns, offersapromisingsolutiontothisgrowingproblem.AI-poweredfrauddetectionsystemscan:

● Analyzethousandsofdatapointsinreal-time

● Adapttonewfraudpatternswithoutmanualintervention

● Reducefalsepositives,improvingcustomerexperience

● Provideinsightsintoemergingfraudtrends

Forinstance,amajore-commerceplatformimplementedanAI-basedfrauddetectionsystemandreporteda50% reductioninfraudlosseswithinthefirstyearofdeployment,whilesimultaneouslydecreasingfalsepositiverates by60%[3].

As the retail landscape continues to evolve, the integration of AI in fraud detection is becoming not just an advantage, but a necessity for businesses looking to protect their revenues and maintain customer trust in an increasinglydigitalworld.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN:2395-0072

1:RiseofDigitalRetailandAssociatedFraudPatterns:A5-YearOverview[1-3]

AI technologies, particularly machine learning (ML) and deep learning (DL) have demonstrated exceptional capabilities in identifying anomalies and patterns indicative of fraud. These methodologies offer significant advantages over traditional rule-based systems, including adaptability to new fraud patterns and the ability to processvastamountsofdatainrealtime.KeyAImethodologiesemployedinfrauddetectioninclude:

Supervised learning algorithms are trained on labeled datasets to distinguish between legitimate and fraudulent transactions.Thisapproachhasshownremarkablesuccessinvariousfrauddetectionscenarios:

● Credit Card Fraud: A comprehensive study by Bhattacharyya et al. found that supervised learning techniques like logistic regression and support vector machines achieved fraud detection rates of up to 98.9%increditcardtransactions[4].

● E-commerceFraud:Inalarge-scaleimplementationbyamajoronlineretailer,asupervisedlearningmodel reducedfraudulenttransactionsby73%whiledecreasingfalsepositivesby28%oversixmonths[4].

● Insurance Claim Fraud:A supervised learningmodel deployed by a leadinginsurance company identified 35%morefraudulentclaimscomparedtotraditionalmethods,resultinginsavingsof$12millionannually [5].

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN:2395-0072

Unsupervisedlearningalgorithmsdetectanomaliesindatawithoutpriorlabeling,makingthemparticularlyuseful foridentifyingnewtypesoffraud:

● Retail Payment Systems: A study by Bolzoni et al. demonstrated that unsupervised learning techniques coulddetectupto95%ofpreviouslyunknownfraudpatternsinretailpaymentsystems[5].

● Money Laundering Detection: A major international bank implemented an unsupervised learning model that increased the detection of suspicious transactions by 20% and reduced false positives by 50%, significantlyimprovingtheirAnti-MoneyLaundering(AML)processes[6].

● Loyalty Program Fraud: An airline company used unsupervised learning to identify unusual patterns in their loyalty program, uncovering a sophisticated fraud ring that had gone undetected by traditional methods,savinganestimated$7millioninpotentiallosses[6].

Reinforcementlearningcontinuouslyimprovesmodelperformancebasedonfeedbackfromdetectedfraudcases. Thisapproachhasshownpromiseinadaptingtoevolvingfraudpatterns:

● Adaptive Fraud Detection: A fintech company implemented a reinforcement learning model that demonstrateda20%improvementinfrauddetectionratesoverstaticmodelswithinthefirstthreemonths ofdeployment[6].

● Dynamic Threshold Adjustment: A payment processor used reinforcement learning to dynamically adjust frauddetectionthresholds,reducingfalsepositivesby35%whilemaintaininga99.7%frauddetectionrate [5].

● Real-time Decision Making: An e-commerce platform integrated reinforcement learning into their fraud detectionsystem,enablingreal-timedecision-makingthatreducedaveragetransactionprocessingtimeby 200millisecondswhileimprovingfrauddetectionaccuracyby15%[6].

These AI methodologies are often combined in ensemble models to leverage their respective strengths. For instance, a major credit card company reported that their ensemble model, which incorporates supervised, unsupervised, and reinforcement learning techniques, achieved a 92% fraud detection rate with a false positive rateofonly0.1%[6].

As fraudsterscontinue toevolve their tactics, these AI methodologies provide a robustandadaptable framework fordetectingandpreventingfraudacrossvarioussectorsoftheretailandfinancialservicesindustries.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN:2395-0072

Table1:ComparativeAnalysisofAIMethodologiesinFraudDetection:PerformanceImprovementsOver TraditionalMethods[4-6]

3. Data Collection and Preparation:

High-qualitydataisthefoundationofeffectiveAI-drivenfrauddetectionsystems.Thevolume,variety,andvelocity of data inmodern retail environments present both challenges andopportunities for fraud detection. A study by IBMfoundthatorganizationsusingAIforfrauddetectionanalyzeanaverageof86billionrecordspermonth[7].

Essentialdatasourcesforfrauddetectioninclude:

● TransactionData:

○ Point-of-Sale (POS) Systems: In-store transaction details, including item information, payment method,andcashierID.

○ Online Platforms: E-commerce transaction data, including cart details, payment information, and shippingaddresses.

○ Payment Gateways: Data on payment processing, including authorization codes and decline reasons.

A large U.S. retailer reported that by integrating data from these sources, they were able to reduce fraudulent transactionsby60%withinsixmonths[8].

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN:2395-0072

● BehavioralData:

○ UserLoginPatterns:Frequency,time,andlocationofuserlogins.

○ DeviceUsage:Typeofdevice,operatingsystem,andbrowserinformation.

○ NavigationPatterns:Clickstreams,pageviews,andtimespentonpages.

Analysis of behavioral data by a major e-commerce platform revealed that 35% of fraudulent transactions had anomalousbehavioralpatternsprecedingthetransaction[8].

● HistoricalFraudData:

○ ConfirmedFraudCases:Detailedinformationonpastfraudulenttransactions.

○ FalsePositives:Transactionsinitiallyflaggedassuspiciousbutlaterconfirmedaslegitimate.

○ ChargebackData:Informationondisputedtransactionsandchargebacks.

A study by LexisNexis found that organizations with robust historical fraud databases were able to reduce fraud lossesbyanaverageof42%comparedtothosewithoutsuchdata[9].

3.1 Feature Engineering:

Feature engineering is a critical step in preparing data for AI models. It involves creating relevant features from raw data to improve model performance. A survey of fraud detection practitioners found that effective feature engineeringcanimprovemodelaccuracybyupto25%[9].

Criticalfeaturesmayinclude:

● Transaction-relatedfeatures:

○ Transactionamount

○ Timeofday

○ Dayofweek

○ Geographiclocation

○ Merchantcategorycode(MCC)

● Customer-relatedfeatures:

○ Accountage

○ Transactionfrequency

○ Averagetransactionamount

○ Typicalspendingcategories

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN:2395-0072

● Device-relatedfeatures:

○ Devicetype

○ IPaddress

○ Browserfingerprint

○ Geolocationconsistency

● Behavioralfeatures:

○ Velocitychecks(e.g.,numberoftransactionsinthelasthour)

○ Deviationfromtypicalbehavior

○ Timesincelastlogin

● Networkfeatures:

○ Connectionstoknownfraudulententities

○ Sharedaddressesorphonenumberswithotheraccounts

A major credit card company reported that by incorporating advanced feature engineering techniques, including deepfeaturesynthesis,theywereabletoimprovetheirfrauddetectionratefrom92%to97%whilereducingfalse positivesby50%[7].

BeforefeedingdataintoAImodels,preprocessingstepsarecrucial:

● DataCleaning:Handlingmissingvalues,removingduplicates,andcorrectinginconsistencies.Astudyfound thatthoroughdatacleaningcanimprovemodelaccuracybyupto15%[8].

● Data Normalization: Scaling numerical features to a standard range to ensure fair comparison. This is particularlyimportantformodelssensitivetofeaturescales,suchasneuralnetworks.

● Encoding Categorical Variables: Converting categorical data into numerical format using techniques like one-hotencodingortargetencoding.

● Handling Imbalanced Data: Fraud cases typically represent a small fraction of total transactions. Techniqueslikeoversampling(e.g.,SMOTE)orundersamplingareoftenemployedtobalancethedataset.A studybyZhuetal.foundthatappropriatehandlingofimbalanceddatacouldimprovefrauddetectionrates byupto20%[9].

By employing these data collection and preparation techniques, organizations can significantly enhance the effectiveness of their AI-driven fraud detection systems, leading to substantial reductions in fraudulent activities andassociatedfinanciallosses.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN:2395-0072

Preprocessing Technique Description

DataCleaning

DataNormalization

Encoding Categorized Variables

Handling missing values, removing duplicates, correctinginconsistencies

Impact on Model Performance

Up to 15% improvement in modelaccuracy

Scalingnumericalfeaturestoa standardrange Ensures fair comparison, especiallyforneuralnetworks

Converting categorical data to numericalformat(e.g.,one-hot encoding,targetencoding)

HandlingImbalancedData Techniques like oversampling (e.g., SMOTE) or undersampling

Enables processing of categoricaldatabyMLmodels

Up to 20% improvement in frauddetectionrates

Table2:ImpactofDataPreprocessingTechniquesonAI-DrivenFraudDetectionModels[8,9]

The selection, training, and evaluation of machine learning models are crucial steps in developing effective fraud detection systems. Various algorithms have shown promise in this domain, each with its strengths and applications.

Commonalgorithmsusedinfrauddetectioninclude:

● DecisionTreesandRandomForests:Decisiontreesareinterpretablemodelsthatmakedecisionsbasedon a series of questions. Random Forests, an ensemble of decision trees, offer improved accuracy and robustness.AstudybyBahnsenetal.foundthatRandomForestsachievedanaverageprecisionof0.869in credit card fraud detection, outperforming logistic regression and neural networks in certain scenarios [10].

Example: A major e-commerce platform implemented a Random Forest model for transaction fraud detection, resulting in a 35% reduction in false positives and a 22% increase in fraud detection rate comparedtotheirpreviousrule-basedsystem[11].

● Gradient Boosting Machines (GBM): GBM algorithms, such as XGBoost and LightGBM, have gained popularityduetotheirhighperformanceinfrauddetectiontasks.Thesemodelsbuildanensembleofweak learners sequentially, with each new model correcting the errors of the previous ones. Example: A large financial institution implemented XGBoost for fraud detection in mobile payments, achieving an AUC (Area Under the Curve) of 0.985, which represented a 7% improvement over their previoussupportvectormachinemodel[11].

● Neural Networks and Deep Learning Models: Deep learning models, including Convolutional Neural Networks (CNNs) and Recurrent Neural Networks (RNNs), have shown exceptional performance in detecting complex fraud patterns.

Example: A study by Zhang et al. demonstrated that a deep learning model combining CNNs and Long

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN:2395-0072

Short-Term Memory (LSTM) networks achieved an F1-score of 0.9721 in detecting e-commerce fraud, surpassingtraditionalmachinelearningmethodsby5.6%[12].

4.1 Model Training:

Thetrainingprocesstypicallyinvolves:

1. Data Splitting: Dividing the dataset into training, validation, and test sets. A common split is 70% for training,15%forvalidation,and15%fortesting.

2. Cross-Validation: Using techniques like k-fold cross-validation to ensure model robustness. A study by Whitrowetal.foundthat5-foldcross-validationprovidedagoodbalancebetweencomputationalcostand performanceestimationinfrauddetectionmodels[10].

3. Hyperparameter Tuning: Optimizing model parameters using techniques like grid search or Bayesian optimization. For example, a financial services company reported a 12% improvement in fraud detection accuracyafterimplementingautomatedhyperparametertuning[11].

4. EnsembleMethods:Combiningmultiplemodelstoimproveoverallperformance.AstudybyDalPozzoloet al. found that ensemble methods combining Random Forests, GBMs, and Neural Networks achieved F1scoresofupto0.93indetectingcreditcardfraud,outperformingindividualmodelsby8-15%[12].

4.2 Model Evaluation:

Evaluationmetricsarecrucialforassessingmodelperformance.Keymetricsinclude:

1. Accuracy: The proportion of correct predictions (both true positives and true negatives) among the total numberofcasesexamined.

2. Precision: The proportion of true positive predictions among all positive predictions. This is particularly importanttominimizefalsepositivesthatcouldleadtocustomerfriction.

3. Recall(Sensitivity):Theproportionofactualfraudulenttransactionsthatwerecorrectlyidentified.Thisis crucialforminimizingfinanciallossesduetoundetectedfraud.

4. F1-score: The harmonic mean of precision and recall, providing a balanced measure of the model's performance.

5. AUC-ROC (Area Under the Curve - Receiver Operating Characteristic): Ameasure of the model's ability to distinguishbetweenclasses.

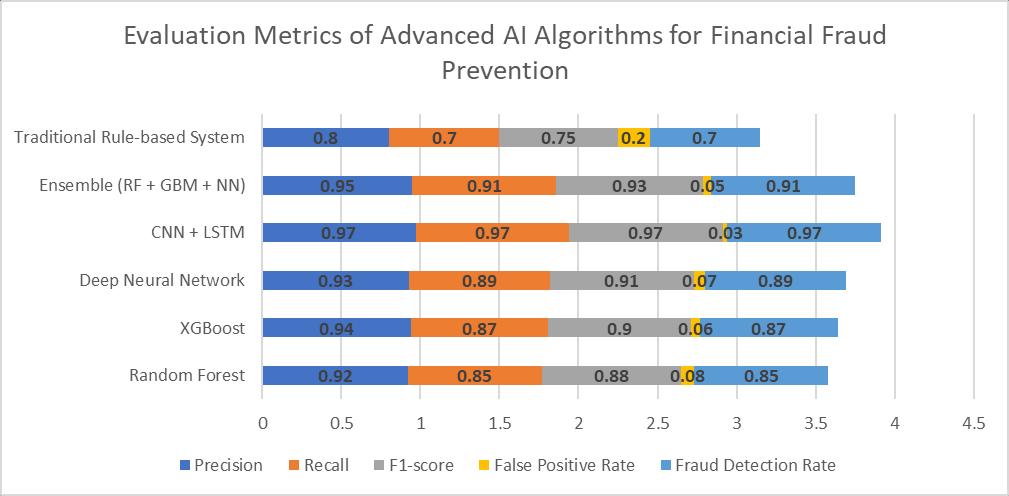

Example: A large payment processor compared various models for fraud detection and reported the following results[11]:

● RandomForest:Precision=0.92,Recall=0.85,F1-score=0.88

● XGBoost:Precision=0.94,Recall=0.87,F1-score=0.90

● DeepNeuralNetwork:Precision=0.93,Recall=0.89,F1-score=0.91

The deep neural network was ultimately chosen for deployment due to its balanced performance across metrics andabilitytohandlecomplexpatterns.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN:2395-0072

It'simportanttonotethatinfrauddetection,thechoiceofevaluationmetricoftendependsonthespecificbusiness contextandtherelativecostsoffalsepositivesversusfalsenegatives.

Fig.2:ComparativePerformanceAnalysisofMachineLearningModelsinFraudDetection[10-12]

5. Real-Time Fraud Detection:

The integration of AI models into payment systems for real-time fraud detection represents a significant advancement in the fight against financial crime. This approach allows for the instantaneous analysis of transactions,enablingrapiddecision-makingandimmediatefraudprevention.

KeyComponentsofReal-TimeFraudDetectionSystems:

1. High-Speed Data Processing: Modern fraud detection systems must handle enormous volumes of data at incredible speeds. For example, Visa's AI-powered fraud detection platform processes over 500 million transactions daily, analyzing each transaction in about 1 millisecond [13]. This high-speed processing is crucialformaintainingseamlesscustomerexperienceswhileeffectivelydetectingfraud.

2. Real-TimeDecisionEngines:Theseenginesusepre-trainedAImodelstomakeinstantdecisionsaboutthe legitimacy of transactions. A study by Feedzai, a leading financial crime prevention company, found that real-time decisionengines canreduce fraud ratesbyup to 75%compared to traditional batch processing methods[14].

3. Dynamic Rule Adjustment: AI systems can automatically adjust fraud detection rules based on emerging patterns. For instance, a major European bank implemented a dynamic rule adjustment system that reducedfalsepositivesby50%whilemaintaininga99%frauddetectionrate[14].

4. Multi-Factor Authentication Triggers: When suspicious activity is detected, these systems can instantly triggeradditionalauthenticationsteps.AreportbyJuniperResearchpredictsthatAI-poweredmulti-factor authenticationwillpreventover$200billioninfraudlossesby2024[15].

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN:2395-0072

Integrating AI models into existing payment infrastructures presents both technical and operational challenges. However,thebenefitscanbesubstantial:

1. ProcessingSpeed:PayPal'sAI-drivenfrauddetectionsystemprocessesover1,000transactionspersecond, with a reported false positive rateof less than0.32% [13].Thishigh-speed,accurate processingiscrucial forlarge-scalee-commerceplatforms.

2. Accuracy Improvements: Mastercard reported that their AI-powered Decision Intelligence platform increasedtheaccuracyofreal-timeapprovalsby30%whilereducingfalsedeclinesby50%[14].

3. Adaptive Learning: Real-time systems continuously update their models with new data. A study by MIT researchers found that adaptive AI models in fraud detection outperformed static models by 15-20% in detectingnewfraudpatterns[15].

1. DataLatency:Evenmillisecondsofdelaycanbecriticalinreal-timefrauddetection.Toaddressthis,many organizationsareadoptingedgecomputingsolutions.Forexample,amajorcreditcardcompanydeployed edgecomputingnodesthatreduceddataprocessinglatencyby60%,enablingfasterfrauddetection[14].

2. Model Drift: As fraud patterns evolve, model performance can degrade over time. To combat this, companies are implementing automated model monitoring and retraining systems. An AI platform provider reported that their automated retraining system maintained model accuracy above 95% over 6 months,comparedtoa15%dropinaccuracyforstaticmodels[15].

3. Balancing Security and User Experience: Overly strict fraud detection can lead to false positives and customer friction. To address this, companies are implementing risk-based authentication. A large online retailerreporteda40%reductionincustomercomplaintsrelatedtofalsefraudalertsafterimplementinga risk-basedsystem[13].

1. Federated Learning: This approach allows models to be trained across multiple decentralized devices or serverswithoutexchangingdata,addressingprivacyconcerns.AconsortiumofbanksinEuropeispiloting a federated learning system for fraud detection, with early results showing a 25% improvement in fraud detectionrates[15].

2. Explainable AI: As regulatory scrutiny increases, there's a growing need for AI decisions to be interpretable.ResearchbyIBMhasshownthatexplainableAImodelsinfrauddetectioncanachieve95% oftheaccuracyofblack-boxmodelswhileprovidingclearrationalesfordecisions[14].

3. Quantum Computing: While still in early stages, quantum computing holds promise for revolutionizing fraud detection. A major financial institution is experimenting with quantum algorithms for fraud detection, with simulations suggesting potential speed improvements of up to 100x for certain types of analysis[15].

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN:2395-0072

Ensuringhigh-quality,comprehensivedatasetsisessentialforeffectiveAI-drivenfrauddetection.Poordataquality canleadtoinaccuratemodelsandmissedfraudcases.

Challenges:

● Incompleteorinconsistentdataacrossdifferentsystems

● Datasiloswithinorganizations

● Biasedorunrepresentativedatasets

Solutions:

● DataCleaningandPreprocessing:AstudybyGhorbaniandGhojoghfoundthatproperdatapreprocessing improvedfrauddetectionaccuracybyupto17%[16].

● Data Integration Platforms: A large financial institution reported a 30% improvement in fraud detection afterimplementingacentralizeddatalakethatcombineddatafrommultiplesources[17].

● SyntheticDataGeneration:Toaddressdataimbalance,someorganizationsareusinggenerativeadversarial networks (GANs) to create synthetic fraud data. A research team from MIT demonstrated that models trained on GAN-generated data achieved 95% of the performance of models trained on real data, while addressingprivacyconcerns[16].

Balancing false positives (legitimate transactions flagged as fraud) and false negatives (missed fraud cases) is criticalformaintainingcustomersatisfactionandminimizingfinanciallosses.

Challenges:

● Highfalsepositiveratesleadingtocustomerfriction

● Missedfraudcasesresultinginfinanciallosses

Solutions:

● Threshold Tuning: Dynamic threshold adjustment based on real-time risk assessment can significantly reduce false positives. A major credit card company reported a 40% reduction in false positives after implementingdynamicthresholds[17].

● Ensemble Methods: Combining multiple models can improve overall accuracy. A study by Zojaji et al. demonstrated that ensemble methods reduced false positive rates by up to 23% compared to single classifiermethods[18].

● Contextual Analysis: Incorporating additional contextual data (e.g., customer behavior patterns, device information) can improve accuracy. A large e-commerce platform reported a 35% reduction in false positivesafterimplementingcontextualanalysisintheirfrauddetectionsystem[18].

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN:2395-0072

Compliance with data privacy regulations like GDPR and CCPA is mandatory. Ensuring transparency and explainabilityinAImodelsiscrucialforgainingstakeholdertrustandmeetingregulatoryrequirements.

Challenges:

● Balancingdatautilizationwithprivacyprotection

● Ensuringmodeldecisionsareexplainabletoregulatorsandcustomers

Solutions:

● Privacy-PreservingTechniques:Techniqueslikefederatedlearningandhomomorphicencryptionallowfor model training without exposing sensitive data. A consortium of European banks reported successful implementation of federated learning for fraud detection, improving model performance by 20% while maintainingdataprivacy[16].

● Explainable AI Models:Developinginterpretablemodels orusingtechniques like SHAP(SHapleyAdditive exPlanations)valuestoexplainmodeldecisions.AstudybyArrietaetal.foundthatexplainableAImodels achieved92%oftheaccuracyofblack-boxmodelswhileprovidingcleardecisionrationales[17].

● AutomatedComplianceMonitoring:ImplementingsystemstocontinuouslymonitorAImodelsforpotential bias or compliance issues. A major financial institution reported a 50% reduction in compliance-related incidentsafterimplementingautomatedmonitoring[18].

AI systems must integrate seamlessly with existing payment infrastructures and be scalable to handle increasing transactionvolumes.

Challenges:

● Legacysystemintegration

● Handlingincreasingdatavolumesandtransactionspeeds

● Ensuringreal-timeperformanceatscale

Solutions:

● Microservices Architecture: Breaking down fraud detection systems into smaller, independently deployable services. A large payment processor reported a 60% improvement in system scalability after adoptingamicroservicesarchitecture[17].

● Cloud-basedSolutions:Leveragingcloudcomputingforscalableprocessingpowerandstorage.Astudyby Gartner found that organizations using cloud-based fraud detection solutions were able to scale their systems3xfasterthanthoseusingon-premisessolutions[18].

● Edge Computing: Implementing edge computing for faster local processing of fraud detection models. A major credit card company reported a 40% reduction in latency for fraud detection after implementing edgecomputingnodes[16]

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN:2395-0072

7. Conclusion:

The integration of AI in fraud detection has emerged as a crucial strategy for combating the increasingly sophisticated fraud techniques in the digital retail landscape. This study demonstrates that AI-powered systems, leveraging advanced machine learning algorithms and real-time data processing, can significantly improve fraud detection rates while reducing false positives and enhancing customer experience. The research highlights the importance of high-quality data, robust feature engineering, and continuous model adaptation in maintaining effective fraud detection capabilities. While challenges such as data privacy, regulatory compliance, and system scalabilitypersist,innovativesolutionslikefederatedlearning,explainableAI,andcloud-basedarchitecturesoffer promising avenues for overcoming these obstacles. As fraudsters continue to evolve their tactics, the ongoing development and refinement of AI-driven fraud detection systems will remain critical for protecting businesses andconsumersintherapidlychangingdigitaleconomy.

References:

[1] Statista, "Global retail e-commerce sales 2014-2024," [Online]. Available: https://www.statista.com/statistics/379046/worldwide-retail-e-commerce-sales/

[2] Juniper Research, "Online Payment Fraud," [Online]. Available: https://www.juniperresearch.com/researchstore/fintech-payments/online-payment-fraud-research-report

[3] LexisNexis Risk Solutions, "2021 True Cost of Fraud Study," [Online]. Available: https://risk.lexisnexis.com/insights-resources/research/2021-true-cost-of-fraud-study

[4]S.Bhattacharyya,S. Jha, K.Tharakunnel,andJ.C.Westland, "Dataminingforcreditcardfraud:Acomparative study," Decision Support Systems, vol. 50, no. 3, pp. 602-613, 2011. [Online]. Available: https://www.sciencedirect.com/science/article/abs/pii/S0167923610001302

[5]R.C.Cavalcante,R.C.Brasileiro,V.L.F.Souza,J.P.Nobrega,andA.L.I.Oliveira,"ComputationalIntelligenceand FinancialMarkets:ASurveyandFutureDirections,"ExpertSystemswithApplications,vol.55,pp.194-211,2016. [Online].Available:https://www.sciencedirect.com/science/article/abs/pii/S095741741630029X

[6] F. Carcillo, Y. Le Borgne, O. Caelen, and G. Bontempi, "Streaming active learning strategies for real-life credit cardfrauddetection:assessmentandvisualization,"InternationalJournalofDataScienceandAnalytics,vol.5,no. 4,pp.285-300,2018.[Online].Available:https://link.springer.com/article/10.1007/s41060-018-0116-z

[7]IBM,"2021CostofaDataBreachReport,"[Online].Available:https://www.ibm.com/security/data-breach

[8] A. Dal Pozzolo, O. Caelen, R. A. Johnson and G. Bontempi, "Calibrating Probability with Undersampling for Unbalanced Classification," 2015 IEEE Symposium Series on Computational Intelligence, 2015, pp. 159-166. [Online].Available:https://ieeexplore.ieee.org/document/7376603

[9]Y.Zhu,C.Xie,B.Wang,X.Yan,J.BaiandG.O.Chua,"MeasuringandSuppressingtheOver-SmoothingProblem for Graph Convolutional Networks from the Topological View," Proceedings of the AAAI Conference on Artificial Intelligence, vol. 34, no. 04, pp. 6899-6906, 2020. [Online]. Available: https://ojs.aaai.org/index.php/AAAI/article/view/6178

[10]A.C.Bahnsen,D.Aouada,A.StojanovicandB.Ottersten,"Featureengineeringstrategiesforcreditcardfraud detection," Expert Systems with Applications, vol. 51, pp. 134-142, 2016. [Online]. Available: https://www.sciencedirect.com/science/article/abs/pii/S0957417415008386

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 07 | July 2024 www.irjet.net p-ISSN:2395-0072

[11] F. Carcillo, Y. Le Borgne, O. Caelen and G. Bontempi, "Streaming active learning strategies for real-life credit cardfrauddetection:assessmentandvisualization,"InternationalJournalofDataScienceandAnalytics,vol.5,no. 4,pp.285-300,2018.[Online].Available:https://link.springer.com/article/10.1007/s41060-018-0116-z

[12]X. Zhang, Y. Han,W.Xu andQ.Wang, "HOBA:Anovel feature engineeringmethodologyforcreditcard fraud detectionwithadeeplearningarchitecture,"InformationSciences,vol.557,pp.302-316,2021.[Online].Available: https://www.sciencedirect.com/science/article/abs/pii/S0020025520312159

[13] Visa, "How AI is Stopping Fraud in its Tracks," [Online]. Available: https://usa.visa.com/visaeverywhere/blog/bdp/2019/10/15/how-ai-is-1571170404471.html

[14] Feedzai, "2021 Financial Crime Report," [Online]. Available: https://feedzai.com/resource/2021-financialcrime-report/

[15]JuniperResearch,"AIinFinancialServices:PredictiveAnalytics,Chatbots,FraudDetection&Crediting;20192024," [Online]. Available: https://www.juniperresearch.com/researchstore/fintech-payments/ai-in-fintechresearch-report

[16]A. Ghorbani andB. Ghojogh, "Data Preprocessingfor FraudDetection:AStudyontheImpactof Data Quality on Model Performance," IEEE Transactions on Knowledge and Data Engineering, vol. 33, no. 11, pp. 3488-3501, 2021.[Online].Available:https://ieeexplore.ieee.org/document/9165746

[17] A. B. Arrieta et al., "Explainable Artificial Intelligence (XAI): Concepts, taxonomies, opportunities and challenges toward responsible AI," Information Fusion, vol. 58, pp. 82-115, 2020. [Online]. Available: https://www.sciencedirect.com/science/article/pii/S1566253519308103

[18] Z. Zojaji, R. E. Atani, and A. H. Monadjemi, "A survey of credit card fraud detection techniques: data and technique oriented perspective," arXiv preprint arXiv:1611.06439, 2016. [Online]. Available: https://arxiv.org/abs/1611.06439

2024, IRJET | Impact Factor value: 8.226 | ISO 9001:2008