N 011 54° "44'

N 011 54° "44'

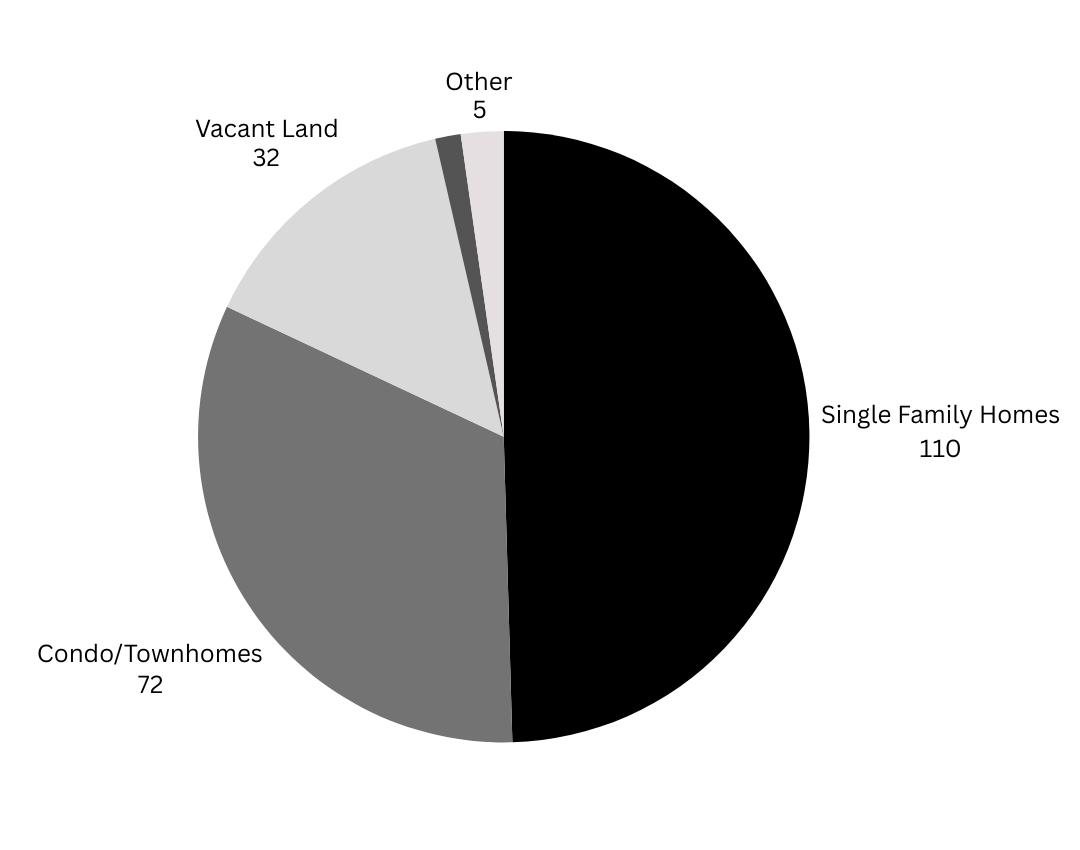

The Jackson Hole real estate market has experienced varied activity across its different segments totaling 222 transactions, reflecting a 5% decrease in total dollar volume or standing at $915.7 million YTD. Despite this decline, the market is showing signs of resilience, as current listings have increased by 5% to 294, providing prospective buyers with a broader range of options.

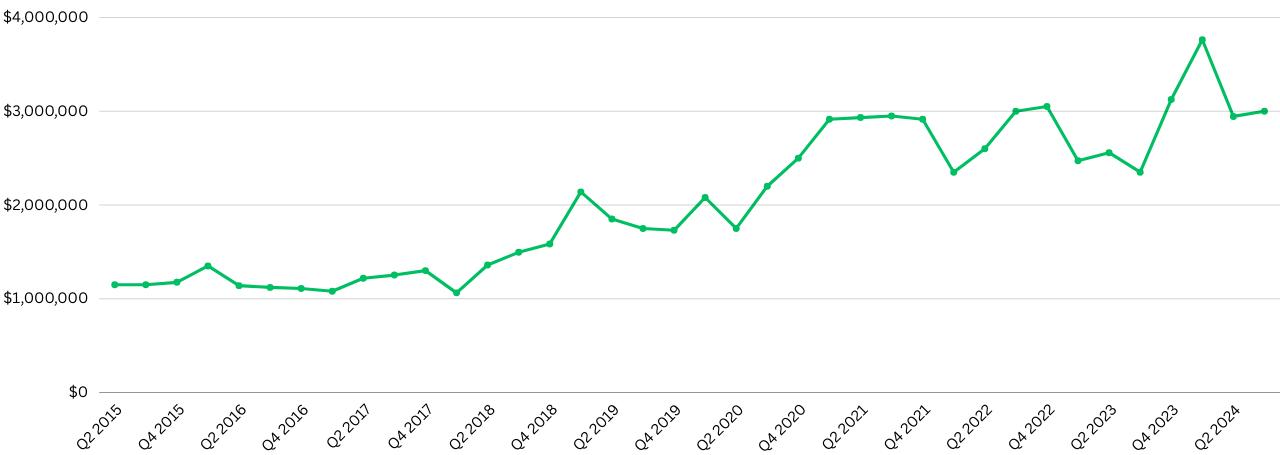

In the single-family home segment, activity remains steady with 110 transactions, marking a 4% increase. This segment saw a modest increase in total dollar volume, up by 1% to $519 million. However, the median sale price experienced an 8% decrease, settling at $3 million, highlighting a shift in market segment activity.

The condo and townhome market showed growth, with 72 transactions reflecting a 13% increase. Total dollar volume in this segment rose by 11% to $137.8 million, despite a 10% decrease in median sale price, which now stands at $1.4 million. A striking 340% surge in pending transactions indicates a renewed buyer interest, suggesting that this segment remains competitive and desirable.

Conversely, the vacant land segment has faced challenges, with 32 transactions representing a significant 29% decrease. Total dollar volume for vacant land fell by 15%, totaling $224.6 million. Nevertheless, the median sale price increased by 34% to $2.9 million, and the maximum price sold rose by 35%, because of the diminishing quantity of lower priced lots. As a result of

a 10% decrease in current inventory, pending transactions declined, and the average days on market rose by 20%, indicating a slowdown in buyer activity in this segment.

The luxury home segment, which encompasses properties priced at $5 million and above, demonstrated mixed results, with 39 transactions representing a 9% decline. Total dollar volume for this segment fell by 10% to $433.2 million. Nonetheless, the median sale price saw a notable increase of 10%, reaching $7.5 million. Additionally, the current inventory of luxury properties increased by 23%, signaling greater availability for high-end buyers in a market that is adjusting to changing dynamics.

While the Jackson Hole market adapts to fluctuations, certain segments exhibit resilience and growth, underscoring the diverse nature of the local real estate landscape. Buyers are navigating a market characterized by increased inventory and shifting price dynamics, making it an exciting yet challenging environment for both buyers and sellers.

With many sales occurring outside of the MLS (Multiple-List Service), it is important to manually track ALL Teton County real estate sales. Typically, it is the higher-end sales that go unreported, vastly skewing the accuracy of MLS data alone. Our market report accounts for all sales, providing a comprehensive overview and deeper insight into the market.

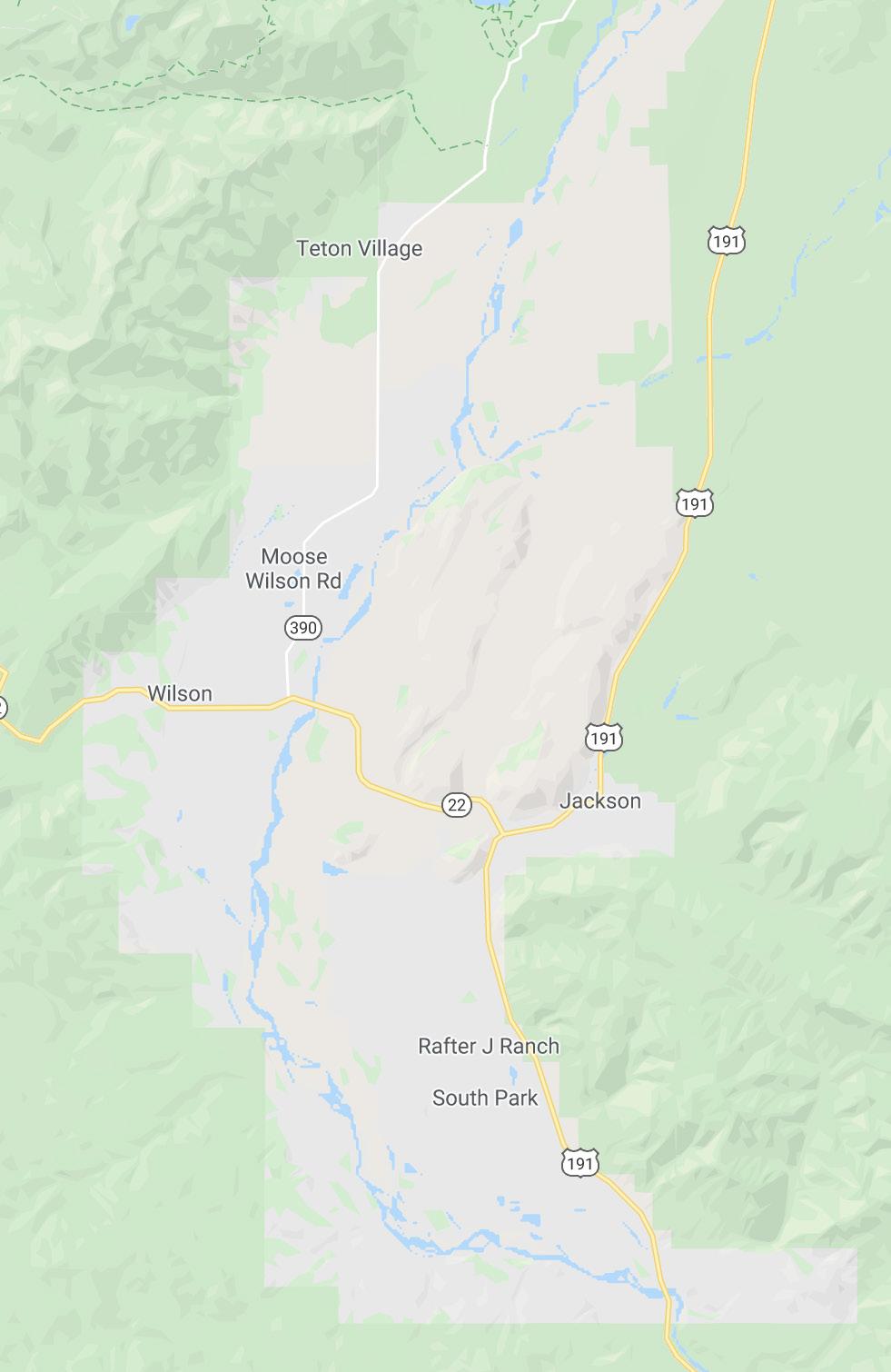

Teton Village: 18

Racquet Club/Teton Pines: 14

West Snake North of Wilson: 13

West Snake South of Wilson: 5

Skyline Ranch to Sagebrush Drive: 24

East Gros Ventre Butte: 8

North Gros Ventre Junction: 15

Town of Jackson: 80

South of Jackson to Snake River Bridge: 34

South of Snake River Bridge to County Line: 11

The single-family home market in Jackson Hole, Wyoming, completed 110 transactions marking a 4% increase in sales. Despite an 8% decrease in the median sale price, now at $3 million, the total dollar volume for the segment saw a slight uptick of 1%, reaching $519 million. Notably, the maximum price sold surged by 21%, underscoring continued demand at the high end of the market.

Inventory levels also increased by 11%, providing more options for buyers, while pending transactions rose by 5%, signaling sustained interest and a competitive market environment.

Number of Transactions

Total Dollar Volume

Minimum Price Sold

Maximum Price Sold

Average Sale Price

Median Sale Price

Average Days on Market

Pending Transactions

Inventory

126 23 134

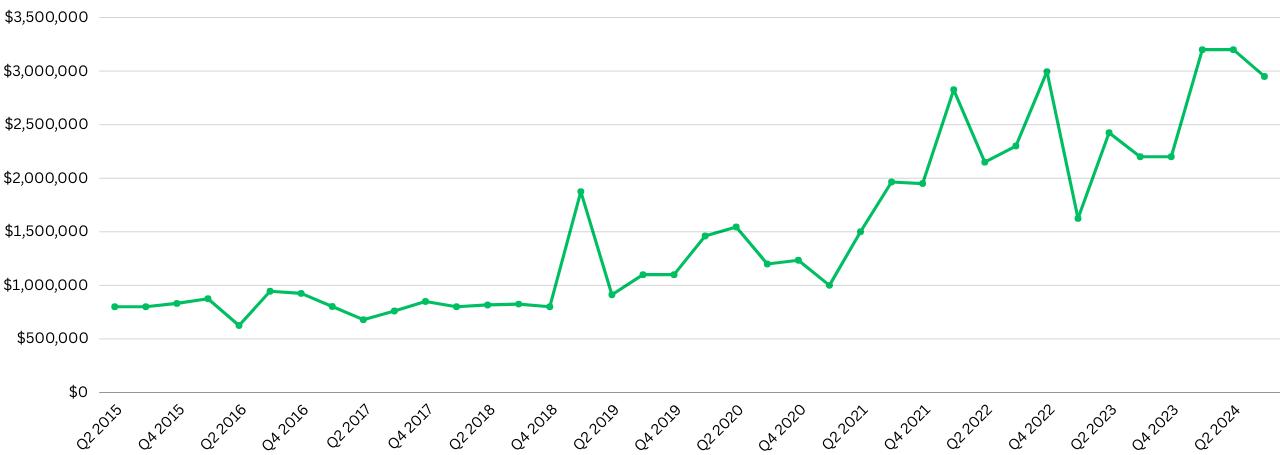

Q2 2015 - Q3 2024

The condo and townhome market in Jackson Hole, Wyoming, has experienced substantial growth, with 72 transactions reflecting a 13% increase. Total dollar volume rose by 11% to $137.8 million, despite a 10% decrease in the median sale price, now at $1.4 million.

Inventory in this segment grew by 13%, offering more opportunities for prospective buyers. Notably, pending transactions surged by 340%, from 5 to 22 highlighting a dramatic rise in buyer interest and activity in this sector.

Number of Transactions

Total Dollar Volume

Minimum Price Sold

Maximum Price Sold

Average Sale Price

Median Sale Price

Average Days on Market

Pending Transactions

Inventory

Median

Q2 2015 - Q3 2024

125 22 54

The vacant land segment in Jackson Hole, Wyoming, continues to shrink as new lot creation (land developments) are near non-existent, with 32 transactions representing a significant 29% decrease. Total dollar volume declined by 15%, settling at $224.6 million.

The market exhibited resilience, as the median sale price increased by 34% to $2.9 million, and the maximum price sold rose by 35%. Despite these positive trends, current inventory saw a 10% decrease, and pending transactions fell 57%, indicating a slowdown in buyer activity. Additionally, the average days on market increased by 20%, reflecting a shift in the pace of sales within this segment.

Number of Transactions

Total Dollar Volume

Minimum Price Sold

Maximum Price Sold

Average Sale Price

Median Sale Price

Average Days on Market

Pending Transactions

Inventory

218 3 62

Q2 2015 - Q3 2024

The luxury home segment in Jackson Hole, Wyoming, encompassing both residential and land properties priced at $5 million and above, has encountered notable fluctuations, with 39 transactions reflecting a 9% decrease. Total dollar volume also saw a decline of 10%, bringing it to $433.2 million (yet is still 47% of the total market dollar volume).

In contrast, the median sale price in this segment experienced a positive shift, rising by 10% to $7.5 million. Current inventory increased by 23%, indicating increased availability for high-end buyers. However, pending transactions decreased by 18%, and the average days on market rose significantly by 44%, suggesting that while the market is adapting to changing dynamics, buyers are taking more time to make decisions in this high-value segment.

Number of Transactions

Total Dollar Volume

Maximum Price Sold

Average Sale Price

Median Sale Price

Average Days on Market

Pending Transactions

Inventory

232 129 108

Q2 2015 - Q3 2024

Experience the Compass Real Estate difference by working with Jackson Hole’s leading real estate experts. We are a team of trusted advisors working collaboratively to leverage our collective knowledge and expertise to deliver fundamentally different service. For us, nothing matters more than creating legacy of excellence that honors and celebrates our people and the exceptional place we call home.

To start your search of all active Jackson Hole listings, scan the QR code.