Force in Global Nickel New A

Nickel Industries Limited is an Australian public company now emerging as a globally significant, diversified low-cost nickel producer

Nickel Industries Limited is an Australian public company now emerging as a globally significant, diversified low-cost nickel producer

Nickel Industries Limited is an Australian public company now emerging as a globally significant, diversified low-cost nickel producer. The company recently announced it has commenced production of nickel matte from its Hengjaya Rotary Kiln Electric Furnaces (RKEF) which will provide it new exposure to the class 1 nickel market for the electric vehicle supply chain. Managing Director Justin Werner describes the latest company development and its vision to become one of the top ten nickel producers in the world.

Nickel Industries Limited, previously known as Nickel Mines Limited, has gone through some exciting devel opments over the last few years, reflected in the name change itself and signifying the company’s transition from an explorer and miner of nickel ore to a globally sig nificant downstream processor of nickel metal for the class 1 and class 2 nickel markets.

PT. GEOSERVICES is a 100% privately owned local company that has a solid base of expertise covering all aspects of the exploration and development of Indone sia’s oil, gas, coal, mineral, and geothermal industries.

Founded in 1971 to offer services to the mining industry, PT Geoservices evolved into a fully integrated exploration ser vices company. Employing more than 1500 people, some of which are expert in specialized fields from a number of foreign countries, the company is offering in mapping surveys, geology, geophysics, downhole measurements, borehole drilling, laboratories analysis, and cargo superin tending for quantity and quality. Today it is a one-stop organization that can fulfill all explo ration and analysis requirements for each of the industrial sectors it serves.

The mineral division services the mining industry by pro vision of exploration analysis, metallurgical testwork, geo technical testwork, advanced mineralogy and provision of onsite laboratory management.

The Mineral Division laboratory in Kendari provides explo ration and production analysis to Companies involved in the Nickel Industry with one of its key clients being Nickel Mines group of Companies.

PT. Geoservices NiBara Division also has setup laboratories in Kendari and Halmahera with a specific goal to provide superintending and analytical services for nickel shipments and associated products such as coal, limestone and quick lime that are required for nickel smelter operation.

OUR PHILOSOPHY: “Excellent Services With High Pro fessional Integrity “

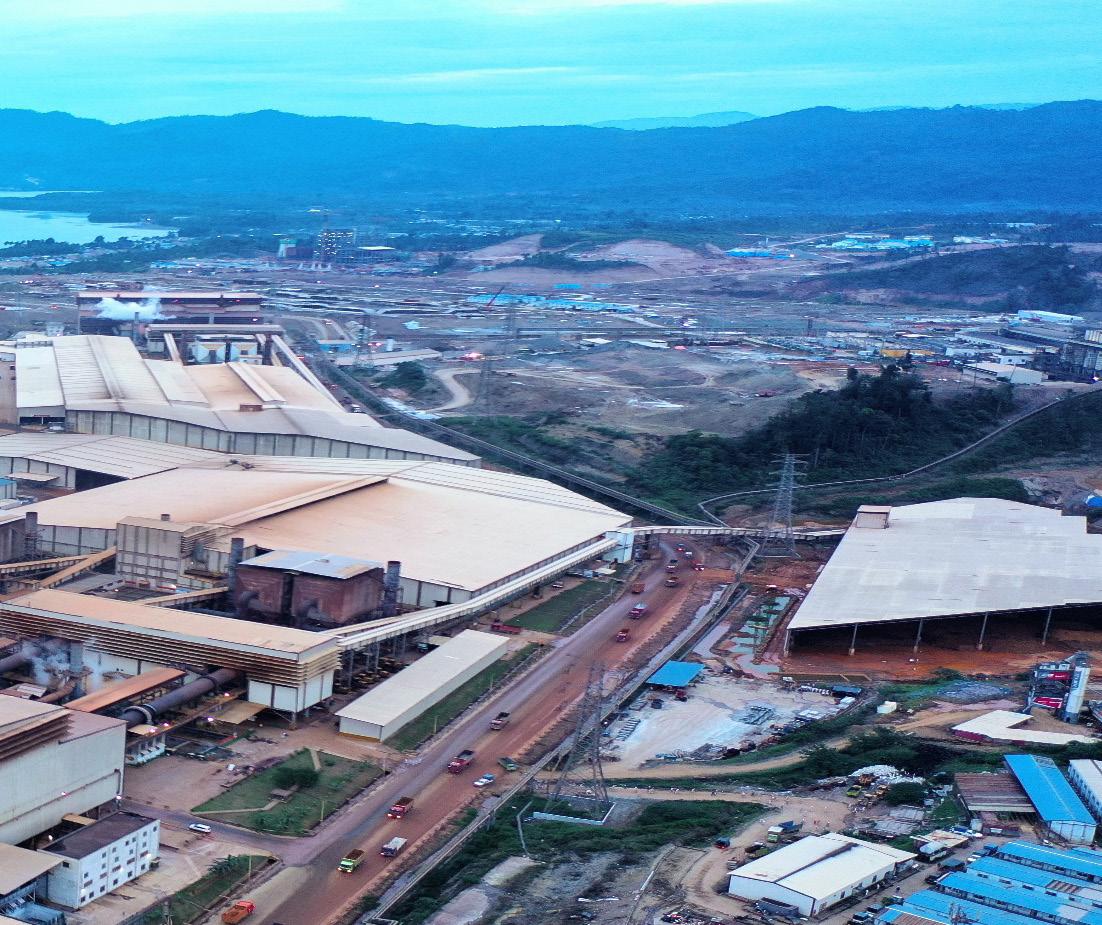

Nickel Industries now holds an 80% economic interest in eight producing RKEF lines which are located in two of the worlds largest nickel pro duction centres, Indonesia Morowali Industrial Park (“IMIP”) and Indonesia Weda Bay Industrial Park (“IWIP”), with a further four lines to commis sion this month at IMIP.

Most recently, in December 2021, the company entered into a definitive agreement to acquire a 70% interest in the Oracle Nickel Project with a capex, name plate and time frame guarantee (similar to all of its past RKEF acquisitions), which comprises four next-generation RKEF lines with an annual nameplate production capacity of 36,000 tonnes of nickel metal which are due to start commissioning this month. This will increase the company’s total attributable nameplate ca pacity to 78,000 tpa of nickel metal.

Mr Werner, the company Managing Director, says: “Since our IPO in 2018 which raised AUS$ 200 million – the second largest resources IPO at that time – we have grown rapidly from basical ly zero nickel metal production to producing in excess of 130,000 tonnes (100% basis) of nickel starting from the beginning of next year. This will

Jl.

Tsingshan

place us amongst the top 10 global nickel producers.”

The company’s progress and transi tion over a relatively short period of time is impressive. We asked Justin Werner to give us a brief overview of how it all started, and what has been behind the company’s growth.

He says: “Nickel Mines was incorpo

rated in 2007 and a year later the company made its first foray into Indonesia. That was when I got involved in the company. We iden tified a large tonnage high-grade project the Hengjaya Mine (“HM”), and success fully took that from permitting, explora tion, land acquisition and into production.

At the time, with direct shipping of all ore to China, it was a very

profitable business.”

However, in 2014 the Indonesian govern ment banned unpro cessed mineral exports in an effort to encour age the development of an in-country down stream processing industry that would allow Indonesians to benefit more from their country’s vast mineral wealth. The ban clearly had a major impact on the business.

At that time, circum

stances changed in the Indonesian ore mar ket with the entry of Tsingshan, the world’s largest stainless steel producer, who pi oneered the RKEF process to produce low-cost nickel pig iron, and which is now the dominant player in the Indonesian NPI and stainless steel industry.

“Tsingshan had already identified the opportunity of adding value in-country and

even before the ore ban came into ef fect, they had started building the Indonesia Morowali Industrial Park, the world’s larg est fully vertically-inte grated stainless steel park with capacity for

around 3 to 4 million tonnes per annum, 45,000 employees and over four gigawatt of power,” recalls Mr Werner.

As Tsingshan re quired additional nickel ore as feed

stock, Nickel Industries entered into an offtake agreement with Tsing shan for high-grade saprolite ore, and in 2015 started supply ing them ore from its mine, becoming one of their highest-grade ore

suppliers. This led to the signing of a col laboration agreement to acquire an interest in an initial two RKEF furnaces for nickel pig iron production.

Justin Werner ex plains that the produc tion of nickel pig iron, which is predominantly used in stainless steel, has grown very rap idly. In addition, the company has recently announced conversion of its Hengjaya RKEF

lines to the production of nickel matte, which is a class 1 nickel prod uct, to be used in the battery sector.

“This will diversify us into both markets, i.e. both the NPI class market and the class 1 market both of which have very different market and pricing dynamics.”

The company has a track record of mov ing fast. In the sum mer, Nickel Industries started commissioning a 380 MW power plant as part of the Angel project within the Indonesia Weda Bay Industrial Park, well ahead of schedule, following the early commissioning of the project’s four RKEF lines between Janu ary and May this year, again well ahead of the contracted delivery.

“The early commis sioning of the Angel RKEF lines more than six months ahead of schedule allowed us to significantly bring forward nickel pro duction. With Angel’s power plant now commissioned, this has allowed us to ramp up to approximately 130% of nameplate capac ity, which will greatly increase nickel metal production and assist in materially reduc ing Angel’s operating costs,” Mr Werner points out.

He acknowledges that the benefits of the partnership with

Tsingshan are mani fold. “All of their RKEF plants and power plants have come with a capex guarantee as well as a nameplate guarantee. Typically they perform 35% above the nameplate guarantee, and the timeframe guarantee. We have seen commis sioning of RKEF lines in as little as 12 months, and ramping up to full nameplate in as little as three months.”

“That’s why we think we’re so at tractive, and hence the change in name from Nickel Mines to Nickel Industries –we generate most of our profit from our RKEF business, which is an industrial style business. We’re not a mining company that requires large amounts of sustain ing capex that has mine life overhang. We have a very stable cost base, we sit right at the very bottom end of the cost curve. And we benefit from a 7 year tax holiday on 4 of our lines and 10 years on our latest 8 RKEF lines. Hence we are a strong mar gin business.”

As one of the largest employers in Indone sia with around 6,000 people in the two Industrial Parks, Nickel Industries is aware of

That’s why we think we’re so attractive, and hence the change in name from Nickel Mines to Nickel Industries

its social role and the importance of support ing local communities.

“We have invested over a billion US$ in equity and half a billion US$ in debt. We are currently the largest Australian investor in Indonesia, and we are very committed to supporting our local communities, as the vast majority of our employees comes from these communities.”

With its long-term economic development vision, the company seeks to develop pro grammes related to the communities’ needs, to create mutual value beyond the life of its operations. In addition to charitable grants, health and education is one of the priority areas for Nickel Indus tries’ social empower ment, and the company implements various initiatives to enhance the education level in its areas of operation.

Similarly, environmen tal protection remains high on the list of pri orities. The company’s commitment to envi ronmental sustainability has been recognised by the Indonesian Ministry of Energy and Natural Resources, which in 2021 awarded the com pany’s Hengjaya Mine a ‘Blue PROPER’ rating to confirm full compli ance with the mine’s operating licence of associated rehabilita tion programmes and commitments.

Within another major initiative to protect the bio diversity of local areas, Nickel Industries has rehabil itated several thousands of hectares of watershed area with commercial timber. More than two million trees have been planted since 2019 with the poten tial for an additional one million trees to be planted.

“In terms of our own operation, we have announced a binding term sheet for 200 megawatts of solar pow er, with a MOU for a further 220 megawatt peak of solar power. We are very much committed to reduc ing our carbon footprint and to increasing our mix of renewable and clean energies,” says Mr Werner.

He affirms that the company is in a good place. After nearly 15 years in Indonesia, Mr Werner feels almost local. “If you’re going to do business in Indonesia, you need to be based here. You need to have an understanding of the culture and the local community. That understanding has been one of the keys to success.”

“We are very happy where we are, and thankful ly are not experiencing some of the issues that the rest of the world is experiencing in supply chains and staff shortages. As Tsingshan provides us with a capex guarantee with all material sourcing, we’ve had no delays due to supply constraints.”

Speaking about the future, he acknowledges that the company is on track with its ambitious plans. “With our 70% interest in the Oracle Nickel Plant now paid for and commissioning on track early again for this month we should be at 130,000 tonne per annum nickel production from early next year, which places us amongst the top 10 global nickel producers.”

“We will very much continue to diversify. Ulti mately I would like to see a third of our production being nickel pig iron, a third being nickel matte, and the third being mixed hydroxide precipitate from HPAL plants. That will make us unique – we would be the only global diversified listed nickel producer that has exposure to all of those three different market segments of the nickel market.”