EXECUTIVE INSIGHT

Queensland

Pacific Metals, an emerging producer of sustainable clean and green nickel, is progressing its TECH projec

Green Critical Metals Production Pioneers

Queensland

Pacific Metals, an emerging producer of sustainable clean and green nickel, is progressing its TECH projec

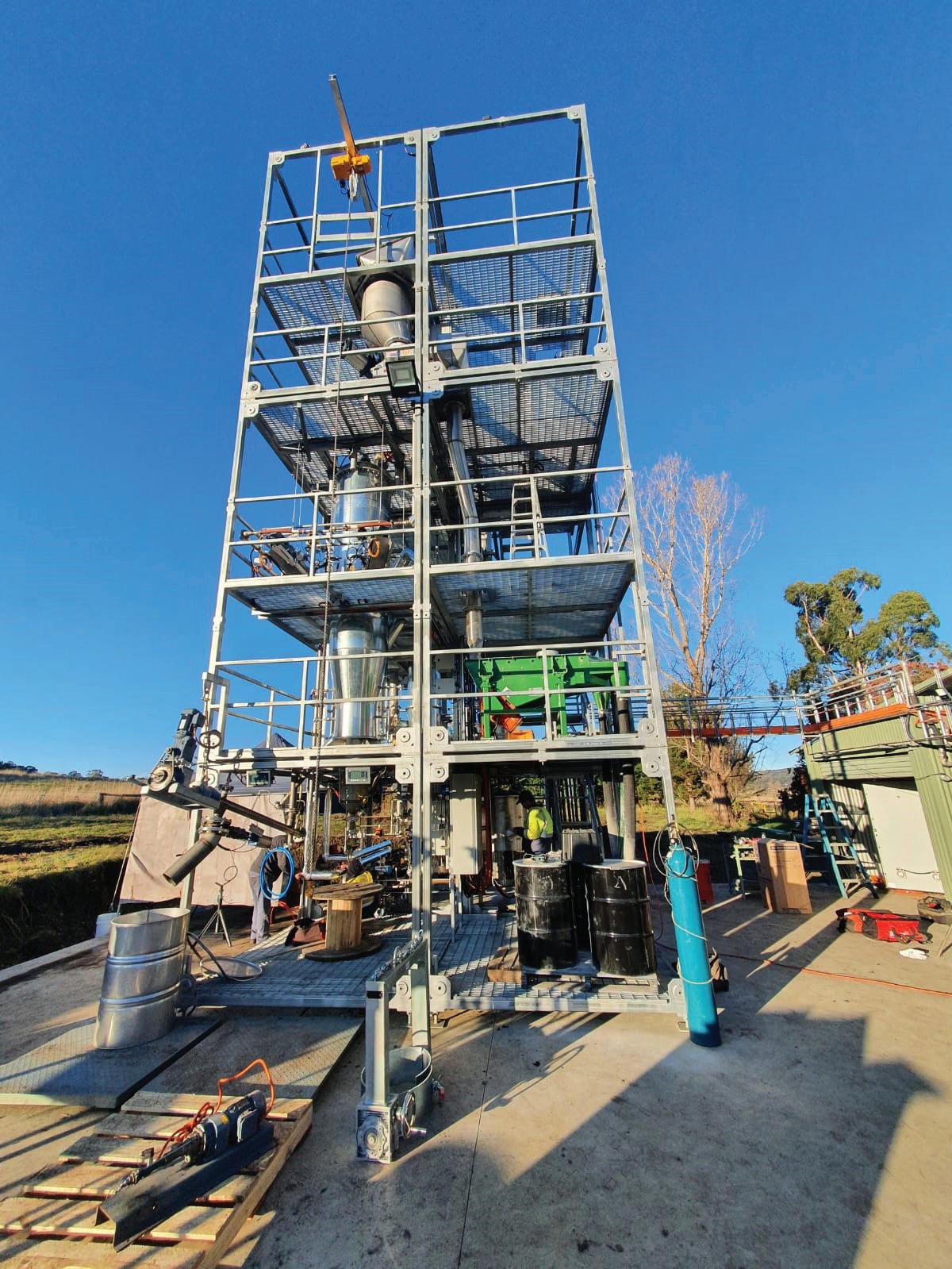

Queensland Pacific Metals, an emerging producer of sustainable clean and green nickel, is progressing its TECH project, which boasts unrivalled world-leading sustainability credentials for minerals processing, with negative carbon emissions, no tailings dam, no process liquids discharge and zero solids waste. “The potential is phenomenal,” says CEO Stephen Grocott.

ASK YOUR SEPARATION SPECIALIST

Increasing throughput while preserving product quality, minimizing energy consumption and operating costs or increasing water recovery: Efficient separation technology backed by innovative automation and digitalization is a crucial competitive advantage.

ANDRITZ‘ current portfolio covers the full solid/liquid separation process

from sedimentation and dewatering to drying, and ensures excellent throughput of high-quality products –all with low operating costs and maximum reliability.

The variety of technologies combined with the opportunity to analyze your processing requirements and conduct tests in a state-of-the-art laboratory means,

that you get the right equipment or individualized line solution for your specific need.

ANDRITZ offers an extensive selection of thickening, dewatering and drying solutions, catering to the precise processing needs of critical minerals necessary for expansion of e-mobility.

ANDRITZ Separation provides mechanical and thermal technologies as well as services and the related automation solutions for solid/liquid separation, serving the chemical, environmental, food, and the mining and minerals industries. The customized, innovative solutions focus on minimizing the use of resources and achieving highest process efficiency, thus making a substantial contribution towards sustainable environmental protection

Increasing throughput while preserving product quality, minimising energy consumption and operating costs or increasing water recovery: efficient separation is a crucial competitive advantage in the mining and minerals business Having mastered these challenges for more than a century, we at ANDRITZ know how to tailor our complete range of state-of-the-art technologies to meet your needs and to find the best processing solutions And, by exploring innovative new ways to automate and monitor remote facilities, we ensure that you are ready for the future as well

Digital innovation is bringing a variety of benefits to industrial operations, and the mining and minerals sector is no exception ANDRITZ has combined the power of smart sensors, big data analytics, and virtual and augmented reality to develop Metris, a portfolio of digital industrial solutions Within this portfolio, Metris addIQ control systems offer cutting-edge machine and process control for solid/liquid separation equipment and systems To ensure safe, trouble-free operations, ANDRITZ automation solutions range from upgrades to individual systems, including electrics, control equipment and instrumentation, to full automation of entire processes and plants

Because of the boom in the battery industry, the demand for lithium is currently exceeding global production At the same time, the evolution of battery content also indicates future increases in the demand for cobalt, aluminum, magnesium, nickel, and other by-products ANDRITZ provides support throughout the whole life cycle of these batteries: With full debrining and drying solutions at major lithium producers to secure more than half the world’s battery-grade lithium production, aluminum battery casing manufacturing lines, and separation solutions for battery recycling Batch and continuously operating filtration centrifuges as well as full dewatering and drying solutions, including centrifuges, filter presses, filters, thickeners, and dryers, deliver superior purity, the right moisture content, and energy efficiency In the meantime, battery minerals processing and battery recycling solutions are offered to meet the demands of a changing market and provide solutions for recovery of the black mass

ANDRITZ’s current portfolio covers the full solid/liquid separation process from sedimentation and dewatering to drying and ensures excellent throughput of high-quality products – all with low operating costs and maximum reliability The variety of different thickening, dewatering, and drying technologies, ranging from thickeners to decanter or pusher centrifuges, heavy-duty belt presses or hyperbaric disc filters to closed-cycle contact dryers means that we are able to configure a processing line tailored to fit your specific needs

www andritz com/separation

Queensland Pacific Metals, a listed Australian company headquartered in Brisbane, was established to focus on developing the 100%-owned Townsville Energy Chemicals Hub (TECH) Project in Queensland.

Located 40 km south of Townsville in northern Queensland, the TECH Project will be a modern and sustainable battery materials refinery, processing high-grade laterite ore imported from New Caledonia to produce nickel sulphate and cobalt sulphate, critical metals for the rapidly emerging lithium-ion battery and electric vehicle sector, as well as other valuable co-products.

With a pre-feasibility study completed, the company is now finalising the necessary funding to move to construction. “This is a very exciting as well as challenging time,” says Stephen Grocott. “The project is unique in many ways and if the world cares about having a clean supply of critical metals, then companies like QPM

have a phenomenal future.”

Mr Grocott was approached by the company in 2020 to become its CEO and lead the project to execution. With a PhD in chemistry, he has enjoyed a long and varied career in metal processing, industrial chemistry, project development and operations, working in prominent roles for leading companies including Rio Tinto and BHP. Still, QPM’s start-up mentality and the exciting opportunity promising significant potential made him accept his current role in 2021.

Since then QPM has grown from a market capitalization of AU$10 million to several hundred million, going from having a 1 in 50 chance of success to a point where it is now poised to turn this project into a reality. “We have made a lot of progress over the last three years, with a lot of development work and engineering studies accomplished, but also offtake agreements signed, demonstrating a significant amount of trust in what we are doing.”

The company plans to import high-grade nickel laterite ore from New Caledonia for processing at the TECH facility, using a patented recovery and recycling process called the DNi Process™. The DNi Process™ is owned by a UK company, Altilium Group, from which Queensland Pacific Metals has obtained the licensing rights to

use it in its operation.

The DNi Process™ has been designed for extracting nickel, cobalt and other precious metals from laterite ore with a view to ensuring the sustainability of natural resources. The technology’s environmental credentials are unmatched. “In typical nickel production from nickel ores, you will get 10 kg of nickel from a tonne of ore. The remaining 990

kg, with the reagents and other ingredients needed for the production process, make between 1.2 and 1.4 tonnes of solid waste,” Mr Grocott points out.

On the contrary, in the TECH Project, all valuable metals will be leached into solution and then recovered and refined into saleable products, revolutionizing the resources sector by becoming a zero-solids waste operation – a

feat that would be an industry first.

“We also have zero liquid wastes, as all the liquid gets reprocessed within our facility, and we capture waste gas and use that as our fuel. So we are negative carbon, zero liquid waste, zero solid waste,” he remarks. “ I’ve been in project development and operations for 40 years and I’ve never seen any project that’s had more than one of the three, much less two of the three. To have a project that’s got all three is absolutely unheard of.”

However, the technology has never been commercialised, and as such comes with a risk, as Mr Grocott admits. “Still, all the new component technologies have been used in other industries. So we’ve got all the Lego building blocks, and if assembled correctly, the outcome will present a great opportunity.”

The company is now focused on the engineering and test work and piloting, and finalising a very complex bankable feasibility study. “Our aim is to secure funding for the project by the end of the year. Construction is a two-year process, so we are looking at first production late 2025, early 2026.”

The total project capital cost is about AU$ 2 billion. The company now has conditional debt lined up of AU$1.4 billion and is working on securing the equity. Not an easy task at a time of global inflation and geopolitical instability, but one that may get easier by the project being classified by the Queensland government as a ‘project of state significance’.

“We have a lot of debt provision from government bodies as well as from private banks and investors, so we are very well covered in that regard. One of our major attractions is that we have signed binding offtake agreements for 100% of nickel and cobalt sales for the life of the project. For any

company, let alone a smaller company like QPM, this is a tremendous achievement.”

The offtake partners include major global companies such as General Motors, LG Energy Solutions, and POSCO. These have also become investment partners with a significant shareholding in QPM. “Having 100% of our production already committed to some of the world’s biggest consumers in this game is truly exceptional.”

Mr Grocott points out that very early on, the company decided to approach the best suppliers in the world to source the required machines. “We didn’t go out and tender for the equipment, we

contacted the companies directly to enter into development partnerships with them. This has been a great success and now we are working with some of the biggest names in this game, such as KBR and Siemens, another sign that our project is viewed highly positively and with great expectations.”

In terms of its key commodity supplies, QPM recently reached an important milestone, when it secured its gas supply by conditionally agreeing to purchase the Moranbah Gas Project. This will create a vertically integrated energy supply chain securing all the gas requirements for the TECH Project. In addition, the excess gas produced will also be sold to external

consumers.

Mr Grocott affirms the company is now pushing ahead in line with its plans to complete financing and move into construction next year, and highlights the remarkable efforts of all employees. “Projects like this attract passionate, committed people and we have a fantastic team in QPM. The success of any company is down to its people and we are very lucky to have secured staff of this calibre.”

In concluding, he affirms that the company is confident in the strong financial metrics and potential for growth of the TECH Project and looks forward to moving forward with debt funding and investment opportunities.