EXTRACTING THE ESSENTIAL

NATIONAL ACCOUNTS ON-PREMISE CUSTOMER DEVELOPMENT

NATIONAL ACCOUNTS ON-PREMISE CUSTOMER DEVELOPMENT

Across dining channels in 2024, SGWS wine and spirit performances had the biggest decline in fine dining (-10%), followed by polished casual (-7%), and then casual (-4%). Following significant softening in visitation and spending in 2024 due to economic concerns, traffic and sales are expected to return to more normalized rates of growth in 2025 across food and beverage.

Fewer operators anticipate taking price on drink menus in 2025, although consumers will remain attentive to menu prices and will evaluate value for the dollar spent on food and beverages, including adult beverages. Deal-seeking will continue, not only because many consumers will need to control spending, but also because consumers are now accustomed to and will expect food and drink promotions that involve notable price reductions.

In 2024, consumer interest in higher-priced alcohol at bars softened. However, towards the end of the year, there was a slight shift in perspectives. There was a three-point increase in the number of consumers who viewed ordering more expensive alcohol as an affordable indulgence. Additionally, there was a slight rise in consumer interest in exploring adult beverages on-premise, indicating more opportunities for trying premium drinks and brands. Consumers showed a slight preference for premiumizing wine and beer over spirits, possibly due to aggressive promotions on mixed drinks and cocktails, especially in casual dining.

Aside from economic concerns, consumers overall are declining in their adult beverage consumption. With the Surgeon General now calling for alcohol labels to include cancer warmings, there has been an on-going battle against the industry. Additionally, cannabis has continued to grow year over year as consumers, particularly younger, are shifting consumption. Cannabis is perceived as a healthier alternative that is also cheaper, as roughly 43% of consumers are low income. On the bright side, mocktails are gaining menu penetration as zero-proof spirits are a trending subcategory. Lastly, tariffs, if imposed, are likely to cause a shift to more domestic adult beverage brands.

Sources:

The Liquid Insights Tour results, video, and press release can be found on the Southern Glazer’s Wine & Spirits Website. It was recently referenced by Forbes in its recent projections on trends for 2025. Be looking for additional communications and a deeper dive into these trends for our On-Premise National Accounts!

Southern Glazer’s Wine & Spirits Completes Closing of Transaction with Horizon Beverage Group, Inc.

The acquisition marks an exciting expansion for Southern Glazer’s, adding Massachusetts and Rhode Island as the 46th and 47th markets in its U.S. footprint, alongside operations in Canada and the Caribbean.

SGWS 12/24/24

10 Cocktail Trends Shaping The 2025 Beverage Market

To assess the latest Mixology trends, we recently sat down with Brian Masilionis, Sr. Director, Channel Development for Southern Glazer’s and his team to discuss latest development in mixology.

Forbes 12/11/24

5 Cocktail and Spirits Industry Trends to Watch in 2025

Between greater scrutiny of celebrity spirits and the looming threat of a trade war, these are the trends and issues the industry will be talking about in the year ahead.

SevenFiftyDaily 1/2/25

We’ll drink to that: Top beverage trends for 2025

Chefs and bartenders are leveling up on consumer interest in healthful beverages served with a dash of creativity, nostalgia and fun, new National Restaurant Association research finds.

NRN 12/3/24

Wine in 2025: key trends to shape the global industry

From experiential marketing to bright whites, 2025 is set to see trends prioritizing wellness, innovation and sustainability, according to a report by AF&CO.

The Drinks Business 1/7/25

The Impact of Trump’s Tariffs on the Wine Industry: Past and Future

The wine industry faced significant challenges due to tariffs imposed by President Trump’s first administration… Trump has made it clear that he will enact higher tariffs as a key part of the political agenda of his second administration.

National Law Review 1/13/25

What Trump’s latest tariff threat might mean for the drinks industry

The incoming US president’s 25% import duty plan could affect products including whisk(e)y and Tequila.

Just Drinks 12/2/24

TOP WINE VARIETALS

SPARKLING WINE

CABERNET SAUVIGNON

OTHER RED

CHARDONNAY

PINOT NOIR

SAUVIGNON BLANC

PINOT GRIGIO/PINOT GRIS

BLUSH/ROSE WINE

OTHER WHITE

MERLOT

SAKE

MOSCATO

RIESLING

RANKED BY DOLLAR SHARE

CALENDAR YEAR 2024

Tequila, though being the #1 top selling SGWS subcategory, saw the biggest loss in dollar volume. Similarly with wine, Sparkling saw the biggest loss as well. Nearly all spirit subcategories are declining with Cordials/Liquor being relatively flat, largely thanks to Aperol’s performance (+16%) as Rye and Cocktails are growing. Wine on the other hand, saw growth in multiple subcategories: Sauvignon Blanc (+3%), Blush/Rosé (+2%), and Other White (+3%). Joel Gott Sauvignon Blanc (+58%), Miraval Rose (+411%), and Franzia (+26%) were the driving for growth in these wine subcategories.

Sources: SGWS Compass Open States 2024

CALENDAR YEAR 2024

CABERNET SAUVIGNON

CHARDONNAY

SPARKLING

OTHER RED BLEND

SAUVIGNON BLANC

PINOT GRIGIO/PINOT GRIS

PINOT NOIR

WINE-BASED COCKTAIL

BLUSH/ROSE

FLAV BEV WINE

MUSCAT/MOSCATO

MERLOT

SPECIALTY

OTHER WHITE

ALL OTHER*

MALBEC

RIESLING

WHITE ZINFANDEL

ZINFANDEL

SANGRIA

CHIANTI

SYRAH/SHIRAZ

NON-ALCOHOLIC WINE

The overall spirits category has seen a slight increase, whereas the wine category is experiencing a decline. The growth in WineBased Cocktails, Sauvignon Blanc, Prosecco, and Non-Alcoholic Wine is counterbalancing the declines seen in Red Blends, Cabernet Sauvignon, Chardonnay, and Sparkling Wines other than Prosecco. Within the spirits sector, Tequila, Prepared Cocktails, and NonAlcoholic Spirits are driving growth, while Whiskey, Cognac, Vodka, and Rum are seeing declines. The decrease in Whiskey consumption is largely due to reductions in Scotch, Irish, and American Whiskies (with Tennessee Whiskey more affected than Bourbon), although Canadian Whisky remains a bright spot.

Non-Alcoholic wine and spirits continue to grow, though they still represent a small portion of their respective categories. Celebrity Tequilas continue to drive substantial volume, with brands like

CANADIAN WHISKY CORDIALS

BRANDY/COGNAC RUM

IRISH WHISKEY

JAPANESE WHISKY

NON-ALCOHOLIC SPIRITS GRAIN ALCOHOL

Teremana and 818 showing strong growth. However, Ultra-Premium Tequilas, such as Don Julio, are posting the most significant gains amid ongoing premiumization trends. Generation Z currently constitutes 9% of beverage alcohol buyers but only accounts for 5% of total spending. In contrast, Generation X exhibits the highest spending, correlating with their peak earning years. NielsenIQ predicts that consumer recruitment of Generation Z will be a key driver in 2025 as this cohort establishes its habits and preferences concerning beverage alcohol. Additional anticipated industry drivers for 2025 include moderation trends, flavor innovation, economic conditions, potential tariffs, and AI/digital engagement-enabled convenience.

Sources: MNIQ BevAl 2024 Year in Review; Nielsen Total US xAOC + Liquor Open State + Convenience Calendar Year 2024 ending 12-28-24.

by Debbi Peek, Director of Mixology

Mexican Street Corn, known as Elote in Spanish, is a popular street food in Mexico that consists of corn on the cob slathered with a mix of mayonnaise, sour cream, or crema, and then sprinkled with cotija cheese, chili powder, and often lime juice and cilantro. Doesn’t that sound like it would make a delicious cocktail?? I think so! Elote Margarita it is, minus the crema!

Corn has a natural sweetness, and building this flavor properly means not letting the vegetal flavor overpower the expected freshness and bright profile that makes a cocktail refreshing.

A fool-proof path on your corn cocktail journey can be found in Nixta Licor de Elote. It’s a Mexican corn liqueur made from a base of tender, ancestral cacahuazintle (kaka • wha • SINT • lay) maize, grown in the high valleys and foothills of the Nevado de Toluca volcano. Nixta is produced at the Destilería y Bodega Abasolo, where they honor the Mexican culture of corn and the ancestral craft of nixtamalization—a 4,000 year old Mesoamerican cooking technique that uncovers the deepest flavors and aromas of maize.

Let’s pair Nixta Licor de Elote with Tequila’s distant step-cousin, Sotol.

“Sotol is a distillate made from a type of shrub, Dasylirion wheeleri, more commonly called desert spoon. That’s in contrast to Tequila and Mezcal, crafted from agave.

“People frequently think it’s an agave distillate, but it’s not,” says Ivy Mix, co-owner of Leyenda, in Brooklyn, New York. The bar is noted for its extensive selection of Latin America-made spirits, which includes Sotol. “[The shrub] is closer to an evergreen plant than an agave.”

Resembling a yucca plant (or a sea urchin), a succulent with long, spiny leaves, the desert spoon plant grows wild. It’s found in Mexico’s Chihuahua region, though it grows as far north as Arizona, New Mexico and Texas. The plant can also be found south in Oaxaca, and thrives in both desert and forest climates.”

Source: Meet Sotol, the Spirit of Mexico | Wine Enthusiast Magazine

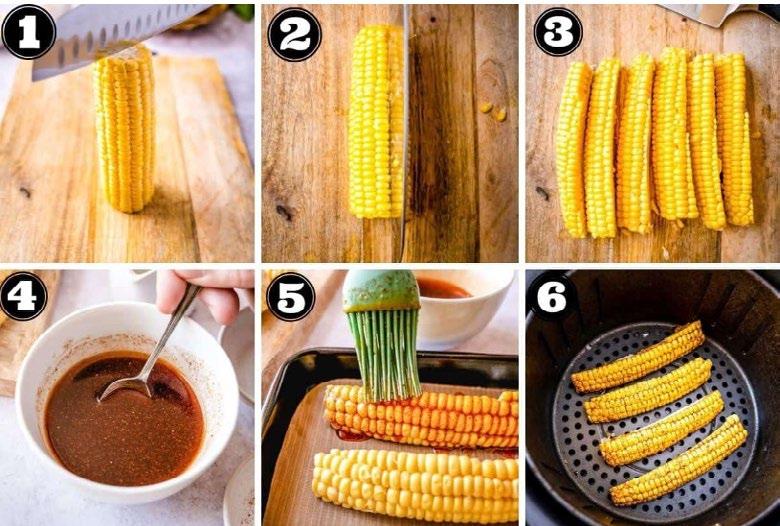

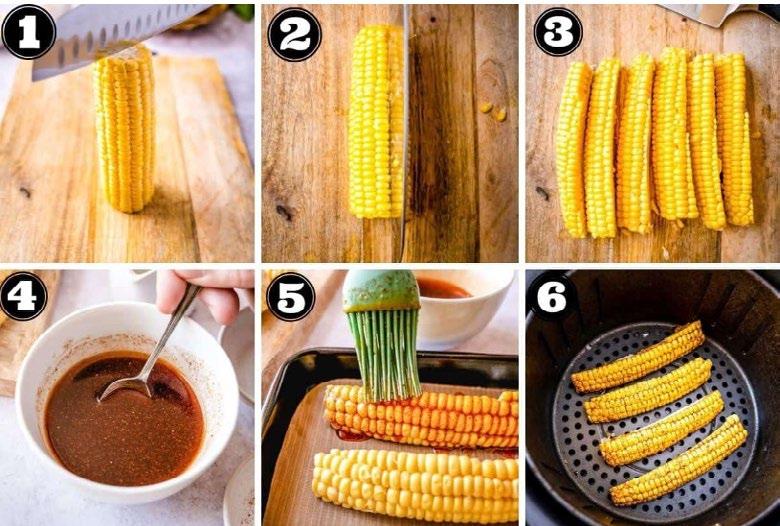

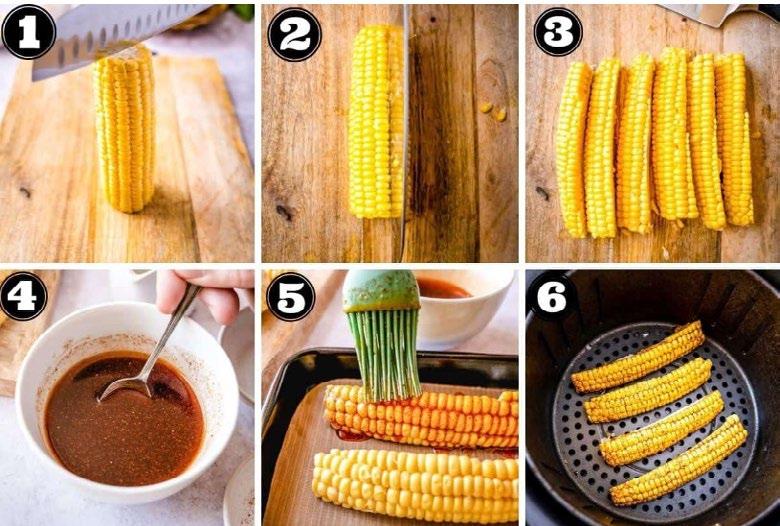

Cut off ends, remove corn from the husk, and take off the silk. Rinse and clean each ear. Microwave the ears for 2 minutes to soften them before slicing. Let them cool for 5 minutes.

1. Cut the corn in half, then into quarters.

2. Mix avocado oil with Tajin, brush over the corn ribs.

3. Place the pieces of corn in the air fryer basket, making sure to keep them in a single layer.

Air fry at 400 degrees for 10 minutes, flipping them after 5 minutes.

1 ½ oz Sotol

1 oz Nixta Licor de Elote

2 oz Fresh Lime Sour

6-8

Cilantro Leaves

Roasted Corn Rib (Garnish)

Crushed Spicy Corn Chip Half Rim (Garnish)

Method: Shake with ice. Strain into a crushed spicy corn chip half rimmed ice filled old fashioned glass. Add Garnish.

Crushed Spicy Corn Chip Rim: Add spicy corn chips to bag and crush with a rolling pin, fine enough to stay on the rim of the glass.

Prepared glass: Brush honey in a thick swipe on the edge of a dry old fashioned glass. Press honey side into crushed spicy corn chips.

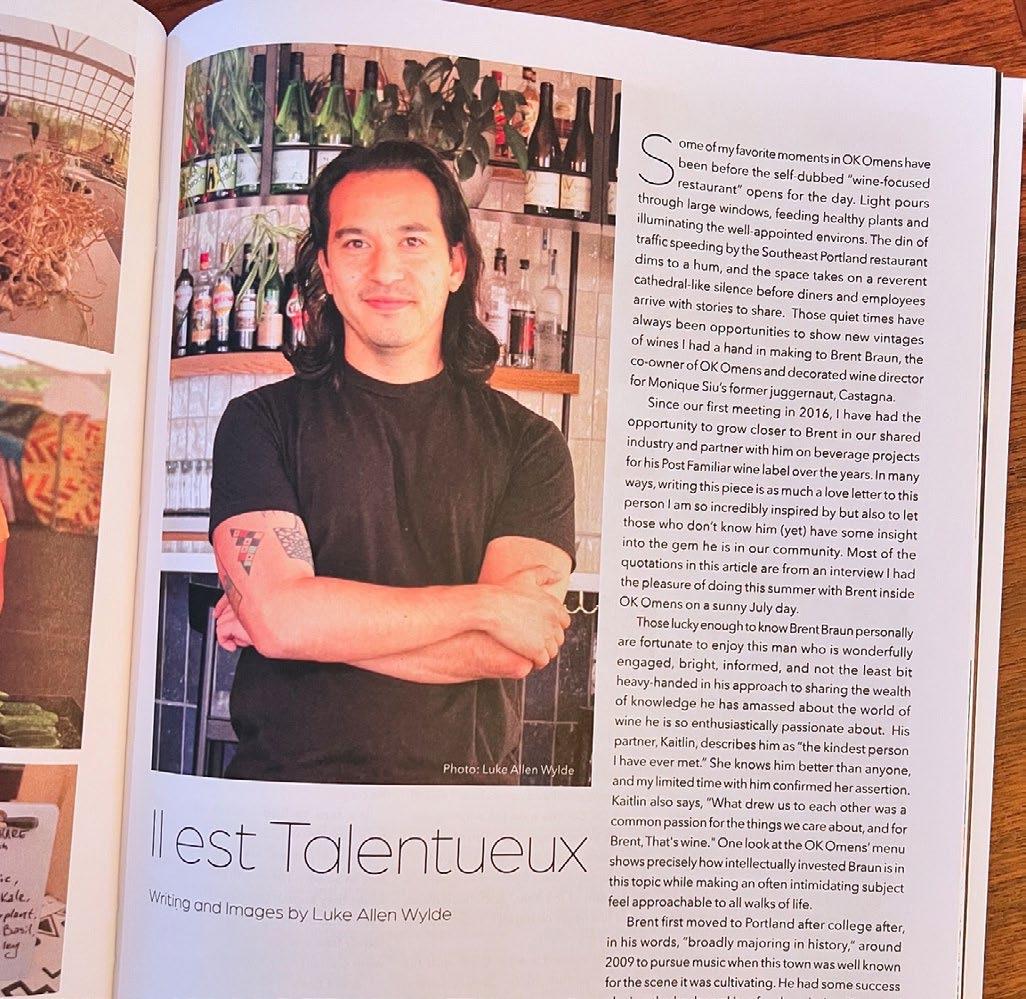

OK OMENS | PORTLAND, OR

In 2023, Wine Enthusiast magazine named OK Omens one of the 50 Best Restaurants in America and it has been recognized as a 2023 and 2024 nominee for Outstanding Wine Program by the James Beard Foundation. That’s why Southern Glazer’s paid a visit to Portland in 2024 on its Liquid Insights Tour. While OK Omens specializes in wine, it also has a diverse offering across beverages on its menu. Some of the innovative takes on its wine program is offering higher-priced items like Champagne and French Burgundy by the full and half glass which ties into the “tiny tipples” trend from the Tour. The wine menu also infuses fun into the descriptions and pairings to make their offering more understandable and approachable for both younger and older guests exploring wine in addition to an extensive by the bottle list with an emphasis on aged Rieslings.

Some other examples of trends they are leveraging for broad appeal is a range of cocktails that incorporate unique twists on the Spritz as well as vegetal and botanical flavors in cocktails like pepper and corn in its “Spicy Bois” cocktail. A notable focus was also paid to a range of low and no-alcohol offerings that deliver a range of flavors like their vermouth and soda offering; Zero Proof Cocktails & Wine and other zero proof items that incorporate unique worldly ingredients like craft juices from Austria simply mixed with soda water. Beyond their offering, they also deliver traffic-driving programming like its 1-hour Oyster & Riesling Happy Hour noted as “Next Level” by the Wall Street Journal in 2024.

LTO APPROACH FOR Q 3 2025 SUMMER FLAVORS

Think of zesty citrus notes from lemons and limes, the sweetness of ripe berries, and the tropical hints of pineapple and mango. 53% of consumers drink still wine cocktails during the Summer, while 48% consume sparkling wine cocktails.

Wine-based cocktails add a sophisticated twist, blending the crispness of white wine or the richness of red wine with fresh fruits and herbs. Sangria combines red wine with oranges, apples, and a splash of brandy and thrives within Upscale and Traditional Casual Dining establishments. White wine spritzer offers a light and bubbly option perfect for hot summer days and is gaining traction with menu penetration growing +17% vs year ago. Sparkling wine is in the top 6 favorite base spirits included in cocktails consumed outside of home. Other tried and true wine-based cocktails include mimosas and bellinis that thrive during breakfast and mid-day hours. Cheers to delightful summer sips!

Sources: CGA by NIQ OPUS US (Fall 2024), Technomic Q1 24, CGA by NIQ BeverageTrak, L12w to Sept 30 2023

4 oz Herbal Liqueur

6 oz Lillet Blanc

4 oz Simple Syrup

1 Bottle Chenin Blanc chilled

4 Nectarines sliced

½ cup Red Grapes

8-10 Sprigs of Fresh Thyme

Preparation: Add Herbal Liqueur, Lillet Blanc, fruit, and a few springs of Thyme to a serving pitcher. Let sit for a few hours. When ready to serve, add chilled Chenin Blanc. Serve over ice, and garnish with a sliced of nectarine, grapes, fresh sprig of thyme and dill.

Chenin Blanc is a versatile white wine grape variety known for its ability to produce a wide range of wine styles, from dry to sweet and even sparkling. Originating from the Loire Valley in France, it is celebrated for its high acidity and rich flavors, which can include notes of green apple, pear, honey, and floral undertones.

Chateau Ste. Michelle offers a limited release Chenin Blanc (Click here) with a crisp and refreshing profile. It pairs perfectly with light dishes such as salads, seafood, and poultry, enhancing the dining experience with its bright acidity and balanced sweetness.

NATIONAL ACCOUNTS ON-PREMISE CUSTOMER DEVELOPMENT