THE ANNUAL REPORT & DIRECTORY Page 22

THE ANNUAL REPORT & DIRECTORY Page 22

SHAPING THE FUTURE

OMERS’ new CPO explains her philosophy of service Page 6

VISION BENEFITS ARCHAIC Plans have not adapted to modern world Page 14

WHAT’S CHANGED? ETFs annual report and directory Page 30

Benefits and Pensions Monitor’s special reports provide an expert-collated resource for the industry when looking for best-in-class partners and the most revered service providers.

The special reports also provide an opportunity to honour the top companies and individuals in the industry for their hard work and commitment to innovation. In 2024, BPM will produce a comprehensive portfolio of special reports covering a plethora of topics and agendas that are top of mind for professionals and most pertinent to the industry.

• Elite Women

• Hot List

• Top Benefit Providers

• Top Consultants

• Top Employers

• Top Money Managers

If you would like further details on how to be involved, please get in touch via email at sophia.egho@keymedia.com.

Canada’s public pension funds have a simple but hugely important mandate – to provide secure retirement income for Canadians. To this end, the “Maple 8” have been a stunning success and consistently rank high in global pension fund league tables. Arguably the biggest reason for this success is their independence from political interference and the freedom they have to make the best investment decisions to sustain their funds.

And yet, not everyone is happy. In an open letter to federal and provincial finance ministers in March, business leaders called for new rules and incentives to reverse a decline in domestic investments and address Canada’s productivity problem.

At the heart of the argument is how much the pension funds are in the pocket of government. John Ruffolo, founder and managing partner of Maverix Private Equity, and founder of OMERS Ventures, is quoted in betatkit.com as saying there is a clear separation of church and state, adding, “This is private capital. It doesn’t belong to government. [The pension funds are] not sovereign wealth funds and people confuse them as such.”

But in the letter, business leaders argue that it’s not so clear-cut. “Without government

“It’s like telling Usain Bolt to wear shoes only made in Jamaica, despite the best spikes being made elsewhere”

sponsorship and considerable tax assistance, pension funds would not exist,” it read. “Government has the right, responsibility, and obligation to regulate how this savings regime operates.”

These two opposing views pose the question of whether public pension funds really have underinvested in Canada. HOOPP’s portfolio holds about a 55 percent allocation to Canada, and pointedly explained that this is done because the assets are of high quality, not out of a sense of national duty. Last fall, the CPPIB pushed back on the idea it wasn’t supporting Canada by citing global context – that Canada represents about 2.5 percent of global capital market opportunities and that the fund typically allocates double digits.

Should these funds, which represent the future safety net for millions of hardworking Canadians, be used to fix problems in the Canadian economy? Should they sacrifice some diversification (a tenet of good investing) for the greater economic good? Such an intervention would inherently make the public pension funds a political football, which would surely distract from their core mandate.

Their independence is essential. Why punish them for their excellence? It’s like telling Usain Bolt to wear running shoes only made in Jamaica, despite the best spikes being made elsewhere. Let’s explore other ways to stimulate our economy rather than interfere with our flagship pension funds, which represent a modern-day Canadian success story.

James Burton, managing editor

EDITORIAL

Managing

Senior

Editor

Nienke Hinton

Senior Sponsored Content Writer Manal Ali

Lead Production Editor Roslyn Meredith

Production Editor Kel Pero

ART & PRODUCTION

Art Director Marla Morelos

Designers

Khaye Cortez, Noel Avendano

Production Coordinators

Kat Guzman, Loiza Razon

Customer Success Executive

Michelle Tamayo

Vice President, Production Monica Lalisan

SALES & MARKETING

Business Development Director Abhiram Prabhu

Business Development Manager Doris Holinaty

Account Manager

Michael Hughes

Webinar Producer Kristyn Dougall

CORPORATE

President Tim Duce

Director, People and Culture

Julia Bookallil

People and Culture Business Partner

Alisha Lomas-Oliver

Chief Revenue Officer

Dane Taylor

Chief Information Officer

Colin Chan

COO George Walmsley

CEO Mike Shipley

EDITORIAL ADVISORY BOARD

Celine Chiovitti, OMERS

Katie McNulty, CAAT Pension Plan

Greg Hurst, Greg Hurst & Associates

Robert Weston, Pharos Platform

Kevin Minas, Mawer Investment Management

Mark Newton, Newton HR Law

Jim Helik, James Helik Consulting

Tim Clarke, tc Health Consulting

EDITORIAL INQUIRIES

james.burton@keymedia.com

SUBSCRIPTION INQUIRIES tel: 416 644 8740 • fax: 416 203 8940 subscriptions@kmimedia.ca

ADVERTISING INQUIRIES

Michael Hughes michael.hughes@keymedia.com

Doris Holinaty doris.holinaty@keymedia.com tel: 416 644 8740

416 644 8740 www.keymedia.com

Benefits & Pensions Monitor is part of an international family of B2B publications, websites and events for the

8740

Stats Canada reports lower after-tax income and rising poverty in 2022 due to inflation and cuts in government aid. The annual rate for 2022 stood at 6.8 percent, and with the full phase-out of pandemic-related benefits by mid-2022 and the reinstatement of pre-pandemic EI eligibility requirements, the median government transfer decreased by 28.9 percent to $10,100.

3.4%

decrease (adjusted for inflation) in the median after-tax income for Canadian families and unattached individuals, dropping from $73,000 to $70,500

9.9%

10.3%

Statcan released statistics that reveal the distribution of Canada’s public service employees by designated group and occupational category as of March 31, 2022

A new study by AgeCalculator.com reveals which countries have

but where is Canada?

The Specsavers Canadian Eye Exam Survey, conducted by Leger, gave a worrying insight into the behaviour of Canadians and their eye health habits.

A survey has revealed nearly half (42%) of Canadian companies have noticed an uptick in requests for improved benefits over the past year, largely due to the increased cost of living.

of those with vision benefits say they do not plan to use available coverage

of Canadians who do not wear glasses have not had an eye exam in more than 10 years of vision loss is preventable and treatable if caught early

OMERS’ new CPO Celine Chiovitti explains her philosophy of service and the issues ahead for DB pension plans and retirement

CELINE CHIOVITTI believes that pensions are a form of social infrastructure. The chief pension officer (CPO) at OMERS began her career working in public service, first for the city of Etobicoke and then the city of Toronto. She worked in public-facing roles and viewed her work as service to the public. A child of immigrants who never had pensions themselves, she saw in her own public service pension plan the idea that people can accomplish so much more working together than they can on their own. That philosophy carried her into a career at OMERS and her new role as CPO.

Chiovitti now sees pensions at an inflection point. Canada is “greying” rapidly as its population ages. The cost-of-living crisis has made all Canadians more concerned about their day to day and less able to focus on the long-term. Defined benefit pension plans like OMERS are far less common and widespread than they once were. Retirement seems to be slipping out of reach for many, and we risk consigning our elders to poverty in their golden years. Chiovitti is convinced that pensions can stand against these demographic and economic tides.

“Defined benefit pensions give the average individual access to professional management and the knowledge that when they’re ready to retire they have access to something that will be payable for their life. They’re not ever going

to outlive their savings,” Chiovitti says. “It’s not about getting rich; it’s about having access to a decent standard of living.”

Chiovitti has three core goals as CPO of OMERS, which she thinks can help address some of the acute issues facing her 600,000 members as well as Canadians as a whole. The first is to advocate for pension plans, raising their profile and underscoring the intrinsic value of pensions. The second is to reconsider

aging parents may be forced to bear unforeseen financial burdens as their parents’ own savings fail to last.

Chiovitti believes that pension plans can play a role in preventing these outcomes. While defined benefit pension plans are the “gold standard,” she says that any push for employer-sponsored pension plans is a positive one. Advocating for pensions also means talking about how retirement should and can

“We’re fortunate to be in a society and in a generation where we’re thinking about diversity”

retirement, opening conversations about what retirement should look like as Canadians live longer. Her final goal is to highlight the additional positive social value that the delivery of pensions provides.

Advocating for pensions in Canada is not work that Chiovitti can do alone. She believes it will take a multi-stakeholder approach for Canadians to recognize how pensions can help alleviate the looming crises we now face. In an aging society, with more individuals aged over 65 than under 14, the stresses caused by mass retirement and extended longevity will become more and more apparent. Children of

look. The current pension model was built at a time when retirement might last 10 to 15 years before a member died. Chiovitti says that OMERS’ oldest living member is 108 and has collected a pension for over 40 years. While an extreme example, the fact of increasing longevity means the traditional retirement model needs to be reconsidered.

For Chiovitti that means preparing her members for their retirement, both financially and conceptually. Canadians at retirement age may not want to end their working lives entirely. They may want a new chapter instead, one that could involve a slowdown in work or

a career change. That means they continue to contribute to the economy and save for their futures, while pursuing other forms of fulfillment or the dreams they always had.

Reimagining how we think about retirement, and creating opportunities for older workers to thrive, are among the many positive social impacts Chiovitti wants to achieve in her role as CPO. On a fundamental level, she sees pension plans like OMERS as providing a level of social infrastructure that contributes positively to the economy while maintaining the quality of life of their members. But that’s not all. As a pension plan, OMERS invests in ways that incorporate long-term thinking and has committed to a climate action plan, an area that is of growing interest to plan members, including millennials and Gen Z members.

Chiovitti’s own appointment as CPO represents a step toward that social progress. As a woman in a major leadership role, she has already contributed a perspective that has helped her members. In OECD countries, women earn about 26 percent less pension income than their male counterparts, due in part to salary discrepancies and leaves. Chiovitti has already begun work at OMERS to make it easier to purchase leaves, with a focus on pregnancy/parental leaves that predominantly involve women. This change will support them in more easily buying back any future pension income they lost by taking a leave. She says that work points to the importance of diversity in this industry. By elevating leaders of different backgrounds, with lived experience of different needs, the needs of the whole membership can be better addressed.

The goals Chiovitti has set are significant. They mean addressing some of the crucial crises of our age. Yet Chiovitti seems ready to tackle these topics, to do that with a smile, and to maintain a philosophy of service throughout the hard work now before her.

“I hope that people start to look at the good we can do collectively. I believe that together we are so much stronger than we are

individually,” Chiovitti says. “I’ve never been more excited to be where we are than today. The world is shifting, and part of that is scary – there’s so much uncertainty. But I feel like we are at a pivotal time when we can come together and make this world a better place. I know that sounds a bit corny, but truly I believe that.

FAST FACTS

Title: Chief pension officer

Year joined: 2013

Number of members: 600,000

Previous experience: Division head at City of Toronto

“I will never be comfortable with the fact that people are just going to be left on their own. I will never be comfortable seeing elder poverty. I don’t think Canada can live with that. So I think we have the ability to shape a future that is more equitable, more accessible, and has more financial resilience in it. But we need to come together and do it together.”

Loneliness and social isolation are negatively affecting health and workplace productivity, says expert

CANADIAN WORKERS under 40 are increasingly feeling isolated and lonely compared to their older colleagues, according to the latest TELUS Mental Health Index. In fact, the index shows the mental health of workers has declined to levels in line with lows during the pandemic.

Nearly half (45 percent) of workers say they do not have relationships with people they trust at work, while younger workers are more

likely to lack trusted relationships altogether. The lack of trusted relationships is a factor in loneliness, which can lead to lower mental health scores and poorer physical health.

It’s a global phenomenon, as the World Health Organization (WHO) has declared loneliness to be a pressing global threat. Moreover, the effects of isolation and loneliness are now recognized and compared to well-known health risks such as smoking,

obesity, and lack of physical activity.

“The index findings reflect a concerning reality, in particular for our younger workers,” says Paula Allen, global leader and vice president of research and insights, TELUS Health. “This also affects businesses, as loneliness and social isolation negatively influence both health and workplace productivity. Rapid societal changes, alongside diminishing social support, are taking their toll.

“When we don’t have that sense of connection, when we don’t have social support, when we don’t have that feeling of belonging – all of which are connected to feeling isolated – we respond with a fear reaction”

Paula Allen, TELUS Health

“Additionally, there are challenges like inflation, housing affordability, and job loss risks that are clear stressors, especially at the start of a person’s career when there is typically less financial stability. Organizations can help by focusing on building a culture of trust, which counters isolation, and highlighting their health, personal, and financial programs, which offer crucial support.”

Not surprisingly, she says that efforts to combat the negative impacts of isolation and loneliness on employee health and productivity not only improve well-being but also have financial benefits for employers.

Currently, however, the index finds that 15 percent of employees rate their company’s culture around mental health as negative. On top of that,10 percent of workers do not feel valued and respected by their colleagues.

Employers need to be aware that 33 percent of workers in Canada are at high risk of mental health issues, 45 percent have moderate mental health risk, and 22 percent are at low risk. It is an issue that needs to be addressed.

“When we don’t have that sense of connection with others, when we don’t have social support, when we don’t have that feeling

of belonging – all of which are connected to feeling isolated – we respond with a fear reaction,” says Allen. “And if we can’t let go of that fear, if it’s chronic and we carry it with us for a long period of time, it makes us a lot more sensitive to stress and less able to be resilient in the face of changes in life. It also wears down our physical health.

“There’s a lot of discussion around whether the return to the office will solve this mental health crisis. The data doesn’t tell me whether that is the case, but the data I do see says when you have trusted relationships at work, that makes a difference in whether you feel that sense of isolation. Forty-five percent of Canadian workers don’t feel that sense of trust regardless of where they work.”

Allen says employers need to start by assessing their culture, looking at what they offer in terms of mental health support, and determining how well these benefits and policies are integrated into the culture.

As far as choosing what initiatives are the best ones to implement, Allen says employers need to make sure that the benefits match the needs. “That’s part of the reason why we do the Mental Health Index,” she says. “We do research to make sure that we’re keeping on top of what the needs of the population are and what current opportunities are available to meet those needs for continuous

improvement. But we also provide assistance for organizations, to help them understand what they can do.”

Communication

Communicating mental health support, programs, and culture is vital for these initiatives to be effective because almost a quarter (21 per cent) of workers in Canada do not know whether or not their employer provides mental health benefits. As well, only a third of Canadian workers know what an employee assistance program (EAP) is, and what it does.

“Many [organizations] have great benefits,” says Allen. “They have processes in place that are supportive, and they have the infrastructure, but their employees have no idea. If the employees don’t know about it, then it does not exist.”

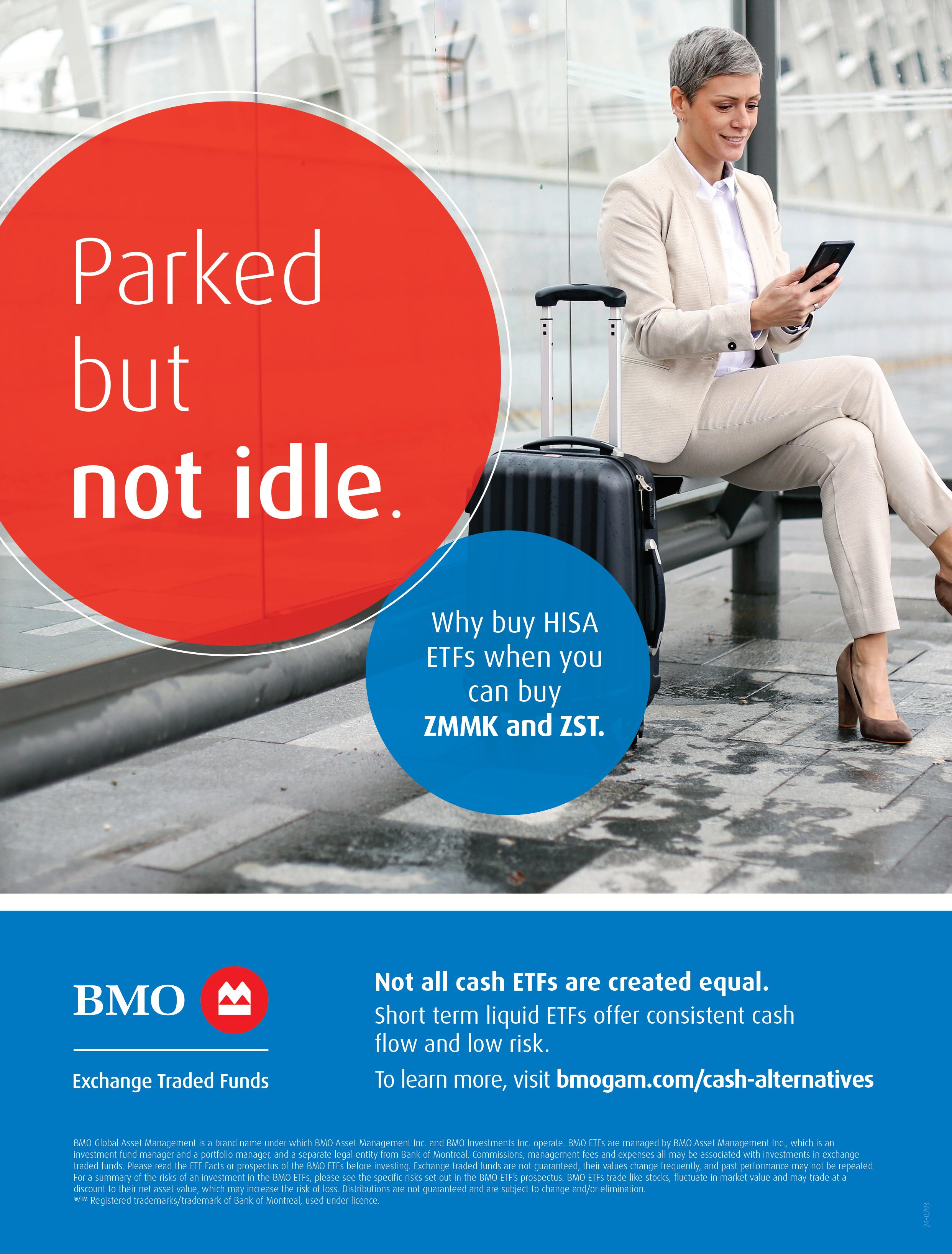

There are a number of opportunities on the sideline, says BMO ETFs portfolio manager Matt Montemurro

WITH INTEREST rates around five percent of the overnight rate, cash has become an asset class for many investors, and that shift made high-interest savings account (HISA) ETFs a white-hot choice in 2022 and 2023. Providing a full picture of their investment profile by holding investments and cash all in one place and paying a premium yield relative to any alternative, the combination vehicle was a win-win. But there’s been a fundamental change in the market, warns BMO’s Matt Montemurro, that requires investors to reconsider their decision.

“The product was very successful for

investors looking to maximize the yield in cash from their savings,” says Montemurro, head of fixed income and equity index ETFs, exchange traded funds at BMO Global Asset Management Inc. “Now there’s been a regulatory change that has structurally altered that benefit on a go-forward basis – but there are opportunities in other products for investors to make up what they’ve lost.”

in

Massive amounts of assets went into HISA ETFs in Canada as the vehicle’s popularity rose with the interest rates beginning in

2020, with the majority coming in over the last two years. By the end of 2023, HISA ETFs held around $30 billion in assets. 1 Traditionally a vehicle to incentivize individuals to save and deposit cash, where it was used by the banks as capital, it was “no longer John and Jane and their savings,” Montemurro notes, but fund managers, investment advisors, and pension plans.

When the Office of the Superintendent of Financial Institutions (OSFI) stepped in to review the product, the regulator found that the ability to take that money out on demand posed a significant risk to the financial system. In response, OSFI ruled that banks can no longer use assets in HISAs and deem them deposits; they must be considered wholesale funding. The 100 percent liquidity requirement, which came into force on January 31, is intended to support all HISA ETF balances that can be withdrawn within 30 days, and in its wake, preferential institutional yields have fallen.2

“If the banks can no longer lend [the money] out, it becomes much less attractive capital,” Montemurro says, adding that yields have come down 40 basis points, they’re expected to continue to fall, and he predicts the long-term trend may see yields sit at around a 25-basis point discount of the overnight rate.3 Effectively, the underlying nature of the ETFs themselves have been changed and investors are looking for other options.

“Those who were doing it for the yield need to rethink the risk they’re taking and their

overall exposure, because there may be better options out there. You can make the trade to another product in the market that allow you to bridge some of that gap.”

Montemurro sees two main solutions in which investors can earn more on their cash, with a few key differences. First is BMO’s ZMMK, a money market ETF that invests in ultra shortterm fixed-income securities. Traditionally what institutional asset managers turned to for cash allocations, Canadian and provincial T-bills and short-term bonds make this option a safe investment route, Montemurro says. As it stands now, the money market funds offer a 25- to 30-basis point premium over the yield of a HISA.4

“Prior to OSFI’s decision, investors were getting less, so I can see why they chose one over the other – but now, for a similar risk profile, you have very little interest rate sensitivity,” Montemurro says. “If this is a yield trade, investors should consider all their options to make sure they are maximizing the opportunity.”

Second, for investors who want to take advantage of some of the opportunities in the fixed income market while also getting paid a greater yield, Montemurro recommends looking at BMO’s ZST. The product provides investors with exposure to ultra short-term fixed-income securities – mainly corporate bonds but potentially some Canadian T-bills as well – all under one year to maturity. The significant amount of exposure to Canadian banks provides a stable return stream, paying a premium between 30 to 40 basis points compared to the HISA products.4 It’s a highquality portfolio, Montemurro says, and again, “for that yield-hungry investor, potentially taking a bit more risk can really make up what was lost following the OSFI decision.” Investors should seek professional advice with respect to any circumstance.

While nobody knows exactly when or by how much, the current consensus is that the hiking cycle is done, and rates look to be coming down in the near future. If rates do come down – say by 50 basis points, for

example – a HISA’s yield would drop by that same amount. But in something like a ZST, buying bonds means that duration impact adds positive performance. A 50 percent drop in rates, with a duration of half a year in the portfolio, equals a 25-basis point pop in the price of the bonds and, subsequently, the price of the ETF.

“When rates come down and prices go up, we’re able to take advantage of some of that, and the net asset value (NAV) of the ETF will increase,” Montemurro says. “Duration can be helpful, and something like ZST not only secures a yield premium, but also gets you some extra upside appreciation.”

Another added benefit of using something like ZST is that there’s a structural advantage in the bond market relative to the HISA products, providing greater tax efficiency in the current market environment. Because rates went up so quickly in 2022, bond prices went down, which means they’re trading at a discount to par: buying bonds with less than one year to maturity and holding them through to maturity means investors are getting a price appreciation. Taxable investors can take advantage of this because capital gains are taxed in a preferential way to income. Please speak to a tax specialist with respect to any specific circumstance.

ZMMK and ZST are compelling solutions in the new landscape, Montemurro says. While HISA ETFs were a great trade historically –especially over the last 2.5 years – the market has shifted. Ultimately, if investors are looking to maximize yield, “there are more attractive options on the sidelines.”

Sources:

1. TD Securities as of October 31, 2023. 2. https://www.osfi-bsif.gc.ca/en/news/osfi-upholds-100-liquidityrequirement-hisa-etfs-promote-financial-resilience

3. TD Securities Report as of October 31, 2023, spoke of similar trends.

4. BMO Global Asset Management as of March 31, 2024.

BMO Global Asset Management. Since inception dates are 11/29/21 and 01/29/11, respectively for ZMMK and ZST. Performance as of 03/29/24. Annualized Performance 1 Year 3 Year 5 Year 10 Year Since Inception

N/A

Sponsored by

Disclaimer:

ThisarticleissponsoredbyBMOETFs.

Thismaterialisforinformationpurposes.Theinformationcontainedhereinisnot,andshouldnotbe construedas,investment,taxorlegaladvicetoanyparty.Particularinvestmentsand/ortradingstrategies shouldbeevaluatedrelativetotheindividual’sinvestmentobjectivesandprofessionaladviceshouldbe obtainedwithrespecttoanycircumstance.

TheviewpointsexpressedbythePortfolioManagerrepresentstheirassessmentofthemarketsatthetime ofpublication.Thoseviewsaresubjecttochangewithoutnoticeatanytime.Theinformationprovidedherein doesnotconstituteasolicitationofanoffertobuy,oranoffertosellsecuritiesnorshouldtheinformationbe relieduponasinvestmentadvice.Pastperformanceisnoguaranteeoffutureresults.Thiscommunicationis intendedforinformationalpurposesonly.

Allinvestmentsinvolverisk.ThevalueofanETFcangodownaswellasupandyoucouldlosemoney.The riskofanETFisratedbasedonthevolatilityoftheETF’sreturnsusingthestandardizedriskclassification methodologymandatedbytheCanadianSecuritiesAdministrators.Historicalvolatilitydoesn’ttellyouhow volatileanETFwillbeinthefuture.AnETFwithariskratingof“low”canstilllosemoney.Formoreinformation abouttheriskratingandspecificrisksthatcanaffectanETF’sreturns,seetheBMOETFs’prospectus. Commissions,managementfeesandexpensesallmaybeassociatedwithinvestmentsinexchangetraded funds.PleasereadtheETFFactsorprospectusoftheBMOETFsbeforeinvesting.Theindicatedratesofreturn arethehistoricalannualcompoundedtotalreturnsincludingchangesinunitvalueandreinvestmentofall dividendsordistributionsanddonottakeintoaccountsales,redemption,distributionoroptionalcharges orincometaxespayablebyanyunitholderthatwouldhavereducedreturns.Exchangetradedfundsarenot guaranteed,theirvalueschangefrequently,andpastperformancemaynotberepeated.

ForasummaryoftherisksofaninvestmentintheBMOETFs,pleaseseethespecificriskssetoutintheBMO ETF’sprospectus.BMOETFstradelikestocks,fluctuateinmarketvalueandmaytradeatadiscounttotheirnet assetvalue,whichmayincreasetheriskofloss.Distributionsarenotguaranteedandaresubjecttochange and/orelimination.BMOETFsaremanagedbyBMOAssetManagementInc.,whichisaninvestmentfund managerandaportfoliomanager,andaseparatelegalentityfromBankofMontreal.

Distributionyieldsarecalculatedbyusingthemostrecentregulardistribution,orexpecteddistribution, (whichmaybebasedonincome,dividends,returnofcapital,andoptionpremiums,asapplicable)and excludingadditionalyearenddistributions,andspecialreinvesteddistributionsannualizedforfrequency, dividedbycurrentnetassetvalue(NAV).Theyieldcalculationdoesnotincludereinvesteddistributions. Distributionsarenotguaranteed,mayfluctuateandaresubjecttochangeand/orelimination. Distributionratesmaychangewithoutnotice(upordown)dependingonmarketconditionsandNAV fluctuations.ThepaymentofdistributionsshouldnotbeconfusedwiththeBMOETF’sperformance,rateof returnoryield.IfdistributionspaidbyaBMOETFaregreaterthantheperformanceoftheinvestmentfund, youroriginalinvestmentwillshrink.DistributionspaidasaresultofcapitalgainsrealizedbyaBMOETF,and incomeanddividendsearnedbyaBMOETF,aretaxableinyourhandsintheyeartheyarepaid.Youradjusted costbasewillbereducedbytheamountofanyreturnsofcapital.Ifyouradjustedcostbasegoes belowzero,youwillhavetopaycapitalgainstaxontheamountbelowzero.

Cashdistributions,ifany,onunitsofaBMOETF(otherthanaccumulatingunitsorunitssubjecttoa distributionreinvestmentplan)areexpectedtobepaidprimarilyoutofdividendsordistributions,and otherincomeorgains,receivedbytheBMOETFlesstheexpensesoftheBMOETF,butmayalsoconsistof non-taxableamountsincludingreturnsofcapital,whichmaybepaidinthemanager’ssolediscretion.Tothe extentthattheexpensesofaBMOETFexceedtheincomegeneratedbysuchBMOETFinanygivenmonth, quarter,oryear,asthecasemaybe,itisnotexpectedthatamonthly,quarterly,orannualdistributionwill bepaid.Distributions,ifany,inrespectoftheaccumulatingunitsofBMOShortCorporateBondIndexETF, BMOShortFederalBondIndexETF,BMOShortProvincialBondIndexETF,BMOUltraShort-TermBondETFand BMOUltraShort-TermUSBondETFwillbeautomaticallyreinvestedinadditionalaccumulatingunitsofthe applicableBMOETF.Followingeachdistribution,thenumberofaccumulatingunitsoftheapplicableBMOETF willbeimmediatelyconsolidatedsothatthenumberofoutstandingaccumulatingunitsoftheapplicable BMOETFwillbethesameasthenumberofoutstandingaccumulatingunitsbeforethedistribution.Nonresidentunitholdersmayhavethenumberofsecuritiesreducedduetowithholdingtax.CertainBMOETFs haveadoptedadistributionreinvestmentplan,whichprovidesthataunitholdermayelecttoautomatically reinvestallcashdistributionspaidonunitsheldbythatunitholderinadditionalunitsoftheapplicable BMOETFinaccordancewiththetermsofthedistributionreinvestmentplan.Forfurtherinformation,seethe distributionpolicyintheBMOETFs’prospectus.

Anystatementthatnecessarilydependsonfutureeventsmaybeaforward-lookingstatement.Forwardlookingstatementsarenotguaranteesofperformance.Theyinvolverisks,uncertaintiesandassumptions. Althoughsuchstatementsarebasedonassumptionsthatarebelievedtobereasonable,therecanbeno assurancethatactualresultswillnotdiffermateriallyfromexpectations.Investorsarecautionednottorely undulyonanyforward-lookingstatements.Inconnectionwithanyforward-lookingstatements,investors shouldcarefullyconsidertheareasofriskdescribedinthemostrecentprospectus.

BMOGlobalAssetManagementisabrandnameunderwhichBMOAssetManagementInc.andBMO InvestmentsInc.operate.Certainoftheproductsandservicesofferedunderthebrandname,BMOGlobal AssetManagement,aredesignedspecificallyforvariouscategoriesofinvestorsinCanadaandmaynotbe availabletoallinvestors.ProductsandservicesareonlyofferedtoinvestorsinCanadainaccordancewith applicablelawsandregulatoryrequirements.

®/™Registeredtrademarks/trademarkofBankofMontreal,usedunderlicence.

BGO’S ROOTS in Canada run deep, and with one of the largest dedicated commercial real estate teams in the country, the firm has stood the test of time through economic cycles over the past century. The diversified firm, now with an expanded presence in the US, Europe, and Asia, still sees Canada through fresh and optimistic eyes.

Simon Holmes, managing partner and portfolio manager for BGO’s flagship core strategy in Canada, sat down with BPM to share his firm’s view of Canada and why this inflection point in the market has him bullish about current investment opportunities.

BGO views Canada as a market of significant importance to their global business. What’s driving the firm’s belief in the Canadian market today regarding commercial real estate?

Simon Holmes : Canada has historically offered a few key elements: geopolitical stability, the resilience of its capital markets, and strong property fundamentals across major metropolitan areas. Canadian real estate has been defined by disciplined long-term ownership across most sectors, with low leverage.

At the asset level, most major Canadian markets remain relatively strong. Vacancy is at or near historic lows across most property types. That’s very different from the dynamics in other developed markets. Today, in addition to that stability and those three factors, major markets in Canada offer very compelling growth dynamics. Major Canadian markets combine the population growth profile of US Sunbelt markets with the real estate

supply constraints common to US coastal markets, which creates conditions for strong long-term rent growth.

We’re starting to see this story gaining global recognition. We’ve seen international investors make some significant investments in the Canadian market in a way they hadn’t in years past. In 2023, foreign investors comprised 13 percent of all investment transactions, which is well above the annual average of approximately three percent.

What are some of the myths around the Canadian market that maybe need to be debunked?

SH: A few myths come to mind. The first is that because of its stability, Canada is a low-return market. What we’ve observed is the opposite: Given the prospects and dynamic of the past few years, we expect significant income growth and compelling returns.

Number two: there’s been a myth, at least up until recently, that Canada was a closely held market with owners who that rarely sell, and so there are limited transaction opportunities. That’s been decisively proven false.

A third myth worth mentioning is specific to the office sector, but not necessarily specific

to Canada. We see a bifurcation in office. The most modern, best-in-class, “trophy” office buildings continue to be resilient. It’s in the more challenged, older “B/C” class buildings that we’re seeing the weakness in the market.

How do you find opportunities in the market? What factors within the market or the wider economy do you look at, and why should investors be looking at those factors as well?

SH: The experience since interest rates have increased has reminded us of how dependent the entire industry is on macroeconomic factors. Over the past few decades, real estate benefited from steady declines in interest rates. This changed abruptly in 2022, which surprised some and resulted in price declines. However, property occupancy and income remain stable.

There is a disconnect in Canada, where we have strong fundamentals, but capital market dislocation is driving prices down. But now, in spring 2024, we’re relatively confident that we’re at or near bottom from a pricing perspective. We have conviction regarding the outlook for both property fundamentals and investment returns.

Given that dynamic, high-quality core assets in Canada are available today at compelling prices. Going-in yields are higher, and high-quality modern properties are trading below replacement cost. That’s a dynamic that has not existed in a very long time. We view this as a fantastic opportunity to buy highquality core assets.

As you’re leader of BGO’s Core Strategy in Canada, what asset classes are you paying special attention to?

SH: A few years ago, we would have had a very clear ranking by property type. Return outper-

formance, until very recently, was determined by the sector and property type exposure. Your returns were defined by whether you were underweight in office and malls and overweight in industrial and multifamily rental.

However, as we assess the transaction market today, we expect portfolio return performance will be increasingly determined by asset selection and business plan execution at the individual property level.

Today, we see compelling value opportunities across the four major property types. Whether it’s industrial, multifamily rental, office, or retail, we’re looking at all four of those sectors and focusing more on property level attributes, rather than focusing on sector weightings to the extent we would have in the past.

As competitive forces in the Canadian market intensify, what advantages does BGO bring that can help deliver better client outcomes?

SH: BGO is well-positioned to capitalize on the dynamics we see in Canada. We are in the very rare position of being a global management platform in 13 countries. When you combine that global footprint with the deep vertical integration and bench strength we have in Canada, we offer a dynamic that other Canadian managers do not have.

The global platform allows for a top-down perspective on key trends. We have information flows in our organization among Canada, the US, Europe, and Asia. That gives us early insight into trends that are unfolding globally that may be coming to Canada.

Our people are our most valuable asset, and with more than 1,400 BGO employees around the world, we’re able to tap into their local networks and on-the-ground expertise.

Sponsored by

“High-quality core assets in Canada are available today at compelling prices”

Additionally, our firm’s early and extensive investments in proprietary data science and AI-driven models are yielding remarkable insights to help us better evaluate the shortand long-term upsides of markets of interest to BGO. This deeper view that combines our depth of professional talent with BGO’s data science infrastructure means we are poised to deliver more prescient decision-making for our clients.

Coverage today is the same as it was in the 1970s – it’s time to discard archaic beliefs

CONTRARY TO the adage, “If it ain’t broke, don’t fix it,” the problem with most group vision benefits plans isn’t just their age, but their refusal to adapt to modern realities. These plans are akin to outdated vehicles, increasingly draining plan sponsors and members of resources without delivering commensurate value, demanding a swift upgrade.

Most vision benefit plans cling to antiquated notions, equating vision care solely with refraction, spectacles, and lenses. The consequence? Nationwide, we witness vision plans that are grossly insufficient, limiting individuals to a single partial eye examination every 24 months for the working population and once every 12 months for children and seniors.

It’s high time to discard these archaic beliefs. Imagine telling someone they can only visit their family doctor once every two years, with no provision for basic health checks without prior authorization, leaving them to bear the expenses. That’s the reality for those reliant on these outdated vision benefits plans.

Coverage limited for advances in optometry

Despite significant advances in optometry and vision care, public and private coverage of these new advancements remains very limited. Vision care coverage

today is the same as it was in the 1970s. This leads to problems such as late diagnosis, vision loss, higher treatment costs, lower employee productivity – and, ultimately, lower return on investment for insurers and sponsors.

It is time for vision benefits plans to catch up with modern medicine and

sive eye examination. Manifestations of several diseases, including some cancers, are also detected by optometrists during comprehensive eye examinations.

This makes the comprehensive eye examination one of the most effective preventative tools for keeping the workforce healthy.

Despite significant advances in optometry and vision care, public and private coverage of these new advancements remains very limited

optometry. At the very least, vision benefits plans should allow for full coverage of the modern comprehensive eye examination. This includes diagnostics such as ocular coherence tomography, wide-angle retinal imaging, anterior segment photo documentation, and full-threshold visual field testing when indicated. This allows for early detection and treatment of conditions such as macular degeneration, diabetic and hypertensive retinopathy, glaucoma, cataracts, and other ocular and systemic diseases. There is already evidence that up to 25 percent of diabetes cases can first be detected by optometrists in a comprehen-

Eye diseases, including diabetic and hypertensive retinopathy, macular degeneration, and glaucoma, are all leading causes of vision loss that can affect individuals in their working years, particularly as we age. Diabetic retinopathy affects approximately one million Canadians. Unaddressed diabetic retinopathy leads to retinal detachment and blindness. The odds of a person being unable to work because of uncontrolled diabetic retinopathy are roughly twice those of someone whose diabetes and retinopathy are under control. They are also likely to have 40 percent more sick days. Benefit costs can

reach almost $20,000 annually, nearly double that of an employee with diabetes whose vision health is preserved.

Macular degeneration affects approximately 2.5 million Canadians. There are age-related macular degeneration (AMD) treatments that are successful in slowing down or stopping the progression of damage to the eye, thus preventing severe vision loss and additional costs to plan sponsors. However, optimal patient outcomes depend on early detection and consequent early treatment.

Glaucoma affects nearly 750,000 Canadians. It is usually too late to prevent permanent vision loss by the time a patient notices glaucoma. Early detection of glaucoma is crucial to its successful management. In addition to the visual manifestations, one in five glaucoma patients suffers from anxiety and depression, and 50 percent suffer from sleep disorders.

The cost of early detection and management through modern diagnostics is not prohibitive. Although fees will vary by province, locality, and provider, the range for modern diagnostics and imaging is usually between $50 and $120. For the average vision care plan, this is equivalent to less than one average-priced prescription drug claim per adult member every two years if every plan member visits their optometrist every 24 months and is identified for diagnostics and imaging.

The Canadian Association of Optometrists calls upon group benefit stakeholders to modernize vision care benefits and fill the gaps in care by including a reasonable allowance for modern diagnostics and imaging procedures to help detect eye disease early and preserve the vision of working Canadians.

The cost of early detection and management [of eye disease] through modern diagnostics is not prohibitive

The rigidity of most current plans, which does not allow optometrists and plan members to use what modern standards of practice have to offer, is doing the opposite. Some Canadian insurance stakeholders are realizing the importance of modernizing vision care benefits. In the coming months, we anticipate that some organizations will begin offering such benefits as modern comprehensive eye examinations to their members. In our view, they will be the ones who will have the competitive edge.

We encourage plan sponsors to familiarize themselves with the vision benefits modernization initiative on our dedicated website, Don’t lose sight of vision care benefits (dontlosesight.ca), and to consider offering modern benefits to their members.

Benefit amounts have not increased over the years, so what can companies do to help their employees?

THE NUMBER-ONE complaint we hear from HR leaders is that their employees say they need greater vision coverage. Traditionally, eyeglasses and lenses have been very expensive, and most group benefit plans include some vision coverage, which helps subsidize the cost. However, the amounts haven’t really changed over the years. Employees may have $150 to $200 coverage every 24 months that they can use toward the purchase of glasses – but glasses cost far more than that. So why hasn’t the benefit amount increased? It’s likelytdue to exposure to extremely high claims. If companies offered substantially higher vision coverage, there would be a dollar-for-dollar increase in

claims, which would not help at renewal time.

If the benefit amount is not going to change any time soon, what can companies do to help their employees? Recent reports show there is cause for concern, because people – employees – are facing many vision and vision care issues, and this can have an impact on their productivity and health.

Almost half of Canadians who had vision benefits in 2022 didn’t plan to use their available coverage by the end of that year, says the Canadian Eye Exam Survey by Specsavers. For 2023, the survey reveals that one-in-four

Canadians who do not wear corrective lenses have not had an eye exam in at least 10 years, including 10 percent of Canadians who have never had an eye exam. The reasons for not going for an eye exam more frequently include cost (33 percent) and no symptoms of vision loss (22 percent).

In addition, the report says over one-third of Canadians (35 percent) would only book an eye exam if they experienced vision issues. However, catching eye diseases early through a comprehensive eye exam allows for preventative measures to maintain as much vision as possible. What many don’t know is that often, eye diseases such as glaucoma progress without symptoms in the early stages.

Moreover, time at work may be contributing to vision problems, as research now points to prolonged screen time as a cause of or contributor to digital eye strain, dry eye disease, and myopia (nearsightedness).

The World Health Organization (WHO) says increased screen time and time spent indoors are leading to more people suffering from myopia. It says that by 2050, 50 percent of people worldwide will have myopia.

The kicker is that 75 percent of vision loss is preventable and treatable, and half of Canadians don’t know this. Specsavers and the Canadian Council of the Blind say eye exams for those without pre-existing conditions should occur at a minimum of every two years, and every year for Canadians under 18 and over 65.

fits plan. If employers increase their vision coverage, they could be penalizing employees who have perfect eyesight. Instead, employers could introduce a health care spending account (HCSA) or increase current allowances. This option adds a tremendous amount of flexibility for all employees.

The addition of eye exam coverage

Finally, since the cost of eye exams seems to be an issue with Canadians, employers should consider changing the eye exam parameters. Most Canadian companies offer a fixed dollar amount toward eye exams every 24 months, perhaps $75 or $100. If employers remove the dollar amount and change it to Reasonable &

The key to good eye health for the long term is prevention – and employers can play a huge role in preventing vision health issues

Employers can play a huge role in prevention

The key to good eye health for the long term is prevention – and employers can play a huge role in preventing vision health issues.

However, if group benefit plans aren’t going to increase vision allowances any time soon, what can Canadian employers do to help their employees?

Employers can start by introducing preferred provider networks – establishing a relationship with a national eyewear company will allow employees to save dollars if they shop at those stores. They can also educate employees on online eyewear companies. These providers might not offer brand-named glasses, but they will keep dollars in employees’ pockets.

The next consideration is removing vision coverage entirely from the bene -

Customary, they offer far more flexibility to their employees. This means the insurance carrier will approve the exam amount based on the average cost associated within that specific geographical region. If an optometrist charges $100 in Brampton, ON, is that reasonable and customary? If an optometrist charges $150 in Vancouver, BC, is that reasonable and customary?

Improve workplace conditions to prevent eye strain

Employers can also improve conditions within the workplace – whether employees work in the office or from their homes – to help prevent eye strain. Employers can provide information on vision health, encourage workers to have regular eye exams, offer educational interventions, and develop official guidance on safe screen use.

Experts recommend that employees:

• Limit screen use and take breaks –workers should follow the 20-20-20 rule to reduce digital eye strain. They should spend at least 20 seconds looking at something at least 20 feet away every 20 minutes. Employers can encourage participation by setting timers to prompt employees to take a break.

• Install screen filters or use computer glasses

• Go outside or just get up from their desks and move around

• Ensure their screens at the proper angle to their eyes

• Move the screen to an angle where they are not straining to look up, and keeping their eyes open wider

• Use lubrication drops with no preservatives

• Have safety measures at work, such as protective eyewear or eyewash stations as necessary

In a 2021 report, Fighting Blindness Canada and the Canadian Council of the Blind claimed that, in 2019, vision loss cost Canadians $32.9 billion. Six billion dollars is spent every year on indirect health costs and lost productivity, including reduced workforce participation and productivity, additional time off work due to illness and caretaking, loss of future earnings due to premature mortality, and loss of caregivers’ income. Employers will benefit from supporting vision health, whether they do that with flexible vision coverage or by creating a workplace where vision health is a priority. They can build a culture that shows employees they care, while at the same time increasing productivity and engagement.

Aaron Pittman and Equiton’s forward-thinking strategy in private

real estate brings a crucial layer of stability amid Canada’s turbulent economic climate

EQUITON, A LEADING Canadian private equity real estate firm, is in the midst of a strategic shift toward institutional investments that it believes will tap into the growing global appetite for Canadian real estate among diverse pools of capital available worldwide. Equiton’s transition reflects a mature understanding of market dynamics and growth opportunities beyond the limited retail sphere.

At the forefront of this transition is Aaron Pittman, Equiton’s head of institutional investments. Pittman’s career has seen him help guide the evolution of several firms from largely retail-oriented shops to the institu-

tional world. “It can be a challenging, yearslong process,” says Pittman. “Not all firms will have the patience to follow through on institutional strategy, but for those that do, the results are transformational.”

Pittman outlines the stark dichotomy between the retail and institutional investment spaces, highlighting the global scale and vast potential of the latter.

Pittman’s career spans over two decades on the institutional side of the business. His unique path through various roles within the sector has equipped him with a comprehensive understanding of institutional asset-gathering. This breadth of experience allows him to act as a “translator” among specialized teams and functions, facilitating effective communication and strategy implementation.

Pittman’s approach to career progression deviated from the more traditional siloed ladder; rather, he sought exposure across all facets of the institutional business, valuing the diversity of perspectives over a linear climb.

“I consciously pursued a varied experience – ranging from business development/investor relations to client servicing, consultant relations, and content management. This wideranging exposure allowed me to serve as a link among highly specialized teams, facilitating

communication between participants who often speak ‘different languages’,” Pittman says.

“The diversity of my roles over the past 20-plus years may have been somewhat atypical, often earning me the moniker ‘Swiss Army knife,’ largely attributable to my broad perspective. This versatility has proven particularly beneficial in my role at Equiton, where the ability to wear multiple hats and possess wideranging expertise is essential.”

Pittman’s breadth of expertise empowers institutional investors with tailored strategies and comprehensive insights, facilitating informed decision-making and optimal portfolio performance.

Since its inception in 2015, Equiton has shown tremendous growth in the Canadian real estate investment landscape. With a strategic focus on private real estate, the firm has not only expanded its operational footprint but has also significantly strengthened its investment portfolio, echoing a commitment to delivering tangible value to its stakeholders.

As the head of institutional investments, Pittman says aligning capital raise activities and business development strategies with the evolving needs of institutional investors is crucial.

“Institutional investors are at the top of the sophistication curve, a trajectory that is

continuously expanding. To stay relevant and become a suitable partner for large institutional capital pools, adopting an outside-looking-in perspective is essential,” emphasizes Pittman.

“This approach is necessary because many managers lose sight of the fact that their contribution is merely a segment of the plan sponsor’s entire ecosystem. We become a component of a larger mechanism. Keeping pace with the ever-changing landscape requires a mindset driven by intellectual curiosity.”

Equiton’s role in addressing supply issues

Pittman highlights that Canada is currently facing a generation-spanning housing crisis. In recent years, Canada has distinguished itself on the global stage with population growth that far outpaces even its fastest-growing G7 peers. This dynamic, coupled with an entrenched shortfall of housing supply, has reshaped Canada as one of the least-affordable housing markets in the world. It could be several decades before supply catches up to surging demand, says Pittman, making housing a critical issue for all Canadians.

In the face of these challenges, Equiton takes a proactive stance as a leader in the real estate sector, contributing positively by increasing supply – developing multi-family residences and bringing new inventory to market. Pittman notes that this important effort is expected to grow easier with Canadian governments at all levels focusing political will on encouraging the development of new housing stock; however, he emphasizes that addressing the housing crisis will ultimately require the active collaboration of privatesector entities like Equiton.

“Recent policy changes are a welcome start, but more needs to be done to reduce unnecessary development charges, shorten timelines, and get shovels in the ground,” says Pittman. “Canada must let home builders do what they do best: build homes.”

Equiton’s commitment to its investors and expanding Canadians’ knowledge of real estate has led to an exciting new collaboration with the John Molson School of Business at Concordia University. This partnership will foster innovative research into the landscape of real estate investment in Canada.

“This partnership represents a fusion of the best of both worlds: Equiton’s investment prowess and Concordia’s academic expertise in the development of large language models and machine learning. This collaboration allows us to explore

ments when financials don’t make sense.”

Such initiatives not only bolster Equiton’s strategic capabilities but also signify a forward-thinking approach to addressing the complex dynamics of real estate markets.

The outlook at Equiton

Institutional investors are increasingly setting their sights on best-in-class assets characterized by supply and demand fundamentals and durable cash flows. These criteria form the bedrock of investment strategies that aim to mitigate risk while

“[Institutional strategy] can be a challenging, years-long process. Not all firms will have the patience to follow through ... but for those that do, the results are transformational”

Aaron Pittman, Equiton

new territories uniquely. It’s an approach I believe may be unprecedented in our industry,” Pittman says.

“The research is being conducted by Dr. Erkan Yönder and his team. We’ve seen some of the early work he’s done and are absolutely delighted, and looking forward to coming insights. So far, we’ve only scratched the surface of what we can achieve from this relationship, and we’ve already begun the preliminary planning to broaden and deepen the research.

“The integration of artificial intelligence with academic models removes emotion from the equation. While perspectives can be clouded by unconscious biases, particularly in real estate, our focus is to minimize emotional influence. At Equiton, we like to say our approach to real estate investing is passion without emotion. We prioritize due diligence and are willing to walk away from invest-

ensuring steady, predictable returns.

Equiton, with its strategically diversified portfolio spanning 17 key regions, carefully selects properties that align with these criteria, ensuring they are positioned for long-term growth and resilience.

Equiton’s focus on managing properties in vibrant, growth-oriented regions ensures that its portfolio is attractive for its current cash flow generation, offering peace of mind to investors looking for alternative investment horizons.

The firm is not only strategic but client-focused, Pittman adds. “True customer focus requires a detachment from your own goals with a singular focus on an exploration of a solution for the client. A clear and open two-way dialogue always results in the most meaningful solution fostering long-term partnerships, and longterm thinking underpins our approach.”

What TD Asset Management Inc. (TDAM) has learned over 35 years of experience managing real estate investments with one of the longest-tenured portfolios in Canada

AT THE core of the TD Greystone Real Estate Strategy is the conviction that sustainable income from quality assets and the growth of that income are the primary drivers of longterm real estate returns.

Central to this strategy is the ownership of strategically significant real estate investments right across Canada, rather than concentrated in three major cities within the country.

The TD Greystone Real Estate Strategy emerges as one of Canada’s premier openended real estate investment vehicles, with an impressive gross asset value exceeding $23 billion. Since its pooled-fund inception in 2004, the strategy has delivered an exceptional annualized performance of over nine percent, a testament to its effective management and strategic foresight.

Part of driving this success at TD Asset Management Global Real Estate Investment are Luke Schmidt, head of transactions, Matt Sych, head of portfolio and asset management, and Mark Cooksley, head of development.

Prairie wisdom and portfolio management

In conversation with Benefits and Pensions Monitor, Sych attributed the disciplined and risk-aware approach to the strategy’s prairie roots, emphasizing the importance of stability and long-term value in real estate investments. “We don’t overreact,” Sych said, highlighting a patient, measured approach to market fluctuations and trends.

He went on to say, “With our firm initially established through Saskatchewan-based

pension plans, we have a deep understanding of the critical, long-term role real estate plays in a pension portfolio.”

Sych said that this understanding has always been fundamental to the firm’s approach. “For over 35 years, we have managed every asset class, recognizing the long-term nature of real estate and the steady income and growth it contributes to the pension portfolio. Consequently, we maintain a steady course through various cycles, whether related to specific property types or broader financial crises, valuing the stability real estate brings to the overall pension portfolio’s income.”

Sych also explained the decision to integrate multi-unit residential properties into the portfolio in 2008, citing a fundamental supply-demand imbalance and the segment’s attractive attributes as an inflation hedge. Unlike commercial properties with longer lease terms, the shorter leases in residential

real estate offer flexibility to adjust rents annually, capturing growth while providing a very stable income stream.

Within real estate, the office sector has largely been dismissed as dead. However, Cooksley pointed out common misconceptions about commercial real estate (CRE), from the conflation with single-family housing markets to the premature obituaries of the office space sector. He argued for a nuanced understanding of CRE’s unique value proposition, especially in terms of income growth potential.

“The notion that the office sector is dead is far from accurate. Despite facing challenges, the office market is alive and evolving. There has been a slower return to office spaces in both Canada and the US compared to other parts of the world, yet there’s a clear trend toward highquality, well-located buildings with excellent transit connections and amenities. This shift

is evident in our portfolio, reflected in both tenant demand and investment interest.”

Another misconception Cooksley addressed is the idea that the single-family residential market can be accurately compared to commercial real estate. It can’t – because income generation is not the primary factor considered when acquiring single-family residential properties.

Lastly, the idea that capitalization rates are directly tied to investment yields is also a misconception. While cap rates do move with interest rates, their relationship isn’t strictly linear. Unlike fixed-rate bonds, cap rates can increase due to income rising faster than valuations, as was the case in 2022 and 2023. Moreover, commercial real estate’s value is also influenced by its income potential and growth prospects, which can lead to a decrease in cap rates on a relative basis.

The current environment, marked by the COVID-19 pandemic and reflation, presents unique challenges and opportunities, with certain sectors like industrial and residential real estate seeing capital appreciation.

As Schmidt highlights, what sets this cycle apart is the varying impact on different property types. Unlike past cycles when all property types would generally rise or fall together, this downturn has seen a clear divergence. Industrial and residential sectors have experienced capital appreciation, a rarity in downturns.

Another distinctive aspect is the battle between rising cap rates and income growth, particularly notable in the industrial sector. Despite the upward pressure on cap rates and yields, the industrial sector saw significant income growth, offsetting these pressures and leading to value stability or even appreciation. The residential sector similarly kept pace due to strong income growth, unlike the office sector, which suffered from weaker fundamentals.

Diversification emerged as a key strategy in managing portfolio performance. Schmidt asserted, “By not being overly concentrated in any particular property type, we could maintain the stability and returns of our portfolio. The industrial sector, having led the market in recent years, was clearly an advantage for industrial-centric portfolios. However, it’s now the residential sector that’s taking the lead, and a more diversified portfolio will reap the benefits of this rotation.”

Schmidt noted that quality remains a constant factor in recovery from downturns. “Quality always tends to perform when we come out of down cycles. Highquality office, retail, and industrial properties will outperform.”

As to where the cap rates are going, Schmidt said, “At the start of this year, we were observing continued increasing pressure on cap rates, particularly within the office and industrial sectors, and [we] anticipate this trend might extend into the second quarter as well. However, with indications that interest rates may decrease later in the year, there’s a growing sentiment that cap rates could be nearing their peak, potentially by the end of the second quarter or later into this year.”

The current outlook suggests we’re nearing a turning point in the market cycle, with optimistic expectations for improvements in cap rates as we move into the latter half of the year. This nearing of the cycle’s bottom is a positive development, signalling potential stabilization and recovery in the market’s overall dynamics.

The portfolio managers at TDAM take a very long-term perspective on all their portfolio investments, and with that future-forward outlook, part of the strategy has been to look to net-zero developments where it makes sense.

Cooksley said, “Our pioneering efforts in sustainable development have positioned us as a leader in the field, evidenced by our creation of Canada’s first net-zero industrial building

Sponsored by

in Halifax, in partnership with Eastport Properties. This innovative project achieved a Zero Carbon Design certification from the Canadian Green Building Council, offering tenants the potential for negligible heating costs throughout the year, contingent on efficient building management. This achievement underscores our commitment to sustainability and the tangible benefits it brings.

“Our investment strategy is characterized by a long-term outlook, spanning 10 to 20 years, ensuring our portfolio remains aligned with future trends and values. This perspective extends to our development projects, where we prioritize sustainability alongside financial viability. By focusing on sectors like industrial and multi-family, we opt for slightly lower immediate yields in exchange for greater longterm income growth, liquidity, and asset value.

“Our commitment to sustainability is not only a fiduciary responsibility to our clients but also a strategic decision to future-proof our investments. For projects where net-zero construction is not immediately viable, we design with future electrification and conversion in mind, minimizing future costs and ensuring our buildings can adapt to evolving sustainability standards.”

By focusing on markets with strong growth metrics while avoiding capital-chasing assets, TDAM’s real estate strategy has a 35-year track record proving that strategic diversification and quality investment result in superior client outcomes in the ever-evolving real estate landscape.

For more information, visit https://www. td.com/ca/en/global-investment-solutions.

As yield

in

fixed

income

picks

up,

a

regime

shift may have begun –but alternatives remain fundamental for institutions, says expert

PENSION FUNDS have been steadily increasing their allocations to alternative asset classes like real estate, infrastructure, private equity, and private debt, a trend driven by the pursuit of higher returns and portfolio diversification.

However, while the alternative investment opportunity set is diverse, and plan sponsors have chosen their paths based on their unique objectives, “there seems to have been a bias among pension plans for private market versus liquid alternatives,” says Jim Cole, managing director and institutional portfolio manager at PH&N Institutional, RBC Global Asset Management Inc. He says a likely reason for this is that “the long-term cash-flow generation profile of many private market asset classes is a good fit for what pension plans are striving to accomplish.”

As for real estate, Cole says that core real estate has featured in pension plan investment programs for many years. It was the era of very low interest rates that saw a significant pick-up in demand for core infrastructure and private debt as alternatives to public market fixed-income portfolios as plans focused efforts on maintaining expected returns at levels that would continue to support the benefit objectives of pension plan sponsors.

As for liquid alternatives, various forms of alternative public market credit have also found their way into portfolios as a way to build yield and income in institutional portfolios in what had been a low interest rate environment for many years.

“So, the theme for much of the past decade has been yield enhancement and portfolio diversification,” Cole says. “However, we may

be in the early stages of a regime shift as fixed-income markets are now offering materially higher yields.”

The challenge of low yields in traditional fixed-income markets has also driven demand in global multi-asset credit strategies that offer the flexibility to invest across sovereign and corporate credit and to invest in both investment-grade and high-yielding issuers, depending on market conditions. Allocations

the overall return profile of an alternatives investment program. As well, specialized funds can offer the opportunity to access tactical opportunities that are presented by a unique and potentially temporary set of market circumstances.”

Specialized investment strategies are often designed to be very concentrated on one small segment of investment markets, says Cole. “Therefore, access to several special-

“We may be at the early stages of a regime shift as fixed income markets are now offering materially higher yields”

Jim Cole, PH&N Institutional

to such public market strategies have helped bolster the yield profile in public market fixed-income portfolios.

Specialized funds can play valuable role

Cole says specialized funds can also play a valuable role in an institutional investment portfolio. “Alternatives are a very diverse asset class, even within individual sectors such as real estate or infrastructure. Specialized funds can be useful to round out core alternative investment exposures by targeting specific risk premiums or sources of return.

“Specialized strategies may be used to take advantage of the unique skillsets of some specialized managers, and through this expertise offer the opportunity to improve

ized funds may be needed to build the desired overall portfolio exposures. This process can be time-consuming and requires very specialized knowledge to consider such investments. Investors will want to ensure they have access to sufficient resources and investment knowledge to consider specialized strategies to any significant degree. Many institutional investors have these resources available to them, and in these instances, it’s common for specialized strategies to form a part of the investor’s overall alternatives program.

“For smaller and mid-sized institutional investors that perhaps don’t have the resources to integrate specialized strategies into their investment programs, the diversification and governance simplicity offered by alternatives funds with broader mandates can or may make them more suitable.”

While alternative investments do not necessarily present additional investment risk relative to traditional asset classes, there are important reasons why due diligence may be more extensive than for some traditional asset classes.

“Differences across strategies, and therefore potential for greater return dispersion, can exist to a greater degree with alternatives versus more traditional asset classes,” says Cole. “There are also often a number of additional operational complexities that are not necessarily presented in traditional asset classes. For example, an investor will likely want to consider factors such as liquidity, portfolio concentration, derivative usage, leverage, performance fees, etc. For these reasons, we do often see a desire for more operational and investment due diligence for alternative investment strategies.”

“It’s common for specialized strategies to form a part of the investor’s overall alternatives program”

Jim Cole, PH&N Institutional

As an expert in the field, Cole says institutional investors should approach the decision to invest in alternative asset classes based on their particular circumstances, including considerations such as long-term return objectives, inflation protection, governance structure, and liquidity needs.

“Lower yields and the desire for return diversification have been important forces driving demand for alternative investments over the past decade,” he says. “Fundamentally, we believe we will be in a lower interest-rate world going forward, if perhaps not as low as it

was immediately post-global financial crisis or post-pandemic. And the uncertain economic backdrop may result in elevated volatility in traditional asset classes. Alternative asset classes will continue to play a role in institutional portfolios for the same reasons they were sought out in the first place.”

Circumstances offer opportunities to contribute to housing solution while driving value for investors

CANADA’S HOUSING crisis presents a multifaceted challenge that has garnered significant attention due to its profound implications for Canadians across the socioeconomic spectrum. The crisis is characterized by a shortage of affordable homes and by rapidly rising real estate prices; this article aims to provide a comprehensive analysis of the structural causes of the crisis.

Key contributing factors to the housing crisis

Reliance on immigration for economic growth

Canada’s strategic reliance on immigration to drive economic growth and demographic expansion has positioned it as one of the fastest-growing G7 nations. However, this has placed immense pressure on the housing market, especially in major urban centres where demand significantly outstrips supply, resulting in soaring housing prices and making homeownership increasingly unattainable for many Canadians.

Government regulation, development charges, and taxes

The regulatory framework governing housing development in Canada significantly contributes to the housing crisis. Developers are hindered by lengthy permitting processes, high development charges, rent controls, and various taxes that escalate the costs of housing construction. These barriers not only deter new developments, but also delay the introduction of new housing to the market, tightening supply and exacerbating affordability issues.

The

The direct consequence of high immigration rates coupled with restrictive development policies is a pronounced housing shortage, particularly acute in major urban centres. This shortage leads to overcrowding and housing insecurity, as many Canadians struggle to find suitable housing.

The widening gap between housing prices and average incomes has led to a decline in homeownership rates, particularly among younger generations. Cities like Vancouver and Toronto have experienced exponential real estate market growth, pushing many Canadians toward renting, which further exacerbates the demand for rental housing.

As homeownership becomes increasingly unaffordable, more Canadians are turning to the rental market, spurring a boom in multi-residential real estate. This sector offers significant investment returns due to high demand and low supply. However, the pace of new rental unit construction has not kept up with the growing demand, resulting in even lower vacancy rates and higher rental costs.

In response to the escalating housing crisis, the Canadian government has implemented

several measures aimed at facilitating housing development, including tax breaks for new rental construction and streamlined regulatory processes. However, these efforts, while steps in the right direction, are insufficient to address fully the systemic issues underlying the crisis.

For a durable resolution to the housing crisis, Canada must adopt a comprehensive approach that addresses both the supply and demand sides of the equation. This includes adjusting immigration levels to align more closely with housing capacity, simplifying the development approval process, and fostering investments in housing infrastructure.

With conservative assumptions and trying to assess the implications of current policy changes, Fiera Real Estate’s projections indicate a persistent shortfall in rental housing, with an estimated deficit of over 500,000 units by 2040. This stark discrepancy highlights the urgent need for accelerated development in the multi-residential sector to accommodate the growing number of renters. Without substantial investment in rental housing, the affordability crisis will only intensify, leading to greater inequality and social instability.

The need for a holistic approach

Canada’s housing crisis requires a holistic approach if it is to be resolved. While shifting government policies to minimize interference with the private sector is necessary, such policies often fall short regardless. More must be done to leverage free-market forces, which can meet housing demand effectively and adjust prices to realistic levels. By understanding the root causes of the crisis and implementing minimal but targeted interventions, Canada can work toward building a housing market that is accessible, affordable, and sustainable for all Canadians.

Contact: Janick Boudreau, CFA

Executive Vice-President

Business Development and Client Partnerships

Address: 800 Rene-Levesque Blvd. W., Ste. 2750 Montreal, QC, H3B 1X9

PH: 514-908-1989

Fax: 514-287-7200

Email: info@addendacapital.com

Web: addendacapital.com/en-ca/ Alternatives management provided to: Canadian pension plans, 31; Canadian foundations, 24; Canadian endowments, 5

Total Canadian alternatives clients: 130 Alternatives asset classes: Commercial mortgages, $4,366.7M

Alternative AUM for Canadian institutional investors: $3,927.6M

Manager style: Core

Ownership structure: Principals, 3%; Third-party (Co-operators Financial Services Limited), 97%

Alternative investment professionals: 14

Established: 1985

Minimum investment: Pooled $5M; Separate, $20M

CANADA INC.

Contact: Oliver Wolf

Business Development Associate

Address: 80 Keil Drive South, Unit #3

Chatham, ON, N7M 3H1

PH: 519-352-8413

Email: oliver.wolf@aginvestcanada.com

Web: aginvestcanada.com

Total Canadian alternatives clients: 100

Alternatives asset classes: Farmland, $120M

Alternative AUM for Canadian institutional investors: $60M

Manager style: Active

Ownership structure: Principals, 100%

Alternative investment professionals: 1

Established: 2012

Minimum investment: Pooled, $150,000; Separate, $150,000

Contact: Wendy Brodkin, Managing Director