Onwards and Upwards March 2023 £5 www.mortgageintroducer.com INTRODUCER Champion of the Mortgage Professional BUY-TO-LET Why buy-to-let is still thriving

UTB MORTGAGES FOR INTERMEDIARIES we understand specialised mortgages T: 020 7031 1551 E: mortgages.enquiries@utbank.co.uk This information is strictly for the use of professional intermediaries only. The easy way in to Buy-To-Let Inside UTB’s broker portal there’s plenty of choice for BTL mortgages Scan here to register and access our broker portal

Managing Editor

Paul Lucas paul.lucas@keymedia.com

Editor

Simon Meadows simon.meadows@keymedia.com

News Editor Jake Carter jake.carter@keymedia.com

News Writer Rommel Lontayao

Commercial Director

Matt Bond matt.bond@keymedia.com

Advertising Sales Executive

Jordan Ashford jordan.ashford@keymedia.com

Campaign Coordinator

Raniella Alonzo raniella.alonzo@keymedia.com

Content Editor

Kel Pero

Production Manager

Monica Lalisan

Production Coordinator

Kat Guzman

Designer

Khaye Cortez

Buy-to-let is alive and kicking

So (famously) wrote the author

Mark Twain. And the same could be said of the UK’s buyto-let sector, which, despite gloom-laden predictions of its demise, still shows signs of being a thriving part of the mortgage industry.

True, it’s a challenging sector – as much of the wider mortgage market is at the moment. But show me an industry that hasn’t felt some pressure over the past six months or so. Few have been immune to the shockwaves that ricocheted through our economy last year.

As our dedicated buy-to-let supplement highlights this month, there are plenty of positives to be drawn from the market currently, as the industry experts we have spoken with attest. It remains a multi-billion-pound sector.

In our special round-table discussion, we heard that there was still demand from smaller investors with portfolios of up to five properties; that the cost of living was potentially boosting the rental marketplace, with business from tenants who couldn’t afford to get onto the property ladder; that landlords were remortgaging to purchase below-asking-price properties; and that demand for quality property had risen since the pandemic.

Contents

4 Interview: UTB’s Buster Tolfree

A healthy market

6 Jane Simpson

Sailing along

7 Grant Hendry Green mortgages: here to stay

8 Richard Rowntree

Let’s encourage landlords

9 Cat Armstrong Landlords need clarity

10 Steve Cox

A range of products

11 Market update

Rents continue to climb

12 Feature: Skipton International Jim Coupe on what’s ahead

14 Feature: Hampshire Trust Bank

Confidence in BTL is warranted

16 Round table

KM Business Information UK Ltd

Signature Tower 42, 25 Old Broad Street Tower 42, London EC2N 1HN www.keymedia.com

UK ∙ Canada ∙ Australia ∙ USA

We also spoke with the highly engaging director of mortgages at United Trust Bank, Buster Tolfree, who described buy-to-let as a resilient, strong market, with some individual professional landlords investing in scores of properties. He forecast it would be worth more than £40bn this year. There were “plenty of opportunities for specialist brokers and lenders to hit their goals,” he said.

Investment in the private rental sector can still be highly lucrative, it seems.

Here’s to a vibrant market.

Simon Meadows

How buy-to-let looks from here

22 Feature: Aldermore Good things are in store

COMMENT EDITORIAL www.mortgageintroducer.com MARCH 2023 BUY-TO-LET INTRODUCER 3

∙ NZ ∙ Philippines

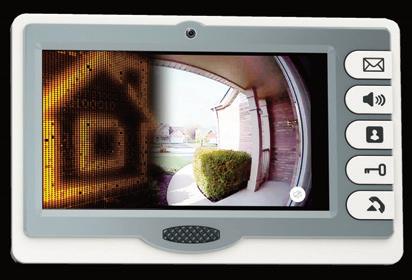

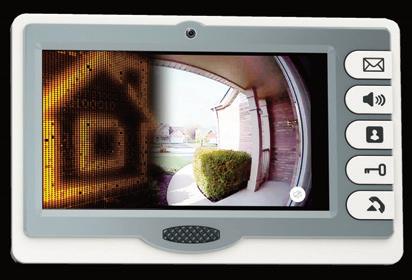

UTB MORTGAGES FOR INTERMEDIARIES UTB Buy-To Let Mortgages • Broker portal with access to: • Online DiPs, Document Upload & Case Tracking Register here and access our broker portal.

“The reports of my death are greatly exaggerated.”

A healthy market

supported by a high demand for rental property, its director of mortgages tells Simon Meadows

I“think the future remains bright for buyto-let,” says Buster Tolfree, director of mortgages at United Trust Bank (UTB), with notable confidence. “There is still strong demand for rental properties. We have a housing shortage, and all the data suggests that we’re not building enough houses.

“Until there are enough properties to meet demand, you’re always going to have a healthy buy-to-let market, which is part of a healthy mortgage market and part of a healthy property market. With interest rates rising and potential inflation of rents, you could argue that it’s going to be even harder for people to save for a deposit.”

He reasons, “Whilst this is the case, you are going to still see demand from landlords to buy properties to let. I think we’re probably in a period of flux. We’ll see some market growth, back from where it was at the end of last year and through 2023, though perhaps not back to 2021–2022 levels. It will start to climb again.”

UTB launched its buy-to-let proposition last April. It was conceived earlier but delayed by the pandemic, – yet Tolfree suggests it was worth the wait.

“The response has been positive,” he enthuses. “We’ve got about 2,000 registered brokers, all of whom have access to our buy-to-let products now. Our customer profile tends to be professional landlords, and 50 per cent of our buy-to-let business is with limited companies rather than private individuals.

“We do have a product for first-time-buyer landlords, but our core customer base is people who have got experience, with an average of three or four properties and an ability to do something with the equity that they have gained. They’re either looking to make money on their rental yields, or playing it as a longer-term, equity-accumulating source of income for when they get to retirement. We’ve also arranged multiple loans for landlords with as many as 50 or 60 properties.”

He continues, “The reason why buy-to-let is such a natural extension of what we do at UTB is that we already had all of these deep broker relationships through our bridging, first- and second-charge propositions. We’ve got a track history of delivering across all our finance products – and our buy-to-let proposition is compelling.”

UTB’s director of mortgages has been in the industry for 25 years, and with the bank since 2014. His enthusiasm for its culture is palpable.

“When I joined it had around 40 staff; there are

BUY-TO-LET INTRODUCER MARCH 2023 www.mortgageintroducer.com 4

UNITED TRUST BANK INTERVIEW

“There are plenty of opportunities for specialist brokers and lenders to hit their goals, while making it clear to the landlord and the consumer ... that the world has changed”

The buy-to-let sector may be facing its challenges, but United Trust Bank’s recently launched proposition for landlords has been well received, and the market is

nearly 400 of us now,” Tolfree reflects. “The bank is very strong from a balance-sheet perspective –£2.5bn – and very strong from a people perspective. The mortgage division is nearly £900m on its own.

“So, the growth has been good, but the thing that hasn’t changed about UTB is that the people who come here are entrepreneurial, they’re driven, they’re high-energy and not afraid of coming forward and giving an opinion. It’s actually a real cauldron of creativity – it’s a positive environment.”

He elaborates, “If you look at the high street as a set of lenders, they do amazing things, the volumes are unbelievable – but in specialist lending, you do need to craft with a bit more care, you need to understand the scenario a little more, you need to take a little more risk to get the margin that attracts specialists. So those are the things that get me up in the morning. It’s not just a job to me; it’s my favourite hobby.”

While Tolfree clearly relishes his role, he is not blind to the challenges facing the buy-to-let sector.

“I think the biggest thing that that we’ve seen is conversion ratios have dropped,” he acknowledges. “We’ve seen somewhere in the region of a 40 per cent drop-off in property purchase transactions market-wide, so that is going to have an effect on what landlords want to do with their funds.

“It takes some getting used to, when you come to remortgage your property, to find that your interest rates are now going to be five, six, or seven per

cent, when in the past you were looking at one, two, and three per cent – that is a mindset shift.”

He says, “I think a lot of people have also been in the state of mind where they want to wait and see what’s going to happen, but this is the new normal. The world isn’t going back to where it was before – but that doesn’t mean it’s a bad thing. There are plenty of opportunities for specialist brokers and lenders to hit their goals, while making it clear to the landlord and to the consumer, right at the start of the process, that the world has changed.

“When times are tough, having relationships with brokers and lenders whom you can trust, and knowing they’re going to do what they say they’re going to do, is the most important thing , along with working with trusted partners who are maximising the conversion.”

A further potential pressure on the market is a tightening of legislation around the energy performance certificate (EPC) and the letting of properties.

“I’m supportive of improving housing conditions; who wouldn’t be?” says Tolfree. “But there’s a lot of property out there, particularly when you think of older properties, where it’s just going to be difficult to get to an A-to-C rating. It’s just not realistic to think that every landlord is going to get done what they need to in a certain period.

“In my opinion, there will be an extension. Otherwise many landlords will put properties on the market because they can’t rent them anymore – and that might adversely affect property values. Do you force landlords to sell? That doesn’t feel like the sort of activity that a government or a regulator would want to be pushing.”

Tolfree doesn’t believe that these changes will have a material impact on buy-to-let landlords, as the economy seemingly settles.

“I think we have ridden the worst of it,” he concludes. “The buy-to-let market has been so resilient. When you think of the regulatory changes that have happened over the last five to six years, everyone was saying it’s the death of buy-to-let, it will never survive. I estimate that the buy-to-let market will probably be worth north of £40bn this year – it’s a decent, strongsized market.” BTL I

www.mortgageintroducer.com MARCH 2023 BUY-TO-LET INTRODUCER 5

UNITED TRUST BANK INTERVIEW

“Until there are enough properties to meet demand, you’re always going to have a healthy buy-to-let market, which is part of a healthy mortgage market”

Buster Tolfree

Why the buy-to-let market will remain buoyant

renters looking for homes that cost less to rent and heat.

In early March, the Bank of England (BoE) released figures revealing that the UK mortgage market had contracted for the fifth month in a row.

If we discount the near-shutdown of the market prompted by the first COVID-19 lockdown, the decline recorded in January saw the number of mortgage approvals hit the lowest level since 2009, when the market was reeling from the upheaval of the 2008 global financial crash.

The mini budget is widely considered responsible for extinguishing what was a red-hot property market, as mortgage lenders were forced to withdraw products.

Even though availability has now recovered, and rates have dropped from the highs seen in October last year, when combined with the limited ability of would-be buyers to save for deposits, affordability is undoubtedly not what it was in the summer.

In the immediate aftermath of the former chancellor’s calamitous fiscal statement, some forecast that this year would see 20 per cent or even 30 per cent wiped off the value of property. While this currently seems a little alarmist, there is certainly evidence to suggest we have experienced a downturn. Zoopla data published in February revealed that asking prices for one in 10 homes listed on the property website had been reduced by more than 10 per cent.

These figures have been used to suggest that the property market is showing signs of stress – but when we view those stats in context, we see a

sector that has held up exceptionally well in the face of significant challenges, and continues to defy forecasts of its demise.

Property has increased in value to record highs over the past few years, so some reduction in value is not necessarily cause for concern, but instead could be considered a natural correction of the market.

With property prices increasing so much and so quickly, some landlords, particularly those with larger portfolios, will have generated sizable equity. This would help to offset higher mortgage rates, and if the downward trend in purchase prices continues, some properties could start to be perceived as providing good value when compared to a year ago.

The knowledge that there is no shortage of tenants looking for goodquality, affordable homes may tempt landlords to acquire what they may now deem to be a bargain.

Rightmove recently published data revealing a rise in searches for rented homes with “bills included,” highlighting how the cost-of-living crisis is influencing what tenants are currently looking for in a home. This adds another dynamic that has the potential to stimulate the market, and we have already seen the appeal of flats’ and HMOs’ return after they fell out of favour during the pandemic, as investors adapt their offering to cater to

And it’s not just affordable homes –high demand for rented properties can be seen more broadly, offering further reassurance that the buy-to-let market will remain buoyant despite the testing economic environment.

Paragon’s PRS Trends report, recently published and covering Q4 2022, highlighted how the record-high levels of tenant demand reported by landlords in the autumn continued into the final quarter of last year. This demand meant that voids reported by landlords during the quarter were at the lowest level since 2017, and also placed upward pressure on rents.

The report also revealed that just under one-third of landlords had experienced at least one tenant in rental arrears during the last year – the lowest level in six years.

Few would disagree that the current imbalance between supply and demand and the resulting record highs paid in rent are issues that need to be solved at the earliest opportunity, but they have meant that landlords have had some degree of protection against rising overheads.

So, while mortgage rates may remain elevated when compared to those we’ve grown used to, we can see that landlords are better equipped to respond to market conditions than it may appear at first glance.

While all but the most optimistic would agree that we’re living through something of a tumultuous time, the daily stream of negative news can lead us to ignore the positives and adopt what I feel is an unnecessarily negative outlook. If you believe everything you read, it’s a gloomy time for the mortgage industry – but by looking past the headlines we can see that the market is very much alive and kicking, and opportunities exist for advisers. BTL I

BUY-TO-LET INTRODUCER MARCH 2023 www.mortgageintroducer.com 6

BUY-TO-LET REVIEW

Jane Simpson MD, TBMC Cardiff

The knowledge that there is no shortage of tenants looking for good-quality, affordable homes may tempt landlords to acquire what they may now deem to be a bargain

Green mortgages are likely to grow

Arange of environmental issues continues to generate attention from an individual and business perspective. Energy efficiency remains top of the agenda for many and, with this in mind, it was encouraging to see the recent launch of the government’s Energy Efficiency Taskforce.

This taskforce is charged with helping reduce national energy consumption by 15 per cent over the next seven years, cutting bills and helping to push down inflation in the process. Responding to industry’s call for long-term funding certainty to help strengthen UK supply chains, £6bn in government funding will be available from 2025 to support this objective, in addition to the £6.6bn allocated this parliament – taking the total to £12.6bn this decade.

It will be interesting to see what impact this initiative has on the housing market. Several factors affect the energy-efficiency levels of our current housing stock, including property type, tenure, and when it was constructed. EPCs remain one of the most prominent measures for charting a property’s energy performance and offer some useful insight into some of the challenges and potential costs involved in upgrading certain properties for both residential and rental purposes.

In October 2022, the OMS published the Energy Efficiency of Housing in England and Wales for 2022 Report, which outlined the performance levels of certain housing stock. This found that flats and maisonettes were the most energy-efficient property type in both England and Wales, with a

median energy efficiency score of 72 in England and 73 in Wales, both of which are equivalent to EPC band C. Detached and terraced dwellings scored the lowest in Wales (both 63), while in England, semi-detached properties (64) were the lowest. Both of these scores are equivalent to EPC band D.

Unsurprisingly, dwellings in both England and Wales constructed after 2012 were reported to have a median energy efficiency score of 83, which is equivalent to EPC band B. In contrast, dwellings constructed before 1930 had a median score of 59 in England and 57 in Wales, equivalent to EPC band E.

Building techniques and regulations have obviously changed over time, but with around 60 per cent of the UK’s housing stock sitting in the EPC D band or lower and generating in the region of 15 per cent of carbon emissions, it’s little wonder that so much attention is being paid to the green mortgage market. This is especially apparent for landlords, with additional legislation likely to be introduced for all new and existing private rental sector tenancies from 2025 onwards.

As a lender, we are keen to continue our strong level of support for green mortgages. It’s also encouraging to see a variety of lenders joining the green mortgage movement, although we still have some way to go from an innovation and education perspective to help a variety of borrowers and intermediary partners in their decision-making process.

The ongoing aim of many lenders is to recognise the shift in terms of increased landlord demand for properties already meeting an EPC level of C, but to also support them where we can in updating the vast proportion of properties that sit below this band.

From a future purchase standpoint, according to the latest Q4 2022 BVA

BDRC Landlord Panel research report, over two-thirds of landlords (68 per cent) said they would now be less likely to purchase a property if it has an EPC rating below C. This opens up an interesting debate around the opportunities and value of properties sitting above and below this important classification.

There has long been a new-build premium in play, which leads to the question of whether this sort of premium might also obtain on any property with an EPC rating of C or better in the future. If so, could this lead to greater opportunity to improve the value for those properties in the D and E bands –provided these can be updated in a cost-effective manner?

How these are funded will play a crucial role. Here at Foundation, our green mortgages specifically include a Day 1 remortgage feature that allows landlords to carry out the work required on a property to get it to this level and refinance with us as soon as that work is completed.

Of course, we are not the only lender offering this type of proposition, but it does lead to further questions regarding whether landlord clients are aware of this possibility and the circumstances in which it might come into consideration. Then there are other factors around the types of improvements that will make a difference for EPC classifications and their potential impact on rental demand and potential yields, and from a borrowing standpoint.

Questions are plentiful in the quest for energy efficiency and how the green mortgage market can better support this. While the specialist lending market doesn’t have all the answers, it’s clear that advisers and their specialist borrower clients now have access to a greater array of products to meet their needs – and the range of choice is likely to grow in the future. BTL I

www.mortgageintroducer.com MARCH 2023 BUY-TO-LET INTRODUCER 7 BUY-TO-LET REVIEW

Grant Hendry director of sales, Foundation Home Loans

Landlords need incentive to continue driving rental-stock improvements

to ourselves, our customers, and the tenants of the properties we lend on to ensure that we are satisfied that they meet our standards. We act as a natural gatekeeper, often preventing poorquality homes from entering the PRS through our lending criteria.

£25,000 upgrading a property, with one in 10 spending between £10,000 and £15,000.

Too often, the same tired narrative is regurgitated about homes in the private rented sector (PRS) – they are poor quality, not fit for purpose, uninhabitable.

Yes, the sector has issues, as does every tenure – but landlords have made significant improvements to the standards of homes in the PRS over the past 15 years. They have been a force for good.

We recently published a report titled Raising the Standards of Privately Rented Property that examined some of the data behind the country’s privately rented stock, and it highlighted clearly how landlords have driven improvements.

In 2008, 44 per cent of homes in the sector were defined as non-decent, according to the government’s English Housing Survey. Today, that figure stands at 23 per cent. That’s still too high – but let’s dig deeper into the numbers.

What has driven the improvement?

Primarily, it is the dilution of poor stock by the addition of good-quality homes to the sector. In 2008, 1.8 million privately rented homes were classed as decent, rising to 3.3 million in 2021 – an 83 per cent increase. There has also been a reduction in the number of properties classed as non-decent, the numbers falling from 1.4 million to 990,000 – a 29 per cent reduction.

Buy-to-let has played a significant role here. As lenders, it is our duty

Lenders, of course, might take a different view of a property that isn’t quite up to scratch if the customer has a plan to upgrade it – and, of course, products exist to facilitate that exact scenario.

At Paragon, we employ our own team of surveyors, and each month our lead surveyor presents examples of “the good, the bad, and the ugly” along the spectrum of properties that we may see cross our desks. Fortunately, the “ugly” element is in the minority.

Our report found that rental properties are today newer and more energy efficient. The number of homes in the PRS built after 1990 has increased 47 per cent, to one million today. Of that number, 602,000 were built after 2002.

The number of properties with an energy performance certificate (EPC) of between A and C has risen by 165 per cent over the past decade to 1.92 million. Additionally, those rated D and E have fallen by 21 per cent to 2.18 million, whilst those rated G – which are not legal under current rental legislation – have diminished to 54,000.

The PRS now outperforms the owner-occupied sector for energy performance, with 44.5 per cent of stock between A and C, compared to 42.9 per cent in owner-occupied homes.

And what compels them to improve the homes they acquire? We surveyed over 500 landlords, and over eight in 10 upgrade every rental property they acquire. Nearly a quarter of landlords said they spend more than

Of course, there is a financial incentive to this capital investment – improving a property will increase its value and, typically, a landlord’s rental income.

But the most common reason landlords gave for upgrading property was to ensure they are providing a good home for their tenants. As our research shows, over four in five landlords cite this as the main driver for the investment.

However, there is more to be done. We await the next steps on energy-efficiency proposals, and the government has also consulted on bringing in the Decent Homes Standard for privately rented property, something we support.

But in order to achieve these aims, the market requires a committed investor base – landlords prepared to expand their portfolios, invest in their businesses, and upgrade their properties. This is something government must recognise and encourage.

The supply/demand imbalance we are experiencing today is a direct result of the abandonment of tenure-neutral housing policy in the mid-2010s.

As widely reported, there has been a large cohort of landlords who have sold up and walked away for a number of reasons – the numbers no longer adding up, burdensome and ever-changing regulation, and the hassle factor are some of the reasons regularly cited.

Predominantly these have been smaller-scale landlords, but the role of all landlords – large and small – needs to be acknowledged, supported, and celebrated, because the UK’s tenants need them. BTL I

BUY-TO-LET INTRODUCER MARCH 2023 www.mortgageintroducer.com 8

BUY-TO-LET REVIEW

Richard Rowntree MD, mortgages, Paragon Bank

Landlords are proactive, but they need clarity

England currently have an EPC rating of A to C, an increase of 1.2 million, or 165 per cent, compared with 2011, with the sector boasting a higher proportion of homes in the bracket compared to those in owner-occupation.

Ifully appreciate that the government has a lot on its plate at the moment and that the wheels of Westminster can turn extremely slowly at the best of times. But surely having a lot on its plate also tends to come with the territory?

This is not going to turn into a political rant; it’s simply a call for some further clarity regarding the long-proposed government plans outlining that properties let under new tenancy agreements must be EPC rated from A to C from 2025, and that all tenancies must meet this standard from 2028.

EPC LEGISLATION

It has now been over two years since the closing of the government’s consultation period on these EPC measures, and we are yet to hear any further details or confirmation on this matter.

Every day, week, and month of silence regarding this issue is having a detrimental impact on a private rented sector that is already struggling to cope with growing rental demand and the delivery of good-quality housing. In short, this lack of direction continues to leave landlords uncertain about whether, how, and when they need to act on potential legislation that already has a tight schedule attached to it.

Despite this ongoing uncertainty, it’s been highly encouraging to see many landlords being proactive in raising the standards and energy efficiency levels of their rental properties. This fact was outlined in analysis of government data by Paragon Bank which revealed that 1.925 million rental properties in

Paragon’s new report Raising the Standards of Privately Rented Property suggested that 44.5 per cent of PRS properties are rated A to C, compared with 42.9 per cent in the owneroccupied sector. Paragon also reported a 44 per cent increase in lending against A-to-C-rated rental property in its last financial year, to £832.2 million.

The green mortgage market is growing in prominence as more lenders extend their residential and BTL product ranges into this area. This represents another important step in the right direction, but this transitional period continues to hamper potential, in addition to generating ongoing concerns for landlords in terms of how and where to implement energy-efficient improvements and their potential impact from a cost perspective. Costs are being further exacerbated by recent market turmoil, which has pushed up mortgage rates, placed additional pressure on stress-testing, and had a major bearing on affordability.

SHIFTING PRODUCT SENTIMENT

Focusing on BTL product types, the fixed rate has been dominant for many years, but in a rising interest and mortgage rate environment we have seen some alternative options become increasingly attractive to an array of landlords.

A recent survey from Landbay suggested that while the majority of landlords prefer the certainty of a fixed rate, sentiment has shifted on tracker mortgages. Seventeen per cent of respondents said they would now consider a variable tracker rate, while six per cent might revert to

standard variable rate (SVR). In the lender’s previous survey, undertaken last August, a month before the mini budget, not one respondent said they would take a tracker. This rise was suggested to be a result of landlords considering trackers against economic uncertainty. Some respondents believe rates will come down in the next year or two so don’t want to commit to a long-term product just now.

Having said that, the survey did show that five-year fixed rates remain the most popular choice for landlords, with 46 per cent preferring this option, but, tellingly, this figure has fallen significantly from 68 per cent in August. Meanwhile, shorterterm fixes have grown in popularity, with 24 per cent of landlords eyeing two- or three-year fixed-rate terms, compared to 13 per cent in the previous survey. The popularity of longer-term fixes, such as seven- or ten-year deals, was similar in the two surveys, marginally rising from seven per cent to eight per cent of landlords.

This data helps demonstrate the shifting demographics of the BTL sector, with the lack of clarity and general market uncertainty pointing to the increased importance of the advice process for landlords –especially for those who may be looking to add to their portfolios, investigating their refinancing options, and evaluating the type and length of products required to help them navigate some choppy economic waters. BTL I

References:

https://www.paragonbankinggroup.co.uk/ news/insights/landlords-have-drivenimprovements-in-the-standard-of-privaterented-property https://www.financialreporter.co.uk/ landlords-opting-for-two-year-fixes-andtrackers.html

www.mortgageintroducer.com MARCH 2023 BUY-TO-LET INTRODUCER 9 BUY-TO-LET REVIEW

Cat Armstrong mortgage club director, Dynamo for Intermediaries

Full product range supports as many landlords as possible

cover those in future articles.

Cox

As we motor into springtime, the nights get shorter, and hopefully a greater amount of daylight puts a little “spring” into all our steps, it’s possible to see a short-term future that brings with it a greater level of business activity in the buy-to-let space.

At present, however, there remain both challenges and opportunities within the buy-to-let space, and that appears to be the case looking forward to the rest of 2023.

No doubt the biggest challenge we are facing as a sector at present is affordability and getting landlord clients to a point with their mortgage finance where they can continue to stay invested and can secure the level of loans they need to do this.

In that regard, there has been a concerted effort to keep up product choice, but also to look at a range of options that may be used in order to get landlord borrowers where they need to be.

that might have shifted by the time you read this.

Until that point, it’s important that lenders provide product alternatives, and that might be achieved through a higher fee/lower rate option – which, on the surface, does look out of kilter with what has gone before, but is a simple opportunity for advisers to work the maths and see whether they can get the deal to fit.

That’s really the important point of this – multiple product choices do provide advisers with the opportunity to run the numbers when it comes to different clients/properties/ rental levels, and to choose the most appropriate one for the client, based on their needs and circumstances.

We all know that, from a remortgage point of view, the market is holding up well, but clearly what we’d also like to see is landlords having the confidence to add to portfolios in order to fill the growing supply gap in the private rented sector (PRS).

First, however, I should point out that I’m writing this prior to the mid-March budget and have no clue whether the chancellor, Jeremy Hunt, has taken the opportunity to support landlords – much-needed after a decade in which they have been targeted – or whether there has indeed been any acknowledgement of what is currently occurring in the PRS, and the housing supply shortage.

My sincere hope is that there has been, but I’m not holding my breath. However, if there is a positive announcement (or two) I will certainly

You’ll have noticed an increase in the number of products that are coming out with lower rates but higher product fees attached, in order to try to square this particular affordability circle for a number of landlords, particularly those seeking to refinance in an environment that has moved into a different rate normality.

I know there was some initial pushback against these higher fee/ lower rate products, and that was perhaps understandable given the fees are clearly above the market norm of the last few years.

However, as I think is becoming more widely known and acknowledged, the release of such products is an attempt by lenders to help landlord borrowers get over the affordability hurdle, which has been raised by the general increase in product rates.

For what it’s worth, I don’t think we are too far away from a point where affordability will start to work for products with “normal” fees – to our mind, that is around the five per cent product-rate mark. At the time of writing, we are not yet there, although

It has been positive to see a growing choice for landlord borrowers here –we have been able to bring back our two-year fixed range, after a turbulent time post-mini budget when this was simply not possible, plus we have also been able to cut rates on other fixed rate products as the market has shifted and swap rates have come off their highs of autumn 2022.

At the same time, we’re aware that other landlords want shorterterm options, as they’re willing to ride out the next six months or year and look again at that point at what they hope will be a better situation in terms of pricing. It means we can offer discount/tracker products to this borrower demographic – which, again, keeps them invested and allows them the time they require.

Overall, as mentioned, it is all about choice and providing advisers with plenty of options to offer up to their clients. No-one believes this is the easiest time for landlord borrowers, but we do believe that a full product range will be able to support as many as possible, whether they are refinancing or looking to purchase. BTL I

BUY-TO-LET INTRODUCER MARCH 2023 www.mortgageintroducer.com 10 BUY-TO-LET REVIEW

Steve

chief commercial officer, Fleet Mortgages

I don’t think we are too far away from a point where affordability will start to work for products with “normal” fees ... that is around the five per cent product-rate mark

Rents soar to record high in February

Report reveals 10% year-on-year increase

At an average of £1,230 per month for a newly let home, rents across the UK hit another record high in February, residential estate agent Hamptons has reported.

Its latest monthly lettings index revealed a 10 per cent year-on-year increase, marking the second-strongest annual growth since the company began recording this data.

London, where average monthly rent rose by 13.8 per cent to £2,161, regained its place at the top of the rental growth charts. Hamptons noted an evenly matched rental growth across both Inner and Outer London, a reversal of last year when Inner London rents were recovering from their post-pandemic lows.

In a reversal of last year, smaller homes are seeing the strongest rent rises. The average one-bed rent increased 13 per cent year-on-year in February, nearly triple the 4.5 per cent rate recorded in February 2022. Rental growth for a three-bed home decelerated from 10.6 per cent in February 2022 to 8.7 per cent in February 2023.

“Rental growth accelerated last month, marking the second-strongest rate of growth recorded since our lettings index began,” Aneisha Beveridge, head of research at Hamptons, stated in an article discussing the monthly lettings report. “The annual increase will cost the average tenant who moves into a new home in Great Britain an additional £1,344 each year.

“While the number of rental homes coming onto the market rose for the fifth consecutive month, unlike in the sales market, demand from new renters remains up yearon-year, too.”

ONE IN SIX BTL PURCHASES IS MORTGAGE-FREE

The Hamptons report also showed that high mortgage rates have led to the majority of new buy-to-let purchases being funded by

cash rather than a mortgage. So far this year, 59 per cent of buy-to-let purchases have been mortgage free, the highest share in six years and up from 53 per cent in 2022.

The biggest shift has come in the southern areas of the country, where yields tend to be lower. A record 61 per cent of investor purchases in the four southern regions of London and the South East, South West, and East of England were made in cash, up from a low of 47 per cent in 2022. This is in contrast in the north of England, where cash purchases have fallen year-on-year, from 62 per cent in 2022 to 60 per cent in 2023.

Hamptons said that cash had become more popular in the lowest-yielding areas of the country to avoid failing lenders’ stress tests and to maintain landlord’s margins. It also estimated that the shift toward cash ownership would save new landlords across the UK around £61.9m in mortgage interest payments this year, based on the average mortgaged investor paying £187,110 for their buy-to-let and putting down a 25 per cent deposit.

“Against a backdrop of higher mortgage rates, investors are adapting,” Beveridge said. “So far this year, 12.1 per cent of homes sold in Great Britain were purchased by a buy-to-let landlord, the same level as in 2022. While existing investors are paying down debt, new investors, particularly those wanting to buy in the lowest-yielding parts of the country, are choosing cash to ensure the sums stack up. Overall, this is set to shrink the total mortgage bill for buy-tolet in 2023.

“The recent rise in cash purchases brings a close to landlords’ ability to access competitive mortgage deals. Sub-two-per-cent mortgage rates – available over the last few years – meant landlords who were able to buy homes outright chose instead to make the most of record-low rates.

“Many investors spread their cash as far as it could go by topping it up with low borrowing costs to maximise their returns. However, today, investors are having to dig deeper into their savings to ensure the sums stack up on any new buy-to-lets.” BTL I

www.mortgageintroducer.com MARCH 2023 BUY-TO-LET INTRODUCER 11 MARKET UPDATE

A better year

It was certainly an eventful 2022, but as we continue business into the year ahead, the outlook should become more constructive as the year evolves, inflation starts to fall, and investors start to anticipate rate cuts and higher growth.

However, as we entered 2023, high inflation, rising rates, and slowing growth expectations were hitting the headlines.

UK house prices may fall by nine per cent between the end of this year and the third quarter of 2024, says the Office for Budgetary Responsibility (OBR), which puts this down to “higher average mortgage rates” on the mortgage debt held by households. This data is included in its latest economic and fiscal outlook paper, which was published recently.

Whilst this drop may be disappointing for current homeowners, it offers an opportunity to landlords and property investors, notably from overseas, for whom UK property in a well-regulated jurisdiction is always an attractive proposition. As property prices fall, new landlords, in addition to first-time buyers, may find that affordable opportunities emerge.

Skipton has just surpassed the £1bn milestone in UK buy-to-let mortgages, with its main borrowers residing in Hong Kong and Singapore – proof indeed of the perception that the UK property market is still an excellent one for overseas and expat investors.

The OBR expects UK house prices to rise “slightly” faster than nominal incomes from 2025, putting this rate at 2.6 per cent a year, while the house-price-to-earnings ratio will come to seven.

The report also says that the average

interest rate on outstanding mortgages will peak at five per cent in the second half of 2024 and then retreat to 4.6 per cent by the forecast horizon – in this case, between 2027 and 2028.

The report explains that, due to the relatively large share of fixed-rate mortgages in the total (around 83 per cent in the second quarter of 2022 versus 51 per cent in 2007), higher rates on new mortgages will take time to feed through to higher average mortgage rates.

The impact on first-time buyers is more immediate, as the higher mortgage costs sit alongside spiralling inflation, which isn’t expected to start falling until the middle of next year. Their affordability will be affected, and it’s likely that many will need to lower their ambitions, as they’re unlikely to be able to borrow at the level they might have achieved 12 months ago.

12 BUY-TO-LET INTRODUCER MARCH 2023 www.mortgageintroducer.com

SKIPTON INTERNATIONAL FEATURE

Last year was one of the most challenging years in finance history. We asked Jim Coupe, MD of Guernsey-licensed bank Skipton International, for his thoughts on what 2023 could bring

The OBR expects UK house prices to rise “slightly” faster than nominal incomes from 2025, putting this rate at 2.6 per cent a year, while the house-price-to-earnings ratio will come to seven

Jim Coupe

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE. Minimum age 18 years. All mortgages are subject to status and valuation. All agreements with Skipton International are completed in Guernsey and governed by Guernsey law. Skipton International Limited (Skipton) requires a first charge on the property as security. To help maintain service and quality, telephone calls may be recorded and monitored. *Correct at the time of print. Application fees apply for Limited Company Mortgages. find out more at www.skiptoninternational.com For Intermediary introduced cases Skipton provides: No application fees on selected mortgage products* Attractive procuration fees Supports Limited Company (SPV) mortgages Dedicated point of contact UK Buy-To-Let Mortgages for non-UK residents

Private rented sector isn’t going anywhere

It may be a cliché, but for good reason: there are always (at least) two sides to every story. From a pair of kids in the playground arguing over who is right, to politicians quarrelling in parliament over policy, the fact that the very same set of circumstances can be perceived differently seems as old as history itself.

Take the buy-to-let market today. It’s undoubtedly a tougher environment for many landlords than it was 12 months ago. Mortgage costs have increased, while the cost of living, constantly exacerbated by the high rate of inflation, is making life harder for everyone.

The upshot is that many quarters report that landlords are looking to sell property, as they feel over-leveraged and are struggling to make a profit or even to fulfil their repayments.

Now, while there are certainly some landlords who are thinking of selling properties, there is another side to the story. In practice, at HTB we are seeing that demand for property remains as strong as ever. The reality is that we’re witnessing investors actively seeking to replace their loweryielding properties with properties from a different part of the property market that can deliver a more impressive yield. This can include looking at holiday lets and semicommercial properties. Other ways of increasing investment income include taking the step to turn larger singlelet homes into houses in multiple occupation (HMOs), or investing in upgrades that will increase appeal, and therefore rental yield.

London and the South East of England have become increasingly difficult areas in which to see a decent yield, especially on the back of new purchases. Instead, investors have been looking farther afield to areas such as the North East of England, where Hartlepool, Middlesbrough, and Sunderland were last year providing gross yields between 7.6 per cent and 7.8 per cent.

LISTENING TO THE MARKET

At HTB, we have spent the past few months in a dialogue with the broker community about the issues their investor clients are having with affordability, and consequently have looked at ways in which we could alleviate some of these issues.

We recently cut five-year fixed rates by up to 130 basis points (starting from 5.99 per cent), with our new two-year fixed rates starting from 5.69 per cent. We also listened to brokers over our bandings, and subsequently we’ve simplified our bandings into just three levels: £100k–£1m; £1m–£5m; and £5m-plus. Add to this the fact that since last year we have been prepared to lend up to £25m to a single investor, and our appetite to support brokers’ clients should be clear.

As a result of our desire to increase choice within the marketplace and to help alleviate affordability issues, we also recently announced an enhancement to our specialist investment loan proposition with the launch of two new specialist fiveyear fixed-rate buy-to-let and semicommercial products with differing early repayment charge (ERC) profiles.

ERC Plus and ERC Lite allow brokers to choose between the two products, depending on the client’s particular affordability requirements and rate preference, and are available in our Specialist BTL, HMO, and

MUFB range as well as our semicommercial offering at up to 75 per cent loan-to-value (LTV).

ERC Plus offers borrowers a lower rate, starting from 6.79 per cent, in exchange for an increase of one per cent in the typical ERC payable in any year for the life of the loan. The ERC Lite product is set at a higher rate, starting from 6.99 per cent, but with HTB’s existing ERC profile applicable. HTB’s ERC is currently four per cent in years one and two and three per cent in years three to five.

We introduced these products to support more borrowers in achieving the leverage they require to retain or expand their buy-to-let and mixeduse portfolios. We are offering choice, rather than forcing borrowers to go down one particular path. It’s not a tech-based innovation; rather, it’s a good, traditional product design, and something that has been well-received by brokers.

Despite all of the economic pressures bearing down on buy-to-let borrowers, the private rented sector isn’t going anywhere. Landlords have proved to be remarkably resilient over the years in the main, dealing successfully with attempts from chancellors such as George Osborne to put the squeeze on them. There are enough buy-to-let lenders in the market who are willing to listen to brokers and look for innovative ways to help landlords continue to make a living from providing good-quality rental properties; you just need to know where to look.

Yes, the market is more challenging for some – but others see opportunity, and that is where lenders such as HTB, offering options dependent on need and circumstance, prove their worth. There are two sides to the current story, and at HTB we’re helping clients choose the narrative with a happy ending. BTL I

14 BUY-TO-LET INTRODUCER MARCH 2023 www.mortgageintroducer.com HAMPSHIRE TRUST BANK FEATURE

Marcus Dussard sales director, specialist mortgages, Hampshire Trust Bank

Is buy-to-let still good to go?

It’s a highly competitive, multi-billion-pound sector, but a tumultuous economy and changing legislation governing the rental market have raised new questions about the future of buy-to-let. Mortgage Introducer’s expert panel debated the key issues facing the market for a special roundtable discussion. Simon Meadows reports.

The UK’s buy-to-let (BTL) market is huge –more than 211,000 buy-to-let mortgages were approved by UK lenders last year, around double the number of a decade ago, and accounting for 13.6 per cent of total mortgage lending. Furthermore, £8.5bn worth of BTL properties were purchased by landlords in Q1 2022, according to a recent study by the price comparison service and switching website Uswitch.com

It reports that the private rented sector is currently the UK’s second-largest housing tenure, consisting of approximately 4.5 million UK households (20 per cent of the total).

Buy-to-let mortgage advances were worth £41.8bn in 2022, estimated to represent around 2.74 million landlords in the UK, with the average landlord holding a portfolio of eight properties, generating a gross annual rental income of around £61,000 per property.

It’s estimated that the private rental market will have

to increase by 227,000 homes a year over the next decade in order to meet a demand for 1.8 million new households by 2032. Buy-to-let mortgage authorisations are expected to reach a peak of almost 250,000 by that date, according to Uswitch.

But despite the impressive figures – count the noughts – the buy-to-let market faces its challenges. Like other areas of the mortgage industry, it is navigating its way through the choppy waters of an unsettled economy and the notorious fallout of last autumn’s so-called mini budget.

Rising inflation and interest rates and hastily withdrawn mortgage products in the weeks after the mini budget spooked the market, while the tightening of legislation around the energy performance certificate (EPC) and letting property is an additional pressure for investors. On the flipside, the cost-of-living crisis and a lack of affordability for those struggling to get on to the property ladder could stimulate business in the rental

BUY-TO-LET INTRODUCER MARCH 2023 www.mortgageintroducer.com 16

BUY-TO-LET ROUND TABLE

market. All of these factors give landlords pause for thought. Do they hold tight or exit now?

To gain a better understanding of the buy-to-let sector and the current challenges it faces, Mortgage Introducer, in association with specialist lender United Trust Bank (UTB), brought together four highly knowledgeable industry professionals to discuss the key issues.

They were: Barry Luhmann, head of buy-tolet mortgages, UTB; Roger Hughes, business development manager, Skipton International; Marcus Dussard, sales director, Hampshire Trust Bank (HTB); and Samuel Whittlesea, mortgage and protection adviser, Whittlesea Mortgages.

Luhmann opened the discussion.

“UTB has been in the residential mortgage market for about eight years, and buy-to-let just under a year,” he began. “I think the important thing for us in launching our buy-to-let proposition was to, where possible, keep it aligned with what UTB Mortgages is known for.

“We’ll look at any kind of residential property, however quirky it might be, and any circumstances, so it can be low personal income, gifted deposits, credit history blips, that sort of thing. We’re in the specialist mortgage market, so, for buy-to-let, that means limited companies, houses in multiple occupation [HMOs], multiple unit blocks [MUBs], holiday lets, near commercial premises, and non-standard constructions.

“We try to keep things relatively simple. We have a standard range, a specialist range, and a non-standard range. So standard is your typical three-bed semi or a flat, including if it happens to be above what we’d probably call a quality commercial property.

“For specialist, we lend on small HMOs, small multiunit blocks, holiday lets, and flats above lower-quality commercial property, and then, for non-standard, it’s large HMOs and large MUBs, high-rise flats and those over almost any commercial premises – for example, we have lent on property such as basement flats, directly over late-night commercial premises, water tower conversions, that sort of thing. We hopefully have a product for everybody.”

Luhmann elaborated, “Expanding in BTL, we initially worked with some of the existing distributors on the UTB residential mortgage side who had expressed an interest in working with us. But now we’re open to all and are seeing many new brokers registering with us for buy-to-let, so we’re hopefully raising awareness with those for our residential side.

“We’re seeing huge demand for holiday let mortgages. You might think it would just be coastal properties, but there’s nothing that we won’t look at, as long as it’s a residential property and it’s plausible. It’s making sense of what the landlord is trying to achieve.”

He added, “BTL is one of the key growth areas for UTB. Despite what’s happened over the last few months, we’re back to where we were and carrying on along an upward trajectory. So we’re excited to be in this market.”

Introducing himself, Hughes explained that Skipton International was a regulated offshore bank based in Guernsey and a wholly owned subsidiary of Skipton Building Society.

“We started doing buy-to-let about nine years ago,” he shared. “Ninety per cent of our book is buy-to-let. We’re arranging unregulated products for either British expats living abroad or foreign nationals from an acceptable country, obviously also living outside of the UK. A lot of our business is broker-introduced. We’ve got brokers in places like Dubai, Hong Kong, and Singapore, which have got big expat communities.”

Hughes added, “I think criteria-wise and pricing-wise, our proposition does stand up very well, and we’ve seen that grow massively over the five years that I’ve been here. The book has probably doubled in that time. So we do feel there is a lot of business out there to be had.”

Dussard detailed how buy-to-let made up the lion’s share of HTB’s offering. It arranged specialist solutions for complex buy-to-let and semi-commercial property, he said, aimed at clients who were looking to expand, restructure, or diversify their portfolios.

“Our underwriters are able to use their expertise to look at each case on its merits, and obviously our BDM team is in place to do that also,” he explained. “Everything’s done on a case-by-case basis – it’s never a one-size-fits-all proposition. Everything that is done at HTB is tailored to the service and customer experience that we can give.

“We lend right across the specialist piece, so anything that would be deemed complex – limited companies, expats, on- and offshore trusts, foreign nationals, freehold MUBs of any size, portfolios of any size, holiday lets, short-term lets, Airbnb, and serviced accommodation – making sure that we find those solutions for complex scenarios that clients and brokers come across.”

Dussard continued, “We lend up to £25m, up to 75 per cent loan-to-value. HMOs can be any size, but all we ask is that on one block, we not lend more than £10m. Holiday lets are a massive area for us as well, and will remain so, with regard to the cost-of-living and people choosing to holiday here in the UK rather than go abroad.”

Giving a broker’s view in the discussion, Whittlesea set the scene for his business, sharing that it →

www.mortgageintroducer.com MARCH 2023 BUY-TO-LET INTRODUCER 17

BUY-TO-LET ROUND TABLE

“Landlords are now remortgaging, and are taking advantage of purchasing below asking prices”

BARRY LUHMANN

was a small general mortgage firm based in Bridgwater, Somerset.

“Buy-to-let probably accounts for 20 per cent of what we do, up from about 15 per cent a decade ago,” he estimated. “With the building of Hinkley Point power station nearby and its associated contractors, there has been an increased need for HMOs and the development, redevelopment, and repurposing of buildings, so it is a key part of our proposition that could expand considerably in future.

“Most of our buy-to-let clients are traditional landlords, tending to have one property. I guess you’d called them hobby landlords in the past.”

He added, “We do tend to deal with the core lenders the majority of the time. I actually prefer the trickier cases because it’s just more of a challenge compared to the everyday work. We’re growing as a business and looking to grow further, so I’d be interested in doing more specialist cases.”

The panel turned its attention to the current fortunes of the buy-to-let market, with Whittlesea identifying affordability as an issue.

“For our landlords, they’ve obviously had a quite significant increase in costs over the last few years, with taxation changes and interest rates going up,” he ventured. “Rental prices have gone through the roof. That is, partly, landlords trying to cover their costs, but I’d say it’s far more led by the market and the rising cost of property over the last few years since COVID. There has to be a sensible point at which the rents can’t go up anymore, because it’s pricing out normal people.

“It might be even harder for professional landlords in some respects when they’re looking at big numbers of properties that might be less profitable or not profitable for periods of times, whereas the hobbyists or amateur landlords might be able to sit out for a bit longer and just see what happens because they’re not so concerned

about short-term cash flow and are looking at longterm retirement income.”

He added, “For those middle landlords, the ones who are looking to try to make money in the shorter term with smaller or medium portfolios, they might be the hardest hit. But it’s an interesting time, for sure, with the cost of living and its impact on renters, and the impact that landlords are feeling from the cost of mortgages and taxation as well.”

For UTB, Luhmann pointed out that since the pandemic, demand for quality property had risen, and property prices had boomed by “at least 10 per cent,” while the affordability of residential, owner-occupied property was under pressure, too.

“So I don’t see demand for buy-to-let decreasing any time soon,” he reasoned. “Landlords who are highly geared, with standard residential mortgages, are going to be the ones who struggle in the future to remortgage on a pound-for-pound basis; the interest cover ratios [ICRs] will push those LTVs way down. Owners of loweryielding property are also going to find that difficult.

“The more specialist properties that we focus on are higher-yielding HMOs, MUBs, holiday lets, that all tend to have higher ICRs anyway, so even though they’ve come down, they’re still supporting what the landlord wants in terms of loan size.”

Luhmann acknowledged, “No one wants to pay a higher interest rate, but those deals are still going through relatively unscathed in terms of LTV. However, all of this is going to come through in rent inflation – it already is, and it will continue to do so.

“The bigger question is, how is that affordable for everyone in the current climate, with everything surrounding the cost of living? I think that now just comes down to the individual landlord in terms of how they wish to run their portfolio.

“Are they looking to just keep putting the rents up and perhaps getting in different tenants, or do they want to try to work with their existing tenants, and what sort of rent increase can they pass on that’s more palatable? It all comes back to interest rates as the current driver.” Hughes reflected on how Skipton International responded to the fallout from the mini budget.

“In September last year, when the Conservatives had their moment of madness, we stopped lending for about 10 days to two weeks, because nothing was floating on an ICR basis,” he recalled. “So I then started looking at a simple, top-slice model and things like that to see what we could do to try to help keep things going.

BUY-TO-LET INTRODUCER MARCH 2023 www.mortgageintroducer.com 18 BUY-TO-LET

“We are still seeing demand from the smaller landlords. We’ve still got a lot of clients with between one and five properties”

UTB MORTGAGES FOR INTERMEDIARIES UTB Buy-To Let Mortgages • No minimum income • No limit to property portfolio Register here and access our broker portal. ROUND TABLE

ROGER HUGHES

“A lot of our overseas clients, who are probably fairly cash-rich and want to do something with their cash, are saying to me now that they want to buy property. We’re competing against some fairly aggressive interest rates on deposit accounts, but we’ve been quite fortunate in that our pricing appears to be quite competitive for what we offer, in the niche that we serve, and it’s been really quite busy since around November.”

Meanwhile, Dussard said HTB preferred customers to have income outside of property. He believed the market would move toward investors “diversifying their portfolios, top-slicing, right across the piece.”

“You have to diversify away from your simple buyto-lets into other areas of the market to sustain your portfolios,” he observed. “It’s now time for lenders to come up with different solutions, so that the loansto-value do work. You’ve got lots of different levers that people are going to try to pull – it’s about trying to innovate, seeing what the competition’s doing, and making sure that we all sort of push forward to find solutions.

“The economy is where it is, this is where we are now, and the current level of interest rates is probably going to become the norm. It’s a very tricky market, but there are always opportunities out there for those who are in this for the long haul.”

Next, the panel assessed how the market would evolve throughout the year – was this the time of professional rather than so-called amateur landlords?

“We are still seeing demand from the smaller landlords,” remarked Hughes. “We’ve still got a lot of clients with between one and five property portfolios, and expats are now looking at limited-company borrowing as a tax advantage.

“In Q4 last year, we launched a very simple Special Purpose Vehicle [SPV] limited-company lending model, and it has really taken off well, particularly with people

who are living abroad. British expats, perhaps wanting to maximise their tax efficiency, are popping these properties into a straightforward property-holding company and borrowing under this structure.”

Dussard noted, “Buy-to-let landlords are a resilient bunch, but there is a breaking point, and with the tax and regulatory changes and the cost of living adding further turmoil for some, the amateur landlord might say, ‘Enough is enough, it’s now time for me to sell, cut my losses and get out of the market.’

“Lots of surveys are suggesting that this has been the case for a while now. As a country, we all aspire, I think, to have our own homes, and then maybe aspire to have a buy-to-let off the back of that, but that sort of model, with the tax changes, means that you don’t make anywhere near as much money as you did before.

“So I do think the amateur landlords are going to be exiting stage left, with the more professional landlords taking over and buying up those assets, particularly as it becomes more and more difficult for people to own their own homes.

“If you’ve got one or two properties and you’ve seen your profits eroding through the tax changes, unless you’re going to go out and buy more properties and really sink your teeth into it, then I would personally not hold onto them anymore. If I had five or six, I would keep on going.”

Luhmann said he hadn’t seen evidence of “thousands of landlords” exiting the market.

“I’m seeing more clients who are perhaps just happy with what they’ve got and with not growing,” he told the panel. “We probably need a new term for the growing number of people whom you wouldn’t call massively professional but who are no longer amateur because of their BTL experience.

“They’ve got this small portfolio that they’ve had for many, many years, and they’re just happy to keep it ticking along – it is their retirement fund rather than something that they’re trying to make money from every single month. We see a lot of self-employed people take this route.”

He continued, “Clearly, rates are still edging down slightly, but we’re at a level where borrowers are now remortgaging, and landlords are taking advantage of purchasing below price, saving chains that are breaking, or they’re working with estate agents to pick up property at better value. There’s certainly a lot more activity out there, but I don’t think we’re back to previous levels.”

In Whittlesea’s view, the cost of living meant →

www.mortgageintroducer.com MARCH 2023 BUY-TO-LET INTRODUCER 19 BUY-TO-LET

UTB MORTGAGES FOR INTERMEDIARIES UTB Buy-To Let Mortgages • Non-standard property accepted • HMO, MUB & Holiday Let Register here and access our broker portal. ROUND TABLE

“It’s a very tricky market, but there are always opportunities out there for those who are in this for the long haul” MARCUS DUSSARD

that people were going to have to be more realistic about how they lived.

“People who assumed they would rent whole houses are going to have to look at renting very small flats, potentially,” he said. “We’re going to have to be much more progressive, much more innovative, I think. HMOs could be the solution – quite a few of our landlords are consolidating their portfolios, getting rid of the properties that aren’t profitable, and replacing them with HMOs.

“There will have to be much more repurposing of buildings – whether that is using empty high street shops or the development of new buildings – to create those smaller, cheaper properties.

“Professional landlords are going to make a killing if they follow that route, because of the demand for and cost of renting. It is a really complex but interesting time, and a time of real opportunity for everyone involved in this market.”

The relationship between lenders and brokers in the buy-to-let market was next on the agenda – how important was it, and what could both do to enhance the relationship? Luhmann declared that it was imperative for UTB.

“We are a 100 per cent intermediary-led lender, so we live and die by the relationships we have with our broker community,” he noted. “We’re working with more and more brokers – there are new registrations into UTB every single day.

“So I would say to any broker looking at UTB, spend some time understanding our proposition and our submission requirements. Following the DIP process makes cases go through so much more smoothly, so that everybody has a better experience. Use our sales team, who are experienced working with new-to-UTB brokers and unusual propositions presented to them.

“We’re always looking at our portal, thinking, how can we make it more user-friendly? It is a relationship that we value immensely and want to continue working on, to help everybody in that chain.”

There was agreement from the owner of Whittlesea Mortgages, who shared that his firm talks to business development managers (BDMs) regularly, trying to understand how to best use their products for its clients’ benefit.

“There are some amazing BDMs out there, and we’ve got some really good relationships with them,” he enthused. “We need lenders to always communicate with us as best they can when things are difficult,

when things are changing rapidly, and to be there to support us.

“Over the last few years, we’ve seen some lenders fail at that, and it’s tended to be the smaller lenders who really stepped up, perhaps because they were small enough to be a bit more reactive and creative. Possibly they were a little bit hungrier as well to maintain relationships.”

Skipton International’s relationship with brokers is “massively important,” confirmed Hughes.

“Eighty-five per cent of our UK buy-to-let business is broker-led,” he said. “Communication is paramount, and it’s got to be a two-way process. You build a relationship with the broker by developing their trust, by not overpromising and not under-delivering, which I see so much and which, I know, drives brokers mad.

“If we can’t lend, saying no quickly is better than things being protracted and drawn out and wasting everybody’s time and efforts. So you only achieve communication, openness, and transparency by building the relationship.”

Hughes admitted, “I’m probably quite old-school. I quite like the hands-on approach. Pre-COVID, I was out on the road all of the time, meeting brokers in their offices, having a coffee, having a chat, shaking their hands, that sort of thing. We have to be a little bit more flexible and a little bit more diversified in how we operate now.”

Dussard also said that as a broker-led business, HTB viewed its relationship with the broker community as the “single most important relationship that we have.”

“I see the relationship as a partnership. We have just come out of one of the most intense periods for our relationship with brokers, with the mini budget coming into play and uncertainty over whether we could complete on certain deals.

“The key to it was communication – being open

BUY-TO-LET INTRODUCER MARCH 2023 www.mortgageintroducer.com 20 BUY-TO-LET

“It’s an interesting time ... with the cost of living and its impact on renters, and the impact that landlords are feeling from the cost of mortgages and taxation”

UTB MORTGAGES FOR INTERMEDIARIES UTB Buy-To Let Mortgages • Quick decisions • Flexible underwriting Register here and access our broker portal. ROUND TABLE

SAMUEL WHITTLESEA

and honest and making sure that we advised people of exactly what we were doing as a lender as quickly as possible. Some of it was very difficult because, to be honest, for the first two or three weeks we didn’t know, so it was really hard to communicate.”

Dussard added, “We’re all trying to work in the same direction, to get to the same result, which is a completion, because without deals completing, we don’t have a business either. Our BDMs and our underwriters have great relationships with brokers, and long may that continue.”

As the conversation drew to a close, our experts’ attention turned to the future of the buy-to-let market. They considered the implications of a proposed tightening of regulations surrounding the EPC.

Skipton International was already onboard with this, the panel heard.

“We’re embracing this now,” Hughes explained. “So we increased our EPC requirement last year, to say that we wanted a property to be an A to C rating – we’ll take a D as long as the potential rating is for a C or above. We had a lot of pushback from brokers and from clients directly, saying, ‘Why are you doing this?’

“If you find out now that a property is E-rated, putting it bluntly, it’s a substandard property. Where is that client going to go afterwards – what’s going to happen when they want to sell? Are they’re going to become victims of their own property and be locked into something that they can’t move, or is it going to be significantly down valued because of the EPC rating?”

He urged, “I think what we’ve got to do is try not to be complacent and try to just move with the change. When I first started doing mortgages, an EPC wasn’t even part of the conversation, but even for an old dinosaur like me, I’m still thinking that’s where we’ve got to go.”

Luhmann suggested that the majority of properties in the BTL marketplace were a D or E rating.

“So the big question that I would then add to this conversation is, how and when will these properties be improved?” suggested UTB’s head of buy-to-let mortgages. “Clearly, some may exit into the residential market, but I think it’s going to be a massively difficult task to improve these properties based on current government timescales.

“We’re already looking at labour shortages, so where are all the builders and tradesmen going to come from to improve all of the buy-to-let properties that are out there? Will there be grants, tax advantages –what’s the carrot and the stick to help the landlord community get there? I just don’t think it can be as blunt as, ‘Right, 2026, you can no longer let Ds & Es,’ without further support

“I do agree that this is the right direction, but the rental market is already under pressure with high demand for a limited number of properties, and there will always be quality issues. I think the last thing we need is this massive upheaval, with one outcome being a huge proportion of properties just tipped into the residential owneroccupied market. There is going to be more from this government, and the next government, to see how this genuinely plays out – with, ideally, the least disruption possible.”

Whittlesea broadly welcomed a move toward higher EPC ratings.

“Apart from the environmental benefit, I do think that improvements in quality of living for people are fantastic, especially with the current cost of energy,” he asserted.

“I think for a lot of landlords, though, the issue is nowhere near as big as has been suggested. A lot of the properties can be raised up to a C very cost-effectively. A lot of them are just a D – it might be that they have ineffective electric heating and that might cost a couple of thousand pounds to address, but we’re not talking a huge amount.

“Some properties are obviously going to need a lot more work in terms of insulation, gas central heating, more efficient boilers – and landlords may get rid of those properties They’ll get bought up by other investors or first-time buyers and others who just currently can’t secure properties. So I think in some ways it’s a win-win, but it’s certainly not going to happen by 2025 – let’s face it.”

Finally, Dussard welcomed the idea of tenants having better housing to rent.

“I think it’s brilliant,” he affirmed. “If you increase the level of the EPCs, that’s going to be a good thing for everyone. There are solutions that lenders are coming up with, where they reward those people whose properties have an A to C rating, or they’re offering ways of helping people improve their properties as well.” He concluded, “It’s good for the market.”

www.mortgageintroducer.com MARCH 2023 BUY-TO-LET INTRODUCER 21

BUY-TO-LET UTB MORTGAGES FOR INTERMEDIARIES UTB Buy-To Let Mortgages • Broker portal with access to: • Online DiPs, Document Upload & Case Tracking Register here and access our broker portal. ROUND TABLE

The future’s bright for buy-to-let professionals

If this is the case, it makes sense to consider specialist lenders, as they might have more flexible criteria. And, of course, it’s worth checking product transfer options.

WIDER CHALLENGES

Your clients will also be looking at the impact of this year’s CGT changes and waiting for updates on the proposals to tighten EPC standards – and the Renters Reform Bill is on the horizon as well.

This includes a myriad of proposed changes designed to protect tenants, from scrapping Section 21 notices to introducing a National Landlord Register. Regulation is part and parcel of operating in the private rented sector (PRS), but these changes could affect your clients.

Experienced landlords know only too well that change is constant in the private rented sector. New rules and regulations keep coming, there’ll be changes to the way landlords are taxed, and continued wider economic challenges are likely to affect the way they fund their property portfolios.

We know it’s all part and parcel of being a landlord, and, like every year, 2023 is delivering a diverse package of obstacles and hurdles. But professional landlords will navigate the changes and adapt their strategies to the suit the economic environment, as they always do.

HIGH DEMAND

There are still positive drivers supporting the wider private rented sector and strong fundamentals underpinning the buy-to-let market.

Demand for rental properties remains high and shows no signs of slowing down. Trade body Propertymark said the number of tenants looking to rent rose sharply in January, to 108 new applicants per letting branch, compared to just 64 in December.

They also noted a “mismatch in supply and demand,” with 11 prospective tenants registering for every available property in January.

High demand naturally feeds through to low void periods and increasing rents, and we’ve seen both in the last year. Average rents in England hit their highest-ever levels in the year to October 2022 at £800 a

month, according to the latest figures from the Office for National Statistics. This is up from an average £755 recorded between October 2020 and September 2021.

MORE PRODUCT CHOICE

Product availability bounced back quickly following the fallout from the mini budget.

The 2,000 buy-to-let mortgages available at the beginning of September 2022 plummeted to just 988 in October as lenders pulled mortgage products from the shelves, said Moneyfacts.

By the end of November, they’d already rebounded to 1,769, as lenders relaunched rates, and by March 2023 there were 2,400 products available.

While landlords have more choice, they are, of course, facing higher borrowing costs.

RISING COSTS

It’s no secret that buy-to-let rates rose significantly last year, meaning landlords looking to renew this year will be facing steep increases in their monthly repayments.

Based on average rates, those coming off a two- or five-year fixed deal will find the latest rates are more than two per cent higher, said Moneyfacts. It said the average two-year fixed buy-to-let rate was 5.81 per cent in March, compared to 3.05 per cent a year earlier.

This affect affordability, of course, and some of your clients could struggle to remortgage, particularly if they don’t have much wiggle room for increasing rent.

Aldermore conducts regular surveys and focus groups to make sure we understand the challenges landlords are facing and how they plan to overcome them. And we share those insights with broker partners.

SPECIALIST SUPPORT