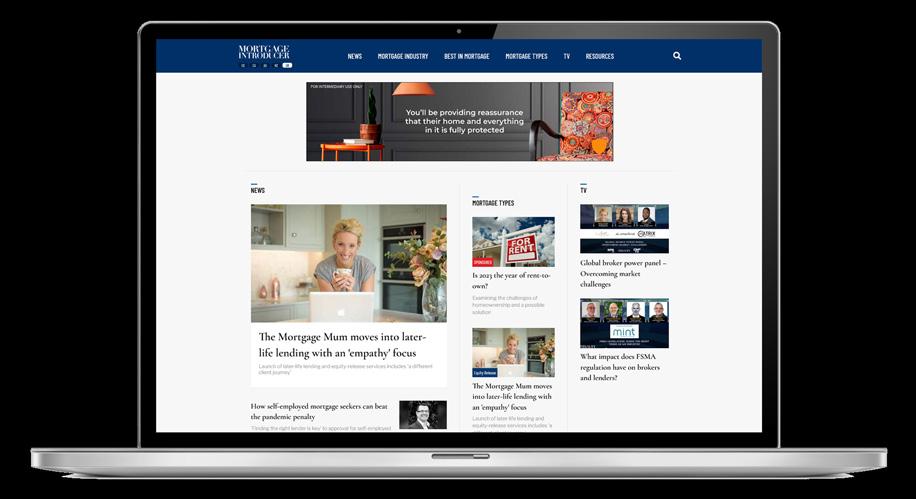

MORTGAGE INTRODUCER Champion of the Mortgage Professional www.mortgageintroducer.com January 2023 £5 STATE OF THE NATION A look at the year ahead MORTGAGE INTRODUCER AWARDS The night of nights for the mortgage industry

MORTGAGE INTRODUCER JANUARY 2023 www.mortgageintroducer.com We know that every case is different and whilst some lenders may not be able to help, we see the potential and cut through complexity. Our strength lies in our flexible common sense approach with a willingness to consider cases that fall outside of our standard criteria. Our underwriters individually assess each case enabling us to find tailored solutions for your buy to let and residential clients. The home of mortgage solutions andcr a fted pecialist BUY TO LET AND RESIDENTIAL MORTGAGES Flexi b le CRITERIA AND UNDERWRITING Individual CASE ASSESSMENT Empowered NATIONAL BDMs TO SUPPORT YOU andcr a fted Call us today on 01634 888260 or visit krfi.co.uk to find your BDM. FOR INTERMEDIARIES ONLY Information correct at time of print (20.01.2023)

Managing Editor

Paul Lucas paul.lucas@keymedia.com

Editor

Simon Meadows simon.meadows@keymedia.com

News Editor

Jake Carter jake.carter@keymedia.com

Commercial Director

Matt Bond matt.bond@keymedia.com

Advertising Sales Executive

Jordan Ashford jordan.ashford@keymedia.com

Campaign Coordinator

Raniella Alonzo raniella.alonzo@keymedia.com

Content Editors

Kel Pero, Christina Jelinek

Production Manager

Monica Lalisan

Production Coordinators Kat Guzman, Loiza Razon

Designers

Khaye Cortez, Allen Dela Paz

Head of Marketing

Robyn Ashman robyn.ashman@keymedia.com

Marketing Executive - Awards

Princess Capili

Forward thinking

Anew year always brings with it a sense of renewal – a seasonal permission, as it were, to look ahead, embrace the fresh twelve months that lie before us, and take the opportunity, if you wish, to move forward with a new resolve. All of this is good, fantastic, life-affirming stuff, and you’ll find no objections here to doing just that.

But it’s important to take stock, too, to get a true sense of where we are and how we’re performing, in readiness for whatever 2023 holds. This month’s Mortgage Introducer does just that, taking the temperature, if you like, of a profession that was truly tested by the economic turbulence of 2022, particularly in the final few months of the year.

“State of the Nation” has become a staple annual feature in the magazine. From the expert team at Just Mortgages, we get an excellent, first-hand appraisal of the industry, in the words of its brokers, delivering their rich insights from vantage points across the length and breadth of Britain.

They’re honest about some of the challenges they have faced, but inspiring, too, in their confidence in the market and their optimism about the business they will do in the coming year.

KM Business Information UK Ltd

Signature Tower 42, 25 Old Broad Street Tower 42, London EC2N 1HN www.keymedia.com

UK ∙ Canada ∙ Australia ∙ USA ∙ NZ ∙ Asia

Mortgage Introducer is part of an international family of B2B publications, websites, and events for the mortgage industry

CANADIAN MORTGAGE PROFESSIONAL cmpadvertise@keymedia.com

MORTGAGE PROFESSIONAL AMERICA mpaadvertise@keymedia.com

MORTGAGE PROFESSIONAL AUSTRALIA claire.tan@keymedia.com

AUSTRALIAN BROKER simon.kerslake@keymedia.com

NZ ADVISER alex.rumble@keymedia.com

Copyright is reserved throughout. No part of this publication can be reproduced in whole or part without the express permission of the editor. Contributions are invited, but copies of work should be kept, as the magazine can accept no responsibility for loss.

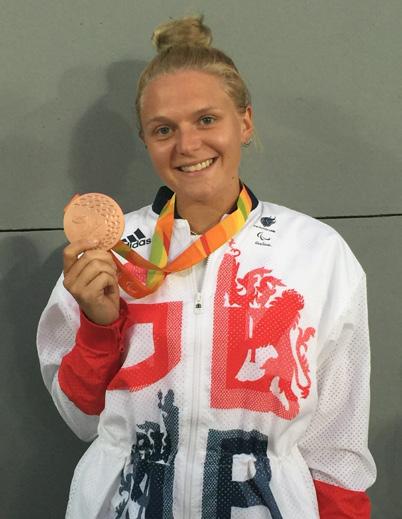

We also bring you extensive coverage of our coveted Mortgage Introducer Awards – an unapologetically celebratory night that shone a light on the brightest and best of the profession, recognising those who define the excellence that can be found at every level of the business, from rising stars to a long-established, lifetime achiever.

The glittering event in London showcased an industry in good heart, keen to acknowledge the successes of the past year and inspire others who wish to follow in the footsteps of the winners by attaining such illustrious accolades themselves.

To speak with the winners just moments after they picked up their awards was an absolute pleasure; their excitement and joy were palpable, and their enthusiasm for their work was infectious, with a positivity of the kind upon which great years are made.

Here’s hoping for more of the same in 2023.

Simon Meadows

www.mortgageintroducer.com JANUARY 2023 MORTGAGE INTRODUCER

COMMENT

EDITORIAL

1

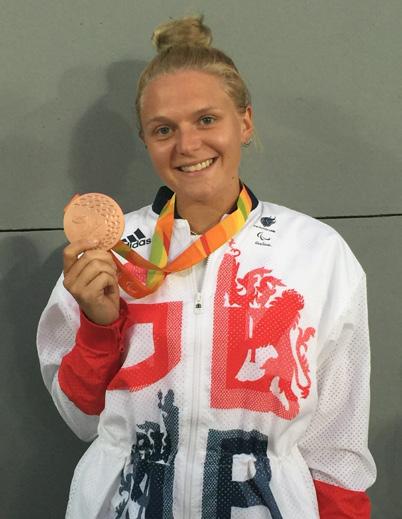

MORTGAGE INTRODUCER JANUARY 2023 www.mortgageintroducer.com WHAT’S INSIDE MAGAZINE Contents 4 Market review 9 Advice review 14 London review 15 Recruitment review 16 Technology review 20 Protection review 25 General Insurance review 28 Cover Feature: State of the Nation Brokers’ takes on what’s ahead 36 MI Awards Shining brightly 46 Jordanne Whiley From tennis to finance 48 Loan Introducer Talking to Specialist Finance Centre’s Daniel Yeo, and the latest from the second-charge market 52 Specialist Finance Introducer Spotlight on Ryan Brailsford of Pepper Money UK, and more on the buy-to-let specialist market 58 Bridging Introducer Experts’ predictions for 2023, spotlight on the Norton Group’s Sonny Gosai, and bridging market reviews 2 23 The MI Awards 36 Consumer duty 13 54 Housing supply still tight Looking up

The intermediary market will be in great demand this year

million fixed-rate mortgage deals were scheduled to end in 2023. The trade body also forecast that around £212bn of product transfers would take place over the course of 2023, compared with an estimated £197bn in 2022.

2023 is set to be an intriguing 12 months for the housing and mortgage markets, on the back of a year that saw many highs as well as a few lows.

Over the past few years, we’ve learned not to get too far ahead of ourselves, as circumstances and scenarios can turn in an instant. However, as a lender, we also have to be prepared – when and where possible – to adapt quickly to economic and market trends as they occur – although predicting the future is certainly not easy.

When it comes to a considered and highly valued approach to potential lending figures for the year ahead, there are strong barometers that we can tap into. In late 2022, UK Finance published its mortgage market forecast for 2023–2024, which anticipated a softening in the mortgage market and a return to prepandemic norms.

This outlined that overall mortgage lending was expected to fall 15 per cent in 2023, compared to 2022 figures. Breaking this down, purchase lending was predicted to drop by 23 per cent, due to cost-of-living pressures and rising interest rates, placing pressure on affordability, while new lending to buy-to-let landlords was projected to fall by 27 per cent.

UK Finance expected the number of property transactions to fall by 21 per cent in 2023 (from around 1.2 million in 2022 to 1 million this year). However, it did expect to see strong demand for refinancing, as around 1.8

Further data from IMLA has suggested that inflation will be a key factor in determining the UK mortgage market’s prospects over the next two years. IMLA’s New ‘Normal’ – Prospects for 2023 and 2024 report predicted that higher interest rates would result in gross mortgage lending falling to £265bn in 2023 and £250bn in 2024. Buy-to-let lending was also expected to fall to £47bn in 2023 as a tougher economy weighed on the market.

More positively, the report did suggest that, in some respects, the effects of the cost-of-living crisis on homeowners might not be as severe as expected. It predicted that the number of households in negative equity would only reach 16,000 by Q4 2024, with an average negative figure of £4,300 per household, despite many experts drawing comparisons between the current situation and the housing downturn of the 1990s, when up to 1.8 million households were in negative equity.

This was said to be due to a lower proportion of lending at high LTVs, rapid house price rises since the COVID-19 pandemic, and a greater uptake of capital repayment mortgages, meaning more borrowers had paid down their mortgage balance. These factors, combined with more rigorous lending criteria and enhanced lender forbearance, meant that actual possessions figures were expected to be less than half of those reported in 2009.

In terms of house prices, a number of predictions have emerged in recent times, ranging from an aggressive slump to a more subdued slide. The national view from Zoopla

was that UK house prices were likely to fall by five per cent in 2023. It also added that price falls in the more affordable markets were likely to be below average as the hit to buying power from higher mortgage rates would be less than in the highvalue markets. This was supported by the evidence of continued aboveaverage demand in more affordable urban areas. In addition, Rightmove projected that average asking prices would decline by two per cent, which meant prices would remain higher than they were after the incredibly busy home-moving period of 2021.

With mortgage rates steadily falling and encouraging signs of further stability from an overall economic perspective, it will be interesting to chart demand from first-time buyers and second-steppers in Q1 2023. High inflation levels and sustained cost-ofliving pressures will continue to affect an array of borrowers, and this will place an increased emphasis on the value of the advice process and the role played by the intermediary market.

This was evident in the aforementioned IMLA report, which outlined that the lion’s share of mortgage business in 2022 was conducted through intermediaries, with their share of distribution rising from 80 per cent to 84 per cent. IMLA expected this share of the market to grow to 90 per cent by 2024.

We have seen just how resilient and robust the UK housing and mortgage markets were in the latter part of 2022, and we are now in a new year that is likely to generate as many opportunities as it does challenges. This is especially apparent for an intermediary market, whose levels of experience and expertise will be so highly prized and in such great demand. M I

MORTGAGE INTRODUCER JANUARY 2023 www.mortgageintroducer.com 4

REVIEW MARKET

Martin Clift head of intermediary services & transformation, Barclays

How limited company lending can be expected to grow

cost of food. Homeowners are more concerned about rising energy prices (73 per cent) than those who don’t own their own homes (66 per cent).

In the wake of rising inflation and cost-of-living expenditure, it’s clear that many people are having to make important financial decisions and lifestyle choices.

For those who are harbouring homeownership aspirations, their ability to save for a deposit has become increasingly narrowed over the past six to twelve months, if not longer in some cases. A further avenue has also recently been closed in the form of the Help to Buy scheme, at least in England.

Thankfully, options do remain available through shared ownership, intergenerational lending, and additional government and lender-led initiatives. However, affordability remains one of the largest hurdles facing first-time buyers and second-steppers.

This was found to be the case in the latest property survey from the Building Societies Association (BSA), which highlighted that twothirds (66 per cent) of respondents cited the affordability of mortgage repayments as the biggest obstacle to buying a property. Over half (53 per cent) said concerns about raising a deposit were blocking them, while access to a large enough mortgage was reported to be the third-biggest barrier, selected by almost half (45 per cent) of respondents.

Focusing on affordability concerns among homeowners and renters over the next six months, 70 per cent are worried about rising energy prices and 63 per cent about the rising

When asked about affordability of monthly mortgage or rent payments over the next six months, the vast majority (87 per cent) of mortgage borrowers did not express concern about keeping up with their mortgage payments. Renters were less confident, with around a quarter (23 per cent) expressing concern about meeting their housing costs.

This heady combination of factors will inevitably place an even greater emphasis on the private rented sector (PRS) as a growing number of potential buyers are having to lower expectations or even postpone their homeownership plans, at least for now.

In light of some of the more immediate homeownership plans being scuppered, existing tenants may have to rent for longer. This will only add to already congested levels across the PRS as the next wave of renters emerges, putting further pressure on what is already limited rental housing stock. The result is likely to be a vicious circle leading to even stronger levels of demand, increased rents, and further affordability concerns.

On paper, at least, this may appear to be the perfect storm for landlords, as it offers the licence to increase yields and bolster their profit margins. However, it’s certainly not as simple as this. Many landlords have been hit hard in recent times due to helping tenants through the pandemic and increased regulatory and tax demands, and they have also been subject to a host of rising costs. They also rely on good tenants who can afford the rents that they impose, which leads us back to that vicious circle.

It’s no secret that many amateur or accidental landlords have sold properties due to some or all of the aforementioned issues. It’s also the case that all landlords are having to re-evaluate portfolios, diversify if necessary, and find ways to maximise individual and collective investments, a trend that will continue in 2023.

As such, it came as no surprise to see that 75 per cent of landlords operating in the UK have now used a limited company to invest in at least one of their investment properties. This was according to a poll from GetGround, which added that external market events are driving adoption of limited companies by landlords.

The data found that 93 per cent of landlords surveyed who incorporate their property investments said that if it were not for the limited company structure, their investments would be less profitable while mortgage rates remain high.

Meanwhile, 57 per cent of landlords say the limited personal liability is a key benefit of incorporation, protecting them against the higher risk of missed rental payments in the current costof-living crisis. The same percentage of landlords believe using limited companies to enable co-investment among multiple people is a second key advantage, creating a path around the not-insignificant cost of entering the investment market.

Limited company lending is an area that has grown steadily in recent years, and it’s reasonable to expect that adoption levels will continue to accelerate. This is an ongoing trend on which intermediaries need to be fully versed, as the emphasis will remain on professional and portfolio landlords in the BTL market through 2023 and beyond. M I

MORTGAGE INTRODUCER JANUARY 2023 www.mortgageintroducer.com 6

REVIEW MARKET

Cat Armstrong mortgage club director, Dynamo for Intermediaries

For the use of mortgage intermediaries and other professionals only. The information contained in this article is the property of Lloyds Banking Group plc and may not be reused or publicised without our prior permission. The information provided is intended to be for information only and is not intended to be relied upon. This information is correct as of November 2022 and is relevant to Halifax products and services only. If you do not have professional experience, you should not rely on the information contained in this communication. If you are a professional and you reproduce any par t of the information contained in this communication, to be used with or to advise private clients, you must ensure it conforms to the Financial Conduct Authority’s advising and selling rules. Halifax is a division of Bank of Scotland plc. Registered in Scotland No. SC327000. Registered Office: The Mound, Edinburgh EH1 1YZ. Bank of Scotland plc is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under registration number 169628. The harder it gets out there, the harder we try to make things easier. Find out more at halifax-intermediaries.co.uk

2023 is about staying true to our purpose

challenges first-time buyers now face.

For hundreds of thousands of would-be first-time buyers, the dream of homeownership may appear to be fading just a little bit more as each month passes. Eye-wateringly high energy bills and the significantly higher cost of food, clothes, and daily living have eliminated many first-time buyers’ ability to save further. Compounding this has been the rise in average mortgage rates, which inevitably puts pressure on affordability.

It’s a triple whammy, hurting the size of deposit and making monthly repayments almost unaffordable. Slowing house-price inflation offers moderate mollification, but homes remain extremely expensive compared to incomes. Those now unable to buy would be forgiven for feeling not just disappointed but seriously frustrated. For more than a decade, mortgage rates have been low, making it cheaper to buy than rent if you’re talking monthly outgoings. But, after more than 13 years, it’s easy to forget that it wasn’t always like this.

For first-time buyers in their 20s and even early 30s, it may be hard to believe that interest rates have been much higher than 5.75 per cent. The periods of high inflation and high mortgage rates happened well before they’d left school or university. Buyers will also have seen the Help to Buy scheme cease at the end of October, spelling the end of government support in keeping mortgage costs down. However, hope is not gone. The nature of the market has changed, and rapidly, yet there are ways around the new

As a building society that is powered by our purpose, helping people own their own homes is fundamental. We believe it’s vital that lenders like us not abandon those hoping to purchase property over the coming year, no matter how bleak the economic situation in which we find ourselves seems to be. Given the pressure on those saving for a deposit, our savings range is rewarding customers with much higher rates – going some way to counter the

supported buyers who couldn’t make use of Help to Buy because of the price caps imposed across England. The other huge advantage of the scheme is that, being industry-led, its support to low-deposit buyers cannot be withdrawn by government – a very reassuring consideration in the current fiscal situation – and we have maintained our commitment to those hoping to buy with lower deposits through Deposit Unlock.

effects of inflation. Yet we also recognise that saving tens of thousands of pounds or even more is simply not practical or possible for many first-time buyers –now more so than ever.

We’ve always been committed to supporting higher loan-to-value lending, and that remains the case today. Even before the Help to Buy scheme closed to new applications, we were the first lender to offer the Deposit Unlock scheme, and remain one of just three. Launched in collaboration with the Home Builders Federation and Gallagher Re, the scheme enables firsttime buyers and existing homeowners to purchase a new-build home for up to £750,000 with a five per cent deposit. The scheme has been hugely successful already, with around 75 per cent of the applications we’ve seen coming from first-time buyers.

Through it, we have also

We’ve also seen strong uptake on First Homes, the long-awaited scheme that allows first-time buyers to purchase a home at a minimum discount of 30 per cent and a maximum of 50 per cent – a benefit that stands with title. As affordability pressures endure, and quite possibly mount in the course of 2023, that discount is considerable. Although the scheme is reasonably restrictive on eligibility, there’s no doubt it is working to keep people in their local communities – even where house prices have risen. We also recently launched a range of standalone products to support the shared ownership market, enabling those on joint incomes up to £80,000 (£90,000 in London) to get onto or move up the property ladder.

In January last year, I wrote that the cost-of-living crisis would dominate throughout 2022. It has, but it has been much, much worse than anyone could have predicted then. 2023 is going to be just as tough – tougher, perhaps. But we will get through it, as we got through the credit crunch and its aftermath, and through the pandemic. As we begin another year, we must not lose sight of the things we can do amid those we can’t. There are far more reasons to be hopeful than it might seem. At Newcastle, our ongoing promise to help buyers realise their dreams of homeownership is just one of them. M I

MORTGAGE INTRODUCER JANUARY 2023 www.mortgageintroducer.com 8

REVIEW MARKET

Stuart Miller board member / chief customer officer, Newcastle Building Society

“In January last year, I wrote that the cost-ofliving crisis would dominate throughout 2022. It has, but it has been much, much worse than anyone could have predicted then”

Talking to clients about protection during the cost-of-living crisis

DUTY OF CARE

The rules contained in the new consumer duty include requirements to

act in good faith

avoid causing foreseeable harm

enable and support customers to pursue their financial objectives

Increases in mortgage interest rates, bills, and general household expenditure have placed many borrowers under pressure. Some will consider cancelling their protection cover; others will resist discussing their protection needs at all.

Nevertheless, as a mortgage adviser you have a responsibility to make sure that your customers are aware of the implications of any decisions they make. This duty of care to your customers, in the current cost-of-living crisis, is arguably greater than ever.

In a recent survey by Guardian Financial Services, 62 per cent of advisers said they believed that, as a result of the pandemic, there was still an increased willingness among customers to talk about protection. Conversely, however, 56 per cent expected the rising cost of living to reverse this trend.

This could be because so many consumers underestimated how long it would take them to run out of money if they lost their means of income. The latest Legal & General Deadline to Breadline report reveals that, on average, most think they could survive for 60 days. The true figure is just 19 days.

That discrepancy is a stark reminder of how much guidance customers need to fully understand the implications – for them and their families – of not having the right protection in place.

How can you meet these expectations if you don’t discuss protection with every single one of your customers? If you don’t, and something goes wrong, you may find yourself having to explain why you didn’t mention protection when discussing mortgages. And it’s not simply a case of sharing your knowledge with your customers; you’ll need every communication skill in your armoury to ask difficult questions

empathise, listen, and fully understand their needs

provide and explain solutions and your recommendations

WHY SOME CUSTOMERS MAY BE RELUCTANT TO PAY FOR PROTECTION

One of the key challenges when discussing personal protection – such as life assurance, critical illness, or income protection – is a perception that it’s an added expense. It’s not mandatory, whereas some luxuries, like subscriptions to streaming services, are often subject to contracts of 12 months or longer. So, many customers do not see these as optional outgoings, but may perceive protection cover as an additional expense.

The other reason customers may be reluctant to pay for protection products is they don’t receive anything tangible unless something goes wrong. And many customers don’t consider the probability, or even the possibility, that

something may go wrong for them.

There are also misconceptions about how the state will help people in times of financial need. Again, your role is to support and educate your customers. So, if your knowledge of state benefits has any gaps, it may be time to address them – and quickly.

Some people believe family will bail them out if they are in financial difficulty. But is this really the case?

ASKING THE RIGHT QUESTIONS

To get a complete picture of your customers’ circumstances, conduct a thorough fact-find to identify all their assets, liabilities, income, and outgoings. It is also a good opportunity to ask them which of their outgoings are contractually committed and which are optional.

Make sure you listen actively – repeat back to them what they say to ensure you have a clear understanding, maintain eye contact, and use positive body language.

Identify their aspirations, their priorities, and their concerns. Here it’s also important to recognise that their priorities are likely to be different from yours.

Building rapport with your customers in this way will make it easier to touch on the sensitive subjects. You need to ask them to consider their financial security, and what would happen to their mortgage payments, in worst-case scenarios. That means making them think about the possibilities that none of us wants to face – such as losing your livelihood, critical illness, and even death. It may feel like a big ask. But if you can empathise with your customers, you can guide them toward the right solutions for themselves and their families. That could be their lifeline in the years to come, and it’s one for which they’ll thank you. M I

www.mortgageintroducer.com JANUARY 2023 MORTGAGE INTRODUCER 9

REVIEW ADVICE

Gordon Reid business and development manager, The London Institute of Banking & Finance

The future for longer-term, fixed rates

12 months will be facing a serious financial hit. For some, that will be a debilitating blow that will leave them unable to afford their payments.

There are key moments for any industry, when the tide turns and everything you thought you knew suddenly needs a bit of a rethink.

For more than a decade, interest rates have been virtually non-existent. Getting a mortgage was a case of saving for a deposit; monthly payments were often lower for owners than for renters.

But things have turned upside down. Savers can find reasonable rates, particularly if they’re prepared to take a fixed-term bond (albeit as I write, rates have softened), so the new norm still has some way to go before we’re settled. So, while no one would suggest this is a windfall, first-time buyers stashing away as much as they can to build their deposit are being helped along by higher interest rates than have been seen in 10 years or more.

Borrowers, on the other hand, now face a much tougher challenge when it comes to affordability. Suddenly rates have gone from sub–one per cent to over six per cent. The effect on monthly mortgage payments is nauseating for anyone pushing their financial limits.

In fact, it takes homeownership off the table for huge numbers of people – even those who have their deposit in the bank.

The media frenzy that followed the former chancellor’s now-defunct mini budget fuelled rising panic among borrowers. But many commentators make a justified point: Anyone heading toward the end of their fixed rate and who needs to remortgage in the coming

Putting a pin in the question of affordability for a moment, I think we need to have a good think about what borrowers now think they want. Because, as all brokers know, what they think they want might not actually be what they really want –or need.

Moneyfacts published some figures on 17 October, when Jeremy Hunt was confirmed as Kwasi Kwarteng’s replacement. Markets reacted reasonably benignly that day. Nonetheless, forward-looking markets retained their cautious stance.

Swaps stayed high – inflation is a dead cert no matter who’s in Number 11– and the average two-year fixedrate mortgage, across all loan-tovalue brackets, hit 6.47 per cent. The average five-year fix was, by stark contrast, 6.29 per cent.

For years and years now, the message from experts, advisers, and the market in general has been that fixed rates mean certainty. Long-term fixed rates make less sense if you think interest rates will stay low or fall. Short-term fixed rates in a stable rate market are probably the optimum balance between certainty and flexibility.

Does that logic still stand in today’s market? Judging from the conversations I’ve been having with colleagues, advisers, investors, and friends, there has been a marked shift from two-year fix enquiries to five-year fixes and much longer. More recently, those enquiries have translated to applications and completions.

This reflects a number of things: people are terrified about energy bills, interest rates, and the undeniably higher cost of living, and they want at least something to be certain. It’s

human nature. When faced with the unknown, we try to make as much of it known as possible. It’s risk maagement. There will be clients for whom the certainty of a long-term fix is absolutely the right thing. For others, it may well be a very expensive mistake, should they have to repay early. Indeed, if the market is moving to longer-term fixes, then there is even more argument that these should be available without costly early repayment charges (ERCs).

If a ten-year fix is available without penalties, compared to a five-year fix, then it surely offers the best of both worlds: certainty of repayments over a longer period and flexibility to move house or pay off your mortgage early. ERCs become a cost of the product –that should be understood at the point of sale, if there is a likelihood that they may be paid because of life’s changes along the way.

Timing is also a considerable risk. Lock in for five years with ERCs, and who knows where we’ll be? Borrowers may need the security of a longer-term fix (and may enjoy greater affordability to boot), but they do not need the complete inflexibility that accompanies that decision if their circumstances change.

In just seven short months, the FCA’s consumer duty will be in play, and that means we all must be considering what good outcomes for our clients look like now. And if the past six months have taught us anything, it’s that things change at speed, and perhaps our original view of a good outcome needs to evolve.

As an industry, we need to make sure our rhetoric matches the real needs borrowers face in a market that has changed out of all recognition. We need to strike a new balance of lowest rate, certainty, flexibility, and affordability. M I

MORTGAGE INTRODUCER JANUARY 2023 www.mortgageintroducer.com 10

REVIEW ADVICE

Tim Hague MD, Sagis

For the next generation of home owners

Up to 95% LTV on New Build Houses

Joint Borrower, Sole Proprietor (with up to 4 applicants)

40-year mortgage terms available

Mortgages designed with first time buyers in mind.

Find out more at skipton-intermediaries.co.uk

For Intermediary Use Only

321112_09/01/23

Filling the energy-efficiency knowledge void

and most cost-effective ways to improve the energy efficiency of a property is to seal air leaks. Caulk can be used to seal gaps around windows and doors, and weatherstripping to seal gaps around door frames.

With increased complexity coursing through the homebuying journey, the green-mortgage market rapidly evolving, and energy efficiency rising to the forefront of homeowner and landlord agendas, an increasing number of clients are seeking additional support from a sustainability, economic, and environmental perspective.

Here at Countrywide Surveying Services (CSS), one of our main goals is to provide guidance and information to UK homeowners on the impact of the significant climate change challenge, with an aim of reducing emissions. With additional EPC-related legislation pending, energy efficiency is also high on the agenda for landlords. And let’s not forget the growing number of tenants who are focusing on how, where, and when energy-related savings can be made in such a challenging economic climate. This trend is making more and more landlords sit up and take note from a demand and longevity of tenancy perspective.

RETROFITTING

Clients can reduce their environmental impact and save money on energy costs today and in the future by retrofitting. However, this may seem like a daunting prospect for many, especially when it comes to understanding which practices and processes can make the biggest impact – not to mention the cost implications. Thankfully, there are some lower-cost options that advisers can share with homeowners and landlord clients.

1. Seal air leaks: One of the easiest

2. Replace light bulbs: Switching to LED light bulbs can significantly reduce energy consumption and save money on energy bills. LED bulbs are more expensive upfront, but they last longer and use less energy than traditional incandescent bulbs.

3. Install a programmable thermostat: A programmable thermostat offers the ability to better control heating and cooling systems when one is in and out of the property.

4. Insulate the hot water heater: Adding insulation to hot water heaters can reduce heat loss and improve the efficiency of the appliance. This is a relatively inexpensive and easy DIY project that can pay off handsomely in energy savings.

5. Use energy-efficient appliances: When it’s time to replace appliances like a refrigerator or washing machine, opt for Energy Star-certified models. These appliances are more energy efficient and can save money on energy costs over time.

By implementing these low-cost retrofits, homes can quickly become more energy efficient and reduce their carbon footprint – without breaking the bank.

If clients are thinking of investing more:

1. Insulating the home: Proper insulation can significantly reduce energy loss, improve energy

efficiency, and keep homes warm in the winter and cool in the summer.

2. Replace old windows: Replacing older windows with energyefficient windows can help reduce heat transfer and improve insulation.

3. Install low-flow fixtures: Lowflow showerheads and faucets can significantly reduce water usage and save money on water bills.

4. Go solar: Solar panels can provide an alternative source of energy for homes and help reduce reliance on fossil fuels. While the initial investment may be steep, solar panels can save money on energy costs in the long run.

5. Landscape for sustainability: People should consider adding native plants to landscaping, as they require less water and maintenance. Rainwater collection systems can also be installed to capture and reuse rainwater for irrigation.

With these retrofit measures, homeowners and landlords can make their properties more sustainable and efficient.

What’s our role in filling the energyefficiency knowledge void? In March 2021, we launched EnergyFact in partnership with Santander, which is designed to help homeowners assess and identify potential property improvements to enhance energy efficiency. The report does not require a surveyor’s visit and is generated through a new, dedicated online portal.

The energy report provides customers with suggested improvements, the cost of completing the work, and an estimate of resulting savings on energy bills. The report also suggests small changes customers can make to their lifestyles.

By raising awareness around these issues, advisers can contribute to the creation of a more sustainable and responsible future. M I

MORTGAGE INTRODUCER JANUARY 2023 www.mortgageintroducer.com 12

REVIEW ADVICE

Kharla Mullen chief operating officer, Countrywide Surveying Services

Looking beyond the headlines

tell the whole story when it comes to measuring local market conditions.

What does 2023 have in store for us? Rather than the roaring 20s of a century earlier, the UK is facing yet another year of financial frugality.

The Bank of England has made it clear we’re in for a two-year recession. Interest rates ended 2022 at 3.5 per cent, and we’ve got more hikes to go.

Even as higher rates begin to put a lid on inflation, it’s going to be painful. Considerable damage has already been done, and there are millions of people grappling with difficult circumstances.

But I am of the view that in the housing market, at least, we shouldn’t be quite as worried as some are suggesting.

When interest rates rise and the global economy is in the proverbial, people begin to murmur. Almost the first question when recession hits, especially in the UK, is, “Will there be a house price crash?”

Talk of a global property crash is getting louder, with a recent article in The Economist noting falls in nine rich economies.

America’s house-price inflation is coming off the boil, gently so far. Where the price of homes has risen insatiably, the falls have been more significant. At the time of writing, Canada’s house prices are down nine per cent since last February. Tighter monetary policy is putting pressure on borrower affordability around the world. As average prices come down, buyers demand hefty discounts and sellers are forced to accept lower offers.

Sounds bad, but you could argue that it’s really a load of rubbish. The dynamic does change in favour of buyers, but averages don’t always

What does matter in this equation is the affordability factor. As is obvious, the rising cost of living has, in just weeks, wiped out some people’s ability to buy. In January of last year, mortgage rates stood at 1.42 per cent and peaked in October at 5.93 per cent. This increase in rates saw the average buyer experience a 38 per cent fall in buying power over 2022, when a monthly payment of £852 in January meant a home worth £356,000, compared to £219,000 in October.

But, ultimately, there are two reasons not to be too gloomy about the outlook for our housing market: supply and demand.

Just as the oversupply of homes in a concentrated area pulls prices down, so the undersupply of appropriate homes supports values.

Supply has not only failed to meet the number of new homes required to house Britain’s growing population, but it has also failed to reflect the significant shift in the sort of homes that population needs.

From a builder’s point of view, developments with lots of five-bedroom executive homes and just the requisite percentage of affordable housing make the biggest profit. Ergo, more big homes, more expensive homes.

It’s contrary to the housing needs we have in the UK, however. Office for National Statistics data shows an estimated 28.1 million households in the UK in 2021, an increase of 6.3 per cent over the past 10 years.

Crucially, the number of people living alone in the UK has risen faster than this, up 8.3 per cent over the past 10 years.

It’s not a coincidence that in 2021, the proportion of one-person households ranged from 25.8 per cent in London to 36 per cent in Scotland.

House prices are almost out of reach for single households in the capital. Even with a substantial deposit, loan-

to-income ratios scaling 10 times are needed to secure a mortgage.

Where prices are less drastically out of sync with incomes, the proportion of those able to afford to buy on their own is much higher.

This tells us both where the market is broken (well, it tells us one of the places it’s broken) and why that will keep a floor under house prices.

Compared to demand, supply of the right type of homes is shrinking. It shows in the figures: in 2021, 3.6 million people aged 20 to 34 years were living at home with their parents. That is a whopping 28 per cent of people in this age group, an increase from 24 per cent a decade ago.

Until we address the inadequate housing mix across the country and match it to demand in the appropriate locations, prices will remain high relative to affordability. The only bit you need to be worried about is where that mix already matches. M I

www.mortgageintroducer.com JANUARY 2023 MORTGAGE INTRODUCER 13

REVIEW ADVICE

Steve Goodall MD, e.surv

Seeing the wood for the trees

Robin Johnson MD, KFH

Another year, another rollercoaster ride for house prices. In mid-December, Halifax published its November house price index, which showed that, true to form, London recorded the slowest rate of annual house-price growth of any UK region in 2022.

The capital saw the average house price rise by 5.2 per cent over the year to November, though let’s not be too despondent about it. At £549,160, London still has by far the most expensive average UK property price.

I do think it’s worth reminding ourselves that house price inflation of more than five per cent in a year, notwithstanding that rate being the slowest among all regions, is pretty extraordinary.

In a city where the average –average – house price has tipped over the half-million-pound mark, that is a very significant rise in value over just 12 months.

In its same report, Halifax said it was expecting an eight per cent drop in average house prices in 2023. They may prove right, but remember that few people purchase property with the intention of selling it again in the next 12 to 24 months.

Both homes and buy-to-let investment properties are bought and kept. And as any fund manager worth his or her salt (and complying with the Financial Conduct Authority rules) will tell you, the value of your investment can go down as well as up.

In the next breath you’ll hear the old adage that it’s not about timing the market; it’s about time in the market. Cliches they may be, but they’re

cliches for good reason. Capital values are wont to fluctuate, and property is no different. If you are buying to flip, an eight per cent drop in values might wipe out your investment case. If, on the other hand, you’re buying to live somewhere for the next five years and you can afford the mortgage, get on with it.

That’s even more pertinent when you consider what is going on in the private rented sector at the moment. It is a market very out of sorts. The concatenation of tax relief reform, energy efficiency standards, higher interest rates, and increasing pressure from institutional landlords has wrought havoc for private landlords over the past five years.

the average London asking rent rose to £2,343 per calendar month in Q3 2022, the biggest-ever annual jump at 16.1 per cent.

The property portal said there were now more new rental properties available everywhere in the country except London – but even so, tenant demand still greatly outweighs the number of homes available to rent.

Rightmove puts tenant demand up by a massive 20 per cent per cent compared with last year. By comparison, the number of properties available to rent is down nine per cent, setting competition among tenants at a record high.

What do all these numbers mean for London residential property? In brief:

1. Ultra-prime property values affect the averages, but demand in that market is totally irrelevant to the domestic housing market. Don’t pay any attention.

This has resulted in swathes of individual landlords selling up and exiting the market. The majority of homes sold have gone back into homeowners’ hands, thereby reducing the supply of privately rented homes available.

The effect on rent inflation has been extreme. Private rental prices paid by tenants across the UK increased by four per cent in the 12 months to November 2022, representing the largest annual percentage change since the Office for National Statistics data series began in January 2016.

In the 12 months to November, rents in London rose 3.5 per cent, up from an increase of three per cent in October 2022, the strongest annual percentage change in London since April 2016.

According to Rightmove figures,

2. Homeowners have struggled to save large enough deposits to purchase homes, and those hoping to buy solo were finding it nigh on impossible to secure a mortgage big enough even with a large deposit. That remains the case.

3. If you can’t buy, you work in the capital, and living at home with family is out, you’ll rent.

4. Smaller landlords are fed up with regulation and narrowing profit margins. They’re out. Supply is down and the commercial case for investing in London rental property has just become more compelling than it has been for some time.

We will hear much more over the coming months about the capital value of the homes we live in. We will hear much less about successes in this area because those are less newsworthy and, frankly, result in fewer click-throughs – for now. But understanding the real dynamics is important in a market driven by sentiment. M I

MORTGAGE INTRODUCER JANUARY 2023 www.mortgageintroducer.com 14

REVIEW LONDON

According to Rightmove figures, the average London asking rent rose to £2,343 per calendar month in Q3 2022, the biggest-ever annual jump at 16.1%

Set career goals rather than hoping you might “manifest” them

of what you want to achieve within a realistic timeframe, and is reinforced when there are milestones throughout the year to keep you focused.

The arrival of a new year sees many people wanting to improve aspects of their lives, and whilst the intentions are great, most people who start off working toward new goals and dreams end up living most of the year in the same way they’ve lived previous ones.

There have been billions of views of “#manifestation” content on TikTok and Instagram, which is the concept that one’s thoughts alone can bring about positive change. The idea that thought itself, honed and directed well enough, can have an impact on the physical world is not new; however, despite many insisting these methods have worked for them, there is little evidence of causation as opposed to correlation. Visualising and believing you can do something do increase the likelihood you will do that thing, but focussed application and effort are the more vital steps, in my opinion.

I’ve long advocated that everyone should have their own career plan, and in much the same way as with resolutions, this shouldn’t be something that comes without a set of actions and goals that you work toward. A lot of new-year resolutions fail because people don’t have a realistic plan to help them sustain their initial resolve. It’s always good to plan and prepare yourself for new challenges in your professional career, in both good times and bad.

A career goal is a specific statement

Think about what steps you can take to progress; a healthy way to develop yourself is to consider what skills and experience you would need to make your case for the next level-up in your own business. Identify potential pathways and then break them down into smaller actions. Taking this approach helps to focus your thoughts and build momentum. You will also be less likely to procrastinate because the steps will seem easier to attain.

What will you need to accomplish by the end of the next six months to progress toward achieving this goal? What actions should you challenge yourself to take within the next 30/60/90 days to move toward the goal? What are the most important skills you’ll need to develop to achieve this goal? How will you develop those skills?

Once you’ve asked yourself these questions and come up with some answers, it’s a good idea to talk to your line manager to hear their perspective. This will help you to validate and challenge your own perceptions and assumptions about the role dynamics to which you are aspiring and identify the gaps between what you’re doing now and what would be required in that enhanced role – and, moreover, to consider the actions you can take to get exposure in these areas and what allies and mentors might be essential to achieving that goal. This will be an important part of reinforcing and supporting your aims.

Whilst planning, consider the hurdles likely to get in your way, and have a plan for how you will navigate those. If

you do miss some of your milestones, instead of blaming yourself, try to look at your behaviour to figure out where the process is breaking down. Analysing why something hasn’t worked will provide evidence of how you respond to situations such that you can consider how you will manage them next time.

On your way to achieving your resolutions, your life goals, or your career plans, one of the tactics that can help is to have an added consequence. By sharing your goals with people who know you well, you build in a kind of accountability to that target that goes beyond selffulfilment to the realms of not being prepared to fail in front of others.

I trust people don’t confuse resolutions – and manifestations – with goals, and do not allow career goals to slip off the agenda just because the year is underway and the needs of the day job distract from the bigger-picture aims.

2023 starts with lots of uncertainty ahead, and the likelihood is that this will continue for a while. Change doesn’t mean it will be worse; it just means it will be different. With so much uncertainty about what tomorrow will bring, it is understandable that some may be feeling anxious about job security, which is completely natural, and in turn accentuates the importance of taking ownership of the aspects of your life that you can control.

It is never too early, or too late, to start mapping out your career objectives. Setting goals is crucial because it gives you a framework within which to achieve milestones, identify the steps required, monitor progress, and record outcomes.

Remember, dreaming of a destination feels good – but it’s goal-setting that provides a path for you to get there. M I

www.mortgageintroducer.com JANUARY 2023 MORTGAGE INTRODUCER 15

REVIEW RECRUITMENT

Pete Gwilliam owner, Virtus Search

The 2023 green agenda has not gone away

lenders have been forced to deal with mounting regulatory requirements to treat customers fairly and, in just months, to evidence a duty of care to consumers.

In 2021, the year the UK hosted the COP26 climate change negotiations in Glasgow, politicians and the media were dominated by net-zero policy and the ESG agenda. Environment was all. Teenage climate activist Greta Thunberg and US president Joe Biden were descending on Britain with great and complicated expectations.

Former Bank of England governor Mark Carney was deep in the development of climate-related financial disclosures along with his global taskforce. Carbon-credit markets were top of the economic agenda, and almost the whole of the financial services industry was focused on how to lead the climate-change clampdown.

It wasn’t until April last year, however, that many of the policy recommendations and statements were implemented. Taskforce on Climate-Related Financial Disclosures (TCFD) reporting was mandated for more than 1,300 firms in the UK on 6 April 2022, including the largest listed companies, biggest private firms, and banks and insurers.

How this disclosure reporting has fared over the past nine months has been largely swept aside by the mainstream media, which instead focused on the financial trials faced by millions of people across the country.

Nevertheless, climate change and the UK’s commitment to reduce the country’s carbon emissions to net-zero by 2050 are enshrined in law, as are the intermediate target deadlines.

Compliance teams for mortgage

Preparation for forbearance as the economic environment worsened has taken priority since the end of Q2 2022, rightly. But that has not precluded the legal responsibility to deliver against environmental targets along with social and governancerelated standards.

Late last year, the Green Finance Institute, along with the climate think tank E3G and input from Santander, NatWest, and Nationwide, laid out what the newly installed prime minister Rishi Sunak must do to ensure lenders can deliver against net-zero targets.

The Climate Change Committee estimates it will cost around £360bn to ensure all homes and buildings are in line with legally binding net-zero obligations by 2050. That is on a similar scale as the eye-watering cost of support packages throughout the pandemic.

Among those recommendations was introducing an energy-saving stamp duty, with a tax rebate available for homeowners who retrofit their property within two years of purchase.

The challenge of helping borrowers and, indeed, other bank and buildingsociety customers to embrace and invest in improving their own energy efficiency cannot be overestimated. Yet it’s a challenge to which we must rise.

But it is not lost on anyone – and our recent Mortgage Efficiency Survey underlined this – that along with that considerable responsibility comes the legally mandated need for lenders themselves to improve their own energy efficiency.

In 2015 the Financial Stability Board outlined the TCFD rules with the aim of helping companies –including many UK mortgage lenders

– to demonstrate their impact on climate change.

This impact covers the use of product design to encourage positive customer behaviour, as well as reducing their own physical carbon footprint and their commercial partnerships’ and investment decisions’ impact on the environment.

Though ESG (Environmental, Social, Governance) reports have been abundant over the past 12 months, evidence of practical action to cut carbon emissions has been relatively thin.

In terms of lenders’ own footprint there are some obvious “hygiene” factors that can help.

Building a new office with greywater recycling, air-source heat pumps, and a carbon-neutral supply chain, in spite of the cost, is almost easier than retrofitting existing inefficient commercial premises.

But it is the carbon impact of running IT hardware and servers, along with heating and cooling buildings, that has the biggest effect.

There is not one simple, single solution when it comes to managing your carbon footprint. In fact, the more you think about it, the more the complexity of that task resembles a giant squid.

You know what they say when it comes to solving problems this big? Don’t try to do it all at once. Don’t even try to plan the end result at once.

Take each step one at a time.

It’s good advice. And given that running IT systems is such a huge part of the problem, targeting that by switching from server-based proprietorial systems to cloud-based software as a service is a relatively easy and meaningful first step –especially when such a step can offer operational benefits and agility that go beyond current platforms. M I

MORTGAGE INTRODUCER JANUARY 2023 www.mortgageintroducer.com 16

REVIEW

Steve Carruthers business development director, Iress

TECHNOLOGY

How tech offerings can help deliver the best advice and service standards

for 41 years (11.1 per cent in November)

A record-low number of available products in September (7,356) – down 58 per cent from 17,392 products in January

It’s never a bad thing to turn back time, to review our thought processes when heading into any new year. I’m sure I’m not the only one, but, at the turn of 2022, I was simply hoping for a little bit of stability throughout the mortgage market and, dare I say, a return to some kind of normality – although, in reality, it’s getting increasingly difficult to understand what normality really is.

As we now know, this didn’t quite materialise. Early in the year, we saw Russia invade Ukraine, which sent shockwaves through the world and started a domino effect of economic factors that have subsequently affected household finances and business sectors across the UK, in many different ways. That’s in no way downplaying the catastrophic suffering of Ukraine as a nation and its people; it’s simply outlining some of the impact beyond its borders.

I could go on, but, focusing on the intermediary market, Coventry Building Society recently offered some insight that sums up some of the many challenges that faced advisers over the course of 2022 better than I could.

During the course of the year, advisers have had to deal with:

Eight base-rate increases

Four fiscal events

Three prime ministers

Four chancellors

Five housing ministers

The highest level of inflation

A record low of 17 days for average product shelf-life in September

Record-breaking days for mortgage searches in September

Record-breaking days for number of broker interactions in August and September

Time and time again, brokers have risen to the many challenges facing them – but there are factors on this list that any business would struggle to combat or cope with, and the intermediary mortgage market is certainly no different. I mean, the first five alone, in the form of eight base-rate increases, four fiscal events, three prime ministers, four chancellors and five housing ministers, make for some astounding reading in their own right – and a pretty horrendous partial reworking of the “Twelve Days of Christmas,” for that matter!

Moving away from influencing factors that are beyond brokers’ control, the focus should be on what they can control as we move into 2023. I’m sure that if you asked individual brokers what they learned over the course of 2022, you would be likely to generate a host of different responses. However, if you were to ask them to name their top five, then it’s fair to say that the influence and importance of technology – in a variety of forms – would feature prominently across the board.

Looking beyond the past 12 months, there has undoubtedly

been an increased emphasis across the mortgage market on a range of systems, applications, and tools to help lenders and brokers better control the controllable elements within the mortgage journey. This is apparent for senior management teams, BDMs, underwriters, advisers, and administrative assistants alike.

As the economic landscape becomes ever more complex, so, too, does reliance on the advice process, and this also has a knock-on effect on the front- and back-office support required to generate the right type of solutions at the right time in the most effective and efficient manner possible. When taking into account the final four factors on the list – a record low number of available products in September (7,356, down 58 per cent from 17,392 products in January); a record low of 17 days for average product shelf-life in September; record-breaking days for mortgage searches in September; and record-breaking days for the number of broker interactions in August and September – then it’s little wonder that increased emphasis is being placed on a variety of tech offerings to deliver the best advice and service standards possible.

The pace of change, from a tech perspective, will not stop. This means that intermediary firms need to be constantly asking questions of their existing tech to ensure that they are not getting left behind and to ensure that they have access to the most effective systems for their business from an efficiency and cost perspective. This is something that intermediary firms of all sizes should be striving for in 2023. M I

www.mortgageintroducer.com JANUARY 2023 MORTGAGE INTRODUCER 17

REVIEW TECHNOLOGY

Neal Jannels MD, One Mortgage System (OMS)

Joined-up thinking and doing is the only way to deliver value

If the last year taught us anything, it was the importance of joining up things. Whether in thinking or decision-making, a wilful disregard for the interconnectivity of things led, in one infamous example, to a neardisaster in financial markets that the UK is still working through.

With joined-up thinking comes a need for greater interoperability. Decoupling is very much in fashion in many areas of thought, but the pandemic showed us that cloud-based interoperable solutions were not only available, but they were also capable of being swiftly implemented. These now offer even more opportunities to scale and build quickly, at low-risk, new APIs (application programming interfaces), improved interoperability, and better interconnectivity than old infrastructure can ever deliver.

Moving data around is putting pressure on legacy systems. Bandwidth, or the size of the pipe required to move data among the many parties in the value chain, is a real obstacle in some instances. And yet the need to access, interpret, and analyse data is more pressing than ever.

Lenders and valuers are acutely aware of the increased value of data in mortgage valuations, and, consequently, their underwriting decisions. And the need to understand new types of data input and its value is increasing – not decreasing. Whether we are assessing the portfolios of landlords or deciding upon lending to residential homeowners, different data points about property are informing decisions.

And then, where the data is unknown, another set of decisions and inputs may be required. Properties without an energy performance certificate, for example, refinanced on a product transfer basis, present a wholly unknown risk. There are around 11 million of those in England and Wales; that’s a lot of unknown risk. Algorithms and other data points to deliver benchmark scoring will be required – and much of it will demand effective interoperability with external data sources.

Some of this, of course, already goes on, but the manner in which it is done is not always the most efficient. In my recent conversations with valuers and lenders, there is a common call for a one-stop shop in future for much of this work.

Part of the reason for this onestop-shop approach, of course, is that property, and more pertinently the data around property, is always changing. Assessing energy-efficiency risk is just one of the challenges lenders and valuers face when it comes to climate change. Property in coastal locations or flood plains is flagged for geographical risks; now that we have experienced a summer with temperatures above 40 degrees in Britain, and winter temperatures falling below -10 Celsius in the south of England, climate change risk looks rather more complex.

So interoperability and interconnectivity require an infrastructure to deliver these things efficiently. You won’t be surprised to know our buy-to-let hub and lender hub are doing just that for many lenders. They offer a new, fit-forpurpose infrastructure that connects the mortgage value chain with data providers through APIs. The output is that it streamlines mortgage lending operations and improves the process of making sound risk decisions.

As part of that journey, we learned

through building our buy-to-let hub the importance of regulatory change to the decision-making process, and built a solution that not only speeds up the underwriting process but also significantly reduces the administrative burden on brokers when submitting buy-to-let portfolios to lenders. Infrastructure that works delivers for multiple parties in the value chain.

We can see it coming again in the form of consumer duty legislation, which will require more data points in due course to evidence good outcomes. Much of this will be internal, but some of that decisionmaking will require interactivity with other datasets. Property prices, affordability, and borrowers’ personal credit circumstances will all influence a decision to lend.

Access to these datasets relies on good-quality inputs and better-quality infrastructure to carry the breadth and depth of data that good lending decisions demand. In the world of valuations, value judgements for the UK housing market cannot in many cases be distilled into an algorithmic binary judgement. But the joining up of data and processing can support and inform the rapid scaling of lower-risk decisions. All methodologies can use a lot of data, but must support the most appropriate decision-making process for the risk under consideration.

Some elements will be climaterelated, location-related, and comparable, and database analytics will usually be the most appropriate for those assessments. But others will need a more nuanced blend. Whatever the process, the data underlying the ultimate decision needs to be accessed and processed, interpreted, and understood quickly and reliably if the customer outcome is to offer lenders and borrowers proper value. M I

MORTGAGE INTRODUCER JANUARY 2023 www.mortgageintroducer.com 18

REVIEW TECHNOLOGY

Mark Blackwell COO, CoreLogic

Building societies lead the way

Jerry Mulle MD, Ohpen

Iknow this year cannot be considered in isolation from the economic hardship we currently face, but, purely from an industry context, there is a lot to be hopeful about.

As we have seen in recent times, with change (unexpected or otherwise) comes opportunity, and the current environment presents huge opportunity for lenders of all sizes.

Ten or 20 years ago, the immediate implication of the word “opportunity” would have been the chance to make money.

Today, I think, opportunity, particularly from the point of view of a lending platform, addresses a broader agenda. The social impact of lenders is now a factor that singles them out for investors and customers alike. How they conduct their business attracts a lot of scrutiny.

Building societies, of course, have always been concerned about their roles in their communities and society at large, with net interest margins always at a minimum in favour of reinvestment and returns for the customer.

2022 has seen a seismic shift in the momentum of societies embracing technological change as a result of the lessons of the pandemic. Technology proved the point that almost everyone can access innovation quickly if they choose to do so.

But if the pandemic was a driver for thinking again, then the economic and regulatory environments of UK mortgage lending have underlined and added urgency to the need to operate on agile, robust platforms that can scale change affordably – benefits hitting home with CIOs across the lending spectrum, but in particular within the

building society community.

Lenders generally, and, from our experience, societies in particular, are realising that re-platforming offers new opportunities to operate and innovate quickly, securely, and affordably.

Relentless repricing of mortgage products has been an unceasing reality for more than a year now, and lenders have been forced to find more flexible ways to deliver a quick turnaround or else face a severe impact on lending targets, service standards, and margins.

The past year has seen the Bank of England hike the base rate at every meeting of the Monetary Policy Committee. In the face of out-ofcontrol inflation, central bankers have cracked down hard on cheap money, forcing businesses and individuals to rethink indiscriminate borrowing.

Kwasi Kwarteng’s now-infamous mini budget showed the need for serious speed when it comes to repricing. That single event showed just how critical flexibility is within systems, funding, and processes. In an industry where margins are invariably tight, responding quickly to market changes is paramount.

But the need for process change is apparent elsewhere, too. Treating customers fairly has been paramount in the mortgage market for almost two decades now, while forbearance when borrowers are under financial duress has been the overwhelming approach since the financial crash in 2008–2009.

At the end of June this year, a further

regulatory standard will strengthen that commitment to ensure customers are not exploited for the financial gain of companies, originators ,or any intermediary.

In practice, I am genuinely of the view that the incoming consumer duty rules from the Financial Conduct Authority will be hugely beneficial for customers in our market.

I believe it won’t radically change how the majority of lenders, and certainly building societies, will conduct their business. However, it will – I think – change the market insofar as the compliance and evidence requirements of good practice will change.

Processes will need to be more rigorous. The reasoning behind decisions will need to adhere to identifiable standards.

We often talk of systems of record in terms of platform technology, and the nature of those recorded details will grow and change as we develop the evidence base.

The bigger challenge, then, is delivery – managing the cost of system updates, capability investments, and staff training. It’s an enormous job.

And lenders have just six months to meet that challenge. Those who embrace the change with an open mind will find they create not only a better customer experience but also a stickier commercial relationship.

In a few months, we will be joining members of the Building Societies Association at their annual conference. We’ve seen increasing momentum in the mutual sector over the past year when it comes to embracing a new approach to technology, systems, and service. These recent motivations of market and regulatory change will get a lot of focus.

The mutual moral compass has meant we have seen a lot of interest and momentum this last year for rethinking how societies choose to platform their lending.

This year that will continue. It is customers who will benefit. M I

www.mortgageintroducer.com JANUARY 2023 MORTGAGE INTRODUCER 19 REVIEW TECHNOLOGY

The past year has seen the Bank of England hike the base rate at every meeting of the Monetary Policy Committee. In the face of out-of-control inflation, central bankers have cracked down hard on cheap money

2023 is looking good for protection sales opportunities

that have emerged since the original mortgage was taken out.

First, a Happy New Year to all readers of Mortgage Introducer, and of this column in particular. And, as it is focused on protection, I would definitely say there are plenty of reasons to be positive for the year ahead.

The much-talked-about consumer duty will be implemented this year, and for those who follow my articles, you should be fully aware of what is required.

I’ve mentioned consumer duty plenty of times in recent months, and we at Paradigm Protect will continue to give free advice to firms via our website and other means regarding what the regulator requires of us all. I will therefore not duplicate those messages here.

What I will say is that, predominantly, the basic sales processes will not change dramatically. In the Factfinding, research, and suitability models all advisers follow, there will be many chances to spot protection opportunities, regardless of implementation in July 2023 – with, however, the need to focus a little more on those opportunities to “avoid foreseeable harm.”

In the mortgage market, according to those in the know, we will see more product transfer (PT) and remortgage activity and less purchase activity, both residential and particularly buy-to-let.

If PTs follow the path that many expect, then that could have a negative impact on intermediary income. Yet, as advisers Factfind clients to ascertain whether a more suitable product than a PT can be found, they will also be able to gauge any changes in client lifestyle

In today’s ever-changing world, it is unlikely clients will not have had any changes whatsoever happen within a two-, three-, or five-year time span. Focusing on health alone, according to official statistics, over a quarter of the population has suffered some sort of stress and anxiety during that period.

This can highlight the value that modern life policies can offer in terms of added-value services – services such as GP and mental health support for them and their families.

Let us not forget that some minimum premiums start at just £5 per month and offer an amazing array of support services free of charge to policyholders – costing far less than the value of the services themselves, regardless of the cover selected.

Talking of diving a little deeper into Factfinds, one of the growth areas yet again for Paradigm in 2022 was in the area of group risk. Forget the traditional perception of group business being for hundreds of lives. You can start a policy from as few as two lives with Paradigm (under certain conditions), and definitely with a minimum of three.

As well as the underwriting benefits of these policies (effectively none up to £600k life cover), the benefits of actually having a scheme in place in today’s very “full employment” scenario can be the difference between recruiting a candidate or not, especially in those industries where the recruitment pools are limited.

Taking the limited time to explain this to clients who own SMEs, information on which is readily available in a Factfind, may deliver value back to you as an adviser far beyond the income generated.

In the same way, it would be wise to look at healthcare; providing private medical benefits to an employee will

definitely be seen as a tangible employee perk, and we have seen the rise in requests for PMI agencies for both individual and group in 2022 and expect this to continue in 2023.

For those not comfortable in writing this business themselves, we provide signposting opportunities for our firms to ensure clients receive the best of advice in an area that can be seen as somewhat complex.

Probably the biggest area of percentage growth in 2022 was income protection. Clients are now, for good reason, more acutely aware of their financial vulnerability than ever before, and as cost-of-living increases continue to bite further into any savings that they have, it is likely to make those savings even more inadequate than they were.

Legal & General’s Deadline to Breadline report came out again later in 2022 and showed worrying signs of consumers not knowing how much time they would have before their bank accounts were running on empty.

With the tightening of access to both secured and unsecured credit, it is hardly surprising to see more and more opt for income protection to cover at least mortgage payments, and this trend will no doubt continue in 2023, especially with the need for firms to steer clear of inducing avoidable financial harm for customers.

What 2022 taught us more than ever, however, was to expect the unexpected and focus on what is within the realm of your own control.

Political uncertainty affected our market more in 2022 than probably any time in the past decade or more. All markets have felt the backlash of what has happened in the UK.

Focusing on what you can control has never been more important to a business’s commercial revenue. I wish you all the best as you offer quality protection advice in 2023. M I

MORTGAGE INTRODUCER JANUARY 2023 www.mortgageintroducer.com 20 REVIEW PROTECTION

Mike Allison head of protection, Paradigm Mortgage Services

The champion of the mortgage professional, covering the latest news and updates within the world of mortgage management

• Interviews with the biggest names in the industry

• Best-practice profiles and case studies

• Special reports and industry rankings

• Business strategy content

www.mpamag.com/uk

SCAN TO LEARN MORE

The importance of reviewing clients’ plans

events. Naturally, a review meeting or Zoom/telephone call can highlight changes and allow for a situation update.

GENERATING NEW BUSINESS

Reviewing clients’ plans has always been an important and potentially rewarding aspect of adviser life, and this is now coming into greater focus with the imminent consumer duty requirements.

Rather than considering this an onerous task, advisers would benefit from embracing what is, after all, an opportunity to obtain new business and highlight the benefits of advice to their clients.

Clients’ circumstances are always changing – moving house, having children, receiving an inheritance, etc. Often an adviser will not be aware of these changes, as many clients fail to realise the full financial impact of these

One reason a review may generate new business is a matter I have touched on before – the disparity between the outstanding sum within a mortgage protection plan and the actual mortgage balance. This frequently enables an adviser to offer cheaper life insurance or cheaper identical or superior critical illness coverage to mortgage-holders. If we look back at the last 14 years, we can see that average two- and fiveyear fixed interest rates have hovered between 1.45 per cent and 4.7 per cent. During this same period, many decreasing term plans used 10 per cent as a default policy rate, with some enabling a choice of policy rate up to 15 per cent or even 18 per cent.

The table below highlights how this rate differential affects a £100,000 25year repayment mortgage.

When looking at a critical illness plan, there is the added benefit that today’s plans are generally superior to those of five, 10, or 15 years ago

Anybody fortunate enough to have averaged three per cent on their mortgage whilst holding a policy with an inbuilt 10 per cent rate is prime for a review because after as little as five years, the mortgage debt is £8,600 less than the policy sum. After eight years the gap has grown to £13,200, and over 10 years it is £15,900. There is great potential for reducing the monthly cost, subject to the usual caveat of continuing good health.

ADDED BENEFITS

With a life-only plan, the premium assumes great importance, but let’s not forget that current plans are awash with added benefits such as second medical opinion, 24/7 GP access, and counselling services, as well as free annual health MOTs with both Aviva and HSBC.