but help is at hand

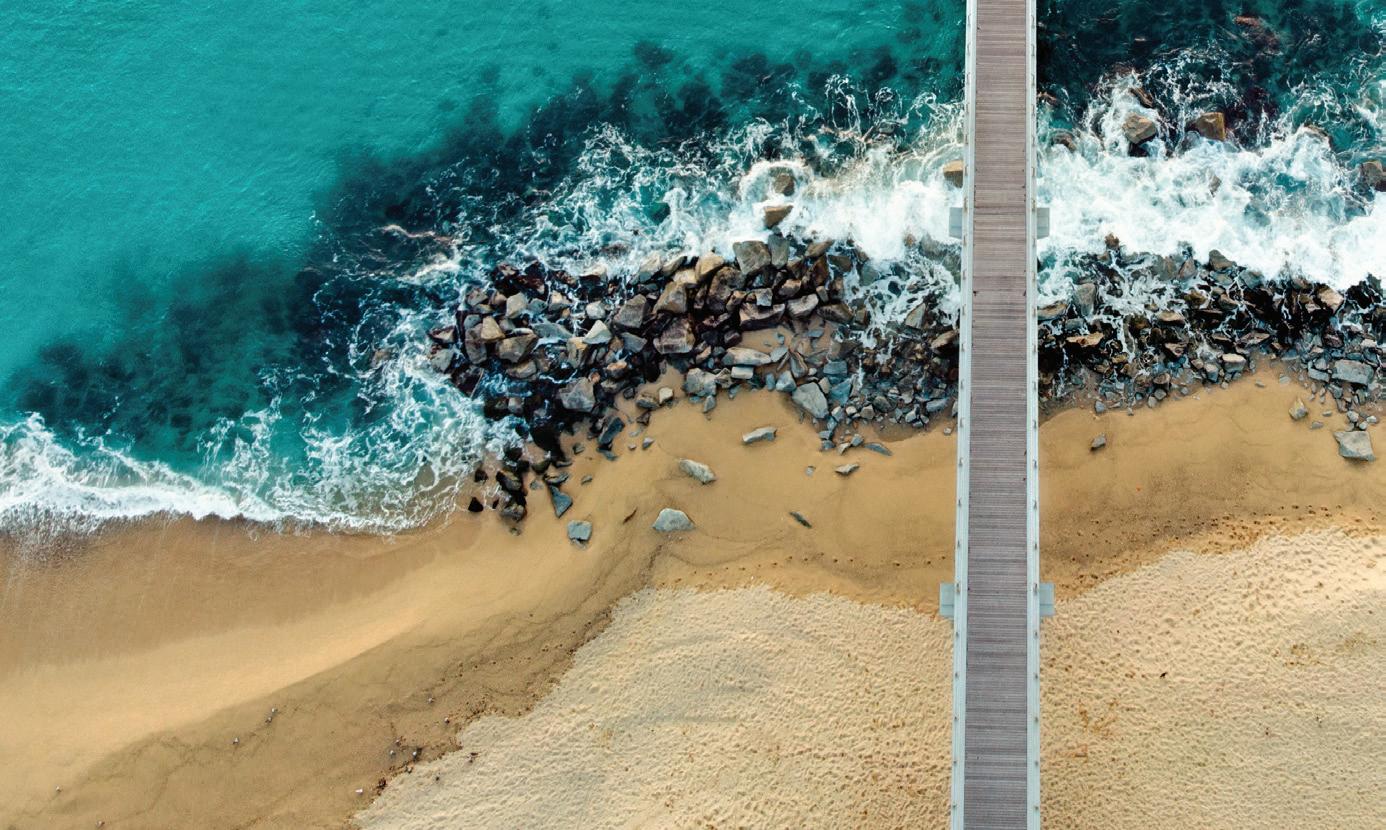

Topping off its 25th anniversary, Liberty has been recognised as Australia’s number one non-bank by the broker community

John Mohnacheff

Liberty

John Mohnacheff

Liberty

but help is at hand

Topping off its 25th anniversary, Liberty has been recognised as Australia’s number one non-bank by the broker community

John Mohnacheff

Liberty

John Mohnacheff

Liberty

The major banks join brokers at MPA’s annual roundtable to discuss the state of the market

Got a story or suggestion, or just want to find out some more information?

twitter.com/MPAMagazineAU

facebook.com/Mortgage ProfessionalAU

Turbulent times are bringing brokers to the fore

A look at the latest numbers as the housing downturn spreads

The value of dialogue as the MFAA continues its work to elevate brokers

Three lenders discuss opportunities in the FHB sector in the light of current market trends

Brokers across Australia reveal their top choice of non-bank lenders and what they want from a non-bank in 2022

Liberty’s group sales manager explains how strong partnerships with the third party channel have driven growth for brokers’ number one non-bank

A group of non-bank lenders talk about the solutions they can provide for small businesses in a challenging market for borrowers

Why making endless lists can be counterproductive to getting the most important tasks done

The key steps to take to ensure your business is well prepared for sale from day one

How partnerships have supercharged Lydian Finance’s rapid growth

Ultramarathon runner Taras Mencinsky also goes the distance for borrowers

Digital transformation of the industry is providing tech tools that give brokers a competitive edge

Our daily newsletter. Keep on top of property market trends, business strategy, and what industry leaders have to say.

www.mpamagazine.com.au

The heat might have come off the housing market, but the trust Australians place in mortgage brokers has never been greater. Brokers facilitated 68% of all new residential home loans in the three months to June 2022, according to the MFAA. This is the highest result ever for a June quarter, while the value of broker-settled home loans was $96.08bn – a record for any quarter.

It’s clear that brokers enjoy an unrivalled position, with two-thirds of Australian homebuyers relying on their expertise when it comes to finding a home loan.

The twin spectres of rising interest rates and inflation are starting to put a dent in property demand and real estate values, but it’s in times of economic turbulence that brokers come into their own. In the complex and fast-changing world of lending, brokers can guide customers through a myriad of products and credit policies to find the most suitable loans for their individual circumstances

Rising interest rates and inflation are putting a dent in the market, but it’s in times of economic turbulence that brokers come into their own

At the time of printing, the RBA had raised the official interest rates six times, from 0.10% to 2.60%. While refinancing was strong during COVID, recent rate rises have encouraged many homeowners to contact their brokers to get better deals.

PEXA’s latest report on refinancing shows that more than a million Australians refinanced their home loans in the last 12 months, saving $1,524 on average, while almost 2.3 million people were considering refinancing in the next two years. This indicates that brokers will continue to be in demand from borrowers wanting a better loan deal, backed up by the intrinsic value of the best interests duty.

In this issue, the importance of broker opinions and how they can shape the policies and actions of lenders is explored in the 2022 Brokers on Non-Banks report.

Hundreds of brokers ranked non-banks across 10 categories, including turnaround times, credit policy, product range, online platform and commission structure.

In MPA’s annual Major Banks Roundtable, CommBank, NAB, ANZ and Westpac discuss housing market trends, refinancing, competition, the broker channel and technology, as well as answering some tough questions from the two brokers present. In our Sector Focuses on the first home buyer market and SME lending, various lenders talk about market trends, the products they offer, and how they assist brokers and their clients. A Sector Focus on broker technology also shows how brokers can streamline their processes and customer interactions

MPA looks forward to continuing to share the latest industry insights and trends to support brokers as they guide their clients in making smart lending decisions

Antony Field, editor, MPAField

Anja Pannek, Aytekin Tank,

Copyright

Razon, Khaye Cortez

Success Manager Andi Zbojniewicz

Executive Officer Mike Shipley

Chief Operating Officer George Walmsley

Chief Commercial Officer Justin Kennedy Chief Information Officer

Chan Director – People and Culture Julia Bookallil

EDITORIAL ENQUIRIES tel: +612 8437 4784 antony.field@keymedia.com

SUBSCRIPTION ENQUIRIES tel: +61 2 8311 5831 • fax: +61 2 8437 4753 subscriptions@keymedia.com.au

ADVERTISING ENQUIRIES claire.tan@keymedia.com

Information Australia Pty

MORTGAGE

INTRODUCER

Sydney -2.3%

believe a broker has the expertise they need to find the right home loan

National housing values fell for the fourth consecutive month in August, with the downturn becoming more broad-based geographically, CoreLogic reports. Every capital city except Darwin is now in a housing downturn. A similar trend is occurring in most regional areas, apart from regional South Australia, which saw an increase in housing values.

Melbourne -1.2%

Brisbane -1.8%

Adelaide -0.1%

Perth -0.2%

Hobart -1.7%

Darwin 0.9%

Canberra -1.7%

Combined capitals -1.6%

were motivated to use a broker because they believe they deliver value

were motivated by the broker’s ability to secure a loan

with three or more properties use a broker to assist with complex loans

Combined regional -1.5% National -1.6%

With interest rates rising steadily since May, property prices started falling. Some homeowners, though, were able to sell when prices were still near their peak, seeing profits in the millions.

The total stock of properties listed for sale in July increased compared to last year, with new listings up 6.5% year-on-year nationally, due in part to the number of capital cities being in lockdown for at least some of July 2021. The 12.2% decline month-on-month reflected the typically quieter winter conditions.

$561,781

Nationally, home values have fallen just 2% from the end of April to July, and regions have seen an average median value decline of 5.9%. Below are the 20 SA3 regions where the deposit hurdle has most improved from March to June this year.

REGIONS WITH GREATEST REDUCTION IN YEARS TO SAVE A 20%

Region Years to save Mar 22 Jun 22

Manly, Sydney 23.2 20.7

Pittwater, Sydney 28.5 25.9

Warringah, Sydney 22.7 20.6

Ku-ring-gai, Sydney 27.6 26 Leichhard, Sydney 20 18.5 Darebin-South, Melbourne 12.4 10.8 Monash, Melbourne 18.1 16.8

$512,531

Sherwood-Indooroopilly, Brisbane 11.6 10.3 Noosa, Qld 22.4 21.1 Richmond Valley – Coastal, NSW 25.9 24.7 Bayside, Melbourne 19 17.8

$808,287

$594,006

$738,321

Eastern Suburbs – North, Sydney 19.6 18.5 Canterbury, Sydney 17.2 16.2

Cronulla-Miranda-Caringbah, Sydney 20.1 19 North Sydney – Mosman 15.9 14.9

Manningah – West, Melbourne 21.2 20.2

Boroondara, Melbourne 17.4 16.4

Eastern Suburbs – South, Sydney 17.2 16.3

Whitehorse – East, Melbourne 16.1 15.2

Yarra Ranges, Melbourne 13.4 12.6

The total number of

fell 17.2% in seasonally adjusted terms in July, led by a sharp decline in approvals for private sector dwelling, excluding houses, which slipped by 43.5%, driven by a lack of

for large

responding to vulnerable customers.

The MFAA continues to deliver relevant and timely education to support the shifting needs of our members and the industry. We’ve seen the success of this recently with our commercial lending workshops across the country. More mortgage brokers are writing commercial loans than ever before, according to the latest MFAA Industry Intelligence Service research.

COMING INTO the role of CEO at the MFAA, I knew the mortgage and finance broking industry was in excellent shape.

The data on our industry tells a clear story of trust and value. Brokers are using their expertise to ensure clients are making respon sible borrowing decisions.

Mortgage broker market share has been breaking records each quarter. In fact, the value of mortgages settled by brokers in the June 2022 quarter was the highest ever, according to MFAA research.

collectively take the industry to the next level.

Throughout the challenges of the past few years, MFAA advocacy has played a crucial role in elevating the role of mortgage and finance brokers. The MFAA’s core focus will continue to be advocating proactively to both promote the strengths of the industry and remain at the forefront of evolving policy.

My approach to advocacy is one of ‘no surprises’. Constant dialogue helps us understand member and stakeholder concerns and ensures we remain ahead of the curve

The MFAA New Commercial Broker workshops focused on giving mortgage brokers the foundational knowledge and skills they need to expand their businesses into commercial finance.

I also know how incredibly rewarding it is to be part of this industry. If we fast-forward, I would like to see broking regarded as a career of choice for many. The MFAA is actively supporting new-to-industry brokers through workshops and resources to help them set up their businesses and have the best chance of success.

While everyone is very busy and customer enquiry levels are high, I think we collectively have an opportunity for the first time in a number of years to lift our sights and look ahead to what the future could hold.

Complaints remain low. The latest AFCA data shows complaints about mortgage brokers continue to comprise less than 0.50% of all banking and finance complaints. The differ ences in arrears between the broker channel and proprietary channels are negligible.

This position is a testament to the experi ence, energy and passion brokers bring to working with their customers and how the industry has evolved and continues to do so.

In the current environment of economic uncertainty, rising interest rates and softening property prices, the value proposition of a broker shines. Customers are actively seeking out their brokers to help them navigate options for their future.

While there are and will be challenges, we have the chance in this great position to

on regulation. Through constructive dialogue with all stakeholders, we can shape our industry together and continue our journey from industry to profession for future generations of brokers, for the benefit of customers.

I firmly believe that is the pathway to a sustainable, healthy industry with a growing ‘pie’ for everyone, and I will maintain my focus on clearing a path for broking to grow as an industry, maintaining trust in the eyes of customers and key stakeholders.

Another important role of the MFAA is education and professional development. The association was at the forefront of developing modules on the best interests duty, ethical decision-making in the industry, and the Banking Code of Practice, including

Innovation in technology, AI and automa tion, use of data, and the digitisation of many aspects of the mortgage, lending and customer experience are occurring. This will shape customer expectations and how brokers run their businesses, manage their teams and interact with their customers.

As these changes emerge and are adopted in the industry, one thing will remain core. Brokers will remain at the centre of how Australians make some of the most important decisions in their lives – be that buying a home, building wealth through property, or starting or growing a business. Our industry will continue to hold this position, anchored in trust and confidence.

I see nothing but opportunity and look forward to reflecting in years to come on how far the industry has come.

My approach to advocacy is one of ‘no surprises’. Constant dialogue helps us understand concerns and ensures we remain ahead of the curve on regulationAnja Pannek is CEO of the MFAA. She has over 20 years’ experience in the finance sector and a proven track record of leading successful businesses within the third party channel.

GOT AN OPINION THAT COUNTS? Email antony.field@keymedia.com

With broker market share breaking records, it’s time to take the industry to the next level, says Anja Pannek

Brokers have a need for speed when it comes to their dealings with non-banks, while interest rates are much less of an issue, despite dominating newspaper headlines

TIME IS of the essence for non-banks. That’s what brokers demand of them, and the data shows it’s becoming even more of a priority.

MPA’s Brokers on Non-Banks 2022 survey shows turnaround time is brokers’ number one concern. It was also their top priority last year, but by a smaller margin.

According to one respondent, non-banks are listening. “I have just noticed in the last 12 months that all lenders’ turnaround times seem to have improved,” the broker said.

The entire data set reveals that nearly three-quarters of brokers said turnaround times had improved or remained about the same. Only 27% said times had worsened – a drop from 33% in 2021.

Possibly even more eye-catching is brokers’ second most important concern: commission structure. It was the lowest concern in MPA’s 2021 survey.

Brokers evidently feel strongly that nonbanks ought to address this issue better.

“One way to show their commitment to the broker channel would be to remove the

ludicrous net of offset commission payments and do something to sort out clawback issues,” said one respondent.

Renewed broker worries about getting paid are in line with trends in other recent MPA surveys, such as this year’s Brokers on Aggregators report, suggesting a resurgence of more traditional priorities.

Third-ranked training and development and fourth-placed BDM support also under score broker concerns about keeping up with the competition as the specialist lending environment continues to change rapidly in terms of macro factors, products and technology.

Non-banks generally have higher rates than mainstream lenders, but MPA’s 2022 survey shows that rates are only of middling importance to brokers this year, despite being the focus of a massive amount of media coverage since the Reserve Bank of Australia started its tightening cycle in May.

Interest rates ranked fifth equal in the survey, tying with online platforms and

services in terms of importance to brokers, higher than its eighth place in 2021 but well below the number one concern of 2020.

While there were a mix of comments about whether rates were high or not, brokers often acknowledged that they were appropriate.

“Although rates are higher, this is not a major obstacle,” said one broker.

The latest national accounts data show that savings levels are still just above what they were in 2019, and that people squir relled away cash at around four times the normal pace during parts of 2020 and 2021.

Record numbers of borrowers have also used the period of ultra-loose monetary policy during the pandemic to lock in fixed rates, affording some protection from more expensive money for the time being. Financial product comparison website RateCity’s anal ysis showed in June that nearly two out of five home loans remain fixed, with a large group of people not coming off their fixed rates until mid to late 2023.

Aged 56 and above

Writes $20m–$40m worth of mortgages a year

Has been in the industry for more than 15 years

Is most likely to live in NSW or Vic

In this year’s survey, brokers were asked to rank non-bank lenders across 10 categories: BDM support; brand recognition; commission structure; communications, training and development; credit policy; interest rates; online platform and services; product diversification opportunities; product range; and turnaround times. Brokers could rank the non-banks with a score out of five in each category.

Only those institutions that achieved a response rate of at least 10% of brokers for each non-bank were included in the final list.

The survey also recorded 322 broker responses on their preferred non-banks in these areas: specialist lending; first home buyers; property investors; commercial; alt doc; SMSF; and foreign non-residents.

MPA asked the brokers a series of questions relating to their business with non-bank lenders, as well as which non-bank they would like to see added to their aggregator’s panel, but these did not influence the overall score.

The proportion of brokers’ loans put through non-banks is down, but brokers continue to underestimate how much they need alternatives to the main lenders for customers requiring flexible solutions

MPA’S SURVEY showed that 63% of brokers increased the amount of loans put through non-banks in the last year, compared to a 69% increase in 2021. It also showed that, of those putting the lowest proportion (less than 20%) of loans through a non-bank, the figure was 44%, versus 45% in 2021.

This was higher use of non-banks than brokers had forecast, likely reflecting the tougher lending criteria at traditional banks and the larger number of self-employed customers seeking flexible lenders not fazed by unstable income records during COVID.

At the top end of the table, just 13% of brokers put more than 60% of their loans through non-banks this year, up from 12% last year but down from 19% in 2020.

The expected proportion of loans forecast to go through non-banks in 2023 is essentially in line with expectations seen in last year’s survey, but with interest rates still rising for now and tighter lending at banks, brokers may once again come to rely on non-banks more than they currently anticipate.

“There’s a great opportunity now and going forward over the next 24 to 48 months for

non-banks to really increase on their market share,” says Peter White, FBAA managing director, who was not part of the survey.

“Even if times get a little bit tough for borrowers going forward – which it will for many – there are lots of options that can be considered. Brokers just need to be wellskilled and well-versed as to what those options are.”

The best interests duty requiring brokers to provide a suite of lending options is another factor in non-banks’ favour.

“They are on just about every aggregator panel in some shape or form or another … if it could well be in the best interest of the client, then [brokers] look at a non-bank.”

Brokers continued to turn to non-banks mainly because they take a wider view of their customers than just looking at their credit scores, with around 24% of brokers saying that was the main reason to use non-banks.

Non-banks are particularly strong in the self-employed sector due to the messy paperwork that regular banks are less able to consider when looking at an application. Life events and fluctuating incomes are also regular fodder for alternative lenders.

Contractors or labourers such as construction workers are a case in point. Such groups generally continued to be employed over the pandemic, but some had difficulty maintaining robust tax records.

One survey respondent said non-banks

“provide clients who are self-employed with options that the banks will not consider. Applicants may not have lodged income tax returns, and this is a concern for banks”.

Non-banks are the only option for such people with truncated paperwork.

Another broker said specialist lending “covers clients who otherwise wouldn’t be able to proceed anywhere else”.

The second, third and fourth most popular reasons why brokers would use a non-bank are all related to this point: banks have tightened their credit policies; the client lacks standard documentation such as payslips; and regulatory changes have ruled out a normal bank as an option for the client.

Lack of standard documentation was bottom of the list of reasons in 2021 and didn’t even make the list in 2020. The fact that it has jumped to third in 2022 suggests that brokers are seeing a rise in borrowers with unusual income records due to seasonality, business disruption and the rise of the gig economy.

One respondent said the existence of products such as near prime at non-banks “has meant homeownership has been possible for clients that did not fit typical lending criteria”.

Borrowers continue to see non-banks as a good option, and a more competitive market means that brokers are becoming more discerning when it comes to rating institutions

IN TERMS of brokers’ ratings of the benefits of using a non-bank, 2022 marks a watershed year not for any single financial organisation but for the industry as a whole. This is reflected in the extreme closeness of the results, underscoring more competition between non-banks.

The top three non-banks overall won just one gold in each of the 10 categories. Pepper Money won gold for the fifth year in a row for its BDM support, Liberty topped credit policy, and Firstmac won gold for product range.

Indeed, non-banks in the middle of the field won more golds than those on the podium, with fourth-placed RedZed winning

two and seventh-placed La Trobe Financial winning three.

This year, it was silver that decided first place, with Liberty collecting six second places, showing strong consistency across a range of criteria.

But final tallies across categories were all much lower this year; the top overall score of 3.659 would only have been good enough for sixth place in the 2021 contest.

The even distribution of the field in 2022 may also have been due to the larger field of entrants who did not make the winners list this year, but still thinned broker votes at the top of the table.

The organisation that brokers most wanted to see added to their aggregator panel this year was also the overall winner – Liberty. Last year’s winner in this area, Mortgage Ezy, slipped to the number three choice, while RedZed came second.

While interest rates only appear mid-table when it comes to importance to brokers dealing with non-banks, they continue to be the major barrier to doing more business with them. This suggests there is a limit to how much share non-banks can take from main stream banks, or at least it shows a dynamic balance that can only change if more borrowers get turned away from regular lenders.

More than half of all brokers said nonbanks’ higher rates and fees were stopping them from using them more.

“Rates are too high still,” said one broker. “I understand there are higher risks with self-declared income, but if the rates reduced

with LVR that would be great.”

Another said, “They are expensive; they have a lot more upfront costs.”

Despite such comments, several respond ents praised the rates available at nonbanks, saying they were “low”, “good”, or

“Rates are too high still. I understand there are higher risks with self-declared income, but if the rates reduced with LVR that would be great” Survey respondent

Your customers can update their payment date, frequency and amount to align with their pay cycle, helping make repayments simpler and easier.

Whether a customer is saving for a holiday, or their family is entering a new life stage, eligible customers can take a three to 12 month repayment holiday to give them more financial flexibility.

Eligible CommBank customers can enjoy exclusive offers and savings through our growing range of partnerships – including More, Amber, Little Birdie and :Different.2

We support eligible owner occupied home loan customers when they need it the most with complimentary protection, covering repayments for around 12 months if an eligible borrower, spouse or dependant passes away or becomes terminally ill.3

Things you should know:

1 Based on CBA competitor comparison of product features and the ability to self-serve changes to home loans.

2 More, Amber, Little Birdie and :Different are partners of CBA. You should review their respective product offerings and terms and conditions before making any decision about their services.

3 Loan and age eligibility requirements and other limitations and exclusions may apply. Home Loan Compassionate Care is underpinned by a group policy held by us with the insurer, AIA Australia Limited ABN 79 004 837 861 AFSL 230043 (AIA Australia). AIA Australia is not part of CBA. Applications are subject to credit approval. Full terms and conditions will be included in our Loan Offer. Fees and charges are payable. Commonwealth Bank of Australia ABN 48 123 123 124 AFSL and Australian credit licence 234945.

Life can be unpredictable and things can change quickly, which is why we support customers with Australia’s most flexible home loa

“competitive”, often tying in praise for rates with praise for the product, such as a “higher borrowing capacity for clients”.

The second biggest barrier to using a non-bank lender was a lack of brand aware ness, a repeat of the survey result in 2021 and 2020. However, non-banks may be beginning to make headway in this depart ment, with only 20% of respondents saying brand awareness was low, compared to 27% last year.

The proportion of brokers who said their clients were typically open to considering non-bank products remained high in 2022, at 89% versus 90% last year. In 2020, the figure was 70%.

Survey comments backed up the higher levels of trust in non-banks than a few years ago. “[There are an] increasing number of customers for these types of processes and policy,” said one respondent.

La Trobe Financial took home the gold medal for brand recognition for the second year in a row, suggesting its marketing is effec tive. But overall, many brokers still believe non-banks need to do more in this area.

“I think they could do a better job of banding together to get awareness out to the general population,” said one respondent, adding that “some people are afraid of non-banks because they don’t understand them”.

Another agreed, saying that “non-bank lenders really need to differentiate them selves from the majors if they wish to secure the bulk of brokers’ business”.

At the same time, the image of banks was not so great in the eyes of a few brokers. “Banks can have limited policy criteria and operate like robots,” said one respondent.

Another criticised mainstream banks for lifting rates too quickly in the current envi ronment. “As soon as the RBA increased their rates the big banks went along for the ride and increased their rates yet again, making them less competitive,” a broker said.

Both positive and negative experiences abound for brokers, but on the whole, tech gains seem to be improving turnaround times more than they did a year ago

NEARLY THREE-QUARTERS of brokers this year said turnaround times had improved or remained about the same. Only 27% said times had worsened – a drop from 33% in

2021. This suggests the tech improvements seen in recent years are finally paying off for non-banks and brokers. Some non-banks were praised by brokers for having same-day

turnarounds, but improvements seem to be across the board.

Brokers cited an increase in staffing levels and people being back in the office post-COVID as a factor, with BDMs easy to reach to move things along.

“In 2021, times were terrible due to the pandemic,” said one respondent.

Brokers also said non-banks were doing better in this area than banks: “[Times have] definitely improved with the major banks not able to deliver with the volumes … the same products are available with nonbank lenders who have capacity to take more customers on board and deliver.”

Negative comments around turnaround cited a lack of knowledge about processes, and difficulty in contacting the right people as factors hurting time to decision.

“[There are] too many gatekeepers who don’t understand the file or documents sent, returning files that are correct. Would a phone call really kill them over emails?” said one respondent.

RedZed, which won gold in this category, was described by several brokers as very efficient, while one broker called bronze winner Firstmac “a joy to deal with”.

But others such as Resimac and La Trobe Financial were panned for slower turna round times. This slowness in turnaround

likely weighed on La Trobe Financial in the overall rankings, given that it won gold in three other categories.

Other brokers cited structural or cyclical factors as reasons for better or worse turnaround times.

“There have been periods post promo tional offers where turnaround times have worsened, but this is the same for any major bank,” said one.

Another respondent said times were quicker “more due to customer involvement in lending rather than good management by institutions”.

When asked how non-bank lenders could improve their service levels, brokers’ responses were different to last year, when better technology was at the top of the wish list by several percentage points. This year, better-trained BDMs and credit successors tied with better tech as ways non-banks could improve their service, suggesting that many brokers are happy with the improvements over the last 12 months.

Fintech is an area that continues to evolve rapidly, with banks and non-banks investing heavily in better systems to improve the broker experience. Providing a seamless experience for brokers is a key way that non-banks compete for custom.

Simplifying the income verification process ranked third on brokers’ wish lists for improving service, and better tech nology plays a key role in this.

There were three chances to win bottle of liquor by answering the question, ‘Do you think the non-banks have provided enough competition to the banks over the last year? Why/why not?’

Winning comment for a bottle of Johnnie Walker Black Label 12-year-old blended Scotch whisky: “Yes, but due to lack of political power, the banks still have a decided advantage. Funny how clawback is supposed to stop churning by brokers, but the banks churn all the time with their cashback rebates to borrowers.”

Winning comment for a bottle of Don Julio Reposado tequila:

Winning comment for a bottle Glenfiddich 12-year-old single malt Scotch whisky: “Yes, clients need flexibility, and the non-banks are delivering on this – however, majors have clawed back ground with the introduction of streamlined policy for self-employed clients.”

“Yes, turnaround times and interest rates have been the most enticing part of non-bank lenders. Customers are happy to go for a lender without big brand names to keep money in their pockets. Non-bank lenders do, however, need to up their ante with online banking apps/platforms for customers post settlement.”

“Yes – but it is the brokers that continue to look for the majors and not educate their clients on other choices. Also, with majors closing branches, now is a great time to spread the love amongst all lenders.”

Close but no cigar: “Non-banks don’t really compete with banks, so no. They provide alternatives for borrowers that banks cannot service due to compliance restraints, so non-bank lenders essentially compete with each other and not the banks.”

“Not too bad, but they can be very much the same regarding lending limits. Lenders should consider larger loan amounts with reduced LVRs for single security, particularly in an expensive property market like Sydney – limit loan sizes to $1.5m–$2m is a little restrictive.”

What challenges and opportunities do you see for the next six to 12 months?

Barry Saoud, general manager, mortgages and commercial lending: In this rising-rate environment, building relationships and confidence with customers is arguably more important than ever for brokers. Ensuring a customer’s loan application makes it all the way to settlement is crucial for our brokers’ success, so supporting conversion is a fundamental focus for us across the next six to 12 months. We see this as an opportunity to continue investing in technology and broker education. For our brokers, this includes better understanding the parameters of their lender panel, whether it be mainstream banks or non-bank lenders, and the probability of customers getting a loan with specific lenders.

Pepper Money won gold in the BDM support category. What are your strengths in this area?

BS: While building strong relationships with our distribution partners has always been part of our mission, it was hugely important in a lending year disrupted by COVID-19, a war in Ukraine, rising rates, and a slowing property market. As customer scenarios are becoming more complex, Pepper Money continues to be at the forefront supporting brokers in trouble-shooting complex scenarios with speed and confidence. Our BDMs are relentlessly focused on ensuring brokers across the country are fully supported now more than ever. In the last 12 months, we’ve introduced additional layers of support, with two new regional managers and five new desktop BDMs to ensure our team continue to deliver world-class service. We’re also upskilling our BDM teams across both the residential and commercial credit spectrum, as one expert point of contact makes for better experiences.

What challenges and opportunities do you see for the next six to 12 months?

Kim Cannon, managing director: The main challenge for everyone is client retention. Official interest rates have been steadily rising, causing many people to review their lending arrangements. It’s a super-competitive, price-sensitive refi market. In this environment, brokers can really help their customers by encouraging them to focus on repaying their home loans instead of being distracted by short-term incentives that may extend their loan term and set them back. The main opportunity for us is to benefit from the strength of refinancing enquiry by maintaining our culture of personal service that is focused on helping brokers get their deals across the line.

Firstmac won gold for its product range. What are your strengths in this area?

KC: Our long-standing strength is in bringing simple, affordable, prime home loans to market. However, brokers are looking more now to diversity their standard offering, and we’ve been able to provide for this with some innovative new product streams. We’ve brought out the best SMSF product in the market and some of the best car loan products.

We also have pioneered green car and home loans that reward customers with cheaper interest rates for energy-efficient assets which help them to protect the environment.

What challenges and opportunities do you see for the next six to 12 months? Chris Calvert, executive general manager for distribution: The immediate challenge non-bank lenders such as RedZed face in this increasing interest rate environment is cost of funding. All lenders are trying to find the right balance between keeping their rates competitive whilst managing their funding position. No matter the economic cycle, there is always opportunity. We believe the lenders that have invested in both their technology and systems with a focus on improving simplicity and speed for their customers are those that can remain competitively priced without sacrificing the service they provide.

RedZed won gold in the product turnaround times and product diversification opportunities categories. What made you stand out in these areas?

CC: The feedback that we constantly receive from our brokers is that turnaround times, consistency of decision-making and offering products that are solutions focused are what is most critical to them in servicing this market. This is what we focus on. We are obsessed with delivering the best customer experience that we can, and measuring key touchpoints such as our turnaround times and the time it takes to answer calls and emails is central to this. Our brokers also want products that reflect the needs of the self-employed, and that’s what we try to do. We are continually enhancing our product features to enable more self-employed borrowers to find a lending solution.

2022 has been a standout year for Liberty. The non-bank has not just celebrated its 25th anniversary in business but won top spot in the Brokers on Non-Banks survey. MPA catches up with group sales manager John Mohnacheff

AS A non-bank that relies heavily on the third party channel for its loan originations, there can be no higher accolade for Liberty than winning MPA’s Brokers on Non-Banks award for top choice of brokers in 2022.

“We’re delighted that our business part ners have chosen Liberty as their preferred non-bank lender in our 25th year,” says group sales manager John Mohnacheff.

“To receive recognition direct from the brokers themselves is a testament to the dedi cation of the entire Liberty team. From our BDMs to our operations teams, underwriters and support staff, every department has come together to ensure we continue providing the excellent service brokers have come to expect.”

Mohnacheff says the Brokers on Non-Banks result also reaffirms that Liberty’s free-thinking approach resonates with brokers. “It’s pleasing to see that our efforts are hitting the mark, and our hope is that brokers have appreciated Liberty’s unwavering support.”

Liberty is proud of its 25-year partnership with the broking community, and grateful for their continued support and ongoing positive feedback, says Mohnacheff.

“Brokers have been key to our formula since the beginning, and Liberty is invested in ensuring we continue to meet the needs of our broker partners.”

Mohnacheff says the non-bank lender also understands that the service it delivers reflects on the broker in the eyes of the customer.

“Feedback from our business partners is critical to ensure we consistently create positive experiences for both brokers and customers.”

Hundreds of brokers from across Australia ranked Liberty and other non-banks in this year’s Brokers on Non-Banks report across

sion structure, interest rates, brand recogni tion, and online platform and services.

Brokers preferred Liberty over other nonbanks when it came to specialist lending and SMSF lending, the report revealed.

“Liberty has always led the market with diversification and operated with agility, innovation and flexibility,” says Mohnacheff.

“Our ability to pivot quickly in response to

10 categories: turnaround times; BDM support; commission structure; communica tions, training and development; interest rates; product range; credit policy; online platform and services; brand recognition; and product diversification opportunities.

Liberty’s credit policy was voted the best overall by brokers, and it also ranked second for turnaround times, BDM support, commis

market needs is what sets us apart.”

He says this ability also helps ensure Liberty is able to navigate challenges, continue providing a high standard of service, and expand its product offering.

Mohnacheff says Liberty recognises that when brokers are looking for the right solution for

“We want to know how we can continue to improve. Surveys such as Brokers on Non-Banks [help] us learn how to best serve business partners and clients, particularly in the current environment”

Name: John Mohnacheff

Title: Group sales manager

Company: Liberty

Years in the industry: 30+

Career highlight: “To have been afforded the marvellous opportunity to meet and work with so many talented people who have helped, supported and encouraged me”

Career challenge: “There’ve been a few, but to me, it’s about how you deal with them. Life has a way of throwing curveballs, but the way you handle them is what counts”

their customer, the choice often comes down to policy.

“We take pride in being a business that’s willing to listen and look beneath the surface, while discovering innovative ways to improve financial inclusion for more borrowers,” he says. “By adopting a freethinking approach and providing out-of-thebox credit solutions we can help find the right fit for more customers.”

Mohnacheff says that since its inception, Liberty has sought to deliver fast turnaround times for its customers and business partners.

“We have built our systems and processes to ensure we can always provide the fast responses brokers depend on.”

Liberty is continually inspired by the dedica tion of its BDM team, says Mohnacheff.

“We know brokers value high-touch, personalised support, and our BDMs work tirelessly to help our business partners achieve the best customer outcomes.”

Mohnacheff says Brokers on Non-Banks

2022 further demonstrates that Liberty is a trusted business partner that brokers can rely on. He says providing a fair commission structure that ensures brokers are rewarded for their hard work and supported in their success is important to Liberty.

“We understand that in addition to getting a fast ‘yes’, customers also want a loan that offers competitive terms and the flexibility to help them move forward,” says Mohnacheff.

Liberty is constantly innovating its online platforms and services so brokers can focus on finding the right solutions, Mohnacheff says.

“By leveraging digital tools, we are creating a more automated process that leads to better broker and customer experiences.”

“We’ve worked hard to strengthen our brand and ensure brokers and customers are aware of the genuine alternative solutions avail able to them,” Mohnacheff says. “It all comes back to our mission of helping more people get financial.”

Mohnacheff says brokers are critical to Liberty’s distribution source.

“We want to know how we can continue to improve. Surveys such as Brokers on Non-Banks are important in helping us learn how to best serve business partners and clients, particularly in the current environment.”

Combining this with internal feedback, such as from the Net Promoter Score survey, helps Liberty to carry out changes with confidence.

“Supported with honest and direct broker feedback, we have been able to refine our product and processes to make our loans easier to understand and use,” says Mohnacheff.

Reaching 25 years is a significant milestone for Liberty, says Mohnacheff, and its growth has only been possible thanks to the support of broker business partners.

“We’re proud to have helped over 700,000 customers get – and stay – financial through various market challenges.”

Beyond the 25th anniversary, Liberty’s mission to champion fairness, financial inclu sion and diversity has also been recognised.

In July, Liberty received the Diversity and Inclusion Award at the MFAA National Excellence Awards 2022. This followed the non-bank being crowned an HRD 5-Star Employer of Choice in March.

Despite a changing economic climate, the company also reported strong FY22 results that reflected record loan origina tions, says Mohnacheff.

“In the next 12 months, Liberty will ultimately do what we have always done – listen, analyse and innovate,” says Mohnacheff. “We will

Which non-bank lender would you like to see added to your aggregator’s panel?

Top choice – Liberty

What do you think is the best non-bank product of the year for the last 12 months?

Top choice – Liberty Star

Comments from brokers:

“Fast turnaround time, good policy, BDM strong support”

“Flexible income, flexible servicing”

“Good rate and borrowing capacity”

“It worked well for me”

“Pricing and policy combination”

Liberty was voted the preferred non-bank lender for:

Specialist lending SMSF lending

continue to deliver a range of solutions that will help a wide spectrum of customers with leading lending options.”

The non-banker lender will strive to achieve this with efficiency and transparency to meet the evolving needs of brokers and customers, he says.

Several technology enhancements are also on their way, including upgrades to the Liberty IQ platform and an ever-expanding suite of services.

“These enhancements are designed to further improve our turnaround times and help our brokers grow their businesses through great service and partnership,” says Mohnacheff.

“We’re confident Liberty has a bright future ahead.”

THE SECOND half of 2022 is proving to be both a challenging and exciting time for Australia’s big four banks.

The Reserve Bank of Australia is moving aggressively to dampen inflation by lifting the official cash rate. At the time of printing this issue, the RBA had increased the cash rate from 0.10% in May to 2.60% in September. Of the five consecutive rate hikes, four were 50 basis point increases, and RBA governor Philip Lowe had signalled further increases could be expected.

While unemployment remains low, infla tion stood at 6.1% as of September, and cost of living pressures are putting the squeeze on the average Aussie household.

For mortgage holders there is good news and bad news. The RBA Financial Stability Review in April showed variable rate home loan borrowers had plenty of petrol left in the tank when it came to loan repayment buffers; however, the interest rate increases since then mean these buffers are being eroded.

The median excess payment buffer for owner-occupiers with a variable rate mortgage was around 21 months’ worth of scheduled repayments in 2022 – up from around 10 months at the onset of the COVID-19 pandemic. CommBank also reported that one in two of its customers were more than three months’ ahead of their scheduled repayments.

But borrowers on fixed home loan rates will soon be in for a rude shock, with the thousands due to come off their fixed rate periods over the next 12 months likely to be hit by interest rates more than double their original rates.

Interest rises are driving record numbers of homeowners to refinance. Refinancing reached a record high of 223.9 on the PEXA Refinance Index in July. More than one million Australians had refinanced their home loans in the past 12 months, and nearly 2.3 million were considering refinancing in the next two years. Much of this activity is going to come through the broker channel, which is responsible for 68% of all new resi dential home loans.

So what do these trends mean for mort gage brokers and their customers, and for the major banks that provide the majority of Australia’s home loans?

MPA held its 2022 Major Banks Roundtable at Bel & Brio restaurant in Sydney, which brought representatives of Commonwealth Bank, NAB, ANZ and Westpac, as well as two mortgage brokers, together to discuss the housing market and the economy, refinancing, competition, broker partnerships and technology.

Participants from the major banks were Adam Croucher, general manager third party banking Australia at CommBank; Phil Waugh, executive broker distribution at NAB; Paul Brick, head of strategic partner ships at ANZ; and Sarah Willsallen, NSW state general manager at Westpac.

Representing the broker community were Deanna Ezzy, director and senior mortgage broker at More Than Mortgages in Canberra, and Justin Doobov, managing director at Intelligent Finance in Sydney. The two brokers were particularly keen to hear from the banks about clawbacks and net of offset.

Rising interest rates and inflation are hitting the economy, but major banks are confident they can ride out the rough times, thanks to healthy loan repayment buffers, a growing refinance market, and strong broker partnerships. The big four banks got together with brokers to discuss the market at MPA’s annual roundtable

The past 12 months have been tumultuous, with the economy recovering from the pandemic but hit by higher interest rates and inflation, and supply chain issues. What are the main trends in the housing market, and how are major banks reacting to changing conditions?

In terms of trends, Phil Waugh commented that interest rates were rising at a rapid rate. “It’s not that we didn’t expect the RBA to move the cash rate. I think it was just the speed and the timing of that increase,” he said.

“The government did a really good job of helping the economy through COVID in a lot of ways that protected the economy.”

Waugh pointed out that post-COVID the cash rate was moving far faster than expected, while inflation and the cost of living were much higher than anticipated.

“The impact of rates slows down the property market and the prices that houses are demanding.,” he said.

There are also fixed rate loan expiries due to occur, and refinancing has increased. Waugh said the focus of the major banks, including NAB, was on managing retention sensibly.

“How do we ensure that the process of refinancing into NAB is as seamless and painless and frictionless as possible?”

Waugh said all these factors had increased customers’ reliance on brokers’ expertise.

“The speed of change has been far faster

than what everyone had predicted, and that has had a flow-on impact on the housing market, probably far faster than economists had forecasted,” he said.

Sarah Willsallen said Westpac recognised that cost of living pressures were real for lots of Australian families.

“We haven’t yet seen it flow through into some of our early indicators, like hardship and customers seeking additional assistance,” she said. “We’re monitoring it really closely.”

Willsallen said Westpac’s modelling showed that about two-thirds of its customers

the key message is just: the earlier you talk to your bank, the earlier you talk to your broker if you’re finding things difficult, the more options that we’ve got, the more we can assist.”

Commenting on why banks, including ANZ, had not seen large numbers of customers seeking assistance, Paul Brick said it was partly due to the “number of fixed rate loans taken, so many payments are still at that lower level”.

“Last year, about 45% of our entire book of new loans were fixed. As they start to come off over the next 12 months … borrowers may move on to a rate that’s higher,” he said.

were ahead on their mortgage repayments. “But our key message to all customers would simply be: if you’re finding yourself starting to find things tricky, engage your broker early.”

She added that there were many options available for assistance options. “As a bank –and we’d all be the same – our hardship teams are all amazing, and they’re all here to help. So

Brick echoed Willsallen’s point about hardship and having a conversation early.

“Not just for customers but for brokers as well,” he said. “We have support that we can offer brokers around discussions on hardship, structuring and so on. There are some brokers that won’t have been through this sort of cycle before, so we’re really keen

“We want to make sure we’re in a really strong competitive position to provide for our existing customers and retain them, but also provide options to attract new customers”

Sarah Willsallen, WestpacAdam Croucher General manager third party banking Australia, CommBank Phil Waugh Executive broker distribution, NAB Sarah Willsallen NSW state general manager, Westpac Justin Doobov Managing director, Intelligent Finance Deanna Ezzy Director and senior mortgage broker, More Than Mortgages

to help them get on the front foot with their customers as well.”

ANZ predicts the cash rate will reach 3.35% by the end of 2022, with house prices to fall 15–20% by the end of 2023. “Our economists also talk to how low vacancy rates are offsetting that [price drop], and that’s one factor that leads to activity in the investor market and an increase in rents,” Brick said.

Adam Croucher said CommBank wanted to make sure brokers had the tools to have conversations with their customers when they needed to. “The feedback that we’re getting from brokers is the amount of conversations they’re having on a daily basis where their customers are contacting them, concerned about potential issues and making sure that their rate is really, really relevant.”

He said it was important to give brokers the tools to have upfront, transparent and informed conversations with customers coming off fixed rates.

“We have certainly seen the average loan size decrease slightly, from $379,000 to $375,000 over the last six months,” Croucher added. “Certain pockets seem to be a little bit higher, but that’s expected in any sort of softening in the housing market. There’s no real alarm there. We’re all watching it very, very closely to make sure that we’ve got the support needed for customers.”

CommBank set up hardship and finan cial assistance teams during COVID, which meant the bank was quicker and better equipped to have conversations with customers, rather than being reactionary.

Broker Justin Doobov asked what tools the banks could now deploy to help customers post-COVID if they had lost their jobs or were struggling financially. “This is important so that we [brokers] can have the conversation with our customer and we can provide guidance as opposed to us saying, ‘Call the hardship line; we’ve got no visibility over what the bank will do’,” he said.

Croucher said it would always be on a caseby-case basis, depending on what was most appropriate for each customer’s individual circumstances, “whether it’s a repayment

holiday, whether it’s a switch to [interest only]”.

“It’s not a one-size-fits-all … those options are really dependent on the customer,” he said. “During COVID we saw repayment holidays and just interest payments; the flexibility is there. The aim is to keep people in their houses.”

Waugh agreed, saying NAB also made decisions case by case when it came to customer hardship.

Following the banking royal commission, he said a lot of focus was on the banks doing the right thing by the customer. “Then we ran into COVID and the importance of banks responding to COVID and helping customers through COVID. I thought it was outstanding. I think that the banks have actually learned from that – that it’s far better to partner with the customer, whether that’s through the broker or just directly to the customer,

to actually help the customer through those trying times.”

Waugh said more than 70% of NAB’s home loan book customers were ahead on their repayments.

Doobov said that with talks of property prices declining over the next two years, there was a danger that some first home buyers had borrowed at 95% LVR with no LMI and could go “under water”, and the bank would be carrying negative-equity clients. He asked what the banks’ position would be in this scenario.

“I think it’s exactly what we’re going to run into, but it’s still going to be around the long-term sustainability of the book and the customer,” Waugh said. “I wouldn’t expect us to go out and go straight into negative equity, repossess and play through that way.”

Doobov said it “may not be as favourable for the bank to place a client’s payments on

hold if they’re at 95% LVR, compared to if they’re at 70%”.

This raised the question about brokers having different conversations with those clients and being unsure how the banks would act, he said. “If we can pre-position that conversation to say, ‘Look, these are your potential options, give the bank a call’ … we can manage those clients and prevent a problem from happening earlier.”

Brick said it was important to recognise that all banks had learnt lessons. “What you’re seeing this time around is house prices coming down and unemployment at histori cally low levels, and so perhaps there’s more tolerance for things like negative equity. But it’s going to be case by case.”

Croucher said it came down to afford

ability. “We’ve been regulated to make sure our assessment rates for customers are meas ured higher than what they’re paying, which is great protection for the customers. I think that’s been very well regulated … showing that [customers] can still afford a rate of 5.25% or 5.50%, depending on what bank you’re at.”

Historically, Australia’s housing market had seen peaks and troughs, Croucher said. “Sustaining 42% growth was always going to, at some stage, come back; 42% is not going to be sustainable forever.”

Broker Deanna Ezzy said she had always been of the view that banks wanted to keep loans in place and make money. “They don’t want to sell houses,” she said. “I’ve always said if it gets to that point, ‘Don’t ghost the bank; work with them. They’ll try and work with you’.

“I’m letting my clients know, given the last couple of years and how unstable everything was and how industry bodies and government and everyone came together to keep everything afloat, that we can probably feel pretty confi dent that the powers that be are not going to let everything fall into a recession now.”

Ezzy said she was also encouraging her clients on fixed rates to start paying 5% prin cipal and interest right now to prepare them, because that could be “where it lands”.

“And also saying, your loan was assessed at 2.5% to 3% higher, so just keep that in mind – don’t panic.”

Willsallen said the current market was an incredibly competitive environment – and that’s “fabulous for customers”.

“That gives them great outcomes, and brokers are wonderful in enabling customers to have lots and lots of choices. So everyone here is competing hard for business – we want to keep our existing clients; we want to attract new clients.”

Agreeing with Waugh and Brick, Willsallen said many customers had followed the advice of their brokers, locking in “cracking” fixed rates.

“As they come off that, they’re naturally going to be looking at the market,” she said. “We just want to make sure that we’re in a really strong competitive position to be able to try to provide for our existing customers and retain them, but also provide options to attract new customers as well.”

Waugh said, “Consumers are far more educated than they’ve ever been. Eleven years ago, the last time rates went up, social media wasn’t as active; just the broader education across the market wasn’t as active.”

The revert rate was also important, Waugh said, in particular sorting out specific customer base pricing for the revert rate once fixed rates ended.

“Brokers have a strong voice in helping design new technology, aligning investment and management. We’re consulting with aggregators to make sure we get the right design” Paul Brick, ANZ

One of the great frustrations for brokers was when they tried to get a better rate from a bank for a refinance, and it wasn’t forth coming, he added.

“An LOI gets issued, and then the reten tion team calls the customer and gives the rate that’s far sharper than the rate that the broker wanted in the first place. So how do we work with our pricing teams to ensure that that process for the broker and for the customer is far better and a better outcome? I think that we’re all trying to do that better.”

Ezzy asked if there were two different teams – a front-end pricing team and a retention pricing team.

Waugh said they were two big teams at NAB that operated differently.

Transparency was key, he said, as was ensuring a better and earlier outcome for the

customer that avoided adding extra cost and inefficiency to the loan process and frustra tion for the broker and client.

He said NAB was also focusing on like-forlike refinances. “Some players in the market have done a really good job on like-for-like refinances – taking the friction out of the process, minimising the amount of paper work and documents required, and using technology and repayment history and CCR to actually make that process faster. So that’s a big piece of work around that.”

He added that the big banks were in a good position, with mature businesses, strong deposit books, and funding costs “that put us in a reasonably strong position to win refinances”.

From ANZ’s perspective, Brick said, “we have to be very mindful of what the market is asking for, what the market is demanding”.

“We’ve looked at a number of things over the last 12 months to make sure we remain a competitive option for switchers. Product was the first – we simplified our product range, and our three Simpler Home Loans aim to allow our customers to see their options more clearly.

“We also removed the Breakfree package from sale, so borrowers can still access great rates and discounts on standard variable loans but only pay for the additional features they want to use. We seek to make our home loans easy to understand, and this is a benefit to brokers as well.”

Brick said the bank had also focused on enabling a simpler switching process for like-for-like-type products to make it easier and faster for those customers to refinance to ANZ.

ANZ’s Simpler Switch is a streamlined OFI refinance process for eligible PAYG customers switching to a similar home loan amount, with the same or lower repayments on an eligible home loan. The process uses compre hensive credit reporting to verify a customer’s ability to repay their existing commitments, with no need for brokers to supply any income documents as part of the application.

“We’re constantly listening to what customers need and exploring opportuni ties to design our products and processes and

“It’s really important to have channel parity. The customer makes the choice. We treat the customer the same, no matter which channel they choose to transact with the bank” Phil Waugh, NAB

policy in that light,” Brick said.

Croucher said that in a competitive envi ronment it was important for CommBank to offer home loans to suit a broad range of customers, “regardless of LVR, regardless of property prices”.

“We want to be the bank for all Australians,” he said. “If we’re not competitive, we don’t get the business. It’s as simple as that.”

With the best interest duty, brokers and customers were looking for the best deal possible, he pointed out. “There’s a lot of great deals out there, which is creating competition and keeping us all on our toes to make sure that we are competitive and we’re within the risk appetites of the organisations that we work for.”

He said non-banks and second-tier lenders were boosting their market share, especially through cashback.

Waugh said NAB was invested in ensuring all Australians had access to buying a home, as shown by its support for the government’s First Home Loan Deposit Scheme.

lot of money from interest, even if the loan is paid out early; however, the broker ends up making a loss, which is not equitable.

Croucher said it was a great question and one that had been raised a lot by the industry, including aggregators, over the last 12 months.

He said there were different clawback models based on the commerciality of the loan, including rebates and commissions.

“I think we’ve got some work to do as an industry to understand and make sure that running the business is profitable,” he added. “It costs the banks a lot of money to process a loan, as well as it does for a broker.”

Doobov said banks needed to look after brokers because they were customers of the banks too – each broker introduced hundreds of loans to banks. He gave the example of a client taking out a loan and then 10 months later the client is enticed by a $4,000 or $6,000 cashback from another lender. The existing lender doesn’t match the rate, and the client refinances with another lender, yet the existing lender has still earned $30,000 interest on a $1m loan, plus other fees. So the bank has still made a profit, at worst case broken even.

“The broker has earned nothing – it has cost the broker $5,000 to process the loan,

so the broker has actually gone backwards after clawback,” said Doobov. “It just seems like a non-equitable position that you would allow your business partner [brokers] to actually lose money from a transaction, even though the bank has made money.”

Doobov said the banks’ arguments about margin had been around for many years, yet every year the banks’ profits continued to increase.

Clawbacks had been discussed by the Combined Industry Forum, and the new MFAA CEO [Anja Pannek] would no doubt be keen to discuss the issue with aggregators and lender partners.

He said lenders had increased cashbacks over time to get more business, and they had become “like a drug that the customers are addicted to”.

“Thirty years ago you would go in a suit and tie to the bank and be on your best behaviour to get a loan,” Doobov said. “Now it has been flipped around where the customer dictates to the bank.”

Croucher said it wasn’t as simple as just get ridding of cashbacks. Given increased competition, it was easy for and “extremely attractive” to a customer to get a $4,000 or $6,000 cashback.

Broker question from Justin Doobov: What is your bank doing to make commission clawbacks more equitable for brokers? Banks make a

Waugh commented that because of the maturity and sophistication of the industry, the government had become comfortable about not performing a remuneration review.

“That remuneration review works across the whole industry, not just for brokers. I think as soon as you trigger one area of remu neration, that is going to trigger a review of the economics across the whole industry,” he said.

“The second point is on the sophistica tion of pro-rata clawback. There’s operational risk and remediation, challenges for systems, and investment in systems. It’s not as easy as saying, we’re going to get it pro rata – it’s actually just not that easy to operationalise. Clawback is quite standardised.”

Waugh said banks and big organisations consistently had issues around systems and implementation of processes. “It’s not as easy as just flicking a switch and it being pro rata across the industry, because everyone’s got different systems.”

Brick said the discussion was not a simple one; it was in fact quite complex. Both he and Croucher were participants in the Combined Industry Forum, which considered the issue.

He pointed out that the industry needed to be circumspect when it came to any wholesale change to remuneration structure.

The impact of any changes would need to be well understood. “This conversation throws up all sorts of considerations that can’t be resolved unilaterally,” Brick said. “We want a sustainable industry.”

Brokers are now writing 70% of residential home loans. How will you grow and strengthen your third party partnerships?

Willsallen said Westpac was super excited about its recent launch of NextGenID, which was designed to make life easier for brokers and customers through better and faster loan processes.

The bank had invested in the technology, which operated in the background and “you can’t always see it”, she said.

CCR reports had been made available through NextGen as well.

“Today we’re helping cash flow, but actually we want the broker to have a really holistic conversation [with customers],” Willsallen said. “We want them to have everything they need to give us everything that we need so we’re in a position to be able to make a deci sion on a loan as quickly as possible with as little to and fro as possible.”

She said Westpac had also responded to broker feedback by simplifying its cash-out policy and making credit policy changes in relation to rental income shading policy.

“One of the things I love about brokers is they’re always very quick to tell you what they like about what you’re doing but also what they don’t like and where you’re behind the eight ball,” Willsallen said.

The big change she was excited about in terms of women in homeownership was the expansion of the bank’s medico policy to include allied health professionals such as occupational therapists and psychologists.

As well as expanding coverage, these were all job families with significant gender disparity – more women were working in these areas, Willsallen said.

“Part of it for us is about how we get more women access to some of our amazing 90% no-LMI policies.”

At ANZ, Brick said shoring up its value proposition for brokers had been critical over the last 12 months. The bank had faced some challenges during COVID regarding loan assessment turnaround times, and these had now been improved.

“Thirty years ago, you would go in a suit and tie to the bank and be on your best behaviour to get a loan. Now’s it been flipped around where the customer dictates to the bank”

Justin Doobov, Intelligent Finance

“We’d seen assessment times move beyond what we deem as a suitable time frame,” Brick said. “Over the past 12 months we’ve made several changes at ANZ so that we can continue to provide the fast, reliable and consistent level of service that brokers expect for their customers. We’ve hired hundreds of new FTE and reconfigured some of our assessment processes to reduce the time it takes to assess an application.

“For the last six months or so, we’ve main tained assessment times at around three days for simple applications, and we’ve reduced assessment times for complex [applications].”

ANZ also wanted to continue to ensure pricing parity and credit policy parity with brokers and branch channels.

Brick said the bank also continued to work on assessment quality. “This is a global, cross-industry phenomenon – there is a skills shortage, so finding new assessors with significant experience has been difficult. It’s just the nature of the environment in which we’re operating. However, our recent appointments are now well placed, and we’re working hard to sustain both assessment time and assessment quality.”

ANZ Plus had gained a lot of attention, Brick said. Launched earlier this year, ANZ Plus is a new digital banking service built on a new banking platform.

“It’s an exciting time for the bank,” Brick said. “We’re conscious that brokers form an important part of ANZ’s home loan origina tion model, and we expect to consult with aggregators and brokers as work continues to expand the functionality available to customers through ANZ Plus.”

Of NAB, Waugh said: “We want to be the bank behind the broker. It’s easy to say that, but actually getting chair, board, CEO and executive endorsement on the third party channel is really important – and we certainly got that through our CEO, Ross McEwan, and through NAB’s executive team.”

NAB’s largest investment was in its broker origination platform, which continues to drive automation and make the origina tion process as seamless as possible.

Waugh said the bank had also launched new products, including a tailored home loan featuring LVR-tiered pricing with a simplified fee structure.

“On the channel conflict, I think it goes

from an earlier point around executive support and ensuring that a customer makes the choice, not the bank, on which channel they’ll enter into for a home loan,” he said.

“It’s really important to have channel parity. The customer makes the choice. We treat the customer exactly the same, no matter which channel they choose to transact with the bank.”

Waugh said being consistent and clear with the messaging at NAB was now evident in its NPS scores. “On NAB Broker we’ve gone from plus 10 to plus 46. And on Advantedge we’ve gone from plus 63 to plus 64. So really pleasing results.

“In terms of consistency and parity, and overall support of the broker channel, it could not be stronger than where we are positioned at the moment,” he said.

Croucher said CommBank had “always made sure that we’ve delivered for brokers on a whole raft of things”. But the support was ramping up in terms of delivery.

COVID had encouraged CommBank to work on enhancements for brokers, including technology, use of CCR, digital docs and electronic customer verification.

“This is all starting to come to fruition now we’ve got through COVID,” Croucher said.

There was also a focus on CommBank staff. “We’re making sure that we’ve got the tools to be able to give the brokers the best service that we can and upskill them from an education and training component.”

The bank had invested heavily in an easily accessible broker training hub, with some of the content receiving around 7,500 views so far, Croucher said, and “phenom enal feedback, covering topics such as selfemployed training, use of pricing tools, application navigation”.

He said CommBank wanted to continue to drive the brokers of tomorrow and use technology to make loan applications as seamless as possible.

“It’s important to get that feedback from our brokers who get to see a whole raft of lenders. They’re our eyes and ears on how we can do things better.

“But we can always focus on too many

things and execute none. We want to make sure we execute the biggest things that are going to make the biggest difference to our brokers and customers.”

Ezzy said she would like to see more consistency when it came to bank credit assess ment teams, whose approach to an application could vary “depending on what side of the bed they woke up on”, and for BDMs to have more sway if they were needed to step in.

“What do you guys do to make sure that they [credit assessors] are all thinking at the same sort of level?” she asked.

Waugh said ensuring assessors had the appropriate skills and experience and consistent training was important. “Consistency across how credit decisioning policy is interpreted is critical to the outcome for the broker.”

At NAB, Waugh said there were credit coaches to assist brokers in workshopping the deal before it went to the credit team. “This is actually really well valued by brokers, because it’s getting to the nitty-gritty and workshopping what’s best for the customer and for the broker.”

the help of team managers.

“We want to approve loans, not decline them … we’re on the right trajectory; it’s up around 80% of all loans going through CommBank’s broker channel is one touch,” he said.

“We’ve got 40 credit assessors per cohort of brokers to make sure that that is really seamless and that the person sitting next to them is making the same decision based on its merits as someone else.”

Broker question from Deanna Ezzy: Is a net-of-offset review on the horizon for lenders now that BID eliminates overborrowing by the broker?

Ezzy prefaced the question by saying net of offsets and clawbacks made it challenging for brokers to run a small business: “We have to double the amount of loans to earn what we need just to make a profit,” she pointed out.

She said brokers were abiding by BID and doing the best for their clients and introducing them to lenders that fit the legislation. While large equity releases weren’t allowed without

of LVR lending through the broker channel, as well as utilised funds – which were very high compared to other channels acquiring home loans. “So the net of offset was designed by the industry as a whole to combat those issues,” Croucher said.

“To Phil’s point earlier around our systems, being able to read and under stand money going in and going out, I think there’s work for us to do there. But as far as relooking at [net of offset], there’s nothing on our agenda at the moment.”

He said the broker remuneration review had not occurred because of all the things the CIF had put in place to show regulators that “we were able to self-govern this industry”.

Brick agreed and said the industry had demonstrated it had the maturity and insights “to deliver reforms without regu lators having to intervene and deliver for the industry”.

“So I would echo the ‘no’ [for a net-ofoffset review]. I’d probably urge caution around that space,” he said.

Croucher said if the funds were utilised the broker would always be paid. “It’s just the trigger dates, whether it’s after 14 days or day 365.”

Waugh said his answer on the net-ofoffset review would also be no. “But we’ve only recently reviewed it [trigger dates] – we do day six and then recalculate at12 months.”

There was also a need for investment in automation “to take out the subjectivity”, he said. “It’s a challenge, but we’re absolutely on board with you on that one, and we try and solve it, and try and get consistency as much as we can across the credit decisioning and policy interpretation.”

Croucher said the knowledge of CommBank’s credit teams had been a real strong point, and when new people started it was important to get them up to speed with

justification, the equity being released was generally used to generate more mortgages via investment purchases, providing further benefits to lenders.

Croucher responded by saying that the Combined Industry Forum, involving the MFAA, the FBAA, lenders and aggregators, had “landed on the same point regarding net of offset”.

He said this was to combat regulators’ concerns over the “exceptionally” high volume

Technology is changing the way banks do business, especially through the rise of digital banks and open banking. What key changes have you made in technology, and how will they improve loan processes and turnaround times for brokers and their clients?

Willsallen said NextGenID was a game changer for Westpac, where it had previously been a branch-based ID process. “So we’re super keen to have that investment, and like wise, in terms of leveraging CCR and open banking, we’re really excited about that and making that available in NextGen.”

The bank had also been investing in

“There’s a lot of great deals, which is creating competition. We want to be the bank for all Australians. If we’re not competitive, we don’t get the business. It’s as simple as that” Adam Croucher, CommBank

safety and security for its customers, through features such as the dynamic CVC on the Westpac app, and Scam block, she added.