AUSTRALIAN

Bankwest wins Bank of the Year and a big crowd enjoys the return of the AMAs as a live

Bankwest wins Bank of the Year and a big crowd enjoys the return of the AMAs as a live

Got a story or suggestion, or just want to find out some more information? twitter.com/MPAMagazineAU facebook.com/Mortgage ProfessionalAU

MPA reveals this year’s ranking of the top-performing brokers in Australia based the strength of their loan values

Bankwest’s general manager third party says the 2022 Bank of the Year is committed to its collaborative relationship with brokers and its goal of national growth

Our daily newsletter. Keep on top of property market trends, business strategy, and what

There is nothing permanent except change, said the Greek philosopher Heraclitus more than 2,500 years ago. It sounds like a cliché now, but this can easily be applied to the Australian economy and the financial services sector in 2022.

The year started with the nation still fighting a fast-spreading pandemic, with isolation restrictions remaining in place and international borders closed. Property was enjoying an unprecedented boom, as prices rose more than 20% over 2021, sales activity was high, and interest rates were at a record low.

Fast-forward 11 months, and while the borders have opened and businesses are enjoying a post-COVID bounce, the economy has taken a hit, with inflation edging close to 8%; cost of living pressures; and supply chain problems exacerbated by the war in Ukraine, flooding on Australia’s east coast and labour shortages.

Then there’s the big elephant in the room for mortgage brokers – interest rates –although this is one problem brokers are happy to talk about with their clients.

Thousands are coming to the end of their fixed rate periods, facing a big jump in rates and needing help from brokers

With seven consecutive hikes to the Reserve Bank’s cash rate, pushing it up from 0.10% to 2.85% (by the time MPA goes to print the rate is predicted to reach 3.1%), how can brokers adjust to a market in which people aren’t flocking to buy property and borrowing capacity has been reduced? The answer is simple: the refinancing market. Homeowners on variable rates are shopping around to find the best refinance deal. Thousands are also coming to the end of their fixed rate periods, facing a big jump in rates and needing help from brokers to secure the lowest rate possible.

ABS figures show that refinancing volumes almost doubled between May 2020 and January 2022, from $16.3bn to $33.2bn. Industry experts expect this refinance boom to grow even further. While the major banks are chasing this market hard, offering cashbacks and other incentives to new customers, there’s still plenty of scope for non-banks, which don’t target the prime vanilla client but work closely with brokers to assist the self-employed and SME sectors.

In this issue, MPA’s annual Non-Banks Roundtable sees a range of non-banks discuss the competitive market, technology and commercial finance, and why more brokers are choosing non-banks Two Sector Focuses examine the importance of broker marketing, and increasing diversification into the commercial space as residential activity slows down. This edition also highlights the winners of the 2022 Australian Mortgage Awards, reveals MPA’s Top 100 Brokers and explores what the industry needs to do strengthen cybersecurity.

It’s a bumper December magazine – we hope you enjoy reading it. Have a safe and happy Christmas and a relaxing New Year. See you in 2023!

Antony Field, editor, MPAwww.mpamagazine.com.au

EDITORIAL

Editor

Antony Field Writers

Mina Martin, Bennett Richardson Contributor Michael Gottlieb Production Editors Roslyn Meredith, Karen Atienza

Designers

Loiza Razon, Khaye Cortez, Juan Ramos Customer Success Manager Andi Zbojniewicz

SALES & MARKETING

Publisher Claire Tan CORPORATE Chief Executive Officer Mike Shipley Chief Operating Officer George Walmsley Chief Commercial Officer Justin Kennedy Chief Information Officer Colin Chan Chief Revenue Officer Dane Taylor Director – People and Culture Julia Bookallil

EDITORIAL ENQUIRIES

tel: +612 8437 4784 antony.field@keymedia.com

SUBSCRIPTION ENQUIRIES tel: +61 2 8311 5831 • fax: +61 2 8437 4753 subscriptions@keymedia.com.au

ADVERTISING ENQUIRIES claire.tan@keymedia.com

KM Business Information Australia Pty Ltd tel: +61 2 8437 4700 • fax: +61 2 9439 4599 www.keymedia.com Australia, Canada, USA, UK, NZ and Asia

AUSTRALIAN BROKER simon.kerslake@keymedia.com T +61 2 8437 4786

NZ ADVISER alex.knowles@keymedia.com T +61 2 8437 4708

CANADIAN MORTGAGE PROFESSIONAL john.mackenzie@keymedia.com

T +1 416 644 8740

MORTGAGEBROKERNEWS.CA corey.bahadur@keymedia.com T +1 416 644 8740

MORTGAGE PROFESSIONAL AMERICA katie.wolpa@keymedia.com T +1 720 316 7423

MORTGAGE INTRODUCER (UK) matt.bond@keymedia.com T +44 7525 456869

I feel like I am part of a family again but with the extra bonus of having an efficient & professional group of leaders around me.

I couldn’t be happier with my change to SFG.

Narelle Kerstan

analysis of census data for three successive generations revealed a decline in the likelihood of owning a home at age 25–39. Some 54.6% of millennials (aged 25–39) are homeowners, compared to 62.1% of Gen Xers and 65.8% of baby boomers when they were the same age.

were down 7.5% month-on-month and 9.2% year-on-year in September, according to PropTrack. The slower start to spring across property markets could be attributed in part to disruptions caused by public holidays, including the National Day of Mourning, Labour Day and the AFL Grand Final, which likely delayed some vendors’ selling campaigns.

The amount buyers are prepared to borrow to buy is the biggest factor determining whether they purchase a home, according to NAB research. Location and good local amenities are also top considerations.

Amount they are prepared to borrow to buy

Good local shops, restaurants, and amenities

Size of the house/apartment

House instead of apartment

Size of the land

Good public transport

Buying in a metro area

Having a study/work area

Being in a regional area

Sustainability and energy efficiency

Apartment instead of a house

GOT AN OPINION THAT COUNTS?

Email antony.field@keymedia.com

A cyber liability policy can also cover expenses and restoration costs related to claims for network security and data breaches in which brokers experience theft or lose client information and no ransom is requested. The policy can cover the lost sales you would have made while your business was out of action due to an attack, as well as the cost of investigating the incident and recovering the data.

It can even cover the cost of dealing with any third-party claims or penalties and any media fallout.

EVEN WHEN I was launching BizCover back in 2008, I knew that helping small businesses protect themselves against the risk of cybercrime would be crucial in the years ahead.

Cybercrime is a shapeshifter – the risks businesses face today will likely be completely different a year from now.

As concern grows among business owners after the latest cyberattacks to hit the headlines, industries like mortgage broking face greater risk than ever.

Dealing with an attack is not cheap. The average cost of a cybercrime incident reached a record $63,500 for small to medium-sized businesses in Australia in FY2022, according to the latest Australian Cyber Security Centre Annual Cyber Threat Report

We have also seen a dramatic increase in the number of cyberattacks, with the report showing Australia had an annual total of 76,000 cases, up 13% from FY 2021.

With the risk rising, many business owners are looking at ways to protect their businesses, as a cyberattack can have a devastating financial and reputational impact on them.

Earlier this year, BizCover’s Small Business Bravery Report found that cybercrime, including data breaches and fraud, was the most concerning risk for small businesses, with 31% flagging it as their key risk. Yet only 7% of these businesses had cyber liability insurance.

However, in what could be a silver lining to the recent high-profile attacks, complacency around cyber liability insurance is changing. With more cybercrime cases in the news, BizCover has seen a 100% annual increase in enquiries about cyber liability insurance.

This is for good reason, as many businesses are now realising the danger they are in.

Mortgage brokerages are particularly at risk for two reasons.

Firstly, COVID-19 resulted in many mortgage professionals changing their work environments from in-office to working from home. This transition saw brokerages change entire systems in a short amount of time.

I believe working from home has become a gateway for cybercrime across many industries,

Of course, there are many steps businesses can take to prevent an attack. Multifactor authentication, password protection software and ensuring your devices update and back up automatically are all valuable components of a good risk management strategy.

Training your staff on cyber safety can also be a helpful way to reduce risk.

But while important, these strategies will not be there to protect you if cybercriminals

with many businesses unintentionally exposing weaknesses for cybercriminals to exploit.

Secondly, the nature of mortgage broking attracts cybercrime. Cybercriminals follow the money, and there is big money in data. Since brokerages store vast amounts of sensitive client information and details around highvalue transactions, the consequences of a cyberattack can be significant and farreaching. A data breach could put clients at increased risk of falling victim to fraud and other terrible situations, which could negatively impact them for years.

Cyber liability insurance is a great way to help protect mortgage brokers from such situations by covering a wide variety of costs related to cybercrime, including cyber extortion, where a ransom payment is demanded for compromised data or services – similar to what was seen in the Medibank and Optus cyberattacks.

do succeed. In many cases, it’s only cyber liability insurance that can safeguard your business from a cyberattack’s impact on your reputation and finances.

The average cost of a cyber liability policy for mortgage brokers through the BizCover platform last financial year was $121.16 per month. For some, that may seem expensive. Others may think they don’t need protection or that cybercrimes only happen to the big guys. But the reality is that any business, regardless of size, can be targeted by cybercriminals at any time.

So, the question I have for brokerages is this: Can your business afford to pay for the impact of a cyberattack out of pocket?

Since brokerages store vast amounts of sensitive client information and high-value transaction details, the consequences of a cyberattack can be far-reachingMichael Gottlieb is co-founder and managing director of BizCover, which provides SMEs in Australia and New Zealand with a more efficient and transparent way to purchase business insurance.

Cyber liability insurance is vital to protecting brokers from the impacts of cybercrime, says BizCover managing director Michael Gottlieb

Investing in broker technology, education and a comprehensive broker portal has helped Bankwest reach new heights, including being crowned Bank of the Year at the 2022 AMAs. MPA talks to general manager third party Ian Rakhit

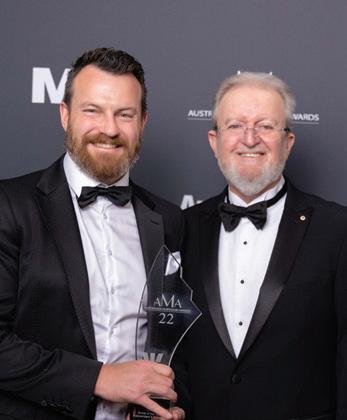

AFTER WINNING MSA National Bank of the Year at the Australian Mortgage Awards 2022 for the second year running, Bankwest could be excused for resting on its laurels.

But as Ian Rakhit, general manager third party, knows too well after a 37-year career in financial services, success in banking requires an ongoing commitment to excellence and a close partnership with brokers.

The non-major bank not only won Bank of the Year but also picked up the award for Best Industry Marketing Campaign at the AMAs.

“Bankwest strives to be the best bank for brokers in the country, and we can only achieve that by working collaboratively with brokers to understand and address their needs, enabling them to deliver the best possible experience for customers,” Rakhit says.

“I’m tremendously proud of my third party colleagues, as well as our critical broker network, and grateful for the recognition we have received over the past 12 months, because it’s a reflection of the authentic, invaluable, collaborative relationship that exists between Bankwest and brokers.”

Rakhit says brokers are vitally important to Bankwest and a key pillar of the bank’s business. “We make no secret of the fact that more than 80% of our home loan customers arrive at Bankwest through a broker.”

Bankwest’s commitment to supporting and

investing in its broker network is in line with the bank’s ambitions to be there for more home loan customers nationally, says Rakhit.

“We’re in constant conversations with brokers and actively seeking feedback and listening to what they tell us so we can improve or create the processes and tools that support them in delivering the best possible experience for customers.”

Rakhit says feedback from brokers has helped Bankwest create a fully digital home loan process that is a faster and far more simple

one-stop-shop Bankwest Broker Portal also means our broker network is empowered to self-serve most of their requirements – but when they need us, our colleagues are always available,” Rakhit says.

“We’ve also been working closely with brokers to develop a new support tool that we look forward to unveiling soon.”

Bankwest is committed to investing in the third party network via innovation, with new digital tools or practical support for brokers when needed, says Rakhit.

“We see that investment through the market-leading solutions in the Bankwest

and efficient experience for brokers and their customers.

This includes features ranging from free digital valuations to application processing and submission with digital signing, through to dispersal.

“Our unique case-ownership model and

Broker Portal and our continual improvement and addition to the tools and services available to brokers.”

The bank is also recruiting more broker development managers to support its network, particularly through its unique case-ownership model.

“We’re in constant conversations with brokers and actively seeking feedback and listening to what they tell us so we can improve or create the processes and tools that support them”

Name: Ian Rakhit

Title: General manager third party Company: Bankwest

Years in the industry: 35+

Career highlight: “I joined Bankwest in 2007, when we were predominantly a West Coast lender. I’m proud that in my time here, I’ve been privileged to play a role in our national growth, and now more than half of Bankwest’s customers live on the East Coast.”

Career challenge: “Coming to Australia 15 years ago with a young family and no networks was very challenging. I threw myself into my work from day one but neglected my home life, and I didn’t help my wife and children to settle in the first 12 months, which I regret.”

Rakhit says Bankwest also provides learning opportunities for brokers, to support their personal and professional development. One example is the Bankwest Broker Learning Library, launched in 2021.

“It provides brokers with ongoing professional development resources, a comprehensive bank of insights, videos and content for growing a business, while our Connect Event series is designed to motivate and empower brokers,” says Rakhit.

Brokers also have complimentary access to Bankwest’s Health and Wellbeing Assistant program – a confidential service that connects

from 11% to 27% between 2021 and 2022; for millennials this was also up (18% to 30%).

“However, Home Truths also told us the ‘Great Australian Dream’ remains alive for most aspiring homeowners, with more than 60% of people telling us that the goal remained important to them,” Rakhit says.

Rising costs of materials and transport, skilled labour shortages and supply issues are also affecting the market nationally, but the effects are different between states.

About 10% of Home Truths respondents said they had cancelled or delayed plans to buy a home because of the current environment, but WA again stood out with significant shifts

Based on a survey of 1,700 people in WA:

60% of respondents (73% of Gen Zers and 57% of Gen Ys) said homeownership remains an important goal

27% of Gen Zers (up from 11% in 2021) and 30% of Gen Ys (up from 18%) feel the goal is unobtainable

10%

24%

brokers with trained coaches for when they need extra support, whether it’s physical, mental, social or financial.

The results of Bankwest’s annual Home Truths survey are revealed in a valuable attitudinal report that the bank commissions to provide insights into the perceptions, intentions, preferences and behaviours of current and aspiring homeowners across Australia.

For Bankwest it’s a means of ensuring it remains informed about the current attitudes of current and prospective homeowners. “It enables us to share critical insights with stakeholders to ensure they are supported in delivering the best possible experience for customers,” says Rakhit.

Bankwest’s 2022 Home Truths report shows there are clear affordability concerns across the country. More young people feel homeownership is less achievable, Rakhit says. That’s most evident in WA, where the report shows a jump in the proportion of Gen Z homebuyers who feel the goal is unobtainable,

in homebuyers’ purchasing intentions.

The number of those looking to build has also fallen significantly in the past year, from 38% to 24%, while those seeking a property ready to move into rose from 46% to 57%. Even those looking to renovate increased (from 13% to 18%). “That would appear to be a direct response to the challenges facing the construction industry, given the reduction in a preference to build, an increased desire for already-established houses, and those not even wanting to move,” says Rakhit.

Customers are at the heart of everything Bankwest does, says Rakhit, whether it’s the bank’s proprietary colleagues focused on delivering the best possible experience, or its third party team ensuring brokers are best supported to do the same.

“We get to work in a collaborative environment in which all our colleagues are supporting each other and pulling towards the same goal as we look to support more customers across Australia to put a roof over their heads.

57% are seeking a property ready to move into – an increase from 46% in 2021

“We pride ourselves on supporting our more than one million customers across the country, and we embrace diversity and inclusivity to ensure our workforce reflects those customers and communities we exist to support.”

Bankwest has a clear ambition to serve more home loan customers nationwide, and with more than 80% of its home loan disbursals broker-originated, “we have a goal to be the leading bank for brokers across Australia”, Rakhit says.

“We’re in a strong position on the East Coast to grow as a homeowner-focused digital bank due to our distinct brand, first-class broker services and digital investment plans,” he says.

“We’ll continue to be a leading retail bank in our home state, a Perth-based national business that WA can be proud of and a major employer that offers new career opportunities for West Australians in the future.”

“We’re in a strong position on the East Coast to grow as a homeowner-focused digital bank due to our distinct brand, first-class broker services and digital investment plans”

SMART brings science to marketing with an automated broker marketing platform that’s continually optimising to serve your business. SMART manages your client communications across the entire customer lifecycle from prospect to reconnect. Take control of your marketing and become the brand you’ve always wanted to be. It’s time to play it SMART.

Go far. Go together. afgonline.com.au/smart

DIVERSIFYING INTO commercial finance is a wise career move for brokers right now. The heat is dissipating from Australia’s real estate sector, with some analysts predicting house prices will fall by 20% or more by 2023 based on the Reserve Bank’s current trajectory of official cash rate hikes.

Rising interest rates and inflation have dampened buying and selling of property, but there is also intense competition between lenders and therefore brokers for the growing number of mortgage holders seeking to

refinance their home loans to get a better rate.

Many residential brokers have clients who are self-employed or small business owners, and they have organised their home loans through these brokers, but not their businessrelated finance needs.

That’s an opportunity lost for brokers, who with the right education, training and support from lenders and aggregators could be tapping into a vast market by offering these clients commercial loans.

The latest figures from the MFAA’s Industry

Intelligence Service 14th Edition report, covering 1 October 2021 to 31 March 2022, show that the proportion of mortgage brokers also writing commercial loans now stands at 29%, up 0.2% on the previous six months. Year-on-year this represents a 14.1% increase, or 669 more brokers writing commercial/asset finance loans.

The figures indicate that there’s huge scope for growth in the commercial lending sector – and certainly far less competition than for residential home loans. Diversifying

More and more residential mortgage brokers are turning their hands to commercial lending to diversify their income streams as the residential property market cools off

into the commercial space can help brokers prevent clients from going elsewhere for business finance, strengthen client relationships and grow their businesses through word-of-mouth referrals.

In a national economy dominated by small

Non-bank lenders Thinktank, Prime Capital and OnDeck Australia, customerowned bank Gateway Bank and major broker aggregator AFG have shared with MPA how they support broker diversification, and the benefits it provides. They say commercial

Zeb Drummond, says education, engagement and support are key to the growth of commercial lending in the broker market.

“Commercial is often perceived as too hard or complex and therefore too daunting to consider,” he says. “In reality, once the key principles are understood, just like in residential, it becomes very apparent when a deal is going to work and what lenders might be best.”

Peter Vala, general manager partnerships and distribution at Thinktank, says that with rising interest rates, ongoing economic uncertainty, and competition between lenders, many borrowers are more actively considering their financial position.

to medium-sized businesses – 98% of the 2.4 million businesses in Australia are SMEs – the recovery from the pandemic continues. Equifax’s September quarter Commercial Insights index shows demand for business loans, trade credit and asset finance has increased year-on-year. Business loan applications grew 2.6% in the September quarter compared to the same quarter in 2021 and a whopping 25.2% compared to 2020.

finance is not as difficult or complex as some brokers assume.

Despite the growing number of mortgage brokers dabbling in the commercial space, it’s just a drop in the ocean in terms of the size of the market. So, how can the industry encourage brokers to get on board?

Gateway Bank’s chief operating officer,

“Some are looking beyond traditional residential loans to restructure debt and improve cash flow,” he says. “Others are taking a more aggressive approach in seizing on the market instability to expand their business operations and acquire commercial property. All of these activities are generating significant opportunities for brokers offering diversified solutions.”

Vala says brokers who have built strong and trusted relationships with their clients and can act quickly and flexibly when turned to for assistance, are the ones making the most of these opportunities.

David Drinkwater, national sales manager commercial and asset finance at AFG, says the

“Diversification can offer significant benefits. Primarily, it’s a valuable strategy for brokers in deepening existing relationships as borrowers seek alternative lending options, which in turn grows business” Peter Vala, Thinktank

broker proposition is just as strong for SMEs as it is for residential customers.

“It makes perfect sense for brokers to be offering their SME customers commercial finance,” Drinkwater says. “Many SME customers have historically only dealt with the lender they hold their transactional banking with, and often there is no real face-to-face relationship with that lender. Customers have a relationship with their brokers, and brokers have proven to their customers the value they can add to the process.”

Drinkwater says brokers have a growing understanding of how great the opportunity to add commercial and asset finance to their proposition can be.

“The main barrier for brokers to offering commercial finance is around the time and willingness to invest in either people or training to gain the skills required to write commercial.

“We’re now seeing lenders, and aggregators like AFG, investing and bolstering resources for their commercial broker models that include more BDMs, streamlined training, and technology platforms that simplify commercial and asset finance broking.”

Prime Capital CEO Steve Sampson says providing education and improving skill sets is the key to encouraging more brokers to write commercial loans.

“Aggregators and lenders should be paving the way with programs to help brokers increase their knowledge and help them diversify,” he says.

“This becomes a win, win, win for all parties. Many brokers think that commercial lending and asset lending is complicated. Well,

that depends on whom they deal with, and starting with more vanilla-type lending is the key to growth and success.”

Sampson says Prime Capital knows that for most residential mortgage brokers, 30% of their client bases are self-employed. “Through our knowledge and coaching webinars and learning sessions, we help them realise that untapped potential.”

OnDeck Australia CEO Cameron Poolman says increasing interest in commercial lending comes as no surprise to the lender.

“Our recent research confirms a high level of demand for brokers’ service across Australia’s small business community,” he says. “Our survey found six out of 10 small businesses (60%) would consider using a broker for their future financing needs. Moreover, an overwhelming 86% of small businesses would return to their broker for support with organising finance in the future.”

Poolman says the small businesses OnDeck surveyed cited a number of drivers for SMEs seeking a broker’s support, including:

• 59% want the advice and opinion of a broker

• 45% have found a broker helpful in the past

• 41% want the best price possible for finance

• 31% lack time to independently arrange financing

• 12% require finance urgently

“The key is for brokers to realise the breadth of opportunity that small business lending offers,” Poolman says. “The challenge facing brokers is that small business lending is traditionally a much-neglected area across

the big banks, and small enterprises can experience a high rate of rejection among traditional lenders.”

OnDeck research in 2020 found that of small businesses that had applied for finance in the past, one in four (24%) had been rejected by a bank when seeking a business loan.

But this “lack of attention” to small business lending among the big banks is creating exceptional opportunities for brokers, says Poolman. “They can step in and help their clients enjoy the benefits of a fast and efficient application and approval process offered by a dedicated small business lender that understands their needs.”

Sampson says it’s inarguable that the residential market has slowed down, and some banks have publicly stated that they are not looking at growing their market share in this sector.

“That makes sense for them because the intense competition they have created over the last few years has stripped margins to a thread. If they aren’t growing, then neither will brokers, so there’s an imminent need to diversify,” he says.

“What we have is a perfect storm, rising interest rates and a subsiding residential property market. Investors are scarce, but commercial assets such as industrial properties are holding strong. If a broker wants to grow their book, then probably the residential market is not the place.”

Drinkwater says right now there’s a substantial uplift in the number of brokers interested in offering commercial finance, compared to the past two years.

“There is a genuine window of opportunity for brokers to make a tactical diversification that can open new revenue streams and add substantial value to their loan books. With over 100 commercial and asset finance lenders in the market, customers can find themselves confused, bewildered and in need of a broker to help them find the right product for their needs,” he says.

Poolman says a slowdown in the residential property space was inevitable to a degree,

“Our research confirms a high level of demand for brokers’ service across Australia’s small business community. Six out of 10 small businesses would consider using a broker for their future financing needs” Cameron Poolman, OnDeck Australia

given the cyclical nature of the market, and this will impact brokers who focus solely on residential lending.

OnDeck has seen significant growth in small business lending volumes since the end of pandemic lockdowns when businesses were able to take advantage of pent-up consumer demand. The non-bank lender recorded 43% growth in loan originations in the first six months of 2022, following the company’s management buyout by an Australian team in late 2021.

“We are seeing brokers diversify into commercial lending because they recognise that fintech lenders such as OnDeck are meeting the needs of their small business clients with an application process that is fast, efficient and easy to navigate,” says Poolman.

This is important as small businesses can’t afford a protracted application and approval process, he says. “OnDeck uses a technology-

in pace, many brokers are taking the opportunity to upskill and strengthen their businesses, while adding new income streams in the process,” he says.

“This may include expanding their offering into areas such as commercial property, SMSF lending and asset finance. The

diversify their loan book and expand the income opportunity.”

Drummond says the MFAA Industry Intelligence Service report for the six months to 31 March 2022 shows that the number of brokers diversifying and leveraging this opportunity has increased drastically, leading to a $5.7bn rise in commercial loans written year-on-year. “That’s a lot of loans,” he says.

Drinkwater says AFG has set up an entire division dedicated to commercial and asset finance. It was specifically created to help brokers start doing commercial finance.

David Drinkwater, AFGbased approach that allows brokers to get the deal done sooner.”

This includes requiring just six months of bank statements to be uploaded to OnDeck’s secure portal for loan applications, while its Lightning Loans can be assessed in as fast as one hour.

“We believe this is the fastest in the industry, and it benefits the broker and the small business,” says Poolman.

Vala says over the past few years the residential mortgage space has been exceptionally busy, and many brokers either didn’t see the need or perhaps didn’t have the time to look at diversifying.

“With lending opportunities now slowing

key is for a broker to review their book of clients and see what new product and finance offerings can reasonably meet their needs now and in the future – and then plan for that.”

Drummond says the slowdown of new sales in residential, with changing consumer behaviour, is impacting brokers and will continue to do so.

“We may go some time before we see the rates of purchase activity growth that we have seen in recent years,” says Drummond.

“The focus will shift to refinances and to servicing existing clients more broadly. Commercial lending is a great way for a broker to open up new customer segments,

He says after helping hundreds of residential brokers diversify into commercial finance, AFG developed a framework that focuses on three key aspects of the support it provides:

• Highly focused training that is accessible digitally as well as in person and covers everything from the basics through to the nuances of structuring commercial deals

• Simplified technology that assists with lender selection, information collection, submissions and accreditations

• An army of commercial experts, including local BDMs and a national scenario and support desk for working hand in hand with brokers to structure deals

Poolman says, “Brokers who are uncertain about commercial lending can rest assured that OnDeck’s accreditation process is very straightforward, and our experienced team

“The main barrier for brokers to offering commercial finance is around the time and willingness to invest in either people or training to gain the skills required to write commercial”Source:

of BDMs is available to offer support at every stage.”

He says OnDeck’s technology-driven approach makes loan applications easy: after uploading six months of bank statements to the secure OnDeck portal, the bespoke KOALA Score™ credit assessment algorithm drives a turbo-charged funding decision.

Poolman says OnDeck has invested in promoting its free ‘Know Your Score’ tool to the broking community. “It allows brokers to have conversations with their small business clients around the credit score of the business. One in two small businesses aren’t even aware that a business has its own credit score independent of owners, so this can be a great way for brokers to engage and educate their small business clients.”

Drummond describes Gateway as a small lender, “not an industrialised machine”.

“We use technology to help us move quickly through the mundane, but appreciate the value in workshopping a deal and connecting brokers with good bankers,” he says.

Gateway entered the market with a simple product with a simple headline rate to help

ways to improve their surplus cash flow via consolidating debt or extending loan terms.

“This need to optimise finances has also resulted in SMSF purchases and refinances remaining strong, with borrowers seeking to utilise the most beneficial tax structure possible to support their retirement expectations,” he says.

In terms of growth areas, Vala says the high demand for industrial property is resulting in a substantial increase in transactions and opportunities in this sector. “In fact, our latest market report has highlighted industrial as the only market segment in Australia that’s improving in every capital city.”

overcome the complexity barrier for both brokers and their clients.

“We wanted to make the process as transparent as possible with our brokers and didn’t feel like risk-loaded below-the-line pricing was helpful in that regard,” says Drummond. “This is also why we opted to have a product that didn’t require annual reviews, as these can increase the broker and banker low-value administrative burden.”

Vala says one of the clear trends at present is the increase in refinancing as borrowers look for

With the demand for residential finance continuing to decline, diversification can offer significant benefits, says Vala. “Primarily, it’s a valuable strategy for brokers in deepening existing relationships as borrowers seek alternative lending options, which in turn grows business. It really comes down to having the implicit flexibility to meet a client’s varying finance needs.”

Vala says the more product solutions a broker can deliver, the greater chance they will have of retaining existing clients and opening up new opportunities. “Brokers who are skilled up to diversify into areas such as commercial and adapt to the challenges of a fluctuating market will be ideally placed to strengthen their business and prosper.”

“Investors are scarce, but commercial assets such as industrial properties are holding strong. If a broker wants to grow their book, then probably the residential market is not the place” Steve Sampson, Prime Capital

Sampson says fast and simple loans are the key: “We believe this so much that we have trademarked the term.”

“SMEs don’t have time to waste when they require finance,” he says. “Forty-three per cent of SME borrowers say the main challenges they experience are that lender requirements are strict; and the amount of time the process takes. Brokers using the right lenders that understand these requirements can carve out a niche for themselves and do it quickly.”

Drummond says there are many customers that have existing commercial loan facilities.

“Commercial customers behave in a different fashion to residential borrowers as they have different needs,” he says. “Commercial lenders behave in a slightly different way too; shorter-term facilities are

your potential trail book multiplier should you wish to sell.”

It may come as a surprise to some residential brokers, but extra qualifications are not required to become a commercial broker, although it’s a good idea for brokers to seek the support of their aggregators and lenders when taking on commercial loans.

Vala says there are no minimum education, experience or volume requirements for workshopping and submitting a loan application to Thinktank. “Our entire focus is to quickly and effectively equip brokers to expand their networks into areas such as commercial and SMSF lending, including how best to structure loan applications and secure a timely approval.

Drummond says while the standard industry qualifications are the same, where the gap lies is in education. “Gateway has different accreditation content that brokers complete before being able to submit a commercial application. The content specifically covers the commercial product range and process for submission.”

Drummond says there are face-to-face and remote courses that can help brokers with the theory and practice of writing commercial loans, “but nothing really beats sitting down with someone to workshop a deal”.

“A mentor is critical to success in this regard,” he says. “Our commercial bankers are also set up to support brokers workshopping deals – this is something we wanted to contribute to the industry.”

Sampson says the need for brokers to have a mentor depends on the complexity of the applications that the broker chooses to work with. “Most aggregators and lenders have excellent support to assist their introducers.”

commonplace due to how commercial facilities are and have been written. This presents as an opportunity to write a large number of deals quickly as review periods drive borrower behaviour.”

There are two main areas of commercial lending that have seen significant growth, says Drinkwater: products that don’t require full accountant-prepared financial data (leasedoc, low-doc, accountant declaration); and SMSF lending.

“In particular, SMSF lending creates a great opportunity for brokers, as a number of the major trading banks pulled out of this market due to the perceived complexity of the transactions,” he says.

“Providing a holistic service offering to your SME customers will assist in customer retention,” he adds. “And apart from the additional income stream, it also adds value to

To support this, our team of dedicated relationship managers are there to help brokers, from establishing the loan through to settlement.”

While no additional qualifications are needed to become a commercial broker, Drinkwater says some lenders want to ensure the broker is either active in this space, completes appropriate training, and/or is a member of a commercial lending industry body.

“AFG’s business program has a conversion ratio of 70% from lodgement to lender to settlement,” he says. “This is based predominantly on the lender-matching capability and knowledge of the lender’s information requirements once a product is chosen.”

Sampson says for brokers to submit commercial loan applications to Prime Capital, the standard industry qualifications for writing residential loans are needed, along with Prime Capital’s accreditation training.

Drinkwater agrees that there are some complexities in moving into commercial. “Scenarios sometimes come with unique characteristics whereby there will be great benefit in having an experienced mentor or good technology that can assist in narrowing lending options and structuring the transaction. AFG provides a unique proposition whereby we offer both technology, BDM support and a lending scenario support desk via our business program.”

Vala says a trusted mentor who brokers can turn to is a great advantage when diversifying into commercial property, particularly as the sector covers a wide spectrum of lending.

“It’s advisable that a broker has more than one mentor or subject matter expert they can turn to in order to support all their commercial lending and knowledge needs,” he says.

“Our best piece of advice for brokers is to ask lots of questions and gather as much intel as possible with any new transaction. Have two or three trusted RM or BDM lenders with different lending backgrounds who can workshop transactions and recommend the best path to follow.”

“Commercial is often perceived as too hard or complex. In reality, once the key principles are understood, it becomes very apparent when a deal is going to work” Zeb Drummond, Gateway Bank

and have no further marketing campaigns, then they have a poor business model and could be deemed non-compliant.”

Buchanan says marketing has many benefits, including improving engagement with existing clients and new customers, and increasing the value of the broker’s business should they sell it or borrow against it.

“Mortgage broking is a highly competitive industry, and how you market your business, both nationally and locally, will be crucial to your success,” says Chadwick. “At Mortgage Choice, we often say ‘you can’t sell a secret’. It’s critical that brokers can leverage the strength of a nationally recognised and trusted brand to be seen and heard in their local communities.”

Chadwick says new-to-industry brokers face all the challenges of starting a small business, and “marketing can sometimes take a back seat”.

IN THE ultra-competitive world of mortgage lending, brokers need to be noticed.

More than 70% of all residential home loans are sourced through brokers, and the competition is fierce. A tailored marketing strategy is vital for brokers to cut through and reach both new and existing customers.

Blake Buchanan, general manager of Specialist Finance Group, and Sally Chadwick, executive manager franchise marketing at Mortgage Choice, share their thoughts on broker marketing.

“You only need to look at the bestperforming brokers from around the country to see that they all have well-thought-out marketing and client engagement programs,” Buchanan says.

He adds that he sometimes hears brokers say they don’t need marketing, and “all of their business is by word of mouth”.

“This statement is often misleading, as once they attract a client they regularly engage them, which is marketing in itself,” he says. “For the ones who attract clients in this fashion

“Yet with some careful planning and discipline, effective marketing can really kick-start your business,” she says.

She advises new brokers to develop a marketing plan first.

“It can be simple, as long as you can action it consistently,” Chadwick says. “Think about who within your existing network you can reach out to, and the types of clients you plan to target, then determine the most effective marketing activities to reach these groups.”

She says all this information should be recorded in the plan. New-to-industry brokers

How can brokers both attract new customers and keep existing clients engaged? The answer is a well-thought-out, targeted marketing strategy

should also speak to established brokers and aggregators for advice and support.

Chadwick says with rising inflation and interest rates, there’s an opportunity for established brokers to not just rely on their existing books but go out and seek new business as well as “guide the next generation of borrowers through these tricky economic times”.

Buchanan says marketing is an ongoing commitment business owners and managers need to continually work on.

“New-to-industry brokers are best served by understanding their skill sets and identifying markets that suit them to market to initially before expanding their reach,” he says. “They should also identify opportunities within their existing networks – sports, church, cultural or other – for the easier wins.”

New brokers should ensure that all their contacts know exactly what they do and why they do it, Buchanan says. “They need great and succinct messaging, offers to assist, requests for business, repetition, and to be across different platforms.”

Usually, social media offers great low-cost vehicles for this, but marketing requires discipline, consistency and time to work, he says.

Established brokerages use marketing campaigns targeted at existing customers to ensure their brokers are front of mind when clients need to chat. “With run-off rates only speeding up, we should look to effectively market to our existing clients to minimise attrition in a more-competitive-than-ever market,” Buchanan says.

SFG believes that all the tools a broker needs to successfully apply their trade should be in their CRM. “Our leading technology, SFGconnect, makes marketing simple with content creation, marketing journeys, automatic and tailored campaigns, to name but a few,” Buchanan says.

It can be as simple as adding a tag to the customer that might identify them as a first home buyer, for example. This triggers automatic emails and text messages (from the broker’s number) to the prospective client. When the client is converted, the tag is

updated and that client can be switched to the full customer journey.

Buchanan says SFG brokers often say they’re tapping into more of their own clients through these features.

Chadwick says REA Group’s acquisition of Mortgage Choice meant a massive reinvestment in the brand. This year, the company ran a national multimedia advertising campaign, You’re Never a Loan, which was complemented by tailored assets for brokers to use in local area marketing.

“The campaign contributed to fantastic results in brand recognition and lead generation,” Chadwick says.

Marketing support for Mortgage Choice franchises includes:

• tailored minisites for each franchise, and search and lead-generation optimisation

• access to seasonal campaigns and marketing

assets that are customised for brokers to use locally

• access to Sprout Social – a social media scheduling and management tool that helps to easily maintain an effective social media presence

• a comprehensive calendar of online marketing webinars and tutorials

• individual broker marketing consultations with franchise marketing experts to help brokers develop local marketing plans, and coaching for franchise owners on local area marketing activities

• opt-in customer EDMs tailored for specific audiences, with content from Mortgage Choice journalists and content creators

• access to marketing event materials for brokers, to help them run local events and activations

• branded and customisable merchandise and stationery supplies

“You only need to look at the best-performing brokers from around the country to see that they all have well-thought-out marketing and client engagement programs”

Blake Buchanan, SFG

Chadwick says technology continues to evolve the way brokers communicate with and market to their clients. The pandemic saw brokers making better use of social and digital tools, such as Zoom, to run online webinars to generate new business.

“While we’ve certainly seen a return to face-to-face interactions, many brokers are continuing to use these digital strategies as part of their marketing mix,” she says.

Buchanan says face-to-face communication will always be important, but digital will replace many of these interactions.

“As time marches forward, people are more and more time-poor and purpose driven. Meeting face-to-face for many is inefficient,” he says.

“The purpose of the meeting is to identify and fulfil a need, and this can easily be done digitally. All of these interactions with clients, digital or otherwise, are marketing opportunities. Every interaction you have is being judged by your clients and tested against their outcomes and experience. So treat every interaction, digital or other, as if you are marketing yourself and your business.”

Digital platforms and open banking will level the playing field for brokers, so how do brokers ensure they stand out?

Buchanan says most clients want a relationship with their broker, like they have with their financial planner or accountant, knowing they are experts. Brokers will in future be able to offer on-the-spot approvals to their clients, and lenders are already working to achieve this.

“Our broker market share will continue to

grow, and when it gets to, say, 80%, rather than increased market share assisting with growth, more and more you will attract business from your fellow brokers,” says Buchanan.

To do this, he says brokers need good marketing to tempt clients to use a new broker, and then they must retain these clients with “impressive service, care and strong relationships”.

“People deal with people they know, they like and they trust, and so whilst we must adapt to new digital processes, you will always be relevant because humans love dealing with humans.”

The digitisation of mortgage broking has progressed, says Chadwick, but “we are nowhere near having technology replace human interactions and the intrinsic value of the customer service a broker can provide”.

The take-up of open banking has been slower than expected, and the “recent data breaches hitting the headlines are likely to slow this further”, she says.

“Most people are not yet ready for a fully digital home loan experience.”

Chadwick says brokers can differentiate themselves through quality service and by building genuine connections with clients. She encourages brokers to regularly contact clients for home loan reviews, and to prove their expertise by sharing their knowledge.

Buchanan says each broker and their business is different, so SFG works with individuals to identify and assist with strategies to enhance their marketing plans.

“A common missed opportunity is your book awareness and opportunities within it,” he says. “Run-off from a mature book is at about 20% and increasing. That means that if you have 500 customers, on average, 100 will refinance, sell and buy each year. If you can successfully engage your book, have amazing relationships and processes, then you could write 100 deals in a year just from your existing database.”

At Mortgage Choice, Chadwick says the franchise marketing team consults with franchisees to help them develop tailored local marketing plans.

“The team explores that franchise’s target audience and the types of local area marketing campaigns that will provide the most effective return on investment,” she says.

One example is the Mortgage Choice ‘Dream Maker’ caravan in the Adelaide Hills. Franchisees Robert Shearwood and Matthew Adam sponsor the AFL Hills Football League and have branded the caravan that broadcasts local games via YouTube and Facebook.

THE FINAL few months of 2022 have been a tough time for non-banks and their broker partners.

In November, the Reserve Bank of Australia lifted interest rates for the seventh month in a row, taking the official cash rate to 2.85%, up from 0.10% in May.

Homeowners on variable rates are doing it tough, dealing not only with higher mortgage repayments but ballooning cost of living pressures due to runaway power, gas, petrol and grocery prices. The RBA is predicting inflation to hit 8% by year-end.

House prices are also falling, with CoreLogic figures showing values fell by 6% nationally in the six months to September and dropped 10.2% in Sydney. New property listings were also down 7.5% month-on-month nationally in September.

But while these factors make things challenging for the Australian economy, the nation’s non-banks are in a healthy financial position and primed for further growth. This is largely due to their strong relationships with brokers, who are increasingly turning to non-banks to help their customers, such as self-employed clients and small business owners who don’t fit the typical vanilla, prime loan profile favoured by the major banks.

The non-banks understand that the big banks have increasingly moved away from alt-doc and SME clients, choosing to focus on the high-volume prime residential home loan space. This gives non-banks the opportunity to service a sizeable portion of the population who are looking for residential or commercial finance and can’t find it anywhere else.

Growing numbers of mortgage brokers are turning to non-bank lenders and also writing commercial loans. The latest MFAA Industry Intelligence Service report for the six months ended 31 March 2022 revealed that 29% of all mortgage brokers had written at least one commercial loan.

MPA invited representatives from some leading non-banks as well as two brokers to attend the 2022 Non-Banks Roundtable held at Seta Sydney. Topics discussed included how non-banks service the broker channel;

competition with banks; growth segments; commercial lending and more.

Participants were John Mohnacheff, group sales manager, Liberty; Cory Bannister, senior vice president and chief lending officer, La Trobe Financial; Barry Saoud, general manager mortgages and commercial lending, Pepper Money; Chris Paterson, general manager distribution, Resimac; Steve Sampson, CEO, Prime Capital; James Angus, chief customer officer APAC, Bluestone Home Loans; Lee Prior, distribution executive, ORDE Financial, and Chris Calvert, executive general manager –distribution, RedZed.

The two broker representatives were Rose Renouf, head of Zinger Finance, and Chris Straw, director and senior mortgage and finance consultant at You’re Welcome Finance.

The MFAA’s Industry Intelligence Service report for the six months to end September 2021 showed three consecutive quarters of growth in broker-originated loan market share for non-banks from December 2020, with a 0.5% decline to 5.8% in the September 2021 quarter. The latest report shows that this recovered in the March 2022 quarter and was up 0.7% to 6.3%. Broker-settled loans through non-banks are at a record $4.9bn [now $5.11bn]. What do your own figures show in terms of how you are performing in the market, in particular with broker-sourced loans?

Mohnacheff got the ball rolling at the roundtable, saying that as non-banks, all those attending the meeting were predominantly focused on the broker market.

“The one thing we have learned is that when things begin to get a little bit unsettled in the marketplace – many brokers have not experienced so many rapid rate rises, and it has unsettled not only some brokers but a lot of mums and dads and mortgage holders – this is the time when the nonbanks shine,” he said.

“This is when we go and make ourselves

even more available to the brokers to help them navigate sometimes a very difficult situation, such as multiple debt consolidation and refinancing.”

Mohnacheff said customers were going to brokers and brokers coming to nonbanks because “we have a very balanced view about how to refinance and how to restructure debt”.

“Due to that, there’s more and more trust going to a broker from the consumers and from the brokers to the non-banks. A lot of them have longstanding and long-trusted relationships with us.”

Bannister said the increasing number of brokers using non-banks (6.3%) was pleasing, but it was also important to recognise that there was still lots of scope for growth in this sector.

“If you look at the historical trend, it was about 8.5% to 9.5% allocation [of brokers using non-banks] over a two-year period leading up to COVID,” he said.

When the pandemic hit, the government provided stimulus funding to major banks, which was important at the time for the sector as a whole, Bannister said. This included giving banks a 0.1% interest rate for three-year fixed-rate funding.

“More and more borrowers sought out major banks, and we [non-banks] got down to 5% [market share]. So we see the return to normal allocations being 8% to 10%. Pleasingly, the sector is already seeing record volumes, with $5.1bn settled in the most recent reported quarter; there’s plenty of opportunity there.”

Bannister said the addressable market for non-banks was expanding. “There’s $2trn worth of residential mortgages in the system, about $600bn of commercial, and they turn over every four years, to the amount of approximately $650bn per annum. Going back to pre-GFC, non-banks were running almost 20% of the [loan] volume in the country. That’s $130bn, a sizeable market

that would satisfy many around this table.”

Bannister said there was “a ton of opportunity”, and La Trobe Financial was certainly optimistic about the future.

At RedZed, Calvert said the non-bank focused on a specific segment – the selfemployed sector. “My observation is that nonbanks, compared to the main bank sector, a lot of them get the service model a lot better. They’re more geared up to work with customers and deliver them a better proposition and outcome.”

RedZed recently commissioned a survey of 250 self-employed people in the SME sector, which included questions about their banking activities.

“At that time, only about 16% of those people said it was easy to secure a loan through one of the main banks, relative to the non-bank sector. That just shows you how the non-bank sector has embraced that whole customer service model,” Calvert said.

“I don’t think it’s getting any easier. While

As a Liberty Adviser, you can supercharge your business and boost your earning potential with home, motor, commercial, business, SMSF and personal loans. You can do so much more with Liberty Network Services!

some of the banks have sharpened up their respective models, it still gives this group in the non-bank sector an opportunity to grow their market share, because they provide a more customer-oriented approach.”

Sampson said Prime Capital dealt solely with brokers, not with the wider market, and the non-bank had performed well.

“Even during the time when the banks were handed virtually free money, we still grew our market share enormously,” he said.

“We have expanded our participation to 11 aggregator panels now, so naturally, we’re getting a growth trajectory off the back of that, and I think that’s only going to continue. We also needed to substantially increase our BDM team, so we looked for experienced, seasoned BDMs to assist us.”

Sampson said all the non-banks at the roundtable would agree that lending was starting to quieten down and the funding market was difficult at present.

“Early next year, I think the market will change, and the banks’ margins will be depleted,” he said. “Non-banks will be in a much better position, and we’ll get some of the market share back from the banks, because there’s no doubt the banks did take the market share off us when that

cheap money was available to them.”

Saoud said Pepper Money’s own broker market share figures reflected those of the MFAA as well as the comments made around the table.

“In the six months to June, we have had record originations. Market share was quite strong for us in the non-bank sector,” he said.

“While the home loan lending commitments have contracted recently due to the macroeconomic environment, there’s both challenges and opportunities for us to continue growing. As a non-bank industry, we’re seeing that the demographics and profiles of borrowers are changing rapidly.”

Saoud said this was where non-banks’ competitive advantage arose in terms of how they accelerated policy change and responded by providing real solutions to customers.

“That’s where I think we will continue to grow market share, as opposed to the banks. They’ve got traditional and firm ways of looking at a borrower, while we’re very responsive and agile when it comes to finding a solution to suit the borrower. The more that we can continue to do that, the more we will be able to better support our brokers and customers.”

Pepper Money was also very reliant on broker-originated loans, which represented

about 96% of its business, Saoud said. For non-banks the focus was investing in that channel and partnering with brokers and aggregators to “really deliver market-leading and exemplary broker and customer services”.

Paterson said he agreed with the comments made. “Our insights show that customers go to brokers for a reason. They put their trust in brokers, and in turn, it’s up to us to provide brokers with a solution. Brokers can trust that we have a broad suite of products that can cater for their customers’ needs, whether it be full-doc, alt-doc or specialist loans.”

Angus said Bannister had touched on something that was “worth unpicking”.

He said when the RBA provided the big banks with term funding facility money for fixed rates, that resulted in brokers writing north of 50% of their residential loan business into fixed rates.

“So when you look at those numbers in isolation, they’re interesting and they look good, but the reality is that on the resi side we’re only playing in half of the market because we just can’t compete on fixed rates.

“When you look at that growth, and I think a lot of us we’re 100%, 200%, 300% year-on-year [loan origination growth], to do that in half the market just shows the

value we add to brokers and customers.”

Angus said there was some naivety about the current lending market among brokers who had only been in the industry for the last five or six years, and they were struggling to join the dots. Non-banks needed brokers and “they need us”, particularly when working with self-employed clients who don’t fit the major banks’ credit profile.

“The flexibility we all have on policy, how we can use different income documentation, even the way we service loans is going to mean that we can provide a solution to that client that nobody else can,” he said.

Angus predicted that once non-banks got through the current rocky period and things settled down, broker-originated loans would rise again.

Prior said the non-bank sector needed to keep being nimble and trusted.

“ORDE is trusted to find the deal, and in the face of uncertainty, to back the resilience of Australian borrowers, which we think can be underestimated,” he said. “When you combine these strengths with a servicefirst and built-for-broker mantra and highly experienced lending and management teams,

we were able to establish brand presence and notable success during the pandemic.

“John [Mohnacheff] talked about this –we’ve got clients that have never seen a change in rate, so there’s that uncertainty there. We need to be known again as that part of the industry that provides stability, provides that education so that we can continue with our market share.”

How are non-banks remaining competitive with banks in the face of higher funding costs?

Prior said that while ORDE Financial may have been the newest non-bank lender at the

roundtable, specialist lending solutions were at the core of a non-bank, and “we must maintain and own the space”.

“Lenders have become a victim of their own success; the ongoing challenge at ORDE is delivering service to handle increased volumes. Our service standards are at the top end, and we must remain here,” Prior said.

Paterson said the answer to how nonbanks competed with banks was simple: “Alternative product solutions and playing to our credit policy initiatives. The parameters, looking at what the customers’ needs are and tailoring a product to suit their needs – that’s where we can compete.”

Angus said he had worked at banks, and from his perspective, non-banks had never been rate driven. “It was always about the solution and improving cash flow. What’s immensely pleasing at the moment is the customers we’re helping today, rates are somewhat irrelevant to them.”

Debt consolidation continued to be a big factor, Angus said. While the ATO had been quite relaxed about tax debt during COVID, “now they’re starting to collect”. This meant there was a lot of tax debt that banks traditionally wouldn’t touch.

“If we just stick to our knitting, and we stay focused on the cash flow, the solution, rate becomes less important,” Angus said.

He agreed there had been a funding challenge for non-banks, which had faced “a very stiff breeze on funding”. Funding markets were pricing in today what they thought would happen in 60 to 90 days’ time.

“If you go back to July, and you look at the disconnect between BBSW [the Bank Bill Swap Rate] and the cash rate, that was 50-plus basis points,” Angus said. “We paid for that – that was a real cost to us … but at the end of the day, if we stay focused on what

“But there’s an element of their profile that’s not easily automatable,” Bannister said. “It could be that there’s a particular structure that’s not easily done by computer. It could be that they’re high net worth and they’ve reached a debt-to-income cap or a portfolio cap with a bank; we’re seeing more and more of that now.”

Sampson said it wasn’t so much the higher funding costs but the lack of supplied funding that was the problem. “We were fortunate we raised some capital just before the rates started to move up. But we’re back in the markets, and it’s much tougher to raise capital now. But talking to our suppliers, we think that January, February, the markets will start opening up again,” he said.

A lot of funders were looking at how far down the stack they wanted to be, Sampson said, with funders even coming into the lower mezzanine facilities.

we do well, and we stay focused on those principles, we’ll continue to grow and thrive.”

Bannister said non-banks didn’t target the same customers as the banks, and the opportunity in the complex prime credit space was significant.

Looking at borrower quality in that space, La Trobe Financial’s independent research via Equifax showed that its borrower credit quality was in line with that of the big four banks.

Investor lending was another opportunity, Bannister said.

“James [Angus] talked about ATO debts; that’s a $33bn opportunity,” he added. “It’s just sitting there for the market to fill. So, as James rightly points out, if you stick to your knitting and you stick to your core target market, let the banks play in that automated vanilla, it’s not something we are generally too concerned about.”

He added that the non-banks had set up product suites for loan types that the banks didn’t particularly want to fund, and nonbanks had helped a lot of people through adverse times. Non-banks would really come to the fore in the next six to eight months when customers were getting knocked back for loans that were previously very bankable.

“If you have a product that is an alternative type of product for self-employed people, employed mature people in their 50s and 60s, who can’t get big cash out from a bank, I think these are the areas that need to be targeted, and non-banks can carve out their niches,” Sampson said.

Similarly, Saoud said Pepper Money was

“More brokers are choosing non-banks because of their service proposition, particularly SMEs … They want a quick response; they want product flexibility”

Chris Calvert, RedZed

not competing for the vanilla, PAYG prime customer. “Our competitive advantage and differentiation is primarily around providing a solution to the non-traditional bank customer, whether it’s someone who is selfemployed or a customer trying to consolidate their debts,” he said.

“We as an industry are able to be responsive and agile due to our smaller business structures that allow us to accelerate credit policy, product, technology, or process changes to cater and respond to those changing borrower demographics and segments.”

To round off the conversation, Mohnacheff came back to the subject of ATO debt.

“If you’ve got an ATO debt, it’s because you made a profit,” he said. “It’s the ability to look at it and say, ‘OK, what is the situation and how can we help you?’ ATO debt can be a good thing as viewed by us; it’s one prism through which you look at that individual and that business.”

The Brokers on Non-Banks 2022 survey revealed that 63% of brokers were sending more loans to non-banks in the last 12 months than in the previous year. Why are more brokers choosing non-banks, and what improvements have you made to technology and your processes to boost this channel even further?

Calvert said more brokers were choosing nonbanks because of their service proposition.

“Particularly in the small to medium enterprise sector where people don’t have time to wait 24 days for the approval of their applications. They want a quick response; they want product flexibility. They want to know if they make a call, it will get answered within 25 seconds. They want to know if they send an email, they will certainly receive a timely response. Turnaround times are critical.”

Due to the way non-banks had been set up with their staff and infrastructure, being far more responsive was important, Calvert said. “As a customer, we always want to have a quick turnaround time and real voice response and not be waiting on the phone for 20 minutes.

impression and makes you think long and hard about whether you would use that bank again.”

The biggest advantage for non-banks was service, Calvert said. “Time is money for these [customers]. They’re often self-employed, a small-to-medium enterprise; they haven’t got time to sit on the phone for 20 minutes just to get a voicemail. And they’re often prepared to pay a little bit more in price for that convenience.”

Bannister said there were two drivers behind why more brokers were choosing non-banks.

Firstly, it was the “phenomenal” maturity of the sector in the past 10 years and a

You also don’t want an automated voice.”

He cited a very recent example of when he rang a bank trying to change credit cards for his mother. “After pressing half a dozen buttons, I was cut off and told, ‘No one’s available to take your call’. That is an example of poor customer service; it creates the wrong

general acceptance that non-banks provided a genuine alternative.

“If we were sitting at a roundtable six or seven years ago, that conversation would be different,” he said.

This customer acceptance was thanks to “the great work of every player in this room”, who were responsible for “incredibly well-run, mature, responsible businesses”.

“Some of us are publicly listed, so they’re very transparent in the way that they go about things. That’s helped raise the profile of the sector generally and built a lot of trust amongst brokers,” said Bannister.

The second driver of brokers favouring non-banks was the human touch.

At the start of the pandemic, borrowers were told by banks that they would be treated as prime credits if they sought hardship assistance or there was variability in their income and expenditure. Bannister

“I’m certainly seeing the rise of non-bank lending in my business. The major banks are very tight in their ways. [Non-banks] have a sensible approach to borrowing capacity”

Chris Straw, You’re Welcome Finance

said that was good in theory, but it was hard to automate.

“Therefore, [these brokers and customers] generally find their way back to the non-bank sector, because it needs some level of understanding and some level of manual intervention to do that,” he said.

“For us, it’s less about tech; it’s more driven by humans. The human element is critical to this component of what we do.”

Finding talent in the last 12 months had been hard – to find the right people, pay them, train them and get them on board in quick time, said Bannister.

Angus agreed. He said Bluestone conducted Net Promoter Score surveys once a quarter, and people were the drivers of NPS scores –BDMs and underwriters.

“We just do the simple things well. We have the time, and I think we actually understand the importance of an underwriter picking up the phone and calling a broker,” Angus said.

“All around this table, we have quality people in the field, and we have quality people underwriting loans, and they all understand or respect the role the broker plays, whereas I don’t think that’s always the case with a lot of our bank competitors.”

Saoud said, “As an industry, we care for the broker. We understand what their needs are, including the importance of speed, transparency, consistency and predictability, as well as a personalised approach to lending and relationship support.

“It’s through those touchpoints we’ve invested in to make a difference. So, whether

it’s having that right BDM team, credit underwriting optimisation, evolving technology and improved business processes has been critical.”

Saoud said non-banks had also stepped up the game in terms of investing in those touchpoints to make a difference. “At Pepper Money we have continued to heavily invest in those personalised broker and customer touchpoints. Investments in next-generation technology development and delivery practices, rapidly evolving automated processes, credit underwriting optimisation and new tools such as e-signing of loan and application documents and launching NextGenID – all of which had been created with a singular focus on the broker and delivering for them and their customers.”

Prior said advancing technology was now set to support and dramatically improve the personal touch provided by great lending teams and so valued by brokers. “Alongside a human touch, brokers want to get a rapid yes, a dependable yes, to get back to their customers, and they want quick processes and a broader product range to service a wider variety of borrowers in the sector.”

Straw said that from a broker’s perspective he was certainly seeing the rise of non-bank lending at You’re Welcome Finance.

“You guys will look at stuff, but the major banks, they’re very tight in their ways,” he said. “You’ve got a sensible approach to borrowing capacity, so we’ll start putting more deals there to satisfy client requirements.”

Straw also echoed Angus’s comments about BDMs, praising the non-banks for having excellent, responsible BDMs with a sensible approach to credit. “They’ve just really helped us get the deals set. With an RHI issue, you guys will say, ‘why?’ we’ve asked that question; it gets treated sensibly.”

Conversely, he said the major banks can sometimes ignore the fact that they have good clients coming to them who have good income streams and assets but “may just have a life problem that just needs to be answered”.

Asked if there were areas where the nonbanks could improve, Straw said his biggest

“Our biggest advantage as a non-bank is our agile credit policy to cater for wider borrower segments. That’s where there’s a differentiation and advantage for us to grow market share”

Barry Saoud, Pepper Money

We’re proud to be once again recognised as brokers’ preferred Non-bank Commercial Lender.

At La Trobe Financial, it’s our deep understanding in commercial lending which helps brokers grow their business by catering to a broader range of client needs.

Speak to an expert BDM on 13 80 10 today

La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence 392385.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 Australian Credit Licence 222213. For a full list of our Awards, please visit the Awards and Ratings page on our website.

Target Market Determinations for our lending products are available on our website or by calling us on 13 80 10.

bugbear was that 15 years ago, they put a line in the sand: a maximum loan of $1.5m per security. Since that time, property values had quadrupled in Sydney, yet the limit had never been raised. “So I look at it and go, why can’t we have a low-LVR, high-dollar value per security? So a $4m loan against a $10m property? To me, that seems like a good deal, but I can’t get that set anywhere except for at a couple of lenders. I’d rather do one home in Vaucluse than 10 in Bankstown at 80%, but I would love to understand the reasoning behind the lack of competition in the larger full-doc, low-doc space.”

This led into Straw’s question to the nonbanks represented at the roundtable.

Broker question from Straw: With alt-doc loans, why is it that most lenders have a maximum loan amount of, say, $1.5m at 80% LVR, or at best $2m at 70% per security?

Could it be feasible to consider higher-value loans with lower LVRs (say, 50%) with single security? Mohnacheff said these types of loans could be done, but generally on a case-by-case basis.

“Show us the deal and let’s have a talk about it. Do we have an appetite? I think the

best place to go is to ring your BDM and ask the BDM, ‘Hey, I’ve got this deal. Do you want to do it? Yes, or no?’ ”