HOUSING PROJECT STUDIO

|PublicHousingRedevelopment

GHBSociety,Chandkheda PUH21178

Thepageisleftblankintentionally.

PUBLICHOUSINGREDEVELOPMENT

ListofTables ListofFigures 1. Introduction 1. StudioBrief 2. SiteSelection 2. CityOverview 1. AhmedabadCity Introduction 2. AhmedabadCity–RealEstateMarket 3. SiteAssessment 1. SiteLocation 2. RegulationComplianceontheSite 3. PolicyFramework 4. CurrentScenario 5. SWOTAnalysis 4. MicroMarketStudy 1. LocalityAnalysis 2. MicroMarketAnalysis 5. Iteration 1. CaseStudy|PracticeinSector 2. AssumptionsfromMicroMarket 3. TentativeProductMixandIterations 6. ProjectBrief 1. ProductMix 2. ConceptualLayout 3. UniqueSellingPoint 7. ProjectPhasing 1. Phasing 8. FinancialFeasibility 1. CashFlowAnalysis 2. BusinessModel 9. RiskManagement 1. RiskIdentificationandMitigation Conclusion Abbreviations Bibliography 5 7 8 9 10 14 15 17 22 23 24 25 27 28 30 31 32 37 38 39 40 42 43 44 45 46 47 50 51 52 55 56 |TableofContent

Thepageisleftblankintentionally.

PUBLICHOUSINGREDEVELOPMENT

1. Table1 ListofSelectedSites

2. Table2 SiteScoreandPreferredSites

3. Table3 UpcomingInfrastructureProjects 4. Table4 CharacteristicsofMajorMarkets 5. Table5 LocationsWithinDifferentMarkets 6. Table6 MicroMarketHealth 7. Table7 PrevailingRegulationsontheSubjectSite 8. Table8 SocietiesMapping 9. Table9 StudyProjectsforMicroMarketAnalysis 10. Table10 ProjectwiseProductMix 11. Table11 PlotAreaCalculation 12. Table12 Iterations 13. Table13 ProjectPhasing 14. Table14 CashInflowandOutFlow 15. Table15 LimitedLiablePartnership

10 11 16 17 18 20 24 27 33 33 41 41 47 51 53

|ListofTables

Thepageisleftblankintentionally.

PUBLICHOUSINGREDEVELOPMENT

1. Figure1 MethodologyofStudio

9 10 11 11 11 12 12 15 15 15 16 16 17 17 18 18 18 19 19 19 23 23 24 24 25 25 26 27 27 27 27 27 27 27 28 28 28 31 31 31 31 32 32 33 34 34 34 34 35 35 35 39 43 43 43 44 45 45 47 48 48 48 51 52 52 53 53

2. Figure2 IdentifiedSitesacross6WardsofAMC 3. Figure3 UnderstandingofDelphiMethod 4. Figure4 Site#15:Hanspura 5. Figure5 Site#11:Hanspura 6. Figure6 Site#12:Muthiya 7. Figure7 Site#3:Chandkheda 8. Figure8 SnapshotofAhmedabadCity 9. Figure9 MapofAhmedabadCity 10. Figure10 AhmedabadCityBRTSMap 11. Figure11 AhmedabadCity GandhinagarCityMetroRailMap 12. Figure12 EconomicandInfrastructureProjectsinAhmedabad 13. Figure13 DevelopmentPatternofAhmedabadCity 14. Figure14 DistributionofMajorMarketsoftheCity 15. Figure15 LocationsWithinDifferentMarkets 16. Figure16 Micro marketSplitofNewLaunchesinH12021andH12022 17. Figure17 Micro marketSplitofNewSalesinH12021andH12022 18. Figure18 LaunchesandSalesTrends 19. Figure19 TicketSizeWiseSalesDistribution 20. Figure20 TypologyWiseSalesDistribution 21. Figure21 SiteLocationwiththeContextoftheCity 22. Figure22 PositionoftheSiteintheSurrounding 23. Figure23 ApplicableBaseZoneandOverlayZone 24. Figure24 DevelopmentRegulationsonSite 25. Figure25 UnderstandingofthePolicy 26. Figure26 ProcessofRedevelopment 27. Figure27 RoleofStakeholders 28. Figure28 CurrentBuiltvsOpenCondition 29. Figure29 SocietiesMapping 30. Figure30 AerialViewoftheSociety 31. Figure31 Non residentialUnits 32. Figure32 OpenSpaces 33. Figure33 OriginalandIncrementedResidentialUnits 34. Figure34 Non ResidentialUnitsMapping 35. Figure35 ProximitytoBRTSCorridor 36. Figure36 ResistancefromRemainingSociety 37. Figure37 Frontage 38. Figure38 SnapshotofChandkheda MoteraWard 39. Figure39 AhmedabadCityWardMap 40. Figure40 SocialInfrastructureoftheWard 41. Figure41 EconomyGenerator 42. Figure42 Micro MarketofChandkheda MoteraWard 43. Figure43 StudyProjectsinRadiusof1km 44. Figure44 MarketRateandJantriRateofStudyProjects 45. Figure45 ProjectwiseMaximumPermissibleFSIandConsumedFSI 46. Figure46 ProjectwiseBreakupofResidentialandCommercialBUA 47. Figure47 ProductwiseCompositionofBUA 48. Figure48 UnitTypologywiseRangeofUnitSize 49. Figure49 UnitTypologyWiseLaunchandSaleofUnitsandBUA 50. Figure50 AbsorptionRateintheStudyProjects 51. Figure51 YearwiseSalePriceRangepersqmtandYoYGrowth 52. Figure52 EktaFestival PublicHousingRedevelopment 53. Figure53 DistributionofBuilt UpArea 54. Figure54 DistributionofUnits 55. Figure55 DistributionofGroundCoverage 56. Figure56 SiteLayout 57. Figure57 3DViewofSite 58. Figure58 SiteLayout 59. Figure59 Phasing 60. Figure60 YearWiseDistributionofBUAandUnits 61. Figure61 ProjectWiseDistributionofBUAandUnits 62. Figure62 PhaseWiseDistributionofBUAandUnits 63. Figure63 CumulativeCashOutFlowandInFlow 64. Figure64 BreakEvenPoint 65. Figure65 RevisedBreakEvenPoint 66. Figure66 SalesStrategyforResidentialUnits 67. Figure67 SalesStrategyforCommercialUnits |ListofFigures

|INTRODUCTION

PUBLICHOUSINGREDEVELOPMENT

1

1. StudioBrief

CitiesacrossIndiaaredeveloping,andthedevelopingcitiesaregrapplingwithvaryingdegreesofhousing unaffordabilityasperthespecificationsoflocallandandlabormarket.Policymakingandplanningensures accesstodecentaffordablehousingfordifferentincomegroupswhichrequiresamulti prongedapproach. Using applied knowledge about evidence based policies, and the local real estate market to formulate housingprojectlifecycleforrangeofhousingsubmarketsandsupplymechanisms.

AIM

OBJECTIVE

The studio focused on developing students’ exposure to the dynamic housing & real estate market and analyzing and proposing optimal development of land parcel (brownfield / greenfield) considering underlying site context, applicable legal norms, existing macro and microrealestatemarketscenario.

Toselectapotentialsiteforrealestatedevelopmentthroughvariousassessmentparameters andcarryoutmacroandmicromarkettoformulateviableproposal.

Developingacompleteprojectproposalwithanimplementableprojectcyclethroughiterative processofproductmix,inflowandoutflowassumptions

Studio

Apart from this, throughout the studio, extensive amount of guest lectures on the relevant topic from professorsandprofessionalwhoareworkinginandaroundthesectorhelpedtounderstandthecomplexity arealestateprojecthasandwaystotackletheissues. Sitevisitsofsmall-scaleproject, mid-scaleproject,and redevelopment project gave handon experience about thepracticethatareperformedinthesectorandgavearealitychecktounderstandthehurdlesand howtomitigatethem.

1. Mr.AnushravBhatt

SessiononRealEstate developmentincompliancewith GDCR

2. Mr.Abhijit Talkedabouttheinvestorspointof view/criterionwhileselecting thesitebeforeinvesting

3. Mrs.AnalVaishnav Casestudyonmasterplan developmentandrealestate development

4. Mr.DhavalPrasanna SessiononMacroand microanalysisonareal estateprojectmanagement

1. Mr.MiteshBhuva Developer’sjourneyonareal estateproject frominceptionto conclusionofaproject

3. Mr.AnandPatel CasestudyonGujaratHousing Board publichousing redevelopment

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 9 N INTRODUCTION

01 02 03 04 05 06 1.Introductiontodynamic housingandrealestatemarket 2.Identifyinglandwithpotential ofrealestateproject 3.Analysisoflandforpotential throughDelphitechnique 4.Macromarketandmicro marketanalysis 5.Projectformulation, conceptuallayoutandphasing 6.Financialmodeland sensitivityanalysis

SITE VISIT

GUEST LECTURES

Figure1 Methodologyof

2. Mr.MalayPatel Marketresearch andfeasibilitystudyfora realestatedevelopment Source.StudioGuideline

DelphiMethod

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 10 N INTRODUCTION

SiteSelection AsapartoftheHousingProjectStudio,landpotentialanalysiswascarriedoutfordifferent15sitesacross different 6 wards of Ahmedabad Municipal Corporation. With the help of Google Earth Imagery and surveyingthesewardstofindpotentialsiteswhohasareaof8to10hector,15siteswereshortlistedwho hasdifferenttypesofownership,frompubliclandtoprivateland,andsingleownertomultipleowners. Figure2 IdentifiedSitesacross6WardsofAMC Source.GoogleEarthImagery(RetrievedinAugust2022) 1 5 4 3 2 7 6 8 9 10 13 14 12 15 11 2 1 4 3 5 6 1 Kali_3 2 ChandkhedaMotera_4 3 Sabarmati_5 4 Ranip_6 5–Sardarnagar_12 6 Nobalnagar_13 SrNo WardName SiteName Area(Ha) 1 Kali Kaligam 8.6 2 ChandkhedaMotera Jantanagar 13.2 3 ChandkhedaMotera GHBHousing 15.7 4 ChandkhedaMotera GHBHousing 14 5 ChandkhedaMotera GHBHousing 16 6 ChandkhedaMotera Metronagar 10.9 7 ChandkhedaMotera Chandkheda 19.4 8 Sabarmati Dharamnagar 7.95 9 Sardarnagar Hansol 9.18 10 Sardarnagar Hansol 7.43 11 Nobalnagar Hanspura 7 12 Nobalnagar Muthiya 6.5 13 Nobalnagar Naroda 8.8 14 Nobalnagar Muthiya 11.6 15 Nobalnagar Hanspura 5.5 Table1 IdentifiedSitesandAreaTable Source.GoogleEarthImagery(RetrievedinAugust2022) To understand the potential of these sites, Delphi Method was applied. Parameters related to land were dividedinto5partsunder1.Spatial,2.Legal,3.Financial,4.Social,5.Environmental.

2.

toarriveatagroupopinion

by

Financial Spatial Legal Environmental Social

Delphimethodisaprocessused

ordecision

surveyingapanelofexperts.For eachgroupofparameters,10expertswerechosen.Theexpertsvariedfromdevelopertourbanplannerto end user Each expert gave weightage to the parameters according to the importance, preference, and relevance.Totaloftheweightageofalltheparametersshouldbe100.

After attaining the weightage of each parameter, scale of 1 to 5 was assigned to each site for each parameter according to the site condition and relevance. Final score of the site is calculated by multiplyingtheweightagegiventoeachparameter andscaleassignedtoeachparameterforeachsite. As each parameter has 100 weightage and maximum scale is 5, each parameter has score of 500,totalingit2500forall5parameters. Selected sites has various concerns that affected thescoreofsuchsites.

LandPotentialAnalysis

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 11 N

Figure3 UnderstandingofDelphiMethod Source.Author’sInterpretation

applying

to

thesites,

sites

SrNo WardName SiteName Area(Ha) Score

8

2

15

14

11

12

3

5

4 Chandkheda

IOCRoad

6 Chandkheda

Metronagar

13 Nobalnagar Naroda

7 Chandkheda

Off

9 Sardarnagar Hansol

1 Kaligam Kaligam

10 Sardarnagar Hansol 7.43

Table2 SiteScoreandPreferredSites Source.PrimarySurvey Location Hanspura Area 55Ha Development Greenfield TPScheme MuthiyaHanspura109 Amalgamation Yes Ownership Private+Public LandUse R1 OverlayZone Comments Landtobebought SiteViable Figure4 Site#15Hanspura Source.GoogleEarthImagery(RetrievedinAugust2022);PrimarySurvey Location Hanspura Area 7Ha Development Greenfield TPScheme MuthiyaHanspura109 Amalgamation Yes Ownership Private LandUse R1 OverlayZone Comments Linearplot SiteViable Figure5 Site#11Hanspura Source.GoogleEarthImagery(RetrievedinAugust2022);PrimarySurvey INTRODUCTION

After

Delphimethod

all

hereis thefinalresultforall15

Highlightedsiteshave higherscoreandpreferred.

(outof2500,%)

Sabarmati Dharamnagar 7.95 2035(81.4%)

ChandkhedaMotera Jantanagar 13.29 2020(80.8%)

Nobalnagar Hanspura 5.5 2018(80.7%)

Nobalnagar Muthiya 11.6 2003(80.1%)

Nobalnagar Hanspura 7 1988(79.5%)

Nobalnagar Muthiya 6.5 1968(78.7%)

ChandkhedaMotera Chandkheda 15.7 1905(76.2%)

ChandkhedaMotera IOCRoad 16 1883(75.3%)

Motera

14 1875(75.0%)

Motera

10.9 1818(72.7%)

8.8 1808(72.3%)

Motera

NewCGRoad 19.4 1763(70.5%)

9.18 1648(65.9%)

8.6 1623(64.9%)

1598(63.9%)

Location Muthiya

Area 65Ha

Development Greenfield

TPScheme MuthiyaHanspura75 Amalgamation Yes

Ownership Private+Public LandUse R1

OverlayZone TOD Comments Landtobebought SiteViable

Location Chandkheda

Area 157Ha

Development Brownfield

TPScheme Non TPArea Division Yes Ownership Public LandUse R1 OverlayZone TOD Comments 40%LandDeduction SiteViable

After land potential analysis, top 7 sites are shortlisted for development, out of which, 3 sites are brownfield, and 4 sites are greenfield Dharamnagar site (#8), which has the highest score, and is a brownfielddevelopmentsite(co opsociety),isnotviable,asTProadsarecuttingthroughthesite.Same, Jantanagar (#2) which is a brownfield development site (co op society), and Muthiya (#14) greenfied development site has TP roads cutting through, making them un viable for development as per studio guidelines.Otherwise,allremaining4sitesareviablefordevelopments.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 12 N

Figure6 Site#12Muthiya

Source.GoogleEarthImagery(RetrievedinAugust2022);PrimarySurvey

Figure7 Site#3Chandkheda

Source.GoogleEarthImagery(RetrievedinAugust2022);PrimarySurvey

INTRODUCTION

Thepageisleftblankintentionally.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 13 N PUBLICHOUSINGREDEVELOPMENT

2|CITYOVERVIEW

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 14 N

PUBLICHOUSINGREDEVELOPMENT

1. AhmedabadCity

Introduction

Ahmedabad, with a population of 5.8 million in the municipal area and 6.3 million in the urban agglomeration region in 2011, is India’s seventh biggest metropolis and the state's largest city. Ahmedabad has grown as a key economic and industrialcenterinIndia.ItisIndia'ssecond largest cotton producer, earning it the nickname "Manchester of India.“ . The eastern and western halves of the city are separated by the river Sabarmati. The city is devoid of any significant physicalfeaturesotherfromtheriver.

Ahmedabad is served by seven main highways and one expressway. The National Highway No. 8, which connects Delhi and Mumbai, goes through Ahmedabad. National Expressway 1 connects the city to Vadodara. State highways link it to Bhavnagar, Nadiad, Mehsana, Surendranagar, Bhuj, Rajkot, and Gandhinagar. The newly expanded corridor connecting Ahmedabad and Pune via four additional metropolitancities(Vadodara,Surat,Mumbai,andPune)hasimprovedtheefficiencyofroadtrafficalong thiscorridor.Alloftheseelementshavecontributedtotheregion'saxialexpansion.Ahmedabadisalsowell connected with major domestic and international cities by airway due to the presence of domestic and internationalairterminals

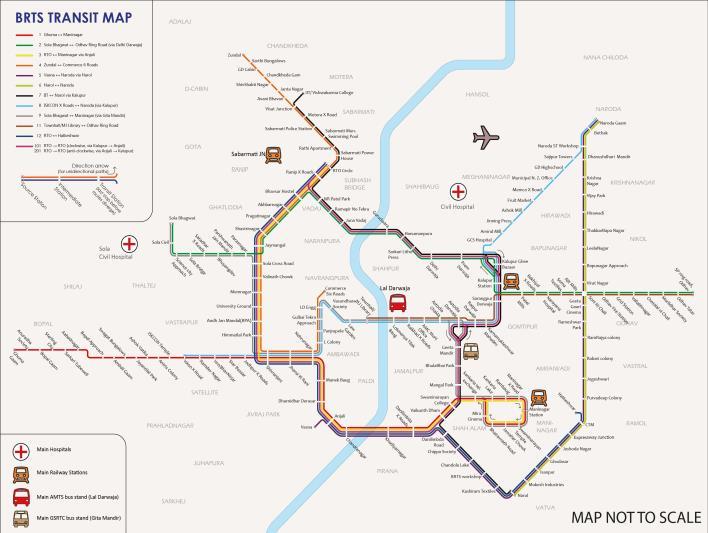

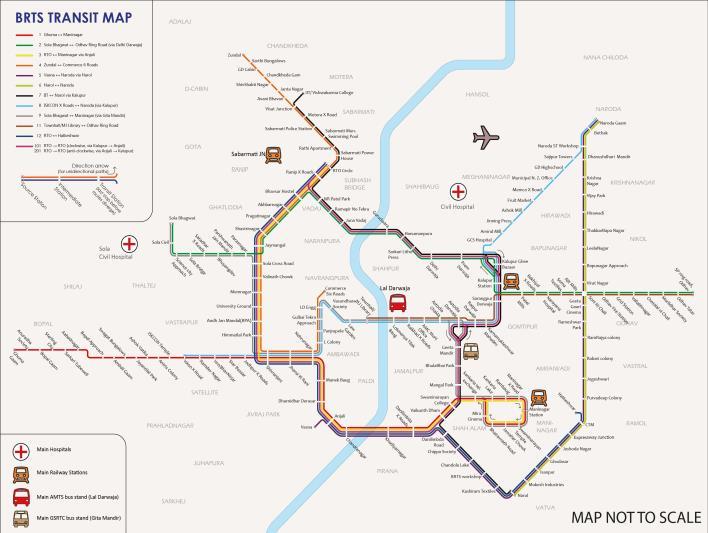

In order to run and operate BRTS buses, Ahmedabad Municipal Corporation established a "Special Purpose Vehicle" named Ahmedabad Janmarg Ltd. Ahmedabad Janmarg Ltd is a 100% subsidiary of Ahmedabad Municipal Corporation and is incorporated under the Companies Act of 1956.Inordertodeliverquicker,moredependable, environmentally sustainable, and technologically sophisticated public transportation, Ahmedabad Janmarg Ltd is devoted to operating and running BRTSservicesforAhmedabadresidents.According to the Memorandum of Agreement, the Municipal Commissioner is the Chairman of the Ahmedabad Janmarg Ltd, and the following are the company's Board of Directors. Ahmedabad Janmarg Ltd is in chargeofoperatingbuses,determiningfares,

maintainingbuslanes,andmaintaining busshelters.

alongtheBRTSrouteandoffersPay&Parkservicesto

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 15 N

CITYOVERVIEW

–

Figure8 SnapshotofAhmedabadCity Source.Census2011

AhmedabadInfrastructure

Figure9 MapofAhmedabadCity Source.mapsofindia

Figure10 AhmedabadCityBRTSMap Source.wikimediacommons

Ahmedabad JanmargLtdalso hasadvertising rights

thecitizensofAhmedabadCity.

TheAhmedabad GandhinagarMetrotrainprojectis being marketed with the goal of delivering safe, rapid, and environmentally friendly transportation services to the people at cheap costs while also decreasingtrafficcongestion.Themetrorailproject isenhancingintegrationwithAMTS,BRTS,railways, andotherpublictransportationsystems.Themetro is mostly elevated, with ballast free tracks, air conditioned coaches, GPS based rail tracking system, train destination signs, and stations with support infrastructure such as automated fare collecting,parkingfacilities,andsoon.NorthSouth Corridor is startingfrom Motera stadium to APMC whereasEastWestCorridorisstartingfromThaltej Gam to Vastral Gam. Phase I extension, Phase II, Phase IIIwillincludeconnectingSardarVallabhbhai Patel International Airport to the Metro network throughMotera.TheservicestoGandhinagar,GIFT City, etc. will be extended from Motera towards North. Also, other parts of the city that have been left as of now e.g. Civil Hospital, etc. will be connected. Most probably, if commissioned, the proposedFedara International Airport,DholeraSIR, etc will be connected to metro too, which will be after10yearsfromnow.

Ahmedabad, known as the "Manchester of the East," has historically been a hub for industry. The city has primarily relied on the textile, chemical, pharmaceutical, gem, and jewelry sectors for its economic growth. An emerging automobile hub is Ahmedabad.

Projects Description

DMIC

WorkontheAhmedabad Dholera stretch,thelargestnodeontheDMIC, hasbegun.

SIR AhmedabadisclosetotheMandal BehcarajiSIRandDholeraSIR.

GMRCL

GIFTCity

Commencingmetrorailconnecting AhmedabadandGandhinagar.

Theinternationalfinancialcentre comingupinGandhinagarisvery closefromAhmedabad

MAHSR

Goingforward,Ahmedabadwillhave bullettrainconnectivitywithMumbai.

Apart from this, DMIC Delhi Mumbai Industrial Corridor, and DFC Dedicated Freight Corridor which connectstoDelhiandMumbai,crossthroughAhmedabad,makingAhmedabadavitalcityforindustrialand logistic development. These will support the GIDC estates in the city such as Naroda, Odhav, Vatva, Sanand,Kathwada.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 16 N

CITYOVERVIEW

Figure11 AhmedabadCity GandhinagarCityMetroRailMap Source.Gujaratmetrorail

GIFTCity

BRTS&MetroNetwork

Figure12 EconomicandInfrastructureProjectsinAhmedabad Source.DevelopmentPlanStudioS2022,CEPTUniversity

Table3 UpcomingInfrastructureProjects

Source.KnightFrankreport:Gujarat’sshiningjewels

2. AhmedabadCity–RealEstateMarket

The western region of Ahmedabad Municipal Corporation (AMC) is growing faster than the eastern region. This is due to the city's population saturation.Afterthe1980s,regionssuchasSatellite, Vastrapur, Jodhpur, Gurukul, and others began to growasresidentialneighborhoods.Duringthistime, residential construction was mostly comprised of individual plotting plans, bungalows, and a few apartmentprojects.Thecity'sbusinessgrowthhas notbeenconcentratedinasingleregiondesignated as CBD over the years. Commercial growth has primarilyoccurred alongmajorthoroughfaressuch as Ashram Road and CG Road Prahaladnagar, which is ideally placed near the S.G Highway and renowned residential neighborhoods like as Bodakdev, Thaltej, Satellite, Chandkheda Motera, and forthcoming residential neighborhoods, has become a new commercial development hotspot. The construction of the Sardar Patel Outer Ring Road,theMetroRailProject,andnewtownplanning initiativesaretransformingthecity'sresidentialand commercialrealestate.

Thecitycanbedividedinto7majormicromarkets covering the city and suburbs based on the characteristicsofthearea.Theeasterncentralpart of the city has traditional type of settlement and comprises the walled city area. The belt from NarodatoNarolisemergingprimarilyasresidential belt, especially around SP Ring Road. Westernpart (CBD) started developing as residential areas for the middleand higher middle income groups after the construction of the bridges across the river Sabarmati Typology of residential development in western part of Ahmedabad is mainly low rise residential apartment complexes, independent bungalows and row houses. The area beyond SP Ring Road, Western Suburb, has two upcoming townships. Northern suburb has seen upsurge in last three to five years' time with Chandkhedaand Moteratakinglead.Thesouthernsuburbisnascent marketwithhousesinlowerticketsizecategory.

Markets

Major

Locations GrowthPotential Characteristics

Western Central&CBD CG Road, Ashram Road, Naranpura, Prahladnagar, Bodakdev, Satellite, Vastrapur,Vejalpur,Paldi

EasternCentral Maninagar, Shahibaug, Kalupur, Saraspur, Kankaria, Dudeshwar

Saturated

• Themostvibrantmarketasofnow.

• Residentialsegmentconsistsofbungalows,rowhouses, low riseandhigh riseapartments

• Retailsegmentconsistsofmallsandhigh streetretail

• Commercialsegmentconsistsofgovernmentaswellas privateoffices.

Saturated

• Theoldestsettlementofthecity.

• Therealestatedevelopmenthassaturatedinthisarea

• New developments are mainly seen WRT the redevelopmentoftheoldstructuresonly

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 17 N

CITYOVERVIEW

Figure13 DevelopmentPatternofAhmedabadCity Source.GoogleMap,Author’sInterpretation

Figure14 DistributionofMajorMarketsoftheCity Source.GoogleMap;DevelopmentPlanStudio,S2022,CEPTUniversity;Author’sInterpretation

Western

Northern

• The emerging market of the city wr.t. Residential andcommercialsegments

• Majority of the developments are plotting and bungalowschemes.

• Thesuburbhasmajorindustrialsettlement.

• Outof5townshipsexistinginthecity,2arelocated inthissuburb

• Highlandavailability

• The emerging market of the city in the respective direction

• Primarily is a residential market with the oldest settlementbeingSabarmatiarea

• ONGC oneofthebiggestindustriesislocatedin thissuburb.

• Outof5townshipsexistinginthecity,3arelocated inthissuburb

• Primarilyanindustrialsettlement.

• Upcomingresidentialmarketalongtheringroad

• Primarilyanindustrialandwarehousingsettlement

• Real estate market at nascent stage. Development isseenmoreinthetermsoflowcosthousing.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 18 N

Locations

Markets Major

GrowthPotential Characteristics

Ambli,Thaltej,Ognaj Developed

WesternSBD

Sub Urbans Bopal, Ghuma, Shela, Shilaj, Rakanpur, Santej, Sarkhej SanandRoad Developing

Sub Urbans Chandkheda, Motera, Adalaj, Sabarmati, Gota, Chandoliya, Sughad, New Ranip Emerging

Naroda,Nikol,Vastral Emerging

EasternSub Urbans

Lamba, Aslali, Sanathal, Narol Emerging

SouthernSub Urbans

Table4 CharacteristicsofMajorMarkets Source.PrimarySurvey No Established No Upcoming 1 OldCity 1 Gota 2 Shahibaug 2 Shilaj 3 Maninagar 3 Sughad/Koba 4 Naranpura 4 NavaNaroda 5 Sabarmati 5 Narol 6 Paldi 6 NewRanip 7 Jodhpur 7 VaishnodeviCircle No Developing No Developing 1 Satellite 6 Thaltej 2 Bodakdev 7 Prahladnagar 3 Vastrapur 8 Chandkheda 4 Bopal 9 Motera 5 Ambli Table5 LocationsWithinDifferentMarkets Source.PrimarySurvey Figure15 LocationsWithinDifferentMarkets Source.GoogleMap;DevelopmentPlanStudio,S2022,CEPTUniversity;Author’sInterpretation While demand has gradually increased, developers have been quick to respond with project launches in ordertoprofitontheimprovedmood.InH12022,10,385unitswerelaunched,representinga67%increase yearoveryear.Homebuyerswereeagertolookforresidencesontheperipherythatwouldprovidethem with a major lifestyle change. During H1 2022, planned developments in gated communities remained popularamonghomeownersandinvestors. 22% 29% 34% 26% 14% 22% 11% 12% 18% 10% 0% 20% 40% 60% 80% 100% H12021 H22022 North West East Central South 32% 29% 25% 26% 19% 23% 15% 13% 9% 10% 0% 20% 40% 60% 80% 100% H12021 H22022 North West East Central South Figure16 Micro marketSplitofNewLaunchesinH12021andH12022 Source.KnightFrankResearch2022 Figure17 Micro marketSplitofNewSalesinH12021andH12022 Source.KnightFrankResearch2022 CITYOVERVIEW

The COVID epidemic had a significant impact on the Ahmedabad residential market, with home sales volumesdropping69%yearonyearwhenthepandemicstruckinH12020.Themarket,ontheotherhand, hasslowlyrecoveredsincethen,withsalesvolumesgrowingineachsucceedingmonth,despitethefact that the second wave was more severe in terms of infection incidence and mortality rate. Despite the introduction of theOmicron model earlier this year, this recovery has been accelerated in H1 2022, with salesquantitiesapproachingpre-pandemiclevels Salesincreasedby95%yearonyearto8,197unitsinH1 2022,drivenby lowhomeprices,arenewedneedforhomeownership,morepersonalspace,and better amenities.Itisnoteworthythatthisgrowthoccurreddespiteincreasedeconomicgrowthconcernsanda cumulative90basispointreporatehikeinMayandJune,whichimpactedhomebuyeraffordabilityduring theperiod.

TherecentchangeindemandtotheINR5 10millionticketsize,from15%inH12018to28%inH12022,has beenconsiderable.Becauseofthenecessitytoupgradethefamily'sprincipaldwellingandtofulfilworkand studyfromhomerequirements,thistrendhasbeennoticedacrosslocales.The>INR10mnticket sizehas alsoincreaseditssalessharefrom8%inH12021to10%inH12022.Since2018,however,therehasbeena gradualreductioninthepercentageofsaleswithticketsizesofINR5million.Thiscategory'ssalessharehas decreasedfrom76%inH12018to62%inH12022.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 19 N -350% -300% -250%

50% 100% 0 2000 4000 6000 8000 10000 12000 H1 2015 H2 2015 H1 2016 H2 2016 H1 2017 H2 2017 H1 2018 H2 2018 H1 2019 H2 2019 H1 2020 H2 2020 H1 2021 H2 2021 H1 2022 No. of Units Launches Sales UnsoldInventory

LaunchesandSalesTrends

-200% -150% -100% -50% 0%

Figure18

Source.KnightFrankResearch2022

22% 29% 29% 8% 12% <INR25Lakh INR25-45lakh INR45-75lakh INR75-100 >INR1crore 11% 37% 42% 10% 1BHK 2BHK 3BHK 4+BHK

WiseSales

Figure19 TicketSize

Distribution

Source.KnightFrankResearch2022 Figure20 TypologyWiseSalesDistribution

Source.KnightFrankResearch2022

CITYOVERVIEW

Zone UnsoldInventory(Units) YoYChangeinUnsoldInventory Quarters to Sell

Central 2,908 43% 7.4

East 2,265 33% 5.0

North 3,670 174% 4.3

South 2,905 5% 11.6 West 6,671 42% 9.6

Theaverageageofinventoryhascontinuallydecreasedoverthelastsixyears,indicatingthegrowingrate at which ready inventory is consumed in the market. Inventory age is at 8.6 quarters, compared to 9.4 quartersinH12021.Unlessitiswithexperienceddevelopersinhighlysought afterareas,theminimalprice savings for under construction property does not justify accepting development execution risks. Unsold inventoryhadincreased47%yearonyearbytheendofH12022,yetitwasstilljusthalfofwhatthemarket carried in 2016. While the strengthening demand picture bodes well for the market, growing inflationary expectationsandinterestratesmayprovideachallengetomarketmomentuminthesecondhalfof2022

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 20 N

Source.

Table6 MicroMarketHealth

KnightFrankResearch2022

CITYOVERVIEW

Ahmedabadhasalwaysbeenapricesensitivemarket,anddevelopershavebeencarefulnottoboostprices despiteincreasesinrawcostssuchassteelandcement,aswellasthecostofland,whichhasclimbed dramaticallyinthelastyear.Thismarketisalsothecheapestintermsofpersquarefootamongtheeightareas underconsideration,resultinginlowerdevelopermargins.Inresponsetogrowingcostconstraintsandahealthy demandclimate,themarketwitnessedaveragepricesriseby28%yearonyearinH12022

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 21 N PUBLICHOUSINGREDEVELOPMENT

3|SITEASSESSMENT

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 22 N

PUBLICHOUSINGREDEVELOPMENT

1. SiteLocation

The subject site is in Chandkheda Motera Ward, on the north western part of the city of Ahmedabad. Location of the site is pre eminent part of it, as it abuts State highway, connecting Ahmedabad city to northernpartofthestate.

SUBJECTSITE

AsshownintheFigure22,thesubjectsiteispartoftheentireGujaratHousingBoardSociety.OverallGHB societyspans47.1hectares,withthesubjectsitecovering17.3hectareshavingtheperipheryof1.75kms. OwnershipofthesiteisunderGujaratHousingBoard,andasdataretrievedfromlandrecords,thelandis undernon TParea.UnderPublicHousingRedevelopmentPolicyof2016,redevelopmentofthesubjectsite istobecarriedout.Thesubjectsitehas3roadfacingsides,onfrontlongerside(585mt)abuts60mtwide state highway and at the back the longer side adjoins 12 mt wide GHB society’s internal road, whereas shorterside(260mt)has24mtwidecollectorroadadjoiningit Thesitehasapproximately820residential housesand30non residentialhouses.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 23 N

SITEASSESSMENT

Figure21 SiteLocationwiththeContextoftheCity Source.github

Figure22 PositionoftheSiteintheSurrounding Source.GoogleMap,Author’sInterpretation

2. RegulationComplianceontheSite

Subject site falls under Residential Zone -1 with overlay of Transit Oriented Zone as per Development Plan (2021) of Ahmedabad city, according to the Comprehensive General Development Control Regulation (2021) section 15, TransitOrientedZone(TOZ)meanstheareafalling within Blue Dotted Verge shown in the sanctioned land use plan and shall be consider as a condition for high density development. All type of building other than obnoxious industries are allowed in R 1 zoneaspersection9.2ofCGDCR(2021).BaseFSI for R 1 zone is 1.8 (Section 9.2) , and maximum permissible FSI for TOZ is 4 (Section 15.4). Thereafter, 22 FSI is purchasable at 40% of the jantrirate(Schedule20)

The subject site is under non TP area, meaning, before any type of development, 40% of the plot area is to be given back to the local authority. As adjoining road has width of 60 mt, maximum buildingheightpermissibleis70mt(Section13.5.1). Shortersideofthesitehas24mtadjoiningroadand backsidehas12mtwideroad,themargintobeleft is7.5mtboththesideandforlongersideitis9mt asitadjoins60mtroad(Section13.6.1).Asanother shortersidehasadjoiningplot,thereforemarginto be left on that side is 8 mt (Section 13.6.7). As per the FSI and ground coverage, 5,60,000 sqmt built uparea(Section266)ispermissibleapproximately, keeping maximum height of 70mt in mind. 35% of total utilized FSI for commercial use shall be requiredforminimumparkingandoutofthat,20% istobeprovidedforvisitor’sparking

Figure23 ApplicableBaseZoneandOverlayZone Source.AhmedabadCityDevelopmentPlan2021

SubjectSite

DevelopmentRegulationsonSite Source.GoogleMap,Author’sInterpretation (Section 15.10.1). 50% of the required visitors parking shall be provided at the ground level. 50% of all requiredparkingshallbeprovidedforcars(Section13.10.1).Basementshallbepermittedundercommon plot,internalroadandinternalmarginalspaceforexclusiveuseofparkingonly(Section13.11.1). Parameter

6.17.4CGDCR2021 PlotArea

6.17.4CGDCR2021

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 24 N

SITEASSESSMENT

17.3

10.04

Residential–1

OverlayZone TransitOrientedZone

BaseFSI 1.8

3

Redevelopment

MaximumPermissibleFSI 4.0

MaxPermissibleHeight 70

7.5

7.5

Permissible

Table7 PrevailingRegulationsontheSubjectSite Source.CGDCR2021;PublicHousingRedevelopmentPolicy2016

Figure24

Value Reference Area

Ha GoogleEarth Areatobededucted 6.94Ha Section

Ha Section

BaseZone

DevelopmentPlan2021

DevelopmentPlan2021

Section9.2,CGDCR2021

PublicHousing

Policy

Section15.4,CGDCR2021

mt Section13.5.1CGDCR2021 Margin(North)

mt Section13.6.1,CGDCR2021 Margin(South) 8mt Section13.6.7CGDCR2021 Margin(East)

mt Section13.6.1,CGDCR2021 Margin(West) 9mt Section13.6.1,CGDCR2021 Maximum

BUA 4,16,400sqmt Section2.66,CGDCR2021

3. PolicyFramework

Asthesubjectsiteisapublichousingsociety,PublicHousingRedevelopmentPolicyof2016isapplicable AccordingtothestatedScheme,publichousingsocietiesthataremorethan20yearsoldorinapoorstate onpropertyheldbytheUrbanAuthoritiescanberedeveloped.AccordingtotheScheme,eachflatholderis entitled to 140% carpet area, and the redeveloper is required to remodel the Scheme at no cost. Furthermore, the redeveloper must offer transit accommodation/rent and maintain the premises for a periodofsevenyears.AccordingtotheScheme,theproceduremaybelaunchedbytheassociationorthe relevantpublicauthority.Anyquarter/associationthatwishestoredevelopmusthavetheapprovalof75% ofitsmembers.Asperthepolicy,thereare3components:1.PublicHousingComponent(Redevelopment); 2.AffordableHousingComponent(Additionalunitstobegiventotheauthorityinlieuofpremium);3.Free SaleComponent(Tobesoldinthemarketbythedeveloper).

30sqmt

carpetareaifexistingunitis<30sqmt 40sqmt

areaifexistingunit

Redevelopment (PHC)

By submitting an application to the relevant public agency, an association or society of owners may starttheprocessofredevelopinganexistingpublic housingscheme.Thefollowingstepsmustbetaken in order to redevelop a public housing project. A resolution must be passed by an existing housing society or association with the support of at least 75% of the membership A worried governmental body will choose a private developer through an openprocessandsolicitelectronicbidding.Forthe goal of cross subsidization, the project can be reconstructed in packages by combining different types of homes. Negative bidding situations must bereportedtothestate levelscreeningcommittee for an appropriate response. The "BUA/Carpet Area/NumberofDU"biddingcriteriawillbeusedto create more housing stock. For the purpose of creating extra dwelling stock, the bidder with the highest"MaximumBUA/CarpetArea/Numberof DU"shallbechosen.

RemainingFSI

tobeusedinfreesalecomponent 99years

Sub leasecanbegivenonfreesaleland GHB

ownershipwillremainsame

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 25 N SITEASSESSMENT

Upto 140% ofexistingapprovedcarpetareaofresidentialunit Upto 125% ofexistingapprovedcarpetareaofcommercialunit

FreeSale Component

Figure25 UnderstandingofthePolicy Source.PublicHousingRedevelopmentPolicy,2016

carpet

is>30 BUA/CA/Units HighestproviderofAHCwinsbid Affordable Housing (AHC)

75%consentfromthepeoplewithinthesociety ApplicationtoGHBforredevelopmentbysociety association FloatingtenderbyGHBtoinvitedevelopers Technicalandfinancialbid(CQCCBS) SelectionofH1bidderbytechnicalbidthenfinancial bid PositivePremium Totalnumberofadditional affordableunits Negotiationtripartiteagreement Figure26 ProcessofRedevelopment Source.PublicHousingRedevelopmentPolicy,2016

Theexistinghousingsocietyorassociationowners,thechosenprivatedeveloper,andtheinvolvedpublic agency will enter into a tripartite agreement for redevelopment. The private developer will need the approvalof75%ofthemembers,includingthosechosenbyaresolutionissuedbyanexistingsocietyor association, in order to implement the redevelopment of the existing housing scheme of the field. The processwillbefacilitatedbytheorganizationorassociationandtherelevantpublicagency.

Thedeveloperwillpayforanynecessaryaccommodationsforthetransitsystemandmayalsoofferrental housingasaformoftransit accommodation.Developerswill beresponsibleforprovidingO&Mforthe firstsevenyearsafterreceivingBUclearance,andthenthebeneficiarysocietyororganizationwillgetit. Beneficiaries must make the required contributions to the maintenance fund for O & M. At the time of possessiontransfer,amaintenancedepositwillbedemandedfromeachbeneficiary.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 26 N SITEASSESSMENT

BearingtotalConstructionCost Givingtransitaccommodationtoexistingresidents OperationandmaintenanceofPHC,andAHC for7years SOCIETYASSOCIATION Getting75%consent Checkingforanyoutstandingdues Applyingforredevelopmenttoconcernedagency

AGENCY-GHB Floatingtenderforbidders Awardingtheworktoeligiblethedeveloper Allottingadditionalaffordablehousingtothebeneficiaries Figure27 RoleofStakeholders Source.PublicHousingRedevelopmentPolicy,2016

DEVELOPER

PUBLIC

4. CurrentScenario

The society is 37 years old, considering that, planning of internal roads, open spaces at different interval is something to appreciate. Currently there are 5 societies having a range of 32 to 110 sqmt of carpet area (1BHK to 3BHK). These semi detached and row houses units are incremented according to the residents’ requirementsbytheresidents.

Residential that have benefit of the frontage have been converted into non residential units to fetch the locational advantages. Residential units facing 60mtwideroadaremostlybeingusedushospitalsandshowrooms.Asthere are no restrictions of going vertical in construction, units which were only 2 story high,havebeenincrementedto4storiesasseeninfigure30,tomake the best of it. Whereas units facing 12mt wide rare road have simple been convertedtovanillashopssuchasgroceryortailoring.Unitsfacing24mtwide collectorroadaregettingbenefitsofproximitytothehospitalsandmostofthe non residential units here are being used as pharmacy or clothing shops as seeninfigure31. Figure34 Non ResidentialUnitsMapping Source.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 27 N SITEASSESSMENT

RUnits CUnits CA(sqmt) ShraddhaPark 68 3 32 Subhashnagar 106 2 85 Vishnunagar 221 4 45 Shivshaktinagar 397 2 32 Karnavati 30 19 110 Figure28 CurrentBuiltvsOpenCondition Source.UnderstandingtheCityStudioM2022CEPTUniversity;PrimarySurvey Figure29 Societies

Source.UnderstandingtheCityStudioM2022CEPTUniversity;PrimarySurvey Table8 SocietiesMapping Source.PrimarySurvey

Source.

Units

Legend Society

Mapping

Figure30 AerialViewoftheSociety

PrimarySurvey Figure31 Non residential

Source.PrimarySurvey

Figure32 OpenSpaces Source.PrimarySurvey

Figure33 OriginalandIncrementedResidentialUnits Source.PrimarySurvey

UnderstandingtheCityStudioM2022CEPTUniversity;PrimarySurvey

5. SWOTAnalysis

Figure35 ProximitytoBRTSCorridor

Source.PrimarySurvey

1. Locationofthesiteattractscommercialcomponenttotheproject.

2. Frontageof585mtsupportstogomulti levelcommercialcomponent.

3. Developmentregulationsworkinfavourforthesiteandproject.

4. Proximityofemploymentsectors,andeducationfacilitiesmayattractconsumers.

Figure36 ResistancefromRemainingSociety

Source.PrimarySurvey

1. Astheprojectis1/3rdpartoftheentireestablishment,itmayaffecttheremaining2/3rdpartof theestablishmentnegatively.

2. Asit isaredevelopmentproject andhasahugescaleto it,arrangementandfinanceoftransit accommodationcanbecrucialtodesignandmanage.

Figure37 Frontage

Source.PrimarySurvey

1. As it is a redevelopment site, additional affordable housing unit can be included in the project briefafterassessingthefeasibilityoftheproject.

2. If no full FSI is achieved, remaining FSI can be converted into Transferable Development Right (TDR)touseanywhereelseinthecity.

1. Negativeresponsefromtheremainingestablishmentcanbereceived.

2. As it abuts 60 mt wide state highway and has frontage of 585 mt, noise pollution from the vehicularmovementscandisturbtheenvironment.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 28 N SITEASSESSMENT

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 29 N PUBLICHOUSINGREDEVELOPMENT Asthereisagreatscopeofredevelopmentconsideringstatedpoints,financialfeasibilityoftheprojectistobe carriedout.Forthat,theprojectmustbeformulatedinalignwithprevailingmicromarketofthelocality.

To study and suggest public housing redevelopment based on the underlying site environment, relevant legal standards, and existing macro and micro real estate market scenarios OBJECTIVE Toupgradeolddilapidatedstock Tobuiltaffordablehousesforconcernedauthority Toleveragepotentialoflandatitsfullest Toenhanceneighborhood

AIM

4|MICROMARKETSTUDY

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 30 N

PUBLICHOUSINGREDEVELOPMENT

1. LocalityAnalysis

Chandkheda locality is a part of ChandkhedaMotera ward, which consist Chandkheda, Motera, NewCGRoad,TP44,andsomepartofTragad.Itis locatedinthenorthernperipheralpartofthecityat theborderofGandhinagarandAhmedabaddistrict. In 2008 Chandkheda Motera has been included into AMC’s jurisdiction from Gandhinagar. ChandkhedaliesontheSardarPatel(SP)RingRoad and State Highway 41. Sardar Patel Ring Road connects Chandkheda to other peripheral areas in Ahmedabad. 11.47sqkm Area 96,260 Population 983 SexRatio 83.9pph Density

A little community previously existed in Chandkheda. Nevertheless, it has become one of the most sought after residential areas. The community's social infrastructure is one of the causes of this. Schools like Kendriya Viyalaya and KV Sabarmati, as well as institutions like VishwakarmaGovernmentEngineeringCollege,are located in the area. In the area, thereare hospitals including Kanoria Hospital and Apollo Hospitals. Postoffices,banks,afirestation,apharmacy,anda stadium may be found nearby The area’s connectivityisfurtherenhancedbytherapidBRTS and Metro system. Sabarmati Railway Station and SardarVallabhbhaiPatelInternationalAirportsarein 8 10kmradius.

Chandkheda has good amount of economy generators that brings population to the locality supporting and pushing real estate market of the locality. ONGC, Airport, and Apollo hospital are major economy generators. As these establishments are nation wide, people from all around the country resides here – making the localitycosmopolitan.

Figure40 SocialInfrastructureoftheWard Source.GoogleMap,Author’sInterpretation

Figure41 EconomyGenerator Source.GoogleMap,Author’sInterpretation

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 31 N MICROMARKETSTUDY

Figure38 SnapshotofChandkheda MoteraWard Source.Census2011

Figure39 AhmedabadCityWardMap Source.DevelopmentPlanStudio,S2022,CEPTUniversity;Author’sInterpretation

2. MicroMarketAnalysis

There are 4 micro markets are observed in Chandkheda Motera Ward, according to the characteristics of buildings that are developed. Chandkheda, New C G Road, Motera, and TP 44. Motera,andNewCGRoadcaterstoMIGandHIG category, in which Motera has indigenous populationofGujaratiduetoproximityofSabarmati area, which is the oldest settlement in northern Ahmedabad, whereas New C G Road is more of a cosmopolitan locality because of the proximity to ONGCcampusthathasemployeesfromallaround the country. Chandkheda and TP 44 caters to LIG and MIG category, in which Chandkheda has the indigenous population of Gujarati because of Chandkhedagam

AsthesubjectsiteisattheintersectionofChandkheda,andNewCGRoadmicromarket,micromarket studywillcovertherealestateprojectsthatarecameupintothesetwomicro marketinpast5years.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 32 N MICROMARKETSTUDY

Figure42 Micro MarketofChandkheda MoteraWard Source.GoogleMap,Author’sInterpretation

Figure43 StudyProjectsinRadiusof1km

Source.GoogleEarthImagery;PrimarySurvey;Author’sInterpretation

Completed

On Going

Project Development MicroMarket Zone

PebbleBay Residential+Commercial

Chandkheda+NewCGRoad R1+TOZ

IshanLuxuria Residential NewCGRoad R1

OmkarLotus Residential+Commercial NewCGRoad R2

ShreeSarjuHeights Residential+Commercial Chandkheda R1 ShivsaiResidency Residential Chandkheda R1

EastEbony Residentiall NewCGRoad R1

SaralSky Residential+Commercial NewCGRoad R1

VihaanAvenue Residential+Commercial NewCGRoad R1+TOZ

ShyaamSanvi Residential+Commercial Chandkheda R1+TOZ ShlokAvenue Residential+Commercial Chandkheda R1

Project

PebbleBay

Completed

On Going

3BHK,4BHK,Retail 147 19

IshanLuxuria 3BHK 88 0

OmkarLotus 3BHK,Retail 28 32

ShreeSarjuHeights 2BHK,3BHK,Retail 110 33 ShivsaiResidency 1BHK,2BHK,3BHK 52 0 EastEbony 3BHK 88 0

SaralSky 4BHK,Retail 46 15

VihaanAvenue 2BHK,Retail 26 3

ShyaamSanvi 3BHK,Retail 144 48 ShlokAvenue 2BHK,Retail 56 13

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 33 N

MICROMARKETSTUDY

MicroMarket:Chandkheda MicroMarket:NewCGRoad

Table9 StudyProjectsforMicroMarketAnalysis Source.PrimarySurvey

ProductMix No. ofResidentialUnits No.ofRetailUnits

Table10 ProjectwiseProductMix Source.PrimarySurvey;GujRERA(RetrieveinSeptember2022) 948 TotalDwellingUnits 1.1lakhsqmt TotalBUA 24,200sqmt Average ConstructionperYear 3 years Average ProjectCycle PebbleBay ShreeSarju Heights ShivSai Residency Shyaam Sanvi Shlok Avenue IshanLuxuria OmkarLotus EastEbony SaralSky Vihaan Avenue JantriRate 5500 4000 5500 5500 4000 4500 4000 5000 5000 5500 MarketRate 73000 45,000 73,000 1,05,000 45,000 1,12,500 1,08,500 1,12,500 1,12,500 1,12,500 Ratio 13 11 13 19 11 25 27 23 23 20 AverageRatio 19 19 19 19 19 19 19 19 19 19 0 5 10 15 20 25 30 0 20,000 40,000 60,000 80,000 1,00,000 1,20,000 Market : Jantri Rate Ratio Rate (/sqmt) JantriRate MarketRate Ratio AverageRatio It is clear that both the micro market has very distinct market rate and jantri rate ratio. Considering the subjectsiteontheedgeofboththemicromarket,averageratiocanbetakenintoconsideration. Figure44 MarketRateandJantriRateofStudyProjects Source.PrimarySurvey;GujRERA(RetrieveinSeptember2022)

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 34 N MICROMARKETSTUDY 0.2 0.5 0.3 0.3 0.3 0.4 0.2 3.2 2.7 1.3 2.4 1.9 2.7 2.4 2.7 3.4 2.3 3.4 2.7 1.8 2.7 1.9 2.7 2.7 3 3.8 2.5 0 0.5 1 1.5 2 2.5 3 3.5 4 PebbleBay IshanLuxuriaOmkarLotus ShreeSarju Heights ShivSai Residency EastEbony SaralSky Vihaan Avenue Shyaam Sanvi ShlokAvenue FSI CommercialFSI ResidentialFSI UsedFSI MaximumPermissibleFSI Figure45 ProjectwiseMaximumPermissibleFSIandConsumedFSI Source.PrimarySurvey;GujRERA(RetrieveinSeptember2022) Figure46 ProjectwiseBreakupofResidentialandCommercialBUA

14% 73% 13% 2BHK 3BHK 4BHK 1,00,964 sqft TotalBUA Figure47 ProductwiseCompositionofBUA Source.PrimarySurvey;GujRERA 0% 20% 40% 60% 80% 100% 120% 0 500 1,000 1,500 2,000 2,500 3,000 PebbleBay IshanLuxuria OmkarLotus ShreeSarju Heights ShivSai Residency EastEbony SaralSky Vihaan Avenue ShyaamSanvi ShlokAvenue BUA ( sqmt ) CommercialBUA(sqmt) ResidentialBUA(sqmt) Commercial% Residential% TotalBUA 18 45 77 121 63 59 126 158 43 51 101 142 0 20 40 60 80 100 120 140 160 Retail 2BHK 3BHK 4BHK Unit Size ( sqmt ) UnitSizeRange(sqmt) AverageUniteSize(sqmt)

UnitTypologywiseRangeofUnitSize

It is observed that compare

2BHK

4BHK

unit

Source.PrimarySurvey;GujRERA(RetrieveinSeptember2022) Abovegraphshowsdistributionofresidentialcomponentandcommercialcomponentintermsofbuilt up areaandusedFSI.Commercialcomponentintherangeofstudyprojectsvariesbetween0 30%builtup area wise, with the absorption of 100% in completed projects. Which shows that there is demand for commercialcomponentandmorethan30%canbeproposedforthesubjectsite.

Figure48

Source.PrimarySurvey;GujRERA

to

and 4BHK, 3BHK is high in demand, that shows rigidity in 2BHK segmentwhile3BHKand

segmenthasflexibilityintermsof

size

It is observed that 96% of 2BHK, and 93% 3BHK typology are being sold in the market. This shows the demand of 2BHK, and 3BHK is high. 4BHK is recently introduced segment in the micro market thus absorptionislow.Consideringthisstudycoversonly4unitsof1BHKtypology,thatweconsideritanoutlier.

Source.PrimarySurvey;GujRERA(RetrieveinSeptember2022)

Itisobservedthat,lowestcommercialabsorptionrateincompletedprojectsis94%,and67%forongoing projects. Whereas lowest residential absorption rate is noted at 91% in completed projects, and 54% in ongoingproject.Thisshowsthatmarkethealthisgood,andconsideringtheseprojectsare5yearsold,age ofinventoryisnottobeworriedabout.

Source.PrimarySurvey;GujRERA(RetrieveinSeptember2022)

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 35 N

MICROMARKETSTUDY Launch Sale Launch Sale Launch Sale Launch Sale 1BHK 2BHK 3BHK 4BHK BUA

180 180

No.ofUnits 4 4 192 185 516

73 48 0 100 200 300 400 500 600 0 10,000 20,000 30,000 40,000 50,000 60,000 No of Units BUA ( sqmt ) BUA(sqmt)

ofUnits

UnitTypologyWiseLaunchandSaleofUnitsandBUA

OnGoingProject CompletedProject

(sqmt)

9941 9574 51761 49857 9547 6494

482

No.

Figure49

Source.PrimarySurvey;GujRERA(RetrieveinSeptember2022)

6% 5% 8% 7% 3% 4% 3% 0% 2% 4% 6% 8% 10% 20,000 25,000 30,000 35,000 40,000 45,000 50,000 2015 2016 2017 2018 2019 2020 2021 2022 Price / sqmt PriceRange(/sqmt) AveragePrice(/sqmt) YoYGrowth PebbleBay Ishan Luxuria Omkar Lotus ShreeSarju Heights ShivSai Residency EastEbony SaralSky Vihaan Avenue Shyaam Sanvi Shlok Avenue Residential 95 91 100 94 100 97 54 88 89 98 Commercial 100 100 94 67 100 67 100 0 20 40 60 80 100 120 No of Units Residential Commercial 48,100 32,600 40,400 YoYgrowthbeforeCOVIDishighercomparedtocurrentYoYgrowthinsaleprice.

wiseSalePriceRangepersqmtandYoYGrowth

Figure51 Year

Figure50 AbsorptionRateintheStudyProjects

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 36 N PUBLICHOUSINGREDEVELOPMENT 90:10AverageResidentialvsCommercialRatio 14:73:132BHKvs3BHKvs4BHKComposition 40,400Rs/sqmtaveragepriceforcurrentyear 24,200sqmtaverageconstructionperyear

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 37 N PUBLICHOUSINGREDEVELOPMENT 35%AverageLoadingFactor 5%AverageYoYsalepriceescalation 91%LowestabsorptioninResidentialUnits 94%LowestabsorptioninCommercialUnits

5|ITERATIONS

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 38 N

PUBLICHOUSINGREDEVELOPMENT

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 39 N ITERATIONS 1. AssumptionsfromMicroMarket As this is a public housing redevelopment project, and the project formulation has to be in line with the policy,somedeviationfrommicromarketisboundtohappen.Suchas,commercialcomponentmightget higherweightagethanmicromarkettoincreasetheprofitabilityoftheproject. 100%consentfromtheresidentsareachieved. Alltheencumbrancestillthedate,alltheduespendingispaid. TheGHBhasfloatthetenderandtheworkorderhasbeenawarded. 18,000 Rs/sqmt ForPHC ConstructionCost 15,000 Rs/sqmt ForAHC ConstructionCost 21,000 Rs/sqmt ForFSC ConstructionCost 35%-45% LoadingFactor(Up) 45-60 sqmt For2BHKFSC CarpetArea 75-125 sqmt For3BHKFSC CarpetArea 150 Rs/sqmt For4BHKFSC CarpetArea 4 units ForPHC PerFloorUnits 6 units ForAHC PerFloorUnits 2-4 units ForFSC PerFloorUnits 4-7 floors ForPHC PerTowerFloor 20 floors ForAHC PerTowerFloor 13-18 floors ForFSC PerTowerFloor 10,000 Rs/Month For48Months TransitAccommodation 91% ForResidential MarketAbsorption 94% ForCommercial MarketAbsorption 7%Constructionpriceescalation(YoY) 8%SalepriceYoYgrowth 20%ResidentialUnitsinPre LaunchSale 40%CommercialUnitsinPre LaunchSale 40,400–48,100 Rs/sqmt SalePriceforResidential 1,20,500–1,27,500 Rs/sqmt SalePriceforResidential

2. CaseStudy|PracticeinSector

Ekta Festival is the first Public Housing Society to gounderredevelopmentasperRedevelopmentof Public Housing Scheme 2016. It caters to MIG Category.Ithad60ResidentialUnitsand36Non Residential Units. The society was constructed 32 years ago, and due to fatal accident on the site, concerned agency GHB took the initiative for redevelopment. For tender procedure, GHB used “SwissChallengeMode”,whereanydevelopermay giveinitialproposal.Basedoninitialproposal,GHB floatedtendertoinviteotherdeveloper’sproposal. Ifanewdevelopercomeswithabetterproposal

theywintheworkorder,inthiscaseoriginaldevelopermayhaveopportunitytoraisehisproposal.Thecase studyistakentounderstandthenegotiationdoneintheproject.

TransitAccommodations

Theexistingresidentswerepaid15,000Rspermonthandexistingshopownerswerepaid18,000Rsper monthwith10%incrementeveryyear.

Negotiations

Amenities:

• Swimmingpool,clubhouse,mini theatre,children’splayarea,2carparkingand2two wheelparking spaceperunit

• Developerprovidedclubhouse,children’splayarea,2carparkingand2two wheelerparkingperunit Shops:

• Shops were at ground floor, and shop owners demanded newly constructed shops on ground floor only

• Developerprovided125%highercarpetareaatfrontmainroadatfirstfloor,extraparkingspaces AdditionalCarpetArea:

• Illegal construction of 10 20 sqmt of carpet area without any documents, common passage or commonparkingareausedillegally

• Ownersasked40%additionalcarpetareaonexistingcarpetarea,butwithoutproperdocumentsand legality,developerrefused IllegalConstruction:

• Manyhousingunitshasincreasedthecarpetareaillegallywithnopropertydocuments,withoutitAMC doesn’tgivepermissionfordemolition

• Ownersrefusedtopaypenaltyandaskeddevelopertopaytogetconsent

• Thisprocesstookextra 3months

Achievement

Conclusions

Olddilapidatedstructurereplaced

OptimumutilizationofFSI

Newhousingstockaddedinmarket

Ektaapartmentsisthefirstpublichousingsociety to go under redevelopment under the RedevelopmentofPublicHousingScheme 2016. The new project where developer has been permitted to build 14 storey building The new structure is earthquake resistant. Amenities like gym, landscape area, game room, children’s play area, car parking, 24x7 security, CCTV surveillance,seniorcitizenseatingareaprovidedin thenewdevelopment.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 40 N

ITERATIONS

Figure52 EktaFestival PublicHousingRedevelopment Source.thefestivegroup

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 41 N ITERATIONS 3. TentativeProductMixandIterations Inredevelopmentproject,accordingtothepolicy,are3component Redevelopmentcomponentisfixed Additionalaffordableunitsaredecideduponthevalueofresiduallandinthemarket.AndremainingFSIwill beconsumedinfreesalecomponent PHC No.ofexistingunits(with40%and25%extraCAforresidentialandcommercialrespectively) AHC MarketvalueofAHCunitsequivalenttoresidualland’smarketvalue FSC Aspermicromarketsupplyanddemand,andprofitabilityoftheproject Parameter Value PlotArea 17.35Ha AfterDeduction 10.41Ha MaximumFreeFSI 3 MaximumBUA 3,12,300sqmt 40% CAaddedto822ResidentialUnits 25% CAaddedto30Non residentialUnits 75,200 sqmt totalredevelopmentBUA Table11 PlotAreaCalculation Source.PrimarySurvey Considering4unitsperfloorand5floorspertower,total44towerscovering15,400sqmt groundforPHC,keepingbuiltvsopenratio37:63,41,640 sqmtplotareaforPHC. TodetermineadditionalAffordableHousingComponent(AHC),AHC’smarketvalueshouldbeequivalent totheresiduallandwhichis62,460sqmt.TotalAHCunits(40sqmtCA)are1,427,withtotal BUAof77,060sqmt. PHCBUA 75,200sqmt AHCBUA 77,060sqmt FSCBUA 1,60,040sqmt TotalBUA 3,12,300sqmt Capital incur cost consist of construction cost, administrative cost, demolition cost, transit accommodation, and gift money. Whereas revenue is generated by selling free sale BUA at current prevailingmarketrate.Differencebetweenthesetwoisdeveloper’sprofitandthepercentageiscounted ontotalcapitalincurcost. TotalCapitalIncurCost 648Cr TotalRevenueGenerated 890Cr Profit 242Cr 37% Inthiscase,builtvsopenratiois37:63,which is not liveable condition, considering less open spacefortheresidents.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 42 N ITERATIONS

iterationsaretobe

out.

this,BUApercentage

and

be

this,

initeration2,builtvsopenratioof31:69isachieved,withpopulationdensityof1,470pphis

For phasing,activitymapping,andcashoutflow–inflow,iteration2istobefollowed Table12 Iterations Source.PrimarySurvey Parameters Iteration1 Iteration2 Iteration3 Iteration4 Iteration5 AHC%ofResidualBUA 32.5% 32.5% 38% 38% 32.5% FSCR%

FreeSaleBUA 80% 80% 90% 85% 90% FSCC%ofFreeSaleBUA 20% 20% 10% 15% 10% Profit 37% 37% 10% 18% 19% PHCHeight(Floor) 5 5 7 7 5 AHCHeight(Floor) 10 20 10 15 15 FSCRHeight(Floor) 15 20 20 20 15 BuiltvsOpen 37:63 31:69 32:68 30:70 35:65 PopulationDensity(pph) 1,470 1,470 1,594 1,568 1,527 TotalCapitalIncurCost 648Cr TotalRevenueGenerated 890Cr Profit 242Cr 37%

Totacklethissituation,

carried

For

forAHC,floorsforAHC, PHC,

FSCisto

considered,apartfrom

percentageofresidential,andcommercialofFSCare decidingfactortoo. Here

there.

of

37%profitattoday’spriceisagoodstarttostartworkingontheproject.Apartfromthiswithfinancialbenefits, thedesiredpopulationdensityandbuiltvsopenratioisachieved.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 43 N PUBLICHOUSING

REDEVELOPMENT

6|PROJECTBRIEF

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 44 N

PUBLICHOUSINGREDEVELOPMENT

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 45 N PROJECTBRIEF 1. ProductMix PHC 2BHKA 2BHKB 3BHK 4BHK 45sqmt 65sqmt 120sqmt 150sqmt 470 225 108 49 17 11 5 2 15,400 46,340 0.72 COMPONENT TYPOLOGY CARPETAREA UNITS TOWERS GROUNDCOVER PLOTAREA FSI AHC 1BHK 40sqmt 1,427 6 3,890 14,330 0.74 COMPONENT TYPOLOGY CARPETAREA UNITS TOWERS GROUNDCOVER PLOTAREA FSI FSC 2BHKA 3BHKA 45sqmt 75sqmt 9,600 38,130 1.54 COMPONENT TYPOLOGY CARPETAREA UNITS TOWERS GROUNDCOVER PLOTAREA FSI 2BHKB 3BHKB 2BHKB 3BHKB 60sqmt 100sqmt 125sqmt 150sqmt 140 288 105 216 173 84 2 4 3 3 5 2 24% 25% 51% PHC AHC FSC 22% 37% 26% 14% PHC AHC FSC Commercial 53% 13% 25% 8% PHC AHC FSC Commercial 3,12,300 sqmt 3,780 units 31% coverage Figure53 DistributionofBuilt UpArea Source.PrimarySurvey;GujRERA Figure54 DistributionofUnits Source.PrimarySurvey;GujRERA Figure55 DistributionofGroundCoverage Source.PrimarySurvey;GujRERA Here,PHCistobegivenbacktotheresidents,AHCisgiventoGHBaspremium.OnlyFSCistobesoldat marketpricetogainprofit.Abovepiechartisofentireproject.Outofwhichonly1,60,040sqmtof BUA,1,007residentialunits,and524commercialunitswillbesold. Comm. 43sqmt 524 4 51% 40% SaleableBUA SaleableUnits Here, as the subject site is at the junction of 2 micro market, wide range of unit size and typology are providedtocoveralltypeofincomegroupandbuyers.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 46 N PROJECTBRIEF 2. ConceptualLayout 60 mt 12 mt Figure56 SiteLayout Source.Author’sInterpretation 2BHKA 1BHK 2BHKB 3BHK 4BHK Commercial 2BHKA 3BHKA Commercial 2BHKB 3BHKB Commercial 3BHKC 4BHK Commercial

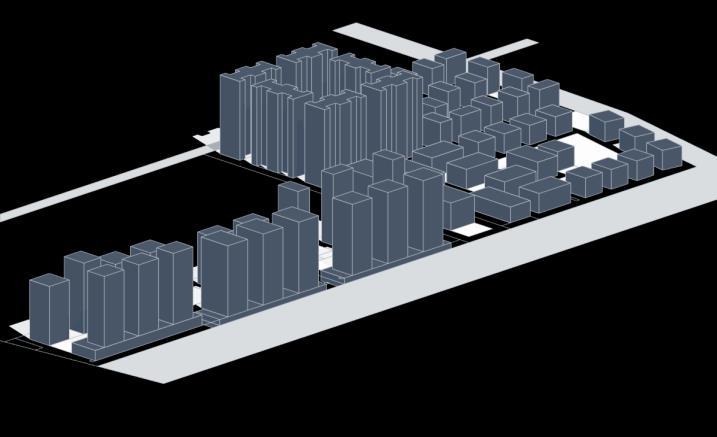

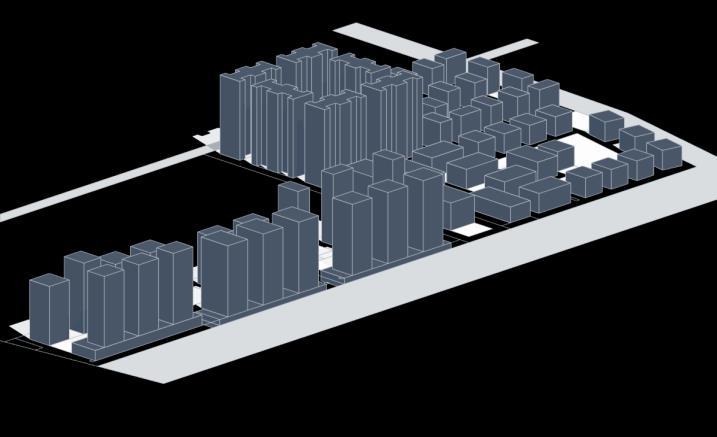

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 47 N PROJECTBRIEF 3. UniqueSellingPoint Amenities Terrace Garden Club House Indoor Games Yoga& Meditation Banquet Hall Gaming Zone Mini Theatre Steam& Sauna 60 mt 12 mt Figure58 SiteLayout Source.Author’sInterpretation UniqueSellingPoint ProximitytoBRTS ProximitytoJobGenerator Figure57 3DViewofSite Source.Author’sInterpretation 1Carparkingtoeachunit 2-wheelerparkingtoeachunit Dedicatedverticalcommonspacetoeach tower Only2 wheelerparkingonground 2Carparkingtoeachunit Dedicatedverticalcommonspacetoeachtower Parkingonlyinbasement 2Carparkingtoeachunit+1bysale

7|PROJECTPHASING

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 48 N

PUBLICHOUSINGREDEVELOPMENT

Phase1

Theprojectisdividedinto three phases. Phase 1 Will focus on constructing redevelopmentpartofthe project Phase1

Phase2

PHASING

Phase3

Phase2isbasedongettinginflowintheproject This phaseiffocusesonmoreconstructionforfastdelivery of affordable housing component and free sale component.

Phase2

Phase3isallabout makingprofitoutof the project, completion of construction work and proceeding to exit of the project.

Phase3

Figure59 Phasing Source.Author’sInterpretation

Averageconstructionperyearis44,500sqmt,whichisalmostdoublethanmicromarket.Here,thereisno land cost involved initially, but to use the benefits of public housing redevelopment, which is free sale component,redevelopmentandaffordablehousingcomponentmustobtainBUpermission,thenafterfree salecomponentcanattainBUpermission.Here,negotiationwiththeresidentswilltake1yeartostartthe project.Apartfromthis,constructioncosts,transitaccommodations,andgiftmoneymajorlysumsupto outflowininitialyears.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 49 N PROJECTPHASING 1. Phasing 3M 6M 9M 12M 15M 18M 21M 24M 27M 30M 33M 36M 39M 42M 45M 48M TotalBUA Percentage Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 75,200 22% 61,465 18% 77,058 23% 68,033 20% 52,950 16% 1,32,643 37% Sale UnitsperYear 87 104 255 446 29% 7% 17% Construction UnitsperYear BuiltUpArea perYear UnitsperPhase BuiltUpArea perPhase 5% UnitsperPhase 6% 1,216 34% 6% 15% 16% 22,257 54,932 55,454 599 17% 446 12% 170 PHASING Project Negotiation/Transactions Sales PHC FSC Luxurious AHC FSC Moderate FSC Compact Phase1 1Year 2Year 3Year 4Year 51M 54M 57M 60M 63M 66M 69M 72M TotalBUA Percentage Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 75,200 22% 61,465 18% 77,058 23% 68,033 20% 52,950 16% 1,408 39% 1,21,786 34% 24% Sale UnitsperYear 684 45% 21% 364 320 Construction UnitsperYear BuiltUpArea perYear UnitsperPhase BuiltUpArea perPhase UnitsperPhase 14% 20% 50,575 71,212 800 22% 607 17%

Project Negotiation/Transactions Sales PHC FSC Luxurious AHC FSC Moderate FSC Compact Phase2 5Year 6Year 75M 78M 81M 84M 87M 90M 93M 96M 87M 90M 93M 96M TotalBUA Percentage Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 75,200 22% 61,465 18% 77,058 23% 68,033 20% 52,950 16% 952 27% 1,01,692 29% 42 Sale UnitsperYear 401 26% 15% 9% 3% 226 133 Construction UnitsperYear BuiltUpArea perYear UnitsperPhase BuiltUpArea perPhase UnitsperPhase 7% 1% 24,010 4,622 21% 26 1% 73,060 776 22% 150 4% PHASING Project Negotiation/Transactions Sales PHC FSC Luxurious AHC FSC Moderate FSC Compact 7Year 8Year 9Year Phase3

Table13 ProjectPhasing Source.PrimarySurvey

MaximumBUAisconstructedinyear6and7,wherealmostall5projectsaregoingsimultaneously.Whereas all three phases have almost equal amount of construction being constructed. In general, free sale componenthasthemaximumBUA,butasfreesalecomponentisdividedintothreeprojects,AHCproject hasthehighestBUAandnumbersofunits.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 50 N PROJECTPHASING 37% 34% 29% 34% 39% 27% Phase1 Phase2 Phase3 22% 18% 23% 20% 16% 22% 9% 37% 18% 14% PHC FSCLuxurious AHC FSCModerate FSCCompact

ProjectWiseDistributionofBUAandUnits

WiseDistributionofBUAandUnits

0 100 200 300 400 500 600 700 800 900 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 1 2 3 4 5 6 7 8 9 No of Units BUA ( sqmt ) Year BUA Units Figure60 YearWiseDistributionofBUAandUnits Source.Author’sInterpretation

Figure61

Source.Author’sInterpretation Figure62 Phase

Source.Author’sInterpretation

Units BUA Units BUA

Thepageisleftblankintentionally.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 51 N PUBLICHOUSINGREDEVELOPMENT

8|FINANCIALFEASIBILITY

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 52 N

PUBLICHOUSINGREDEVELOPMENT

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 53 N FINANCIALFEASIBILITY 1. CashFlowAnalysis 3M 6M 9M 12M 15M 18M 21M 24M 27M 30M 33M 36M 39M 42M 45M 48M 51M 54M 57M 60M 63M 66M 69M 72M 75M 78M 81M 84M 87M 90M 93M 96M 87M 90M 93M 96M TotalBUA Percentage Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 75,200 22% 61,465 18% 77,058 23% 68,033 20% 52,950 16% 0 1 6 12 12 8 6 7 17 17 10 16 13 12 29 22 29 27 17 17 34 34 24 35 39 32 27 27 18 14 6 6 4 4 0 0 0 1 6 13 13 9 7 8 20 20 12 20 16 16 37 29 38 37 24 24 49 50 36 53 60 50 42 43 29 23 10 10 7 7 0 0 0 0 0 0 0 0 35 35 23 23 17 20 20 22 67 67 49 49 54 77 74 40 32 44 45 19 17 18 22 18 8 7 6 6 2 2 0 0 0 0 0 0 40 40 27 28 21 26 26 29 90 92 68 69 78 113 111 61 50 69 72 32 28 30 39 31 14 14 12 12 3 3 0 -1 -6 -13 -13 -9 32 32 7 7 10 6 10 13 53 63 30 32 54 88 62 12 15 16 13 -18 -14 -13 10 9 4 4 5 5 3 3 ₹819 0 1 7 20 33 42 49 57 77 98 109 129 145 161 198 227 265 302 326 351 399 449 485 538 598 648 690 733 762 785 795 804 812 819 819 819 ₹1,330 0 0 0 0 0 0 40 80 107 135 156 182 208 237 327 419 487 556 634 747 858 919 969 1039 1111 1143 1171 1201 1241 1272 1286 1299 1312 1324 1327 1330 ₹511 0 -1 -7 -20 -33 -42 -10 23 30 37 47 53 63 76 129 192 222 254 308 397 458 470 484 501 514 495 481 469 479 487 491 495 500 505 508 511 CumulativeNetCashflow NetCashflow SubTotalofOutflow(Cr) TotalOutflow(Cr) SubTotalofInflow(Cr) TotalInflow(Cr) CumulativeOutflow CumulativeInflow 1,408 39% 952 27% 1,32,643 37% 1,21,786 34% 1,01,692 29% 42 24% Sale UnitsperYear 87 104 255 446 29% 7% 17% 684 45% 401 26% 21% 15% 9% 3% 364 320 226 133 Construction UnitsperYear BuiltUpAreaperYear UnitsperPhase BuiltUpAreaperPhase 5% UnitsperPhase 6% 1,216 34% 7% 1% 24,010 4,622 6% 15% 16% 14% 20% 21% 26 1% 22,257 54,932 55,454 50,575 71,212 73,060 800 22% 776 22% 150 4% 599 17% 446 12% 607 17% 170 PHASING Project Negotiation/Transactions Sales PHC FSCLuxurious AHC FSCModerate FSCCompact 7Year 8Year 9Year Phase1 Phase2 Phase3 1Year 2Year 3Year 4Year 5Year 6Year Table14 CashInflowandOutFlow Source.PrimarySurvey TotalCapitalIncurCost ₹819Cr TotalRevenueGenerated ₹1330Cr Profit ₹511Cr IRR 36% NetProfit 62% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 3M 6M 9M 12M 15M 18M 21M 24 M 27 M 30 M 33 M 36 M 39 M 42 M 45 M 48 M 51M 54 M 57 M 60 M 63 M 66 M 69 M 72 M 75 M 78 M 81M 84 M 87 M 90 M 93 M 96 M 87 M 90 M 93 M 96 M 1Year 2Year 3Year 4Year 5Year 6Year 7Year 8Year 9Year CumulativeOutflow 0 1 7 20 33 42 49 57 77 98 109 129 145 161 198 227 265 302 326 351 399 449 485 538 598 648 690 733 762 785 795 804 812 819 819 819 CumulativeInflow 0 0 0 0 0 0 40 80 107 135 156 182 208 237 327 419 487 556 634 747 858 919 969 103 111 114 117 120 124 127 128 129 131 132 132 133 0 200 400 600 800 1,000 1,200 1,400 INR in Cr CumulativeOutflow CumulativeInflow Figure63 CumulativeCashOutFlowandInFlow Source.Author’sInterpretation Asseeninthegraph,withnoinitiallandcost,theprojectstarttomakeprofitcomparativelysooner.Evenif Q1’searningisspentinQ2,thereisstillsurpliceremaining,makingtheprojectself sustainable.

BreakEvenPointisadeterminant,whennetcashflowisinpositivenumber,meaningtheprojectisearning morethanspending.Fortheproject,breakevenpointiscomingatY2Q3.TillY2Q3,externalinvestmentis needed.Afterbreakevenpoint,project’searningscanbespent inproject’s cost.Here,initialinvestment neededis49CrINR.If20%marginistaken,60CrINRisrequiredinitialinvestment.Inthiscase,developer can run the project as a promoter and developer, where he has 100% share in equity and revenue generation,assumingthedeveloperhas60CrINRretainedfrompreviousproject’sprofits.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 54 N FINANCIALFEASIBILITY 2. BusinessModel -200 0 200 400 600 800 1,000 1,200 1,400 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 3M6M9M 12 M 15 M 18 M 21 M 24 M 27 M 30 M 33 M 36 M 39 M 42 M 45 M 48 M 51 M 54 M 57 M 60 M 63 M 66 M 69 M 72 M 75 M 78 M 81 M 84 M 87 M 90 M 93 M 96 M 87 M 90 M 93 M 96 M 1Year 2Year 3Year 4Year 5Year 6Year 7Year 8Year 9Year INR in Cr CumulativeNetCashflow CumulativeOutflow CumulativeInflow Break

Y2Q3 ₹49Cr

EvenPoint

Figure64 BreakEvenPoint Source.Author’sInterpretation ₹49Cr ₹60Cr Scenario1 INITIALINVESTMENT ₹511Cr 867% NETPROFIT RoI -200 0 200 400 600 800 1,000 1,200 1,400 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 3M6M9M 12 M 15 M 18 M 21 M 24 M 27 M 30 M 33 M 36 M 39 M 42 M 45 M 48 M 51 M 54 M 57 M 60 M 63 M 66 M 69 M 72 M 75 M 78 M 81 M 84 M 87 M 90 M 93 M 96 M 87 M 90 M 93 M 96 M 1Year 2Year 3Year 4Year 5Year 6Year 7Year 8Year 9Year INR in Cr CumulativeNetCashflow CumulativeOutflow CumulativeInflow BreakEvenPoint Y2Q3 ₹49Cr Y4Q2 ₹161Cr Figure65 RevisedBreakEvenPoint Source.Author’sInterpretation

ThereisnotmuchprofitgainedbetweenY2Q3toY4Q2.Thus,ifY4Q2isconsideredasbreakevenpoint, initialinvestmentneededis161CrINR.If20%marginistaken,195CrINRisrequiredinitialinvestment.Inthis case,developercan formalimitedliabilitypartnershipwithtwootherdevelopersaspartners.Wherethe developerwillactaspromoterandpartner1with40%shareinequityandrevenue,andothertwopartners will share 30% equity and revenue each. Limited Liable Partnership is secured business model to do businesswithtwoormoreentities.Evenifoneentitybacksoff,otherpartnersarefinanciallysecured.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 55 N FINANCIALFEASIBILITY

₹161Cr ₹195Cr Scenario2 INITIALINVESTMENT ₹511Cr 265% NETPROFIT RoI Parameter Promoter+ Partner1 Partner2 Partner3 EquityShare 40% 30% 30% RevenueShare 40% 30% 30% SalesStrategy Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 ConstructionPeriod 20%Pre launchSale 10%ReadytoMoveSale SalesPeriod

selling

price

loan

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 40%Pre launchSale Construction SalesPeriod Figure66 SalesStrategyforResidentialUnits Source.Author’sInterpretation Figure67 SalesStrategyforCommercialUnits Source.Author’sInterpretation Table15 LimitedLiablePartnership Source.PrimarySurvey

Pre launchofferiswheninvestorsbuyinbulkindownpayment.Thisstrategybringsinflowinbulkamount, but it comes with current prevailing rates. Thus, it is important to control

here to leverage

escalation.WhereasReadytomovesalehasescalatedprices,butasthe

paymentperiodhereislonger, minimum30%bookingamountistobecollected.

9|RISKMANAGEMENT

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 56 N

PUBLICHOUSINGREDEVELOPMENT

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 57 N 0 200 400

Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 1Year 2Year 3Year 4Year 5Year 6Year 7Year 8Year 9Year INR in Cr CumulativeOutflow CumulativeInflow 0 200

Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 1Year 2Year 3Year 4Year 5Year 6Year 7Year 8Year 9Year INR in Cr CumulativeOutflow CumulativeInflow RISKMANAGEMENT

RiskIdentification

Mitigation Anytypeofbusinessispronetogetaffectedbyexternalities.To

the

externalities,sensitivityanalysis

riskidentification,1.

and

LowAbsorptionintheMarket 91%AbsorptioninResidentialUnit 94%AbsorptioninCommercialUnit ₹195Cr InitialInvestment 33% IRR 204% RoI 0 200 400 600 800 1,000 1,200 1,400 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 1Year 2Year 3Year 4Year 5Year 6Year 7Year 8Year 9Year INR in Cr CumulativeOutflow CumulativeInflow Y2Q3 Inthisscenario,ifmarketabsorptionisconsidered,90residentialand30commercialunitsareleft unsold.Tomitigatethissituation,theseunitscanbesoldinbulkorseparatelyataveragesalepriceor lowestsalepricetoexittheproject. DropinYoYGrowthinSalePrice ₹195Cr InitialInvestment 32% IRR 169% RoI Y2Q3 Inthisscenario,ifhighestsalepriceisnotachieved,salebeforeachievingaveragepriceiscontrolled, itwouldbeadvisabletosellmaximuminventoryafteraveragesalepriceisachieved. 8% 5% HikeinConstructionPriceEscalation ₹210Cr InitialInvestment 34% IRR 180% RoI Y2Q3 Inthisscenario,constructionofmaximumpossibleinventoryshouldbedonebeforeachieving averageescalatedsaleprice,tocompensatethat,goodnumberofunitsshouldbesoldlateron. 7% 10%

600 800 1,000 1,200 1,400

400 600 800 1,000 1,200 1,400

1.

and

knowif

projectcouldsurvivethese

iscarriedout.Forthis

Lowabsorptioninmarket,2.Dip inYoYgrowthinsaleprice,

3.Hikeinconstructionpriceescalation aretakenintoconsideration.

Inallthreecases,theprojectislittletonothinggetsaffected,meaning,projectissensitiveenoughtotakeahit ofanyexternalities.Apartfromthis,thereareotherunforeseenexternalitiessuchaspandemic,thatmightaffect unitsaleaswellasconstructionrates.

REDEVELOPMENT

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 58 N PUBLICHOUSING

Thepageisleftblankintentionally.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 59 N PUBLICHOUSINGREDEVELOPMENT

|CONCLUSION

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 60 N

PUBLICHOUSINGREDEVELOPMENT

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 61 N PUBLICHOUSINGREDEVELOPMENT Upgradationof oldstock ofassociation Provisionof newstock totheagency Additionof newstock tothemarket PHC AHC FSC 9years Project Cycle 36% IRR 265% RoI Theprojectisdefinitelyviablewith36%ofIRRand265%ofRoI.Althoughtheprojectcycleis9yearslongand therearecomplexityinvolved,theprojectisviableenoughtostandagainstanyexternalities. Apartfromthis,theolddilapidatedstockisgettingupgraded,concernedauthorityisgettingtheiroldstock upgradedandnewaffordablehousesconstructedfreeofcostintotheirinventory.Thelandisopenformore greenfielddevelopmentthatcontributestothemicromarketandneighbourhood.

Thepageisleftblankintentionally.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 62 N PUBLICHOUSINGREDEVELOPMENT

|Abbreviations

AHCAffordableHousingComponent

AMCAhmedabadMunicipalCorporation

AMTSAhmedabadMunicipalTransportService

AUDAAhmedabadUrbanDevelopmentAuthority

BHKBedroomHallKitchen

BRTSBusRapidTransitSystem

BUABuiltUpArea

BUBuildingUse

CACarpetArea

CBDCentralBusinessDistrict

CCTVClosedCircuitTelevision

CGDCRComprehensiveGeneralDevelopmentControlRegulation

CQCCBSCombinedQualityCumCostBasedSystem

DFCDedicatedFreightCorridor

DMICDelhiMumbaiIndustrialCorridor

DUDwellingUnit

FSCFreeSaleComponent

FSCCFreeSaleComponentCommercial

FSCRFreeSaleComponentResidential

FSIFloorSpaceIndex

GHBGujaratHousingBoard

GIDCGujaratIndustrialDevelopmentCorporation

GIFTGujaratInformationandFinanceTechnology

GMRCLGujaratMetroRailCorporationLimited

GujRERAGujaratRealEstateRegulationAuthority

INR IndianNationalRupee

IRR InternalRateofReturn

MAHSRMumbaiAhmedabadHighSpeedRail

O&MOperations&Maintenance

ONGCOilandNaturalGasCorporation

PHC PublicHousingComponent

PPHPeoplePerHactare

RoIReturnonInvestment

SBDSubBusinessDistrict

SIRSpecialInvestmentRegion

TODTransitOrientedDevelopment

TP TownPlanning

YoYYearonYear

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 63 N

Thepageisleftblankintentionally.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 64 N PUBLICHOUSINGREDEVELOPMENT

ahmedabadbrts.org.Www.ahmedabadbrts.org.RetrievedSeptember19,2022,fromhttp://www.ahmedabadbrts.org/

AnnualReport2020 21.Gujrera.gujarat.gov.in.RetrievedSeptember18,2022,from https://gujrera.gujarat.gov.in/resources/staticpage/Annual_Report_2020 21/Annual_Report_2020 21.html

ChandkhedaEmergesOneoftheMostPreferredLocalitiesinAhmedabad.Www.commonfloor.com.RetrievedSeptember19,2022,from https://www.commonfloor.com/guide/chandkheda emerges one of the most preferred localities in ahmedabad 41806

GSDPofGujarat,EconomicGrowthPresentationandReports|IBEF.(n.d.).IndiaBrandEquityFoundation.RetrievedSeptember18,2022,from https://www.ibef.org/states/gujarat presentation

GujaratMetroRailCorporationLimited.GMRC.RetrievedSeptember19,2022,fromhttps://www.gujaratmetrorail.com/

INDIAREALESTATERESIDENTIALANDOFFICEMARKET.Www.www.knightfrank.co.in.RetrievedSeptember19,2022,from https://www.knightfrank.co.in/research/india real estate residential and office market 2021 8699.aspx

WhyGujaratRealEstateMarketIsHot.RealtyplusMagazine.RetrievedSeptember18,2022,fromhttps://www.rprealtyplus.com/design const/why gujarat real estate market is hot 106049.html#:~:text=INVESTMENTS%20WORTH%20RS%205%2C005%20CRORE

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 65 N

|

Bibliography

Thepageisleftblankintentionally.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 66 N PUBLICHOUSINGREDEVELOPMENT

Thepageisleftblankintentionally.

PublicHousingRedevelopment HousingProjectStudioUH4001 KhyatiShah|PUH21178 67 N PUBLICHOUSINGREDEVELOPMENT

PublicHousingRedevelopment

GHBSociety,Chandkheda PUH21178