April 2023 Edition. Vol 4 Advancing Auditing &Accountability

AUDITING

impact of artificial

INTERNAL

The

intelligence

NEW STRATEGY

MUNICIPALITIES WITH CLEAN AUDIT OPINIONS: What are they doing right? AGSA'S

AUDITOR-

INTERVIEW WITH

GENERAL TSAKANE MALULEKE

BUCKLE UP

Bumpy political & economic ride ahead

Editorial Director: Kgomotso Sethusha Contibutors: David Harrison Thato Moeng Cobus van Rensburg Lesedi Matlala Blessing Masuku Phillip Rakgwale Dumisani Mahlangu Kemi Mathatho Justice Malala Sales Director: Nardine Nelson nardine@kwedamedia.co.za Publishing Partner: Kweda Media www.kwedamedia.co.za Editorial Enquiries T: 012 004 0741 E: researcher@saiga.co.za Advertising Enquiries T: 082 739 3932 E: auditingsa@kwedamedia.co.za CONTENTS 08 06 CEO'S Note 08 AGSA's new strategy 14 Why SA supermarkets should slash the price of foods by a fifth 18 The impact of artificial intelligence on internal auditing 22 Municipalities with clean audit opinions: What are they doing right? 26 The significance of external audit in enhancing governance (ESG) programmes 29 Strap in for South Africa’s bumpy political and economic ride ahead 32 Overreliance on outsourcing a contributory factor to public sector maladministration 36 Inequality and poverty, every billionaire represents policy failure 40 Professionalising public sector finance – the journey towards sound governance and clean administration 44 The role of internal audit function in contributing towards combined assurance 48 The rise and fall of Eskom CONTRIBUTORS Auditor-General

4 www.saiga.co.za Advancing Auditing &Accountability

Tsakane Maluleke speaks to Auditing SA

Poor audit reports are without doubt the bane of existence for public sector auditors.

Audits have shown in recent years how the lack of transparency, poor governance, accountability and effective financial management from those entrusted with public resources have had major implications on the very quality of life of ordinary citizens.

In this edition, our first issue of the year, we learn about how Auditor-General Tsakani Maluleke has been tackling these and many other challenges in her pursuit of audit quality.

In our cover feature, Maluleke shares AGSA’s new strategy, the #cultureshift2030, and talks about how the amended Public Audit Act is helping to promote a culture of accountability, integrity, transparency and performance in the public sector.

Almost daily, we read about how South African municipalities are battling with problems relating to local government, ranging from complaints regarding inadequate service delivery, to serious financial management woes. Read our feature on the subject to understand what municipalities with clean audit opinions are doing right.

As it has become the norm, you may be reading this in the dark, if not by candlelight. Are we really going back to the Dark Ages? The answers may well lie in one of the articles chronicling the rise and fall of the power utility, Eskom.

Power outages have a direct effect on the economy, and it is inevitable that ordinary citizens face the burden of the rise in food prices. The price of groceries is astronomical as load-shedding affects food production. Can supermarkets heed the call of one of our writers, David Harrison, and slash food prices by a fifth?

We need to buckle up for a bumpy ride on the economic and political front.

And who better to unpack that for us other than reknown political commentator and columnist Justice Malala?

CEO's Note

Artificial intelligence (AI) is expected to have a huge impact on the audit profession in the coming year. As AI technology advances, auditors will likely rely on AI to assist with various aspects of the audit process. Read more on this and the growing impact of technology in the auditing and accounting field in the issue.

You will also get to learn about how Chief Executive Officers, their executive colleagues, and governing board members all have critical roles to play in maintaining clean administration and governance.

This magazine continues to be a means for us to keep our members, the RGAs, MoU partners, stakeholders and the public informed about activities in the auditing space as SAIGA moves forward with the development of ethical public sector professionals.

Once again, I’d like to congratulate the SAIGA team and the writers for their commitment and contribution to the growth of the Institute. There is still work to be done to strengthen the organisation and continue building the RGA brand.

Happy reading!

Russel Morena SAIGA CEO

6 www.saiga.co.za Advancing Auditing &Accountability

AGSA’S NEW STRATEGY

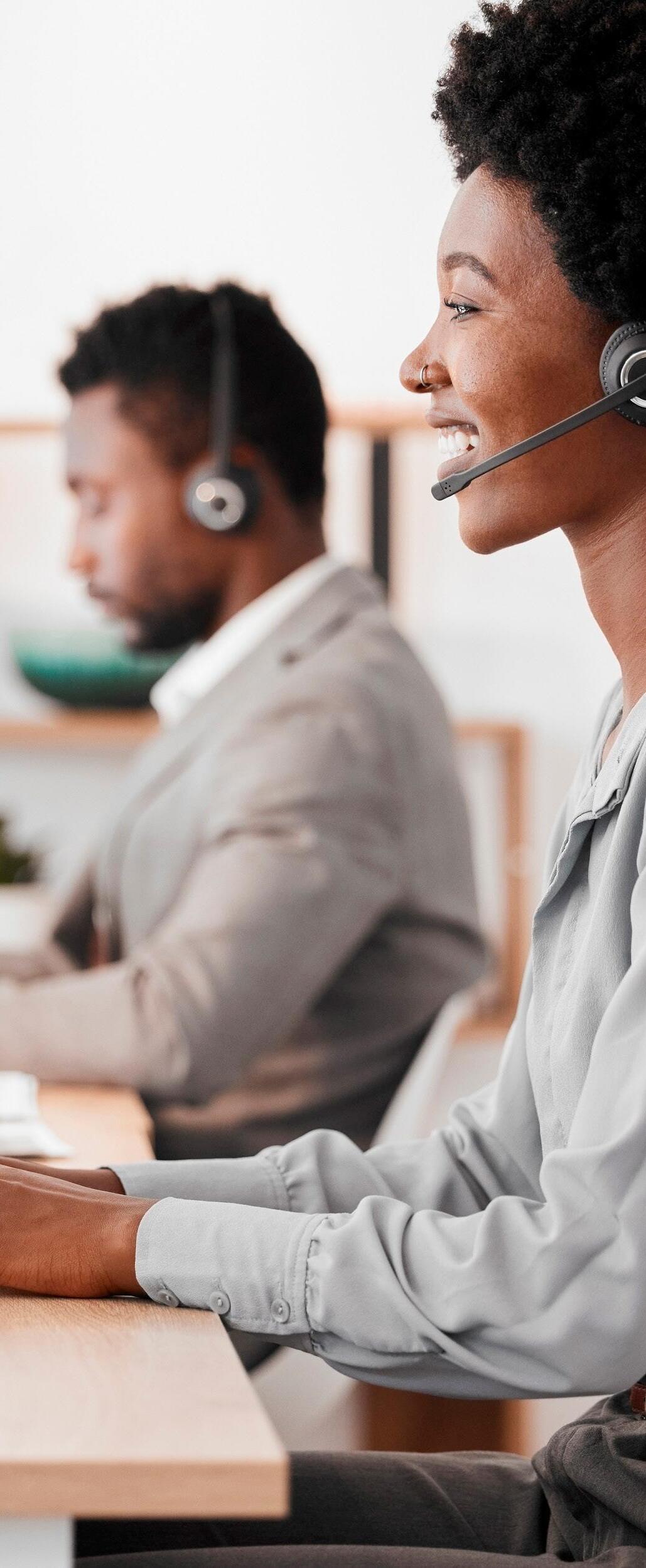

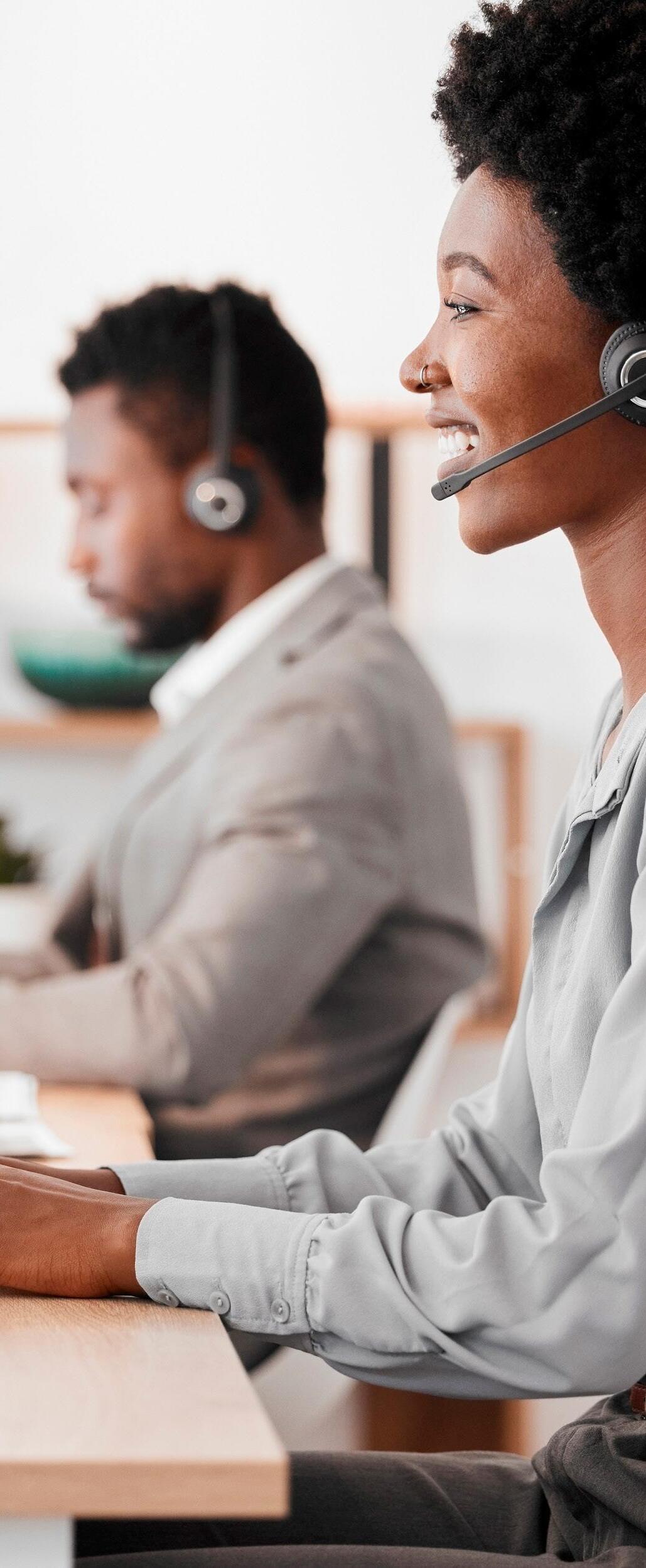

Auditor-General Tsakane Maluleke speaks to Auditing SA about AGSA’s new strategy, #cultureshift2030, major milestones achieved thus far in her tenure, and how the citizens may hold elected representatives accountable through public audit results.

Emboldened by the amended Public Audit Act, Maluleke is determined to maintain audit quality, hold government officials accountable for public funds, and ensure that auditors adhere to AGSA’s high professional ethics, accountability, and transparency standards.

8 www.saiga.co.za Advancing Auditing &Accountability

AGSA

BY KGOMOTSO SETHUSHA

It’s been two years since you came into office. What are the highlights/ achievements that you can point to so far?

Tsakane Maluleke (TM): I assumed office during a very challenging time in our country. We were in the grip of the Covid-19 pandemic.

The organisation has had to adapt to doing things differently, and the resilience and perseverance of our people were severely tested. I am pleased to say that one of my successes is maintaining the sustainability of our institution during this time.

We also tried new ways of working, we introduced innovations into the business of auditing, and I am pleased to say that we fared very well and have incorporated some of these elements into the business more permanently.

We also delivered the country’s first Covid-19 real-time audits report during this time. I am quite proud of our team because once again we rose to the occasion and delivered the service of our country. We expanded this work to include observations on the distribution of covid vaccines.

The real-time audits have now become a bit more regular. We did these following the floods in Kwa-Zulu Natal a year ago and we will also be assisting the government with these in terms of the new energy programme that was announced by the President at the State of the Nation Address earlier this year.

We have also delivered a new organisation strategy, the Culture Shift 2030, whose strategic aspiration is to influence the role players in the public sector towards building a culture of performance, integrity, good governance and accountability while improving the lived experiences of citizens. We have been consistently improving our insights into government while ensuring that our audit quality

remains high.

We have been gradually introducing and implementing our enhanced powers since they came into effect in 2019 and we are making significant progress.

In the past financial year, 202122, we audited and pronounced on the financial statements of 1 060 government and public sector entities, and summarised our results in two general reports which, read together, provide a comprehensive, whole-ofgovernment insight on the use of invaluable public resources. By making the results of our audits public, we enable citizens to hold their elected representatives accountable for the economy, efficiency and effectiveness of service delivery.

Our pursuit of audit quality is relentless. After a brief period during which we fell short of our stated targets, for the second consecutive year we have been able to report excellent results: 86% of the sampled audit files were found to be following the applicable audit standards. This outcome is a result of the systematic implementation of targeted initiatives, continuous monitoring of our progress and fine-tuning of our approaches.

The amended Public Audit Act empowers the AG to personally hold senior government officials accountable for the misuse of public funds. Has the accountability legislation helped your effort to hold those who mismanage funds to account?

TM: We are seeing auditees move from inaction to action and the >

9 Auditing SA Advancing Auditing &Accountability

raising of material irregularities has helped to advance the work of the AGSA more positively.

Our work in moving our auditees from doing harm to reducing such behaviours, and eventually to doing good will be further supported by our new organisational strategy, Culture Shift 2030. A key feature of our strategy is the strengthening of the accountability ecosystem. We have again been quite deliberate in the inclusion of this as a key pillar of the strategy. It speaks to each part of the system doing the right thing and showing up differently, it speaks to courageous leadership and fearless public service.

We are currently rolling out this strategy and introducing it to our auditees and other stakeholders. This is very important.

TM: We made major strides in implementing our extended powers – from 25 auditees in the first year to 189 in the third year of implementation.

We applied all elements of the material irregularities definition earlier than our original implementation plans. We developed unique audit methodologies to deal with instances of irregularities resulting from fraud, theft, or breach of fiduciary duty, or to assess whether the impact of an irregularity resulted in misuse, or in loss or substantial harm to public resources.

Since the inception of our extended powers, we identified 327 material irregularities with an estimated financial loss of R14,7 billion.

We reached an important milestone in the use of our powers by issuing our first remedial action to Prasa, the Department of Defence and Human Settlements, and the Ngaka Modiri Molema District Municipality.

Material irregularity. Last year, your office uncovered fraud and noncompliance, resulting in an R3.9 billion financial loss. After your institution issued material irregularity notifications to affected towns, you indicated that action would be taken to address 81% of the issues raised. Are there any new developments in this regard?

Albeit slowly, we have noticed successes in using the material irregularity process: we resolved 11 material irregularities over the past year, i.e., the financial loss was either recovered or avoided, internal controls were strengthened, and consequences applied as intended by the law.

Even more encouraging are the unforced behavioural changes at some auditees. Of their own accord, accounting officers cancelled irregular contracts before incurring expenditures to prevent financial losses,

corrected system weaknesses such as billing, improved the safeguarding of assets, and instituted fraud and criminal investigations against the officials responsible.

We also briefed Parliament on this on 10 March 2023.

We briefed Parliament that in terms of the audit outcomes from the Public Finance Management Act of 2021-22, of the 179 MIs on non-compliance and fraud identified to date, 169 resulted in a material financial loss (estimated

"We need all hands on deck if we are to improve the audit outcomes as they currently are. I also want to raise at this point that we need to see the audit outcomes correlating with the service delivery on the ground."

10 www.saiga.co.za Advancing Auditing &Accountability AGSA

at R12 billion), while nine led to substantial harm to public sector institutions and one related to misuse of material public sector resources. And until we raised these issues, no actions were being taken to address 82% of these matters.

However, through the actions taken by accounting officers and accounting authorities in response to MI notifications, the following noticeable progress was observed:

• Financial loss of R636 million was prevented from taking place.

• Financial loss of R148 million was recovered.

• Financial loss of R509 million was in the process of being recovered.

• Thirty-six responsible officials were identified, and disciplinary processes for these officials have been completed or are in progress.

• Fifteen fraud/criminal investigations were instituted.

• Five supplier contracts where money is being lost were stopped.

This is a clear demonstration that our enhanced powers are having an impact and we are pleased

with the attention that accounting officers and accounting authorities are giving to addressing and acting on the MIs.

Real-time auditing was announced as a mechanism to prevent, detect and report on findings to ensure an expeditious response to stop potential fraud and wastage. Accounting officers and authorities of public institutions were equipped to act wiftly on weaknesses in controls and prevent losses. Would you say you are pleased with the real-time audits, especially in the aftermath of the floods in KZN and in the Eastern Cape? >

11 Auditing SA Advancing Auditing &Accountability

TM: I would respond to this with yes, and no. No, because it is unfortunate that at a time of such turmoil and disaster, we cannot count on our public officials to do the right thing and as the AGSA, we needed to come in to ensure that funds were well used with wastefulness and corruption avoided.

That said, the work itself was very useful and we hope to build on this with our auditees. We identified lots of inefficiencies in the systems being implemented, a lack of monitoring and evaluation, and a general lack of preparedness for such situations.

We are therefore monitoring the implementation of our recommendations and continue to audit key aspects of how the relief funds are used. I must again commend our teams who executed this task on behalf of the citizens of our country.

There have been reports in the past of how auditors examining municipalities have been intimidated and instructed to cover up evidence of corruption. In other instances, there have been acts of attempted bribery and direct intimidation of staff. Have such reports reached your office so far and if so, how have you addressed them? How do you ensure that auditors adhere to the institution's high professional ethics, accountability, and transparency standards?

TM: Our audits are conducted by audit teams, who follow our audit methodology, which complies with international audit standards. Our audit staff are professional

auditors who individually subscribe to the international code of ethics which applies to all professional accountants. Where there are threats and intimidations, we have strict protocols that inform how we deal with them.

If we want to make a decisive impact on improving the audit outcomes, we must deal with accounting officers who failed to respond or institute actions for more than a year.

Importantly, going forward at the local government level, financial health and service delivery has regressed over the duration of the previous administration, which has had a negative effect on these communities.

We similarly raised service delivery concerns at the national and provincial government levels. Of the total budget allocated to these levels, less than 20% was governed by auditees with clean audit outcomes.

Lack of internal controls and financial management disciplines, deteriorating financial health and declining service delivery demonstrate the pervasive absence of urgency and intention to change the audit outcomes.

We must appreciate that auditees are diverse organisations characterised by the sum of the individuals that work there and their behaviour. They do not exist in a vacuum; they form part of a complex ecosystem where each role player has a specific, allocated part to play.

An auditee’s success is dependent on its intrinsic culture. We believe that it is possible to instil the correct culture.

Our new strategy, cultureshift2030, is based on the premise that our audits and the insights generated through them, our influence over various role players in the accountability ecosystem and, as a last resort, enforcing our extended powers, can impact the culture of the auditees positively so that it is defined by transparency, integrity, accountability and performance.

Our focus in the near future will be on executing tailored programmes aimed at understanding the auditee’s mandate and their role in the accountability ecosystem, their level of performance and the impact they have on the citizens.

South Africa lags in terms of the number of women in executive roles. For many years, the country has faced gender discrimination, particularly when aspiring to leadership posts. Is it more difficult to hold your position as the first female? If so, how have you dealt with it while remaining to serve as an inspiration to the many women in the auditing and accounting industry?

"We believe that courageous, ethical, accountable, capable, and citizen-centric leadership is required to improve public sector culture and, ultimately, service delivery."

12 www.saiga.co.za Advancing Auditing &Accountability AGSA

TM: I consider myself a professional and I prefer to be taken as such before my gender is considered. I also believe that women are equally capable and can deliver even better on the tasks they have been entrusted with. To demonstrate this point, the World Bank [1], looking at the impact of Covid-19 on businesses found that:

“Despite the challenges, womenled businesses are responding to the Covid-19 crisis with resilience and innovation. In fact, our survey found that women-led small and microbusinesses were much more likely to increase the use of digital platforms compared to those led by men. While firms globally are turning to technology to cope with the pandemic, it was encouraging to see that women-led microbusinesses are leading the charge.”

In addition to the resilience women generally display, it makes good business sense to create workplaces and institutions that support the inclusion of women.

According, the International Labour Organisation (ILO), when the CEO is a woman, enterprises are:

• 6.8% more likely to have female senior managers in operations.

• 7.2% more likely to have women in senior management in profit and loss functions.

• 12.6% more likely to fill senior general management positions with women

However, although women have been filling managerial positions faster than men since 1991, particularly in high-income countries, the data indicate that women still have a long way to go before they equal the number of men in these roles.

Speaking on South African women in business and in the corporate world Maluleke had this to say:

Although we have made great strides South Africa still has quite a way to go in creating gender-friendly corporate spaces that support the

inclusion of women.

• PwC reports showed that the percentage of female CEOs in JSE-listed companies improved to 8% at the end of June 2022 from 5% a year earlier.

• Looking at the entire executive population of all JSE-listed companies, 15% is female, increasing from 13% last year.

• In actual numbers, only seven of the JSE Top 100 companies were led by female CEOs by the end of June 2022.

• The average tenure for female executive directors ranges from 1.3 to 5.1 years, while men stay for an average of between 2.9 and 8.1 years.

Ms Tsakani Maluleke is the first woman to hold the position of South Africa’s auditor-general in the supreme audit institution’s 109-year history. She was also the first female deputy auditor-general.

[1]

13 Auditing SA Advancing Auditing &Accountability

https://blogs.worldbank.org/psd/covid-19-and-women-led-businesses-more-innovation-greater-financial-risk

WHY SA SUPERMARKETS SHOULD SLASH THE PRICE OF FOODS BY A FIFTH

David Harrison CHIEF EXECUTIVE OFFICER OF THE DG MURRAY TRUST

David Harrison CHIEF EXECUTIVE OFFICER OF THE DG MURRAY TRUST

Makhulu Klaas, 74, from Mdantsane, a township near East London in the Eastern Cape, is grateful for the R90 extra she’ll get each month as part of her old-age pension as announced by Finance

Minister Enoch Godongwana in his recent budget speech.

Klaas lives with her daughter, who works as a cleaner, and two grandchildren, of two and ten years, in a corrugated iron shack. On the one side, there’s a tarred road, on the other, just behind the tiny backyard of her small, unfenced plot, a stream.

The R90 added to her current

R1 980 pension from April, will help Klaas to buy an extra 5kg bag of mealie meal and half a kilogram more sugar beans. These items are daily staples, which analysts include in tracking the prices of a basket of basic foods.

But while the government gives with one hand, it takes with the other. From 1 April, electricity will cost 18.65% more, after the National Energy Regulator of South Africa approved a price hike by Eskom, the country’s electricity provider. Her household spends about R500 a month on electricity, which means R93 extra for lights and heating — her entire grant increase.

So, how should South Africa tackle the problem of getting people to eat healthy things if they have too little money to spend on food in the first place?

ECONOMY001ECONOMY

14 www.saiga.co.za Advancing Auditing &Accountability

In short: here’s one thing more that the Treasury — and the food industry — can do to make food more affordable.

The quick fix

The government’s lifebuoys — such as upping the old-age pension — offer some relief.

In his budget speech, the finance minister now also included food manufacturers in the list of industries that can benefit from the diesel refund, which is already in place for primary producers such as farming, forestry and fishing businesses.

This will apply until 2025 to help ease the pressure of inflation on the price of basic nutritious food items, such as maize meal, rice, eggs and amasi.

Child support grants — R480 per child per month — can fund about

three-quarters of a child’s basic food needs. This support is for a parent who earns less than R4 400 a month and, according to the national budget for 2023, will be upped to R500 from April and R510 a month from October.

COVID-19 relief grants (R350 a month for people older than 18 who have no income and no other financial help from government) have proved a critical safety net over the past two years. This extra money, which will be available until March next year, spared 1.1-million children from slipping below the food poverty line — a boundary that affected 6.9-million kids in 2020. The food poverty line, which sits at R663 a month at the moment, is the least amount of money someone needs for buying food that will give them enough energy for a day.

But these financial buffers are not enough. Stats SA estimates that in 2022 each person in a household needed R945 to live on, considering food, clothing and other costs. At R500 a month, this year’s child support grant will only cover about half of what is needed.

The long game

The long-term solution is to shift to a national food and agricultural policy that is designed to make healthy foods more affordable. The United Nations Food and Agriculture Organisation (FAO) says that government subsidies work best if they help consumers to buy more food. But if primary producers such as farmers simply have to accept the prices food manufacturers and large retailers offer for their products, the plan could fail, FAO says, because it would undermine their livelihood.

South Africa’s Competition Commission has found that food manufacturers and big shopping chains have a big say in setting food prices in the country. While the profit margins on foods such as meat, dairy and chicken are fairly low, the Essential Food Price Monitoring Reports of the Competition Commission found that they still contribute substantially to retail prices. For example, in 2020, only about 30% of what retailers charged for a litre of fresh milk ended up in the farmer’s pocket, despite the farmer doing far more work to produce the milk than the store to sell it.

Similarly, the August 2022 report notes that the price consumers pay for bread, and to some extent also maize, has risen faster than what retailers pay the manufacturers, which, the Commission says, suggests price-setting behaviour along the chain.

Public funding for social grants is a massive contributor to the revenue of the food retail market in South Africa, equal to 30% of total turnover. This means that taxpayers effectively subsidise part of the profits of the big supermarket chains like Shoprite, Spar and Pick ’n Pay.

A bold move from food manufacturers and retailers is needed to help South Africans buy nutritious food with the money they have. Being willing to waive their mark-ups on an essential >

The responsibility of big manufacturers and supermarkets is not only a moral one, but a financial one too.

15 Auditing SA Advancing Auditing &Accountability

basket of foods rated by the Grow Great zerostunting campaign as the “ten best buys”, including eggs, speckled beans, pilchards and peanut butter — if government finances matched that commitment — will go a long way.

Based on the reports of the Competition Commission, a reasonable estimate is that such discounting by manufacturers and retailers would let the cost of the specified basket of goods drop by about 20%. A matching subsidy by government would make the basket go one-fifth further, helping to close the gap between what households need and what they earn. Together with their existing VATexempt status, the basket price could be half of what the market might dictate.

It’s not business as usual

The initiative for a basket of discounted foods will have to come from the industry. In Egypt, India and the Philippines, targeted food subsidies increased household access to food and reduced the prevalence of underweight children. In field studies in several other countries, including South Africa, retail subsidies helped people to buy healthier foods.

But it doesn’t always work. For example, in China and Iran, the support has little effect, because the subsidy, in this case, provided by the government to reduce the cost of food, was kept by the retailer and not passed on to the consumer.

If this idea is going to work, it can’t be done grudgingly. Without food retailers readily sharing information about how they determine margins on items, it’s possible that the potential of a discounted food basket to improve nutrition over the next five years may be overestimated.

David Harrison is the Chief Executive Officer of the DG Murray Trust. The Trust sees itself as a public innovator through strategic investment in early child development, education and support for young people entering the labour market.

16 www.saiga.co.za Advancing Auditing &Accountability

ECONOMY

This story was produced by the Bhekisisa Centre for Health Journalism.

@APT_APCprogram APT_APCprogramme

THE IMPACT OF ARTIFICIAL INTELLIGENCE ON INTERNAL AUDITING

Artificial intelligence (AI) is expected to impact the audit profession in the coming years significantly. As AI technology advances, auditors will likely rely on AI to assist with various aspects of the audit process.

One of the primary ways in which AI is expected to impact auditors is through automation. AI algorithms can be trained to perform certain tasks, such as data extraction and analysis, which can save auditors time and allow them to focus on more value-added tasks. This can help auditors complete their work more efficiently and effectively.

Another way in which AI is expected to impact auditors is through improved accuracy. AI algorithms can analyse large amounts of data quickly and accurately, which can help identify potential issues that might have been missed by humans. This can help auditors provide more accurate and reliable audit services to their clients.

AI is also expected to enhance risk assessment for auditors. AI algorithms can analyse data from a variety of sources (e.g., financial statements, market data, and news articles) to help auditors understand the risks

facing their clients and provide more effective and targeted audit services.

Despite the potential benefits of AI, it is important to note that auditors will still need to exercise judgment and critical thinking in their work. While AI can assist with certain tasks and provide valuable insights, auditors will need to interpret and analyse this information to provide meaningful and reliable audit services to their clients.

Overall, the use of AI in the audit profession is expected to have a significant impact in the coming years. It is likely that auditors will increasingly rely on AI to assist with various aspects of the audit process, which will help improve the efficiency and effectiveness of audit services.

ChatGPT was introduced in November of 2022. Microsoft collaborates with the San Francisco-based startup OpenAI, which created this technology.

It is part of a new breed of artificial intelligence (AI) systems that can communicate, write readable text on demand, and even create novel visuals and videos based on what they've learned from a massive collection of digital books, online writings, and other media. Chatbots will likely impact

the accounting, legal, medical, and financial industries. These Chatbots are currently employed in numerous sectors.

In January of 2023, I tried the ChatGPT and was blown away by its capabilities. It is capable of assembling audit plans, findings, and recommendations. It can also generate biographies and curriculum vitae for auditors; the list is exhaustive.

Artificial intelligence solutions can consider internal and external information to an organisation and thus can help the organisation recognise emerging risks and threats they haven't yet considered. For instance, say a government agency wanted to audit the benefits payments

18 www.saiga.co.za Advancing Auditing &Accountability

TECHNOLOGY

Thato Moeng CISA, CISM, RGA

issued due to Covid-19. Rather than starting from scratch, AI would enable the agency to populate a risk register using results from past audits of benefit payments, Lemay says.

district manager can instruct store employees to move these products behind the counter.

Some auditors are currently utilising artificial intelligence in their evaluations of client organisations. Because no one has the time to examine every transaction, this enables you to determine which ones are riskier so that you can prioritise them.

an administrator had used his credit card for charges unrelated to the organisation. Due to the insignificance of the transactions, they were not located.

Artificial intelligence also can provide actionable information internal auditors can use to mitigate risk, Audit universe. In a retail setting, for example, AI might reveal how thefts of certain products are spiking. The

For example, when dealing with corporate businesses or non-profit organisations, the AI solution can identify a series of small-dollar credit card transactions occurring for years without detection.

Further investigation can reveal that

An additional advantage of AI is its capacity to streamline operations. To restrict spending, many firms, for instance, require management clearance for bills beyond a specific amount. To increase control even further, finance may examine a fraction of the transactions. Artificial intelligence technologies can review real-time transactions and report those violating guidelines.

AI will assist auditors in optimising their time by making it feasible for them to work more efficiently and >

19 Auditing SA Advancing Auditing &Accountability

AI will assist auditors inoptimisingtheir timebymakingit feasible for them to workmoreefficiently andeffectively

effectively, allowing them to use their human judgement to assess a more significant and comprehensive set of data and documents.

Moreover, AI can be applied to the contract review audit. Machine learning techniques allow humans to examine a more significant number of contracts, such as leases, in a shorter amount of time than is possible with a manual examination. During a recent pilot, AI technologies could accurately extract information from lease contracts using pre-selected criteria in many instances — with greater precision than the typical human reviewer.

In addition to new skills, standards, and an evaluation of ethical problems, several factors are crucial for the successful deployment of artificial intelligence. Data science knowledge is required for AI users. The machine is only as intelligent as the information you provide it. Indeed, an internal audit team can certainly enlist external consultants' assistance in this regard.

Nonetheless, an efficient AI solution necessitates an infrastructure that can be continuously updated when data changes due to, for example, evolving products, regulations, or

markets. There will be a need for many organisations to acquire internal knowledge.

Implementations in businesses with robust data governance rules and data-literate personnel tend to proceed more smoothly than those with these characteristics.

Internal auditors utilising AI must also comprehend the underlying assumptions and algorithms. Consider a scenario in which the programme flags an inventory expense line because the wrong item was acquired and had to be returned, relocated, or written off. The auditor would want to know how frequently such occurrences occur. Similarly, purchases for actual one-time promotional events may be reported.

Organisations should define measurable success criteria for AI. This includes evaluating the accuracy with which the AI solution identifies problems. In general, an abundance of false positives indicates two concerns. One is a lack of diverse data sources, such as photographs and emails.

The second challenge is a deficiency of external data. For example,

suppose the programme is processing employee entertainment charges, and it looks like a group spent money at a gentleman's club violating company regulations. Data augmentation, or the addition of external data, such as that from apps such as Yelp, can assist in evaluating whether the group has truly broken the guideline.

Also essential are patience and training. As it takes time to train the application, AI will not be ideal in its initial iteration. Every time an AI programme is used, it learns more about the patterns it observes and becomes better equipped to discern between valuable and unimportant data.

Organisations must ultimately build an AI culture that combines education and alertness. Leaders must give vision and direction for AI projects and cultivate a climate of experimentation in which failure is not just allowed but actively encouraged. Employees must be mindful of data privacy issues and amenable to reframing the problems they are examining.

Given the infancy of artificial intelligence applications, internal auditors can give their expertise to organisations developing solutions. This is an opportunity to contribute to the design of the software.

As software advances, standards evolve, and ethical concerns are addressed, AI solutions can potentially increase the internal value audit provides to the firm. You will now have the data and capability to see realtime patterns within an organisation's inner workings.

In a word, auditors must be aware of technological advancements that will have a favourable or negative impact on the auditing profession. These disruptive technologies are unavoidable. Any auditor who avoids these changes commits professional suicide — forewarned is forearmed!

20 www.saiga.co.za Advancing Auditing &Accountability

TECHNOLOGY

REAP THE REWARDS OF YOUR HARD WORK.

Becoming a leader in business is a significant achievement, and one which acknowledges your diligence and professionalism. At BMW Menlyn, we recognise the value of excellence, which is why we would like to introduce you to the exclusive benefits and preferential pricing that come with the BMW Professional Programme.

To learn more, please contact cathrine.mathebula@bmw-menlyn.co.za

BMW Menlyn

Corner Garsfontein Road and Lois Avenue

Tel. 012 426 2700

www.bmw.co.za/menlyn

MUNICIPALITIES WITH CLEAN AUDIT OPINIONS: What are they doing right?

Cobus van Rensburg

Former Senior Lecturer: Department of Auditing, University of Pretoria

Cobus van Rensburg

Former Senior Lecturer: Department of Auditing, University of Pretoria

South African municipalities appear to be struggling on many fronts. Problems relating to local government, ranging from complaints regarding inadequate service delivery to serious financial management woes, are reported almost daily.

In June 2022, the Auditor-General of South Africa (AGSA) reported that merely 41 municipalities (15.9%) received a clean audit opinion in the 2020/21 financial year. The AuditorGeneral (AG) defines a clean audit

report as financial statements that “are free from material misstatements (a financially unqualified audit opinion)” with “no material findings on reporting, on performance objectives or non-compliance with legislation.” A lot has been said about what municipalities are doing wrong, but the question as to what the few municipalities that seem to be getting it right, are doing to get it right, remains unanswered to a large extent.

In an attempt to answer this question an in-depth interview was conducted with a director of a large audit and accounting firm. The director has extensive experience with South African municipalities, from both an audit and a financial reporting perspective. The director proposed that municipalities that managed to

ensure clean audit reports have done so consistently for several years due to embedding the following 10 principles in their organisations:

1. Setting the clean audit objective. The first step to a clean audit report is to dream it and set it as a specific strategic objective. The objective must be driven by the municipal manager (MM) and buy-in must be obtained from all highlevel stakeholders, including senior management, Council and governing bodies, such as the Audit and Risk Committee.

2.Understanding that a clean audit is a secondary objective. All stakeholders must understand

22 www.saiga.co.za Advancing Auditing &Accountability

MUNICIPALITIES

that a clean audit report should not be obtained “at all cost”. A municipality’s main objective is service delivery, and the opportunity costs should be considered when, for example, deciding to outsource the preparation of financial statements to a consulting firm, when the funds could have been utilised to repair roads or improve water infrastructure.

3.Consider the AG as a partner to add value and not as a financial policeman. All AG findings should be considered as a tool to improve processes. Every Communication of audit findings (COMAFS) should be individually considered and responded to by management and the municipality’s internal audit function should also be involved in this process.

4.Fostering a culture of accountability. This entails firstly ensuring that all staff are held accountable for their part in the process and secondly strongly discouraging silo management. All senior managers must understand that a clean audit report takes an integrated effort and is not merely the responsibility of the finance department. This culture should also include a value system that rewards “doing the right thing”, but without instilling fear of making mistakes. The culture that should be fostered should rather portray an ethos that states: “we do everything right, but when we make a mistake, we don’t hide it, we deal with it and correct it.”

5.Strict management of timeframes. All stakeholders

should closely observe the calendar to ensure that key deadlines are met and processes are in place to monitor compliance with legislative requirements, service delivery and financial reporting.

6.Harnessing the risk management process. An effective risk management process can contribute greatly to achieving the clean audit objective. However, the relevant role players should act quickly to leverage this, as the time frame from receiving COMAFS from the AG to the next financial year end, is short (roughly seven months). The municipal risk register should be updated immediately when the AG findings were received to ensure that all root causes are incorporated. This will positively influence the management >

23 Auditing SA Advancing Auditing &Accountability

of key risks as it will impact internal audit efforts and ensure that action plans are immediately drafted to address the root causes. Audit committee (AC) oversight to ensure the prompt updating of the risk register and quick addressing of these causes should also be ensured by adding these as standing points on AC agendas.

7.Harnessing internal auditing. The municipality’s internal audit function can also prominently influence the clean audit goal, especially in conjunction with effective risk management. If risk registers are promptly updated to reflect the AG’s findings and root causes, the internal audit plan and scope can be adjusted accordingly to ensure optimal value is added by prioritising internal audit assurance on key processes, such as supply chain management and the grant register, at the most appropriate time (typically during the municipality’s third or fourth quarters).

The AC should also provide oversight on this, bearing combined assurance in mind, to ensure that internal audit has adequately considered the impact of the AG’s findings and the risk of a negative future external audit report.

8.Staying abreast with changes and emerging risks. All relevant stakeholders of the municipality (governing bodies, senior management, internal audit, etc.) should stay up to date with changes in legislation as well as the emerging risks identified by the AG. This will assist the municipality to be proactive in addressing the risks associated with a negative audit report

9.Collaboration. Municipalities that seek solutions for strategic challenges (such as the implementation of a new regulation

or the impact of a new accounting standard) with other municipalities as well as their province, instead of trying to operate in isolation, have a better chance of overcoming these challenges.

10.Consequence management. AG findings relating to unauthorised, irregular or fruitless and wasteful expenditure, must be responded to immediately with the appropriate level of action, for example, disciplinary procedures. Not doing this will almost guarantee a loss

of a municipality’s clean audit report. The AG touched on some of the above points in the General Report on Local government outcomes for 2020-21 financial, by setting the theme of the report as: “Capable leaders should demonstrate change by strengthening transparency and accountability”.

A clean audit report is therefore not impossible but will require specific interventions, commencing with the tone at the top and entrenching the goal of a clean audit in the culture and processes of the entire municipality.

24 www.saiga.co.za Advancing Auditing &Accountability

MUNICIPALITIES

APPLICATIONS TO STUDY THE FOLLOWING

POSTGRADUATE PROGRAMMES IN 2023 ARE NOW OPEN:

INSPIRING GREATNESS

FOR FULL DETAILS, VISIT: WWW.SAEF.UKZN.AC.ZA

THE SIGNIFICANCE OF EXTERNAL AUDIT IN ENHANCING GOVERNANCE (ESG) PROGRAMMES

ESG PROGRAMMES

Lesedi Matlala EXECUTIVE DIRECTOR AT GO-GETTERS BRAND CONSULTANCY

ESG programmes are gaining importance in South Africa due to the need to address environmental and social challenges and promote sustainable business practices. Adopting ESG programs is seen as a tool to achieve economic growth and development that is inclusive and sustainable.

These programs are critical in achieving the United Nations Sustainable Development Goals, especially in areas such as renewable energy, water conservation, poverty reduction, and gender equality. Companies with ESG programs are viewed as more attractive to investors because they have a long-term vision and a commitment to sustainable business practices.

The external audit ensures companies adhere to their ESG programs and report accurate information to stakeholders. In addition, it provides independent assurance of the effectiveness of a company's ESG policies, processes, and reporting mechanisms, which builds trust and credibility with stakeholders. External auditors can also identify areas for improvement, which helps companies enhance their ESG performance over time. In South Africa, public companies

are required by the Companies Act to have their financial statements audited by registered auditors. Additionally, the King IV Code of Corporate Governance recommends independent assurance of companies' ESG performance reporting by external auditors.

I. Importance of External Audit in ESG Programs

The external audit is crucial in validating ESG data, which is vital for organisations to measure their environmental, social, and governance impact. By objectively evaluating an organisation's ESG data, an external audit helps ensure the accuracy, completeness, and reliability of the data. This, in turn, enables organisations to enhance their credibility and transparency, increase stakeholder trust, and identify areas for improvement.

An external audit also assures investors, regulators, and other stakeholders that the ESG information disclosed by the organisation is reliable and trustworthy.

External audit validates ESG data and ensures compliance with regulations and standards. With governments implementing regulations and standards to >

27 Advancing Auditing &Accountability

address ESG issues, organisations must disclose their ESG information in their financial statements and other reports to comply. An external audit helps organisations to ensure their ESG information meets these regulations and standards, avoiding legal and reputational risks associated with non-compliance. Furthermore, an external audit helps organisations identify potential areas of non-compliance and provide recommendations to address them, which ultimately helps organisations to improve their ESG performance and meet stakeholder expectations.

II. Challenges of External Audit in ESG Programmes in South Africa

South Africa has made significant efforts to promote ESG practices. However, the external audit in ESG programs in South Africa faces challenges such as limited ESG expertise among auditors and a lack of clarity on ESG standards and regulations. In addition, external auditors in South Africa may lack the expertise needed to perform ESG audits effectively due to the complex and rapidly evolving nature of ESG. This lack of expertise may result in inaccuracies in ESG reporting, reducing stakeholder confidence in an organisation's ESG performance. Moreover, the lack of clarity on

ESG standards and regulations creates challenges for external auditors who may struggle to determine what ESG information should be reported and how it should be reported. This lack of clarity may lead to inconsistencies in ESG reporting and undermine the credibility of ESG programmes. There is a need for more clarity and guidance on ESG regulations and standards in South Africa to address this challenge.

III. Recommendations for Enhancing External Audit in ESG Programmes in South Africa

External audits have been proven to be important in assuring the effectiveness of ESG programmes. Several recommendations have been proposed to enhance further the impact of external audits in ESG programmes in South Africa. These include enhancing the expertise of external auditors on ESG, encouraging collaboration among stakeholders, developing clear and consistent ESG standards and regulations, and investing in resources for ESG audits.

The enhancement of the expertise of external auditors on ESG can be achieved through training and development programs that focus on ESG issues and their relevance to financial reporting. Encouraging collaboration among stakeholders involves creating forums or

platforms for engagement to share best practices and develop common standards and metrics for measuring ESG performance.

Developing clear and consistent ESG standards and regulations involves adopting international standards such as the GRI or TCFD framework. Investing in resources for ESG audits includes dedicating adequate staff, and financial resources to ESG audits and ensuring that auditors have access to the necessary tools and technology to conduct thorough and effective ESG audits.

In conclusion, external audit plays a crucial role in ensuring the effectiveness of ESG programmes in South Africa. It provides independent assurance of the accuracy and transparency of ESG reporting, enhances credibility with stakeholders, and identifies areas for improvement. However, challenges such as a lack of expertise, inconsistent standards, and resource constraints remain.

To overcome these challenges, recommendations such as enhancing the expertise of auditors, promoting collaboration among stakeholders, and investing in resources have been proposed. It is a call to action for all stakeholders to work together to enhance ESG programmes through an external audit, thus promoting sustainable business practices and achieving inclusive economic growth and development in South Africa.

28 www.saiga.co.za Advancing Auditing &Accountability

ESG PROGRAMMES

STRAP IN FOR SOUTH AFRICA’S BUMPY POLITICAL AND ECONOMIC RIDE AHEAD

By JUSTICE MALALA Malala is an award-winning journalist, political commentator, TV host and columnist for the Sunday Times and Financial Mail

By JUSTICE MALALA Malala is an award-winning journalist, political commentator, TV host and columnist for the Sunday Times and Financial Mail

TIGHTEN your seatbelts. There is no other way to put it and I am not going to pull my punches: tighten your seatbelts. The next year and a half in South Africa will be similar to flying into O.R. Tambo Airport on a cloudy, thunderstorm-filled, summer afternoon in a small plane. >

29 Auditing SA Advancing Auditing &Accountability

It’s going to be bumpy. It’s going to be full of scary moments. It might even make you feel like you are about to lose your lunch.

The reason why the next year and a half will be bumpy is that we are reaching rock bottom in terms of economic and infrastructural challenges we face as a country – and we have a highly-contested election coming up around May next year. A combination of just these two factors will make for a noisy and contested eighteen months. These are conditions no professional, from lawyers to accountants, engineers to architects, can or should ignore. They are the reality of our environment.

The Scandinavians have a beautiful saying: “There is nothing like bad weather, only bad clothes”. It is a

saying I live by. It means nothing is bad unless you are not prepared for it. Then it is beyond bad. It is excruciating.

Now, let me start by saying that I am an optimist. Many readers will have read the paragraphs above and thought: “Oh no, not another pessimist!”

That is wrong. I believe in knowing what the terrain looks like before I engage in a contest or even conflict. When you enter a fight, you must believe that things are going to be alright to be able to stand up against what’s coming. You cannot be an effective fighter for justice if you are not an optimist at heart, if you don’t believe it’s going to be alright, that the good will defeat the bad. Optimists always win. It might take longer, and it might be tricky along the way, but optimists win

in the long run. They win because they know when things are bad. They don’t lie to themselves or their followers.

So, let me give you the lowdown: tighten your seatbelts because politically we are entering the silly season and economically, we are in the doldrums. Reserve Bank governor Lesetja Kganyago says economic growth will dwindle to a paltry 0.3% this year from 1.1% last year. Growth could have been 2.3% this year were it not for the continuing blackouts. If these blackouts continue, the economic loss to the country will be a staggering US$ 12.7 billion.

Now, it seems as if we are set for a winter in which we will kiss Stage 8 load shedding. That means that the economic hit may be even more pronounced than we

30 www.saiga.co.za Advancing Auditing &Accountability

POLITICS

initially calculated. Unemployment, inequality, and poverty will increase.

Meanwhile, crime has now reached emergency levels. Lawyers, auditors, business rescue practitioners, and accountants, are no longer out of bounds. They are now subject to hits in pretty much the same way that local councillors in KwaZuluNatal have been targeted.

Then there’s the politicking. With an election due in May, many political players will be jockeying for position, positioning themselves as saviours. Others will be trying to loot the coffers of the state in fear that they will lose their lucrative positions and the benefits that come with them. It will be a frenzy – and a challenge to the auditing profession.

Political noise will ratchet up, and

political uncertainty will be our daily diet.

This is the situation for the next 18 months. Because we know what things will be like, we are able to prepare for the storms ahead.

What can we take solace in, then? Well, the key thing to remember here is that we are a country in transition. For 29 years the governing party, the ANC, has been in charge of South Africa. Now, many polls indicate that the ANC may lose dominance in provinces such as Gauteng and even nationally. Transitions are tough and contested. So, it is natural that this will be a noisy election. Power may well be changing hands, and that is difficult.

The key thing here is that South African civil society must remain energised and active. The media,

civil society organisations, professional bodies, and nongovernmental organisation, have always been the first to stand for the rights of citizens. Now, more than ever, they will need to be alert.

Finally, institutions such as the judiciary, the IEC, the SA Broadcasting Corporation, and others, will need to be protected from interference so that they can help guarantee a free and fair election. Without their independence then we face a contested election and chaos afterwards.

A lot is coming towards us. Tighten your seatbelt. And remain an optimist.

*Malala is the author of The Plot to Save South Africa: Chris Hani’s Murder and The Week Mandela Averted Civil War (Jonathan Ball)

31 Auditing SA Advancing Auditing &Accountability

Overreliance on outsourcing A contributory factor to public sector maladministration

It is quite shocking that nearly three decades have passed since the democratic dispensation, and public entities notably municipalities in South Africa are increasingly outsourcing municipal services, including basic infrastructure services such as water and sanitation. Municipalities are struggling financially to pay service providers, yet they continue to rely on outsourced services.

Even though municipal services are being outsourced at an exponential rate, most municipalities are still found to be underperforming and failing to meet clean audits. What was intended to be a short-term solution (i.e., outsourcing services,) at South Africa’s public entities, continues indefinitely, endangering South Africa’s skills development and personnel retention sustainability.

Buchanan (2008:87) defines outsourcing as the “act of transferring services which the organisation previously performed ‘in-house’ to one or more external organisations. Usually, outsourcing happens when the organisation does not have the internal capacity, resources, skills,

and expertise to perform a task(s), hence opting to procure external services or products to meet strategic organisational goals. Outsourcing, however, has many benefits which include among others reducing costs associated with employee recruiting, training, retention, and retirement, and improving service or product quality because of the utilisation of specialised external technical services and new technology.

Greaver (1999) and Irish et al. (2012) warn that for the public sector to transfer services to the private sector could also mean transferring decision-making powers to the external organisation which renders the outsourced services, hence giving the implementing organisation ultimate control of the technical knowledge, skill and technology in the running of the internal organisation. This can also mean the internal organisation loses the power to retain skills and gain new technology that can facilitate productivity optimisation.South Africa's neoliberal strategy in the 1990s resulted in the country becoming one of the world's top outsourcing countries.

32 www.saiga.co.za Advancing Auditing &Accountability

WORKFORCE

Blessing Masuku SABPPI Professional

This has also been necessitated by the vast cheap labour in the country. As part of its national shared vision enshrined in the National Development Plan, the government views outsourcing as a critical enabler for accelerating its broad-based black economic empowerment programme. As much as this is not a bad idea, evidence points to the concept of outsourcing within South Africa’s public service notably municipalities myriad with discrepancies of poor implementation, corruption, maladministration, poor performance and poor service delivery.

Outsourcingis destroyingthe performanceand servicedeliveryof SouthAfricanpublic institutions such as municipalities.

Instead of investing in internal human talents, public institutions divert a large portion of their financial resources to outsourcing services that fail to produce the required results. While public institutions, such as

municipalities, have the responsibility to offer quality service delivery to citizens, the public (citizens) cannot hold the outsourced private contractor accountable for poor services, but the public institutions.

As a result, public sector institutions such as municipalities should carefully examine the pros and cons of outsourcing before making decisions that could threaten their organization's integrity, growth, and viability.

Only 27 of South Africa's 257 municipalities receive clean audits, according to the Auditor-2019/20 General's report. The Auditor General revealed in the 2020/21 report that 75% of municipalities were struggling to submit adequate financial statements for audits, despite having depended on outsourced external audit services. Most municipalities that relied on the external audit procedure paid expensive audit fees yet still failed to achieve clean audits.

About 27% of municipalities with irregular expenditures did not reveal all of their irregular expenditures that should have been reported in their

financial statements (AGSA, 2021). By 2021, a total of R1,26 billion had been spent on outsourcing consultant services, with another R3.47 billion incurred in wasteful expenditure, leaving many local municipalities bankrupt and unable to conduct and fulfil their constitutional mandates.

The consultant services were used to bridge a vacancy gap mainly in the financial and accounting sectors as these were critical skills gaps that most municipalities (69%) lacked to balance their financial books. The skills gap experienced by most municipalities across the country demonstrates a serious challenge as to why public entities like municipalities heavily rely on outsourcing consultant services year after year which has become an indefinite exercise instead of capacitating the internal municipal staff through skills transfer. Under the ANC-led government banner of ‘radical economic transformation,’ public entities are in a financially dire situation to effectively perform their obligations due to poor budgeting practices and ineffective financial management. >

33 Auditing SA Advancing Auditing &Accountability

2020/21 Reasons consultants were not effective Inadequate / lack of records and documentation 55 Poor project management 26 Work of consultants not adequately reviewed 20 Consultants appointed too late 13 Consultants did not deliver 7 11% 6% 17% 21% 45%

Source: AGSA

According to Section 2.7 of the AGSA 2020/21 report, 121 municipalities that used outsourced consulting services reported misstatements in their financial statements submitted for auditing.

Insufficient financial records were found in 45% of municipalities, while project management violations were found in 21%. Another 17% had unfinished work from outsourced constant services, and 11% had too late outsourced consultant services that did not make a meaningful difference in repairing the damage. Finally, 6% of municipalities used outsourced consulting services that did not provide any services despite being paid to do so.

Conclusion and Recommendation

The heavy reliance on outsourced services in public institutions has proven to be ineffective in terms of improving organisational performance, growth, and sustainability. As described in this article, data suggests that municipalities are underperforming and failing to obtain clean financial audits, despite the increasing rate at which they outsource consultant services. Audits, on the other hand, reveal inconsistencies in how finances are managed and used. The article does not intend to dismiss the concept of public entities outsourcing services, but rather to argue that outsourcing should be a short-term goal that transitions to transferring critically needed skills to organisation staff so that they can conduct the service that their own organisation requires rather than relying on external services all the time.

Most municipalities continue to outsource services because their employees lack the necessary skills and capabilities to meet changing work expectations. As a result, I urge that public entities, particularly municipalities, invest more in competent human resources to capacitate their own staff in critical skills such as accounting, finance, information and technology, and engineering, which will contribute to effective service delivery. This will enable them to maintain a competitive advantage by reducing their dependency on external services and strengthening internal skills through education and training. One such change is the set of information, skills, and abilities that are now required for success.

34 www.saiga.co.za Advancing Auditing &Accountability

WORKFORCE

Together, we can build a capable, ethical & developmental South Africa.

• Service delivery

• Reputation & credibility

• Ethical practices

• Audit outcomes

• Risk identification & mitigation

• Management

• A robust ethical approach

• Stronger stakeholder relationships

• Efficient & economic ways of working

• A competitive edge

• Full control through performance measurement

Ensure Decrease

• Accountability

• Employees are highly skilled & competent professionals through up-skilling

• Costs

• Wastage

• Complexity

Assisting Local Government and Municipalities to strengthen their Procurement & Supply Chains and help deliver better services to communities. Now is the time

Email saenquiries@cips.org.za to find out more.

INEQUALITY AND POVERTY, EVERY BILLIONAIRE REPRESENTS POLICY FAILURE

Karl Marx argued that capitalists reduced worker pay as much as possible in order to maximise profit margins. This was referred to as "primitive accumulation" by the German philosopher since it was extremely impossible for the laborers to protest or change their situation. Not only were they in desperate need of employment, but their landlords and employers could conspire to keep them desperate by increasing the price of living along with any rise in wages. Modern living also brought new challenges that weakened the proletariat: crowded quarters, disease, crime-ridden cities, and injuries in the factory. In short, Marx argued that workers may be exploited indefinitely.

In the South African context

South Africa is one of the most unequal countries in the world.

The average national income of the adult population in South Africa is (R117,260).

While the bottom 50% earns (R12,340), the top 10% earns more than 60 times more (R780,300).

Today, the top 10% in South Africa earn more than 65% of the total national income, and the bottom 50% is just 5.3% of the total.

South African income inequality

Available estimates suggest that income inequality in South Africa has been extreme throughout the 20th and 21st centuries. The top 10% income share oscillated between 50 and 65% in this period, whereas the bottom 50% of the population has never captured more than 5-10% of national income.

When democratic rights were

36 www.saiga.co.za Advancing Auditing &Accountability

WEALTH

Phillip Rakgwale CISA, CIA, CFE, RGA, M.Inst.D President of the SAIGA

provided to the entire people following the end of apartheid in 1991, significant economic inequities continued and worsened.

Post-apartheid governments have not enacted enough structural economic reforms (such as land, tax, and social security reforms) to challenge the dual economy structure.

Wealth inequality

While the wealth levels of the richest South Africans are essentially equal to those of affluent Western Europeans, the bottom 50% of South Africans have no wealth at all. The richest 10% control over 86% of total wealth, while the lowest 50% have a negative proportion, indicating that they have more debts than assets. The average household wealth of the bottom 50% has been below zero since 1990.

Global context

The rich get richer while the poor get poorer.

Elon Musk, one of the world’s richest men, paid a ‘true tax rate’ of just over 3% from 2014 to 2018. Aber Christine, a market trader in Northern Uganda who sells rice, flour, and soya, makes $80 a month in profit. She pays a tax rate of 40%.

We are living through an unprecedented moment of multiple crises. Tens of millions more people are facing hunger. Hundreds of millions more face impossible rises in the cost of basic goods. Climate breakdown is crippling economies and seeing droughts, cyclones, and floods force people to leave their homes. Millions are still reeling from the continuing impact of Covid-19,

which has already killed over 20 million people.

Since 2020, the richest 1% have accumulated about two-thirds of all new wealth – roughly twice as much money as the bottom 99% of the world’s population. Billionaire fortunes are increasing by $2.7bn a day, despite inflation outpacing the wages of at least 1.7 billion workers, more than India’s whole population.

Every billionaire is a policy failure

Excessive wealth concentrations stifle economic progress, erode democracy, and fuel political polarisation.

A billionaire emits a million times more carbon than the typical individual, and billionaires are twice as likely as the average investor to invest in polluting businesses like fossil fuels.

The existence of thriving billionaires and record profits, while most people endure austerity, rising poverty, and a cost-of-living crisis, demonstrates an economic system that fails to deliver for mankind. For far too long, governments, international financial institutions, and elites have misled the world with a fictitious story about trickledown economics, in which low taxes and high profits for a few will ultimately benefit us all. It's a story without any basis in truth.

It is a system that is largely discredited yet continues to monopolise the minds of our leaders. It is a system that continues to work very well indeed for a small group of people at the top – predominantly rich, white men based in the global north. >

37 Auditing SA Advancing Auditing &Accountability

To disrupt the discredited cycle of never-ending billionaire wealth accumulation, governments must address all the many ways in which the economy is rigged in their favour, including labour laws, privatisation of public assets, CEO compensation and much more. While all of this is necessary, research has shed light on one of the key solutions that it believes has enormous potential: taxing the wealthy.

Research believes that, as a starting point, the world should aim to halve the wealth and number of billionaires between now and 2030, both by increasing taxes on the top 1% and adopting other billionairebusting policies. This would bring billionaire wealth and numbers back to where they were just a decade ago in 2012. The eventual aim should be to go further and abolish billionaires altogether, as part of a fairer, more rational distribution of the world’s wealth.

According to research, the globe should aim to half the wealth and number of billionaires between now and 2030, both by increasing taxes on the top 1% and implementing other billionaire-busting policies.

This would return billionaire wealth and numbers to where they were a decade ago in 2012. The ultimate goal should be to do away with billionaires entirely as part of a more equitable, more rational distribution of the world's riches.

world's billionaires would raise $1.7 trillion annually.

This would be enough to lift 2 billion people out of poverty.

It's time for some new common sense

Increased taxes on the wealthy and corporations is the way out of today's polycrisis. It can avert austerity, it can be used to fight inflation and higher prices, and it can avoid the unnecessary cruelty of mass destitution and hunger.

More taxation is required for effective, strategic governments to invest in universal healthcare and education, happier, healthier societies, innovation, research, and development, the transition to green economies, and the prevention of climate breakdown.

Researchers utilised Wealth-X and Forbes data to calculate that a 2% wealth tax on the world's millionaires, 3% on those with wealth over $50m, and 5% on the

To address these issues, we must reimagine, reinvent, and repurpose our economy to urgently build a more equal world and save our planet. We must relearn the lessons of our own history, when the rich paid their fair share of taxes, which helped support the growth of rights such as universal access to healthcare and education.

Inequality does not have to be unavoidable. Inequality is a deliberate policy choice. Governments may take clear, concrete, and practical steps to eliminate inequality and provide fiscal firepower to protect their people. They have the option of assisting them safely through crises rather than imposing unnecessary suffering on them through austerity policies.

Sources: https://www.oxfam.org/en/ research/survival-richest https://inequalitylab.world/en/

38 www.saiga.co.za Advancing Auditing &Accountability

One of the most effective strategies for combating inequality and polycrisis is to tax the wealthy.

WEALTH

ARE YOU PLANNING TO ADVANCE YOUR CAREER IN THE PUBLIC SECTOR? MILPARK EDUCATION (PTY) LTD IS REGISTERED WITH THE DEPARTMENT OF HIGHER EDUCATION AND TRAINING (DHET) AS A PRIVATE HIGHER EDUCATION INSTITUTION (NO 2007/HE07/003). 011 718 4000 MBS@MILPARK.AC.ZA WWW.MILPARK.AC.ZA To apply or request more information please contact us on: TOMORROW IS BEAUTIFUL DEVELOPING ETHICAL LEADERS FOR THE COMMON GOOD. The Postgraduate Diploma in Public Administration may be the qualification for you. With this qualification you will have the opportunity within government to serve at a local, provincial or national level in a management capacity and in so doing, increase your ability to influence and impact key decisions, policy and strategy formation and implementation, within your particular governmental department.

40 www.saiga.co.za Advancing Auditing &Accountability PUBLIC SECTOR FINANCE

PROFESSIONALISING PUBLIC SECTOR FINANCE – THE JOURNEY TOWARDS SOUND GOVERNANCE AND CLEAN ADMINISTRATION

Dumisani Mahlangu BCom (Financial Accounting) Manager: Compliance and Internal Control

Enshrined in Chapter 10 of The Constitution of South Africa are basic values and principles which must be adhered to in governing public administration. Section 195 (1) (a) and (h) of the constitution prescribes the promotion and maintenance of high standards of professional ethics as well as the maximisation of human potential through proper human resources management and career development practices.

The year 2022 was marked by the commitment to professionalise the public sector, as the government of South Africa published a national framework towards professionalising the public sector in

October 2022. The month after that, the Association of Chartered Certified Accountants, in collaboration with the International Federation of Accountants, published a guide also aimed at professionalising Public Sector Finance.

Reforms in Public Financial Management might mean different things to different people. For example, the proposal in the 2013 World Bank Report on Observance of Standards and Codes (ROCS) can be viewed as one reform, although other major players view the change in the Accounting Reporting Framework by Governments from a Cash Basis to an Accrual Basis as another.

Clean Administration and Governance is an >

41 Auditing SA Advancing Auditing &Accountability

absolutely needed reform, especially considering the wounds created by the disastrous governance failures caused by years of state capture.

It is important to understand what is meant by governance. South Africa's Auditor-General Tsakani Maluleke borrowed the description from the United Nations High Commissioner for Human Rights (UNHCHR) when delivering a keynote address at a Governance and Accountability Conference in Durban last September.

The UNHCHR defines governance as "the procedures of governing the institutions, processes, and practices through which issues of common concern are decided upon and regulated."

Maluleke further states that the true test of 'good' governance is

"the degree to which it delivers on the promise of human rights: civil, cultural, economic, political, and social rights... [with the] key question being whether institutions of governance effectively guarantee the right to health, adequate housing, sufficient food, quality education, justice, and personal security."

She gave credence to her speech by advancing the following governance elements:

• Equity and inclusiveness, where citizens feel they have a stake in, and are not excluded from the mainstream of society;

• Effectiveness and efficiency, where processes and institutions produce results that meet the needs of society while making the best use of the resources at their disposal; and

• Accountability, which cannot be enforced without transparency and the rule of law.

It is undeniable that the United Nations' definition of governance aligns with the role of South Africa's Auditor-General. The Office of the Auditor-General continuously advocates for improved audit outcomes in the public sector through its activities.

Improved audit outcomes will demonstrate that South Africa's public sector is an efficient, capable, development-oriented, and ethical state devoid of corruption and graft. These are the government's goals, as outlined in the National Development Plan, which will ultimately improve the lives of the people of South Africa.

Clean Audit outcomes is a means for the government to achieve its goals.

42 www.saiga.co.za Advancing Auditing &Accountability

PUBLIC SECTOR FINANCE

To achieve that aim, the ACCA and IFAC recommend that governments professionalise public sector finance operations and strengthen their financial competence and competencies as part of broader public finance management improvements. Professionalisation of the workforce, according to ACCA and IFAC, is thus one of the most important aspects of the Public Financial Management journey.

Despite its importance in the Audit value chain, the professionalisation framework referred to earlier emphasises the importance of professionalisation of the public sector beyond the Finance Management function when it states that the public service must be staffed by men and women who are professional, skilled, selfless, and honest and strictly adhere to the Constitution of the Republic of South Africa.

The best practices for achieving Clean Administration and Governance

It is often said that fish rots from the head. This idiom suggests that, while leadership is a major contributing factor to the entity’s success, it is also a major root cause for its failure and its demise.

Chief Executive Officers, their executive colleagues, and Governing Board members all play critical roles in maintaining clean administration and governance. Leadership that responds to the Auditor-General of South Africa's request by implementing its recommendations on improving controls and address risk areas assist their organisations achieve clean audit outcomes.

Entities that achieve clean audits have a character in their recruitment efforts

to recruit finance specialists who have served articles or completed their gateway programmes and are fully qualified professional accountants or on the path to qualifying as one.

These recruiters greatly benefit the entities to achieve clean outcomes because they have innately professional mannerisms and naturally adhere to the code of ethics and standards of their various accounting bodies. It also helps that these rofessionals have a greater level of integrity, take pride in their work, and are always committed to excellence.

Giving due regard to daily disciplines of internal controls, financial reporting, and compliance with laws and regulations at every transaction level contributes to these entities achieving clean audit outcomes.