“We were content with the coverage we had and were not shopping our plan. After meeting with KBA Insurance Solutions, we had no choice but to make the move to Chuck and his team. They proposed a thoughtful plan design & introduced benefits that we had not previously offered. When we showed the rates KBA Insurance Solutions offered to our prior agent, she said: “…you have to make this change.” Since changing our results have been better coverage, expanded offerings and greater cost savings. I would highly recommend that any bank explore the options available through KBA Insurance Solutions.”

Mr. Charlie Dicken, EVP Trust Officer, First Kentucky Trust

WHO WE ARE: The KBA is a nonprofit trade association that has been providing legislative, legal, compliance and educational services to its member institutions since 1891. KBA's directors and staff work together with its members to make the financial services industry a more effective and successful place to work. The strength of the KBA is bankers unifying as an industry to speak as one voice.

WHAT WE DO: The purpose of the Kentucky Bankers Association is to provide effective advocacy for the financial services industry both in Kentucky and on a national level; to serve as a reliable and responsive source of information and education about areas of interest to the industry; and to provide a catalyst and forum for collective industry action. The KBA does this in 4 ways:

1. Government relations & industry advocacy

2. Information interchange

3. Education

4. Products and services

KENTUCKY BANKERS ASSOCIATION

600 West Main Street, Suite 400 Louisville, Kentucky 40202

KENTUCKY BANKER is the official bi-monthly magazine of the Kentucky Bankers Association (KBA). No part of this magazine may be reproduced without express written permission from the KBA. The KBA is not responsible for opinions expressed by outside contributors published in KENTUCKY BANKER. The KBA reserves the right to publish submissions at the discretion of the KENTUCKY BANKER editorial team. For more information, or to submit an article, pictures or pass on a story lead, contact Matt Simpson, Managing Editor, at msimpson@kybanks.com

Ballard W. Cassady Jr. President & CEO bcassady@kybanks.com

Timothy A. Schenk General Counsel tschenk@kybanks.com

Miriam Cole Executive Assistant Office Manager mcole@kybanks.com

John P. Cooper Legislative Solutions jcooper@kybanks.com

Paula Cross Education Coordinator pcross@kybanks.com

Nina K. Gottes Sponsorship & Events Coordinator ngottes@kybanks.com

Casey Guernsey Enrollment and Billing Specialist cguernsey@kybanks.com

Jamie Hampton Education Coordinator jhampton@kybanks.com

McKenzie Just Caldwell Staff Accountant mcaldwell@kybanks.com

Tamuna Loladze Chief Operating Officer HOPE of the Midwest tloladze@hopeofthemidwest.

Michelle Madison IT Manager mmadison@kybanks.com

Chuck Maggard President & CEO KenBanc Insurance cmaggard@kybanks.com

Lisa Mattingly Director of Sales & Service KBA Benefit Solutions lmattingly@kybanks.com

Donna McCartin Benefit Support Specialist dmccartin@kybanks.com

Tammy Nichols Finance Officer HOPE of the Midwest tnichols@hopeofthemidwest.com

Katie Rajchel Accounting Manager krajchel@kybanks.com

Selina O. Parrish Director of Membership sparrish@kybanks.com

Jessie Southworth Director of Education jsouthworth@kybanks.com

Jennifer Schlierf Sales Support KBA Insurance Solutions jschlierf@kybanks.com

Matt Simpson Communications Director msimpson@kybanks.com Visit us online at KYBanks.com

Brandon Maggard

Account Representative KenBanc Insurance bmaggard@kybanks.com

Amanda Cole Coordinator Bank Performance Report acole@kybanks.com

Matthew E. Vance, CPA Chief Financial Officer mvance@kybanks.com

Billie Wade Executive Director HOPE of the Midwest bwade@hopeofthemidwest.com

Audrey Whitaker Insurance Services Coordinator awhitaker@kybanks.com

Wesley Githens IT Support Specialist wgithens@kybanks.com

CHAIRMAN

Mark Strother, President & CEO Commercial Bank of Grayson

VICE CHAIRWOMAN

April Perry, Chairman & CEO Kentucky Farmers Bank Co.

TREASURER

W. Lee Scheben, President Heritage Bank, Inc

GROUP REPRESENTATIVES

Represents Group 1

Jeff McDaniels, President & CEO Farmers Bank & Trust Company

Represents Group 2

Michael W. Hunt, President & CEO The Sacramento Deposit Bank

Represents Group 3

Greg Pawley, President & CEO The Cecilian Bank

Represents Group 4

Jason T. Jones, President Morgantown Bank & Trust Co.

Represents Group 5

Don D. Jennings, CEO First Federal Savings Bank of KY

Represents Group 6

Robert Miles, President & CEO Peoples Bank of Lebanon

Represents Group 7

Lucas Shepherd, CEO First National Bank of Manchester

Represents Group 8

Lonnie Foley, CFO Peoples Bank of KY, Inc.

PAST CHAIRWOMAN

Ruth O’Bryan Bale, Chairman South Central Bank, Inc.

KBA PRESIDENT & CEO

Ballard W. Cassady, Jr., President & CEO Kentucky Bankers Association

Represents Group 9

James Ayers, Regional Manager First State Bank, Inez

THRIFT REPRESENTATIVE

Glenn Meyers, Executive Vice President Citizens Federal Savings & Loan Assoc.

BANK SIZE REPRESENTATIVES

Represents Banks w/ Assets of $1B+

Michael F. Beckwith, Executive Vice President, Chief Banking Officer, German American Bank

Represents Banks w/ Assets of -$1B & at least $200M

H. Alexander Downing, President & CEO Franklin Bank & Trust Company

EDUCATION ALLIANCE REPRESENTATIVE

Lanie W. Gardner, Community President First Southern National, Central City

KBA BENEFITS TRUST COMMITTEE REPRESENTATIVE

W. Fred Brashear, II, President & CEO Hyden Citizens Bank

COMPLIANCE ALLIANCE

SOUTHSTATE | DUNCAN WILLIAMS

ARCHITECTURE & DESIGN

by Mark Strother | KBA Chairman, 2024

Talented women are vital to this Association, this industry, this state, and our whole society. This edition of Kentucky Bankers Magazine features a spotlight on Jean Hale’s many years of service to Community Trust Bank. You’ll also see an invite to the Women in Banking Conference coming up August 20-21 in Louisville. Check the back of this magazine for details...

Our banks are strong because of the efforts of leaders like Jean Hale. She may not remember, but when I was very green in the business, my father had me contact a few bankers concerning some of their operations. Jean was among those I contacted, and I appreciated how she made me feel valued and respected. Her example set a standard for Community Trust and its growth and success.

As we celebrate the achievements of women like Ms. Hale, we also recognize the importance of nurturing the next generation of female industry leaders with events such as the Women in Banking Conference. This event’s agenda is substantial and provides a platform for networking, mentorship, and professional development. I encourage each bank to identify up-and-coming leaders within their organizations, as we have done for this invaluable conference.

At the Association, we are fortunate to have a team of talented advocates for our banks. From our experienced new Director of Education, Jessica Southworth, to long-time team members such as

Selina Parrish and Miriam Cole, who played a positive role in my professional development through their assistance with the Young Bankers’ Division, these outstanding professional women play vital roles in making the KBA the best Association in America. We must each acknowledge the invaluable contributions of women within our banks. One such example at Commercial Bank was Phyllis Davis, a friend and mentor. She served our bank well with her expertise in lending, her leadership as a Board member and Executive Officer, and her active role in our community organizations. Her efforts continue to positively impact our bank and Grayson and Carter County, even several years after her passing.

The Association is excited to welcome April Russell Perry as our soon-to-be Chairwoman. The difference she and Kentucky Farmers Bank make in Northeast Kentucky is substantial, and we look forward to her impact on the KBA. I also thank former Chairwoman Ruth O’Bryan Bale from South Central Bank for the positive impact her leadership has made on the KBA and Western Kentucky.

It is an honor to serve alongside many talented and dedicated women whose leadership positively impacts our communities throughout the Commonwealth.

by Ballard Cassady | KBA President

The short answer? California, and it may simply be a case of going too far. That thought hit me as I watched an excerpt from a talk show where health guru Jillian Michaels was interviewed about why she left California. If you haven’t seen it, you should look it up.

She described herself as a lesbian, the child of an Arab and a Jew, and the mother of an adopted child of black and Latino parentage. Yet here’s what she had to say about her move from California, a state with some of the most ‘progressive’ laws in the nation, to Florida, where conservatives have successfully opposed such trends: “I hold a million cards in your game of woke victimology poker….when you have me running from my home, maybe it’s gone too far.”

Something about that brought to mind a familiar Bible verse from Mark and Matthew: What good does it profit a man to gain the whole world and forfeit his soul?

Both gaining the world and forfeiting one’s soul are open to interpretation, especially when carried into the political realm. My dad’s take on it touched upon his quibbles with the design of our welfare state. He put it this way: if you want to keep a man down, give him what he wants so that he has no reason to get up. In other words, when our good intentions fail to account for our human natures, we will lose more than we ever hoped to gain.

No one I’ve ever come across has less in common with my dad

than Jillian Michaels, so to hear a faint echo of his convictions in her words had me piecing some things together in my thoughts.

My take on ‘victimhood’ admittedly comes from the perspective of one who has lived a blessed life. Besides attending good schools in healthy communities, I was raised on my grandmother’s farm with loving parents who wouldn’t tolerate idle hands. I honestly can’t remember not working, from picking strawberries at age six to learning patience through steering cattle for beef that wouldn’t be ready for another year as a teen, to working alongside coal miners while in college. All of it added up to the best education I could have had, with a close-up of a lot of time-tested wisdom and life paths.

When the going got tough in a few college courses, I had vivid memories of those coal mines to keep a fire lit under my rear. I learned about fitness and survival in the ways of any farmer. And thanks to athletics, I learned that our differences

aren’t as significant as what binds us. In a football huddle with hands joined, we saw stoved-up fingers and bloody elbows of young men united in our determination to win for our school; the range of colors on those hands was beside the point. That focus served us well as a team and as people.

What I’m getting at is that “life lessons” have to be learned in living your life; they have to be earned through trial and error, with the best learning coming through the mistakes. I think that’s a place where our entire culture has gone astray, from our lawmakers to our parents. With more affluence than wisdom, we’ve acted like we could bestow the fruits of that learning, things like character and competence and material goods and contentment.

That’s what we’re doing when we hand out ‘free stuff’ with too few questions asked. When we invalidate student loan obligations to spare some favored few the pain of their poor decisions. When we think it’s no big deal to give illegal

immigrants voting rights so that they can help ensure the ‘free stuff’ keeps on pouring out of D.C. But the results? It’s undoubtedly not character, competence, or anything else that made America a place worth living.

In giving us what we ask for, our nation’s welfare state and policies ‘profit’ many. But all of us are experiencing the ‘forfeit’ at the level of our nation’s fiscal and cultural health. I think the path forward also must include understanding what we’ve forfeited at the level of our souls. That goes beyond our short-sighted determination to limit Christianity in the public sphere. Too many of us are being deprived of a chance to learn what only life can teach us, and that’s what will keep us down.

Whether or not you were blessed enough to grow up learning life’s lessons within a functional family or had them forced upon you in other ways, be grateful for them. And if your father was one of your teachers, I hope you gave him some extra thanks this past Father’s Day, and on the next Mother’s Day, remember again.

Integris is a leading technology services company, renowned for its tailored IT solutions and support for financial institutions. Committed to innovation, security, and excellence, Integris is the trusted partner of choice for banks seeking to enhance growth and operational efficiency through technology.

by Tim Schenk | KBA General Counsel

Seven in ten people say they have a rewards, points, or cashback credit card. Folks across America use these rewards for travel, discounts at retail stores, or just to bank a few extra dollars at the end of the year. Needless to say, these unique perks are wildly popular. So why have these benefits recently come under fire from the CFPB? As usual, Rohit Chopra leads the charge of regulatory overreach under the false pretense of consumer protection.

On May 9th, the Consumer Financial Protection Bureau issued a report highlighting consumer frustration with credit card rewards programs.

In its press release, the CFPB said, “Consumers tell the CFPB that rewards are often devalued or denied even after program terms are met. Credit card companies focus marketing efforts on rewards, like cash back and travel, instead of low interest rates and fees. Consumers who carry revolving balances often pay far more interest and fees than they get back on rewards. Credit card companies often use rewards programs as a ‘bait and switch’ by burying terms in vague language or fine print and changing the value of rewards after people sign up and earn them. New problems have been created by the growth of cobrand credit cards and rewards programs where consumers can transfer miles or points to merchants.”

CFPB Director Rohit Chopra said, “Credit card companies promise upfront benefits for signing up and using their rewards card, but often bury complex terms in the fine print for using the rewards. The CFPB will be looking for ways to protect people’s points, stop bait-and-switch scams, and promote a fair and competitive market for credit card rewards.”

The CFPB comes to wholesale conclusions that: “Credit card issuers impose vague or hidden conditions that keep consumers from receiving rewards; Companies devalue rewards; Consumers encounter redemption issues with earned benefits; and Companies revoke previously earned rewards. If true, these

conclusions are concerning and worthy of a Congressional hearing.”

So, who are these consumers being misled and having their reward points stolen? On the first page of the CFPB’s Credit Card Rewards Issue Spotlight, the basis for the conclusions above states, “We analyzed several hundred consumer complaints relating to the administration of credit card rewards programs and identified four recurring themes that resulted in consumers not receiving the rewards.” Several hundred? Will the CFPB determine the validity of credit card rewards programs based on several hundred complaints?! I’m sure those several hundred consumers adequately represent the roughly one hundred and ninety-one million Americans with credit cards. I’m sure they represent these one hundred and ninety-one million Americans with credit cards so well that we should forego all statistical analyses such as standard deviation or a survey not based solely on complaints. I hope you can feel the sarcasm here dripping off the page.

The day before the CFPB released its “Spotlight,” the Electronic Payments Coalition (EPC) released its study, which showed that “credit card rewards are a lifeline for working-class Americans.” Now wait. How can that be true? The CFPB just said that credit card rewards are a problem. The EPC study was conducted in the first quarter of 2024 and “represents more than half of the credit card market measured by purchase volume.” Half of the credit card market? There is no way that can be more statistically

“Seven in ten (71%) people say they have a rewards, points or cashback credit card... half said they pay those off each month to avoid interest rates.”

- IPSOS CONSUMER

accurate than a few hundred complaints. Again, excuse my sarcasm, but this is ridiculous.

Unsurprisingly, the EPC study reached drastically different conclusions than the CFPB “Spotlight.” The EPC study found that:

• Rewards are for everyone. Since 2020, rewards card ownership has grown the fastest among the low-to-moderate (LMI) income segment. Currently, more than two-thirds of LMI cardholders own a rewards card. This result illustrates that reward cards are popular among low-income households, and reward programs do not exclusively serve upper-income customers.

• Rewards supplement consumer income. All cardholders receive a boost to income from their rewards. Many cardholders save up rewards over months to supplement holiday and back-to-school shopping. Total rewards savings in 2023 accounted for 23% to 32% of planned holiday purchasing.

• There is no cross-subsidy or so-called “Reverse Robin Hood.” Rewards redemption rates are similar across income groups, suggesting that each income group is taking advantage of their rewards at the same level.

• Rewards are essential to lower-income consumers. LMI accounts are most likely to redeem cash rewards, implying that this income segment uses rewards for everyday spending needs.

In short, the EPC study found that credit card rewards are valuable to customers of all demographics. This makes sense when ninety percent (90%) of Americans make payments with a credit or debit card, with nearly seventy-five percent (75%) of those opting to use a reward card.

Director Chopra expressed deep concern during his testimony in his joint hearing with the Department of Transportation that consumers were storing points that could become unusable. EPC explained that “reward cardholders often carry a balance of unredeemed rewards. This represents an important safety net for these cardholders.”

So, who is right? I tend to believe a study with a larger group of consumers whose sole identification was not a complaint. But there is a larger question: Why is this happening now?

In my personal opinion, federal agencies want to create the impression that points are worthless. If something is worthless, it is easier to take it away. As regulations such as Reg II and the Durbin Amendment loom, pressure on the card market will increase, and points, miles, and benefits will suffer. If you tell people those things are worthless, it seems easier to take them away.

Regardless of my thoughts, the reality is that if you value your points, miles and card services, let your elected officials know it before those benefits, and this argument, becomes a thing of the past.

Author: James Ayers Assistant Vice President Regional Retail Manager Kentucky Market First State Bank

Artificial Intelligence is reshaping our world daily, and Mustafa Suleyman’s “The Coming Wave” delves deep into this transformation. Through captivating examples and expert analysis, Suleyman highlights AI’s thrilling advancements and unsettling potential.

Discussions of Artificial Intelligence dominate the news cycle daily. At the KBA Spring Conference in French Lick, IN, attendees saw a frightening example of what AI voice cloning is and can do. Conversely, we witnessed presentations that, whether explicitly stated or not, would not have been possible without AI.

Around the same time as our spring conference, JP Morgan CEO Jamie Dimon wrote in his annual shareholder letter that AI could be “as transformational as some of the major technological advances of the past…the printing press, steam engine, electricity, computing, the internet.” Dimon is not alone in these thoughts. Elon Musk believes that AI will be “smarter than the smartest human,” noting that he believes biological intelligence will be less than 1% at some point. The CEO of Google is more succinct, stating at an investor conference that “AI is going to be more important than fire.”

Hoping to learn more about AI and what it means for the future, I came across The Coming Wave by Mustafa Suleyman. Suleyman is an expert in the field of AI. He co-founded Deep Mind, an artificial intelligence lab focusing on machine learning. Google eventually acquired this company, with Suleyman becoming the VP of AI product management and policy at Google.

Suleyman opens the book with a discussion of technological advancements throughout world history. In a chapter titled ‘The Containment Problem’, he gives various examples of how an unavoidable challenge of any technology is the inventor’s inability to control the invention once it is introduced to the world. He cites Thomas Edison’s invention of the phonograph to record thoughts and help blind people, yet Edison was horrified when most people were only interested in using it to play music.

Almost every inventor has encountered this same issue, and the advent of AI is no exception. The conclusion that this chapter reaches and what forms the basis for much of the book is that it does not appear that containment of AI can be possible, but it must be possible for the world’s sake. To demonstrate this, Suleyman gives a deep dive into several areas where disruption has occurred at a remarkable pace. He then discusses what this coming wave looks like and makes a convincing case that there is much more involved than AI, but that AI has made this coming wave possible. Some key takeaways from this book:

AI is nothing new. It first entered the lexicon in 1955. Yet until very recently, development had been slow. Then, in 2012, a deep learning system named AlexNet changed the world of AI. Since this occurred, AI has been a significant focus of governments and academic institutions around the globe.

Title: The Coming Wave

Author: Mustafa Suleyman

Publisher: Crown Publishing

Technology is getting ever cheaper, quickly. For example, in 2003, human genome sequencing cost $1 Billion. By 2022, it will cost under $1000, a millionfold price drop in two decades. This technology, coupled with deep learning, has profound implications for our future. Suleyman discusses how hobbyists can do gene editing and DNA synthesizing today in a ‘bio-garage’ with no regulatory oversight.

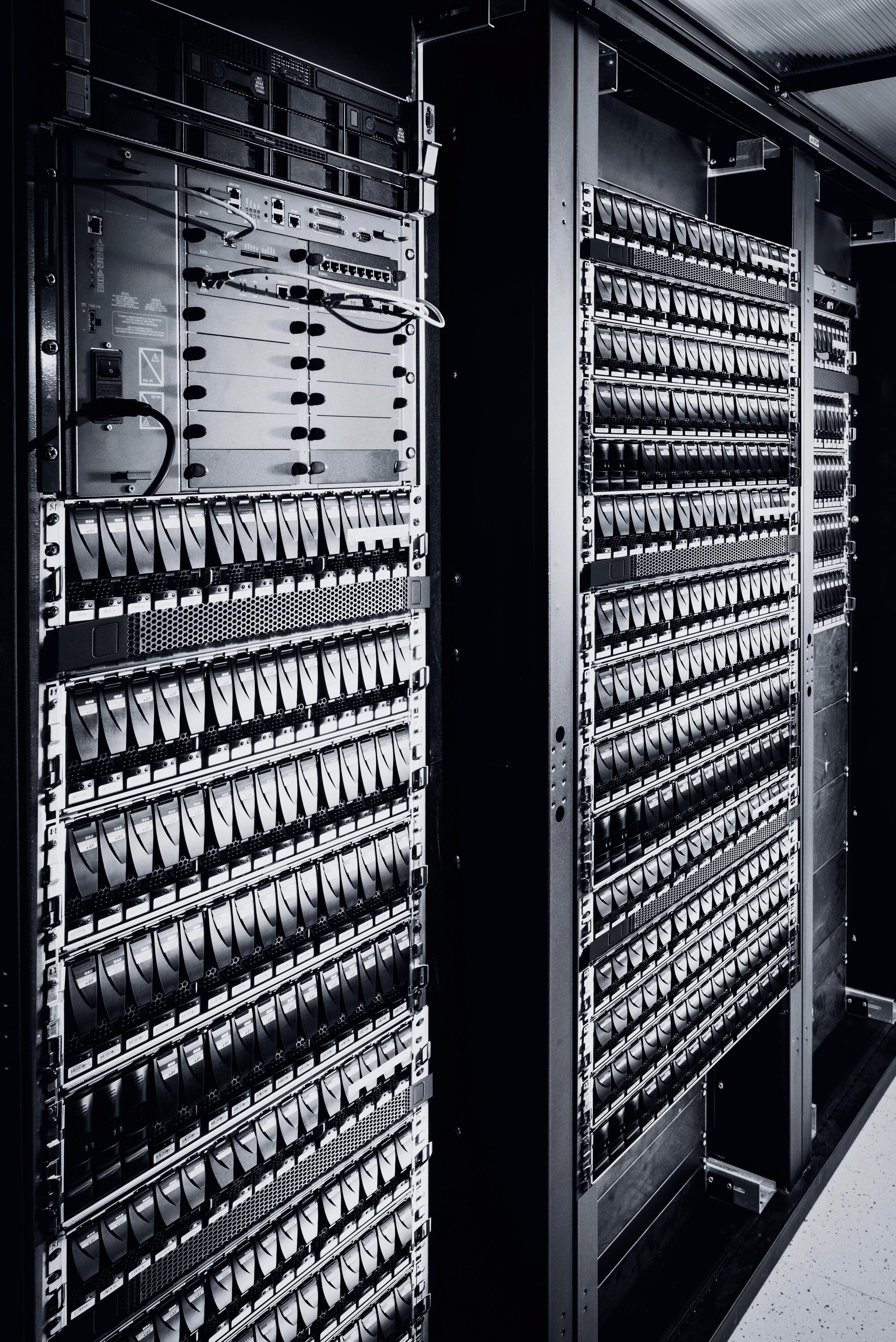

Quantum computing went from being theoretical 40 years ago to working prototypes today. The threat posed to cryptography is now very real, and the banking industry and governments are spending billions of dollars to address this threat. The challenge this poses to secure systems will be unlike anything to date.

The neural networks in AI models are not totally explainable. Engineers cannot explain how an AI model produces a certain prediction. This paradox presents a paradox that these technologies are within our ability as humans to create, but once created, the technology itself takes over, and we don’t know the ‘why’ behind how it came to a particular conclusion. This has enormous implications for the banking industry.

It’s not all doom and gloom. AI has the potential to diagnose rare diseases, invent miracle drugs, optimize traffic, and find lost children. New industries will be created, new wealth generated, and both life span and health span will dramatically increase.

I am curious to know if any of the business leaders I mentioned at the beginning have read this book. I can attest that when I started reading it, I was skeptical and felt that the statements about AI were hyperbolic. I no longer feel that way. I suggest Suleyman’s book if you want to understand better why AI drives so many discussions and what our future holds.

by Jessie Southworth | KBA Director of Education

In an age where banking is more easily accessible than ever, a portion of the population continues to be excluded from a safe and stable banking system. In Kentucky, five percent of households are unbanked and sixteen percent are underbanked. An unbanked household is one where no member has a checking account or savings account, while an underbanked household is one where at least one person uses a nonbank transaction or credit product such as a money order, check cashing service, or payday service as their means of banking. Jennifer Inman, Executive Director of the Kentucky Financial Empowerment Commission (KFEC), believes this number is more significant due to the common misconception that cash apps, such as Venmo, PayPal, and Google Pay, are a banking service.

The Cities for Financial Empowerment Fund (CFE) conducted a survey consisting of 650 unbanked households. The top three reasons these households were staying outside the banking system were:

1) Insufficient money to keep in account.

2) High fees associated with having an account.

3) A lack of trust in banks.

In the banking industry, we face significant challenges. Building trust and dispelling the myth that bank fees are more prohibitive than nonbank transaction costs are just a part of the equation. Individuals outside the banking system often resort to cash apps that lack FDIC insurance or, even worse, turn to payday lenders and check cashing services. The absence of a bank account can cost consumers an estimated $40,000 over their lifetime.

Our mission is clear: to illuminate the true value of banking services and provide secure, cost-effective financial solutions that empower individuals and foster long-term financial health.

In an effort to improve the banking participation rate, the CFE created Bank On, an initiative that strives to ensure everyone has access to a safe and affordable account. For a checking account to qualify as a certified Bank On account, specific standards must be met, including minimum opening deposits, absence of overdraft ability, and minimal account fees. The KFEC believes that many banks either already offer an account that fits the national Bank On standard or are within a few modifications of having one.

Executive Director Inman strongly believes that financial literacy and participation in the banking system go hand in hand. She has found that the first step in cultivating financial literacy is to meet people on their own terms in a place where they feel comfortable.

It’s a goal that the KFEC takes very seriously. In an effort to put their theories into practice, the KFEC participated in a 4-Day Youth Summer Camp presented by the International Center of Kentucky and Careustz. This camp consisted of 35 refugee youth aged 16 to 21 and included three interpreters speaking Swahili, Pashto, Dari, and Burmese who translated their message to the youth. This summer camp taught these young refugees the skills needed to successfully integrate into the United States through interactive activities such as examining the average cost of living expenses and how a budget can help them achieve their goals. At the end of this camp, refugees were given resources in English and their native language to take home, including a list of banks offering Bank On certified accounts. Refugees continue to be one of the KFEC’s top priorities.

Kentucky State Treasurer Mark H. Metcalf commends the KFEC on their efforts to improve financial literacy among Kentuckians, stating, “I wholeheartedly commend the KFEC, a true beacon of financial education in the Commonwealth. Their groundbreaking programs and initiatives transform lives by equipping individuals with the financial skills needed to achieve economic stability, resilience, and independence. The Commission is not just creating a brighter future for Kentuckians but empowering future generations. I am honored to support the Commission’s remarkable work.”

By offering a Bank On certified product, bankers receive a Community Reinvestment Act (CRA) credit. A certified Bank On account is a product that meets the “service test.” As stated in an interagency guidance released in 2016 titled “The CRA: Interagency Questions and Answers Regarding Community Reinvestment Guidance,” examiners will consider retail banking services as community development services if they provide a benefit to lowor moderate-income individuals and an example of a product that would fit in that category is a low-cost deposit account.

“The goal is to start off in a Bank On account, graduate to a traditional checking account, and eventually obtain a loan and other services from their financial institution,” said Jennifer Inman. Jennifer is spot on. If a bank can gain the customers’ trust and show that the customer can bank safely and affordably, they will likely develop a relationship for years to come. Join the nationwide Bank On network aimed to offer low cost, affordable checking accounts.

Join KFEC’s Kentucky Bank On Informational Webinar on Tuesday, August 27th at 12:00 pm ET to learn more about offering a Bank On account.

Jean Hale has been honored with induction into the prestigious Junior Achievement of the Bluegrass Business Hall of Fame, an accolade that celebrates the most respected leaders in our state for their commitment and contributions to the community. She had a 53-year career in banking, all with Community Trust Bancorp, Inc. At the time of her retirement in 2022, she had served as the Chairman and CEO of Community Trust Bancorp, Inc. and Chairman of its subsidiaries, Community Trust Bank and Community Trust and Investment Company for 23 years. We here at the Kentucky Bankers Association celebrate Jean’s recognition and longstanding contributions to the banking industry! Jean was able to give us a few thoughts on her career. Enjoy!

Can you share the story of how you began your career in banking and what initially drew you to the industry?

We had a career day when I was a senior at Pikeville High School. As a result of the career day, our English teacher asked us to go out into our community and interview someone in the profession we were most interested in, return to class, and give a speech on that profession. I interviewed Robert B. Johnson, President of Pikeville National Bank, now known as Community Trust Bancorp, Inc. I was curious about banking, and the interview made me interested in the industry. The rest is history, as I spent 52 years with Community Trust Bancorp, Inc.

What were some milestones in your 52-year Community Trust Bancorp, Inc. career?

So much change occurred in my 52 years of banking that it is difficult to identify all the milestones. The bank’s Total Assets were $27 million when I joined the company. I worked at the bank when we got our first computer system, which required an entire air conditioning room. I was there when we built our new bank headquarters, which we quickly outgrew, so we expanded and created an Operations Center in a former Walmart building. We made our first acquisition and continued during my 52 years to acquire 15 banks and 17 branches and opened new branches in new growth markets. For years, we operated several of our first acquisitions as independent subsidiaries and then saw the need to merge all the banks into one. Subsequently, acquisitions were incorporated directly into Community Trust Bank. We merged bank-level trust operations to form our trust subsidiary, Community Trust and Investment Company, Inc.

With our commitment to community banking, we focused our business operating model on decentralized decision-making and centralized risk management. The local market leaders can make decisions to support their specific community’s customers and their overall community. We covered risk management by building strong Finance, Audit, Compliance, Loan Review, Quality Control, Legal, and Collection departments and solid policies.

At the time of my retirement, Community Trust had Total Assets of $5.4 billion, with 70 banking offices in eastern, northeastern,

central, and southcentral Kentucky, six banking locations in southern West Virginia, three banking locations in northeast Tennessee, and four trust officers in Kentucky and one in Tennessee. Since my retirement, Community Trust has continued its growth. At the end of the first quarter of 2024, it had total assets of $5.9 billion. It operated 71 branches across Kentucky, six in West Virginia, three in Tennessee, and four trust offices across Kentucky and one in Tennessee.

I worked through all the regulatory changes impacting the industry during my entire career. I was the first compliance officer for the company, and I also had lending responsibilities. With continuous changes and additional regulations, that position grew to be compliance staff and a separate department. I came up on the bank’s lending side, having worked in Consumer Lending, Indirect Lending, and Commercial Lending.

During my 52 years, we grew to have almost 1,000 employees, and with the hard work and dedication of those employees, we continued to be Kentucky’s outstanding community bank. Of course, I am prejudiced and will say Kentucky’s best community bank.

What were some of the biggest challenges you faced as the first woman to hold various leadership positions within the Corporation?

I faced some challenges that women, thankfully, do not face in our industry today. Being the only woman sitting at the table or in the room was a challenge. This was true inside the company and outside, serving on other boards and attending different functions within the community, state, and industry. Being the best at everything I did was very important because I felt a responsibility to the women coming after me to succeed so as not to impact their opportunities for advancement.

How did you approach leadership and decision-making as Chairman and CEO of CTBI?

It is essential to remember the definition of leadership. Understand that you need people to see your vision, develop and finalize it, and plan to execute it. Your leadership team brings excellent value to

you and the company. You need to be a good listener, not the first person to speak, so you encourage others to share their thoughts and ideas. Everyone on the team has something of value to give and you must be a willing recipient. I also had an open-door policy that welcomed and encouraged all employees to share their thoughts and ideas to make us a better Company.

Can you discuss the strategies you implemented to expand the Corporation’s geographic reach and service offerings?

Community Trust for many years has had a growth strategy utilizing acquisitions and de-novo branches while having organic growth expectations for all the markets it serves. We focused on growth markets and companies that fit our corporate culture and operating model.

How did you navigate the company’s transition to a publicly traded entity on NASDAQ?

Transitioning the company to be publicly traded on NASDAQ was very positive for existing shareholders as it provided liquidity to their investment. Being publicly traded has expanded our shareholder base to include hundreds of institutional investors and mutual funds. It also, at times, provided a sound currency for acquisitions. CTBI’s inclusion in the NASDAQ Achiever Index, NASDAQ Global Select Market, and NASDAQ Bank Stock Index helps CTBI to be identified as an excellent potential investment for investors. Additional compliance and reporting come with being publicly traded so it is essential to have strong internal departments and external service providers to meet SEC and NASDAQ requirements. I enjoyed very much the opportunity to meet with potential investors and share the history and performance of Community Trust.

What advice would you give young women aspiring to leadership roles in the banking industry?

I have always believed that the more you know the more valuable you are to your employer. I encourage young women to learn

something every day! I would enable them to be problem solvers, not just to identify a problem or opportunity but also to identify its solution or action. I also believe in continuing education, not just formal education but education on the job and education by reading and keeping up with changes in the industry. Not just accepting what you read but thinking about how things apply to your company’s unique operating model and needs. Always doing your very best in everything you do! Share your knowledge and experience with others as someone will need to take your responsibilities if you are promoted. I would also encourage young women to volunteer in their community and share their expertise with community organizations. Always remember to “pay it forward”.

How did your commitment to volunteerism and community service influence your professional life?

We as individuals need to do everything we can to grow our communities and our state and provide a better place for people to live. Raise their families and have good work opportunities. My volunteerism has always focused on the two things I am passionate about: education and economic development. They go hand in hand in building our communities into great places to live and work. The growth and success of our communities provide growth opportunities for businesses, including banks.

What legacy do you hope to leave behind, both within Community Trust Bancorp, Inc. and the broader community?

I have always felt that making a difference in the lives of people has been a strong motivation in my work and volunteerism. It is rewarding to be involved in providing employment, educational opportunities and services like lending, investing or savings that help make people’s dreams come true. I believe that companies just like individuals should operate with a set core values. The core values of Community Trust are fairness, respect and integrity. I always tried to show that you can operate a publicly traded company with Christian values.

The KBA also wishes to congratulate President of Central Bank Winchester, Glenn Leveridge, on his induction to the JA of the Bluegrass Business Hall of Fame. Glenn retired in 2020, as President of Central Bank Winchester, having served 50 years in the financial services industry. A native of Jackson, Kentucky, he began his banking career at Central Bank in 1970. A community banker at heart, he led and managed through decades of change and transition with his primary focus being customers and fellow team members. His experience in guiding his board of directors and coworkers through Kentucky’s Multi-Banking Holding Company expansion was pivotal in customer retention and new business development. Glenn was unable to be reached for comment, but the KBA celebrates his achievement in banking and beyond! Thank you, and congratulations Glenn!

Citizens National Bank in Somerset is pleased to announce Shawn Daugherty’s promotion from Senior Lender to President/ CEO effective March 1, 2024. Shawn has been in banking for nearly thirty years and will celebrate his ten year anniversary with CNB this year.

First Kentucky Bank President Will Hayden was named President at the end of 2023 and is now being named as both President and CEO of First Kentucky, effective July 1st. Hayden joined First Kentucky in 2016 and has 24 years of banking experience. Congratulations Will!

Bank of the Bluegrass & Trust Co. in Lexington is pleased to announce Brian Lippert has joined the bank as Vice President, Senior Compliance Officer. Brian has been in banking since 2005 and has extensive experience in the audit and compliance areas of banking.

Bank of the Bluegrass & Trust Co. in Lexington is pleased to announce the promotion of Helen “Lynn” Rivera from Universal Banker at the Downtown location to Assistant Financial Center Manager at the Southland Drive location.

Campbellsburg, KY

Bank Board Solutions innovatively spearheaded comprehensive board succession planning initiatives aimed at ensuring continuity and effectiveness for organization’s governance structure. In addition, they design custom training for institutions and organizations that focus on board continuity to ensure effective institutional oversight.

Contact: Susan Roberts

For more than 40 years, Strunk, LLC has developed and implemented successful profit improvement, compliance and risk management solutions for hundreds of community FIs. KBA has endorsed Strunk’s Pricing Manager, a fully hosted, web-based solution that allows banks to deploy a tool to all lenders to ensure they are armed to price loans profitably and consistently based on your bank’s target profitability objectives. It also provides the ability to understand the details of relationship profitability so better pricing decisions can be made. Pricing Manager is affordable, easy to implement and use, and it will increase your bank’s net interest income by 25-50 basis points.

Contact: Kristi Daly

Birmingham, AL

FraudSentry and FraudXchange, offered by ThreatAdvice, are AI-based solutions designed to safeguard financial institutions from check fraud. FraudSentry employs advanced machine learning and AI to monitor and analyze transactions in real-time, identifying and mitigating potential fraud risks seamlessly. Its user-friendly interface and robust threat detection capabilities ensure quick responses to threats, safeguarding assets and maintaining customer trust. FraudXchange leverages dark web intelligence and internal fraud case management empowering institution to build, track, manage and report on fraud cases internally. By mining dark web data and performing comprehensive analysis, FraudXchange enables proactive identification of stolen checks. Complementing these features are fraud policies, fraud training and a number of other fraud-related tools.

Contact: Coy Ogle

First Horizon Bank, Memphis TN:

For over 100 years, First Horizon Bank’s Correspondent Banking Division has been a steadfast provider of industry-leading Correspondent Banking services. Our team of experienced bankers maintain relationships with large and small financial institutions across the country, tailoring our products and services to meet the ever-changing credit, liquidity, and treasury management needs of our clients.

Contact: David House

Jeff Klump

by Jeff Klump President of K4 Architecture + Design

In recent years, the banking landscape has been shifting, as larger and regional banks have been withdrawing from smaller communities, creating a void that community banks are uniquely positioned to fill. This shift has generated an opportunity for these smaller financial institutions to capitalize on the potential customer base in smaller underserved markets. Two emerging trends that are gaining traction in this scenario are the concepts of micro branches and freestanding ITM’s.

The microbranch trend represents a significant opportunity for community banks to not only serve their existing customer base more effectively, but also to expand their reach and grow their business in the future, especially in these underserved markets. Micro branches are typically between 1,000-1,500 square feet in size, with a focus on efficiency and convenience, and staffed with two to three universal bankers. These smaller branches require much less in investments to get into the market, and are more agile and designed to meet the specific needs of these communities. They are designed to provide all the essential banking services that customers need on a day-to-day basis, while also offering the flexibility to handle more complex transactions when necessary.

Another emerging trend is the use of Interactive Teller Machines (ITMs) which are similar to ATMs but allow customers to interact with a live teller remotely, enabling them to conduct a wider range of transactions without the need for a traditional teller window. Freestanding ITM kiosks can be placed in parking lots or other convenient locations. These kiosks offer many of the same benefits as traditional micro branches in terms of transactions, including convenience and flexibility, but at a lower cost and with a much smaller footprint. Also, since the transaction is a “live” video, the video teller/universal banker can also arrange and set up meetings for customers for more complex transactions such as loans, at one of their local staffed facilities. This makes them an attractive option for community banks looking to expand their reach without committing to a full-scale branch. Although many people may prefer the person-to-person interaction, the ITM could be an alternative or option during busy times.

One of the key advantages of micro branches is their cost-effectiveness. Due to their compact size and lower staffing requirements, they are more affordable to build and maintain compared to traditional branches. This makes them an attractive option for community banks seeking to expand their presence in less populous markets. Another advantage of micro branches is their flexibility and the ease at which they can be adapted to meet the specific needs of different communities. For example, a microbranch in a rural area might focus more on agricultural lending, while a microbranch in a suburban area might offer more mortgage and consumer lending services. This flexibility allows community banks to tailor their offerings to the unique needs of each market, increasing their appeal to local customers.

From a design standpoint, micro branches present a distinctive array of challenges and opportunities. Given their limited size, each square foot must be meticulously utilized, necessitating careful attention to the layout and circulation of the space to ensure it is both practical and functional. This demands thorough planning to guarantee efficiency and aesthetic appeal, maximizing the space’s utility while maintaining a warm and welcoming environment for customers and clients.

The emergence of micro branches presents a compelling opportunity for community banks to reimagine their customer service and business growth strategies. Embracing this trend and committing to innovative design and technology investments allow these institutions to distinguish themselves as pioneers in the branch renaissance. They can establish a blueprint for the future of banking in less populous areas, solidifying their identity as genuine community banks.

All of us at the Kentucky Bankers Association celebrate the naming of Matt Vance, KBA CFO, as a Best in Finance honoree by Louisville Business First! Over his 23-year tenure, Matt has overseen all financial actions for the KBA and its subsidiaries, maximizing profits with the help of his carefully selected team. His successful acquisition of BPR Services elevated the KBA to national recognition, while his KBA Retirement Solutions continues to offer invaluable retirement options to community bankers. In 2019, Matt led a victorious charge against the unreasonable Bank Franchise Tax, saving Kentucky banks millions annually. He also directs the Kentucky Bankers Relief

6-8,

Carol Ann Warren

General Counsel, Compliance Alliance

by Carol Ann Warren General Counsel, Compliance Alliance

As the saying goes, there are two things for certain in life, “death and taxes.” When customers pass away, the bank has many issues to deal with related to the death of an accountholder, such as probate, payable on death accounts, family members, etc. One of the main questions related to death is what information the bank can divulge without violating the Right to Financial Privacy Act (RFPA) and the Gramm Leach Bliley Act (GLBA).

RFPA was enacted in 1978. The goal of RFPA is to limit the circumstances in which a government entity can access financial information. Ultimately, the government can only access financial information in response to specific authorization by the consumer, subpoena, warrant, or a formal written request from a government entity.

The RFPA does not extend past the death of the customer. While not explicitly stated in the regulation itself, there have been many court cases and opinions that solidify this point. The bank must protect this information prior to death, but it is not bound by the confines of RFPA after death.

While that may be true, this likely does not give the bank the opportunity to freely release personally identifiable information to the general public or the government. The bank will ultimately need policies and procedures in place to protect the financial information of the deceased to protect the bank, the individual’s estate, and the bank’s goodwill.

GLBA was enacted in 1999 and is facilitated through Regulation P. This law took RFPA a step further. Regulation P provides protections specifically for consumers who obtain financial products from financial institutions. This regulation requires banks to send certain disclosures related to privacy, information sharing, and information disclosure.

Under GLBA and Regulation P, the law and regulation are silent as to the death of an individual and whether the requirements still apply. Furthermore, this has not been litigated, so there is not a case law precedent, like there is with RFPA. Fortunately, the regulation gives some insight into this issue.

A customer under Regulation P is referred to as a “Consumer”, which is defined as “(1) Consumer means an individual who obtains or has obtained a financial product or service from you that is to be used primarily for personal, family, or household purposes, or that individual’s legal representative.” 12 CFR § 1016.3(e)(1). Therefore, there is an argument that the Regulation may extend past death the death of a consumer due to the inclusion of the “legal representative” text.

As most bankers know, this is not the “end” of the customer relationship. There are many considerations and responsibilities for the bank. The bank must pay payable-on-death (P.O.D) accounts to the intended beneficiaries, facilitate estate accounts, communicate with executors, and comply with applicable court orders. Ultimately, this leads to the question of what information the bank may divulge and to whom may the bank divulge that information.

Under RFPA, the bank will generally be allowed to communicate with Federal government entities. For example, if the individual is receiving VA benefits, the bank has a responsibility to return those benefits after the bank receives notice of the death of the account holder. The bank

PARTNER

would be allowed to divulge that the recipient has passed and that the funds are to be returned.

Under GLBA, while the conservative argument is to keep those Regulation P protections in place, certain exceptions apply to divulging information to interested parties.

“A) Exceptions to opt out requirements. The requirements for initial notice in § 1016.4(a)(2), for the opt out in §§ 1016.7 and 1016.10, and for service providers and joint marketing in § 1016.13 do not apply when you disclose nonpublic personal information:

(1) With the consent or at the direction of the consumer, provided that the consumer has not revoked the consent or direction;

(2) . . . (iv) To persons holding a legal or beneficial interest relating to the consumer; or

(v) To persons acting in a fiduciary or representative capacity on behalf of the consumer;” 12 CFR 1016.15(a)(2)

Based on the above, the bank would be able to divulge information if the bank has prior consent from the consumer, if there is a beneficiary or related interest to that individual, or to a fiduciary or representative, which would include executors. The bank will likely need to verify the identity of these individuals and have appropriate due diligence procedures in place prior to revealing private banking information. This may include court orders identifying the executor or driver’s licenses for P.O.D. beneficiaries. There is not a lot of regulatory guidance on what is required. Therefore, this will be more of a matter of internal policy.

As the saying goes, taxes and death are inevitable, but hopefully, the bank will be prepared to handle the death of an account holder. The bank will want to have policies and procedures in place when the bank receives notice of a deceased customer, but the bank has options to divulge information to those with interests in the applicable accounts. The bank will want to weigh those policies and procedures with safety and soundness considerations. When death inevitably arises in the banking world, the bank does have options.

Carol Ann Warren serves as Associate General Counsel for Compliance Alliance. She graduated cum laude from Mississippi College with a Bachelor of Finance. She earned a Juris Doctorate and a Master of Business Administration through a joint degree program at Mississippi College School of Law and Mississippi College. Carol Ann is a licensed attorney in Mississippi, Tennessee, and Texas.

by NContracts www.ncontracts.com

What’s the difference between Enterprise Risk Management (ERM), Integrated Risk Management (IRM), and Governance, Risk, and Compliance (GRC)? Does it really matter if financial institutions use one of these risk management frameworks?

As it turns out, it does. Selecting the right risk management framework empowers financial institutions to meet their strategic goals and achieve better business outcomes.

Let’s first define these frameworks before discussing their benefits.

What are the risk management frameworks?

Financial institutions might rely on one of the following risk management frameworks:

Baseline Risk Management: Baseline risk management involves a systematic approach to recognizing, evaluating, and addressing the risks that may impact a financial institution. It’s Risk Management 101. It encompasses an assessment of the likelihood and consequences of risk, creating strategies to mitigate these risks, and monitoring the effectiveness of these strategies.

Enterprise Risk Management (ERM): ERM is a comprehensive approach to managing risk that necessitates ongoing communication and coordination between business units. Distinct from baseline risk management, ERM involves active participation from senior management and the continuous evaluation of risk.

Integrated Risk Management (IRM): IRM is a framework that fosters a risk-aware culture. It builds on ERM by integrating technology to improve decision-making and boost performance.

Governance, Risk, and Compliance (GRC): GRC is a complex and expansive framework that focuses on achieving business objectives, managing risk, and upholding ethical standards. Unlike the other frameworks, risk is merely one component of GRC.

How can ERM, IRM, and GRC benefit financial institutions?

ERM enhances baseline risk management by adding value and improving performance. It differs from baseline risk management in the following ways:

1. ERM is a continuous, ongoing process led by senior leadership instead of a periodic task performed solely by risk and compliance officers.

2. It integrates insights from across business units, breaking down silos for a more holistic understanding of risk.

3. ERM promotes a collaborative, team-based approach to managing risk.

4. It places a strong emphasis on data to inform decisions.

IRM is a more advanced framework than ERM, offering the following benefits:

1. It adopts a comprehensive perspective on risk, embedding risk management practices into setting goals, assessing performance, and responding to risk.

2. IRM employs a data-centric strategy, utilizing longitudinal analysis to track and interpret risk patterns over time.

3. It fosters a risk-conscious culture, ensuring employees appreciate the importance of risk management and comply with regulations.

4. IRM decreases compliance costs and lowers the expense of fraud and remediation while also offering crucial risk insights for existing and new activities, thereby accelerating the decision-making process.

The Governance, Risk, and Compliance (GRC) framework originated for Fortune 500 companies as a response to Enron and other corporate implosions. It emerged during a period when risk management for financial institutions began to expand from merely addressing financial and security risks to encompassing a broader spectrum of risks.

Designed for large, complex companies, the GRC framework is more resource-intensive than either ERM or IRM, making it particularly suitable for larger financial institutions. Smaller institutions might find the ERM or IRM framework more appropriate, with the option to incorporate GRC solutions into their risk management programs over time.

What risk management framework is the best fit for your institution?

Choosing the most suitable risk management framework requires financial institutions to assess several key aspects introspectively:

1. The size and complexity of their institution

2. The prevailing organizational culture – whether it’s more processoriented or people-driven

3. Plans for strategic growth

4. Internal core competencies – while investing in technology is crucial for ERM and IRM, institutions must ensure they possess the requisite resources. It’s important to consider whether institutions have adequate risk management personnel and technological expertise to support a more comprehensive approach to risk.

5. Support from the board and executive leadership.

Additionally, it’s critical to evaluate the external risk environment. As the landscape of risk broadens and intensifies – from macroeconomic uncertainty and concentration risk in commercial real estate to challenges posed by neo-banks and the integration of digital banking services – financial institutions must assess their risk management requirements rigorously.

Risk management approaches that were sufficient in simpler times may not be adequate in managing the complexity and scale of current risks.

by Lelia Coggins SouthState Duncan Williams

As we approach the halfway mark for 2024 many portfolio managers continue to face limited visibility and firm conviction for a directional path of interest rates.

While the yield curve inversions suggest a slowdown ahead, it is the re-steepening of the yield curve that offers a timing predictiveness the downturn will hit sooner rather than later. As the Fed plants firm messaging of holding the Federal Funds rate steady for longer, what clues within spreads across segments of the yield curve can offer timing to when the Fed could pivot? Can we glean insight on how the yield curve shifts through the business cycle? And what are the implications of these curves shifts on constructing an investment portfolio strategy to balance these risks?

Typically, once the spread between 10Yr/ 3Mo UST reaches peak inversion a recession follows within 9-12mos. The current cycle inversion looks to have peaked in May 2023 at -185bps, indicating a slowdown or recession could be nearing.

Two other key segments of the yield curve, the 30Yr/5Yr and 30Yr/3Mo, historically offer early signs of a recession being imminent and starting within several months. The 30Yr/5Yr spread needs to un-invert. This segment remaining in positive territory since Sept-23 and currently sits at +13bps. The 30Yr/3Mo spread needs to sustain a meaningful steepening trend even if remaining inverted. This cycle has seen two explicit steepening patterns before unwinding progress. The spread remains well off its peak inversion hit last July of -156bps, re-steepening to -94bps today. Previous cycles show this segment steepens well before other parts of the curve leading up to an economic slowdown.

The Fed initiating buyback operations and easing of quantitative tightening should offer support to treasury yields. This combined with softening economic and jobs data and firming market conviction for at least one 25bp rate cut this year suggests the next wave of steepening could be led by falling yields on the front end of the curve.

The direction of the business cycle drives the shape of the yield curve. When the economy is at the start of a recovery and moving toward expansion the yield curve sits in its normal, upward sloping fashion. As the economy expands nearing a peak, the yield curve transition resembles a bear flattening like move as the short end pushes higher (alongside Fed hikes) and possibly inverts. Higher rates begin to choke off growth, the business cycle slows with rising recession risk. As economic destruction builds the curve shifts in a bull steepening fashion with the front end of the yield curve falling (alongside Fed cuts). We are late cycle and even though recession probabilities remain subdued, the likelihood of declining rates near term remains probable as the Fed looks to kick off cutting rates later this year.

The focus now is to protect interest income. Investors need to evaluate the ability to add duration that will build income to protect earnings now to when the economy recovers (essentially building a bridge to the other side of the business cycle). Investing too short could lead to the inability to build and maintain income through the trough while longer duration securities that are less likely to see a rise in prepayments amid a falling rate backdrop help extend the interest income bridge to the next peak. The Bridge is a layered portfolio strategy with each “pillar” designed to capture value for a segment of the yield curve. The portfolio strategy

is primed for a gradual steepening of the yield curve while remaining adaptive during economic cycle progression.

Broadly “The Bridge” sector allocation targets:

•20-25% Adjustable Front End - SBA 7a pools, Freddie Ks, and CMOs

•20-25% Front End Cashflow - Front End SEQ CMO and Hybrid ARMs

•35-45% Call Protection in the Belly - Agency structures with longer lock out periods and 1x calls, SBIC, and FN DUS/ FR PC

•10-20% Longer Duration - Off Coupon 20 and 30yr MBS with longer ACMBS, specifically FR PC TELs

Utilize structures on the front end of the curve to reconstruct the portfolio’s short term cashflow that extended out of the covid low-rate environment alongside improving portfolio allocation toward floatingrate exposure. This supplies an immediate boost to interest income and provides the ability to redeploy heavy front end principal roll-off. Earlier cash flows provide support for unforeseen liquidity events while also hedging against the risk that rates do not fall as quickly.

Across the belly of the curve, more positive convex structures with less optionality, ensure the sustainability of interest income. A focus toward the ~3-5yr part of the curve to balance duration risk and benefit from the potential for strong capital appreciation should rates fall. Not only will these investments bridge interest income over the economic slowdown or recession gap but also offer the ability to harvest gains and support earnings in the face of potential rising loan losses amid a deteriorating economy.

It is important to note the bridge sector allocation is not a one size fits all approach and dependent upon current portfolio holdings, the institution’s outlook on interest rates and timing of Fed rate cuts, current balance sheet position and existing funding needs / constraints.

Rob Nichols

by Rob Nichols President & CEO / American Bankers Association

The banking agencies are tasked with writing implementing regulations for the laws enacted by Congress, but they do not have free reign. In creating these rules, regulators must act within the boundaries of their statutory authority or run the risk of legal challenge—and ABA has not been afraid to hold them accountable in court when they get it wrong. But Congress can also hold agencies accountable when there are policy disagreements by simply overriding final rules.

In ABA’s view, regulators have exceeded their authority in several recent regulatory actions, including the 1071 final rule, the credit card late fee final rule, the new Community Reinvestment Act final rule, and the expansion of UDAAP authority via an update to an examination manual.

When I addressed bankers at the 2024 ABA Washington Summit earlier this year, I assured them that ABA would use every tool in our toolbox to push back against the “regulatory tsunami” that regulators have unleashed upon the banking industry. Litigation is obviously a tool that we’ve been forced to use now several times—as evidenced by our four current legal challenges against bank regulators—but it isn’t the only option.

Among the other tools available is a lesser-known mechanism called the Congressional Review Act—which we sometimes refer to as “the other CRA.”

The Congressional Review Act was enacted in 1996 to provide Congress with an avenue for overturning certain federal regulatory actions, but inexperience with the new law and divided government meant it was only used once in its first 21 years. During the Trump administration, however, when Congress and the White House were controlled by the same party, the CRA was used successfully 16 times. Highlights included ABA-backed resolutions to overturn the CFPB’s rule effectively banning the use of mandatory arbitration for financial products—a rule that ABA strongly opposed—and a resolution to nullify the bureau’s 2013 indirect auto lending guidance, after the Government Accountability Office issued a formal decision in 2017 that the guidance constituted a rule.

Congress passed CRA resolutions three more times during the Biden administration, and lawmakers continue to introduce them. Recently, ABA supported a CRA challenge to the CFPB’s 1071 final rule. That CRA challenge was passed by a bipartisan majority in both the House and Senate—and though President Biden ultimately vetoed the measure, it sent a strong and clear signal that Congress disagreed with the bureau’s rule.

In addition, a resolution of disproval under the CRA was also passed in May to invalidate the Securities and Exchange Commission’s Staff Accounting Bulletin 121, which changed the way that banks and other publicly traded entities are expected to account for digital assets held in custody. ABA is also supporting a CRA challenge to the CFPB’s recently finalized credit card late fee rule. The House Financial Services Committee favorably reported that resolution of disapproval in April.

The Congressional Review Act is so powerful because resolutions can move to the Senate floor quickly through an expedited “fast track” procedure and that, once on the floor, a resolution requires only a simple majority vote to pass—not 60 votes, like most legislation. This fast-track process stipulates a specific timeframe during which rules

issued in this Congress can be invalidated by the next Congress: the rule must be issued during a window of 60 session or legislative days prior to Congress’ adjournment at the end of the year in order for the next Congress to have an opportunity to invalidate the rule. We are now nearing the window where any final rules that are issued by the agencies could be challenged under the CRA in the next Congress—yet another reason why electoral outcomes matter.

However the elections shake out in November, ABA’s focus will remain unchanged: supporting a policy environment that supports America’s banks in their mission to supply credit to their customers, clients and communities. And we’ll continue to use every tool in the toolbox to ensure that our broad and diverse banking sector can continue to thrive.