June 3, 2024

Champions’ Trace Golf Course

Nicholasville, KY

June 3, 2024

Champions’ Trace Golf Course

Nicholasville, KY

“We were content with the coverage we had and were not shopping our plan. After meeting with KBA Insurance Solutions, we had no choice but to make the move to Chuck and his team. They proposed a thoughtful plan design & introduced benefits that we had not previously offered. When we showed the rates KBA Insurance Solutions offered to our prior agent, she said: “…you have to make this change.” Since changing our results have been better coverage, expanded offerings and greater cost savings. I would highly recommend that any bank explore the options available through KBA Insurance Solutions.”

Mr. Charlie Dicken, EVP Trust Officer, First Kentucky Trust

WHO WE ARE: The KBA is a nonprofit trade association that has been providing legislative, legal, compliance and educational services to its member institutions since 1891. KBA's directors and staff work together with its members to make the financial services industry a more effective and successful place to work. The strength of the KBA is bankers unifying as an industry to speak as one voice.

WHAT WE DO: The purpose of the Kentucky Bankers Association is to provide effective advocacy for the financial services industry both in Kentucky and on a national level; to serve as a reliable and responsive source of information and education about areas of interest to the industry; and to provide a catalyst and forum for collective industry action. The KBA does this in 4 ways:

KENTUCKY BANKERS ASSOCIATION 600 West Main Street, Suite 400 Louisville, Kentucky 40202

Ballard W. Cassady Jr. President & CEO bcassady@kybanks.com

Timothy A. Schenk General Counsel tschenk@kybanks.com

Miriam Cole Executive Assistant Office Manager mcole@kybanks.com

John P. Cooper Legislative Solutions jcooper@kybanks.com

Paula Cross Education Coordinator pcross@kybanks.com

Nina K. Gottes Sponsorship & Events Coordinator ngottes@kybanks.com

Casey Guernsey Enrollment and Billing Specialist cguernsey@kybanks.com

Jamie Hampton Education Coordinator jhampton@kybanks.com

McKenzie Just Caldwell Staff Accountant mcaldwell@kybanks.com

Chuck Maggard

President & CEO

KenBanc Insurance cmaggard@kybanks.com

Lisa Mattingly Director of Sales & Service KBA Benefit Solutions lmattingly@kybanks.com

Donna McCartin Benefit Support Specialist dmccartin@kybanks.com

Tammy Nichols Finance Officer HOPE of the Midwest tnichols@hopeofthemidwest.com

Katie Rajchel Accounting Manager krajchel@kybanks.com

Selina O. Parrish Director of Membership sparrish@kybanks.com

Jessie Southworth Director of Education jsouthworth@kybanks.com

Jennifer Schlierf Sales Support KBA Insurance Solutions jschlierf@kybanks.com

Matt Simpson Communications Director msimpson@kybanks.com

Matthew E. Vance, CPA Chief Financial Officer mvance@kybanks.com

KENTUCKY BANKER is the official bi-monthly magazine of the Kentucky Bankers Association (KBA). No part of this magazine may be reproduced without express written permission from the KBA. The KBA is not responsible for opinions expressed by outside contributors published in KENTUCKY BANKER. The KBA reserves the right to publish submissions at the discretion of the KENTUCKY BANKER editorial team. For more information, or to submit an article, pictures or pass on a story lead, contact Matt Simpson, Managing Editor, at msimpson@kybanks.com facebook.com/kybankers

Tamuna Loladze Chief Operating Officer HOPE of the Midwest tloladze@hopeofthemidwest.com

Michelle Madison IT Manager mmadison@kybanks.com

Brandon Maggard Account Representative KenBanc Insurance bmaggard@kybanks.com

Billie Wade Executive Director HOPE of the Midwest bwade@hopeofthemidwest.com

Audrey Whitaker Insurance Services Coordinator awhitaker@kybanks.com

Wesley Githens IT Support Specialist wgithens@kybanks.com

CHAIRMAN

Mark Strother, President & CEO

Commercial Bank of Grayson

VICE CHAIRWOMAN

April Perry, Chairman & CEO

Kentucky Farmers Bank Co.

TREASURER

W. Lee Scheben, President Heritage Bank, Inc

GROUP REPRESENTATIVES

Represents Group 1

Jeff McDaniels, President & CEO

Farmers Bank & Trust Company

Represents Group 2

Michael W. Hunt, President & CEO The Sacramento Deposit Bank

Represents Group 3

Greg Pawley, President & CEO The Cecilian Bank

Represents Group 4

Jason T. Jones, President Morgantown Bank & Trust Co.

Represents Group 5

Don D. Jennings, CEO First Federal Savings Bank of KY

Represents Group 6

Robert Miles, President & CEO Peoples Bank of Lebanon

Represents Group 7

Lucas Shepherd, CEO First National Bank of Manchester

Represents Group 8

PAST CHAIRWOMAN

Ruth O’Bryan Bale, Chairman South Central Bank, Inc.

KBA PRESIDENT & CEO

Ballard W. Cassady, Jr., President & CEO Kentucky Bankers Association

THRIFT REPRESENTATIVE

Glenn Meyers, Executive Vice President Citizens Federal Savings & Loan Assoc.

BANK SIZE REPRESENTATIVES

Represents

Lonnie Foley, CFO Peoples Bank of KY, Inc. Represents Group 9 James Ayers, Regional Manager First State Bank, Inez

Amid regulatory upheaval, the steadfast advocacy of community bankers emerges as our most powerful tool for safeguarding the future.

by Mark Strother, KBA Chairman, 2024Last week in Washington, I heard ABA President Rob Nichols echo a sentiment I’ve frequently heard from Ballard about the KBA: the key focus of the association is advocacy. At no time in my career has this advocacy been more crucial in both Frankfort and DC than it is today.

From our nation’s capital, proposed rulings are introduced almost weekly that, if enacted, could either adversely impact the way we serve our clients or directly reduce our earnings capacity. Rules supposedly intended for “too-bigto-fail” banks inevitably trickle down to the smallest institutions.

In Frankfort, bills often emerge from cookie-cutter language actively promoted nationwide, typically with a

political slant or without considerable thought to the consequences of their implementation.

Leaders of community banks find themselves initially occupied with combating these proposals through comment letters, calls to legislators, and meetings with regulators. When these measures proceed despite our efforts, the need arises to review the rule changes, access educational resources to understand the requirements, and then dedicate time and resources to prepare and train for implementation. This shift in focus diverts valuable time from our clients and strategic planning for future profitability. We find ourselves addressing minor issues elevated solely by bureaucratic decisions, reducing the time we could spend on managing the real risks that daily threaten our banks’ stability and expose our industry to significant threats.

John, Ballard, and Tim excel in advocating for us both in Frankfort and DC.

In Frankfort, they have achieved considerable success in passing laws that strengthen the industry and in quashing harmful bills before they become law. In Washington, the divided government makes passing legislation nearly impossible, but an active bureaucracy still finds ways to complicate our jobs. Despite their experience, even skilled advocates like John, Ballard, and Tim can only achieve so much.

It is essential for us to lend our voices to give a Main Street perspective on the impacts of these regulatory decisions. Many of us maintain strong relationships with our state representatives and senators. We should leverage these connections to communicate our positions on specific issues and their effects on local constituents. Be assertive and prepared to counter any justifications they might offer. Our U.S. congressmen and senators may not know us as well, but an effort should be made to ensure they understand who we are and the regions we represent. Even if they don’t know us personally, they recognize the impact we have locally and are likely to listen.

Government advocacy is something we need to actively participate in, rather than delegate. The more involved we become on behalf of our banks, the more significant our impact on the legislative process will be. Ultimately, we should expect no one else to fight as hard for our banks as we do ourselves.

At the recent Washington ABA Summit, a rallying cry echoed through the halls. Esteemed speakers like former FDIC head Jalena McWilliams urged us to confront the tide of regulatory overreach and ideological bureaucrats. The spirit of the good fight was palpable, and I’ll admit to leaving D.C. feeling cautiously optimistic about our collective goals.

The cornerstone of the summit was unmistakable: advocacy must extend beyond the boardrooms and into the public eye and courts. To put it bluntly, bankers are sick and tired of being bullied by rogue regulators pretending to care about the American people. They’re sick and tired of it, and they’re ready to fight back.

I’m reminded of some folk wisdom I learned as a kid… It’s something I’ve come to call “Pikeville-ese” and it’s really simple: the only way to stop a bully is to punch him in the mouth. This sentiment captures the prevailing mood at the summit—there’s no more room for passivity when dealing with the bullies in Washington pushing unchecked agendas. We have tried to compromise. We have tried to negotiate. The clear

takeaway? Sitting in the middle of the road just means you get hit by both sides. That’s some more Pikeville-ese for you… Some truths you just won’t get with a college education.

The ABA seems to understand this now. There appears to be a significant shift in the ABA’s strategy from negotiation to assertive legal confrontation, illustrated by their initiation of three new lawsuits since the last gathering, bringing the total to four ongoing legal battles. With potentially more on the horizon, the banking community is showing its readiness to challenge overzealous regulatory actions head-on. It goes without saying, the KBA welcomes this new direction. Once more, into the fray we go.

All of this just reflects something I’ve known for a long, long time: compromises with ideologues are futile. It’s like screaming at a wall. The inability of a split Congress to safeguard the industry’s interests, coupled with the executive veto of critical bills like 1071, has left us with little choice but to seek any advantages we can get in the courts. Fighting in court isn’t easy, of course. But our resolve has never been stronger, and the stakes have never been higher. If we have to teach Washington a few more lessons in “Pikeville-ese”, well, so be it.

While May in Kentucky is known for the fastest two minutes in sports, mint juleps, and a blanket of roses, June brings a different flair to Kentucky’s banks. Each year, during the first week of June, bankers from across the state gather at the Griffin Gate Marriott in Lexington for General Banking School. From tellers and loan officers to compliance specialists, IT experts, accountants, attorneys, trust specialists, and fraud investigators—each role in a bank demands a unique set of skills and knowledge.

Our General Banking School is designed to address this complexity by bringing together employees from all these diverse functions. This two-year program helps participants understand how different parts of the bank interact and depend on each other. It combines theoretical knowledge with practical application, culminating in a state-of-the-art bank simulation. In this simulation, participants step into the roles of upper management, making critical decisions that affect the bank’s operations. Beyond gaining knowledge and skills, the program also offers a valuable networking opportunity. Participants connect with banking professionals from across the state, often forming lasting relationships that extend well beyond their time at the General Banking School.

Recently, we had the opportunity to reach out to three successful bankers who participated in General Banking School early in their career. Check out what they had to say about their experience below!

Charles Beach, IV GBS Graduate, Class of 2015 Vice President, Peoples Exchange Bank Winchester, KY

Charles Beach, IV GBS Graduate, Class of 2015 Vice President, Peoples Exchange Bank Winchester, KY

“I really enjoyed meeting all of the other bankers from across Kentucky and learning about their lending practices, the intricacies of their individual markets and the businesses that drive the economy in each of those markets. Whether it was banking Soybean farmers in Western Kentucky, looking at commercial real estate in Louisville or addressing the banking needs of the Amish community in Bath County you were able to see the full spectrum of banking in Kentucky.

I found the classwork quite interesting mainly due to the instructors, specifically Dr. Dianna Preece. The instructors make various topics like CAMELS, UBPR or Financial Analysis surprisingly engaging. I gained a comprehensive understanding of how a community bank works from the ground up; which I use daily as we examine how to maximize efficiencies in our institution.

The lasting benefit of attending the General Banking School is the network of bankers across the state that you are introduced to as a banking school attendee and can call upon to compare notes and seek advice. The KBA actually cares about promoting the interests of community banks and community bankers and the infrastructure that they provide for the banking industry in our state is an incredible resource for all of us to call upon.”

Doug Lawson

GBS Graduate, Class of 1999

President and COO, Field & Main Bank Henderson, KY

“I thoroughly enjoyed meeting new people. The opportunity to learn more about them, their families, their banks, and to make friends for life was worth the price of admission. It is amazing how many classmates I can recall, still see, and have maintained relationships with since we graduated in 1999. General Banking School taught me to love banking and that passion still lies deep inside of me 25 years later. The benefit is that I love what I do, I was blessed with great teachers, coaches, mentors, and bankers who invested in me and who continue to invest in me daily. The biggest benefit is the gratitude I feel every morning when my feet hit the floor. Thank you KBA for the opportunity to learn and to grow my career.”

What skill did you learn in GBS that was was most useful in your career?

“ALCO – without question the best part of banking. Asset Liability Management is a little art and a little science. I am a little competitive, so the bank simulation game was particularly fun for me, and it really hooked me on the idea of running a community bank someday. Being a well-run bank is the precursor to helping people and I believe that great communities have great financial institutions.”

Lonnie Foley

GBS Graduate, Class of 2005

Chief Financial Officer, Peoples Bank of KY

Flemingsburg, KY

“Having never been exposed to the interworkings of how a bank functions on the financial side, the numerous topics covered by the instructors was a huge benefit. It provided a great foundation, especially early in my banking career. Since my accounting career began some 20 years ago, I always had a good understanding of balance sheets and profit and loss statements in private organizations. I realized once I began my banking career, banks are somewhat different in this respect. Banking School helped me understand the total package using the simulation and being taught the interworkings of the UBPR. Attending GBS provided an overall bird’s eye view of how the bank functions. Most importantly it provided a networking opportunity that has proven to be invaluable. I still communicate with banking school “colleagues” to this day and for that I am forever grateful for the opportunity to attend the KBA Banking School. “

Integris

a leading

services company, renowned for its tailored IT solutions and support for financial institutions. Committed to innovation, security, and excellence, Integris is the trusted partner of choice for banks seeking to enhance growth and operational efficiency through technology.

by Timothy Schenk, General Counsel

by Timothy Schenk, General Counsel

As regulators start holding banks accountable for their AI systems, the question arises: how deeply should banks understand and manage these technologies? What are the challenges in ensuring AI is implemented ethically and securely? Bankers face the underlying fears of mismanagement and reputational risk.

Artificial intelligence. AI. We hear these keywords daily on the news. If you run a quick search on AI, you will find articles ranging from “Massive AI Growth is Outpacing U.S. Power Capacity” to “How AI is Boosting Drug Discovery” to “How AI is Wreaking Havoc of Music Fans”. So how is AI being used in banking? I may not know the totality of that answer, but what I do know is that regulators are going to hold banks responsible for it.

When I first read the FDIC’s March 2024 Consumer Compliance Supervisory Highlights, I found myself reading pages fifteen (15) and sixteen (16) saying, “On June 9, 2023, the FDIC, FRB, and OCC (collectively, the agencies) issued final guidance on managing risks associated with third-party relationships (FIL-29-2023). The guidance provides sound principles that support a risk-based approach to third-party risk management that banking organizations may consider when developing and implementing risk management practices for all stages in the life cycle of third-party relationships. This guidance replaces the agencies’ existing guidance on this topic, providing a consistent approach to managing risks associated with all third-party relationships. Banks can use this guidance as a resource in overseeing its third-party relationships.”

What does that mean? What is the life cycle? Does this include AI?

While prudential regulators have consistently avoided specifically addressing AI, because the “broad-based scope of the guidance captures the full range of third-party relationships”, it made me wonder what is happening with banks and AI during examination. I started asking bankers what they had experienced on the issue and their response was clear; examiners are asking about it during the review cycle and expecting us to know how it works and if it is discriminatory. My concern increased.

Do banks need to know if their vendors use AI? Must bankers learn to code? How can banks detect

When I began asking prudential regulators about the expectations regarding banks and AI, I realized that many of the aforementioned questions did not matter; banks are responsible for all their vendors and should know everything about AI.

I asked one regulator directly: “So banks bear the entire burden of third parties and their use of AI whether they know it or not.” The response was: “They should know it and they are responsible.”

Wait. Isn’t there a four-letter agency that’s supposed to protect consumers that should be overseeing this? Couldn’t they publish a list of problem vendors? Why are banks always

bearing the burden of compliance for everyone else?

The answer to those questions is that the bureau that’s supposed to protect consumers is focused on other things. The agencies are not publishing a list of problem vendors, “but a Google search will help,” and yes, banks always bear the burden. Well, isn’t that just great?! One more thing to worry about.

The reality is that prudential regulators are going to examine all banks on AI. It could be for safety and soundness, fair lending, UDAAP (which I have yet to find anyone who can clearly define), or any other regulation examiners see fit. So what should bankers do to stay out of trouble?

The answer to that is that banks have to change their vendor management systems. Banks must now ask third-party vendors if they are using AI. Not just at the beginning of the contract but throughout the life cycle of the relationship. If the vendor is using AI, the bank should ask how the vendor is using AI and what fields it is using. There should be a sample test to analyze the vendor’s impact on different demographics and questions on how the vendor is ensuring that discrimination is not taking place. This all has to be considered in addition to traditional third-party vendor questions such as data security and safety.

I heard one banker ask a regulator about what his institution should do if it somehow finds out that a third-party vendor is causing issues for its AI use. The response was direct and simple: terminate the contract and report. The regulator added that the length, cost, and duration of the contract did not matter. Get out of it. Easier said than done and potentially crippling to a bank if it comes from a core provider. Nonetheless, regulators move on.

While I disagree with the prudential regulators that bankers should be held responsible for third-party vendors use of AI, in reality, it seems unlikely that the prudential regulators are going to change their minds. What that means for us is that we have to be even more diligent when I did not even think that was possible.

Oftentimes I feel like the bearer of bad news when it comes to regulation and this column is no exception. However, as others in the industry study AI and its effects on banking, and hopefully decide to directly oversee third parties, I will remain optimistic that our bankers will continue doing their work as the best bankers in the country and keeping the bad actors utilizing AI negatively out of our industry just as they have other bad actors for decades.

The art at the beginning of this article was generated by AI art tool, MidJourney.

Timothy Schenk, General Counsel for the KBA, addresses bankers at the KY Bankers Day, 2024 -ed.$

6 Billion of private investor equity

61,000 units of affordable housing

1,035 developments and partnerships

0 foreclosures

The recent closing of Ohio Equity Fund 33A at $181 million will provide over 1,200 units of affordable housing in 16 projects in Ohio, Kentucky, and West Virginia.

OCCH RECOGNIZES THE SUPPORT OF FUND 33A’S INVESTORS

CF Bank

City National Bank

Civista Bank

Community Trust Bank

Farmers National Bank of Canfield

Farmers National Bank of Danville

Fifth Third CDC

First State Bank

German American Bank

Heritage Bank

Huntington CDC

JPMorgan Capital Corporation

Key CDC

discuss the benefits and features our CRA investment provides.

Jonathan Welty Executive Vice President

614.591.9356

JWelty@occh.org

Middlefield Banking Company

Minster Bank

Park National Bank

Premier Bank

Republic Bank

Springfield State Bank

Stock Yards Bank & Trust

The Union Bank Company

WesBanco

Author: James Ayers Assistant Vice President Regional Retail Manager Kentucky Market First State Bank

Author: James Ayers Assistant Vice President Regional Retail Manager Kentucky Market First State Bank

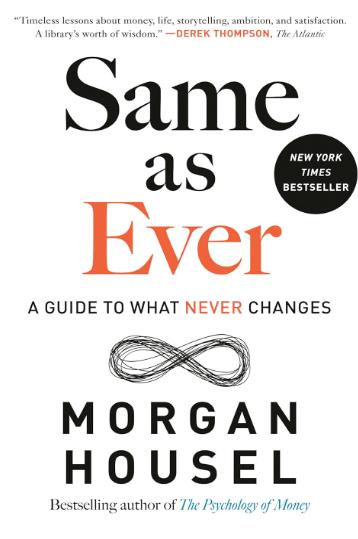

Every investment plan under the sun is, at best, an informed speculation of what may happen in the future, based on a systematic extrapolation from the known past. Same as Ever reverses the process, inviting us to identify the many things that never, ever change.

Change is everywhere. A few months ago, I wrote a review on Leading Change. While it’s true that our world is constantly changing, it is also true that certain things never change. What are some of those things, and how can we utilize the knowledge of past occurrences to better understand today’s world and what the future may look like? Morgan Housel attempts to answer those questions in his recently published book, Same As Ever.

Same as Ever contains 24 chapters, each of which can be read independently, about how certain behaviors and certain aspects of life and business will always be the same. Being intrigued by the idea of looking backward to help look forward, I recently read this book and recommend it to anyone tasked with attempting to forecast (how often have you been asked where rates are going in the last 24 months) or anyone who finds themselves in constant awe of the decision-making process of others (and maybe even your own).

To give an example of what is contained in these 24 chapters, below is a highlight of some of the stories and the subsequent point that Housel is making with them.

Related directly to banking, it’s easy to forget that 3 days before Lehman filed for bankruptcy, their tier 1 capital ratio was 11.7%, which was higher than it had been the previous quarter and was higher than both Goldman Sachs and Bank of America. What changed? Faith. On September 10, 2008, investors believed in the company. Three days later they did not. Examples of the power of faith permeate throughout history, yet faith is hard to model and even harder to quantify. Housel makes the point that if you relied on only data and logic to understand the economy, you would have been confused for over a century.

Another example related directly to banking involves an explanation of the 2008 financial crisis. Housel asks if the reader knows what caused it. As bankers, of course we do. Or at least we think we do. To truly understand the financial crisis, one must understand the mortgage market in the lead up. To understand the mortgage market, you must understand the 30-year decline in interest rates that preceded it. Why did rates decline so much? Well, to understand that you must understand the inflation of the 1970s. Why was their high inflation in the 1970s? To answer that you must understand the monetary system of the 1970s

Title: Same as Ever

Author: Morgan Housel

Publisher: Portfolio

and the effect from the Vietnam War. What caused the Vietnam War? Well, you must understand the West’s fear of communism after World War 2. What caused World War 2? This game could go on and on and on- which is the point. We are often in a moment that was created decades or even centuries before, the product of seemingly unrelated events. It’s easy to forget that while we often know how a story ends, we don’t really know how it truly begins.

It’s incredibly hard to predict the future because past connections can be best described as absurd. As such, much of today’s world is a result of things that we would never think of. Two stories here that are fascinating to think about. The Battle of Long Island was a disaster for Gen. George Washington’s troops. If the British had sailed up the East River on the night of August 28th, 1776, they would have wiped out General Washingtons troops and effectively ended the Revolutionary War. But that didn’t happen because it was impossible to sail up the river that night. The wind was blowing in the wrong direction for the British. The life that we know today was determined by the direction of the wind over 200 years ago.

Housel’s work is a quick, enjoyable read that will provoke much thought. Perhaps we need more of that as we try to understand the world in which we operate today. And perhaps we are operating in a much better world than we realize, one that is a result of luck as much as anything else. As the author would say, its always been that way and it always will be that way, same as ever.

FNB Bank is proud to announce that Steven Hulsey has been named Consumer Loan Officer for FNB’s Mayfield Main Office. Steven has five years of prior banking experience with FNB, having most recently served as an Underwriter/Dealer Representative for FNB’s Indirect Lending Department.

Mark A. Gooch, Chairman, President and CEO of Community Trust Bancorp, Inc., is pleased to announce that James Clark has been named the Mt. Sterling Market President of Community Trust Bank, Inc.

Mr. Clark’s responsibilities include providing consumer, residential, and commercial lending options to new and existing clients, as well as offering a variety of financial solutions to individuals and businesses including the acceptance of time and demand deposits, providing cash management services to corporate and individual customers; issuing letters of credit; renting safe deposit boxes, and providing electronic banking and funds transfer services.

City National Bank has been named the top bank in the country on the Forbes list of America’s Best Banks 2024. The 200 largest publicly-traded banks and thrifts by assets were eligible, and City National led the rankings at number 1.

The Murray Bank President and CEO, Bob Hargrove, presented Q Taylor with the

Employee of the Quarter award at the Bank’s recent employee meeting. Taylor currently works as a Customer Service Representative at the North Office of The Murray Bank.

Please join The Peoples Bank in congratulating Ashley Yocum on her recent promotion effective January 1, 2024. Ashley has been promoted to Senior Vice President ~ Chief Operations Officer. Ashley has been with PBK Bank since August 2008 and previously served in the role of Supervisor of Bookkeeping and Compliance Officer.

The Officers and Directors of Republic Bancorp, Inc. (the “Company”) and Republic Bank & Trust Company (“Republic” or the “Bank”) are pleased to announce the appointment of Yoania “Jo” Cannon and Alejandro “Alex” Sanchez to the Company’s Boards.

Farmers National Bank announces the addition of Todd Harne, Vice President, Casey County Market Manager. Harne will lead the bank’s business development and community engagement efforts in Casey County.

Central Bank Chairman, President, and CEO Luther Deaton, Jr., announces Buckner Woodford joins Central Bank as vice president, senior portfolio manager. Buck brings over two decades of banking, investment management, and advisory experience. A graduate of the University

of Virginia, he holds a Bachelor of Science degree in Commerce with a concentration in Finance. He is a member of the CFA Society Cincinnati, having earned the Chartered Financial Analyst designation in 2003.

Mark A. Gooch, Chairman, President and CEO of Community Trust Bancorp, Inc., is pleased to announce that Terrell Medley has been promoted to the position of Senior Market Loan Officer in the Williamsburg Market of Community Trust Bank, Inc.

Bank of the Bluegrass & Trust Co. in Lexington is pleased to announce the addition of Dan Pauley to the Southland Financial Center, located on Southland Drive. Dan joins the team as a Universal Banker. He has 3 years of prior experience in banking, as well as work experience in the education and hospitality fields. During his career, he has developed expertise in customer service, account management and team leadership.

FNB Bank is proud to announce that they have donated over $21,000 back to Mayfield, Graves County, Trigg County, and Marshall County Schools through their Spirit Debit Card Program. These donations to the school systems are a result of FNB’s 1st quarter 2024 Spirit Debit Card Program.

Jamie Douglas has been promoted to Assistant Vice President within the loan division at Farmers National Bank.

Skip Hageboeck President and CEO

City National Bank

Skip Hageboeck President and CEO

City National Bank

City National Bank has once again distinguished itself as a leader in the banking industry, securing the top spot on the Forbes list of America’s Best Banks 2024. This recognition is a testament to the bank’s robust presence among the 200 largest publicly-traded banks and thrifts by assets, underscoring its superior growth, credit quality, profitability, and stock performance throughout the 2023 calendar year and up to March 18, 2024.

City National’s commitment to excellence extends beyond these achievements. Recently, the bank also claimed the #1 rank in customer satisfaction in the North Central Region in the J.D. Power 2024 U.S. Retail Banking Satisfaction Study. This marks the fifth time in seven years that City National has earned this top honor, outperforming all other banks in West Virginia, Kentucky, Ohio, Indiana, and Michigan. The study evaluated multiple facets of banking, including trust, the quality of personnel, account offerings, accessibility, efficiency, digital services, and problem resolution.

President and CEO Skip Hageboeck expressed his pride in these accomplishments, stating, “This goes to show what wonderful communities we’re fortunate to be part of. And that a consistent, disciplined, even predictable customerand community-focused strategy never goes out of style. I’m thrilled to see our employees once again recognized nationally for their excellent work.” He further noted, “This award is about more than providing excellent service. It is about the way all City employees interact with and support their customers, communities, and each other every day. We are honored to once again be recognized by our customers.”

These accolades highlight City National Bank’s pivotal role in setting industry standards for customer satisfaction and operational excellence. All of us here at The Kentucky Bankers Association celebrate City National Bank’s achievement, and look forward to seeing what the future holds for Skip and his team!

Bank of America breaks ground on St. Matthews

The KBA would like to formally congratulate president John Gardner and the team at Bank of America on all your success!

Located at 4621 Shelbyville Road, at a site that was formerly an Outback Steakhouse, the new financial center will be a more than 4,160-square-foot location with the latest technology, private offices to assist clients one-on-one, and on-site specialists, according to bank officials. Total investment in the project is estimated to be about $7 million. - Louisville Business First

The KBA would like to announce that ImageQuest LLC is now a KBA-endorsed company! ImageQuest is a Managed Security Services Provider (MSSP) that focuses on providing Information Security Advisory Services and Managed IT Services to the community banking sector.

ImageQuest helps its banking clients “sleep better at night” by assisting them with security and regulatory requirements. A bank may know what it needs to do but lacks the staff and time to do it. Or, help may be needed in prioritizing security tasks and measures, to improve security, compliance, and productivity.

Our services include Virtual CISO or ISO, Cybersecurity Risk Assessments, Operational Risk Assessments, Information Security Policies, Business Impact Analysis, Business Continuity Management and Testing, Incident Response, Vulnerability Management, Security Awareness Training, Penetration Testing, Banking Operations Consulting, and Information Technology Consulting.

kba retirement solutions | a different kind of retirement plan

When was the last time you had a trusted advisor take an objective look at one of your most important employee benefits – your employer sponsored employee retirement plan? There have always been high standards placed on 401(k) plan sponsors, made increasingly so by the passing of the Pension Protection Act of 2006. These duties include:

Understand all administrative and investment fees paid from plan assets, especially those charged directly to participant accounts, and to make sure they correspond to the services being provided.

Use appropriate due diligence and have a prudent process in place (including documentation) in the selection of vendors and investment vehicles and when implementing contractual service arrangements.

Keep an eye on the marketplace to ensure the plan provides appropriate benefits and services at a reasonable cost to the participants.

Ensure that participants understand the benefits of participation and eliminate barriers to their participation.

It is considered a fiduciary best practice to re-evaluate your 401(k) service providers at least every three to five years and compare fees and services to make sure employers and their employees are getting the best value.

New class action lawsuits are being filed with increasing regularity that allege breaches of fiduciary duties in connection with the fees 401(k) plan participants are incurring. As a 401(k) plan fiduciary, it is essential that plan sponsors evaluate fees because ERISA requires fiduciaries to act solely in the interest of participants while ensuring fees charged are necessary and reasonable.

Using our fully-integrated retirement plan program as a barometer, as well as access to national bank-specific benchmarking data, the KBA offers a free member service to conduct a no-hassle, no-commitment evaluation of your current 401(k) plan. This free evaluation would require very little input from your end and includes the following areas of concentration:

• Plan Design

• Investment Fund Lineup and Performance

• Plan Fees

• Investment Advisor

• Recordkeeper

• Employee Education

Through the State Banking Association Master Defined Contribution Trust, we are able to offer our members very competitive fees due to economies of scale with over $500+ million in combined plan assets. The SBA 401(k) plan utilizes the explicit fee model which creates transparency for participants and allows the ability to select lower share class mutual funds options (including institutional share class funds) while also still producing strong investment performances for plan participants.

We have performed several KBA member plan evaluations with eye-opening results as it pertains to Plan fees. To name just a few:

by Matt Vance, CPA, MBA Chief Financial Officer

by Matt Vance, CPA, MBA Chief Financial Officer

Is your 401(k) Plan all that it can be? Are the Plan fees being passed on to your employees necessary and reasonable? How are the funds in your Plan performing vs. marketplace benchmarks? Are there provisions that could be added to your Plan to make it more in line with ERISA requirements and Industry best practices? Are your employees getting the appropriate level of retirement/participation education?

For expert guidance on these questions and more, contact Matt today!

In the digital age, financial institutions find themselves sitting on a goldmine of data—a treasure trove with the potential to revolutionize the way they operate. From understanding consumer spending habits to predicting financial needs, institutions want to leverage that data to drive success in an ever-evolving industry.

Before delving into the multiple ways financial institutions can use data to their advantage, it’s crucial to first establish clear objectives and outcomes rather than utilizing data without a clear purpose. And, when it comes to growth, financial institutions typically focus on a few key goals.

1. Growing the Number of Primary Financial Institution (PFI) Relationships

In today’s environment, most FIs want to grow core relationships—and along with those, low- or no-cost core deposits. For solid proof, just look at recent offers from large institutions and the sheer amount of

marketing around these offers, all to lure new core relationships. Chase offers up to $900 for opening a checking and savings account. Other large national banks are offering anywhere from $500 to $3,000 to earn a variety of relationships.

The ultimate measure of success for any FI’s growth strategy is its ability to establish new PFI relationships. Our answer: Challenge yourself. If you do not currently have an always-on strategic approach to growing core relationships, adopting an always-on strategy should help you increase your new core relationships by 50% to 150%.

2. Increasing Relational Intensity

Increasing relational intensity is about cross-serving, not cross-selling. To foster growth, FIs must attract NEW consumers and deepen those relationships while also deepening relationships with EXISTING consumers and businesses.

Achim Griesel Dr. Sean PayantThe key to success is increasing relational intensity over time, with an incremental increase in product and service utilization. Based on client data, earning six or more product and/or service relationships per household is realistic, even while executing a core relationship growth strategy.

Behind every successful FI is a dedicated team. Data can help identify human performance metrics that matter and provide a framework for measuring coaching effectiveness. Your focus should be on coaching high-value activities like service behaviors, sales presentations, product knowledge, etc. It’s not just about coaching; it’s about data-driven coaching, measurement, and accountability.

Word-of-mouth referrals have always been a powerful growth tool for FIs. A customer’s desire to refer others to their FI is driven by exceptional service, with approximately 18% of openings stemming from referrals. In today’s digitized banking world, service has two key components: (1) Technology that allows people to use your digital channels with the least friction possible; and (2) The service your team members provide.

Once you determine your goals and identify key performance targets, you must drive growth. Overall success hinges on aligning successful marketing strategies with effective execution strategies.

a. Have Better Retail and Business Products

For marketing to be as effective as possible, it must be paired with compelling retail and business products. In the absence of good products, the choice will come down to access and locations.

b. Implement Intelligent Policies and Processes

For your marketing to achieve your growth goals, your policies and processes must not become roadblocks. Have you tried to open an account online with your organization? Have you recently visited one of your own branches to open an account or add a service? To be able to compete with high-incentive offers from large FIs, you must outperform them. Your service must be better, and your policies must be friendlier.

Once you’ve set your goals, evaluated your policies and processes, and implemented an ongoing training and coaching plan, it’s time to market.

Identifying the right audience is critical in marketing. Before we determine which marketing channels will be most effective or what an omni-channel mix should look like, we help FIs use data modeling to discover the right audience. Effective targeting begins with learning from your existing data. It’s also important to look at further data to help refine your target audience. For example: When it comes to core relationship growth, we have found that drive pattern and trip frequency concluded from GPS-based device metrics within your branch footprint can be powerful predictors for highprobability prospects.

The right marketing channel is the one that’s in front of your prospective customer. That starts with (1) Traditional marketing, utilizing your branch locations as effective messaging tools, and highly targeting the prospective customer through one-on-one print solutions. This is then supported by (2) Opt-in emails such as USPS Informed Delivery and (3) Digital marketing tactics that allow for the highest level of targeting.

What is the right frequency? Today, when large FIs market at least every six weeks, your frequency must be higher if you want to hold your results at the same level. This not only applies to traditional marketing but digital marketing as well.

The modern banking landscape is defined by datadriven strategies. To achieve sustainable growth, FIs must harness the power of data.

By aligning marketing efforts with intelligent processes, employee training, and data-driven decision-making, FIs can drive growth and success in the competitive world of banking, thus positioning themselves at the forefront of the data-driven revolution.

Achim Griesel is President and Dr. Sean Payant is Chief Strategy Officer at Haberfeld, a data-driven consulting firm specializing in core relationships and profitability growth for community financial institutions. Achim can be reached at 402.323.3793 or achim@haberfeld.com. Sean can be reached at 402.323.3614 or sean@haberfeld.com.

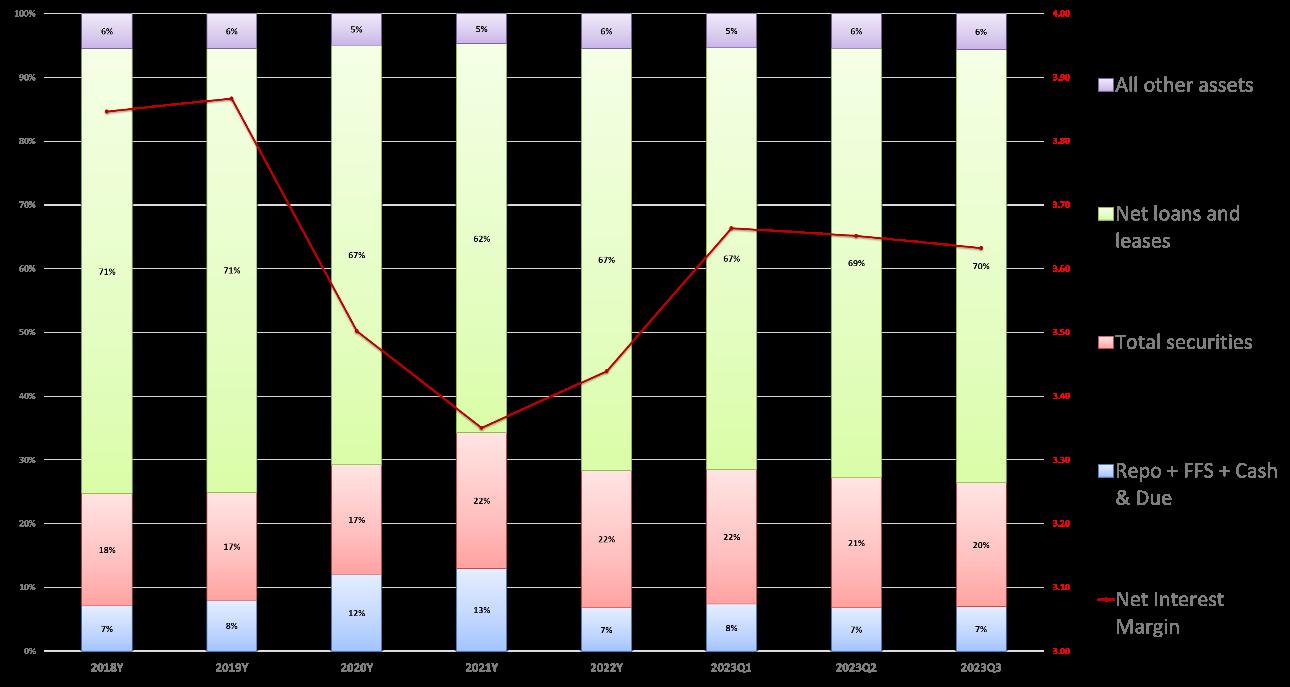

The rising rate cycle has been challenging for financial institutions for several reasons, with Net Interest Margin (NIM) and profit volatility being top of list for many bankers. Challenging waters lie ahead for institutions as the yield curve remains deeply inverted and the Federal Reserve signaling potential for monetary policy adjustments. The industry has experienced significant NIM volatility over the past 5 years, mainly due to a rapidly shifting interest rate environment. With rate cuts penciled in for 2024 and potential yield curve volatility, a fresh approach to ALCO can help provide stability for NIM and profit going forward.

Why Must We Reprioritize the NIM?

Most institutions are heavily net interest income dependent, so net interest income drives the lion’s share of profitability. The median community institution’s net interest income dependency is 88%, meaning net interest income represents 88% of aggregate revenue. Since 2018, we have observed significant NIM volatility

related to asset/liability mix changes, interest rate cycles and optionality. Those institutions with higher net interest income dependency have felt more profit volatility.

The ALCO process has evolved over time as interest rate risk modeling has become more complex and regulatory expectations continue to rachet up. However, all too often we find that ALCO is simply an exercise in regulatory appeasement: reviewing reports, regurgitating ratios, checking the minimum regulatory boxes. Many times, ALCOs get caught overweighting certain areas: the economy, loan and deposit pricing, interest rate risk reports, or investments. While regulatory appeasement and these items merit inclusion in ALCO, what is often missed is utilizing ALCO as a profit center. What if decisions and strategies at your ALCO improve and or stabilize profitability? Can effective strategies move the NIM by 10bps? What could that equate to in dollars? For a $500MM institution, NIM improvement of 10bps can translate to $500,000 in pre-tax income.

Net Interest Margin is the ultimate scorecard for your ALCO, and we have found strong correlations between highly effective ALCO processes and higher, stable NIMs over time. When you think about your ALCO membership…the ALCO meeting may very well be the most expensive meeting for your institution. Not just from the human capital expense, but also from the strategies that can make or lose money for your institution. “Balance Sheet Management” varies greatly from other approaches to ALCO. Interest Rate Risk Management and Asset Liability Management are terms often used interchangeably with Balance Sheet Management, but in reality these approaches produce very different outcomes over time. Balance Sheet Management is the most comprehensive of the three and is where position assessment and strategy execution meet. Assessing risks and opportunities through the lens of the entire balance sheet helps to craft unique strategies to protect and to expand the NIM. For example:

• Are you growing market share with your loan pricing strategy? Do you have a loan strategy?

• How do loan structure and pricing decisions impact interest rate risk and liquidity?

• What effect do deposit pricing strategies have on marginal cost of funds?

• How can you utilize your investment portfolio to manage liquidity, interest rate risk, and expand income?

• How does robust capital stress testing impact contingency funding planning?

These are all examples of topics often missed at average ALCOs that cost your institution basis points at a time when institutions desperately need more basis points for earnings. Your peers with highly effective ALCOs are leveraging their meetings, having these discussions, and executing strategies that come from each session.

HUB | Taylor Advisors’ Take: Interest rate volatility in 2024 will lead to more Net Interest Margin volatility. As such, your ALCO approach and process will be critical for ensuring budget and stretch goals are achieved. Many institutions may have the talent internally to run reports and aggregate an ALCO packet; however, an independent facilitator can bring powerful perspectives, best practices, and strategies to squeeze basis points out of your balance sheet. The ALCO packet is not just a document that gets approved by the Board of Directors, but rather a unique word problem that deserves custom crafted strategies for risk management and profitability to optimize your balance sheet!

An Associate Member of KBA, HUB|Taylor Advisors provides consulting and advisory services in the areas of ALCO, capital, liquidity, interest rate risk and investments to community-based financial institutions throughout the country. To learn more, visit www. tayloradvisor.com or contact Todd Taylor at todd.taylor@ hubinternational.com and Omar Hinojosa at omar. hinojosa@hubinternational.com.

Community banks, often at the heart of local economies, find themselves at a crucial juncture where their approach to risk management, particularly in cybersecurity and operational resilience, could determine their future success or vulnerability.

Whether your regulator is the OCC, the FDIC, and DFI, or the FRB, you will likely face a heightened focus during your next exam on how you manage and mitigate risks, making this cycle a pivotal moment for your bank. This article draws on our firsthand experiences with community bank clients across recent examinations to shed light on emerging regulatory trends. By sharing insights into the specific focus areas we have noted during this exam cycle, from business continuity to cyber expertise, we offer a roadmap for your bank to effectively prepare for your next exam.

The goal is not just to prepare for the scrutiny of the next examination but

to foster a culture of proactive risk management that safeguards your bank’s future in an increasingly uncertain world.

Examiners have asked detailed questions about business continuity management (BCM), specifically how your bank tested your plans and the results of those tests. But more than that, examiners wanted to know that management regularly presented the results to the bank’s board. Examiners asked for documentation detailing when management presented BCM testing results to the board.

Examiners wanted to see that management had done more than summarize BCM into a paragraph in the annual Information Security report. They wanted clear evidence that BCM planning and subsequent testing were presented to the board as a detailed report – and discussed thoroughly by management.

What does that mean for you? First, you should prepare a testing calendar at the beginning of the year that details your planned BCM tests. Then, regularly update the document throughout the year, detailing test results, observed issues, and relevant remediation activities. Lastly, share that information with the board or an appropriate board committee.

Examiners have also asked what and how often management reported to the board - specifically about cybersecurity and IT operations - and how well directors grasped essential issues.

Examiners’ questions focused on whether bank directors read their banks’ annual Information Security reports and asked relevant questions of management. There were questions about the IT Strategic Plan, how recently it was updated, and what visibility the board had in the process. It is part of a board’s governance responsibility to approve the IT Strategic Plan, which should include the directors being familiar with its contents.

Given the current cybersecurity landscape, it is vital to have regular conversations with your directors about their IT and cybersecurity governance responsibilities. Not just once a year but an ongoing dialogue.

You will want to ensure you have identified any systems for which it is difficult or impossible to build a redundant operational strategy (e.g., hosted core processor, SaaS-based LOS). Ensure your board clearly understands that if the provider is hard down for these identified systems, you are hard down, too. No one expects your bank to have a “backup” core processor, but examiners expect the board to know which systems or vendors present that risk.

Of course, your board understands this for vendors like your core processor – but do your directors understand how your bank could be impacted if other vendors were to have an extended outage? Take your ATM or ITM vendor, for example. Last year, a regional service provider’s issue affected thousands of supported devices across hundreds of banks. What would you do if your ATM/ITM service provider has an outage that takes all of your ATMs or ITMs offline?

What is your process to respond to customers needing to transact with your bank if one of these services or vendors is unavailable? Has management discussed this with your board? Do your directors know which

of your other vendors could significantly impact bank operations? And do they know how your bank would adapt to that situation?

Elevating Vendor Due Diligence

You already know you must be able to demonstrate how you assess your vendors and their controls. But are you looking at the complementary user entity controls in your critical vendors’ SOC 1 and SOC 2 reports? Are you reviewing each of those and ensuring your bank has the specific controls in place? This has always been an expectation, but recently, examiners are diving deeper and asking for more and better evidence that you regularly evaluate these risks.

In one specific bank, an examiner questioned the competence of the bank’s IT Manager for the role. The examiner was concerned that the person had been doing that job for several years but had not kept pace with appropriate professional development.

You should ensure your IT management staff have adequate expertise in the technologies your bank employs. That may sound simple, but if the board and senior management have little or no technology expertise, it may be difficult for the bank to supervise the IT staff effectively. You must ensure they continually update their knowledge and expertise as the cybersecurity landscape evolves.

The concern is valid. Bad actors continually refine their attacks and improve their methods, and you need to expand your security approach commensurately. Systems and expertise that were adequate five years ago may no longer be enough to thwart a sophisticated attack.

Your management team – and your board – need to understand that and be willing to address aging approaches that may be creating vulnerabilities.

As regulatory bodies intensify their focus in these areas, it is imperative that banks prepare for heightened scrutiny and view these examinations as a catalyst for strengthening their operational foundations. By prioritizing comprehensive business continuity planning, enhancing board oversight, and rigorously managing third-party risks, your bank can not only navigate the complexities of the current regulatory environment but also lay a solid groundwork for sustainable growth and resilience.

With new loan originations, one-year or longer termed Advances can be priced as low as FHLB’s cost of funds through our Economic Development and Community Investment programs

Many projects qualify by geography and census tract

Get approval now and use funding up to 12 months later

Residential, multifamily and commercial projects can qualify in communities where average resident income reaches up to 115 percent of HUD-defined Area Median Income (AMI) limits

If you have new loan originations, check to see if you qualify for a discounted Advance Contact your FHLB relationship manager or visit www fhlbcin com to learn more!

Bank-Owned Life Insurance (BOLI) Non-Qualified Benefit Plans to provide BOLI consultative services.

BCP is steadfastly committed to serving Kentucky’s community banks, and we are privileged that our clients include 10 of the past 11 Chairs of the KBA.

T o learn more about how BOLI can improve core financials or h ow no n-qualified benefit plans can secure t op talent, contact Lou and Lon at Banc Consulting Partners.

Lou Moore MANAGING PRINCIPAL

440.356.8860 PHONE 216.789.8889 MOBILE lmoore@yourbankpartner.com

Lon P. Haines MANAGING PRINCIPAL

267.773.7617 PHONE 856.577.7305 MOBILE lphaines@yourbankpartner.com

Fraud Academy is a pioneering initiative designed to arm bankers with the skills needed to detect and combat fraud. Our unique program features insights from experts across the DEA, FBI, law enforcement, AARP, and the financial industry, offering a robust education in fraud prevention from those who know it best.

With fraud costing every bank valuable time and money, our curriculum targets over eighteen types of fraud, including check fraud, elder fraud, cybercrimes, and introduces effective prevention tools. Equipping bankers with the knowledge to minimize fraud-related losses and protect your institution’s bottom line.