1 minute read

Texas Land Markets Third Quarter

FIND ANOTHER GEAR! TEXAS LAND MARKETS THIRD QUARTER—2019 Texas Land Markets

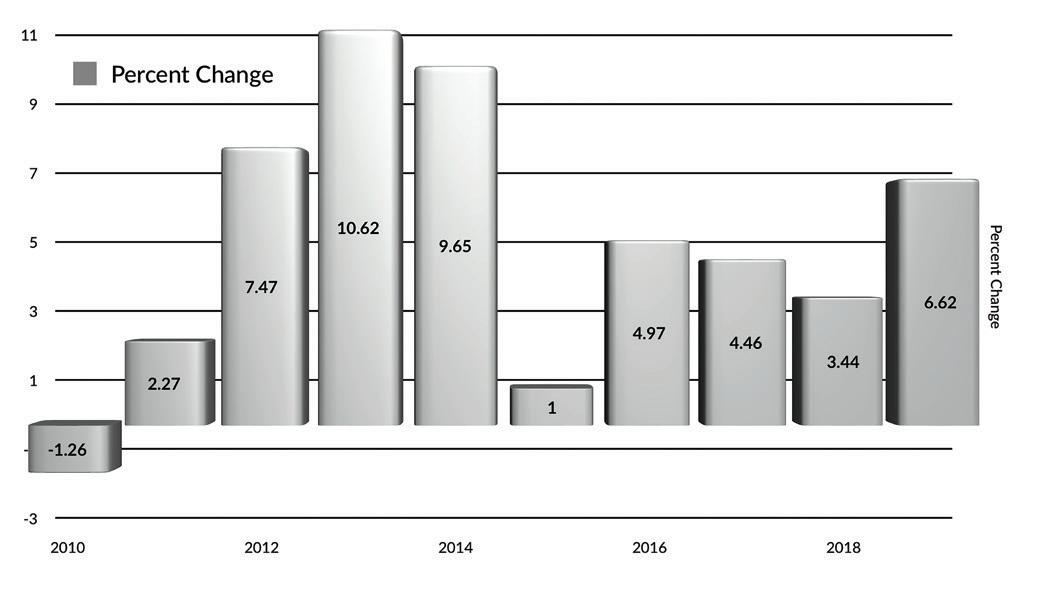

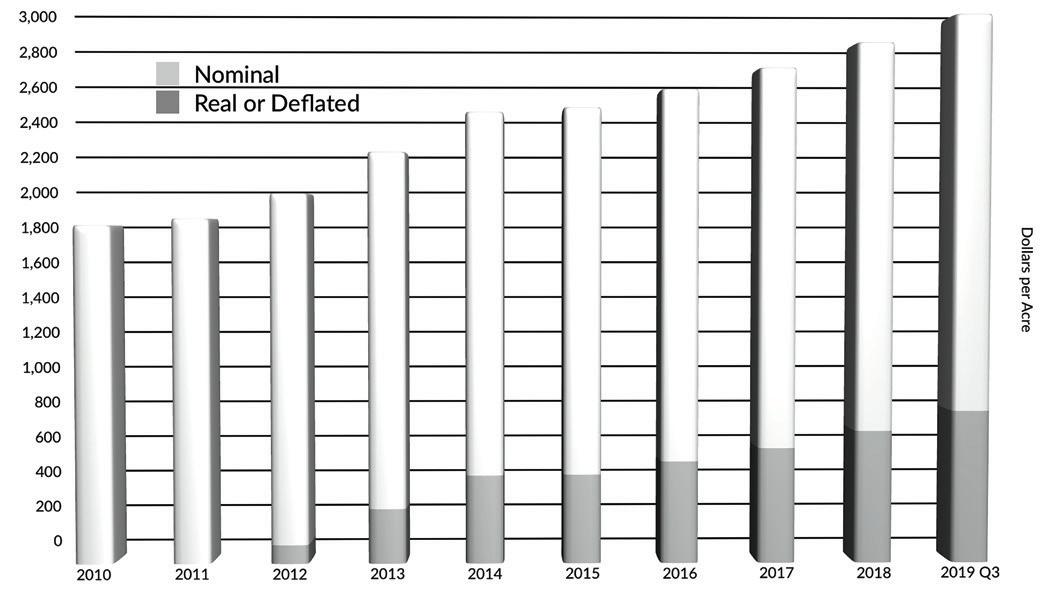

Robust economic activity, buoyant oil prices and falling interest rates pushed Texas land prices up 6.6 percent as the preliminary third-quarter price reached $2,930 per acre by the end of September. Investors flocked to the high plains, and recreational users continued to buy rural properties. However, the typical size fell 23.6 percent to 1,241 acres continuing a trend to smaller acreages. Never-the-less, total dollar volume expanded to $1.4 billion driven by an increase in acreage to 478,913 acres. All of that was accomplished with 5,576 sales, well short of the 6,198 in 2018. Together these statistics point to sales of some very large acreage properties. The statewide Texas land market has reached a new vigorous high with positive price trends. Statewide results reflect positive price growth in most regions. The Panhandle and South Plains continued to post strong price growth, driven by investment buyers. Reflecting the strong economy, Northeast Texas prices climbed nearly 10 percent while the Central Texas— Hill Country and Gulf Coast—Brazos Bottom markets produced 14 and eight price growth respectively. West Texas prices perked up to a seven percent growth rate. However, South Texas prices remained stagnant posting a one percent decline. Far West Texas prices slumped 19 percent, but volume soared to nearly double the normal acreage, sending total dollar volume sharply higher. These results suggest active markets with strong upward pressure on prices for most regions. As the Fall begins, a growing gaggle of economists have begun to see cracks in the recovery that began in 2009. Despite the perceived headwinds, Texas posted record growth in personal income. Oil field activity has slowed somewhat but continues in the Permian at a rapid pace, producing high prices for large acreage ranches. Investors still desire farmland. Slower economic growth seems destined to appear sometime in the future. So, the Fed appears set to cut interest rates further. Therefore, barring some unforeseen event such as a war with Iran or a political storm, markets should continue to thrive.

Source: Real Estate Center, Texas A&M University Story By Charles E. Gilliland, Ph.D. Research Economist | Real Estate Center | Texas A&M University