DESTINATION

OLYMPIA

SEE PAGE 6

Adapting and Thriving

The Future of Office Space

2024: The Year of the Landlord?

Ground Rents Reform

What is the Future of the PRS?

Top European locations to Invest in

SEE PAGE 6

Adapting and Thriving

The Future of Office Space

2024: The Year of the Landlord?

Ground Rents Reform

What is the Future of the PRS?

Top European locations to Invest in

The warmest of welcomes to the first LI Mag of 2024. It looks like it's going to be quite a year for the PRS.

The Renters' Reform Bill in finally heading towards legislature and it looks like we'll have a general election before the year's out as well. The polls are predicting a landslide victory for the opposition, but what will that mean for the Private Rented Sector? Preparation is the key word on everyone's lips, and the first Landlord Investment Show of the year at Olympia London is geared heavily towards it, with panel sessions including Landlords, are you really ready for 2024(?), a Landlords Open Forum, plus innumerable exhibitors and expert seminars. Back to the mag we have some great content for you to digest. Reece Mennie ponders the Trends shaping commercial property investments in The Future of Office Space. Staying with the theme of investment and the current landscape, Jeni Browne asks is 2024 The Year of the Landlord? In a special outlook piece Paul Shamplina suggests how to keep Adapting and thriving with The 2024 guide for landlords navigating market shifts. Also in Outlook Mark Chick examines The Need for Ground Rents Reform and Peter Littlewood asks What is the Future of the PRS? We have a South West Spotlight featuring CJ Hole in The Bristol Agent and a Home Safety Spotlight with Aico - Enhancing Fire Safety through Accessible Alarm Controls. I'll also be shining the Professional Spotlight on Peter Licourinos, Founder of HMO Premier and winner of the 2023 LIS Award for Best HMO Services Provider. Finally we wrap up with a great international piece by youroverseashome Top European locations to invest in. There's no shortage of issues to consider there, and I trust this issue of LI Magazine helps you on your property investor journey.

TH

Show Update

Destination Olympia

Investment

The Future of Office Space

Investment

2024: The Year of the Landlord?

Home Safety Spotlight

Enhancing Fire Safety through Accessible Alarm Controls

Outlook

Adapting and thriving: The 2024 guide for landlords navigating market shifts

Outlook

The Need for Ground Rents Reform

Outlook

What is the Future of the PRS?

South West Spotlight

The Bristol Agent

Five Questions

Q&A with Mr Investa

Professional Spotlight

Tracey Hanbury interviews Peter Licourinos

International

Top European locations to invest in

Editor

LANDLORD INVESTOR MAGAZINE

Tracey Hanbury

Design

Marc Riley

Social Media

Charlotte Dye

Printing

IOP Marketing

www.landlordinvestmentshow.co.uk | Follow us on...

PLEASE NOTE: The National Landlord Investment Show, LIS Media and Landlord Investor Magazine are content aggregators only. Views, statements and opinions expressed in articles, reviews and other materials herein are those of the authors, exhibitors and third-party contributors and not the editors and publishers of LI Magazine. Under no circumstances does the content of this publication constitute investment or legal advice. We do not undertake to advise individuals or organisations upon investment strategy. All investments should be approached with caution under professional guidance. While every care has been taken in the compilation of this publication and every attempt made to present up-to-date and accurate information, we cannot guarantee that inaccuracies will not occur. LIS Media Limited and our contributors will not be held responsible for any claim, loss, damage or inconvenience caused as a result of any information within these pages or any information accessed through the promoted links. Published by LIS Media, Registered address: Foresters Hall, 25-27 Westow Street, London SE19 3RY. © 2024 LIS Media Ltd.

Team: Donegal GAA

Song: Galway Girl, Steve Earle

Film: Dirty Dancing

Food: Indian

Likes: A busy show - can’t beat it

Dislikes: Rudeness

Fave thing about LIS: Building client relationships

Team: Manchester United

Song: Bonkers, Dizze Rascal

Film: American Gangster

Food: Indian

Likes: Family time, Man Utd, golf (not necessarily in that order)

Dislikes: Tinned sweetcorn

Fave thing about LIS: No day is the same (hence the song choice)

Team: Spurs

Song: The view from the afternoon, Arctic Monkeys

Film: E.T

Food: Chinese

Likes: Anything four legged and furry

Dislikes: Clowns and Spiders

Fave thing about LIS: Office cuddles with Ollie

Team: Barcelona FC

Song: Hotel California, The Eagles

Film: Shawshank Redemption

Food: Anything Spanish (I'm very biased lol)

Likes: Cooking great food

Dislikes: Liars. Oh, and liver (can't stand it)

Fave thing about LIS: Socialising with the whole team

Team: Millwall

Song: Never too much, Luther Vandross

Film: Carlito’s way

Food: Italian

Likes: Friends and family, also the pub

Dislikes: People who wear shorts in winter

Fave thing about LIS: Socializing with the Team and clients

Team: Crystal Palace

Song: Plastic Dreams, Jaydee (Original)

Film: Goodfellas

Food: Indian

Likes: Team meetings in the pub

Dislikes: Bad manners

Fave thing about LIS: Show day (as anything can happen)

Team: Letterkenny Gaels

Song: What’s going on, Marvin Gaye

Film: Anything by the Coen Brothers

Food: Sea

Likes: Clean typography

Dislikes: Paywalls and clickbait

Fave thing about LIS: The website

Team: Manchester United

Song: Brown eyed girl, Van Morrison

Film: Meet the Parents

Food: Italian

Likes: Hitting a nice drive on the fairway (not!)

Dislikes: Salad

Fave thing about LIS: Meeting new clients and building rapport

Team: Crystal Palace

Song: Michael Bibi - Got the Fire

Film: Step Brothers

Food: Sunday roast

Likes: Skiing, Gym, Crystal Palace

Dislikes: Dirty finger nails

Fave thing about LIS: Great atmosphere at the shows

Team: Crystal Palace

Song: Who let the dogs out

Film: 101 Dalmatians

Food: Roast Dinners

Likes: Walkies

Dislikes: Poo in bags left on branches

Fave thing about LIS: Getting all the attention

100+

50+

TRACEY HANBURY EDITOR & SHOW FOUNDER

TRACEY HANBURY EDITOR & SHOW FOUNDER

Iappreciate this column always seems to begin with exasperation of some form, but I genuinely can't believe our first 2024 show on March 6 is almost upon us! As you have probably gathered by now dear reader, we're returning to our old London home at Olympia for the first Landlord Investment Show of 2024 on March 6. Now in its 11th year, the show features a packed schedule. The roster includes 50+ seminars, offering the latest insights and advice on everything from tax and finance through to investment opportunities, training and more. As always, you’ll have the opportunity to network extensively with likeminded professionals and peruse the 100+ exhibitors showcasing the latest products and services for helping your property investment journey.

With the Renters’ Reform Bill heading towards legislature, we have a plethora of seminars and panel sessions on the subject. Doors open at 8.30am, giving landlords a great chance to network with exhibitors and property professionals before the ever-popular morning panel debate begins in the auditorium at 10.15am. Hosted by TalkTv’s Ian Collins, and with the pertinent title ‘Landlords, are you really ready for 2024?’, a panel of industry experts will discuss how a general election may impact the UK property market, and why preparing for factors such as the abolishment of section 21 &

Fixed Term Contracts is now a matter of urgency for private rental landlords. Ian Collins (TalkTv) commented…

"To be asked to host this panel session for the National Landlord Investment Show is a real privilege. Debates and discussions around the subject of property have hugely accelerated in the last few years, so to be at the very heart of this event will be both a joy and an education"

From 12.00 to 12.30 ‘Property Mastermind’ presented by Paul Shamplina (Landlord Action) tests the knowledge of three guest landlords by asking as many questions as possible within a minute and a half, all on the subject of property. This is going to be a great new addition to the show and the winner will go into the Property Mastermind final at the National Landlord Investment Show finale in October 2024.

Between 14.00 & 14.45 we continue the theme with ‘Landlords Open Forum’ Hosted by Peter Licourinos of HMO Premier, this is a landlord advice forum focusing on tax, finance, HMO, legal, Investment and more. If you're a landlord or investor make sure you attend this session to get your questions answered.

As ever, the National Landlord Investment Show is dedicated to helping landlords and investors make informed decisions in a rapidly changing market. Whether you're an experienced landlord looking to expand your portfolio or just starting out, the National Landlord Investment Show offers a wealth of information and opportunities to help you succeed and is a must-attend event.

Register now for your free show tickets at www.landlordinvestmentshow.co.uk. We look forward to seeing you there.

THThe Renters’ Reform Bill is heading towards legislature now and we have a plethora of seminars and panel sessions on the subject.

REECE MENNIE FOUNDER & CEO, HJ COLLECTION

REECE MENNIE FOUNDER & CEO, HJ COLLECTION

It’s no secret that the Covid-19 pandemic changed the way we work. With at-home offices and hybrid schedules now the norm, Hays found that less than half – 43% – of the UK’s desk-bound workforce comes in full time. Meanwhile, the BBC reported that 74% – almost three quarters – of our nation’s business professionals physically come into work for just two days or less, leaving employers with a difficult decision. Should they keep paying for large, premium spaces in the centre of our cities, sell up altogether, or move into smaller, serviced buildings that can better accommodate the needs of a modern workforce?

According to the BBC, the average company is currently downsizing by about 30-40% compared to pre-Covid levels, leaving an overwhelming square footage of office space vacant around the country. Indeed, property analytics company CoStar estimates that Covid has more than halved demand, with a 65% reduction in rental uptake leaving commercial landlords with a hefty 102 million square feet of unprofitable property on their hands.

One could be forgiven for thinking that – with conversations surrounding a return to the office on the rise and the worst of the pandemic hopefully behind us – by 2024, this downturn in commercial activity could show signs of reverse. Nevertheless, for the next few years at least, we should expect a continuation of the current trend, since many companies are simply waiting for their present leases to be up before they, too, downsize. A good case in point is HSBC, which, in June this year, announced plans to abandon its 45-storey headquarters in Canary Wharf for a much smaller, more central building in 2026.

It all seems like a terrible waste of space when you consider that we are in the midst of a housing crisis likely to see millions of households struggle to find decent homes. Indeed, the latest reports from This is Money show that

the UK has a backlog of 4.3 million houses, which Bloomberg estimates would take almost eight decades – or until the year 2100 – to fix. Younger populations appear to be the worst off, with university towns suffering a marked shortage of student housing and almost three million five hundred thousand 20- to-35-year-olds still living with their parents, according to the ONS. For many, this is not so much due to a lack of desire to move out but rather down to the dearth of quality, affordable housing available to them if they do.

Far from an isolated case, the housing shortage is affecting all demographics within our population. Indeed, plenty of families, senior citizens and seasoned professionals are in desperate need of new homes, too – and rental prices are only going up as a result, making the exploration of residential pursuits increasingly profitable.

Whilst a property landscape marked by both an abundance of commercial space and a corresponding lack of residential housing might seem absurd, it is precisely in this imbalance that huge, untapped opportunity to turn things around for both occupants and investors lies. Nobody wants to see office buildings sitting vacant –and research from the CRBE suggests that by converting empty office space into residential housing, we could create an additional 28,000 homes in London alone.

In 2021, the government introduced new legislation to make converting former office spaces into multifamily residences much simpler, too. New permitted development rights now allow developers to take advantage of otherwise underutilised regeneration opportunities on a larger scale, furthermore facilitating a faster turnaround-time on project builds. For investors, commercial to residential property conversions are an excellent opportunity for investors to generate reliable, sizable income in an otherwise fluctuating property market.

The housing shortage is affecting all demographics within our population. Indeed, plenty of families, senior citizens and seasoned professionals are in desperate need of new homes, too – and rental prices are only going up as a result, making the exploration of residential pursuits increasingly profitable.

The current juxtaposition of empty office spaces against a critical housing shortage presents an exceptional opportunity for action. As we move forward from the disruptions caused by the pandemic, it is crucial to realign our strategies and repurpose these unoccupied commercial areas into vibrant residential communities. Legislative changes introduced by the government serve as a clarion call for investors and developers to reshape our urban landscape, converting former symbols of business into beacons of housing relief. This transformation is more than an astute financial decision; it's a stride towards social betterment, ensuring that every square metre is utilised to its fullest potential in serving the community's most pressing needs. In this new era, our constructions must serve not solely the interests of capital but the welfare of the populace.

" A d o m i n a t i n g d e v e l o p e r w i t h a r o o t e d p u r p o s e t o c o n t r i b u t e t o e a s i n g t h e h o u s i n g s h o r t a g e t h r o u g h g r e e n e r p u r p o s e s . "

H J C o l l e c t i o n i s a s p e c i a l i s t d e v e l o p e r w h i c h s p e c i a l i s e s i n l e v e r a g i n g P e r m i t t e d D e v e l o p m e n t R i g h t s t o t r a n s f o r m u n l o v e d c o m m e r c i a l b u i l d i n g s i n t o s o u g h t - a f t e r r e s i d e n t i a l d e v e l o p m e n t s w i t h i n t i e r 2 a n d 3 c i t i e s a c r o s s t h e U K . H J C o l l e c t i o n h a s e v o l v e d i n t o a r e p u t a b l e a n d d e p e n d a b l e p r o p e r t y d e v e l o p e r w i t h a p r o v e n t r a c k r e c o r d o f s u c c e s s .

0207 117

46%

£80m+

650+ AVERAGE UPLIFT

TOTAL GDV

TOTAL UNITS

Up to 17% passive income a year

Fixed-term

Fixed-returns

No fees

FCA-regulated security trustee

UK asset-backed

Phone: 0207 117 2583

Website: www.hjcollection.co.uk

UK:

BRINGING YOU DUBAI’S

LEADING PROPERTY INVESTMENTS

OBTAIN A DUBAI GOLDEN VISA

DUBAI INVESTMENT OPPORTUNITIES

2ND SAFEST CITY IN THE WORLD

7%+ AVERAGE RENTAL YIELDS

ATTRACTIVE VISA PROCESS

TOP 5 CAPITAL GROWTH

JENI BROWNE SALES DIRECTOR, MFB

JENI BROWNE SALES DIRECTOR, MFB

Sales Director and BTL landlord Jeni Browne discusses what to expect from mortgage interest rates, property prices, and rising rents in 2024, making this the essential read to start the year.

Like many of our landlord clients and peers, I was more than happy to see the end of 2023. As an industry, we endured ongoing market volatility, with consecutive Base Rate rises, a new influx of tricky legislation to navigate, and increasing costs across the board.

What we all need desperately from this year is stability and a positive outlook –which, I’m delighted to say, is what we expect.

What to expect from mortgage interest rates

The Bank of England keeping the Base Rate at 5.25% for three meetings has brought confidence back to UK money markets. Early January saw SWAP rates drop significantly, with 5-year SWAPs falling to 3.36% and 2-year SWAPs hovering slightly higher at 4.04%. As a result, many lenders introduced rate reductions, offering borrowers more competitive rates.

However, at the time of writing, SWAP rates were creeping up again in response to wider geopolitical unrest, so those aforementioned reductions may be adjusted back up quickly.

However, many expert economists still expect we will see at least two, possibly three, Base Rate decreases in 2024, with the first expected as early as the summer, with BBR down to 4.5% by December. Until then, we’ll see slow but steady reductions in mortgage interest rates.

Over 2023, we saw an annual house price drop of -2%, primarily due to rising interest rates, tightening buyer appetite and the broader cost of living crisis placing a hold on purchase

activity. This is far less than the 10% crash many news outlets predicted at the start of 2023!

This year, mortgage rates will continue to drive property prices, and there are currently split opinions on where this will leave us in terms of property price growth. Whilst Halifax expect house prices to decline between 2-4%, Nationwide are slightly more optimistic, expecting prices to remain unchanged.

It's important to remember that buy to let is a long-term investment, and while capital gains might be slow these next couple of years, the experts at Savills anticipate an 18% increase by 2029.

Zoopla’s latest Rental Market Report showed that, despite the number of homes available to rent up 20% year-on-year, rental supply is still 30% below average for the time of year. Consequently, this ongoing supply and demand imbalance will continue to provide landlords with the high yields we have become accustomed to.

The UK’s political landscape

Several political factors may impact the mortgage market, although we can’t be entirely sure to what extent. Landlords will be closely watching the upcoming general election, which is expected to be held in the Autumn.

Based on current opinion polls, we could see a Labour government by the end of the year, who are likely to move quickly to pass their Renters’ Charter if the Conservative Renters’ Reform Bill has not gone through already. Therefore, it is more essential than ever for landlords to stay informed about upcoming legislative changes to protect their property investments.

We are about to enter a new era for the private rental sector. Landlords are currently in a great position to bolster their existing portfolios and acquire new property investments. With interest rates still likely to soften, property prices stable, and rents predicted to rise, 2024 could be the Year of the Landlord.

Many expert economists still expect we will see at least two, possibly three, Base Rate decreases in 2024, with the first expected as early as the summer, with BBR down to 4.5% by December. Until then, we’ll see slow but steady reductions in mortgage interest rates.

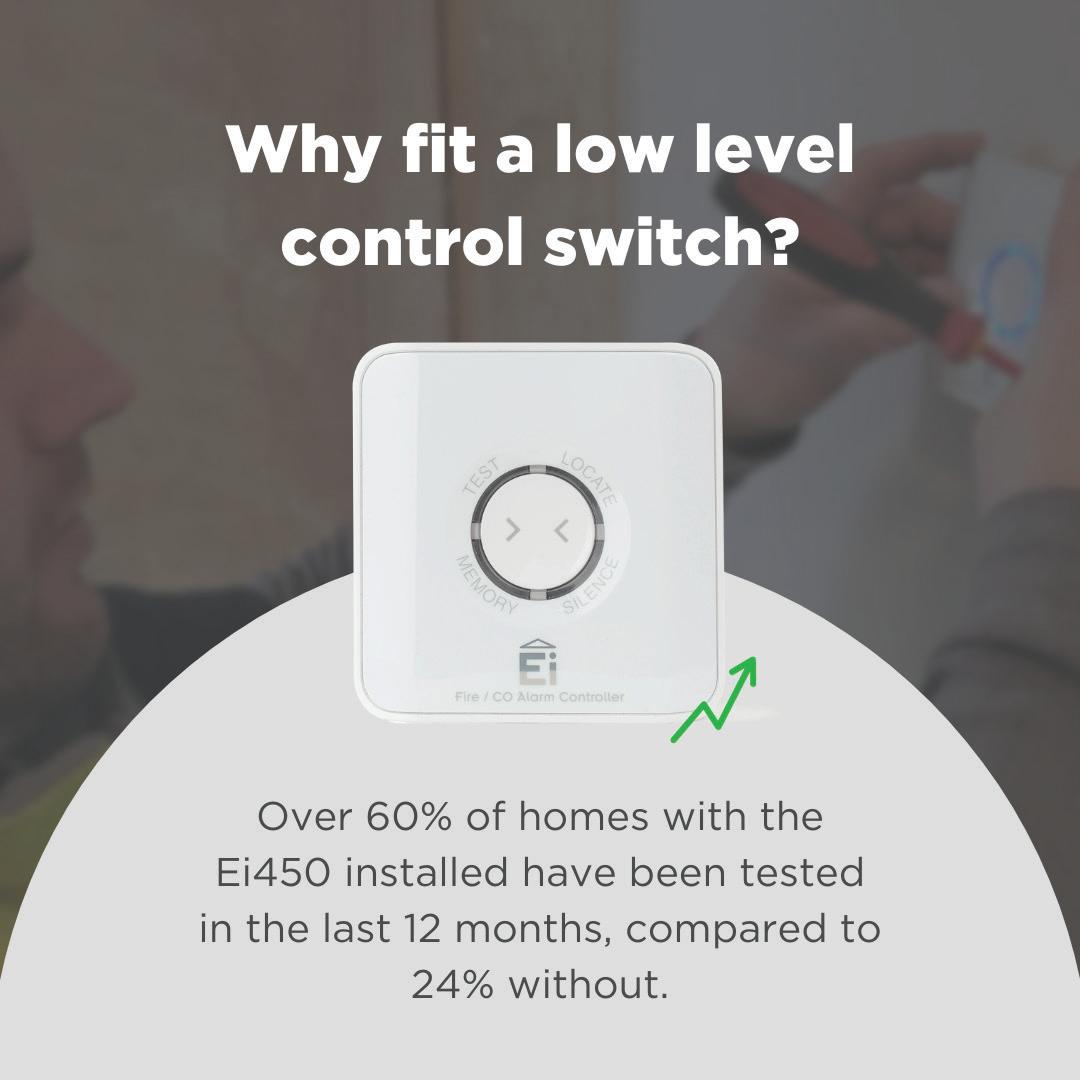

Smoke and Carbon Monoxide (CO) Alarms play a crucial role in early fire detection, however, accessibility to these alarms can pose a challenge for individuals with physical limitations or when alarms are installed in hard-to-reach locations. Low-level Smoke and CO Alarm controls, like Aico’s Ei450 RadioLINK Alarm Controller, provide an efficient solution to these challenges.

Low-level control switches provide occupants with accessible control over their alarm systems, enabling them to test, locate, and silence alarms from a convenient location. This feature is particularly beneficial for individuals who may struggle to reach high-mounted alarms or those with limited mobility. Low-level switches offer a simple method to identify the sounding alarm in the event of activation, especially crucial in homes equipped with a combination of Smoke and CO alarms.

While regular alarm testing is essential for ensuring proper functionality, recent data reveals a concerning trend. A study of over 50,000 homes, predominantly social housing, connected using HomeLINK technology, indicated that only half of the properties had alarms linked to low-level control switches. This disparity in accessibility resulted in a striking difference in alarm testing behaviour. Over 60% of homes with low-level control switches tested their alarms at least once within the past year, with this number decreasing dramatically to 24% in homes without these switches.

This data highlights a critical issue: the lack of engagement with fire safety measures among occupants of homes without low-level control switches. The 75% non-testing rate suggests that homeowners may not be adequately aware of the potential dangers posed by fire hazards and may not be taking necessary precautions to protect themselves and their loved ones.

The over 60% testing rate in homes with low-level control switches demonstrates the positive impact of accessible alarm testing. By facilitating regular testing, these switches educates the occupier to recognise the different sound patterns that Fire and CO Alarms make.

Encouraging occupants to think about fire safety and Prompting them to consider potential fire hazards, develop escape plans, and discuss fire safety measures with family members.

Statistics published by the Home Office reveal that most fatal domestic fires occur in properties with either no or non-functioning Smoke Alarms. While occupants in homes with working alarms are undoubtedly safer, the data suggests that those who actively test their alarms will have an even higher level

of protection. Regular testing indicates a heightened awareness of fire risks and a willingness to take additional steps for home life safety.

Removing barriers to enable participation and engagement is a common theme in various aspects of life, low-level Smoke and CO alarm control switches represent a successful example of barrier removal in the realm of domestic fire safety. The data overwhelmingly supports the positive impact of these switches on alarm testing.

JOIN THE UK’S MARKET-LEADIN MANAGEMENT COMPANY.

W

e n e r gy m a r k e t .

A

w i t h o u r consolidated billing service a n d o n e

p a y m e n t .

F r o m v o i

Be Smart

We're dedicated to our nationwide smart meter rollout, eliminating the hassle of meter readings. Cutting admin costs as well as o ering personalised products for you.

Be

Huddle's environmental commitment is at its peak. All our properties are powered by 100% renewable energy, and for every new house connected, we plant a tree.

Huddle and TruEnergy thrive amidst the energy crisis. We secure energy for all properties upfront, shielding you and tenants from price uctuations or supplier risks.

PAUL SHAMPLINA FOUNDER OF LANDLORD ACTION & CCO OF HFIS GROUP

PAUL SHAMPLINA FOUNDER OF LANDLORD ACTION & CCO OF HFIS GROUP

As the year unfolds, the private rented sector will continue to evolve, revealing both more complexity and more opportunities for landlords than ever before. Paul Shamplina, a seasoned expert in the sector with over 25 years’ experience helping landlords with problem tenants, and dual roles as the Founder of Landlord Action and Chief Commercial Officer at HFIS, shares his insights into how landlords can successfully navigate the labyrinth that is 2024’s rental market.

From the outset, it was clear that 2024 would bring a mixed bag of challenges and changes. One change that has brought significant relief for landlords is the Government's decision to postpone the ban on Section 21 eviction notices until the HM Courts & Tribunals Service are fully equipped to address delays in the possession process. This move underlines a shift in the Government’s thinking and an acknowledgement of the vital role landlords play as housing providers.

The phrase "housing providers”, resonates profoundly with me and I think accurately reflects what the majority of landlords are. Despite the term ‘landlord’ having acquired negative connotations, it’s important to recognise that the vast majority of the 2.74 million landlords are diligently supplying an excellent and desperately needed service, especially during a housing stock crisis.

Landlords today are not just property owners; they are pivotal players in the housing sector –housing providers ensuring their tenants have safe and comfortable homes. Despite the introduction of new regulations and the ever-changing market dynamics, landlords’ ability to adapt combined with their commitment to professionalism, are reasons for optimism amongst the landlord community.

Looking ahead as landlords navigate 2024, the Renters (Reform) Bill is likely to shift focus towards the duration of the tenancy. Landlords will be expected to maintain regular contact with tenants, fostering a mutual understanding of each other's needs. This shift presents an opportunity for a more collaborative and communicative approach to 'landlording’.

The phrase 'housing providers', resonates profoundly with me and I think accurately reflects what the majority of landlords are.

Undoubtedly, 2024 brings its financial challenges, predominantly due to soaring interest rates. The climb from 0.1% in December 2021 to a 15-year peak of 5.25% just two years later has put many landlords in a tight spot. But this doesn't necessarily spell doom for buy to let ventures. Landlords who can contribute towards mortgage payments, alongside rental income, can still see their property's equity grow. However, with tenants already stretched thin, landlords must tread carefully with rent adjustments. Balancing the need for income against retaining reliable tenants is more crucial than ever.

Legislative changes: a call for adaptation and proactivity

The rental market is under the microscope, with reforms like the anticipated Renters (Reform) Bill changing the game. The delay in abolishing Section 21 evictions reflects the Government’s increasingly nuanced understanding of the sector's complexities. Landlords are encouraged to stay informed and proactive, adapting to these changes while making sure they maintain open lines of communication with their tenants.

While recent shifts in government policy have eased the immediate pressure on landlords to upgrade their properties' energy efficiency, the trend towards eco-friendly living is undeniable. Landlords are advised to proactively seek out opportunities to enhance the sustainability of their

properties. This not only aligns with tenant demands but can also lead to cost savings in the long run.

Integrating technology into property management can also streamline operations, making the landlordtenant relationship smoother and more efficient.

Networking and continuous learning: staying ahead of the curve

In a rapidly evolving market, continuous learning is key. Engaging with fellow landlords, attending industry events, and staying abreast of market trends and best practices is invaluable. This not only helps in adapting to changes but also fosters a community of informed and proactive landlords.

While 2024 poses its unique set of challenges, it also presents opportunities for growth and innovation. By embracing their role as essential housing providers, adapting to financial and legislative changes, and leveraging technology and sustainability, landlords can not only emerge from these turbulent times successfully, but also set the stage for a prosperous future in the rental market.

Rebranding ourselves as 'housing providers' requires a conscious effort to change how we communicate, and our self-perception of the impact we can make by fostering safe and sustainable living spaces. It involves taking a comprehensive approach to business, carrying out regular reviews of services, efficiency and costs, and assessing whether handson management is still viable or if

external support, such as property management, is necessary. The journey ahead, while it will inevitably bring challenges, is also ripe with potential for those willing to adapt, learn, and innovate.

I'm passionate about educating landlords and have been honoured to be awarded Best Seminar Speaker of the Year at the National Landlord Investment Show Awards for three consecutive years.

For more guidance and advice visit Total Landlord’s Knowledge Centre www.totallandlordinsurance.co.uk/ knowledge-centre.

The rental market is under the microscope, with reforms like the anticipated Renters (Reform) Bill changing the game. The delay in abolishing Section 21 evictions reflects the Government’s increasingly nuanced understanding of the sector's complexities.

MARK CHICK DIRECTOR, ALEP

MARK CHICK DIRECTOR, ALEP

In a survey of ALEP (the Association of Leasehold Enfranchisement Practitioners) members, 80% agreed with government’s consultation on ground rent reform. The statement posited that ‘residential ground rents can have a negative or undesirable impact on the sale of leasehold properties.’

As part of the government’s broader leasehold reforms, a consultation titled “Modern Leasehold: Restricting Ground Rent for Existing Leases” is currently underway, seeking opinions on limiting the ground rents imposed on leaseholders.

ALEP, a professional body representing over 1,200 solicitors, barristers, and surveyors specializing in leasehold enfranchisement, conducted a recent survey where 81.8% of members agreed with the aforementioned statement, while 18.2% disagreed.

The Consultation

The ground rent reform consultation by ALEP mirrored the government’s efforts and explored potential negative impacts of ground rents and ways to mitigate them. Findings from ALEP members highlighted several concerns related to ground rents as follows:

• 70% expressed that certain ground rents could impede property sales.

• 43.2% cited issues arising from unclear terms about ground rent payments during property purchase.

• 31.8% mentioned leaseholders’ lack of knowledge about the future increase in their ground rent.

• 27.3% were concerned about ground rent payments becoming more expensive over time.

• 25% pointed out that leaseholders pay ground rent without receiving a clear service in return.

• 6.8% found ground rent payments unaffordable.

• 2.3% reported no problems with ground rents.

Concerning potential solutions, members favoured capping ground rent at a percentage of the property value (38.6%). This is followed by capping at an absolute value (27.3%). Plus capping at a peppercorn (20.5%). Notably, the government’s preference aligns with capping ground rent at a peppercorn, but members expressed apprehension about its disproportionately negative impact on freeholders and investors.

75% believe that if a ground rent cap is introduced, compensation should be paid to freeholders and/or intermediate landlords.

A majority of members (47.7%) supported an increase tied to a predetermined index, such as the Retail Price Index (RPI). Exemptions to ground rent caps were also considered by ALEP members, with significant support for various

categories, including home reversion plans, business leases, negotiated agreements, leases of fewer than 21 years, and community-led housing.

I'd like to emphasise that members generally support the government’s proposals. However, they also highlighted the need for nuanced consideration in addressing ‘problem’ ground rents. The suggestion? A targeted approach rather than a broad restriction.

Experts now think that further detailed discussions are needed before it progresses to legislation. It underscores the importance of professional advice when dealing with leasehold properties to prevent unexpected costs. ALEP’s ongoing efforts aim to raise public awareness of these issues.

Many issues related to ground rents stem from what can be termed an ‘advice failure’. ALEP’s website offers a tool to help those seeking suitable professionals in their area.

Mark ChickThe ground rent reform consultation by ALEP mirrored the government’s efforts and explored potential negative impacts of ground rents and ways to mitigate them.

All we hear in the media is doom and gloom. Apparently, everyone is rushing to sell because it’s no longer worth being a landlord. Should we be using the Sun's famous headlineWill the last person to leave Britain please turn out the lights?

No, we shouldn’t. Let’s have a quick look at landlords’ history.

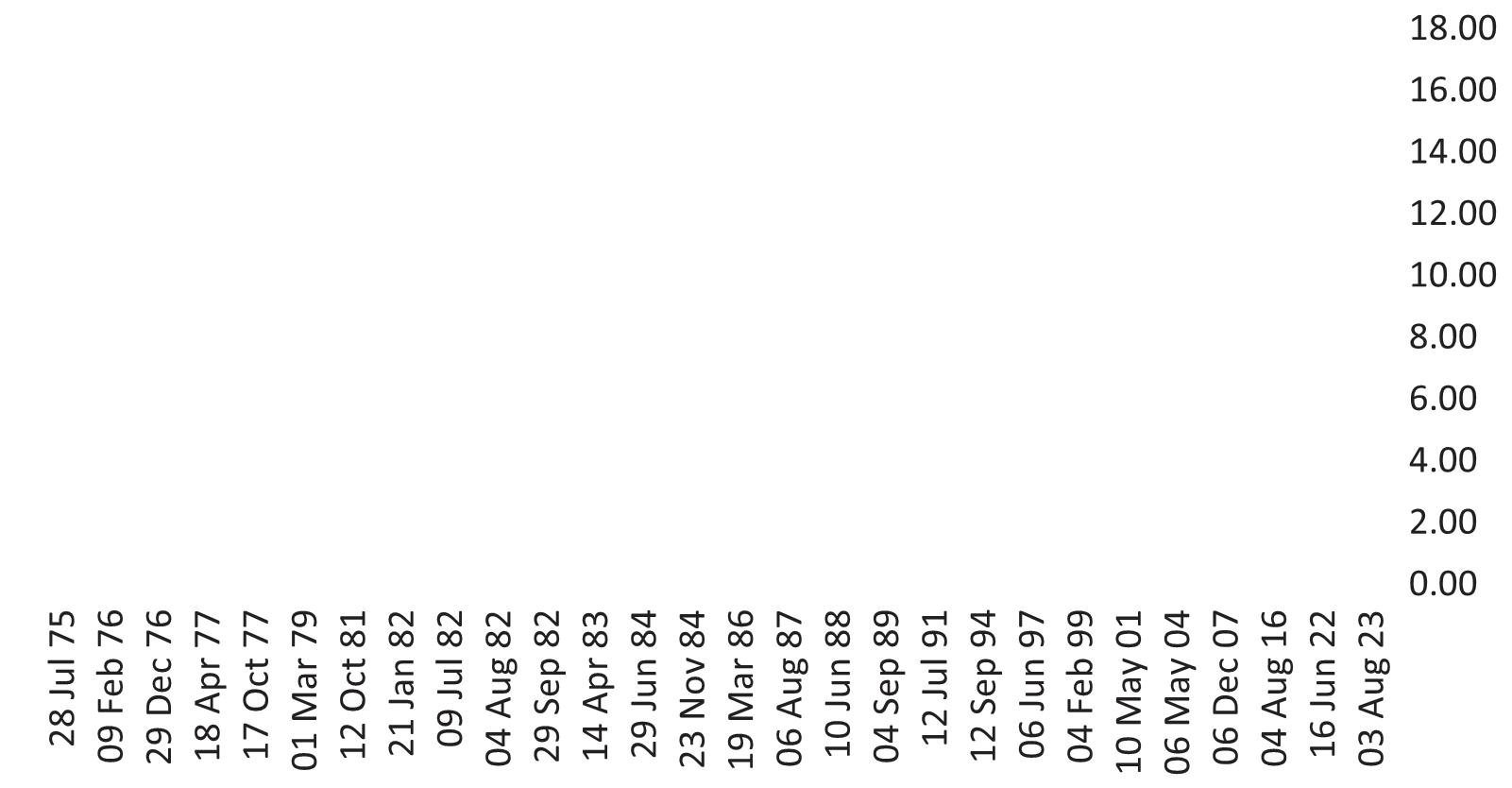

Let’s look at base rates. It’s true to say they have risen substantially quite quickly, but if we look at the base rate over many years, we can see in Figure 1 that it was abnormally low for some time and has now returned to normal.

If we’re lucky, the rate might bottom out around 4% late 2024/early 2025, still a historically low rate.

Landlords are certainly paying more tax than before.

The biggest problem for many has been the restriction of mortgage tax relief (Section 24) announced by George Osbourne in 2015, designed to slow down the growth of the private rental sector – well it did that!

The changes were rolled out from 2017 and came into full effect in April 2020, giving landlords 5 years to take appropriate action, by reducing their interest rate payments – probably by selling some property.

Source: Data from Bank of England

Unfortunately, many ignored the warning, buoyed on by historically low interest rates, they didn’t realise the true impact of this change until interest rates shot up.

Mind you, at the same time Osbourne also introduced an extra 3% on stamp duty (SDLT) and Capital Gains tax

(CGT) for ‘any additional properties beyond your main residence’. So, whilst Section 24 was trying to get you to sell, the extra 3% SDLT and CGT had the opposite effect!

But the point is that savvy landlords have had some time to ensure they minimised their tax bill.

The biggest problem for many has been the restriction of mortgage tax relief (Section 24) announced by George Osbourne in 2015, designed to slow down the growth of the private rental sector.

If landlords are looking for capital gains, then this has been an area of success, but over a long period of time.

Figure 2 shows Nationwide data where a general increase in property values over time.

Rents have generally also increased over time, as can be seen by this graph (Figure 3) from the Office of National Statistics (ONS).

It is true that Government keeps piling on more legislation. At the last count iHowz reckon there are 174 pieces of legislation that landlords must follow, some of it going back to 1730!

But, how much of this is due the incredible turnover of Housing Ministers. Lee Rowley became the Minister in November 2023, making him the 16th Housing Minister since 2010. Each minister will want to put their own stamp on the portfolio, and to leave their own legacy, so appointing so many ministers is bound to lead to a plethora of legislation.

And it’s not going to stop. The Renters Reform Bill will make it 175 pieces of legislation if, and when it becomes law.

Michael Gove is determined to force this through, even though many Conservative MPs are against it as being un-conservative.

Gove re-iterated his determination to at least ban the Section 21 notice as recently as Sunday February 11th.

So, is it all doom and gloom?

No.

We’ve already had two optimistic reports in February. Anthony Codling of RBC Capital Markets is optimistic about the current housing market for investors, highlighting the resilience of the market despite challenges.

The latest Halifax Price Index has reported a continued rise in average house prices, with January marking the fourth consecutive month of growth.

The media keeps saying all landlords are selling, but anecdotally, iHowz are finding that many of the landlords selling are approaching retirement age, and, yes, they may have been forced to sell a few years early, but they were planning to sell anyway.

It is critical that all landlords now act in a professional manner and run their portfolios correctly and professionally. The days of the dinner party landlord are long over.

iHowz are of the view that all landlords should be trained and accredited. They are managing tenants’ homes, after all.

And no-one likes uncertainty. Landlords should be urging Government to:

• Ensure Housing is treated seriously, by appointing a minister who understands housing, and will stay, and not see it as a stepping stone to greater things.

• Sort out the energy requirements for all rental property – private and social housing.

• Build more houses, especially affordable, in the correct location.

• Abolish the extra 3% SDLT and CGT. This would give the rental market a boost.

When will Government stop treating private landlords like whipping boys and understand they are earning a living by housing over 20% of the population, at their own expense –not taxpayer expense.

The Bristol Agent, proudly independent since 1867, CJ Hole offers extensive experience + expertise in Residential Sales, Lettings, Property + Portfolio Management, Land & New Home Sales.

Why Bristol?

Bristol is a city with its vibrant culture, rich history, and booming economy making it an attractive location for property. Here are some reasons why Bristol is fast becoming a global destination for businesses and one of the most desirable places to live in the UK.

Growing Demand: Bristol's population is growing rapidly, which means there is a high demand for housing. This demand is expected to continue to rise as we’ve experienced the most London leavers in 2023, making it an ideal market for property investors.

Strong Economy: Bristol has a strong economy that is diverse and resilient. It is home to many successful businesses and has a thriving creative sector. This strong economic foundation means that investing in property in Bristol is a lowrisk proposition.

Excellent Connectivity: Bristol is wellconnected with excellent transport links to other major cities in the UK, including London. It takes 68 minutes to London Paddington from Bristol. Also, 85% of the UK is within a 4 ½ hour drive from this city. This makes it an attractive location for professionals and students, which in turn drives demand for housing.

Cultural Hub: Bristol is a cultural hub, with a vibrant arts and music scene. It is also home to many festivals throughout the year, including the famous Bristol International Balloon Fiesta. This cultural richness makes it an attractive location for both residents and visitors.

High Rental Yields: Rental yields in Bristol are among the highest in the UK. This means that property investors can enjoy a good return on their investment, whether they are looking to buy-to-let or invest in commercial property.

Overall, investing in property in Bristol is an excellent decision for investors looking for a stable and profitable investment opportunity. The city's growing

population, strong economy, excellent transport links, cultural richness, and high rental yields make it an attractive location for property investment.

Bristol, a leading city for investors

Cj Hole is pleased to sponsor one of UK’s leading investment events on their first show in this thriving city of Bristol.

Hosting the National Landlord Investment Show in Bristol can be a great way to attract potential investors and showcase the city's growing real estate market. Bristol is a vibrant and diverse city with a strong economy, making it an attractive destination for property investors. Additionally, with the ongoing development of several key areas in the city, such as Temple Quarter and the Harbourside, there are plenty of opportunities for investors to get involved in exciting projects.

Bristol as the leading hub for technology and innovation, with a thriving startup scene and a growing number of businesses choosing to set up in the city has driven up demand for high-quality offices and commercial spaces and created a strong demand for residential properties in the city, making it an ideal location for property investment.

Having an event in this city can also be a great way to network with other industry professionals, share insights and best practices, and gain valuable knowledge about the local market.

CJ Hole: 150 Years in the making

With offices throughout the city and covering South Gloucestershire and North Somerset, CJ Hole covers expertise.

• Residential Sales

• Residential Lettings

• Property Investment

• Portfolio Management

• Land & Development

• New Home Sales

• Student Accommodation

• Property Management

One of the key strengths of CJ Hole Bristol is its local knowledge. The company has been operating in Bristol for over 150 years, which means that its team has an in-depth understanding of the local property market. Local insight allows CJ Hole Bristol to provide clients with accurate and up-to-date advice on property sales and lettings.

Bristol is well-connected with excellent transport links to other major cities in the UK, including London. It takes 68 minutes to London Paddington from Bristol.

Another strength is its commitment to using the latest technology. The company has invested heavily in digital marketing, which means that it can effectively market properties to a wide audience. CJ Hole Bristol also uses the latest property management software, which allows it to efficiently manage properties and provide clients with real-time updates on their properties.

Overall, CJ Hole Bristol is a reputable estate agency that offers a comprehensive range of propertyrelated services. Its experienced team, local knowledge, and use of technology make it an excellent choice whether you are looking to buy, sell, or rent a property in Bristol.

cjhole.co.uk

1. For those that don't know, tell us a little bit about Mr Investa and the services you offer.

Mr Investa is an e-commerce buy to let market place offering completed and tenanted properties nationwide at the click of a button. Using the latest technology like VR, 3D Mapping & Drones allowing buyers to view in the comfort of their own home or on the go.

2. Mr Investa was founded in 2020 in the middle of lockdown, apart from the obvious, what was the biggest challenge you faced when you launched the company?

As an ambitious, forward thinking company which wanted to be a nationwide service from the beginning offering our service from anywhere in the UK having properties from Scotland to London and anywhere in between. Covering this amount of ground from the start was difficult but over the years we have built a fantastic Satellite network across the UK to cover Marketing, Viewings, Surveys etc.

3. You'll be exhibiting at all three London events we'll be hosting in 2024, why should our delegates come and meet with your team on the day?

If you are interested in buying or selling completed and tenanted buy to let property with full marketing material and financial performance our stands are not to be missed. Meet the team, get real insight to the current market and your route into, out of or extend you buy to let portfolio.

4. Your property predictions –What do we have in store for 2024?

Every year in property is different and we believe personal circumstance should be the deciding factor not current market conditions as there is always a good time for someone to buy & sell. However in 2024 we are seeing an increase in available stock offering more opportunities in different locations and price brackets in return creating more buyers. There is always a Cash Vs Finance debate and at the moment the old phrase "cash is king" we believe is very relevant, not from a negotiating aspect but more margin in the investment compared to current buy to let finance interest options (as of Jan 2024).

5. It's fair to say that you are a young entrepreneur. Give us an insight into how your career in Property began, developed, and what advice would you give to someone of a similar to age yourself that is thinking about starting a business in the property industry?

This year we see me celebrate 20 years in property, Starting when I was 15 years old on the building site mixing sand, hoisting bricks up 3 floors on a very wobbly ladder refurbishing 3 bedroom terrace houses converting them into 6 x1 bedroom Apartments. I did everything from the painting to the carpet fitting, bathroom tiling and learning the trades as I went. Then at 16/17 moved into lettings carrying out inspections/checkins/viewings. Moving to management at 18 years old looking after 300 rooms mixed between

Student/DSS and resdiental with an approx valuation of £15M in 2013. We exited that portfolio and I moved in to construction from ground up building 15,30 & 45 apartments. Then moved into asset disposal travelling the world assisting landlords to buy and sell their tenanted properties in the UK whilst being based in the middles east and Asia. This allowed me to get an in depth, first hand experience on the service required for landlords nationwide and overseas creating Mr Investa in 2020 to assist their needs via a proptech platform and first class service.

An ambitious, forward thinking company which wanted to be a nationwide service from the beginning, offering our service from anywhere in the UK having properties from Scotland to London and anywhere in between.

Peter Licourinos Founder, HMO Premier

Peter Licourinos Founder, HMO Premier

So Peter, why HMOs?

Becauce they return the best profits. We combine high yields and ROCI. We buy below market value and add value. We buy in areas that will provide longer term capital as well. The market is evolving, the opportunity is huge.

What does HMO Premier do?

The beauty of HMO Premier's service is that we do everything for investors; new or experienced. From financial and legal advice, sourcing, planning, design, development, legislation, licensing, interior design, letting and management. Some investors come to us for hands free investing whilst others want to select a variety of our services

How many years experience have you got?

Personally over 25 years, but our team has over 100 years property experience! We were humbled to win HMO Service Provider of the Year but are also part of ARLA, PRS and the The Property Ombudsman. Experience is important and we have lived through the highs and lows over the years which helps us keep ahead of the curves.

What makes HMO Premier different?

Firstly, the size and combined experience of our team and wider network. Secondly, a proven formula: the best areas and the right properties.

We ensure you make money when you buy - buy wisely and it's hard to lose money, plus the returns we offer are amazing. We view up to 30 houses a week to find the right ones and we find opportunities and negotiate deals that no one else can do.

We provide investors peace of mind. Once we have delivered with the first project, our clients always choose to invest again and again. We care, we are passionate, we work hard, we have the experience and we love what we do - this makes us unique! Most of our clients become part of the family. Clients for life.

Can you help investors with their buy-to-let portfolios?

We certainly can and we are doing exactly that. Either through consultancy or around Berkshire and Surrey we can transform them into modern day HMO and Co-Living properties which can treble the income and get them really working for you again.

What type of clients do you work with?

Investors: We like to work with a selected group of serious investors so we can guarantee an incredible level of service and investment quality.

Tenants: Professionals - a market where we can see incredible opportunities in the immediate future and sustainability moving forward. People prefer to stay in our HMO Co-Living homes than in an apartment meaning we can attract monthly room rents of up to £1000pcm.

What makes you stand out from the competition?

Our approach, the quality of our service and an ethical win-win providing the best accommodation in the UK with the best returns. We theme our homes, we provide incredible kitchens, bathrooms and bedrooms, amazing furniture, Smart TVs and all the mod cons tenants expect, plus

so much more. We can provide our clients with a one-stop-shop, trust, a proven concept and exceptional returns.

What sort of ROI and yields can you provide?

We get asked this question a lot and this is the beauty behind the investments we provide: we aim for a combination of returns that provide immediate, medium and long term returns. Yields in excess of 10-15%, ROI 10%, ROCI 20%. This coupled with us buying into 10% below market value and then buying and planning widely to add an additional 10% value this means investments keep giving and can flourish in any market and economy. We also buy in areas on the up, sustainable for the next decade and longer term capital appreciation, the cherry on the top!

Is now a good time to be buying HMOs?

Yes! Get in touch. Prices are down, rates for HMO Developing are low and rental prices are up! It's an outstanding time to be an investor.

How can people get in touch?

You will find us on social media, so please give us a follow, or visit our website to request a free brochure and Discovery Call with one of the team. www. hmopremier.co.uk

www.youroverseashome.com

Your Overseas Home has highlighted the most popular regions in Europe for prospective expats and holiday home owners, showcasing the diverse attractions each destination offers:

Cyprus – Paphos: Known for its historical significance, Paphos attracts buyers with its ancient ruins, serene beaches, and mythical landmarks like Petra tou Romiou. Property options cater to various preferences and budgets, with options including villas, apartments, and properties in coastal or inland areas. Paphos is also popular among retirees for its relaxed lifestyle and quality healthcare.

France – Nouvelle-Aquitaine: This region, encompassing Bordeaux and La Rochelle, entices buyers with its cultural richness, gastronomy, and overall quality of life. Property options range from traditional houses to luxury villas, spread across historic towns, cities, and picturesque villages.

Greece – Crete: Crete boasts a strong expat community, affordable cost of

living, and cultural heritage evident in its traditional villages and cuisine. Property choices include traditional homes, modern apartments, and luxurious villas, with prices varying based on location and proximity to the coast.

Italy – Tuscany: Renowned for its timeless beauty and culinary delights, Tuscany offers picturesque landscapes of rolling hills and vineyards. Property options in Tuscany include villas, farmhouses, townhouses, or contemporary apartments, with prices influenced by location, size, and condition.

Portugal – Faro: Faro, the capital of the Algarve region, attracts buyers with its history, cultural interest, and culinary offerings. Coastal areas like Albufeira and Vilamoura are particularly sought after, offering various property types with sea

views. Faro’s robust property market is driven by domestic and international demand, with the Golden Visa Programme attracting further investment.

Spain – Andalusia: Andalusia offers a blend of ancient cities, coastal areas, and picturesque villages. Cities like Seville, Granada, and Cordoba showcase impressive architecture and historic landmarks, while the Costa del Sol boasts beautiful beaches and resorts. Inland, Andalusia features mountain ranges and white-washed villages, providing diverse options for potential buyers.

These regions stand out for their unique appeal, whether it’s historical significance, cultural richness, natural beauty, or investment potential, making them popular choices for those seeking property abroad.

CELEBRATING THE SHINING STARS OF THE LANDLORD & PROPERTY INVESTMENT SECTOR