A very warm welcome to Issue 78 of Landlord Investor Magazine. What a year it’s been already! Events in the sector have moved at a dizzying pace, and there are still many questions to be answered in the coming year. It has been a busy year at LIS Media too, as we tee-up seven major shows, training days, and the launch of our UK Property News channel. I know – that’s a big one to drop! You can find out more on page 22. I’d love to expand further, but I’ve

06 16 18 22 24 10 12

Surviving the Renters’ Rights Bill

Outlook

Why landlords shouldn’t fear the Renters’ Reform Bill – but must be prepared

Outlook

Building from the ground up: Accelerating action with women in property

Outlook

It's time for landlords to start developing

Outlook

Total Property survey exposes deepening rental sector crisis

Outlook

The cost of being a landlord in the UK

Outlook

Proposed changes to EPC ratings –What does this mean for landlords?

been told to keep it brief as there’s so much amazing content to list below. Anyway, don't forget - we will be celebrating our 90th show at Old Billingsgate in London on 19th March, and with the two-part panel debate Surviving the Renters' Rights Bill, it really is an unmissable event. Hot on its heels, on 30th April, we’ll be in Kent, so don’t forget to book your free show tickets via www.landlordinvestmentshow.co.uk. Wishing you the very best on your property investment journey.

28 32 34 36 40 42 46 Show Update

LANDLORD INVESTOR MAGAZINE

Editor Tracey Hanbury

Design

Marc Riley

Social Media

Charlotte Dye

Printing

IOP Marketing

Investment

Launching the UK Property News Channel: A game-changer for UK landlords & property investors

Investment

Why investing in supported accommodation & children’s homes is not just ethical – it’s smart

Investment

How landlords will invest in 2025

Investment

Why property investment remains the best long-term asset – even with new legislation

Investment

Top 5 best cities to invest in property, UK

Taxation

Innovative tax strategies for landlords: how to protect your profits & your wealth

Proptech

Aico launches new solution to help maintain safe and compliant homes

www.landlordinvestmentshow.co.uk | Follow us on...

PLEASE NOTE: The National Landlord Investment Show, LIS Media and Landlord Investor Magazine are content aggregators only. Views, statements and opinions expressed in articles, reviews and other materials herein are those of the authors, exhibitors and third-party contributors and not the editors and publishers of LI Magazine. Under no circumstances does the content of this publication constitute investment or legal advice. We do not undertake to advise individuals or organisations upon investment strategy. All investments should be approached with caution under professional guidance. While every care has been taken in the compilation of this publication and every attempt made to present up-to-date and accurate information, we cannot guarantee that inaccuracies will not occur. LIS Media Limited and our contributors will not be held responsible for any claim, loss, damage or inconvenience caused as a result of any information within these pages or any information accessed through the promoted links. Published by LIS Media, Registered address: Foresters Hall, 25-27 Westow Street, London SE19 3RY. © 2024 LIS Media Ltd.

TRACEY HANBURY CO-FOUNDER /

DIRECTOR

Team: Donegal GAA

Song: Galway Girl, Steve Earle

Film: Dirty Dancing

Food: Indian

Likes: A busy show - can’t beat it

Dislikes: Rudeness

Fave thing about LIS: Building client relationships

KIERAN MCCORMACK SALES DIRECTOR

Team: Manchester United

Song: Bonkers, Dizze Rascal

Film: American Gangster

Food: Indian

Likes: Family time, Man Utd, golf

(not necessarily in that order)

Dislikes: Tinned sweetcorn

Fave thing about LIS: No day is the same (hence the song choice)

CHARLOTTE DYE OPERATIONS DIRECTOR

Team: Spurs

Song: The view from the afternoon, Arctic Monkeys

Film: E.T

Food: Chinese

Likes: Anything four legged and furry

Dislikes: Clowns and Spiders

Fave thing about LIS: Office cuddles with Ollie

ALICIA CELA HEAD OF ACCOUNTS

Team: Barcelona FC

Song: Hotel California, The Eagles

Film: Shawshank Redemption

Food: Anything Spanish (I'm very biased lol)

Likes: Cooking great food

Dislikes: Liars. Oh, and liver (can't stand it)

Fave thing about LIS: Socialising with the whole team

STEVE HANBURY CO-FOUNDER / DIRECTOR

Team: Crystal Palace

Song: Plastic Dreams, Jaydee (Original)

Film: Goodfellas

Food: Indian

Likes: Team meetings in the pub

Dislikes: Bad manners

Fave thing about LIS:

Show day (as anything can happen)

MARC RILEY CREATIVE DIRECTOR

Team: Letterkenny Shamrocks

Song: What’s going on? Marvin Gaye

Film: The Sound of Music

Food: Sea

Likes: Clean typography

Dislikes: Last minute edits

Fave thing about LIS: The website

JACOB HANBURY SALES EXECUTIVE

Team: Crystal Palace

Song: Michael Bibi - Got the Fire

Film: Step Brothers

Food: Sunday roast

Likes: Skiing, Gym, Crystal Palace

Dislikes: Dirty finger nails

Fave thing about LIS: Great atmosphere at the shows

LEWIS HANBURY CONTENT CREATOR

Team: Crystal Palace

Song: Fire in Cairo, The Cure

Film: Star Wars, A New Hope

Food: Pasta

Likes: Filming

Dislikes: Editing

Fave thing about LIS: My colleagues

OLLIE HANBURY ENTERTAINMENT & SECURITY MANAGER

Team: Crystal Palace

Song: Who let the dogs out

Film: 101 Dalmatians

Food: Roast Dinners

Likes: Walkies

Dislikes: Poo in bags left on branches

Fave thing about LIS: Getting all the attention

TRACEY HANBURY EDITOR & SHOW FOUNDER

PETER LITTLEWOOD DIRECTOR, IHOWZ

The Renters' Rights Bill is set to bring the biggest shake-up to the UK rental market in decades, with major changes to eviction rules, fixed-term tenancies, and rent regulations. Here we'll look at the salient points, but don't forget to book your place at our two-part panel debate on March 19 at our first London show of 2025 to hear what our panel experts have to say.

Are You Ready for the Renters' Rights Bill?

There has been a lot of discussion about the Renters' Rights Bill recently – and with good reason. It’s the most significant change for landlords since the Housing Act of 1985 and it is imminently expected to become law as soon as summer 2025.

This reform poses significant changes for the UK housing sector as new reforms aim to transform renters' rights and landlord accountability. These measures address systemic issues but pose challenges for landlords and policymakers.

To stay ahead of how the Renters’ Rights Bill will affect you and your responsibility as a landlord, the first thing you need to do is book your free ticket for the National Landlord Investment Show at Old Billingsgate on March 19th to attend and be part of a two-part exclusive panel discussion on ‘Surviving the Renters’ Rights Bill’.

Part I hosted by Ian Collins of TalkTV, featuring a key expert panel of top property professionals critically unpacking the implications for Tenancy Reform, Redress, Landlord Redress Scheme and Awaab’s Law. Moving onto the most contentious aspects, the

Part II panel discussion hosted by Paul Shamplina of Landlord Action dissects the practical and legal implications of Grounds for Possession, Tenant Rights, Obligations and Penalties with practical tips and insights for navigating this complex new era. So let’s briefly touch upon some of the key reforms as part of the Renters’ Rights Bill.

One of the biggest talking points has been the loss of Section 21 notices. Personally, I don’t believe this will be as catastrophic as some fear. Many landlords already rely on Section 8 notices instead. Are you one of them? Yes, Section 21 is easier to use, but we have to adapt. The real issue will

be controlling Anti-Social Behaviour (ASB). Section 8 simply doesn’t have enough teeth in this area. Landlord Association Groups continue to lobby for stronger powers to tackle ASB, but in the meantime, be diligent. Carefully reference all prospective tenants, monitor your current ones, and consider rent guarantee insurance.

A far greater concern is the loss of fixedterm tenancies, effectively creating what the Government calls a "Tenancy for Life." I’ll let that sink in – a tenancy for life. While you can still evict if you plan to sell or move in, otherwise, tenants can stay indefinitely unless they break the rules, typically by not paying rent.

This reform poses significant changes for the UK housing sector as new reforms aim to transform renters' rights and landlord accountability.

This brings me to another key point: stay on top of rent arrears. Don’t let them pile up. With the new rules, you’ll only be able to increase rent using a Section 13 notice, and the Government is actively encouraging tenants to challenge these at a Tribunal.

If a tenant disputes your rent increase, the new rate won’t take effect until the Tribunal rules on it – and it won’t be backdated. With Tribunal wait times already stretching up to six months, this delay will only get worse. Stay proactive with your rent increases.

Another major change is the restriction on rent in advance. Landlords can

now only collect one month’s rent in advance, and only after the tenancy agreement has been signed. We all know how difficult it can be to collect anything once the tenant has the keys – this is a serious issue, particularly for student landlords and those renting to tenants with no UK rental history.

If you rent to students, things are getting even more complicated. There are too many challenges to cover here, but if this affects you, even more reason to get down to the National Landlord Investment Show on 19 March. The Key Message: Be Professional. I recently attended a conference where Lord Best spoke. His message was clear: the days of amateur landlords are over – especially if you ever need to evict a tenant.

Get informed. Stay informed.

Don’t delay in registering for free attendance at the National Landlord Investment Show on Wednesday 19 March at Old Billingsgate, London to stay ahead of the game when it comes to the Renters’ Rights Bill and setting you up so you are ready and compliant for the new regulatory landscape. As always, The National Landlord Investment Show is a dedicated platform and hub to help landlords, property investors and anyone with an interest in the buy-to-let market thrive and succeed in an ever-changing regulatory landscape with expert critical conversations from key players across the UK property industry. You enjoy. All the very best for 2025.

Tenancy Reform | Landlord Redress Scheme | Awaab’s Law

Hosted by Ian Collins

Grounds for Possession | Tenant Rights | Obligations and Penalties

Hosted by Paul Shamplina

KATE FAULKNER OBE

LEADING UK PROPERTY EXPERT

The consumer press is full of news about the Renters’ Rights Bill and its impact, focusing on the additional rights it grants tenants. Meanwhile, the property and trade press aimed at anyone lettings services or owning a property are focusing on

the

potential horror scenarios of the Bill, mainly caused by the loss of rights for landlords, most notably, the abolition of Section 21 “no-fault”

evictions.

Now, it’s true that the RRB will be a big change – for both tenants and landlords. Landlords will lose some rights, making letting property in England more difficult and risky. And, on the surface, for many tenants, their life as renters will get just that bit better – provided they can secure a rental in what is likely to be an increasingly competitive market.

Will the Renters’ Reform Bill Make Letting More Difficult?

For those landlords who let a property legally and safely, treat their tenants well, and intend to be 'landlords for life’, once the changes have been implemented, while compliance may become more demanding and the risk slightly higher, long-term landlords could see stronger returns as reduced landlord numbers drive rental demand higher.

However, if you're an accidental landlord – especially one managing a property without professional support – the message from the government is clear: either work with a qualified letting agent or consider selling up.

Landlords Have Adapted Before –And Will Again

The reality is, as landlords, we are used to seismic changes and we’ve managed to survive them to date, despite the many worries and fears expressed at the time.

Overtime, we’ve survived:-

• The introduction of the Housing Health and Safety Rating System (HHSRS) with its 29 compliance rules

• Handing over deposits to licensed tenancy deposit protection schemes

• Right to Rent checks

• The complexities of GDPR compliance

• HMO licensing requirements

• Minimum EPC ratings

On top of all these changes, for a time, we even managed to navigate our way through 47 changes made to regulations – at speed – during Covid*.

In addition, financially, the changes over the last few years have been brutal:-

• Section 24 tax changes, meaning landlords pay tax on rental income rather than profit

• Increases in Stamp Duty Land Tax (SDLT)

• Reduction in Capital Gains Tax (CGT) allowances

• Soaring mortgage rates

If we can adapt to all of these changes and still find a way to succeed, we can, albeit with a lot of preparation, continue to provide much-needed roofs over people’s heads after the RRB becomes an Act.

How Can Landlords Prepare for the RRB becoming an act?

Whether you need new property investment strategies, financial planning, legal support, compliance guidance, or energy efficiency support, working with industry experts will help you manage these changes effectively.

That’s why events like the Landlord Investment Show on 19th March 2025 at Old Billingsgate, London, are invaluable. Organised by Tracey and Steve, this event brings together genuine experts who will help you make informed decisions for yours and your property’s future.

Key Takeaway: While the Renters’ Reform Bill will reshape the lettings landscape, proactive landlords who seek expert guidance will continue to thrive.

The reality is, as landlords, we are used to seismic changes and we’ve managed to survive them to date, despite the many worries and fears expressed at the time.

TRACEY HANBURY EDITOR & SHOW FOUNDER

Gender equality is the principle that ‘everyone should have the same opportunities and rights, regardless of gender’. Throughout history, women have had to fight for change in many aspects of society and faced many more challenges, including when it comes to property ownership and leadership within the property industry.

Thankfully, due to changes in legislation and shifting cultural attitudes, we live in a time where these challenges are less detrimental than they were in the past. However, there is still much work to be done to establish stronger foundations and empower women in the property industry, ensuring even progress. Highlighting women’s journeys and amplifying the voices of leading women in property allows us to do this.

Historically, property ownership in the UK was largely restricted to men. Under coverture laws, married women had no legal rights to own property independently until the Married Women’s Property Acts of 1870 and 1882, which allowed them to control their earnings and own property.

The Sex Discrimination Act of 1975 marked another milestone, granting women equal rights in employment and professional advancement, including within the property sector.

Now, let’s look at the current statistics for the role of women in property –an impressive achievement considering these historical challenges. According to the Government’s latest English Private Landlord Survey (2024), ‘55% of landlords identified as male, while 44% identified as female. Even more interestingly, female landlords were more likely than their male counterparts to own a single property – 55% of those owning just one property were female, compared to 45% who were male’. A stark contrast to the past and rightfully so.

To celebrate the role of women in property, the National Landlord Investment Show (NLIS) is proud to host the Women in Property Panel on Wednesday, 19 March 2025, at Old Billingsgate, London. This year’s International Women’s Day theme, “Accelerate Action,” reflects the panel’s focus on how women are driving change and shaping the future of property investment. Our esteemed and expert panellists will share their successes, journeys, challenges, and strategies for success in an evolving industry. The panel will be hosted and facilitated by the National Landlord Investment Show’s (NLIS) very own female CoFounder and Director Tracey Hanbury who is an influential figure in the UK property investment sector, with over a decade of experience connecting landlords, investors, and industry professionals. Alongside her husband Steve Hanbury, she has built the UK’s No. 1 property and investment exhibition for landlords offering expert-led exhibitions, networking opportunities and an educational platform..

With a background in media, sales and events, Tracey identified a niche in the market for a dedicated space where landlords and property professionals can connect. Prior to launching the shows, Tracey and her husband Steve Hanbury as young landlords and property investors themselves found it challenging to access the resources, service providers and education to run their property portfolio which initiated the idea to launch the first National Landlord Investment on 16 march 2013 in Croydon. She continues to work in running

and growing the family-run property portfolio alongside heading NLIS.

Since launching NLIS in 2013, she has expanded her influence through the growing brand LIS Media, which includes Landlord Investor (LI) Magazine, Property Notify, the annual LIS Awards, LIS Live Lounge, Talk Property, and Landlord Investor Hour. This brand continues to evolve, grow and expand as the UK Property News Channel is the newest addition to this brand serving the industry with breaking news and critical conversations about the UK Property sector. Tracey is a strong advocate for education, collaboration, and innovation in the property industry, championing women in a traditionally male-dominated sector and applies this advocacy across all her brands and leadership.

Under coverture laws, married women had no legal rights to own property independently until the Married Women’s Property Acts of 1870 and 1882, which allowed them to control their earnings and own property.

Hayley Andrews – Award-winning property investor, developer, and entrepreneur

Hayley Andrews is an award-winning property investor, developer, and entrepreneur with over two decades of experience in the property industry. Recognised as one of the UK's most inspirational female entrepreneurs, she has built a strong reputation for her expertise in strategic property investment and development. She is the CEO of multiple businesses and a large portfolio landlord, managing a diverse range of properties across the UK. Her industry knowledge and experience have made her a sought-after speaker and a regular property expert on SKY TV. She is also an Angel investor on the hit SKY TV show Property Elevatoroften referred to as Dragons' Den for property developers. Hayley is commended for her work with women in business and property and is the founder of Hard Hats to Heels, an award-winning female networking group dedicated to supporting and inspiring women in the industry. Beyond her professional achievements, Hayley is passionate about restoring historic buildings and contributing to local communities, ensuring that property investment creates a positive and lasting impact.

Amy Schofield – Auction Sales Director, Together

Amy has over 10 years' experience in the financial services sector having started her career at one of the UK's largest high street banks initially in mortgage lending and moving into Private Banking. Amy's experience in lending, together with her passion for property took her career into the specialist lending sector and to industry giant Together. To date, Amy remains with Together and has become well established in her position, playing such an integral part in the impressive growth of the groups lending channel through her vast network of Auction contacts. Amy takes pride in building valuable, long term client relationships - supporting their journey through fast common sense lending decisions.

Louise Reynolds – Director of Property Venture, Landlord, Investor, and Developer

Louise is a Surrey-based, landlord and developer who helps others make better quality property and wealthbuilding choices. She is naturally risk-averse, so de-risking is at the heart of what she does, both for her own investments and for those of her clients. Known as the Prudent Property investor, she has developed techniques to overcome a fear of risktaking, so that she can move forwards and not be frozen by fear. Louise is an experienced and seasoned professional with over 2 decades' worth of business experience before she started her property journey in 2007. She started her career in brand marketing, then moved to financial services and Management Consultancy. She has worked with global brands and companies like Heinz, Reckitt Benckiser, Diageo, Krug Champagne as well as UK-based organisations like The London Stock Exchange and Nationwide Building Society. She also has a decades' worth of Advisory Board experience, having sat on the Advisory Board of the Association of International Property Professionals (AIPP). She is a Chartered Marketer and Fellow of the Chartered Institute of Marketing. This combined with her business background helped her business win an Award for Best Boutique Property Business.

Suzanne Smith - The Independent Landlord

Suzanne Smith is the founder of The Independent Landlord, a website and YouTube channel providing reliable, free resources for landlords, letting agents and property businesses. The Independent Landlord has grown into one of the leading resources in the PRS, with over 8,000 subscribing to Suzanne’s weekly newsletter. A former corporate lawyer, Suzanne transitioned to property investment after a 25year career in senior in-house legal roles for multinational life sciences companies. Now a self-managing landlord with a property portfolio in Kent, she combines legal expertise with hands-on experience. Suzanne also serves as an independent member of Propertymark’s disciplinary tribunal and provides consultancy services for businesses in the PRS.

Thankfully, due to changes in legislation and shifting cultural attitudes, we live in a time where these challenges are less detrimental than they were in the past. However, there is still much work to be done to establish stronger foundations and empower women in the property industry, ensuring even progress.

Conclusion: Laying Stronger Foundations

So in conclusion, Women are not just participating and leading in property; they are leading its transformation – brick by brick, building from the ground up and accelerating action. As more women rise in the industry, we need to continue to highlight women’s journeys and amplifying their voices, we can drive meaningful change –because representation, visibility, and action are key to shaping a more inclusive future for the Property Sector. Get your free tickets here for the National Landlord Investment Show on 19th March at Old Billingsgate, London to join the Women in Property Panel: Building from the ground up alongside a full day of education with 50+ seminars and networking opportunities with 100+ property service providers.

TH

RITCHIE CLAPSON CO-FOUNDER PROPERTYCEO

We've all heard the famous but gruesome metaphor involving a frog being placed in tepid water that gradually gets heated to boiling point. But because the increasing threat is gradual, the frog fails to take action and stays put, only realising the danger when it's too late.

This reminds me of the situation that many landlords currently find themselves in. Buy-tolet used to be a sensible and lucrative investment strategy, but to say that the last ten years have seen the heat turn up would be a massive understatement. The assault has been gradual, but now many landlords have decided to exit. Those who remain are wondering what other financial and regulatory slings and arrows will come their way in 2025 and beyond. How many landlords would go into buy-to-lets today if they were starting from scratch?

Yet property remains a rock-solid wealth creation tool. There's a massive long-term undersupply of homes in this country, and Savills predicts that house prices will rise 23.4% over the next 5 years. So, how can existing landlords reap the benefits of property investment while dodging the buy-to-let bullets that successive governments seem intent on showering on them?

One of the fundamental strategies of any agile business is the concept of pivoting, which essentially involves a change in direction when the current business model isn't working. And one of the obvious pivot points for landlords is to develop property as well as letting it out.

Let's consider some of the benefits of being both a landlord and a developer:

Development creates large amounts of cash over comparatively short timescales, perfect for growing a portfolio or simply providing a second stream of income.

The government is actively encouraging landlords to get involved in development. It needs to deliver 1.5m new homes over the next 5 years, and there are 1.2m homes that can be created by converting redundant commercial buildings. The latest permitted development rights have made this easier and less risky than it's ever been before

The opportunity is huge – there are hundreds of thousands of existing buildings all over the country that are ripe for repurposing, including shops, offices and light industrial buildings

You'll have your financial eggs in two baskets rather than one. If your buy-to-lets struggle, then you'll have development income to fall back on and vice versa

Cash is king; in an uncertain world, the liquidity of cash has a significant advantage over the illiquidity of a buyto-let portfolio

It all sounds great, but how easy is it for landlords to become developers? Won't it be a lot more risky and more timeconsuming? And won't you need to have a lot more cash to invest?

As many landlords have discovered, the transition into development has proven to be highly leveraged, and the amount of personal investment required is much less than it would be to buy a rental property, even using a buy-to-let mortgage, which means that the ROI for property development is off the scale.

Does this mean you should immediately dive into property development in 2025?

Absolutely not.

But it might mean you should find out what small-scale property development is all about BEFORE everyone else dives in.

The government is actively encouraging landlords to get involved in development. It needs to deliver 1.5m new homes over the next 5 years, and there are 1.2m homes that can be created by converting redundant commercial buildings.

A comprehensive new survey by Total Property, a major player in the private rented sector with brands including mydeposits, Property Redress, Client Money Protect, Total Landlord, and Landlord Action, has laid bare the mounting pressures facing landlords in the UK’s private rented sector. The results paint a bleak picture: rising costs, everchanging legislation, and growing uncertainty are pushing landlords to the brink, making it harder than ever to remain in the market.

With nearly 3,500 respondents – including landlords, tenants, and letting agents – the findings confirm what many of us already know: the private rented sector is in trouble, and landlords are bearing the brunt of the crisis.

Landlords feeling the squeeze: rising costs, compliance, and an uncertain future

It’s no surprise that 67% of landlords surveyed believe the private rented sector has worsened in recent years. Even more alarming, nearly half are planning to exit the market within the next five years. The reasons? A perfect storm of increasing financial and regulatory burdens:

Over-regulation – More than half of landlords cited frequent regulatory changes as the primary reason for exiting the market, with 29% specifying the abolition of Section 21 as a major concern, while 24% point to the Renters’ Rights Bill as another significant worry

Compliance overload – 34% feel the sheer volume of ever-changing rules and regulations is making it too difficult to operate

Rising costs – Operational expenses are skyrocketing, with 19% of landlords citing this as a key issue along with taxation changes, which are making matters even worse

The survey revealed that 75% of landlords have been in the sector for over a decade. These are experienced property owners who understand the

market, yet many now feel they are being pushed out. Meanwhile, new investment is almost non-existent, with just three per cent of landlords having entered the market in the past year and seven per cent in the last two to four years, indicating a concerning slowdown in new landlord participation.

Despite the challenges, landlords are still making efforts to improve their properties, with 58% having made ecofriendly upgrades to meet regulatory requirements and tenant demand for sustainable housing. But with all these mounting pressures, it’s clear many are questioning whether it’s worth staying in the game at all.

The future of the private rented sector: a wake-up call for policymakers

Eddie Hooker, CEO of Total Property, has issued a stark warning about the direction of the UK rental market:

“The private rented sector is undergoing one of the most significant periods of change we’ve seen in decades. Rising costs, increasing regulation, and shifting tenant expectations are reshaping the market, and this survey reveals just how deep these challenges run.

With nearly half of landlords considering leaving the sector in the next five years and tenants struggling with affordability, urgent action is needed.

What’s particularly concerning is that the vast majority of landlords have been in the market for over a decade, while new investment has slowed to a trickle. The fact that so few new landlords are entering the sector is a clear indicator of where the market is heading.

While strengthening tenant rights through increased regulation is vital, on the other side of the coin, landlords have little incentive to reinvest in the market under current conditions. Unless this changes, these protections will mean little, as we risk a crisis where tenants have nowhere to rent at a price they can afford.

Regulation must support both landlords and tenants fairly to strike the right balance and create a sustainable rental market for the future.”

With nearly half of landlords considering leaving the sector in the next five years and tenants struggling with affordability, urgent action is needed.

The message from this survey is loud and clear: landlords are being pushed to the brink. From a spiralling possession crisis to an evolving legal framework and high mortgage rates, landlords have faced unprecedented challenges. Yet, amidst the turbulence, the survey highlights emerging opportunities for those who adapt, evolve, and stay the course.

With rising costs, tax burdens, and regulatory changes pushing some landlords out, rental demand is outpacing supply. For those who remain, this presents a prime

opportunity to maximise returns. Fewer competitors means higher yields and stronger tenant demand for well-managed properties. As homeownership remains out of reach for many, the private rented sector plays a crucial role – one that savvy landlords can capitalise on by offering quality homes.

Landlords are often unfairly blamed in the housing debate, despite providing a vital service in a market short on supply. Now is the time to challenge misconceptions and push for fair treatment. Getting involved in landlord associations, forums, and policy discussions can help shape legislation that balances tenant

protections with landlord rights, ensuring a sustainable future for the sector.

Success requires resilience, adaptability, and engagement with industry changes. Those who stay informed and proactive will be best placed to thrive. It makes more sense than ever to take out legal expenses and rent protection insurance to cover for loss of rent and legal fees. Total Landlord offers this an additional layer of security. At Landlord Action, we're also here to help – whether it’s navigating possession delays, understanding new regulations, or optimising your portfolio.

You can read the full Total Property survey report here and listen to expert analysis in The LandlordZONE podcast.

ALISON WILD MARKETING MANAGER TOWERGATE INSURANCE

As a UK landlord, you’re responsible for the maintenance and repair of your properties. But it can be difficult to keep track of the costs, especially if you’re not sure whether to do the job yourself or hire professional help. So how much does it cost to be a landlord in the UK?

How much do landlords spend on maintenance?

In 2024, we found that UK landlords spend £1,374.07 each year on maintaining their rental propertiesthat’s £285 more per year since our 2022 survey, an increase of 26.24%. Maintenance costs in areas across the UK differ significantly, with Edinburgh coming in as the highest spending city for landlords.

The most expensive repairs

We asked landlords how much they spend when repairing or replacing common household furnishings and fixtures, as well as how often these repairs are needed. We found that roof damage is the most expensive repair costing £906 on average - but it’s a less common fix, with landlords only needing to spend money on it once every three years. In second place came electrics (costing £665) with maintenance required at least once a year, and in third came heating issues, costing £655 and needing attention at least once a year.

Pest damage remains the cheapest repair as we found in our 2022 survey, followed by locks and security, with both needing to be carried out less than once every three years.

What is most likely to damage a rental property?

Aside from expected wear and tear, there are a few main reasons why a property can become damaged and need repairing. When looking at the average cost of repairs, this has increased by a significant 121% from £473 in 2022, to £1043 in 2024.

Theft damage is the most expensive cause of damage to rental properties and landlords spent an average of £1128 a year fixing post break-in related repairs. It’s also one of the most time-consuming tasks, with landlords reporting 2 to 4 days’ time spent on making repairs. The second most expensive issue for landlords to fix in the UK is fire damage, and in third place, is damage caused to properties from heatwaves.

However, sometimes there can be ambiguity surrounding who is responsible for property damage - 59.80% of UK landlords have had a dispute with a tenant over who is responsible for property repairs or replacements. Unfortunately, while damage may be caused by a tenant, landlords are usually responsible for handling any repairs, meaning that the majority of the costs also fall on them. Paying for professional repairs can be a financial blow, especially without landlord insurance.

When dealing with property damage, 53% of UK landlords have attempted to repair something in their rental property themselves. Of landlords that have made DIY repairs, 60% said this was due to pressures to get them done quickly and 56% said it was due to money constraints. However, 46% of landlords that have tried to repair something themselves also had to have their work redone by a professional, often spending more money than if they had had the repairs made by tradesmen in the first place.

Do UK landlords have insurance?

In 2022, 20% of UK landlords said they didn’t have insurance, and this has shifted dramatically down to just 3.8% of landlords saying this in 2024. Having an insurance policy can help keep costs down, even when a professional is needed to fix the problem.

To find out more about your Landlord Insurance options please visit www.towergateinsurance.co.uk/landlords-insurance

Theft damage is the most expensive cause of damage to rental properties and landlords spent an average of £1128 a year fixing post break-in related repairs.

The proposed changes to Energy Performance Certificate (EPC) ratings for rental properties could have a significant financial and operational impact on landlords. Here’s a breakdown of how these changes might affect the private rented sector:

1. What Are the Proposed EPC Changes?

Currently, rental properties in England and Wales must have a minimum EPC rating of ‘E’to be legally let. However, the government has proposed tightening these regulations, requiring landlords to improve their properties to a minimum EPC rating of ‘C’.

The deadline was initially proposed as:

• 2025 for new tenancies

• 2028 for all tenancies

Although these plans were scrapped in 2023, a future government (especially under Labour) could reintroduce them as part of broader efforts to cut carbon emissions and improve energy efficiency.

2. Potential Costs for Landlords

Upgrading properties to meet an EPC ‘C’ rating can be expensive, particularly for older homes. Costs will vary depending on the property type, but estimates suggest:

• Basic upgrades (e.g., insulation, LED lighting, draft-proofing)

£3,000–£5,000

• More extensive work (e.g., double glazing, heat pumps, solar panels)

£10,000+

A 2021 government impact assessment estimated that 60% of rental properties would require improvements, with the average cost being £4,700 per property. However, older homes (especially Victorian terraces) could cost significantly more to upgrade.

Landlords with large portfolios or properties with poor energy efficiency could face tens of thousands of pounds in upgrade costs.

3. Potential Impact on the Rental Market

If stricter EPC rules return, landlords may respond in several ways:

a) Selling Properties

• Many landlords may choose to sell rather than invest in costly upgrades.

• This could shrink the rental market further, driving rents even higher due to reduced supply.

b) Raising Rents

• Landlords who do invest in energy efficiency improvements may pass on costs to tenants by increasing rents.

• This could exacerbate affordability issues for renters, who are already facing record-high rental costs.

c) More Selective Tenant Choices

• Landlords who spend thousands upgrading properties may only accept tenants with strong financial backgrounds to mitigate risks.

• This could make it harder for benefit claimants or lower-income renters to secure housing.

4. Will There Be Financial Support for Landlords?

Many landlords have called for grants, tax breaks, or subsidies to help fund

improvements. The £5,000 Boiler Upgrade Scheme has helped some landlords switch to low-carbon heating, but broader financial incentives are lacking.

If EPC ‘C’ rules return, the government could introduce:

• Tax relief on energy efficiency improvements

• Grants or interest-free loans for landlords

• Exemptions for hard-to-upgrade properties

However, these measures are not currently in place.

Landlords who spend thousands upgrading properties may only accept tenants with strong financial backgrounds to mitigate risks.

5. Are Any Exemptions Available?

Under current EPC rules, landlords can apply for an exemption if:

• Upgrading costs exceed £3,500 (though this cap could rise in future regulations).

• The property is listed or in a conservation area (where certain upgrades aren’t allowed).

• Energy improvements would devalue the property.

If a stricter EPC rating of ‘C’ is introduced, exemptions may still apply, but the cost cap would likely be much higher.

The Conservative government scrapped the 2025 and 2028 EPC deadlines in 2023, arguing that the costs were too high for landlords and homeowners.

However, Labour has committed to ambitious climate targets and may reintroduce stricter EPC rules if they win the next election.

A Labour-led government could:

• Bring back the 2025/2028 EPC deadlines.

• Increase the cost cap for improvements.

• Provide financial support for landlords to encourage compliance.

If this happens, landlords may face new deadlines and financial pressures, making it essential to plan ahead.

The Government has also announced a complete review of the methodology to produce EPC’s. It is likely, but not guaranteed, that electric heating will be favoured over other forms, especially gas or oil.

When planning property upgrades, be aware that installing electric heating may currently lower your EPC rating but could improve it under the new system. Conversely, gas heating may be beneficial now but less so once the new EPC methodology is implemented.

There is no confirmed date for these changes, and it may be several years before they take effect.

While the proposed EPC rating changes align with sustainability goals, they pose significant financial and operational challenges for landlords. Many will need to carefully assess upgrade costs and explore potential support schemes to comply with the new regulations. If these changes are enforced without adequate financial assistance, they could lead to higher rents, reduced rental stock, and further instability in the private rental market.

Steps to consider:

• Get an EPC assessment – See what improvements are needed.

• Make cost-effective upgrades early – Insulation, LED lighting, and draft-proofing are relatively cheap improvements.

• Explore grants & tax relief – Keep an eye on government schemes.

• Budget for potential future changes – Labour’s housing policies could bring stricter rules back.

If tougher EPC rules return, landlords will need to adapt quickly to stay compliant and protect their investments.

While the proposed EPC rating changes align with sustainability goals, they pose significant financial and operational challenges for landlords.

Helping landlords build insurance policies that can protect their portfolios is what we do best.

We know what matters to landlords. When you need us, we’ll help you tackle it one thing at a time.

TRACEY HANBURY EDITOR & SHOW FOUNDER

In an era of unprecedented change in the UK property market, staying informed isn’t just important – it’s essential. And it’s even more essential to stay informed with factual expert information. With new regulations, evolving tenant rights, and shifting investment strategies, landlords and property investors need a reliable, educational platform that cuts through the noise and delivers real insights from industry experts.

That’s exactly why UK Property News has launched – a brandnew property news channel and platform, proudly launched by the National Landlord Investment Show.

Why the UK Property News channel is Essential

For over 13 years, the National Landlord Investment Show has been at the forefront of the UK property sector, delivering events, expert panels, and networking opportunities that have helped shape the industry. But now, more than ever, the need for on-demand, accessible property education is critical.

UK Property News isn’t just another media outlet – it’s a dedicated hub for landlords, investors, and property professionals looking to navigate the ever-changing landscape with confidence. Ian Collins (Journalist & Broadcaster) takes on the role as main host alongside co-hosts Tracey and Steve Hanbury, Founders of the National Landlord Investment. The UK Property News channel dives straight into the most monumental conversations in the UK property industry, tackling pressing issues head-on and provides a platform for anyone within the UK property space to ask the experts.

Diving into the Renters’ Rights Bill: Debut Episode

The first episode of UK Property News wasted no time in addressing one of the most significant legislative changes in recent history – the Renters’ Rights Bill. Co-host Tracey Hanbury opens the first episode with a statement “Landlords are questioning is there too much risk and not enough reward when it comes to property investment?” and hands over to Ian Collins to debut this critical conversation. The first episode features guest industry leaders Maxine Fothergill - (MD of Amax Estates & Property

Services) and Peter Littlewood (CEO of iHowz) who shared expert perspectives and opinions while answering questions from UK landlords and property investors with Ian Collins facilitating the conversation.

This interactive, engaging approach is what sets UK Property News apart – giving landlords and investors the opportunity and platform to ask questions about pressing topics and conversations within the UK property industry.

What Will You Get From the UK Property News Channel

Bi-weekly episodes featuring top property experts and thought leaders

Deep dives into critical topics from legal changes to investment strategies

Actionable insights for landlords, investors, property professionals

Opportunities to engage, ask the experts, and stay ahead of UK property updates

Industry Leaders Weigh In on UK Property News

Steve Hanbury, Co-Founder of the National Landlord Investment Show: "In all my years in this industry, I’ve never seen as many changes happening at once. The UK property market is evolving rapidly, and landlords need the right information at the right time. UK Property News is here to deliver exactly that."

Tracey Hanbury, Co-Founder of the National Landlord Investment Show: "We’re incredibly proud to launch the UK Property News channel as an extension of our commitment to educating and empowering property professionals. This platform ensures landlords and investors stay informed, prepared, and ahead of the curve."

For over 12 years, the National Landlord Investment Show has been at the forefront of the UK property sector, delivering events, expert panels, and networking opportunities

Stay Tuned for Launch Updates to Stay Informed

The UK Property News Channel will be available to watch as part of the National Landlord Investment Show’s (LIS) media offering with the first episode coming soon.

Stay tuned and engaged with the National Landlord Investment Show’s media communications for the launch of the UK Property News channel to gain insights, expert commentary, and the latest UK property updates and education to help you grow and retain your property portfolio.

Join the conversation COMING SOON via UK Property News brought to you by the National Landlord Investment Show. Stay informed.

TH

PETER LICOURINOS DIRECTOR, PROJECT HOMES

Arecent study by University College London (UCL) found that “one in four children in England need social care services by the time they turn 18” (IDJPDS, 2025). This alarming statistic highlights an urgent reality: vulnerable children in care need access to safe, nurturing homes – yet the current housing supply is falling short

As a property investor myself, I see it as my mission to provide accommodation that goes beyond bricks and mortar –homes that foster security, stability, and growth. And the truth is, investing in supported accommodation isn’t just a moral responsibility; it’s also a financially sound decision. Here’s why – and how Project Homes can help you become part of this transformative movement.

By definition, supported accommodation aims to help young people develop ‘independence while keeping them safe in a homely, nurturing environment’ (GOV). There is positive news that there is a rising number of children’s homes in England – now just under 3,500 (GOV) – there remains a significant shortfall. Additionally, the existing homes are unevenly distributed, leaving many children without access to appropriate care facilities within their local areas.

This growth, but uneven gap represents an urgent call for action – and an opportunity for investors to contribute to a revolutionary distributed approach

By definition, supported accommodation aims to help young people develop ‘independence while keeping them safe in a homely, nurturing environment’

in ethical property investment: one that delivers long-term, stable returns while making a genuine social impact on young people’s lives.

How to Get Started: Join Us at the National Landlord Investment Show

If you’re interested in investing in supported accommodation and children’s homes, your first step is to educate yourself and connect with the right experts. That’s why you can’t afford to miss the upcoming National Landlord Investment Show at Old Billingsgate on 19 March.

This event features an exclusive expert panel discussion on: “Property Investing in Supported Accommodation and Children’s Homes: The Most TalkedAbout Property Strategy in the UK”.

During this session, you’ll gain essential insights on:

• Building the right team

• Securing financing

• Navigating OFSTED compliance frameworks

• Sourcing investment opportunities

• Managing developments effectively

• Partnering with the right providers – or becoming a provider yourself

Have questions? Our panel has the answers. Facing challenges? They’ll help you solve them. This is your chance to learn from industry experts – don’t miss it. Get your free ticket to the show here

Project Homes: Transforming Lives Through Purpose-Driven Property Investment

At Project Homes, we believe that every child deserves a safe, nurturing home. With extensive expertise in property investment, care operations, and compliance, we’re committed to creating spaces where children can thrive – and we want to help investors do the same.

It goes without saying Investments should be more than numbers on a spreadsheet – they should leave a legacy.

If you're ready to build a legacy and invest ethically whilst being smart, the time to act is now. Join us at the National Landlord Investment Show and take your first step toward purpose-driven property investment.

Find out more...

https://ijpds.org/article/view/2454/ https://www.gov.uk/government/publications/providing-supported-accommodation-for-children-and-young-people https://dera.ioe.ac.uk/id/eprint/40782/1/children%E2%80%99s%20social%20care%20in%20England%202024%20-%20GOV.pdf

JENI BROWNE BUSINESS DEVELOPMENT DIRECTOR, MFB

If I had to sum up the past two years in one word, it could only be ‘turbulent’. This time last year, I optimistically predicted that 2024 would be ‘The Year of the Landlord’. Hindsight is a funny thing.

Ashock election announcement stalled the Base Rate decreases that would have settled the money markets, so mortgage rates came down much slower and by less than we had all expected. Unsurprisingly, the new Labour government were quick to make the Renters’ Rights Bill much tougher on the market, with significant changes coming this year.

What none of us could have expected was for Rachel Reeves to penalise landlords even further with a surprise hike to the Stamp Duty surcharge on additional properties. This 5% surcharge is going to deter many property investors from expanding portfolios this year.

But we’re landlords. We shift the focus and adapt to the hand dealt to us. We must – the supply and demand gap for rental properties means tenants need us more than ever. So, how will landlords invest this year to boost their portfolios and keep mortgage costs down?

Let’s talk semi-commercial

For landlords with established portfolios, semi-commercial property is a fantastic opportunity, but now more than ever.

Purchasing these types of properties is generally cheaper than buying a standard buy to let, but with the 5% surcharge, this is now more prevalent than ever. For example, here’s how much Stamp Duty you would pay (assuming you own at least one residential property):

For a residential property priced at £300,000, you will pay:

Stamp Duty to pay: £20,000 (incl. 5% surcharge)

For a semi-commercial property purchase comprised of flats above a commercial unit at £300,000, you will pay:

Stamp duty costs: £4,500

Savings on purchase compared to a buy to let purchase for landlords: £15,500.

Converting commercial properties to residential

So far, commercial-to-residential conversions have been most popular with more-experienced landlords. However, as the government continues to discuss improved planning permission process to speed up these conversions, many landlords are considering whether this type of invest could be for them.

To convert commercial property to residential under permitted development, you can apply for prior approval from your local council. You can consult an architect or your local authority for help.

Here are the steps:

1. Check the building's classification: Make sure the it’s in Use Class E (commercial, business, and service).

2. Check the building's history: Make sure the building has been in commercial use for at least two years and vacant for at least three months.

3. Check the proposed changes: Make sure the conversion doesn't increase the height of the building, lose floor space, or make the property unsuitable for its original use.

4. Prepare the application: Have an architect prepare designs and a planning package.

5. Apply: Submit a prior approval application to your local council.

6. Wait for approval: Wait for your local council to respond with a grant of prior approval.

There are a number of factors to consider here:

Local authorities can still turn down the conversion for a number of reasons.

The conversion must be subject to prior approval.

The conversion must not create any new homes that would be considered “household units”.

Financing semi-commercial property

How to finance these property types will depend on your plans. If you’re just looking to purchase a semi-commercial property, then our MFB experts can help you navigate the market and secure a competitive semi-commercial mortgage.

However, if you’re looking to complete a conversion project, then bridging finance will be the route to go down. As always, working with a broker is the only and best way to find the right mortgage for your needs.

This year may bring new challenges for the market, but we’re more than prepared. With opportunities out there to boost your portfolio profits, I’m excited to see what 2025 brings.

For landlords with established portfolios, semi-commercial property is a fantastic opportunity, but now more than ever.

For 26 years, I have been a landlord, property investor, and developer. I founded Amax Estates 23 years ago, where we specialize in sales, lettings, and block management – though our core business today is primarily lettings and managing blocks of flats.

Additionally, I have been a trainer for the London Landlord Accreditation Scheme for 21 years and served as Past President of ARLA Propertymark from 2021 to 2022. As a public speaker on all things propertyrelated regularly featuring at the National Landlord Investment Show and as a guest columnist for LI Magazine and Property Notify, I am passionate about educating landlords and investors on how to succeed. Recently, I also became a published author with my book, How to Become a Successful Property Investor, which shares insights on building a profitable and compliant property portfolio.

For years, property has consistently proven to be one of the most resilient and rewarding investment opportunities. Even now, with the Renters' Rights Bill on the horizon and legislative changes on the way, property investment remains unmatched in its ability to provide longterm wealth, stability, and security.

In this article, I’ll explain why property investment continues to be the best asset class and how landlords who do their research, plan ahead, and take a long-term view can thrive in this evolving market.

1. Yes, Legislation Is Changing – But That’s Not a Reason to Avoid Property

Whenever new regulations are introduced, we hear the same concerns from landlords: “Is buy-to-let still worth it?” or “Will these changes make it impossible to operate?”

The reality? Legislation changes all the time, and experienced investors know how to adapt. Even with increased compliance, property remains one of the safest, most lucrative long-term investments.

Yes, the Renters' Rights Bill is bringing changes, which include:

• The abolition of Section 21 (“nofault” evictions)

• A mandatory landlord portal and ombudsman scheme

• New rules on rent increases and pet requests

• Stronger safety requirements under Awaab’s Law and the Decent Homes Standard

But let’s focus on the positives –because there are plenty.

2. Why Property Investment Still Makes Sense

Property Always Provides a Tangible Asset

Unlike stocks or cryptocurrencies, property is a physical, tangible asset that will always hold value, even during economic downturns. Over the last century, UK house prices have continued to rise – even after financial crises, interest rate hikes, and political uncertainty.

• Property values grow over time, offering both capital appreciation and rental income.

• Unlike other investments, you have direct control over your asset – you can renovate, remortgage, or sell at the right time.

• Even with regulatory changes, rental demand remains strong, making property a consistent cashflowing investment.

Mid to Long-Term Investments Will Always Win

Short-term speculation can be risky, but those who invest for the long haul nearly always come out ahead.

If you:

• Do your research before purchasing

• Buy in the right locations with strong rental demand

• Think strategically about financing

• Understand how to manage a property effectively

… then your investment will be secure, regardless of policy changes.

For years, property has consistently proven to be one of the most resilient and rewarding investment opportunities.

In my book, How to Become a Successful Property Investor, I share my best hints and tips for making smart property investments – from choosing the right properties to maximizing returns while staying compliant.

Rental Demand Continues to Grow

One key reason property remains a top-tier investment? Demand for rental homes is at an all-time high.

• The UK rental market is undersupplied, meaning properties are occupied quickly.

• House prices and mortgage rates remain high, so more people are renting for longer.

• Even with regulatory changes, landlords who provide wellmaintained, compliant properties will always have tenants.

If you own high-quality rental properties, you will attract long-term tenants who want stability – which means reliable rental income for you.

3. The Key to Success? Invest with Your Eyes Wide Open

The biggest mistake new landlords make is jumping into property investment without understanding the industry. If you’re going to succeed in buy-to-let, you need to be:

• Informed – Keep up with legal changes so you can adapt.

• Prepared – Do your due diligence and ensure your numbers stack up.

• Long-term focused – Property isn’t a “get-rich-quick” scheme – it’s a strategic investment.

If you take this approach, you will always stay ahead of the market.

4. How to Make the Most of the Renters' Rights Bill Changes

Even though compliance is increasing, these changes will benefit professional landlords in the long run.

• The new landlord register will make it easier for professional landlords to stand out.

• It could improve tenant quality, as renters will see who runs their properties properly.

• While evictions will require a valid reason, landlords will hopefully gain more long-term tenants, reducing void periods.

• With stronger Section 8 grounds, landlords can still reclaim properties when necessary.

Awaab’s Law & Decent Homes Standard Will Strengthen the Market

• Only landlords who cut corners will struggle – if you maintain your properties well, these rules won’t affect you.

• A safer, higher-quality rental sector means stronger investment value over time.

Rent Increases Will Still Be Possible Under Section 13

• Landlords can still increase rent annually, as long as it’s in line with market conditions.

• The process will be more structured, reducing disputes and uncertainty.

Thoughts: Property Remains the Best Investment

It is still early days, and the final legislation has not been laid yet, so updates may still occur. However, on a positive note, despite these new regulations and penalties, property investment remains one of the safest and most rewarding ways to build long-term wealth.

As long as you:

• Do your research before purchasing

• Read my book for expert hints & tips

• Invest with a mid-to-long-term mindset

• Stay informed on regulations

… then you will always have a profitable, stable, and secure investment.

By Maxine Fothergill – MD of Amax Estates & Property Services in Gravesend, Past President of ARLA Propertymark (2021/2022), landlord, property investor, developer, public speaker, columnist, and published author of How to Become a Successful Property Investor.

Success and dedication in the local market

• Full Property Management & Letting Service

• Tenant Find Fee - Included

• Guaranteed Rent Fee - Included

• Expert Consultation Services For Self Managed Property - Included

• Tenancy Set Up Fee - Included

• Tenant References - Included

• Guarantor References - Included

• Inventory Preparation - Included

• Checkout Fee - Included

• Preparing & Negotiating Renewals For Let Only - Included

• Service Of Notice For Let Only - Included

• Administration Fee - Abortive Re Advertising - Included

• Vacant Property Management - Included

• Arrangement of Landlords Compulsory Certificates - Included

• Decorating & Refurbishment Service - Included

• Purchasing Items On The Landlords Behalf - Included

• Sale to the tenant - Included

• Attending Formal Proceedings (County Court etc) - Included

• Managing Insurance Claims - Included

• Preparing Accounts for Submission To HMRC - Included

• Negotiating Dilapidations For Let Only/Rent Collection - Included

If you’re considering where the best place to invest in property in the UK is, it's important to look beyond the initial investment price tag and average rental yield to see the bigger picture.

While property trends come and go, cities with strong economies, high rental demand, and strategic infrastructure development offer stable, long-term returns.

Ultimately, cities demonstrating a combination of economic strength, robust rental markets, and forwardthinking policies will be top investment destinations.

Here are our top 5 best cities to invest in UK property in 2025.

Manchester

As we delve into the performances of individual cities, there are some clear highlights, including Manchester, which continues to perform well for investors looking for capital growth potential and reliable rental returns.

Over the last ten years, Manchester has been one of the biggest success stories for investors, delivering some of the strongest gains on the market. In the last year alone, values have climbed by 3.4%, with the average property price currently at £228,600 (Zoopla, February 2025), compared to the average annual UK gains of 1.9%.

According to the Office for National Statistics (ONS), private rents in Manchester increase to an average of £1,300 in January 2025, marking an annual increase of 11.1% from £1,171 in January 2024. This was higher than the rise in the North West (9.7%) over the year.

For buy-to-let investors, Manchester's local economy, rapid population growth, and appeal to young people – both workers and university students – make it one of the most viable locations for acquisition. Manchester's appeal is further solidified by its increasing status as a media and technology hub.

For landlords and investors, the city's property market benefits from sustained demand from students and young professionals, resulting in reliable rental yields. Enhanced infrastructure, including improved transport and urban development projects, also add to its attractiveness.

The positive ripple effect felt across the region adds to Manchester's appeal. Greater Manchester hubs such as Salford and Stockport offer investors valuable diversification beyond Manchester city centre, providing varied asset classes and distinct local markets. According to Rightmove, Stockport was a topperforming rental hotspot in 2024, seeing average rents climb by 12.2%.

Home to one of the UK's youngest and fastest-growing city centre populations, Liverpool has been a popular choice for investors seeking lower entry-level assets and higher-than-average rental yields.

Long-term regeneration commitments provide a unique opportunity for early adopters to capitalise on the future growth of a city, rewarding them with impressive long-term results. And with Liverpool currently benefitting from an influx of public and private investment, including the £5.5 billion Liverpool Waters Scheme, the city’s buy-to-let market has certainly emerged as one to watch.

According to Zoopla, average property values increased by 3.5% in the year to February 2025 in Liverpool, with values reaching £161,600.

The value on offer in Liverpool is clearly evident compared to the average cost of buying a home in the UK (£299,138).

For investors looking to reduce the upfront cost of their next rental property purchase, the lower entry-level of Liverpool’s property market will help with Stamp Duty obligations, allowing investors the potential to reduce the upfront cost of purchasing through location diversification.

When it comes to rental market, the ONS has reported that private rents climbed to average of £826 in January 2025, an annual increase of 9.8%. Such a significant rent increase indicates robust demand for rental properties across Liverpool.

Ultimately, cities demonstrating a combination of economic strength, robust rental markets, and forward-thinking policies will be top investment destinations.

As we look to the future, Liverpool presents a compelling opportunity for property investment in 2025, buoyed by a vibrant economy and rich cultural scene. The city's property market is notably accessible, offering some of the most affordable prices among the UK's major cities. This affordability, combined with promising rental yields, makes Liverpool an attractive option for investors.

Birmingham is a prime candidate for property investment in 2025, supported by extensive infrastructure projects and a flourishing local economy.

As the UK's second-largest city, Birmingham boasts robust growth in both business and population. Key developments such as the HS2 railway project and ongoing urban regeneration initiatives have significantly enhanced its investment potential. These projects are expected to increase property values and rental demand, offering investors opportunities for both capital appreciation and healthy rental yields.

The city's vibrant cultural life, coupled with its renowned educational institutions, continues to attract a steady stream of renters, from students to young professionals. Additionally, Birmingham's strategic location and excellent transport links make it an appealing destination for businesses and residents alike. This combination of factors ensures that Birmingham remains a top choice for savvy property investors aiming to diversify their portfolios and achieve substantial returns in the coming year.

For investors, the case for property ownership in Birmingham is impressive, especially considering that the average property value is currently £211,300, marking a 2.5% year-on-year climb, according to Zoopla’s February 2025 House Price Index.

The ONS reported that rents rose to an average of £1,043 in January 2025, up 8.4% from £962 in January 2024, slightly above average rises in the West Midlands (7.7%) over the year.

Looking ahead, JLL's 5-year Residential Forecast Report projects a strong future for the West Midlands property market, forecasting a 21.6% cumulative growth between 2025 and 2029, significantly exceeding the UK average of 19.9%.

Whilst actual gains will likely vary depending on the property and location, investors could benefit from higherthan-average house price growth in the coming years.

London, often hailed as the pinnacle of property investment, presents a compelling, albeit complex, opportunity for 2025. While recent property value growth has lagged national averages, projections paint a significantly more optimistic picture.

JLL’s latest five-year forecast anticipates that average London house prices could increase by 21.6% between 2025-2029,

underpinned by a lack of new homes reaching the market for sale. This rate is higher than the expect national growth of 19.9%.

According to the ONS, London's rental market saw the highest inflation in England, with a rate of 11.0% in the 12 months leading up to January 2025. The average rent was highest in Kensington and Chelsea (£3,615).

London remains an attractive destination for property investors in 2025, despite the city's higher entry costs. The capital's diverse neighbourhoods provide a range of investment opportunities, from highend properties in prime central locations to more budget-friendly options in upand-coming areas, with commuter belt locations often offering stronger returns.

For those looking to dip their toe into the London property market in 2025, it’s important to focus on areas with growth potential and consider the long-term benefits of owning property in one of the world's most dynamic cities. Each borough and asset class will have a unique appeal, so understanding the pros and cons will help investors futureproof their property investment to determine the best areas to invest in property London.

Sheffield is flying slightly under the radar, emerging as a compelling buy-to-let hotspot for 2025, driven by favourable market conditions. The city's property values are on the rise, outpacing the national average with a 2.7% year-onyear increase, according to Zoopla. With a strong regional five-year forecast of + 19.3% (JLL), Sheffield is a location on the up for rental property investors.

In relation to rents, according to Rightmove, the average asking rent climbed by 12.5% annually, making it a contender for one of the best place to buy rental property in the UK.

This dynamic, where rental increases significantly exceed property value growth, is a primary driver of the healthy 6.9% average landlord yields observed in Sheffield.

These yields, coupled with the relative affordability of Sheffield's property market, create an attractive proposition for investors and, with average property values of around £174,900, the lower entry-level of this regional market will have a wide appeal.

London remains an attractive destination for property investors in 2025, despite the city's higher entry costs.

The capital's diverse neighbourhoods provide a range of investment opportunities, from highend properties in prime central locations to more budget-friendly options in up-and-coming areas

The factors driving these strong yields include the city's economic growth, strong student population, and a supply and demand imbalance within the rental market. This combination of factors makes Sheffield a region to watch in 2025, as it shows strong signs of continued growth and stability for property investors in the coming years.

We hope this article helped highlight which city is best to invest in in the UK. Overall, the UK property market in 2025 presents varied opportunities and its up to investors to consider the unique strengths and challenges of each city to make informed decisions. By strategically selecting cities that align with their investment goals and adapting to evolving market conditions, investors can effectively navigate the UK property landscape in 2025.

Notably, early indicators suggest a continued north-south divide in house price inflation, a factor investors should consider when sourcing properties. This regional disparity highlights the importance of granular market analysis.

SIMON HOWITT SENIOR PARTNER, ACUITY PROFESSIONAL

The UK housing crisis, coupled with regulatory changes, increased taxation, and higher interest rates since 2017, has made it challenging for landlords to operate profitably.

Over 31% of landlords are selling their portfolios, often triggering substantial capital gains tax (CGT) liabilities. However, with proper tax planning and expert advice, landlords can mitigate these financial burdens and continue to grow their property investments. Acuity has helped over 4,000 landlords implement innovative, legal tax strategies to protect their wealth and ensure longterm success.

Section 24 of the Finance Act 2017 has significantly affected landlords by disallowing the deduction of mortgage interest from rental income before calculating tax liability. Instead, landlords receive a basic rate tax credit, often resulting in higher tax bills, especially for those in higher tax brackets. With interest rates rising from 1-3% in 2020 to 5-6% by late 2024, many landlords are barely breaking even or running at a loss. Fortunately, there are legal and effective ways to manage this issue that we can help you with. Plus, there is a glimmer of hope now, as the BOE has been forced to drop rates in response to zero growth in the economy under this new anti-landlord government.

Acuity offers tailored tax solutions to help landlords move their properties into a more commercially efficient structure, typically a limited company. This allows landlords to:

Mitigate Section 24 restrictions and reclaim mortgage interest as a deductible business expense.

Benefit from lower corporation tax rates compared to higher personal income tax rates.

Retain profits within the company for reinvestment rather than losing a significant portion to higher personal tax liabilities.

Transitioning from personal ownership to a limited company structure can be complex, but Acuity's strategies often minimise or mitigate CGT liability and transfer properties without triggering stamp duty.

Some landlords, frustrated by the increased burdens, seek to exit the market. Acuity helps landlords consider their options and implement strategies to exit if required. Diversification is another option, with landlords looking to create multifaceted portfolios, including residential buy-to-let, commercial properties, and serviced accommodations. Creating group structures where profits can be aligned and shared helps businesses grow stronger.

Inheritance tax (IHT) is a critical consideration for landlords with longterm investments. Without proper planning, up to 40% of a portfolio could be lost to IHT upon transfer to heirs. Acuity offers solutions such as family trusts, gifting strategies, and strategic use of limited companies to facilitate smoother generational transfers and minimise tax exposure.

Acuity provides clients access to all its multiple specialisms, including mortgage teams, property accountants, tax and financial advisors, and estate planners, all working together seamlessly. Acuity has a proven track record of helping landlords reduce tax liabilities, optimise profits, and navigate the constantly changing regulatory landscape.

If you're a landlord looking to protect your property assets, minimise tax liabilities, and future-proof your wealth and investments, Acuity is here to help. Contact us today for your free tax consultation.

Visit us at the Landlord Investment Show at stand number 9.

T: 020 7280 0500

E: property@acuityprofessional.com

W: www.acuityprofessional.com

With interest rates rising from 1-3% in 2020 to 5-6% by late 2024, many landlords are barely breaking even or running at a loss.

Fortunately, there are legal and effective ways to manage this issue that we can help you with.

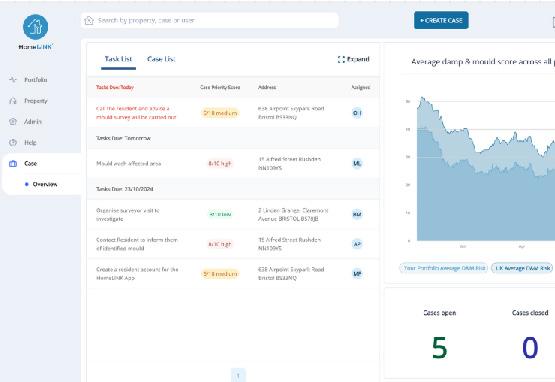

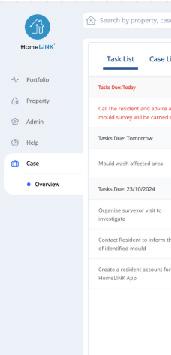

Aico, the European market leader in home life safety, announced the launch of its innovative HomeLINK Case Management (HCM) system in November 2024. This advanced tool designed to address landlords’ biggest challenges in maintaining safe and compliant homes. HCM provides landlords with a comprehensive, intuitive solution to manage issues like damp & mould, with plans to expand into fire and CO compliance and decarbonisation in future updates.

HomeLINK is a leading technology in smart property management solutions, dedicated to helping landlords create healthier, safer living environments through advanced technology and datadriven insights. HomeLINK solutions are trusted by landlords across the UK, supporting their efforts to stay compliant, enhance tenant satisfaction, and achieve sustainability goals.

Informed by feedback from customers and recent industry legislation, Aico created HCM to help property managers meet compliance requirements and streamline complex processes. This launch is well-timed, given the increasing regulatory pressures that landlords face to maintain safer, healthier living environments for residents.