EXISTING

Existing Conditions and Growth Trends Report

Lexington Sustainable Growth Study

November 17, 2021

Prepared for:

The LFUCG Sustainable Growth Task Force

Prepared by:

Stantec Consulting Services Inc.

EHI Consultants

MXD Development Strategists

Urban3

CONDITIONS AND GROWTH TRENDS REPORT

EXISTING CONDITIONS AND GROWTH TRENDS REPORT Table of Contents EXECUTIVE SUMMARY ......................................................................................................................................... 1 1.0 INTRODUCTION ..................................................................................................................................... 10 2.0 DEMOGRAPHIC PROFILE.................................................................................................................... 11 2.1 POPULATION ........................................................................................................................................................... 11 2.2 HOUSEHOLDS 13 2.3 AGE PROFILE 14 2.4 RACE AND ETHNICITY ........................................................................................................................................ 17 2.5 INCOME ...................................................................................................................................................................... 18 3.0 EMPLOYMENT ........................................................................................................................................ 19 3.1 EMPLOYMENT ANALYSIS .................................................................................................................................. 19 3.1.1 Fayette County Location Quotient 19 3.1.2 Lexington Region (excluding Fayette County) ................................................................... 23 3.2 COMMUTER PATTERNS...................................................................................................................................... 26 4.0 LAND USE ANALYSIS ............................................................................................................................ 29 4.1 EXISTING LAND ...................................................................................................................................................... 29 4.1.1 Zoning by Class 29 4.1.2 Existing Land Uses by Description 35 4.2 VACANT LAND ........................................................................................................................................................ 45 4.2.1 Vacant Land by Zoning Classification .................................................................................... 45 4.2.2 Vacant Land by Land Use Description 50 5.0 HOUSING OVERVIEW ........................................................................................................................... 53 5.1 EXISTING HOUSING STOCK 53 5.2 REAL ESTATE STATISTICS 57 5.3 HOUSING OCCUPANCY AND COST ................................................................................................................. 64 5.4 AFFORDABLE HOUSING NEEDS ASSESSMENT ......................................................................................... 66 5.4.1 Affordable Housing Subsidies 66 5.4.2 Market Based Housing Affordability ...................................................................................... 67

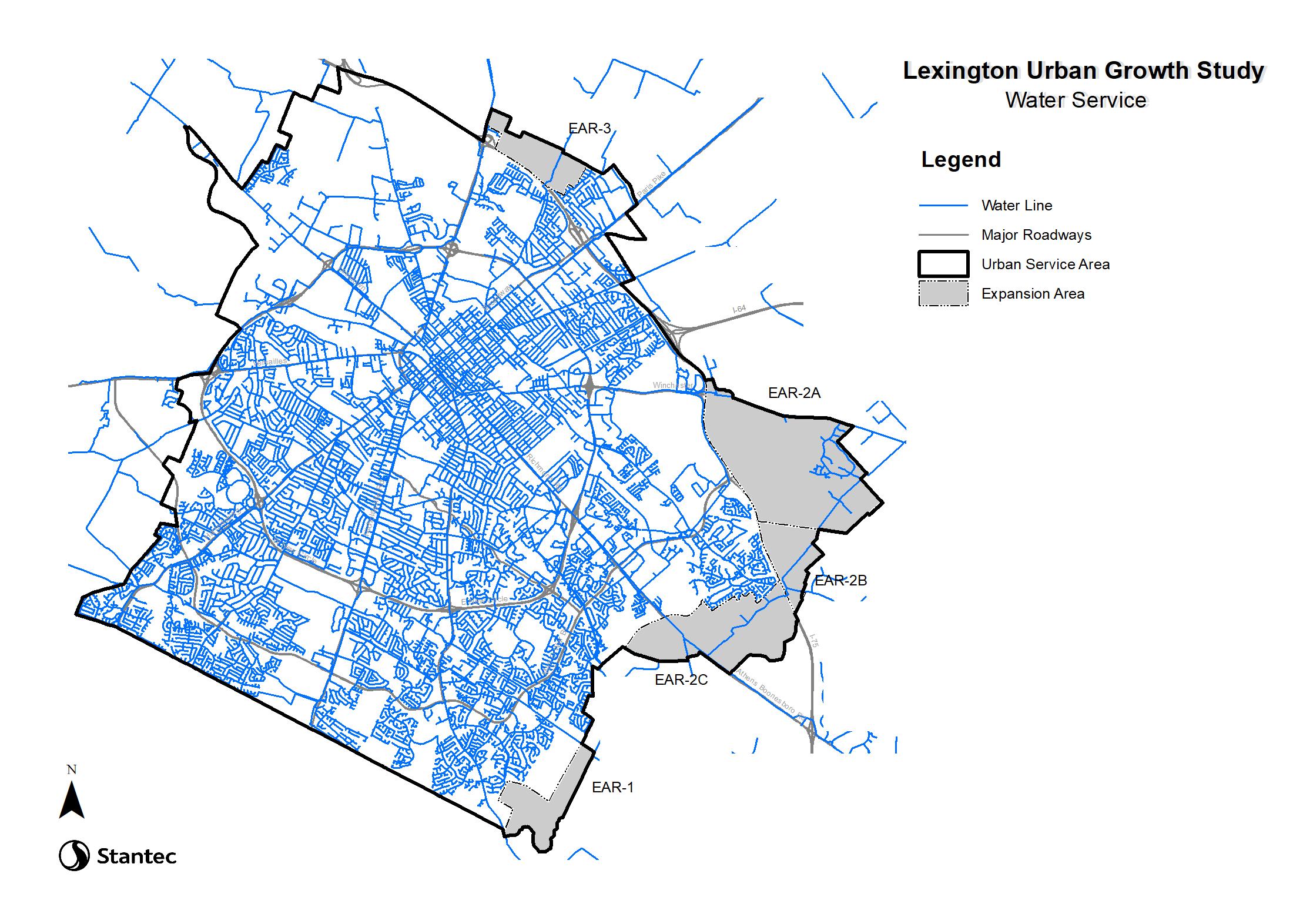

EXISTING CONDITIONS AND GROWTH TRENDS REPORT 6.0 COMMERCIAL DEVELOPMENT ......................................................................................................... 68 6.1 INDUSTRIAL ANALYSIS....................................................................................................................................... 68 6.2 6.2 OFFICE ANALYSIS 72 6.3 RETAIL ANALYSIS ................................................................................................................................................. 75 7.0 FISCAL PROFILE .................................................................................................................................... 78 7.1 REVENUE 78 7.2 EXPENDITURES ...................................................................................................................................................... 82 8.0 INFRASTRUCTURE AND COMMUNITY FACILITIES .................................................................... 85 8.1 TRANSPORTATION ............................................................................................................................................... 85 8.1.1 Roads ................................................................................................................................................... 85 8.1.2 Transit 85 8.2 WATER AND SEWER ............................................................................................................................................ 86 8.3 SCHOOLS ................................................................................................................................................................ ... 88 8.4 PUBLIC SAFETY ...................................................................................................................................................... 89 8.5 PARKS AND RECREATION 91 9.0 POPULATION GROWTH TRENDS .................................................................................................... 92 10.0 COMMERCIAL GROWTH TRENDS .................................................................................................... 94 10.1 INDUSTRIAL GROWTH TRENDS ..................................................................................................................... 94 10.1.1 Considerations Moving Forward 94 10.1.2 Trendline Analysis ......................................................................................................................... 94 10.2 OFFICE GROWTH TRENDS ................................................................................................................................ 95 10.2.1 Considerations Moving Forward 95 10.2.2 Trendline Analysis 96 10.3 RETAIL GROWTH TRENDS ................................................................................................................................ 96 10.3.1 Considerations Moving Forward ............................................................................................. 96 10.3.2 Trendline Analysis 97

EXISTING CONDITIONS AND GROWTH TRENDS REPORT LIST OF TABLES Table 2.1 Fayette and Regional Population 12 Table 2.2 Fayette and Regional Households .............................................................................................................. 14 Table 2.3 2019 Age Cohort Distribution ...................................................................................................................... 15 Table 2.4 Median Age by County 15 Table 2.5. Fayette Age Cohorts by Year ........................................................................................................................ 16 Table 2.6 Racial and Ethnic Population ........................................................................................................................ 17 Table 2.7 Fayette Racial and Ethnic Composition by Year 17 Table 2.8 Income and Poverty Rates by County ....................................................................................................... 18 Table 2.9 Distribution of Household Income ............................................................................................................. 19 Table 3.1 Fayette County – Employment Sector Location Quotient (LQ) Analysis 20 Table 3.2 Fayette County – Economic Base & Shift-Share Analysis: 2008 - 2018 ...................................... 22 Table 3.3 Surrounding Region Employment Sector Location Quotient (LQ) Analysis ............................. 23 Table 3.4 Surrounding Region Economic Base & Shift-Share Analysis: 2008 - 2018 25 Table 3.5 Primary Job Commutes within the Urban Service Boundary .......................................................... 26 Table 3.6 USB Commuter Inflow and Outflow ........................................................................................................... 28 Table 4.1 Existing Parcel Count, Acreage and LivUnits by Zoning Class within the USB, 2020 31 Table 4.2 Analysis of the Built Environment of Non-Residential Zoning Classes ....................................... 32 Table 4.3 Summary of Existing Industrial Zoning and Uses within the USB, 2020 .................................... 34 Table 4.4 Existing Parcel Count, Acreage, and LivUnits by Land Use within the USB, 2020 36 Table 4.5 Existing Land Uses by Subarea .................................................................................................................... 43 Table 4.6 Apartment Land Use and LivUnits by Subarea, 2020 ......................................................................... 44 Table 4.7 Summary of Vacant Land and Land in Transition by Zoning Class 47 Table 4.8 Summary of Vacant Land and Land in Transition by Land Use Description ............................ 52 Table 5.1 Housing Units by County ................................................................................................................................ 53 Table 5.2 Housing Units by Year of Construction 54 Table 5.3 Fayette County Single and Multi-unit Development ........................................................................... 56 Table 5.4 Housing Units by Type .................................................................................................................................... 57

EXISTING CONDITIONS AND GROWTH TRENDS REPORT Table 5.5 Total Home Sales by County 58 Table 5.6 New Home Sales by County ........................................................................................................................... 59 Table 5.7 Median Sales Price: All Housing Types 60 Table 5.8 Median Sales Price: Single-family Homes 61 Table 5.9 Median Sales Price: New Single-family Homes ..................................................................................... 62 Table 5.10 Median Sales Price: First-time Single-family Homes 63 Table 5.11 Housing Occupancy by Tenure and Monthly Costs 64 Table 7.1 LFUCG Revenue Sources ................................................................................................................................. 78 Table 7.2 LFUCG Revenue by Land Use Type 79 Table 7.3 LFUCG Top Level Expenses 83 Table 7.4 Infrastructure Cost Estimates ...................................................................................................................... 83 Table 9.1 Kentucky State Data Center Population Projections, Fayette County 92 Table 9.2 Growth Rate Comparison of Population by County 93 Table 9.3 20 Year Household Growth Trendlines .................................................................................................... 93 LIST OF FIGURES Figure 2.1 Population Share by County ........................................................................................................................ 12 Figure 2.2 Population Growth Since 2000 13 Figure 2.3 2019 Age Cohorts Comparison 15 Figure 2.4 Fayette Age Cohorts by Year ....................................................................................................................... 16 Figure 2.5 Fayette Racial and Ethnic Composition 17 Figure 2.6 Distribution of Household Income ........................................................................................................... 19 Figure 3.1 Fayette County – Employment Sector Location Quotient (LQ) Analysis .................................. 21 Figure 3.2 Surrounding Region Employment Sector Location Quotient (LQ) Analysis 24 Figure 3.3 Distance and Direction of Commuter Travel to and from the USB, 2018 ................................. 27 Figure 3.4 Origin of Commuters with Jobs Inside the USB ................................................................................... 27 Figure 3.5 USB Commuter Inflow and Outflow 28 Figure 4.1 Existing Zoning ................................................................................................................................................. 30 Figure 4.2 Existing Zoning within the USB by Major Use Category, 2020 ..................................................... 33

EXISTING CONDITIONS AND GROWTH TRENDS REPORT Figure 4.3 Summary of Existing Residential Zoning Acreages within the USB, 2020 33 Figure 4.4 Existing Land Uses........................................................................................................................................... 35 Figure 4.5 Existing Land by Use Description, Acreage and Percent of Total 37 Figure 4.6 Existing Industrial with a Land Use Code 410 by Parcel Size Range, 2020 38 Figure 4.7 Other Land Uses ............................................................................................................................................... 39 Figure 4.8 Sub Area Descriptions 42 Figure 4.9 Vacant Land by Zoning Classification 45 Figure 4.10 Vacant Land by Zoning 2020 .................................................................................................................... 46 Figure 4.11 Locations of Vacant Industrial Parcels by Acreage Range, 2020 48 Figure 4.12 Locations of Vacant Residential Parcels by Acreage Range 49 Figure 4.13 Vacant land by Land Use ............................................................................................................................ 51 Figure 5.1 Fayette County Single and Multi-Family Development 55 Figure 5.2 Total Home Sales by County 58 Figure 5.3 New Home Sales by County ......................................................................................................................... 59 Figure 5.4 Median Sales Price: All Housing Types 60 Figure 5.5 Median Sales Price: Single-family Homes 61 Figure 5.6 Median Sales Price: New Single-family Homes.................................................................................... 62 Figure 5.7 Median Sales Price: First-time Single-family Homes ........................................................................ 63 Figure 5.8 Housing Tenure by County 64 Figure 5.9 Monthly Housing Costs by County ............................................................................................................ 65 Figure 5.10 Households with High Housing Costs by County ............................................................................. 66 Figure 6.1 Regional Analysis Submarkets 68 Figure 6.2 Regional Industrial Inventory by Submarket (Q4 2020) ................................................................ 69 Figure 6.3 Regional Industrial Vacancy Rates by Submarket (Q4 2020) ....................................................... 70 Figure 6.4 Fayette County Industrial Annual Inventory and Vacancy Rate 71 Figure 6.5 Regional Office Inventory by Submarket (Q4 2020)......................................................................... 73 Figure 6.6 Regional Office Vacancy Rates by Submarket (Q4 2020)................................................................ 73 Figure 6.7 Fayette County Office Annual Inventory and Vacancy Rate 74

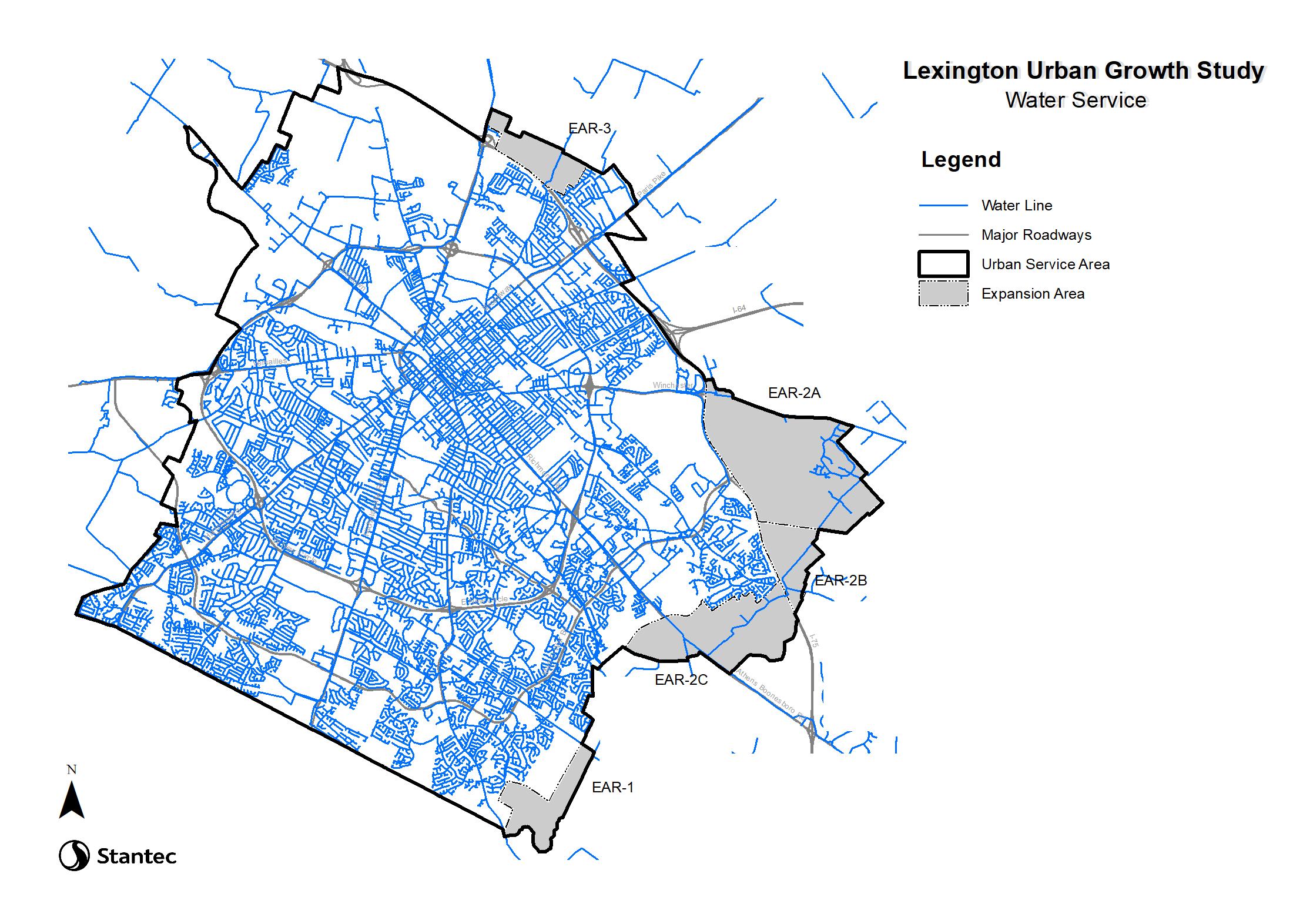

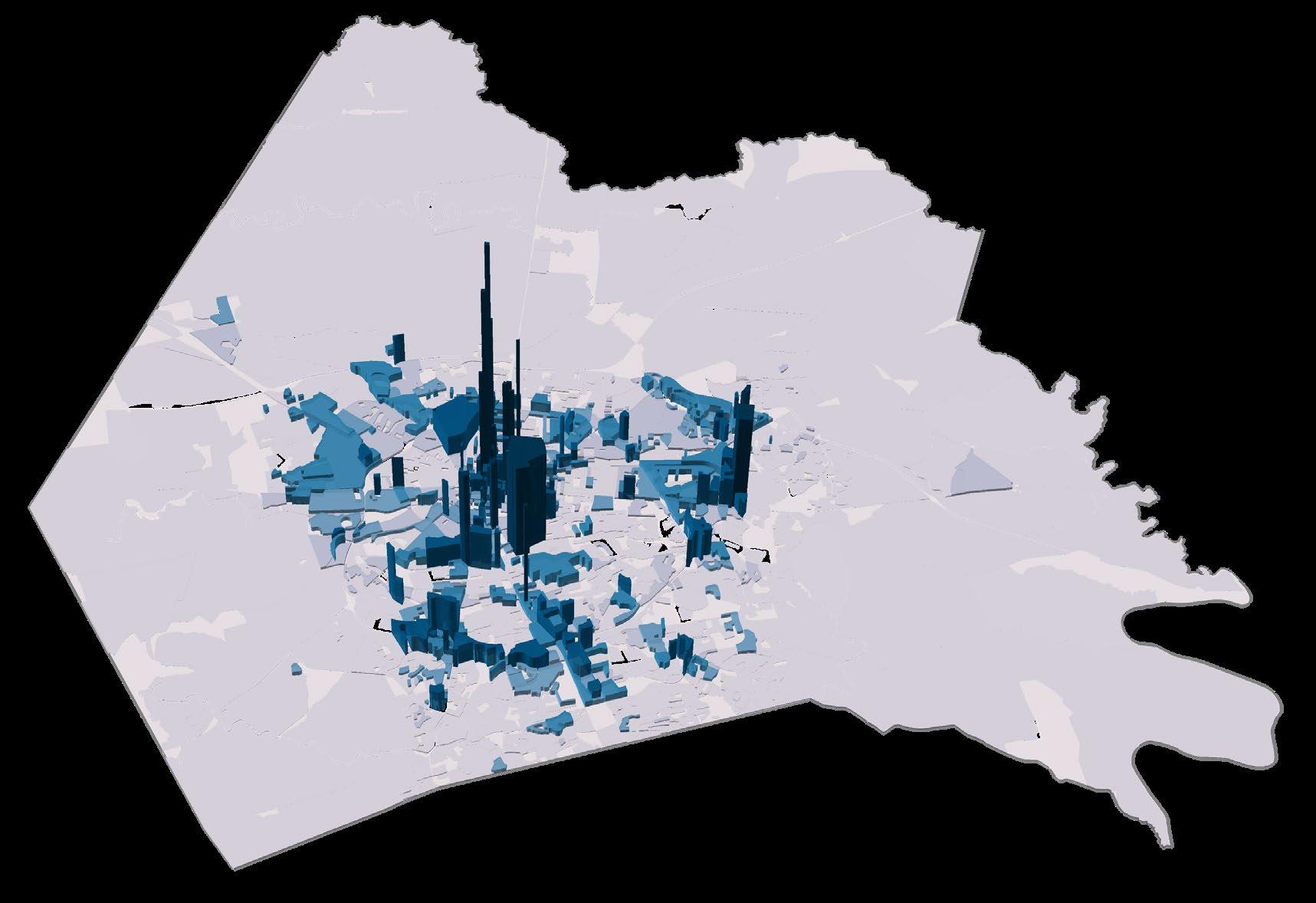

EXISTING CONDITIONS AND GROWTH TRENDS REPORT Figure 6.8 Regional Retail Inventory by Submarket (Q4 2020) 76 Figure 6.9 Fayette County Retail Annual Inventory and Vacancy Rate........................................................... 76 Figure 7.1 LFUCG Revenue by Land Use Type 80 Figure 7.2 Property Tax Value per Acre 81 Figure 7.3 Occupational License Fee Value per Acre .............................................................................................. 81 Figure 7.4 Combined Property Tax and Occupational License Fee Revenue 82 Figure 7.5 Revenue Related to Average Per Acre Cost 84 Figure 8.1 .................................................................................................................................................................................. 86 Figure 8.2 Water Service Coverage 87 Figure 8.3 Sewer Service Coverage 88 Figure 8.4 FCPS School Locations ................................................................................................................................... 89 Figure 8.5 Police and Fire Coverage 90 Figure 8.6 LFUCG Parks 91 Figure 10.1 20 Year Industrial Growth Trendline for Fayette County (Cumulative SF) .......................... 95 Figure 10.2 20 Year Office Growth Trendline for Fayette County (Cumulative SF) 96 Figure 10.3 20 Year Retail Growth Trendline for Fayette County (Cumulative SF) 97

Introduction

Executive Summary

During the development of the current Imagine Lexington Comprehensive Plan adopted in early 2019, the question of expanding the USB was much discussed, resulting in a fundamental debate over what criteria and indicators, if any, would be sufficient to demonstrate the need for expansion. The Lexington Sustainable Growth Study was born from that discussion and debate, codified in Theme E, Goal 4 of the plan:

“Protect Lexington’s invaluable rural resources and inform long-range planning for infrastructure, community facilities and economic development through the creation of a new process for determining long-term land use decisions involving the Urban Service Boundary and Rural Activity Centers.

A. Establish the process via a study, involving diverse stakeholders and constituents, that meets the projected needs of the agricultural and development communities, by preserving key agricultural resources from development pressures and identifying land for future urban development.

B. Ensure the study designates rural land for long-term preservation, identifies land for potential future urban development and specifies triggers, thresholds and timing for the addition of the identified urban land into the Urban Service Boundary, keeping infill and land use efficiency as the continued primary objectives.”

To address the first part of that process, the Existing Conditions and Growth Trends Report identifies the foundational data for evaluating a set of growth scenarios designed to establish a plan for the type of development necessary to allow the USB to accommodate growth for as long as possible. This report evaluates demographics, employment, land use, housing, commercial (office, retail, and industrial) development, LFUCG finances, infrastructure, and community facilities as they relate to development patterns and decision making about the USB. The report also presents growth trends for populations and commercial growth to understand the demand for development within the USB.

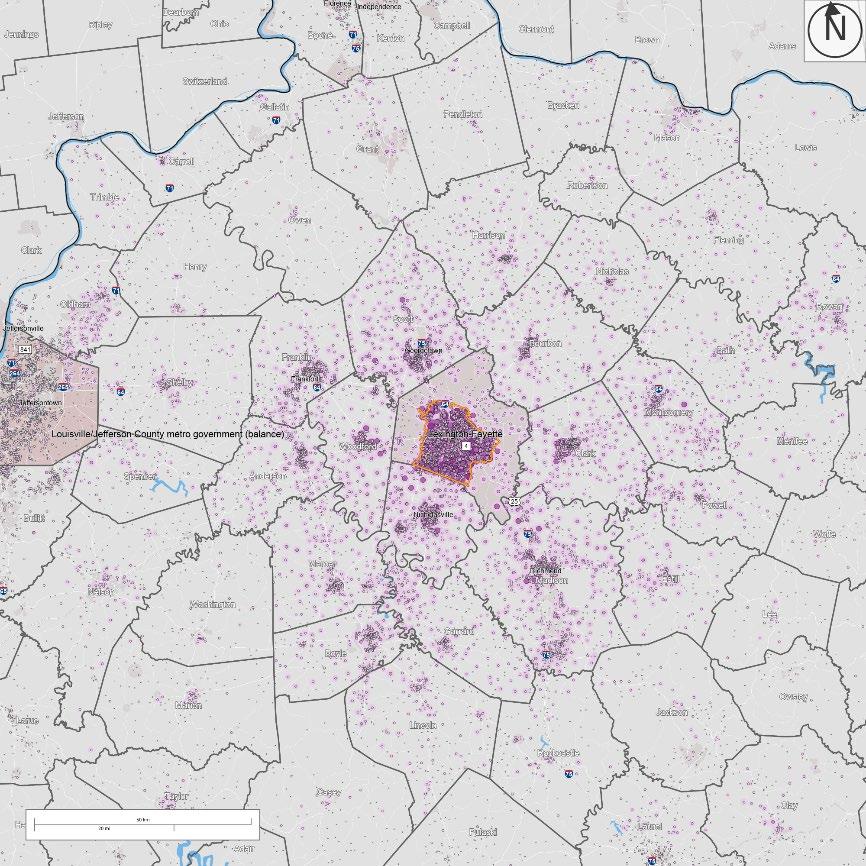

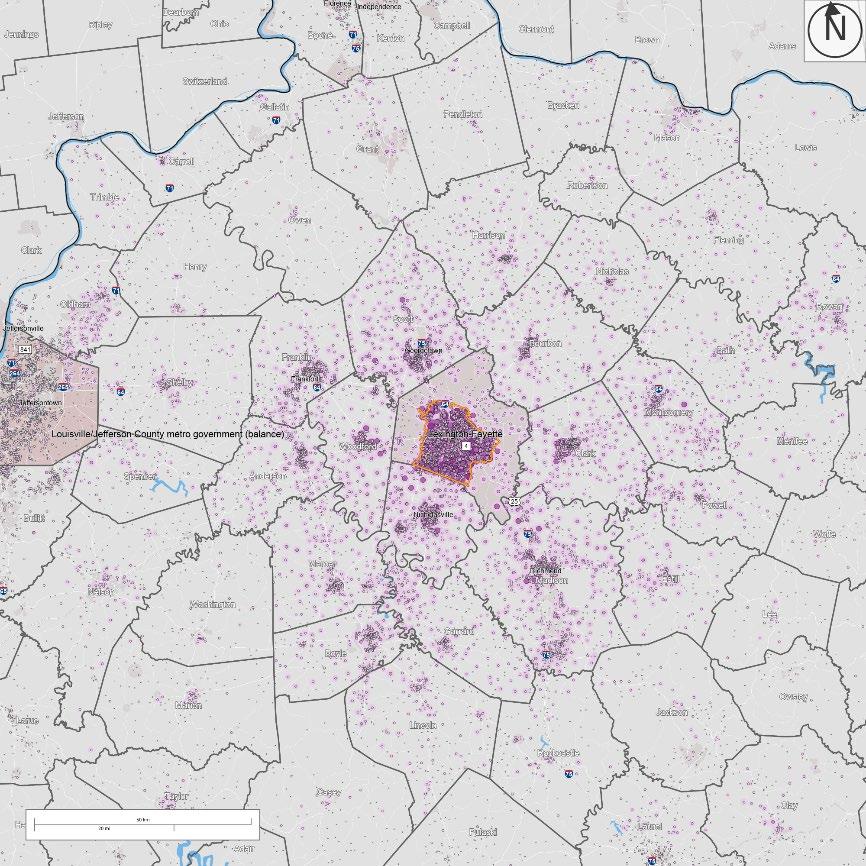

The growth in and around Lexington have been consistent for many decades and in recent years increasingly interconnected, particularly within the housing and employment markets. Figure E.1 illustrates how many people commute into the USB for work, whether due to Lexington’s large job market or to take advantage of the new housing that is rapidly developing outside Fayette County.

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

1

Introduction

Understanding vacant and underutilized land within the USB along with projected demand and financial impacts are one set of key elements for making decisions about expansion. The amount of vacant land within the USB is approximately 5,117 acres all of which has an assigned zoning classification. Table E.1 and Figure E.2 illustrate the current status of vacant land within the USB. In Transition Acreage includes areas where development proposals are currently in process with LFUCG, recently approved, or under construction.

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

2

Figure E.1 USB Commuter Inflow and Outflow

EXISTING CONDITIONS AND GROWTH TRENDS REPORT Introduction 3

Land Use Code Description Count Acres In Transition Acreage Total 100, 105 F- Agricultural Vacant Land/Development Land Farm 33 730.8 114.2 101, 103 F- Farm <10 ac/General Purpose Farm 34 1,490.5 86.0 102 F- Horse Farms 15 911.2 Subtotal 82 3,132.5 200.2 400, 405 C- Commercial Vacant Land/Dev Land Commercial 718 1,009.8 228.8 440, 463 C- Hospitality/Recreation; Golf courses, 4 6.9 137.5 430 C- Retail 6 18.6 450 C- Governmental 4 365.6 499 C - Other Commercial Structures 5 1.0 11.3 Subtotal 737 1,036.3 743.2 402 M- Apartments 20-39 units 1 2.6 502, 503 R- Rural <10 acres/Rural Residential 4 4.2 0.8 500, 504 R- Residential Vacant Land, Lot/Rural Res Vacant 2,002 472.8 505 R- Development Land Residential 65 531.6 94.9 510 R- Single Family Dwelling, Platted Lot 40 7.1 550, 551 R- Condominium/Townhomes 20 2.5 590, 591 R- Transfer/Non-Qualifying 4 2.0 13.4 Subtotal 2,135 1,020.2 109.1 700 HOA/Ret Basin/OS/Greenway 1 3.9 750, 751 Other - Land Only 14 8.3 55.8 Total 2,970 5,200 1 1,112.1 6,312.2

Table E.1 Summary of Vacant Land and Land in Transition by Land Use Description

Introduction

Growth trends for population, industrial development, office development, and retail development were developed to project demand for land through 2040. Conservative and Full growth trends were projected for each of these primary land use categories based on the most recent ten year (conservative) and 20 year (full) periods. The benefit of this approach is that it reflects both medium-term and recent events in these sectors and provides a transparent and easily replicable method for revising the respective trend lines with future data as it becomes available for future analyses. Population projections from the Kentucky State Data Center and recent population trends estimated from the United State Census American Community Survey were used to project the total number of households within Fayette County in 2040 Ten and 20-year trends for the development of new commercial (retail, office, and industrial) inventory, were extrapolated to project the total square footage of new space needed by 2040 in these categories.

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

4

Figure E.2 Vacant land by Land Use

Note: Vacant land inside the USB, including 1,112 acres of land in transition, totals 6,312 acres. This analysis was conducted using PVA data and input from the LFUCG Division of Planning for parcel zoning classifications. All agricultural and farmlands inside the USB are presumed to ultimately transition to developed land. Discrepancies between data fields were resolved via professional judgement of the attributes available in the PVA and LFUCG data as well as Google Earth Pro aerial imagery.

Introduction

Conservative and Full trendlines project 20-year population in Fayette County to grow between 29,750 and 41,200 households by 2040 respectively. The conservative trendline is based on the past ten years of population estimates from the American Community Survey (2010 – 2019), while the full trendline reflects the projected forecast of the Kentucky State Data Center based on population estimates from the 2010 Census and the 2015 American Community Survey The household estimate for Fayette County from the 2020 Census will be released later this year. Figure E.3 shows the Conservative and Full growth household projections through 2040.

20 Year Household Growth Trendlines

Conservative Full

Figure E.3

20 Year Household Growth Trendlines

Conservative and Full trendlines project 20-year demand between 1.3 million square feet and 5.6 million square feet of new industrial space in Fayette County This translates to between 65,000 square feet to 278,000 square feet on an annual basis. The wide range between trendlines reflects a significant building boom in the period before the recession beginning in 2008, followed by a much lower rate of industrial development after the recession. The impending development of a new LFUCG initiated industrial park on the site of the old University of Kentucky Dairy Research Farm will not only provide new capacity, but also offer an indication of current demand for new capacity in this category, affecting these trendlines going forward. Figure E.4 shows the growth projections for industrial square footage through 2040.

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

5

0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040

Introduction

20 Year Industrial Growth Trendline (Cumulative SF)

Conservative and Full trendlines of medium-term and recent office development project 20-year demand between 2.5 million square feet and 4.6 million square feet of new office space in Fayette County. This translates to between 123,000 square feet to 231,000 square feet on an annual basis. The Lexington office market has demonstrated itself to be a stable market, with less speculative development occurring than in the larger office markets in Louisville and Northern Kentucky, resulting in comparatively low vacancy rates. The lasting effects of the current shift to remote office work due to the COVID pandemic, whether large or small, will be reflected in the development of new space in the near future. This near-term development will in turn affect the future trends for office demand going forward. Figure E.5 shows the growth projections for office square footage through 2040.

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

6

Figure E 4

20 Year Industrial Growth Trendline for Fayette County (Cumulative SF)

0 1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 6,000,000 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040

Conservative Full

20 Year Office Growth Trendline (Cumulative SF)

Conservative Full

Conservative and Full trendlines project 20-year demand between 2.2 million square feet and 5.0 million square feet of new retail space in Fayette County. This translates to between 110,000 square feet to 250,000 square feet on an annual basis. Traditionally, the development of new retail space is highly correlated to the patterns of new residential development. The effects of the recent rise of online retail competition will also continue to impact the future development trends for this sector. Figure E.6 shows the growth projections for retail square footage through 2040.

20 Year Retail Growth Trendline (Cumulative SF)

Conservative Moderate

EXISTING CONDITIONS AND GROWTH TRENDS REPORT Introduction 7

Figure E.5

20 Year Office Growth Trendline for Fayette County (Cumulative SF)

0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 3,500,000 4,000,000 4,500,000 5,000,000 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040

Figure E.6 20 Year Retail Growth Trendline for Fayette County (Cumulative SF)

0 1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 6,000,000 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040

Introduction

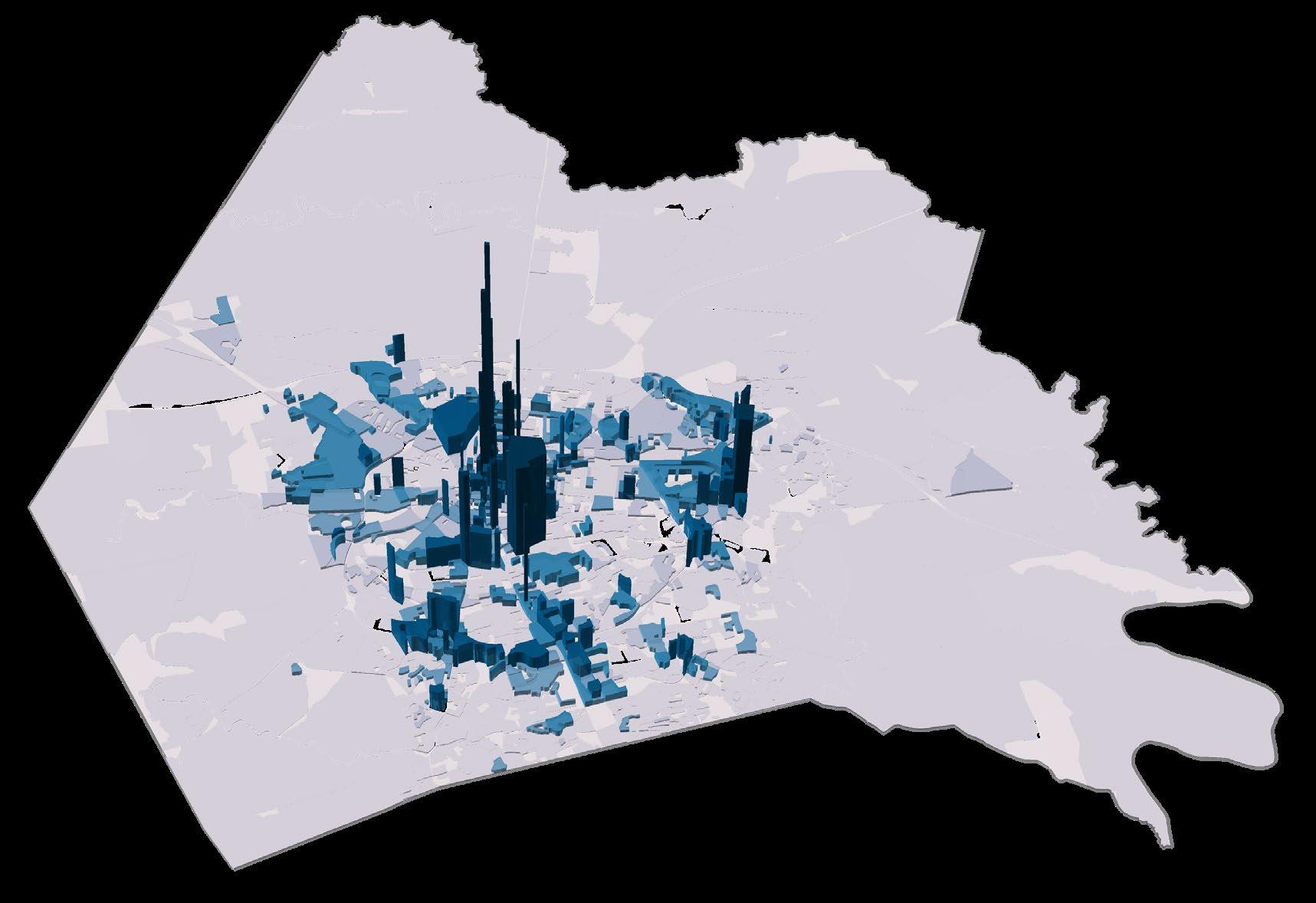

Impact to LFUCG finances should be an important consideration in deciding if, when, where and how the USB will be expanded. Knowing how different types of development patterns translate to revenue and expenditures should be considered alongside how they meet demand and how they meet LFUCG goals such as the provision of affordable housing, accessibility, or preservation of green space. LFUCG’s revenues are significantly weighted towards the collection of occupational license fees, which represent a payroll tax on work performed inside the county. As a result, offices with many workers per square foot of space produce the most revenue per acre for LFUCG of any land use Conversely, single family residential and agricultural uses, from which LFUCG primarily collects property taxes, generate the least amount of direct revenue However, these land uses directly support the land uses where higher revenues are generated. Figure E.7 illustrates the revenue generated by the various land use types.

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

8

$$50 $100 $150 $200 $250 $300 $350 $400 Business Fee/Acre Property Tax/Acre

Figure E 7 LFUCG Revenue by Land Use Type

Introduction

Understanding the relationship between revenue and cost of services should help make decisions about what types of development should occur when the USB is expanded. Figure E.8 illustrates where in Fayette County generates revenues that exceed the average per acre government expenditures and by how much. Areas in green illustrate the essential sources of land use-based revenue generation for LFUCG. That is not to imply that all development patterns should generate high revenues for the city, however there must be an appropriate balance of the revenue base for city finances to be sustainable.

Other Revenue, 144,775,000

Property Tax, 25,975,000

Business License

Fees, $208,250,000

Roads, $71,937,989

Pipes, $69,800,990

General Government, $379,000,000

Revenue

Expenses

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

9

Figure E.8 Revenue Related to Average Per Acre Cost

Introduction

1.0 INTRODUCTION

Land use planning in Lexington and Fayette County is inextricably linked with the nation’s first adopted Urban Service Boundary (USB), which creates Lexington’s uniquely distinctive balance of urban and rural landscapes and economies. The USB designates more than 85 square miles of Fayette County for urban uses, with the remaining 200 square miles of the county reserved for agriculture and other natural and rural land uses. The USB was last amended in 1996, adding 5,329 acres within three new expansion areas governed by an Expansion Area Master Plan. Since 1996, the metropolitan area of Lexington has continued to grow and expand, both within the USB and in the counties that surround it, which are increasingly interconnected with it. During the development of the current Imagine Lexington Comprehensive Plan adopted in early 2019, the question of again expanding the USB was much discussed, resulting in a fundamental debate over what criteria and indicators demonstrated the need for expansion. This Sustainable Growth Study was born from that discussion and debate, codified in Theme E, Goal 4 of the plan:

“Protect Lexington’s invaluable rural resources and inform long-range planning for infrastructure, community facilities and economic development through the creation of a new process for determining long-term land use decisions involving the Urban Service Boundary and Rural Activity Centers.

C. Establish the process via a study, involving diverse stakeholders and constituents, that meets the projected needs of the agricultural and development communities, by preserving key agricultural resources from development pressures and identifying land for future urban development.

D. Ensure the study designates rural land for long-term preservation, identifies land for potential future urban development and specifies triggers, thresholds and timing for the addition of the identified urban land into the Urban Service Boundary, keeping infill and land use efficiency as the continued primary objectives.”

The primary purpose of the Lexington Sustainable Growth Study is to establish an objective datadriven framework for evaluating the growth trends and projections that will determine whether Lexington has the land resources available to meet the needs of a continually growing community and economy. This Existing Conditions and Growth Trends report identifies and analyzes the datapoints that are necessary to include in that evaluation framework. These data points cover demographics and economic activity, housing and commercial inventory, fiscal and infrastructure considerations, and most importantly, the analytics of the land available to accommodate the future growth of the community.

This document informs the other primary task of the study, the development of the evaluation framework, which will be tested and refined in this study via the evaluation of three potential

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

10

Demographic Profile

development scenarios. The existing conditions presented in this report, along with the growth trends identified will be the starting point for these development scenarios.

An important aspect of this study and the development of the evaluation framework is the ability to regularly repeat evaluation scenarios. Data sources must be readily available and consistently updated to reflect current conditions and to establish consistent analyses. In addition to census data and other primary sources for understanding and developing trends, this study has relied on LFUCG’s parcel-level GIS databases covering zoning and PVA information related to land development. While there are many areas covered in this report, the most critical database is this GIS database, which the study will return to LFUCG, along with detailed guidance for future use.

It should be noted that although this report covers similar ground, it is not intended to be a thorough reexamining or replacement of the comprehensive land use planning and housing analyses performed in previous studies. It attempts to identify data points and trends with a focus on the parcel level zoning and land use data essential to the study.

2.0 DEMOGRAPHIC PROFILE

2.1 POPULATION

Fayette County is Kentucky’s second most populous county behind only Jefferson County. Its population growth continues to rank among the fastest growing counties in Kentucky, particularly among large counties with populations over 100,000 people. Fayette County is the primary county within the Lexington–Fayette, KY Metropolitan Statistical Area, which comprises five of the six adjacent counties, excluding Madison County. As an adjacent county, Madison County is included in this analysis and included in a seven-county region. Table 2.1 presents a comparison of the total population growth in Fayette and its neighboring counties over the past 20 years, beginning with the 2000 Census through the latest available estimates collected by the United States Census as part of the 2019 American Community Survey (ACS). (County-level data from the 2020 Census will be available later this year.)

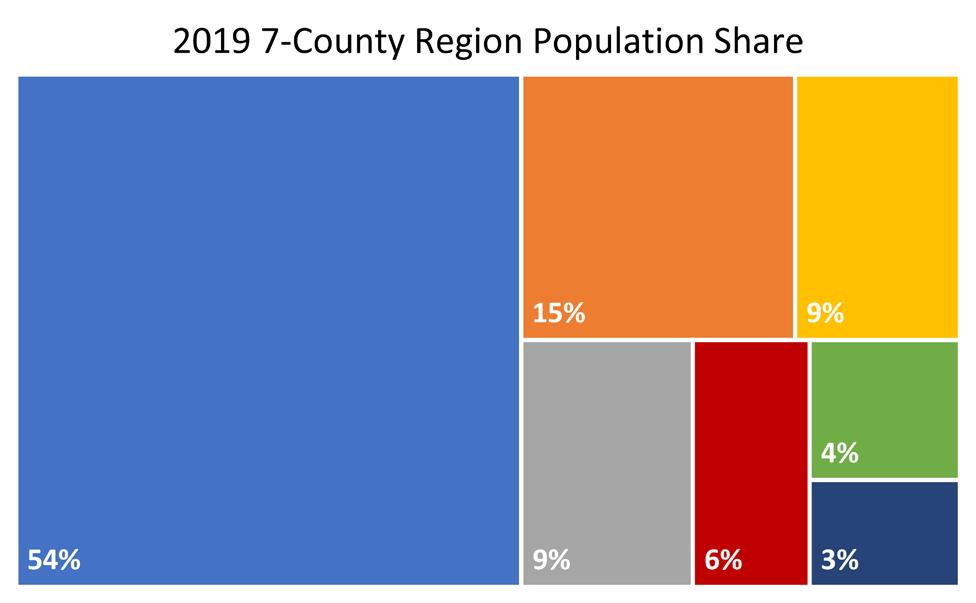

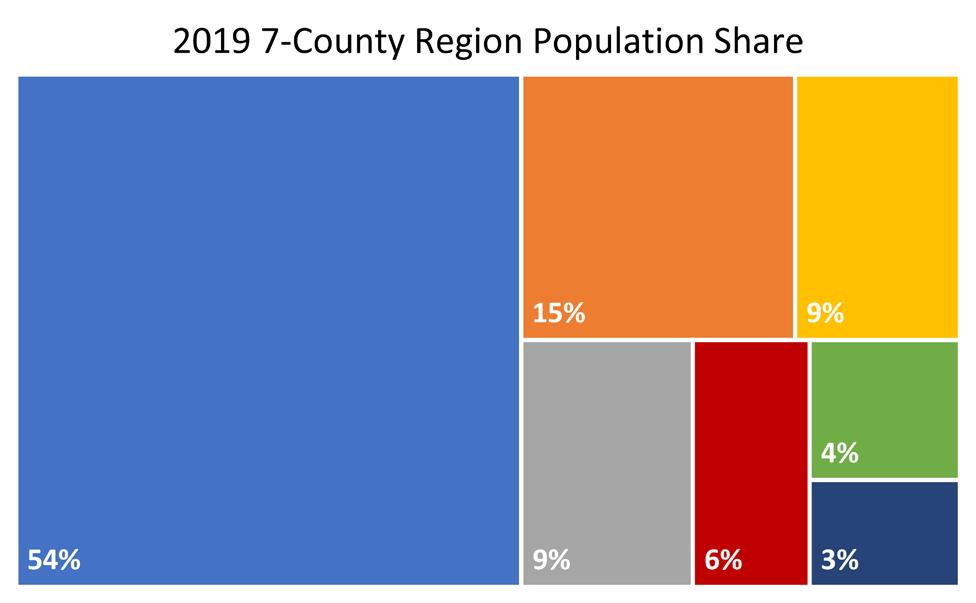

As illustrated in Figures 2.1 and 2.2, Fayette County comprises slightly more than half of the population of the seven-county region and represents 50 percent of the growth that has occurred in the region since 2000. Outside of Fayette County, Madison, Scott and Jessamine counties represent the largest and fastest growing counties, with the largest increment of growth occurring between 2005 and 2010. As of 2019, Fayette County makes up more than seven percent of the state population and almost 15 percent of the state’s growth since 2000. Approximately 97 percent of Fayette County’s population resides within the USB.

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

11

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

12

County 2000 Census 2005 (Cens. Est.) 2010 Census 2015 ACS 2019 ACS Growth (2000-2019) % Growth (2000-2019) Fayette County 260,512 273,601 295,803 314,488 323,152 62,640 24.0% Madison County 70,872 73,534 82,916 85,838 90,802 19,930 28.1% Scott County 33,061 39,524 47,173 50,178 54,667 21,606 65.4% Jessamine County 39,041 43,381 48,586 50,328 53,032 13,991 35.8% Clark County 33,144 34,860 35,613 35,657 35,971 2,827 8.5% Woodford County 23,208 24,167 24,939 25,317 26,318 3,110 13.4% Bourbon County 19,360 19,797 19,985 20,013 20,058 698 3.6% 7 County Region 479,198 508,864 555,015 581,819 604,000 124,802 26.0% Kentucky 4,041,769 4,173,405 4,339,367 4,425,092 4,467,673 425,904 10.5% Source:

Demographic Profile

Table

2.1 Fayette and Regional Population

United States Census; American Community Survey

Figure 2.1 Population Share by County

2.2 HOUSEHOLDS

The composition of households represents the fundamental building block of residential development and includes all residents living outside group quarter arrangements, such as nursing homes, school dormitories, and prisons. Household composition affects the type and quantity of the housing stock necessary to accommodate the household population, particularly regarding household size and the age of householders. Households can include single persons, non-related persons living together, and families with both related and non-related members.

Table 2.2 compares Fayette County’s households with the adjacent counties. Fayette County has a slightly lower average household size than the region and state, but its average family size is close to regional and state averages. The proportion of households in families in notably lower in Fayette County than surrounding counties, as well as the proportion of households that include minors under 18 years of age and adults over 60 years of age. This reflects Fayette County’s role as a regional metropolitan center, which tend to have a larger contingent of younger, working-aged adult households. The presence of the University of Kentucky and Transylvania University also contribute to the consistent influx of younger householders who come to Lexington for school and stay for career opportunities. Adjacent counties with a higher proportion of families and minors partially reflect their role as bedroom communities for Lexington. It is also typical to find higher proportions of households with older adults in rural areas with slower growth and fewer nonagricultural employment opportunities, which comprise much of the neighboring counties

EXISTING CONDITIONS AND GROWTH TRENDS REPORT Demographic Profile 13

Figure 2.2 Population Growth Since 2000

-50,000 50,000 150,000 250,000 350,000 Fayette County Madison County Scott County Jessamine County Clark County Woodford County Bourbon County Population by Year by County 2000 2005 2010 2015 2019 0 5,000 10,000 15,000 20,000 25,000 30,000 Fayette County 6 Surrounding Counties Population Growth: 2000-2019 2000-05 2005-10 2010-15 2015-19

2.3 AGE PROFILE

A comparison of the age profile of Fayette County with the combined population profile of the six surrounding counties reiterates the demographic distinctions between Fayette County and its neighbors. As shown in Table 2.3 and Figure 2.3 the surrounding counties have higher proportions of minors and older adults while Fayette County has a notably higher percentage of people in their twenties and slightly higher percentage of people in their thirties. Ideally, Fayette County’s housing stock should reflect the additional demand for the type of housing units that are most compatible in size and affordability for this outsized age group.

EXISTING CONDITIONS AND GROWTH TRENDS REPORT Demographic Profile 14 Table 2.2 Fayette and Regional Households County Households Household Population Avg. Hshd. Size Families % Familes Avg. Family Size Hshds. with minors Hshlds. with 60+ Fayette County 129,784 308,140 2.37 73,062 56.3% 3.02 28.4% 31.1% Madison County 33,359 84,215 2.52 22,219 66.6% 3.03 30.0% 35.5% Scott County 20,551 53,322 2.59 15,073 73.3% 2.97 38.1% 31.4% Jessamine County 18,821 51,163 2.72 13,726 72.9% 3.14 34.2% 38.8% Clark County 14,509 35,530 2.45 9,943 68.5% 2.88 32.0% 42.1% Woodford County 10,355 25,953 2.51 7,295 70.4% 2.97 31.6% 43.8% Bourbon County 8,106 19,804 2.44 5,445 67.2% 2.92 33.5% 43.9% 7 County Region 235,485 578,127 2.46 146,763 62.3% 3.01 30.5% 34.0% Kentucky 1,734,618 4,317,164 2.49 1,129,276 65.1% 3.06 31.1% 39.3% Source: United States Census; American Community Survey

Demographic Profile

2019 Age Cohorts by Population Share

*Bourbon, Clark, Jessamine, Madison, Scott and Woodford Counties combined

Source: United States Census; American Community Survey

Fayette County reflects the general aging trend occurring throughout the region, Kentucky, and the nation. Table 2.4 shows that except for Madison County, Fayette has the youngest median age in the region, but that median age has risen from 33 to 35 since 2000. In Table 2.5 and Figure 2.4, Census data and forecasts from the Kentucky State Data Center (KSDC) depict the movement of the cohort born between 1950 and 1970 as they age from their 30’s and 40’s in 2000 to their 70’s and 80’s by 2040. By 2040, people aged over 60 will represent more than 22 percent of Fayette County’s population, as compared to 13 percent in 2000. Recognizing an aging population indicates the need to plan for housing types that are appropriately sized, designed, and located to accommodate this growing demographic.

Source: United States Census; American Community Survey

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

15

Age Fayette County 6 Surrounding Counties* 00-09 12.0% 12.6% 10-19 12.5% 13.9% 20-29 18.7% 14.5% 30-39 14.3% 12.5% 40-49 12.1% 12.8% 50-59 12.1% 13.0% 60-69 10.0% 11.2% 70-79 5.3% 6.3% 80+ 3.0% 3.1%

Table 2.3 2019 Age Cohort Distribution

County 2000 2010 2019 Fayette County 33.0 33.7 35.0 Madison County 30.7 33.7 34.5 Scott County 35.9 35.0 36.4 Jessamine County 32.9 35.8 38.4 Clark County 36.8 39.8 41.7 Woodford County 37.1 41.0 43.0 Bourbon County 37.6 40.7 42.5 Kentucky 35.9 38.1 38.6

Table 2.4 Median Age by County

0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 00-09 10-19 20-29 30-39 40-49 50-59 60-69 70-79 80+

Figure 2.3 2019 Age Cohorts Comparison

Fayette County 6 Surrounding Counties*

Demographic Profile

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

16

Age 2000 2019 2040 00-09 12.2% 12.0% 12.1% 10-19 12.8% 12.5% 11.2% 20-29 20.0% 18.7% 18.2% 30-39 16.2% 14.3% 14.3% 40-49 15.0% 12.1% 11.9% 50-59 10.4% 12.1% 10.3% 60-69 6.1% 10.0% 9.0% 70-79 4.7% 5.3% 7.3% 80+ 2.6% 3.0% 5.8% Source: United States Census; American Community Survey; Kentucky State Data Center 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 00-09 10-19 20-29 30-39 40-49 50-59 60-69 70-79 80+

Table 2.5. Fayette Age Cohorts by Year

2000 2019 2040

Fayette County Age Cohorts by Year

Figure 2.4 Fayette Age Cohorts by Year

2.4 RACE AND ETHNICITY

Table 2.6 indicates that Fayette County reflects a more diverse racial and ethnic population than the rest of the region and Kentucky. Fayette County’s minority population is more than double the state average and nearly three times greater than its neighboring counties. Table 2.7 and Figure 2.5 illustrate how minority populations in Fayette County have grown within the total population since 2000, with the number of residents identifying as Hispanic or two or more races doubling in share. Given historical and existing inequities and barriers to housing experienced by minority communities, particular emphasis should be placed on ensuring that sufficient and equitable housing options are available to accommodate these growing communities.

*Bourbon, Clark, Jessamine, Madison, Scott and Woodford Counties combined

Source: United States Census; American Community Survey

Source: United States Census; American Community Survey

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

17

Demographic Profile

Race / Ethnicity Fayette County % of Total 6 Surrounding Counties* % of Total Kentucky % of Total Non-Hispanic White alone 227,629 71.0% 248,077 88.3% 3,761,855 84.6% Black alone 46,338 14.5% 12,862 4.6% 353,997 8.0% Asian alone 12,004 3.7% 2,678 1.0% 64,764 1.5% Some other race alone 1,622 0.5% 1,200 0.4% 16,954 0.4% Two or more races 9,945 3.1% 5,405 1.9% 88,488 2.0% Hispanic (All Races) 23,063 7.2% 10,626 3.8% 162,994 3.7%

Table 2.6 Racial and Ethnic Population

Race / Ethnicity 2000 2010 2019 Non-Hispanic White alone 79.1% 72.4% 71.0% Black alone 13.4% 14.3% 14.5% Asian alone 2.4% 3.5% 3.7% Some other race alone 0.4% 0.4% 0.5% Two or more races 1.4% 2.5% 3.1% Hispanic (All Races) 3.3% 6.9% 7.2%

0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 2000 2010 2019 Racial and Ethnic Composition by Year White Alone Black Alone Asian Alone Some Other Race Alone Two of More Races Hispanic (All Races)

Table 2.7 Fayette Racial and Ethnic Composition by Year

Figure 2.5 Fayette Racial and Ethnic Composition

2.5 INCOME

The connection between income and housing costs is indicative of the relative affordability of housing in the community. Of particular concern is recognizing the extent of those who are most vulnerable to housing insecurity as reflected by their income or poverty status. Table 2.8 shows that Fayette County has the highest per capita income in the region, as would be expected as the largest employment center with a high concentration of higher paying employment opportunities. Scott County and Woodford County have higher median household incomes, suggesting a higher concentration of multiple income family households in Scott County and overall higher affluence among Woodford County’s smaller household population. Poverty rates in Fayette County are within the range of the other counties and lowest for children living in poverty. Fayette County matches the state average for seniors living in poverty.

Source: United States Census; American Community Survey

Table 2.9 and Figure 2.6 compare the distribution of household income within Fayette County with the combined households of the six surrounding counties. It demonstrates a relative uniformity between Fayette County and its neighbors, indicating the connections of the counties within a shared regional economy.

As a method for categorizing households for the analysis of housing affordability, the 2017 Fayette County Housing Demand Study set 50% of the medium income and 80% of median income as the upper thresholds for low and moderate households. The income range for workforce housing was set between 80% and 120%. According to these thresholds, households in Fayette County with less than $29,200 in annual income qualify as low-income households, households with incomes up to $46,700 qualify as moderate income households, and households with incomes up to $70,000 qualify as middle income workforce housing.

EXISTING CONDITIONS AND GROWTH TRENDS REPORT Demographic Profile 18

County Per Capita Income Median Household Income Persons in Poverty Children in Poverty Seniors (65+) in Poverty Fayette County 34,947 $ 58,356 $ 15.6% 17.6% 9.4% Madison County 26,387 $ 49,421 $ 18.3% 20.1% 11.0% Scott County 32,796 $ 70,817 $ 11.6% 18.2% 6.0% Jessamine County 31,146 $ 58,245 $ 16.9% 25.0% 8.7% Clark County 28,802 $ 54,953 $ 14.7% 19.6% 10.9% Woodford County 32,264 $ 63,820 $ 13.0% 23.6% 4.7% Bourbon County 27,802 $ 49,637 $ 15.3% 22.7% 18.5% Kentucky 29,029 $ 52,295 $ 16.3% 21.7% 9.4%

Table 2.8 Income and Poverty Rates by County

Employment

Household Income

Fayette

3.0 EMPLOYMENT

3.1 EMPLOYMENT ANALYSIS

3.1.1 Fayette County Location Quotient

Fayette County’s economy was examined in terms of its concentration of various employment sectors compared to the national average, as well as the change in number of jobs in each sector over the past decade. A Location Quotient (LQ) was calculated for each employment sector compared to the U.S. average. An LQ greater than 1 demonstrates a higher concentration of that employment sector in Fayette County over the national average, while less than 1 demonstrates lower concentration.

The County’s traditionally strongest sectors include Health Care (LQ 1.33), Educational Services (LQ 1.25) and Administration & Support (LQ 1.21). These sectors grew significantly faster than the national average, further entrenching their role in the County economy. These sectors are considered “Stars” in terms of performance and significance and are likely to drive commercial, industrial, and institutional real estate development in the local area in the coming years.

Overall, Fayette County experienced a faster growth in employment than the national average over the 2008-2018 period (the latest available data). Of particular note is the rapid growth in the

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

19

Household Income Fayette County 6 Surrounding Counties* Less than $10,000 7.0% 6.7% $10,000 to $14,999 4.5% 4.7% $15,000 to $24,999 9.6% 9.8% $25,000 to $34,999 9.9% 9.7% $35,000 to $49,999 13.0% 13.1% $50,000 to $74,999 17.6% 17.5% $75,000 to $99,999 12.2% 13.1% $100,000 to $149,999 14.2% 14.5% $150,000 to $199,999 5.9% 5.6% $200,000 or more 6.2% 5.3% *Bourbon, Clark, Jessamine, Madison, Scott and Woodford Counties combined Source: United States Census; American Community Survey

Table 2.9 Distribution of Household Income

0.0% 5.0% 10.0% 15.0% 20.0%

County 6 Surrounding Counties*

Figure 2.6 Distribution of Household Income

Employment

Transportation & Warehousing employment sector, which is associated with significant large scale industrial real estate development such as Logistics centers.

Conversely, sectors where Fayette County has not demonstrated a strong concentration of, such as Manufacturing, Finance and Wholesale Trade further lost ground to the national average. These sectors are considered “Transforming” and are likely consolidate for many years before emerging in local concentration.

Retail Trade and Agricultural-related employment are well-represented in Fayette County but have lost ground vis-à-vis other employment sectors in the local area. These are considered “Mature” employment sectors unlikely to generate significant new employment and related real estate development over the forecast horizon.

Only a single sector, Other Services, considered as an “Emerging” employment sector in Fayette County. Emerging employment sectors have lower representation locally than the national average but are growing relatively quickly and likely to generate significant real estate development in coming years.

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

20

Table 3.1 Fayette County – Employment Sector Location Quotient (LQ) Analysis

Employment Employment Employment Employment LQ LQ Employment Sector 2008 2018 Change 2008 2018 Change 2008 2018 Agriculture, Forestry, Fishing & Hunting 920,239 1,041,689 13.2% 2,514 1,785 -29.0% 1.77 1.07 Mining, Quarrying, and Oil & Gas Extraction 524,102 720,870 37.5% 631 579 -8.2% 0.78 0.50 Utilities 744,869 784,345 5.3% 250 302 20.8% 0.22 0.24 Construction 6,327,293 6,150,010 -2.8% 8,808 9,679 9.9% 0.90 0.98 Manufacturing 13,575,714 12,138,869 -10.6% 15,874 11,990 -24.5% 0.76 0.61 Wholesale Trade 5,431,941 5,715,032 5.2% 6,868 7,535 9.7% 0.82 0.82 Retail Trade 13,330,251 14,046,782 5.4% 22,481 23,071 2.6% 1.09 1.02 Transportation & Warehousing 3,997,468 4,630,244 15.8% 5,735 7,961 38.8% 0.93 1.07 Information 2,827,293 2,785,734 -1.5% 4,231 2,930 -30.7% 0.97 0.65 Finance & Insurance 5,371,702 5,649,363 5.2% 5,840 5,656 -3.2% 0.71 0.62 Real Estate 1,933,399 1,970,936 1.9% 3,181 2,888 -9.2% 1.07 0.91 Professional, Scientific & Technical Services 6,407,770 8,392,778 31.0% 11,662 12,834 10.0% 1.18 0.95 Management of Companies & Enterprises 1,717,970 2,280,235 32.7% 1,930 1,702 -11.8% 0.73 0.46 Administration & Support 6,667,408 7,759,631 16.4% 10,141 15,155 49.4% 0.99 1.21 Educational Services 10,535,982 11,887,247 12.8% 17,137 23,881 39.4% 1.06 1.25 Health Care & Social Assistance 13,705,464 18,168,563 32.6% 25,542 38,977 52.6% 1.21 1.33 Arts, Entertainment & Recreation 1,694,430 2,003,713 18.3% 2,843 3,846 35.3% 1.09 1.19 Accommodation & Food Services 8,949,179 11,002,947 22.9% 16,583 21,047 26.9% 1.20 1.19 Other Services 3,639,306 3,860,788 6.1% 5,054 5,925 17.2% 0.90 0.95 Public Administration 4,829,484 6,052,431 25.3% 6,981 6,499 -6.9% 0.94 0.67 TOTAL 113,131,264 127,042,207 12.3% 174,286 204,242 17.2% 1.00 1.00 United States Study Area

Source: U.S. Census

Employment

An Economic Base Analysis identifies those sectors that are export-oriented (to regional, domestic and/or international markets) and therefore importing earned capital into the local economy Fayette County reports a low proportion of export-oriented jobs at 10.9%, led by Health Care, Education and Administration & Support employment sectors.

Employment sectors such as Transportation & Warehousing, as well as Professional, Scientific & Technical Services demonstrate very low levels of export-orientation. These sectors have generated

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

21

Figure 3.1 Fayette County – Employment Sector Location Quotient (LQ) Analysis

Employment

a major share of the nation’s employment growth in recent years and could potentially represent opportunities for the Lexington economy.

A Shift-share Analysis identifies employment sectors which Fayette County demonstrates important comparative advantages over the rest of the national economy. These advantaged sectors will be key demand drivers for new real estate development over the next decade or more. Fayette County demonstrates a strong comparative advantage in the same sectors which it has an export orientation: Health Care, Education and Administration & Support.

The County appears to be at a comparative disadvantage to other regions in terms of Professional, Scientific & Technical Services, Manufacturing, and Information (ie Media) sectors.

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

22

Basic Non-Basic National Industrial Regional Employment Sector Employment Employment Share Mix Shift Agriculture, Forestry, Fishing & Hunting 110 1,675 309 23 -1,061 Mining, Quarrying, and Oil & Gas Extraction 0 579 78 159 -289 Utilities 0 302 31 -17 39 Construction 0 9,679 1,083 -1,330 1,118 Manufacturing 0 11,990 1,952 -3,632 -2,204 Wholesale Trade 0 7,535 845 -487 309 Retail Trade 488 22,583 2,764 -1,556 -618 Transportation & Warehousing 517 7,444 705 203 1,318 Information 0 2,930 520 -582 -1,239 Finance & Insurance 0 5,656 718 -416 -486 Real Estate 0 2,888 391 -329 -355 Professional, Scientific & Technical Services 0 12,834 1,434 2,179 -2,441 Management of Companies & Enterprises 0 1,702 237 394 -860 Administration & Support 2,680 12,475 1,247 414 3,353 Educational Services 4,770 19,111 2,107 91 4,546 Health Care & Social Assistance 9,768 29,209 3,141 5,177 5,117 Arts, Entertainment & Recreation 625 3,221 350 169 484 Accommodation & Food Services 3,358 17,689 2,039 1,767 658 Other Services 0 5,925 621 -314 563 Public Administration 0 6,499 858 909 -2,250 TOTAL 22,317 181,925 21,431 2,821 8,525 EXPORT JOBS 10.9% ECONOMIC BASE ANALYSIS SHIFT SHARE ANALYSIS

Table 3.2 Fayette County – Economic Base & Shift-Share Analysis: 2008 - 2018

Employment

3.1.2 Lexington Region (excluding Fayette County)

The six counties surrounding Fayette County experienced modest employment growth from 20082018. Overall employment grew by 7.9% during this period, compared to 12.3% nationally and 17.2% in Fayette County.

This area has benefitted from a relative concentration in Manufacturing employment historically (LQ 1.6), and despite losing nearly 1,000 jobs in this sector, it has performed better than the national average.

The outlying counties have a strong representation of “back office” type employment sectors including “Administration & Support” and “Management of Companies”. These sectors have grown in significance in recent years and are considered “Stars” in terms of future office real estate development potential. Emerging sectors relate to Professional, Health Care and Government, as well as growth in Accommodation/Food & Beverage employment. Retail Trade employment has been above the national average in the suburban counties but has declined in relative concentration, much as it has nationally.

Source: U.S. Census

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

23

Table 3.3 Surrounding Region Employment Sector Location Quotient (LQ) Analysis

Employment Employment Employment Employment LQ LQ Employment Sector 2008 2018 Change 2008 2018 Change 2008 2018 Agriculture, Forestry, Fishing & Hunting 920,239 1,041,689 13.2% 2,525 2,871 13.7% 4.28 1.60 Mining, Quarrying, and Oil & Gas Extraction 524,102 720,870 37.5% 237 115 -40.0% 0.70 0.26 Utilities 744,869 784,345 5.3% 387 338 -12.7% 0.81 0.70 Construction 6,327,293 6,150,010 -2.8% 3,128 2,881 -7.9% 0.77 0.76 Manufacturing 13,575,714 12,138,869 -10.6% 20,420 19,651 -3.8% 2.34 1.60 Wholesale Trade 5,431,941 5,715,032 5.2% 2,966 3,183 7.3% 0.85 0.90 Retail Trade 13,330,251 14,046,782 5.4% 8,527 9,269 8.7% 1.00 1.07 Transportation & Warehousing 3,997,468 4,630,244 15.8% 2,193 2,161 -1.5% 0.85 0.76 Information 2,827,293 2,785,734 -1.5% 990 832 -16.0% 0.55 0.48 Finance & Insurance 5,371,702 5,649,363 5.2% 1,244 1,248 0.3% 0.36 0.36 Real Estate 1,933,399 1,970,936 1.9% 548 473 -13.7% 0.44 0.39 Professional, Scientific & Technical Services 6,407,770 8,392,778 31.0% 1,409 2,197 55.9% 0.34 0.42 Management of Companies & Enterprises 1,717,970 2,280,235 32.7% 769 1,518 60.0% 0.70 1.08 Administration & Support 6,667,408 7,759,631 16.4% 3,656 5,937 60.0% 0.85 1.24 Educational Services 10,535,982 11,887,247 12.8% 8,245 7,136 -13.5% 1.22 0.97 Health Care & Social Assistance 13,705,464 18,168,563 32.6% 4,901 6,514 32.9% 0.56 0.58 Arts, Entertainment & Recreation 1,694,430 2,003,713 18.3% 1,269 1,081 -14.8% 1.17 0.88 Accommodation & Food Services 8,949,179 11,002,947 22.9% 5,067 6,266 23.7% 0.88 0.92 Other Services 3,639,306 3,860,788 6.1% 1,167 1,379 18.2% 0.50 0.58 Public Administration 4,829,484 6,052,431 25.3% 2,949 3,264 10.7% 0.95 0.87 TOTAL 113,131,264 127,042,207 12.3% 72,597 78,314 7.9% 1.00 1.00 United States Study Area

Employment

Several sectors in these counties are considered “Transforming” in that they are neither highly concentrated in the local economy or growing. These include a wide range of sectors.

13.2% of jobs in the surrounding region counties are classified as export-oriented, with Manufacturing demonstrating a high LQ and high proportion of export jobs.

Shift-share analysis indicates that the surrounding counties have a significant comparative advantage in Manufacturing and Administration & Support. However, it does lack strength in the Education Services sector, Arts, Entertainment and Recreation, and Public Administration.

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

24

Figure 3.2 Surrounding Region Employment Sector Location Quotient (LQ) Analysis

Employment

Overall the surrounding region appears to be a slow-growing employment area generally dependent on its established Manufacturing enterprises for a significant portion of its employment market and is not well engaged with rising employment sectors such as Professional, Scientific & Technical Services.

Source: U.S. Census

In summary, Metro Lexington’s employment has increasingly concentrated in Fayette County in recent years. Employment growth in the surrounding counties has been modest and largely concentrated in manufacturing and “back office support” type activity. No industrial-related employment sectors have demonstrated strong new employment growth outside of Fayette County.

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

25

Table 3.4 Surrounding Region Economic Base & Shift-Share Analysis: 2008 - 2018

Employment

3.2 COMMUTER PATTERNS

Using U.S. Census data and its on-line tool, OnTheMap, users can upload spatial geography and aggregate Longitudinal Employer-Household Dynamics (LEHD) Origin-Destination Employment data. These tools provide information on the worker age, earnings, jobs in industry NAICS sector, race, ethnicity, education attainment and worker sex. Using the USB as the analysis area, several statistics relating to local and regional commuting patterns were developed. The area profile report indicates that in 2018, 131,595 people living in the USB commuted to a primary job, which could be located anywhere. Further, 141,414 people commuted to a job located inside the USB. and are classified as having a private primary job. Table 3.5 identifies the distance these workers commute for their jobs, indicating that a higher share of commuters to work traveled longer distances than residents within USB.

All Primary Jobs

Source: US Census, OntheMap

The OnTheMap tool also analyzes the distance and direction of jobs. This permits us to identify and visualize the magnitude of employment by direction workers’ travel. Figure 3.3 illustrates the information in radar charts for workers commuting from within the USB to work and workers commuting to work within the USB While the LEHD data does not distinguish the mode of commuter travel, it is presumed that inter-county travel is overwhelmingly via private occupancy vehicles. The highest proportion of residents traveling outside the USB tend to have destinations toward the west to the north, while commuters traveling into the USB travel from further distance and have a higher concentration of travel from west, south, and east. Figure 3.4 presents a heat map of the home location of commuters working inside the USB, illustrating both the concentration of resident workers inside the USB as well as the distribution of long-distance commuters throughout the region.

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

26

Live Inside Work Inside Jobs Share Jobs Share Total Primary Jobs 131,595 100.0% 141,414 100.0% Less than 10 miles 93,001 70.7% 67,712 47.9% 10 to 24 miles 13,754 10.5% 24,989 17.7% 25 to 50 miles 3,615 2.7% 13,288 9.4% Greater than 50 miles 21,225 16.1% 35,425 25.1%

Table 3.5 Primary Job Commutes within the Urban Service Boundary

Employment

Source: US Census, OntheMap

Source: US Census, OntheMap

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

27

Figure 3.3 Distance and Direction of Commuter Travel to and from the USB, 2018

Figure 3.4 Origin of Commuters with Jobs Inside the USB

Employment

Another OnTheMap tool is the inflow outflow analysis. This analysis compares the number of workers who live and work inside the USB with those who commute into and out of theUSB. Table 3.6 presents the commute totals between 2002 and 2018 and indicated that while the share of workers living outside and commuting to the USB has significantly increased since 2002 and now outnumber residents of the USB working inside the USB. Twice as many workers commute to the USB as commute from the USB. Figure 3.5 presents the visualizations of the inflow and outflow pattern for 2018.

All Primary Jobs

Source: US Census, OntheMap

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

28

Table 3.6

Jobs Share 2002 2010 2018 2002 2010 2018 Live inside / Work inside 86,364 71,095 87,046 46% 37% 38% Live inside / Work outside 39,495 37,068 44,549 21% 19% 20% Live outside / Work inside 60,563 82,013 95,470 32% 43% 42%

USB Commuter Inflow and Outflow

Figure 3.5

USB Commuter Inflow and Outflow

4.0 LAND USE ANALYSIS

4.1 EXISTING LAND

The USB totals approximately 85.3 square miles or 54,630 acres divided into primary octants by Leestown-Richmond Road-Athens Boonsboro Rd northwest to southeast, Harrodsburg-Broadway southwest to northeast, Versailles-Winchester west to east, Nicholasville Road-Newtown Pike south to north. According to the information provided LFUCG, there are 36 zoning classes, eleven of which are for residential uses, eight business zoning classes and the balance a mixture of expansion area residential, commercial, office, industrial and agricultural and farmland.

4.1.1 Zoning by Class

Figure 4.1 illustrates the distribution of zoning throughout the USB and Table 4.1 summarizes the count of parcels and acreage within each class and a value for the reported number of living units for zones with multiple dwelling units per parcel. Residentially zoned property dominates the USB. Residential property constitutes 89% of all parcels and 59% of land area. If the values recorded in the “LivUnits” field of the PVA data are reliable, the developed density of R-3 zoning equates to 3.2 dwellings per acre, 7.1 dwellings per acre in R-4 and 12.0 dwellings per acre in R-5. In addition to the Planned Unit Development and residential zones, LivUnits were tallied in the Downtown Business, Frame Business, Lexington Business Center, all three Expansion Areas, Mixed Use, and the Professional Office zones for a total of 37,255 units in these zones. A great deal of multi-family zoning is located near the University of Kentucky campus and on the north side of the downtown business district. However, pockets of multi-family development are often located adjacent to the R-3 zoning classes with higher densities near Richmond Road and along Man O War Boulevard Industrial uses are concentrated in the northwest quadrant served by numerous rail lines in the area north of Versailles Road east and north of downtown. Additional industrial uses are located near Winchester Road and along Palumbo Drive, both areas also served by rail. A smaller concentration of industrial land is located on both sides of northwest New Circle Road and east of Nicholasville Road. Commercial and office zoned parcels proliferate along the major corridors with a high concentration along New Circle Road. Farm and agricultural lands are chiefly found along the edges of the USB, most of which are contained within an Expansion Area boundary.

EXISTING CONDITIONS AND GROWTH TRENDS REPORT Land Use Analysis 29

Land Use Analysis

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

30

Figure 4.1 Existing Zoning

EXISTING CONDITIONS AND GROWTH TRENDS REPORT Land Use Analysis 31 Table 4.1 Existing

Zone Description Count Acres LivUnits A-R Agricultural Rural 221 2,168.74 0 A-U Agricultural Urban 213 4,179.75 0 B-1 Neighborhood Business 1,209 673.23 0 B-2 Downtown Business 99 33.72 162 B-2A Downtown Frame Business 188 70.38 182 B-2B Lexington Business Center 263 106.15 247 B-3 Highway Service Business 702 1,046.6 0 B-4 Wholesale and Warehouse Business 441 5,57.55 6 B-5P Interchange Service Business Zone 70 147.68 0 B-6P Commercial Center 245 983.87 0 EAR-1 Expansion Area Residential - LDS 1,055 937.89 100 EAR-2 Expansion Area Residential - MDS or 9 du w TDR 4,013 1,359.78 590 EAR-3 Expansion Area Residential - HDS 6-18 or 24 du w * 6 97.16 264 ED Economic Development Zone - Indus, warehouse, off* 16 468.94 0 I-1 Light Industrial 1,175 3,257.15 11 I-2 Heavy Industrial 209 621.11 0 CC Expansion Area Community Center Mixed Use 24 102.15 0 M-1P n/a 1 45.44 0 MU-1,2,3 Mixed Use 1-3 14 64.77 297 P-1 Professional Office 709 1,199.8 118 P-2 Office Industry and Research Park Zone 44 602.27 0 PUD-1,2 Planned Unit Development 340 77.3 0 R-1A Single Family Residential - 25k lot 206 330.59 0 R-1B Single Family Residential - 15k lot 2,929 2315.6 7 R-1C Single Family Residential - 8k lot 26,759 8,672.78 342 R-1D Single Family Residential - 6k lot 19,898 4,924.09 178 R-1E Single Family Residential - 4k lot 4,485 658.47 430 R-1T Townhouse Residential - 1.5k lot 3,779 1,012.44 593 R-2 Two-Family Residential - 7.5k lot 6,209 1,313.22 830 R-3 Planned Neighborhood Residential - 6k lot 17,354 5,553.8 17876 R-4 High Density Apartment Residential - 6k lot 3,327 2,011.88 14322 R-5 High Rise Apartment Residential - 6k lot 40 58.28 700 Total 96,243 45,653 37,255

Parcel

Count, Acreage and LivUnits by Zoning Class within the USB, 2020

Land Use Analysis

In order to understand the future potential on vacant parcels within the non-residential zoning classes, an analysis was conducted on the developed landform using the PVA data and attributes for zoning, year built, and reported commercial building square footages. All records that had incomplete data were omitted. The objective was to identify an existing building to land area ratio by zone to ascertain potential square footage for the business, commercial, industrial and office use categories for the build-out scenarios. In all cases, if there was a sufficient sample size of post 2000 and/or 2010 development to use as a guide, that ratio was used to forecast future square footage values. Table 4.2 summarizes the results of this analysis. Instances of n/a reflect an absence of more recent data.

Table 4.2 Analysis of the Built Environment of Non-Residential Zoning Classes

Source: PVA Data; Stantec

Figure 4.2 categorizes the 35 zoning classes into major categories and provides a total acreage within each zone. This graphic illustrates the significance of the residential zoning use compared to the employment generating use acreages (41%). The 59% residential zoning ratio doesn’t include the acreage currently designated as Farmland or Agricultural. Many of the acreages in these categories have been identified for future residential uses.

Figure 4.3 depicts the eleven residential zoning classes, which are dominated by the R-1C and R-3 uses. When aggregated, these two zones represent 53% of all residential classes. Since R-3 permits

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

32

Building Sq Ft/Lot Ratio Zoning Description Citywide >2000 B-1 Neighborhood Business 0.18 0.11 B-2 Downtown Business 0.90 n/a B-2A Downtown Frame Business 0.38 0.74 B-2B Lexington Business Center 1.73 1.95 B-3 Highway Service Business 0.22 0.16 B-4 Wholesale and Warehouse Business 0.27 n/a B-5P Interchange Service Business Hospitality 0.30 Retail 0.09 B6-P Commercial Center Hospitality 0.11 Retail 0.14 CC Community Commercial 0.07 n/a I-1 Light Industrial 0.18 0.08 I-2 Heavy Industrial 0.12 0.04 P-1 Professional Office 0.24 0.20 P-2 Office Industry and Research Park 0.21 0.17

Land Use Analysis

higher densities and there are currently very few acres in the R-5 zone, vacant R-3 provides a valuable future resource for new residential units to meet the needs of population growth.

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

33

Figure 4.2 Existing Zoning within the USB by Major Use Category, 2020

Figure 4.3

26,928 1,912 3,878 469 2,395 102 3,619 6,348 0 5,000 10,000 15,000 20,000 25,000 30,000 Residential Mixed Use/Professional Office Industrial Economic Development Expansion Areas Community Center Business Agriculture Acreage Zoning Description 77 331 2,316 8,673 4,924 658 1,012 1,313 5,554 2,012 58 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,000 PUD-1,2 R-1A R-1B R-1C R-1D R-1E R-1T R-2 R-3 R-4 R-5 Acreage Residential Zoning

Summary of Existing Residential Zoning Acreages within the USB, 2020

Land Use Analysis

The count of residentially zoned parcels within the USB is approximately 85,326. As indicated above the predominate zoning class for residential is R-1C followed by R-3. The minimum lot size in R-1C zoning is 8,000 sq ft and 6,000 in R-3 zoning. In recent years, R-3 zoning was modified to permit lot sizes smaller than the 6,000 sq ft and according to staff in the Planning Department, new development ranges between 10-12 dwelling units per acre. As a result, smaller lots for the vacant R-3 zone class were used to calculate future build-out scenarios. See Figure 4.3.

Using a similar approach for the two Industrial classes I-1 and I-2 but filtering out those parcels with an industrial zoning but a reported different land use such as retail, commercial, farmland, etc., the numbers change in interesting ways. As shown in Table 4.3, the number of industrial parcels with an explicitly industrial use, drops by 50% as does the total acreage. But the average parcel size increases slightly from 2.77 to 3.48 for I-1 and from 2.97 to 3.14 for I-2. This suggests the existing and future land area needs for industrial uses may be slightly smaller than the reported desirable size of 5.0-acre parcels. Slightly smaller parcel sizes make the valuable inventory of vacant land for industrial uses stretch a bit further.

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

34

Figure 4.3 Average Parcel Size of Existing Residential Uses within the USB, 2020

All Parcels I-Zoning + C- Industrial Land Use 410 Industrial Zoning Count Acreage Avg Parcel (ac) Count Acreage Avg Parcel (ac) Avg Bldg. Sq Ft I-1 Light Industrial 1,176 3,257 2.77 539 1,870 3.48 29,341 I-2 Heavy Industrial 210 621 2.97 114 355 3.14 18,052

Table 4.3 Summary of Existing Industrial Zoning and Uses within the USB, 2020

Land Use Analysis

4.1.2 Existing Land Uses by Description

Figure 4 4 illustrates the distribution of land uses throughout the USB and Table 4.4 summarizes the count of parcels and acreage within each category and a value for the reported number of living units. In the PVA data, the number “LivUnits” has been captured in the R-Duplex/Half Duplex code (520) or MApartment codes (401, 402 and 403). The number of units reported for residential units only appears in these categories.

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

35

Figure 4.4 Existing Land Uses

EXISTING CONDITIONS AND GROWTH TRENDS REPORT Land Use Analysis 36 Table 4.4 Existing Parcel Count, Acreage,

Land Use Code Description Count Acreage LivUnits 100, 105 F- Agricultural Vacant Land/Dev Land Farm 39 910 0 101,102,103 F- Farm<10 ac/General Purpose/Horse 70 2,743 0 199 F- Other Agricultural 6 70 0 510 R- Single Family Dwelling, Platted Lot 80,162 18,661 0 549,550,551 R- Condo Mother/Condominium/Townhome 1,264 822 0 520 R- Duplex/Half Duplex 4,043 895 567 500 R- Residential Vacant Land, Lot 2,000 528 0 502, 503 R- Rural Residential/Rural <10 acres 79 159 0 504, 505 R- Rural Residential Vacant/Development Land Res 90 691 0 590, 591 R- Transfer/Non-Qualifying 15 129 0 401, 402, 403 M- Apartments 4-40+ 1,721 1,982 36,485 400, 405 C- Commercial Vacant Land/Dev Land Comm 775 1,538 0 410 C- Industrial 857 2,556 0 420 C- Office 1,010 1,170 0 430 C- Retail 1,319 2,004 0 440 C- Hospitality/Recreation 483 727 0 450 C- Governmental 206 2,822 5 456 C- Parking Structures 529 262 0 460 C- Healthcare 82 372 0 463 C- Golf Courses 13 904 0 468, 469, 489 C- Telecom w Tower/Telecommunications/Public Svc 153 575 0 499 C- Other Commercial Structures 449 1,721 0 700 HOA/Ret.Basin/Open Space/Greenway 821 3,068 0 725, 750, 751 Air Lot/Improvement Only/Land Only 49 160 0 Blanks 109 184 0 96,344 45,653 37,057 Source: PVA, Stantec

and LivUnits by Land Use within the USB, 2020

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

Land Use Analysis

The information from a land use description perspective is less granular for residential but more granular from a commercial/office/industrial perspective. Interesting to note the tally of LivUnits appears in the Multifamily land uses albeit with slightly different totals (37,255 in zoning; 37,057 with land use).

Visualized as a bar chart in Figure4.5, the land use descriptions that comprise the USB are 52% pure residential uses although residential is permitted in commercial/office/farmland and agriculture, and hospitality/recreation and golf designed parcels. The areas designated as HOA/Retention Basin/Open Space/Greenway or Other were not used in any analysis to accommodate future demands in housing or other services.

37

Single Family Residential Multifamily Residential Vacant Residential Commerci al/Office Industrial Governme ntal Hospitality /Rec/Golf Vacant Commerci al Farm/Hors e/Other Agricultura l Vacant Agriculture /Farm HOA/Ret Basin/OS/ Greenway Other Acreage 20,666 1,982 1,219 5,267 2,556 2822 1,631 1,538 2,813 910 3,068 1,181 % of Total 45% 4% 3% 12% 6% 6% 4% 3% 6% 2% 7% 3% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% 0 5,000 10,000 15,000 20,000 25,000 Acreage

Land Use Descriptions

Figure 4.5 Existing Land by Use Description, Acreage and Percent of Total

Land Use Analysis

As shown in Figure 4.6, existing industrial uses total 857 parcels or count with an acreage of 2,556. This data is based upon the PVA land use code 410. However, this land use includes both light and heaving industrial zoning classes in addition to numerous commercial classes such as neighborhood business, wholesale and warehouse, business etc. For purposes of the existing conditions analysis, we assume the PVA assesses the use on the land use and not the zoning. There are a large number of very small parcels and a small number of very large parcels. The decline in the number of parcels with an increasing parcels size is steady.

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

38

0.0-0.99 1.0-1.99 2.0-2.99 3.0-4.99 5.0-9.99 10.0-19.99 20.0-49.99 50 acres+ Count 358 195 92 90 73 33 12 4 Acres 161 272 225 350 500 469 311 269 0 100 200 300 400 500 600 Count Acres

Figure 4.6 Existing Industrial with a Land Use Code 410 by Parcel Size Range, 2020

Land Use Analysis

EXISTING CONDITIONS AND GROWTH TRENDS REPORT

39

Figure 4.7 illustrates the physical location of the various parcels and their corresponding land use designations that were not considered developable for the build-out scenarios, with the exception of the Land Only category. There are a total of 16 parcels with this designation totally 20.9 acres.

Figure 4.7 Other Land Uses

Land Use Analysis

Figure 4.8 illustrates the nine subareas defined by the Fayette Alliance Housing Demand Study, modified slightly to conform to the USB. These areas were drawn for the existing conditions analysis to better understand the overall context of development within the City of Lexington.

Downtown: The Downtown subarea is the smallest of them measuring 0.57 square miles and consisting of 366 acres. Five percent of the land area is considered vacant. The boundaries are W. 3rd Street on the north, Midland Avenue on the east, Manchester on the south, and Newtown Pike on the west. Existing zoning is predominantly commercial and R-3. Existing land uses are a combination of Commercial/Office/Healthcare, Residential, and Government. Not surprising, the primary uses Downtown consist of Office, Hospitality/Recreation, Other Commercial Structures, and Parking. Somewhat surprising is the number of acres designated as Single-Family Dwelling/Platted Lot. This number totals 61.9 acres, second to the land area dedicated to parking uses. The number of developed parcels total 460 with an average size of 0.27. Approximately 1,525 more residential units are located within the Downtown subarea in the form of apartments, duplexes, townhomes, and condominiums. With an overall average parcel size of 0.47, redevelopment of vacant parcels within this subarea may require additional time and/or incentives.