South African Women Entrepreneurs Job Creators Report

Small and medium sized enterprises (SMEs) play a vital role in job creation in the South African economy. According to the South African National Development Plan (NDP), the country needs to create 11 million additional jobs by 2030 to absorb its growing workforce; it is expected that 90 percent of this job growth will stem from new and expanding SMEs.²

The 2020 Future of Business Survey, conducted by Facebook in partnership with the World Bank and OECD, found that 34 percent of South African SMEs were women led, 38 percent were male led, and 28 percent had balanced teams of men and women.³ South Africa’s share of women led SMEs is slightly higher than global per country average of 31 percent.

The importance of women entrepreneurs to the South African economy is signi�cant. The country is one of only 12 with economies showing growth in the share of women’s entrepreneurial activity. According to the Mastercard 2022 Index of Women Entrepreneurs, 11 percent of South Africa’s working aged women are engaged in early stage entrepreneurial activities.⁴ Their role as job creators is also signi�cant and demands better understanding.

¹gov.za/speeches/president cyril ramaphosa 2022 state nation address 10 feb 2022 0000 ²oecd ilibrary org/sites/37b75ad0 en/index html?itemId=/content/component/37b75ad0 en ³oecd org/sdd/business stats/the future of business survey htm ⁴mastercard com/news/media/phwevxcc/the mastercard index of women entrepreneurs pdf

“We all know that government does not create jobs— business creates jobs. Around 80 percent of all the people employed in South Africa are employed in the private sector.”President Cyril Ramaphosa, State of the Nation Address (SONA), February 10, 2022¹

The 2022 South African Women Entrepreneurs Job Creators Report aims to provide key insights into the pivotal role that women entrepreneurs play as job creators. This is the second edition of the Report and builds on the insights and trends covered in the previous edition.

The Report focuses on what women entrepreneurs are achieving in job creation, their future job-creation potential as indicated by their intentions to hire in the future, and the barriers and challenges they face in growing their businesses and jobs. It highlights the timing and business conditions needed for women entrepreneurs to make that all important �rst hire, taking them from solo entrepreneur to employer entrepreneur.

The Report assesses the ability of women entrepreneurs to access funding and whether this remains a barrier to growing their businesses and creating jobs. It also assesses the impact of digitization on women-owned businesses and whether it contributes to their likelihood of growing their businesses and employment.

This is the second annual edition of the South African Women Entrepreneurs Job Creators Report. It is based on research by Lioness Data, the research and insights unit of Lionesses of Africa Public Bene�t Corporation, a social enterprise advancing Africa’s women entrepreneurs. Lioness Data taps into a growing network of over 1.5 million women entrepreneurs across Africa to extract actionable insights that help investors, policymakers, and development agencies make faster and better data driven decisions. Lionesses of Africa is partnering with researchers from New York University to provide reliable, timely data and insights into women entrepreneurs and their businesses and give Africa’s women entrepreneurs a voice in shaping resources targeted to them.

The analysis in this Report is based on the results of �ve surveys conducted across 2022 with women entrepreneurs recruited from the Lionesses of Africa network in South Africa. The �rst was conducted in January 2022 and the subsequent surveys were carried out between June and August 2022. This approach was adopted to reach and accommodate the inputs of a wider spectrum of women entrepreneurs, re�ecting a range of industries, sizes, and levels of maturity. The survey covered all nine provinces.

A total of 1,339 respondents took the opportunity to share their experiences as South African women entrepreneur job creators.

Their insights were gathered in order to:

• Better understand the impact women entrepreneurs make by way of jobs created

• Assess their commitment to job creation and intentions to hire in the future

The Report provides insights into both “Employer Businesses” made up of women led SMEs and large businesses, and “Non Employer Businesses” made up of women solo entrepreneurs, independent contractors, freelancers, or otherwise self employed. The “Non Employer Businesses” are important to job creation, even if the label may suggest otherwise. Each “Non Employer Business“ or solo entrepreneur is a job creator, having created a job for herself.

Respondents varied from women led business with no sta� to those leading businesses with thousands of employees. They represent all nine provinces and re�ect a wide range of industries, sizes, and levels of maturity.

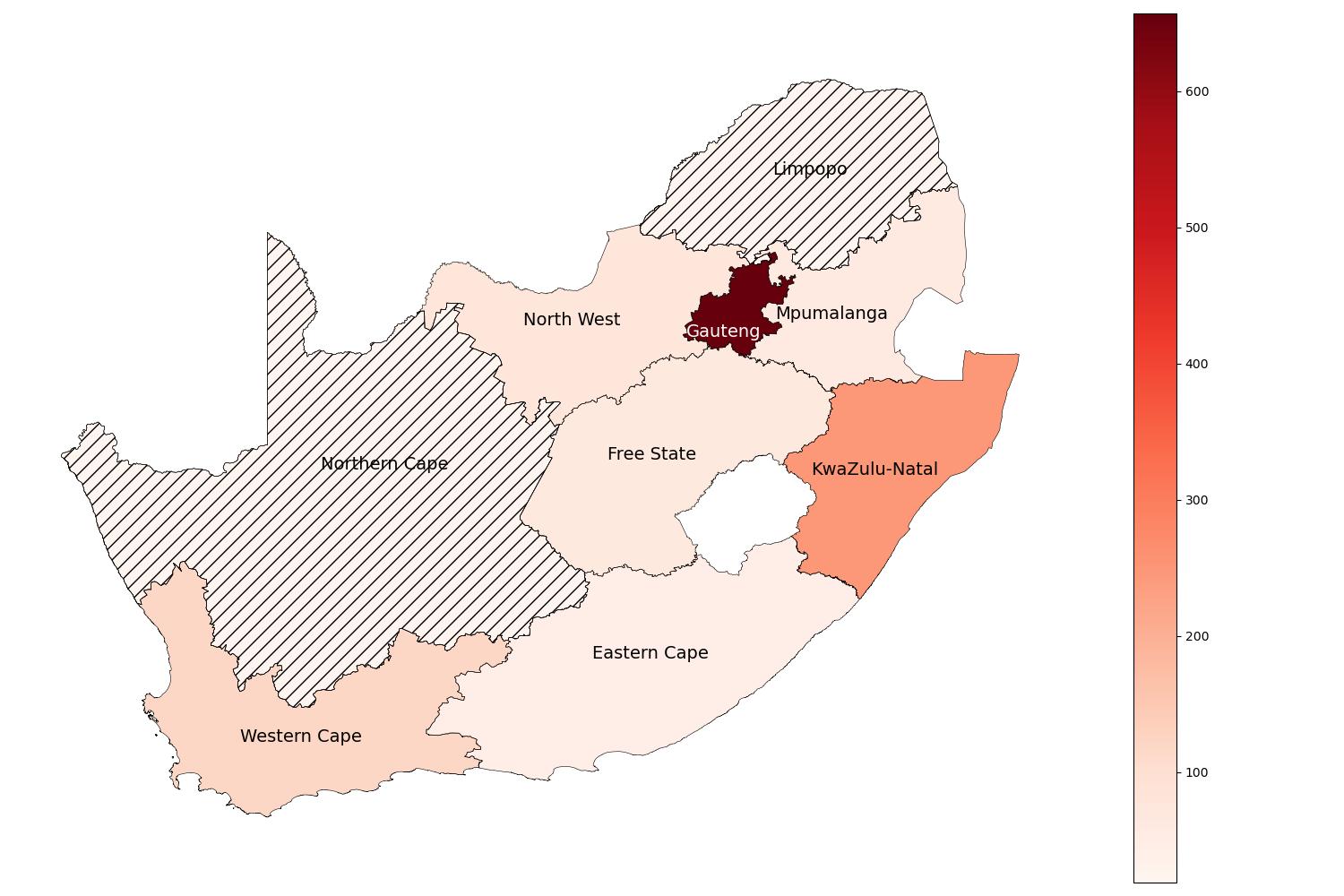

ndents included 1,339 South men entrepreneurs from all nces. The map below shows dents’ locations, with darker dicating a larger number of s. Sizable shares of the study s were from Gauteng, ape, and KwaZulu Natal. We dings from all nine provinces rting aggregate measures but Northern Cape and Limpopo rting disaggregated results at ce level, due to the small f respondents from those p

from

The respondents lead a wide range of business types, from micro enterprises and small businesses to medium sized and large enterprises. They represent a wide range of ages, with 35 44 the largest share of respondents of both employer and non employer business types. Those with more employees are older, on average. Highest

South Africa’s women entrepreneurs reported a strong commitment to job creation, indicating that it was “very important” (73%) or “important” (19%) to them as a business owner. This commitment was consistent across business type, size, and age of respondent and mirrors the �ndings reported in the South African Women Entrepreneurs Job Creators Survey 2021. When it comes to con�dence in the capabilities of who will create new jobs in South Africa, women entrepreneurs were “extremely con�dent” (33%) or “very con�dent” (36%) in the capabilities of their own business and were similarly “extremely con�dent” (42%) or “very con�dent” (42%) in the capabilities of the country’s women entrepreneurs to create new jobs. Women entrepreneurs report much less con�dence in the capabilities of government to create new jobs; 39 percent were “not at all con�dent” and only a small share was “extremely con�dent” (4%) or “very con�dent” (18%). “Asabusinessowner,howimportantisjobcreationtoyou?”

The South African National Development Plan (NDP) estimates that 11 million new jobs need to be created by 2030 to absorb the growing workforce. But who will create these new jobs? The NDP anticipates that 90 percent of these jobs will come from new and expanding SMEs. We also know that women entrepreneurs lead over a third of these SMEs in South Africa. So, a better understanding of their level of job creation and who among them are most e�ective at creating jobs would inform policymaking and funding agendas and improve resource allocation.

The surveys provide insights into both the level of jobs created and the characteristics of the entrepreneurs and businesses creating them.

Together, the 1,339 women entrepreneur respondents employ 8,503 people excluding owners and partners, an average of 6.4 employees per survey respondent.

Women led businesses in Gauteng create the most jobs overall, given the large number of businesses in that province. However, women led businesses in the the Western Cape and KwaZulu Natal have the largest number of employees per business, on average.

The surveys reveal a negligible relationship between business maturity and job creation. There was only a small negative correlation between the year a business started trading and its number of employees.

The surveys provide important insights into how business size, by revenue, is related to job creation. Women entrepreneurs leading businesses with larger revenues employ more sta�, on average, than those with smaller revenues. However, as a group, the smallest businesses (those with a revenue of less than R250,000) employ the most employees overall. These small businesses had the fewest employees, on average, but due to the large number of these businesses, as a group they dwarf all other business size categories as job creators.

Older women entrepreneurs, on average, employ more sta� than younger employers. However, as a group, women entrepreneurs age 35 44 employ the most employees overall, given the large number of businesses led by women entrepreneurs in this age range.

Insight: Con�dent women entrepreneurs are more likely to hire Survey responses reveal a strong relationship between the respondents’ con�dence as an entrepreneur and their reported con�dence in their ability to employ sta� in the short term. 79 percent of “very con�dent” women entrepreneurs report con�dence in hiring additional sta� in the short term, compared with 52 percent of “con�dent” and 19 percent of “neutral” women entrepreneurs. Those reporting being “very con�dent” also reported making a larger number of new hires in 2022, compared to less con�dent respondents.

Adding her �rst employee is arguably among the biggest growth events a women entrepreneur will experience on her business journey, as this hire e�ectively doubles her workforce. The decision to take the leap from non employer to employer is complex. The entrepreneur will grapple with trust and shared responsibilities, the weight of being responsible for other people’s livelihoods, and the administrative burden that comes with being an employer. She will also need con�dence that her business can generate the revenue required to sustain the new hire.

For some businesses, hiring starts at launch. However, many new businesses begin as non-employers. Having more women solo entrepreneurs go on to hire at some point in the future, after having created a job for themselves, should be seen as an important opportunity for job creation and needs to be better understood.

The surveys provide insight into the intentions of women entrepreneurs to make a �rst hire and, importantly, the characteristics of those entrepreneurs and the businesses that go on to make hires.

The survey data indicate that South Africa’s solo entrepreneurs intend to grow jobs within their businesses. 71 percent of women entrepreneurs with non employer businesses report intentions to make a hire at some point in the future. Women age 18 44 who are non employers report signi�cantly greater interest in making a �rst hire (79 percent indicate intentions to hire) than non employers 45 and over (54 percent intend to hire). Solo entrepreneurs’ intentions to make a �rst hire were consistent across business size (measured in revenue) and business sector, with the exception of women solo entrepreneurs in the intellectual sector, who were less likely to report intentions to hire.

The surveys provide insight into the timing of �rst hires and indicate that women are achieving this growth milestone early in the life of their business. 55 percent of women leading businesses with employees had made their �rst hire within the �rst year of operating and 22 percent in the second year. The early introduction of hires (years 1 and 2) is consistent across sector and across respondent education levels.

“Atwhatstagedidyourbusinesshireitsfirstemployee(excludingownersandpartners)?”

What are the precursors to job creation, that is, the conditions that make women entrepreneurs feel con�dent that they can responsibly take on new employees? Survey responses provide insights into how the decision to add new sta� relates to revenue expectations, access to external �nancing, con�dence in the national economy, and past performance.

Survey responses indicate that con�dence in sales revenue for the coming 12 months is a precursor to hiring. Respondents who expected their sales revenue to “increase a lot” in the next 12 months were currently looking to hire nearly four times as many employees as those who expressed less con�dence in their revenue outlook.

NumberofEmployeesCurrentlyLookingtoHire,byExpectationsforSalesRevenueinthe Next12Months

An important impetus to hire is access to funding and con�dence in future access to external funds. As we document in “The Funding Link” on page 17, women entrepreneurs who had successfully secured funds and felt con�dent in their ability to secure funds in the next 12 months were seeking to �ll more positions than did those who were unsuccessful in securing funds and lacked con�dence in their ability to secure them in the future.

Feeling con�dent in the national economy in the next 12 months is also a precursor to hiring. Those with greater con�dence in the national economy over the next 12 months were looking to hire, on average, four times as many new employees as those who were pessimistic about the national economic outlook.

Past performance is a precursor to hiring. There was a strong positive correlation between the number of jobs added over the past 12 months and the number of people the business is looking to hire.

The vast majority of the 11 million additional jobs that South Africa needs to add by 2030, to keep pace with the growing labor force, is expected to be created through new and growing SMEs. Developing a large cadre of viable SMEs is therefore a high priority for policymakers. However, access to �nancing is a key constraint on SME growth and is among the most cited obstacles, including to employment growth.

The reality for most South African SMEs is that they are less likely to obtain bank loans than are large �rms. Survey respondents report that they rely on internal funds, including personal/owner funds (48%) or business pro�ts (47%), to run their businesses. Only �ve percent report that their business operations are funded mostly using external �nancing.

The International Finance Corporation (IFC) estimates that almost half of formal SMEs don’t have access to formal credit and that the �nancing gap is even larger when micro and informal enterprises are considered. The data provided by respondents in this survey re�ect this �nancing gap and o�er insights into the linkages among funding, con�dence in meeting future funding needs, and the ability of women entrepreneurs to employ more people.

Survey responses reveal an association between job creation and access to external �nancing. Women entrepreneurs who received external �nancing in the past 12 months were currently looking to hire, on average, about twice as many employees, and had added roughly twice as many employees over the past year, as those who had not received external �nancing.

Entrepreneurs are more likely to hire if they believe their businesses can sustain those new positions. Survey responses show a close association between respondents’ con�dence in their ability to secure �nancing in the future and the number of employees they are currently seeking to hire.

COVID 19 had a major impact on accelerating digital transformation in businesses. Almost overnight, South African women entrepreneurs were forced to follow global trends and move the majority of their employees and operations to remote work solutions. The pandemic also accelerated the development of their digital presence, to sell and market online and to upgrade their websites

The 2021 edition of South African Women Entrepreneur Job Creators survey highlighted that businesses with a digital presence were somewhat more resilient during COVID 19; women leading businesses whose products were sold through an app or online marketplace were more likely to report that their businesses were not a�ected by COVID 19 or that they expected a fast recovery (within less than 12 months). They were also more likely to project revenue increases for 2021. Across all sectors, the women who were selling a majority of their products through an app or online marketplace were the most optimistic about their future revenues (projecting “large revenue increases” for 2021).

In 2022, the majority of respondents continue to show progress in their digital transformation, with 89 percent saying they are making greater use of social media or online marketing for their business. The respondents also reveal that 18 percent were “very con�dent” and 43 percent were “con�dent” in their business’s current digital capabilities to meet needs. Respondents were also taking actions in their digital transformation to grow their businesses, with 57 percent currently marketing through social media and 24 percent developing online sales or e commerce capabilities. However, challenges in digital transformation persist, with 27 percent identifying a “major challenge” in adopting new technology and e-commerce and 40 percent identifying a “major challenge maintaining social media and online presence.”

This year’s survey yields further insights into the impact of digital transformation and digital con�dence on job creation and future hiring intentions. Women entrepreneurs who were “very con�dent” in their business’s current digital capabilities to meet needs added signi�cantly more jobs in the past 12 months and were currently looking to hire signi�cantly more people than those who were less con�dent. DigitalConfidenceandJobCreation

The women entrepreneurs surveyed were asked to identify what they considered to be the biggest barrier or challenge to employing more sta� in their businesses.

Issues around �nancing presented the biggest challenge, with 42% of respondents citing access to capital, maintaining consistent cash�ow, and ensuring salary bills could be reliably met among the biggest concerns.

“Consistent cash�ow remains one of my biggest barriers to afford a fulltime employee”

“The lack of �nancial support results in instability to keep employees”

“In�ation concerns, rising interest rates and geopolitical issues have all contributed to a roller-coaster of change, and it’s much more dif�cult to raise new funding in this environment”

A related barrier to hiring identi�ed by 42 percent of women entrepreneur respondents was a lack of su�cient sales revenues and cash�ow to cover additional salaries, exacerbated by the challenge of acquiring new customers to drive sales growth. 31 percent of respondents experienced access to market barriers, making new customer acquisition and sales revenue growth more di�cult.

“A challenge for job creation is the responsibility of paying a salary if I’m uncertain about future sales”

“Low sales turnover at the moment means we can’t provide a reasonable salary to someone”

“The challenge is to grow our client book and our sales revenue to the point when we feel comfortable to hire extra people to build our business to the next level”

Another identi�ed barrier to creating jobs was the lack of key skills among job seekers in the marketplace and the resulting requirement for ongoing training and development upon hiring. 18 percent of respondents cited challenges in sourcing skilled sta�, together with the additional cost of on the job training and development needed.

Other challenges impeding new hiring decisions included a lack of appropriate workplace infrastructure to support new employees and insu�cient specialist equipment, highlighted by 7 percent of respondents. Poor business growth was also identi�ed by 5 percent of women entrepreneurs as an impediment to hiring, with political and economic instability and government red tape cited by 3 percent.

“The challenge is �nding the right skills at the right price”

“Finding the right person to �t into our extremely specialist team with the right skills is a challenge”

“The lack of industry-speci�c skills is a challenge”

Data gathered from 1,339 respondents drawn from the Lionesses of Africa network in South Africa provide key insights into South Africa’s women entrepreneurs as job creators.

• The 1,339 women entrepreneur respondents employ 8,503 people.

• 71 percent are employers, with an average of 9 employees, and the “typical” or median number of employees is 6.

• 29 percent of women entrepreneurs are solo entrepreneurs with no employees.

• Women entrepreneurs in the manufacturing industry had the largest number of employees, employing approximately 14 staff on average.

• 77 percent of employers hired their �rst employee in year 1 or 2, with 55 percent hiring in Year 1.

• 72 percent of solo entrepreneurs expect to hire full time employees at some point in the future.

• 24 percent of women entrepreneurs expect the overall number of jobs in their business to increase a lot over the next year.

• 68 percent of women entrepreneurs reported con�dence in making new hires this year.

• On average, women 45 and over have the largest number of employees.

• 84 percent of women entrepreneurs make less than R250,000 per year.

• 73 percent of women entrepreneurs de�ned job creation as “very important” to them.

• Just less than half of women entrepreneurs cite lack of access to capital as a major barrier to job creation.

• Women entrepreneurs who are con�dent in their business’s digital capabilities are creating more jobs than those who are not.

• A third of women entrepreneurs cite �nding the right employees to grow their business as a major challenge.

South African women entrepreneurs continue to show a deep commitment to job creation. They exhibit high levels of con�dence in the ability of their own business, and that of their fellow women entrepreneurs’ businesses, to power job creation. The data reveal that across a wide range of demographics, women led business are succeeding in creating jobs. They are also exhibiting strong intentions to make their �rst hire, or additional new hires, now and over the coming year.

That women entrepreneurs are creating jobs at the rate they are has to be welcomed. Especially in light of the tremendous job creation challenge facing the country. The South African government quanti�es this in the National Development Plan (NDP) to be in the order of 11 million additional jobs by 2030. The NDP also anticipates that 90 percent of this job growth will need to come from new and expanding SMEs. Considering that 38 percent of the country’s SMEs are led by women, the importance of women entrepreneurs’ role as job creators would seem self evident.

In order to better understand the impact women entrepreneurs are having on job creation, the second edition of the South African Women Entrepreneurs Job Creators Report reveals a number of practical insights and trends.

Women are good at creating jobs. The data show that women entrepreneurs with varying characteristics are creating jobs across a range of business demographics. Women young and more mature, leading both small and large businesses, are shown to be motivated and e�ective at creating jobs. They represent a clear opportunity for the country. Support women entrepreneurs better, and more e�ectively, with funding, resources, know how, and access to markets, and they can help South Africa meet its signi�cant job growth targets.

First hires are happening early. Despite all the challenges and complexities of becoming an employer for the �rst time, women are doing it. And, they’re doing it in year one or two. The reality, however, is that early stage job creation is happening at precisely the same time as women entrepreneurs and their businesses are most vulnerable. Typically, they are under resourced, operationally stretched, clamoring to make sales, and ultimately short of the requisite track record to convince lenders to back them. If women are not going to get �nancial backing at this critical juncture (as is overwhelmingly shown to be the case) then they need at the very least to get other kinds of business support and interventions. Failing this, a signi�cant amount of job-creation potential will simply go to waste.

Sales drive job growth. Sales positivity is clearly a vital precursor to women feeling con�dent to take on the responsibility of new employees. Making it easier for women entrepreneurs to achieve faster sales growth and more predictable revenues will signi�cantly help them hire more. This can be achieved through more e�ective, gender lens procurement practices on the part of big business. Buy from women led SMEs and pay them on time, and you will see them grow their employee numbers. As for women entrepreneurs helping themselves: they need to get better at sales.

Digitally ready SMEs hire more. Women entrepreneurs who have a high degree of digital con�dence in their business are hiring more. Digital transformation positively a�ects sales growth, improves business resilience, and drives brand recognition and business con�dence. This makes for more con�dent employers, particularly in early stage businesses. Supporting women entrepreneurs to speed up their digital transformation will speed up job creation.

It’s always about the �nances. The association between increased job creation and access to external �nancing for women entrepreneurs is clear. Those who have received funding have hired at twice the rate, and those who are con�dent of securing funding in the future are also currently hiring signi�cantly more.

Solo entrepreneurs have great employer potential. The potential job gains to be made by more “non employing” businesses becoming employer businesses cannot be overstated. These self-employed women have already e�ectively created one job a job for themselves. Their intentions to hire at some point in the future remain extremely strong. The more they can be supported to make that �rst hire, the better for job growth. Solo entrepreneurs also work in clusters, stimulating the growth of additional freelancers, independent contractors, etc., who in turn join the growing pool of self employed.

Con�dent women entrepreneurs are more likely to hire. There is a strong relationship between high levels of personal con�dence as women entrepreneurs and their con�dence in their abilities to employ. Line of sight to other successful women entrepreneurs is key to building con�dence, business resilience, and positive entrepreneurial mindsets. Ensuring access to peer networks, supportive entrepreneur communities, and peer to peer mentoring plays an important role in such con�dence building.

Overall, South Africa’s women entrepreneurs report a strong dedication to job creation. They are creating jobs for themselves and are motivated to lift others in their communities through job creation. Their potential to help South Africa meet the challenge of creating 11 million additional jobs by 2030 is evidenced by this Report. Women entrepreneurs are showing themselves to be up to the task. They do, however, require better and more e�ective support from policymakers, lenders, big business, and key in�uencers to ful�ll their promise.

The Marron Institute of Urban Management at New York University is a provostial institute that operates as a think do tank. The lnstitute’s mandate is impact It invests in faculty and practice scholars who conduct on the ground research and programming, working alongside practitioners and the publics they serve to gain insights and test new approaches with the potential to dramatically improve the quality of life in cities across the globe. The Institute brings a multidisciplinary approach, with expertise in the natural and social sciences, engineering, and governance. Through innovation, experimentation, and data analysis, the Institute promotes responsive decision making in all sectors. The Institute addresses critical challenges in development and public services across six continents

For further information about the Marron Institute, visit www marroninstitute nyu edu

Lioness Data is the research and insights unit of Lionesses of Africa Public Bene�t Corporation, a social enterprise advancing Africa’s women entrepreneurs Lioness Data taps into a growing network of over 1.5 million women entrepreneurs across Africa to extract actionable insights that help investors, policy makers, and development agencies make faster and better data driven decisions Lionesses of Africa builds and delivers development programmes, business tools, community plat forms, digital media, network ing events and information resources that women entrepreneurs need connect ing them with key global markets for growth. Lionesses of Africa’s community stretches across 54 African countries and thousands of users in the Diaspora in Europe and North America

For further information about Lionesses of Africa, visit www lionessesofafrica com

Absa Group Limited

Absa Group Limited (‘Absa Group’) is listed on the Johannesburg Stock Exchange and is one of Africa’s largest diversi�ed �nancial services groups Absa Group o�ers an integrated set of products and services across personal and business banking, corporate and investment banking, wealth and investment management and insurance. Absa operates in 14 countries. The Group owns majority stakes in banks in Botswana, Ghana, Kenya, Mauritius, Mozambique, Seychelles, South Africa, Tanzania (Absa Bank Tanzania and National Bank of Commerce), Uganda and Zambia and has insurance operations in Botswana, Kenya, Mozambique, South Africa and Zambia Absa also has representative o�ces in Namibia and Nigeria, and securities entities in the United Kingdom and the United States

For further information about Absa Group Limited, visit www absa africa