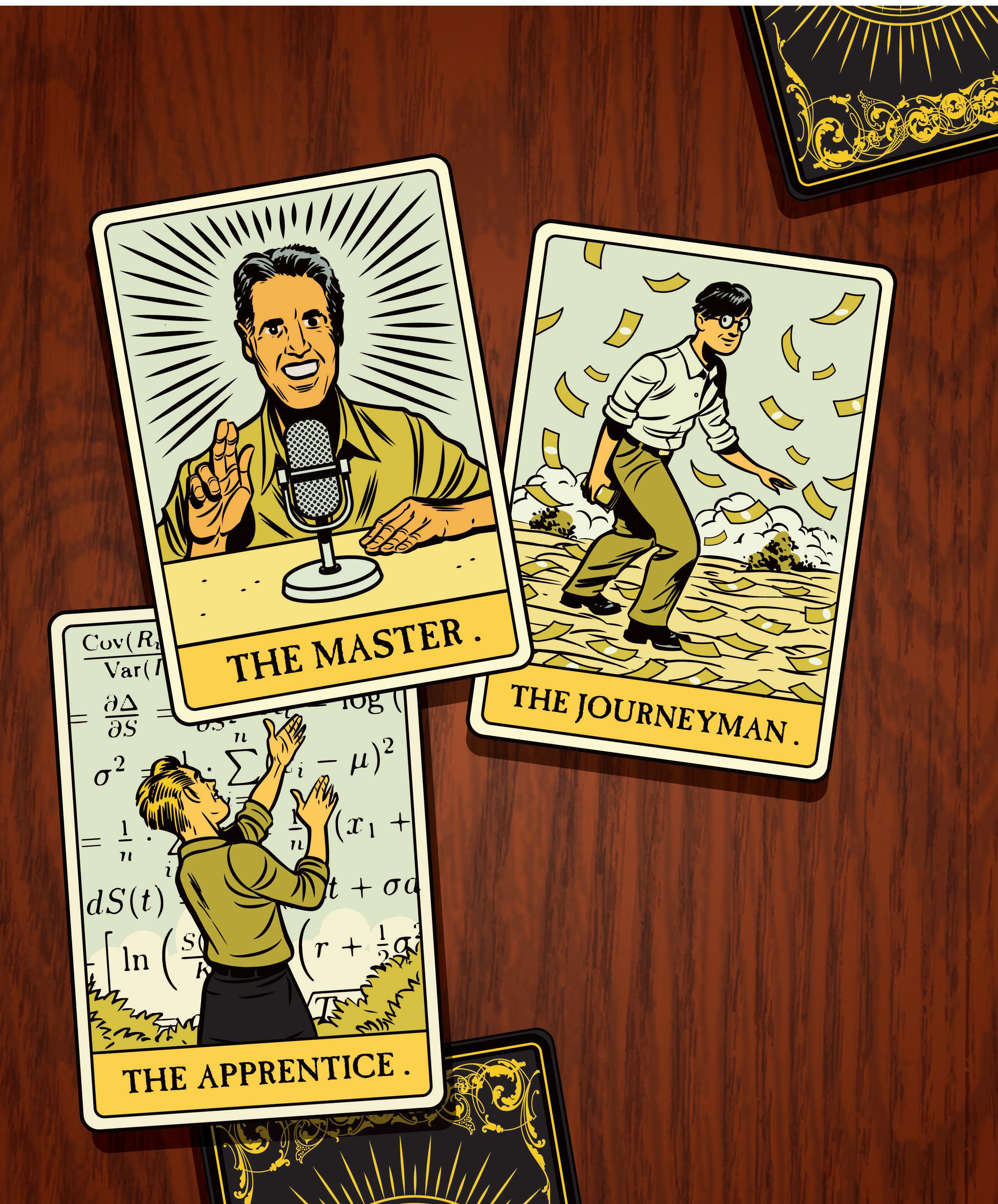

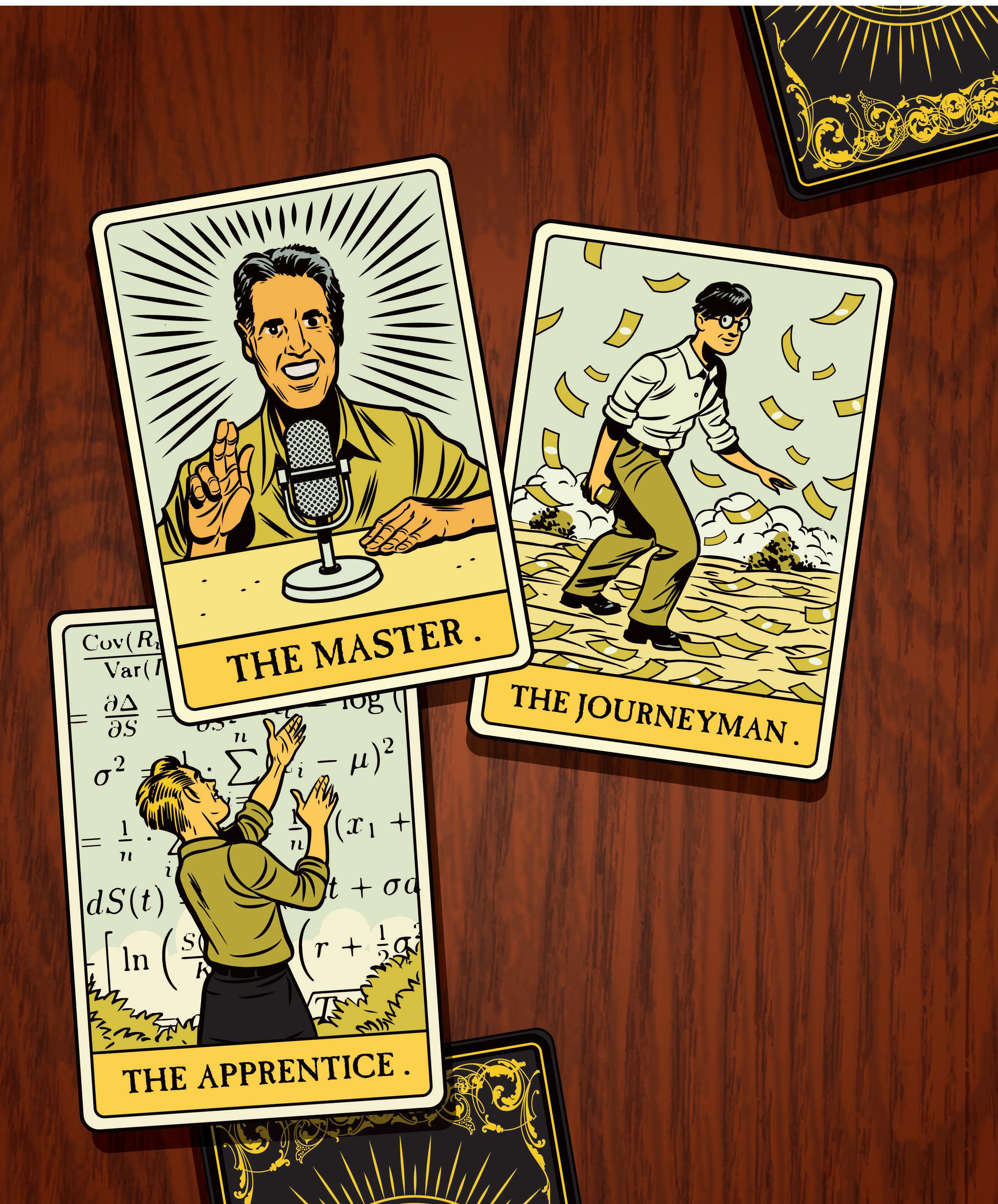

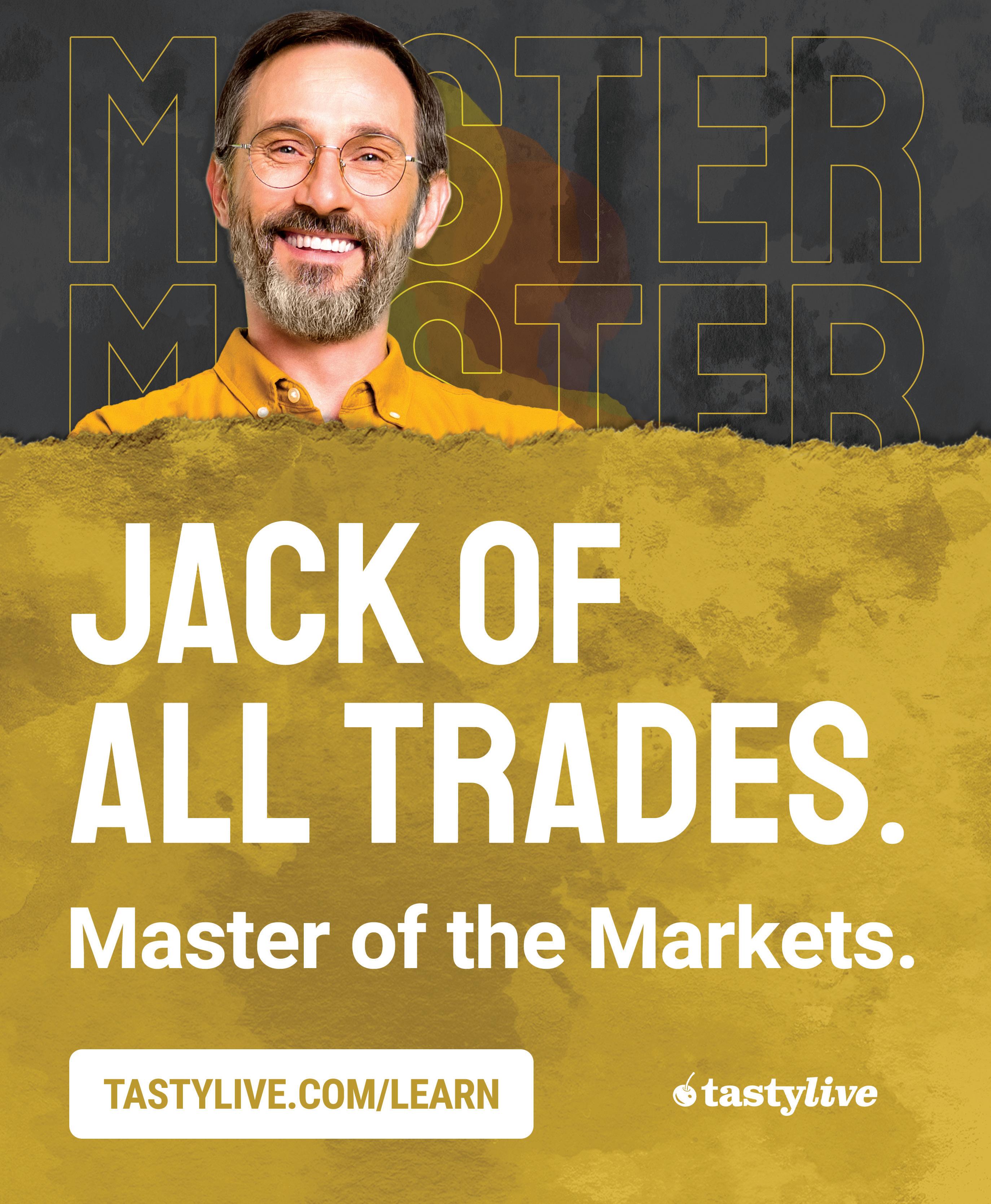

18 | The Master: Trader & Educator

Tastylive co-host Tony Battista shares his expertise on options trading—and he doesn’t charge a cent.

22 | The Journeyman: The Path to a 153,000% Return

Dao turned $1,600 into $2.5 million in

made a

editor in chief ed mckinley

managing editors

yesenia duran james melton associate editors

kendall polidori navpreet dhillon editor at large garrett baldwin technical editor james blakeway contributing editors vonetta logan, tom preston, mike rechenthin creative directors tim hussey, gail snable contributing photographer garrett roodbergen editorial director jeff joseph

comments, tips & story ideas feedback@luckboxmagazine.com contributor’s guidelines, press releases & editorial inquiries editor@luckboxmagazine.com subscriptions & service support@luckboxmagazine.com

media & business inquiries associate publisher james melton jm@luckboxmagazine.com publisher jeff joseph jj@luckboxmagazine.com

Luckbox magazine, a tastylive publication, is published at 19 N. Sangamon, Chicago, IL 60607 Editorial offices: 312.761.4218 ISSN: 2689-5692 Printed at Lane Press in Vermont luckboxmagazine.com

Luckbox Magazine content is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment strategy is suitable for any person. Trading securities and futures can involve high risk and the loss of any funds invested. Luckbox Magazine, a product provided by tastytrade, Inc. (which uses the brand name tastylive) does not provide investment or financial advice or make investment recommendations through its content, financial programming or otherwise. The information provided in Luckbox Magazine may not be appropriate for all individuals, and is provided without respect to any individual’s financial sophistication, financial situation, investing time horizon or risk tolerance. Luckbox Magazine and tastytrade, Inc. are not in the business of executing securities or futures transactions, nor do they direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Luckbox Magazine and tastytrade, Inc. are not licensed financial advisers, registered investment advisers, or registered broker-dealers. Options, futures and futures options are not suitable for all investors. Transaction costs (commissions and other fees) are important factors and should be considered when evaluating any securities or futures transaction or trade. For simplicity, the examples and illustrations in these articles may not include transaction costs. Nothing contained in this magazine constitutes a solicitation, recommendation, endorsement, promotion or offer by tastytrade, Inc., or any of its subsidiaries, affiliates or assigns. While Luckbox Magazine and tastytrade, Inc. believe that the information contained in Luckbox Magazine is reliable and make efforts to assure its accuracy, the publisher disclaims responsibility for opinions and representation of facts contained herein. Active investing is not easy, so be careful out there!

I’m starting with the man in the mirror (oh) I’m asking him to change his ways (oh) And no message could’ve been any clearer If you wanna make the world a better place Take a look at yourself and then make that Change

If you’re a passive investor, it may be time for a change.

The moment to begin trading actively has arrived with the Federal Reserve’s decision to stop propping up zombie companies and thus transform the exchanges into genuine free markets.

Because the Fed is continuing to increase interest rates to slow growth and tame inflation, less money will flow into the economy, making it more difficult for lackluster businesses to compete.

That creates volatility and, in turn, opportunities for active investors to make frequent but well-conceived trades.

One investor who’s poised to capitalize on the emerging heyday for active traders is Son Dao, who was born in Vietnam but now makes his home in Georgia.

See p. 22 for the story of how Dao turned $1,600 into $2.5 million in just 17 months of trading.

The account of Dao’s journey is flanked by the success stories of two other accomplished investors with a lot to teach us.

We’ve called those three featured investors the master, the journeyman and the appren-

tice, but those catchy appellations may not do them justice. All three have achieved mastery in their own ways.

But trading doesn’t end with the exchanges. Just about everything in life requires trades and tradeoffs. That’s a lot to cover, so we made some choices.

One type of trading we decided to explore is “timebanking.” Adherents swap their time and skills instead of shelling out cash.

By exchanging an hour or two here or there, they not only get to make the most of their own abilities but also benefit from the passions, training and experience of others. As a result, timebankers say everyone involved can benefit.

We also investigated high prices in the markets for two commodities a lot of Americans trade: sneakers prized for their collectability and used cars valued mostly for their practicality.

The pursuit of sneakers doesn’t just fill the shelves of enthusiasts. Devotees experience the thrill of the hunt as they track down and capture coveted shoes. Astute aficionados can trade up and thus amass the value they need to obtain the pair they want most.

With used cars, practicality—and even survival—can supersede other considerations.

Thinking Inside the Luckbox Luckbox is dedicated to helping active investors achieve skill-derived, outlier results.

1 Probability is the key to improving outcomes in the markets and in life.

2 Greater market volatility brings greater opportunity for astute active investors.

3 Options are the best vehicle to manage risk and exploit market volatility.

4 Don’t rely on chance. Know your options because luck smiles upon the prepared.

Microchip shortages have kept new vehicles in short supply, so frustrated shoppers and dealers have turned to the second-hand market to take up the slack.

That blasted the price of used cars into the upper reaches of the stratosphere, sometimes placing formerly affordable models out of reach for average families. Is relief on the way? It’s complicated.

Yet, if things get bad enough, hard-pressed consumers can always fall back on the services of that way station on the road of hard luck—pawnshops.

But in these times, pawnshops no longer cater only to the most unfortunate clientele. Our Fake Financial News columnist paid a telephone visit to the proprietor of a luxury pawn shop in Southern California.

He describes his customers as “asset rich but cash poor.” They may need a loan on a pristine designer handbag or a faultless luxury wristwatch, and he accommodates them with a concierge-style experience.

What began with the exchange of a sharp rock for a saber-toothed tiger skin is still expanding its boundaries.

Trading: It’s all around us.

Your thoughts on this issue?

Please take the next reader poll at luckboxmagazine.com/survey

We asked Luckbox readers...

How would you describe your financial experience and literacy?

I am a professional 11%

Above average 59% Average 25%

Below average 5%

What type of investor are you?

Very active 43%

Somewhat active 45% Passive 9% I don’t invest 3%

How often do you trade using personal investment accounts?

At least once per day 40%

Several days per week 23%

At least once per week 14%

At least once per month 6% A few times per year 14%

What does your trading include?

Options 79% Equities 75%

ETFs 63%

Futures 38% Crypto 33%

Do you watch the tastylive network?

Yes 74%

Two ways to send comments, criticism and suggestions to Luckbox

Email tips@luckboxmagazine.com

Visit luckboxmagazine.com/survey

A new survey every issue.

Your thoughts on this issue? Take the reader survey at luckboxmagazine.com/survey

I liked the Grammy Awards article most this time. The probability and futures articles were at the high level I expect from the magazine. Great layout and wonderful formatting makes it a joy to read. —Nicolaas Pereboom, Aix-en-Provence, France

I loved the Forecasting issue: Dr. Jim’s health piece, six traders, Julia Spina’s stats piece and holiday gifts that I haven’t seen elsewhere. Really good work. —Jack White, Berryville, Virginia

I enjoy the variety of topics—from predictive analytics to indie music. Great to learn a bit about a lot of things. —Jenny Thorvaldson, Denver

I read Luckbox to see what all the smart people are thinking. I often fade the consensus, because that’s how I roll. As long as your articles make me interesting at parties, I’ll keep reading.

—Tony Porter, Trego, Montana

I really enjoy the printed publication. All the articles are great. I’ve worked in publishing, so I know how hard it is to put out a quality magazine month after month. Good job!

—Annie Goodman, Edwards, Colorado

There’s more to Luckbox than meets the page.

Look for this QR code icon for videos, websites, extended stories and other additional digital content. QR codes work with most cell phones and tablets with cameras. Open your camera

1 Hover over the QR code

2 Click on the link that pops up

The number of pawnshops in the U.S.

—IBISWorld, 2022

Twenty-four

SEE PAGE 26

SurveyMonkey Market Research, 2021

SEE PAGE 14

SEE PAGE 10

The trading returns of Son Dao

The 28-year-old Georgia-based investor turned $1,600 into more than $2.5 million in just 17 months.

—Verified by Luckbox

SEE PAGE 22

Wiz Khalifa

SEE PAGE 28

“When

Do rich people pawn stuff? California-based Ideal Luxury offers clients private consultations in an office that looks more like an Edward Jones than an EZ Loan.

By Vonetta Logan

By Vonetta Logan

Orange County, California: Home to smog, pristine beaches, housewives botoxed to within an inch of their life…and pawnshops?

I hadn’t been to a pawnshop since I was 15 years old and in the market for a used acoustic guitar so I could become the Black Jewel. (Does that make me onyx?) Anyhoo, all of my knowledge of pawnshops comes from the reality series Pawn Stars

But this issue of Luckbox is all about trading and bartering, so we decided to interview the nation’s premier luxury pawnbroker. Our objectives included learning about the upscale pawn market, discovering how to get luxury goods for less and finding out whether rich people really pawn stuff.

In his book Pawnonomics, author Stephen Krupnik details the 5,000-year history of the pawnbroking industry and makes the tonguein-cheek claim that pawnbroking is the second oldest profession. But that joke may have a basis in fact—depending upon your experience, you might walk out of a pawnshop feeling like you got screwed.

“Every year, some 30 million Americans frequent the country’s 11.8k pawnshops in the hopes of securing a loan in exchange for collateral,” writes Zachary Crockett for The Hustle , a website created to debunk nearly everything. Pawnshop loans, purchases and sales add up to $6 billion dollars per year, he notes.

But dollars and cents alone can’t explain the whole pawnshop “experience” of neon signs, buzzing doors, and a man with a cigar protruding from his mouth saying, “Best I can do is…”

Yet, California entrepreneur Mark Schechter suspected there was a better way. To

spend time with his family, he went into the jewelry and loan business with his father in 2008. At first, their store was a traditional pawnshop, and Schechter found himself working even more hours than at his old corporate job.

“I had a good friend whose wife is Panamanian,” he said. “Yeah, in Panama [pawn] is totally different. You go sit in someone’s office with a cup of coffee and discuss your private business behind closed doors. It’s done privately—not publicly.”

That seed of an idea germinated, and in 2013 Schechter launched Ideal Luxury in Tustin, California. The American luxury pawn concierge was born.

Ideal Luxury provides clients private consultations in an office that looks more like an Edward Jones than an EZ Loan. He offers loans, consignment and a retail arm of the business.

Some 7.4% of all U.S. households have visited a pawnshop, according to the National Pawnbrokers Association. That figure jumps to 40% among lower-income earners.

The average pawn loan is just $150, but even that amount can be significant to someone in dire financial need. During the pandemic, Schechter quickly pivoted to meeting the needs of high-end customers who wanted to buy tangible assets.

“We saw our retail sales go nuts when COVID first hit,” he recalls. “We had a streak, and I want to say it was almost two straight months where every week we had a retail sale that was five figures or greater.”

Watches became his favorite tangible asset during the pandemic, and Ideal Luxury offers timepieces only from companies like Rolex, Patek Philippe and Audemars Piguet.

Now, as the economic climate shifts, Schechter is seeing changes in his business. “You’ve got to add some zeros” to the end of the loans his clients now need, he says.

“Our loans might have been 20% of our business because we’re a quality play, not a quantity play,” Schechter says of the days before the pandemic. “I would say right now on the lending side it’s probably closer to 40%,” with an increasing number of loans sought for luxury purses, watches and jewelry.

So, what’s next for Ideal Luxury?

“We’ve pulled back on what we take in and how much we offer,” Schechter acknowledges. “It’s gone from a seller’s market to a buyer’s market. So, before I would take what I could get, but I can only buy so many watches and diamonds in the next 30 days. I’ve got to make sure that what I’m buying is something that I don’t mind owning for a long time if things get really bad.”

He sees that trend lasting until the end of Q4 2023.

I assume rich people dive into their rooms full of money á la Scrooge McDuck. So, I asked Schechter for examples of how his clientele use the loan part of his business.

In California, pawnshops’ monthly interest rates are around 3% for loans under $2,500. Over that amount, rates are “negotiable.”

Schechter’s clientele qualify as “asset rich and cash poor” and use his loans to bridge a liquidity crisis, he says. He tells me of a young real estate agent out to make a name for herself. She closed her first deal but her commission check wouldn’t hit her account for another six to eight weeks. But she had a Birkin

Rolex, had a value of $50,000. Ideal Luxury takes 25% on consignment, so the customer walked away with nearly four times as much cash. Schechter’s industry knowledge paid off.

Bougie-adjacent shoppers find really good deals at pawnshops. Curious about this trend, I visited the premier pawnshop in Chicagoland. (Narrator: “It was not premier. It was in a sad strip mall next to Papa John’s.”)

The jewelry in the pawnshop’s case looked appropriate—for an out-of-the-way Service Merchandise in 1984. Luxury offerings included a sad-looking cream-and-white Louis Vuitton Neverfull tote. A mint green Gucci clutch looked out of place next to a gun rack.

I then toured the Ideal Luxury site for comparison and was blown away by the high-quality luxury goods and competitive prices. Unlike sites like Tradesy and Poshmark, Schechter takes in only the pristine goods and then uploads their unretouched, unedited photos to the site.

He once acquired a Harry Winston ring valued at $2 million on a fortuitous charity ski trip but sold it for less than a million.

A fetching pink diamond in a gorgeous setting caught my eye on the site. A widow sold it to Schechter so she could buy property.

handbag her mom gave her for graduation. She used a loan on the bag to live on until her check cleared. (I think I got a Panda Express gift card when I graduated.)

Ideal Luxury’s loans also help entrepreneurs—sometimes a lot. “I always say we’re not saving lives,” Schechter continues, “but I’ve had someone that had to make a COBRA (health insurance) payment. Within two hours they’re going to lose their health insurance.”

On the consignment side of the business, Schechter offers the tale of a man who brought in a bag of jewelry and a wristwatch without straps. A competing broker had offered the man $10,000 for the watch, but Schechter wanted to do some digging, and the client agreed.

It turns out the watch, a rare, sought-after

One potential client offered to sell a Rolex watch at a considerable discount, even though it “will get me out of jail anywhere in the world,” he says. Um, you do you, buddy.

I hope never to need a luxury concierge, but if I ever do I’d want one that lists core values on its website—the way Ideal Luxury does.

The pawn industry is under threat because legislators want to wrap pawn loans in the same blanket as “predatory payday loans”— even though the owners reclaim most of the goods offered up for pawn.

Schechter is confident and charismatic, and he remarks more than once to Luckbox that “I’m not of the business—I’m in the business.” But he’s changing the way the pawn business works and for the better. So, if you’re a large bearded man, I’m a ring size 6 and I love the color pink.

The luxury pawn clientele is asset rich and cash poor.

A TRADER’S MARKET IS RESULTING FROM THE CONVERGENCE OF FOUR ELEMENTS—A RECESSION, INFLATION, HIGHER VOLATILITY AND A HAWKISH FEDERAL RESERVE, ACCORDING TO ECONOMIST GARRETT BALDWIN. THIS LUCKBOX SPECIAL SECTION ON TRADING KICKS OFF WITH BALDWIN’S VIEWS ON HOW ACTIVE INVESTORS CAN CAPITALIZE ON THAT MASHUP OF ECONOMIC TRENDS. THE SECTION’S TRADING COVERAGE CONTINUES WITH PROFILES OF THREE SUCCESSFUL INVESTORS WHO’LL BE MAKING THE MOST OF THIS YEAR’S OPPORTUNITIES FOR ACTIVE TRADING. WE’RE CALLING THEM THE MASTER, THE JOURNEYMAN AND THE APPRENTICE.

BUT REGARDLESS OF A TRADER’S EXPERTISE, TIME IS MONEY. THE SECTION ENDS WITH AN ACCOUNT OF “TIMEBANKING,” A MOVEMENT WHOSE ADHERENTS TRADE AN HOUR OR MORE OF THEIR TIME INSTEAD OF PAYING CASH FOR GOODS AND SERVICES.

CHAOS WILL ROIL THE ECONOMY THIS YEAR, BUT THE FEDERAL RESERVE IS CREATING MARKET OPPORTUNITIES FOR ACTIVE INVESTORS

BY GARRETT BALDWINKeeping active doesn’t just improve your health. It also bolsters financial well-being. But it hasn’t always been that way. For years, the debate over active and passive investing has favored the latter. Capital has swung toward exchange-traded funds (ETFs) and mutual funds in an equities market driven by Federal Reserve policies.

Active investing requires a portfolio owner, manager or other “active participant” to make investment decisions and buy and sell equities frequently. Passive investing requires fewer trades and usually involves trying to replicate or outperform the performance of a stock index, such as the S&P 500.

Passive investing has been on a roll. In 2007, Warren Buffett inspired traders to pour more capital into passive funds by winning a $1 million wager against money manager Ted Seides.

Seides had bet his hedge fund could beat a passive S&P 500 fund, but it didn’t. And for years afterward, the performance of active managers continued to trail the relevant indexes.

It’s been difficult to beat the market because the Federal Reserve has been

propping it up. Over the last 13 years, the Fed poured nearly $8 trillion into the economy by keeping interest rates at record lows. Unprofitable zombie stocks surged, and careers blossomed for fund managers hawking innovative ETFs and passive strategies—regardless of valuations or fundamentals.

But now the markets have shifted. The Fed is continuing its tightening, including higher interest rates and a planned balance sheet reduc-

tion of $1 trillion. In the first nine months of 2022, 60-40 portfolios containing 60% stocks and 40% bonds turned in their worst performance ever. Cryptocurrencies shed 90% or more of their value, and exchange-traded funds like the WisdomTree Cloud Computing Fund

This market is jittery with investors responding differently to the same news in a matter of weeks.

-0.30 (0.07%)

Nov. 2—Fed chairman signals commitment to higher interest rates to combat inflation. SPY drops 13.87 points in 90 minutes.

Nov. 10—CPI registers at 7.7% for October. SPY gains 20.54 points from previous day’s close.

Nov. 30—Fed chairman signals commitment to higher interest rates to combat inflation. SPY jumps 14 points in five hours.

410.00 405.00 400.00 395.00 390.00 385.00 380.00 375.00 370.00 365.00

407.38

(WCLD) dropped in value roughly 50% in 11 months.

What’s more, the pain may not be over for the zombie stocks.

But this year will bring a stock picker’s paradise and an active trader’s market that will see momentum swings, bear rallies and short squeezes like in 2022. And if the Fed does pivot, expect even brighter skies.

So, let’s discuss the joy of active trading and seven reasons why investors can beat the market in 2023 and outperform the ever-growing crop of passive investment vehicles.

Investors have hung on every word uttered by Federal Reserve Chairman Jerome Powell since the central bank began contemplating rate hikes and balance sheet reductions late in 2021.

Markets sank in January 2022 on the expectation of small rate hikes and surged on the promises of “no recession” in March, following a meeting of the interest-rate-setting Federal Open Markets Committee (FOMC). Wild swings defined the markets of 2022.

By the end of the year, the slightest change in what Powell said about inflation could trigger a slump or fuel a rally. In November, for example, markets experienced dramatic swings up and down based on his statements.

First, Powell reminded investors the central bank would continue to raise rates to combat inflation. His statement set off the worst one-day performance ever on the day of an FOMC meeting.

breakdowns. It also showed differing interpretations of a Fed message can cause wild swings in equities in the months ahead.

As of December 2022, markets continued to price in odds of rate cuts by late 2023, suggesting the central bank has reached its goal of bringing inflation down to its 2% target. Such an achievement would have no historical precedent, and supply chain challenges and energy volatility may persist, creating inflation in the year ahead.

By May 2023, the market will likely start to anticipate that the Fed will begin discussing the timing of rate cuts. Instead of focusing on the size of rate hikes as in 2022, future speculation will center on the size and timing of moving the Fed funds rate lower to stimulate the economy.

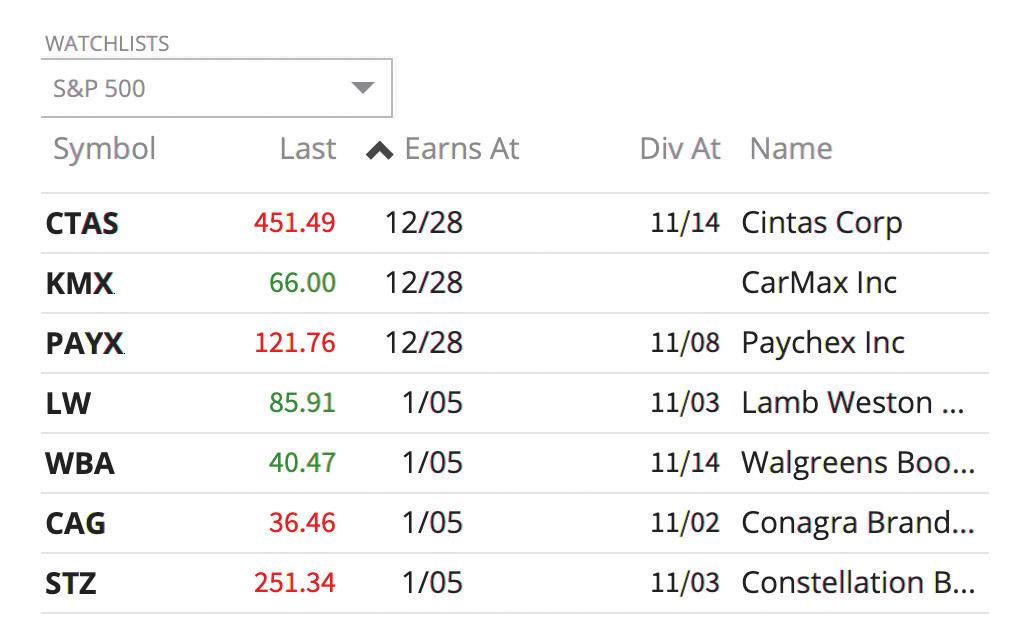

Wary corporate executives have yet to jump back into buying stock in the companies they manage.

Then, Powell spoke at the Brookings Institution on Nov. 30 and again declared the Fed would raise rates with the goal of reaching 2% inflation—but at a slower pace. Speculation that the Fed might call for a 50-basis-point hike touched off a short-covering S&P 500 rally over the last two hours of the trading day.

Powell’s language had changed only a little, yet markets delivered two much different outcomes.

Given the dramatic short exposure in the market, a squeeze pressed the S&P 500 to a critical technical level of 4,100 in two days. It was a reminder of how contrarian approaches based on technical levels and never-ending speculation can cause dramatic rallies and

Expect more volatility, more range-bound trading and more price swings through the duration of the Fed’s quantitative tightening. It makes for a more exciting market for active, disciplined traders who aren’t afraid of riding these waves.

November and December are typically strong months for executive insider buying, which occurs when corporate leaders buy stock in the companies they run.

However, insiders haven’t bought aggressively since January 2022, signaling they may believe the bottom isn’t in. The whipsawing markets have created chaos, squeezed out shorts and fueled dramatic reversals.

But executives appear keenly aware of potential recessionary pressure, the threat of earnings compression and more challenges for the macroeconomic outlook.

The chart above shows the five-day moving average of insider buying to insider selling over 17 years.

The higher the blue line on the chart, the higher the

IT’S BEEN DIFFICULT TO OUTPERFORM THE MARKET BECAUSE THE FEDERAL RESERVE HAS BEEN PROPPING IT UP.

ratio of executive purchases to sales. In October 2008, executives were historically early in calling a bottom in the market but soon doubled down in March 2009 when the Fed expanded its quantitative easing.

The chart suggests executives collectively called the bottom in the market in the 2011 European debt/U.S. debt ceiling crises, the 2015 China tantrum, the 2018 Fed rate hike cycle pivot and the March 2020 crisis after the Fed’s stimulus program.

Insiders were early again in January 2022, with the most robust buying ratio since the beginning of COVID. However, we haven’t seen a purchasing period that resembles the previous crisis, which means executives

S&P 500 Index fund and carries a 26.4% stake in information technology stocks. Again, someone should explain the investment thesis. While those funds may continue to hold a large swath of technology stocks, there’s the threat of forced selling, capitulation or capital rotation among funds to other assets.

If thematic ETFs start to sell assets like Apple and move back to their investment thesis, it could create interesting price action.

For 13 years, it’s been easy to believe fundamentals no longer matter.

The post-COVID rally of 2020 helped power a remarkable equity rally that started to deflate in February 2021 in tech stocks and compounded with a decline in January 2022.

remain wary of the economy and await more direction from monetary leaders.

That suggests more pressure may come for this economy and the market.

Last year was challenging for managers at ETFs as valuation compression and speculation about Fed policy pushed asset prices lower.

ETF managers have engaged in more crowded trades to align with their benchmarks. A fine example is widespread adoption of Apple (AAPL) shares to both active and passive ETF portfolios.

In January 2021, 289 ETFs owned Apple shares, according to ETF.com. By December 2021, the figure had increased to 320. By the end of 2022, the tally grew to 403. The proliferation of ETFs is undoubtedly driving the trend.

Still, the significant increase explains an ongoing adoption of technology stocks to align with the performance of benchmarks—largely the S&P 500 ETF (SPY) and the Invesco Nasdaq100 ETF (QQQ). Apple represents 6.5% of the weight on the SPY and 13.2% of the QQQ.

As geopolitical tensions have grown worse, supply-side challenges remain in critical sectors like energy, agriculture, real estate and materials. Even in the face of China’s increasing demand for oil, uncertainty about Russia’s supply and domestic upticks in production, several companies are trading in U.S. energy markets at attractive valuations.

For example, Marathon Oil (MRO) and Epsilon Energy (EPSN) operate in oil production and exploration. Both companies have strong balance sheets and low buyout multiples. Their enterprise value compared with earnings before interest, taxes depreciation and amortization (EV/EBITDA) is under eight.

Instead of purchasing these stocks at current prices, active investors can sell put spreads to maximize long-term gains. For Marathon Oil,

As with most bear markets, 2022 saw sharp, short-lived rallies, followed by drastic drops.

Such decisions may have violated the original investment thesis of the ETF itself. For example, the Global X S&P 500 Catholic Values ETF (CATH) reputedly aims “to provide an efficient solution for investors looking to invest by Catholic beliefs.” So, what does a 6.6% weight in Apple, 5.6% stake in Microsoft (MSFT), 2.5% stake in Amazon (AMZN), and 1.7% stake in Alphabet (GOOGL) have to do with Catholic values? The Fund’s net asset value has a nearly identical performance to the

consider selling the $23 put for April 2023. Buying the $21 put for protection requires $145 in buying power to generate $55 in credit. That represents a 38% possible return by April and gives traders a breakeven price of $22.45. That breakeven represents a 16% drop from

December and has a probability of profit above 65%. Consider doing it if the implied volatility rank is above 30.

Next year could create some unstudied liquidity tension for the markets. The Federal Reserve will still be cutting its trillion-dollar balance sheet.

Meanwhile, corporate buybacks—companies using excess cash to repurchase and retire stock—may have peaked. Last year, Goldman Sachs (GS) noted that buybacks totaled nearly $1 trillion with companies like Apple leading the way. But in October, Goldman slashed its outlook for S&P 500 buybacks by 10% because of concerns about future earnings.

Any pullback in buybacks could create additional liquidity pressure, while the January implementation of the 1% buyback rule mandated in the Inflation Reduction Act of 2022 may deter the practice.

In 2019, Larry Light at Fortune magazine noted that financed debt funded more than 50% of corporate buybacks that year. The practice is common, but with interest rates rising and concern about recession, more pressure could come to bear on companies to stay calm but be ready for problems.

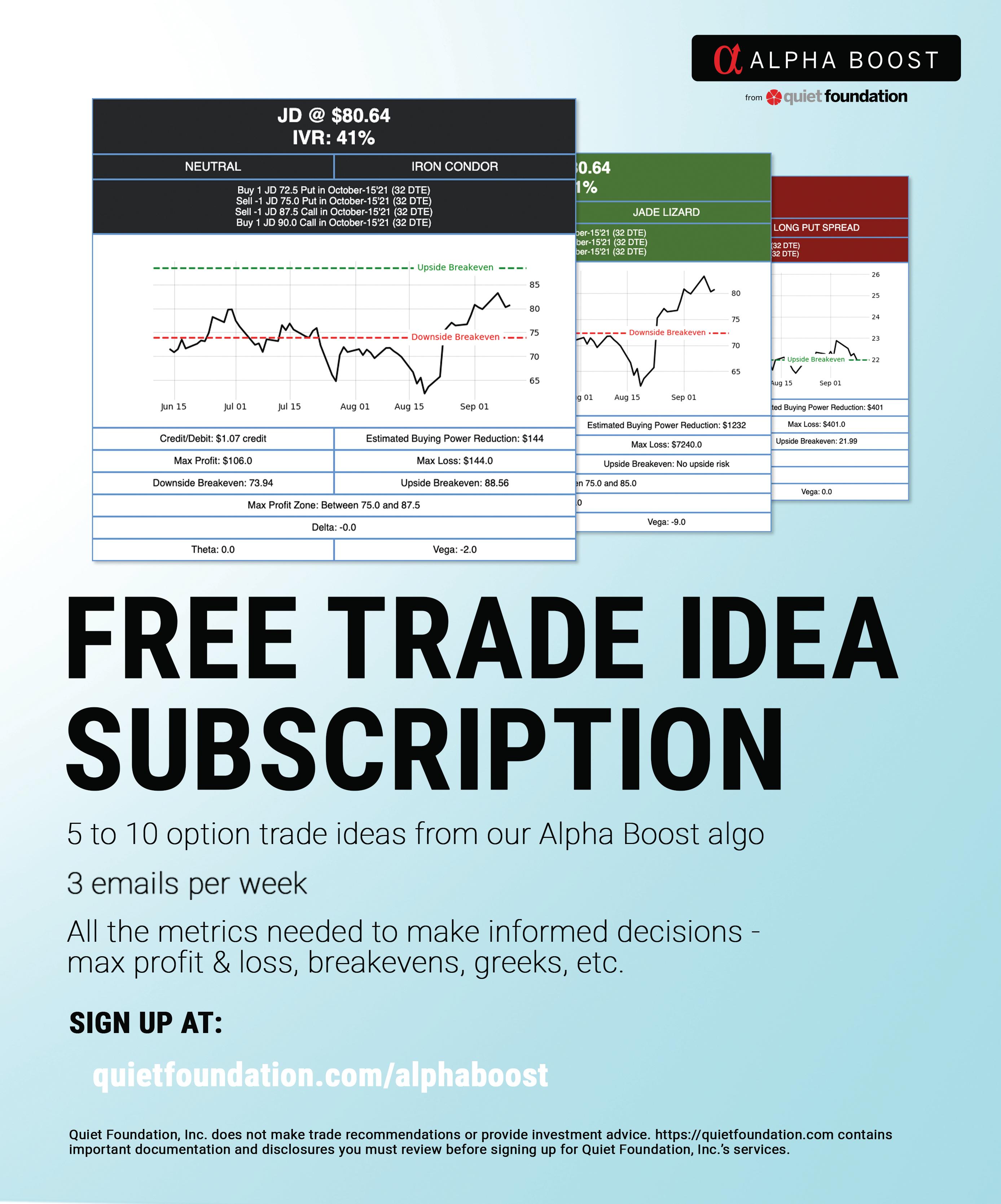

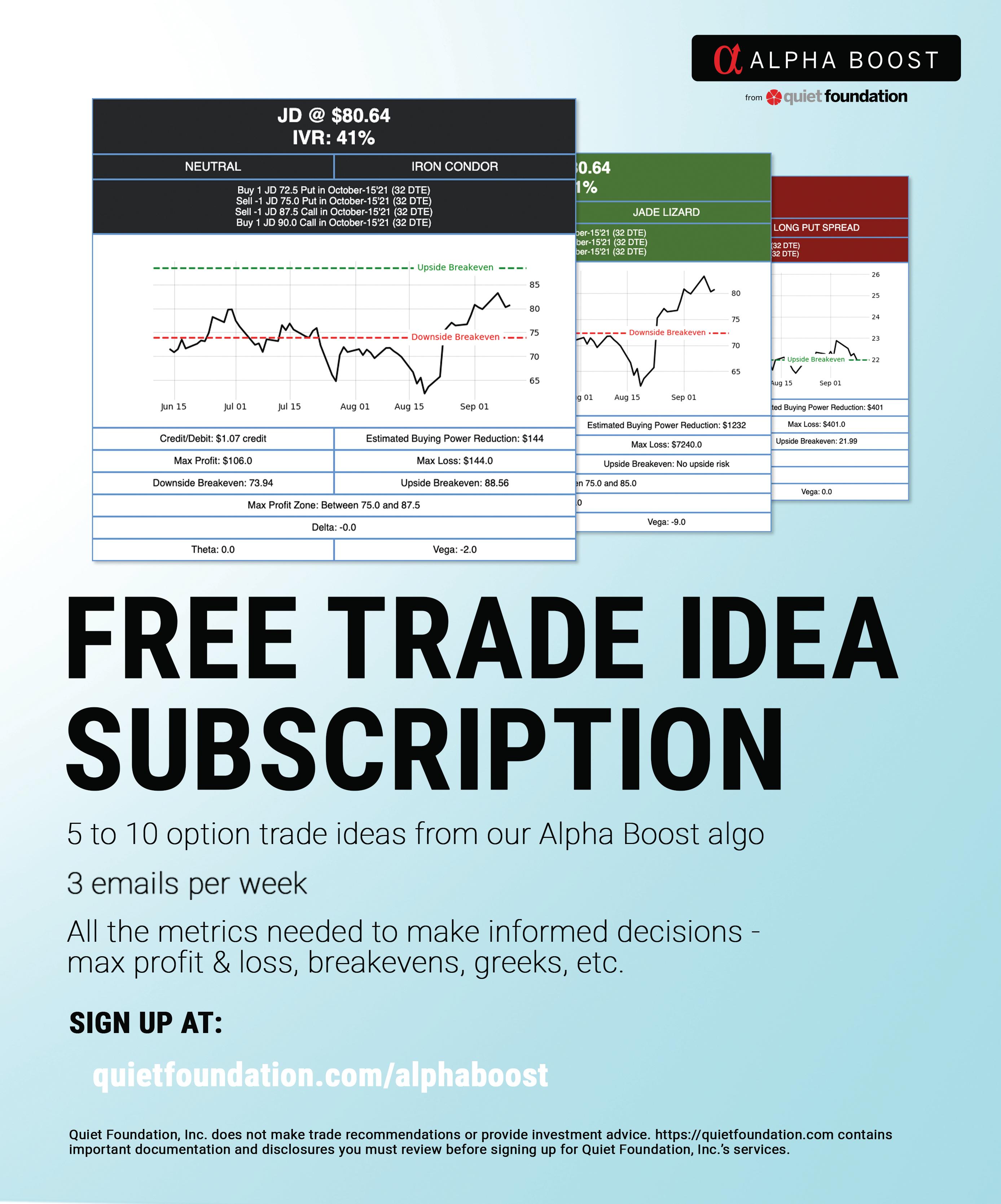

Tastylive, the online television network for active options traders, continues to expand its coverage of implied volatility rank (IVR). It focuses on active trading strategies that use IVR to gain advantage.

IVR on a 52-week scale compares the current ranking of a stock’s implied volatility to all other days over the past year. Understanding IVR can help traders identify what to trade and what strategy to use.

An IVR of 25 would mean implied volatility sits 25% of the way between last year’s highs and lows. An IVR of 60 indicates implied volatility sits at the 60% level in that range.

Tastylive hosts Tom Sosnoff and Tony Battista typically look for stocks with an IVR over 30 to sell options to generate income at a high probability of success. When stocks are trading under 30 it’s a potential opportunity to go long premium and buy calls and spreads.

Look for stocks with high liquidity scores indicating tight liquid markets. Combine them with high IVR to sell premium. Look for high liquidity scores and low implied volatility to buy premium.

Decades of research have established that investors can’t time the market.

But would-be traders would do well to learn about market momentum gauges, an active tool created by J.D. Henning, an academic, active trader at Seeking Alpha, and editor of Value and Momentum Breakouts, a service for investors.

Henning uses a variety of technical trading strategies to manage 12 portfolios, including an active ETF portfolio and a leveraged/inverse leveraged ETF portfolio. As of Dec. 1, 2022, all his portfolios had beaten the S&P 500.

His automated momentum gauges that actively track capital flows in the market have been even more impressive. There are lots of momentum switches, but Henning’s versions had remarkable success in 2022.

He bases his extensive research on his doctoral dissertation, and

he follows S&P 500 and Russell 2000 momentum by tracking breakout and breakdown conditions in an entire universe of stocks. He brings it down to one positive or negative number and actively trades stocks, index funds and leveraged funds based on his proprietary momentum gauges.

Henning’s record of avoiding dramatic selloffs in 2022 is complemented by his service’s historical performance dating back to 2019. His model has measured 22 topping signals that preset short-term selloffs and correctly tracked large inflows that fueled positive momentum swings and moved higher on the SPDR S&P 500 ETF

and the iShares Russell 2000 ETF.

Through September 2022, four major topping events occurred in the market, which predated more significant selloffs. They were on Jan. 13, April 6, June 10 and Aug. 26.

In April, a furious selloff complemented the most substantial outflows of capital from ETFs since 2018. Following the June 8 selloff that pushed the market from overbought to oversold in seven days, the gauge was correct in the early stages of the sharpest hedge fund selloff in more than a decade.

The system creates another tool for active S&P 500 and Russell 2000 traders. Active traders are better at managing options strategies—like put selling and covered calls.

So, what does it all mean? In 2023, markets will continue to parse every word Powell utters, algorithms will still account for 80% of the trading and options will continue to explode in popularity.

The macroeconomic climate, technical setups, and fundamental opportunities create a very active environment.

Don’t buy and hold. Trade smart… and actively.

Garrett Baldwin, a commodity and trade economist, serves as Luckbox editor-at-large. He actively trades value and momentum stocks and wagers on sports and prediction markets.

IN 2023, MARKETS WILL CONTINUE TO PARSE EVERY WORD POWELL UTTERS, ALGORITHMS WILL STILL DISTILLATE 80% OF THE TRADING AND OPTIONS WILL CONTINUE TO EXPLODE IN POPULARITY.

ony “The Bat” Battista has been “in it to win it” since his early days on the streets of Brooklyn.

The legendary trader, skillful educator and valued co-host to Tom Sosnoff on the tasty live financial network, recently sat down with Luckbox to reflect on how he taught himself to trade and why he helps others write their own rags to riches stories.

The only child of a single mother who tried to keep him on a straight and narrow path, Battista learned much later in life that he was one of five children from his father. As a child, he thought his dad was on a very long car-buying trip, but he was actually serving time in Lewisburg State Penitentiary for bookmaking.

Battista chose not to follow in his father’s loan-shark footsteps. Instead, in 1980 at the age of 18, he packed up his mother’s Dodge Diplomat, shoved his last $300 into his pocket and pointed the car westward toward Chicago and the new Chicago Board Options Exchange (CBOE).

“I always thought when I left Brooklyn, New York, to come to Chicago, that I would stay in Chicago for a couple of years, make a fortune and then move right back to my same neighborhood in Brooklyn,” Battista said. “But you quickly learn once you get a taste of a good life here, what you had there was good only because your bubble was so small.”

Thanks to his cousin, he landed a job as a runner on the floor of the CBOE making $600 a month, which barely covered his daily commuter train ticket and the rent for his studio apartment in suburban Highwood.

“I was broke,” Battista remembered.

A man of the side hustle—such as selling discounted Jordache and Sasson designer jeans out of his trunk as a New York livery driver—Battista set up a legit sideline in Chicago that connected him to some of the most influential CBOE players.

Forty years ago, floor traders made their marks on trading sheets—actual pieces of paper, not computer screens. Trades happened fast and the handwriting was often sloppy, so the heavy hitters liked to come into the office on Saturday morning, collect their trading sheets, check the math and have their work done before starting fresh on Monday morning.

Battista witnessed this and decided to head into the office on a Saturday morning, too, and pitched a courier service for traders. Suddenly, everyone

“THOSE WHO CAN’T DO, TEACH” IS A TRUNCATION OF A LINE FROM MAN AND SUPERMAN, A 1905 GEORGE BERNARD SHAW PLAY.

IT’S A MAXIM THAT’S OFTEN TRUE IN THE WORLD OF OPTIONS TRADING, WHERE HUCKSTERS POSE AS TEACHERS TO PEDDLE POINTLESS NEWSLETTERS OR CHARGE FEES FOR DUBIOUS ADVICE.

YET, ONE ALTRUISTIC EDUCATOR OFFERS TRUE WISDOM TO OPTIONS TRADERS STRUGGLING TO NEGOTIATE THE MARKETS—AND HE DOESN’T CHARGE A CENT FOR IT. MEET TONY BATTISTA.

BY ELIZABETH OWENS-SCHIELEwanted it and he was collecting $700 a weekend delivering sheets.

“When I started, I didn’t realize I was going to meet all the market makers,” he said. They invited him into their luxurious homes, where he met their kids, enjoyed their pools and became their friend.

One of those market makers, Kenny Weiss, offered Battista a sweetheart deal he couldn’t refuse—a free office and desk, plus a network of market makers to show him the way. He joined Brandt & Associates, and Harry Brandt, one of the first to buy a CBOE seat, offered Battista 50% of the cost of a seat so he could also buy his way in. Battista put in a bid of $260,000 and the day the market crashed in 1987, he won that seat and began trading as an independent.

“It was one of the best purchases of my entire life,” he said, adding that the seat eventually led to making millions of dollars. “When they say it’s better to be lucky than good, it’s true. But you’ve got to put yourself in the right position.”

So, Battista set about doing exactly that.

“In the ‘87 crash, I made a million dollars in a day by being right,” he said. “I was louder

and faster than most and traded a good amount of volume—I took a lot of small wins.”

Battista was 23 years old making $1,000 a day working for himself, and he didn’t know what to do with the money after he bought a condo. A friend convinced him and others to invest in one of Chicago’s soon-to-be-hottest nightclubs, Cairo, and he did, spending the next six years enjoying the club life and trading on the side. But he eventually returned to trading full time, even dabbled at the Chicago Board of Trade, until computers became mainstream tools for investing.

He finally left trading in 2005 after 22 years of never having a losing year and started his own business, which didn’t work out. Battista eventually landed on air first at thinkorswim, and then tastytrade—which is now named tastylive.

Tom Sosnoff said Battista turned him down three times before joining his team at the former thinkorswim brokerage firm.

“We’ve been friends for close to 40 years—we met playing base-

ball together,” Sosnoff said, remembering their Saturday afternoon games in Chicago. The two traded in the pit together, maintaining their friendship for years.

“I brought him on for our education team and thought he’d be really good, and he was,” Sosnoff said. “He was very personable, he loved teaching, he loved being in front of a crowd of people. Then we built tasty and I asked if he wanted to come over to join.”

Although Sosnoff jokes that Battista is annoying and feels he deserves “some kind of combat pay” for spending so much time with his sidekick, he admits they’re able to play off each other on the air to create a nice balance for viewers. After 18 years of working together, “You can tell the friendship is genuine,” he said.

Comedian Vonetta Logan often plays point guard between Tom and Tony on the tastylive morning show.

NOW IS THE PERFECT TIME TO BECOME AN ACTIVE INVESTOR.

“Tony’s very confident, boisterous, gregarious, very charismatic and very loud. He’s also great at improvisation,” she said, adding he is not only the true archetype of a trader, but also a true teacher.

“He’s hands down, one of the best teachers we have,” she said. “He really wants you to understand things because it makes him happy. He has an innate joy about trading and that shines through in the way he tries to teach and explain things to people.”

Logan admires Battista’s backstory: He’s a kid who didn’t go to college but made a move with so little and created life-changing generational wealth for his family.

Logan commends Battista for overcoming a tough childhood to be the father he is to his children.

“He works with his son here and that relationship is phenomenal,” Logan said. “They really are two peas in a pod.”

When Tony recruited his son Nick Battista to work at tastylive seven years ago, Nick had no idea what was in store for him.

“My first week here, I was told, ‘Next week, you’ll start a show with your dad live on air,’” remembers Nick, now 32. But he didn’t mind being thrown right into it. The two are close.

“I always wanted to be like my dad,” Nick said. “He’s the best—he’s cool, good looking, successful, checks all the boxes and a good role model to have growing up and into my adult life.”

His dad coached Nick’s sports teams when he was growing up—baseball, basketball and football. But his family’s story was much different than others in the posh Chicago suburb of Glencoe.

“My dad was a trader who didn’t have a college education, didn’t come from a lot of money, and my dad came from a family of gangsters,” Nick said. “It’s the opposite of what I grew up around. It definitely made him cooler. He was this rugged outlier in the town, a rich, successful, loud, talkative, good looking, tall guy—he had it all.”

Proud to say he was the first Battista to graduate from college, Nick studied economics and business at the University of Kansas. He said learning how to trade options was heavily influenced by his dad who is now less of a risk taker than he is.

“We always talk about how volatility brings opportunity and that’s how we trade,” Nick said. “Higher volatility means that there’s more risk and more reward out there. Being engaged in these markets is super important and for a younger audience, not being afraid of the risk is really, really important.”

He explained that over long periods

of time, markets tend to go up and to the right on the charts, and if investors have a disposable income to trade with and they’re in it for the long term, now is a great time to make an investment.

“The risk reward skews heavily in our favor—that’s how younger people should look at this opportunity,” Nick said.

“If you missed the last two years, you kind of got a mulligan,” he said. “You should definitely be taking risks right now because this market is paying you to take risks. Why wouldn’t you be buying right now?”

Sosnoff said today’s market isn’t much different from other markets and advises investors to get active.

Some investors make a profit and reduce personal financial risk by leveraging “OPM”—other people’s money. But not Tony Battista, the trader who rose to fame as “The Bat.”

“I never took anybody else’s money—I only trade my own money,” Battista told Luckbox. “I grew up on welfare. For me, having money was the ticket out, so I didn’t give my money to anybody but myself.”

While others saw the value in watching money grow, Battista viewed it a little differently. “I saw the value of money to change my status,” he said.

“It’s never a good time to be passive— it’s never a time to be out for us,” Sosnoff said. “Now is an interesting time because there’s a lot of opportunity all over the place in lots of different areas of finance, but no different than any other time.”

Battista agrees it’s always better to be an active investor.

“I’m not a math guy and I have no formal education,” said Battista, who spent only a few weeks in college studying criminal justice before discovering academics was not in his future. Instead, he studied strategies in the market and the bell curve.

This is what he recommends to investors in the coming year.

“Stay within the ranges,” Battista recommended. “Make a lot of little investments. If you hear complex spread it should always perk up your ears. If someone describes something as complex, more than likely,

they are trying to keep you out of their game.”

He recognized that 70% of the time, a stock falls within its expected range, and 30% of moves will be outside of that range—that’s the math that drives probabilistic investment choices.

“Now is the perfect time to be an active investor,” Battista said of the market. “Stay small,” he recommends, “because the time you think you know something, you don’t.”

So, what’s next for The Bat?

“I’m not done yet,” he says with a sly, toothy smile.

SON DAO HAS MADE A FORTUNE IN ALMOST NO TIME BY BUCKING THE MARKET’S BEARISHNESS. HE TURNED $1,600 INTO $2.5 MILLION IN 17 MONTHS. YES, LUCKBOX VERIFIED THE NUMBERS.

BY ED MCKINLEY

BY ED MCKINLEY

Twenty-eight-year-old Son Dao was born in Vietnam, but now he’s living a spectacular version of the American dream just outside Atlanta.

Despite a bear market—or really because of it—he traded stocks, options and exchange-traded funds skillfully enough to turn an initial stake of $1,600 into more than $2.5 million in just 17 months.

Think of it this way: His tastyworks brokerage account posted a 153,182.48% return between June 2021 and November 2022—while the Standard & Poor’s 500 declined 7.9%.

Translating those dizzying numbers into human terms, he made more than enough money to retire from his job as a mechanical engineer long before reaching the age of 30.

Still, Dao wasn’t the overnight success his triumphant run might suggest. His unshakable desire to avoid spending 40 years in a cubicle helped him overcome five years of stumbling badly as he learned to trade stocks.

His admirable perseverance aside, he benefitted from the reluctant acquiescence of his long-suffering wife, the encyclopedic knowledge he gathered from studying nearly 30 books on stock trading and his fruitful collaboration with fellow traders.

Yes, Dao combined the time-honored virtues of hard work, determination and something that used to be called “pluck.”

Looking back, he describes a personal trading history that began on the printed page.

“I read about Warren Buffett when I was 20 years old or so, and I find it so cool that all he did was investing in stocks to become one of the richest people on Earth,” recalls Dao, who came to America at the age of 15.

He became fascinated with the idea of using compound

interest to put money to work even while you’re asleep.

Yet simply holding stock for the long term became boring, and soon enough he found himself making the transition from passive investor to active trader—but not just any kind of active trader.

When deciding on a trade, Dao doesn’t engage in fundamental analysis— which is based on evaluating the underlying company’s performance, the prospects for its industry and the state of the economy in general.

He also disregards technical analysis, the study of charts that plot stock prices over time in the hope the past predicts the future.

“I’m neither a fundamental trader nor technical trader,” Dao maintains. “I believe these fields are too crowded, so it would be impossible, or nearly impossible, to find an edge or a holy grail in fundamental or technical trading.”

Instead, he specializes in event-driven trading, placing his trades before, during and after company earnings reports and breaking financial news stories.

ILLUSTRATION BY MARK MATCHOHe prides himself on discovering market makers’ mistakes and turning those errors to his advantage.

Volatile stocks attract Dao’s attention, and he pays particular attention to implied volatility (IV).

Dao also considers himself something of a contrarian who thrives on parting ways with the masses. That mentality emboldens him to make bullish trades on single stocks when most investors are feeling bearish.

But he doesn’t necessarily pursue his maverick tendencies when market sentiment turns bullish. “I believe markets always go up over time, so no point fighting the long-term trend,” he says.

As Dao was developing his philosophy of trading, he honed his skill at choosing the right strategies to help him execute on his ideas.

Dao identifies his favorite gambits as the call calendar, double calendar, double diagonal and short naked put. His entry requirements for a trade vary depending upon the strategy.

He sells at-the-money (ATM) naked short puts at the nearest expiration when the market is expressing bearish sentiment before an earnings report. Recent examples have included Meta Platforms (META), Carvana (CVNA), Beyond Meat (BYND), Redfin (RDFN), Robinhood Markets (HOOD) and Coinbase Global (COIN).

Several sources help Dao gauge the market’s mood, but to maintain his edge over other traders, he chose to reveal just one—WallStreetBets, a subreddit where investors discuss their views.

Dao chooses long strangles for stocks he believes will report earnings with the options’ implied move much lower than average moves of previous recent earnings. He opens the position before earnings and closes it before the report, playing for the implied volatility ramp up.

For stocks that reported preliminary earnings or updated guidance, he sells short straddles through their earnings reports.

according to Dao.

“I would open a calendar or diagonal trade if I expect IV on the short leg that’s near expiration is about to collapse a lot more than IV on the long leg that’s far from expiration,” he continued, “or if I expect the IV on the long leg to climb up while the IV on the short leg stays the same or goes down.”

He uses a calendar if he thinks the stock won’t move much. If he anticipates big movement, he uses a diagonal, which locks in a gain if the stock moves far from the long strike. With a double diagonal he buys either a straddle or a strangle, then sells a strangle farther out-the-

money (OTM) than the ones purchased for a nearer expiration.

Dao prefers swing trades and tends to hold them anywhere from a day to two weeks. “I rarely make a day trade nowadays,” he says.

When earnings reports season reaches its peaks from mid-January to mid-February, mid-April to mid-May, mid-July to mid-August, and mid-October to mid-November, Dao may open five to 10 trades a day, mostly during the last hour before market close.

When earnings seasons end in early March to mid-April, early June to mid-July, early September to mid-October, and early December to mid-January, he might make only one or two trades a week.

He characterizes call calendars, call diagonals, double calendars and double diagonals as his “bread and butter.” When implied volatility is at the bottom and the implied move is lower than it should be, the best trades to take are double calendars and double diagonals, Dao says.

“Calendars and diagonals are time spreads, and because you’re trading the difference between the short legs’ premium and the long legs’ premium, you are effectively trading volatility,” he notes.

Theta, which tells how much the price should decrease as an option nears expiration, is well known and built into calendars and diagonals, but it’s not as important as vega, the measure of how sensitive an option’s price is to changes in the volatility of the underlying asset,

The three products that brought Dao the biggest gains during his run of good fortune have been the S&P 500 (SPX), which netted him $819,830; Taiwan Semiconductor (TSM), which earned $783,835 for him; and Twitter (TWTR), which poured $700,093 into his coffers.

One of the best trades he made during that time was when he bought 400 SPX call calendars for $490 each on Sept. 8, 2022, and sold them for $2,400 each on Sept. 12, netting a gain of $764,000 or 400%.

But nobody wins every time. Dao opened 300 Meta short puts at the 115 strike on Oct. 26, 2022, and closed

The United States isn’t the land of opportunity it once was. In fact, the World Economic Forum says America has slipped to 27th place among nations when it comes to economic mobility—the probability of making more money than your parents.

But don’t bring up that gloomy prospect with Son Dao, a 28-year-old immigrant from Vietnam who grew an initial stake of $1,600 into $2.5 million in just 17 months of trading options on stocks.

Dao came to the United States with his parents at the age of 15. The family settled in Atlanta, where his grandparents had already begun building a new life.

His parents had made a living in their hometown of Bien Ho by running a small hardware store. It’s notable that Dao, a confirmed capitalist, calls Ho Chi Min City by its former name of Saigon—the appellation it bore before falling to Communist rule.

The Dao family was making it in Vietnam. They had a motorcycle there, but the good life that included a car seemed out of reach.

So, they came to the promised land. Dao’s parents couldn’t speak much English, which relegated them to working for just a bit more than minimum wage preparing in-flight meals for Delta Airlines.

But in the classic fashion of the offspring of immigrants, Dao climbed the socio-economic ladder and earned a degree in mechanical engineering at Georgia Tech, graduating in 2017.

Still, he didn’t believe he was destined for the 9-5 confines of a regular job. In 2015, he used $2,000 he’d made as an engineering intern to begin trading stocks.

It didn’t work out, and soon the money was gone. Dao’s wife, who studied to become an elementary school teacher, urged him to forget the market, focus on academics and get a “real job” in engineering.

So, he took care of business on the “practical” side of life. But at the same time he read nearly 30 books on trading the markets. He got back into investing with a $1,000 stake and lost it.

Gains and losses followed, and by 2021 Dao was gradually becoming desensitized to the ups and downs. He learned to buy and sell stocks almost without emotion.

Dao kept trading until he became a journeyman. Along the way, he collaborated with other traders on a Discord server, but that didn’t have much influence on his trades.

Today, he lives in Snellville, Georgia, with his wife and 4-year-old daughter in a house big enough to accommodate a heated indoor pool. A second child is on the way.

Besides bringing him wealth, the journey has taught Dao something. “You have to have an edge that gives you an advantage over other traders,” he advised. “That—and risk management.”

them the next day for a $365,100 loss.

He suffered his biggest drawdown in dollars between Oct. 11 and Oct. 27, 2022, when he dropped $1.4 million from top to bottom. His biggest drawdown as a percentage took place from March 7 to June 27 of 2022, when his trading account plummeted from nearly $1 million to about $200,000, a drop of almost 80%.

That’s a lot to lose, so Dao has learned to rein in risk.

Dao has erected guardrails to keep from veering off the road to profitable trading.

“Everything is wrapped around losing no more than 3% of the account on any given trade,” he says.

For long premium trades, like buying call calendars or strangles, the dollar amount he allocates—therefore the maximum loss—is 3% of the value of his account.

For short premium trades, like short strangles and straddles, he computes the specific trade’s two standard deviation loss—an outlier move—and then limits the amount he allocates so the loss would be no more than 3% of his account.

That cautious approach is something Dao learned the hard way.

“I had no respect for risk management until after I turned the initial $1,600 into hundreds of thousands of dollars,” Dao recalls, “and even after that, there were a few times I opened a huge position that could cut my account in half if I were wrong, and it did happen a few times.”

On March 30, 2022, Dao opened a huge long strangle position in the publishing company Houghton Mifflin Harcourt (HMHC) for $164,680. The company’s options were priced low because market makers believed a tender buyout at $21 would be approved. Some sources said the shareholders wouldn’t approve the deal and the company would get a buyout at a higher price.

Dao knew that if the tender buyout failed, the stock would either go up or down, and options premiums would go up. So, he bought a strangle (an OTM call and OTM put) because it offered an asymmetric risk versus reward ratio.

“If I’m wrong, I would lose 100% of the position,” he says. “But if I’m right, I would make roughly 1,000% on the position—a 10-bagger! Well, I was wrong. Approval votes were only a little bit higher than 50%, but it was enough to make me take a 100% loss of $164,680.”

Another rough patch lasted from Aug. 29 to Sept. 13, 2022, when Dao invested in Zim Integrated Shipping Services (ZIM).

“I opened a lot of short naked puts on Zim—and I mean a lot,” Dao laments. “In total, I sold 3,680 naked puts at strikes $35, $30 and $25, all with expiration on Oct. 21.”

Zim was trading below net cash value with a price-to-earnings (P/E) ratio of 0.7. In the previous three quarters, the company made more in profits than their market capitalization. Its forward P/E was two, which meant that in the next year Zim was expected to post a net profit equal to half of its market cap.

That looked great to Dao, but he was wrong. He closed his positions for a $612,311 loss, his biggest ever on a single company.

After that, it would take another $154,750 loss on Snap (SNAP) short OTM naked puts and a $365,100 loss on Meta Platforms (META) with the same strategy for him to realize the most important rule of selling a naked put: Always sell an ATM put—never sell an OTM put.

“Selling an OTM put is like picking up pennies in front of a steam roller,” Dao says. “When a black swan event happens, one loss will wipe out six, seven or even 10 winning trades’ gain. You eat like a bird and poop like an elephant.”

Selling an ATM put protects against an unusual move in the price of a stock and enables investors to take advantage of the rule of large numbers, he notes, adding that one loss then offsets the gains of only three or four winning trades.

But for Dao, the wins have far outweighed the losses.

In June 2021, the meme-stocks phenomenon helped Dao turn $1,130 into $40,000 in one week with call calendar trades in BlackBerry (BB), Workhorse Group (WKHS), Microvision (MVIS), Clover Health Investments (CLOV) and Wendy’s (WEN).

“Market makers were not prepared for the wave of retail trading,” he says of the meme-stocks spectacle. “They got caught in the storm and mispriced a bunch of options, so I was able to take advantage of it and opened these trades, which are very close to risk-free.”

Good fortune came Dao’s way again in September 2022 when market sentiment was bearish in the days leading up to the announcement of consumer price index data. As a contrarian, he made a big bullish bet the market would go up before the report was released Sept. 13.

On Sept. 8, he opened an SPX call calendar at a $4,100C strike, sold Sept. 12 expiration and bought Sept. 13 expiration. For 400 at $490 each, he had a $196,000 position. SPY pumped $10 (2.64%) in two days, which is a 100-points jump in SPX. He closed the position on Sept. 12 at $2,400 each for a $764,000 gain of 390%.

“It feels great to be contrarian and right,” Dao says.

Great enough that he managed to do it again a month later. On Oct. 6, he opened 4,000 put calendar spreads on Twitter (TWTR) at $50 strike, selling Oct. 14 and buying Jan. 20 expiration. The Jan. 20 expiration was selling for just a little more than the Oct. 14 expiration.

He later rolled the short put from Oct. 14 to Oct. 28 and then closed the whole position on Oct. 27. Twitter was delisted the next day, and he netted a $483,331 gain on the original $400,000 position, a return of 120.8%.

For Dao, it seems the American dream of prosperity just keeps rolling along—all it takes is courage, hard work and plenty of savvy.

Reading’s no substitute for experience, but Son Dao attributes a lot of his good fortune as a stock trader to the books of two particular authors.

His favorites include the six books in the Market Wizards series by Jack D. Schwager:

> The New Market Wizards: Conversations with America’s Top Traders (1992)

> Stock Market Wizards: Interviews with America’s Top Stock Traders (2001)

> Hedge Fund Market Wizards: How Winning Traders Win (2012)

> Market Wizards Updated: Interviews with Top Traders (2012)

> The Little Book of Market Wizards: Lessons From the Greatest Traders (2014)

> Unknown Market Wizards: The Best Traders You’ve Never Heard Of (2020)

He’s also a fan of the five books in the Incerto series by Nassim Nicholas Taleb:

> Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets (2001)

> The Black Swan: The Impact of the Highly Improbable (2007)

> The Bed of Procrustes: Philosophical and Practical Aphorisms (2010)

> Antifragile: Things That Gain from Disorder (2012)

> Skin in the Game: Hidden Asymmetries in Daily Life (2017)

Taleb’s books inspired Dao to discover antifragile trading—the neutral strategies that make money regardless of what happens.

“Heads I win, tails I win—simple as that,” he says of the antifragile approach. “That’s how I was able to turn a small amount of money into a fortune.”

AS HE LEARNS TRADING, A TEENAGER IS ALREADY STOCKPILING FINANCIAL WISDOM—AND CASH

BY ELIZABETH OWENS-SCHIELEn the case of 18-year-old Jacob Intrator, youth isn’t wasted on the young. While learning to trade equities, he’s increased his nest egg nine-fold in four years.

Not many 14-year-olds pick up Burton G. Malkiel’s A Random Walk Down Wall Street to study the markets, but Intrator says the book changed his life. He also became a follower of the tastylive financial network, where he gained valuable insights on financial markets.

It all started with his eighth-grade macroeconomics class. Homeschooled in Miami throughout high school, Intrator, a triplet with two sisters, set up his own course of study.

He became fascinated with the theoretical mechanics of pure economics, as well as how personal decisions play a role in behavioral economics. So, he devised a plan.

“I love math,” Intrator said, “so I built a quantitative trading system.”

He spent hundreds and eventually thousands of hours conducting research, back testing, analyzing trends and modeling. Although he won’t reveal the details of his proprietary system, he can share how he got there.

“I eventually found something in ticker symbols OILD and OILU, which were oil exchange-traded funds (ETFs) and are now extinct,” he said.

ILLUSTRATION BY MARK MATCHOI LOVE MATH, SO I BUILT A QUANTITATIVE TRADING SYSTEM.

Intrator dove into the market, investing his first $4,500.

“I had a blowup and I lost 11% of that— $500—on my first trade,” he said. “My first drawdown taught me perseverance and to fight through the hardships.”

So, he kept at it, eventually growing his capital to $15,000 until another setback struck.

“I was confident my system was working,” Intrator said.

He eventually stopped trading oil ETFs because they became too volatile. He turned to small and mid-cap equities because he liked the pricing structure.

“With small caps, I could risk less money, which made me sleep better at night and still have very good returns,” he said.

This spread trading, as veteran tastylive investor Tom Sosnoff called it during his own interview with Intrator, contributed to growing his nest egg from $4,500 to $41,300.

For the first three years, Intrator said he made around 600 trades, an average of about 15 a month. But during the last year, he’s only made about six trades.

Although he didn’t touch meme stocks, he has explored cannabis equities in what’s known as a sympathy-sector play. It’s called that because the stocks in the group move together in price as a reaction to news or

market events. The cannabis sector often experiences sharp volatility.

For now, Intrator is managing his own portfolio and is up 3.5% this year, thanks to his models which positioned him in a risk-off stance.

He has found great success investing in Guardion Health Sciences (GHSI), adding $6,000 to his own assets and another $2,000 to his family’s portfolio.

He’s also serving as an intern to U.S. Rep. Josh Gottheimer, a Democrat representing the Fifth District of New Jersey.

Intrator, who runs a non-profit foundation promoting financial literacy among American youth, earned a 1540 on his SAT.

He hopes to attend The Wharton School of Business at the University of Pennsylvania, or another university of that caliber.

But what’s his long-term goal? “Run a hedge fund.”

400 communities across the country, and more than 20 additional sites are in the works.

n enthusiastic gardener who hates to bake might be a perfect candidate for “timebanking,” an international movement whose members swap time and skill instead of shelling out cash for what they need.

For every hour timebankers spend performing a service, they’re eligible to receive an hour of work in return from another member. Everyone’s time has equal value in the eyes of the organization, whether it’s spent patching a leaky roof or raking autumn leaves.

Exchanging labor beats volunteering because it strengthens self-worth by making members feel their time has value, says Christine Gray, one of the founders of timebanking.

“Getting things for free can actually undermine your sense of capacity,” Gray maintains. Members of timebanking organizations don’t feel they’re getting handouts, even though they’re not paying for goods and services, she says.

Gray helped create timebanking with her late husband, Edgar S. Cahn, a law professor, speechwriter for Robert F. Kennedy and co-founder of the Antioch School of Law. They described the idea in an article published in the 1980s by the Stanford Social Innovation Review, a magazine and website.

The couple went on to start TimeBanks USA, which has now become TimeBanks.Org. It’s active in more than

Local organizations operate autonomously, making some of their own rules and setting many of their own policies, says BJ Andryusky, founder of one of those local groups, the St. Pete Timebanks in St. Petersburg, Florida.

Calculating the value of the work performed by members at $29.95 an hour, timebanking has contributed at least $104.6 million to the economy. But members emphasize that the accounting is loose and thus greatly undervalues the group’s contribution.

Timebankers view their movement as neither bartering nor volunteering. Instead, they think of it as an entity that produces a non-taxable currency called “time credits.”

Let’s share the adventures of some imaginary characters to get a better understanding of timebanking.

Suppose Abby, an avid gardener, joins a local timebank. Another member, Greg, needs help planting tulips in his backyard. Abby works with Greg for one hour and logs one time credit into her timebank account, which removes one time credit from Greg’s account.

A little later, Abby needs help putting up a fence post. Maria spends two hours helping Abby with the fence and logs two time credits, which come from Abby’s account.

Next, Maria decides she wants to use Mason jars to make candles. Frank has plenty of them, and the two agree 12 jars equal one time credit. Maria spends one time credit to obtain a dozen jars, and Frank gains one when he hands over the jars.

Every time credit has the same worth, regardless of the task performed—a proposition that stumps some economists, Andryusky notes. It means the labor of a highschool student who bags groceries is an even trade for the work of a skilled tax preparer.

With “real world” currency, it doesn’t work that way. A skilled tax preparer makes $30 an hour, while someone grilling burgers in a fast-food joint might barely make minimum wage.

“Societal value is what separates income,” Andryusky says, “And we don’t live in an egalitarian society.”

But time credits mean more than the everyday type of money everyone always exchanges, according to Gray. She quotes a beer ad from the 1970s to make her point.

“Heineken refreshes the parts other beers cannot reach,” she says. That parallels the notion that time credits have more dimensions than mere dollars and cents can provide. “This currency reaches the parts that other currencies can’t,” she says.

Besides promoting self-worth, timebanking makes a formidable contribution to communities, as noted on hOurworld (not a typo), a platform that logs timebanking hours across the world. Nearly 3.5 million hours had been exchanged when Luckbox went to press.

But the actual number of hours traded is probably much greater. “People use the software and then they get sort of lazy about it,” Gray says. “They continue to exchange, but it doesn’t matter because it’s about the premise behind it.”

The finances vary among local timebanking operations. St. Pete Timebank, for example, received a grant for 2020 that provided $5,000 for software, $2,500 to cover liability insurance and $4,000 to bankroll leadership training, among many other expenses, Andryusky says.

Each timebank operates on its own, down to the point of deciding how to capitalize timebank, Timebank or TimeBank. Some use software from TimeBanks.Org called Community Weaver, which costs between $1,200 to $5,000, depending on the year, while other local organizations rely on hOurworld software.

With either software provider, users can log time credits and post proposed exchanges. Both sets of software differentiate between the all-important timebanking ideas of giving and receiving.

Differences among local organizations don’t end with the software. Because they’re autonomous, some charge membership fees

and others don’t. Avoiding that fee can force them to solicit donations—just to keep the lights turned on.

Gray summarizes the necessity of finding funding this way: “How does the airplane keep flying without any fuel?”

One of the nation’s largest timebanks, Crooked River Alliance of TimeBanks in Kent, Ohio, relies on donations, says Heather Waltz, who serves as chair. But in a world where money and culture intertwine, even timebanks aren’t sustainable without cash.

“Membership to our timebank is free for all,” Waltz says, “but we ask anyone who is willing to, to donate towards our costs. This and our fundraisers allow us to continue to make the timebank free.”

Local timebanks and TimeBanks.Org rely on boards of directors who earn time credits for their administrative work.

Timebanking has been around nearly 40 years but has never grown as quickly as Gray and Cahn had hoped.

In 1992, the movement bloomed but then crashed. “There were thousands of people wanting to start up timebanks,” Gray says of those days.

Gray and Cahn went international with timebanking in 1998, spurring what Gray dubbed a renaissance. The phenomenon quickly gained momentum in the United Kingdom.

Later, she began telephoning timebankers on a list of about 100 timebanks. “I called everyone on the list and about 30 responded,” she remembers. “Some of them were very healthy and some were struggling.”

Now, timebanking is surging again. Twenty-three new local organizations are pending timebanks in cities ranging from San Diego to Philadelphia to Gary, Indiana. As timebanks grow, local economies flourish, promoters say. “Everyone can benefit from a timebank,” Andyrusky concludes. “It just depends on whether you value your time enough to join.”

EVERYONE’S TIME HAS EQUAL VALUE IN THE EYES OF TIMEBANKERS.

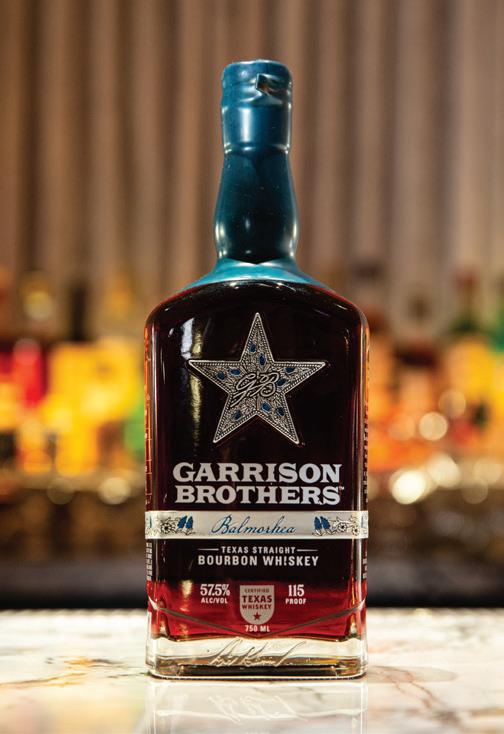

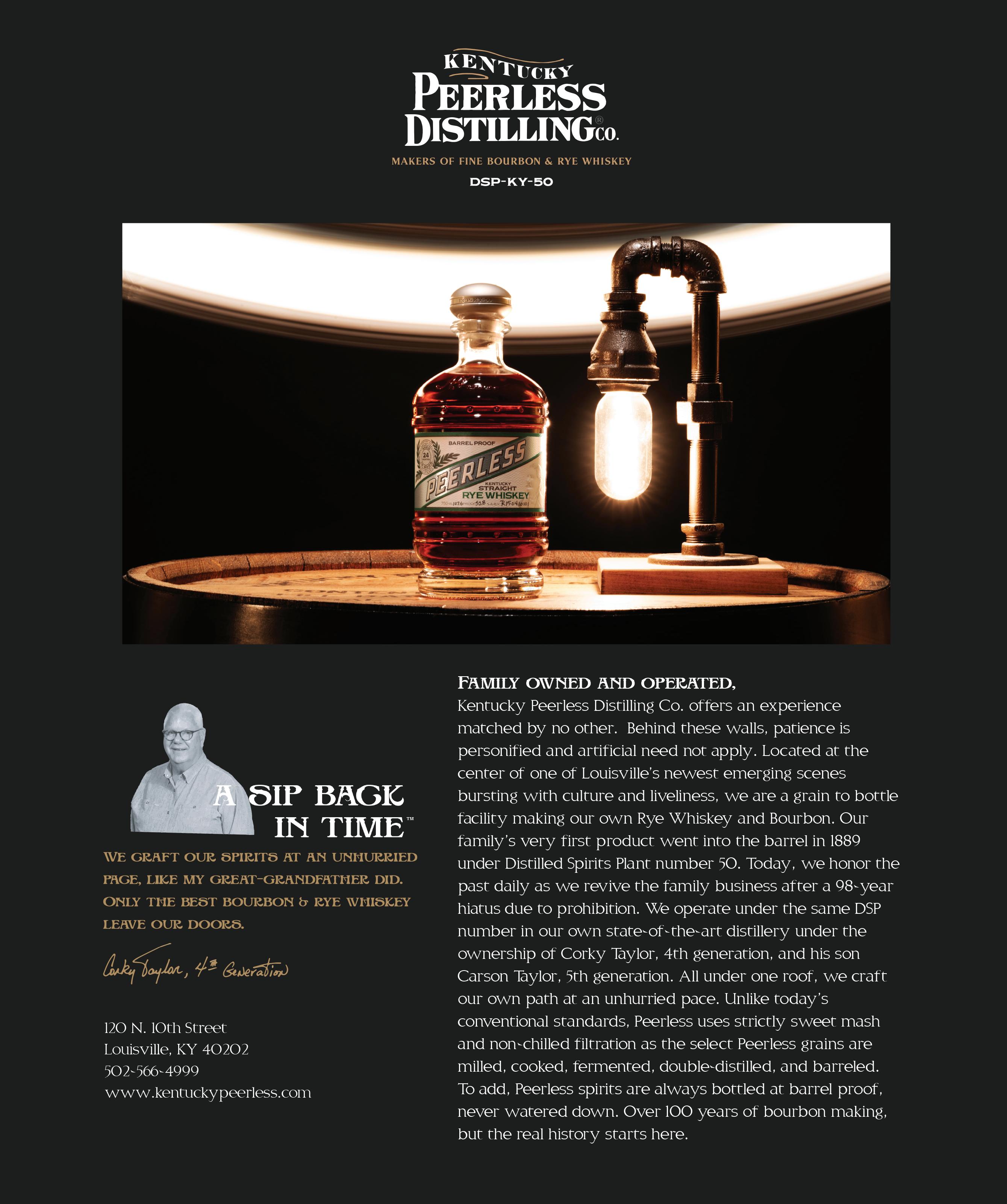

Judging whiskey awards may sound like fun, but after sipping dozens over a couple of hours it becomes harder for any one spirit to impress your taste buds.

My first exposure to Garrison Brothers Whiskey Distillery was as a judge during the blind tasting session at the 2021 Whiskey and Barrel Consumer Choice Awards.

The half-ounce pour provoked my palette enough that I later inquired as to the name of the anonymous spirit. It turned out to be Garrison’s Double-Oaked Balmorhea Texas Straight Bourbon Whiskey—a mouthful in more ways than one.

Balmorhea is a true Texas whiskey—a grain-based distilled spirit produced and aged entirely within the borders of the Lone Star State.

And like Texas, Balmorhea is big. It’s a 115 proof whiskey boasting a big flavor profile.

Bold notes of amaretto, fudge, pecan and coffee emerge after aging five years in the warm Texas climate before bottling at barrel strength.

awards, including the coveted title of American Micro Whiskey of the Year from Jim Murray’s annual Whiskey Bible magazine

But this is not everyman’s whiskey. The flavors are so bold that I routinely find several drops of distilled or deionized water (or dare I say, an ice cube) are necessary to reduce Balmorhea to drinking strength.

Master distiller Donnis Todd unapologetically describes Balmorhea as “bourbon candy in a bottle.”

Since its initial release in 2017, Balmorhea has won more than 50

Counterintuitively, whiskey lovers may find the 134.8-proof Garrison Brothers Cowboy Bourbon inexplicably more approachable. Somehow, the cacao chocolate, molasses, carob, brown sugar and date flavors overpower its high proof. This year’s 9,600-bottle release is exceptionally good. Every barrel in this release was at least eight years old.

Above:

Today’s sky-high used car prices can’t last forever. Experts expect a reset—but at a level still painfully higher than before the pandemic.

“There’s talk about prices declining,” confirms Charlie Chesbrough, senior economist at Cox Automotive, a company with multiple brands in the automotive industry, including Autotrader and Kelley Blue Book.

But don’t get overexcited. “It seems very difficult to see them shifting anywhere back to where they were pre-COVID,” Chesbrough warns.

How bad has it been? Well, the average price of a used vehicle sold by a new-car dealership leaped from $21,210 in 2020 to $30,800 in 2022—an astounding 45% increase, according to the National Automobile Dealers Association.

Place the blame for the rocky used-car market at least partly on what’s been happening with new cars, Chesbrough said. Pandemic-induced microchip shortages limited production, thus raising prices for the few

vehicles manufacturers managed to build. Many new cars sold for more than their sticker price—a nearly unprecedented trend.

“The industry is trying to come back from a very difficult couple of years with very lean inventories,” he said “There’s a lot of folks out there that wanted to buy vehicles but haven’t been able to because of the chip shortage.”

High prices for new cars drove many consumers to consider buying used vehicles. The increased demand for second- or third-hand cars naturally drove up prices in the pre-owned market.

What’s more, the limited selection of new vehicles also encouraged shoppers to turn to used vehicles for the options and features they wanted. Why settle for a new rear-wheeldrive SUV in the wrong color when the perfect one-year-old all-wheeldrive version was available?

Inflation in the overall economy didn’t help matters, either. Rising interest rates also muddled the market. And don’t forget that car deal-

It’s not the best time to buy or sell a vehicle.

erships were suffering from the shortage of workers that plagued nearly every sector of the economy.

Dealers readily acknowledged the situation. Fifty-three percent of them cited the economy as a leading factor in the market, according to Cox Automotive.

But a bit of relief from high used-car prices may be on the way.

Used-car prices apparently reached their peak in January 2022, a Bloomberg report said. They then fell 16% by the end of last year and

could decline another 20% this year, according to the news service.

CoPilot, a service that helps consumers make car-buying decisions, put it this way late last year: “Prices are now $8,497 (or 34%) above projected normal levels, a premium that fell by a staggering 9% from July.”

Prices are easing, Chesbrough agreed. “We’re starting to see that the air is being let out of that bubble, and the prices are starting to come back down to earth,” he told Luckbox

Yet, challenges remain.

The depleted inventory of used cars will continue to keep prices high, Chesbrough said.

“We’re still a market that just does not have enough product out there for the people who need personal transportation,” he noted.

Besides the lack of new cars, Chesbrough is seeing a slump in new-car leasing, which has been a significant source of vehicles for the used-car market. That weakness could last through 2025, he said.

“Normally about 30% of all retail sales activity are a lease, but that’s fallen to just about 20% so far in 2022,” Chesbrough said.

About 2.5 million fewer leases will end every year for the next three years, robbing the used marketplace of that inventory, Chesbrough

maintained.

Until now, about 65% of lease customers turned their vehicles back in at the end of the lease. The leasing firms then sold the vehicles at wholesale auctions open only to certified car dealers.

These days, however, consumers who lease vehicles are often exercising their option to buy them at the end of the lease. They’re doing it because the buy-back price agreed upon at the beginning of the lease tends to be much lower than the current pandemic-influenced value.

So, there are headwinds in the used car business, as Chesbrough puts it. Prices are declining a bit now, but limited inventory may soon start another round of price increases.

Let’s look at some actual figures.

Although used-car prices remain high, they’re not flagrantly overvalued because their quality is at least as good as it’s ever been, Chesbrough said.

The average price for used vehicles purchased at franchised new-car dealerships in September 2022 was $31,025, according to the J.D. Power research firm.

That was “roughly flat compared to August 2022 but represented an increase of 7.2% compared to September 2021,” researchers said.

But trade-in values have also climbed, said a joint forecast report from J.D. Power and LMC Automotive, a forecast provider. Average trade-in was an estimated $10,381, a 49.2% increase from a year ago.