TV’s third incarnation is changing viewing habits— again.

Cord-cutting TV viewers are spending more time watching streaming video.

A wildly popular social medium just might be a Trojan horse for espionage.

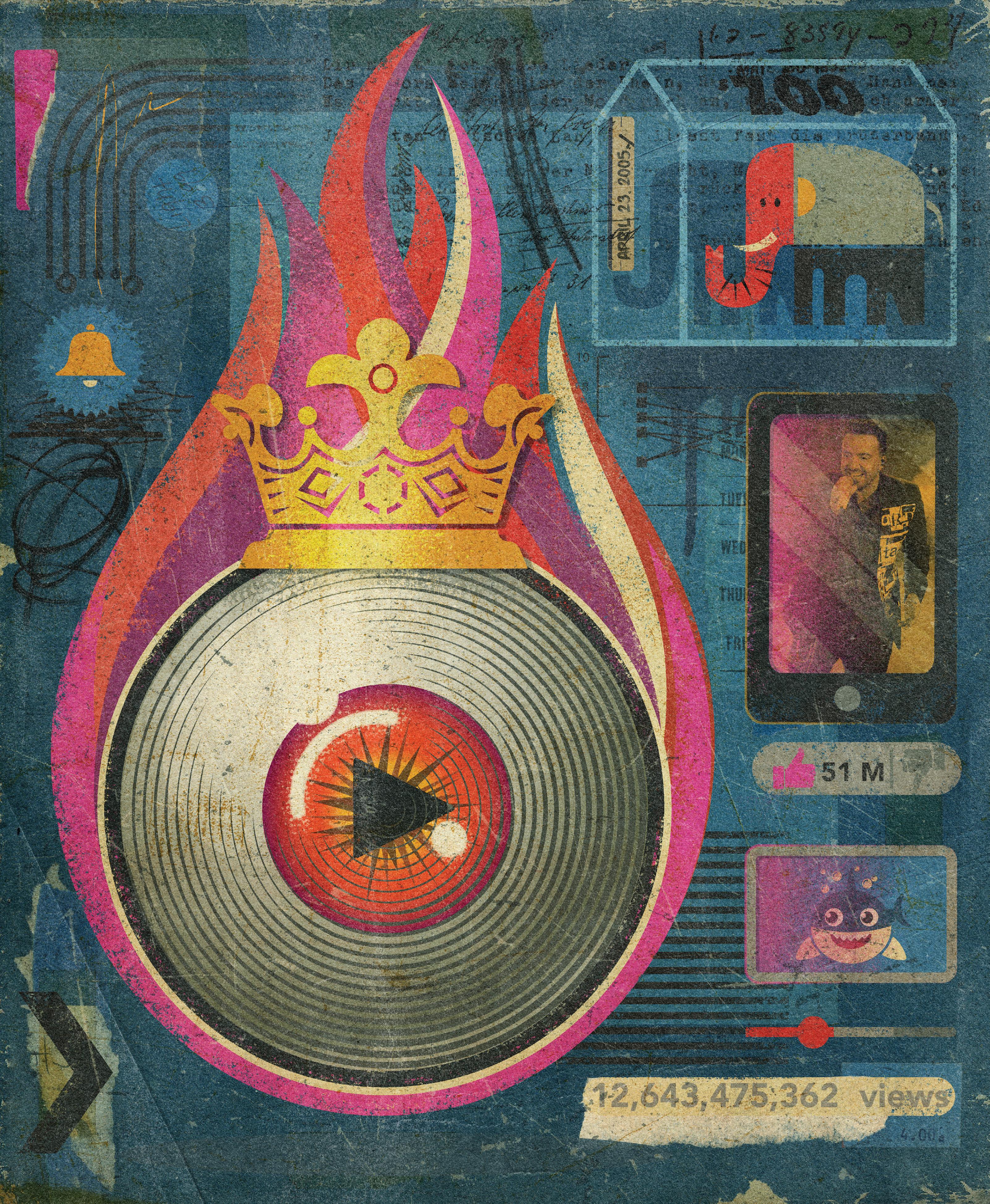

42 YOUTUBE CREATORS YOU SHOULD KNOW

Notable YouTube channels: entertainment, education, music, travel and more.

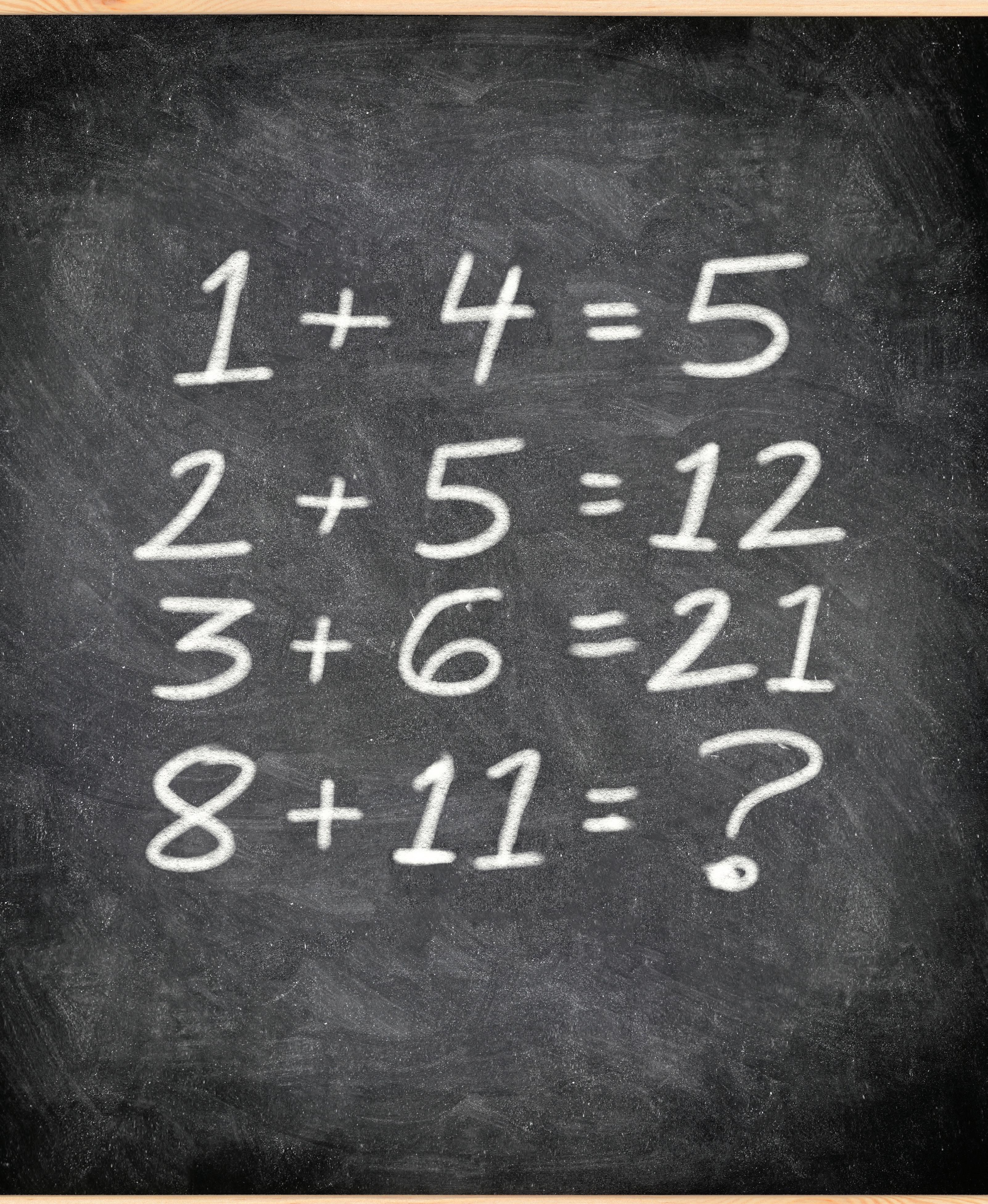

+

Your guide to exactly what it takes to run a profitable YouTube channel.

48 LUCKBOX LEANS IN WITH KAYA YURIEFF

The Information reporter discusses YouTube, TikTok and the creator economy.

=

Tackle the math puzzle that broke the internet.

“The old-fashioned TV business is slowly but surely sliding into the ocean.”

“I’ve

like

only 19.”

—JOHN MCENROE

“Good luck trying to cancel me.”

—LOGAN PAUL

“We’re only at the beginning of what AI can accomplish. Whatever limitations it has today will be gone before we know it.”

—BILL GATES

Our candlestick investor sees technical downside for Airbnb.

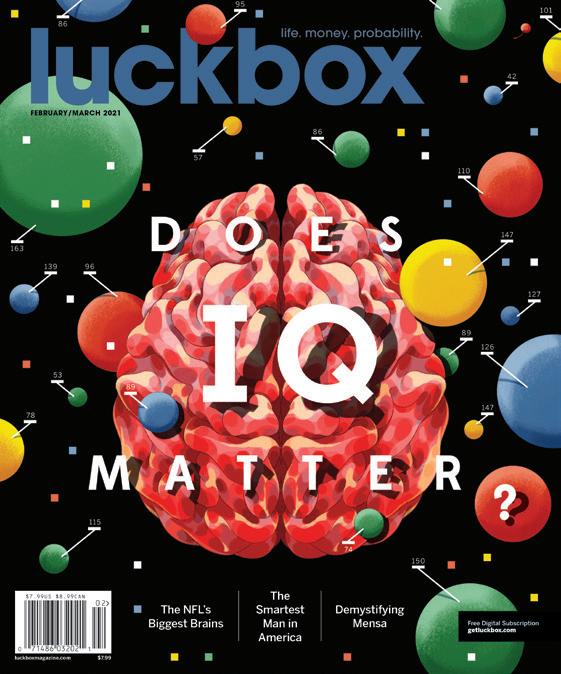

Luckbox has a new look! Acting on your suggestions, we’ve repositioned familiar departments and introduced striking editorial elements. The makeover is based on a bold new layout by Grace Lee and Robert Priest of the award-winning Priest+Grace design firm and will be carried forward by the Luckbox design team of Gail Snable and Tim Hussey. With each upcoming issue, their visual fireworks will make our words more interesting!

Already the most popular streamer on America’s large-screen TVs, YouTube was the only major streaming service that gained viewing time in April, according to a Nielsen report.

Ed McKinley EDITOR IN CHIEF

Here’s how the market share of viewing time shook out among streaming services in April as measured by Nielsen: YouTube (8.1%), Netflix (6.9%), Hulu (3.3%), Amazon Prime Video (2.8%), Disney+ (1.8%), HBO Max (1.2%) and so on.

At least some of YouTube’s success may be coming at the expense of scripted television. Although streaming video on channels like Netflix is cutting into cable TV’s market share, YouTube may also be a factor in the decline of cable.

One reason for the prominence of YouTube is the popularity of its content creators. The best example, MrBeast, had 151 million subscribers as of May 2023. There’s apparently a lot of interest out there in costly stunts and acts of philanthropy.

Jeff Joseph EDITORIAL DIRECTORBut YouTube’s success in building viewership hasn’t translated into an increase in advertising dollars. Ad revenue declined 2.6% to $6.7 billion year over year during the first quarter. Google, by comparison, suffered a decrease of less than 1%.

YOUTUBE MIGHT get an unintended boost from an unlikely source—the Hollywood writer’s strike.

With writers on hiatus, scripted new programming becomes scarce. That could force the public to abandon broadcast, cable and streaming TV and look elsewhere for entertainment.

Some viewers—especially younger ones— would turn to social media apps like YouTube and TikTok. What’s more, they might never come back to the narratives peddled on more-traditional TV.

Bolstering YouTube would be a case of enlarging something already big. Last year it contributed more than $35 billion to America’s gross domestic product, according to the Oxford Economics advisory firm.

Alphabet-owned YouTube also provided the

equivalent of nearly 400,000 full-time jobs last year, the report said.

Plus, YouTube continues to grow at a healthy pace. The number of YouTube channels with more than a million subscribers increased by more than 15% last year, and the channels earning more than $100,000 increased 5%, Oxford Economics says.

Two ways to send comments, criticisms and suggestions to Luckbox.

Email: feedback@luckboxmagazine.com

Visit: luckboxmagazine.com/survey

A new survey every issue

In fact, YouTube has probably never made a profit in the 18 years since Alphabet’s Google division bought it, says Samir Chaudry of the Colin and Samir creator economy podcast.

Chaudry has more to say about YouTube later in this issue of Luckbox. But let’s wrap up this column with a look at a YouTube competitor: TikTok.

Congress might ban TikTok—not because its short videos are truncating the American attention span, but instead because it’s capable of spying on the citizenry for the Chinese Communist Party.

But why not seize the opportunity presented by the TikTok controversy? Legislators and regulators could create rules that would not only tame TikTok but would also assure that all tech companies use data ethically and securely. Writers could tell that story when they come back from their strike.

We asked Luckbox readers ...

What’s your favorite YouTube channel? I watch tastylive every day—all day if I’m off work, otherwise in the morning before work. I must have a dose of Vonetta every day. I also follow Coin Bureau and have been involved in blockchain research and digital asset investments for several years.

— Kris Robinson | Salt Lake City

Popular Mentions:

• Coin Bureau: 2.26 million subscribers (crypto news)

• Andrew Huberman: 3.26 million (fitness channel)

• Russell Brand: 6.43 million (commentator, podcaster, comedian)

• Joe Rogan: 14.8 million (commentator, podcaster, comedian)

• Scammer Payback: 5.75 million (scams and frauds)

• Trevor Noah: 3.6 million (comedian, cultural commentator)

— Ranked in order of response frequency

Awesome in-depth look into many different aspects of AI. You guys really came at the topic from a number of angles, and I was enthralled by every article.

—CALEB BOLANDER | LOVELAND, COLORADO

Much of what you believe is wrong. Now that we have your attention, we’ll walk that back a bit—but not completely. All of us carry around plenty of misconceptions.

Most of our errors, illusions and flawed perceptions result from outdated “facts.” We harbor beliefs that were disproved decades ago. Truth evolves.

With that in mind, Luckbox is setting out to dispel myths, present new data and combat disinformation.

“TK” is journalism lingo for “to come.” The answers to the questions posed below can be found in articles that appear in this issue.

1. By the end of last year, how many U.S. households have become “cord cutters?” That means they used to have cable TV but dropped it.

13 million

23 million

33 million

43 million

2. How much time does the average TikTok user spend on the app per day?

35 minutes

55 minutes

75 minutes

95 minutes

3. How much did Alphabet pay content creators on Google Play, YouTube and other platforms over the three years ending Dec. 31, 2023?

More than $100 billion

More than $150 billion

More than $200 billion

More than $250 billion

See answers on pages 33, 38 and 46

There’s more to Luckbox than meets the page. Look for this QR code icon for videos, websites, extended stories and other additional digital content. QR codes work with most cell phones and tablets with cameras.

EDITOR IN CHIEF

Ed Mckinley

MANAGING EDITORS

Yesenia Duran

James Melton

ASSOCIATE EDITORS

Kendall Polidori

Navpreet Dhillon

EDITOR AT LARGE

Garrett Baldwin

TECHNICAL EDITOR

Nick Battista

CONTRIBUTING EDITORS

Vonetta Logan, Tom Preston, Mike Rechenthin

EDITORIAL ASSISTANT

Madison Bruno

CREATIVE DIRECTORS

AptCDesign + Gail Snable

CONTRIBUTING PHOTOGRAPHER

Garrett Roodbergen

EDITORIAL DIRECTOR

Jeff Joseph

COMMENTS, TIPS & STORY IDEAS

Feedback@Luckboxmagazine.com

CONTRIBUTOR’S GUIDELINES, PRESS RELEASES & EDITORIAL INQUIRIES

Editor@Luckboxmagazine.com

ADVERTISING INQUIRIES

Advertise@Luckboxmagazine.com

SUBSCRIPTIONS & SERVICE

Support@Luckboxmagazine.com

MEDIA & BUSINESS INQUIRIES

PUBLISHER: JEFF JOSEPH

jj@Luckboxmagazine.com

Luckbox Magazine, a tastylive publication, is published at 19 N. Sangamon, Chicago, Il 60607

Editorial Offices: 312.761.4218

Issn: 2689-5692

Printed at Lane Press in Vermont Luckboxmagazine.com

Luckbox Magazine is a product and service offered by tastylive, Inc. (“tastylive”). Luckbox Magazine content is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involves risk and may result in a loss greater than the original amount invested. The information provided in Luckbox Magazine may not be appropriate for all individuals, and is provided without respect to any individual’s financial sophistication, financial situation, investing time horizon or risk tolerance. Transaction costs (commissions and other fees) are important factors and should be considered when evaluating any securities, futures, or digital asset transaction or trade. For simplicity, the examples and illustrations in these articles may not include transaction costs. Nothing contained in this magazine constitutes a solicitation, recommendation, endorsement, promotion or offer by Luckbox Magazine or tastylive, Inc., or any of its subsidiaries, affiliates or assigns. While Luckbox Magazine and tastylive believe that the information contained in Luckbox Magazine is reliable and make efforts to assure its accuracy, the publisher disclaims responsibility for opinions and representation of facts contained therein. Active investing is not easy, so be careful!

GATHER ‘ROUND KIDS and hear a tale from the late 1900s. In those days, getting rich quick required driving to the nearest Marriott hotel and conference center to hear an impassioned speech from a charismatic financial evangelist. You’d find out how to parlay your latte money into the stuff of Lifestyles of the Rich and Famous

Speakers from Robert Kiyosaki to Tony Robbins and Suze Orman had written blockbuster books, but if you wanted their sage advice in real time you needed to pony up cash to see

them on their coast-to-coast tours.

Because this issue of Luckbox touches on the creator economy, I’m happy to tell you that in 2023, the charlatans are the same, but the medium has changed. Can making passive income be as easy as watching a few YouTube videos and getting to know AI?

Buckle in for this true tale of how I used YouTube and chatbots to create a quasi-legal side hustle. Will this be my last article before I blow this pop stand and head to the Maldives?

Illustration by Tyson Cole

Illustration by Tyson Cole

ChatGPT exposed millions of people to a new form of automation. Generative AI can pass the bar, write an operatic aria or code an entire website in minutes. I typed, “How to get rich using ChatGPT” into YouTube and more videos than you can swing a cat at appeared in my feed.

“It’s one of the craziest softwares I’ve ever seen on planet Earth, and you can become a millionaire just using ChatGPT, I guarantee you,” advises one entrepreneur wearing a “CEO” beanie. I mean, that hat seems legit.

The money-making suggestions varied from signing up as a freelance copywriter on a site like Fiverr and then using AI to fulfill your clients’ needs, to using AI to write articles embedded with links to products from your affiliate marketing site.

“In each video, though, the narrator tends to skim over a few important points: like whether or not the content they’re creating is accurate, helpful or even good,” writes James Vincent for The Verge.

One idea stood out. You can use ChatGPT to write a children’s book, illustrate it with Midjourney text-to-image AI and then use Amazon’s KDP as a self-publishing platform. If there’s anyone who probably shouldn’t write a book for children, it’s me, but I decided to give it a go.

Beginning with our enterprise GPT-4 account, I prompted: “Write a children’s book featuring a baby bear who learns about the banking collapse.” In nanoseconds, a full children’s story was scrolling up my screen.

Amazed, I read it. Decent, but it needed more intrigue, so I kept adjusting the prompt until I got a story about a baby bear named Benny who encounters several of his forest friends bewildered by a smashed piggy bank in the magical woods. He then learns all about income inequality from his friend Elizabeth Raven, and together they set out to right all economic injustice. Damn, I smell a Newbery Medal.

So, my story was written, and because I was using our corporate account, I have invested a total of $0 in this project. The next step was to illustrate my masterpiece. The weekend before I started this project, a viral image of

a “swagged out” pope wearing a white, puffy Balenciaga coat and a diamond-encrusted crucifix went viral even though the image was fake. A guy in Chicago, high on mushrooms (true story), thought it would be funny, and the viral image’s near-perfect details fooled everyone. Because of this, Midjourney got rid of their free trial program, so I signed up for an account for $10 a month.

I prompted: “Baby bear walking through the woods drawn in children’s book illustration style.” I got some good images, but then I had to watch some more YouTube videos to learn how to give the character a consistent look.

My book, Benny The Bear & The Great Banking Collapse, is for sale on Amazon for $10.25 ... a girl’s gotta eat.

When using AI, it’s super easy to get a cute image, but how do you transition that into other settings? This is the glory and sorrow of YouTube. You can spend hours and hours teaching yourself new skills to the detriment of all your other responsibilities. But if I’m going to make it to the Maldives, I need to hustle. It took me two days of “illustrating,” but I got 14 full-color, beautifully rendered pictures.

I asked one of my coworkers, a talented illustrator and artist, how long it would take him to complete just one of the images Midjourney had rendered for me in less than five minutes.

“If I was chained to my desk, with no breaks, probably about six to eight hours’ worth of work for each image,” he said. How much would he charge? Between $250 and $350. Putting the theoretical cost of my book at over $3,500 just for the art. Again, I paid $10.

I then turned to YouTube to learn: “How to self-publish a book on Amazon.” Seriously helpful step-by-step videos showed how to use Canva (free edition) to format my book.

Then, I opened an Amazon KDP account and succeeded in submitting my book as both a paperback and a Kindle title. Using Amazon KDP is entirely free. Amazon prints your book on demand when it receives an order, and as an author you can order your own books from Amazon at cost (my print cost is $3.25). My book, Benny The Bear & The Great Banking Collapse is now for sale on Amazon for $10.25 (a girl’s gotta eat) and the Kindle version is $4.99.

This to me will always be the transformative power of generative AI and YouTube. In two days, using only YouTube videos as a guide, I wrote, illustrated and published a children’s book that, in theory, could generate passive income. My out-of-pocket cost was $10.

But this is where I started to get the “ick.” I honestly felt bad. As a fellow creative, I was delighted by this process and the new ways it allowed me to create in a medium that isn’t my forte. But I’m wracked with guilt over using AI that could be stealing artists’ work or at least taking work away from them.

So, does YouTube offer actual suggestions on how to get rich? Absolutely. Just make sure you understand what they’re selling and make sure that you’re the consumer and not the product.

Like, Comment, Subscribe: Inside YouTube’s Chaotic Rise to World Domination (2022)

By Mark Bergen

By Mark Bergen

Like, Comment, Subscribe explains how YouTube’s technology and business practices contribute to the success of its parent company, Alphabet (GOOGL). YouTube has prospered largely by inventing today’s attention economy, where companies compete for eyeballs. It has attracted video streaming’s largest audience by making it relatively easy for content creators to display their work. Everyone knows YouTube, but virtually no one knows how it works.

No Rules Rules: Netflix and the Culture of Reinvention (2020)

By Reed HastingsIn No Rules Rules: Netflix and the Culture of Reinvention, company co-founder Reed Hastings pulls back the curtain to expose the unorthodox corporate culture of one of the world’s most successful companies. Hastings, nearly a generation older than the entrepreneurs behind other tech companies, describes his “adult” business philosophy as “people over process.” It brings talented employees together in a flexible structure.

The YouTube Formula: How Anyone Can Unlock the Algorithm to Drive Views, Build an Audience, and Grow Revenue (2021)

By Derral Eves

By Derral Eves

As YouTube grows in popularity, its content creators are competing more fiercely for subscribers. But help is on the way with The YouTube Formula by Derral Eves, an expert video producer and YouTube coach. He shares what creators need to know to launch a channel, improve searchability, and drive viewer and subscriber growth. Eves even promises to reveal secrets about the YouTube algorithm.

By Jenny Odell

By Jenny Odell

In How to Do Nothing: Resisting the Attention Economy, artist and critic Jenny Odell offers advice on living in a world where YouTube’s addictive technology is designed to capture and sell our attention. Despite its title, the book can serve as a field guide to winning back our lives and doing what’s genuinely worthwhile. Former President Barack Obama considers the book a favorite.

Far too often, book reviews drive readers away. They’re written from the viewpoint of just one stranger, and taking them to heart leaves great books undiscovered. That’s why the Book Value offers profiles instead of reviews. Don’t look to this page for opinions. Think of it as a place to find writing that educates, entertains and challenges entrenched beliefs.

Vonetta Logan, a writer and comedian, appears daily on the tastylive network. @vonettaloganal spokespeople that look, speak and act like authentic users but are designed to push the interests of third parties.”

Those spokespeople could bring the dan gerous “potential deployment of real-time in teractive experiences that are designed to per suade, coerce or manipulate users as a form of AI-powered targeted influence.”

Besides clicking on fewer links, users can look forward to personal AI co-pilots and interac tive appliances. They’re certain to open end less possibilities for professional productivi ty and lifestyle hacks. (“Hey toaster, make my toast browner.”)

BConversational computing will also create new platforms for advertisers. “Making your toast browner? Don’t forget Scott’s Turf Builder can make your brown grass greener!”

That’s amusing, but the ads could have a darker side, too, says Louis Rosenberg, chief scientist for both the Responsible Metaverse Alliance and the California-based predictive analytics firm Unanimous AI.

Something called “conversational influence” is worrying Rosenberg.

He defines it this way: “AI-powered virtu-

SEARCH WILL SOON have a new look. At its annual I/O conference in May, Google announced generative AI results would soon assume top billing on its search pages, nudging the familiar “10 blue links” farther down on the results page.

But the changes won’t end there. As conversational AI becomes ubiquitous, users will simply ask a question and the chatbot will respond with the answer instead of a list of sites.

Manipulative advertising aside, AI also has lots of potential for good. Take the example of identifying peopancreatic cancer

The disease has the highest mortality rate of all major cancers, and long-term survival is extremely uncommon—just 2% to 9% of patients at five years. Early-stage pancreatic tumors don’t show up on imaging tests, so people often don’t receive a diagnosis until the cancer has metastasized.

An AI tool can accurately identify individuals most likely to fall victim to pancreatic cancer up to three years before their actual diagnosis based solely on their medical records, according to a new study in Nature magazine by researchers at Harvard Medical School and University of Copenhagen.

AI can benefit investors, too. If your trading account is in the red, new research at the University of Florida suggests “incorporating large language models into the decision-making process can yield more accurate predictions and enhance the performance of quantitative trading strategies.”

Meanwhile, Alejandro Lopez-Lira, co-author of a research paper called Can ChatGPT Forecast Stock Price Movements?, told Luckbox that ChatGPT sentiment scores exhibit a “statistically significant predictive power on daily stock market returns.”

In the paper, he describes AI’s “advanced language understanding capabilities, which allow it to capture the nuances and subtleties within news headlines.”

That got our attention. But when we pressed Lopez-Lira on defining “statistically significant” (a detail suspiciously absent from the research paper), he cited a 13 basis point next-day increase in stock prices.

“It’s not huge, but it’s not that small either,” he observed.

is all in on AI.

Look for this recurring recap in subsequent issues.

Cutting-edge, large-language-model AI systems require the latest high-capacity AI-specific chips. Older AI chips are slower and expensive to scale. But even with state-of-the-art AI chips, training an AI algorithm can cost tens of millions of dollars, which is why a sizable portion of AI spending is on graphic processing unit (GPU) chips.

Nvidia (NVDA) and Advanced Micro Devices

They all need state-of-the-art GPUs to be competitive. Regardless of which company sells the most products, Nvidia and AMD will be the beneficiaries. The AI gold rush is on, and these two are the classic “pick and shovel” players.

AMD could earn $400 million in AI revenue in 2024, and perhaps as much as $1.2 billion, says Morgan Stanley semiconductor analyst Joseph Moore.

While the intermediate and long-term cases for both companies are exceptionally compelling, Nvidia is richly priced relative to AMD. Both have significant China/ Taiwan geopolitical exposure. While AMD is worth a nibble at current prices, these companies should lead your watch list for opportunities to accumulate shares on weakness.

Open to Debate (formerly Intelligence Squared U.S.) pits some of the world’s brightest thinkers against each other in debates organized in the traditional Oxford style. The side that convinces more audience members to embrace its arguments wins. The excerpts below come from a debate in March and have been edited for brevity.

55% FOR 34 % AGAINST

— Audience opinion before the debate

There are two concerns. The first is the data is being amassed and potentially used for surveillance by China. Second, there’s the potential for it to be a propaganda tool because it’s a major media platform. The problem isn’t TikTok. The problem is the Chinese government because there’s no such thing as a Chinese company that’s truly independent of the government. And no matter where the data is collected or stored, China’s data law applies extra-territorially. So, it will have access to data collected and stored anywhere. The second concern is that as people increasingly use it as a media platform, China can censor and boost content on it, which it did during the Hong Kong protests and which it does over Xinjiang repression. We need controls over government-related businesses from foreign countries having the ability to conduct espionage and to manipulate media in the United States.

Kori Schake, senior fellow and director of foreign and defense policy studies at the American Enterprise Institute, is former deputy director general of the International Institute for Strategic Studies in London.

672 million

DOWNLOADS IN 2022

OF LUCKBOX READERS SUPPORT A TIKTOK BAN

China is not exporting censorship through TikTok. TikTok actually is an independent company. When we talk about banning TikTok, we are banning the voices of 90 million Americans. It is not true that TikTok is just turning over all its information to the Chinese Ministry of Public Security. This is simply a false assertion. The investment capital behind TikTok is American and Japanese, as well as Chinese. I think we must stop imitating Chinese policies. We should not respond to authoritarianism with more authoritarianism. We must have confidence in a free society. The critics of TikTok are advocating data protectionism and data nationalism. They’re advocating blocking and censoring apps. They are advocating a militarization of the information economy. And this is exactly what China does. TikTok is not a tool of the Chinese government. It is a commercial entity.

Milton Mueller, professor at the Georgia Institute of Technology School of Public Policy, is co-founder and director of the Internet Governance Project.

See who won the debate.

A LEGENDARY SPORTS figure’s retirement creates a power vacuum for would-be successors to fill, and that could happen in triplicate in men’s professional tennis.

The sport’s “Big Three”—Roger Federer, Rafael Nadal and Novak Djokovic—are nearing the end of epic careers. Each has captured at least 20 major titles; six more than Pete Sampras, the next player in line.

Amazingly, all three emerged as stars in the early years of this century, making this the “golden era” of tennis history.

Fans view the trio as the Mount Rushmore of men’s tennis, along with Rod Laver, the last male player to win the calendar Grand Slam.

AOnly one of the Big Three has officially hung up his racket—Roger Federer. He played his last professional match in September 2022 at the Laver Cup.

Federer, known widely as the “Maestro,” was the first of the triumvirate to surpass Sampras’ major record, motivating Nadal and Djokovic to do the same.

However, Federer was plagued with injuries during the twilight of his career, so his ranking and results slipped well before his retirement.

Moreover, both Nadal and Djokovic have eclipsed Federer in terms of major titles, which is one reason a true power vacuum didn’t develop after Federer ended his professional career.

Djokovic is ranked No. 1 in the world and won the opening major of the 2023 season in Australia. Nadal won multiple major titles in 2022 and will be a top betting favorite this year—assuming he’s fit to compete.

But with Djokovic and Nadal nearing the sunsets of their careers, and Federer now out of the picture, a partial power vacuum has de-

veloped. And in 2022, one player stepped in to seize the opportunity.

That player is Carlos Alcaraz of Spain, who finished 2022 ranked No. 1 in the world.

That’s notable not only because Alcaraz did it with Djokovic and Nadal still active on the tour, but also because of his relative inexperience at the professional level. At 19 years old, Alcaraz became the youngest player ever to reach the No. 1 ranking.

Beginning in 2004, a member of the Big Three has claimed the year-end No.1 ranking every year except 2016, when Andy Murray

As the sport’s Big Three fade into history, a young player appears poised to enter the pantheon

In 2022, 19-yearold Carlos Alcaraz of Spain became the youngest tennis player ever ranked No. 1 in the world.

achieved that distinction, and 2022, when Alcaraz did it.

En route to his historic accomplishment, Alcaraz won two Masters 1000 tournaments and the U.S. Open—the latter his first major title. The first of many, one would think.

Unfortunately, a hamstring injury forced Alcaraz to skip this year’s first major tournament. But he returned to the tour in March and claimed his third and fourth career Masters 1000 titles (the level just under the majors) at the BNP Paribas Open in Indian Wells, California and the Mutua Madrid Open in Spain.

Alcaraz—along with Djokovic and Nadal— is one of the favorites to win the second major tournament of the year when the French Open begins May 28.

Like Nadal, Alcaraz hails from Spain. That’s one reason his style of play has drawn comparisons to his fellow countryman’s.

However, on court, the two aren’t necessarily that similar. For starters, Nadal is left-handed and hits his forehand with a motion that calls to mind a cowboy lassoing a steer. Both Spaniards enjoyed success early in their pro careers, but Nadal did it based on speed, consistency and defensive prowess— an approach that hinged on hitting one more ball than his opponent.

Alcaraz, on the other hand, leverages an aggressive style that’s more akin to a boxer’s— bludgeoning his opponents from the baseline with powerful ground strokes.

That’s not to say Alcaraz doesn’t possess variety and touch. The up-and-coming teenager is also known for his ability to deploy a well-disguised and, in many ways, indefensible drop shot.

The young Spaniard uses that drop shot to disrupt the rhythm of his opponents, much like a fastball pitcher who mixes in a nasty change-up.

Alcaraz was so impressive in 2022 that former tennis great Wally Masur praised him as “the most complete 19-year-old player that I’ve ever seen.”

Early in his career, Alcaraz studied under his father’s tutelage at the Real Sociedad Club de Campo. Since 2018, he has trained with former world No. 1 Juan Carlos Ferrero at the latter’s Equelite Sports Academy. Both institutions are in Spain.

Ferrero hasn’t tried to mold Alcaraz into a replica of himself. In his day, Ferrero was known for speed and a big forehand, and he was effective across the spectrum of surfaces—clay, grass and hard. However, his slight build earned him the nickname “Mosquito.”

Alcaraz, on the other hand, sports a solid and chiseled physique more comparable to Nadal’s build.

What’s more, Alcaraz can pull off worldclass moves, displaying not just speed but also the ability to change direction on a dime.

Most of the world’s top players possess the world-class flexibility and mobility that’s critical in the modern game. More than any other up-and-comer, Alcaraz is similar to the Big Three when it comes to those factors.

With Nadal currently sidelined, Alcaraz and Djokovic are arguably the best bets to claim the final three majors of the year. After those two, Daniil Medvedev, Casper Ruud, and Stefanos Tsitsipas round out the Top 5 in the world rankings.

Oddsmakers favor Alcaraz, Djokovic and Nadal to win the French Open—in that order. However, if Nadal gets a clean bill of health in time—which is entirely possible—he could climb to the top of that list.

The fact that Alcaraz is grouped with Nadal and Djokovic on the short-list of favorites for the next tennis major proves how far he’s come in a year’s time.

One can only wonder where Alcaraz might be a year from now, or even two or three years down the road. He might sit atop the tennis mountain all by himself, having shed the mantle of heir apparent.

Andrew Prochnow, a sports writer and options trader, has contributed to Luckbox, Bleacher Report and Yahoo! Sports.Three legendarytennis

players emerged as stars in the early years of this century, arguably making this the sport’s “golden era.”

It’s no longer just about writing and performing songs—musicians have to become their own promoters on social media. Just ask Justin Bieber, The Weeknd and Ed Sheeran.

THIRTEEN YEARS AGO , a 10-year-old Jackie Evancho found herself competing on America’s Got Talent—and it all began with a YouTube video.

From the moment she could really sing, at 6 years old, Evancho’s mother recorded videos of her covering songs from Phantom of the Opera. She built her career on the platform, and she’s been under the eye of video content and social media ever since. Still, she’s never quite gotten a grip on how to use it, she said.

“Music has always been something that I let my gut guide,” Evancho said. “I always thought as long as I’m doing it, someone will listen.”

Then she realized at age 15 that she could use social media as a tool to grow her career.

“But I’m still at a point where I’m trying to figure out the formula,” she said. “I feel like I’m a bit of an old lady in that aspect and don’t understand it much.”

Just the same, Evancho maintains around 328,000 subscribers on YouTube.

Her story brings to mind Justin Bieber, The

Weeknd, Ed Sheeran, Alessia Cara and Pinegrove. All were young musicians who posted videos of themselves singing acoustic covers or originals hoping the right person would see it—and in their cases, it paid off.

TIn its infancy, YouTube was the first content hub for true remote artist discovery. There were no rules. There was no quota for the number of likes or subscribers a person should have. Evancho noted that during that time, her America’s Got Talent “audition” video had zero requirements. All she had to do was sing and post.

But now, the number of likes, shares, followers and subscribers is top of mind on platforms like YouTube, Instagram and TikTok— especially for musicians striving to become known. And artist discovery has changed, too. The days of finding young Biebers on YouTube are numbered.

TikTok has become the main source of artist discovery, but all social platforms play a role, said Jay Schaff, associate manager at Range Media Partners, an online music and video publisher that reaches targeted audiences.

Schaff witnessed the rise of TikTok in the music industry, as artists began incorporating it into marketing plans.

“It’s more of an opportunity for younger artists, and artists in general, to throw things at the wall and not be as insecure about it, whereas Instagram and YouTube add a little bit more insecurity,” he said.

In a recent example, Schaff said his company was brought in to work with Rich The Kid, a rapper whose hit single Plug Walk went viral in 2018. He went quiet after the song’s hype cooled but is now being introduced to TikTok as a way to revamp his career.

So, is YouTube still relevant? Yes, but differently, according to Schaff.

“Once you’re in the industry, signed to a label or have a record deal, it assumes you’re in the position to appeal to other platforms,” Schaff said. “I love YouTube, but it’s not top of mind for discovery purposes.”

He said YouTube is the go-to spot for music videos because most appeal only to an established audience. But of the seven artists he has discovered through social media, four were through YouTube, he said.

YouTube has become the hub for long-form engagement. Many artists with Reclaim Music Group have leveraged it as a live streaming platform, said Sarah DeFlaminio, a senior business analyst at Gupta Media, a marketing agency, and head of marketing for Reclaim, which handles a genre-spanning roster of artists.

“As TikTok continues to take over, even as a search engine alternative, I think it will be interesting to see where YouTube falls in the mix of priorities for many artist management teams,” DeFlaminio said.

Technology has evolved, and musicians need a social media presence to gain and maintain relevance.

What’s expected of artists is also shifting, said Abbie Duquette, artist manager and founder of Loudmouth Management.

“The job used to be just creating music and writing songs,” Duquette said. “Now it’s 10 jobs rolled into one. They’re expected to write music, tour, be an influencer and keep up with the newest trends.”

When internet content creators hold sway over enough followers, they’re considered “influencers.” At that level, they can make enough money through ads, sponsorships and paid subscriptions to create a career.

But not many musicians can sustain themselves financially by becoming that kind of organic YouTube artist, said Abbie Duquette, artist manager and founder of Loudmouth Management.

Instead, touring, streaming and merchandise sales remain their main sources of income, Duquette noted.

To start earning money through YouTube (not including merchandise or ads), a creator must have at least 1,000 subscribers and 4,000 watch hours per year. That qualifies them to apply for YouTube’s Partner Program.

It’s possible but not likely for musicians to garner an organic following through YouTube, Duquette said.

Playing that many roles can disrupt the creative process, but it’s what musicians have to do to stay afloat.

In a recent interview with Variety magazine, YouTube’s global head of music put it this way: “The fine print for an artist these days, which they didn’t sign up for, is [generating] likes, clicks, subscribers—all of these taxing things they need to do to find their fans. I think it’s a real struggle for a lot of them, and it’s also a struggle for the labels.”

Range Media, which has a roster that includes Jack Harlow, Nicki Minaj, Tyga, Cordae, D Smoke and Mariah Carey, works with new and established artists to build on their strengths and develop a plan to downplay their weaknesses.

Last year, the company started its own label, Range Music, and signed distribution deals with Capitol Music Group and Virgin Music & Artist Label Services. Schaff said the label had created opportunities to sign young artists and offer one-off distribution deals.

“That allows us to pick up [an artist] who might only have 5,000 to 10,000 followers and blow them up,” Schaff said.

He manages artists and oversees his own roster and the roster of Matt Graham, Range Media co-founding partner and president. He also handles A&R research for Range Music, which gives him direct insight into what the label looks for in musicians.

As an independent music manager in his first year of law school in Boston, he based decisions on gut feelings. But now, he reviews specific criteria before working with someone, whether for the label or management purposes.

“Certain factors I look for include age, relevance on social platforms, cultural relevance, voice—both singing or rapping voice and cultural voice—and historical data and trends,” Schaff said. “Ultimately, if all those boxes are checked, then it comes down to superstar material. One of the first questions I ask is ‘what are your goals?’”

Schaff noted the constant competition he encounters with other media companies and

Creator Music, an audio licensing and revenue-sharing service, is expected to enter beta testing this year. YouTube designed it to simplify agreements between video content creators and musicians, while also generating revenue for both. The service is meant to appeal to Gen Z—people born between the mid-1990s and early 2010s—and it feeds on the hype of the TikTok video streaming service. Music is fundamental to TikTok because content creators use it in the background of most videos.

YouTube is attempting to make music just as accessible to its creators. To that end, the platform will offer a list of tracks specifying how much it costs for creators to license them from musicians. Negotiations will occur before the music is offered through the platform.

For now, the list will feature mainly independent artists—musicians who aren’t signed to major labels, said Lyor Cohen, YouTube’s global head of music.

“YouTubers reach more listeners than the largest pop radio stations today,” Cohen noted.

labels. Most of the time, he goes for young new acts, where some of that back-end research doesn’t always apply.

Duquette’s process is similar, but before signing an artist, she has to believe in their work and feel inspired by it. That often rides on a vibe she gets from their work ethic and passion. Musicians with passion have a good shot at becoming successful recording artists, she said.

Duquette also offered some advice. Artists should try not to bog down in the vast possibilities in front of them, she said. Instead, they can hone in on what excites them and use it to their advantage.

Meanwhile, DeFlaminio noted the lore

surrounding algorithmic favoritism and discussed whether certain stats get artists preferential treatment on platforms. Ultimately, she said, we’ll never know. The goal should be to cultivate an engaged fanbase versus a massive fanbase.

Schaff agrees and said musicians should experiment to see what sticks with audiences.

“The misconception is that a lot of things go unnoticed,” he said of listener reaction. “Most of the time, everything is noticed and is just ignored.”

Either way, audience feedback is there for anyone who’s open to it. “If it comes across my desk, then it’s getting on other people’s desks,” Schaff maintained.

The goal should be to cultivate an engaged fanbase versus a massive fanbase.Justin Bieber made his first live U.S. television appearance on Ellen in November 2009.

YouTube music videos that reached 1 billion views in the shortest period

Artist/song: Adele / Hello

88 DAYS

Artist/song: Ed Sheeran/ Shape of You

97 DAYS

Artist/song: Luis Fonsi/ Despacito (featuring Daddy Yankee)

97 DAYS

BLACKPINK: 88.1 million

BANGTANTV: 74.7 million

Justin Bieber: 71.3 million

Marshmello: 56.3 million

EminemMusic: 56.2 million

Ed Sheeran: 53.3 million

Ariana Grande: 52.5 million

Taylor Swift: 51.7 million —YouTube

STATS

247 MILLION

STREAMING’S NOW the most popular way to watch TV in the U.S., accounting for more than 34% of total TV viewing in February, according to The Nielsen Co. And among streaming destinations, YouTube ranked highest that month, with 7.9% of total TV viewing.

The heart of YouTube is “creator” videos— original content made specifically for a YouTuber’s audience. Other videos are created by entities that include brands, children’s channels, and recording artists and labels.

What’s popular on YouTube changes constantly, but in 2022 MrBeast ranked No. 1 among creators for the third consecutive year. MrBeast was also the second most-subscribed channel as of March 17.

YOUTUBE

51 MILLION

NUMBER

CHANNELS —Zippia

For seven years, YouTube Music has been striving to compete with streaming giants like Spotify and Apple Music. In 2016, the company brought on Cohen—a former Def Jam Records and Warner Music executive—in a move many hoped would quash any beef between YouTube and the three major record labels.

The friction with Universal Music Group, Warner Music Group and Sony Music had arisen because of copyright issues involving the platform’s use of artists’ music.

But Cohen seems determined to get past all that. “YouTube offers fans the ability to discover music, consume music and participate with music—all in one place,” he wrote in a blog post last September.

In fact, Cohen indicated he hopes YouTube can “save the music industry.” What the media platform is doing to accomplish that is listed on these pages.

EVERYBODY KNOWS MUSIC is big business, but the numbers are staggering and only getting bigger for YouTube and other players.

The industry collected $15.9 billion in revenue last year, up from the previous record of $15 billion, according to the Recording Industry Association of America (RIAA).

Streaming accounted for much of the jump. It grew 7.3% to $13.3 billion last year and now accounts for 84% of U.S. recorded music revenue, the RIAA reported.

Meanwhile, paid subscription services, including YouTube Music, Spotify and Apple Music, brought in a record $10.2 billion last year.

YouTube is getting its share of that total. Last year, the platform contributed $6 billion to the industry—with 30% of its content generated by users, said Lyor Cohen, its global head of music.

Meanwhile, YouTube surpassed 80 million music and premium subscribers globally, up from 30 million in 2021, he noted.

$1 PER 136 STREAMS

$100 PER 13,605 STREAMS

$1,000 PER 136,054 STREAMS Estimate of YouTube Music payout to artists

30 billion views per day, with 1.5 billion monthly logged-in users—YOUTUBE SHORTS, WHICH OFFERS EXCLUSIVE MUSIC INTERVIEWS, LIVE PERFORMANCES AND PREMIUM MUSIC VIDEOS

Creator Music simplifies agreements between creators and artists while generating revenue for both. It makes indie music available to use in streamed content.

242 MILLION

The number of YouTube subscribers to T-Series, an Indian music record label— more subscriptions than on any of the platform’s other channels

88 MILLION

The number of subscribers to BLACKPINK, a K-pop girl group, making them the most popular act on YouTube

100 MILLION

The number of songs on YouTube Music

Paid subscription services, including YouTube Music, Spotify and Apple Music, brought in a record $10.2 billion last year.

The U.S. music festival season kicked off in May and runs through October. Here are The Rockhound’s picks for the best festivals to attend in person or to stream.

WWHAT AN INCREDIBLE WORLD! Anything you’d ever want to know about any subject is easily accessible within seconds in written, audio or video form—whatever you prefer. And very soon, with the advent of AI, simply thinking about the information you’d like to access should be sufficient to bring it into your purview.

Here are four YouTube channels that can serve as excellent resources in your quest to get leaner, stronger, fitter and healthier.

@JeffNippard / 3.7 million subscribers

If you train more days than not and really get into it, you’re well on your way to 80% of the potential benefits. Nevertheless, some of us want to invest the time and effort for that last 20%.

Jeff Nippard’s channel does an excellent job of showing how to set up your training and nutrition strategically—from proper technique and physical cues to macronutrient breakdowns.

But he also dives into the details to give you the why behind the what.

Whether you want to know more about the moment arm on your dumbbell flys or the

necessity of a caloric deficit for your fat-loss phase, this channel is for you.

@PeterAttiaMD / 276,000 subscribers

Our fitness goals can change as we age.

In our youth, it’s about training to look good—health benefits and longevity are just a bonus. Later, those goals can flip.

Peter Attia’s channel is focused on this change, making it invaluable for anyone with the invincibility of their 20s and 30s in the rearview mirror.

@SquatUniversity / 1 million subscribers

Eventually, you’re going to get banged up—it’s a cost of doing business on the rubber mats.

Nobody can train hard for months, years or decades without accumulating injuries or at

least some nagging aches and pains. Most of those problems involve one of the four horsemen of the injury apocalypse: shoulder, knee, elbow, back.

Dr. Aaron Horschig and Squat University do an incredible job of dealing with injuries around those joints and areas.

He offers clear and detailed tests to screen injuries to determine their root cause. Then, he follows up with strength and mobility drills you can begin doing right away to strengthen

the injured area, ease the pain and get back into training.

@Hubermanlab / 3.1 million subscribers

A collection of fitness-related content, the Huberman Lab podcast with Andrew Huberman, professor of neurobiology and ophthalmology at Stanford School of Medicine, focuses on science-based tools for everyday life.

But it’s more about neural circuits and less about your next squat session.

Providing insight into the benefits or drawbacks of everything from cold exposure to morning light, the HLP will help optimize your performance in all areas of life.

Jim Schultz, Ph.D., a derivatives trader, fitness expert, owner of livefcubed.com and the daily host of From Theory to Practice on the tastylive network, was named North American Natural Bodybuilding Federation’s 2017 Novice Bodybuilding Champion. @jschultzf3

Dr. Aaron HorschigLOGAN PAUL’S BUSINESS ventures have taken him from Vine to YouTube to the wrestling ring, but his newest cash grab is in the sports drink industry.

PRIME Hydration, a sports drink company co-owned by Paul and rapper and YouTube personality KSI, has garnered significant attention since its release in January 2022.

But the hype was generated not by the drink itself but by the years of internet feuding between the two co-owners.

Paul originally gained a following through Vine, a defunct short-form video app, in 2013. He then moved to YouTube in 2015 and became famous for dare vlogs filled with click bait.

Although his rise to fame was quick, it was also littered with controversies. Despite multiple disputes with YouTube about his content, including suspension of his advertising in February 2018, Paul has attracted 23.6 million subscribers to his vlog YouTube channel and 4.48 million subscribers to his podcast YouTube channel Impaulsive

Paul’s co-owner at PRIME, JJ Olatunji, is better known by his online name KSI and is no stranger to fame and controversy. Before they became partners, KSI’s history with Paul was riddled with rivalry.

The simmering tension between the two

began in 2018 when KSI challenged Logan Paul and his brother Jake to a boxing match after his victory over Joe Weller in 2018.

That sparked hostility and diss tracks, with both Logan and KSI figuratively punching below the belt at every opportunity. Paul agreed to fight KSI and planned the match for August 2018.

The animosity between the two came to a head at a press conference a month before the fight, which resulted in Logan storming off the stage and Greg Paul, Logan’s father, getting punched in the head by a KSI fan.

The match ended in a majority draw, meaning two of the three judges scored it as a tie. But the size of the crowd and the profits constituted clear victories.

Some 20,000 fans attended the fight in person, while 770,000 paid to watch a livestream. The match generated around $11 million.

That sealed the deal for their second matchup in 2019, wherein KSI was deemed the winner.

After almost three years of tweets and in-person and online attacks, the beef be-

PRIME hits the mark as a lowcalorie Gatorade alternative. PRIME’s coconut water enhanced the flavors we sampled: Meta Moon, Tropical Punch, Strawberry-Watermelon and Lemon-Lime. Our favorite? Meta Moon, which scored 4.5!

tween these two YouTubers was put to rest in 2021 when KSI appeared as a guest on Paul’s podcast and teased a secret project in the works, which we now know to be PRIME Hydration.

This shocking collaboration illustrates the No. 1 rule of YouTube hype: Where there’s controversy, there’s cash.

Born of the YouTube hype surrounding Paul and KSI’s highly publicized feud, PRIME Hydration has rapidly become a major product in the sports drink industry.

In 2022 alone, PRIME posted $250 million in retail sales. This past April, it became the official sports drink of the Los Angeles Dodgers, and it’s offered at concession stands throughout the team’s stadium.

Meanwhile, this new sports drink has become a craze in the United Kingdom, with fans paying up to 100 British pounds for a single can. The drink was introduced in the U.K. in June 2022— about five months after its release in the U.S.

The U.K.’s lust for this highly promoted sports drink has brought about the PRIME Tracker UK app, which shows where the beverage is restocked in stores for just £0.99. Some retailers there are limiting purchases to no more than three bottles per customer to avoid running out as soon as they put the drink on the shelves.

Although PRIME has created a sensation here and abroad, it’s not that much different from other sports drinks. Just like Gatorade, it helps replenish electrolytes, but PRIME has significantly less sugar than Gatorade and other competing sports drinks, which seems to be the main draw.

Yet PRIME Hydration’s standout feature isn’t listed among the ingredients. It’s the hype surrounding the co-founders. Paul and KSI’s years of online drama and physical blows have paid off in the most lucrative way.

Although Logan Paul’s rise to fame was quick, it was also littered with controversy.

JJ Olatunji, better known by his online name KSI, is no stranger to fame or altercations.

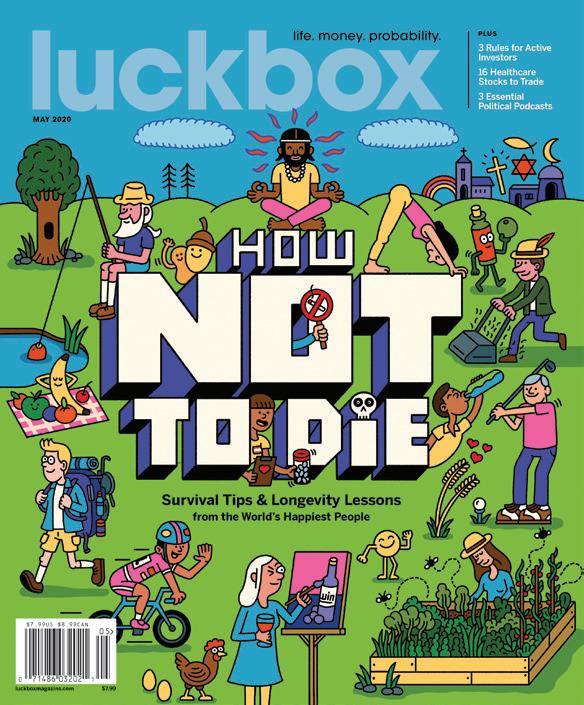

YOUTUBE, Netflix and video streaming in general have become intertwined with life as we know it. So, what better subject could there be for this Luckbox special section?

We begin with a brief history of how streaming grew to prominence. Plus, we consider what the future may hold as we close the book on the “second golden age of television.”

Next comes a chat on the creator economy and the business of streaming content with Samir Chaudry, half of the Colin and Samir podcast team.

Following that, you’ll see an account of how and why streaming has overtaken cable TV as the method of choice for viewing flashing images on the nation’s flatscreen televisions.

But not everything’s copacetic in the world of steaming. Members of Congress recently lambasted TikTok’s CEO for operating a channel that could supply the Chinese Communist Party with sensitive information on virtually everyone in America. Can legislators explain to the public how that intrusion justifies a proposed ban on cat videos?

Returning to the upside, the section’s next article lists a host of video channels that have captured our attention—from the wildly popular to the undeservedly obscure. Look for your favorites and discover something new.

That’s followed by a comprehensive examination of the content-creation scene in streaming—including an account of who makes money and how they do it.

The section ends with an interview with Kaya Yurieff, one of streaming’s premier journalists.

As usual in Luckbox, the theme spills over from its section into other portions of the magazine. You’ll see streaming covered in the Trends section and in Trades and Tactics. As we said at the outset, streaming’s intertwined with life.

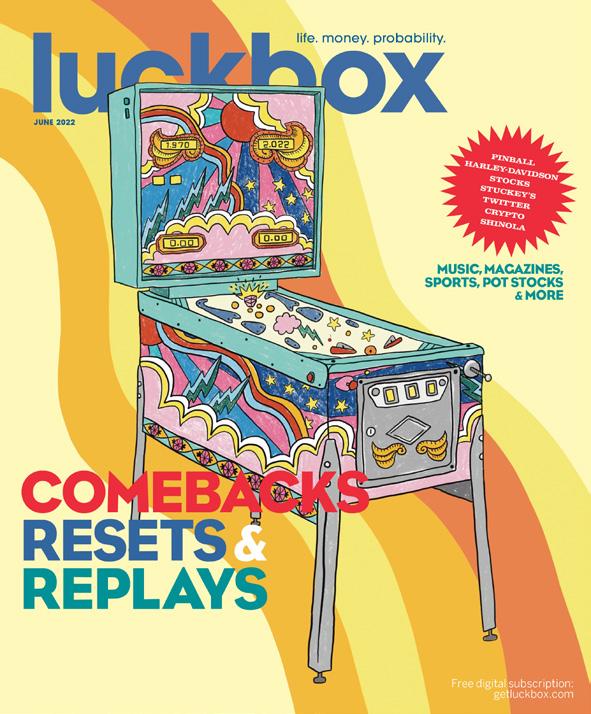

TELEVISION’S THIRD INCARNATION IS CHANGING—AND IT’S NOT FOR THE BETTER

BY ED MCKINLEYTHE ERA OF “Television 3.0” dawned last summer when streaming video topped cable TV in viewership for the first time. Let’s take a couple of steps back in time to remember how we got here.

After World War II, antennas sprang up across the land as broadcast television transformed the delivery of entertainment and information. The number of households with TV sets exploded from 9% in 1950 to 90% in 1960, according to the Library of Congress. Think of broadcast as TV 1.0.

A few national TV networks and smattering of local channels seemed like enough for a while. But before long, viewers wanted more. The seemingly unlimited choices brought by cable television, which we’re calling TV 2.0, ushered in another transformation.

It happened almost as quickly as the spread of TV in the ’50s and proved nearly as pervasive. In 1970, 8% of households subscribed to basic cable. By 1990, 60% had basic, and half of those viewers also had premium channels. Cable reached its peak of 100 million households in 2013.

But then something happened. The subscription base for cable began shrinking as Americans turned to streaming video—the phenomenon we’re calling TV 3.0. Last summer, streaming supplanted cable as the mostwatched form of television. The numbers appear in an article on p. 32 of this issue.

The reasons behind the shift to streaming won’t shock most TV fans. First, subscribing

to streaming services usually costs less than cable. Second, streaming enables viewers to watch their favorite movies and series whenever they choose, instead of at an appointed time dictated by some faceless cable company technician.

That may sound great, but it touched off open warfare.

By the end of 2019, streaming services that included Netflix, Amazon Prime Video, Hulu, Disney+, HBO Max and Apple TV+ were locked in a fierce competition for subscribers.

The struggle became so heated it earned the name “streaming wars.” The combatants fought with such abandon that their business plans didn’t seem to include a path to profitability. Companies wanted market share immediately. Healthy return on investment would have to wait.

To that end, streaming services began to

VIDEO STREAMING had already been around a few years when three former PayPal employees started YouTube in 2005. But streaming had never been like this.

YouTube quickly grew to prominence, simply because it was better than the handful of streaming services already in existence, said Dan Rayburn, a consultant and chairman of the Streaming Summit at the National Association of Broadcasters annual show.

“YouTube was easy, and it worked,” Rayburn told Luckbox. “That was the No. 1 reason it grew.”

A year or so after creating the platform, the founders sold it to Google (now called Alphabet (GOOGL), for $1.6 billion. Ever since, Google has been searching for a way to make money with it, Rayburn noted.

“To this day, the company won’t come out and say whether or not they’re cashflow-positive, so what does that tell you?” he asks rhetorically. “It tells you they’re not.”

produce their own movies and series. They pulled out the financial stops by hiring A-list stars and big-name directors. They spent freely on computer-generated imagery that can typically cost $570,000 per minute.

The cost of creating shows skyrocketed. Netflix paid $30 million per episode for the fourth season of Stranger Things. The eight-episode first season of Lord of the Rings: The Rings of Power, which airs on Amazon Prime, cost $715 million, including $250 million just for the rights.

To some degree, television began to equal or even eclipse Hollywood movies for artistic innovation and integrity. The current era even became known as the “The Second Golden Age of Television,” more highly regarded than the first “Golden Age” of live broadcasting in the 1950s.

Then the COVID-19 pandemic struck, forcing people to stay home to avoid catching the disease and giving television a boost in viewership. But the day has only so many hours, and the time spent watching streaming video reached a plateau.

It began to look as though streaming couldn’t attract more viewers or nudge existing viewers into watching more video. The time had come to stop concentrating simply on adding viewers and instead figure out how to make a profit.

The media declared the streaming wars over sometime in 2022 but had a difficult time naming the industry’s next phase. Streaming services seemed to go their own ways without providing an overriding theme other than the search for financial sustainability.

One shortcut to black ink on financial reports was spending less on the actors, writers

CONTENT CREATORS have three hurdles to clear along the way to success, according to Samir Chaudry, who co-hosts the Colin and Samir podcast with Colin Rosenblum.

First, they should strive to create a thumbnail that attracts an audience to their video. Chaudry tests multiple versions of thumbnails, searching for one that elicits clicks from 6% to 10% of the people who see it.

Next, the video must be good enough to hold viewers until the end. “If you make a 10-minute video and people only watch one minute of it, it’s gone nowhere, right?” he says. “So, what people aspire to in our space is 70% retention.”

Finally, creators should keep it authentic if they’re looking for longevity in the business. “I’m not capable of doing that formula repeatedly with something I don’t want to make,” Chaudry emphasizes. “I will burn out. I will lose interest. I’m not capable of that. So, I caveat that advice with, ‘Are you excited about making it?’”

and directors who create prestige productions. A number of streaming services have canceled high-priced production deals.

Streaming providers are also choosing original programming designed to appeal to wider audiences and turning their backs on shows for niche audiences. The “Golden Age” is dead on arrival.

Cost-cutting can occur at home, too. Disney, for example, is laying off 7,000 employees this year, which is 3% of its workforce of 220,000. It hopes to save $5.5 billion as a result. At the same time, the company’s raising prices.

In another example, Netflix began cracking down on sharing passwords, a practice that had enabled multiple consumers to take advantage of a single account. The company rolled out restrictions country-by-country, and the new constraints are scheduled to reach the United States in the next few months. It’s hiking prices, too.

Meanwhile, streaming services are experimenting with advertising by offering some content for free if viewers are willing to sit through commercials, many of them repeated almost endlessly. For older viewers, it can feel like a return to broadcast television when they reacted to breaks in the action by turning off the sound or by ducking into the kitchen to make a sandwich.

Though disorder reigns, some believe a new pattern will emerge.

HAD BASIC

THE SUBSCRIPTION BASE FOR CABLE TV BEGAN SHRINKING AS AMERICANS TURNED TO STREAMING VIDEO.Colin Rosenblum (left) and Samir Chaudry devote their podcast to the business of streaming content creation.

“Bundling” could become the next big thing in video streaming. Individual services appear ready to join forces and offer themselves as packages. That worked for cable when providers made paid TV available in conjunction with internet connections and phone service.

But the new era of bundling will come with fewer prestige shows as the streaming services continue to cut costs. Consumers will be getting less value despite higher prices. Plus, they’ll have to learn to live with interruptions caused by an increasing number of ads.

The era of streaming TV 3.0 will continue, but the “Golden Age” is fading to black.

ON THE INFLUENTIAL podcast Colin and Samir, hosts Samir Chaudry and Colin Rosenblum offer expert advice for creators of streaming video content. At last count they had an audience of more than 1.2 million listeners. Luckbox spoke with Chaudry, one half of the duo. Streaming’s ascendant. What’s the fate of cable and broadcast TV?

Because of streaming, we’ve gotten to a point where we have choice, which is very interesting from a consumer perspective. When I was a kid, I would turn on the TV Guide channel to see what was on MTV or Nickelodeon for the next three hours. If you missed a show, you’d have to wait a whole cycle to see it. That was a lean back experience of saying, “Hey, I’m going to turn this thing on. You tell me what’s on right now, and I’ll let you decide for me.” With streaming, you can watch what you want, when you want. But cable isn’t going away. There are times when we don’t want so much choice. We want a lean back experience rather than a lean in experience. There’s always a spectrum of options, and those range from incredibly active, like pursuing entertainment on Twitter, to incredibly passive, like just thinking “entertain me.”

How important is YouTube Shorts to the creator economy?

YouTube has been at the center of the creator economy in that audiences were really connecting to this new “For You” style. Creators were able to build large followings, and the creator economy built out to the point where there was a system for brand ambassadorship and brand deals. Advertisers are willing to spend directly with creators.

When I look back at what our channel did last year with Shorts, we got about 130 million views, and that probably gained us 300,000 subscribers. So, the brand of Colin and Samir has risen.

TikTok has a strong algorithm and delivers content meant to entertain— not to engage, correct?

And there’s also the intent of the audience. When you open TikTok, it’s already playing a video. When I open YouTube, I have to search. That’s an important distinction. YouTube is a search engine— TikTok is actually giving me something immediately.

What do you think of the proposed ban on TikTok?

People suggest a TikTok ban is unprecedented. But, there have been times when

the U.S. has censored media that have been spreading ideology, right? TikTok drives culture and ideology in a way and at a pace that we’ve never experienced before, and it’s very scary for it to not be U.S.-owned.

YouTube pays content creators 55% of the ad revenue they generate. Is there any competitive pressure to change the payout?

Since the beginning, I’ve looked at YouTube ad revenue as found money. I’ve never put it into a budget. I’ve never put it into projections. I’ve never expected it to be there. It’s too volatile and for us can vary from $7,000 a month to $49,000 a month.

We have no control over how much we get paid from YouTube. That’s a deal that’s made between an advertiser and YouTube—based on the volatility of the ad market and our viewership. What I do have control over is picking up the phone and pitching my media to a sponsor. We can monetize by going direct to our audience through subscriptions, right? We can sell merchandise, or we can find advertisers that fit our niche and sell premium advertising directly into the content. That’s how most creators make money through brand deals and partnerships.

Without question, we should be compensated by YouTube for supporting their environment. They’re running an ad business. We’re providing the content. We should be compensated.

At the same time, they don’t take a percentage of the thing I have the most control over—sponsorship—which generates 85% of my revenue. They don’t charge me to upload, and there’s no fee for me to use their platform to reach my audience— which I am selling brand partnerships into.

There’s a three-legged revenue stool of sponsorships, subscriptions and merchandise—plus the found money of ad revenue. What should new creators target first?

Sponsorships. We have an incredibly robust system in the creator economy right now for sponsorships. Good deals are available if you’re creating something of value. A lot of creators can make stuff, but it’s not reaching a specific audience. That’s not going to be great for sponsorship.

So, you have to have a hyper-defined understanding of who your audience is and the value you provide to your audience. If you can understand that, you can find brands that want to do the same thing.

THE ERA OF STREAMING VIDEO WILL CONTINUE, BUT ITS “GOLDEN AGE” IS FADING TO BLACK.

VIDEO STREAMING has surpassed cable TV as America’s favorite delivery system for movies and television shows.

It took the lead last July, thanks partly to the runaway popularity of Netflix’s fourth season of Stranger Things, which viewers worldwide watched for 1.35 billion hours in the first 28 days after its release.

The show contributed significantly to streaming’s 34.8% share of TV viewing that month, compared to 34.4% for cable and 21.6% for broadcast, according to a Nielsen report. Streaming had achieved a milestone.

Subscription stats also support what analysts have been expecting for years: the steady decline of cable and satellite TV.

Just 48% of American households have cable or satellite, said Samba TV’s recent State of Viewership Report. Meanwhile, 83% subscribe to one or more streaming services, according to Statista.

Netflix began streaming in 2007. Since then, more than 200 streaming services have popped up worldwide. Netflix and Hulu were once the primary competitors, but now Amazon Prime Video, Disney+ and Max (previously HBO Max) have joined them to round out the Top 5 most popular services in the U.S.

For a while, streaming replaced only some cable viewing. AT&T launched DirecTV Now (currently DirecTV Stream) in 2016 and found itself with an expensive failure on its hands— for the company and consumers. After reaching a high of 1.8 million subscribers, it’s now below 700,000.

But even though AT&T flopped, it opened the door for the non-linear TV. Programming

is considered linear when shows appear at certain times, like on cable. With non-linear streaming, viewers choose when to watch videos.

A few months after DirecTV Now’s launch, YouTube and Hulu created their own paid live TV subscriptions, with YouTube TV reaching 5 million subscribers in 2022 and Hulu with Live TV just under 4.4 million subscribers. Neither of those services compares to Pluto TV’s 79 million monthly active users. As a free ad-supported service, Pluto TV is the mostviewed live TV provider. It’s owned by Paramount but tops Paramount+, which holds 4% of the paid market share at 56 million subscribers. For those tempted to ditch their cable subscriptions, streaming services provide every reason to do so. The average cable package costs $217 per month, while the streaming customers spend an average of $70 a month, according to Allconnect, a company that pro-

THE NUMBER OF MINUTES VIEWERS WATCHED THE OFFICE IN 2020

57.3 BILLION

vides home services.

Households that subscribe to paid streaming services choose an average of four, says Deloitte’s 2021 Digital Media Trends survey. But its 2022 study reveals that 59% of consumers prefer a low-cost, ad-supported subscription to a high-cost, no-ad service.

That means cable-like ads still work both for advertisers and consumers.

Josh Jackson, a professor of media studies at the University of California, Berkeley, wants to change how the television industry perceives its audience.

43 MILLION

The number of Americans who have dropped their cable TV subscriptions. Subscriptions peaked in 2013, when approximately 100 million households had paid TV.

“We need to think about cable versus streaming in terms of demand,” Jackson says. “And that demand isn’t just viewers and viewer preference, but also advertiser preference.”

TV networks collect the largest share of their revenue from advertising, and as long as advertisers pay for placements, cable companies will continue to function.

“In the 1990s, it was first registered that

more people were watching cable than were watching broadcasts, and yet 30 years later broadcast is still very much in operation,” Jackson maintains. “In fact, the broad majority, if not all of the major broadcast channels, also have cable channels and also share a parent company with streaming operations.”

The movement toward streaming constitutes an “industry realignment” and not a war against cable, he says. Media companies try to achieve a balance between cable and streaming and attempt to appeal both to audiences and to advertisers.

Take the example of Comcast, the largest U.S. media conglomerate. It owns Xfinity, Universal Pictures/Studios, Dreamworks Animation, NBCUniversal (including Peacock) and plenty more. While cord cutting resulted in the loss of 3,786 households every day in 2022, amounting to a total of 43 million lost households from cable’s peak in 2013, Comcast gained 4.33% in annual revenue compared to the previous year.

Expect more of the same. Luke Bouma, founder of Cord Cutting News, predicts this: “The growth of cord cutting is expected to speed up in 2023 as inflation and other economic troubles … push Americans to look for cheaper options. At this rate of growth, we could see cord cutting top 7 million households in 2023—if not more.”

Streaming and cable both offer advantages when it comes to commercial messages. Advertisers can use data gleaned from the internet to craft individualized ads to run on streaming services, but cable provides broader reach to a wider demographic.

Tailoring commercials to fit an individual instead of the entire audience can benefit advertisers, but consistency also occupies a prominent place in the world of television.

For example, viewers can become frustrated when a favored show switches platforms, a change that’s occurring more often these days.

Consumers sometimes cancel a service that drops a popular show and then subscribe to the one that picks it up. Some 37% of subscribers both added and canceled a streaming service within six months, the 2022 Deloitte

Digital Media Trends survey shows. The leading causes? Price and shows moving from one medium to another.

The Office provides the perfect example of the latter. From 2005 to 2013, NBC aired the program about the antics of a hapless group of white-collar workers. It later found a home on Netflix, where all nine seasons became available.

In 2020, The Office was streamed more than any other show, with viewers watching 57.13 billion minutes that year. NBC wanted it back. So, despite its towering popularity, the show became unavailable for three years while Netflix and NBC wrangled over licenses and rights. In January, it returned on NBC’s Peacock streaming service.

Robert Greenblatt, former chairman of NBC, looked back on the situation in a 2019 interview with Vulture, a website operated by New York magazine.

“I believe that Netflix helped make The Office extraordinarily popular, and more popular than when it was on the network,” Greenblatt said. “If we knew how popular it was going to be before they made the deal, we would have asked for more money from them!”

The Office isn’t the only show that found its audience after moving to Netflix—another indication viewers prefer streaming to broadcast or cable. And fans followed the show when The Office appeared on Peacock after its successful run on Netflix.

Peacock also stocked up on some of the most popular comedy shows in television history, acquiring Saturday Night Live from Hulu, and both Parks and Recreation and That 70’s Show from Netflix—among many others.

That made Peacock a challenger to other streaming services, even with just a 4% share of the paid streaming market.

Then there’s the case of companies like Comcast, where streaming poses less of a threat and seems more like an area for growth.

“We’re selling shows right and left to these [streaming services],” Greenblatt said. “They’re frenemies of the network, but they’re certainly friends of the studio.”

IN 2021, Matthew Pottinger, a former national security adviser to the Trump administration, sounded the alarm on the threat posed by China’s penchant for collecting data on U.S. citizens.

Pottinger told a Senate panel the Chinese Communist Party (CCP) had stolen enough information to create a dossier on every American. He said bad actors could use the data to “influence and intimidate, reward and blackmail, flatter and humiliate, divide and conquer.”

To protect private data, the Trump administration banned the social media platform TikTok, owned by ByteDance, a company with links to the CCP. Trump cited emergency economic powers to kick the video-sharing app out of the country.

However, in December 2020, a federal judge blocked the Trump order. U.S. District Judge Carl Nichols ruled the Trump administration had overstepped its authority. That still didn’t end regulatory pressure on the app, which competes with U.S. tech firms like Meta Platforms and Snapchat.

Over the last two years, political efforts to curb the use of TikTok have

become commonplace, with at least 30 states banning the platform on phones and devices used by public employees.

The anti-TikTok movement gained even more momentum in March with a Congressional hearing that gave voice to the platform’s opponents on both sides of the aisle. They delivered a bipartisan message to the CEO of TikTok: We don’t like you. You’re a danger to national security. And we will shut you down.

Now, votes are pending on Capitol Hill on two bills that would ban TikTok in the United States.

Against that backdrop, let’s examine the platform’s broader impact, including the scope of its influence, the potential regulatory response and the expected fallout from this rare display of bipartisan outrage.

Younger generations have flocked to the social media platform, downloading the application more than 2 billion times worldwide.

The platform enables users to create and share videos from 15 seconds to 10 minutes. Content includes everything from hilarious skits to helpful financial recommendations and investment advice. It showcases pranks, recipes, dance routines and just about everything else.

TikTok debuted in China in September 2016

58 % 42 % SUPPORT

under “Douyin” as a rival to social networking services like Instagram and Facebook. The latter two were banned in China, giving ByteDance a pathway to dominance there.

The platform’s growth accelerated with the purchase of the rival app Musical.ly in the fall of 2017. The merger made TikTok available in far more places around the globe.

In a March 21 video on the platform, TikTok CEO Shou Zi Chew said TikTok now has more than 150 million users in the U.S., a higher total than in any other country. According to the trends-following website DataReportal, Indonesia is TikTok’s No. 2 country, with 109.9 million active users ages 18 and above.

TikTok differentiates itself from rivals like Snapchat and Instagram with an algorithm that makes the video experience engaging if not addictive. It tracks users’ comments, shares, likes and preferences for long or short videos. It then uses that information to determine what videos to deliver to each user.

The algorithm also gathers information about users’ device settings, location and language preferences. Combining that with information on their interest in popular trends culminates in a “For You” page customized for each user.

The algorithm aligns with the user’s behavior and interests to create a digital profile. While this customization creates a dynamic user experience, it raises questions about privacy and how the data is used.

The audience for TikTok expanded during the COVID-19 lockdown as Americans turned inward for entertainment. Users are typically millennials, born between 1981 and 1996, or members of Generation Z, born between the late 1990s and early 2000s, according to the consulting firm SocialSphere. They’re split nearly evenly between males and females.

Social media automation software firm Hootsuite says TikTok was the second-most downloaded app globally in 2022, trailing only Instagram. But TikTok was the most-downloaded app on the Apple App Store that year, HootSuite says.