The SCEPTICAL INVESTOR

GOING AGAINST THE CROWD

Investing in Gold

The World of Cryptos

Silicon Valley Syndrome: How to improve your posture

The Magazine of the Elite Investor Club September 2019 £5.95

LIFESTYLE

www.eliteinvestorclub.com

A CELEBRATION OF ACHIEVEMENTS BY ITS MEMBERS AND PARTNERS

WEDNESDAY 20TH NOVEMBER 2019

THE VICTORY SERVICES CLUB, LONDON W2

3 COURSE DINNER & GUEST SPEAKER

SNOOKER CHAMPION DENNIS TAYLOR

TICKETS £99 (£10 DONATED TO HELP FOR HEROES )

NOW IN ITS 4TH YEAR, THE ELITE INVESTOR CLUB IS PLEASED TO PRESENT… ELITEINVESTORCLUB.COM/AWARDS

2019 ELITE AWARDS EVENING

From the Editor W

elcome to our September edition and I hope you all had a good summer break. We kicked our summer off with a week in Montenegro, which is a very beautiful country. If you like lots of mountains and lakes, as well as wonderful coastal resorts, then I’d recommend visiting. Our first clients have completed their inspection trips over the summer and have come back excited at discovering this jewel of the Adriatic. You can see more at montenegroproperty.co.uk

Now it's all systems go for autumn, and we’ve got four events lined up in the diary so far. See page 17 for more details. Also kudos to Graham for passing the 10,000 subscriber level on our Youtube channel, Elite Investor TV!

I’m delighted that we have John Stepek from Money Week speaking at our September event. John has just published a book called The Sceptical Investor and has kindly allowed us to use an extract from the book in this magazine, which you can read on page 4.

The final event for 2019 will be our Annual Awards evening, now in its fourth year. This is purely a social evening, so please bring along your partners and/or friends. It’s a chance to wine and dine and hear our guest speaker, snooker legend Dennis Taylor. Even if you don’t like snooker, Dennis has a reputation as a great after dinner speaker. Afterwards, you’ll be able to dance to our very own Elite DJ Paulie-W! Many of you will have seen Paul in action as MC at our Elite events, but he is a man of many talents. When he is not sorting out his HMOs or looking after lions in Africa (see our July edition), Paul likes to spin a bit of vinyl. He tells me that he is very empathetic to the music tastes of all age groups, so will cater for all eras!

As the last few months have seen a great leap in the price of gold, I thought it was time to include an article about Investing in Gold and gold miners, so I’m grateful to former Money Week and Agora expert Simon Popple for his article on page 14.

Finally on page 18, if you’re heading for later life (or ‘Life Two’ as author Don Ezra calls it), then Graham has 3 Killer Questions for you. Watch out also for more details about a special one day Second Life Summit that we’ll be holding in the second half of October. ◗

Daphne

Investing in Gold • Page 14

The Sceptical Investor • Page 4

Elite Lifestyle • Welcome 3

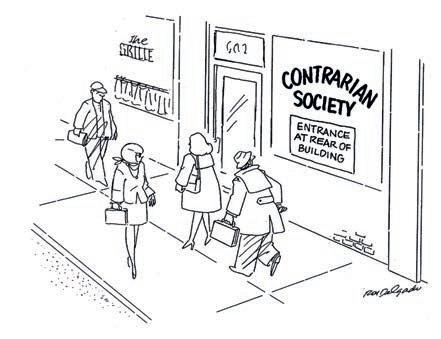

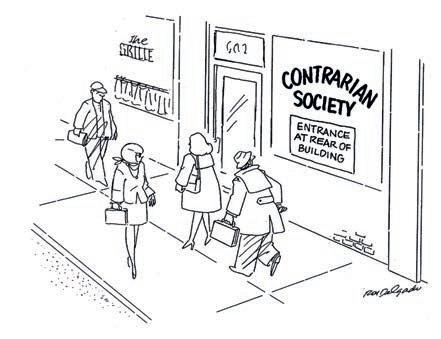

There are a great many forces in investment that push individuals to run with the crowd, from apathy to "career risk” (the fear fund managers have of being fired for underperforming) to peer pressure. That should spell opportunity for those who go against the crowd. The one problem – and it’s a big one – is that even if you know this, you will still struggle to escape your own desire to run with the herd when you are investing.

A behaviour model for crowd

As with any complex system, you can’t model the human mind perfectly. We’re a morass of conflicting, shifting desires affected by changes in both our internal environment and our interactions with our external environment. But we don’t need to go into complicated models of individual minds to get a good idea of how crowds work. There are just two key impulses to wrap your head around.

See John speak live on 26th September 2019

See Page 17 for details

The SCEPTICAL INVEST0R

They’re commonly described as ‘greed’ and ‘fear’. But I’m not so keen on those – both have very negative connotations. I prefer to say we have an expansionary impulse, and a contractionary one. When you are in an expansionary mood, your focus is on growing your wealth, grabbing a bigger piece of the cake, empire-building. When you are in contractionary mode, you want to hunker down, build walls, protect what is yours. These two impulses are in turn, driven by one simple fact: the knowledge that, one day, you will be dead.

When evolutionary psychologists and behavioural economists talk about what drives our herding instincts, they often hark back to the days when we were dwelling in Stone Age tribes out on the African savannah, at constant risk of being picked off by lions, or nibbling on some poisonous vegetation. The idea is that we are programmed to run with the crowd because it’s safer.

But there’s more to it than a simple evolutionary hangover. You don’t have to go back to the Stone Age to find unforgiving death lurking around every corner. Vaccines and antibiotics only became widely available to most people (in developed countries at that) in the middle of the last century. In 1924, four years before the discovery of penicillin, the 16-year-old son of the most powerful man in the world – US president Calvin Coolidge – died of septicaemia that resulted from a blister that developed on his toe while he was playing tennis in ill-fitting shoes. →

John Stepek

Elite Lifestyle • Cover Story 4

❝Leaving your ‘tribe’ incurs definite costs in return for uncertain gains, so switching out of a world view that has so far proved relatively successful is a huge risk.❞

5

Even today, even in the most advanced societies, life is unpredictable, and full of potentially lethal threats. And while all animals have a ‘fight or flight’ instinct when faced with life-threatening situations, only humans (as far as we can tell) have a sufficiently evolved brain to ‘bless’ us with an ever-present awareness of the inevitability of our own extinction. This fear may not always be at the forefront of our minds, but it’s never far away.

What does any fundamentally rational being crave in such an environment? It’s not happiness or contentment (although these may be desirable side-effects). It’s security and certainty. I want to keep myself and my loved ones safe, and I also want to know that after I am gone, the things that I value will persist (it doesn’t matter that I’ll be gone at that point – what matters is how I feel about that now, while I’m alive). To do that, I need to be able to do two things. I need to get out there and explore and master my environment in order to take advantage of opportunities that could make my life better and my situation more secure (the expansionary impulse), but I also need to be highly alert to danger and ready to raise my defences in response to threats to that security (the contractionary impulse).

Building and defending our models of the world

So how do we navigate an uncertain world? How do we impose order on the chaos around us? We look for elements that appear to be predictable – we seek patterns. We look for cause-and-effect rules that govern outcomes and can be used to influence them. If we know (or at least think we know) that “x” causes “y”, then we can increase our level of certainty in our worldview.

Some rules are governed by natural phenomenon – don’t fall off cliffs; don’t eat poisonous mushrooms. Some are instinctive (social animals such as humans and apes have been found to have an inherent sense of ‘fairness’, even although the world itself is clearly not naturally ‘fair’). But many of the most important ones are social (such as learning the conventions for crossing a road or transacting with one another). And the critical point is that we don’t formulate these world views alone. They are passed down from our parents, and reinforced by our schools, friends, co-religionists and colleagues. In fact, historian Yuval Noah Harari, in his

Elite Lifestyle • Cover Story 6

❝Shiller believes that “the prevalence and vividness of certain stories” may even have more bearing on the length and depth of a recession, say, than specific economic factors (as people react to their belief in stories by amending their behaviour accordingly).❞

recent bestselling book Sapiens, argues that this ability to create and believe in epic, society-spanning shared world views – from religions to legal systems to money itself (which ultimately derives its value from our belief in it, and the social structures that give everyone the confidence to rely upon it) – is key to our spectacular success as a species.

You can call them stories, as Harari does, or you can call them social structures, or you can think of them as rules for a particularly complicated board game. But however you describe them, they are all systems that human beings have invented to enable us to co-operate in a more mutually beneficial way – and our brains are wired to be receptive to information presented like this.

Terror Management Theory and investing

The thing is, natural rules work regardless of how you feel about them – you don’t argue with gravity. But social structures only work because everyone buys into them. Your shared values keep you safe. The values of others could disrupt the social cohesion that underwrites that sense of safety. Note that it doesn’t matter whether adopting another set of values might improve your life – leaving your ‘tribe’ incurs definite costs in return for uncertain gains, so switching out of a world view that has so far proved relatively successful is a huge risk. And make no mistake – the psychological stakes are extremely high. It really is a matter of life or death.

The idea that the awareness of our own mortality has a major impact on our behaviour – “terror management theory” – was pioneered by Abram Rosenblatt and Jeff Greenberg of the University of Arizona, building on the ideas of anthropologist Ernest Becker. And countless studies (outlined in a very readable book, The Worm at the Core, by Sheldon Solomon, Greenberg and Tom Pyszczynski) have shown how it affects our actions.

On the one hand, thoughts of death make us defend our existing world view and cultural standards more aggressively against ‘outside’ views. In a 1987 experiment, for example, a group of municipal court judges in the US were asked to set bail for a hypothetical case in which a woman had been charged

with prostitution. Half of the judges were given a questionnaire probing their beliefs and feelings about death before doing so, while the others were not. The latter group set bail at $50, the average for the crime at the time. Those judges who had been “primed” with thoughts of death, however, set a far higher average bail of $455. In other words, a simple reminder of their mortality drove the judges to uphold the moral standards of their culture more aggressively.

In another experiment, noted Greenberg in a 2012 interview with the Atlantic, “simply subliminally flashing the word ‘death’ on a computer screen to Americans for 28 milliseconds is enough to amplify negative reactions to an author who criticizes the US.” In short, notes Greenberg, “when death is close to mind… people become more adamant in their beliefs… They increase prejudice and aggression against others who are different.”

It also works the other way around. In another study, Canadian subjects were asked to read essays that either belittled Canadian society or Australian society. They were then asked to play a speciallydesigned anagram game. The subjects who had read the attack on their own values produced more death-related words in the anagram game than those who had read the attack on Australia. In other words, having their world view attacked brought thoughts of death and vulnerability closer to the surface.

Look at it this way, and you can see why we have such a strong desire to go along with the ‘in group’ and be sceptical or downright hostile towards the ‘out group’. You need only look at the tone of the debate over something like Brexit, or Donald Trump, to see just how aggressive or histrionic people can become when they feel that their fundamental world view is being challenged. It's because we view it literally as a matter of mortal peril.

What this means for investment

What implications does this have for investment psychology and for contrarian investing in particular? Firstly, our desire for certainty and acceptance discourages us from going against the prevailing wisdom, particularly when it’s espoused by ‘people like us’. So when other investors are in expansionary mode – when they’re feeling greedy – we want to do the same, because we don’t want to miss out or get left behind. Similarly, when they’re in

contractionary mode – when they’re afraid – we’d rather be on the same side too. Ultimately the market expresses a number of competing world views – as participants in the market it’s our natural desire to get on the same side as the most dominant one. As Gustave Le Bon wrote in his 1895 book, Psychologie des foules (The Crowd): “Ideas, sentiments, emotions, and beliefs possess in crowds a contagious power as intense as that of microbes”.

Secondly, our instinctive patternspotting and craving for explanations makes us suckers for a good story. Stories are after all, just large, complicated patterns – convincingly embroidered tapestries of cause and effect. Some are based on fundamental data; others are constructed after the fact to explain a market move that’s already happened; and most are a combination of the two. This tendency is something that Nobel-winning Yale finance professor Robert Shiller calls the “narrative fallacy”. In his 2017 paper, ‘Narrative Economics’, he points out that “the human brain has always been highly tuned towards narratives, whether factual or not, to justify ongoing actions, even such basic actions as spending and investing. Stories motivate and connect activities to deeply felt values and needs.” Indeed, Shiller believes that “the prevalence and vividness of certain stories” may even have more bearing on the length and depth of a recession, say, than specific economic factors (as people react to their belief in stories by amending their behaviour accordingly). ◗

7

John Stepek

CRYPTO: What's Going On?

In Feb 2017, I spent a lot of time and effort in making (what many people said) the best Basic Crypto Investing course in Europe. Of course, that's subjective, but it definitely was Europe's only CPD accredited crypto course at the time, long before universities jumped onto the bandwagon. And for £347 and over 12 hours worth of video, it was a bargain.

In it, there were a bunch of strategies which proved really fortuitous. I used them myself and turned a public £25k account up to $1.1m in about 4 months.

Of course the critics will say, "2017 was a massive bull year, any monkey could just HODL and make a fortune." Yes, I agree. But my methods made 4300% ROI which was a lot higher than simply buying ICOs at random and hoping and HODLing.

Anywho, the other day I logged onto my portal to have a look at this course and was simply flabbergasted. The whole course is now pretty much defunct and way out of date. The basics of Cryptos and some of the strategies are still relevant, but the market has evolved SO MUCH in just two years.

The market is changing so fast that if I were to keep up, I'd have to update the course every 3-6 months! To put this in perspective, I update my Currency Trading programme every 3-4 years. And even then, I simply tweak bits and pieces.

So if someone like me (15 years of trading under my belt) struggles to keep abreast of all the changes, how on earth is a normal person supposed to cope? It's literally a full-time job. But I've come to an odd conclusion;

❝

Don’t be that dog! 99% of the things emerging or that the media grabs hold onto is irrelevant noise! ❞

Elite Lifestyle • Money 8

Siam Kidd

DON'T keep up with it... It's pointless and futile.

It’s all noise. You’re no different to a dog chasing cars. And when a dog finally catches up with a car, what does it do?

It just sits there barking at it. It’s the same for Crypto dabblers. They chase the news and when they’ve discovered some new event, they get all in a fluster and probably do something stupid. So don’t be a Crypto dog.

So what if a major exchange gets hacked? This is expected! And you shouldn’t store your cryptos in an exchange in the first place!

So what if a major Government hauls in a major Crypto CEO over the coals and grills them and launches a massive anti-crypto campaign? This is expected! It’s only going to cause temporary price fluctuations.

So what if there’s a new fancy pants tech-fandangled Crypto project ICO/ STO brewing in the background? This is expected! They’re a dime a dozen. New crazy tech takes a minimum of a decade to implement! Hell, DARPA (the sneaky beaky science branch of the US) developed the Respirocyte in 2009 which is an artificial red blood cell. It’s 240 times more effective than a red blood cell and supposedly helps you hold your breath for four hours or sprint for 15 minutes straight! Totally bonkers and hard to believe. 10 years later, where is it? In 2004, Graphene was discovered. It’s going to be the material of the future, but it’s still in the labs. The same will apply to crazy new Crypto tech. just research the Gartner Hype Cycle.

So what if a major Government/Bank launches its own Crypto? This is expected! Of course the world nations will do this. If you can’t beat them, what do you do? You join them. WRONG! You slander them, you beat them up, you threaten them, you suppress them, you dominate them, you get the public to mock them and then you own and control the space on your own terms. Sounds brutal right? It’s the sad but true playbook deployed by governments and intelligence agencies for hundreds of years.

So what if Bitcoin or any other Crypto crashes 90%? Or rallies 900%? This is expected! Don’t chase the price. You should have no more than 10% of your net liquid worth in Cryptos so these silly price swings shouldn’t make you feel depressed. Hell, you don’t check the price of your house every 10 minutes, do you? You’d be a chronic depressant otherwise. Especially if you’ve just bought a house. You’re massively down on the stamp duty, numerous fees and bank interest for the best part of a decade in most cases. Finally, so what if a behemoth of a company like Facebook tries to launch its own Crypto? This is expected! In my book (The Crypto Book), I mentioned Facebook and their potential plans in depth and that this is inevitable. Also it won’t just be Facebook. Do you really think everyone else of that ilk will just applaud them and go “Nice one Zucks. You beat us to it! Congrats on becoming King of Earth.” Errr no. Just give it time, we’ll see Google, Apple, Microsoft, Amazon, Disney and any other massive international corporation launch their own.

So what’s the overriding message of this article? Simple:

1. Don’t chase the news or price of Cryptos. Don’t be that dog! 99% of the things emerging or that the media grabs hold onto is irrelevant noise! Reallocate your time and attention to revenue generating activities!

2. Only have up to 10% of your liquid net worth in Cryptos and be prepared to wait 3-10 years for it to moon and turn into the Lambo of your dreams.

3. WHEN your stash becomes Lambolevel of profits, don’t be an idiot and buy a Lambo. (Buy a Tesla!) Splashing it on a depreciating toy is what a 23-year-old Siam would have done. When I was 23, I made £80k from trading in about two weeks. So I splashed £60k on a beautiful Aston Martin V8 Vantage and then wasted £20k trying to turn that £20k into £200k! What a tit!

4. Instead, use that personal net worth leap-frog lottery win to generate long lasting wealth! Use it to buy LAND and BUSINESSES! Construction 3D Printing will inevitably run amok with Property prices, but you still need the land to print buildings on. So I am going to simply divest my crypto lottery wins into land and cashflow-generating businesses! You need to be obsessed with converting your CAPITAL INTO CASHFLOW! That’s the true path to wealth. Then use that cashflow to blow on a new Tesla Roadster with the Space X upgrade and a Space X ticket to orbit the Earth. www.TheWap.org will help you set up an online business. ◗

9

SILICON VALLEY SYNDROME

The incidence of Silicon Valley Syndrome in Singapore’s working population is 8090% so, in all likelihood, this probably means that this is something you have or will develop.

When we first saw this condition back in the 90s in Northern California, we named it Silicon Valley Syndrome. Now it is world wide; you can call it ‘Text-Neck’, ‘Turkey-Neck’ or ‘Hunchback’. We can also call it ‘Computer Posture’ but it’s all semantics. They are all the same thing and it is everywhere you look. Chances are… you’ve got it too. Read on and lets see.

Stiff neck and tight, tight shoulders? Not the shoulder joint itself but that bit on the top edge of your shoulder blade. Sometimes it goes down the spine and you think that this is what it must be like to be old. It improves at the weekends but settling back at your workstation on Monday, you just know its coming back with a vengeance.

As it worsens during the day with every hour at your screen, you rub and poke and try to get your fingers into the muscles to make them release. You rotate your neck and windmill your arms. That doesn’t seem to do much either. Then the burning starts across the upper back and now it’s only a matter of time before the numbing sensation or those dreadful pins and needles appear in the fingers or spread down the arm.

What about function? That’s being lost too, I’m afraid. Is it becoming harder to pull something over your head, perhaps your polo or a sweater, or maybe that bra strap is starting to cause problems? What about reversing the car? This stiffening surely isn’t good and it definitely makes you feel old before your time.

They say that 40 is the new 30, then why at 30 do you sometimes feel 50? And just why can’t you turn your neck like before? And those recurring headaches, the ones that the GP says are ‘stress or tension’; are they getting worse? Are the Panadol 500’s still doing the trick?

Well, welcome to working life in Singapore. Your pain goes with those twelve hour working days… and it IS telling you something. Is it stress? That’s what they tell you it is. Well, it’s not the stress you’re thinking about. It’s actually physical stress mostly. The greatest stress on your body is the physical stress of gravity acting on a slouching spine.

Of course we are designed to live in gravity, ask NASA – you can’t live without it. But you must be aligned for efficiency or there’s going to be trouble. That tension you are feeling across your shoulders is the accumulation of gravitational forces after years of slouching at your computer. This is the main stress you feel and it shouldn’t be ignored or the consequences can be quite catastrophic, especially if you end up getting nerve involvement and talking to an orthopedic surgeon.

Tim Errington

❝It’s only a matter of time before the numbing sensation or those dreadful pins and needles appear in the fingers or spread down the arm.❞

Elite Lifestyle • Health 10

Of course, the other stresses in your life don’t help – public transport, traffic, parking charges, neighbours, politics, taxes. You name it, they all contribute. And, yes, it is official, we in Singapore work the longest hours in the world. Stress is cumulative and increasingly something seems to tip you over the edge bringing back that familiar pain.

So what exactly is Silicon Valley Syndrome?

Well, basically your head is creeping forward on your shoulders as you slouch at your screen hour after hour. Your neck is straightening and the weight of your head has moved forward onto the discs. Disc degeneration is starting and eventual structural failure is what your body is concerned about, hence the pain. The head is becoming heavier due to leverage and physics and the shoulder muscles have to cope. Your body will try everything to protect its nerves and as the spinal cord comes under tension and the delicate nerves that leave your spine between the vertebrae are pinched, stretched and twisted, the muscles are instructed to tighten even more to immobilise or splint. Gradually, the muscles will lose their elasticity and reduced function becomes permanent.

Total

Chiropractic,

Tel: +65 6224 6326

Worryingly, the symptoms can be far reaching because the nervous system controls everything. Digestive disorders are extremely common, headaches and dizziness of course, depressed immunity and reduced vital capacity (breathing).

A quick posture test for you

Push your head forward into really bad posture and take a deep breath. Now pull your head back onto your shoulder, standing tall and take a deep breath. Feel the difference? This is your brain stem being stressed. Imagine it like this all the time, the loss of oxygen supply to your cells, organs and tissues. Think – did you ever see anyone with poor posture running up a flight of stairs? Probably not!

And why so much fatigue? Well, this incessant muscle contraction is an enormous waste of your energy supply.

The muscles just don’t let go – ever! Try showing me your bicep – now hold that muscle contraction. How about holding it for a day, or a week. Imagine you can’t ever let it go? Well that’s just what is going on across the top of your back and shoulders. This IS what is causing your fatigue and a good reason for your waking up exhausted each morning.

If you don’t do anything, what’s next?

Arthritis is next I’m afraid – premature spinal aging. Over 80% of you will get spinal arthritis yet it can never be considered normal. It is mostly due to your vertebrae being locked by spinal misalignment →

Dr Tim Errington

Dr Tim Errington

11

Health

Singapore

(generally poor posture). e vertebrae begin to change their shape as bone spurs form. ese irritate the surrounding tissues and will eventually block the nerves.

at tingling down the arms tells you the nerves are being irritated; numbness means the nerves are being pinched. A medical emergency is on the way and pain will tell you that your body is concerned.

at nagging pain was never the real problem. It was just trying to save you, give you a gentle nudge. Your body certainly knows that if you stay on the wrong track for too long, you WILL end up somewhere you really don’t want to be. e problem was the premature degeneration, the loss of function, the stressed nervous system and the impending health collapse; that’s what the pain was all about!

What are the solutions for Silicon Valley Syndrome?

You need to make changes. Make sure your spine maintains its healthy balance which means it must keep its shape. Your neck curve is there for a reason, as a shock absorber for your heavy ‘bowling ball’ head. Do what you can to get your head back on your shoulders and for this you will almost certainly need the right chiropractor to assist. Without the right intervention your spine stays painful and locked. It needs recognising and unlocking.

My advice – nd the right doctor, one who knows when to recommend X-rays, one who can read the X-ray, explain the X-ray and work from the X-ray. You don’t want guessers and you don’t want ‘one x for all’. Your spine is unique and the person who needs to know what’s going on is you.

You need adjusting, precise and focused, and frequently enough to evoke real change. And, of course, you’ll need some stretching, maybe some gentle traction and of course some stability work so it stays put. Of course it takes a little initiative but anything worthwhile does.

Once your normal shape and movement is restored the healing powers inside you will do the rest. Pressure will come o the nerves, all manner of health improvements can be expected and you’ll get your youth back. More than that; you can cancel that rocking chair because you’re going to get back your sixties, seventies and eighties.

Who else can help you?

Until you nally recognize what it is and understand the cause, there is no solution. Certainly surgery is not the answer, as cutting away a bit of the arthritis to take some pressure o the nerves doesn’t even slow the process. It merely gives temporary relief. e drugs don’t work as they just block the pain. is is hugely dangerous as the process continues and things are going to get much, much, worse.

You may get a little symptomatic relief from a massage, or acupuncture, or ‘cupping’, or electric stimulation or even some magic lotion. However, if you have Silicon Valley Syndrome and someone says they can x it, if they are not addressing the cause (see above) then you are only looking at a little symptomatic relief at best. ere are many, many symptom alleviators out there and it’s a very good repeat business.

How long is it going to take? is very much depends on you. How late have you left it? How much arthritis is there? How much overlying muscle? How much pain? How much loss of conditioning and, of course, your commitment to change? How willing will you be to make daily changes and to kick the bad habits that caused the problem in the rst place? Anything from four weeks to six months, or then again maybe never; it really depends on where you are and how much you want it.

Still a sceptic?

If you live in Singapore, I invite you to come and talk to us, bring in your X-rays and let us explain them to you, attend our spinal health class or read our testimonials. We have helped literally thousands with these problems and our success is exceptional. You have but one life. It is yours to get the most out of, and your spine will determine how you are going to age. No regrets later! We urge you to take a proactive approach with your health and allow us to help you ensure a better future for yourself and for your family. ◗

❝

Elite Lifestyle • Health 12

Worryingly, the symptoms can be far reaching because the nervous system controls everything.❞

The Tangle in Taipei

Graham Rowan

For more of Graham's opinions, visit: www.eliteinvestorclub.com/opinion

With the hand-wringing over the melt-down in Neil Woodford’s Patient Capital Fund, something big may have flown under your radar.

It seems we’ve all climbed on board Dr Who’s Tardis and been whisked back to 2017. The price of Bitcoin is up over 250% year to date, hitting highs around $11,800. Still nowhere near its all time high, but impressive nonetheless.

Another bubble or, is it time to dust off those favourite words of the devotee, ‘this time it’s different’?

The financial establishment is once again forced to take sides. Having said he ‘didn’t give a sh*t’ about Bitcoin at a conference last October, JP Morgan boss Jamie Dimon promptly oversaw the launch of his own bank’s crypto coin shortly afterwards.

The big banks’ currency traders would love to get involved because high margins and high volatility equals high bonusses. But it’s still a tiny market worth just $400 million a day compared to the $5 trillion a day traded on the forex market for grown-ups.

With the Fed and the Bank Of England making noises about interest rate cuts, there is now almost $13 trillion of government bonds giving a negative return. That’s making gold and cash under the mattress attractive again as a zero yield is better than a negative one. Gold just made a six year high above $1400 an ounce, with investors increasingly bracketing the yellow metal and Bitcoin in the same asset class as uncorrelated stores of value.

There’s also the recent news from Mr Zuckerberg that he would like to gather even more information on us through the launch of his own digital coin, Libra. Given it will be pegged to a mix of real currencies to keep its value stable, I’m not sure it can be regarded as a ‘pure’ crypto. Mind you, even a cent or two taken in payment processing fees

from 2 billion users worldwide is going to add up to a useful chunk of change.

Would you buy or hold shares in the big banks with all this going on? One of the biggest profit centres for banks remains foreign currency broking. Money Week editor and FT columnist Merryn Somerset Webb recently said ‘we need a product that fully disrupts the woefully inefficient global payments system and starts to break the power of the big banks’. A new fintech platform that I am involved with is going to do just that in the non-crypto world –those with reasonably deep pockets will be receiving a letter from me about it soon.

The conflict between believers and sceptics will come to a head soon in a conference in Taiwan being billed as

‘the Tangle In Taipei’. The heavyweights in the ring will be Arthur Hayes, a former ‘serious’ trader at Deutsche Bank who now runs a crypto exchange and Nouriel Roubini, who continues to insist that Bitcoin is a bubble waiting for a pin.

While the jury may be out on whether Bitcoin is destined to become a serious asset class, there’s a lot more certainty that the underlying blockchain technology is a big leap forward. Will it be cash, digital coins or coloured beads that we end up transmitting across the blockchain with its absence of third parties, speed and transparency of audit?

That, dear reader, is the $64,000 question. Or do I mean the 5.4237288136 Bitcoin question? ◗

❝Money Week editor and FT columnist

Merryn Somerset Webb recently said ‘we need a product that fully disrupts the woefully inefficient global payments system and starts to break the power of the big banks’. ❞

13 Elite Lifestyle • Opinion

INVESTING IN

GOLD

You’d have to be living under a rock to not be aware about the gold price. Trade wars and real wars lead to uncertainty. Gold being certainty in the real world. Not surprisingly, the price has been going up. Even though it has a new neighbour in Bitcoin, somewhat ironically depicted as a gold coin. Gold has not lost its safe haven status.

Why the hike in prices?

I think there are really two factors at play here. Each impacting different types of investors. Let’s look at each of these in turn.

First of all we’ve got the baby boomers. They’re retiring and in search of income. This is not a good time to be doing that.

As you can see in Figure 1, most bonds are either offering a negative or tiny yield. There are three concerns here. Firstly, many bonds are not generating enough income to live off. You have to eat into your capital to do that, leaving uncertainty about the future. What will you be left with? Secondly, if we get inflation, you’re tied into a fixed income instrument which could be going south at some pace. Finally, the reason for such low yields is

invariably very high priced bonds. So if the bond price falls, you’re capital is worth less, so back to point one. Personally, all this makes me a little nervous.

But income (or lack of it) is only part of the story. People must also protect their purchasing power. If we get inflation you still need to be able to afford stuff. Doubling your money doesn’t mean much if it’s worth less and you can’t buy what you need. Gold has often been viewed as a way of protecting your purchasing power. And although that’s not always been the case, because you can’t print it, it’s not unreasonable to assume that you’ve got more chance of preserving your purchasing power with it, rather than without.

Putting the income hunters and wealth protectors to one side, you’ve also got the speculators. If you compare where we are now with what happened in the 1970s bull market, you could be forgiven for getting quite excited.

Take a look at Figure 2, which compares the current bull market to where we were in the 1970s. Just look at where the red line is.

Now, if you’re losing money on your fixed income holding or worried about the equity markets, it’s no wonder the gold price is catching a bit of a bid.

Alhough it’s now north of US$1,450 per ounce, if you cast your mind back to 2011, it was as high as $1,895 per ounce. Some distance from where we are today.

What’s getting people really excited is the mining sector. In the last gold bull market some mining stocks went up 10x, 50x even 100x. Literally making →

Simon Popple

Elite Lifestyle • Gold 14

❝

15

Doubling your money doesn’t mean much if it’s worth less and you can’t buy want you need.❞

fortunes for those that got it right. One of the reasons some stocks really took off is because of the leverage to the gold price.

Let me explain…

The average All-In Sustainable Cost for a Gold miner is around US$1,000 per ounce. With a gold price of US$1,400 per ounce, that's a profit to our mining company of US$400 per ounce.

Let's say the gold price moves up 20% to $1,680 per ounce (the average price in September 2011 was US$1,772 per ounce), then although costs are likely to rise, they are unlikely to rise by the same amount. Let's say they move up 10% to US$1,100 per ounce. This would provide a notional profit of $580. An increase of 45%.

In this example, a 20% increase in the gold price has delivered a 45% increase in profitability. Imagine what would happen to the mining stocks. In fact, don't imagine –look at the mining stocks in 2009, 2010 and 2011. There was a lot of money to be made.

If you want to get involved. It makes sense to have a system, which is where I'd like to help. Not only will I walk you through it, but also open the door to my detailed knowledge of the mining shares, especially the Juniors, where share price performance can literally be can life changing.

Even if you've invested in gold before, my aim is to introduce you to companies you're not familiar with. Try and find the next Apple or Amazon in the gold sector.

Gold investment has been around for thousands of years, but over our lifetime the focus has been on other things. I think that's about to change.

This is how the B.R.I.D.G.E. system works:

Balance sheet – make sure this is right for the company Resources – what do they already have?

Infrastructure – if it's not already in place, they'll likely have to pay for it Diversity – you don't want all your eggs in one basket Grade – is it economic?

Exploration – what's the potential to find more gold?

Not only do I try and help you find the right stocks, but I also pass on my

experience of investing in the sector. Sometimes it’s very tempting to exit a winning position, but if you do that too soon you could be swapping a 2x gain for something potentially much bigger.

My newsletter, the Brookville Capital Newsletter tries to take care of anyone who happens to be interested in gold. There’s a lot of free information on my website www.brookvillecapital.com which you’re more than welcome to sift through.

If you’d like a couple of free editions then please contact The Elite Investor Club at support@eliteinvestorclub.com and I’ll make sure you get something. ◗

❝

B R I D G E Elite Lifestyle • Gold 16

Even if you've invested in gold before, my aim is to introduce you to companies you're not familiar with.❞

Forthcoming EVENTS at

Thursday 26th September

CLUB EVENING: With guest speaker John Stepek, Executive Editor of Money Week, Baker Street, London W1. The first 50 to reserve tickets will receive a FREE copy of John’s new book. The Sceptical Investor. Plus wine, canapés and a talk from Graham as we approach a certain Halloween deadline. Get your £20 ticket at eliteinvestorclub.com/sceptical-investor

Wednesday 16th October

BOARDROOM BREAKFAST: Our guest speaker is a real life hero decorated for his SAS work in Iraq and Afghanistan. Since then Floyd Woodrow MBE AAA has led the Cobra anti-terror group, become a success in the business world and an author and speaker on leadership. Join us at the Victory Services Club near Marble Arch to hear Floyd’s story and pick up some elite leadership skills. Tickets at eliteinvestorclub.com/breakfast

Late October (date & venue TBC) SECOND LIFE SUMMIT: A unique all day event aimed at helping the over 50s to maximise their health and wealth in the best years of their lives. An exciting line-up of speakers that you won’t want to miss.

Wednesday 20th November

THE 4TH ANNUAL ELITE AWARDS: With guest speaker, snooker legend Dennis Taylor. At the Victory Services Club in Marble Arch, each £99 ticket includes a donation to Help for Heroes. Champagne reception, 3 course dinner, after dinner speaker, the awards ceremony then dancing to DJ Paul Watson. Tickets at eliteinvestorclub.com/awards

Check Out Our Youtube Channel

Elite Investor TV now has over 10,000 subscribers and a wide range of video playlists waiting to entertain, educate and inform. The latest playlist is Elite Insights, a series of short videos on everything from investment to politics to pets. Go to Youtube.com and search ‘Elite Investor TV’. Recent titles include:

• The Tammy Wynette Conundrum

• It’s Not Just Facebook Spying On You

• Mind The Advice Gap

• Mars Bars For Your Dog?

17 Elite Lifestyle • Events

❝An exciting line-up of speakers that you won’t want to miss.❞

KILLER QUESTIONS

For more of Graham's opinions, visit: www.eliteinvestorclub.com/opinion

Words like ‘retirement’ and ‘pension’ are a big turn off to most people. Depending on their age and circumstances, the very thought of later life produces boredom in some and panic in others.

I’m always looking for ways to make thinking ahead more attractive, so kudos to Don Ezra who’s coined a new term –Life Two.

Life One is the career that you studied hard for, spent decades climbing the ladder in and stressed over ever-bigger houses, cars and school fees. Life Two is the chance to change all that and start again.

The trouble, as Don rightly points out, is that there’s nowhere to go for your Life Two education. We don’t receive a financial education at any point during Life One, so why should we expect that to change as we prepare for the best years of our lives?

Lots of surveys have found that we are happier in later years than middle years, as we start to realise that traditional measures of success don’t really satisfy. For some of us, that leads to more focus on our spiritual development. For others, it may be a desire to make a difference through charity work or local politics.

I’ve always maintained that you don’t just retire ‘from’ something, you need to retire ‘to’ something.

Ezra supports that by arguing that there are three main fears that we need to tackle if we want to live well in later life:

• The psychological – if my focus has been on my career or my business, what happens when I give it up? Will I lose my identity?

• The practical – what will I do all day? How will I spend all this new free time?

• The financial – will I run out of money before I run out of life?

To help prepare people for addressing these fears Ezra asks three killer questions:

• If money was no object how would you live your life?

• If you were told you had between 5 and 10 years to live, how would you change your life?

• If you were told you only have 24 hours to live, what would be your regrets?

Wow. If that doesn’t get you thinking on a profound level, it’s time to check your pulse. He suggest seven ‘Asset Classes’ which should help to achieve a more balanced view of a successful life:

• Financial

• Family

• Friends

• Work

• Play

• Physical health

• Mental and spiritual health

Why not do an inventory of where you stand in each asset class? Then come up with a plan to work on all seven as you prepare to enrich your later years. I don’t believe in reincarnation. But I do like the idea of living Life Two straight after Life One. What a great opportunity to correct the mistakes I made the first time around… ◗

Elite Lifestyle • Opinion 18

Graham Rowan

Here we are at the final letter in our special alphabet of the A to Z of Investing…

And yes, I’ve even found an important lesson to learn with one of the most challenging letters. Because Z stands for the Zulu Principle.

For many people the word Zulu might conjure up an old Michael Caine film about the tribe of 30,000 warriors in South Africa. If you’re a policeman you might use zulu to confirm the letter z on a car number plate. But I have a far more interesting use of the word to share with you that could make you very wealthy indeed.

I want to tell you about the Zulu principle first articulated by investment guru the late Jim Slater more than twenty years ago. He coined the name after watching how his wife went about learning all she could about the Zulu tribe in Africa. Because the subject was so narrow, by studying it in depth she quickly became a global expert who could pit her knowledge against anyone on the planet.

Jim decided to apply the same approach to investing. Focus all your energy on one specific sector of the market and study it in depth. Malcolm Gladwell reckons that it takes 10,000 hours of study to become an expert in any topic. Imagine what you could know about one area of investing after that amount of research!.

Zulu Pri n ciple stands for

In Jim’s case he decided to focus on small companies that have been under valued by the market. If the brokers and analysts are not following a stock, you are more likely to pick up a company with great potential at a bargain price while it is still flying under the radar. To help him find these stocks Jim developed a number of criteria to screen out the dross and point him in the direction of the cream of the crop.

Start by looking for a low price earnings ratio relative to growth, strong cash flow and manageable gearing, a significant competitive advantage which will almost certainly lead to strong return on capital employed and good operating margins relative to the industry the company operates in.

See if the directors are buying rather than selling shares in the company, look for a market capitalisation in the £30 million to £250 million range and ideally the first signs of a dividend being paid to shareholders. Finally, look for something new that could trigger a growth spurt like a new CEO or a product launch.

That may sound like a lot of research. So the $64,000 question is, does it work?

From the results I’ve seen, I’d have to say yes. Irish stockbrokers Merrion backtested a Zulu Principle portfolio of stocks over nine and a half years from October 1994 and reviewed it every six months. In October 2004 they concluded that

a Zulu Principle portfolio would have delivered a compound annual growth rate of 24.5% compared to just 4.4% for the FTSE All Share index.

The good news is you don’t have to do all the leg work yourself. You can apply a Zulu Principle stock screener on sites like Stockopedia and it will produce a list of shares that meet the criteria. Don’t be surprised if it’s a small list. But, on the subject of returns on small stocks, Andrew Craig shared a startling statistic at the 2015 Elite Investor Summit. He had recently spoken with a fund manager who specialises in smaller companies and had just completed some research with two London Business School Professors. They found that the annualised return on London-listed UK smaller companies from 1955 to 2015 was no less than 16.8%. Compound those returns across the decades and a modest investment would make you a multi-millionaire.

You see, there are loads of ways to achieve financial independence. I’ve covered 26 of them in this A to Z series. What matters is that, once you’ve done your research and decided on a strategy, you develop the discipline to stick with it and to continue regular investing.

Whether you take Andrew Craig’s broad diversification strategy expressed in How To Own The World or the narrow focus on small companies in Jim Slater’s Zulu Principle, recognise the commonality. The reason these people become successful is as much to do with stickability and calm emotions as it is anything to do with the specific strategy. ◗

❝

Elite Lifestyle • A-Z of Investing 19

It takes 10,000 hours of study to become an expert in any topic.❞

• A climate to rival the Mediterranean

• Exclusive developments that will take your breath away

• High end facilities including spas, private pools and marinas

• Rental programmes to provide a return on your investment

• Reclaim 21% VAT by setting up a local company

• Our English speaking team is waiting to design your bespoke tour

Create enduring family memories in a beautiful location that is only just being discovered by Europe’s most discerning buyers. Come and see. You won’t be disappointed.

ADRIATIC EXCLUSIVES Brought to you by Elite Investor Club Montenegro London office: +44 (0) 20 8940 7000 support@eliteinvestorclub.com Learn more at adriaticexclusives.com YOUR HOLIDAY HOME AWAITS YOU IN EUROPE’S BEST KEPT SECRET…

Adriatic See us on Stand 37a at the Luxury Property Show

MONTENEGRO Jewel of the

Dr Tim Errington

Dr Tim Errington