8 minute read

OUR SURVEY SAYS

Darren Haine, Unity Printworks, Frome Flyers, Somerset.

Five packs of Fedrigoni’s Sirio White White.Ideal for ideal for packaging, covers, business cards, invites, and coordinated graphic materials: Tori, Signs Express, Bromsgrove.

Four boxes HP Paper International Paper: Richard Porter, Chapel Press, Stockport.

https://greatbritishprintsurvey.com

SURVEY Q&AS 1 How do you feel about the future for your business?

The ‘very positive’ response increased over the future from 11.3% at three months to 24.39% over the next two years. With ‘quite positive’ recording a rise of 34.09% to 48.78% over the same forecast. On a sliding scale for this question only 2.44% registered a ‘very negative’ response over the next two years.

2. Are you likely to or have you made changes to staffing numbers?

Great to see that staff requirements returned a Pre-Covid result of 47.62% staying the same level. An increase forecast of 9.52%, remain the same at 38.1% and finally plans to reduce the number of staff at only 4.76%

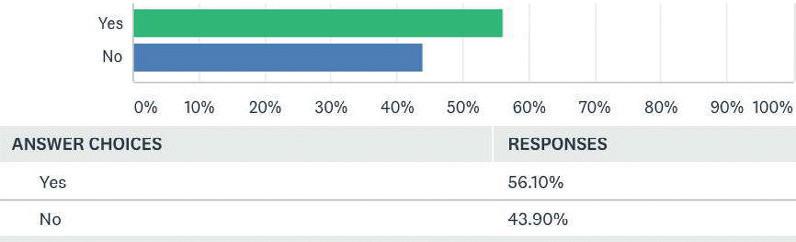

3. Have you used the UK Government’s Coronavirus Job Retention Scheme (Furlough)?

Surprisingly only 56.1% of survey responses have taken advantage of the furlough support, maybe more print businesses have been open with critical printing of Covid warning signage than we first thought?

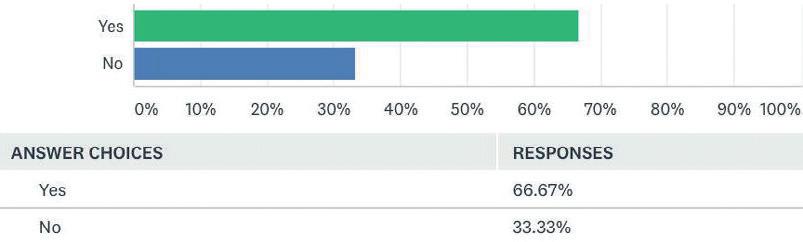

4. With these current challenges due to COVID-19, will your business diversify into new sectors such as signage, labels, packaging, workwear etc?

Well, the yeahs win this one with 66.67%.

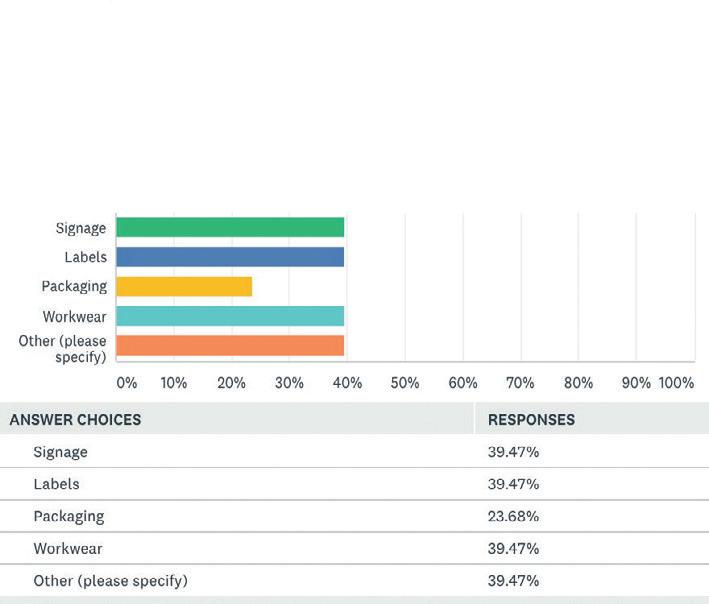

5. If yes, which ones would you consider to be

Pooled experience from fellow quick print pros is published here to share the benefit across the whole of the UK’s frontline print industry.

A huge thank you goes out to our favourite suppliers who donated prizes to our completed survey contributors. Mind you we are all winners by checking the temperature of our part of the print industry from this group feedback.

THE 2020 GREAT BRITISH PRINT SURVEY PRIZE WINNERS

Epson EcoTank ET-2750. Ideal for working from home or small offices. 3-in-1 cartridgefree printer with LCD screen. The included ink is equivalent to 72 cartridges (RRP £349.99): Christopher Smith at Vibrant Colour, Huntington.

Pantone Gifts: (x4 recipients): Andrew Wilson, Time 2 Display, Fordingbridge, Hampshire; Kevin Smith, Harmony Creative Print, Minstead, Lyndhurst; John Stevenson, Glasgow Creative Design & Print, Glasgow; and C Bircumshaw, SynchroPrint, Northwich.

Antalis, £200 of digital print paper stock: Phil Earle, Swiftprint, Huddersfield.

Graphic Warehouse, £200 credit voucher: Iain Whittles, Pixel 2, Hull.

HP Sprocket Portable Photo Printer. Instantly prints ZINK 2x3” sticky backed photos from your iOS and Android device:

more likely?

Interestingly signage, labels and workwear share 80% of the yes expansion vote followed by packaging.

6. Are you planning to invest in plant and equipment over the next 12 months?

By a tight margin, more print businesses will be spending more rather than standing still.

7. Are you planning to reduce your services and focus on profitable areas of your core business?

A big no to this as only 26.67% are reducing their print product range and concentrating on their regular business.

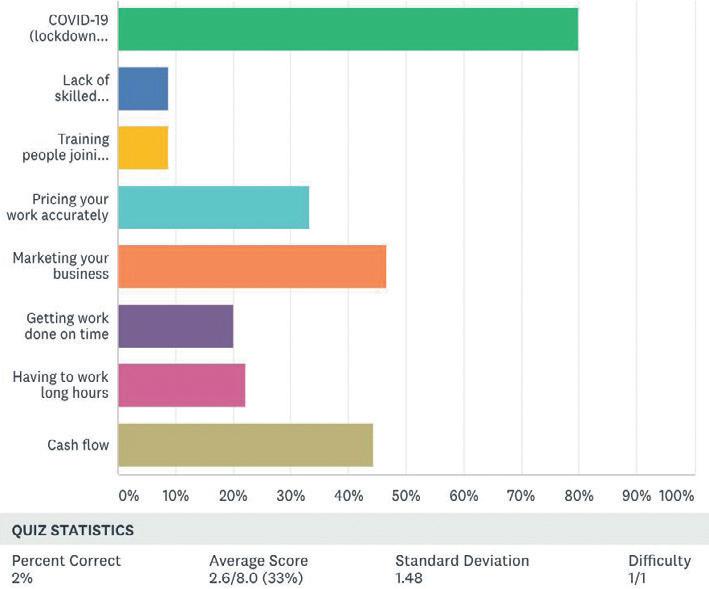

8. Select all of the threats you currently see to your business

No surprises with the biggest threat being Covid, then cash flow. The results indicate the need to market your business more in a downturn.

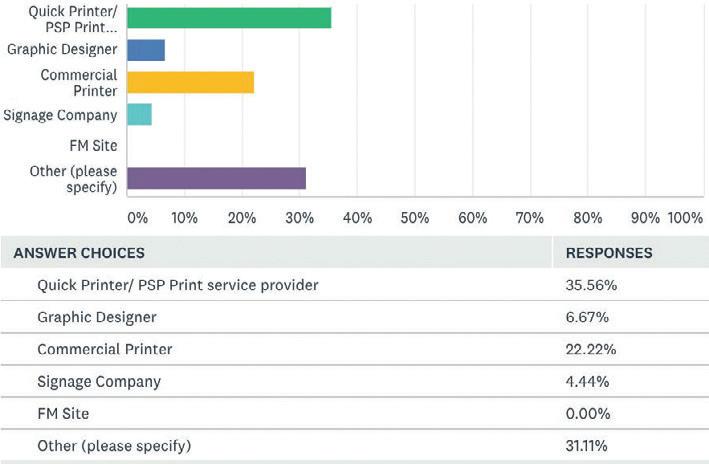

Our survey reports that the recipients business types are 35.56% best described as Quick Printers/ Print Service suppliers. Commercial Printers register 22.22%. The others are made up of other printers, Graphic Designers and signage companies. Amusingly no one owns up to being a FM site, a term obviously now sent to room 101. Maybe the original description of in-plants will make a resurgence?

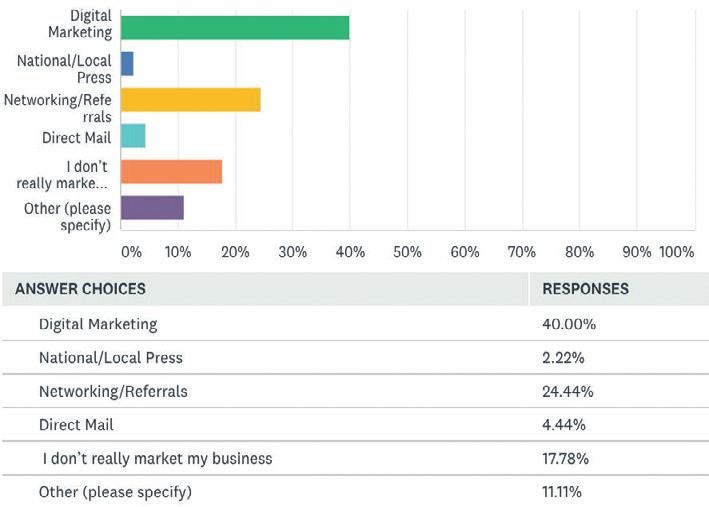

10. How do you promote your business to gain new customers?

Our survey says: 40% digital marketing and 25% referrals and networking. Direct mail and local press make up another 10%. As for the rest, well it is the same old story with our nation’s print shops too busy promoting their customers with the power of print to be doing much for themselves. If you have more time now, you know what to do.

footprint to your business?

As in the last downturn printers corporate responsibility statements are less looked at by surviving customers as they seek to buy to price if you will let them. New start businesses will look to stand out with their own green credentials and appoint suppliers to match, so you will need to improve your carbon footprint and offsetting is a valid option.

12. Do you sell large format print?

With 60% of printers offering large format, I wonder about the other 40%. To retain customers with an assortment of requirements, by saying no to posters, banners etc can put your cut sheet volumes at risk? Maybe traditional book and bound report printers will be bullet proof but for first point of contact instant printers we are perceived to do everything. If you don’t have room in house look for a trade partner.

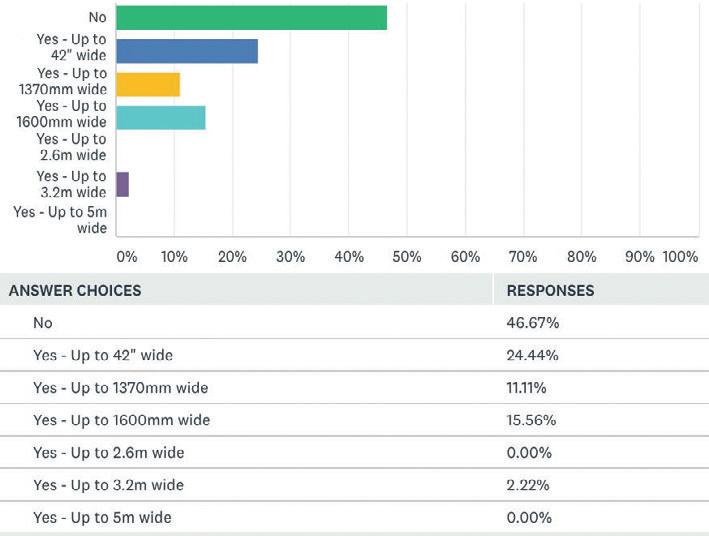

13. Do you have large format printing in-house?

is no surprise that 47% do not operate their own LFP with a further 25% printing up to 42”, 11% up to 1370mm wide and 16% up to 1600mm. On a grander scale print is reported to be sold and the trade work farmed out.

14. How often do you sub-contract Large Format Printing?

Sub-contract LFP is often seasonal to match regular customers requirements, shows, open days etc. This is borne out by 36% of out work produced just a few times a year, with 27% as more regular including weekly.

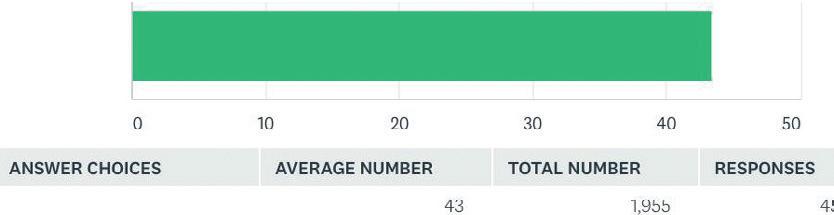

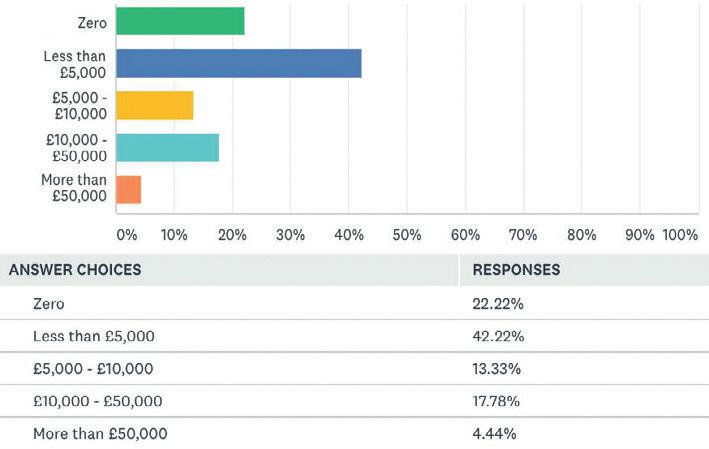

spend on large format graphics and signage each year?

This question delivered a mixed bag of results as you can’t sell what you don’t offer. 22% of our part of the print industry does not buy in trade LFP as they either don’t offer this service or produce what they sell in-house. The next 56% spend up to £10,000, which leaves the higher 18% buying between £10000 -£ 50,000 and 4% above that.

16. Thinking over the last year which of the following types of large format graphics and signage have you ordered? Please tick all that apply.

If you are looking for inspiration to increase your print product range for 2021 then consider this breakdown of opportunities. You may want to join in with a popular line or go for something different. Don’t worry that these do not add up to 100% as most responses offer more than one and so should you. Foamex Boards 60.00%, Correx Board 44.44%, Di-Bond Boards 40.00%, PVC Banners 60.00%, Mesh Banners 33.33%, Signage 35.56%, Posters 40.00%, Floor Vinyls 28.89%, Wall Vinyls

13.33%, Roller Banners 44.44%, Pop Ups 24.44% Window Stickers 24.44%, Labels 31.11%, Flags 22.22%, Wallpaper 8.89%, Estate Agency Boards 8.89%, A Boards 13.33%, Strut Cards 4.44%, Table Cloths 17.78%, Canvas 13.33%, Sneeze Guards 20.00%, Sanitising Stations 13.33%, Face Shields 15.56%, Packaging 17.78%

17. Which of these products could you sell to existing customers to increase your turnover and

15. Approximately how much does your company

11. How important is offsetting your print carbon

customer loyalty? Please tick all that apply.

The graphics show the variance when compared to the previous question that may well confirm your areas of interest.

18. Which trade magazines and websites do you read?

A clear winner! Which is of course why you choose to follow these QPP pages and initiatives.

19. Do you promote your print services and buy

trade products using any of the following?

Proof that multi-media marketing activity is the goal. Facebook 62%, Twitter 24%, Instagram 23%, LinkedIn 29%, Email 84%, By telephone 44%. By post 29%, By video call 5%

20. Is your digital press running at less than 5p per print?

Time to upgrade as we are in a forever increasing circle of service charges rising on existing and older print presses. Often buying new at a good service click saving will return a lower production cost if volumes permit. Don’t put off doing the sum as an increase in quality, speed and finishing options may ignite your marketing to new customers.