April 2023 • Vol. 36 No. 4 FIRST CLASS MAIL US POSTAGE PAID BOSTON, MA PERMIT NO. 216 MSADA, One McKinley Square, Sixth Floor, Boston, MA 02109 auto DEALER M A ss A chus E tts The official publication of the Massachusetts State Automobile Dealers Association, Inc It’s Never Been About the Cars Ray Ciccolo’s Village Automotive celebrates 60 years in “a very, very exciting business”

St A ff Directory

Robert O’Koniewski, Esq. executive Vice President rokoniewski@msada.org

Jean Fabrizio Director of Administration jfabrizio@msada.org

Auto De A ler MAg A zine

Robert O’Koniewski, Esq. executive editor

Tom Nash, Chelsea Gilmour editorial coordinators nashtc@gmail.com cgilmour03@gmail.com

Subscriptions provided annually to Massachusetts member dealers. All address changes should be submitted to MSADA by e-mail: jfabrizio@msada.org

Postmaster: Send address change to: one McKinley Square, Sixth floor

www.msada.org Massachusetts Auto Dealer APRIL 2023

The official publication of the Massachusetts State Automobile Dealers Association, Inc

auto DEALER M A ss A chus E tts

AD Directory ethos, 2 nancy Phillips Associates, 21 gW Marketing Services, 21 reynolds & reynolds, 23 ADt forum registration, 29 o’connor & Drew + Withum, 38

rAteS Join us on twitter at @MassAutoDealers Quarter Page: $450 Half Page: $700 full Page: $1,400 Back cover: $1,800 inside front: $1,700 inside Back: $1,600 tABle of contentS

From the President: A Well-earned Milestone 5 AssoCiAte memBers direCtorY

the roUndUP: Legislative Process Continues 11 eConomiC imPACt stUdY sUrVeY Form 12 AUto oUtLooK 16 Cover Story: it’s never Been About the cars 19 neWs From Around the horn 22 deALer oPs: cox Dealer Sentiment index 24 ACCoUnting: Annual Warranty Labor rate increase—statutory or Factory submission? 26 ACCoUnting: three tips for Auto dealers to survive high Inflation and a High-Interest Environment 29 ACCoUnting: Planning for 2023 28 LegAL: new legal Protections for Pregnant employees and nursing Mothers 30 LegAL: Spring cleaning—Why Sprucing up your Dealership’s t ime and Pay records can Help Avoid litigation 31 LegAL: Lawmakers File Bills Affecting Dealers 32 nAdA mArKet BeAt 34 AiAdA: Attention lawmakers—the Business of America is Business 35 trUCK Corner: the launch of the clean freight coalition 36 nAdA UPdAte: franchised Dealers More important than ever

Auto Dealer is published by the Massachusetts State Automobile Dealers Association, inc. to provide information about the Bay State auto retail industry and news of MSADA and its membership.

ADVertiSing

4

6

A Well-Earned Milestone

Celebrating six decades of Ray Ciccolo in this great business

By Jeb Balise, MSADA President

What is there left to say about Ray Ciccolo? Plenty.

Yes, he has been inducted into our Hall of Fame, a two-time TIME Dealer of the Year Nominee, and celebrated for his accomplishments time and again. But every time we bestow more recognition it is because Ray is always adding to that list of accomplishments. New stores. New charitable work.

Perhaps the most important award, however, is the privilege of making it well beyond even a half-century in this industry. When Ray set up his first store six decades ago, he had no idea how things would turn out, more than any one of us would. His determination and – most importantly – simple decency has ensured that generations of customers have been something more. Something that it takes a dealer time, and effort, to achieve.

There is no greater compliment than continued relevance. And for Ray, his influence in our industry remains, and our respect has only grown with each passing year. Most importantly, he remains engaged in working to secure a future for a new generation of dealers, even in the face of mounting obstacles.

You can read more about what he is up to in this month’s cover story. He is always effortlessly conveying the wisdom of many years in this industry and a thirst to learn more. It is an entertaining and enlightening read.

Ray represents the best of what our great business community has to offer, and this anniversary is a rare feat. It is a reminder that the work we do every day is part of the essential fabric that makes up Main Street America. As we continue to do more than most to help drive our communities forward, this accomplishment should make us all proud.

It is a reminder that we are in the people business as much, if not more, than the technology business. As the technology in our vehicles continues to grow at an increasing rate, that simple ability to earn trust and keep it remains essential. Whether the cars are electric, flying, or drive themselves, that will never change.

Our reputations among our customers will always be more important than the particulars of what any one vehicle might hold. Ray’s longevity and passion for this industry is proof.

Please join me in congratulating Ray on six decades in this ever-changing, fast-paced, and rewarding business.

MsAdA BoARd

Barnstable County

Brad tracy, tracy Volkswagen

Berkshire County

Brian Bedard, Bedard Brothers Auto Sales

Bristol County

richard Mastria, Mastria Auto group

Essex County

William Deluca iii

Bill Deluca family of Dealerships

Franklin County [open]

Hampden County

Jeb Balise, Balise Auto group

Hampshire County

Bryan Burke, Burke chevrolet

Middlesex County

frank Hanenberger, MetroWest Subaru

Norfolk County

Jack Madden, Jr., Jack Madden ford

charles tufankjian, toyota Scion of Braintree

Plymouth County

christine Alicandro, Marty’s Buick gMc isuzu

Suffolk County

robert Boch, expressway toyota

Worcester County

Steven Sewell, Westboro chrysler

Dodge ram Jeep

Steve Salvadore, Salvadore Auto

Medium/Heavy-Duty Truck Dealer Director-at-Large [open]

Immediate Past President

chris connolly, Jr., Herb connolly chevrolet

NADA Director

Scott Dube, Mcgovern Hyundai rt.93

OFFICERs

President, Jeb Balise

Vice President, Steve Sewell

Treasurer, Jack Madden, Jr. Clerk, c harles tufankjian

From the President APRIL 2023 Massachusetts Auto Dealer www.msada.org

MSADA 4

t

“Ray represents the best of what our great business community has to offer, and this anniversary is a rare feat”

Associate Members

MSADA A SS oci Ate M e M ber D irectory

ACV Auctions

Steve Sirko (856) 381-3914

ADESA

Jack Neshe (508) 626-7000

Albin, Randall & Bennett

Barton D. Haag (207) 772-1981

Ally Financial

Maryanne Recupero (617) 997-9574

American Fidelity Assurance Co.

Kathleen Weisenbach (402) 523-5945

America’s Auto Auction Boston

Jim Lamb (781) 596-8500

Armatus Dealer Uplift

Joe Jankowski (410) 391-5701

Auto Auction of New England

Steven DeLuca (603) 437-5700

Automotive Search Group

Howard Weisberg (508) 620-6300

Bank of America Merrill Lynch

Dan Duda and Nancy Price (781) 534-8543

BCI Financial Corp.

Timothy Rourke (203) 439-9400

Bellavia Blatt

Leonard Bellavia (516) 873-3000

Bernstein Shur PA

Ned Sackman (603) 623-8700

Broadway Equipment Company

Fred Bauer (860) 798-5869

Burns & Levinson LLP

Paul Marshall Harris (617) 345-3854

Sarah Decatur Judge (617) 345-3211

CDK Global

Rob Steele (508) 564-1346

Chase Auto

Ken Miller (508) 902-8908

Clifton Larson Allen

Rick Parmelee (860) 982-9307

ComplyNet

Adam Crowell (614) 634-8843

Cooperative Systems

Scott Spatz (860) 250-4965

Cox Automotive

Ernest Lattimer (516) 547-2242

CVR

John Alviggi (267) 419-3261

Dave Cantin Group

Woody Woodward (401) 465-7000

DealerSafeGuardSolutions

Doug Fusco (972) 740-8638

DealerShop

Ken Grove (248) 444-6283

Brian Fleischman (716) 864-0379

Downey & Company

Paul McGovern (781) 849-3100

DP Sales Distributors

Andrew Prussack {631) 842-7549

Driving Dealer Performance

Kimberly Guerin (978) 760-0322

Eastern Bank

David Sawyer (617) 620-3484

EasyCare New England

Greg Gomer (617) 967-0303

Electric Supply Center

Jennifer Williams (781) 265-4272

Enterprise Rent-A-Car

Timothy Allard (602) 818-3607

Ethos Group, Inc.

Drew Spring (617) 694-9761

F&I Direct

Sean Wiita (508) 414-0706

Michelle Salas (508) 599-0081

F & I Resources

Jason Bayko (508) 624-4344

Federated Insurance

Matt Johnson (606) 923-6350

Fisher Phillips LLP

Joe Ambash (617) 532-9320

Jeff Fritz (617) 532-9325

Josh Nadreau (617) 532-9323

GW Marketing Services

Gordon Wisbach (857) 404-0226

Hilb Group

James Pietro (508) 791-5566

Huntington National Bank

Michael Ham (740) 815-5085

John W. Furrh Associates Inc.

Pamela Barr (508) 824-4939

Key Bank

Mark Flibotte (617) 385-6232

KPA

Abe Cohen (503) 902-6567

LocaliQ Automotive

Jay Pelland (508) 626-4334

LoJack by Spireon

Ashvir Toor and Robin Dukes (800) 557-1449

LotLinx

Giovanna Scognemiglio (310) 526-1463

M & T Credit Corp.

John Federici (508) 699-3576

Management Developers, Inc.

Dale Boch (617) 312-2100

McWalter Volunteer Benefits Group

Shawn Allen (617) 483-0359

Merchant Advocate, LLC

Dan Giordano (973) 897-2778

Mintz Levin

Kurt Steinkrauss (617) 542-6000

Murtha Cullina

Thomas Vangel (617) 457-4000

Nancy Phillips Associates, Inc.

Nancy Phillips (603) 658-0004

NEAD Insurance Trust

Charles Muise (781) 706-6944

Northeast Dealer Services

Johna Cutlip (401) 243-7331

OCD Tech

Michael Hammond (844) 623-8324

O’Connor & Drew, P.C. + Withum

Kevin Carnes (617) 471-1120

Performance Management Group, Inc.

Dale Ducasse (508) 393-1400

Piper Consulting

Jim Piper (207) 754-0789

Pro-Vigil

Sasha Lam-Plattes (408) 569-2385

Pullman & Comley LLC

James F. Martin, Esq. (413) 314-6160

Resources Management Group

J. Gregory Hoffman (800) 761-4546

Reynolds & Reynolds

Austin Ziske (802) 505-0016

Rinn Advisors

John Corcoran (617) 480-6693

Rockland Trust Co.

Joseph Herzog (508)-830-3241

Samet & Company

John J. Czyzewski (617) 731-1222

Santander Bank

Richard Anderson (401) 432-0749

Chris Peck (508) 314-1283

Schlossberg, LLC

Michael O’Neil, Esq. (781) 848-5028

Shepherd & Goldstein CPA

Ron Masiello (508) 757-3311

Southern Auto Auction

Joe Derohanian (860) 292-7500

Sprague Energy

Robert Savary (603) 430-7254

The Towne Law Firm P.C.

James T. Towne, Jr. (518) 452-1800

TrueCar

Pat Watson (803) 360-6094

Truist

Andrew Carmer (401) 409-9467

US Bank

Vincent Gaglia (716) 649-0581

Wallbox USA, Inc.

Sean Ugrin (720) 220-1711

Wells Fargo Dealer Services

Josh Tobin (508) 951-8334

Windwalker

Herby Duverne (617) 797-9316

Zurich American Insurance Company

Steven Megee (774) 210-0092

5 www.msada.org Massachusetts Auto Dealer APRIL 2023

Legislative Process Continues – Bills Sent to Committees

By Robert O’Koniewski, Esq. MSADA Executive Vice President rokoniewski@msada.org

Follow us on Twitter • @MassAutoDealers

Month by month, the legislative process continues to move forward at its deliberative pace. To recap, in late January, legislators filed over 6,500 bills they want to advocate for during the 2023-2024 session. February saw the Speaker and Senate President issue the joint and standing committee assignments for their colleagues in the respective chambers. And now, during March, in the next step of this legislative dance, the House and Senate clerks referred all those bills to the joint and standing committees of appropriate jurisdiction. We have no indication yet from the committees when the public hearings will be scheduled. Below, see where the bills legislators filed for us presently reside:

The Joint Committee on Consumer Protection and Professional Licensure

• Improvements to Chapter 93B, the auto dealer franchise law (H.331, Hunt; S.151, Crighton)

• Modernize the online motor vehicle purchase process (H.351, Lewis; S.150, Crighton)

• Fixes the right to repair law (H.290, Finn; H.329, Howitt)

• Class 1 license appeal (H.270, Chan; H.289, Finn; S.204, O’Connor)

The Joint Committee on Financial Services

• Increase insurance-reimbursed labor rates for auto body repairers (H.1095, McMurtry; H.1118, Philips; S.688, Moore)

• Protect consumer choice in vehicle service contracts (H.1121, Puppolo; S.639, Feeney)

The Joint Committee on Transportation

• Inspection waiver for new motor vehicles (H.3255, Arciero; S.2219, Cronin)

In addition to these matters, we have identified several hundred bills in these three and other committees for which we have an interest as potentially impactful – good or bad – on dealership operations. As hearing schedules are established, we will be encouraging our members to get involved with the process and contact their legislators in advocacy of our position on the relevant bills we need to support or oppose.

In the meantime, the House and Senate Committees on Ways and Means have been holding public hearings jointly across the state to take testimony on Gov. Maura Healey’s proposed FY2024 budget. The House is expected to take up the budget in the coming weeks, with the Senate following suit in May. A FY24 budget must be in place by July 1, a date which is more aspirational than actual given the Legislature’s track record over the last several years.

RMV to Begin Temp Tags for Out-ofState Buyers

The Registry of Motor Vehicles issued guidance to dealers announcing that, beginning April 5, a new Non-Resident Short-Term Registration transaction will be available to issue short-term registrations to out-of-state residents purchasing a vehicle from a dealer in Massachusetts.

These registrations will be valid for nine days from the transaction date and will allow the outof-state customer to take possession of the vehicle and drive it home. Customers will be issued a Registration Certificate and will be provided a paper temporary plate inserted into a plastic sleeve.

6 APRIL 2023 Massachusetts Auto Dealer www.msada.org t he r oundu P

A Title will NOT be issued, and a vehicle inspection will NOT be required.

These plates can only be used for transporting a vehicle back to the customer’s home state; they cannot be used for commercial purposes (including the transportation of passengers, goods, wares, and merchandise).

This new program is a direct result of MSADA-initiated legislation Governor Charlie Baker signed into law earlier this year on the last day of his term that mandated the Registry of Motor Vehicles to move forward with a temp tag law for Massachusetts residents as well as for vehicle purchasers coming to Massachusetts dealerships from out-of-state. Although a temp tag law sat on the state’s books for over 40 years that gave the RMV the option to establish a temp tag law, it was never fully implemented. It took the Covid pandemic for the RMV to start a temp tag program to accommodate those in-state residents purchasing a vehicle who sought vanity or specialty plates; in this way, the RMV could avoid wasting hard plates on a vehicle in the short-term that would have alternate plating within several weeks.

We commend the RMV for moving forward with this program in a timely manner, and we stand ready to work with it to address any implementation issues as the program is rolled out.

Here are key elements of the RMV announcement:

Customer Requirements

• Individual customers will need to present an ID based on the current identity requirements. Businesses will need to present proof of FID and proof of business in their state (equivalent to our SOC).

• The customer will need to pay a $20 temporary plate fee and the sales tax. Sales tax exemptions will be allowed for customers with disabilities (DOR form MVU-33) and even trades.

• Initially, this transaction will ONLY be available for walk-in customers in RMV Service Centers or for dealers through B2B locations. This transaction will be available through EVR in the future.

Excise Tax: The customer will be subject to Massachusetts excise tax. The Department of Revenue will send the excise tax bill to the mailing address provided during the registration transaction. Excise tax is calculated on a monthly basis. Therefore, if the registration is active for parts of two months (such as January 28 - February 5), it would be subject to two months of excise tax. If the start and expiration of the registration is within a single month, it would be subject to one month of excise tax. [NOTE: There is an amendment to the law under consideration in the Legislature to eliminate this excise tax requirement.]

Insurance Requirements: The customer’s insurance company must complete the new Stand Alone Insurance Certification Form verifying that the customer has insurance equal to or greater than Massachusetts standards. The insurance company will not be listed on the registration; therefore, the customer must carry proof of insurance when operating the vehicle.

Cancellation: If a customer registers the vehicle in his or her home state before the temporary plate has expired, he or she can cancel it prior to the expiration date at: https://www.mass.gov/howto/cancel-your-vehicle-registration-license-plates. Rebates will not be issued for cancelled plates.

Mass. AG to Commence Enforcement of RTR Law

As the auto manufacturers’ lawsuit challenging the legality and constitutionality of the November 2020 expanded rightto-repair law remains in decisional limbo in Boston’s Federal District Court, the Massachusetts Attorney General, Andrea Campbell, filed notice with the court on March 7 that her office will begin to enforce the law on June 1.

Enforcement of the law will include the requirement that new- and used-vehicle dealers provide a form, drafted by the Attorney General, to prospective vehicle owners describing the existence and abilities of the telematics system, including data collection content, in the vehicle. Failure to comply with the law will allow

car owners to sue under the state’s Consumer Protection Act for triple damages or $10,000, whichever is greater. Additionally, the dealership could be subject to revocation of the Class 1 or Class 2 license.

In mid-2012, Gov. Deval Patrick signed our original RTR law, based on a deal legislators structured with MSADA, the aftermarket parts companies, and the independent repair community, but not in time to have the initiative petition removed from the November 2012 ballot. After overwhelming passage of the ballot question, legislators re-enacted, and the governor resigned, the deal bill from 2012, thus putting Chapter 93K on the books. In January 2014, this statutory deal was ultimately memorialized in a national memorandum of understanding between the auto manufacturers and many in the RTR coalition. As a result of the MOU, independent repairers across the country, without incident or controversy, have received from auto manufacturers the information, tooling, and equipment they need to diagnose and repair motor vehicles. To date, no other RTR bill has passed in the country.

Fast forward to 2019 – fearing that the current RTR law is not enough to drive business to independent repair shops or to the aftermarket companies, the coalition filed an initiative petition to expand the RTR law and ensure a more comprehensive data grab, including a requirement for the placement of certain communicative software in the vehicle telematics beginning with Model Year 2022 vehicles. The Legislature’s Joint Committee on Consumer Protection held a constitutionally required public hearing on the bill in January 2020, at which time no actual incidents of noncompliance of the 2013 law were detailed and the coalition members expressed their fear the manufacturers will hide the necessary diagnostic and repair info in the telematics, even though the current law already prohibited that. Your MSADA along with the manufacturers testified in opposition to the proposed ballot question. Due to legislative inaction by May 2020, the petition went to the November ballot, where it received overwhelming voter approval.

7 www.msada.org Massachusetts Auto Dealer APRIL 2023 MSADA

Under the state constitution, the law took effect upon certification of the vote by the Secretary of State, December 3, 2020.

The auto manufacturers, through the Alliance for Automotive Innovation, however, filed a lawsuit (Alliance of Automotive Innovation vs. Maura Healey, Attorney General of the Commonwealth of Massachusetts) in Boston federal district court ten days after the election to challenge the legality and constitutionality of the new law. At a status conference before the court in December 2020, upon the court’s request, Attorney General, now governor, Maura Healey filed a non-enforcement stipulation that was to last until July 2021. In June and July 2021, the court held a non-jury trial and took parties’ arguments. As the court’s decision was put off at least six times through 2021 and 2022, the AG, at the court’s request, continued the non-enforcement stipulation. During that time, in fairness to the court, delays were caused by the technical complexity of the trial evidence; COVID-19 disruptions; the AG’s alleging that manufacturers could comply with the law without incurring penalty, as evidenced by, so the AG claimed, Subaru’s actions turning off vehicle telematics; and RTR coalition members in Maine pushing their own initiative petition that would create similar federal legal and constitutional challenges as the Massachusetts law.

Feeling that there have been enough legal delays with the pending lawsuit, AG Campbell now asserts the time has come for the law to take effect and for her to enforce the provisions of that law as passed overwhelmingly by the voters in 2020. It is not our job to speculate as to the AG’s motivations to terminate the non-enforcement stipulation, as she has a job to do for which she was duly elected. However, if there is going to be an appropriate response to her announcement, it would come in the form of the Alliance’s seeking an injunction in court, something they did not have to do in December 2020, to stall the AG’s enforcing the law while the lawsuit awaits the court’s “appealable final judgment.”

RTR Notice Requirement for Customers: As a result of the ballot ques-

tion, under MGL Chapter 93K, Section 2(g), the Attorney General must create for prospective vehicle owners a “motor vehicle telematics system notice” that includes, but is not limited to, the following features: (i) an explanation of motor vehicle telematics and its purposes; (ii) a description summarizing the mechanical data collected, stored, and transmitted by a telematics system; (iii) the prospective owner’s ability to access the vehicle’s mechanical data through a mobile device; and (iv) an owner’s right to authorize an independent repair facility to access the vehicle’s mechanical data for vehicle diagnostics, repair, and maintenance purposes.

The notice form must provide for the prospective owner’s signature certifying that the prospective owner has read the telematics system notice.

Further, under Section 2(h) of the law, when selling or leasing motor vehicles containing a telematics system, a dealer holding a Class 1 or Class 2 license issued under Section 58 of Chapter 140 must provide the motor vehicle telematics system notice to the prospective owner, obtain the prospective owner’s signed certification that he or she has read the notice, and provide a copy of the signed notice to the prospective owner. A dealer’s failure to comply with these requirements will be grounds for any action by the municipal licensing authority relative to the dealer’s license, up to and including revocation, pursuant to section 59 of chapter 140.

Moving Forward: Since the AG has said she will begin, on June 1, to enforce the new RTR law, including the distribution of the motor vehicle telematics system notice by dealers to prospective vehicle owners, we will work with her office to ensure a smooth transition to the creation and distribution of the customer notice.

We also need to see what next steps the Alliance may make, especially if it seeks injunctive relief in the federal court to prevent the AG’s moving forward with the June 1 enforcement date if the lawsuit decision is still pending. After all, the court could issue a decision that upends all this, which certainly could be appealed by the

losing party.

Finally, back in 2020, we expressed our opposition to placing the onus of the customer notice on dealers as well as the impossible-to-meet MY22 requirement. As a result of the law’s passage, we advocated for legislation during the 2021-2022 session to make the customer notice the responsibility of the manufacturers through insertion in the vehicle owner’s manual, as they are the ones who produce the vehicles in question here, and to extend the kick-in date to MY25. Because of the pending litigation, the Legislature took no action. We have re-filed the legislation for the 20232024 session.

Federal Bill - State AGs Sign ProRTR Letter: As we noted in last month’s column, federal right to repair legislation based on our state law has been filed in Congress by a group of bipartisan legislators, which NADA and ATD are opposing. On March 24, 28 state and territorial attorneys general sent a joint letter to Members of Congress asking them to support RTR bills implementing coverage for automobiles, agricultural equipment, and digital electronic equipment. All the New England AGs signed the letter save our Massachusetts AG, Andrea Campbell.

IRS Issues Changes to NewVehicle EV Tax Credits

On March 31, the U.S. Department of the Treasury and the Internal Revenue Service released proposed guidance (available at https://www.federalregister.gov/public-inspection/2023-06822/section-30d-newclean-vehicle-credit) which, effective April 18, 2023, will significantly change the electric vehicle tax credits available under Section 30D of the Internal Revenue Code as established in the new clean vehicle provisions of last year’s Inflation Reduction Act. In particular, the IRS guidance will put in place new critical mineral and battery component content requirements that EVs must meet to qualify for the full $7,500 tax credits under Section 30D.

The IRS’s proposed guidance has been filed for public review and will be published in the Federal Register on April 17,

the roundu P APRIL 2023 Massachusetts Auto Dealer www.msada.org 8

2023. For dealers, these new requirements will mean two key things:

• First, beginning on April 18, 2023, the number of EV make/models that are potentially eligible for a Section 30D credit will likely be dramatically reduced from the current pool of eligible vehicles available for sale.

• Second, for those vehicles that may qualify for a Section 30D credit under the proposed guidance, there will be only two possible credit amounts: $3,750 or $7,500. Until April 18, potential Section 30D credits will continue to vary but will typically be for $7,500.

Readers may recall that the Inflation Reduction Act of 2022 established critical mineral and battery component requirements which must be met for a consumer to receive the full $7,500 tax credit toward the purchase of an eligible vehicle. Vehicles placed-in-service on or after April 18, 2023, will be subject to these rules.

• To meet the critical mineral requirement and be eligible for a $3,750 credit, the applicable percentage of the value of the critical minerals contained in the battery (beginning at 40 percent in 2023 and increasing at annual increments to 80 percent in 2027) must be extracted or processed in the United States or a country with which the United States has a free trade agreement or be recycled in North America.

• To meet the battery component requirement and be eligible for a $3,750 credit, the applicable percentage of the value of the battery components (beginning at 50 percent for 2023 and increasing in annual increments to 100 percent in 2029) must be manufactured or assembled in North America.

Last year’s Act set vehicle price caps and consumer income eligibility requirements. Vehicles eligible for the clean vehicle credit must undergo final assembly in North America and must not exceed a Manufacturer’s Suggested Retail Price of $80,000 for a van, pickup truck, or sport utility vehicle, or $55,000 for any other vehicle. The program has income caps of $300,000 for married couples, $225,000 for heads of

households, and $150,000 for others.

The OEMs are now working to determine how the new proposed guidance applies to the EVs they manufacture. Given the guidance’s complexity, this process could take some time. Beginning April 18, FuelEconomy.gov will contain a list of eligible clean vehicles that qualified manufacturers have indicated to the IRS meet the requirements to claim the new clean vehicle credit, including the amount of the credit.

Accordingly, dealerships offering new EVs for sale are cautioned against providing customers with seller report forms, or otherwise representing the potential value of a Section 30D tax credit for a given make/model, without first consulting with their OEMs on the impact of this proposed IRS guidance. Dealers are encouraged to avail themselves of the information on FuelEconomy.gov as well.

All the pertinent IRS information regarding this subject matter can be found at https://www.irs.gov/credits-and-deductions-under-the-inflation-reduction-act-of-2022.

Mass. House to Release Tax Package in Coming Weeks

As we previously reported in our March Roundup, Democrat Governor Maura Healey released on February 27 details of a $859 million tax relief package that would build upon proposed changes that the Legislature never finalized last year as it was paralyzed by how to handle the mandatory $3 billion in Chapter 62F relief taxpayers received last Summer and Fall. The governor’s package includes a tripling of the estate tax threshold at which the tax would kick in, from $1 million to $3 million, and a reduction in the short-term capital gains tax rate from 12 percent to 5 percent, putting it at the levy level applied to most other income and the long-term capital gains tax rate. The biggest chunk of the proposed relief, approximately $460 million, would come in the form of a new child and family tax credit.

On March 28, the Legislature’s Joint Committee on Revenue held a public hear-

ing on the governor’s bill at which the governor testified to promote her proposed tax changes. Under the state constitution, any change in tax law must originate legislatively in the House. On March 30, House Speaker Ron Mariano spoke at a business forum hosted by the Greater Boston Chamber of Commerce and indicated the House will release for consideration a comprehensive tax package to address matters left unresolved in the last session as well as promoted by Governor Healey. The Speaker provided no details as to what may be included in the House tax package. Stay tuned for further developments.

CFPB Issues Final Rule on Small Business Lending Data Collection

The Consumer Financial Protection Bureau (CFPB) recently issued its long-awaited final rule to implement section 1071 of the Dodd-Frank Act requiring financial institutions to compile, maintain and report to the CFPB certain data on credit applications received from small, women-owned and minority-owned businesses.

The final rule applies only to financial institutions within the CFPB’s jurisdiction. In particular, this does not include motor vehicle dealers engaged in indirect vehicle financing transactions, which are subject to the jurisdiction of the Federal Reserve Board (FRB) in this matter. The FRB has not yet proposed a rule to implement section 1071 for such motor vehicle dealers, although, when it does, the FRB can be expected to seek consistency with the CFPB’s final section 1071 rule. For this reason, NADA and the National Association of Minority Automobile Dealers (NAMAD) jointly have advocated on this issue on multiple occasions to both the FRB and the CFPB.

For banks, finance companies, and other financial institutions that are covered by the CFPB rule and must report data to the CFPB, the requirements are extensive, and these financial institutions may seek to have dealers make adjustments to the credit application process to facilitate their ability to satisfy these requirements.

MSADA www.msada.org Massachusetts Auto Dealer APRIL 2023

9

While the NADA Regulatory Affairs team is in the process of reviewing the CFPB’s final 888-page rule, certain features are particularly noteworthy:

• The rule only applies to credit applications received from a small business, which is defined as a business whose gross annual revenue for the preceding fiscal year is $5 million or less;

• The obligation to compile and report data only applies to financial institutions that originated at least 100 covered credit transactions in each of the two preceding years;

• Leasing transactions with small businesses are not covered by the rule and therefore are excluded from this calculation; and

• The final effective date of the CFPB rule depends on the number of covered credit transactions that a financial institution originated in 2022 and 2023 for each year and ranges from October 1, 2024 (2,500 or more transactions) to April 1, 2025 (500–2,499 transactions) to January 1, 2026 (100–499 transactions).

NADA will disseminate additional information on the CFPB’s final rule after it has been more thoroughly analyzed, and NADA will continue its active advocacy with the FRB.

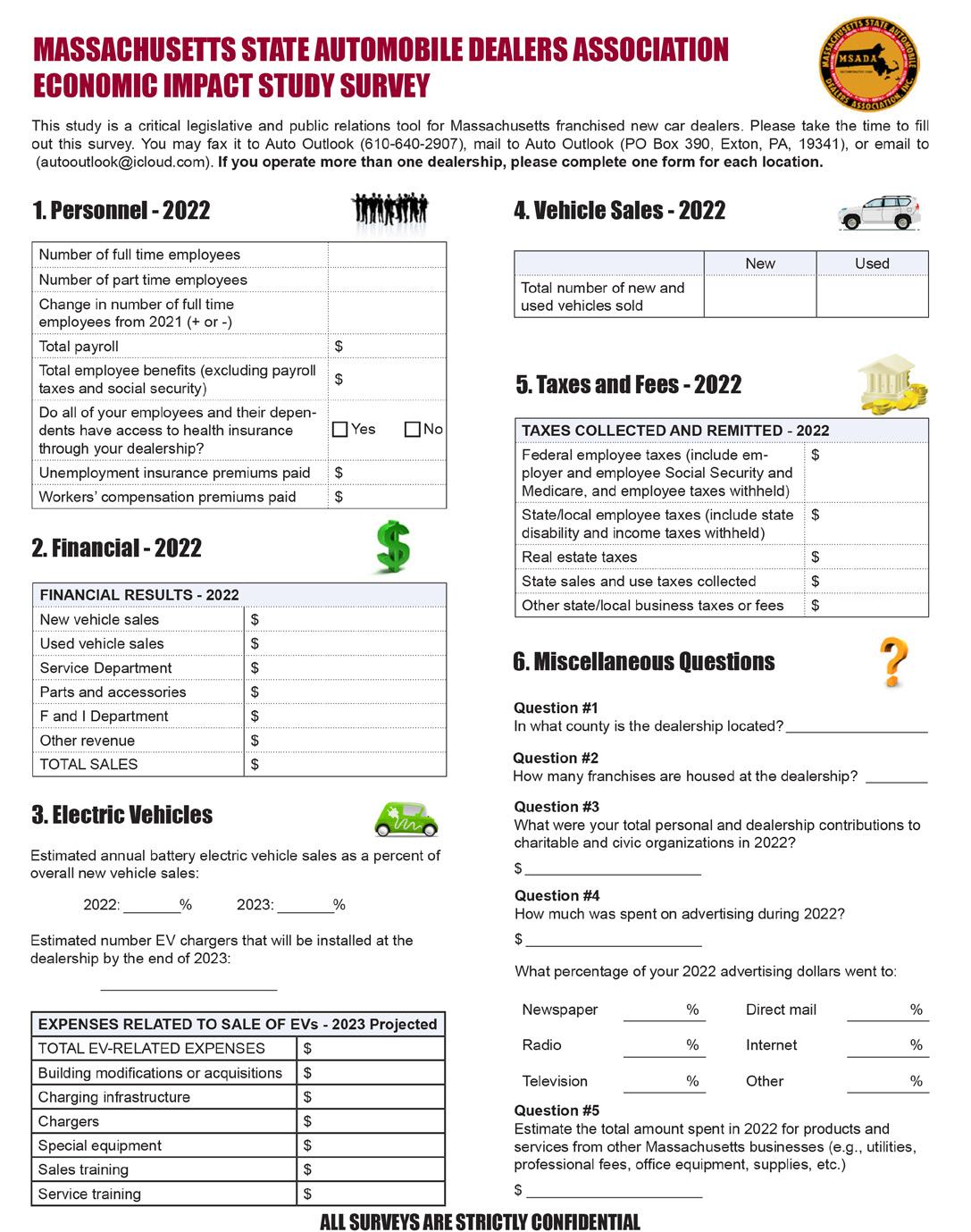

Complete the 2022 Economic Impact Survey

Once again, we are asking you to assist us in creating our annual Economic Impact Report, which we use with legislators and opinion makers to demonstrate the real dollar and cents economic impact that dealers have on our Commonwealth and in their cities and towns.

People not involved in our industry, including lawmakers and the media, are consistently surprised by the fact that our dealers’ businesses account for almost 20 percent of the total retail economic activity in Massachusetts. Getting these figures out is crucial to raising awareness of our industry’s importance, especially as legislators ponder various ways to regulate business operations and create new revenue streams.

Please take a few minutes to complete the survey today for each of your dealerships. The survey is available on page 11 of this issue and also at this link: https://www.surveymonkey.com/r/msadaeconimpact22. Your submitted survey is strictly confidential. We need returns from at least half our members for our survey to be accurate. We will be collecting the surveys until the end of April.

Thank you for your assistance in this project. Should you have any questions, please do not hesitate to contact me

ATD Forum and Fly-In

Registration is open for the ATD Truck Industry Forum and Legislative Fly-In, which will be held June 20-21, in Washington, DC, at the Capital Hilton. The registration deadline is May 20. For the first time, ATD will be holding the ATD Truck Industry Forum in conjunction with the Fly-In. Attendees will be joined by fellow truck dealers and industry stakeholders and will hear from policy experts prior to meeting with elected officials about the challenges facing the business. Truck dealers can register at www.nada.org/atd-forum. Please reach out to ATD’s Kim Carey at kcarey@ nada.org with general event questions; registration or housing questions should be directed to NADA’s Elizabeth Dietz at edietz@nada.org.

Reminder - FTC Safeguards Rule Compliance Due June 9

Throughout last year, with our communications and webinars with several vendors, including a presentation at our October annual meeting, we attempted to prepare dealers to meet the compliance requirements for the Federal Trade Commission’s Safeguards Rule deadline of December 9, 2022.

In mid-November, the FTC postponed the deadline for some of the FTC safeguard provisions. The extension moved the deadline for certain components of the rule until June 9, 2023. In March, our associate member OCD Tech conducted a webinar to cover what should have been accomplished by December 9 and what

still needs to be in place by June 9.

Even though more time was provided to complete some of these safeguards, dealers needed to continue with their compliance efforts. The FTC recognized it was an unrealistic expectation for auto dealers to achieve full compliance by December 9 because so much work was required. Although the FTC provided an additional six months to meet the compliance requirements that were postponed, we stressed at that time that the absence of these safeguards still poses a significant security risk for organizations.

Dealers are now within a two-month window to achieve full compliance by June 9. Dealers need to remain diligent in their efforts towards full compliance with all parts of the rule. Contact us at MSADA if you require information for our numerous associate members who operate in this realm.

2023 Dues Invoices

At the start of January your Association sent out 2023 dues invoices to all our dealership and associate members. Our members’ dues help fund the Association’s activities on their behalf, including our lobbying on Beacon Hill and in Washington, our member counsel services, and our education and training activities.

Over the last several years we have witnessed quite a bit of economic disruption in our industry, including governmental over-regulation. More than ever, our dealers need a strong MSADA. MSADA will continue to lead on the various issues that threaten the viability of our dealerships. We will strive continuously to keep you informed of developments in our industry and how they will play out in Massachusetts. These efforts also include working closely with NADA to better serve our members.

Our strength lies in our members. With your continued support and membership renewal, we can build on our current foundation and begin to enhance your Association’s core purposes of communication, advocacy, and education.

the roundu P MSADA 10 APRIL 2023 Massachusetts Auto Dealer www.msada.org

t

11 www.msada.org Massachusetts Auto Dealer APRIL 2023 MSADA e C ono M i C i MPAC t sur V e Y

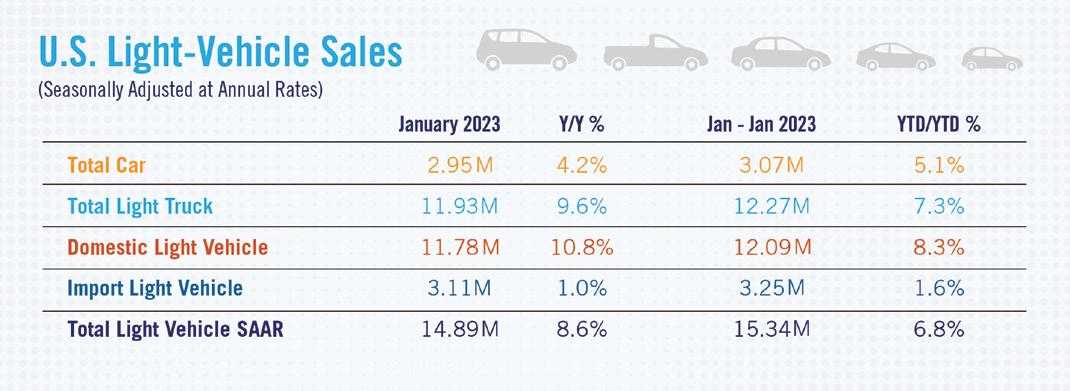

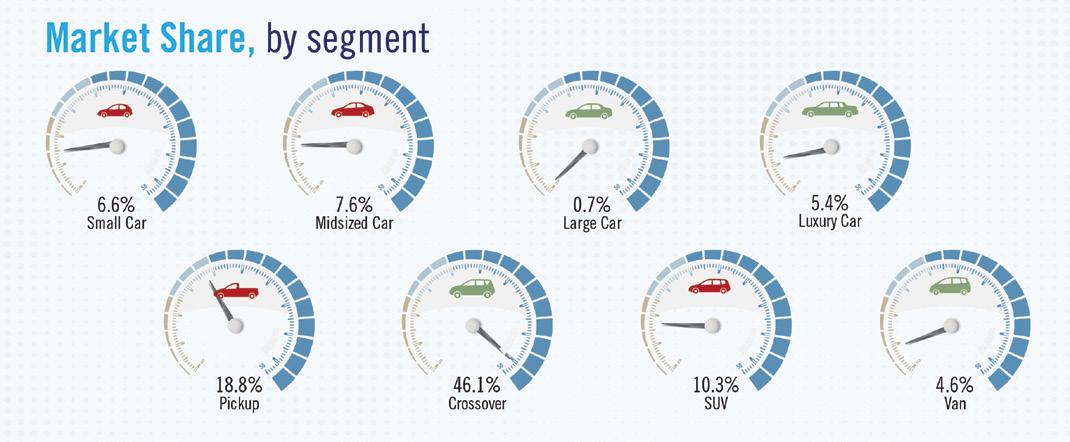

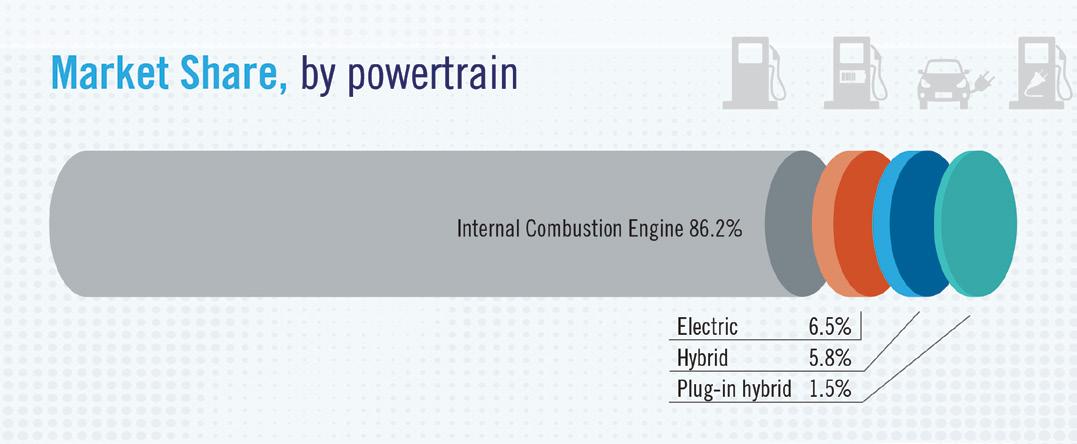

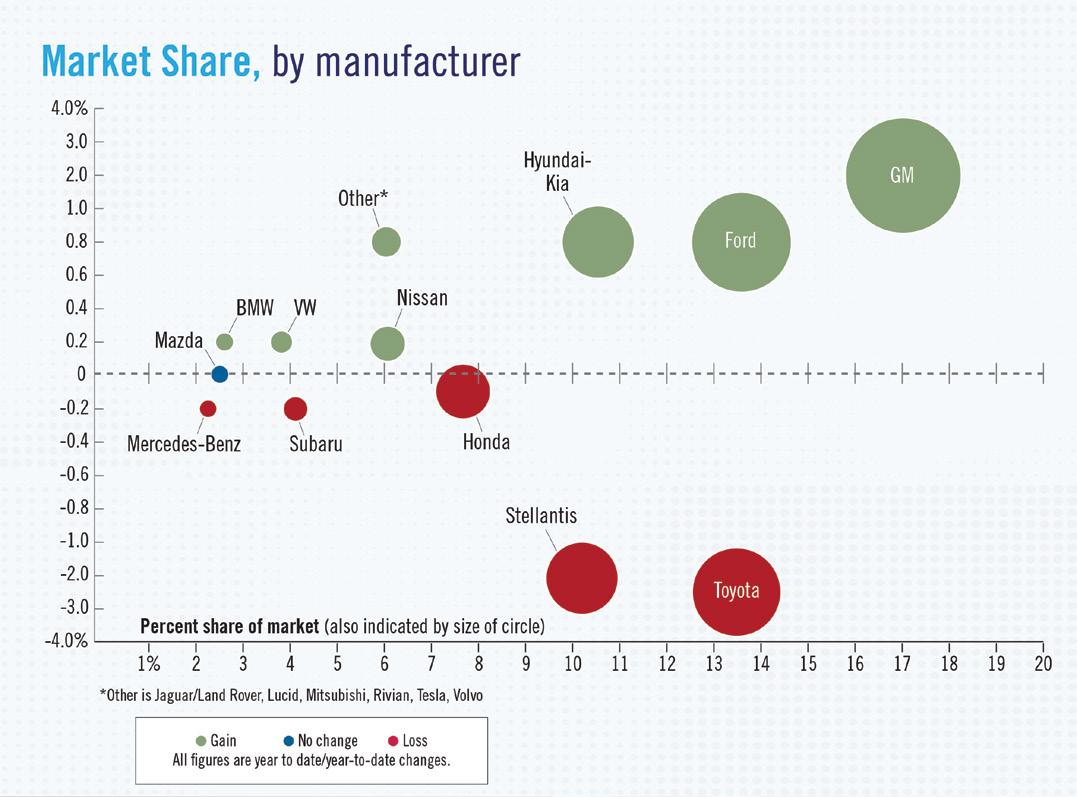

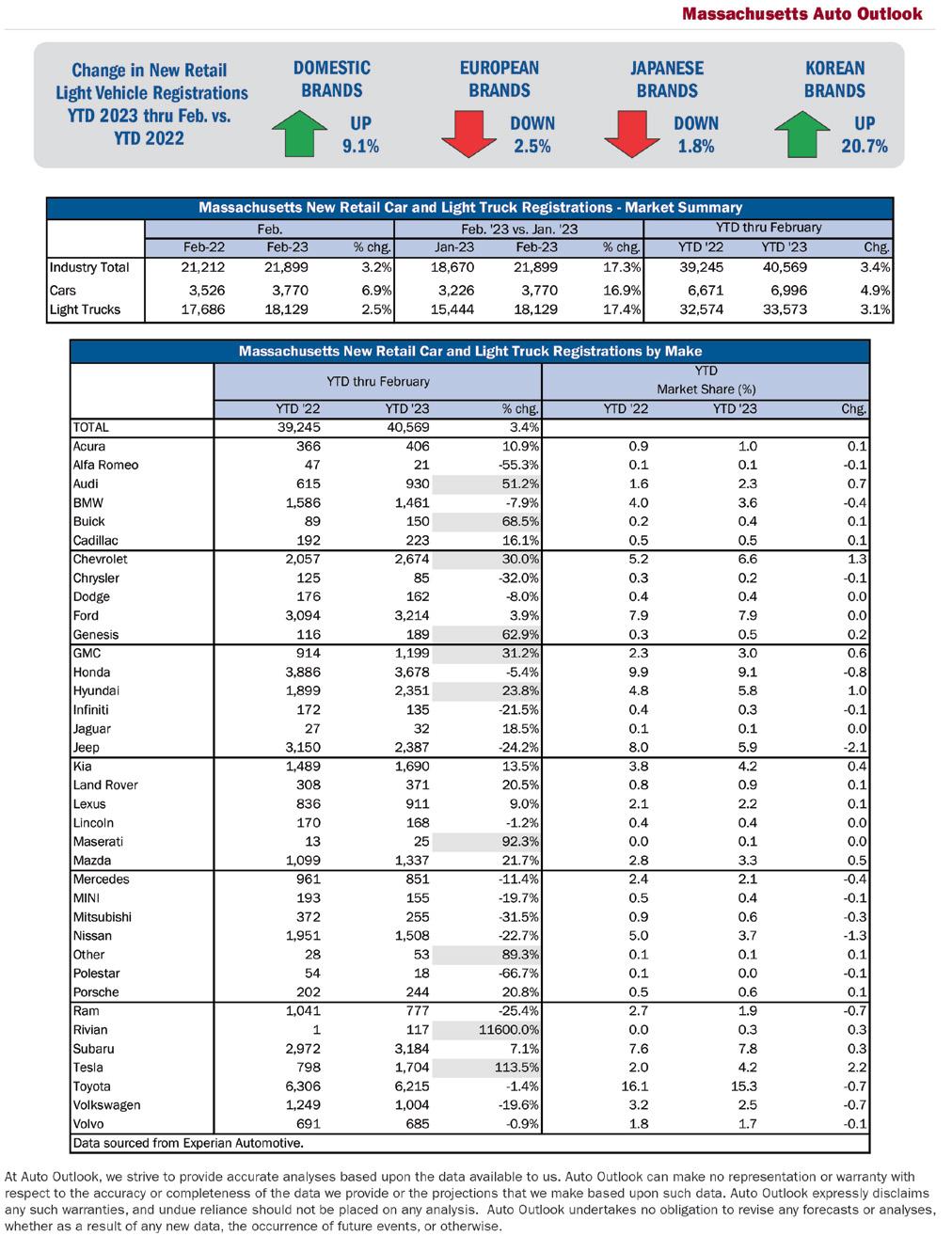

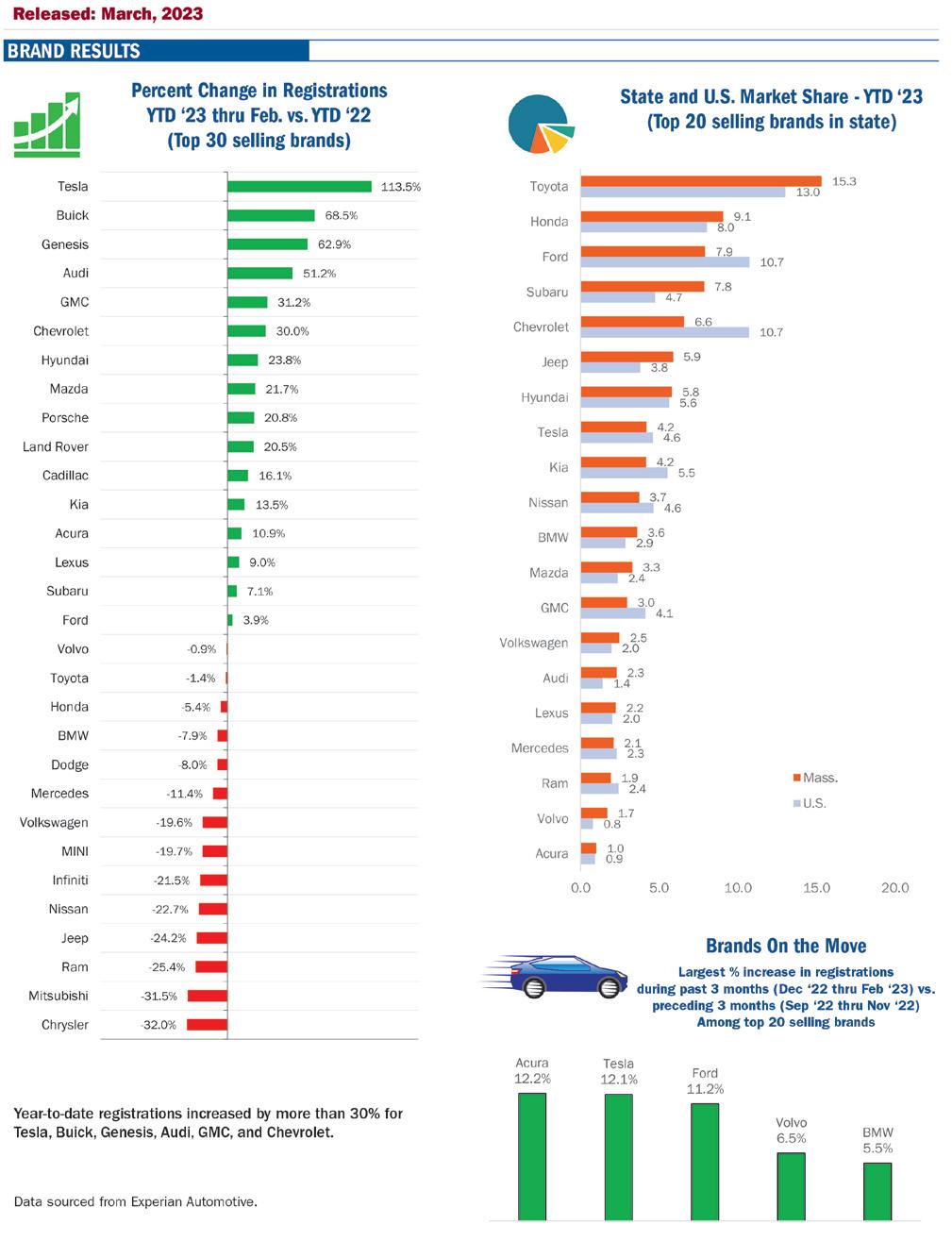

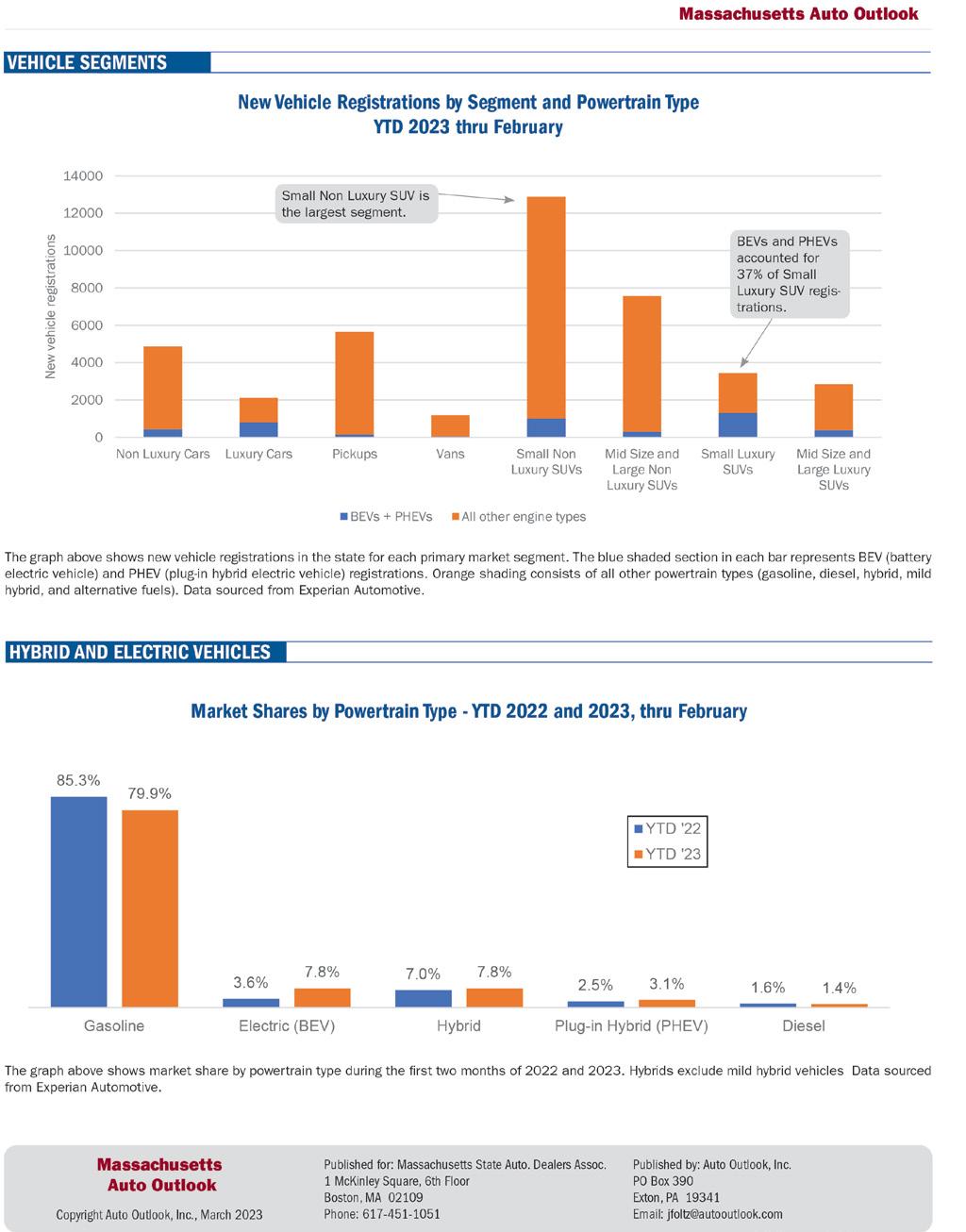

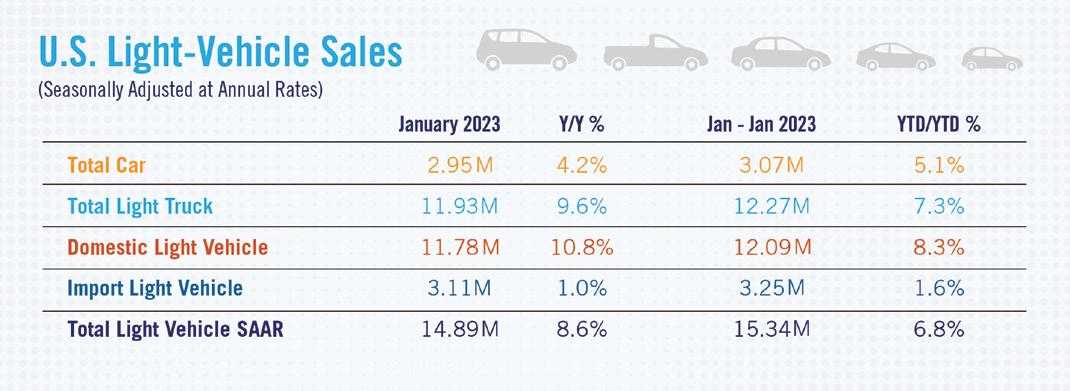

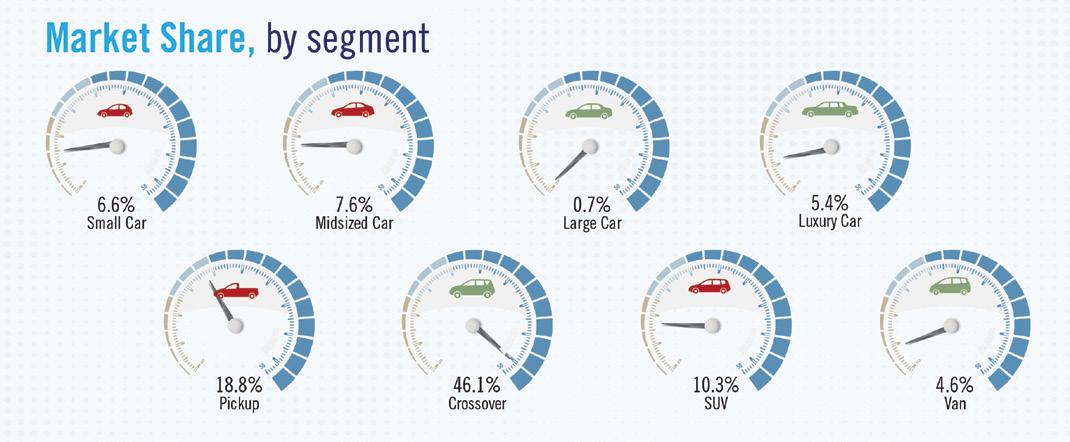

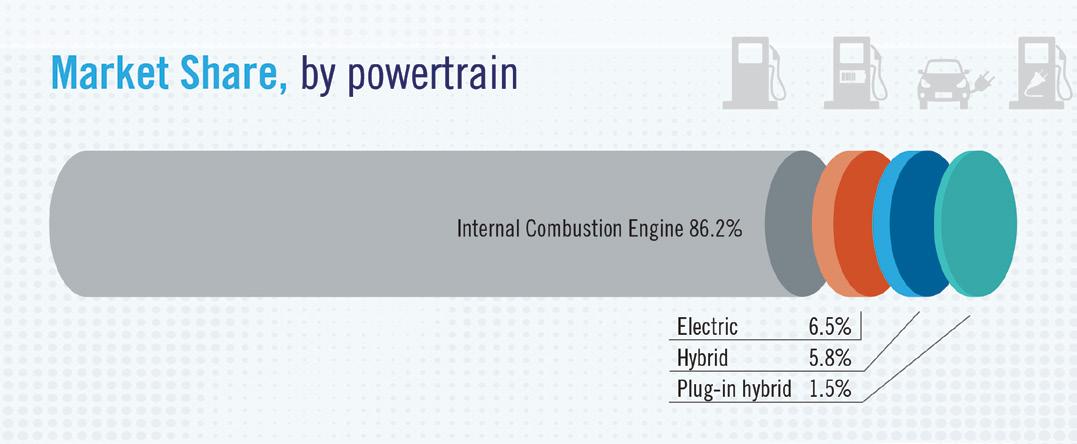

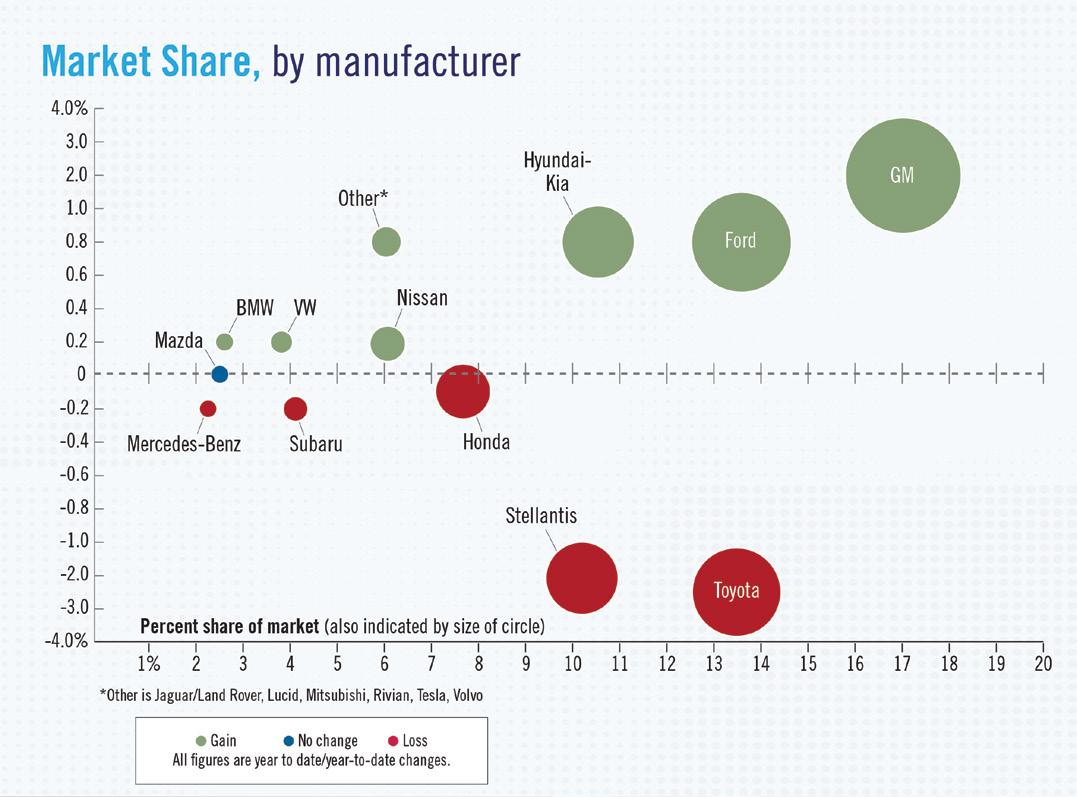

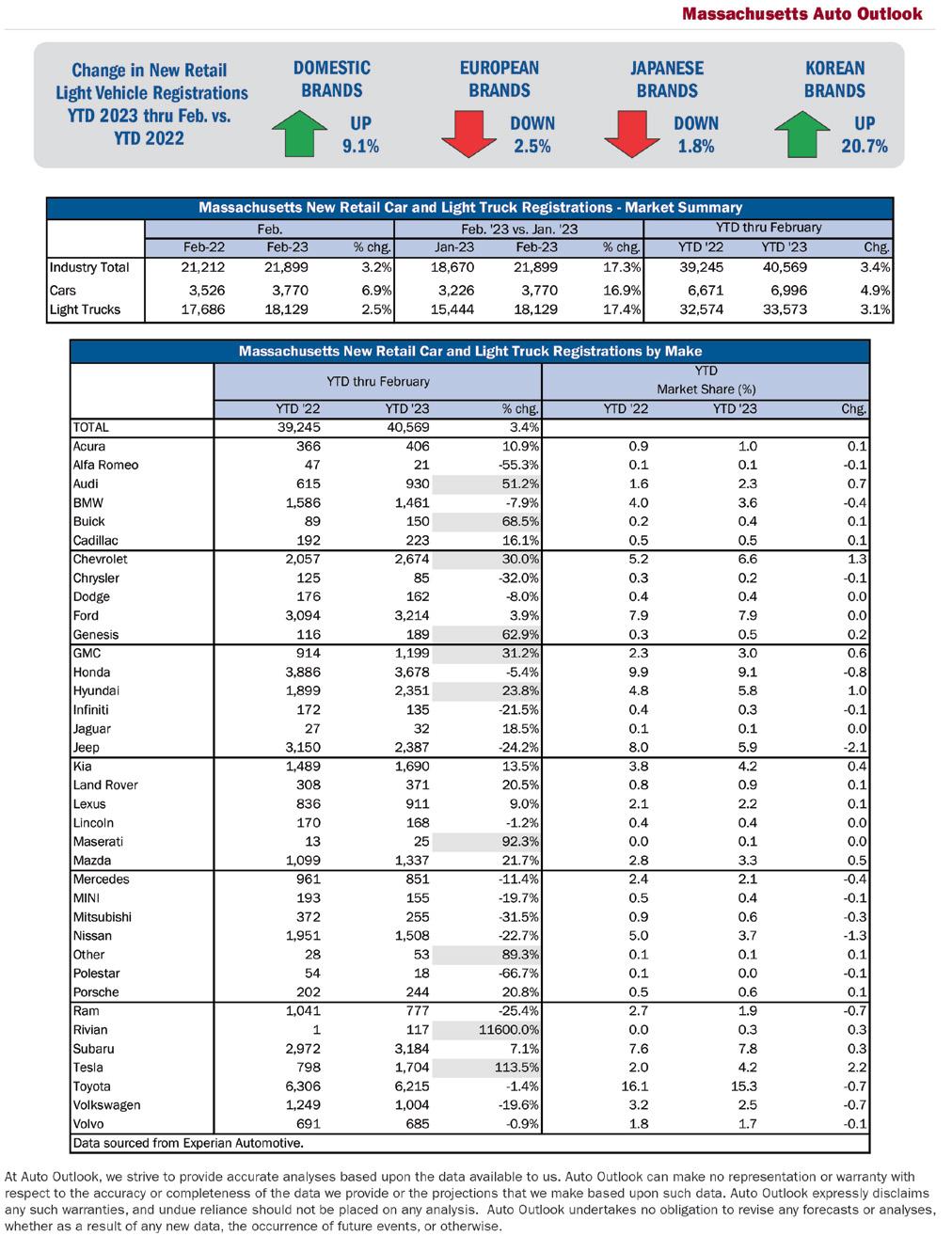

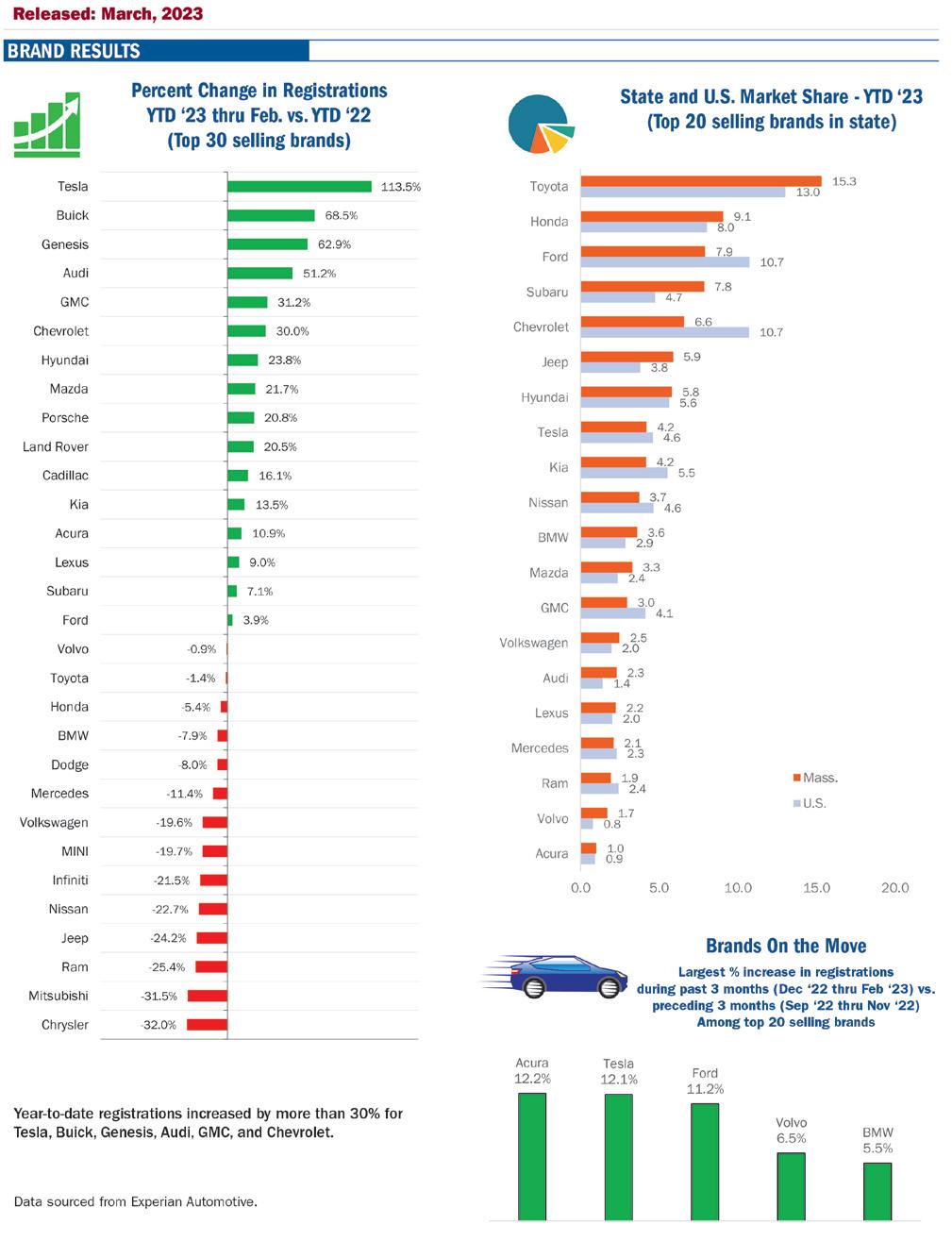

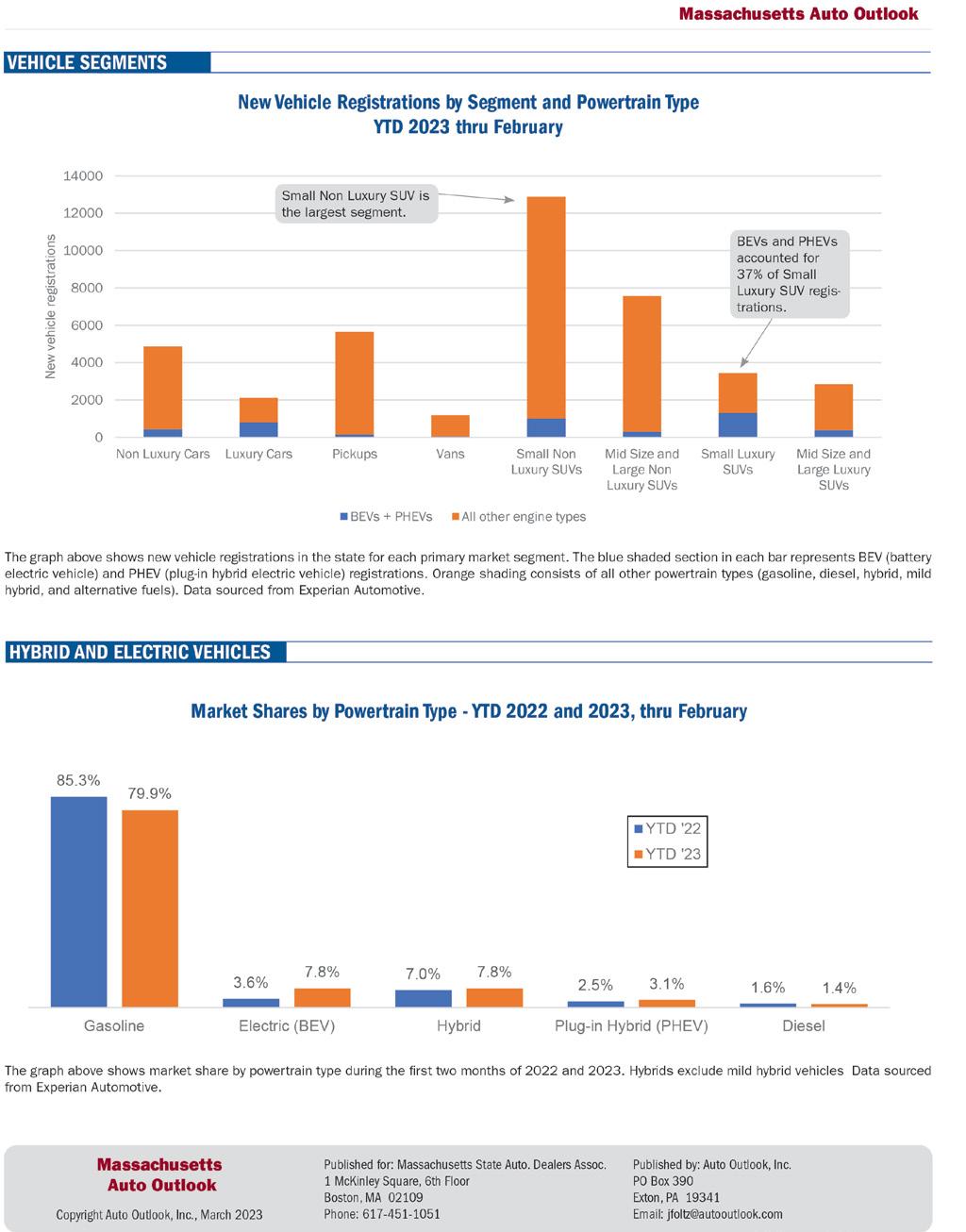

FEBRUARY 2022 Massachusetts Auto Dealer www.msada.org APRIL 2023 Massachusetts Auto Dealer www.msada.org 12 AUTO OUTLOOK

www.msada.org Massachusetts Auto Dealer FEBRUARY 2022 www.msada.org Massachusetts Auto Dealer APRIL 2023 MSADA 13

APRIL 2023 Massachusetts Auto Dealer www.msada.org 14 AUTO OUTLOOK

www.msada.org Massachusetts Auto Dealer APRIL 2023 MSADA 15

It’s Never Been About the Cars

By Heather Beasley Doyle

The idea seemed fun to 24-year-old Ray Ciccolo. He was not secretly itching to get close to Porsches and Lamborghinis, nor did he care about cars more than the average American. What compelled Ciccolo to purchase his first auto dealership in 1963 was an innate need to create his own business, a need that had expressed itself from very early on. “I was five years old, selling Kool-Aid on a corner,” the Cambridge, Mass., native recently told MSADA magazine.

By the time he bought his first dealership, Gene Brown Motors in Newton Centre, Ciccolo had graduated from Suffolk University in 1959 with a degree in business administration. He owned three laundromats, which he sold to fund his new venture. The previous owner “was a bit of a playboy and I just figured if I employed what little business experience I had, I ought to be able to make a go of it,” Ciccolo said. “Worst case scenario” he figured, “I lose everything and start over.” He did not lose everything. Ciccolo’s first dealership flourished, and today — 60 years later — his company, Village Automotive Group, includes 13 dealerships in Greater Boston and employs more than 500 people. Ciccolo has no complaints about his six decades in the auto business. Now 85, he laughs out loud at the idea of retirement, instead offering takeaways, advice, and thoughts on the future of car dealerships.

16 COVER STORY APRIL 2023 Massachusetts Auto Dealer www.msada.org

Ray Ciccolo’s Village Automotive celebrates 60 years in “a very, very exciting business”

Early Effort

Soon after buying Gene Brown Motors, then a Volvo/Nash dealership, Ciccolo did two things to boost profits. He ended the dealership’s longstanding practice of allowing customers to buy vehicles on store credit. “You never knew when you were going to get paid” for a vehicle bought on credit, he said. Ciccolo also stopped selling Nash vehicles, which created more expenses and brought in less money than Volvos. “I gave up Nash and the rest, as they say, is history,” Ciccolo said. “Profitability went up significantly” at the renamed Volvo Village.

Since then, the business has grown markedly. With his wife Grace by his side, Ciccolo began attending countless meetings early in his career, from manufacturers’ new car introductions to 20 Group gatherings, establishing himself as a presence in the Massachusetts automotive world. He eventually represented Volvo and Saab nationally, served as a director of both the National Automobile Dealers Association and MSADA, and a myriad of other roles that have defined him as more than just a local dealer. He has been recognized by the American International Automobile Dealers Association and was inducted into the MSADA Hall of Fame. Volvo Village began offering Hondas in

1974, and, in 2010, the company expanded to Norwell, then a year later into Danvers. In 2021, the group began representing Polestar electric cars, and earlier this year Village Automotive moved into Metro West by acquiring the Brigham-Gill dealership in Natick. Several hundred thousand customers have done business with Village Automotive Group, according to the company’s website. “It’s been a wonderful ride,” Ciccolo said.

Weathering Economic Trends, Adapting to the Climate Crisis

That ride has endured challenges affecting the national and global economies. “We went through 25% interest rates, and we went through no gasoline” during the 1973-1974 gas crisis, he

17 www.msada.org Massachusetts Auto Dealer APRIL 2023 MSADA MSADA

TO THE FINISH

said. “We went through a complete collapse of the economy where all the banks called in all their loans.” In 2009, Chrysler filed for bankruptcy. But the biggest surprise of Ciccolo’s career came later that year when General Motors followed suit. “They were the premier car company; there’s no way in the world you could even imagine a company like General Motors going bankrupt,” he said.

The climate crisis has also sparked many changes to the car industry and to Ciccolo’s dealerships, which now offer water-filling stations instead of bottled water. Four Village Automotive locations feature solar panels, and Ciccolo’s business has adapted to electric vehicles, investing millions of dollars into charging stations and power supplies, for charging and servicing electric vehicles. “You have to make that commitment now,” Ciccolo said.

And over the past decade or so, technology has enhanced auto safety while online shopping op tions such as Carvana have changed the very nature of buying a car. Many manufacturers have been push ing for dealer-free transactions. Despite the trends, Ciccolo thinks dealerships will abide, especially for the average buyer and harder-to-sell vehicles. Cutting dealers out of the transaction is “a lot of baloney,” he said, adding that “customers will “do all the work online,” he said. “They’ll find the cars, they’ll even get a price online, but then when they finally want to finalize the deal, they turn to the dealer to do it.

Keeping Employees Happy and Giving Back

Ciccolo attributes his own business success to one core value that he explains with almost evangelical zeal: “You start with the employee[s] and then make sure they’re happy, because they can’t

make a customer happy unless they’re sincerely happy. Otherwise, they’re being disingenuous, and a customer would see right through it.”

In the early 1960s, this was an unusual management style, Ciccolo said. He had learned about it through case studies at Suffolk and, later, a class at Harvard. So he talked with his team about it. “We needed employees that just understand it’s a lot easier to make and take care of a customer than try to answer complaint letters,” he said. He feels good about the culture he has created; that employees, regardless of their role, are empowered to make decisions and that people work at Village Auto for decades.

Ciccolo credited his father with influencing his work values, which also led him to create the Ciccolo Family Foundation to fund scholarships and to support a variety of local and global philanthropic initiatives. “I was born dirt-poor in Cambridge,”

Ciccolo said. “With such amazing financial success it almost became embarrassing, and I started to say, ‘Okay, what can I now do to help people that were a lot like me?’”

Informed by his life and work, Ciccolo advises people to live a balanced life. “You just can’t be a workaholic,” he said, noting that he has taken “a fair amount of time off,” including some summers.

“Could I have accumulated more dealerships? Absolutely. So what good would that have done me?” he said. “I wouldn’t have had the experiences in my lifetime that I’ve had and that my children have had.”

Ciccolo hopes that his family will keep Village Auto as long as the work resonates and remains as rewarding for them as it has for him. It certainly has resonated more deeply than expected for someone without an initial passion for cars. “This is a never-ending, changing business. It’s a very, very exciting business. I enjoy it now as much as I did the first day I went into it. The cars change all the time, the situations change,” he said. “It’s just a very, very exciting business. I really recommend it to everybody.”

t 16 RACE

APRIL 2023 Massachusetts Auto Dealer www.msada.org 18

IT’S NEVER BEEN ABOUT THE CARS

Gary Rome Hyundai & Gary Rome Kia are Official Drop Off Locations for Supplies for Turkey

Gary Rome Auto Group has partnered with the Turkish-American Society of Western Mass., to collect supplies and monetary donations for Turkey. Gary Rome Hyundai in Holyoke, MA and Gary Rome Kia in Enfield, CT will be official drop off locations for supplies to be shipped to Turkey. Collection bins will be set up at both dealerships.

“We want to do our part in the community and help the people of Turkey who have been devastated by the tragic earthquake. We have the platforms for assistance and exposure, with two dealerships in very convenient and visible locations,” said Gary Rome, President of Gary Rome Auto Group. “Don’t wait! Time is of the essence. Medical supplies and blankets are needed urgently. Please drop off supplies as soon as you can!” Rome added.

BOSTON Fenway Concert Series Adds New Corporate Sponsor

The Fenway Concert Series has a new corporate sponsor as it heads into its 20th year. Nucar, an automotive company that has six dealerships along the Automile in Norwood, will top the concert series’ name, now officially the “Nucar Fenway Concert Series Presented by Wasabi Technologies.” Wasabi Technologies remains in a presenting sponsor role for the second year. Back Bay-based Wasabi also added its branding to NESN’s Fenway Park studio starting last year. Nucar, owned by DCD Automotive Holdings of Norwood, has dealerships in Delaware, New Hampshire, Rhode Island, and Vermont, as well as Massachusetts.

BOSTON ‘Millionaires Tax’ Loophole Could Cost State $200M-$600M

The state stands to lose between $200 million and $600 million in potential tax revenue if $1 million-earning couples who file federal taxes jointly choose to file separately at the state level to avoid the State’s new so-called “millionaires tax,” a recent study suggests. Approved by voters in November, the four percent surtax on all income topping $1 million is expected to bring in more than $1.4 billion in 2024, according to state officials. The funds are meant to go toward transportation and education spending. But the study by the Massachusetts Budget and Policy Center says

high-income couples could avoid the surtax – cutting into that revenue by up to $600 million – by filling their state taxes separately.

NORTHAMPTON

TommyCar Auto Announces Annual Scholarship Program for High School Students

TommyCar Auto is proud to announce the launch of its annual scholarship program for high school students. The program is designed to support and recognize students who demonstrate academic excellence, leadership skills, and a commitment to community service.

The scholarship program will award two high school students from two different schools, Hopkins Academy in Hadley and Northampton High School in Northampton, with $2,500 each towards their college tuition. The recipients will be chosen based on an application process that includes academic transcripts, essays, and letters of recommendation.

“We believe that investing in the education of young people is crucial to their success and the future of our community,” said Carla Cosenzi, President of TommyCar Auto. “Our scholarship program is designed to support students who are dedicated to achieving their academic goals and making a positive impact on their community. We look forward to receiving many outstanding applications and selecting the most deserving candidates for our scholarship program.”

To be eligible for the scholarship, students must be graduating seniors from one of the two participating high schools. Applications are now open and must be submitted by May 31, 2023. The winners will be announced on June 2, 2023, at their respective high schools.

For more information about the program, please visit www. TomCosenziScholarship.com.

BOSTON

Herby Duverné of Windwalker Group Honored as One of the Most Influential Men of Color in Boston

Windwalker Group Principal and CEO Herby Duverné, an MSADA associate member, was recently honored as one of the most influential minority businesses in Boston. Duverné is also the Founder and CEO of Rise Development and Construction. “So honored and grateful to be named one of the Most Influential Men of Color in Boston!” said Duverné.

HOLYOKE

NEWS from Around the h orn www.msada.org Massachusetts Auto Dealer APRIL 2023 19 MSADA

NEWS from Around the h orn MSADA

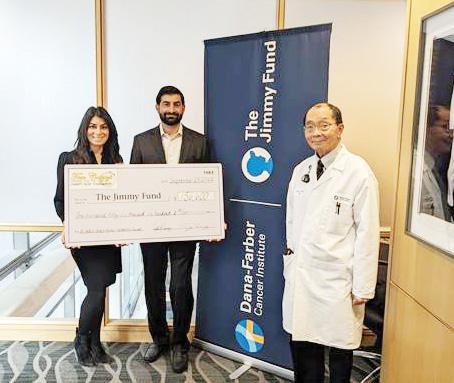

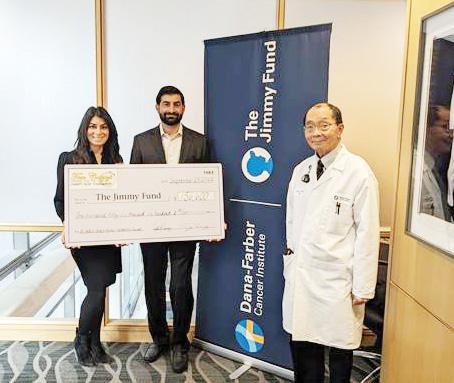

Annual Cosenzi Charity Golf Tournament Raises $156,600 for Dana-Farber Cancer Instutute

The Tom Cosenzi Driving For The Cure Charity Golf Tournament hosted its annual charity golf tournament on September 28, 2022, and the event was a resounding success. Golfers from the local community, as well as corporate sponsors, came out in droves to show their support for the Dana-Farber Cancer Institute. The tournament raised an incredible $156,600, setting a new fundraising record for the event.

The charity golf tournament has been a cornerstone of Dana-Farber Cancer Institute’s fundraising efforts for many years, and this year’s event was no exception. Generous donations from both golfers and sponsors have contributed towards the Dana-Farber Cancer Institute’s ongoing mission of conquering cancer.

“We are incredibly grateful for the outpouring of support we received for this year’s golf tournament. The funds raised will go a long way in helping us to continue providing vital programs and services to those in need. We couldn’t have done it without the help of our Presenting Sponsor, CDK Global, as well as other sponsors, volunteers, and golfers who participated in the event. Thank you all for your generosity and support,” said Carla Cosenzi, President and Co-owner of TommyCar Auto.

Connolly Auto Group Sells Two Dealerships

The Herb Connolly Hyundai, Acura, and Genesis auto dealerships in Framingham were sold to a dealer group out of West Palm Beach, Florida.

In February, the Framingham License Commission unanimously approved the transfer of the dealerships’ Class 1 Motor Vehicle Licenses at 500, 520, and 540 Worcester Road in Framingham.

The dealerships were part of the Herb Connolly Auto Group. The financial terms of the sale were not disclosed. The City of Framingham has assessed the land and buildings of the properties at about $8 million.

The dealerships will remain open; just the ownership is changing. Connolly Auto Group will continue ownership of Herb Connolly Chevrolet at 350 Worcester Road in Framingham.

Herb Connolly Auto Group is one of America’s oldest, continuously family-owned automobile dealerships in the country. Herb

The charity golf tournament was held at Twin Hills Country Club. The tournament featured a raffle, silent and live auctions, hole-in-one contests, and live music, adding to the excitement and enjoyment of the day.

Connolly, Sr. sold his first new car in 1918. His son, Herb Connolly, Jr. took over in 1940 when Herb Sr. died unexpectedly. He ran the dealership for 55 years, in Boston and Framingham, until his death in 1995. His grandsons, Adam and Christopher Connolly, Jr., took over in 1995 and operated the three dealerships with their brothers, Doug and Brendan. The Acura dealership opened in 1988. The Hyundai dealership opened in 2010.

LAWRENCE

DeLuca Dealerships Provides Generous Donations to College Scholarship Funds

The Greater Lawrence Boys and Girls Club recently expressed its gratitude to the DeLuca Family of Dealerships for its devotion to helping their graduates achieve the dream of a college education by providing scholarships. Each year, the Scholarship Committee accepts applications from youth members and awards scholarships based upon academic achievement, effort, cost of

NORTHAMPTON

APRIL 2023 Massachusetts Auto Dealer www.msada.org 20

FRAMINGHAM

(left to right: carla cosenzi, tommy cosenzi, and Patrick Wen, MD, Director, center for neuro-oncology Dana-farber cancer institute)]

NEWS from Around the h orn

attendance, unmet financial need, and participation in the club. Based on these selection criteria, scholarship support is provided through the Club’s scholarship program. The DeLuca Dealerships has donated two $10,000 Scholarships for the full four years of college. They have donated $80,000 per year for last two years in honor of William P. DeLuca, Jr., the former Chairman of the Club. Scholarships provided by the Club’s donors are critical funding components for the GLBGC’s graduates to complete their college education since federal financial aid programs are insufficient for meeting most of our members’ needs, even when attending community college.

WEST SPRINGFIELD

Balise Toyota & Balise Lexus Donate $40K to Junior Achievement of Western Mass.

Balise Toyota and Balise Lexus in West Springfield are giving back to a program that provides economic education and financial literacy to young children in Western Massachusetts.

On March 20, the dealerships presented a check of $40,000 to Springfield’s Junior Achievement of Western Massachusetts. The donation will help build a career leadership and innovation center, which will feature a virtual reality and maker’s space for students

to gain hands-on experience in their chosen field.

Balise Lexus and Balise Toyota each donated $10,000 along with a matching donation of $20,000 from Toyota and Lexus corporate.

“What this allowed us to do is help Junior Achievement get a permanent location right here in Springfield where we can bring these students in and give them the education they need to be successful in their careers,” said Ben Sullivan, COO of Balise Motor Sales

“That will focus on workforce development and offer students an opportunity to gain credentials if they want to go into a certain career in the trades in health services,” said Jennifer Connolly, President of Junior Achievement.

Junior Achievement helps students interested in fields ranging from entrepreneurship, physical therapy, and manufacturing.

DANVERS

VW 2022 Wolfsburg Crest Club Winner

Volkswagen recently announced the recipients of its 2022 Wolfsburg Crest Club award. Brian D. Kelly, owner of Kelly Volkswagen in Danvers, was the sole Massachusetts dealer recognized for superior sales and market performance achievements.

www.msada.org Massachusetts Auto Dealer APRIL 2023 21 MSADA

t

Cox Automotive Dealer Sentiment Index: Strong U.S. Auto Market

U.S. automobile dealer sentiment in the first quarter of 2023 was little changed from the level recorded in Q4 2022 and remains at the lowest level since the height of the global COVID-19 pandemic, according to the Cox Automotive Dealer Sentiment Index (CADSI). At 43, the current market index is below the threshold of 50, indicating more dealers view the current auto market as weak. The index remained stable quarter over quarter and down 14 points year over year.

On a positive note, the 3-month, forward-looking market outlook index rose sharply in the first quarter to 52, up from 41 in Q4 2022. In spite of factors holding back their business, a majority of dealers view the Q2 auto market as strong. The increase in Q1 breaks a trend of three consecutive quarters with a declining market outlook. However, even with the improvement in Q1, the market outlook remains below last year’s Q1 score of 64, when dealers were entering 2022 with a stronger sense of optimism.

“Despite high interest rates and stubborn inflation, the U.S. consumer continues to prop up the economy,” said Cox Automotive Chief Economist Jonathan Smoke. “Auto sales are slow by historical standards, but the sales pace has been improving in early 2023, giving dealers reason to feel somewhat optimistic about the year ahead.”

Profits Remain Under Pressure; Costs Rise to Near Record High

The overall profit index declined to 42, down from 44 last quarter and down significantly from 54 a year earlier. The profit index reached record highs in late 2021 and in the early part of 2022 – particularly for franchised dealers – but has declined for six straight quarters. The profit index continues to be propped up by franchised dealers who believe profits remain particularly strong. Independent dealers, conversely, now see profits as weak.

“For franchised dealers selling new vehicles at or above MSRP, the profit picture continues to be very strong,” added Smoke. “The profit index for franchised dealers is down from the records seen in 2021 but still healthy and well above the long-term, pre-pandemic level. Unfortunately, for independent dealers, it’s a different story altogether.”

In Q1 2023, the cost index – specifically the cost of running a dealership – climbed 3 points quarter over quarter to 75; it is now 1 point below the record high recorded in Q2 2022. After reaching a record low of 51 at the height of the pandemic, the cost index has steadily increased.

Inventory Continues to Improve; Used-Vehicle Sales Still a Challenge

The new-vehicle inventory index improved in the first quarter and is up significantly from one year ago. The index was at 25 in the first quarter of last year. Now at 63, the new-vehicle inventory index indicates more franchised dealers feel their inventory is growing, not declining. Importantly, the sentiment index is currently at or above pre-pandemic levels.

The used-vehicle inventory index also improved in Q1 2023 to 43, 1 point higher than the previous quarter and up 7 points year over year. Unlike new inventory, franchised dealers indicate their used-vehicle inventory was declining in Q1. Among franchised dealers, the used-vehicle inventory level index improved by 4 points year over year to 49, just missing the threshold of 50. The index for independent dealers saw a 7-point gain year over year to 40.

Overall, franchised dealers continue to be far more positive about inventory than independent dealers. However, consistent with last quarter, “Limited Inventory” ranks as one of the top factors holding back business for dealers in Q1.

With new-vehicle inventory sentiment improving, the view of new-vehicle sales

improved as well, increasing from 52 to a healthy 57, indicating more dealers see the new-vehicle sales environment as good. One year ago, the index score was 50. The new-vehicle incentives index dropped by 2 points quarter over quarter to 23 and has remained relatively stable since Q3 2021. The index reading indicates dealers view OEM incentives as small instead of large. For comparison, the incentive index was at 49 in Q1 2021.

In contrast to new-vehicle sales, which are viewed as good, most U.S. dealers view used-vehicle sales as poor. The overall used-vehicle sales index increased only 1 point quarter over quarter to 43, down significantly from Q1 2022 when the index score was 52. For franchised dealers, the used-vehicle sales index increased 1 point to 55 in Q1 but is down 9 points from yearago levels. For independent dealers, the index rose 2 points from the previous quarter to 40 but is down 8 points from a year ago.

Majority of Dealers Feeling Pressure to Lower Prices

The price pressure index indicates a majority of dealers are feeling pressure to lower prices. Interestingly, the pressure to lower prices is being felt equally among franchised and independent dealers with scores of 59 and 60, respectively. The index is significantly higher than a year ago when it was 37 but remains below pre-pandemic levels when it averaged 64.

High Interest Rates and a Declining Economy Darken Market Outlook

Overall, “Interest Rates” are now the top factor holding back dealer business in the U.S., with 55% noting it as their primary concern, according to the Q1 2023 CADSI. “Economy” (54%), “Limited Inventory” (43%), “Market Conditions” (42%), and “Expenses” (29%) round out the top five factors holding back business.

MSADA de AL er o P s

t

APRIL 2023 Massachusetts Auto Dealer www.msada.org 22

23 MSADA

Annual Warranty Labor Rate Increase: Statutory or Factory Submission?

By Jordan Jankowski Armatus Dealer Uplift

Every year, as dealers begin to work on their annual labor rate submissions, many are quick to grab their policies and procedures manuals to get started. For most, it is a process that may involve filling out a competitive survey, producing a certain amount of consecutive qualified repair orders, or a combination of the two. Does this process yield as much of an increase as the dealership wants or is entitled to? Many times, the answer is no.

Most dealers are surprised to learn that a factory submission is not their only choice. In fact, 49 states have some type of law in place that allows dealers to perform a statutory labor submission. The purpose of a statutory submission is for a dealer to achieve warranty labor compensation at its retail rate, which is a market-driven rate based on its warranty-like customer-pay repair transactions. Any dealer who is submitting for a labor rate increase should be evaluating its factory protocol and its statutory protocol to determine which is most advantageous.

Factory Submissions

The guidelines for a factory labor submission are different for each manufacturer and can typically be found in your policies and procedures manual. The process can be as simple as filling out a competitive survey or as arduous as producing 100 sequential qualified repair orders; most manufacturers will require a combination of a survey and a certain amount of qualified repair orders. In some cases, it is a quick and simple process to request your rate and wait for

a response. While this process may seem enticing, there are some pitfalls to filing a factory submission. First, your manufacturer is not required to respond in a certain time frame; many dealers have told us they have waited months for a response, only to receive a significantly reduced offer. If this occurs, it is typically a “take it or it leave it” proposition. It is also possible that you will be afforded no increase, as to which you will likewise have no recourse. Although some factory protocols allow you to submit fewer total ROs than a statutory submission, following your state law may yield a greater increase for a variety of reasons.

Statutory Submissions

A statutory submission will give the dealer more control over the process and possible outcomes. Although a statutory submission involves more complicated protocols and can be more work than a factory submission, the benefits usually make the additional work worth it. Most states require 100 sequential qualifying ROs that have been closed in the last 180 days, and prescribe how the rate is to be calculated and what type of services can be excluded from the sample. Once the submission is complete, the manufacturer must respond within a specific time frame (usually 30 days), and most statutes will outline a rebuttal process if the manufacturer approves a reduced rate or offers no increase at all. To further expound on the benefits, let’s focus on three reasons why a statutory submission may be more advantageous than your factory protocol, and what services are available to help dealers through what might be an unfamiliar process.

1. Dealers Are Better Protected

One of the biggest benefits of a statutory submission is the state laws in place that protect dealers from their manufacturers having unilateral control over the resulting labor rate. Although the factory protocols often require less work, it is often

advantageous to submit statutorily to put the dealer in control of the outcome, not the manufacturer.

If you disagree with the outcome of your submission, most statutes have a rebuttal process in place that allows a dealer to dispute a rejection or reduction of its rate-increase submission. Simply put, a factory submission is controlled completely by the manufacturer and ultimately gives them the upper hand, while a statutory submission is controlled by state law to help dealers obtain a fair market rate from their labor submissions.

2. States Exclude Certain Repairs

Many state laws have specific excluded repairs that are designed to eliminate from the sample non-repairs and non-warranty-like repairs to help you achieve your “true” retail rate. For example, the manufacturer’s rules may require that you include battery replacements or wheel alignments in your labor submission. This type of competitive routine maintenance work typically has a low effective labor rate and does not represent what you charge your customers for warranty-like repairs. Certain state laws allow you to exclude this type of work, as well as other non-retail repairs such as those paid for by service contracts/insurance companies, or repairs for fleets or government agencies. All of these exclusions are placed in the law to protect dealers from having to include non-warranty-like work in their labor rate calculation.

3. The Resulting Numbers Are Often Higher

As previously mentioned, you should be evaluating both a statutory submission and a factory submission every year when contemplating a labor-rate increase. In most states, a statutory submission will have different rules than your factory protocol based on a number of specific nuances in the law. We have often had dealers

ACC ountin G 24 APRIL 2023 Massachusetts Auto Dealer www.msada.org

ask why they would complete a statutory submission when their factory protocol required less work. Let’s say a manufacturer requires 20 consecutive qualified ROs that have closed in the last 30 days, which is far less than the 100 qualified ROs that most statutes require. You may wonder, how can a dealer get a larger increase providing 5 times the amount of ROs? One answer is that you can use the last 6 months of data in most states, rather than the limited timeframe prescribed by most factories. The larger data set for a statutory submission makes sure that your increase is indicative of your typical retail pricing policies, while a truncated period of time may be far less representative, or be subject to an unfavorable work-mix. The extra work can seem daunting to a dealer who has only ever performed factory submissions, but it usually pays for itself.

How Do I Get Started with My Statutory Submission?

The next time you are due to perform a labor rate increase submission, think twice about automatically submitting your factory RO sample or survey.

A statutory submission can seem overwhelming to already overworked dealership personnel trying to focus on selling and servicing cars, but that is where a qualified and well-referenced third-party vendor comes into play. A third-party vendor that

is familiar with statutory submissions can guide you through the unfamiliar process and perform it for you, seamlessly.

Before you decide to engage a vendor, you should ask yourself some key questions to make sure you are achieving the optimal result with the least disruption to your business:

Exactly how much work will the vendor be completing for your submission? The process between a vendor and dealer can be very different depending on who you work with. If you are working with a best-in-class vendor to perform your submission, it should be completing all the work for you. If the vendor is asking you to complete tasks like pulling thousands of repair orders, you may be better off completing the submission yourself.

Does the vendor evaluate which submission type is best for you? Many vendors simply provide one form of submission over the other, without much thought given into which submission is right for the dealer. However, other vendors have processes in place that allow them to review a dealer’s data in a way that can identify the most profitable submission type. Most often, this is a statutory submission, but it is possible that a factory submission could be better. You will not know for sure unless your vendor evaluates both opportunities.

How is the vendor ensuring you get the best result? Working with a best-in-

class vendor means it will have software built specially to ensure the best labor rate submissions, based on both state and manufacturer guidelines. If a vendor says it can produce the best result, ask it how; get specific; there are lots of loose claims out there. Attempting to use spreadsheets or DMS reports may help avoid some unfavorable repairs but will make it nearly impossible to identify the optimal range to submit within the prior 6 months. Most of the time you can only submit one time per year, so missing the best possible rate will cost you for at least the next 12 months.

Next Steps

A statutory submission does not have to be as complex as it sounds. That is why third-party vendors immerse themselves in state laws and factory behaviors, in order to give dealers the industry knowledge and tools needed to get you the best labor rate increase possible. With no commitment necessary, there is really no reason not to take a look at working with a third-party vendor to see just how much you could be adding to your bottom line.

Jordan Jankowski is the Chief Operating Officer of Armatus Dealer Uplift, a firm specializing in retail warranty reimbursement submissions. Jordan can be reached at jordanj@dealeruplift.com.

25 MSADA www.msada.org Massachusetts Auto Dealer APRIL 2023

t

Three Tips for Auto Dealers to Survive High Inflation and a High-Interest Environment

By Benjamin DeForest Manager, CPA, MBA, O’Connor & Drew, P.C., plus Withum

Let’s face facts: high inflation and interest rates are plaguing the current financial environment of our country. The effects of this reality have far-reaching consequences throughout the business world, including the auto industry, and it is logical to ask the question “How did we get here?” The fundamental reasons are simple: As inflation rises, the United States central banking system, the Federal Reserve, raises interest rates to combat said inflation. The Fed is amid its most recent war with inflation, and the battle appears to have no end in sight.

Inflation has been running rampant, averaging 8 percent during 2022, which is a rate not seen since the early 1980s. As a response, the Fed increased the Federal Funds Rates seven times over the eleven months from March 2022 to February 2023, with the most recent rates ranging from 4.50 percent to 4.75 percent, an increase from 0.25 percent to 0.50 percent in the prior year. While inflation has slowly fallen since June 2022, it still hovers around 6 percent as of February 2023.

With the Fed seeking to reduce inflation down to 2 percent, the expectations are that the Fed will continue to increase rates at upcoming meetings in March, May, and June 2023. The unexpected collapse of multiple banks in March 2023, including Silicon Valley Bank and Signature Bank, has raised questions about whether rates should be presented in a time of instability in the banking sector. It remains to be seen what action the Fed will take, but the fact remains that high-interest rates are here for the foreseeable future. The question now

becomes, how is the combination of high inflation and interest rates affecting auto dealers, and what strategies are available to neutralize the negative effects?

The hard truth is that high inflation and interest rates have various effects on auto dealers. These effects include reduced new and used vehicle demand from customers due to rising vehicle costs and higher financing rates, increased floorplan expenses to the dealer, reduced F&I product sales, and steeper borrowing rates for other financed infrastructure projects. Based on these factors, dealer profits will likely begin to get squeezed. Below are three approaches for auto dealers to consider to offset the adverse effects of the high inflation and interest environment.

Number 1: Move excess cash to a high-yield business money market account or certificate of deposit.

Outside of cash management accounts to offset floorplan interest expense, dealers generally keep excess cash in the dealership’s checking account. Dealers can optimize their interest income by considering placing their extra cash into a high-yield money market account or a certificate of deposit. While the returns might not be mind-blowing, these accounts are widely considered to be conservative alternatives to a simple checking account. Given the recent collapse of certain mainstream banks, it is important to keep the FDIC insurance limit in mind for each deposit.

Number 2: Evaluate the effects of a vehicle price and financing rate on dealer reserves and F&I product acceptance.

Although dealer reserves and F&I product acceptance have been riding high in recent years due to inventory shortages, customers may be more wary of overspending in this new environment. Since customers are paying more for their vehicles and financing, additional dealer revenue sources such as dealer reserve and F&I product ac-

ceptance will likely take a hit as customers look for ways to save. Dealers should evaluate their customer base and determine if any reductions need to be made in either of these areas to ensure the customer is happy with the transaction and becomes a repeat customer.

Number 3: Inventory Management

In Automotive News’ 2023 Dealer Outlook Survey, 179 dealer respondents selected higher floorplan expense as their largest concern regarding rising interest rates, tied with a reduction in new vehicle demand compared with 2022. Although not yet back to pre-pandemic levels, new vehicle inventory is on the rise in early 2023 and is significantly higher than in early 2022. An increase in new units and vehicle value, coupled with higher interest rates, has the potential to bring floorplan expense to an uncomfortable level. Dealers must also be sensitive to used vehicle inventory and consider pushing more cash into purchasing used vehicles outright as an alternative to adding those vehicles to the floor plan. Dealers must proactively manage all aged inventory, particularly as inventory creeps back toward pre-pandemic levels. As customers try to wait out inflation and interest rates, the dealer must keep an eye on the days’ supply of inventory as it can create significant variation in floorplan interest expense.

Conducting business in a high inflation and high-interest rate environment takes creativity and discipline as business and customer behaviors change on a macroeconomic level. Adding to the uncertainty is the disruption of the banking industry and interest rate unknowns as the Fed determines their plan to quell inflation. Dealers must be proactive and use existing resources to stave off the negative effects of future uncertainties. It is not an easy task, but dealers have certainly persevered through these dire situations before and come out stronger on the other side.

ACC ountin G 26 MSADA APRIL 2023 Massachusetts Auto Dealer www.msada.org

t

Planning For 2023

By Barton D. Haag

Many dealers have taxes on the mind this time of year. We are working with many of our clients to wrap up 2022 and create strategies for 2023 and beyond. Taxes appear to be going up, especially in Massachusetts as the state looks to balance its budget and raise revenue. Usually cutting expenses, like taxes, are of most interest to dealers; however, raising revenue and remaining tax efficient is where you should also focus.

We believe car washes are an excellent complement to the new vehicle business. Dealers typically have the land required to build a new car wash and the tax incentives can be substantial. Building a car wash near your dealership will allow you to run all reconditioned cars and all service customer car washes through it. You can shift that income to your own pocket from the pockets of other vendors, or you can reduce expenses or redeploy personnel previously assigned to hand washing vehicles.