https://drive.google.com/file/d/1uU2IVWnvT2edvo6NG8PfQH2-Eqq5...

April 2024 • Vol. 37 No. 4 auto DEALER M A ss A chus E tts

RETURNS

The

official publication of the Massachusetts State Automobile Dealers Association, Inc

Privacy

Guardian

Workforce

Create

Safety Stay

ComplyCrypt

Schedule

Month-to-Month Contract Zero Implementation Fees Unlimited One-on-One Customer Support is pleased to partner with the 〜10,000 Active Dealers +39 Association Endorsements 98.5 % Dealer Retention Rate

Dealership Privacy & Cybersecurity Platform, FTC

Compliance

#1

Safeguards

AI-powered sales, F&I, and advertising compliance engine

OSHA compliant, reduce risk, and keep employees safe in one simple solution

and manage essential HR policies and employee training

Encrypted Messaging

End-to-End

a Consult to learn more

St A ff Directory

Robert O’Koniewski, Esq. executive Vice President rokoniewski@msada.org

Jean Fabrizio Director of Administration jfabrizio@msada.org

Auto De A ler MAg A zine

Robert O’Koniewski, Esq. executive editor MSADA o ne McKinley Square Sixth f loor Boston, MA 02109

Subscriptions provided annually to Massachusetts member dealers. All address changes should be submitted to MSADA by e-mail: jfabrizio@msada.org

and its

AD Directory complyAuto, 2 Driving Dealer Performance, 13 ethos group, 31 gW Marketing Services, 22 Merchant Advocate, 32 nancy Phillips, 22 ocD tech, 27 PlugStar/Plug in America, 37 reynolds & reynolds, 28 Sprague energy, 25 Withum, 43

ADVertiSing rAteS inquire for multiple-insertion discounts or full Media Kit. e-mail jfabrizio@msada.org

www.msada.org Massachusetts Auto Dealer APRIL 2024 The official publication of the Massachusetts State Automobile Dealers Association, Inc

auto DEALER M A ss A chus E tts

published

Massachusetts State Automobile

Association,

provide information

Bay State auto retail industry

news

MSADA

membership.

Auto Dealer is

by the

Dealers

inc. to

about the

and

of

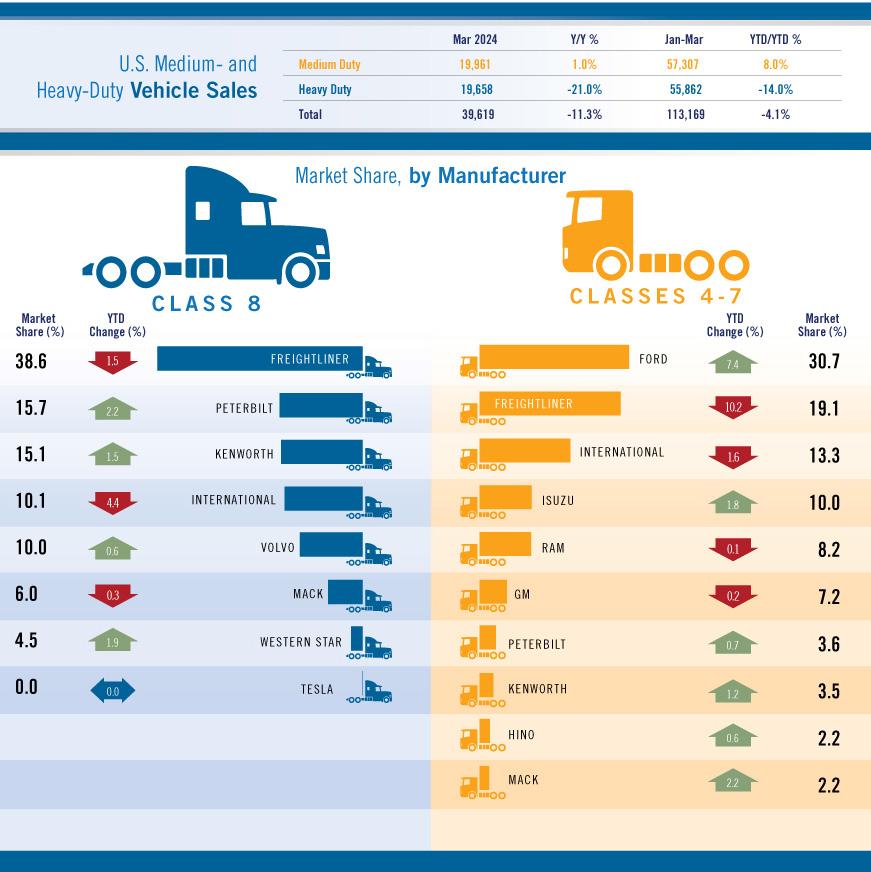

Join us on X at @MassAutoDealers Quarter Page: $450 Half Page: $700 full Page: $1,400 Back cover: $1,800 inside front: $1,700 inside Back: $1,600 tABle of contentS 4 From the President: Auto Show Success 5 AssoCiAte memBers direCtorY 6 the roUndUP: Auto Show returns 11 MSADA 2023 econoMic iMPAct StuDy SurVey forM 12 LeGisLAtiVe sCoreCArd 14 AUto oUtLooK 18 Cover Story: new england international Auto Show 2024 22 neWs from Around the horn 26 ACCoUntinG: Supply chain Disruptions, turbulent inventory, and cash Management Strategies 29 LeGAL: Best Practices for Dealership nil Deals 30 deALer oPs: the “Shift” Has Hit the fan 33 LeGAL: Pregnant Workers fairness Act rules 34 nAdA mArKet BeAt 36 AiAdA: consumer Arbitration in the Spotlight 38 trUCK Corner: ePA issues emissions Standards for trucks –essentially an eV Mandate 41 nAdA UPdAte: Dealers need to Keep up and Stay engaged

Auto Show Success

By Jeb Balise, MSADA President

This month we were able to welcome back our New England International Auto Show at the Boston Convention and Exhibition Center after a four-year Covid-inspired sabbatical. And, based on the sight of enthusiastic attendees coming through the turnstiles and sliding in and out of over 250 eye-catching vehicles amid stunning manufacturer displays, it was quite a success.

The major challenge for all auto shows of every size across the country is translating attendees’ enthusiasm and interest into sales.

This year’s Show had something for everyone. It was the perfect place to browse hundreds of the newest vehicles, from affordable sedans starting at $22,000 on up to a $3 million Koenigsegg. It is our – the MSADA franchised dealers’ – premier showcase of the newest cars, vans, crossovers, hybrids, electrics, light trucks, and sport utilities. We had vehicles to suit every budget, need, and lifestyle, with factory representatives on site to answer all attendees’ questions in a no pressure environment, making it easy to compare prices and features saving our future customers time and money.

When one walks the floor, one can spot a whole range of emotions from our attendees – from the concerned parents looking for a safe drive for their young son or daughter, to the future parents checking out a family van or CUV/SUV, to the contractors reviewing the latest pickup trucks, to the socially conscious doing the deep dive on their next – or perhaps first – EV purchase. Vehicles and future customers were all there for four days.

The major challenge for all auto shows of every size across the country is translating attendees’ enthusiasm and interest into sales. That is where our dealers take over. Every manufacturer there had a comprehensive method for identifying potential customers and leads for our member dealers. Manufacturer reps we heard from were all excited to be back in Boston for 2024 and ecstatic with the look and feel of the Show. There was a definite vibe we were missing with no show for the last four years. Hopefully this is something we can build off of for our dealerships heading into the Summer and for our future auto show events.

I want to thank all our dealers and OEMs who were the key cogs to making our 2024 return a success. Without their commitment, none of this would have happened. I also want to thank our past president Chris Connolly and our other MSADA directors who worked with our Show producer, Paragon Group’s Garry Edgar, to help put on a product we can be proud of.

2025 awaits!

MsAdA BoARd

Barnstable County

Brad tracy, tracy Volkswagen

Berkshire County

Brian Bedard, Bedard Brothers Auto Sales

Bristol County

richard Mastria, Mastria Auto group

Essex County

William Deluca iii, Bill Deluca family of Dealerships

Paul Bertoli, Priority chryslerJeep Dodge ram

Franklin County [open]

Hampden County

Jeb Balise, Balise Auto group

Hampshire County

Bryan Burke, Burke chevrolet

Middlesex County frank Hanenberger, MetroWest Subaru

Norfolk County

Jack Madden, Jr., Jack Madden ford charles tufankjian, toyota Scion of Braintree

Plymouth County

christine Alicandro, Marty’s Buick gMc isuzu

Suffolk County

robert Boch, expressway toyota

Worcester County

Steven Sewell, Westboro chrysler Dodge ram Jeep

Steve Salvadore, Salvadore Auto

Medium/Heavy-Duty Truck Dealer

Director-at-Large [open]

Immediate Past President

chris connolly, Jr., Herb connolly chevrolet

NADA Director

Scott Dube, Mcgovern Hyundai rt.93

OFFICERs

President, Jeb Balise

Vice President, Steve Sewell

Treasurer, Jack Madden, Jr. Clerk, c harles tufankjian

From the President APRIL 2024 Massachusetts Auto Dealer www.msada.org

MSADA 4

t

ACV Auctions

MSADA A SS oci Ate M e M ber S D irectory

Steve Sirko (856) 381-3914

ADESA

Elizabeth Morich (508) 270-5400

Albin, Randall & Bennett

Barton D. Haag (207) 772-1981

American Fidelity Assurance Co.

Kathleen Weisenbach (402) 523-5945

America’s Auto Auction Boston

Chris Colocousis (774) 218-8930

ArentFox LLP

Paul Marshall Harris (617) 973-6179

Sarah Decatur Judge (617) 973-6184

Armatus Dealer Uplift

Joe Jankowski (410) 391-5701

Auto Auction of New England

Steven DeLuca (603) 437-5700

Bank of America Merrill Lynch

Dan Duda and Nancy Price (781) 534-8543

Bellavia Blatt

Leonard Bellavia (516) 873-3000

Broadway Equipment Company

Fred Bauer (860) 798-5869

Brown & Brown Dealer Services

Jason Bayko (508) 624-4344

CDK Global

Rob Steele (508) 564-1346

Clifton Larson Allen

Rick Parmelee (860) 982-9307

Cooperative Systems

Scott Spatz (860) 250-4965

Cox Automotive

Ernest Lattimer (516) 547-2242

Creative Resources Group

Charlie Rasak (508) 726-7544

CVR

John Alviggi (267) 419-3261

Dave Cantin Group

Woody Woodward (401) 465-7000

Dealer Pay

Shannon Wischmeyer (636) 293-8038

Downey & Company

Paul McGovern (781) 849-3100

DP Sales Distributors

Andrew Prussack {631) 842-7549

Driving Dealer Performance

Kimberly Guerin (978) 760-0322

Eastern Bank

David Sawyer (617) 620-3484

EasyCare New England

Greg Gomer (617) 967-0303

Ethos Group, Inc.

Drew Spring (617) 694-9761

F&I Direct

Sean Wiita (508) 414-0706

Michelle Salas (508) 599-0081

Federated Insurance

Kevin Sundberg (559) 547-9694

Fisher Phillips LLP

Joe Ambash (617) 532-9320

Jeff Fritz (617) 532-9325

Josh Nadreau (617) 532-9323

GW Marketing Services

Gordon Wisbach (857) 404-0226

Hilb Group

James Pietro (508) 791-5566

Huntington National Bank

Michael Ham (740) 815-5085

ION Bank

Timothy Rourke (203) 439-9400

JM&A Group

Chris “KC” Hwang (954) 415-6961

John W. Furrh Associates Inc.

Pamela Barr (508) 824-4939

Key Bank

Mark Flibotte (617) 385-6232

KPA

Abe Cohen (503) 902-6567

LoJack by Spireon

Ashvir Toor and Robin Dukes (800) 557-1449

M & T Credit Corp.

John Federici (508) 699-3576

Management Developers, Inc.

Dale Boch (617) 312-2100

Marcum LLP

Nichole Rene (203) 781-9690

McWalter Volunteer Benefits Group

Shawn Allen (617) 483-0359

Merchant Advocate, LLC

Dan Giordano (973) 897-2778

Mintz Levin

Kurt Steinkrauss (617) 542-6000

Murtha Cullina

Thomas Vangel (617) 457-4000

Nancy Phillips Associates, Inc.

Nancy Phillips (603) 658-0004

NEAD Insurance Trust

Charles Muise (781) 706-6944

Northeast Dealer Services

Johna Cutlip (401) 243-7331

OCD Tech

Michael Hammond (844) 623-8324

Performance Management Group, Inc.

Dale Ducasse (508) 393-1400

Piper Consulting

Jim Piper (207) 754-0789

Plug In America

Joel Levin (237) 925-1364

Portfolio

J. Gregory Hoffman (800) 761-4546

Pullman & Comley LLC

James F. Martin, Esq. (413) 314-6160

Reynolds & Reynolds

Austin Ziske (802) 505-0016

Rockland Trust Co.

Joseph Herzog (508)-830-3241

Samet & Company

John J. Czyzewski (617) 731-1222

Santander Bank

Richard Anderson (401) 432-0749

Chris Peck (508) 314-1283

Schlossberg, LLC

Michael O’Neil, Esq. (781) 848-5028

Shepherd & Goldstein CPA

Ron Masiello (508) 757-3311

Southern Auto Auction

Joe Derohanian (860) 292-7500

Sprague Energy

Rick Pasquatelli (508) 768-7640

The Towne Law Firm P.C.

James T. Towne, Jr. (518) 452-1800

TrueCar

Pat Watson (803) 360-6094

Truist

Andrew Carmer (401) 409-9467

US Bank

Vincent Gaglia (716) 649-0581

Wells Fargo Dealer Services

Josh Tobin (508) 951-8334

Withum

Kevin Carnes (617) 471-1120

Zurich American Insurance Company

Steven Megee (774) 210-0092

5 www.msada.org Massachusetts Auto Dealer APRIL 2024

Associate Members

Auto Show Returns

By Robert O’Koniewski, Esq.

MSADA

Executive Vice President

rokoniewski@msada.org

Follow us on X (formerly Twitter) • @MassAutoDealers

Your Association leadership was very excited this month to kick off our 64th New England International Auto Show, April 25-28. After enduring a Covid-inspired three-year absence since our last show in January 2020, we were able to rally manufacturers, our member dealers, and dealer ad groups to take a run at revitalizing our event for this year.

Based on the reactions of factory reps, dealers, and attendees, the Show was a success. After an absence of any kind – “out of sight, out of mind” – there is always apprehension as to what the reaction may be. In the end, we can be pleased with the product we rolled out. We had attractive vehicles and the people showed up.

There were over 250 vehicles of all types and pricing levels, a considerable variety on hand for all consumers from those seeking their first purchase, to those figuring out how to accommodate their growing family, on up to those ready to convert to, or buy again, a ZEV. Attendees were filling the OEM areas and continually climbing in and out of vehicles throughout the show. Linemake ambassadors were collecting consumer information in an effort to convert customer interest to sales by our members.

Throughout the economy, personal-touch businesses dependent on live action have slowly been growing back from the adverse Covid economic restrictions and shutdowns. I see it every day in downtown Boston as office buildings and storefronts remain dark. Slowly, however, one

sees more traffic on the roads and people in town each month. It will not be at 2019 levels, but it certainly is growing gradually.

For our 2024 Show, we did what we had to do and took a shot with it. We were cautiously optimistic and ended up pleasantly surprised. We look forward to growing our factory participation in 2025 and inspiring more spectators to attend.

We thank everyone who helped make our Show a success for dealers, manufacturers, and the buying public. On to bigger and better for 2025!

House Approves E-Titles, E-Signatures

On April 26, the Massachusetts House completed action on its version of the FY25 budget, approving on a 153-4 vote the $58 billion spending plan. The budget includes no tax increases, seeks to push overall state spending up by about 3.3 percent, or $2 billion, and aims to drive up the state rainy day fund balance to nearly $9 billion. House Democrats were united in their support of the bill while there were divisions within the 25-member House Republican caucus, where four members voted against the budget.

In a matter of interest to new and used-car dealers, we were able to successfully lobby the House to include in the bill three outside sections that would call for the Registrar of Motor Vehicles to establish a process for not only accepting electronic signatures on all vehicle transactional documents, including titles and all odometer statements, but also creating an e-title process in

6 APRIL 2024 Massachusetts Auto Dealer www.msada.org t he r oundu P

lieu of the current paper title requirement.

The bill will now go to the Senate, which is expected to take up its own version of the FY25 spending plan in mid-May. FY25 begins on July 1, so the two chambers will need to resolve any budgetary differences in a conference committee, and then submit the final report to the governor for her review and signature by that date. However, keep in mind, the legislature and governor have missed the July 1 for at least the past eight years.

Senate Approves Changes to Consumer Protections

On April 25, the Massachusetts Senate approved a bill, Senate 2736, An Act Modernizing Protections for Consumers in Automobile Transactions, which would change several Class 2 licensing requirements and amend the used vehicle lemon law express warranty mileage standards. The bill would also include lessors and lessees within the state’s Motor Vehicle Installment Sales Act.

Under the current used vehicle lemon law, no used vehicle can be sold by a dealer unless it is accompanied by an express warranty covering the full cost of both parts and labor necessary to repair any defect that impairs the used vehicle’s safety or use. The duration of the required warranty is based on the mileage of the used vehicle if it is known at the time of sale, or, if unknown, the age of the vehicle at the time of sale.

The bill would make the following mileage changes:

• For used vehicles operated less than 50,000 miles (currently in law set at 40,000), the warranty would be 90 days or 3,750 miles, whichever occurs first;

• For used vehicles operated 50,000 miles but less than 100,000 miles (currently in law set at 40,000 and 80,000), the warranty would be 60 days or 2,500 miles, whichever occurs first;

• For used vehicles operated 100,000 miles but less than 150,000 miles (currently in law set at 80,000 and 125,000), the warranty would be 30 days or 1,250

miles, whichever occurs first.

The bill, further, would double the bond to $50,000 from $25,000 that a used vehicle dealer would need to acquire for the Class 2 license. And, more significantly, the bill would enable the attorney general to make a claim of recovery against the bond on behalf of a person who suffers a loss in a used vehicle transaction.

The bill now goes to the House for its consideration.

EPA Issues Final Phase 3 GHG Emissions Standards for HeavyDuty Vehicles

On March 29, the Environmental Protection Agency (EPA) issued its final Phase 3 greenhouse gas (GHG) rule. The EPA’s rule includes stronger greenhouse gas standards that phase in over MYs 2027 through 2032 and increases the adoption rate stringency at a slower pace than the proposed rule but is still extremely aggressive and costly.

The EPA’s standards are structured to attempt to allow manufacturers to choose what set of emissions control technologies will work for their vehicle fleet to attempt to meet the standards, but battery electric will need to be the predominant technology.

In the final rule, the EPA requires manufacturers to convert an annually increasing percentage of their total vehicle sales to zero-emission vehicles (ZEVs), with projected sales percentages for the following categories of vehicle:

• 60 percent ZEV for light-heavy vocational vehicles by MY 2032

• 40 percent ZEVs for medium-heavy vocational vehicles by MY 2032

• 30 percent ZEVs for heavy-heavy vocational vehicles by MY 2032

• 40 percent ZEVs for day cab tractors by MY 2032

• 25 percent ZEVs for sleeper cab tractors in MY 2032

American Truck Dealers (ATD) is opposed to the EPA’s final Phase 3 GHG rule because it will have unprecedented negative impacts on American commercial trucking, large swaths of U.S. businesses,

customers and consumers, and likely overall emissions and the environment. The Phase 3 rule will only exacerbate this problem by further forcing commercial vehicle customers to hold on to existing fleets or purchase used trucks. Having older trucks remain on the road does nothing to save fuel, make our roads safer, or reduce GHG emissions.

Less than 1% of commercial vehicle sales today are ZEVs, yet this rule sets overly aggressive electric truck targets on a short timeline that will not result in increased zero-emission truck sales and lowered GHG emissions but will have lasting negative consequences. The technology-forcing regulations and barriers to new-truck sales are enormous and are resulting in only one outcome: new trucks that commercial customers simply cannot afford, reliably charge, or utilize, and therefore will not purchase.

ATD supports sound policies that increase fuel efficiency and reduce GHGs for America’s trucks. ATD will continue to advocate for the EPA to amend their Phase 3 rule to match realities of the commercial truck market and the commercial electric charging infrastructure.

Further, a Roland Berger study released by the Clean Freight Coalition found that full electrification of the U.S. commercial truck fleet would require nearly $1 trillion in infrastructure investment and grid networks to meet the demand.

OSHA Issues Final Rule on Workplace Site Inspections

On March 29, the Occupational Health and Safety Administration (OSHA) issued a new rule that expands who can participate in OSHA walkaround inspections. The rule takes effect on May 31, 2024. The rule allows third parties, potentially not connected with the workplace, to accompany OSHA during the inspection process/facility walkaround if OSHA considers such parties “reasonably necessary to the conduct of an effective and thorough physical inspection of the workplace.”

This modification will likely complicate

7 www.msada.org Massachusetts Auto Dealer APRIL 2024 MSADA

future OSHA inspections by allowing third parties, such as a labor union representative, attorney, consultant, or worker advocacy organization, to be part of the inspection process. Non-employees allowed to enter the workplace and access information otherwise not available may lead to a more contentious OSHA inspection process and increase legal risks.

The new rule would allow employees to designate someone who does not work for their employer to represent them during the “walkaround” part of an OSHA inspection. In the previous rule, a walkaround representative could only be an employee. The final rule does not change existing regulations that give OSHA compliance officers the authority to determine if an individual is authorized by employees and to prevent someone from participating in the walkaround inspection if their conduct interferes with a fair and orderly inspection, or to limit participation to protect employer trade secrets.

Substantial questions remain about the longevity of the final rule, including whether it will survive anticipated legal challenges, and whether it will be in jeopardy should there be a presidential administration change. In the meantime, dealerships should work with their attorneys to consider a written procedure that clearly instructs management on how to receive OSHA inspectors who wish to gain access to the job site.

FTC’s Govt. & Bus. Impersonation Rule Now Effective

Beginning April 1, the final FTC Government and Business Impersonation Rule took effect. The rule prohibits commercial speech that “impersonates” a business or government agency (or officer thereof).

Federal law enforcement agencies have reported government impersonation “scams” connected to efforts to extort money or steal personally identifiable information from consumers. The FTC

alleges that “[g]overnment and business impersonation scams have cost consumers billions of dollars in recent years.” The FTC also notes that “both categories saw significant increases in reports to the FTC in 2023,” and that such impersonation efforts are proliferating with the rise in AI “deep-fakes” and similar technological tools.

The FTC states that the rule will, for example, “enable the FTC to directly seek monetary relief in federal court from scammers that:

• Use government seals or business logos when communicating with consumers by mail or online.

• Spoof government and business emails and web addresses, including spoofing “.gov” email addresses or using lookalike email addresses or websites that rely on misspellings of a company’s name.

• Falsely imply government or business affiliation by using terms that are known to be affiliated with a government agency or business (e.g., stating “I’m calling from the Clerk’s Office” to falsely imply affiliation with a court of law).”

Of course, dealers are not involved in efforts such as these. However, the FTC has, in the past, brought enforcement actions against marketers for impermissibly representing or implying a relationship with a government agency based on marketing materials or statements made by marketers. Dealers should take steps to avoid even the implication of any such “impersonation” or any alleged affiliation with a government agency in marketing materials or otherwise.

The FTC also has announced a supplemental notice of proposed rulemaking that would extend the prohibition under the rule to the impersonation of individuals.

Mass. RMV Cautions Public of Deceptive & Mimic Websites

The Massachusetts Registry of Motor Vehicles issued a warning on April 4 reminding customers to use only www. Mass.Gov/RMV for information and to perform transactions, including when

renewing a license or a registration. There has been no sharp increase in reports of deceptive and mimic websites to the RMV. As a busy time of year for customer transactions, the RMV is issuing this reminder to the public about sites which have been created to mislead customers into thinking they have reached the official RMV website.

A Message from Registrar Colleen Ogilvie: “We urge everyone to be vigilant when performing transactions or providing information online for RMVrelated services. Customers should avoid using any unofficial third-party websites claiming to assist with RMV services and inform their relatives and friends about this as well. On our official website Mass.Gov/RMV, customers can look up how much specific services cost and see which services are available to them at no charge.”

To ensure you are accessing the official RMV site, please remember the following: In Massachusetts, we use the term “Registry of Motor Vehicles” and “RMV.” Please log-off if the site references the “DMV” or the “Department of Motor Vehicles.”

At www.Mass.Gov/RMV:

• You will never be charged to check your license, registration, or title status.

• You will never be charged to access Registry forms and information.

• You will never be charged to change your address on file.

The RMV actively posts online about this topic including on X @MassRMV, and a warning regarding third-party websites remains featured in the RMV’s Driver’s Manual.

Report a Fraudulent Website: Reports of fraudulent websites can be directed to the Attorney General’s Office at http://www.mass.gov/ago/consumerresources/consumer-assistance/consumercomplaint.html and at the FTC: https:// www.ftc.gov/. Customers should beware of text messages or emails which claim to be from MassDOT or the RMV, as these communications often are dangerous phishing scams and not official MassDOT

the roundu P APRIL 2024 Massachusetts Auto Dealer www.msada.org 8

and RMV sources. These fraudulent texts and emails may include links, which do not lead to official MassDOT or RMV websites. Customers should not follow the links nor reply to these messages with personal information.

Customers and dealers with additional questions about how to identify and avoid scams can contact the Office of Consumer Affairs and Business Regulation by calling the Consumer Hotline at (617) 973-8787, or toll-free in Massachusetts at (888) 283-3757.

States Sue to Block EPA Rules on Tailpipe Emissions

On April 18, Republican attorneys general from 25 states sued the U.S. Environmental Protection Agency to block rules intended to reduce planet-warming emissions from cars and light trucks and encourage electric vehicle manufacturing, arguing the agency exceeded its legal authority. The lawsuit challenging the regulations for passenger vehicles, which the Biden administration finalized on March 20, was filed by attorneys general from states led by Kentucky and West Virginia in the U.S. Court of Appeals for the District of Columbia Circuit. We will provide updates as they may occur.

EEOC Issues Final Regs, Guidance on Pregnant Workers Fairness Act

On April 15, the Equal Employment Opportunity Commission (EEOC) published a final rule that provides interpretative guidance regarding the Pregnant Workers Fairness Act (PWFA). The PWFA, which became law in December 2022, requires covered entities to make reasonable accommodations for qualified employees affected by pregnancy, childbirth, or related medical conditions, and prohibits employment policies and practices that discriminate against such employees. Under the PWFA, “covered entities” include public and private employers with 15 or more employees, unions, employment agencies, and the Federal Government.

The new rule takes an expansive view of what qualifies as “affected by pregnancy, childbirth, or related medical conditions.” Under the PWFA Regulations:

• The terms “pregnancy” and “childbirth” encompass not only current pregnancies but also previous pregnancies and any planning or attempts to become pregnant, such as infertility, fertility treatments, and the use of contraception;

• “Related medical conditions” refer to health conditions associated with an employee’s pregnancy or childbirth that require accommodation, including complications from ending a pregnancy, like miscarriage, stillbirth, or abortion, as well as postpartum issues such as anxiety, depression, incontinence, menstruation, and lactation;

• Reproductive health matters that may not be linked to a current or recent pregnancy – like menstruation, contraception usage, endometriosis, incontinence, and infertility – are covered, despite objections to this broad interpretation. The rule generally takes effect 60 days after it is published and will likely go into effect mid-summer. Dealers, their attorneys, and vendor partners should review the final rule to ensure that their employment policies and practices comply with the regulations and guidance. Please note that state laws that are more protective of workers’ rights are not preempted by the PWFA.

Reminder: In February 2023, NADA issued guidance following the initial passage of the Pregnant Workers Fairness Act.

FTC Bans Non-Compete Restrictions

On April 23, the Federal Trade Commission issued a final rule that prohibits the use of non-compete contracts by employers. The commission’s Democrat majority voted 3-2 to move forward with the new rule. The rule prohibits employers from enforcing existing noncompete agreements on anyone other than senior executives; however, the rule does ban employers from imposing new non-

compete contracts on senior executives in the future. Since the FTC rule is essentially a blanket ban, inconsistent state law would be preempted. Thus, for Massachusetts employers, virtually all non-compete contracts would be void, both retroactively and prospectively. Business groups actively opposed the rule when it was first proposed in January 2023, so this final rule most likely will face a court challenge. The final rule will become effective 120 days after publication in the Federal Register.

For additional details, members can access MSADA Bulletin #54 (4/25/24) at www.msada.org.

U.S. DOL Issues New Rules Defining OT Exemptions

On April 23, the U.S. Department of Labor published a final rule that raises the minimum annual salary threshold to classify an employee as exempt from overtime rules under the federal Fair Labor Standards Act (FLSA).

The new rule’s dramatic increase in salary thresholds will require dealers to reclassify some exempt employees as non-exempt and require justification for classifying some employees as nonexempt.

• Salary threshold: Under FLSA, a worker may be exempt from overtime pay if paid on a salary basis over the minimum annual salary threshold and qualifies as an executive, administrative, professional, computer, or outside sales employee (commonly referred to as “EAP” exemptions), defined here. Beginning on July 1, 2024, all employees with a salary under $43,888 (up from the current $35,568) per year must be reclassified as non-exempt and, therefore, receive overtime pay. Beginning January 1, 2025, the salary level changes to $58,656.

• Highly compensated employees: Highly compensated employees performing office or non-manual duties are not subject to the EAP test but are exempt from the FLSA overtime rules if they regularly perform at least one of the duties of an EAP. Beginning July 1, 2024, all

MSADA

www.msada.org Massachusetts Auto Dealer APRIL 2024 9

the roundu P

employees earning between $43,888 and $132,964 (up from the current $107,432) must qualify under all the factors defining an EAP employee. Beginning January 1, 2025, all employees earning between $58,656 and $151,154 must qualify under all the factors defining an EAP employee.

• Incentive payments and Dealership Exemptions: Employers may use nondiscretionary bonuses and incentive payments (including commissions) that are paid on an annual or more frequent basis to satisfy up to 10% of the standard salary level. Existing exemptions under federal law for salesmen, partsmen, and mechanics primarily engaged in selling or servicing automobiles remain unchanged. (Massachusetts law does not exempt salesmen from overtime pay requirements; plus, dealers must follow the Sleepy’s rules regarding minimum wage pay, OT pay, commissions, and bonuses.)

The new rule will almost certainly be challenged in court. In 2016, a federal court stayed President Obama’s attempt to dramatically increase salary thresholds and ultimately struck it down. A future lawsuit would likely challenge the new rule on the same grounds.

MSADA Webinar with Merchant Advocate –May 7, Noon

The Silent Equity Partner You Never Knew You Had

Are you happy with your credit card expenses? Do you think they should be lower? Are you aware that the credit card companies can include erroneous and duplicative fees and charges in your monthly bills? Have you ever had an analysis done to see if you are being charged accurately?

Of course, you would love to save money on your credit card expenses at your dealership. Who wouldn’t? Now you can optimize your dealership’s payment system for increased profitability without switching credit card processors.

Do not miss MSADA’s endorsed vendor Merchant Advocate for a live webinar on Tuesday, May 7, at Noon ET,

to learn about:

• The real cost of payment processing;

• Where the hidden fees are and how you can optimize your system;

• The lifecycle of a transaction and who gets paid on your transaction; and

• Adding more to your dealership’s bottom line.

Do not delay – take the first step today to address your credit card processing fees at your dealership.

Register today at https://us06web. zoom.us/meeting/register/tZUqcOhrTssGd3yZM4axwiK7Onw7KQkiQ6u#/ registration

MSADA Webinar – May 9, 11am

Critical Compliance Rules Affecting Your Dealership

The ever-changing state and federal compliance requirements make the legal landscape nearly impossible to navigate.

Join us on Thursday, May 9, at 11:00 a.m., when we host Terry O’Loughlin, Director of Compliance at Reynolds and Reynolds, in the latest in our series of compliance series webinars, “Critical Compliance Rules Affecting Your Dealership”, as he takes a deepdive into the latest automotive dealership regulations. This webinar will explore the critical compliance rules affecting your dealership, highlighting the changes of which you need to be aware. By the end, you will gain not only peace of mind but also a clear roadmap for regulatory navigation.

A long-time MSADA-endorsed partner for our forms program and the owner of the LAW® brand, Reynolds Document Services invests substantial resources in monitoring legal regulations in addition to market needs and best practices. When it comes to these legal matters, education is key.

Terry has been a frequent presenter at MSADA events, including our annual meetings, dealer summits, and webinars such as this. Dealers here and around the country have depended on his expertise for decades to ensure comprehensive compliance with state and federal laws and regulations. Do not miss this opportunity to stay ahead of the curve, especially as an

activist federal government continuously strives to make life more difficult for small businesses such as franchised auto dealers. Do not wait until it is too late – take control of your dealership›s success today! Please register for the webinar at https://reyrey.zoom.us/webinar/register/ WN_vXr27vumTHKlCDbcCamAPw#/ registration

Our PACs - NADAPAC & NCDPAC

We greatly appreciate the contributions we receive from our member dealers who answer our calls for donations to our PACs. Each year MSADA expresses itself politically through NADA’s federal PAC, NADAPAC, and through our state PAC, the New Car Dealers Political Action Committee (NCDPAC).

We depend on contributions from our dealers to keep these PACs strong, as we need to have an active voice in Washington and on Beacon Hill. Contributions to our PACs are an inexpensive insurance policy. Since by law we cannot use our membership dues or other association revenues for political contributions, the PACs help us to remain strong politically as we advocate for our dealers’ interests in the political process.

If you have not yet given to the PACs this year, please contact me at rokoniewski@ msada.org and we can make sure your contributions happen. Thank you.

Complete the 2023 Economic Impact Survey

Please assist us again in creating our annual Economic Impact Report, which we use with legislators and opinion makers to demonstrate the real dollar and cents economic impact that dealers have on our Commonwealth and in their cities and towns. Please take a few minutes to complete the survey today for each of your dealerships. The survey is available on page 11 of this issue. Your submitted survey is strictly confidential. We will be collecting the surveys until May 17. Thank you for your assistance with this project.

t APRIL 2024 Massachusetts Auto Dealer www.msada.org 10

MASSACHUSETTS STATE AUTOMOBILE DEALERS ASSOCIATION

ECONOMIC IMPACT

STUDY SURVEY

This study is a critical legislative and public relations tool for Massachusetts franchised new car dealers. Please take the time to fill out this survey. You may fax it to Auto Outlook (610-640-2907), mail to Auto Outlook (PO Box 390, Exton, PA, 19341), or email to (autooutlook@icloud.com). If you operate more than one dealership, please complete one form for each location.

1. Personnel - 2023

Number of full time employees

Number of part time employees

Change in number of full time employees from 2022 (+ or -)

Total payroll

Total employee benefits (excluding payroll taxes and social security)

Do all of your employees and their dependents have access to health insurance through your dealership?

insurance premiums paid

compensation premiums paid

2. Financial - 2023

FINANCIAL RESULTS - 2023

4. Vehicle Sales - 2023

Total number of new and used vehicles sold

5. Taxes and Fees - 2023

TAXES COLLECTED AND REMITTED - 2023

Federal employee taxes (include employer and employee Social Security and Medicare, and employee taxes withheld)

State/local employee taxes (include state disability and income taxes withheld)

estate taxes

State sales and use taxes collected

Other state/local business taxes or fees

6. Miscellaneous Questions

Question #1

In what county is the dealership located?

Question #2

How many franchises are housed at the dealership?

3. Electric Vehicles

Question #3

2023: % 2024: %

Estimated annual battery electric vehicle sales as a percent of overall new vehicle sales:

Estimated number EV chargers that will be installed at the dealership by the end of 2024: EXPENSES RELATED TO SALE OF EVs - 2024 Projected

What were your total personal and dealership contributions to charitable and civic organizations in 2023?

Question #4

How much was spent on advertising during 2023?

What percentage of your 2023 advertising dollars went to:

Question #5

Estimate the total amount spent in 2023 for products and services from other Massachusetts businesses (e.g., utilities, professional fees, office equipment, supplies, etc.)

MSADA

$

$

$

Real

$

$

$

$

$

$

Unemployment

Workers’

New Used

New vehicle sales $ Used vehicle sales $ Service Department $ Parts and accessories $ F and I Department $ Other revenue $ TOTAL SALES $ ALL SURVEYS ARE STRICTLY CONFIDENTIAL

$

Newspaper % Direct mail % Radio % Internet % Television % Other % Yes

No

$

$

TOTAL EV-RELATED EXPENSES $ Building modifications or acquisitions $ Charging infrastructure $ Chargers $ Special equipment $ Sales training $ Service training $ 11 www.msada.org Massachusetts Auto Dealer APRIL 2024

EGISLATIVE S CORECARD

APRIL 2024

BILL# SPONSOR SUBJECT STATUS

S151

H331

H290

H329

S204

H270

H289

S150

H351

Sen Crighton Rep Hunt

Rep Finn

Rep Howitt

Sen O’Connor

Rep Chan

Rep Finn

Sen Crighton

Rep Lewis

Amendments to Ch. 93B, the auto dealer franchise law.

RTR law amendments to fix Model Year start date and consumer notice.

Creates process to appeal improperly issued Class 1 license.

Modernize on-line vehicle purchase process.

S199 Sen Moore Amends definition of heavy-duty trucks in RTR law.

S220 H400 Sen Velis Rep Walsh Open safety recalls notifications.

H354 Rep Linsky Allows an OEM to open a factoryowned store, without a dealer, if there is no same line-make dealer in the state. (The so-called “Tesla Exemption.”)

S688

H1095

H1118

S639

H1121

H995

Sen Moore

Rep McMurtry

Rep Philips

Sen Feeney

Rep Puppolo

Rep Donahue

Creates process to increase the insurance reimbursed labor rate paid to auto body repairers.

Protects consumer choice in vehicle service contracts.

S2219 H3255 Sen Cronin Rep Arciero Eliminates initial state inspection for new vehicle.

Joint Committee on Consumer Protection held public hearing on July 17, 2023; placed into study.

Joint Committee on Consumer Protection held public hearing on July 17, 2023; placed into extension order.

Joint Committee on Consumer Protection held public hearing on July 17, 2023. H270 reported favorably on Jan. 25, 2024; sent to House Ways and Means.

Joint Committee on Consumer Protection held public hearing on July 17, 2023. H351 reported favorably on Jan. 25, 2024; sent to House Steering & Policy Committee; House ordered to third reading on 2/12/24.

SUPPORT Joint Committee on Consumer Protection held public hearing on July 17, 2023; placed into extension order.

SUPPORT Joint Committee on Consumer Protection held public hearing on July 17, 2023. Redraft H4277 reported favorably on January 25, 2024; sent to House Ways and Means.

OPPOSE Joint Committee on Consumer Protection held public hearing on July 17, 2023; placed into study.

Joint Committee on Financial Services held public hearing on October 3, 2023; reported redraft H4412 favorably and sent to House Ways and Means.

Joint Committee on Financial Services held public hearing on October 3, 2023; H995 reported favorably and sent to House Steering & Policy Committee.

SUPPORT Joint Committee on Transportation held public hearing on Jan. 24, 2024; placed into study.

H3348 Limit doc prep fee amounts. OPPOSE Joint Committee on Transportation held public hearing on Jan. 24, 2024; reported favorably and sent to House Ways and Means Committee. Rep Howitt

S2210

Sen Crighton

Safety shutoff for keyless ignition technology.

Sen Creem Rep Carey

Joint Committee on Transportation held public hearing on October 17, 2023; reported favorably.

S25 H60 Personal data privacy and security. OPPOSE Joint Committee on Advanced Information Technology, the Internet and Cybersecurity held public hearing on October 19, 2023.

S227 Sen Finegold Mass. Info Privacy & Security Act. OPPOSE Joint Committee on Economic Development and Emerging Technologies held public hearing on October 19, 2023. Bill sent to AITIC Committee on November 2, 2023.

S171 H311 Sen Feeney Rep Gonzalez Protect consumers in auto transactions. OPPOSE Joint Committee on Consumer Protection held public hearing on July 17, 2023; reported S171 favorably on 1/25/24 and referred to Senate Ways and Means. SWM reported redraft S2736 favorably on 4/22/24. Senate engrossed on 4/25/24.

SUPPORT SUPPORT SUPPORT SUPPORT OPPOSE SUPPORT SUPPORT

12 APRIL 2024 Massachusetts Auto Dealer www.msada.org

www.msada.org Massachusetts Auto Dealer APRIL 2024

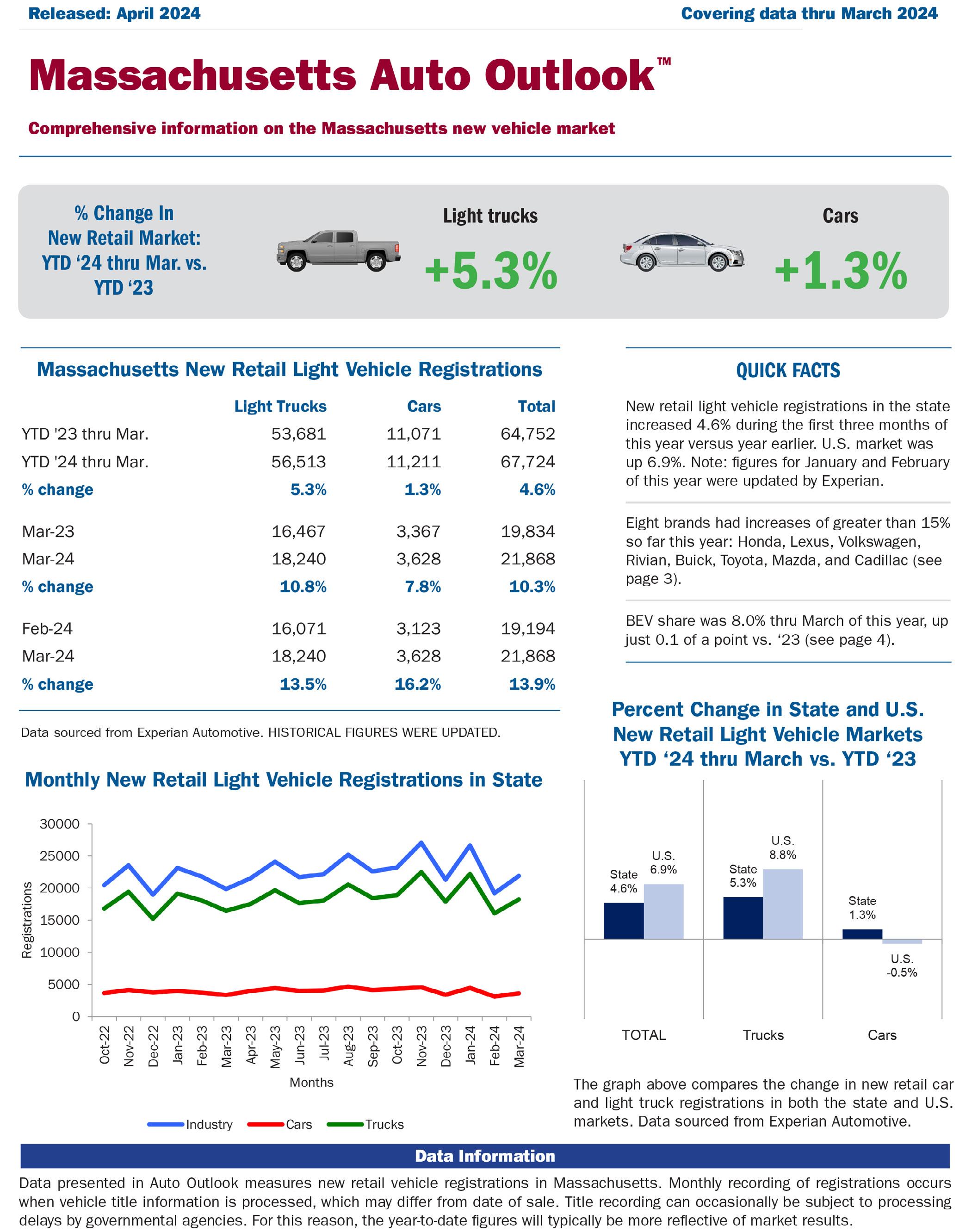

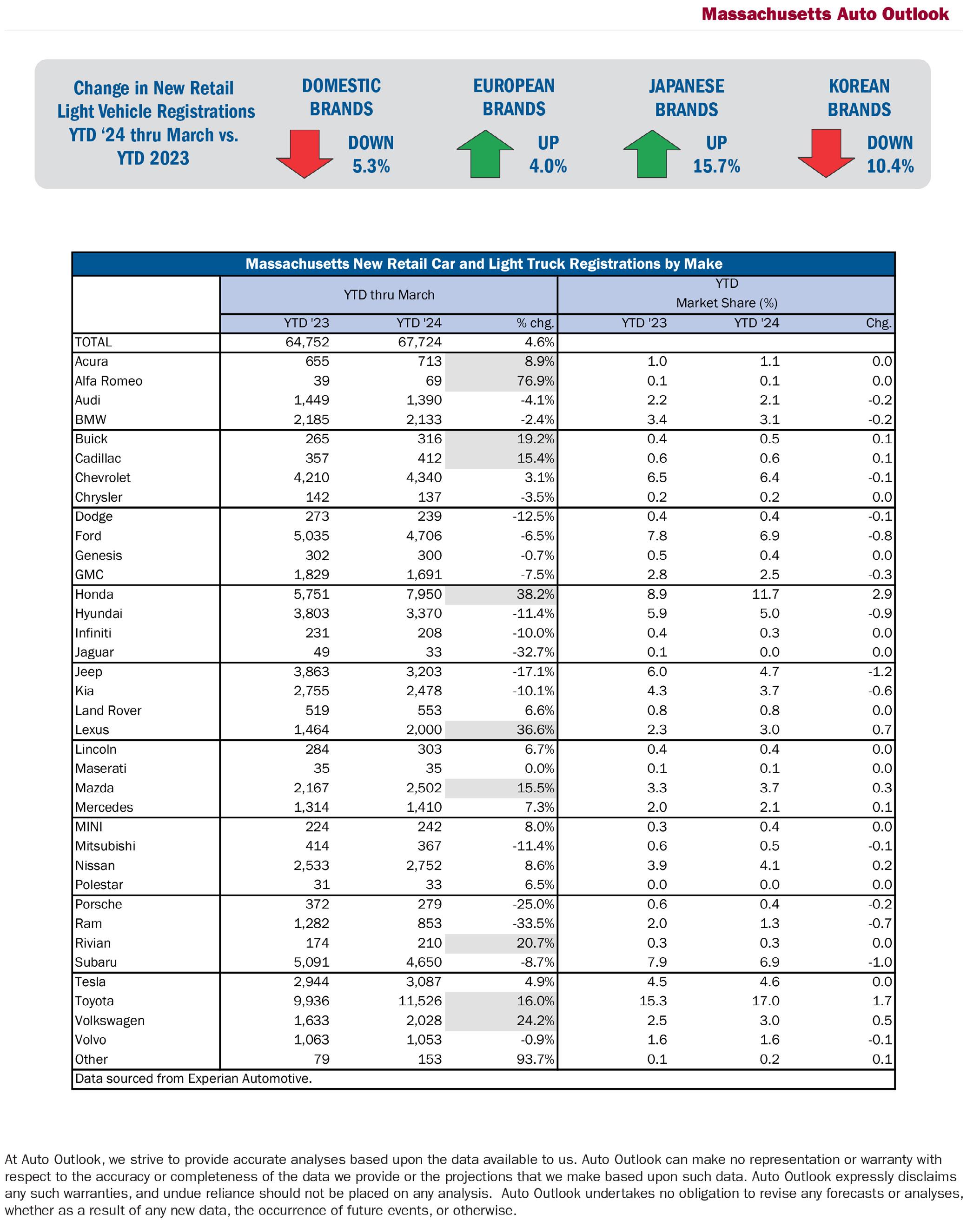

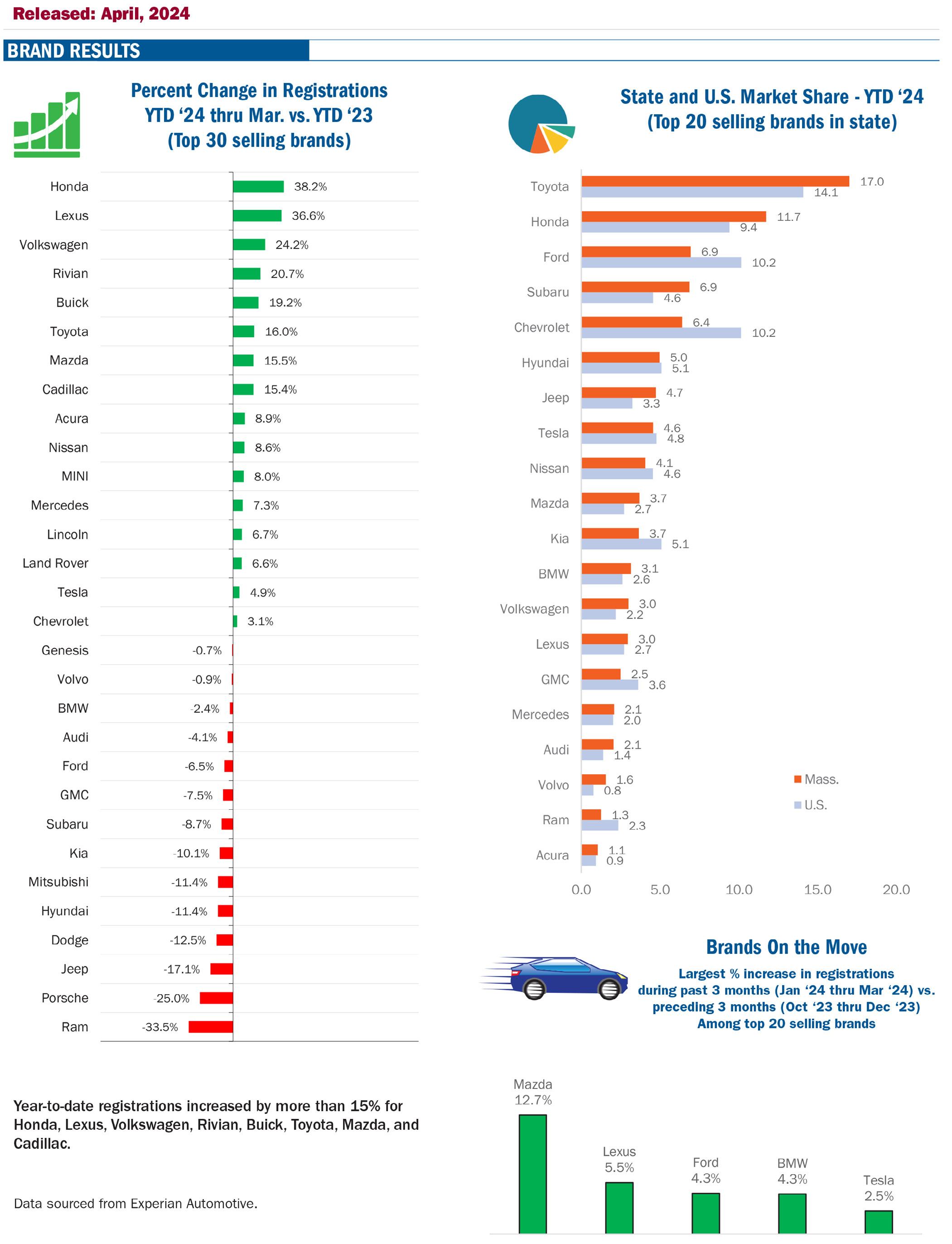

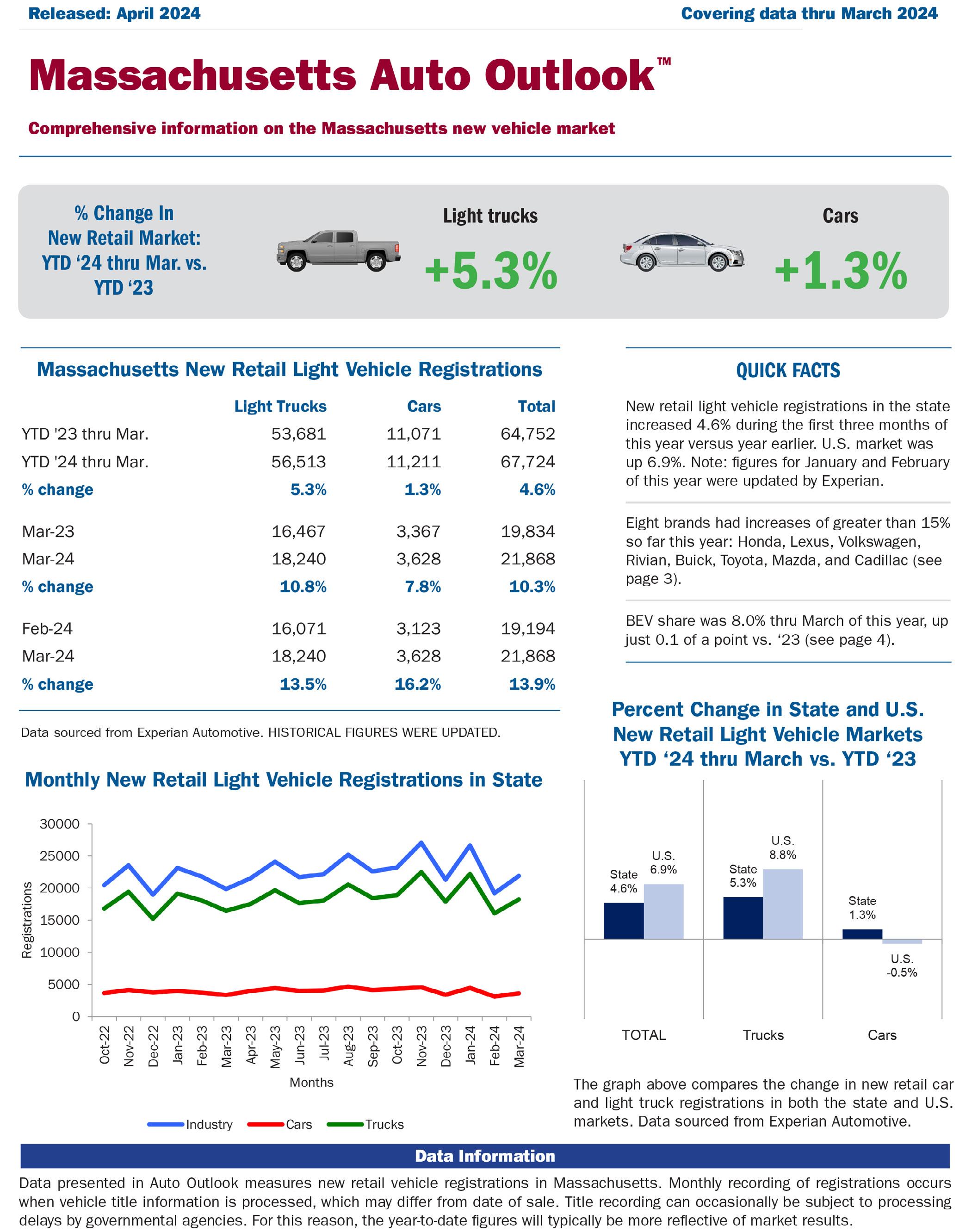

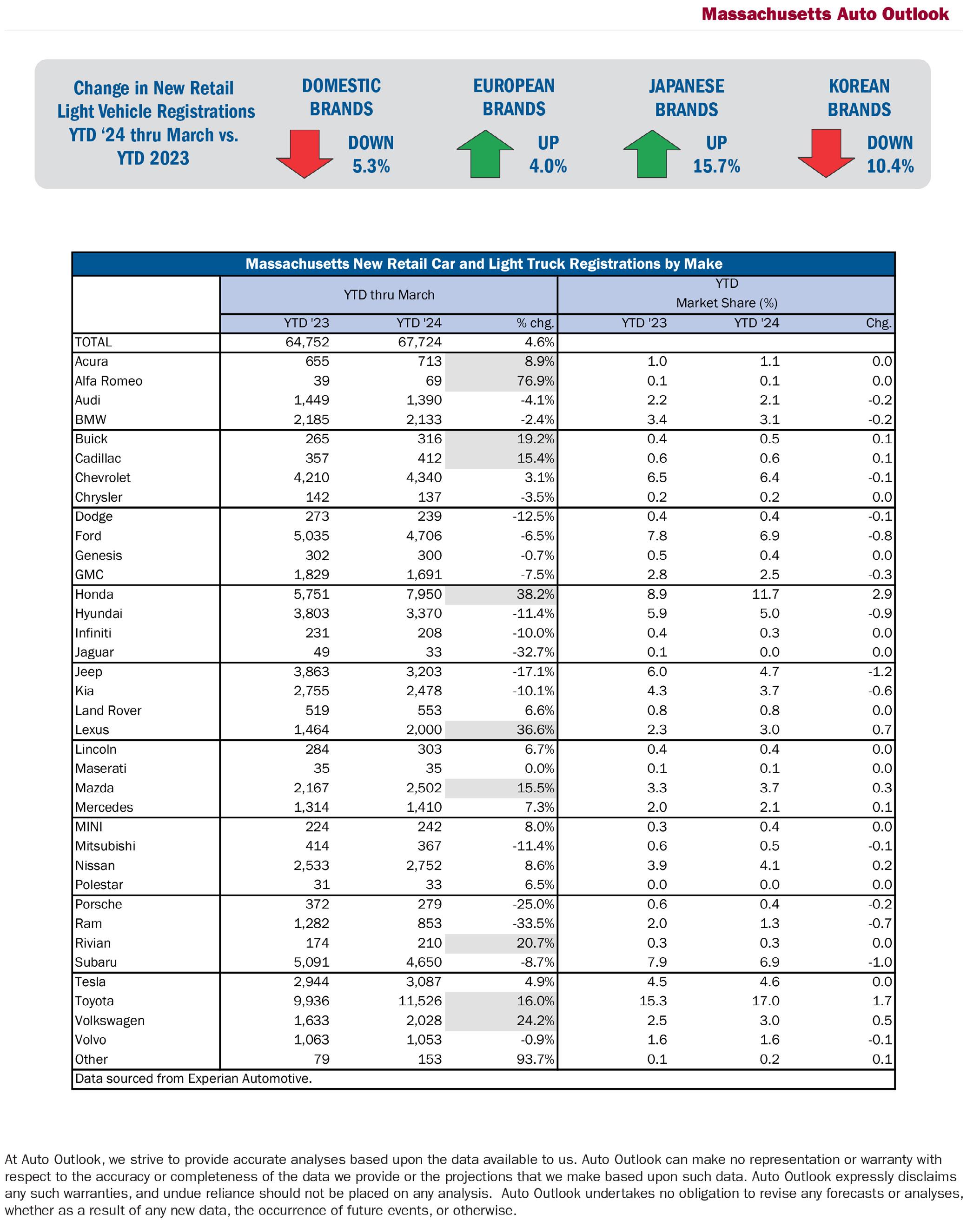

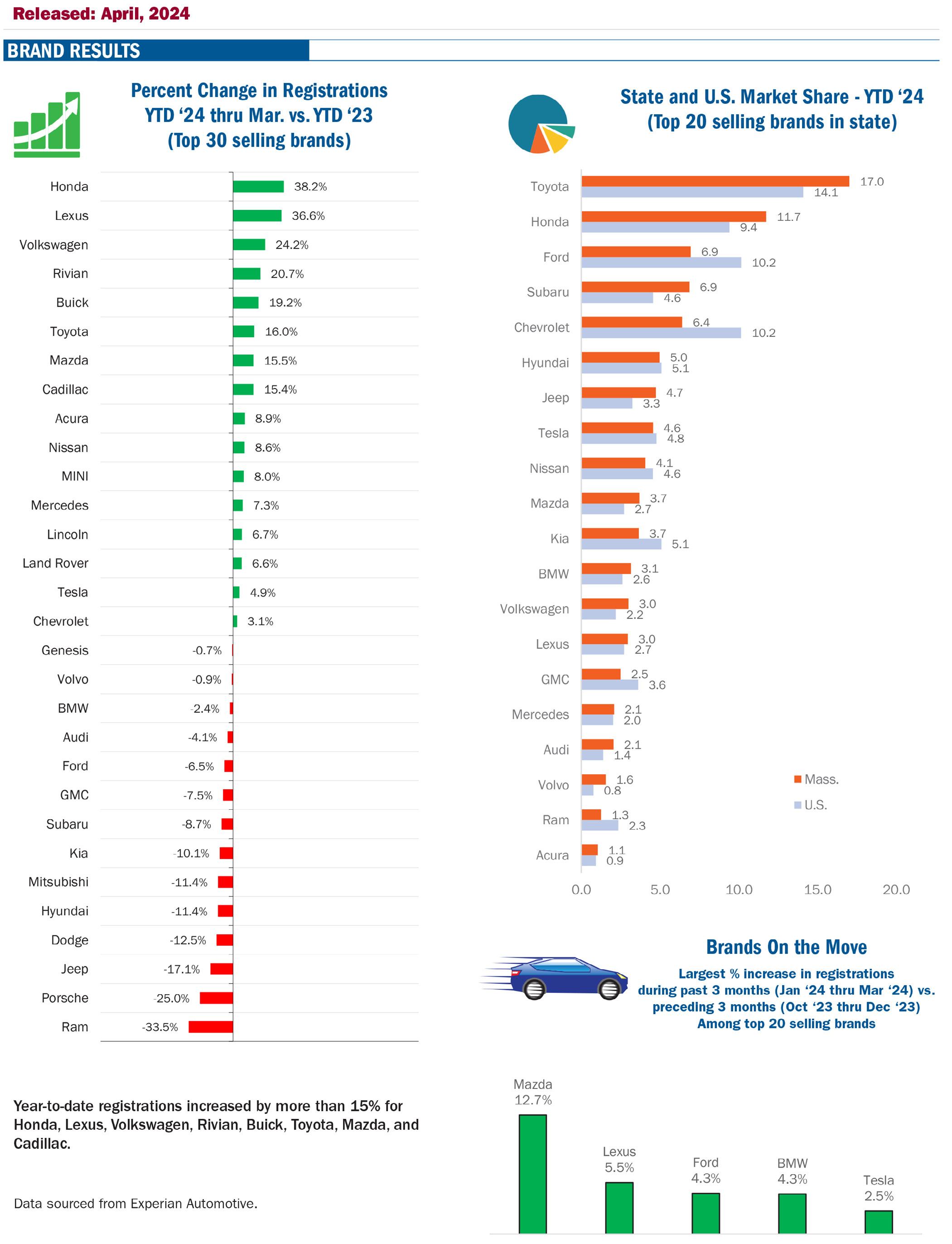

FEBRUARY 2022 Massachusetts Auto Dealer www.msada.org APRIL 2024 Massachusetts Auto Dealer www.msada.org 14 AUTO OUTLOOK

www.msada.org Massachusetts Auto Dealer FEBRUARY 2022 www.msada.org Massachusetts Auto Dealer APRIL 2024 MSADA 15

APRIL 2024 Massachusetts Auto Dealer www.msada.org 16 AUTO OUTLOOK

www.msada.org Massachusetts Auto Dealer APRIL 2024 MSADA 17

2024

On April 25-28, your MSADA held our 64th edition of the New England International Auto Show at the Boston Convention and Exhibition Center in South Boston. Check out the photographs of our wonderful vehicle displays and enthusiastic customers returning to the convention hall in 2024 for this year’s Show.

car.jpg https://drive.google.com/file/d/19MpfP0C2kZd_3ttBZ10hd3dvvB1JQ-a...

18 COVER STORY

APRIL 2024 Massachusetts Auto Dealer www.msada.org

www.msada.org massachusetts Auto dealer APRIL 2024 MSADA MSADA 19

20 2024 NEW ENGLAND AUTO SHOW

APRIL 2024 Massachusetts Auto Dealer www.msada.org

MSADA MSADA 21 www.msada.org Massachusetts Auto Dealer APRIL 2024

NEWS from Around the h orn

Premier Jeep Cape Cod Grand opening

On April 10, dealer Joseph Laham celebrated the grand opening of his newest dealership, Premier Jeep Cape Cod in Hyannis. Check out the following photos from the celebratory evening. Congratulations, Joe, and good luck!

16 MSADA 22 APRIL 2024 Massachusetts Auto Dealer www.msada.org

HYANNIS

NEWS from Around the h orn MSADA

HUDSON

Copeland Acquires durand Chevrolet

Recently Todd Copeland purchased Durand Chevrolet in Hudson. Copeland Chevrolet Hudson is now their third Chevrolet store along with Copeland Chevrolet in Brockton and Copeland

Chevrolet Hyannis. It is Copeland’s fifth store total, along with Copeland Subaru Hyannis and Copeland Toyota. Good luck, Todd, with the new acquisition!

MCLEAN, VIRGINIA

NAdA Academy Graduates in April 2024

The following Massachusetts dealership employees graduated NADA Academy in April this year:

• Jimmy Gianino, Acton Toyota; and

• Mark Shanahan, Koch Route 2 Toyota

Congratulations and good luck with your endeavors in our industry.

DETROIT

GM and Ford Count on Gas-Powered Trucks as EV Growth slows

(Originally published by Reuters)

U.S. automakers General Motors and Ford face a challenge in common when they report first-quarter results this month: Explaining to investors where profit growth will come from in the months ahead as EV growth slows.

The slowdown in global electric-vehicle demand, intensifying

competition from Chinese automakers, and high U.S. borrowing costs have forced the U.S. automakers to delay investments and ratchet down costs over the past 12 months. With China’s economy slowing and U.S. inflation running hot, a macroeconomic growth boost looks a long way off.

That has companies like GM and Ford focusing on sales of their core gasoline-powered vehicles, from which they derive most of their profit. GM and Ford are scheduled to report results on April 23 and 24, respectively.

GM CEO Mary Barra will get a lift from strong demand for the automaker’s highly profitable Chevrolet and GMC brand pickup trucks and SUVs. Barclays earlier this month boosted its target price for GM shares by 10% to $55, citing robust sales for GM’s truck and SUV lineup.

GM Chief Financial Officer Paul Jacobson said the year was off to a good start and the company felt positive about where demand was trending, while Ford CFO John Lawler, in reaffirming the company’s full-year profit outlook, said vehicle prices were holding up better than expected.

Legacy U.S. automakers, which rely heavily on sales of large trucks and SUVs, have been bogged down by higher expenses related to electrifying their vehicle lineups and bumpy demand for battery-electric vehicles.

Evercore ISI analyst Chris McNally said in a research note that the momentum has shifted for the previous winners like Tesla as growth in EV sales slows. Investors have refocused instead on GM, Stellantis, Toyota, and others that rely less on EVs, he added.

The high ratio of gas-burning trucks to EVs in GM’s North American sales mix will help offset a projected loss in the automaker’s operations in China. GM said first-quarter U.S. vehicle sales slipped 1.5% on lower commercial-customer deliveries, but retail sales jumped 6%.

Barra has yet to outline specific plans for restructuring GM’s China business. Last year, GM delivered 2.1 million vehicles in China, down almost half from the 4.04 million it reported in 2017.

Meanwhile, investors want an update at GM’s struggling Cruise robotaxi unit. Barra has not said how GM will fund relaunching and rebuilding the business after a serious accident forced the company to halt driverless ride operations. GM has said it will slash spending by $1 billion this year at Cruise. The unit has lost more than $8 billion since GM acquired it in 2016. Cruise said on April 9 it will put some vehicles back on the road in Phoenix, Arizona, with human drivers.

The Detroit automaker’s shares jumped in January when it signaled more cash would be returned to shareholders.

Ford, too, is getting power from its combustion truck business as well as its Ford Pro commercial vehicle operations. The automaker reaffirmed its forecast for $10 billion to $12 billion in core profit this year. The automaker earlier this month said it would slow two major electric-vehicle programs. CFO Lawler told an investor conference that future EV investments will not go forward unless they can “stand on their own” to show a profit.

www.msada.org Massachusetts Auto Dealer APRIL 2024 23

NEWS from Around the h orn MSADA

BOSTON

Annual oEM Awards

The recognition continues for annual OEM awards for performance. Congratulations to our award winners.

Acura Environmental Leadership Program Award

• Acura of Peabody

Audi 2023 Magna Society Elite Award for commitment to excellence and consistent business achievement

• Audi Natick

• Audi Norwell

• Audi Peabody

Chevrolet 2023 Dealer of the Year:

• Dan Quirk, Quirk Chevrolet, Braintree

Genesis 2023 Circle of Prestige Award:

• Daniel Quirk, Genesis of Braintree

Toyota 2023 Customer First Advisory Board Award for tremendous achievements in Parts, Service, and Customer Satisfaction

• Daryl A. Kenningham, Ira Toyota, Danvers

Toyota 2023 President’s Award

• Bristol Toyota in Swansea

• Copeland Toyota in Brockton

• Haddad Toyota in Pittsfield

• Ira Toyota in Danvers

• Nucar Toyota of North Attleboro

• Nucar Toyota of Norwood

• Parkway Toyota of Boston

• Toyota of Dartmouth in North Dartmouth

• Toyota of Watertown

• Toyota of Wellesley

• Westboro Toyota in Westborough

Volkswagen 2023 Wolfsburg Crest Club Award for superior sales and market performance achievements

• Christopher Dagesse, Nucar VW of Norwood

• Brian Kelly, Kelly VW, Danvers

Volvo 2023 Excellence Award

• Herb Chambers Volvo Cars, Norwood

MCLEAN, VIRGINIA

Harvard Business Review Echoes NAdA on EV Challenge

(Originally published by NADA)

Last November, NADA President and CEO Mike Stanton authored an op-ed in Automotive News that shaped the automotive industry narrative on EVs and the then-forthcoming EV regulations from the Environmental Protection Agency.

Entitled “Crossing the chasm on EVs may require plug-in hybrids,” Stanton laid out the challenge of getting mass market consumers to adopt new technologies adored by early adopters:

“In the marketing classic Crossing the Chasm, Geoffrey Moore describes the difficulty of moving new technology from early adopters to the mass market. The problem is so universal and so difficult that Moore says there is effectively a ‘chasm’ in the market between early adopters and the mass market that can be nearly impossible for tech companies to cross. … the real-life drawbacks of range anxiety, slow charging and undeveloped charging infrastructure are keeping many [mass market consumers] from buying them.”

Stanton concludes: “Promoting plug-in hybrids may be the way to get EVs across the chasm… Plug-ins would ease the transition to EVs, get consumers used to charging, create the demand necessary for investments in the charging network and build a bridge across the chasm to bring EVs to the mass market.”

NADA even had Geoffrey Moore on its Driving Ahead podcast to talk about the difficulty of EV’s crossing the chasm.

Harvard Business Review is now echoing this analysis. In a new article “Why has the EV market stalled?” author Jeremy Korst writes: “We have reached a classically difficult point … where the challenge becomes figuring out how to move from what early adopters want to what a broader segment of the market wants.”

Korst continues: “To travel safely over Moore’s chasm — many consumers will need a bridge. …[Consumers] see hybrid and plug-in hybrid vehicles as a bridge that will help them eventually get to an all-electric future. … Automakers and policymakers alike need to acknowledge and meet this demand by making more hybrids and hybrid plug-ins available as soon as possible.”

The new EPA regulations released last month made a step toward embracing plug-in hybrids, although not nearly to the levels petitioned by NADA or the automakers.

As the federal government tracks consumer sales of EVs, hopefully they too will realize the bigger role hybrids and plugin hybrids should play in the future of the fleet.

2416

APRIL 2024 Massachusetts Auto Dealer www.msada.org

t

www.msada.org Massachusetts Auto Dealer JANUARY 202 Natural Gas | Electricity msada@spragueenergy.com 508.768.7640 | spragueenergy.com Local Energy Expertise & Insight Strong Commitment to Sustainability Fueling Possibilities Since 1870 WHY CHOOSE SPRAGUE Visit us online at spragueenergy.com/msada To efficiently manage all your energy needs 150 years of evolution to meet the changing energy landscape Commitment to sustainability, evident by our solar offerings, carbon offsets, and renewable fuels

Supply Chain Disruptions, Turbulent Inventory, and Cash Management Strategies

By Barton Haag CPA, Albin Randall & Bennett bhaag@arbcpa.com

By Barton Haag CPA, Albin Randall & Bennett bhaag@arbcpa.com

For automotive dealerships, maintaining a healthy cash flow has never been more crucial than in today’s era of fluctuating inventory and frequent supply chain disruptions. From semiconductor chip shortages to major infrastructure failures, the past few years have exposed vulnerabilities in the global auto supply chain. As an auto dealer, having robust cash management strategies in place can mean the difference between staying afloat or going under when the next disruption inevitably strikes.

When it comes to understanding and predicting our client’s challenges, we rely on our Auto Dealership Business Intelligence (ADBI) reports. One of our many resources for providing insights and strategies to clients, ADBI is a custom-designed, financial benchmarking tool that gives dealership clients a clearer picture of their operational statistics, their profitability, and areas of opportunity. Each report includes key statistics by department, but the real value is the customized comments and analysis from the ARB team.

While no one tool or strategy can inoculate you completely against supply chain shocks, by combining data from our ADBI reports with the prudent measures we will discuss in this article, dealerships can improve resiliency and ensure they have the liquidity to weather any storm. Here are some key cash flow tactics auto dealers may consider:

• Optimize Inventory Levels: One emerging data point that our ADBI is showing

is that frozen capital is starting to rise. Bloated inventories tie up large amounts of working capital that could be put to better use, especially in times of disruption. Dealerships should leverage data analytics and demand forecasting to maintain leaner inventory levels aligned with actual sales. When supply hiccups occur, prioritize inventory of your fastest-moving, highest-margin vehicle lines.

• Rethink Vehicle Stocking Strategy: Another option for freeing up frozen capital is, rather than stocking large amounts of a few high-volume models, consider stocking fewer units across a wider array of trims and configurations based on customer demand data. This build-to-order approach results in lower working capital tied up on lots while better matching inventory to what customers actually want to purchase.

• Reevaluate Floorplan Financing: When supply disruptions restrict new vehicle supply, you may need to carry used vehicle inventory for longer periods. Scrutinize your floorplan financing arrangements to minimize the costs of holding this inventory. Extending floorplan terms even briefly can provide a meaningful cash flow boost.

• Leverage Data for Dynamic Pricing: When vehicle supply is constrained, you may be able to command higher prices and maintain margins. Closely monitor market data and competitive pricing analytics to dynamically adjust sticker prices based on real-time supply/ demand conditions. Implementing disciplined pricing optimization can significantly boost cash flow during inventory shortages.

• Accelerate Digital Sales Processes: Lengthy sales cycles tie up working capital unnecessarily. Accelerate the vehicle purchase process by enabling more digital retail experiences like online configurators, automated financing

approvals, and contactless Pick-up. This gets vehicles off your lot and paid for faster.

• Stay Close to Customers: Maintaining open communication with customers about inventory constraints builds loyalty and can help you better forecast demand. Use analytics to identify your highest-value customers to prioritize for limited stock. Offer after-sale services like accessories to supplement revenue during supply shortfalls.

• Explore Alternative Financing Sources: Traditional lenders may tighten credit if your cash flow is strained by disruptions. Evaluate opportunities to access capital from alternative lending sources like asset-based lenders, PE funds focused on auto retail, or fintech platforms matching investors directly with dealers. Diversifying funding sources provides a vital cash flow backstop.

• Cut Operating Costs Aggressively: Another issue our ADBI is tracking is an increase in expenses on average. Dealerships should identify ways to manage low-hanging fruit by reducing operating expenses like payroll, utilities, advertising, and other overhead during periods of supply chain strain. Doing so allows you to preserve more of your gross profits for servicing debt and other fixed obligations. No area should be off-limits when cash flow is tight. In our globalized industry, no dealer is immune from supply chain disruptions and having to reevaluate their inventory expectations. Having ample cash reserves and a nimble cash flow management strategy can empower you to navigate these challenges far more effectively. It is an essential part of building a truly resilient automotive business. Consult with your CPA regularly to develop a comprehensive cash management strategy that aligns with your dealership’s goals and priorities.

ACC ountin G 26 APRIL 2024 Massachusetts Auto Dealer www.msada.org

t

www.msada.org Massachusetts Auto Dealer JANUARY 2024

Trust LAW ®

There are over 1,500 attorneys in the United State who focus on legal actions against car dealers.

Who reviews your F&I documents for legal or regulatory changes?

What if your dealership had access to a complete suite of documents needed in F&I?

Only the LAW F&I Library™ provides:

A complete set of state-specific F&I documents in both pre-printed and electronic formats.

An industry leading team of in-house and outside legal resources reviewing forms for legally required and best practice updates.

A trained team of compliance consultants who can work with you to manage your compliance risks.

Get started with a free F&I Document Review. ©2023 The Reynolds and Reynolds Company. All rights reserved. 5/23

Best Practices for Dealership NIL Deals

By Tom Vangel, Esq. James Radke, Esq.

Lindsey McComber, Esq.

Murtha Cullina LLP

Since 2021, auto dealers across the country have been taking advantage of the changes in NCAA rules, which allow college athletes to profit off of their name, image, and likeness (NIL), and have started entering into deals with local student athletes. While such deals can generate additional commercial opportunities for dealerships, dealers must take steps to protect themselves from liability when entering into such deals.

In most NIL contracts involving dealers, student athletes will agree to promote the dealership on social media and make appearances at various dealer events in exchange for a lease of a new luxury vehicle. Many dealerships view these partnerships as a way to expand their outreach and boost their reputation, as fans of these particular colleges and athletes perceive the partnership as the dealer supporting these athletes and schools. Dealers believe these agreements may make sports fans more likely to utilize the dealership when it comes time to purchase or service a vehicle.

Unlike other forms of advertising that dealers employ, NIL deals do not necessarily transform directly into sales. However, dealers in Massachusetts who have entered into these contracts have seen great increases in their social media equity with an increase in followers and their posts being shared at a much greater level.

This rule change was enacted after the United States Supreme Court ruled against the NCAA in the landmark 2021 decision NCAA v. Alston. In this decision, the Court upheld a district court decision holding that the NCAA’s rules limiting education-related compensation violated

the Sherman Antitrust Act. In the unanimous decision, the Court found that the NCAA’s compensation limits effectively “produce significant anticompetitive effects in the relevant market.”

In coming to this decision, the Court took issue with the fact that the significant sums of money generated from college athletics seemed to flow to everyone except the students themselves and asserted that there was no other business in America that could “get away with agreeing not to pay their workers a fair market rate.”

Shortly after this decision was released, the NCAA voted to allow student athletes to receive compensation in exchange for use of their name, image, and likeness.

Since this decision was released and the NCAA subsequently changed its rules, dealerships in Massachusetts have been entering into NIL deals with local college athletes. These agreements often give the student a lease for a short term, usually around forty-five days, to keep the mileage on the vehicle low. The frequent turnover of these vehicles increases the amount of social media posts that the athlete will provide and allows for more news articles covering the athlete’s newest car to be published. Local dealers have found that these deals have created increased buzz around their dealerships, so much so that athletes from the NFL and the NBA have reached out to enter into deals.

Although these deals generate positive buzz around the dealership, dealers need to ensure that they are protecting themselves from liability when working with college athletes. Therefore, it is recommended that dealers entering into NIL contracts should:

• require a formal lease agreement with the athlete;

• require a usage and control agreement to ensure that the athlete is the only person driving the vehicle;

• confirm that the student has valid insurance; and

• verify that the dealership is listed as an additional insured under the policy.

Further, to prevent the dealership from accusations of negligently entrusting their vehicles to the athlete, dealers should pull the driving record of the athlete and confirm that they have a valid driver’s license and have no accidents or other issues on their record.

Dealers also need to take precautions to ensure that they are complying with NCAA rules and state law pertaining to NIL. Under the NCAA rules, both parties to an NIL agreement must receive benefits to prevent “pay-for-play” arrangements or other unfair incentives to play for a certain team. Thus, the student athlete must provide a deliverable to the sponsor, such as social media posts, content shoots, appearances, or other marketing activities or endorsements.

NIL agreements, moreover, cannot be based on compensation or incentives for athletic performance, enrollment decisions, or membership of the team. Dealers must be cognizant not to enter deals with athletes who are not yet enrolled in the school as the NCAA may view this as an unfair recruitment tactic, which could result in penalties to the dealership.

NIL contracts provide dealers with a new opportunity to expand their outreach by increasing their advertising channels. Dealers, however, need to take steps to protect themselves from liability when entering into these agreements. Therefore, dealers should consider requiring formal lease agreements that include usage and control provisions, ensuring that the athlete’s insurance includes the dealership as an additional insured, and verifying that the athlete has a valid license and clean driving record. Dealers also must stay up to date with changes in the NCAA rules to make sure that their arrangements are compliant.

Tom Vangel, Jamie Radke, and Lindsey McComber, with the law firm of Murtha Cullina LLP in Boston, specialize in automotive law and can be reached at (617) 457-4072.

29 www.msada.org Massachusetts Auto Dealer APRIL 2024 L e GAL MSADA

t

The “Shift” Has Hit the Fan

By Tim Marbut Ethos Group

By Tim Marbut Ethos Group

Although we would like to believe the current success rate in the retail automotive world will last for another 5, 10, 15 years, our history tells us otherwise. Very often, right when we think things are going well and it seems sustained growth is in sight, something happens to put us back on our heels.

The industry has experienced fantastic growth since 2009 with only a few dips along the way. Often, however, the biggest detriment to success is success. As we achieve greatness, sometimes we overlook areas where we are starting to falter. We allow shortcuts in our processes, in our hiring standards, and in holding our people to a high level of excellence.

History has always shown ups and downs in sales volume and profitability. What we do in prosperous times will dictate our ability to weather the storm of the “Shift”.

As leaders and managers, we have a responsibility to our people to prepare them for a potential slowdown. In fact, our job is to do three things consistently to ensure their continued success no matter what the current market conditions. These three actions are: Educate, Motivate, and Hold Accountable.

Education must precede motivation.

Jim Rohn

Education is a must for continued growth. We should consistently educate on our processes, values, vision, and ex-

pected behavior habits. If management and leadership are continuously reviewing our foundational beliefs and striving for ongoing growth, we should be better prepared to handle any slowdowns in business. This is not just about educating our staff; we should always prioritize our own growth first. We should constantly analyze current market trends, new pricing models, technology advancements, and compliance issues.

It is crucial for us, as leaders, not only to stay updated on business issues and changes but also to actively develop our emotional, social, and adversity intelligence. Emotional intelligence focuses on our awareness of our personal emotions and the ability to regulate them. Social intelligence focuses on our awareness of our communication effort and ability. Adversity intelligence focuses on our awareness of how we handle problems when they occur. These three areas directly affect our ability to lead others in their growth and in the growth of our business.

Motivation in the good times is easy. Motivation in a slowdown is a different story. It has been said that there is no better motivator for you than you. Our responsibility as leaders and managers is to eliminate all the negative influences around our people that affect their personal motivation. It is also our responsibility to help them grow.

One way to do this is to regularly have One-on-One meetings with our staff. Oneon-Ones, if possible, should be performed weekly. This allows us to stay engaged with our team members and stay informed about their needs.

Four areas should be addressed in these meetings: personal matters such as family concerns, hobbies, and goals; things done right, like exemplary performance or daily actions that stood out as exceptional; areas needing improvement; and, finally, effective follow-up procedures, including actively reaching out together to unsold customers. All four areas focus on your

involvement

in your employees’ lives and success.

Remember, there is no perfect time for anything. There is only now.

–Jack Canfield

Accountability is a word frequently overused, especially when we do not follow up with meaningful action. As managers and leaders, our goal is to ensure that our team adheres to our company’s processes, values, vision, and successful behavior attributes as mentioned earlier. However, to foster genuine, ongoing growth within our team, we must also hold them accountable to their goals in both their professional endeavors and their personal lives.

To do so effectively, we must genuinely know and understand them, including their goals, motivations, and expectations. But accountability of others begins with accountability of ourselves first. Leaders and managers should always model the behavior and actions they expect from their team. Remember, your actions speak louder than your words.

When we focus on the three objectives of Education, Motivation, and Accountability, we are focusing on the growth of our business and, more importantly, the growth of our people. No matter what direction the “Shift” is taking, we can grow with intentional, focused behavior.

For more information on how Ethos Group can help your dealership develop more leaders in your F&I office, sales management tower, and your sale’s floor in 2024, please contact Drew Spring at dspring@ethosgroup.com or (617) 6949761.

de AL er o P s 30 APRIL 2024 Massachusetts Auto Dealer www.msada.org

t

Pregnant Workers Fairness Act Rules

By Jeff Fritz, Esq., and Joshua Nadreau, Esq., Fisher Phillips LLP

The U.S. Equal Employment Opportunity Commission issued a new rule this month to require dealerships to accommodate applicants and workers who need time off or other workplace modifications for pregnancy-related care. The federal Pregnancy Accommodation Act, which took effect June 2023, requires employers with at least 15 employees to consider employee and applicant accommodation requests related to pregnancy, childbirth, or related medical conditions the same way you consider requests for accommodation related to disabilities under the Americans with Disabilities Act. On April 15, the EEOC issued regulations “interpreting” the law and providing guidance to employers.

Here are the seven most important aspects of the final regulations that your dealership needs to know.

1. Coverage Includes Abortion-Related Accommodations. The finalized rule contains a very broad definition of “pregnancy, childbirth or related medical conditions.” A non-exhaustive list of possible circumstances that fall within the broad definition includes: current, past, and potential pregnancy; infertility and fertility treatment; the use of contraception; termination of pregnancy, including via miscarriage, stillbirth, or abortion; pregnancy-related sicknesses; lactation and issues associated with lactation; and menstruation.

2. Many Employees “Qualified” For Protection. Only “qualified” applicants and employees will be covered under the PWFA, but the final rule provides a sweeping definition that covers many workers. Someone is qualified if they can perform the essential functions of the position, with or without reasonable accommodation. Someone is also qualified if their inability to perform the essential functions is just temporary and the essential functions can be performed “in the near future.” “Temporary” means a limit-

ed time, not permanent, and may extend beyond “in the near future.” “In the near future” generally – but not automatically – means about 40 weeks.

3. “Limitations” Do Not Have to Be Very Limiting to Be Covered. The law says that qualified employees and applicants are covered by the law if they have “known limitations” that relate to pregnancy, childbirth, or related medical conditions. This will likely apply to workers with healthy and normal pregnancies. Unlike the ADA, there is no threshold for the severity of the physical or mental conditions for accommodation requests.

4. Rule Includes List of Possible Accommodations. Accommodations are modifications or adjustments that would enable an applicant or employee to perform the essential functions of the job. They could apply to the job application process or the job itself. Potential accommodations employers will need to consider, include: job restructuring; schedule changes, part-time work, and paid and unpaid leave; frequent breaks; acquiring or modifying equipment, uniforms, or devices; making existing facilities accessible or modifying the work environment; allowing sitting or standing (and providing means to do so); light duty; telework or remote work; providing a reserved parking space; temporarily suspending one or more essential function; and adjusting or modifying workplace policies.

This list is not exhaustive. The EEOC and courts may consider other accommodations to be “reasonable,” so employers will want to work with the employee during the interactive process to review these options but to also identify other possible accommodations.

5. You Can Check Documentation in Certain Cases. If you have reasonable concerns about whether a physical or mental condition or limitation is “related to, affected by, or arising out of pregnancy, childbirth, or related medical conditions,”

you may request information from the employee regarding the connection. But the rule requires you to be reasonable in your requests for documentation and not seek more information than is required in order to make a proper determination.

6. Rule Clarifies When You Can Deny Accommodation Requests. An employers can only deny an accommodation request if it would impose an “undue hardship” on business operations. In general, an accommodation would create an undue hardship if it would cause significant difficulty or expense for operations.

7. Do Not Forget Other Laws. The rule confirms that the PWFA does not replace federal, state, or local laws that are more protective of workers affected by pregnancy, childbirth, or related medical conditions. Massachusetts already has a similar version of the PWFA which requires employers to provide some form of accommodations to pregnant employees. We expect Massachusetts courts to look to these new rules for guidance in interpreting the state law too.

What Should You Do?

The rule will become effective on June 18, 2024, so you have two months to prepare. At a minimum, you should consider the following steps:

• Make sure you are in compliance with the PWFA.

• Train your HR department on the ins and outs of the regulations, including a list of suggested accommodations provided in the rule as a good starting point for use during the interactive process.

• Adjust your mandatory HR trainings to include a discussion of this law and the new regulations as necessary.

• Contact your legal counsel before denying any pregnancy or childbirth-related accommodation request under the undue hardship theory given the high stakes involved.

33 MSADA www.msada.org Massachusetts Auto Dealer APRIL 2024 L e GAL

t

Patrick Manzi NADA Senior Economist

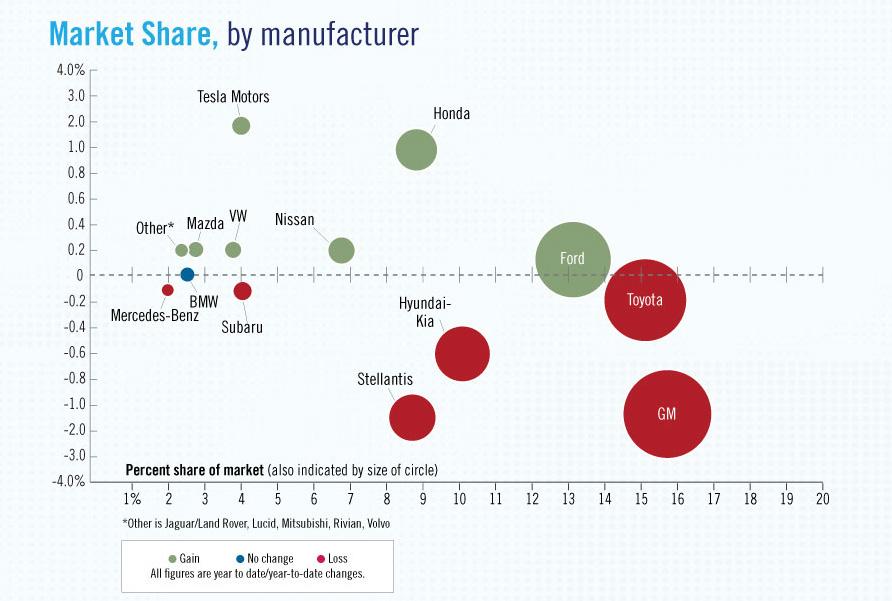

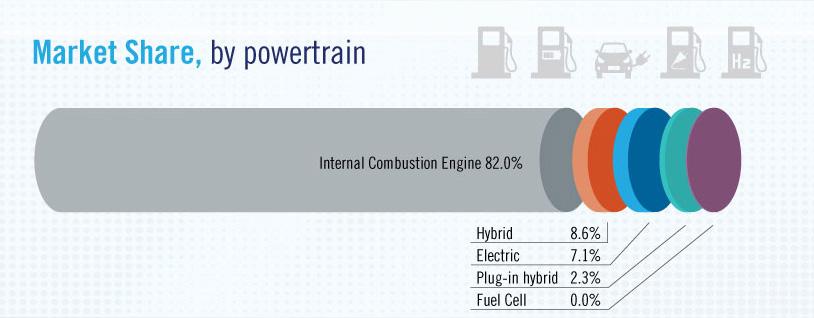

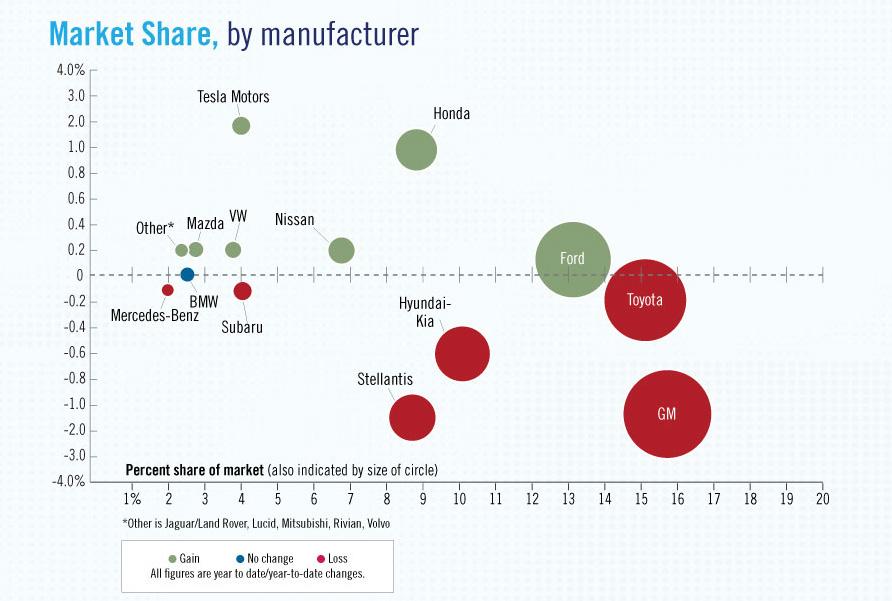

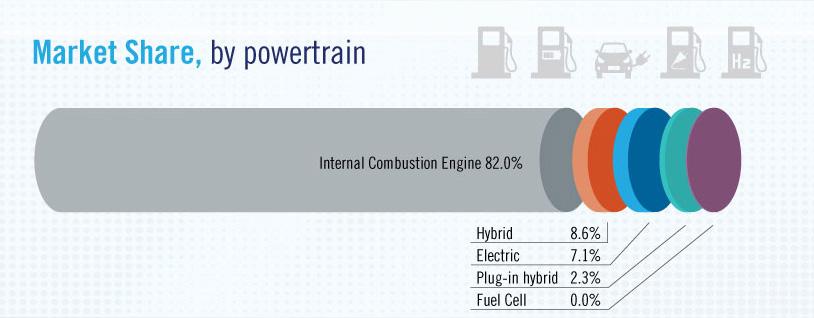

In March 2024, the new light-vehicle sales SAAR was 15.5 million units, an increase of 3.8% compared with March 2023. March saw the highest raw sales volume for all of first-quarter 2024, even though the March SAAR was down slightly from February. The first-quarter SAAR was 15.4 million units, an increase of 7% compared with first-quarter 2023.

In March 2024, new-vehicle shoppers had many more vehicles to choose from versus last year. New light-vehicle inventory on the ground and in-transit totaled 2.58 million units, an increase of 40.2% compared with March 2023. As vehicle inventory and OEM incentives have risen, average transaction prices have fallen. According to J.D. Power, average incentive spending per unit should total $2,800 in March 2023, a year-over-year increase of 66.6%. The average new-vehicle transaction price in March is expected to total $44,186, down 3.6% compared with March 2023.

In first-quarter 2024, alternative-fuel vehicles represented 18% of all new vehicles sold. Conventional hybrids, which were 8.6% of new-vehicle sales during this period, have had the largest gain in market share, an increase of 2.4 percentage points year-overyear. Battery electric vehicles (BEVs) and plug-in hybrid vehicles (PHEVs) gained market share as well, but to a lesser degree than conventional hybrids. In first-quarter 2024, the BEV market share was 7.1% and PHEV market share was 2.3%, year-overyear increases of 0.2 and 0.8 percentage points, respectively. Looking ahead, we expect inventory to increase and then plateau in the second quarter before rising again in the fourth quarter. We also anticipate inventory will total some 2.7 million to 2.8 million units heading into 2025. Overall, with sales volumes likely rising throughout the year, our new-vehicle sales forecast is for 15.9 million units for all of 2024. t

APRIL 2024 Massachusetts Auto Dealer www.msada.org 34 mArCh 2024

www.msada.org Massachusetts Auto Dealer APRIL 2024 35 MSADA MA r K et B e At

Consumer Arbitration in the Spotlight

By Cody Lusk President & CEO, American International Auto Dealers Association

By Cody Lusk President & CEO, American International Auto Dealers Association