The Right to Repair Rollercoaster

MAssAchusEtts

Robert O’Koniewski, Esq. executive Vice President rokoniewski@msada.org

Jean Fabrizio Director of Administration jfabrizio@msada.org Auto De A ler MAg A zine

Robert O’Koniewski, Esq. executive editor

MSADA o ne McKinley Square Sixth f loor Boston, MA 02109

Subscriptions provided annually to Massachusetts member dealers. All address changes should be submitted to MSADA by e-mail: jfabrizio@msada.org

www.msada.org Massachusetts Auto Dealer AUGUST 2023

Automobile Dealers

The official publication of the Massachusetts State

Association, Inc St A ff Directory

auto DEALER MAssAchusEtts Auto Dealer is published by the Massachusetts State Automobile Dealers Association, inc. to provide information about the Bay State auto retail industry and news of MSADA and its membership. AD Directory ethos, 2 nancy Phillips Associates, 20 gW Marketing Services, 20 reynolds & reynolds, 27 o’connor & Drew + Withum, 34 ADVertiSing rAteS inquire for multiple-insertion discounts or Join us on X at @MassAutoDealers Quarter Page: $450 Half Page: $700 full Page: $1,400 Back cover: $1,800 inside front: $1,700 inside Back: $1,600 tABle of contentS

From the President: Perpetual Advocacy 5 AssoCiAte memBers direCtorY 6 the roUndUP: legislature finally Passes Budget 10 LeGisLAtiVe sCoreCArd 12 AUto oUtLooK 16 Cover Story: the right to repair rollercoaster continues nonstop 20 neWs from Around the horn 22 ACCoUntinG: managing Factory incentives 23 ACCoUntinG: irs severely Limits erC “supply Chain dispuptions” 24 LeGAL: Dealers Win on courtesy Vehicle liability; ftc looks to Ban Spot Deliveries 26 LeGAL: Massachusetts Wage-Hour claims on the rise Since Reuter 28 nAdA mArKet BeAt 30 AiAdA: numbers Do not lie – Dealers Must engage 31 trUCK Corner: 2024 AtD Show returns to las Vegas 32 nAdA UPdAte: nADA Show 2024 in Vegas right Around the corner

4

Perpetual Advocacy

By Jeb Balise, MSADA President

Soon a contingent of MSADA representatives will head to Washington, D.C., to wave the dealer flag for our industry and provide our Members of Congress with our insights on some of the pressing matters of the day.

Anyone paying attention can see that government never stops growing. State and federal budgets increase unabated, as more regulators are hired to implement an expanding maze of rules designed seemingly to make businesses more difficult to be successful.

Our industry is regulated at all levels – by municipalities, state authorities, and the federal government. We all know that, while regulations keep consumers and dealers safe, misconceptions and assumptions can get in the way of sound policy without our constant input. Each year, however, the same founding American principle is under attack: free enterprise. The small businesses that make up the fabric of our communities are being tugged at the seams.

Dealers are getting hit from all sides – from government officials who put forth solutions in search of phantom problems as well as from our own manufacturers who seem intent on overturning the franchise retail system. Nature abhors a vacuum. If we do not stand up for ourselves, the inevitable bad policy will emerge and overtake all that we have built. That means we must make the effort to communicate with our elected officials to provide our side of the story.

As part of our on-going efforts, for a couple days this September, dealers from around the country and their dealer association executives and staff – almost 400 strong – will travel to DC to collectively remind the Members of Congress of the extent of our economic footprint. While there, we will be addressing such matters as the FTC’s proposed over-extensive and unnecessary “vehicle shopping rule”, which we have been fighting since June 2022; the EPA’s recently proposed new emissions standards that would lead to unrealistic EV mandates on all states; LIFO relief; misguided right to repair proposals; and federal efforts to combat the national epidemic of catalytic converter thefts.

Every little bit helps in our perpetual advocacy to promote our industry. We may not agree with our legislators on every issue, but as we have seen proven over the years, when the chips are down the time put into establishing these relationships can really pay off. It is important to remember that relationships matter, whether we are talking about the local Zoning Board, our state reps or senators, or Congress.

I encourage you to get involved in any way you feel comfortable, even if it is just to pick up the phone and make a call or send an email to your legislators. While you may worry that time spent with legislators who may seem less than sympathetic is wasted, nothing could be further from the truth. When we do not make our presence felt, we lose by default. Need help getting started? Feel free to reach out to me or our Executive Vice President Robert O’Koniewski for talking points or other tips for representing your business. We are here to help, but you can always take steps to help yourself, too.

MSAdA BoArd

Barnstable County

Brad tracy, tracy Volkswagen

Berkshire County

Brian Bedard, Bedard Brothers Auto Sales

Bristol County

richard Mastria, Mastria Auto group

Essex County

William Deluca iii

Bill Deluca family of Dealerships

Franklin County [open]

Hampden County

Jeb Balise, Balise Auto group

Hampshire County

Bryan Burke, Burke chevrolet

Middlesex County

frank Hanenberger, MetroWest Subaru

Norfolk County

Jack Madden, Jr., Jack Madden ford

charles tufankjian, toyota Scion of Braintree

Plymouth County

christine Alicandro, Marty’s Buick gMc isuzu

Suffolk County

robert Boch, expressway toyota

Worcester County

Steven Sewell, Westboro chrysler

Dodge ram Jeep

Steve Salvadore, Salvadore Auto

Medium/Heavy-Duty Truck Dealer Director-at-Large [open]

Immediate Past President

chris connolly, Jr., Herb connolly chevrolet

NADA Director

Scott Dube, Mcgovern Hyundai rt.93

OFFICERs

President, Jeb Balise

Vice President, Steve Sewell

Treasurer, Jack Madden, Jr.

Clerk, c harles tufankjian

From the President AUGUST 2023 Massachusetts Auto Dealer www.msada.org

MSADA 4

t

Associate Members

MSADA A SS oci Ate M e M ber D irectory

ACV Auctions

Steve Sirko (856) 381-3914

ADESA

Jack Neshe (508) 626-7000

Albin, Randall & Bennett

Barton D. Haag (207) 772-1981

Ally Financial

Maryanne Recupero (617) 997-9574

American Fidelity Assurance Co.

Kathleen Weisenbach (402) 523-5945

America’s Auto Auction Boston

Jim Lamb (781) 596-8500

Armatus Dealer Uplift

Joe Jankowski (410) 391-5701

Auto Auction of New England

Steven DeLuca (603) 437-5700

Automotive Search Group

Howard Weisberg (508) 620-6300

Bank of America Merrill Lynch

Dan Duda and Nancy Price (781) 534-8543

BCI Financial Corp.

Timothy Rourke (203) 439-9400

Bellavia Blatt

Leonard Bellavia (516) 873-3000

Bernstein Shur PA

Ned Sackman (603) 623-8700

Broadway Equipment Company

Fred Bauer (860) 798-5869

Burns & Levinson LLP

Paul Marshall Harris (617) 345-3854

Sarah Decatur Judge (617) 345-3211

CDK Global

Rob Steele (508) 564-1346

Chase Auto

Ken Miller (508) 902-8908

Clifton Larson Allen

Rick Parmelee (860) 982-9307

ComplyNet

Adam Crowell (614) 634-8843

Cooperative Systems

Scott Spatz (860) 250-4965

Cox Automotive

Ernest Lattimer (516) 547-2242

Cresative Resources Group

Charlie Rasak (508) 726-7544

CVR

John Alviggi (267) 419-3261

Dave Cantin Group

Woody Woodward (401) 465-7000

DealerSafeGuardSolutions

Doug Fusco (972) 740-8638

DealerShop

Ken Grove (248) 444-6283

Brian Fleischman (716) 864-0379

Downey & Company

Paul McGovern (781) 849-3100

DP Sales Distributors

Andrew Prussack {631) 842-7549

Driving Dealer Performance

Kimberly Guerin (978) 760-0322

Eastern Bank

David Sawyer (617) 620-3484

EasyCare New England

Greg Gomer (617) 967-0303

Electric Supply Center

Jennifer Williams (781) 265-4272

Enterprise Rent-A-Car

Timothy Allard (602) 818-3607

Ethos Group, Inc.

Drew Spring (617) 694-9761

F&I Direct

Sean Wiita (508) 414-0706

Michelle Salas (508) 599-0081

F & I Resources

Jason Bayko (508) 624-4344

Federated Insurance

Matt Johnson (606) 923-6350

Fisher Phillips LLP

Joe Ambash (617) 532-9320

Jeff Fritz (617) 532-9325

Josh Nadreau (617) 532-9323

GW Marketing Services

Gordon Wisbach (857) 404-0226

Hilb Group

James Pietro (508) 791-5566

Huntington National Bank

Michael Ham (740) 815-5085

JMA Group

Chris “KC” Hwang (954) 415-6961

John W. Furrh Associates Inc.

Pamela Barr (508) 824-4939

Key Bank

Mark Flibotte (617) 385-6232

KPA

Abe Cohen (503) 902-6567

LocaliQ Automotive

Jay Pelland (508) 626-4334

LoJack by Spireon

Ashvir Toor and Robin Dukes (800) 557-1449

LotLinx

Giovanna Scognemiglio (310) 526-1463

M & T Credit Corp.

John Federici (508) 699-3576

Management Developers, Inc.

Dale Boch (617) 312-2100

McWalter Volunteer Benefits Group

Shawn Allen (617) 483-0359

Merchant Advocate, LLC

Dan Giordano (973) 897-2778

Mintz Levin

Kurt Steinkrauss (617) 542-6000

Murtha Cullina

Thomas Vangel (617) 457-4000

Nancy Phillips Associates, Inc.

Nancy Phillips (603) 658-0004

NEAD Insurance Trust

Charles Muise (781) 706-6944

Northeast Dealer Services

Johna Cutlip (401) 243-7331

OCD Tech

Michael Hammond (844) 623-8324

O’Connor & Drew, P.C. + Withum

Kevin Carnes (617) 471-1120

Performance Management Group, Inc.

Dale Ducasse (508) 393-1400

Piper Consulting

Jim Piper (207) 754-0789

Pro-Vigil

Sasha Lam-Plattes (408) 569-2385

Pullman & Comley LLC

James F. Martin, Esq. (413) 314-6160

Resources Management Group

J. Gregory Hoffman (800) 761-4546

Reynolds & Reynolds

Austin Ziske (802) 505-0016

Rinn Advisors

John Corcoran (617) 480-6693

Rockland Trust Co.

Joseph Herzog (508)-830-3241

Samet & Company

John J. Czyzewski (617) 731-1222

Santander Bank

Richard Anderson (401) 432-0749

Chris Peck (508) 314-1283

Schlossberg, LLC

Michael O’Neil, Esq. (781) 848-5028

Shepherd & Goldstein CPA

Ron Masiello (508) 757-3311

Southern Auto Auction

Joe Derohanian (860) 292-7500

Sprague Energy

Robert Savary (603) 430-7254

The Towne Law Firm P.C.

James T. Towne, Jr. (518) 452-1800

TrueCar

Pat Watson (803) 360-6094

Truist

Andrew Carmer (401) 409-9467

US Bank

Vincent Gaglia (716) 649-0581

Wallbox USA, Inc.

Sean Ugrin (720) 220-1711

Wells Fargo Dealer Services

Josh Tobin (508) 951-8334

Windwalker

Herby Duverne (617) 797-9316

Zurich American Insurance Company

Steven Megee (774) 210-0092

5 www.msada.org Massachusetts Auto Dealer AUGUST 2023

Legislature Finally Passes Budget

By Robert O’Koniewski, Esq.

MSADA Executive Vice President

rokoniewski@msada.org

Follow us on Twitter • @MassAutoDealers

The most important task any legislative body has – whether we are talking about our General Court, U.S. Congress, or even our local city councils – is to pass a budget to fund governmental functions. During the appropriations process, legislators can set spending priorities, change agency policies, and establish tax functions to bring in the necessary revenues.

In Massachusetts, our state government’s fiscal year begins each July 1. Unfortunately, our Legislature has rarely met that deadline, and this year was no exception.

One month into FY2024, as the state muddled along on a 1/12th temporary spending plan, the legislative conference committee charged with resolving the differences between the two chambers’ budgets finally came to agreement enabling the House and Senate to send the budget to Governor Maura Healey on July 31. The budget cleared the Senate unanimously, and the House passed it 156-2, winning support from all but two House Republicans. On August 9, Gov. Healey affixed her signature to the legislation (Chapter 28 of the Acts of 2023) and sent back several vetoes and suggested amendments, which the Legislature has not yet taken up.

Two items not included in the final FY24 document: long-discussed tax relief and a fix to the current auto body labor rate crisis that has Massachusetts auto body repairers reimbursed for insurance-paid work at the lowest rate in the country.

The $56.2 billion budget, an increase of $3.5 billion over FY23, includes considerable hikes in spending for education and transportation, utilizing $1 billion in new revenues from the recently created millionaires’ tax, as well as for health

care programs for citizens and non-citizens. The law includes major wins for education and immigration advocates, including funding for universal free school meals, clearance for students without legal immigration status to qualify for lower public higher education tuition rates and state financial aid if they attended a Massachusetts high school or got a GED in the state, and a commitment to allow everyone over 25 to attend community college for free.

Legislators also needed to tap more than $600 million from other state funds and sources to fuel the spending surge. The proposed spending represents a 6.6 percent increase from the $52.7 billion annual budget former Gov. Charlie Baker signed on July 28, 2022. Spending has increased 18 percent in two years, from a $47.6 billion state budget in fiscal 2022. Healey’s first state budget represents a 47.5 percent, or $18.1 billion, increase from the first budget Baker signed in fiscal year 2016, a $38.1 billion spending plan.

One thing the Legislature has not addressed, now going into its third fiscal year of consideration, is the tax relief plans, first initiated by Gov. Baker in FY22 but not agreed upon by the Legislature for FY23 because of the $3 billion rebate sent to taxpayers last Fall pursuant to the state’s Chapter 62F tax-cap law. Legislative leaders have indicated a desire to resolve the competing House-Senate tax plans after Labor Day.

As part of the FY24 budget, legislators did not take up several proposals initiated by the governor, House, and Senate, including a Senate proposal to create an auto body labor rates advisory board within the state Division of Insurance to resolve the lowest reimbursement rate in the country

6 AUGUsT 2023 Massachusetts Auto Dealer www.msada.org t he r oundu P

for the labor component of insurance-paid body work. Related legislation is presently before the Joint Committee on Financial Services.

Legislators are operating under considerable angst regarding incoming revenues as they discussed this spending plan and the tax relief proposals the House and Senate passed earlier this year and which now sit before a conference committee.

When lawmakers started negotiations in June, the Massachusetts Taxpayers Foundation (MTF) said the maximum proposed spending from both House and Senate budgets would exceed available revenues by about $500 million, forecasting a need to rein in some outlays. The final budget closes that gap using $205 million from a transitional escrow fund and roughly $200 million from projected reversions of unspent state appropriations, and by selecting the lower proposed spending in multiple line items. With revenue growth slowing down, budget negotiators also opted to pull $192 million from a behavioral health trust fund created in December 2021, and drew $225 million from an early education trust fund that lawmakers put about $490 million into last year, according to the MTF.

All eyes are on the Department of Revenue, as policymakers assess the need to tap the brakes on our on-going spending binge. Needless to say, the programmatic expansions and influx of federal COVID funds have enabled our politicians to build in new spending commitments that will not be sustainable in the future absent increased taxes. The millionaires’ tax is just the tip of the iceberg.

Public Hearings Begin

Once the House cleared the hurdle of its budget deliberations in April, the joint committees began their public hearings to take testimony on the almost 6,000 bills filed thus far. On July 17, the Joint Committee on Consumer Protection and Professional Licensure held a hearing on bills affecting our industry, including several that legislators filed for us.

Bills we testified in favor on:

• House 331 (Hunt) and Senate 151 (Crighton): An Act Further Regulating Business Practices Between Motor Vehicle Dealers, Manufacturers, and Distributors. The bills would amend several provisions in MGL Chapter 93B, the Massachusetts Automobile Dealer Franchise Law, to address issues that have arisen in the dealer-manufacturer franchise relationship. The Committee gave a favorable report to an amended version of the legislation in 2020. The bills would address the following:

• Prohibit a manufacturer from requiring a dealer to purchase goods or services from a vendor designated by a manufacturer without making available to the dealer the option to obtain the goods or services of substantially similar quality from a local vendor chosen by the dealer;

• Limit a manufacturer’s requirement for a dealer to reconstruct dealership facilities to once every ten years;

• Protect dealers from manufacturers that penalize dealers for cars that a buyer exports without the dealer’s knowledge;

• Prohibit additional vehicle surcharges by a manufacturer to pay for warranty repairs that are already included in the price of the vehicle when purchased by the dealer from the manufacturer. These surcharges increase the cost of the vehicles for consumers;

• Prohibit a manufacturer from restricting its franchised dealer from selling service contracts not exclusive to the manufacturer; dealer must provide consumer notice that the non-factory service contract is not backed by the dealer’s franchisor;

• Prohibit a manufacturer from competing with its franchised dealers by directly or indirectly offering leases or subscription rentals of vehicles of the same line make as those sold by its franchised dealers in the Commonwealth;

• Protect dealers from a manufacturer unreasonably altering the dealer’s area of responsibility and then using that

change to take adverse action against the dealer for failure to penetrate the new market within 18 months; and

• Require the manufacturer, under the warranty/recall reimbursement section, to provide reasonable compensation to a dealer who performs over the air repair for customer at the dealership on behalf of the manufacturer.

• House 351 (Lewis) and Senate 150 (Crighton): An Act Relative to Consumer Protection on Online Automobile Franchise Transactions. The bills would modernize the motor vehicle purchase process and the three-day right of cancellation statute covering off-site sales to deem contracts, which are executed via an automobile dealership’s online portal, to be considered as executed as part of the dealership’s physical place of business. The Committee gave this bill a favorable report in the last session.

• House 290 (Finn): An Act Relative to the Right to Repair Motor Vehicle Data Law. The bill would address two problems with the law as amended at the November 2020 ballot. First, the bill would move the implementation date of the new law to Model Year 2025 from Model Year 2022, which began in January 2021, thereby making it impossible to comply with the new requirements. Second, the bill would remove the onus of the consumer disclosure requirement from the dealer and place it on the vehicle manufacturer, who made the vehicle and knows all its technological characteristics. The lawsuit initiated by the manufacturers in federal court against the 2020 amendments had a trial in July 2021, and the parties still await a decision from the judge, who has not indicated when a decision will be issued.

• House 329 (Howitt): An Act Relative to the Disclosure Notice in the Right to Repair Motor Vehicle Data Law. This bill is Section 2 of House 290. It would remove the onus of the consumer disclosure requirement from the dealer and place it on the vehicle manufacturer, who made the vehicle and knows all its technological characteristics.

7 www.msada.org Massachusetts Auto Dealer AUGUST 2023 MSADA

• House 270 (Chan), House 289 (Finn), and Senate 204: An Act Relative to the Issuance of a Class 1 Dealer License. The bills would create a process to appeal an allegedly improperly issued class 1 license to a party that is not a franchised vehicle dealer.

• House 400 (Walsh) and Senate 220 (Velis): An Act Relative to Vehicle Recalls. The bills would require the Registry of Motor Vehicles to provide, as part of the registration renewal notice to vehicle owners, a notification of any and all safety recalls which are open and unremedied on the owner’s vehicle. The vehicle owner would be required to have the safety recall remedied prior to the following year’s registration renewal.

• Senate 199 (Moore): An Act Relative to Custom-Built Heavy-Duty Vehicles Sold in the Commonwealth. The bill would restore the treatment of custom-built heavy-duty trucks back to its pre-2020 status under the right to repair law; namely, such trucks built to custom specifications would not be required to comply with the requirement for an inter-operable, standardized, and open access platform.

We testified in opposition to House 354 (Linsky), An Act Relative to Clarification of the Massachusetts Franchise Law, which would allow a vehicle manufacturer to own sales points without a dealer. This bill would allow a motor vehicle manufacturer to own and operate a dealership in Massachusetts, outside the current prohibition of factory-owned stores, if there are no independently owned franchised dealerships affiliated with that manufacturer doing business in the Commonwealth. This is the fifth session such legislation has been filed; it has never moved out of committee.

There are bills of interest in several other committees, such as Financial Services and Transportation, which have not yet been scheduled.

MOR-EV Program Changes

In August 2022, Gov. Charlie Baker signed into law An Act Driving Clean Energy and Offshore Wind (Chapter 179

of the Acts of 2022). The law created a new Electric Vehicle Adoption Incentive Trust Fund for funding electric vehicle incentive programs such as the MOR-EV program.

The law also authorized the state to enhance the current rebate program, in which the consumer applies for the rebate directly to the state post-sale or lease, by allowing for the creation of a point-ofsale rebate process in which the rebate can be used as “cash on the hood” as part of the transaction. The state has implemented the point-of-sale rebate process, which requires a dealership to enroll in the program. Enrolment includes the store being featured on the MOR-EV website.

The MOR-EV program administrators also commenced an income pre-qualification process on August 31 for used EV rebates and the rebate adder of $1,500 under MOR-EV+ so that eligible individuals can take their approved voucher to a participating dealership and receive point-ofsale rebates under the program.

The state Legislature authorized, and MOR-EV has implemented, income qualifications for vehicle buyers to be eligible for the $3,500 rebate for the purchase of eligible used light-duty electric vehicles (EVs) and fuel-cell electric vehicles (FCEVs).

Further, under MOR-EV+, certain income qualifiers can obtain an additional $1,500 rebate on top of the standard MOR-EV rebate for a new vehicle, the MOR-EV used vehicle rebate, and the MOR-EV Trucks rebate.

Used EVs: As of August 8, 2023, a rebate of $3,500 for the purchase of eligible used light-duty electric vehicles (EVs) and fuel-cell electric vehicles (FCEVs) is available for Massachusetts residents that:

• Participate in one of the approved income-qualifying programs; OR

• Have a maximum modified adjusted gross income (AGI) as follows: $150,000 for married filing jointly or a surviving spouse; $112,500 for heads of households; or $75,000 for all other filers.

Eligible used EVs must have a final purchase price of $40,000 or less, and

residents must apply for the used vehicle rebate post purchase or use the option to receive the MOR-EV Used rebate through a participating dealership at the point of sale. Eligible residents that have purchased a qualifying used light-duty electric vehicle (EV) or fuel-cell electric vehicle (FCEV) between November 10, 2022, and August 8, 2023, must apply for the post-purchase rebate no later than November 6, 2023.

Low-income rebate add-on (MOREV+): As of August 8, 2023, an additional rebate of $1,500 is available on the purchase of a new vehicle to income-qualifying Massachusetts residents participating in one of the following approved programs:

• Residential Assistance for Families in Transition (RAFT)

• Prescription Drug Assistance

• Child Care Financial Assistance (CCFA)

• Mass Save Income Eligible Programs

• Supplemental Nutrition Assistance Program (SNAP)

• Massachusetts Rental Voucher Program (MRVP)

• Low-Income Home Energy Assistance PROGRAM (LIHEAP)

• Massachusetts Health Connector

• Supplemental Security Income (SSI)

• State Supplement Program

• Mass Health

• Massachusetts Transitional Aid to Families with Dependent Children (TAFDC)

• Low-Income Weatherization Assistance Program (LIWAP)

• Emergency Aid to the Elderly, Disabled, and Children (EAEDC)

• Section A8 Housing Choice Voucher Program (HCVP)

• Women, Infants, and Children Program Nutrition Program (WIC)

• Veterans Programs (Chapter 115 Benefits)

• Veterans Dependency and Indemnity Compensation (DIC) Surviving Parent

• Veterans Affairs Non-Service-Connected Pension (VANSCP)

The MOR-EV+ rebate is available in addition to the MOR-EV Standard rebate, MOR-EV Used rebate, and MOR-EV Trucks rebate. Eligible residents must ap-

the roundu P AUGUsT 2023 Massachusetts Auto Dealer www.msada.org 8

ply for the MOR-EV+ additional rebate alongside their application for a new or used vehicle or MOR-EV Trucks rebate post purchase or invoke the point-of-sale option to receive the MOR-EV+ rebate through a participating dealership.

GAO RTR Interviews

On July 27 a two-man team from the U.S. Government Accountability Office (GAO) visited Herb Connolly Chevrolet in Framingham and MetroWest Subaru in Natick to obtain dealer input regarding the right to repair matter, including background on the decade-old Massachusetts law and its impacts on dealership operations. The GAO interviewed Chris Connolly and Frank Hanenberger along with their key staff.

The GAO is an independent, nonpartisan government agency that provides Congress, the heads of executive agencies, and the public with timely, factbased information that can be used to improve government and save taxpayers billions of dollars. The agency is headed by the Comptroller General of the United States, who is appointed by the president. It supports congressional oversight, and its work is done at the request of congressional committees or subcommittees or is statutorily required by public laws or committee reports, per Congressional Protocols.

The dealers engaged in robust discussion at both dealerships with their GAO guests. MSADA extends its gratitude and appreciation to Chris and Frank for setting aside the time to participate in the GAO’s fact finding efforts. We also want to than David Regan, who heads NADA’s legislative office, for setting up the meetings and coordinating our efforts that day with the GAO staff.

GAO representatives were scheduled to meet with dealers in Maine and Chicago, also. We look forward to seeing the final report.

Upcoming NADA Wash. Conf.

Your MSADA is looking forward to its annual trek to Washington, D.C., in September as part of NADA’s Washington

Conference to lobby our Congress folks on several issues important to our industry. Our contingent will include MSADA President Jeb Balise, the Balise Auto Group; our NADA director, Scott Dube, the McGovern Auto Group; MSADA Past President Chris Connolly, Herb Connolly Chevrolet; and two Next Generation dealers: Chad Bouchard, the Ron Bouchard Auto Stores, and Ruddy Brito, the Mastria Auto Group.

Issues we will focus on include opposing the FTC’s proposed vehicle shopping rule; opposing the EPA’s recently proposed EV mandates and emission standards; supporting LIFO relief legislation; and opposing right to repair legislation.

If you want to participate locally in meetings with your Congressperson, please feel free to reach out to me. Also, think about being part of our traveling group next September. It is a great way to participate in the political process and get a sense of how our federal legislative process works (or does not work).

Annual Meeting – Oct. 13, Encore Casino

We will be holding our annual meeting on Friday, October 13, at the Encore Hotel and Casino, in Everett. We are in the process of developing our speakers line-up, running 1-5pm after our Noon welcome reception. The day will conclude with our cocktail reception, 5-8pm. Please use the registration information that has been emailed to you to sign up. We look forward to seeing you on the 13th.

Our PACs - NADAPAC & NCDPAC

We appreciate the contributions we receive from our member dealers who answer our calls for donations to our PACs.

Each year MSADA expresses itself politically through NADA’s federal PAC, NADAPAC, and through our state PAC, the New Car Dealers Political Action Committee (NCDPAC).

We depend on contributions from our dealers to keep these PACs strong, as we need to have an active voice in Washington and on Beacon Hill. Contributions to

our PACs are an inexpensive insurance policy. Since by law we cannot use our membership dues or other association revenues for political contributions, the PACs help us to remain strong politically as we advocate for our dealers’ interests in the political process.

If you have not yet given to the PACs this year, please contact me at rokoniewski@msada.org and we can make sure your contributions happen. Thank you.

Auto Show 2024

Circle the dates! After a three-year COVID-induced hiatus, the New England International Auto Show will return for 2024 on Thursday, April 24, to Sunday, April 28, at the Boston Convention and Exposition Center, in South Boston. Your Association is very excited to see our Show return along with the great automotive vehicles and innovations that entails.

NADA Report to FTC on Costs of Vehicle Shopping Rule

In mid-July, the NADA sent a letter to the FTC urging the FTC to consider carefully a recent report released by the Center for Automotive Research (CAR) that details the massive costs the FTC’s Proposed Vehicle Shopping Rule, released in June 2022, would impose on consumers if finalized as proposed. CAR summarized its findings in the following statement: “[W]hile the FTC estimates the proposed rule will generate $29.7 billion in net consumer benefit over a ten-year period…, CAR’s analysis reveals that the proposed rule would actually cost consumers $38.1 billion over those same ten years.” In its letter to the FTC, NADA stated: “We are confident that the FTC will find CAR’s cost analysis to be substantially more developed and reflective of actual market conditions than that produced by the FTC in the notice of proposed rulemaking and, to that end, we hope the CAR Report aids the FTC in considering many of the adverse consequences that the proposed rule, if finalized, would cause for consumers and small businesses alike.”

MSADA

t www.msada.org Massachusetts Auto Dealer AUGUST 2023 9

EGISLATIVE S CORECARD

BILL# SPONSOR SUBJECT STATUS

S151 H331

H290 H329

S204 H270 H289

S150 H351

Sen Crighton Rep Hunt

Rep Finn Rep Howitt

Sen O’Connor Rep Chan Rep Finn

Sen Crighton Rep Lewis

Amendments to Ch. 93B, the auto dealer franchise law.

RTR law amendments to fix Model Year start date and consumer notice.

Creates process to appeal improperly issued Class 1 license.

Modernize on-line vehicle purchase process.

S199 Sen Moore Amends definition of heavy-duty trucks in RTR law.

S220 H400 Sen Velis Rep Walsh

SUPPORT

Open safety recalls notifications. OPPOSE

H354 Rep Linsky Allows an OEM to open a factoryowned store, without a dealer, if there is no same line-make dealer in the state. (The so-called “Tesla Exemption.”)

S688 H1095 H1118

S639 H1121

S2219 H3255

H3348

S2210

Sen Moore Rep McMurtry Rep Philips

Sen Feeney Rep Puppolo

Sen Cronin Rep Arciero

Creates process to increase the insurance reimbursed labor rate paid to auto body repairers.

Protects consumer choice in vehicle service contracts.

Joint Committee on Consumer Protection held public hearing on July 17, 2023.

Joint Committee on Consumer Protection held public hearing on July 17, 2023.

Joint Committee on Consumer Protection held public hearing on July 17, 2023.

Joint Committee on Consumer Protection held public hearing on July 17, 2023.

Joint Committee on Consumer Protection held public hearing on July 17, 2023.

Joint Committee on Consumer Protection held public hearing on July 17, 2023.

OPPOSE Joint Committee on Consumer Protection held public hearing on July 17, 2023.

In Joint Committee on Financial Services; no hearing scheduled yet.

In Joint Committee on Financial Services; no hearing scheduled yet.

Eliminates initial state inspection for new vehicle. SUPPORT

In Joint Committee on Transportation; no hearing scheduled yet.

Limit doc prep fee amounts. OPPOSE In Joint Committee on Transportation; no hearing scheduled yet. Rep Howitt

Sen Crighton

Safety shutoff for keyless ignition technology.

In Joint Committee on Transportation; no hearing scheduled yet.

2023

AUGUST

SUPPORT SUPPORT SUPPORT SUPPORT

OPPOSE SUPPORT SUPPORT

AUGUsT 2023 Massachusetts Auto Dealer www.msada.org 10

11 www.msada.org Massachusetts Auto Dealer AUGUST 2023 MSADA • I will attend the MSADA Annual Meeting on Friday, October 13 • I will attend the Cocktail Reception • I want to Reserve a Room at the Encore Boston Harbor Hotel for Friday evening (Limited number available for dealers only) Don’t Delay Reserve Your Seat Today! 2023 MSADA AnnuAl M eeting Friday Oct. 13 Encore Boston Harbor Everett Ple AS e MA rk the APP r OP ri A te re SPO n S e S r SVP reque S te D by Fri DA y, Oct O ber 6, 2023 q YES q NO q YES q NO q YES q NO Fax back to MSADA at (617) 977-9261 Any questions, contact Jean Fabrizio at (617) 451-1051 or by em ail jfabrizio@msada.org N AME D EA l ERSHI p E MAI l ADDRESS pHONE #

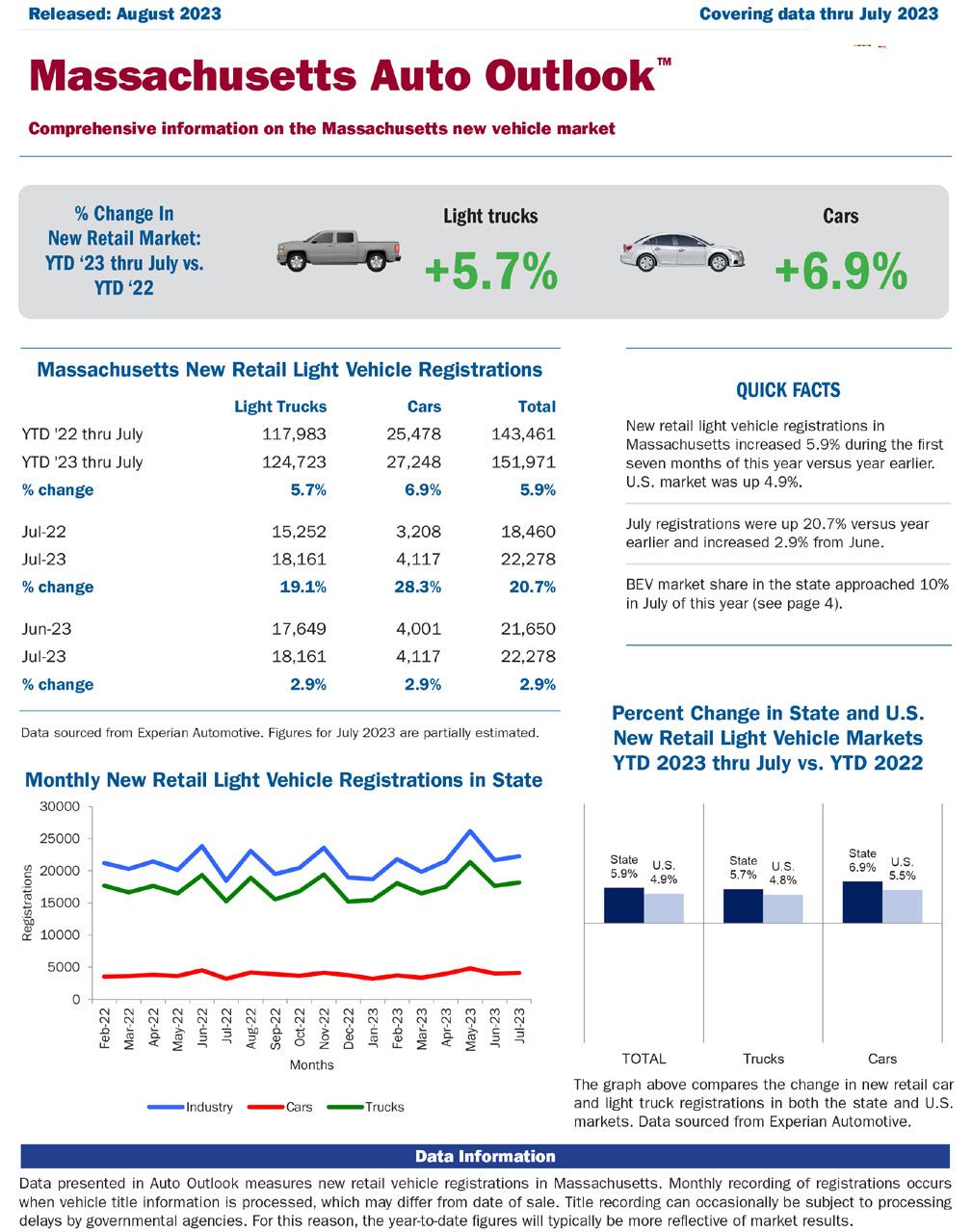

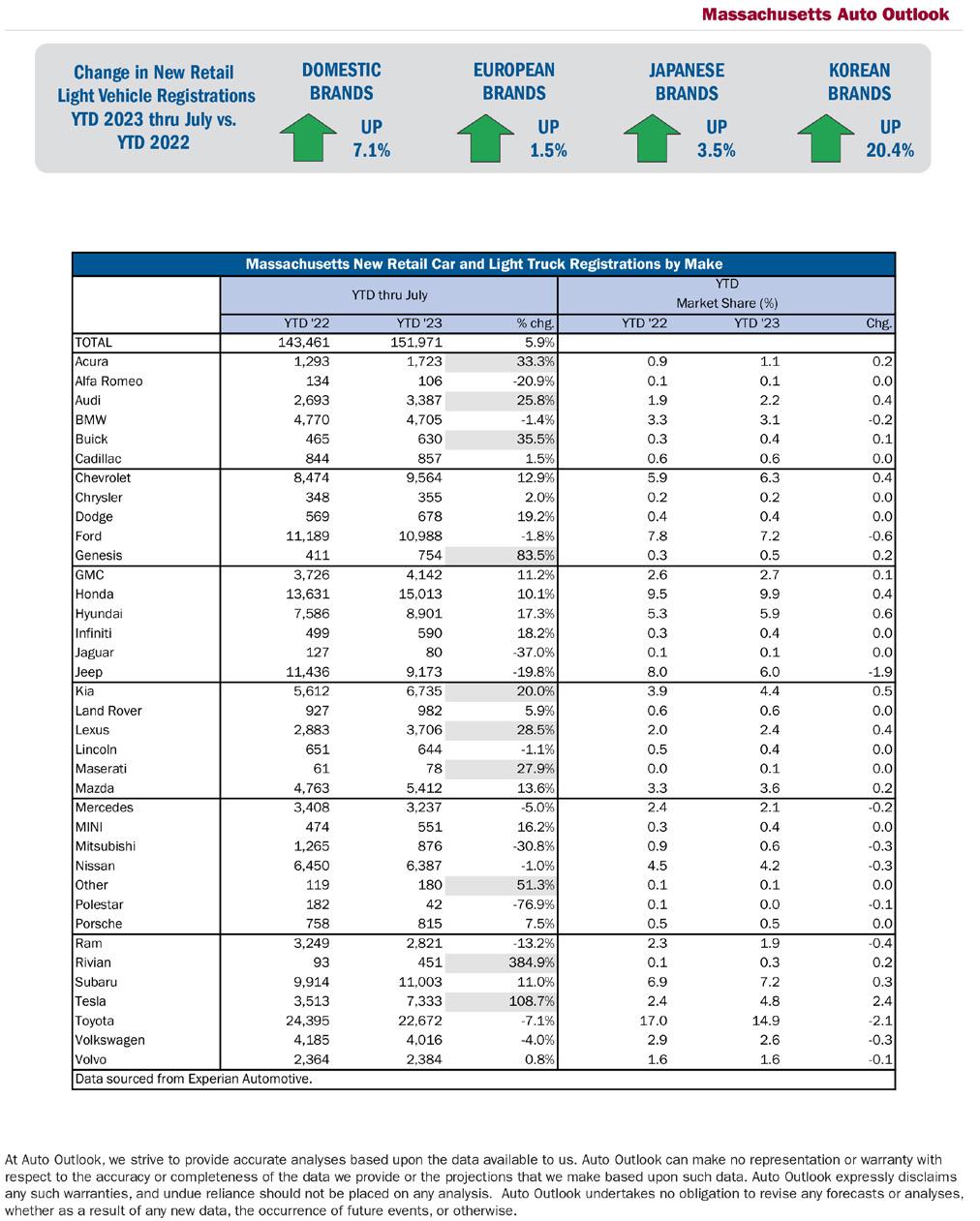

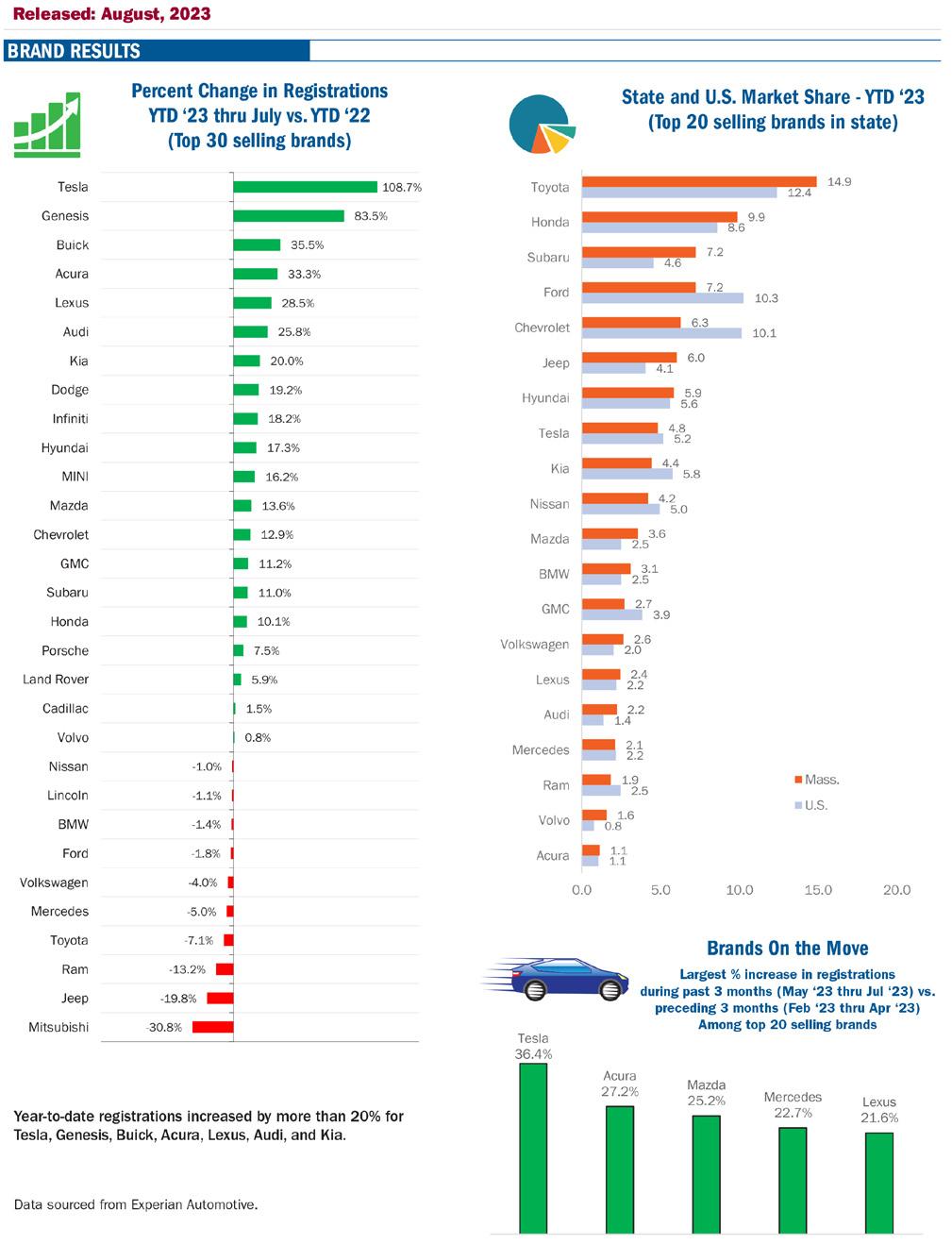

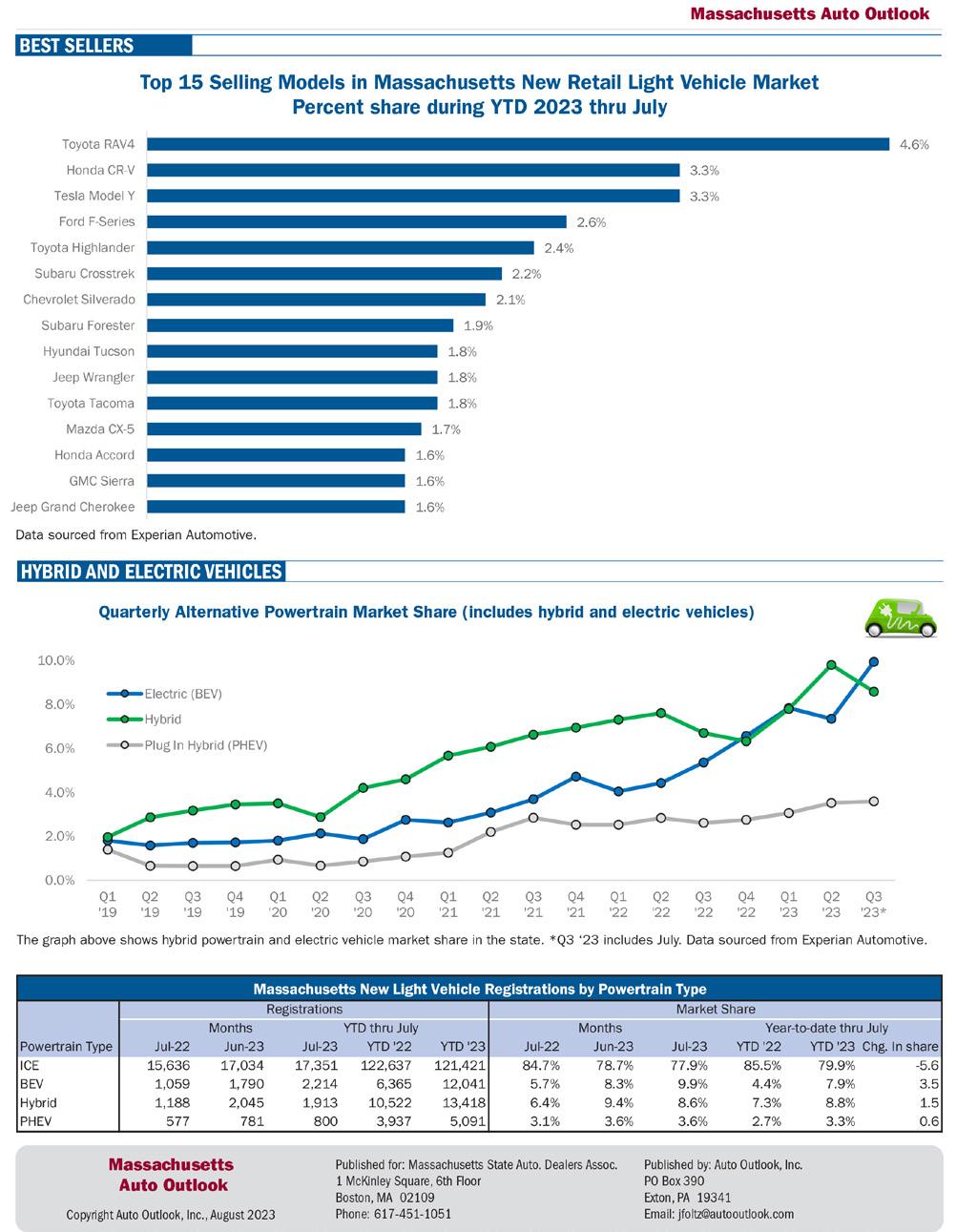

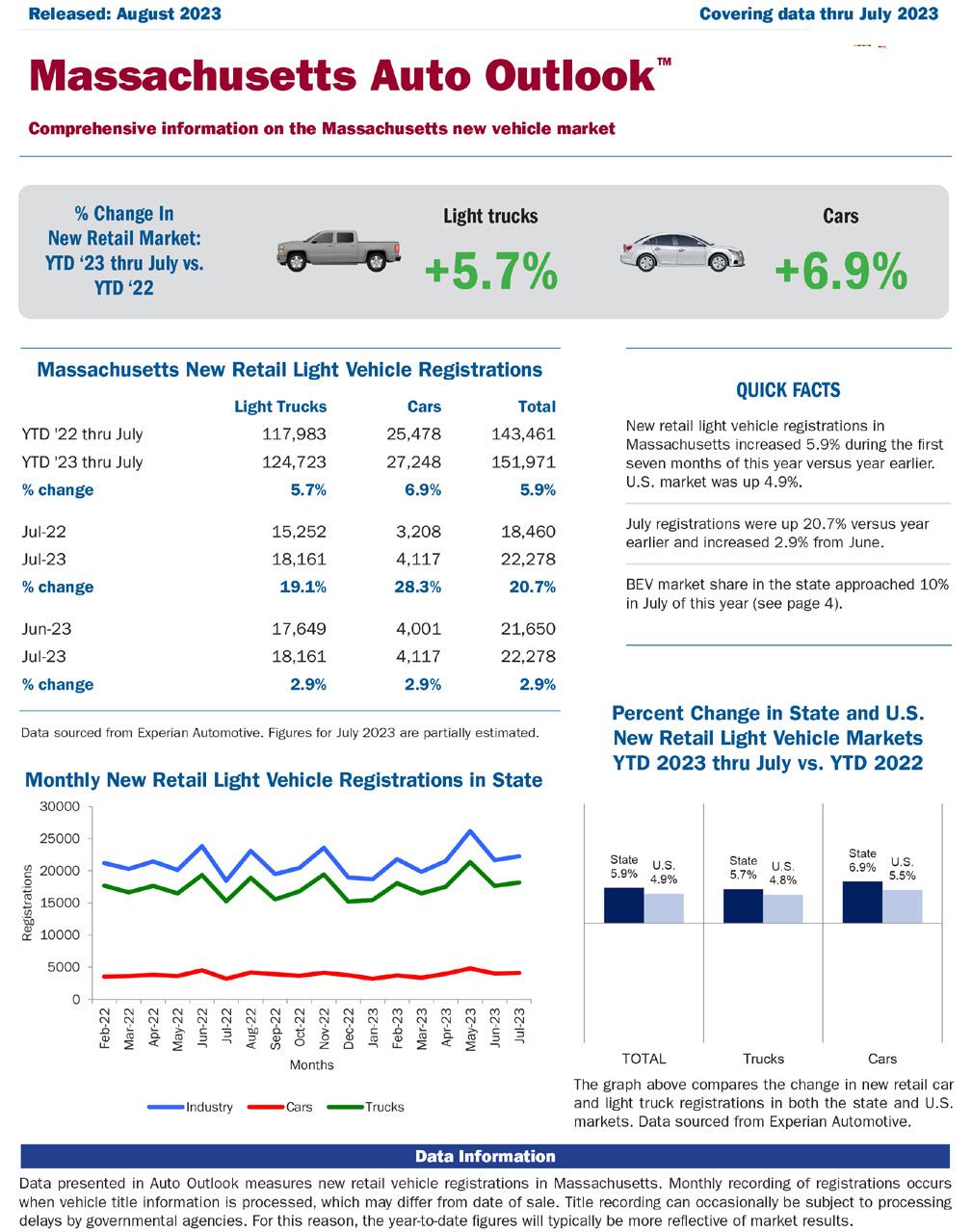

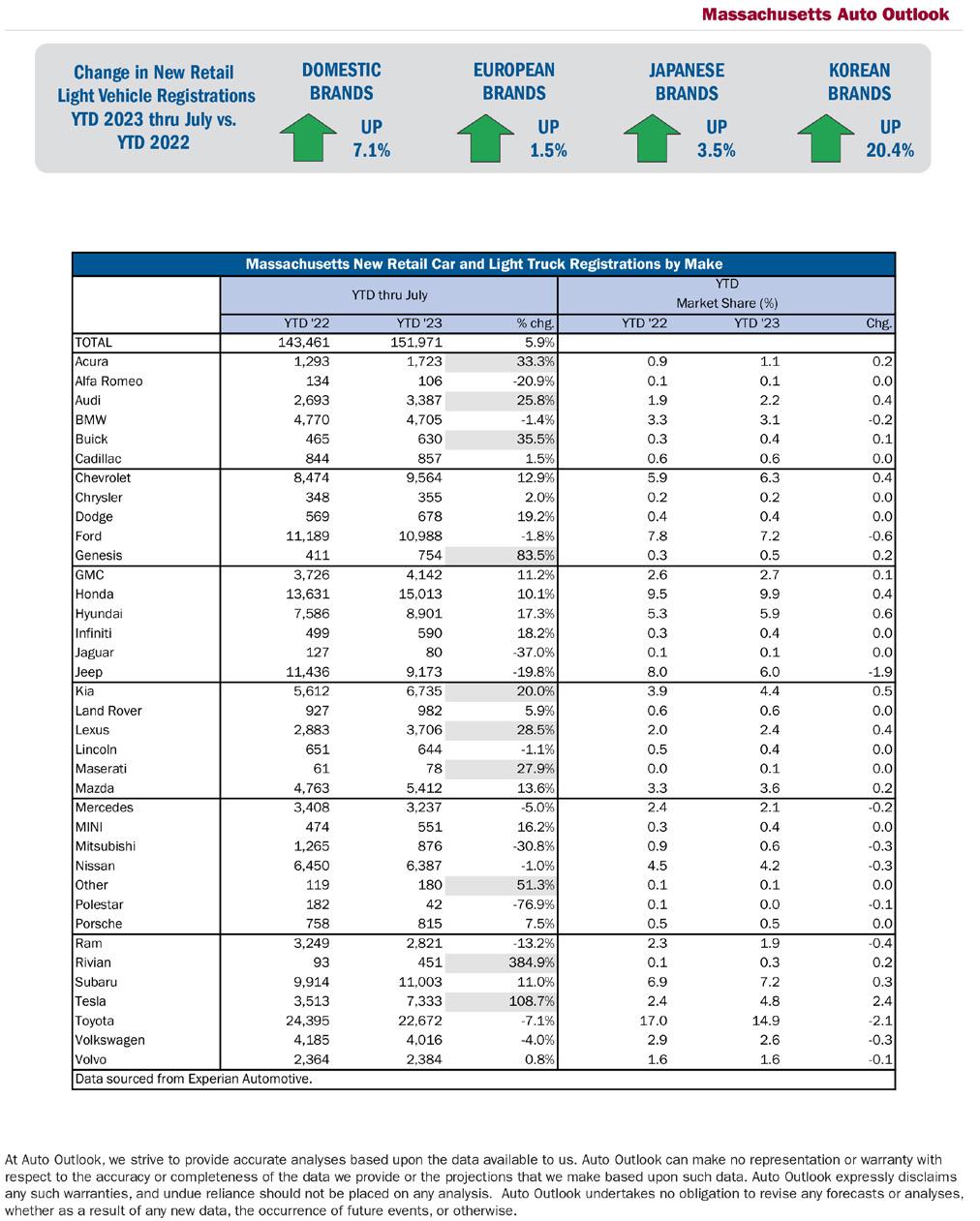

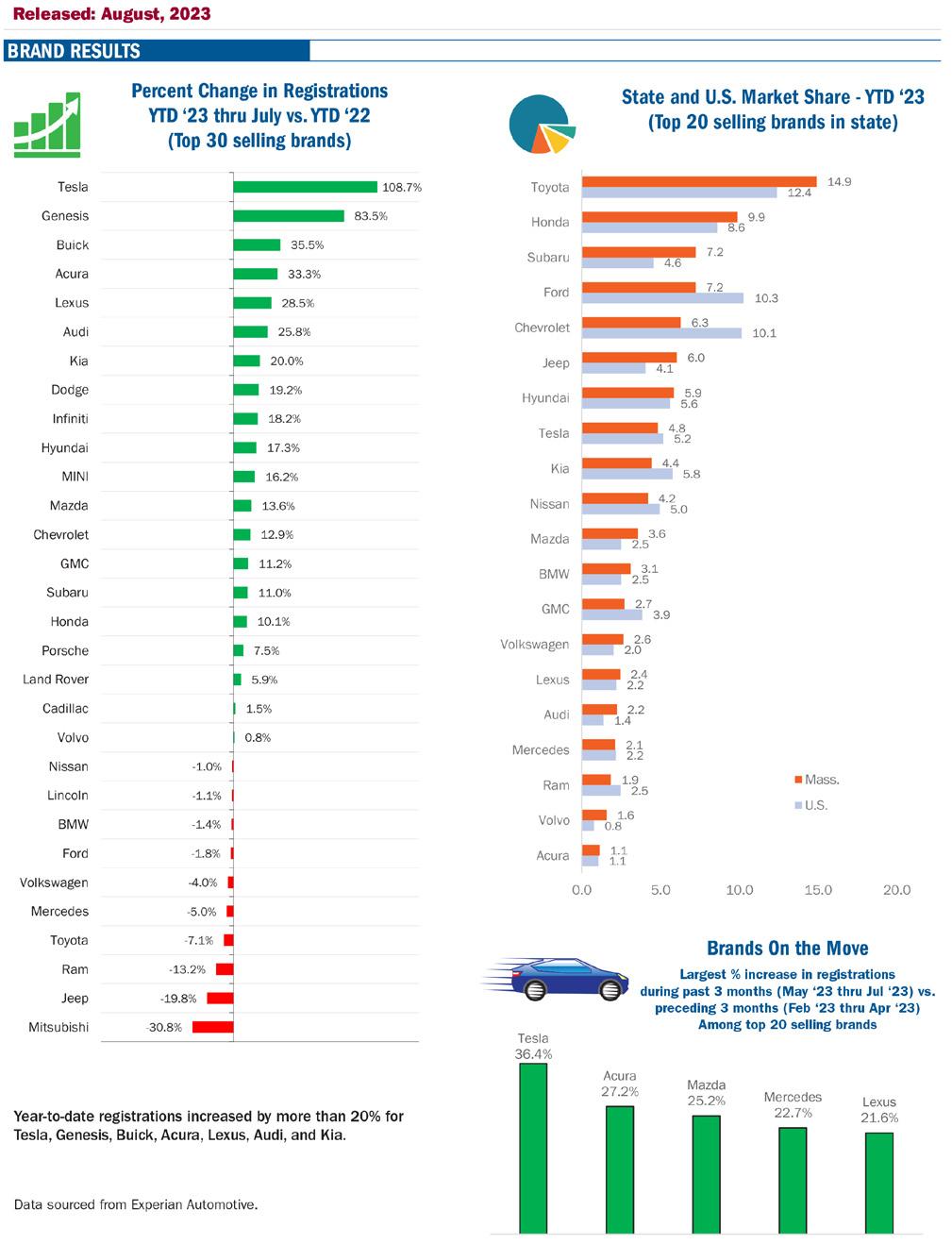

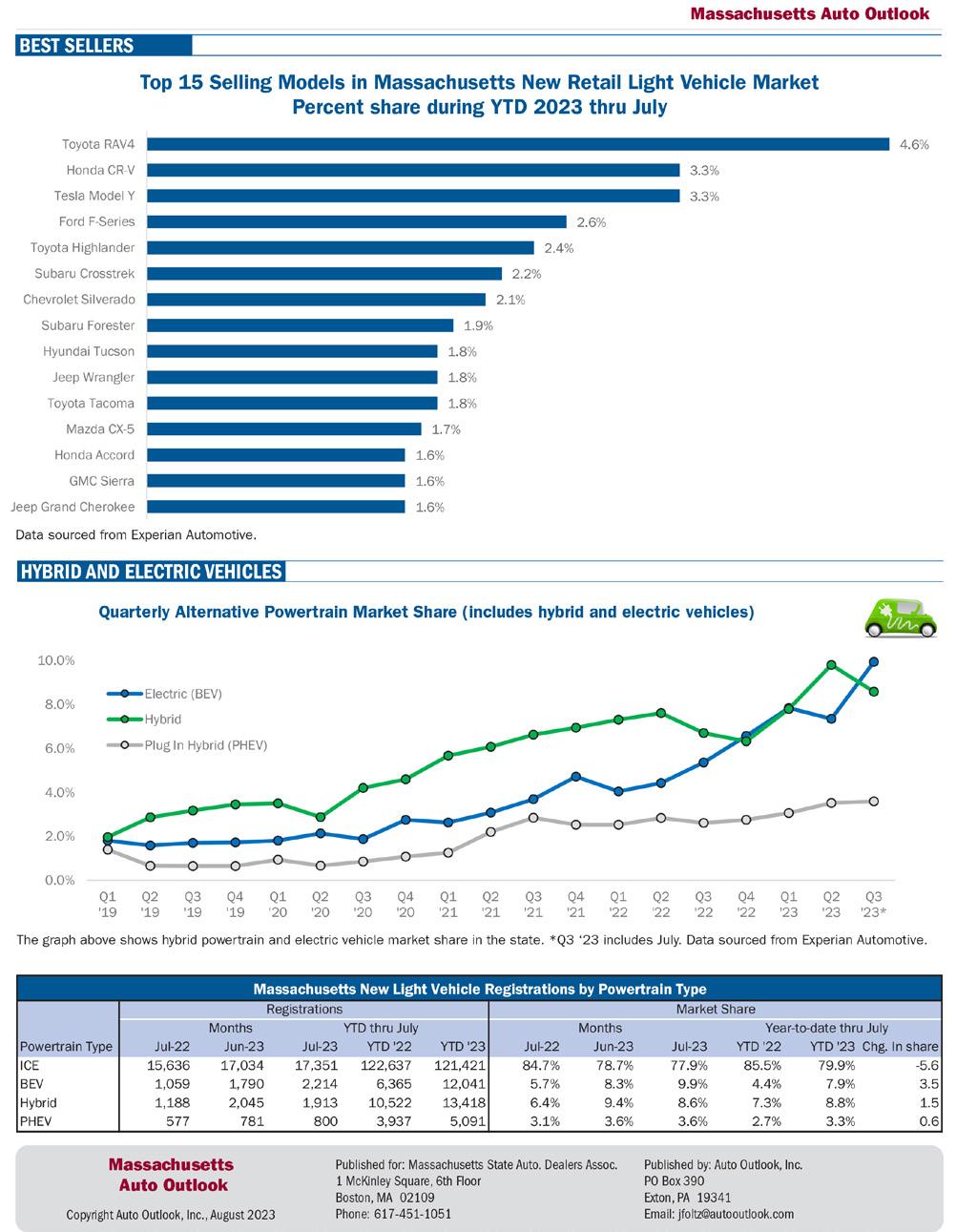

FEBRUARY 2022 Massachusetts Auto Dealer www.msada.org AUGUST 2023 Massachusetts Auto Dealer www.msada.org 12 AUTO OUTLOOK

www.msada.org Massachusetts Auto Dealer FEBrUArY 2022 www.msada.org Massachusetts Auto Dealer AUGUST 2023 MSADA 13

AUGUST 2023 Massachusetts Auto Dealer www.msada.org 14 AUTO OUTLOOK

www.msada.org Massachusetts Auto Dealer AUGUST 2023 MSADA 15

theRighttoRepair Rollercoaster continuesNonstop

In politics, a day can feel like a lifetime. In the case of the unresolved challenges to the Massachusetts right to repair law, those in the industry seem to be suffering through a thousand lifetimes, without an end in sight.

The original state law had been implemented over the years without significant conflict. First passed by the legislature in 2012 and again in 2013 after the 2012 initiative petition, it was subsequently supported by the automotive manufacturers, then represented by the Alliance of Automobile Manufacturers and the Global Automakers, and the aftermarket and independent repair industry in a national memorandum of understanding in January 2014.

That was not good enough for certain parties within the auto repair industry. Because of a stated concern, which has never materialized, that the auto manufacturers would restrict diagnostic and repair info, software, and tooling behind vehicle telematics – which would be a blatant violation of the law – the repair coalition went to the 2020 Massachusetts ballot to rewrite the law. And, of course, the proposed law changes passed, thereby prompting an immediate lawsuit from the manufacturers, now represented by the Alliance for Automotive Innovation, filed the week after the November 2020 election.

“Since the early part of this century, we have been battling these right to repair issues, and it has always been about chasing a solution for a problem that just did not exist,” said Robert O’Koniewski, MSADA executive vice president and general counsel. “For twenty years now, no one in the independent repair community or the aftermarket parts companies has been able to identify any significant issue with a repairer not having the information and tools to diagnose and repair a vehicle problem. This has been nothing but a full employment opportunity for lobbyists pushing this issue.”

The 2013 law and 2014 MOU put in place nationally a process

AUGUsT 2023 Massachusetts Auto Dealer www.msada.org 16 COVER STORY

for information and tooling commitments from the manufacturers as well as a conflict resolution forum should suppression occur.

The law purposefully excluded telematics, Chris Connolly, Jr., a partner at Herb Connolly Chevrolet in Framingham and MSADA Immediate Past president, told Wards recently. Connolly was part of the dealer group that helped to draft the 2012 law. To overcome manufacturers’ objections, “we ended up passing the law that carved out telematics,” he says. “We made the language more sensible. No information about repairing cars would be sent over the air anyway.”

The feared suppression has never materialized, even as the independent repair groups pushed those fears as a motivation for the 2020 law. Taking it one step further, the manufacturers’ litigation threw the 2020 amendments into limbo, where it remains, to the consternation of all parties.

Businesses desire certainty, especially for the rules under which they must operate. The 2020 law and subsequent litigation have upended any pretense of certainty. Beginning in 2021, the approach taken by the manufacturers varied, going to both extremes and in between; some turned off their vehicle telematics systems while others did nothing.

At the onset of the manufacturers’ filing their litigation, the Massachusetts attorney general, at that time

Maura Healey, who is now governor, said her office would not enforce the new amendments while the lawsuit was in play.

That all changed on March 7 this year, when the new Attorney General, Andrea Campbell, said her office would begin to enforce the law starting June 1, including the mandate that new and used vehicle dealers must provide “prospective buyers” a “telematics system notice”, drafted by the AG. However, just before the Memo-

rial Day weekend and days out from the June 1 enforcement date, the Alliance, on May 26, filed papers with the court seeking a temporary restraining order barring enforcement of the law until the court could render a decision in the lawsuit or until the court could issue a preliminary injunction granting such re-

lief. After the court’s May 30 hearing to take arguments on the Alliance’s request, federal District Court Judge Douglas Woodlock denied the Alliance’s request. One aspect the judge took note of was the fact that federal agencies had not submitted comments at any time during the litigation to support the Alliance’s argument that federal law and regulations pre-empted them from complying with the state RTR law.

As a result of the judge’s decision, the AG was set to begin enforcement. Since the AG can only respond to complaints, everyone took a wait-and-see approach. As of this writing, the AG’s Office has no complaints before it.

NHTSA Letters Shake Things Up

Seemingly prompted by Judge Woodlock’s admonishment, there arrived a surprising new twist to the RTR saga impacting the vehicle manufacturers, consumers, dealerships, and the advocates for the 2020 law, including independent repairers and the after-market parts companies.

On June 13, out of the blue, the U.S. Department of Transportation’s National Highway Traffic Safety Administration filed with the federal district court a letter it had sent to 22 motor vehicle manufacturers informing them that the Massachusetts right to repair law (MGL Chapter 93K) conflicts with, and is therefore pre-empted by, existing federal law, namely the National Traffic and Motor Vehicle Safety Act. In the letter, NHTSA warned the manufacturers not to comply with the state RTR law.

One leg of the manufacturers’ argument in the lawsuit against the law is federal pre-emption. The NHTSA letter provided support for that argument. The NHTSA letter was viewed as an impetus to discourage the vehicle manufacturers from altering telematics systems in the vehicles in a manner that allowed for compliance with Chapter 93K but could put the vehi-

www.msada.org Massachusetts Auto Dealer AUGUST 2023 MSADA MSADA 17

cles in violation of federal law and regulations, thereby creating potentially hazardous conditions for vehicle owners and drivers.

Politics being what it is, the reaction from the pro-RTR crowd was immediate and hostile.

Massachusetts’ U.S. Senators Elizabeth Warren and Edward J. Markey, both Democrats, sent a letter to Secretary of Transportation Pete Buttigieg and Deputy Administrator of the National Highway Traffic Safety Administration, calling on NHTSA to reverse its course after it sent a recent letter to auto manufacturers,

senators concluded.

NHTSA’s response to the political outcry was immediate. The next week, NHTSA reversed its initial position and subsequently stated the independent repair shops can access the repair data through short-range telematics technology such as Bluetooth. In its August 22 letter to AG Campbell, NHTSA wrote, “One way that vehicle manufacturers can comply with the Data Access Law is by providing independent repair facilities wireless access to a vehicle from within close physical proximity to the vehicle, without providing long-range remote access.” And, as reported in Ward’s, Ben Halle, director of public affairs at the U.S. Department of Transportation, of which the NHTSA is a part, stated DOT’s support for Right-to-Repair provisions and it is “eager to promote consumers’ ability to choose independent or DIY repairs without compromising safety to themselves or others on our nation’s roads.”

Yet Another MOU

And while the NHTSA theater played out, the Alliance struck a deal on another MOU with the independent repair groups, which the local RTR folks seemed to embrace and then walked back from.

advising them not to comply with the state’s Right to Repair law.

“NHTSA’s decision to give auto manufacturers a green light to ignore state law appears to favor Big Auto, undermine the will of Massachusetts voters and the Biden Administration’s competition policy, and raise questions about both the decision process and the substance of the decision by NHTSA’s leadership. We are asking NHTSA to explain its rationale for its harmful actions and respect Massachusetts state law by reversing course,” wrote the senators.

“NHTSA sent the June 13 letter with no warning, circumventing the legal process, contradicting a judicial order, undermining Massachusetts voters, harming competition and hurting consumers, and causing unnecessary confusion by raising this novel view two weeks after enforcement of the law began. Moreover, NHTSA’s position is not consistent with Administration policy. President Biden’s Executive Order on Promoting Competition in the American Economy encourages the FTC to draft new regulations limiting ‘manufacturers from restricting people’s ability to use independent repair shops or do DIY repairs,’” continued the senators.

“It is disappointing that NHTSA’s letter relies on the argument pushed by major automobile manufacturers that there is, in this case, an irresolvable conflict between maintaining data security and providing independent repair shops with the data they need to conduct repairs. Auto manufacturers have routinely raised safety concerns to ‘change the subject’ and distract consumers from the fact that ‘vehicle repair and maintenance services from independent repair shops keeps the cost of service and repair down,’” the

On July 11, organizations representing the country’s independent automotive repairers, collision repair experts, and the Alliance announced an agreement that affirms the 2014 national MOU, stating that “independent repair facilities shall have access to the same diagnostic and repair information that auto manufacturers make available to authorized dealer networks.” Additionally, the manufacturers will make training and education programs available to repairers so they can keep up with advancements in vehicle technologies.

Quoting from the letter they submitted to Congress, “This commitment was created with our mutual and valued customers in mind: vehicle owners. It affirms that consumers deserve access to safe and proper repairs throughout a vehicle’s lifecycle [and] it is built to last because it anticipates changes in automotive technologies and market evolutions.”

“Automakers support right-to-repair, and today’s independent auto repair market is working well with lots of competition,” said John Bozzella, the Alliance’s president and CEO. “Auto repairers across the U.S. have access to the same repair and diagnostic information provided to auto dealers. It’s not just automakers who say this. It’s the Federal Trade Commission. And with today’s agreement, it’s also the thousands of independent auto repairers and small businesses in all 50 states who together with automakers have once again made this fundamental commitment to customers.”

“The new MOU gives meaning to the adage that the proof is in the taste of the pudding,” said O’Koniewski. “The major players basically came out and said all the information repairers need is out there and available, as updates occur they will have them, and consumers will continue to be served by their repairer of choice, whether it is the local independent or their favorite dealer.”

AUGUsT 2023 Massachusetts Auto Dealer www.msada.org 18 Righ T TO R EPA i R R O ll ERCOASTER

Congressional Solution?

For several years, legislative proposals have floated around the halls of Congress, unfortunately now beginning to gain bipartisan support.

With the retirement of Democrat Rep. Bobby Rush from Chicago in 2022, Florida GOP Rep. Neal Dunn has filed H.R. 906, the so-called “REPAIR Act”. The bill has little to do with repairing a vehicle. What it would do is compel auto and truck manufacturers to provide any “aftermarket parts manufacturer” the information necessary “to produce or offer compatible aftermarket parts.” The bill also would give any third-party access to sensitive consumer data from vehicles, which raises consumer privacy, vehicle security, and automotive safety concerns.

The National Automobile Dealers Association and American Truck Dealers, along with the Alliance, have expressed strong opposition to the bill. However, bipartisan support – a rare sight in D.C. – is lining up behind the legislation, as 18 Republicans and 18 Democrats have signed on as cosponsors.

While the bill lingers out there, the U.S. Government Accountability Office (GAO) has been visiting with dealers and other parties across the country to assess the impact of the Massachusetts right to repair law and the 2014 MOU.

The GAO is an independent, nonpartisan government agency that provides Congress, the heads of executive agencies, and the public with timely, fact-based information that can be used to improve government and save taxpayers billions of dollars.

On July 27, a two-man team from the GAO visited Herb Connolly Chevrolet in Framingham and MetroWest Subaru in Natick to obtain dealer input regarding the right to repair matter. The GAO interviewed Chris Connolly and Frank Hanenberger along with their key staff. The dealers engaged in robust discussion at both dealerships with their GAO guests. GAO representatives were scheduled to meet with dealers in Maine and Chicago, also. .“I very much appreciated the GAO including us in their investigation; I thought it was the right thing for them to do,” said Frank Hanenberger, the dealer principal at MetroWest Subaru. “The investigators seemed genuinely interested in how things worked on the ‘front lines’ where the rubber literally hits the road. They asked the right questions and were open to our point of view. I feel they were unbiased and impartial in their approach.”

Unfortunately, Hanenberger, like the rest of us, does not have a crystal ball that can predict where all this is heading.

“Do you think the agreement that was struck between the OEMs and independent repair associations will stick and help move this legislative resolution?” stated Hanenberger. “Or will Congress see that as being ‘good enough’ and not even make the effort to address it on their end?”

Over two years after the conclusion of the federal trial before Judge Woodlock on July 21, 2021, all affected parties still await a decision that could bring some clarity to the situation – the 2013 law, the continued efficacy of the 2014 MOU, potential federal pre-emption, NHTSA’s schizophrenic approach, another MOU.

“Bottomline, our original law from 2012 and 2013 works as was intended for car owners, repairers, dealers, the manufacturers

alike,” said O’Koniewski. “We at MSADA worked with legislators and repair advocates to craft a law that was balanced and based in reality. The irony of all this is, even with the suspension of the 2020 amendments and the uncertainty behind a federal court decision, consumers still have their cars and trucks fixed wherever they want to go, and repairers have all the access they need to diagnostic and repair information, software, and tools. In 2012, independent were doing just over 70% of the non-warranty repairs customers needed and today they do just over 70% of the non-warranty repairs. Nothing really has changed but a lot of money going to lawyers and lobbyists. It has been a recession-proof issue for them.”

“From our perspective this has always been much ado about nothing,” concluded O’Koniewski. “Unfortunately, we are all stuck for now on this rollercoaster ride with no indication when we can climb off.”

www.msada.org Massachusetts Auto Dealer AUGUsT 2023 MSADA MSADA 19

t

Gary rome receives Three Prestigious Awards From Hyundai

On July 27, executives from Hyundai Motor America visited Gary Rome Hyundai and presented three prestigious awards given only to top dealers: the 2022 Board of Excellence Award, the Global Dealer Award, and the impressive Golden Turtle Ship Award.

The Hyundai Board of Excellence Award is only given to a small number of dealers each year, and it is a national recognition program that rewards top-performing dealerships for sales and service excellence.

The Global Dealer Award is only given to 100 dealers each year globally, and Gary Rome Hyundai is one of the 19 in the United States. The award incorporates sales, service, customer satisfaction, and facility key performance indicators for all dealers glob-

ally. The Global Dealer Award is given to the top elite tier of those dealers.

The Golden Turtle Ship Award represents strength and impenetrability. When the Koreans were fighting the Japanese, they were outnumbered. The Japanese had 100 ships and the Koreans only had 12; however, they were successful and won. Due to a long period of peace, the ship is still famous today for its innovative design as well as its role as a symbol of strength and military power. The most common and popular meaning of the turtle is longevity.

Hyundai leadership attending the event at the dealership included Bob Kim, Vice-President, National Sales; John Szymanski, Regional General Manager, Eastern Region; Bryan Thompson,

NEWS from Around the h orn 16 MSADA 20 AUGUsT 2023 Massachusetts Auto Dealer www.msada.org HOLYOKE

Regional Sales Manager, Eastern Region; Kim Bucci, Regional Parts & Service Manager, Eastern Region; Chris Stotts, District Sales Manager; John Kouroupas, District Parts and Service Manager; and Rick Asci, Hyundai Finance, Eastern Region.

WASHINGTON, D.C. House Committee Votes to defund FTC Vehicle Shopping rule

On July 13, the House Appropriations Committee passed language as part of a broader spending bill to stop the Federal Trade Commission (FTC) from finalizing, implementing, or enforcing the Vehicle Shopping Rule. NADA strongly supported this provision, which was included in the House Financial Services and General Government Appropriations bill.

This effort on the Appropriations Committee was spearheaded by Nevada Congressman Mark Amodei, a Republican who is the chair of the Committee’s Subcommittee on the Legislative Branch; as a chair of one of the twelve subcommittees, he has the authority to request the inclusion of a provision that would cut off funding for certain executive branch actions. (Note: No member

of the Massachusetts House delegation serves on the Appropriations Committee.)

The FTC proposed this rule in June 2022. MSADA and NADA filed comments with the FTC opposing the proposed Rule. The Appropriations Committee’s initial defunding action is a major step by Congress to use its “power of the purse” to protect consumers and dealers from this deeply flawed proposed rule that would needlessly inject massive amounts of time, cost, inefficiency, and complexity into the vehicle sales process.

Further, NADA sent a letter to the Committee urging passage of this provision to prevent the FTC from implementing the Vehicle Shopping Rule. In the letter, NADA highlighted the major fatal flaws of the proposed rule and again called Congress’s attention to the recent Center for Automotive Research (CAR) study, which found that the FTC’s rule would cost consumers $38 billion.

The House will likely consider the full appropriations bill, including the Vehicle Shopping Rule provision, at some point after its August recess.

WASHINGTON, D.C. & STARKVILLE, MISS. report Highlights Positive Consumer Experiences with Service Contracts

A new report has been released which highlights the favorable experiences that consumers have with optional vehicle service contracts and their willingness to not only purchase such contracts in the future but also recommend them to family and friends.

The report, Service Contracts on Vehicle Purchases: Findings from a New Survey, was prepared by three distinguished authors based on a survey of 1,200 consumers in the first quarter of 2023. Among many other positive findings, the report explains that a very high percentage of purchasers of service contracts indicated that the dealer explained the costs and features of service contracts (94%), understood that the purchase was optional (96%), and would purchase a service contract again (76%). Importantly, the authors concluded that: “Vehicle dealers typically offer service contracts as part of the vehicle sales process, but the sales process itself does not appear to govern the outcome.”

This report, which was prepared by a retired senior economist and a retired principal economist with the Federal Reserve as well as the Chair of Financial Institutions and Consumer Finance at Mississippi State University, complements a 2021 report by the same authors that details the positive experiences that consumers overwhelmingly report with optional GAP Waiver protection that dealers offer to finance customers. Taken together, these reports provide robust and current data from nationally representative samples of consumers demonstrating that consumers understand and view positively the value that Voluntary Protection Products can provide to protect their vehicle purchase investments.

t www.msada.org Massachusetts Auto Dealer AUGUST 2023 21 NEWS from Around the h orn MSADA

Bob Kim (Hyundai Motor America national Sales Manager) gary rome, Kevin Schechterle (gary rome Hyundai general Manager)

Managing Factory Incentives

By Matthew Marcoullier CPA, Albin, Randall & Bennett

By Matthew Marcoullier CPA, Albin, Randall & Bennett

With supply chains still shaking off the effects of the pandemic and demand starting to soften, the OEMs are looking for new ways to cut costs. Clients and others in the industry have reported an increase in frequency of incentive audits. These also have started to transition back to on-site audits vs. desk or mail-in audits. Further, the OEMs have been able to “do more with less” as they utilize and rely more heavily on computer-assisted techniques and targeted auditing to expedite their reviews and obtain the most favorable outcome (for the OEM, of course).

To better understand these incentive audits and what dealers can do to prevent or mitigate the negative impacts of an audit, we spoke with Sherralyn Peterson, an Automotive Incentive Specialist who helps dealers improve their incentive management processes, train their staff, and prepare for incentive audits. Her input helped us to address some of the following questions around incentives.

What are manufacturers focused on?

Every OEM has incentive programs. None of them are the same, and all of them are complex. Plus, the OEMs have many tools that enable them to quickly validate a claim. One of the changes resulting from the chip crisis is that the OEMs now watch everything and every vehicle very closely, and they know exactly where vehicles are at all times, from shipment to final delivery to the customer. It is important to make sure you know

the rules and requirements for delivery reporting and that you are doing so accurately. For example, can you sell a vehicle before it hits your lot? Is it a retail sale or fleet or commercial sale? It is also very easy for the OEMs to use VIN look-ups to determine what incentives are available or if a customer was the original purchaser of a vehicle being used toward loyalty or similar programs.

What are some best practices for incentives compliance?

Incentive programs are complex and ever-changing. With seemingly minor infractions enough to disallow a claimed incentive, sales managers need to know their programs inside and out. There needs to be an understanding that you cannot just plug someone into a role where they are responsible for managing and reviewing incentives. They need experience and/or training. Even switching between OEMs can be difficult, and having someone master a particular program does not mean they will be able to perform at the same level for another franchise. Specific and intentional training is imperative; prevention is much more effective than trying to resolve issues during an audit.

Dealers and their managers should also take compliance seriously and make their sales staff know that errors or incomplete information will not be overlooked. Do what you can to get all of the necessary signatures and information before the customer leaves. It is inefficient, ineffective, and poor customer service following up with a customer looking for additional information after he or she has driven off the lot, especially if it is days, weeks, or months later. Linking accountability to compensation is a great way to get results.

How do you get off/stay off the OEM’s radar?

The OEMs are more targeted in their approach to incentive audits. Dealers

should not really be surprised if they end up selected for an audit, as it is most likely prompted by something they have done. Audits generally are not random. The OEMs are obtaining information from various internal and external sources, such as DMV registrations, exporters, banks, etc. They are using this information to analyze and compare what you are doing with other dealers and can quickly target anomalies. It is important to make sure your team is well-versed in program requirements and follows through with proper documentation.

What do you do if you are selected for an audit?

In the event of an audit, you want to make sure you are not surprised by what is in your deal jackets. Review any highrisk deals, get your paperwork in order, and follow up on missing information. Be aware of what not to show the auditors. You should only provide the minimum required information; unnecessary or irrelevant information should not be handed over. Along these same lines, control and be intentional about who is in contact with the auditor and how they are communicating.

Despite the complexity of incentive programs, they are an important part of a dealer’s business and bottom-line, especially as interest rates reach 20-year highs and new vehicle prices continue to climb. Properly managing your incentive programs can help to make sure these are a tool available to your dealership rather than a compliance nightmare. Training, execution, and oversight are all important to any process, and that is no different for incentives. Being proactive can help keep you out of the OEM’s crosshairs. In the event you are selected for an audit, help to ensure you are prepared. For more information, consult your CPA for assistance in navigating the complexities of incentives.

ACC ountin G 22 MSADA AUGUST 2023 Massachusetts Auto Dealer www.msada.org

t

IRS Severely Limits ERC “Supply Chain Disruptions”

By Daniel Mayo, Partner; Matthew Walsh, Partner; and louis Young, Principal, Withum

The IRS released a generic legal advice memorandum (GLAM) addressing the employee retention credit (ERC) and supply chain disruptions on July 20, 2023. The GLAM discusses five scenarios where taxpayers might qualify for the ERC on the basis of a supply chain disruption, and then it dismisses each of the claims in order. While the specific principles that can be distilled from the GLAM are discussed below, we believe it is telling that the IRS issued a pronouncement on supply chain disruptions, and none of the examples discussed in the pronouncement actually qualify under the rule.

ERC Generally

The ERC is a fully refundable tax credit for employers impacted by the COVID-19 pandemic. Eligible employers can receive a maximum benefit of $26,000 per employee for wages paid to employees in 2020 (up to $5,000) and in 2021 ($7,000 per eligible quarter, up to $21,000). To qualify for the credit, employers need to have had suffered either a significant decline in gross receipts or a full or partial suspension of their business operations due to a governmental order due to Covid-19. To learn more about the general requirements, check out our ERC flowcharts at https://www.withum.com/ service/covid-19-financial-assistance-services/employee-retention-credit/.

Supply Chain Disruptions

In Q&A #12 of the IRS’s Notice 202120, the IRS outlined a path to ERC eligibility based on the concept of a supply chain disruption. For an employer to successfully claim a full or partial suspension due to a governmental order that impacts its supplier, it must meet the following requirements:

• The employer was unable to obtain critical goods or materials from a supplier;

• The supplier was unable to deliver the critical goods or materials due to full or

partial suspension of its business due to a governmental order;

• The employer was unable to obtain the critical goods or materials from an alternate supplier; and

• The employer suffered a full or partial suspension of its business due to the inability to obtain the critical goods or materials.

We have always stressed the importance of starting the partial suspension analysis with the relevant governmental orders, and this applies for supply chain disruptions, too; focusing solely on the impacts of supply chain disruptions, without more, will not qualify a business.

The GLAM

The recent IRS memorandum, AM 2023-005, discusses five scenarios involving supply chain disruptions. Rather than summarize all of them here, we highlight the key principles that can be distilled from the IRS’s analysis of the scenarios:

(1) There can only be a supply chain disruption if a taxpayer identifies the specific governmental order that fully or partially suspended the supplier’s business. In other words, vague confirmations from the supplier that it was affected by Covid-19 are not enough.

(2) There is no supply chain disruption if a taxpayer experiences delays in obtaining critical goods or materials, even if it experiences several delays, as long as it had a surplus of goods to operate its businesses. In the words of the IRS, “the relevant inquiry is whether [the employer’s] trade or business operations could continue.”

(3) The inability to obtain critical goods or materials due to bottlenecks at the U.S. border/port, or due to trucking or shipment delays, does not qualify as a supply chain disruption. Taxpayers need to identify a specific governmental order that suspended the supplier’s business and then demonstrate that the supplier’s inability to

deliver the critical goods or materials was caused by the governmental order.

(4) Even if a taxpayer can demonstrate that a governmental order suspended its supplier’s business and that the taxpayer’s business was suspended as a result of the supplier’s suspension, then the taxpayer can only claim a supply chain disruption for a period of time that is coterminous with the supplier’s suspension period. In other words, delays that continue or occur after the supplier’s suspension period do not qualify as a supply chain disruption.

(5) There is no supply chain disruption just because critical goods or materials were more expensive than they were before the pandemic; the critical factor is whether the taxpayer was prevented from operating its business. See point #2 above – “the relevant inquiry is whether [the employer’s] trade or business operations could continue.”

(6) There is no supply chain disruption if a retailer was unable to stock a limited number of products and was forced to raise prices on its other products, as long as it was not prevented from operating its business and had a wide variety of products available to its customers.

Consistent with Q&A #12 that outlined the requirements of a supply chain disruption, the IRS is taking a narrow view of the rule. The release of the GLAM is consistent with the IRS’s various efforts to scale back the ERC. It will be interesting to see how widely IRS auditors apply the GLAM to taxpayers under audit.

If you have questions about the ERC or have received a notice that your ERC claim is being reviewed by the IRS, it is critical that you obtain advice from tax professionals that are steeped in the nuances of the ERC. Withum is and has represented more than 40 clients before the IRS on ERC claims. Our team of dedicated ERC experts can help ensure you get the best outcome possible.

23 www.msada.org Massachusetts Auto Dealer AUGUST 2023

t

ACC ountin G MSADA

Legal Updates: Dealers Win on Courtesy Vehicle Liability; FTC Looks to Ban Spot Deliveries

By Tom Vangel & James Radke

By Tom Vangel & James Radke

On June 27, 2023, the Massachusetts Supreme Judicial Court (SJC) determined that a federal law protects dealers from liability for accidents caused by their customers’ negligence while driving dealership courtesy vehicles. More particularly, the SJC determined that the so-called Graves Amendment (49 U.S.C. § 30106), a federal statute that protects rental car companies from liability for the negligence of their customers, also applies to auto dealerships that regularly provide courtesy loaner vehicles as part of their business. This issue had been unresolved previously in Massachusetts and provides an important layer of protection for dealers.

The case, Garcia v. Steele, involved Mercedes-Benz of Caldwell, a New Jersey Mercedes-Benz dealership, and a customer who drove a courtesy vehicle provided by the dealership to Massachusetts in 2016 while his vehicle was being serviced. In the process of providing the courtesy vehicle, the dealership required the customer to provide his license, proof of insurance, and credit card, and to sign a loaner car authorization form and a courtesy car agreement, which included a provision that he would be the only person authorized to drive the vehicle.

The customer drove the courtesy vehicle to Boston with his wife as a passenger. The drive exceeded the limitation set by the dealership that the customer be the only operator of the vehicle within 100 miles of the Mercedes-Benz dealership. While in

Boston, the customer parked illegally in a drop-off only zone, left the key in the ignition with the engine running and the turn signal on. His wife, who did not have a driver’s license, remained in the car. When a parking enforcement officer instructed her to move the car, the customer’s wife moved to the driver’s seat and pressed a button intending to turn off the turn signal, but instead the car rolled forward through a red traffic light and struck a pedestrian who was walking in the crosswalk.

The plaintiffs in the case, the injured pedestrian and her husband, brought a negligence claim against the Mercedes-Benz dealership, arguing that the Dealership is liable under a Massachusetts law (MGLA Chapter 231, section 85A) that creates a

on part of the owner. To trigger the protection under the Graves Amendment, the car in question must have been “rented” or “leased”. The plaintiffs argued that the courtesy car was not rented or leased, as there was no consideration given by the customer in exchange for use of the car. The Dealership maintained that it received consideration in the form of performing repair work, and receiving payment for that work, while offering the courtesy vehicle as a further incentive to retain the customer’s business.

In addition, to be covered under the Graves Amendment, the dealership must be in the “trade or business of renting or leasing motor vehicles.” The Dealership maintained a fleet of 125 courtesy vehi-

dealers who regularly provide courtesy vehicles to customers as part of their business and use a robust courtesy vehicle agreement will have an additional layer of protection from liability

presumption that the owner of a vehicle is vicariously liable for injuries caused by the driver of the vehicle. The plaintiffs contended that the Dealership was the owner of the courtesy vehicle, and therefore was presumptively in control of the customer and his wife at the time of the incident. Additionally, the plaintiffs claimed that the Dealership owed them a duty of care to reasonably supervise their courtesy vehicle program, and that it breached that duty by failing to train its employees to instruct customers orally on the restrictions placed on the use of the courtesy vehicles.

However, the Dealership maintained that it is covered by the Graves Amendment, which generally protects rental car companies from being held vicariously liable for torts committed by customers driving their rental vehicles where there is no negligence or criminal wrongdoing

cles that were regularly loaned to customers. Approximately ninety to ninety-five percent of the vehicles are with customers at any given time.

The SJC determined that the restrictions on the courtesy vehicle were set out in writing in the agreement signed by the customer, and therefore a jury could not reasonably find that the Dealership’s alleged failure to train its employees to orally explain the provisions in the agreement caused the accident which injured the plaintiff. The accident occurred while the customer’s wife, an unlicensed and unauthorized driver, was behind the wheel. The signed agreement explicitly stated that the customer could not drive more than 100 miles outside of Caldwell and, in boldface, capital letters, read, “The undersigned client is the only person authorized to operate the vehicle.” Given this

24 MSADA L e GAL

Partners at Murtha Cullina LLP, (617) 457-4072

AUGUST 2023 Massachusetts Auto Dealer www.msada.org

language, the customer was aware he was the only person authorized to operate the courtesy vehicle.

As a result of this decision, dealers who regularly provide courtesy vehicles to customers as part of their business and use a robust courtesy vehicle agreement will have an additional layer of protection from liability for accidents that occur in those vehicles.

FTC Considers Ban on Spot Deliveries/Conditional Sales Contracts

Recently, several consumer advocacy groups petitioned the Federal Trade Commission (FTC) to adopt rules that would ban the practice of so-called spot deliveries of motor vehicles on a national level. The proposed rule would require that any financing contract between a dealer and consumer constitutes the final, binding agreement with the customer. The rule would further prohibit dealers from making any sales contract conditional on the customer’s subsequent credit approval or on the dealer’s ability to assign the contract to a third party on the agreed terms.

A spot delivery, sometimes referred to as “yo-yo” financing, occurs when a dealership delivers a vehicle to the customer before the retail installment sales contract has been assigned to a lender. Spot deliveries are usually made on the condition that the contract will be void if the dealer is unable to assign the contract to a third party on the agreed terms. While the practice of spot deliveries is not permitted in Massachusetts, some dealers engage in this practice nonetheless, often as a matter of convenience to the customer.

The petitioners to the FTC allege that spot deliveries are by their nature a deceptive practice that harms consumers and are inconsistent with federal consumer protection laws, including the Truth in Lending Act. In their petition, the consumer groups highlight instances in which customers entered a sales contract and took delivery of the vehicle, only to be told that they need to return to the dealership days,

weeks or even months later to sign a new contract on different financing terms. Given that this situation almost always occurs when the customer has not been approved for financing on the terms negotiated by the dealer, the new terms are almost always unfavorable to the customer. In cases in which the customer refuses to sign the documents or return the vehicle and pay associated costs, dealers are left with few options and sometimes report the vehicle as stolen.

The National Automobile Dealers Association (NADA) submitted comments to the FTC in response to the petition for rulemaking on June 30, 2023. The NADA countered that the alleged problems highlighted by the petitioners are not widespread and that dealers typically engage in spot deliveries for the convenience of the customer. Customers in many cases do not want to wait and return to the dealership to pick up their vehicles after the financing contingencies have been final-

it remains to be seen whether the agency will proceed with the requested rulemaking. Whether or not dealers engage in the practice of spot deliveries, they should be aware that the proposed rule would have several serious implications for their businesses, including the following:

• Upon the signing of any retail installment sales contract, the sale will be considered final on the terms set forth in the contract;

• Upon signing, the consumer will be deemed approved for credit on the specified terms;

• Dealers will be considered the creditor for all sales that are financed through the dealership until the contract is assigned to a third party; and

• For any sale in which a dealer is unable to assign the contact to a third party, the dealer will be required to hold the loan for the life of the contract term.

The characterization of the dealer as a creditor raises further concerns for Massachusetts dealers. Any business that holds retail installment contracts for the purchase of motor vehicles is deemed to be a “sales finance company” under Massachusetts law. This would require the dealer to obtain a license with the Commissioner of Banks.

ized. The market has addressed consumer demand for spot deliveries using contracts that are conditioned on the final approval by a lender. The NADA further noted in its comments that dealers have no incentive to deceive customers and that the terms of the new financing deals are often less favorable to dealers as well, given that they must find another source willing to “buy the deal” when one financing source would not. The proposed rule, if enacted, would add costs and time to many auto transactions, according to NADA.

The period for public comments to be submitted to the FTC has now closed and

Certainly, most dealers do not want to be in the financing business and would like to avoid this scenario altogether. If the FTC enacts the proposed rule as requested, the only way for dealers to be sure that they will not be forced to serve as the lender on any deal is to wait until all financing approvals have been received prior to executing the sales contract.

Along with the MSADA, we will continue to monitor this proceeding at the FTC and will update dealers with respect to any developments.

25 MSADA

t

Tom Vangel and Jamie Radke, partners with the law firm Murtha Cullina LLP in Boston, specialize in automotive law. They can be reached at 617-457-4072.

www.msada.org Massachusetts Auto Dealer AUGUST 2023

[dealers] should be aware that the proposed rule would have several serious implications for their businesses

Massachusetts Wage-and-Hour Claims on the Rise Since Reuter