Since its inception, this guide has been the industry standard for aiding investors in understanding the position of their assets in the overall market. Utilized by institutional and professional investors, developers, and private clients, this guide provides the data and resources necessary to make informed investment decisions effectively as you navigate the shopping center market from Tampa to Naples.

Whether you're the owner of a single shopping center or a large portfolio within Southwest Florida, The Definitive Guide to Shopping Center Rents will provide you with immediate actionable information to:

› Protect your cash flow

› Increase your leverage as an owner

› Secure your wealth

Ultimately, you will thoroughly understand where your shopping center in Southwest Florida stands and how to plan for the future.

Matthews Real Estate Investment Services™, a commercial real estate investment services and technology firm, holds recognition as an industry leader in investment sales, leasing, and debt and structured finance. Matthews™ delivers superior results through the firm’s industry revered work ethic, unique culture, collaboration, and advanced technology.

Since 2015, Matthews™ has experienced unprecedented growth adding over 600 real estate professionals to serve clients. Founded in El Segundo, CA, and strategically positioned in 25+ offices across the United States, Matthews™ continues to expand into new markets.

Matthews™ redefines what clients expect by accelerating the evolution of how the commercial real estate industry services clients through technology. By leveraging technology and industry-leading resources, Matthews™ is committed to growing and preserving client wealth and adding value to their investment strategy.

When you hire Matthews™, you have the power of investment professionals strategically positioned across the country to sell your deal. We have access to the largest database of capital from private and institutional investors. With our collaborative culture, agents from across the country work together to source buyers through the Matthews™ network.

Our professional team of agents have many years of experience with representing the top institutions, developers, and private clients in commercial real estate. We hire the best and provide them with top of the line support, systems, and materials with the goal of exceeding expectations

Our

Aiden Hawkins

Aiden Hawkins

DIRECT +1 (813) 600-5908

MOBILE +1 (305) 394-5735

aiden.hawkins@matthews.com

License No. SL357790 (FL)

Aiden Hawkins serves as an Associate at Matthews™, specializing in the acquisition and disposition of shopping centers and net lease properties, primarily in the Tampa market. He also serves as a retail leasing professional through landlord and tenant representation. Aiden’s unwavering commitment and dedication to the industry make him a valuable resource for his clients throughout the entire transactional process. He ensures his clients consistently feel supported and aids them in defining clear objectives that align with their long-term financing goals.

B.A. Economics, Minor in Business Florida State University

Similar to numerous markets throughout the U.S., the Tampa market is experiencing an imbalance between supply and demand. Since mid-2022, the availability of retail spaces has consistently stayed below 4%, leading to a shortage of space that is affecting leasing operations. The majority of construction projects are either already leased out or tailored to specific tenants’ needs, offering minimal assistance to prospective lessees in search of space.

The vacancy rate in the Naples retail market remains steady at 3.9%, virtually unchanged from a year ago, with only a slight increase of 0.1% observed during this period. Within this timeframe, 94,000 square feet of retail space has been completed, while 66,000 square feet have been occupied.

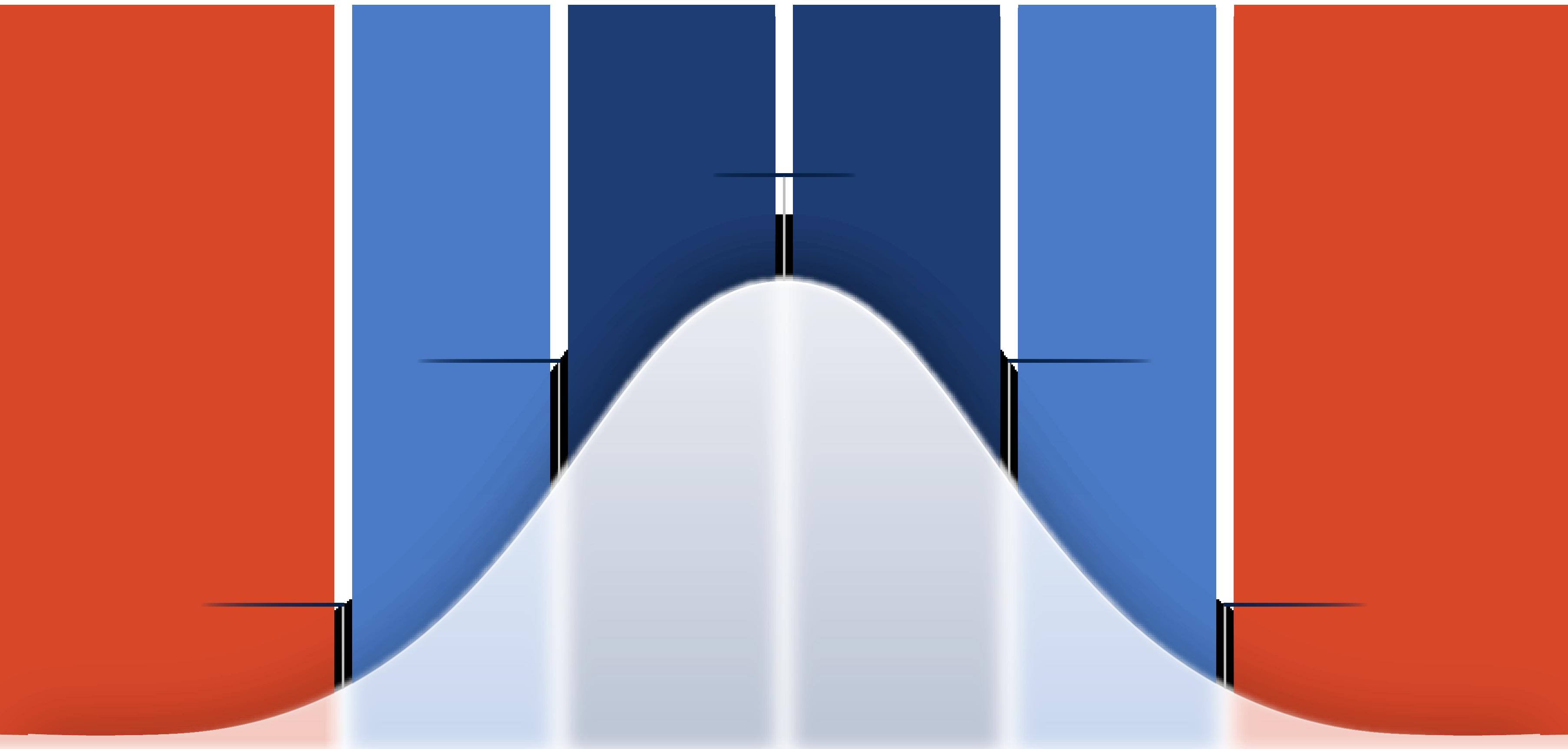

Less asking rent than 2% of all Tampa and Naples properties.

Less asking rent than 2% - 16% of all Tampa and Naples properties.

Less asking rent than 16% - 50% of all Tampa and Naples properties.

Higher asking rent than 50% - 84% of all Tampa and Naples properties.

Higher asking rent than 84% - 98% of all Tampa and Naples properties.

Higher asking rent than 98% of all Tampa and Naples properties.

The goal of a landlord/owner is to increase the income earned from rents and fees during which the property is held by either increasing the rents or selling the property at the highest price possible. The key to maximizing your income is to charge a competitive but realistic monthly rent. The average rent per square foot in Southeast Florida for a shopping center property is $22.27.

As demonstrated by the normalized distribution graphs on the previous pages and with the data provided above, you are able to determine the health of your multifamily property. So long as your rent falls within the same Zone (standard deviation), you are considered to have an average investment. By comparing your property to similar shopping center properties in Southeast Florida, you can more accurately determine a competitive and realistic rent for your tenants. Having a high rent is not a bad thing so long as your vacancy is low. Conversely, having low rent and vacancies is not bad; however, increasing your rent to market rent is recommended if demand is present. Should your rent fall in high or low Zones with high vacancy, it might be a good idea to analyze how the market is performing, as your investment is considered risky.

A strong market with strong demand will support rent increases. A good indicator of a strong market is when the population increases or development occurs. In markets that haven’t seen a lot of new multifamily construction, it’s important to analyze the improvements other shopping centers have undertaken.