RETAIL TRENDS & ANALYSIS SHOPPING CENTER DEVELOPMENT

REGULATORY LANDSCAPE IN NYC

WINNING IN TODAY’S MARKET

EVOLUTION OF INDUSTRIAL PROPERTY INVESTMENTS

$54.98B IN DEALS CLOSED

20,334+ TRANSACTIONS 1,000+ AGENTS & EMPLOYEES

Kyle Matthews

David Harrington

Raddie Zlatkov

Duerk Brewer

Sean Clancy

Paul Mudrich

Matt Fitzgerald

Bill Pedersen

Alex Goodman

Alexander Harrold

Antonio Sibbio

Austin Graham

Ayden Colbert

Ben Snyder

Blake Wagenseller

Boris Kopelev

Boris Shilkrot

Brandon Senia

Brett Davis

Cade Norland

Cameron Hooper

Chase Cameron

Christian Becker

Cole Voyles

Cliff Carnes

Bob Osbrink

Michael Pakravan

Matthew Wallace

Cory Rosenthal

Daniel Withers

Nicole Capobianco

Lori Valencia

Corey Selenski

David Treadwell

DJ Johnston

Dylan Schroeder

Geoffrey Arrobio

Gerard Hamas

Grant Morgan

Haidyn DeJean

Harrison Auerbach

Harrison Wachtler

Isaac Wulff

Jack DeLine

Jack Julick

Jake Sandresky

James McGinnis

Jeff Enck

Leanne Jenkins

Lauren Huling

Cameron Hart

Alfonso Lomeli

Maria Rubio

Francisco Gonzalez

Brooke Farris

Sam Kuzminski

Katie Carpenter

Julia Leonard

Maxx Bauman

Hutt Cooke

Chuck Evans

Andrew Gross

Keegan Mulcahy

Kurt Sauer

L. B. Sierra

J. A. Charles Wright

Patrick Graham

Brian Streilein

Erik Vogelzang

Jeff Perkins

Joe Polak

John Simonson

Josh Bishop

Josh Ein

Josh Lesaca

Kevin Sugavanam

Kyle Stonis

Megan Matthews

Michael Wolsiefer

Nathan Roberto

Nathaniel Newhouse

Nicholas Mundo

Nick Hahn

Nolan Lehman

Pierce Mayson

Robert Goldberg

Roman Stuart

Ryan Fitzgibbons

Ryan Foss

Ryan Schulten

Scotty Latimer

Shaheen Javadian

Spencer Mason

Stephen Dadourian

Tanner Sanford

Tucker Brock

Vincent Renna

Zach Stevens

cliff.carnes@matthews.com +1 (760) 212-9204

david.treadwell@matthews.com +1 (720) 862-3074

geoffrey.arrobio@matthews.com +1 (310) 308-4116

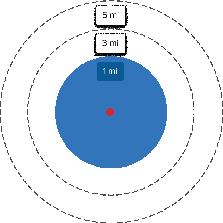

Fueled by growth motives, owner-users in select markets opt for empty rather than fully leased, investment-grade industrial properties.

BY SPENCER MASONThe industrial sector is rife with “dry powder”—unspent cash reserves waiting to be invested. Investors, who mostly have sat on the sidelines for the past two years, made 13% fewer transactions year-over-year at the start of 2024. Private buyers were the largest source of commercial real estate capital last year, making up 62% of the U.S. buyer composition with $230 billion in total acquisitions. With growing optimism and mild hope for interest rate cuts later this year, many investors have started to deploy capital again.

SOURCE: RCA

Not only are buyers back, but they have returned in an unlikely way. Remarkably, the demand for vacant industrial buildings has surpassed that of fully leased, investment-grade buildings. The pattern is a notable outlier compared to historical supply and demand and suggests a departure from 2022 and 2023 trends.

The demand for vacant industrial buildings has surpassed that of fully leased, investment-grade buildings in select markets.

While construction costs remain high and net absorption has slowed for larger, big-box industrial facilities, investors can expect to face premiums for vacant buildings under 50,000 square feet. Smaller U.S. industrial space is in such high demand, with comparatively low vacancy rates and strong rent growth, that developers and brokers often advise waiting to sign a lease and leaving a building vacant.

Since the start of 2023, newly built distribution centers and vacant industrial properties over 500,000 square feet have faced several challenges. Tenant demand for big-box industrial properties slowed substantially as the year progressed. As supply outpaced demand, the U.S. industrial property vacancy rate rose from a record low of 3.9% in 2022 to 6.2% in Q2 2024.

However, this trend disproportionately reflects the market. While a slowed net absorption is prevalent among spaces larger than 500,000 square feet, demand remains generally healthy for properties

20% YOY, but higher than some pre-pandemic years. MARKET ASKING RENT & ASKING RENT PER SF (50,000 & BELOW)

SOURCE: RCA

below 50,000 square feet. Construction has also exacerbated vacancy numbers. As the result of widespread groundbreakings for new distribution centers during the pandemic, the stock of U.S. industrial properties is growing at its fastest in more than three decades.

The total stock of U.S. industrial space has grown by 2.8% over the last 12 months, almost triple the pre-pandemic 20-year average for annual supply growth. New deliveries will likely remain elevated for the next six to nine months, driving the U.S. vacancy rate higher, but fewer development completions for properties under 50,000 square feet will curb national average vacancies later this year.

SOURCE: COSTAR GROUP

What’s happening is a fundamental shift in how empty buildings are perceived. In other words, vacancy in the industrial sector isn’t necessarily a bad thing. For speculative properties—ones built without a pre-leased tenant—it makes more sense for landlords who want the highest market rent or price to wait before leasing or selling and have the building remain unencumbered by an agreement.

For example, investors are advised to wait until a property is completed instead of pre-leasing it a year in advance. Otherwise, they may experience substantial “loss to lease” since the property was leased before market rents increased. In some industrial markets, especially those where strong demand exceeds supply, landlords can wait to close a deal without facing too much risk.

While industrial rents rise and vacancies remain low in select markets, it’s better not to lock down a tenant too early.

While cap rates have compressed nationwide, industrial property owners have felt the effects most intensely. In Q1 2024, industrial cap rates increased to 6%, though well below the 7.1% average fixed 10-year mortgage rates. With the burden of rate hikes unlikely to ease until late 2024 or early 2025,

industrial property prices remain dislocated. Sellers remember the prices they saw in 2021 and 2022 all too well, and buyers won’t buy at the same peak pricing. Because of this, industrial property owners are advised to sell vacant or lease to a short-term tenant rather than hunt for a new, long-term tenant.

Investors are forgoing long-term leases to avoid “loss to lease” or the opportunity cost of leasing before substantial market rent increases.

SOURCE: RCA

Investors and owner-users have different motives. The former, mainly institutions or REITs, aren’t involved in the tenant’s business and tend to be more change-averse. They make rental income from the property, typically a warehouse, distribution center, or manufacturing space pre-leased by a creditworthy tenant. The latter, building owners and operators, are motivated by growth. They have skin in the game and want a property they can grow with. For instance, a manufacturing company might buy an industrial building for production purposes. Owner-users are uniquely motivated to move into an unleased property if it helps their business. To them, a vacant property is invaluable. Owner-users reap several benefits from owning the property they use:

The demand for vacant industrial buildings is strongest among buildings 50,000 square feet or smaller. This has created a disproportionate share of new, large warehouses compared to shallow-bay and flex industrial properties. Specifically, several new developments in Denver larger than 100,000 square feet remain vacant while owners look to secure tenants. As a result, vacancy rates in Denver and other markets have been reportedly high, according to major news outlets. However, this is only half of the picture. Since developers focus on

• Growth Benefits: Vacant properties appeal to owner-users looking to scale operations and benefit a bottom line.

• Long-Term Stability: By owning a property outright, owner-users can avoid uncertainties associated with lease renewals. This stability can help businesses establish a more permanent presence in a specific location.

• Ownership: Though more financially straining upfront, purchasing a vacant property allows owner-users to appreciate their property values over time.

• Flexibility and Control: A vacant building is a blank slate, which gives owner-users the utmost control over customizations and modifications to the space.

large industrial buildings, the demand for vacant flex and shallow-bay industrial properties is actually stronger, while vacancies are lower.

Property size directly affects the cost of construction. As costs remain high, it doesn’t make sense for developers to build projects smaller than 50,000 square feet. Most builders consider building large warehouses—and securing long-term leases from established businesses—a better use of investors’ dollars. But realistically, shallow-bay and flex buildings suit most industrial businesses with shorter lease expectations. As a result, small vacant industrial buildings have seen strong pricing and rent appreciation.

As more businesses expand and adopt omnichannel strategies, the industrial sector’s tenant mix continues to diversify beyond giants like Amazon. Tenants are expanding their logistics infrastructure and omnichannel operations to meet consumer demand better. Industrial’s tenant diversification bodes well for the property type, especially as economic conditions look to rebound from high interest rates and inflation, which ate into consumer wages and savings.

Disrupted supply chains have made new, up-to-date facilities more attractive to logistics tenants seeking more efficiency. Plus, consumer preferences for shorter delivery times and increased favorability of

2021 have seen accelerated lease-ups compared to new buildings built before the pandemic.

Certain markets will continue to experience strong demand for space despite the deceleration in economic activity within the last year, driven by elevated retail and e-commerce sales. With a record level of supply and a possible pull-back in leasing from major players in the market, upcoming deliveries are expected to continue seeing solid lease-ups, thanks to the diverse tenant mix propelling demand, and the appeal of newer properties to meet tenant preferences. Supply risk varies across markets. However, the large amounts of new supply delivered could outpace demand,

Several things come to mind that don’t belong in a backyard: Weeds, intruders, and dangerous wildlife are a few. Then there’s development. Whether or not new multifamily housing belongs near someone’s backyard is a more sensitive matter that’s been burdening developers, renters, and homeowners for half a century.

The general NIMBY (“Not In My Backyard”) sentiment originated in the 1970s and has evolved from a political stance to real estate’s most delicate catch-22 affecting the lives of millions of people in the U.S. During that time, NIMBYers met growing opposition from the YIMBY (“Yes In My Backyard”) crowd, primarily renters, developers, investors, and affordability advocates. By contrast, most NIMBYers are homeowners in suburban or rural areas motivated by their properties’ sentimental and intrinsic value. Some would argue that the NIMBY versus YIMBY debate is not a battle to win but a chronic condition to be managed. Regardless, both sides can’t ignore the glaring problem that pits each against the other: The U.S. desperately needs housing.

The U.S. multifamily housing market is incredibly underdeveloped. The problem can be traced back to the dot-com bubble and the September 11 attacks shortly after the turn of the century. During the dotcom bubble, widespread investment in technology

diverted capital away from traditional investments, including real estate. After the attacks on September 11, many investors sought refuge in tangible assets in suburban and rural areas, viewed as safer than urban areas, causing an imbalance in affordable housing development. Then, when the U.S. faced the housing crisis in 2008, the underdevelopment issue was too far gone.

The issue is a vicious circle. People need housing because the U.S. is so far behind its development target, which places greater stress on the need for more development. In 2023, the U.S. was short over seven million affordable homes for the nation’s 10.8 million extremely low-income families. New multifamily construction quickly declined, with starts down 30% year-over-year in Q4 2023, while the U.S. average asking rent remains increasingly high at $1,713 in Q1 2024. Not only have rents risen, but they have outpaced incomes for two decades. Renter households with an annual income under $30,000 have just $310 a month, an all-time low, after paying for rent. In other words, while personal savings reach a new low, personal debt burden is at its highest.

The nation’s population growth adds another dimension to its lack of housing, as 60% of U.S. counties gained population in 2023. While the number of households increases, older demographics like Baby Boomers show hesitation about selling their homes. If they do sell, they want

Source: Joint Center for Housing Studies of Harvard University

Source: United States Census Bureau

Percent Change

3.00 or more

0.00 to 1.49

1.50 to 2.99 -1.49 to -0.01 -2.99 to -1.50 -3.00 or more

a price that most buyers aren’t willing to pay for decades-old properties. Most zoning maps and future land use are also outdated, specifically in states like Florida, Tennessee, and Texas, where populations outpace regulations created years ago. Thus, developers look to add density—more units in smaller spaces—to offset years of insufficient development.

Density is one part of a much larger solution to overcoming NIMBY opposition. Supporters of YIMBY must remember that their opponents are driven by sentiments. While a win-win outcome for developers and homeowners is possible, it won’t be achieved by pointing to truth and facts. Instead, YIMBYers can rally more NIMBYers by bridging sentiment to an urgent need: The nation’s communities are sacred, and they must be opened to a deeply lacking population.

Most folks in the NIMBY crowd fear that new, dense multifamily development will deteriorate the value of their homes. Many are incumbent residents of at least 10 years, and some have lived in their homes for 20 to 30 years. They have already made significant returns on their homes regardless of the market. If NIMBYers can’t justify their home value deteriorating—which many may struggle to—they’ll hold onto sentimental value instead.

Common fears about new development among the NIMBY crowd include:

● It will cause more crime.

● It will create more traffic.

● It will change the neighborhood dynamic.

● It won’t blend in well with the neighborhood.

So far, the appeals have worked on local officials, who have enacted stricter barriers to building in areas where NIMBY sentiment and voting power are strong. Recent NIMBYers are also more

Source: Yardi Matrix

$1,400

sophisticated than before, using tactics unknown to previous generations, such as litigation under the California Environmental Quality Act (CEQA) to stall development in that state. Once a powerful provision for sustainable development, CEQA, which mandates that environmental impact reports be prepared for proposed projects in California, has been largely exploited by NIMBYers to delay unwanted projects.

There is also the matter of animosity toward developers in general. A 2018 survey by UCLA reported that opposition to new development increases by 20% when residents see that the developer is likely to earn a large profit from building. Comparably, opposition increases by just 10% when concerns are traffic-related. It goes without saying that most people are

“It will cause more crime.”

inherently and psychologically change-averse, whether NIMBYer or YIMBYer. Thus, overcoming development fears becomes less a matter of “what” is said, but “how” it’s said. The NIMBY crowd is sentimental and deeply protective, so earning their approval starts with the right delivery.

Modern development efforts can often be captured with a common phrase: “Retail follows rooftops.” The idea that activity creates activity has become the driving force behind most YIMBYer-backed development motives. Two recent examples are the completion of Avalon Communities in the Tysons Corner Center in Virginia and New York City’s High Line Park, both known for stimulating additional development in surrounding neighborhoods.

“It will create more traffic.”

“It will change the neighborhood dynamic.”

“It won’t blend in well with the neighborhood.”

The necessary income to pay for new multifamily rents, which on average waver around $2,000, correlates with a wellemployed demographic making $75,000 per year or more.

Typical multifamily tenants, single or recently married residents with no kids, do not impact traffic patterns the same way homeowners do.

By providing detailed renderings upfront and with plenty of planning, developers can mitigate most NIMBY concerns about changing dynamics. Most of the time, residents are much less concerned about their fears once a project is completed.

A shared development process, in which developers meet with local owners to incorporate historically-minded features into a building’s design, helps YIMBYers gain traction.

City Manager of Greensboro, North Carolina, and former city planner of Charlotte, North Carolina, Taiwo Jaiyeoba says developers’ biggest mistake is spending too much time and effort getting NIMBYers to accept something they’re against. Instead, developers can focus on rallying more support from their YIMBY cohort at the local level. David Block, a Chicago-area developer and former planner with Evergreen Real Estate Group, describes his approach to community organizing: “Make the case that this is something we need, this is something that we shouldn’t be afraid of, this is something that would benefit the community—and here’s why.”

The goal shouldn’t be to convert every NIMBYer to a YIMBYer. Many NIMBY concerns are real and rooted in deep sentimental value, while most YIMBY motives are thoughtful and warranted. Instead, overcoming opposition to new development is about developers addressing the nation’s urgent need for more housing with tactical solutions.

One way developers aim to tackle the massive housing shortage in the U.S. is by creating more dense developments. The logic is simple: If two units share a wall, developers don’t need to build two walls. Similarly, if a 40-acre project is slated for 100 homes, a developer can likely build 400 homes by turning the same amount of dirt. Density allows builders to improve their horizontal development costs while delivering higher volumes.

Developers can also build smaller to create more dense projects. One way they do this is by creating smaller units and lot frontages. For example, a unit built in the 1970s may have a 70-foot frontage, while a comparable unit built today may have a 17-foot frontage. Many new projects also opt for smaller, one-car garages instead of a standard two-car space. By saving on square footage, developers can build more units and address the overall shortage of homes in the U.S.

Addressing and overcoming NIMBY sentiment has long been a troublesome part of a developer’s job. Change of any kind inevitably brings pushback— whether it’s change to a neighborhood’s buildings, traffic patterns, or property values—and the historically lengthy processes developers need to follow regarding zoning and land use give their opponents ample time to delay projects or shut them down altogether. Developers can only do so much with density and smaller units; they also need government support. Two recent legislative instances offer hope to the ever-optimistic YIMBY crowd: California’s Executive Directive 1 (ED1) and Florida’s Live Local Act.

Los Angeles is known for its lengthy construction delays due to the city’s exhaustive regulations and code enforcement. Shortly after taking office, Mayor Karen Bass signed Executive Directive 1 in 2023 to tackle the city’s notorious development red tape. Considered an “emergency declaration,” ED1 calls for city departments to expedite 100% affordable projects. The directive’s first year added more than 16,000 affordable units to the city’s pipeline—more than 2020, 2021, and 2022 combined. Encouraging developers to pursue more multifamily projects while cutting costs and expediting the process helps make the “math work,” as one developer explained.

Source: CoStar

In 2023, Florida’s state legislature passed the Live Local Act, which allows developers to bypass local zoning rules and qualify for tax breaks if their projects meet specific housing criteria. Specifically, the measure allows multifamily or mixed-use development in commercial or industrial zones if it provides at least 40% affordable housing for 30 years or more. The Live Local Act reserves affordable units for individuals or families whose annual income is greater than 30% but no more than 60% of the area’s median household income. After its first year, the law faces amendments to clarify language regarding waterfront properties on industrial-zoned land.

As long as developers build, there will be NIMBY sentiment. And as long as opposition to new multifamily development persists, there will be YIMBY hopefuls. The U.S. is far from closing its housing gap after decades of unfavorable financial and global conditions. If there’s any hope of catching up, it’s in bridging the disparity between NIMBYer nostalgia and YIMBYer motives with some reason, a lot of planning, and one common belief: People need housing.

Matthews™ Capital Markets (MCM) is a fully integrated and dedicated financing division of Matthews™. MCM provides capital solutions ranging from $500,000 to $100 million for all property types across the U.S. Through long-standing lender relationships, we have the ability to customize and structure financing solutions that best suit our clients’ needs.

Connect Midwest Multifamily W City Center | Chicago, IL

Connect Investment & Finance Washington, DC

Connect Canada Investments:

& Private Capital

Connect Canada CIBC Square | Toronto, ON

Connect Tri-State Multifamily

Studio Gather | New York, NY

Connect Texas Multifamily

Virgin Dallas Hotel | Dallas, TX

Connect Orange County

Hyatt Regency Irvine | Irvine, CA

Connect Healthcare Real Estate

Hyatt Regency Irvine | Irvine, CA

Connect Retail West Luxe Sunset Blvd | Los Angeles, CA

Connect Money: Real Assets Capital Raising Luxe Sunset Blvd | Los Angeles, CA

Connect Southeast Multifamily Rusty Pelican | Key Biscayne, FL

Connect South Florida Rusty Pelican | Key Biscayne, FL

•

•

NEW LOCATIONS, STRATEGIC CLOSURES, FRESH CONCEPTS, AND JOINT FORCES WELCOME RETAIL’S NEXT ERA OF SUSTAINED, PRACTICAL GROWTH.

BY JOSH EIN

At the start of the year, most news outlets published articles about big-box retailers’ plans to reduce their footprint. It seemed the retail giants were pulling back. Then, headlines about new and improved stores hit the front pages in a matter of weeks. There was hardly time to digest the news before more stories about mergers and acquisitions arrived. What’s a landlord to make of the noise and, more importantly, retail’s dynamic future?

If anything, it’s to hang on tight. Retail consumers in the last two years have proven endurance above

all else. Since 2022, the U.S. retail sector has faced a 40-year inflationary high, almost a dozen interest rate hikes, limited new supply, and frequent closures and bankruptcies. It’s almost remarkable that the sector has shown such growth since pandemicera lows. But landlords shouldn’t be so surprised. Retail’s resilience merely reflects the economy’s most favorable outcomes: Even when new supply is low, at 49.3 million square feet of deliveries from Q1 2023 to 2024, retail sales and rent growth remain strong.

SOURCE: COSTAR GROUP

While fundamentals tighten and consumers favor a more price-conscious approach, retailers have begun to adjust. In fact, most brands are keen to “rightsize” their spaces. Moves to downsize or expand may be less a performance indicator and more an appeal to consumers. As retailers look to

be more profitable—especially in a tighter and more costly market—investors can expect more locations, controlled closures, new store formats, and strategic mergers and acquisitions to carry retail into its next growth phase.

SOURCE: PNC

Sometimes, more is more. From small to bigbox retailers, several brands across discount, grocery, experiential, and food and beverage plan a substantial increase in store locations. After consecutive years of growth in demand for retail space, including a net absorption of over 53 million square feet in 2023, many retailers show no signs of shrinking their footprints.

Price-conscious retailers like Dollar General, Five Below, and Ollie’s Bargain Outlet make up the fastest-growing retail category, suggesting consumers remain skeptical despite income increases, cooling inflation rates, and general wealth growth. Last year, consumers shopped year-round for everything from discount hardware to home goods, and store visits saw a notable jump around the holidays. Dollar General is committed to opening 800 new stores in 2024 to promote its upscale shopping concept Popshelf, while Five Below expects 600 additional locations.

SOURCE: PLACER.AI

The ongoing Kroger and Albertsons agreement remains in a holding pattern after the Federal Trade Commission (FTC) sued to block the grocery merger, a move that would allow for closer competition with Walmart, Amazon, and Costco. Budget-friendly grocer Aldi plans to add 800 U.S. stores by the end of 2028 through a combination of new openings and store conversions. Its five-year, $9 billion plan includes opening nearly 330 stores across the Northeast and Midwest, expanding in hubs like Phoenix and Southern California, and entering new cities like Las Vegas. Grocery Outlet acquired value grocer United Grocery Outlet (UGO), which will add 55 to 60 new stores to the retailer’s operations. Phoenix-based Sprouts Farmers Market has a pipeline of nearly 100 stores and 60 executed leases, most of which will follow the grocer’s compact store format (21,000 to 25,000 square feet).

SOURCE: PLACER.AI 2023

Consumers are more interested in services than in recent years. The demand for spaces bigger than 10,000 square feet reflects new growth for fitness and experiential tenants, who accounted for 15% of all leasing activity, up 5% from 2015. Planet Fitness, Crunch Fitness, and Urban Air are among the fastest-growing experiential retailers. Crunch Fitness, which was ranked Entrepreneur’s 2024 top fitness franchise, saw visits increase by 28.2% year-over-year. The boost in activity was partly fueled by the gym’s steady expansion, growing its now 443-store footprint by 47.3% since 2020.

Retail tenants in the food and beverage sector accounted for nearly 20% of all retail leasing activity in 2023. Fast-casual sandwich shop Jersey Mike’s leads the sector with its aggressive growth target of more than 1,100 new stores in three years, adding to its existing footprint of 2,500 shops. Playa Bowls, a quickserve smoothie and juice bar, will add 75 locations by the end of the year, while its legacy competitor, Smoothie King, will up its footprint by 100 stores. Emerging coffee leader Dutch Bros, ranked among the top three coffee and bakery chains in the U.S., plans to challenge incumbents Starbucks and Dunkin’ with 165 new locations.

SOURCE: PLACER.AI

2023 Q4 2023

While more gradual than other retailers, Target’s expansion plans include 300 new stores over the next 10 years. CEO Brian Cornell disclosed that the new locations will follow a large store format and provide broader food offerings. Walmart has plans to add 150 stores over the next five years and remodel 650 existing stores in almost every U.S. state this year. Some smaller stores will be converted to Walmart Supercenters, while hundreds of others will be remodeled to embrace the retailer’s “Store of the Future” concept with new technology and expanded product selections. Most added stores will be newly constructed and supplement its existing footprint of 4,600 stores.

The most gripping news to hit the headlines has been retail’s widespread store closures. It’s hard to say who’s been more burdened in recent years: Consumers with the weakest spending power in a decade, whose incomes grossly lag prices, or retailers who fail to deliver the experiences consumers want. Either way, retailers have taken heed, and one significant change in the industry is the reason for store closures—more often, a move to rightsize.

During the pandemic, retail closures meant life or death. Average move-outs peaked at 418 million square feet, compared to an average 400 million square feet per year in 2018 and 2019. Retailers with century-long legacies feared closures, bankruptcy, or total extinction. The latest demand gains and declining move-outs, which fell by 20% to 330 million square feet in 2023, seem like a natural recoil more than anything. But the tone of closures is different now. Retailers want to serve their customers better, even if that means moving from a 20,000 to 10,000 square foot format and saving on rent, which is at a record-high of $25.00 per square foot. Now, store closures reflect retail’s return to a simpler, more refined customer experience.

Dollar Tree plans to shutter 970 of its Family Dollar stores, which were previously under review, citing struggles to keep up with consumers. Still, Dollar Tree remains in a favorable position and continues to attract price-conscious consumers from a broader range of income levels. Macy’s will close 150 stores, or about 30% of its fleet, over the next three years. The affected locations comprise a quarter of the retailer’s gross square footage but less than 10% of sales. The department store plans to open 30 small-format Macy’s stores—30,000 to 50,000 square feet—over the next two years. After acquiring sleep retailer Mattress Firm, Tempur Sealy plans to sell roughly 200 Sleep Outfitters and Mattress Firm locations. The mattress provider also intends to shed seven distribution centers. Rite Aid is one of the few

retailers yet to pursue new or renovated locations this year. Its ongoing bankruptcy discourse has resulted in over 300 planned store closures.

As more retailers settle into best-fit formats, opting to expand or downsize, some industry players have capitalized on the shift. Closures from major brands like Bed Bath & Beyond, BuyBuy Baby, Party City, and Macy’s have opened the door for owners to backfill at a higher rent or use a shuttered department store for redevelopment. The opportunity allows landlords to place more attractive merchants—who pay higher rents—in a more diverse store mix that will drive more traffic and sales. Barnes & Noble grabbed several former Bed Bath & Beyond and BuyBuy Baby locations, while Hobby Lobby, Burlington, and Planet Fitness backfilled other anchor and junior anchor spaces.

For some brands, expanding means modifying. Prominent retailers like Whole Foods and Macy’s are pursuing small store formats, while Target is exploring remodels to create more meaningful consumer experiences. Target, which plans extensive remodels for several of its locations, reported yearly sales increases of up to 4% once a store is renovated. Whole Foods introduced a smaller format for its stores, called Whole Foods Daily Shops, which are 7,000 to 14,000 square feet. Eliminating the grocer’s traditional salad bar and meat counter will create more efficient experiences for grocery delivery services like Instacart. Similarly, Macy’s narrowed its focus to its smaller footprint Bluemercury beauty stores and Boomingdale’s department stores to target higher-income customers at a community level.

Several major retail mergers and acquisitions made headlines earlier this year alongside news about blended brands. The former includes moves from Kroger and Albertsons, Tempur Sealy and Mattress Firm, and Aldi and Winn Dixie, while the latter indicates a new blended IHOP and Applebee’s concept. Retailer mergers and acquisitions in 2023 totaled $24.2 billion, trailing a ten-year peak of $39.8 billion in 2017.

SOURCE: PNC

While mergers and acquisitions aren’t new to retail’s front pages, the latest developments signal a more strategic direction for the sector’s joining hopefuls. For instance, news about the FTC’s move to block the KrogerAlbertsons merger suggests that brands are under more antitrust scrutiny than ever. Kroger-Albertsons’ combined 5,000 stores would generate $220 billion and place the retailer second in the U.S. grocery space with an estimated market share of 13.4%, behind Walmart.

SOURCE: PLACER.AI

Dual-branded restaurants are another way retailers are joining forces. Dine Brands Global, which operates over 3,400 Applebee’s and IHOP locations, wants to combine more restaurants under one roof to save money on real estate and supplies. With the same square footage as a traditional standalone IHOP or Applebee’s restaurant, all eight dual-branded prototypes (located outside the U.S.) generate twice as much revenue.

Headlines come and go, but retail’s new direction toward practical growth exhibits staying power. Investors may reflect on 2024 as the year that retailers remet consumers in best-fit spaces, whether in a remodeled format, a merged concept, or a smaller or larger store.

Finding balance between the objectives of landlords and community stakeholders is vital in shaping the future of a shopping center. Key factors such as merchandising and placemaking define the property’s ambiance and drive foot traffic, creating a dynamic and profitable environment for landlords, tenants, and the community. The integrations of experimental shopping, technology, and innovative store formats have become cornerstones, ushering in a new era of traffic generation for landlords. Those willing to embrace these new trends reap the benefits of something the sector has not seen before.

Examples of placemaking include hosting events like live concerts, partnering with local farmers’ markets, displaying interactive art, and organizing weekly community gatherings. All of these have one thing in

common: community.

Retail placemaking has one key goal: give people a compelling reason to visit the center.

In today’s digital environment, consumers have hundreds of options to choose from when it comes to their shopping needs. Placemaking is the landlord’s ability to breathe life into otherwise mundane areas, converting centers into focal points that draw in more foot traffic.

An inviting, stimulating, and pleasant atmosphere helps consumers prioritize social interaction and shared experiences when shopping in person. This characteristic of consumer behavior underscores the importance of aligning shopping centers with the surrounding community’s needs, ensuring a seamless blend of community engagement and commerce.

Placemaking has redefined a center’s core role. Instead of solely concentrating on the physicality and shopping options, placemaking empowers developers to become visionaries, crafting environments where individuals can live, work, and thrive. With this new focus on community comes a new responsibility for landlords, who should be prepared to collaborate with local government authorities on placemaking initiatives. This collaboration is inevitable, particularly when planning events, as it can require obtaining the necessary permits, utilizing police resources and diverting normal traffic patterns.

Shopping centers serve as “front porches,” where people can gather, make connections, and interact on a public level.

SOURCE: PROJECT FOR PUBLIC SPACES (PPS)

The four key qualities that contribute to placemaking success:

SOURCE: PROJECT FOR PUBLIC SPACES (PPS)

The application of placemaking principles has resulted in numerous social advantages, including fostering connections among individuals, promoting social unity, decreasing crime rates, and fostering trust among different stakeholder groups. These principles ultimately serve as a catalyst for economic growth.

SOURCE: SURVEY OF ULI MEMBERS

The Grove Los Angeles, CA

Features entertainment amenities like a cinema, sit-down restaurants, and major retailers in a visually appealing outdoor environment that promotes community engagement.

Crocker Park Westlake, OH

Upscale, open-air mall offering trendy brandname shops, a range of restaurants, and an IMAX theater.

King of Prussia Philadelphia, PA

Chic lifestyle development and open-air mall with shops, restaurants, and landscaped seating areas.

The Battery District Atlanta, GA

The Battery Atlanta brings restaurants, stores and entertainment to Truist Park.

Retail merchandising is the strategy that the tenants undertake to draw people into their store.

The traditional retail business model has become outdated. For retailers to maintain their competitive edge, they must embrace online and offline transformations, ultimately reshaping how consumers interact on a merchandising level. The current retail landscape is evolving into a dynamic, innovative, intuitive, and highly engaging environment. Retailers that have integrated these initiatives into their merchandising strategies are reaping substantial benefits.

Having an effective retail merchandising strategy has the ability to convert more browsers or window shoppers into purchasing customers, as well as create a more positive in-store experience for consumers.

SOURCE: RAYDIANT

IN-STORE EXPERIENCES WERE “VERY IMPORTANT” OR “IMPORTANT”

ECOMMERCE SHARE OF TOTAL U.S. RETAIL SALES

SOURCE: U.S. DEPARTMENT OF COMMERCE

The U.S. Department of Commerce provides quarterly data on overall retail sales within the country, distinguishing between traditional retail and e-commerce. In the latest update for Q4 2023, e-commerce sales reached $285.2 billion, marking a 0.8% increase compared to the previous quarter.

Thriving shopping center landlords understand that the success of their property hinges largely on the tenants themselves. Selecting the right tenants is a strategic decision that involves a thorough analysis of the tenant’s format, target demographic, annual average revenue, and more. The shopping center’s location, size, and overall theme are also other factors.

The ideal tenant lineup will differ depending on the shopping center and is not a one-size-fits-all approach. By aligning the tenant mix with the specific characteristics of the center and its customer base, landlords can optimize customer engagement and drive increased sales.

Including an anchor tenant in a retail project greatly enhances its credibility and has the potential to attract substantial foot traffic. Grocery stores and category killers such as Walmart and Target continue to be the most sought after anchor tenants in the open air space.

These tenants will often own their own dirt, or work collaboratively with landlords to share in the risk of the shopping center development.

As the digital age transforms retail, it’s become more prevalent that landlords must use technology to gain insights into tenant performance and enhance overall center success. One such technology is mobile location data, which offers a wealth of information regarding customer behavior and trade areas–the geographic distance retail consumers travel. By analyzing this data, landlords can gain insights into customer behavior patterns, helping them make informed decisions about tenant selection and center optimization.

Geofencing is a popular tool that landlords can use to establish digital boundaries around specific areas. Landlords can see which tenants are drawing in the highest number of consumers, how often these people visit, and what their shopping patterns look like.

So, how does this work?

When a smartphone is activated, it emits signals containing its MAC address (media access control) while searching for Wi-Fi or Bluetooth connections. These signals can be captured by store sensors, providing information such as the frequency of shopper visits, duration of their stay, preferred sections like shoes, children’s clothing, or sporting goods, and whether they engage with window displays or simply pass by.

A study conducted by Airship and Sapio Research (2023) revealed that 80% of global consumers visit a retailer’s website on their smartphones, and 74% use a retailer’s app while shopping in-store.

The following case study highlights phone and geofencing data from The Grove, a shopping center located in Los Angeles, CA.

3.2M 7.2M 129.51

The study concluded that AMC The Grove 14 was the main driver of traffic, followed by Nordstrom and Sephora. The data also shows a preference toward food-related items, with five of the seven top-visited tenants being restaurants. The peak number of visits occurs on average around 4:00 to 8:00 pm, with Saturday having the highest number of daily visits throughout the year.

The following case study highlights mobile phone tracking and geofencing data from the Crocker Park.

2.36

9.4M

1.4M

The research findings indicated that Market District Supermarket had the most significant impact on foot traffic, followed by Regal Crocker Park, The Cheesecake Factory, and Chick-fil-A. The analysis highlighted a clear preference for food-related offerings, as evidenced by five out of the top seven visited establishments being either restaurants or grocery stores.

From viral trends on TikTok to Taylor Swift asking her fans to make friendship bracelets for an upcoming concert, social media’s influence has boosted store sales for several retail brands.

Michael’s, North America’s largest provider of arts and crafts, sales have experienced a significant jump since mid-April 2023, a month into Taylor Swift’s “The Eras Tour.” Chief Merchandising Officer John Gehre said, “Overall, sales in our jewelry category, including jewelry-making kits, are up more than 40% chainwide since the friendship bracelet-making trend really began to take off.” Michael’s stores in Pennsylvania, where two concerts were held,

TJ Maxx, the parent company of Marshalls and Homegoods, experienced a sales boost attributed to a viral TikTok trend among Gen Z consumers. The trend gained traction after a TikToker shared a video praising the brands for their budget-friendly outfits and guiding followers to discover great finds in the stores. This surge in interest contributed to a 6% sales growth during the quarter ending July 29, 2023.

Other major retailers, including Nordstrom, Victoria’s Secret, and Lowe’s, are also embracing the power of social media within their physical stores to engage mobile-savvy shoppers, leading to increased sales. Retailers are strategically integrating social media elements into their window displays and marketing efforts. For example, Nordstrom utilized a giant 3D installation on its roof to promote its summer sale, creating a captivating Instagramworthy experience. Lowe’s innovatively transformed its Fix In Six Vine tutorials into animated window displays at one of its Manhattan locations. Similarly, Victoria’s Secret encourages shoppers to take selfies in front of displays for a free gift, tapping into the interactive nature of social media to enhance the in-store experience and drive

Shopping centers continue to hold their own in the realm of heightened online shopping habits. Landlords that embrace placemaking, take the time when choosing their tenant mix, utilize emerging technologies, and continue to place emphasis on community building have a much higher likelihood of success in a competitive and alwayschanging market.

Matthew Wallace

+1 (216) 220-8860 matthew.wallace@matthews.com

DON’T JUST ADAPT. THRIVE WITH MATTHEWS™ PROP TECH

UNLEASH THE FUTURE OF CRE BROKERAGE WITH UNRIVALED CAPABILITIES

GlobeSt.’s suite of publications and events covers the entire commercial real estate ecosystem, providing our users with a 360-degree view of their industry. Punctuated by well-researched and incisive news and analysis, and bolstered by insightful thought leadership, innovative ways to access information, exclusive events, and pragmatic tools for implementing new strategies, GlobeSt.’s real estate industry capabilities are uniquely focused on giving our readers a competitive edge in their business initiatives.

GlobeSt.com’s trusted and independent team of experts provides commercial real estate owners, investors, developers, brokers and finance professionals with comprehensive coverage, analysis and best practices necessary to innovate and build their businesses. We celebrate those that are adapting and succeeding in new ways, translate the impact of macro issues, local market trends and emerging technologies into digestible, shareable information that can be immediately put into real-life practice.

GlobeSt.’s event portfolio delivers a combination of local market commercial real estate forums and national forums designed to tackle some of the most challenging real estate opportunities across sectors such as Healthcare, Multifamily, Net Lease and Women of Influence.

Through our real estate brands, GlobeSt. reaches nearly 300,000 CRE professionals across all markets, sectors and business disciplines. Our unique integrated business model allows us to deeply understand the dynamic real estate industry and the evolving needs of our audience.

CAREER OPPORTUNITIES AT MATTHEWS ™

SHARED SERVICES

PLATFORM

INNOVATIVE AGENT-FIRST TECHNOLOGY

INDUSTRY-LEADING DATA

CULTURE OF EXCELLENCE

SCAN FOR MORE INFORMATION

The 421A Tax Abatement program was started in 1971 to incentivize the development of underutilized or vacant properties, allowing developers to forego property taxes on new construction projects for a decade or longer, provided they offered rental units at affordable rates for low- to middle-income families. However, in January 2016, the program expired, only to be succeeded by a revamped version named Affordable New York, introduced by Governor Cuomo in January 2017, with an expiration date set for 2022.

Prior to the first expiration in 2015, New York City experienced an unprecedented surge in construction activity as developers raced to qualify for the tax incentives. Within the first six months of that year, developers secured permits for 42,088 new residential units in the city, according to the U.S. Census Bureau. This surpassed the total for any full year since 1963, when nearly 50,000 permits were issued. The surge in permits was largely attributed to developers rushing to commerce foundation work by June 15, 2015, in time to qualify for the tax abatement program. To note, developers had until 2019 to complete construction to qualify for the abatement.

The average estimated hard construction cost per unit jumped to $124,300 in 2015 from $99,500 in 2014.

Brooklyn emerged as a hotspot for development in 2015, accounting for 46% of residential permits.

Leading up to the expiration of the most recent version of the program, developers embraced the program as a way to ease the cost of doing business in New York. Consequently, building permits surged in the months preceding the program’s expiration as developers broke ground in time to qualify for the tax break. However, following these expirations, new building permits plummeted, and the city has seen fewer new rental developments come to market. Some developers have pivoted their projects to condos; others have decided to build all-affordable developments with some help from the Department of Housing Preservation and Development.

Over the past decade, approximately 3,000 properties in the city, totaling around 117,000 units, utilized the 421A program.

PERMITTED FILINGS FOR NEW CONSTRUCTION IN NYC

Source: NYC DCP, Office of the NYC Comptroller

Overall sales volume has drastically slowed, with Q4 2023 figures falling below $1 billion, a rarity since 2010.

2023 was the second-lowest volume year of the past decade.

Investors note that factors such as rising borrowing costs, moderating rent growth levels, and the potential of a near-term recession may contribute to a continued slowdown in transaction volume in 2024. Unless buyers are zeroing in on specific buildings or locations with massive rent growth potential, advertised cap rate projects on multifamily properties will likely need upward readjustment.

As New York City grapples with housing affordability and supply constraints, policymakers, developers, and community stakeholders face complex challenges. While recent years have seen efforts to boost construction and preserve affordable housing, more comprehensive strategies are needed to address the root cause of housing insecurity.

Moving forward, policymakers may need to explore innovative approaches to incentivize affordable housing development, enhance rent regulation mechanisms, and promote equitable urban planning. Additionally, addressing cost pressures and fostering growth will ensure that New York City remains vibrant and accessible to residents, developable for developers, and maintainable for landlords.

TenantFinder TM by

TenantFinder TM by

TOTAL EPISODE DOWNLOADS 60,000+

ENTREPRENEURSHIP CATEGORY Ranked #33

TOTAL EPISODE PLAYS 250,000+

"It’s informative, interesting and inspiring. Love it!"

- Anonymous Listener

Listen Now on