Looking overseas for housing solutions

Creating a healthy workplace starts with a solid foundation for wellbeing – the overall physical, mental, emotional, spiritual, and social health of people. A positive culture, increased productivity, higher staff retention, and better health and safety outcomes are just some of the benefits that come from making wellbeing a key focus of an organisation.

Leading health and safety organisation Site Safe New Zealand is on a journey to work with the construction industry to shift the approach to wellbeing in the workplace and set people up for success with the tools and resources they need to support wellbeing.

Since the release of a 2019 research report conducted by Site Safe into suicide in New Zealand’s construction industry, there has been acknowledgement from industry that mentally healthy and well workplaces have benefits for both health and safety and business success.

small organisations who don’t have the financial resources to invest in this area.”

This year, Site Safe has partnered with Ignite Aotearoa to give Site Safe members free access to their

are evidence-based, easy to access, flexible and affordable, with a focus on partnering with workplaces to enhance employee wellbeing.

Site Safe are also investing in the wellbeing of the industry by sponsoring a

“We know how important it is to destigmatise the idea of looking after ourselves, especially in our industries who have typically had more of a ‘toughen up’ attitude when it comes to our wellbeing,” says Brett Murray, Site Safe New Zealand Chief Executive.

“We already work with key partners like MATES in Construction and Hato Hone St John to provide resources and training courses focusing on mental health in the industry, but we knew there was more we could do to support our industry and members, and in particular

online platform and a large range of mental health and wellbeing resources, information, and workshops.

Ignite Aotearoa is a social wellbeing enterprise backed by Emerge Aotearoa – one of New Zealand’s largest independent mental health and social service organisations. Ignite Aotearoa’s mental health and wellbeing offerings

number of one-on-one support sessions so members can try out one of the services offered by the platform. Ignite

Aotearoa hosts over 100 different providers, including financial advisors, human resource consultants, occupational therapists, dietitians, social workers, counsellors, psychologists, and more.

“80% of our members are

small businesses who may not have ready access to tools and resources that support workplace wellbeing,” explains Murray. “We want to support our members to create a solid foundation for wellbeing by giving them access to a wide range of information and support that suits their needs.”

“Both our organisations have strongly aligned values,” says Murray. “Like us, Ignite Aotearoa believe New Zealanders should be able to access mental health and wellbeing support whenever they need it.”

By being proactive and getting support, employers can set a positive example for workers. Being open, honest, and free of judgement is a sure way to ensure people feel comfortable speaking up and ask for help when they need it.

To learn more, visit

https://www.sitesafe.org. nz/news--events/news/ new-member-benefit-igniteaotearoa/

CoreLogic’s latest Cordell Construction Cost Index (CCCI) recorded a 0.8% rise in the fourth quarter of 2023. Despite a slight uptick in the pace of growth compared to each of the previous three quarters (0.4%-0.6%), it remained below the longterm average of 1.1%.

This brought the annual change to 2.4%, well below the 10-year average of 4.5%. This is the slowest annual rise since Q3 2016 (2.2%), and the second slowest since records began in Q4 2013.

CoreLogic Chief Property Economist Kelvin Davidson says the heat has really come out of New Zealand’s residential construction sector over the past quarter.

“The industry itself is simply facing less pressure on overall capacity, compared to its peak at the end of 2022, where over-stretched builders struggled to keep up with workloads for new houses and renovations.”

“Records show material supply chains are easing further, with timber prices stabilising, and even some modest falls for metal products.”

“On the flipside however, there have been some price rises on general hardware, mainly imported products. It’s also possible that H1 insulation standards are exerting some upwards pressure but it’s not possible to disentangle that effect from all the other influences.”

Looking ahead into 2024, Davidson says the pace of construction cost growth could remain subdued.

“The surge in net migration may help to restrain the pace of construction sector wage growth, which could also cap overall cost growth, considering that salaries account for 40-50% of the total cost of a new-

After a period of rapidly rising costs in the building sector, pressures on supply chains and capacity are easing and the annual growth in residential construction costs has reduced to the lowest level in around seven years

build, excluding land,” Mr Davidson said.

“It wouldn’t be a surprise to see the annual rate of change in the CCCI run at 3-4% throughout the year, with builders still reasonably busy but not facing the intensity of recent years.”

The decline in new dwelling consents suggests that this softer phase for activity could also be a pattern that remains for some time.

“Although it’s unlikely costs for households potentially looking to buy a new-build or commission their own project will get

any cheaper, at least costs shouldn’t be spiking higher either.”

“Encouragingly, demand incentives such as lower deposit requirements under the LVRs for people to invest in new-build properties should give developers some degree of confidence to keep bringing forward new projects. In the long run, this new supply is what we need to keep housing affordability under some kind of control,” he says.

CoreLogic researches, tracks and reports on mate -

rials and labour costs which flows through to its Cordell construction solutions to help businesses make more informed decisions, estimate rebuild and insurance quotes easily and, ultimately, appropriate risk effectively.

The CCCI report measures the rate of change of construction costs within the residential market for a typical, ‘standard’ three-bedroom, two-bathroom brick and tile single-storey dwelling.

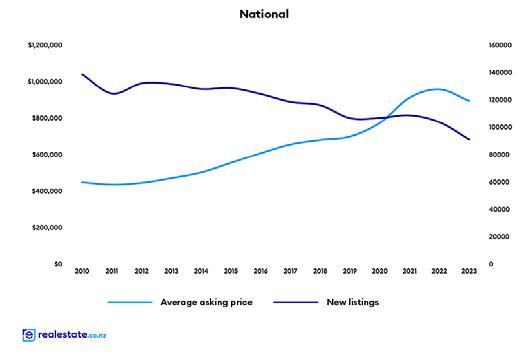

Though almost $100 billion worth of property was put up for sale last year, this was a substantial drop compared with 2022, realestate.co.nz Chief Executive Sarah Wood says

It’s clear that people who didn’t need to sell property in 2023 preferred to sit on the sidelines.

$97,015,251,805 worth of property was put up for sale, which is the sum of asking prices on all residential dwellings listed on realestate.co.nz during the year. This was a 22.8% drop from the $125,601,880,575 listed in 2022.

Down by almost a quarter compared to 2022, this decrease in total value was

two-fold, with fewer listings coming onto the market and lower asking prices.

Around 90,000 properties were newly listed during 2023, a drop of 12.1% on 2022. It was a year of record new listing lows, with the first seven months and December all recording the lowest number of new listings for the month in 16 years of data (excluding Covid-19 lockdown).

At $895,289, the national average asking price was

also down by 6.6% from $959,034 in 2022. This is the first time in more than ten years that the average asking price has dipped below the previous year.

In a year of uncertainty around economic conditions, ongoing interest rate hikes, and a cost-of-living crisis, it’s not surprising that fewer Kiwis decided to put their homes up for sale last year.

Equally, falling price headlines likely made any

opportunistic sellers pause in anticipation of better times to come.

All of our 19 regions had fewer new listings in 2023 than in 2022.

Buyers in Gisborne had the least choice, with the smallest number of new listings and the biggest year-on-year decrease for

the second year in a row.

Across the region, just 361 new property listings came onto the market during 2023, a whopping 36.4% drop on the previous year.

Low supply didn’t increase prices in the region. Interestingly, we’ve seen low supply levels for a couple of years in Gisborne, but the average asking price for the region was back by just over 4% year-on-year. It’s likely that extreme weather events affecting the region in early 2023 are continuing to hamper market activity.

After Gisborne, Wellington (down by 24.0%) and Wairarapa (down by 19.5%) experienced the most significant declines in new listings last year. In contrast, Coromandel, Nelson & Bays, Marlborough, Canterbury, and Southland were the regions least impacted, with new listings in each region decreasing year-onyear by less than 5%.

In every market, there

will be people who need to transact. According to the Real Estate Institute of New Zealand, a total of 63,361 residential properties were sold in 2023, a slight increase of 0.6% compared to 2022.

While fewer homes came onto the market and changed hands, there was no waning Kiwis’ interest in property.

The number of New Zealand-based property seekers active on realestate.co.nz in 2023 was up by 6.5% compared to 2022.

While most regions across New Zealand experienced falling prices, some standouts continued to command higher prices.

West Coast, Central Otago/Lakes, and Marlborough were the only three regions to see year-on-year average

asking price growth in 2023. Our most affordable region, West Coast, had the largest year-on-year increase of 6.1% but remained the only region below $500,000, with an average asking price of $467,361 for 2023.

On the contrary, Central Otago/Lakes, which sits at the opposite end of the price scale, continued to buck the trend of falling prices in 2023 with a 12-month average asking price of $1,463,453 in 2023, (up 1.9% on 2022).

In July, the region became the first in New Zealand to surpass a $1.5 million average asking price. By December 2023, it hit a record high of almost $1.6 million.

Prices in Central Otago/ Lakes have been trending upward since the beginning of 2022. Touted as one of the most naturally beautiful places in the world, property within Central Otago/

Lakes seems exempt from market conditions as demand continues to soar.

We know from buyer search data that a significant amount of interest comes from offshore, and it may be that favourable exchange and interest rates mean these buyers have more to spend than many New Zealanders.

The regions to experience the biggest falls in asking prices in 2023 were Auckland (back by 9.5%), Wellington (back by 9.0%), and Coromandel (back by 6.8%).

While it’s common to see the bigger centres like Auckland and Wellington affected by market cycles, Coromandel’s spot within the top three could be down to the weather events, which effectively cut off parts of the region for several months during the year.

Following the slowdown experienced in 2022 and 2023 the signs are pointing towards increased sales volumes in the coming months.

The stabilisation of interest rates, while no longer at the unprecedented lows of 2021, have provided investors with a clearer direction for the year ahead and they can now forecast

accordingly.

We saw bursts of transactions in late 2023 and it has been encouraging to see those expectations beginning to align between vendors and purchasers.

While there is the possibility of a further increase to the Official Cash Rate, there is consistency with interest rates and many banks are predicting

no further increases.

This provides fertile ground for buyers who will have the opportunity to make strategic purchases.

A change in government late last year contributed to renewed optimism in the property sector.

The new Government has signalled their intent to change the bright-line test from 10 years to two and restore mortgage interest

deductibility, which could encourage residential investor activity.

A housing shortage remains in many areas of New Zealand and record-setting immigration numbers to round out 2023 will put further pressure on rental rates.

Data from Stats NZ released in December notes there was a net migration gain of 128,900 in the year

to October, the highest figure recorded for an annual period.

From a residential development perspective, to help meet this demand, land that is already zoned for residential use will be highly sought-after.

We also believe construction costs may be beginning to level out following extensive rises in recent years. In part this is due to a slower development pipeline forecast for Q2 and Q3 of this year, creating greater competition for projects.

One other angle to monitor from the new Government will be around how their desire to reduce the public service headcount could have an impact on the office market.

Public and private sector businesses throughout New Zealand are continuing to examine the right balance for their team members with hybrid work models

remaining popular among employees.

Prime grade office space in New Zealand’s major centres continues to experience strong occupancy figures and vacancy rates are among some of the lowest across the main global cities.

These low vacancy rates have put upward pressure on rental rates and are pushing demand into higher-quality B-grade space.

Pockets of Auckland’s CBD, such as Wynyard Quarter and Viaduct Harbour, have a vacancy rate below 1 per cent for prime floorspace, while the CBD fringe in Wellington has a prime vacancy rate of only 1.8 per cent.

Providing a desirable office environment for team members continues to remain front of mind for many organisations and this feeds into their ESG commitments.

These commitments will continue to shape the workforce and cause businesses to think about their contributions to a lower carbon future. Sustainability is a key pillar for how many businesses operate and they are constantly exploring new ways to promote and champion sustainable business practices.

While the retail sector has experienced challenges of late due to increased household expenses in an inflationary environment, the outlet shopping development at Auckland Airport called Mānawa Bay, which Colliers is leasing, will provide this sector with a boost.

From a transactional point of view, retail assets drew strong investor interest in 2023 with our Capital Markets team selling a number of notable properties in this space.

Assets that have further value-add potential remain attractive and that will likely continue this year.

In the rural market, whilst transactional activity has declined over the past 18 months due to the current economic environment, the dairy sector is supported by strong market fundamentals and a good domestic buyer pool.

The value of well-located, environmentally compliant dairy farms with good quality infrastructure is likely to remain resilient, even in the face of a period of impeded cashflow.

Farms entering the market with a well-defined and assured approach to land use consents, winter grazing areas, compliant effluent systems, dependable irrigation water sources, and a grasp of nutrient responsibilities will maximise the potential for achieving premium sale prices.

The gravity of New Zealand’s infrastructure deficit is well traversed. The conservative estimate is over $200 billion and the increasing frequency of climate related disasters alongside the pressures of growth will continue to add to this multigenerational challenge. Our infrastructure deficit is the legacy of historic underinvestment but also represents a significant opportunity for our economy, people and environment.

It's time for a mindset shift in how we fund, finance, procure and deliver our infrastructure. Structural reform is needed to supercharge the sector’s ability to deliver for New Zealanders. To deliver infrastructure faster and leverage the full benefit of projects, external partnerships need to be at the heart of a reset approach to infrastructure delivery.

In partnership, Infrastructure New Zealand and Brightstar look forward to presenting the upcoming Infrastructure Funding and Financing Conference on 26 March in Wellington. The gathering is essential for infrastructure professionals to come together and explore what the changed

environment will mean for infrastructure funding and financing, and how the sector can come together to pave the way ahead.

The first panel discussion will investigate the challenges inherent in structural reform and what new revenue tools for local government might mean. We will be joined by Jim Palmer, Chair of the Review Future for Local Government Review Panel and Anne Tolley, Commission Chair in Tauranga as we consider the way forward.

This session will include newly announced Partner at Russell McVeagh, Bevan Peachey, Infrastructure, Government and Specialised Finance at BNZ, Susan Lucking and Amelia East, Partner and Head of Advisory, Asia Pacific at HKA. The discussion will explore the future of a refined PPP, or community and economic partnership, model. They will provide key insights from Infrastructure New Zealand’s funding and

financing work and explore what change will mean for the sector.

Peter Colacino, Infrastructure Strategy and Transformation Lead –Australia, Mott MacDonald and former Chief of Policy and Research at Infrastructure Australia will host a fireside chat to discuss programmatic procurement to drive positive economic and community outcomes.

Colacino brings close to 20 years of experience in public policy and is an internationally recognized leader in policy and reform, having authored or contributed to more than 50 influential reports and publications on topics such as regional development, infrastructure, urban planning, market capacity, transport, funding and financing.

Bevan Peachey will also be facilitating a masterclass which offers a focused and comprehensive opportunity for participants to delve into the critical aspects of risk management in infrastructure projects. Participants will gain a foundational understanding

of the principles that underpin risk allocation in contracting for infrastructure projects.

Placed-based agreements for local government professionals

Local government professionals are encouraged to attend a second masterclass to gain practical takeaways that will enable them to navigate the complexities of place-based agreements effectively, fostering informed decision-making and strategic planning within the New Zealand landscape. There will be lessons and learnings from overseas, along with discussions of New Zealand’s opportunities and risks.

Facilitators are Patrick McVeigh who is the Practice Lead, People and Places and MartinJenkins alongside Linda Meade, Managing Director at Kalimena.

The Infrastructure Funding and Financing Conference stands as a testament to the collaborative spirit driving New Zealand's infrastructure towards excellence. We look forward to seeing you there. To view the programme visit brightstar.co.nz/IFF

26 MARCH 2024

TE PAPA, WELLINGTON

• Lessons from successful long-term agreements

• Challenges and opportunities of structural reform

• The future of public-private partnerships (PPPs) in New Zealand

• Alternative funding and financing tools

• Funding and financing climate resilient infrastructure and adaptation brightstar.co.nz/IFF

AMELIA EAST

& Head of Advisory, Asia Pacific, HKA

SUSAN LUCKING Head of Infrastructure, Government and Specialised Finance, BNZ

JIM PALMER

Future for Local Government Review

NICK LEGGETT

Executive, Infrastructure New Zealand

Contruction of the Sydney Metro West started in 2020 and when completed in 2032 it will connect Greater Parramatta and the Sydney CBD.

In December 2023 the New South Wales (NSW) government announced the potential for more stations to help drive new housing supply.

Sydney Metro has been directed to work on increasing the delivery of new housing supply along the Metro West alignment, to support the government’s plan to build more well-located homes near new and existing transport infrastructure.

The government acknowledges that if it is to create more housing supply that will drive down the cost of renting or buying a home, Sydney is going to have to change. This means well-located houses and apartments near well-connected transport infrastructure.

The NSW government has directed Sydney Metro to complete scoping studies for up to 2 new stations to be constructed west of Sydney Olympic Park, along the existing planned route, with a decision made based on their ability to drive greater urban infill housing.

The announcement has been endorsed by the recommendations of the Sydney Metro Independent Review.

Independent reviewers Amanda Yeates and Mike Mrdak have concluded their thorough analysis of the Sydney Metro project. Their findings include:

• The government should commit to the current 9 station alignment of Sydney Metro West at a minimum, targeting an opening date of 2032. The reviewers made a

While the new government puts the brakes on light rail in Auckland, Sydney is steaming ahead with its new 24-kilometre metro line

and is making plans for extra stations to encourage tens of thousands of new houses

point of noting the “arbitrary” nature of the previously announced delivery date determined by the former government.

• Ensure the current design and construction plans do not preclude additional stations from being considered as station locations in future.

• That Sydney Metro to provide a consolidated property and placemaking strategy across all existing lines to support the government’s priorities regarding housing supply.

• That a business case should be prepared

to improve bus and active transport connections to broaden the catchment of the existing alignment.

Sydney Metro West will ensure tens of thousands of people will be able to live next to a ‘turn up and go’ service that connects them to their jobs, their services and their communities with a train every 4 minutes.

Sydney Metro will move to shortlist delivery partners and develop a procurement model that provides opportunities to get the most housing and the best return from this significant investment for the people of NSW.

25,000 new homes on Rosehill Racecourse

The critical need to deliver housing in well located areas, along transport links means the NSW government has commenced discussions with the Australian Turf Club (ATC) on a proposal to relocate Rosehill Racecourse and build up to 25,000 new homes, surrounded by greenspace and a new Sydney Metro West station.

The proposal, which was brought to the NSW Government by the ATC, centres around the potential to build more than 25,000 new homes on the Rosehill Racecourse site. This would allow the government to explore the feasibilty of a new Metro West Station at Rosehill.

Icontinue to feel disappointed and frustrated at the previous government for botching this project so badly that it was further from becoming a reality in 2023 than it was when they took it over in 2017.

Under Labour’s first transport minister Phil Twyford, Waka Kotahi were ready to start delivering it, and my understanding is they had contracts ready to sign to start enabling works – that was, until the government got distracted by the NZ Super Fund proposal – which then led to the bizarre twin-track process that saw Waka Kotahi competing with the NZ Super Fund for who would build it. It turns out the Super Fund would have won the gig, had Winston Peters not blocked it a few months out from the 2020 election.

The next transport minister, Michael Wood, reset the process in 2021 – but notably put in charge the same consultants who were behind Waka Kotahi’s failed bid in the previous process; and this resulted in the tunnelled light rail proposal which bloated the cost of the project.

I feel that both Phil Twyford and Michael Wood got distracted by thinking they could be the ones to right the wrongs of the past – for example, the abandonment of schemes like that pushed by Sir Dove-Myer Robinson. Both often repeated the urban legends that have built up around ‘Robbie’s Rail‘ but ignored the hardlearned lessons, that any programme needs to be fundable and builable in a rational, staged way. They were certainly encouraged by some officials and industry players to ‘build big‘ from the start, and not repeat the experience of the Harbour Bridge which soon

Light rail was a key part of Labour’s policy platform when they were elected to office in 2017 – they were even handed a scheme by Auckland Transport that had seen significant design work already undertaken, yet in six years nothing was achieved and the project has been cancelled, Greater Auckland’s Matt Lowrie says

needed to be expanded again – even though (as the Harbour Bridge example shows), taking a staged approach would likely have resulted in a better overall system.

Had they not been distracted, light rail along Dominion Rd would be in operation now – but sadly, the concept is probably now dead for a generation due to Labour’s mismanagement.

I do think discussion about Light Rail will come back at

some stage, but probably not for a decade or more. The reality is the factors behind the need for it still exist, such as that there is only limited space in the city centre for more buses. Reductions in public transport use since COVID have brought probably a few years reprieve but usage is rising again and will eventually get back to, and exceed, those pre-pandemic levels and that will reignite the discussion about higher capacity options.

And speaking of the type of capacity light rail can deliver, it’s notable that Sydney’s 12km CBD and Southeast light rail line, which opened just before the pandemic, recorded 31 million trips in 2023. That’s the same as what Labour’s Tunnelled Light Rail was estimated to achieve in 30 years.

Barry Dyer Chief Executive Responsible Care NZ

Barry Dyer Chief Executive Responsible Care NZ

Today, chemical suppliers and their customers continue to adjust to the Covid operational environment.

They struggle with supply chain delays, the loss of experienced staff, frustration with unanswered queries to risk-averse authorities, inflexible and prescriptive regulations, rising compliance costs, diminishing resources and increasing public chemical safety expectations.

While 130,000 businesses are reportedly captured by the Hazardous Substances and Major Hazard Facilities regulations, the official mantra of “600-900 persons seriously harmed each year by unwanted exposure to chemicals in their workplace” presumably applies to all of the country’s 530,000 workplaces.

Increasing community concerns about vulnerability to unwanted chemical exposure and damage to our fragile environment places additional pressure on both suppliers and users of the chemicals.

We all need to sustain and improve our quality of life and these products must be safely managed throughout their life cycle.

Downgrading the flawed but effective HSNO Certified Handler requirement has inadvertently undermined an invaluable capability.

The action deprived businesses, particularly SMEs, of an immediate and recognisable source of workplace chemical safety and compliance advice -- a safe chemical handling capability and emergency response knowledge – critical when a chemical incident occurs.

PCBUs and SMEs must now devise their own solutions to ensure employees are competent to safely handle the chemicals with which they work.

Chemical industry leaders are moving away from relying on lagging indicators of safety performance in favour of identifying safer work practices and work-

places, by responding to workers’ suggestions about improvements.

Conscientious business operators can add value by sourcing accurate, cost-effective workplace chemical safety advice and compliance tools from their suppliers, industry partners and Responsible Care NZ.

A proven strategy is government agencies collaborating with proactive industry associations to best achieve workplace safety aspirations. The problem is that SMEs rarely join associations.

However, they all obtain their chemical requirements from suppliers and can benefit from product stewardship advice and cost-effective industry compliance initiatives.

Responsible Care NZ extols less regulation in favour of enabling business operators to be increasingly self-sufficient, using cost-effective products and services such as site compliance assessments and specialist training.

The focus is keeping people safe around the chemicals we encounter every day by adding value to businesses.

Responsible Care is a global voluntary chemical industry initiative developed autonomously by the chemical industry for the chemical industry.

Chemical suppliers continue to help customers achieve workplace chemical safety aspirations through product stewardship initiatives.

To help solve the in-house chemical compliance dilemma in New Zealand, Responsible Care NZ delivers specialist and cost-effective Certified Handler standard training, complete with a certificate.

Responsible Care NZ site compliance assessments are non-threatening, effectively capturing and assessing chemical safety performance in a variety of workplaces.

+64 4 499 4311

info@responsiblecarenz.com

www.responsiblecarenz.com

Community Land Trusts (CLTs) are a growing response to the failures of market provision of housing in a number of countries, a new report finds, but can they work to address housing issues in New Zealand?

The report, Community Land Trusts: Performance and Relevance for Aotearoa New Zealand, suggests that CLTs have the potential to respond to the immediate crisis of a lack of reasonable quality, affordable housing for low-income families and key workers and sustain people in their homes for generations.

Written by Patricia Austinfrom the University of Auckland’s School of Architecture and Planning, she says the CLT model exhibits considerable diversity both between countries, within countries, within cities and even within communities.

It has becoming an effective answer to unaffordable housing worldwide, especially in the US and the UK but

also emerging in Western Europe, Australia, and South America.

Across these diverse contexts, Community Land Trusts (CLTs) vary from case to case, not only in purpose, number of dwellings and housing typologies etc., but also in their institutional settings, legislation, and funding arrangements.

But all incorporate three elements:

• Community – most often as a place-based element in which the development of continuously affordable housing will be guided by the local community;

• Land – management and stewardship of the land attained by removing the land from the market-place permanently; and

• Trust – usually non-profit organisations with the main aim of providing affordable

housing for people who have not been served by the housing market and of preserving affordability into the future.

The model has many appealing characteristics, and hence proponents, with guidance material on implementation available in abundance. But how does the model work in practice?

Given the diversity of CLTs, what can we learn from the research literature, to determine the relevance of the approach for addressing housing issues in Aotearoa New Zealand?

The English experience with the model starts with its emergence in small rural villages. The UK has approached growing the CLT sector through supporting the exchange of “good practice” between locally-based projects, recognizing the diversity of places, communities and capacity to respond. This is a “horizontal model” of growth which does not assume a one-size fits all.

This diversity can also be seen in the US where the features of the “Classic” Community Land Trust, which is directly linked to funding regimes and legislation in the US can be found in some, but not all, Community Land Trusts in that country. Indeed, CLTs in the US have emerged in response to their local contexts and exhibit considerable diversity as a result.

Their comparative success has led to pressures for growth especially in urban areas in large and small American cities. In this context, upscaling (via funding and institutional structures) encourage each CLT to grow in size and in locational spread, referred to as a “vertical model” of growth.

Some key emerging issues are the tensions between ongoing stewardship and the pressures for growth; the meaning of “community” in Community Land Trusts; and the reframing of CLTs (especially in the US) away from community-control

institutional frameworks, legislation and funding.

In all of these case studies, some elements of startup funding, subsidy or gift of land; institutional support; appropriate legal and financial structures; and funding sources are identified as necessary

and empowerment to becoming primarily tools for perpetual affordability and subsidy retention.

The emergence of CLTs in Western Europe, draws on the results of a large European research project seeking to create a supportive local, regional and national policy, funding and regulatory environment for CLTs. Even from the small number of case study examples provided it is clear that each case study has unique characteristics, and as a result inherent complexity needs to be considered in developing appropriate supporting regimes, including

to overcome the barriers facing implementation of this new form of housing. Once CLTs are established research findings identify that the potential for CLTs lies across a number of policy interventions and housing market processes. These include supporting mixed-communities in urban regeneration projects; mitigating some of the negative impacts of gentrification; mitigating some of the negative impacts of significant market uncertainty and volatility; making good use of land in public ownership for affordable housing; positively

impacting the price of neighbouring properties; providing pathways to ownership opportunities for households excluded from housing market purchase; helping individual household build wealth; enabling households to remain home-owners over time; delivering more than affordable housing; engaging residents and support community capacity building; and meeting the needs of vulnerable households at on-selling.

CLTs face challenges in meeting their full potential. The research literature clearly identifies that many CLTs have to work around existing legal frameworks and funding regulations in order to deliver housing for their target communities. There is a need to develop and implement appropriate legal frameworks, public funding, and requirements around internal governance. In many contexts local government already plays an important role but with guidance could provide more support for emerging CLTs.

What are the lessons for Aotearoa New Zealand?

1. Legislation: There is a lack of an explicit statute for Community Land Trusts in Aotearoa New Zealand. Adopting a CLT-based legal structure would enable the development and growth of CLTs. In crafting a statute care must be taken to design for, expect and accept diversity in CLTs. The level of correspondence between CLTs and papakāinga should be recognised upfront, acknowledging both the similarities and the differences

2. CLTs need legal

frameworks that acknowledge their diversity, where this diversity encompasses funding mechanisms, policy frameworks and internal governance. CLTs need legal frameworks that enable the sector to grow horizontally – leading to a network of place-based and community-based CLTs.

3. CLTs must have regard to the following legal issues: a clear vision statement; effective governance; and an articulated ground lease (or equivalent arrangement) that establishes security of tenure, protects affordability in perpetuity, and establishes management mechanisms.

4. CLTs need institutional support (including financial and policy frameworks) that grow the sector horizontally – leading to a network of place-based and community-based CLTs. A national network organisation should be considered to provide education and training,

dissemination of best practices, easily accessible legal advice, and standard documentation that could be used by and adapted as needed by all CLTs.

5. The existence of national funding is an important factor in almost all of the cases considered in this report, both in the research and practice literature and should be considered in Aotearoa New Zealand. In addition there is a high priority need for funding to support setup and pre-development costs.

6. In areas experiencing urban regeneration and / or gentrification, CLTs have significant potential to support mixed-income communities, to enhance community stability, to reduce displacement and to contribute to building community assets. Funding support for CLT initiatives in advance of urban regeneration should be considered.

7. CLTs should be a

primary consideration for public policies for marginal house purchasers. CLTs can provide owner opportunities for marginal purchasers and maintain that ownership. CLTs have the potential to mitigate some of the negative impacts of falling house prices and negative equity.

8. CLTs should be considered for all housing developments on publiclyowned land.

9. CLTs can enable owners to build wealth – both financial and personal. The potential for CLTs should be considered as part of social, community and economic development policies.

10. A provision in the ground lease should clearly establish the conditions around re-sale balancing long-term affordable provisions with certainty for individual households. The CLT should consider what conditions it might place on exercising an option to repurchase a dwelling if the

owner wants to sell and is unable to find an eligible purchaser.

11. Local government can play a number of roles in supporting CLTs from identifying potentially available sites, through capacity building and funding. Guidance should be provided on possible roles for local government, and best practice, knowledge and experience should be shared.

12. Where there is an inclusionary zoning policy in place (as in Queenstown Lakes), the local council should consider directly linking the outputs of inclusionary zoning (dwellings, land or other equivalent funds) to a CLT and to local Māori Housing Providers

13. CLTs should either be exempt from paying local rates or be appraised on the basis of incorporating perpetual affordability with restrictions on resale price

Read the full report

Though National u-turned on its bipartisan agreement with Labour on the Medium Density Residential Standards (MDRS), there is a way it can be salvaged whilst winning the ACT Party’s support in the process, writes Yes In Our Backyards co-author Marko Garlick

National’s alternative policy, a ‘30 years of growth’ housing target, is ambitious but has already been criticised as hard to define and police, and would likely take years to implement. Meanwhile the MDRS has already been partially implemented in most major cities, with hearing panels determining the scope of exemptions in

the coming months as the final step.

Many of our major problems – housing (un)affordability, carbon emissions, low productivity and social ills – stem from our chronic shortage of homes. The MDRS was one of our best hopes at tackling those issues.

With the new Government formed, there is a way

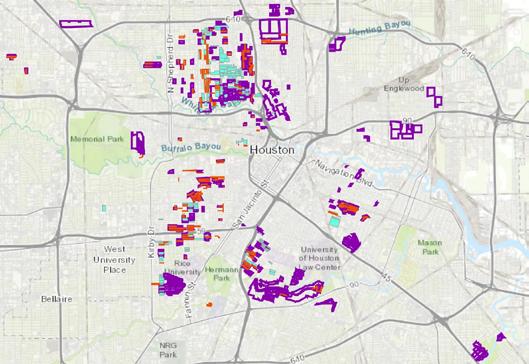

National could use an idea from Houston, Texas to save the MDRS, and even get ACT on board.

Houston’s street-level opt outs

Houston, Texas has famously cheap housing. In 2023, the house price to income ratio in Houston was only 4.7 compared to 10.4 in Auckland. Flat land,

abundant freeways, and sprawl-enabling policies has allowed housing supply to easily keep up with demand by adding new suburbs at the city fringe.

Houston has almost no zoning, with some basic restrictions on building. For years, the city enforced a minimum lot size of ~450 square metres in most neighbourhoods meaning

only large detached homes could be built.

In 1998, the city reduced that minimum to ~130 square metres and adjusted setbacks, which allowed three townhouses on a typical lot across most of the city. Sound familiar?

This change was extended into the outer suburbs in 2013, unleashing a torrent of townhouse developments. Now, Houston has plentiful quality townhouses at a range of price points. This new density means the city is now urbanising from its sprawly, exurban starting point. New frequent bus and light rail lines are pencilled in, and getting built.

If Houston was anything like cities in New Zealand (or Australia, the UK, or other big US cities) these density-enabling changes would’ve been fiercely resisted by density-hating homeowners. But by most accounts, these changes were largely uncontroversial. Why? Perhaps because Houston allowed pockets of homeowners to ‘opt out’ of these city-wide changes.

Anya Martin’s excellent article in Works in Progress goes through this optout process. Landowners within small blocks could collectively opt out of the density-enabling rules via private deed restrictions – similar to covenants in New Zealand – which are automatically recognised by the city. These deeds could be used to, amongst other things, set a higher minimum lot size than the new city minimum – effectively banning townhouses. A simple petition needed to attract just 51% support from landowners. These private deed restrictions would typically expire after 25–30 years.

In short the opt outs:

• Apply to small geographic areas only; a block, not a whole suburb.

• Require a majority consent from landowners in that area; a few people can’t decide for everyone.

• Have a sunset clause; they don’t last forever.

makes it hard to convince the average homeowner that new homes provide a net positive that should be welcomed, rather than a net negative that should be avoided.

Proposed exemptions have already abounded. Vocal suburbs that were previously tightly zoned have desperately tried to

The MDRS enable lots of houses and isn’t subject to the definitional challenges of the housing targets proposed by National, which would open the door to local council shenanigans and gerrymandering (see California’s experience). But it was clearly a politically risky policy. It applies to all suburbs, in all major cities. Councils’ weak financial incentives and poor infrastructure track record

rely on extensive ‘character’ areas, ‘the angle of the southern latitude sun’, and ‘lack of public transport’ (in Christchurch), and ‘the existence of possible public transport’ (in Auckland). These exemptions are clearly not what Ministers envisaged when the MDRS was developed.

Street-level opts out could solve a lot of these problems. Under the status quo scenario, motivated residents with anti-density preferences can only stop ambitious city-wide reforms like the MDRS by advocat-

ing for large suburb-wide exemptions, or by calling to scrap the reforms entirely (successfully, in the case of National’s backdown).

Allowing street-level opt outs, like in Houston, would mean accepting that in some areas residents really really value their current low-density, built environment. Allowing them to opt out easily at their immediate local level, prevents them resorting to campaigns that tank housing capacity in large parts of a city or the entire country as a side effect.

Here’s how this could save the MDRS: National establishes a new “Street-level Private Plan Change” process that would allow a small area to opt out of the MDRS and retain their current zoning. This could only occur if, say, 70% of homeowners in the area vote to agree. A ten year sunset clause limits the duration of this opt out. In exchange for providing this opt-out process, National could credibly take a strict approach and crack down on the various city-wide exemptions currently proposed by local councils. Strong mandates but with small opt outs as a pressure valve to make the whole thing politically viable.

There would obviously be some serious design issues to work through. How do you define a ‘street block’? Should these opt-outs apply to the NPS-UD upzoning areas too? What should the voting threshold be set at? Difficult yes, but these questions can all be worked through.

ACT campaigned hard against the MDRS despite its ostensible libertarian roots, probably because of its home-owning voter base in the leafy Auckland electorates of Epsom and

Tāmaki. Instead, it put forward a policy of street level ‘opt-ins’, based on an idea from London YIMBY called Street Votes. With street-level opt-outs, ACT could support the MDRS by saying it gives residents the option to avoid central government mandates. NZ First appears to oppose the MDRS too, but might be amenable to street-level opt outs.

The main benefit of street-level opt outs is that they confine vocal opponents to blocking housing only in their immediate vicinity, rather than needing to pursue suburb-level exemptions. A pressure valve of sorts. The majority voting requirement also means the handful of extreme anti-density types, who usually run residents associations, would be just a handful of voters among many on their street, rather

than having their fringe voice amplified through traditional local government processes. These people are surprisingly influential, and effective, despite being quite irrational. A bit of targeted direct democracy could seriously quash their power – pursuing small scale opt-outs could keep them very busy. If they really think everyone hates density, they should have to prove it by convincing their neighbours to vote accordingly.

Opt outs will probably be more prevalent in wealthy suburbs like Ponsonby and Fendalton yes, but even in those suburbs there will still be upzoning. Unlike, typical zoning carve outs (which at present tend to exempt entire suburbs), street-level opt outs would require each street to vote to not upzone. In practice, that will likely be quite confined. Just

see the modest scope of opt outs in Houston in that image above.

Many people will value the right to redevelop their property from one home with three, over preventing all their neighbours from having the same right. In some parts of Auckland, opting out of the MDRS could mean some homeowners forgoing a truly massive uplift in the value of their land. That’s why opt outs are better than opt ins: it is very clear to homeowners what they are losing. We’ve already seen this in New Zealand: see the push back from Lower Hutt residents to proposed new character protections, citing harms to their property values. Sunset clauses mean residents on a street would have to reaffirm their opposition to density and choose to forgo a property value uplift periodically.

In time, the opt out process might make it politically viable to extend the MDRS to places like Queenstown and Nelson, or make the MDRS even better by enabling perimeter block housing.

Would this work? These opt outs feel wrong on a certain level. The ability for high-income neighbourhoods to vote to freeze themselves in time and stop new residents is far from egalitarian. But I have come around to them, and with all the exemptions being pursued right now, the MDRS was going to be compromised in one way or another eventually.

Our housing shortage is so bad, this alternative idea might just be worth a shot.

The National Health & Safety Leaders’ Summit, set to unfold in 2024, promises a dynamic exploration of the latest developments, trends, and challenges in the ever-evolving landscape of workplace health and safety.

On the Plenary Day One of the Summit, an impressive lineup of speakers is poised to deliver critical insights and practical strategies to safety leaders navigating the complexities of their roles.

Kicking off the summit, Robyn Bennett, President of the New Zealand Institute of Safety Management, will spearhead discussions on the latest trends in health & safety management.

From changing market conditions to economic shifts and workplace trends, Bennett will shed light on how these factors impact safety leaders. Emphasizing a redefined business ecosystem with a focus on worker safety and wellbeing, she will draw lessons from recent highprofile workplace health and safety challenges.

Following Bennett, Steve Haszard, Chief Executive of WorkSafe, will deliver a keynote addressing

organizational change and expected responses within the health & safety sector. He will delve into the impact of WorkSafe’s new strategy on safety leaders and elucidate how performance measurement mechanisms will shape the sector's future.

Christian Hunt, Founder of Human Risk Ltd, brings an international perspective to the summit. His keynote will explore driving transformation in organizational culture to embed safety. By delving into the interface of culture, human factors, and behavioural science, Hunt aims to provide actionable strategies for fostering continuous improvement in safety culture.

Derek Toner, Director of Engaging Solutions, will share insights on driving culture change by engaging with leadership and front-line teams.

Toner will emphasize the pivotal role of visibility in culture change and the responsibilities of safety

leaders in co-designing safer working practices.

Moira Loach, Senior Health & Safety Advisor, and Jodhi Warwick-Ponga, Board Trustee, will introduce the Haumaru Tāngata (Māori Health & Safety) Framework. Addressing the overrepresentation of Māori in workplace statistics, they will outline the framework’s components and application in workplace health & safety initiatives.

Grant Nicholson, Partner at Anthony Harper, will discuss the evolving legal landscape of health & safety in New Zealand, highlighting recent legislation, regulatory changes, and court cases. The summit will also feature a panel discussion on the role of health & safety leaders in critical incidents, and insights from Women In Safety Excellence NZ on shaping the future of health & safety.

In essence, the National

Health & Safety Leaders’ Summit promises a comprehensive journey through the nuances of health and safety leadership, providing attendees with actionable insights and strategies to enhance workplace safety and wellbeing.

Attendees can tailor their conference experience with Day Two Streams For safety leaders traversing the dynamic intersection of technology and safety you can attend Stream A which will focus on emerging technologies; including trends that leverage AI to enhance safety through virtual reality.

Wellbeing at work is on the radar for many organisations and Stream B will delve into topics ranging from psychological health and safety obligations to preventing worker burnout and promoting resilience at work.

The event will be held on 19-20 March at the Ellerslie Events Centre in Auckland and you can view the programme at brightstar. co.nz/safety

19 - 20 MARCH 2024 ELLERSLIE EVENTS CENTRE, AUCKLAND

Critical insights for leaders to improve workplace safety & wellbeing

DAY 1 : 19 MARCH

Plenary Stream

DAY 2 : 20 MARCH

Choose between: OR

STREAM A Innovation & Technology in Health & Safety

STREAM B Health & Wellbeing at Work

brightstar.co.nz/safety

Asbestos remains the country’s number one work-related killer, with about 220 people dying each year from preventable asbestos-related disease

Two recent court cases serve as a reminder to tradies and businesses of the dangers, and how to manage the risks of the known carcinogen.

The latest WorkSafe prosecution involves Wilson Building Timaru Limited. The company was fined for the unauthorised removal of asbestos by the company director, which put workers at high risk of asbestos exposure over several days. The company did not seek an asbestos management plan from the

building owner at any point. The asbestos should have been removed by a licensed expert.

Earlier in the year, Inspired Enterprises Limited was sentenced over a case of poorly handled flooring containing asbestos. There was no asbestos management plan, and the customer’s quote did not mention the possibility of asbestos. Both cases highlight concerning gaps that fall well short of best practice.

“In New Zealand, businesses have a responsibility to manage the risks to their

workers associated with asbestos,” says the Head of WorkSafe’s General Inspectorate, Tracey Conlon.

WorkSafe requires asbestos management plans to be in place for workplaces where asbestos or asbestos-containing material has been identified or is likely to be present.

“The health consequences seen today are the legacy of historic exposure to asbestos, often while at work. Actions taken today will help prevent yourself, workers and others being harmed by asbestos-related

disease in the future,” says Tracey Conlon.

WorkSafe has a broad range of advice and guidance online about managing asbestos-related risks, including what businesses are required to do to manage asbestos exposure risks.

Read more about the case against Inspired Enterprises Limited

Read more about the case against Wilson Building Timaru Limited

W i t h y o u r s u p p o r t w e c a n c o n t i n u e t o p r o v i d e p ra c t i c a l h e l p , c a r e a n d c o m f o r t .

A c c o m m o d a t i o n a n d h o m e v i s i t s a r e j u s t t w o o f t h e w a y s w e s u p p o r t N e w Z e a l a n d e r s a f f e c t e d b y c a n c e r.

The housing market’s slow but steady recovery continues, with all bar one of New Zealand’s main centres recording an increase in average house prices this last quarter, QV’s latest figures find

The latest QV House Price Index for January 2024 shows the average home increased in value nationally by 2% this last quarter to $925,461, representing a faster rate of growth than in the three months to the end of December, but still slightly slower than in October and November. The national average value is now just 1% less than at the same time last year.

Only Invercargill (-0.6%) posted a small average

home value reduction this quarter, following six consecutive months of growth. Otherwise 10 of the 16 main urban areas we monitor recorded more growth in this index than in the last one, with Queenstown (4.4%), Christchurch (3.4%), and Dunedin (3.1%) experiencing the largest gains on average this quarter.

QV operations manager James Wilson says the housing data continued to be volatile in some areas of the country where a rela-

tively low number of sales had still been occurring.

“It doesn’t take much change in activity to increase or decrease the value performance of some of our less populous regions, but the overall trend is the housing market is slowly but surely strengthening.”

“Over the last few months there’s been a pretty major shift in mindset. Many prospective buyers are now thinking that things can only get a bit better this year when interest

rates eventually reduce and interest deductibility is reintroduced for investors, so they’ve been cautiously returning to the market in slowly increasing numbers, trying to get ahead of any further price rises,” Wilson says.

He said widespread predictions of a possible drop in shorter term mortgage rates later in the year and only a small recent rise in unemployment would likely reinforce this perception. “You can’t underestimate

how powerful a shift in the prevailing mindset can be. Confidence is rising, even as financial and economic pressures are continuing as they have been for some time.”

“After a brief stalling in home value growth over the holiday period, it looks increasingly likely that residential property values in New Zealand will broadly continue to follow the same trend they left off in October and November last year, with slow but steady growth overall, as well as a likely uptick in activity throughout February and into March.”

“Outside of our largest cities, I expect that we’ll still see some fluctuations from month to month, with patchy, often variable growth – especially where continued high immigration is less of a factor and activity is low – but once again the overall picture is of a slowly strengthening housing market,” Wilson says.

Home value growth has remained relatively steady across the wider Northland region.

The latest QV House Price Index shows the region’s average home value increased by 2.7% to $741,535 in the three months to the end of January 2024. It’s a small increase in our rolling three-month average from 2.3% at the end of December.

At the district level, the average home value in the Far North increased by 4% to $706,200. Whangarei experienced half as much growth at 2% for the quarter – the average home value is now $738,671 – and Kaipara wasn’t far behind with the average home increasing by 2.2% to

$851,686.

Auckland’s residential property market continues to slowly strengthen.

The average home value has increased by 1.1% to $1,291,387 throughout the January quarter – down on

slowed this quarter.

The city’s average home value increased by 2.2% to $1,028,042 in the January quarter, down from the 3.3% growth reported for the December quarter. The average value is still 2.5% less than the same time last year.

Local QV registered valuer

the 1.9% quarterly growth recorded back in December. The largest gains have occurred on the North Shore (2.7%) and in Manukau (2.1%).

The Super City’s average home value is still 2.2% lower than the same time last year.

Local QV registered valuer Hugh Robson commented: “Sales volumes and home value growth is somewhat down on the November and pre-Christmas period, as is typically the case at this time of year, but the market remains buoyant and its slow-but-steady recovery is ongoing.

“We should see a steady increase in activity throughout February and March. In the meantime, well located and tidy homes are continuing to attract strong interest.”

Tauranga’s average rate of home value growth has

Meghan Crowe commented: “The start of the year has started off slower than expected. However, it’s still being predicted that we’ll see an uptick in sales volume and values over the next 6-12 months, if interest rates lower.”

Home values continue to slowly build back up in Hamilton.

The city’s average residential property value increased by 1.8% to $789,770 – a slight increase from the 1.1% quarterly growth reported in our previous QV House Price Index – but remains 2.2% less than at the same time last year.

Local QV property consultant Marshall Wu commented: “The housing market has started the year with a similar trend to where it left off in 2023, with values generally trending higher and recovering from the downturn. Despite ongoing cost

of living pressures, high-interest rates, low consumer sentiment, and affordability constraints, homes are still selling.”

“Housing demand has been increased by high migration. The tight rental market has likely incentivised renters to transition towards homeownership if they can afford it,” he added.

Meanwhile, the regional market has also continued to strengthen on average this quarter – most notably in Waikato District (3.2%) and in South Waikato (2.8%).

Home values have risen across the Taranaki region this quarter.

The largest quarterly increase was in New Plymouth, where the average home value increased by 2.6% to $715,862. But South Taranaki and Stratford weren’t far behind, with values also increasing by averages of 2.1% and 1.4% respectively since the end of October.

Both Napier and Hastings have kicked off 2024 with a small amount of home value growth.

Napier’s average home value increased by 0.9% in January and 1.9% this quarter to reach $760,471. That figure is 2.1% less than the same time last year.

Hasting’s average home value also increased by 0.5% in January and 2.5% this quarter to reach $796,561. That figure is 0.6% higher than the same time last year.

Home values continue to

gently rise in Palmerston North.

Residential property values have risen across the city by an average of 1.5% this quarter – down on the 2.4% quarterly growth reported in our previous QV House Price Index – with the average home value now sitting at precisely $645,273.

Local QV registered valuer Olivia Betts commented: “The overall statistics have continued to show a steady upward movement pattern since mid-2023. This has come after a significant drop in house prices. Over the past 12 months we are also now seeing a slight increase.”

“Interest rates have been more stable over the last three to six months, which provides a level of assurance to purchasers. Affordability is still a significant concern though,” she added.

The Wellington region continues to experience relatively steady home value growth, with one exception this quarter.

The average home value increased across the wider region by 2.8% throughout the three months to the end of January 2024, with all local districts bar Porirua (-0.2%) recording upward growth. Hutt City and Kapiti Coast recorded the largest quarterly home value gains on average at 3.8% and 3.5% respectively.

Local QV registered valuer Blake Ngarimu said the average home value across the region was now just 0.2% lower than at the same time last year.

“The market is still currently dominated by firsthome buyers trying to get into the market before values increase any further, which means they are having to take on higher inter-

est rates in the meantime. Listings have also significantly increased across the region, which is also likely to put a damper on major value growth, with prospective buyers having more options to choose from.”

“Though interest rates appear to have peaked, we’re unlikely to see any major home value increase until interest rates start to ease, which is speculated to be towards the end of 2024,” Mr Ngarimu added.

Nelson recorded a modest increase in average home value this quarter.

The city’s average home value increased by 0.4% in the January quarter – down from the 1.5% quarterly home value growth recorded in the previous QV House Price Index – with the average value now sitting at $774,435. That figure is now 3.4% lower than at

the same time last year.

QV Nelson/Marlborough manager Craig Russell commented: “We are seeing a continuation from the trend that emerged near the end of last year, with the market stabilising and increasing market optimism. Open homes continue to attract good numbers –particularly for properties under the $800,000 mark – but interest rates continue to be a major barrier for many purchasers.”

Home values continue to strengthen at a relatively rapid rate on the West Coast.

There continues to be heightened volatility in the local QV House Price Index data due to relatively low sales volumes, with the average value of a home in Grey District increasing by 7.4% throughout the Janu-

ary quarter to $410,715.

In nearby Buller ($353,584) and Westland ($433,305), the quarterly rate of home value growth has been slower at 4.3% and 3.3% respectively, but this is still well above the national average of 2% growth for the quarter.

Value levels have increased across much of the Canterbury region.

The QV House Price Index shows residential property values have increased across the overall Canterbury region by 1.9% for the 12 months ending January 2024. This is an increase from the 0.2% growth shown for the 12-month period ending December 2023.

January’s quarterly figures show the region’s average home value increased by 2.9%. This is a small increase on the 2.3% growth recorded in the previous index, with all districts experiencing positive growth, except Mackenzie.

In Christchurch, the average home value increase was 3.4% this quarter, which is a sizeable increase on the 2.5% quarterly growth reported in the previous QV index. The average home value is now $765,104, which is 2.1% higher than the same time last year.

The wider Christchurch region also experienced positive growth this quarter, with the average value in the Waimakariri and Selwyn districts increasing by 1.6% to $711,750 and 2% to $838,606 respectively.

Local QV registered valuer Rod Thornton commented: “With regards to Christchurch and surrounding districts the latest quarterly index figures are posi-

tive and reflect the latter months of 2023, when we saw a general trend of increased buyer interest and

city increased by 3.1% to $633,474 this quarter, including by 1% in January. The average home value is

value increases following a slowdown of the market and easing of values around late 2022 and early 2023.”

“What the next few months will bring is unknown. However, the market since Christmas still

now just 0.9% lower than at the same time last year.

Home value levels have also increased across the wider Otago region by an average of 3.9% for the January quarter – a small increase on the 3.3% quar-

appears to be in a positive mode despite higher interest rates and cost of living concerns still being present.”

Dunedin’s average home value has increased for the fifth straight month.

The latest QV House Price Index shows the value of the average home in the

terly growth reported back in December. Just Dunedin is showing negative growth on an annual basis, with Waitaki (1.8%), Central Otago (4.2%), and Clutha (1.5%) all in the black.

Local QV registered valuer Rebecca Johnston commented: “Local real estate agents have noted that people are looking to relocate to areas such as Taieri Mouth due to its desirability

and coastal appeal. The smaller provincial towns have seen less interest –although there is a current shortage of rental accommodation due to seasonal work and fixed term rental agreements.”

“Demand has continued to be strong in the Catlins Coastal areas and smaller coastal settlements east of Milton,” she added.

Residential property values are up once more in Queenstown.

The average home value increased by 4.4% to $1,807,282 throughout the January quarter – an increase on the 3% quarterly increase reported at the end of December 2023.

Queenstown’s average annual rate of home value growth is currently 7%.

Invercargill recorded a small reduction this quarter.

The city’s average home value reduced by 0.6% to $466,898 throughout the three months to the end of January 2024.

“This quarterly decrease follows six monthly increases in a row and may be an anomaly due to the Christmas holiday break,” said QV registered valuer Andrew Ronald.

“There is still much less demand now compared to early in 2022, especially for properties within the $600,000 to $1,000,000 range. While there is still healthy demand from first-home buyers, only a limited number of investors are currently active in the market – although this is expected to change with the restoration of interest tax deductibility rules.”

Changes to our Global Harmonisation System (GHS) chemical regime applying from 30 April 2021 require accurate and timely advice - non-compliance could prove costly.

Competent staff avoid expensive and sometimes confusing compliance advice, while enabling an effective response to chemical incidents, often without requiring emergency services.

Inspectors and certifiers with years of expertise warn of a declining national workplace chemical safety performance.

A crucial factor is the continuing loss of onsite chemical safety advice, primarily due to replacing flawed but effective mandatory Approved Handlers with whatever employers now deem sufficient.

A second major chemical incident in the same public facility is a timely reminder that safe chemical management is not receiving the attention it deserves. Competent staff are essential.

Onsite Responsible Care NZ (RCNZ) Competent Chemical Handler

Certification courses are tailored to reflect your chemical inventory and enable compliance.

Upskill the last of your HSNO Approved Handlers, update Certified

Handler requirements and successfully implement the updated Global Harmonisation System (GHS).

For struggling, noncompliant business operators who are attracting attention from enforcement agencies, practical onsite advice from Competent Chemical Handlers helps lessen the load on a diminishing number of Compliance Certifiers. It helps to ensure site chemical safety measures remain effective.

RCNZ Competent

Chemical Handlers (CCH) are increasingly in demand, resulting from our popular ‘Walk and Talk’ site visit to assess actual chemical management performance, identifying the need for specialist training, throughout the product life cycle.

Chemical incidents now guarantee media attention, often sensationalising the incident by highlighting persons adversely affected by unwanted exposure to chemicals.

This can irretrievably damage reputations to both customers and suppliers, particularly if employers have not taken all practicable steps to safely manage their chemical inventory throughout their operations.

When chemicals do cause problems, employees, customers, WorkSafe

Ensuring staff are competent to safely manage the harmful chemicals essential to your business includes your effective response to a chemical incident.

To enable a smooth, cost-effective transition to and beyond compliance, you need compliance tools:

- the updated RCNZ industry Codes of Practice reflecting our revised GHS chemical management system

- your 24/7 CHEMCALL® emergency response subscription; and the all-important ‘how to’ advice arising from our popular site ‘walk and talk’ assessments

- replacing your Approved Handler with our Competent Chemical Handler certification

These are all cost-effective measures which add value to your business. Talk to us today about compliance tools, which confirm you are a good employer, committed to safeguarding employees and our environment by safely managing your chemical inventory.

Responsible Care NZ

04 499 4311

www.responsiblecarenz.com

inspectors, local authorities, health protection officers and emergency response organisations all benefit from the expertise and product safety information available 24/7 from 0800 CHEMCALL®, our industry’s unique, subscription based chemical emergency advisory service.

Supported by thousands of compliant Safety Data

Sheets (SDS) combined with their collective industry expertise and local knowledge, CHEMCALL® responders provide callers with comprehensive advice about how to safely manage the incident, safeguarding people and often avoiding business disruption.

The Commerce Commission has filed criminal charges against two construction companies and two directors for alleged bid rigging of publicly funded construction contracts

The charges follow a Commission investigation into allegations that the companies and their directors colluded to rig bids for infrastructure projects in Auckland. It is the country’s first-ever criminal prosecution for cartel conduct.

Commerce Commission Chair, John Small, says the criminal proceedings filed in the Auckland District Court send a strong message to businesses that

the Commission will not tolerate cartel conduct, and is prepared to lay criminal charges to enforce the law.

“Cartel conduct harms consumers through higher prices or reduced quality, and it harms other businesses that are trying to compete fairly. The criminalisation of cartel conduct in 2021 underlines just how serious and harmful this offending is.

“Bid rigging of publicly funded construction

contracts loads extra costs onto taxpayers and the New Zealand economy as conduct of this type undermines fair competition. The Commission will not hesitate to bring criminal proceedings in appropriate cases to ensure kiwis are getting the benefits of fair prices, quality services and more choice.”

What is cartel conduct?

A cartel is where two or

more businesses agree not to compete with each other by price fixing, allocating markets or customers, or restricting the output or acquisition of goods and services. Bid rigging is a form of price fixing and can also involve allocating markets or customers.

Bid rigging or collusive tendering is when there is an agreement among some or all of the bidders about who should win a tender or have an unfair advantage in

the tender. This may involve potential bidders not bidding for a tender to support the proposed winner or bidders may agree the prices that each party will bid. This often occurs in the form of “cover pricing.”

Cover pricing is where one or more parties submits a tender bid or bids at an inflated price with a view to increasing the prospects that another designated firm wins the tender. Such an agreement prevents open and effective competition and means procurers are unlikely to achieve best value for money for their business, customers, and in some cases, taxpayers.

Cartel conduct is prohibited under section 30 of the Commerce Act. As of 8 April 2021, cartel conduct is punishable with a term of imprisonment of up to 7 years, underlying just how serious and harmful offending of this nature can be.

• Make sure that you and your staff are familiar with the requirements of the Commerce Act. Keep records of who has at-

involved.

• Do not agree prices, discounts or any matters relating to price with your competitors (unless it is a specific sub-contract you are discussing).

tended training about the Act.

• Think carefully about who you are, or may be, in competition with, especially if sub-contracting is

• Do not agree to restrict output in any way, or to allocate customers or geographic markets between competitors.

• Do not exchange

pricing, how much you plan to produce in the future, customer information or which markets you sell into with your competitors.

• If you are approached by another business to discuss pricing, allocating customers, bids for contracts or restricting outputs you should raise an objection straight away. Leave the discussion immediately and contact the Commerce Commission.

• Review internal documents, policies and procedures for compliance with the Commerce Act and seek independent legal advice.

• If you become aware of anti-competitive conduct, contact the Commerce Commission immediately.

The team was forged by three friends working in the industry who realised that the key thing stressed building managers, business owners and landlords needed was to make a single call and get a reliable and qualified support team that would cover any aspect of facilities management.

The Rapid trio set down a business philosophy that “we will do what others can’t or won’t do “ and set about assembling a highly trained, efficient and safety-conscious team of professionals who get the job done right, the first time.

Today that service stretches from food manufacturers’ audit cleaning, all aspects of industrial cleaning, painting, building and floor safety management to anti-microbial and moss

Having worked in the industry for many years, three friends, Paul Schoch, Robyn Schoch and Andrew Chan realised that by combining their skills, they could create a company unlike any other

and mould treatments to prevent surface damage to roofs, ceilings, walls, floors and specialised equipment.

Weather events are becoming more unpredictable, more intense and more damaging, posing huge challenges in both preparing for and recovering from their growing impact, says Jeremy Kelly, Global Director of Cities Research at JLL

From extreme heat across southern Europe to the heaviest rainfall on record in Shenzhen and Hong Kong, to flooding in Brazil and cyclones devastating parts of southern Africa, cities face unprecedented physical risks.

Four in five cities across the world now face significant climate hazards such as heatwaves, floods

and droughts, according to non-profit CDP, which surveyed 998 cities. Much of this extreme weather is down to a changing climate, and in the latter part of 2023, it’s coupled with the cyclical effects of El Nino.

Many cities are facing multiple threats from extreme weather. While they currently establish longer-term resilience plans, they’re also having to deal

with the immediate consequences of unprecedented and costly weather events.

Changing weather patterns have huge implications for real estate and the people that live in cities. For nearly a third of cities surveyed by CDP, climate-related hazards pose a threat to at least 70% of their populations.

More than 90% of the world’s largest compa-

nies will have at least one asset – offices, factories, warehouses or data centers – financially exposed to climate risks such as water stress, wildfires or floods by the 2050s, according to S&P Global.

Rising temperatures have broken records for longer

and more intense heatwaves in multiple urban areas in recent years. Cities, in response, are implementing a range of policies and measures to cool their streets.

City-appointed chief heat officers are increasingly leading the charge on tackling soaring temperatures and keeping local populations safe. Sierra Leone’s capital, Freetown, recently appointed Africa’s first chief heat officer, a role that cities such as Miami, Melbourne and Monterrey in Mexico have also invested in.